财务管理专业英语topic

财务管理专业英语最新版精品课件Topic 6

the stock contributes to the market portfolio.

i

i M

iM

•β0.5: Stock is only half as risky as the market, if held in a diversified

portfolio.

•β1.0: Stock is about as risky as the market, if held in a diversified portfolio.

What is Risk?

risk is usually estimated with the standard deviation, which is the square root of the variance of returns.

INTRODUCTION TO RISK AND RETURN

FINANCIAL MARKET EFFICIENCY

Three main factors associated with informational market efficiency

The type of information to which the market price reacts The speed at which the market price reacts to information The degree to which market participants over-or under-react to

Uncertainty • sensitivity analysis • scenario analysis Probability Normal distribution

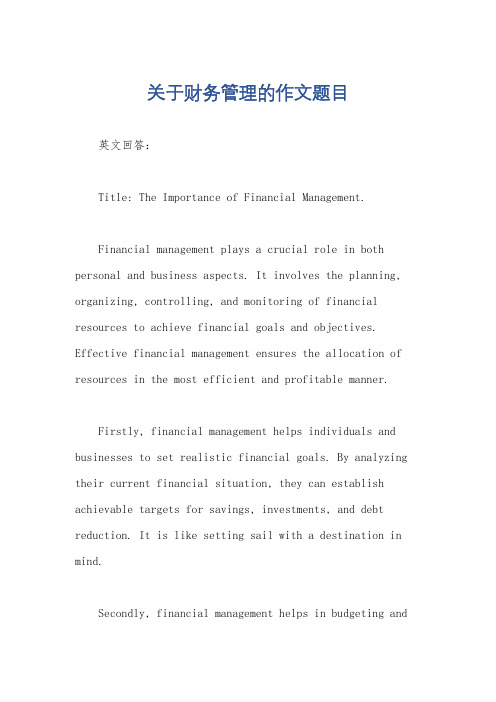

关于财务管理的作文题目

关于财务管理的作文题目英文回答:Title: The Importance of Financial Management.Financial management plays a crucial role in both personal and business aspects. It involves the planning, organizing, controlling, and monitoring of financial resources to achieve financial goals and objectives. Effective financial management ensures the allocation of resources in the most efficient and profitable manner.Firstly, financial management helps individuals and businesses to set realistic financial goals. By analyzing their current financial situation, they can establish achievable targets for savings, investments, and debt reduction. It is like setting sail with a destination in mind.Secondly, financial management helps in budgeting andcash flow management. It allows individuals and businesses to track their income and expenses, ensuring that they are spending within their means. As the saying goes, "Don't put all your eggs in one basket." It is important to allocate funds wisely and avoid unnecessary expenditures.Thirdly, financial management helps in risk management and contingency planning. By having a solid financial plan in place, individuals and businesses can better prepare for unexpected events, such as job loss or economic downturns. As the saying goes, "Don't put all your eggs in one basket." It is important to allocate funds wisely and avoid unnecessary expenditures.Furthermore, financial management enables individuals and businesses to make informed investment decisions. By understanding the risks and potential returns of various investment options, they can maximize their returns and minimize their losses. As the saying goes, "Don't put all your eggs in one basket." It is important to allocate funds wisely and avoid unnecessary expenditures.In conclusion, financial management is essential for individuals and businesses to achieve their financial goals. It provides a roadmap for success by setting realistic goals, managing cash flow, preparing for contingencies, and making informed investment decisions. As the saying goes, "Money makes the world go round." Therefore, it is crucialto manage our finances wisely to secure a stable and prosperous future.中文回答:题目,财务管理的重要性。

大一财务管理的英语知识点

大一财务管理的英语知识点一、Introduction to Financial ManagementFinancial management is a crucial aspect of business operations, involving the planning, organizing, controlling, and monitoring of financial resources. It plays a vital role in determining the financial health of a company and maximizing its value for shareholders. To excel in the field of financial management, it is essential to have a strong understanding of key concepts and principles in English. In this article, we will explore some important English knowledge points related to financial management for first-year college students.二、Financial StatementsFinancial statements are essential tools used by managers, investors, and creditors to analyze a company's performance and financial position. There are three main types of financial statements: the balance sheet, income statement, and cash flow statement.1. Balance SheetThe balance sheet provides a snapshot of a company's financial position at a specific point in time. It consists of three key components: assets, liabilities, and equity. Assets represent what the company owns,liabilities represent what the company owes, and equity represents the shareholders' ownership in the company.2. Income StatementThe income statement, also known as the profit and loss statement, shows a company's revenues, expenses, and net income (or loss) over a specific period. It helps assess a company's profitability and overall performance.3. Cash Flow StatementThe cash flow statement tracks the inflows and outflows of cash within a company during a given period. It provides information about the company's operating, investing, and financing activities and helps evaluate its liquidity and ability to generate cash.三、Financial RatiosFinancial ratios are useful tools for analyzing a company's financial performance and comparing it to industry standards. Here are some commonly used financial ratios:1. Liquidity RatiosLiquidity ratios measure a company's ability to meet short-term obligations. Examples include the current ratio (current assets divided by current liabilities) and the quick ratio (quick assets divided by current liabilities).2. Solvency RatiosSolvency ratios assess a company's long-term financial stability and its ability to meet long-term obligations. The debt-to-equity ratio (total debt divided by total equity) and the interest coverage ratio (earnings before interest and taxes divided by interest expense) are examples of solvency ratios.3. Profitability RatiosProfitability ratios measure a company's ability to generate profits relative to its assets, equity, or sales. Common examples include return on assets (net income divided by average total assets) and return on equity (net income divided by average total equity).四、Capital BudgetingCapital budgeting refers to the process of evaluating and selecting long-term investment projects. It involves estimating the future cash flows associated with each investment opportunity and determining itsviability. Several methods are used in capital budgeting, including net present value (NPV), internal rate of return (IRR), and payback period analysis.1. Net Present Value (NPV)NPV measures the profitability of an investment by comparing the present value of expected cash inflows to the present value of cash outflows. A positive NPV indicates that the investment is expected to generate a return higher than the cost of capital.2. Internal Rate of Return (IRR)IRR is the discount rate at which the present value of cash inflows equals the present value of cash outflows. It represents the expected rate of return for the investment and is used to rank different investment projects.3. Payback Period AnalysisPayback period analysis calculates the length of time required for an investment to recover its initial cost. It is a simple method that helps assess the risk and liquidity of an investment.五、Risk ManagementRisk management involves identifying, assessing, and mitigating potential risks that may impact a company's financial performance. It is crucial for financial managers to understand different types of risks and implement strategies to manage them effectively.1. Market RiskMarket risk refers to the uncertainty associated with changes in market conditions, such as interest rates, exchange rates, and stock prices. Hedging techniques, diversification, and financial derivatives are commonly used to manage market risk.2. Credit RiskCredit risk arises from the possibility of default by borrowers or counterparties. Credit analysis, credit ratings, and risk diversification are common strategies employed to manage credit risk.3. Operational RiskOperational risk relates to risks arising from internal processes, systems, and human error. Implementing robust internal controls, conducting regular audits, and maintaining proper insurance coverage are essential to manage operational risk.六、ConclusionAs first-year college students studying financial management, it is essential to grasp the fundamental knowledge and concepts in English. This article has provided an overview of key knowledge points in financial management, including financial statements, financial ratios, capital budgeting, and risk management. By developing a solid understanding of these topics, students can lay a strong foundation for their future studies and career in the field of finance.。

财务管理专业英语Topic 10

Dividends and Dividend Policy

Types of Dividends

❖ Cash Dividends ❖ Stock Dividends ❖ Property Dividends

❖ Second, the dividend can be a regular dividend, which is paid at regular intervals (quarterly, semi-annually, or annually), or a special dividend, which is paid in addition to the regular dividend.

