第04章 特定要素与国际贸易(英文习题)

I_E_11e_Ch_04

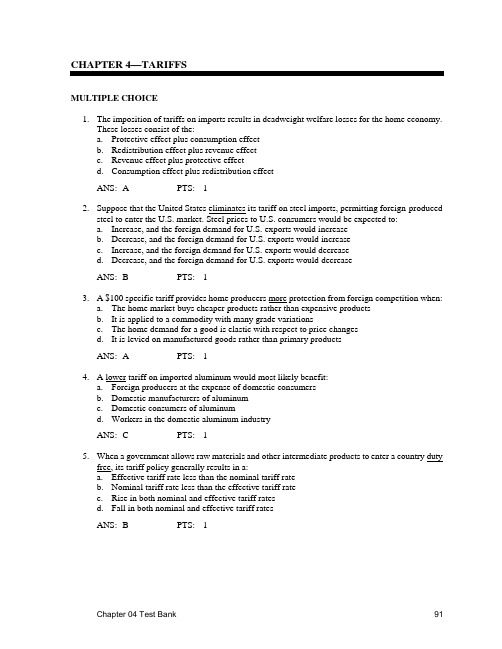

CHAPTER 4—TARIFFSMULTIPLE CHOICE1. The imposition of tariffs on imports results in deadweight welfare losses for the home economy.These losses consist of the:a. Protective effect plus consumption effectb. Redistribution effect plus revenue effectc. Revenue effect plus protective effectd. Consumption effect plus redistribution effectANS: A PTS: 12. Suppose that the United States eliminates its tariff on steel imports, permitting foreign-producedsteel to enter the U.S. market. Steel prices to U.S. consumers would be expected to:a. Increase, and the foreign demand for U.S. exports would increaseb. Decrease, and the foreign demand for U.S. exports would increasec. Increase, and the foreign demand for U.S. exports would decreased. Decrease, and the foreign demand for U.S. exports would decreaseANS: B PTS: 13. A $100 specific tariff provides home producers more protection from foreign competition when:a. The home market buys cheaper products rather than expensive productsb. It is applied to a commodity with many grade variationsc. The home demand for a good is elastic with respect to price changesd. It is levied on manufactured goods rather than primary productsANS: A PTS: 14. A lower tariff on imported aluminum would most likely benefit:a. Foreign producers at the expense of domestic consumersb. Domestic manufacturers of aluminumc. Domestic consumers of aluminumd. Workers in the domestic aluminum industryANS: C PTS: 15. When a government allows raw materials and other intermediate products to enter a country dutyfree, its tariff policy generally results in a:a. Effective tariff rate less than the nominal tariff rateb. Nominal tariff rate less than the effective tariff ratec. Rise in both nominal and effective tariff ratesd. Fall in both nominal and effective tariff ratesANS: B PTS: 16. Of the many arguments in favor of tariffs, the one that has enjoyed the most significant economicjustification has been the:a. Infant industry argumentb. Cheap foreign labor argumentc. Balance of payments argumentd. Domestic living standard argumentANS: A PTS: 17. The redistribution effect of an import tariff is the transfer of income from the domestic:a. Producers to domestic buyers of the goodb. Buyers to domestic producers of the goodc. Buyers to the domestic governmentd. Government to the domestic buyersANS: B PTS: 18. Which of the following is true concerning a specific tariff?a. It is exclusively used by the U.S. in its tariff schedules.b. It refers to a flat percentage duty applied to a good's market value.c. It is plagued by problems associated with assessing import product values.d. It affords less protection to home producers during eras of rising prices.ANS: D PTS: 19. The principal benefit of tariff protection goes to:a. Domestic consumers of the good producedb. Domestic producers of the good producedc. Foreign producers of the good producedd. Foreign consumers of the good producedANS: B PTS: 110. Which of the following policies permits a specified quantity of goods to be imported at one tariffrate and applies a higher tariff rate to imports above this quantity?a. Tariff quotab. Import tariffc. Specific tariffd. Ad valorem tariffANS: A PTS: 111. Assume the United States adopts a tariff quota on steel in which the quota is set at 2 million tons,the within-quota tariff rate equals 5 percent, and the over-quota tariff rate equals 10 percent.Suppose the U.S. imports 1 million tons of steel. The resulting revenue effect of the tariff quota would accrue to:a. The U.S. government onlyb. U.S. importing companies onlyc. Foreign exporting companies onlyd. The U.S. government and either U.S. importers or foreign exportersANS: A PTS: 112. When the production of a commodity does not utilize imported inputs, the effective tariff rate onthe commodity:a. Exceeds the nominal tariff rate on the commodityb. Equals the nominal tariff rate on the commodityc. Is less than the nominal tariff rate on the commodityd. None of the aboveANS: B PTS: 113. Developing nations often maintain that industrial countries permit raw materials to be importedat very low tariff rates while maintaining high tariff rates on manufactured imports. Which of the following refers to the above statement?a. Tariff-quota effectb. Nominal tariff effectc. Tariff escalation effectd. Protective tariff effectANS: C PTS: 114. Should the home country be "large" relative to the world, its imposition of a tariff on importswould lead to an increase in domestic welfare if the terms-of-trade effect exceeds the sum of the:a. Revenue effect plus redistribution effectb. Protective effect plus revenue effectc. Consumption effect plus redistribution effectd. Protective effect plus consumption effectANS: D PTS: 115. Should Canada impose a tariff on imports, one would expect Canada's:a. Terms of trade to improve and volume of trade to decreaseb. Terms of trade to worsen and volume of trade to decreasec. Terms of trade to improve and volume of trade to increased. Terms of trade to worsen and volume of trade to increaseANS: A PTS: 116. A beggar-thy-neighbor policy is the imposition of:a. Free trade to increase domestic productivityb. Trade barriers to increase domestic demand and employmentc. Import tariffs to curb domestic inflationd. Revenue tariffs to make products cheaper for domestic consumersANS: B PTS: 117. A problem encountered when implementing an "infant industry" tariff is that:a. Domestic consumers will purchase the foreign good regardless of the tariffb. Political pressure may prevent the tariff's removal when the industry maturesc. Most industries require tariff protection when they are matured. Labor unions will capture the protective effect in higher wagesANS: B PTS: 118. Tariffs are not defended on the ground that they:a. Improve the terms of trade of foreign nationsb. Protect jobs and reduce unemploymentc. Promote growth and development of young industriesd. Prevent overdependence of a country on only a few industriesANS: A PTS: 119. The deadweight loss of a tariff:a. Is a social loss since it promotes inefficient productionb. Is a social loss since it reduces the revenue for the governmentc. Is not a social loss because society as a whole doesn't pay for the lossd. Is not a social loss since only business firms suffer revenue lossesANS: A PTS: 120. Which of the following is a fixed percentage of the value of an imported product as it enters thecountry?a. Specific tariffb. Ad valorem tariffc. Nominal tariffd. Effective tariffANS: B PTS: 121. A tax of 20 cents per unit of imported cheese would be an example of:a. Compound tariffb. Effective tariffc. Ad valorem tariffd. Specific tariffANS: D PTS: 122. A tax of 15 percent per imported item would be an example of:a. Ad valorem tariffb. Specific tariffc. Effective tariffd. Compound tariffANS: A PTS: 123. Which type of tariff is not used by the American government?a. Import tariffb. Export tariffc. Specific tariffd. Ad valorem tariffANS: B PTS: 124. Which trade policy results in the government levying a "two-tier" tariff on imported goods?a. Tariff quotab. Nominal tariffc. Effective tariffd. Revenue tariffANS: A PTS: 125. If we consider the impact on both consumers and producers, then protection of the steel industryis:a. In the interest of the United States as a whole, but not in the interest of the state ofPennsylvaniab. In the interest of the United States as a whole and in the interest of the state of Pennsylvaniac. Not in the interest of the United States as a whole, but it might be in the interest of the stateof Pennsylvaniad. Not in the interest of the United States as a whole, nor in the interest of the state ofPennsylvaniaANS: C PTS: 126. If I purchase a stereo from South Korea, I obtain the stereo and South Korea obtains the dollars.But if I purchase a stereo produced in the United States, I obtain the stereo and the dollars remain in America. This line of reasoning is:a. Valid for stereos, but not for most products imported by the United Statesb. Valid for most products imported by the United States, but not for stereosc. Deceptive since Koreans eventually spend the dollars on U.S. goodsd. Deceptive since the dollars spent on a stereo built in the United States eventually wind upoverseasANS: C PTS: 127. The most vocal political pressure for tariffs is generally made by:a. Consumers lobbying for export tariffsb. Consumers lobbying for import tariffsc. Producers lobbying for export tariffsd. Producers lobbying for import tariffsANS: D PTS: 128. If we consider the interests of both consumers and producers, then a policy of tariff reduction inthe U.S. auto industry is:a. In the interest of the United States as a whole, but not in the interest of auto-producing statesb. In the interest of the United States as a whole, and