❖ 股利宣布日是董事会宣布他们打算支付股利的日 期。

❖ The ex-dividend date is the cut-off date for receiving the dividend.

❖ 除息日是收到股利的截止日期。

❖ The record date is the date on which an investor must be a shareholder of the record to be entitled to the upcoming dividend only if they have bought the stock for at least two business days before the record date.

❖ In chronological order, the four important dates associated with a dividend payment are as follows.

财管课件Financial Management-topic04-2013

Term Structure of Interest Rate

Theories of term structure

Three theories of term structure: the expectation theory, the liquidity preference theory and the market segmentation theory

6-4

Learning Goals

LG7 Differentiate between debt andfeatures of both common and preferred stock. LG9 Describe the process of issuing common stock, including venture capital, going public and the investment banker.

2

Learning Goals

LG1 Describe interest rate fundamentals, the term structure of interest rates, and risk premiums. LG2 Review the legal aspects of bond financing and bond cost. LG3 Discuss the general features, yields, prices, popular types, and international issues of corporate bonds.

2

3 5

7

maturities

1 0

2 0

TreasuryYield Curve

介绍财务管理专业的英语作文范文

介绍财务管理专业的英语作文范文全文共10篇示例,供读者参考篇1Hello everyone! Today I am going to talk to you about the Finance major in college.Finance is a really cool major where you learn all about money and how to manage it. You learn about things like budgeting, investing, and saving. It’s super important to know how to handle money because it’s something we all use every day.In Finance classes, you will learn about different financial concepts like stocks, bonds, and mutual funds. You will also learn about how to create a budget and stick to it. Budgeting is like having a plan for your money so you can make sure you have enough for everything you need.Another thing you will learn about in Finance is investing. Investing is when you put your money into things like stocks or real estate to make more money over time. It’s like planting seeds and watching them grow into big plants.Saving is also a big part of Finance. You will learn about different ways to save money like putting it in a bank account or a retirement fund. Saving money is important because it helps you reach your financial goals in the future.Overall, Finance is a really interesting major where you can learn a lot of useful skills that will help you in your future. So if you are good with numbers and like working with money, Finance might be the perfect major for you!篇2Hello everyone! Today I want to talk to you about the Finance Management major. Finance Management is a super cool major where you can learn all about money and how to manage it wisely. It's like learning how to be a money wizard!In finance management, you will learn about things like budgeting, investing, and even how to make smart decisions with your money. You will also learn about different types of financial instruments like stocks, bonds, and mutual funds. It's kind of like playing a game but with real money!One of the most exciting things about studying finance management is that you can use your knowledge to help people and businesses make better financial decisions. You could workin a bank, a financial planning firm, or even start your own business someday. The possibilities are endless!So if you love math, have a knack for problem-solving, and want to make a difference in people's lives, then finance management might be the perfect major for you. It's challenging, rewarding, and most importantly, a lot of fun!I hope you consider studying finance management and join me in becoming a money wizard. Thanks for listening!篇3Oh, hi everyone! Today I want to talk to you about the major of financial management. Financial management is a super cool major that teaches you all about money and how to manage it properly. It's like learning how to be a money wizard!In this major, you will learn about things like budgeting, saving, investing, and even how to make wise decisions about your finances. You will also learn about different financial instruments like stocks, bonds, and mutual funds. It's like being in a big treasure hunt and learning how to make your money grow.One of the best things about studying financial management is that it opens up a lot of career opportunities for you. You can become a financial analyst, a financial planner, or even work for a big financial institution. The world is your oyster when you have a degree in financial management!But remember, with great power comes great responsibility. Managing money is a big deal and it's important to be smart about it. So if you're interested in numbers, money, and making smart decisions, then financial management might just be the perfect major for you.So why not give it a try? Who knows, you might just become the next Warren Buffett or Suze Orman! Think about it, and maybe one day you'll be managing your own money like a pro. Good luck!篇4Sure, here is an example of an English essay introducing the finance major in a more child-friendly and casual tone:Finance Major Rocks!Hi guys! Today I want to tell you about something super cool - studying finance! Finance is all about managing money andmaking smart decisions about how to use it. Sounds awesome, right?First of all, let me tell you why finance is so important. Money makes the world go round, and knowing how to handle it is essential. With a finance degree, you can work in banks, investment firms, or even start your own business. You can help people save for their future, invest wisely, and make smart financial decisions.In finance classes, you'll learn all about budgeting, investing, and financial planning. You'll also learn about stocks, bonds, and other ways to make money grow. It's like a super fun puzzle where you get to figure out the best ways to make and manage money.But don't worry, it's not all about numbers and math. Finance is also about problem-solving, critical thinking, and communication skills. You'll work with others to come up with creative solutions to financial challenges, and learn how to explain complex ideas in simple ways.So, if you love numbers, challenges, and helping people make smart decisions, finance might be the perfect major for you. Plus, it's a great way to set yourself up for a successful andrewarding career. What are you waiting for? Join the finance major club today and start rocking the finance world!篇5Hello everyone! Today I want to introduce to you the major of Financial Management.Financial Management is a really cool major because it helps you learn how to handle money and make smart decisions about finances. You get to learn all about budgeting, investing, saving, and even how to plan for the future. It's like being a money superhero!In this major, you will learn about different financial tools and techniques that can help you manage money for yourself or for a company. You will also learn how to analyze financial data, make forecasts, and create budgets. It's like solving a big money puzzle!One of the best parts about studying Financial Management is that you can use what you learn in real life. You can help yourself and others make smart decisions about money. It's like having a superpower that can make people's lives better!If you are good with numbers, like solving problems, and enjoy thinking about the future, then Financial Management might be the perfect major for you. It's a fun and rewarding field that can open up a lot of opportunities for your future career.So if you want to learn how to be a money superhero and help people with their finances, consider studying Financial Management. It's a super cool major that can lead to a super bright future!篇6Hi everyone! I want to introduce you to the exciting world of financial management. Financial management is a cool major that teaches you how to manage money and make smart decisions about finances. It's like playing a game where you have to make the right moves to win!In financial management, you learn about things like budgeting, investing, and saving. You also study how businesses make money and how to make sure they are using their money wisely. It's super interesting and you get to use your math skills to solve problems and make predictions.One of the best parts about studying financial management is that you can apply what you learn to your own life. You'll learnhow to create a budget, save for the future, and even start investing in the stock market. It's like learning the secrets to building wealth and securing your financial future.So if you love math, puzzles, and money, then financial management might be the perfect major for you. You'll learn valuable skills that will help you succeed in the business world and in your personal life. Plus, you'll have a lot of fun along the way!I hope this introduction to financial management has piqued your interest. Give it a try and see where it takes you. Who knows, you might just discover a passion for managing money and building a successful financial future. Good luck!篇7Hi everyone, today I want to introduce you to the major of Finance Management. It's super cool and important, so listen up!Finance Management is all about managing money. Yeah, you heard me right, MONEY. Money is important in our lives, right? We need money to buy stuff, go on trips, and even save for the future. That's why Finance Management is so important. It teaches us how to handle money wisely and make smart decisions about it.In this major, we learn about budgeting, investing, and financial planning. Budgeting is like making a plan for howyou're going to spend your money each month. It's important to budget so you don't spend more than you have. Investing is about making your money grow. You can invest in stocks, real estate, or even start your own business. Financial planning is all about setting goals for your future and figuring out how to reach them.With a degree in Finance Management, you can work in many different jobs. You could be a financial analyst, a banker, or even start your own financial planning business. The possibilities are endless!So, if you're good with numbers and like working with money, Finance Management might be the perfect major for you. It's challenging, but also super rewarding. Who knows, maybe you'll be the next Warren Buffett!篇8Title: Introduction to Financial ManagementHey guys! Today I'm going to talk to you about the super cool major - financial management! Financial management is allabout managing money, making smart investment decisions, and helping businesses grow. It's like being a money wizard!First off, let's talk about what financial management actually is. Basically, it's all about planning, organizing, directing, and controlling financial activities within a business or organization. This includes things like budgeting, forecasting, analyzing financial statements, and making investment decisions. It's like being the boss of money!One of the coolest things about studying financial management is learning how to make smart investment decisions. You get to study different investment options, analyze risks, and come up with strategies to help businesses make money. It's like being a detective, but instead of solving crimes, you're solving money problems!Another awesome thing about studying financial management is that you get to work with numbers all day. If you love math and problem-solving, this major is perfect for you! You also get to learn about different financial tools and software that can help you make better decisions. It's like having a superpower!So, if you're interested in money, math, and helping businesses grow, consider studying financial management. It's asuper fun and rewarding major that can open up a ton of career opportunities for you. Plus, who knows, maybe you'll be the next Warren Buffett!篇9Hello everyone, I'm here to introduce you to the exciting world of finance management! Finance management is a really important subject that helps us learn how to handle money wisely and make good financial decisions.In finance management, we learn all about budgeting, saving, investing, and even how to plan for big expenses like buying a house or starting a business. We also study things like taxes, insurance, and how to manage debt. It's all about understanding how money works and how we can use it to reach our goals.One of the coolest things about studying finance management is that it can open up a lot of career opportunities for us in the future. We can work as financial analysts, investment bankers, financial planners, or even start our own businesses. The possibilities are endless!But studying finance management isn't just about getting a good job or making a lot of money. It's also about developingimportant skills like critical thinking, problem-solving, and communication. These skills will help us succeed not just in our careers, but in life in general.So if you're interested in learning how to make smart financial decisions and build a secure future for yourself, consider studying finance management. It's a fun and rewarding subject that will help you grow and achieve your goals. I hope this introduction has inspired you to explore the world of finance management further. Thank you for listening!篇10Financial management is super cool! It's all about money, budgeting, and making smart financial decisions. If you're good with numbers and like to plan ahead, then this might be the perfect major for you.In financial management, you'll learn all about how to manage money for businesses and individuals. You'll study topics like investment strategies, risk management, and financial analysis. It's like being a money detective, trying to figure out the best ways to make and grow money.One of the best things about studying financial management is that it's super practical. You'll learn skills that you can use inyour everyday life, like how to create a budget, save for the future, and make smart investment choices. You'll also learn how to analyze financial statements and make recommendations based on your findings.Another great thing about this major is that it can lead to a wide range of career opportunities. You could work in finance, banking, investments, or even start your own business. The possibilities are endless!So if you love numbers, planning, and making money work for you, then financial management might be the perfect major for you. It's a challenging but rewarding field that can set you up for a successful and fulfilling career. So why not give it a try? Who knows, you might just become a financial whiz kid!。

财务管理专业英语练习题

专业英语作业Topic 1:Agency is an area of commercial institution dealing with a contractual or quasi-contractual, or non-contractual set of relationships when a person, called the agent, is authorized to act on behalf of another (called the principal) to create a legal relationship with a third party.Money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames.Capital market is a market for securities (debt or equity), where business enterprises and governments can raise long-term funds. It is defined as a market in which money is provided for periods longer than a year.Spontaneous financing refers to the automatic source of short term funds arising in the normal course of short term course of business. Trade credit and out standing expenses are examples of spontaneous financing.Financial intermediary is a financial institution that connects surplus and deficit agents. Secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan.Unsecured Loan A loan that is issued and supported only by the borrower's creditworthiness, rather than by some sort of collateral.Marketability is a measure of the ability of a security to be bought and sold for a price at which similar items are dealling.Perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. Hedge-matching In asset management, the coordination of an organization's cash inflows with cash outflows by matching the maturity of income generating assets (such as certificates of deposit) with the maturity of interest incurring liabilities (debts).Topic 2:美国IBM从1984年左右开始由兴到衰,由年盈利66亿美元到1992年亏损达49.7亿美元。

财务管理专业英语翻译(老师划的重点)

第一单元Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理师为了实现一个公司总体目标而进行涉及到获取、融资和资产管理的综合决策过程Other names for financial management include managerial finance , corporate finance, and business finance.财务管理的其他名称,包括理财,企业融资,商业融资。

Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-held firms to large publicly-traded corporations做财务管理决策对于所有形式和规模的商业组织,无论是小型私人公司还是大型股份公开交易的公司来说,都是不可分割的一部分。

The person associated with the financial management function is usually a top officer of the firm such as a vice president of finance or chief financial officer (CFO).与财务管理职能相关的人通常是在诸如财务副总裁或财务总监的公司高层官员This individual typically reports directly to the president or the chief executive officer (CEO).这样的人通常直接报告总裁或首席执行官In today’s rapidly changing environment, the financial manager must have the flexibility to adapt to external factors such as economic uncertainty, global competition, technological change, volatility of interest and exchange rates, changes in laws and regulations, and ethical concerns.在当今瞬息万变的环境、财务经理必须有灵活的时间来适应外部因素如经济不确定性、国际竞争、技术变革、利息和汇率波动变化的法律、法规,伦理问题。