in the interest of auto-producing statesc. Not in the interest of the United States as a whole, nor in the interest of auto-producingstatesd. Not in the interest of the United States as a whole, but is in the interest of auto-producingstatesANS: A PTS: 129. Free traders point out that:a. There is usually an efficiency gain from having tariffsb. There is usually an efficiency loss from having tariffsc. Producers lose from tariffs at the expense of consumersd. Producers lose from tariffs at the expense of the governmentANS: B PTS: 130. A decrease in the import tariff will result in:a. An increase in imports but a decrease in domestic productionb. A decrease in imports but an increase in domestic productionc. An increase in price but a decrease in quantity purchasedd. A decrease in price and a decrease in quantity purchasedANS: A PTS: 1Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico, a "small" nation that is unable to affect the world price.Figure 4.1. Import Tariff Levied by a "Small" Country31. Consider Figure 4.1. In the absence of trade, Mexico produces and consumes:a. 10 calculatorsb. 40 calculatorsc. 60 calculatorsd. 80 calculatorsANS: C PTS: 132. Consider Figure 4.1. In the absence of trade, Mexico's producer surplus and consumer surplusrespectively equal:a. $120, $240b. $180, $180c. $180, $320d. $240, $240ANS: B PTS: 133. Consider Figure 4.1. With free trade, Mexico imports:a. 40 calculatorsb. 60 calculatorsc. 80 calculatorsd. 100 calculatorsANS: D PTS: 134. Consider Figure 4.1. With free trade, the total value of Mexico's imports equal:a. $220b. $260c. $290d. $300ANS: D PTS: 135. Consider Figure 4.1. With free trade, Mexico's producer surplus and consumer surplusrespectively equal:a. $5, $605b. $25, $380c. $45, $250d. $85, $195ANS: A PTS: 136. Consider Figure 4.1. With a per-unit tariff of $3, the quantity of imports decreases to:a. 20 calculatorsb. 40 calculatorsc. 50 calculatorsd. 70 calculatorsANS: B PTS: 137. According to Figure 4.1, the loss in Mexican consumer surplus due to the tariff equals:a. $225b. $265c. $285d. $325ANS: C PTS: 138. According to Figure 4.1, the tariff results in the Mexican government collecting:a. $100b. $120c. $140d. $160ANS: B PTS: 139. According to Figure 4.1, Mexican manufacturers gain ____ because of the tariff.a. $75b. $85c. $95d. $105ANS: A PTS: 140. According to Figure 4.1, the deadweight cost of the tariff totals:a. $60b. $70c. $80d. $90ANS: D PTS: 141. Consider Figure 4.1. The tariff would be prohibitive (i.e., eliminate imports) if it equaled:a. $2b. $3c. $4d. $5ANS: D PTS: 1Assume the United States is a large consumer of steel that is able to influence the world price. Its demand and supply schedules are respectively denoted by D U.S. and S U.S. in Figure 4.2. Theoverall (United States plus world) supply schedule of steel is denoted by S U.S.+W.Figure 4.2. Import Tariff Levied by a "Large" Country42. Consider Figure 4.2. With free trade, the United States achieves market equilibrium at a price of$____. At this price, ____ tons of steel are produced by U.S. firms, ____ tons are bought by U.S.buyers, and ____ tons are imported.a. $450, 5 tons, 60 tons, 55 tonsb. $475, 10 tons, 50 tons, 40 tonsc. $525, 5 tons, 60 tons, 55 tonsd. $630, 30 tons, 30 tons, 0 tonsANS: B PTS: 143. Consider Figure 4.2. Suppose the United States imposes a tariff of $100 on each ton of steelimported. With the tariff, the price of steel rises to $____ and imports fall to ____ tons.a. $550, 20 tonsb. $550, 30 tonsc. $575, 20 tonsd. $575, 30 tonsANS: A PTS: 144. Consider Figure 4.2. Of the $100 tariff, $____ is passed on to the U.S. consumer via a higherprice, while $____ is borne by the foreign exporter; the U.S. terms of trade:a. $25, $75, improveb. $25, $75, worsenc. $75, $25, improved. $75, $25, worsenANS: C PTS: 145. Referring to Figure 4.2, the tariff's deadweight welfare loss to the United States totals:a. $450b. $550c. $650d. $750ANS: D PTS: 146. According to Figure 4.2, the tariff's terms-of-trade effect equals:a. $300b. $400c. $500d. $600ANS: C PTS: 147. According to Figure 4.2, the tariff leads to the overall welfare of the United States:a. Rising by $250b. Rising by $500c. Falling by $250d. Falling by $500ANS: C PTS: 148. Suppose that the production of $500,000 worth of steel in the United States requires $100,000worth of iron ore. The U.S. nominal tariff rates for importing these goods are 15 percent for steel and 5 percent for iron ore. Given this information, the effective rate of protection for the U.S.steel industry is approximately:a. 6 percentb. 