财务管理专业 英语

business 企业商业业务financial risk 财务风险sole proprietorship 私人业主制企业partnership 合伙制企业limited partner 有限责任合伙人general partner 一般合伙人separation of ownership and control 所有权与经营权分离claim 要求主张要求权management buyout 管理层收购tender offer 要约收购financial standards 财务准则initial public offering 首次公开发行股票private corporation 私募公司未上市公司closely held corporation 控股公司board of directors 董事会executove director 执行董事non- executove director 非执行董事chairperson 主席controller 主计长treasurer 司库revenue 收入profit 利润earnings per share 每股盈余return 回报market share 市场份额social good 社会福利financial distress 财务困境stakeholder theory 利益相关者理论value (wealth) maximization 价值(财富)最大化common stockholder 普通股股东preferred stockholder 优先股股东debt holder 债权人well-being 福利diversity 多样化going concern 持续的agency problem 代理问题free-riding problem 搭便车问题information asymmetry 信息不对称retail investor 散户投资者institutional investor 机构投资者agency relationship 代理关系net present value 净现值creative accounting 创造性会计stock option 股票期权agency cost 代理成本bonding cost 契约成本monitoring costs 监督成本takeover 接管corporate annual reports 公司年报balance sheet 资产负债表income statement 利润表statement of cash flows 现金流量表statement of retained earnings 留存收益表fair market value 公允市场价值marketable securities 油价证券check 支票money order 拨款但、汇款单withdrawal 提款accounts receivable 应收账款credit sale 赊销inventory 存货property,plant,and equipment 土地、厂房与设备depreciation 折旧accumulated depreciation 累计折旧liability 负债current liability 流动负债long-term liability 长期负债accounts payout 应付账款note payout 应付票据accrued espense 应计费用deferred tax 递延税款preferred stock 优先股common stock 普通股book value 账面价值capital surplus 资本盈余accumulated retained earnings 累计留存收益hybrid 混合金融工具treasury stock 库藏股historic cost 历史成本current market value 现行市场价值real estate 房地产outstanding 发行在外的a profit and loss statement 损益表net income 净利润operating income 经营收益earnings per share 每股收益simple capital structure 简单资本结构dilutive 冲减每股收益的basic earnings per share 基本每股收益complex capital structures 复杂的每股收益diluted earnings per share 稀释的每股收益convertible securities 可转换证券warrant 认股权证accrual accounting 应计制会计amortization 摊销accelerated methods 加速折旧法straight-line depreciation 直线折旧法statement of changes in shareholders’equity 股东权益变动表source of cash 现金来源use of cash 现金运用operating cash flows 经营现金流cash flow from operations 经营活动现金流direct method 直接法indirect method 间接法bottom-up approach 倒推法investing cash flows 投资现金流cash flow from investing 投资活动现金流joint venture 合资企业affiliate 分支机构financing cash flows 筹资现金流cash flows from financing 筹资活动现金流time value of money 货币时间价值simple interest 单利debt instrument 债务工具annuity 年金future value 终至present value 现值compound interest 复利compounding 复利计算pricipal 本金mortgage 抵押credit card 信用卡terminal value 终值discounting 折现计算discount rate 折现率opportunity cost 机会成本required rate of return 要求的报酬率cost of capital 资本成本ordinary annuity普通年金annuity due 先付年金financial ratio 财务比率deferred annuity 递延年金restrictive covenants 限制性条款perpetuity 永续年金bond indenture 债券契约face value 面值financial analyst 财务分析师coupon rate 息票利率liquidity ratio 流动性比率nominal interest rate 名义利率current ratio 流动比率effective interest rate 有效利率window dressing 账面粉饰going-concern value 持续经营价值marketable securities 短期证券liquidation value 清算价值quick ratio 速动比率book value 账面价值cash ratio 现金比率marker value 市场价值debt management ratios 债务管理比率intrinsic value 内在价值debt ratio 债务比率mispricing 给……错定价格debt-to-equity ratio 债务与权益比率valuation approach 估价方法equity multiplier 权益乘 discounted cash flow valuation 折现现金流量模型long-term ratio 长期比率undervaluation 低估debt-to-total-capital 债务与全部资本比率overvaluation 高估leverage ratios 杠杆比率option-pricing model 期权定价模型interest coverage ratio 利息保障比率contingent claim valuation 或有要求权估价earnings before interest and taxes 息税前利润promissory note 本票cash flow coverage ratio 现金流量保障比率contractual provision 契约条款asset management ratios 资产管理比率par value 票面价值accounts receivable turnover ratio 应收账款周转率 maturity value 到期价值inventory turnover ratio 存货周转率coupon 息票利息inventory processing period 存货周转期coupon payment 息票利息支付accounts payable turnover ratio 应付账款周转率coupon interest rate 息票利率cash conversion cycle 现金周转期maturity 到期日asset turnover ratio 资产周转率term to maturity 到期时间profitability ratio 盈利比率call provision赎回条款gross profit margin 毛利润call price 赎回价格operating profit margin 经营利润sinking fund provision 偿债基金条款net profit margin 净利润conversion right 转换权return on asset 资产收益率put provision 卖出条款return on total equity ratio 全部权益报酬率indenture 债务契约return on common equity 普通权益报酬率covenant 条款market-to-book value ratio 市场价值与账面价值比率 trustee 托管人market value ratios 市场价值比率protective covenant 保护性条款dividend yield 股利收益率negative covenant 消极条款dividend payout 股利支付率positive covenant 积极条款financial statement财务报表secured deht担保借款profitability 盈利能力unsecured deht信用借款viability 生存能力creditworthiness 信誉solvency 偿付能力collateral 抵押品collateral trust bonds 抵押信托契约debenture 信用债券bond rating 债券评级current yield 现行收益yield to maturity 到期收益率default risk 违约风险interest rate risk 利息率风险authorized shares 授权股outstanding shares 发行股treasury share 库藏股repurchase 回购right to proxy 代理权right to vote 投票权independent auditor 独立审计师straight or majority voting 多数投票制cumulative voting 积累投票制liquidation 清算right to transfer ownership 所有权转移权preemptive right 优先认股权dividend discount model 股利折现模型capital asset pricing model 资本资产定价模型constant growth model 固定增长率模型growth perpetuity 增长年金mortgage bonds 抵押债券。

财务管理基础英文大纲

财务管理基础英文大纲 Company Document number:WUUT-WUUY-WBBGB-BWYTT-1982GTFoundation of Financial ManagementModule syllabusTeacher Name: Zhanwei LiuSchool Name: Xuchang University1. Unit descriptionFinancial management is part of the decision-making, planning and control subsystems of an enterprise. It incorporates the treasury function, which includes the management of working capital and the implicationsarising from exchange rate mechanisms due to international competition, evaluation, selection, management and control of new capital investment opportunities, raising and management of the long-term financingof an entity.The management of risk in the different aspects of the financial activities undertaken is also addressed. Studying this course should provide you withan overview of the problems facing a financial manager in the commercial world. It will introduce you to the concepts and theories of corporate finance that underlie the techniques that are offered as aids for the understanding, evaluation and resolution of financial managers’ problems. This subject guideis written to supplement the Essential and Further reading listed for this course, not to replace them. It makes no assumptions about prior knowledge other than that you have completed Principles of accounting.The aim of the course is to provide an understanding and awareness of both the underlying concepts and practical application of the basics offinancial management. The subject guide and the readings should also help to build in your mind the ability to make critical judgments of the strengths and weaknesses of the theories, just as it should be helping to build a critical appreciation of the uses and limitations of the same theories and theirpossible applications.On successful completion of the module, learners will be able to:●describe how different financial markets function and estimate thevalue of different financial instruments (including stocks andbonds)●make capital budgeting decisions under both certainty anduncertainty●apply the capital assets pricing model in practical scenarios●discuss the capital structure theory and dividend policy of a firm●estimate the value of derivatives and advise management how to usederivatives in risk management and capital budgeting●describe and assess how companies manage working capital andshort- term financing2. Pre-requisite units and assumed knowledgeAccounting, Economics3. Learning aims and outcomesLearning Outcome 1Explain the method of financial analysis and planningASSESSMENT CRITERIA:a. Explain the goals and objectives of financial managementb. Demonstrate a reasonable ability to prepare the three basic financialstatementsc. Discuss the method of financial analysisd. Explain the operating leverage, financial leverage. and combinedleverageLearning Outcome 2Explain the manager how to manage working capitalASSESSMENT CRITERIA:a. Explain the context of risk-return analysisb. Explain the financial manager how to choose between liquid, low-returnassets and more profitable, less liquid assetsLearning Outcome 3Explain the process of the capital budgetingASSESSMENT CRITERIA:a. Discuss the time value of moneyb. Explain the valuation of bonds and stocksc. Explain the cost of capital and capital structured. Explain the capital budgeting decision and risk-return analysisLearning Outcome 4Explain the long-term financing in the capital marketsASSESSMENT CRITERIA:a. Explain the long-term debt and lease financingb. Explain the common stock and preferred stock financingc. Explain the dividend policy and retained earningsd. Explain the warrants and convertibles covered, as well as the moreconventional methods of financing4. Weighting of final gradeGrades will be assigned on the basis of the following percentages:5. GradingA 100-95 A- 94-90 B+ 89-87B 86-83 B- 82-80 C+ 79-77C 76-73 C- 72-70 D+ 69-67D 66-63 D- 62-60 F 59 or lower6. PoliciesAttendance PolicyAttendance in class is a very important part of your learning experience. As such, failure to attend class will reduce your grade, and may be grounds for failure in the course. If you are late to class, your attendance score may also be affected. In the event of unavoidable absences, such as serious illness, or deaths in the family, students may be requested to provide documentary evidence of the reason for their absence to their academic coordinator. You should not give these to your instructor. Students are solely responsible for the makeup of any missed classes, and for obtaining any class materials or assignments that they may miss. You are expected to come to class prepared to actively participate in class discussions.Participation PolicyStudents should participate in their chosen classes actively and effectively. The Participation Grade is related to the Attendance Grade. Students’ final attendance grade is the maximum of their participation grade.Participation grade will be based on a variety of factors including, but not limited to taking part in class discussions and activities, completingassignments, being able to answer questions correctly, obeying class rules, and being prepared for class, frequent visiting your instructors and chatting in English during their office hours is highly recommended.Policy on Assignments and QuizzesStudents should finish their assignments completely and punctually. Assignment should be submitted on the date appointed by the instructor. If a student cannot hand in the assignment on time, the reasonable excuse will be needed. Late assignments will receive a maximum grade of 80. An assignment that is late for 3 days will be corrected but receive 0.You are recommended print all your assignment in the uniform format with the heading of Student’s Pledge of no cheating. Written assignment or printed ones without the uniform heading of pledge will receive a maximum grade of 80.It is mandatory to have weekend assignment every week. Any weekend assignment should be submitted on first class of next week. It is mandatory to have holiday assignment on the public holidays. Any holiday assignment should be submitted on the first day on returning to school. Students are required to do a multitude of presentations during the course.Plagiarism and CopyingPlagiarism is using someone else’s work or ideas as your own without giving them proper credit or copying someone else’s work a nd presenting it as your has a very strict plagiarism policy and will not tolerate academic cheating in any form. Penalties can be as severe as expulsion from the university. At the very least, no one will receive any credit for assignments that appear to be copied from another student. To avoid plagiarism, do your own work, or cite the work of others appropriately. You can refer to the course catalogue for more information about plagiarism policy.If you cheat on the homework, I can guarantee you that you will fail the class. Every exam I give has several problems that require you to submit journal entries, create financial statements in proper form, or to create schedulesshowing certain details that you have to calculate. If you do not practice doing these things by doing the homework yourself and correcting your own work in class, you will lose a significant number of points on the exams.Classroom Policies●No eating, cellular phones, electronic dictionaries, smoking, chatting ordrowsing in class.●Please speak in English rather than Chinese in class.●Students are not allowed to attend class without textbooks.●Stand up when answering questions.●Respect classmates’ ideas, opinions, and questions of your classmates.●You are welcome to visit the instructor’s office in his/her office hours.●Take good care of the laboratory facilities. Do not splash water on thedesktop.●When each class is over, hang the earphone on the hanger. Put the trashinto the trash-bin.●All your classroom involvement, performance and after-classcommunications with instructor will affect your participation score.7. Texts and other recoursesThe primary textbook:Stanley . Foundation of financial management, 14th ed.The supplementary textbook:Richard A. Barealey et al(2011) fundamentals of corporate finance(6th ed.). Renmin university of China pressWEB SITES:Teaching methodsDiscussions and Homework8. Session Plan。