12 percentc. 18 percentd. 24 percentANS: C PTS: 149. Suppose that the production of a $30,000 automobile in Canada requires $10,000 worth of steel.The Canadian nominal tariff rates for importing these goods are 25 percent for automobiles and10 percent for steel. Given this information, the effective rate of protection for the Canadianautomobile industry is approximately:a. 15 percentb. 32 percentc. 48 percentd. 67 percentANS: B PTS: 1Exhibit 4.1Assume that the United States imports automobiles from South Korea at a price of $20,000 per vehicle and that these vehicles are subject to an import tariff of 20 percent. Also assume that U.S.components are used in the vehicles assembled by South Korea and that these components have a value of $10,000.50. Refer to Exhibit 4.1. In the absence of the Offshore Assembly Provision of U.S. tariff policy, theprice of an imported vehicle to the U.S. consumer after the tariff has been levied is:a. $22,000b. $23,000c. $24,000d. $25,000ANS: C PTS: 151. Refer to Exhibit 4.1. Under the Offshore Assembly Provision of U.S. tariff policy, the price of animported vehicle to the U.S. consumer after the tariff has been levied is:a. $22,000b. $23,000c. $24,000d. $25,000ANS: A PTS: 152. Suppose an importer of steel is required to pay a tariff of $20 per ton plus 5 percent of the valueof steel. This is an example of a (an):a. Specific tariffb. Ad valorem tariffc. Compound tariffd. Tariff quotaANS: C PTS: 153. A compound tariff is a combination of a (an):a. Tariff quota and a two-tier tariffb. Revenue tariff and a protective tariffc. Import tariff and an export tariffd. Specific tariff and an ad valorem tariffANS: D PTS: 1Table 4.1. Production Costs and Prices of Imported and Domestic VCRsImported VCRs Domestic VCRs Component parts $150 Imported component parts $150 Assembly cost/profit 50 Assembly cost 50 Nominal tariff 25 Profit 25 Import price Domestic priceafter tariff 225 after tariff 22554. Consider Table 4.1. Prior to the tariff, the total price of domestically-produced VCRs is:a. $150b. $200c. $225d. $250ANS: B PTS: 155. Consider Table 4.1. Prior to the tariff, the total price of imported VCRs is:a. $150b. $200c. $225d. $235ANS: B PTS: 156. Consider Table 4.1. The nominal tariff rate on imported VCRs equals:a. 11.1 percentb. 12.5 percentc. 16.7 percentd. 50.0 percentANS: B PTS: 157. Consider Table 4.1. Prior to the tariff, domestic value added equals:a. $25b. $50c. $75d. $100ANS: B PTS: 158. Consider Table 4.1. After the tariff, domestic value added equals:a. $25b. $50c. $75d. $100ANS: C PTS: 159. Consider Table 4.1. The effective tariff rate equals:a. 11.1 percentb. 16.7 percentc. 50.0 percentd. 100.0 percentANS: C PTS: 160. If the domestic value added before an import tariff for a product is $500 and the domestic valueadded after the tariff is $550, the effective rate of protection is:a. 5 percentb. 8 percentc. 10 percentd. 15 percentANS: C PTS: 161. When a tariff on imported inputs exceeds that on the finished good,a. The nominal tariff rate on the finished product would tend to overstate its protective effectb. The nominal tariff rate would tend to understate it's protective effectc. It is impossible to determine the protective effect of a tariffd. Tariff escalation occursANS: A PTS: 162. The offshore assembly provision in the U.S.a. Provides favorable treatment to U.S. trading partnersb. Discriminates against primary product importersc. Provides favorable treatment to products assembled abroad from U.S. manufacturedcomponentsd. Hurts the U.S. consumerANS: C PTS: 163. Arguments for U.S. trade restrictions include all of the following excepta. Job protectionb. Infant industry supportc. Maintenance of domestic living standardd. Improving incomes for developing countriesANS: D PTS: 164. For the United States, a foreign trade zone (FTZ) isa. A site within the United Statesb. A site outside the United Statesc. Always located in poorer developing countriesd. Is used to discourage tradeANS: A PTS: 1TRUE/FALSE1. To protect domestic producers from foreign competition, the U.S. government levies both importtariffs and export tariffs.ANS: F PTS: 12. With a compound tariff, a domestic importer of an automobile might be required to pay a duty of$200 plus 4 percent of the value of the