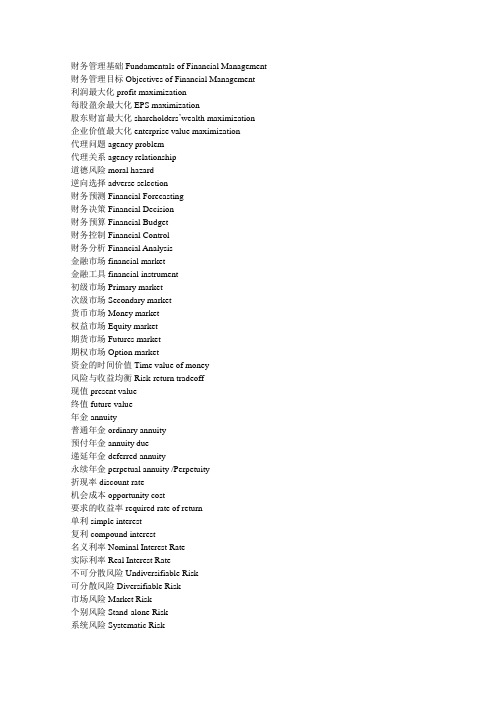

财务管理专业英语

财务管理基础Fundamentals of Financial Management 财务管理目标Objectives of Financial Management利润最大化profit maximization每股盈余最大化EPS maximization股东财富最大化shareholders’wealth maximization企业价值最大化enterprise value maximization代理问题agency problem代理关系agency relationship道德风险moral hazard逆向选择adverse selection财务预测Financial Forecasting财务决策Financial Decision财务预算Financial Budget财务控制Financial Control财务分析Financial Analysis金融市场financial market金融工具financial instrument初级市场Primary market次级市场Secondary market货币市场Money market权益市场Equity market期货市场Futures market期权市场Option market资金的时间价值Time value of money风险与收益均衡Risk-return tradeoff现值present value终值future value年金annuity普通年金ordinary annuity预付年金annuity due递延年金deferred annuity永续年金perpetual annuity /Perpetuity折现率discount rate机会成本opportunity cost要求的收益率required rate of return单利simple interest复利compound interest名义利率Nominal Interest Rate实际利率Real Interest Rate不可分散风险Undiversifiable Risk可分散风险Diversifiable Risk市场风险Market Risk个别风险Stand-alone Risk系统风险Systematic Risk非系统风险Nonsystematic Risk经营风险Operational Risk财务风险Financial Risk期望收益expected return方差variance标准差standard deviation标准离差率coefficient of variation普通股common stock优先股preferred stock有面值股票par value stock无面值股票no par value stock记名股票inscribed stock无记名股票bearer stock特别处理ST(Special Treatment)特别转让PT(Particular Transfer)累积优先股Cumulative preferred stock非累积优先股Non-cumulative preferred stock参加优先股Participating preferred stock非参加优先股Non-participating Preferred Stock可转换优先股Convertible preferred stock长期借款Long-term loan债券Bond面值face value, maturity value or par value息票率stated interest rate市场利率market interest rate租赁Lease经营租赁Operating lease融资租赁capital lease应付账款Accounts payable应付票据Note payable资本成本The Cost of Capital留存收益Retained earnings股利折现模型(Discounted Cash Flow, DCF)股利固定增长模式(Dividend-yield plus growth rate approach)资本资产定价模型(CAPM)债券收益加风险溢价法(Bond-yield-plus-risk-premium approach) 加权平均资本成本(Weighted Average Cost of Capital, WACC)边际资本成本(Marginal Cost of Capital, MCC)经营杠杆系数(Degree of Operating Leverage, DOL)财务杠杆系数(Degree of Financial Leverage, DFL)资本结构Capital Structure现金流量cash flow净现金流量net cash flow净现值(Net Present V alue, NPV)内部收益率(Internal Rate of Return, IRR)获利指数(Profitability Index, PI)会计收益率(Average Rate of Return, ARR)投资回收期(Payback Period, PP)营运资本working capital应收账款Accounts receivable存货Inventory宣告日Declaration date除息日Ex-dividend date股权登记日Record date发放日Payment date现金股利cash dividend股票股利stock dividend财产股利property dividend股利分配政策dividend policies剩余股利政策residual dividend policy固定股利或稳定增长股利政策stable dollar dividend policy固定股利支付率政策constant dividend payout ratio低正常股利加额外股利政策low regular plus specially designated dividends。

财务管理专业英语期末复习

财务管理专业英语期末复习Coca-cola standardization office【ZZ5AB-ZZSYT-ZZ2C-ZZ682T-ZZT18】财务管理专业英语期末重点一、单词Topic1财务管理 financial management资本预算 capital budgeting资本结构 capital structure股利政策 dividend policy存货 inventory风险规避 risk aversion股东权益 stockholder s’ equity流动负债 current liabilityTopic2财务风险 financial risk合伙制企业 partnership私人业主制企业 sole proprietorship收入 revenue主计长 controller财务困境 financial distress股票期权 stock option首次公开发行股票(IPO) initial public offeringTopic 3盈利能力 profitability偿付能力 solvency利润表 income statement有价证券 marketable securities提款 withdrawal应收账款 accounts receivable递延税款 deferred taxTopic4流动性比率 liquidity ratio权益乘数 equity multiplier资产收益率(ROA) return on assets毛利 gross profit margin权益报酬率 return on equity市盈率 P/E ratio杠杆比率 leverage ratio息税前盈余(EBIT) earnings before interest and taxes Topic5货币时间价值 time value of money年金 annuity折现率 discount rate机会成本 opportunity cost递延年金 deferred annuity条款 covenant到期收益率 yield to maturity违约风险 default riskTopic6组合 portfolio可分散风险 diversifiable risk概率 probability灵敏度分析 sensitivity analysis有效市场假说 efficient market hypothesis套利定价理论(APT) arbitrage pricing theory资本资产定价模型 capital asset pricing model期望收益 expected returnTopic7资本支出 capital expenditure资本预算 capital budget破产 bankruptcy制造费用 overhead模拟 simulation期后审计 post-audit沉没成本 sunk cost附加效应 side effectTopic8金融市场 financial market回购 repurchase操纵 manipulate承销 underwriting私人控股公司 privately held corporation公开上市 go public公开发行 public offer加权平均资本成本 weighted average cost of capital Topic9混合证券 hybrid security风险资本 venture capital期权交易 option exchange贷款额度 line of credit租赁 lease最优资本结构 optimal capital structure目标资本结构 desired or target capital structure 可转换债券 convertible bondTopic10股票回购 stock repurchase股票股利 stock dividends股票分割 stock split所有权稀释 dilution of ownership剩余股利政策 residual dividend policy清算股利 liquidating dividend现金股利 cash dividends股票股利 stock dividendsTopic11营运资本管理 working capital management商业票据 commercial paper支出 disbursement信用期限 credit period交易动机 transaction motive短期有价证券 marketable security回购协议 repurchase agreement银行承兑汇票 bankers’ acceptanceTopic12国际财务管理 international financial management国际货币基金组织 International Monetary Fund跨国公司 multinational corporation /international corporation汇率 exchange rate间接标价 indirect quotation贬值 depreciate远期交易 forward trade货币互换 currency swap二、计算公式公式资本资产定价模型公式 capital assets pricing modelr i=r RF+(R M- r RF)?i r RF= risk free rate资产无风市场风险系数R M= market rate预期险市回报回报场利率率率公式加权平均资本成本 weighted average cost of capitalWACC=(k e*w e)+[k d*(1-t)*W d]WACC=[equity/(equity+debt)]*cost of equity*(1-corporate tax rate) Wacc=(股权/总资本)*股权成本+(债务/总资本)*债务成本*(1-企业所得税率)三、填空risk of an asset can be considered in two ways (1)on a stand-alone basis. where the asset’s cash flows are analyzed bythemselves ,or(2)a portfolio context, where the asset’s cash flows are combine with those of other asset.a portfolio context ,an asset’s risk can be divided into two components :在投资组合中资产风险可以分为(1)diversifiable risk ,which can be diversified away and thus is of little concern to diversifiedinvestors , and (2)market risk, which reflect the risk of a general stock market risk decline and cannot be eliminated by diversification.3 .There are three types of financial market efficiency 金融市场的有效性(1)allocationally efficient(2)operationally efficient(3)informationally efficient4. Project Classifications 项目分类(1)expansion project 扩建项目(2)replacement project 更新项目(3)Independent project 独立项目(4)Mutually exclusive project 互不相容项目Rules 投资政策Managers use a variety of rules to evaluate and select capital investments; 管理使用各种各样的规则来评估和选择投资(1)Net Present value (NPV) 净现值(2)Profitability index(PI) 现值系数(3)Internal rate of return (IRR) 内部报酬率(4)Payback period (PP) 回购期 and(5)Discounted payback period (DDP) 折扣回购期6,The post-audit has two main purpose :期后审计的两个虽最重要目的(1)Improve forecasts 提高预测(2)Improve operations 改善经营market serve three important functions in a healthy economy:金融市场在健全经济体系中的三个重要功能(1)Help channel funds from suppliers to demanders 帮助供应商和需求者建立资金渠道(2)Provide a resale market .提供零售市场(3)Set market price and rates of return 设置市场价格和收益率of Financial Markets 金融市场的类型(1)Money Market /Capital Market 货币市场和资本市场(2)Primary Market /Secondary market一级市场和二级市场(3)Private Market / Public Market 私下市场和公开市场banks provide three major services in handing a new security issue :投资银行在持有新证券发行时提供的三个主要服务:(1)Advising 咨询(2)Underwriting 承销(3)Marketing 营销股权融资(1)Owner’s equity所有者权益(2)Venture Capital and private Equity风险投资和私募投资(3)common stock 普通股(4)warrants 认证权证(5)Contingent value right 或有价值权利债务融资(1)bank debt 银行借款(2)bonds 债券(3)leases 租赁generally consider the following factor when making capital structure decisions:公司选择资本结构时一般要考虑下列因素(1)Sale stability 销售稳定性(2)Asset structure 资产结构(3)Operating leverage 经营杠杆(4)Growth 增长率(5)Profitability 盈利能力(6)Taxes 税收(7)Control 控制(8)Management attitudes 管理(9) Lender and rating agency attitudes 贷款人及评级机构的态度(10) Market conditions 市场条件(11) The firm’s internal condition 企业内部条件(12)Financial flexibility 财务灵活性payout procedure 派息程序(1)Declaration date 除息日(2)Ex-dividend date 除息日(3)record date 股权登记日(4)Payment date 股利支付日14. Types of dividends 股利种类(1)Cash dividend 现金股利(2) Stock dividend 股票股利(3)Property dividend 财产股利15. Factors Influencing the dividend decision 影响股利决策因素(1)Shareholder factors 股东因素 (2) Firm factors 公司因素 (3) Other constraints 其他因素16. Cash management involves three major decision areas 现金管理的三个决策(1)Determining appropriate cash balances 确定适当的现金余额(2)Investing idle cash 投资闲置资金(3)Managing collections and disbursements 管理收款和付款17. Credit policy 信贷政策5csOne technique that is useful aid in deciding whether to grant credit is the Five Cs of Credit .Credit analysts generally consider five factors when determining whether to grant credit:(1)character 特征 (2) capacity 能力 (3) capital 资本 (4) collateral 抵押(5)conditions 条件18. Inventory management techniques 存货管理技术Management commonly use four inventory management techniques:管理者通常使用的4个存货管理制度(1)the abc system abc系统(2)the economic order quantity(EOQ) model 经济定价量模型(3)the just-in-time (JII) system 定时采购系统(4) the materials requirement planning (MRP) system 物料需求。

财务管理专业英语

PPT文档演模板

财务管理专业英语

1.2.2 Financing Decisions

o If the firm decides to raise funds externally, the financial manager can do so by incurring debts, such as through bank loans or the sale of bonds, or by selling ownership interests through a stock offering.

o 会计科目;账户

PPT文档演模板

财务管理专业英语

1)Account、Accounting & Accountant

o Accounting:会计、会计学 Financial Accounting and Managerial Accounting are two major specialized fields in Accounting. 财务会计和管理会计是会 计的两个主要的专门领域。 Accounting elements 会计要素

PPT文档演模板

财务管理专业英语

三、others—其它

o 作业 o 平时成绩占期末总成绩的10%

PPT文档演模板

财务管理专业英语

1、Introduction to Financial Management (1)

1.1 Financial Management and Financial Manager

9. Capital Structure 资本结构

10. Dividend Policy 股利政策

11. Working Capital Management 营运资本管理

财务管理专业外语 翻译

Capital budgeting is an extremely important aspect of a firm’s financial management。