automobile.ANS: T PTS: 13. With a specific tariff, the degree of protection afforded domestic producers varies directly withchanges in import prices.ANS: F PTS: 14. During a business recession, when cheaper products are purchased, a specific tariff providesdomestic producers a greater amount of protection against import-competing goods.ANS: T PTS: 15. A ad valorem tariff provides domestic producers a declining degree of protection againstimport-competing goods during periods of changing prices.ANS: F PTS: 16. With a compound duty, its "specific" portion neutralizes the cost disadvantage of domesticmanufacturers that results from tariff protection granted to domestic suppliers of raw materials, and the "ad valorem" portion of the duty grants protection to the finished-goods industry.ANS: T PTS: 17. The nominal tariff rate signifies the total increase in domestic productive activities compared towhat would occur under free-trade conditions.ANS: F PTS: 18. When material inputs enter a country at a very low duty while the final imported product isprotected by a high duty, the result tends to be a high rate of protection for domestic producers of the final product.ANS: T PTS: 19. According to the tariff escalation effect, industrial countries apply low tariffs to imports offinished goods and high tariffs to imports of raw materials.ANS: F PTS: 110. Under the Offshore Assembly Provision of U.S. tariff policy, U.S. import duties apply only to thevalue added in the foreign assembly process, provided that U.S.-made components are used by overseas companies in their assembly operations.ANS: T PTS: 111. Bonded warehouses and foreign trade zones have the effect of allowing domestic importers topostpone and prorate over time their import duty obligations.ANS: T PTS: 112. A nation whose imports constitute a very small portion of the world market supply is a price taker,facing a constant world price for its import commodity.ANS: T PTS: 113. Graphically, consumer surplus is represented by the area above the demand curve and below theproduct's market price.ANS: F PTS: 114. Producer surplus is the revenue producers receive over and above the minimum necessary forproduction.ANS: T PTS: 115. For a "small" country, a tariff raises the domestic price of an imported product by the full amountof the duty.ANS: T PTS: 116. Although an import tariff provides the domestic government additional tax revenue, it benefitsdomestic consumers at the expense of domestic producers.ANS: F PTS: 117. An import tariff reduces the welfare of a "small" country by an amount equal to the redistributioneffect plus the revenue effect.ANS: F PTS: 118. The deadweight losses of an import tariff consist of the protection effect plus the consumptioneffect.ANS: T PTS: 119. The redistribution effect is the transfer of producer surplus to domestic consumers of theimport-competing product.ANS: F PTS: 120. As long as it is assumed that a nation accounts for a negligible portion of international trade, itslevying an import tariff necessarily increases its overall welfare.ANS: F PTS: 121. Changes in a "large" country's economic conditions or trade policies can affect the terms atwhich it trades with other countries.ANS: T PTS: 122. A "large" country, that levies a tariff on imports, cannot improve the terms at which it trades withother countries.ANS: F PTS: 123. For a "large" country, a tariff on an imported product may be partially absorbed by the domesticconsumer via a higher purchase price and partially absorbed by the foreign producer via a lower export price.ANS: T PTS: 124. If a "large" country levies a tariff on an imported good, its overall welfare increases if themonetary value of the tariff's consumption effect plus protective effect exceeds the monetary value of the terms-of-trade effect.ANS: F PTS: 125. If a "small" country levies a tariff on an imported good, its overall welfare increases if themonetary value of the tariff's consumption effect plus protective effect is less than the monetary value of the terms-of-trade effect.ANS: F PTS: 126. A tariff on steel imports tends to improve the competitiveness of domestic automobilecompanies.ANS: F PTS: 127. If a tariff reduces the quantity of Japanese autos imported by the United States, over time itreduces the ability of Japan to import goods from the United States.ANS: T PTS: 128. A compound tariff permits a specified amount of goods to be