Although a single capital asset usually comprise a small percentage of a firm’s total assets,all capital assets are long-term。

Therefore,a firm that makes a mistake in its capital budgeting process has to live with that mistake for a long period of time。

资本预算是一个公司财务管理中一个极其重要的方面。

一个单向的资产通常由公司的一小部分总资产组成,所有的资产都是长期的。

因此,一个公司在它的资本预算过程中犯了一个错误,那这个错误也将持续一段时间。

For instance,management may wish to know the effect on net present value if a project’s net cash flows are either 20 percent less than,or20 percent greater than,those estimated。

Knowledge of the sensitivity of net present value to changes or errors in the variables places management in a better position to decide whether a project is too risky to accept。

例如,管理过程中希望知道如果一个项目的现金流量净额小于20%或者大于20%是否对净现值有影响。

财务管理专业英语期末复习

财务管理专业英语期末重点一、单词Topic1财务管理financial management资本预算capital budgeting资本结构capital structure股利政策dividend policy存货inventory风险规避risk aversion股东权益stockholder s’ equity流动负债current liabilityTopic2财务风险financial risk合伙制企业partnership私人业主制企业sole proprietorship收入revenue主计长controller财务困境financial distress股票期权stock option首次公开发行股票(IPO) initial public offering Topic 3盈利能力profitability偿付能力solvency利润表income statement有价证券marketable securities提款withdrawal应收账款accounts receivable递延税款deferred taxTopic4流动性比率liquidity ratio权益乘数equity multiplier资产收益率(ROA) return on assets毛利gross profit margin权益报酬率return on equity市盈率P/E ratio杠杆比率leverage ratio息税前盈余(EBIT) earnings before interest and taxes Topic5货币时间价值time value of money年金annuity折现率discount rate机会成本opportunity cost递延年金deferred annuity条款covenant到期收益率yield to maturity违约风险default riskTopic6组合portfolio可分散风险diversifiable risk概率probability灵敏度分析sensitivity analysis有效市场假说efficient market hypothesis套利定价理论(APT) arbitrage pricing theory资本资产定价模型capital asset pricing model期望收益expected returnTopic7资本支出capital expenditure资本预算capital budget破产bankruptcy制造费用overhead模拟simulation期后审计post-audit沉没成本sunk cost附加效应side effectTopic8金融市场financial market回购repurchase操纵manipulate承销underwriting私人控股公司privately held corporation公开上市go public公开发行public offer加权平均资本成本weighted average cost of capital Topic9混合证券hybrid security风险资本venture capital期权交易option exchange贷款额度line of credit租赁lease最优资本结构optimal capital structure目标资本结构desired or target capital structure可转换债券convertible bondTopic10股票回购stock repurchase股票股利stock dividends股票分割stock split所有权稀释dilution of ownership剩余股利政策residual dividend policy清算股利liquidating dividend现金股利cash dividends股票股利stock dividendsTopic11营运资本管理working capital management商业票据commercial paper支出disbursement信用期限credit period交易动机transaction motive短期有价证券marketable security回购协议repurchase agreement银行承兑汇票bankers’ acceptanceTopic12国际财务管理international financial management国际货币基金组织International Monetary Fund跨国公司multinational corporation /international corporation汇率exchange rated]]*cost of equity*(1-corporate tax rate)Wacc=(股权/总资本)*股权成本+(债务/总资本)*债务成本*(1-企业所得税率)三、填空1.The risk of an asset can be considered in two ways (1)on a stand-alone basis. where the asset’s cash flows are analyzed by themselves ,or(2)a portfolio context, where the asset’s cash flows are combine with those of other asset.2.In a portfolio context ,an asset’s risk can be divided into two components :在投资组合中资产风险可以分为(1)diversifiable risk,which can be diversified away and thus is of little concern to diversified investors , and (2)market risk, which reflect the risk of a general stock market risk decline and cannot be eliminated by diversification.3 .There are three types of financial market efficiency 金融市场的有效性(1)allocationally efficient(2)operationally efficient(3)Private Market / Public Market 私下市场和公开市场9.investment banks provide three major services in handing a new security issue :投资银行在持有新证券发行时提供的三个主要服务:(1)Advising 咨询(2)Underwriting 承销(3)Marketing 营销10.Equity 股权融资(1)Owner’s equity所有者权益(2)Venture Capital and private Equity风险投资和私募投资(3)common stock 普通股(4)warrants 认证权证(5)Contingent value right 或有价值权利11.Debt债务融资(1)bank debt 银行借款(2)bonds 债券(3)leases 租赁12.Firms generally consider the following factor when making capital structure decisions:公司选择资本结构时一般要考虑下列因素(1)Sale stability 销售稳定性(2)Asset structure 资产结构(3)Operating leverage 经营杠杆。

第三版财务管理专业英语重点

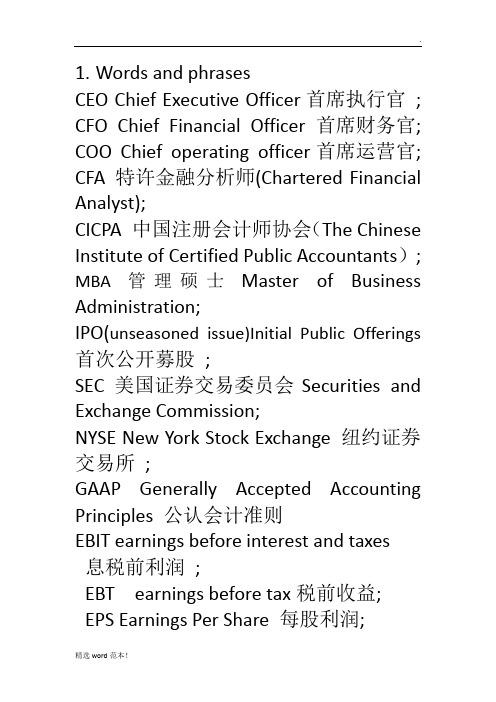

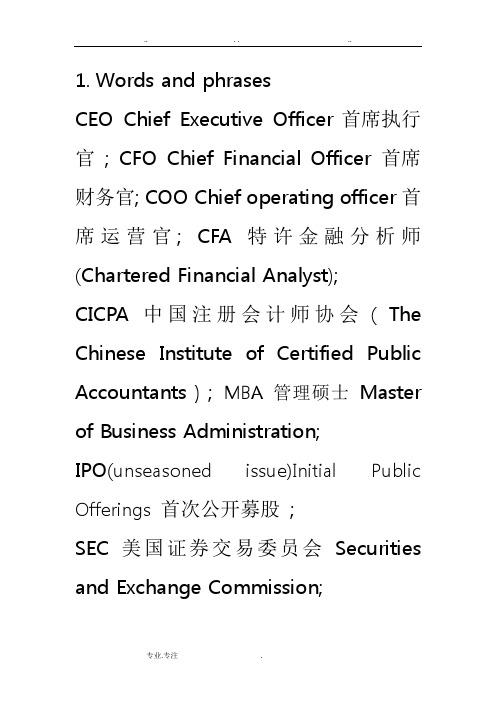

1.Words and phrasesCEO Chief Executive Officer首席执行官; CFO Chief Financial Officer 首席财务官; COO Chief operating officer首席运营官; CFA 特许金融分析师(Chartered Financial Analyst);CICPA 中国注册会计师协会(The Chinese Institute of Certified Public Accountants); MBA 管理硕士Master of Business Administration;IPO(unseasoned issue)Initial Public Offerings 首次公开募股;SEC 美国证券交易委员会Securities and Exchange Commission;NYSE New York Stock Exchange 纽约证券交易所;GAAP Generally Accepted Accounting Principles 公认会计准则EBIT earnings before interest and taxes息税前利润;EBT earnings before tax税前收益; EPS Earnings Per Share 每股利润;ROE Rate of Return on Equity权益报酬率; NCF net cash flow 现金净流量;NPV net present value 净现值;IRR Internal Rate of Return 内部收益率FVIFA future value interest factors of annuity年金终值系数;PVIFA present value interest factors of annuity年金现值系数;YTM Yield to Maturity 到期收益率; CAPM capital asset pricing model资本资产定价模型;WACC weighted average cost of capital加权平均资本成本;EOQ Economic Order Quantity 经济订购量; JIT system just in time 实时生产系统2.TranslationOverview of each topic1商业公司每天都在做决策。

第三版财务管理专业英语重点

1.Words and phrasesCEO Chief Executive Officer首席执行官; CFO Chief Financial Officer 首席财务官; COO Chief operating officer首席运营官; CFA 特许金融分析师(Chartered Financial Analyst); CICPA 中国注册会计师协会(The Chinese Institute of Certified Public Accountants); MBA 管理硕士Master of Business Administration;IPO(unseasoned issue)Initial Public Offerings 首次公开募股;SEC 美国证券交易委员会Securities and Exchange Commission;NYSE New York Stock Exchange 纽约证券交易所;GAAP Generally Accepted Accounting Principles 公认会计准则EBIT earnings before interest and taxes 息税前利润;EBT earnings before tax税前收益; EPS Earnings Per Share 每股利润; ROE Rate of Return on Equity权益报酬率; NCF net cash flow 现金净流量; NPV net present value 净现值;IRR Internal Rate of Return 内部收益率FVIFA future value interest factors of annuity年金终值系数;PVIFA present value interest factors of annuity年金现值系数;YTM Yield to Maturity 到期收益率; CAPM capital asset pricing model资本资产定价模型;WACC weighted average cost of capital加权平均资本成本;EOQ Economic Order Quantity 经济订购量;JIT system just in time 实时生产系统2.TranslationOverview of each topic1商业公司每天都在做决策。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Maximize the value of the firm (or the shareholders’ wealth) (企业价值最大化或股东财富最大化)

Mini CMasinei case

In 1990, two of General Motor’s largest

She worked for the well-being of the underprivileged. 她为下层贫困民众的福利而努力。

We must diversify our products. 我们必须于产品多样化。 23.learning curve 学习曲线 going concern 持续的 24.agency problem 代理问题

New York Stock Exchange composite index 纽约证券交易所混合指数 10.Financial standards 财务准则

11.initial public offering (IP0) 首次公开发行股票

A $100 investment in Dell stock at the 1988 initial public

7.Management buyout 管理层收购 管理层收购在英文中简称MBO,是指公司的经营

管理者利用借贷融资买断或控制公司的股份,旨在改 变公司的所有者结构、控制权结构和资产结构,使公 司原经营者变成企业所有者的一种收购行为。MBO的 主要投资者是目标公司的管理人员,或是管理人员与 投资者结成的联盟,通过MBO,他们的身份由单一的 经营者角色变为所有者与经营者合一的双重身份。

GM’s senior

managers rebuffed the

shareholders. They could do that because the

two large stockholders each owned less than

1% of the company’s stock.

Read the mini case and think:

这是美国主流的公司治理模式,股权的分散化使得决 策权从股东转向了职业经理。这种公司治理机制是利弊互 现的,即公司管理的职业经理化与代理成本的存在。那么 在以后设计出的种种公司治理机制就是为了减少公司代理 成本。

Words Study

1.business 企业,商业 business circle 企业界 2.financial risk 财务(金融)风险 There is no financial risk in selling to East European countries on credit. 向东欧国家赊销没有财务风险。 3.sole proprietorship 私人业主制企业

Non-ececutive 非执行董事 chairperson(chairman)主席、董事 长

independent director 独立董事

An ‘’independent director‘’ is a director who should be in a

position to exercise independent judgment in carrying out

have a better understanding of the types of business organization、corporate structure of the company、objectives of financial management、separation of ownership and control、agency relationships.

the functions of the Audit Committee of a listed company.

“独立董事”是一个能够在执行审计委员会的功能时,做出独立判断

的上市公司董事 。

14.controller 主计长、管理者 The controller of BBC Radio 英国广播公司广播电台负责人

8.tender offer take over bid (要约收购) 收购上市公司,有两种方式:协议收购和要约收购,而后者是更 市场化的收购方式。从协议收购向要约收购发展,是资产重组 市场化改革的必然选择。 要约收购(即狭义的上市公司收购),是指通过证券交易 所的买卖交易使收购者持有目标公司股份达到法定比例(《证 券法》规定该比例为30%),若继续增持股份,必须依法向目 标公司所有股东发出全面收购要约。 hostile tender offer 恶意收购 9.New York Stock Exchange 纽约股票交易所

offering is worth more than $56,000 today

在1988年最初上市时仅投资100美元的戴尔股票今天价值56000美元

12.private corporation

私募公司

closely held corporation 控股公司

13.board of directors 董事会 executive director 执行董事

Wisdom

How do we want the firms in our economy to measure their own performance? How do we want them to determine what is better versus worse? Most economists would answer simply that managers have a criterion for evaluating performance and deciding between alternative courses of action, and that the criterion should be maximization of the long-term market value of the firm .This Value Maximization proposition has its roots in 200 years of research in economics and finance.

15.treasurer 司库、出纳、财务主任

Who can we have as treasurer? 我们能让谁掌管财务呢? 16.Master of Financial Management 财务管理专业硕士 Master of Accounting 会计学硕士 Master of Business Administration (MBA)工商管理硕士 17.revenue 收入 profit 利润 earnings per share 每股盈余( EPS) 18.return 回报 market share 市场份额

Why can the GM’s senior managers rebuff the shareholders?

1990年,通用汽车公司的两个最大的机构投资者股东, 因为对公司在20世纪80年代的市场份额减少、利润下降 及公司业绩欠佳不满,试图借总裁退休,在继任者的选择 问题上发表自己的意见,但他们的要求遭到公司管理层的 断然拒绝。公司管理层的反对之所以有效,是因为这两个 最大股东所持有公司股票的份额都不超过1%。这就是公 司所有权分散、公司经理主导的美国公司治理模式的特点。

Unit 2: Introduction to Financial Management(2)

Teaching objectives:

After learning this section, the students are reqiured to:

grasp some important words and expressions;

——Michael C Jensen

What’s the objection of financial

management?

The objection of financial management

Maximize the profit (revenue) of the firm (利润最大化)

25.free-riding problem 搭便车问题 搭便车理论首先由美国经济学家曼柯·奥尔逊于1965年发表的 《集体行动的逻辑:公共利益和团体理论》(The Logic of Collective Action Public Goodsand the Theory of Groups)一 书中提出的。其基本含义是不付成本而坐享他人之利。 rmation asymmetry 信息不对称 该理论认为:市场中卖方比买方更了解有关商品的各种信息;掌 握更多信息的一方可以通过向信息贫乏的一方传递不可靠信息在 市场中获益;买卖双方中拥有信息较少的一方会努力从另一方获 取信息;市场信号显示在一定程度上可以弥补信息不对称的问 题;信息不对称是市场经济的弊病,要想减少信息不对称对经济 产生的危害,政府应在市场体系中发挥强有力的作用。

The reason of the agency relationship is the separation. 代理关系产生的原因就是所有权与经营权的分离。

6.claim 要求权 have a claim on (to) 有对...要求权

claim a large amount against him 要求他赔偿大量金额

institutional shareholders, unhappy with the

company’s declining market share and profits

during the 1980s, sought to talk to GM’s

leaders about a successor to the retiring CEO.