imported at one tariff rate while anyimports above this amount are subjected to a higher tariff rate.ANS: F PTS: 129. A tariff can be thought of as a tax on imported goods.ANS: T PTS: 130. Although tariffs on imported steel may lead to job gains for domestic steel workers, they can leadto job losses for domestic auto workers.ANS: T PTS: 131. Relatively low wages in Mexico make it impossible for U.S. manufacturers of labor-intensivegoods to compete against Mexican manufacturers.ANS: F PTS: 132. According to the infant-industry argument, temporary tariff protection granted to an infantindustry will help it become competitive in the world market; when internationalcompetitiveness is achieved, the tariff should be removed.ANS: T PTS: 1Exhibit 4.2In the absence of international trade, assume that the equilibrium price and quantity of motorcycles in Canada is $14,000 and 10 units respectively. Assuming that Canada is a small country that is unable to affect the world price of motorcycles, suppose its market is opened to international trade. As a result, the price of motorcycles falls to $12,000 and the total quantity demanded rises to 14 units; out of this total, 6 units are produced in Canada while 8 units are imported. Now assume that the Canadian government levies an import tariff of $1,000 on motorcycles.33. Refer to Exhibit 4.2. As a result of the tariff, the price of imported motorcycles equals $13,000and imports total 4 cycles.ANS: T PTS: 134. Refer to Exhibit 4.2. The tariff leads to an increase in Canadian consumer surplus totaling$11,000.ANS: F PTS: 135. Refer to Exhibit 4.2. The tariff's redistribution effect equals $7,000.ANS: T PTS: 136. Refer to Exhibit 4.2. The tariff's revenue effect equals $6,000.ANS: F PTS: 137. Refer to Exhibit 4.2. All of the import tariff is shifted to the Canadian consumer via a higher priceof motorcycles.ANS: T PTS: 138. Refer to Exhibit 4.2. The tariff leads to a deadweight welfare loss for Canada totaling $1,000.ANS: F PTS: 139. Unlike a specific tariff, an ad valorem tariff differentiates between commodities with differentvalues.ANS: T PTS: 140. A limitation of a specific tariff is that it provides a constant level of protection for domesticcommodities regardless of fluctuations in their prices over time.ANS: F PTS: 141. A tariff quota is a combination of a specific tariff and an ad valorem tariff.ANS: F PTS: 142. A specific tariff is expressed as a fixed percentage of the total value of an imported product.ANS: F PTS: 143. The protective effect of a tariff occurs to the extent that less efficient domestic production issubstituted for more efficient foreign production.ANS: T PTS: 144. A tariff can increase the welfare of a "large" levying country if the favorable terms-of-tradeeffect more than offsets the unfavorable protective effect and consumption effect.ANS: T PTS: 145. If the world price of steel is $600 per ton, a specific tariff of $120 per ton is equivalent to an advalorem tariff of 25 percent.ANS: F PTS: 146. An import tariff will worsen the terms of trade for a "small" country but improve the terms oftrade for a "large" country.ANS: F PTS: 147. Suppose that the tariff on imported steel is 40 percent, the tariff on imported iron ore is 20 percent,and 30 percent of the cost of producing a ton of steel consists of the iron ore it contains. The effective rate of protection of steel is approximately 49 percent.ANS: T PTS: 1。

国际贸易英文习题(含答案)

国际贸易英⽂习题(含答案)国际经济学模拟习题(3)⼀、True or F al se (10*1’=10’)1. Trad e i s a zero-su m activi t y; i f one country gain s, the oth er must lose.2. A nation maxi mi zes satisfaction b y reachin g th e highest possibl e indi fference curve, and inthe absence o f t rad e will p roduce where it s productio n possibili ties sch edule is tangent to an indifference curve.3. Th e factor endo wment s mod el predict s th at int ernational trad e will t end to equali ze theprices o f trade-abl e good s amon g nations, but to in crease the wage gap b et weencapit al-abundant and labo r-abundant nations.4. A tax o f 10 percent on i mport s o f sho es would be an exampl e o f a sp eci fi c tari ff.5. An i mport quot a wi ll not rai se the do mesti c pri ce o f the produ ct as would a t ari ff, becau seit is not a t ax on i mport s.6. In bal anc e-o f-payment s account, a t ran saction resultin g in receipt o f a p ayment is recordedas a credit, wh ereas a tran saction resul ting in a p ayment to other n ations is recorded as adebit.7. Becau se they do not in clude an exchan ge o f goods or servi ces, unil at er al transfers do notappear on a n ation's b al ance o f payment s account.8. David Hu me was one of th e fi rst econo mi sts to provide an al yti cal support fo r mercan tili sttrad e polici es.9. A nat ion would be mo st li kel y to find it s trad e balan ce i mp rovin g aft er a curren cydepreci ation i f th at nation’s d emand fo r i mport s and forei gn d emand fo r i ts expo rts was ver y inelasti c.10. A nation with n eith er a bal ance o f p ayment s surplus nor a bal ance o f p ayments defici t i s saidto be in int ernal bal ance.⼆、choi ces(15*3’=45’)1. The law o f co mp arati ve advant agea). was rati fied b y th e Wo rld Trad e Organizationb). explains ho w all countries can ben efit when each specializes in producin g it ems in wh ich i t hasthe great est relati ve effi ci encyc). explain s ho w onl y the mo st effi ci ent nations can benefi t fro m traded). is used to evalu at e a country’s mi lit ary stren gth2. The theory o f absolut e advant age was developed b ya. the Mercantili stsb. David Hu mec. Ad am S mithd. David Ricardo3. David Ricardo developed the pr inciple o f co mparative advantage sho win g th ata. a nation must b e th e least-cost produ cer o f a good in order to export th at it emb. no nation could have an absolut e ad vantage in all goodsc. in a t wo-country exampl e, onl y one nation can have a co mp arati v e ad vantaged. even a nat ion that has lower producti vit y in all goo ds can ben efi t b y export ing the it em in which it is rel ati vel y l ess inefficient4. An indi fferen ce curvea. sho ws th at most p eople reall y are indifferent abou t intern ational tradeb. sho ws th e demand preferences o f con su mersc. refl ects th e rel ati ve co sts o f product ion within a n ationd. indicat es ho w mu ch l ab or a country h as5. To maxi mize it s sati sfaction, a nation will ensure that it s t erms-o f-trad e lin ea. is tan gent to its produ ct ion possibiliti es fronti er at one point (production po int) and also to th e highest att ainabl e indi fference cu rve at another poin t (consu mption point)b. is t angent to it s product ion possibilit ies fronti er and intersects an indi fferen ce curvec. int ersects its p roduction possibili ties frontier and is t angent to an indi fferen ce curved. intersect s it s productio n possibilit ies fronti er at one point and an indi fference curve at another point6. Facto r-p rice equali zatio n predicts th at with int ern ational trad ea. the price o f a n ation’s abundant factor will rise an d that o f it s scarce factor will fallb. the pri ce o f a n ation’s abundant factor will fall an d that o f it s scarce factor will risec. the prices o f a nation’s abundant and scarce factors both will rised. the pri ces o f a nat ion’s abundant and scarce factors both will fall7. The effecti ve rat e o f p rotect iona. distingui shes bet ween t ari ffs th at are effecti ve an d those th at are ineffecti veb. is the mini mu m level at which a t ari ff b eco mes effecti v e in li mitin g i mportsc. sho ws th e increase in value-added for do mestic production that a parti cular tari ff st ructure makes po ssibl e, in p ercent age t ermsd. sho ws ho w effecti ve a t ari ff is in rai sin g revenu e8. The institut ional frame wo rk developed in 1947 to pro mote trade lib erali zati on is kno wn asa. the GATTb. the WTOc. the IMFd. The World Ban k9. Developing n ationsa. have very li mited invol vement in int ern ational tradeb. trad e mo stl y with each otherc. rel y heavil y on export s of pri mary pr oducts to ind ustri al nationsd. rel y h eavil y on exports of manu factured product s10. A custo ms union i s uni que in that ita. has no tari ffs on trade among memb er n ationsb. has no t ari ffs on trade among memb er n ations and a co mmon set o f t ari ffs on i mpo rt s fro mnon-membersc. has no tari ffs on trade among memb er n ations, a co mmon set o f tari ffs on i mports fro mnon-members, and free mo bilit y o f factors o f product ion such as labor and capit al amon g membersd. allo ws unrest ricted l abo r i mmi gration fro m non-memb er n ations11. A n ation's b al ance o f p ayments st at ementa. is a record o f th at n atio n's assets abro ad and it s li abiliti es to those fro m oth er nationsb. is an accounting adjust ment pro cess en surin g that a nation's exports will be equal to its i mpor tsc. does not includ e transactions o f forei gn citi zen s o r co mp ani es l iving o r operatin g wi thin thatnation d. i s a record of th e econo mic t ran sactio ns bet ween resid ents o f th at nation and the rest o f th e world, usual l y for a p eriod o f one year.12. Since b alan ce-o f-p ayments accountin g is a doubl e-entry accounting syst em, an export o f U.S.wh eat to M exico p aid for b y a d eposit to the U.S. exporters account in a M exican ban k would b e recorded on the U.S. b al ance o f payment s asa. a credit fo r merch andi se exports and a credit to sh ort-term finan ci al flo wsb. a credit for merch andise export s and a deb it to sh ort-term finan ci al flo ws.c. a credit fo r merch andise exports and a d ebit to uni lat eral transfersd. a credit for merch andise export s and a deb it to o ffi ci al set tlements13. The fo rei gn-exchan ge marketa. is locat ed in New Yorkb. is a market in Chi cago for the int ern ational trading o f co mmoditi es such as wh eat or copper.c. is a mechani sm fo r individual s and insti tutions to exch ange one nation al or regional cu rren cy o rdebt inst ru ment for those of oth er n ations or region s.d. is open fro m 9:00 a.m. t o 3:00 p.m. New Yo rk ti me, Monday throu gh Frid ay.14. Market fund ament als t hat mi ght be exp ected to i nflu ence exchan ge rat e mo vements in clude all o fthe follo wing factors excepta. di fferences in real in co me gro wth rat es b et ween countriesb. differences in real interest rates bet ween countriesc. sp ecul ati ve opinion abo ut futu re exch ange rat esd. chan ges in p ercei ved profit abili t y o f econo mi c in ve st ment s b et ween t wo countries15. If in fl ation is high er i n Mexico th an in the Unit ed States, th e law o f on e price would predict thata. t rad e bet ween M exi co and th e Unit ed States would declin eb. the dollar pri ce o f au tos purchased in Mexi co would be hi gher th an the dollar pri ce ofco mp arable autos purchased in the Unit ed Statesc. the p eso would appreci ate relati ve to th e dollar b y an amount equal in p ercen tage t erms to thedifference bet ween th e t wo infl ation rat esd. the peso would depreci ate rel at ive to the dollar b y an amount equal in percen tage t erms to thedifference bet ween th e t wo infl ation rat es三、Questi ons(45’, answer these questi ons i n Chi nese)1. Assu me that l abor i s th e onl y factor used in production, and that the cost s o f producing b utt er and cloth are gi ven b y the t abl e belo w.(8’)Cost in labor-hours to produce Home Foreign1 unit of butter 1/8 11 unit of cloth 1/4 1/2(1) Express the pri ce o f bu tter rel ati ve to th e pri ce o f cloth in t erms o f l abor content for Ho me and Forei gn in the ab sen ce o f t rade.(2) Wh at do these relati ve prices reveal about each country’s co mparati ve advantage?(3) Wh at do these rel ati ve prices su ggest about the wo rld pri ce o f butt er rel at ive to cloth th at wi ll exist on ce these countri es trad e wi th each oth er?(4) If the world price st abilizes at 1 wi th trad e, what are the gain s b y the Ho me country achieved through trade with th e Forei gn country?2. Expl ain th e i mmi seri zi ng gro wth and li st the case for i mmiserizin g gro wth to be occur. (8’)3. Expl ain the ex chan ge rate o vershootin g theory (8’)4. Suppose that the no min al interest rate on 3-month Treasury bill s is 8 percent in the United Stat esand 6 percent in th e Unit ed Kingdo m, and the rat e o f infl ation i s 10 percent in the Unit ed Stat es and 4 percent in th e Unit ed Kingdo m.(9’)(1) Wh at i s the real interest rat e in each nation?(2) In whi ch direction wou ld intern ational invest men t flo w in response to these real int erest rates?(3) Wh at i mpact would these in vest ment flo ws h ave on the dollar’s exch ange value?5. Wh at effects do es labor mi gration have on th e country o f i mmi gration? Th e country o f emi gration?Th e world as a whole?(12’)国际经济学模拟习题(3)参考答案⼀、判断题(每题1分,共10分)╳√ ╳╳╳√ ╳╳╳╳⼆、选择题(每题3分,共45分)bcdba acacb dbccd三、简答题(共45分)1、(1) 封闭条件下,本国可以⽤⼀半的⽣产⼀单位布的劳动时间⽣产⼀单位黄油。

国际经济学习题与答案2。。2011.1.8

国际经济学习题第二章古典贸易理论习题(一) 选择题本国生产ABCD四种产品的单位劳动投入分别为1、2、4、15,外国生产这四种产品的单位劳动投入分别为12、18、24、30,根据李嘉图模型,本国在哪种产品上拥有最大比较优势?在哪种产品上拥有最大比较劣势?()(a)D 、A(b) C 、B (c) A、D (d) B ,、C(二) 简答题1.亚当.斯密对国际贸易理论的主要贡献有哪些?2.比较优势和比较成本的区别是什么?3.绝对优势理论和比较优势理论的区别是什么?4.假定在短期内每个国家的劳动力不能在产业间流动,因此每个国家一定是在封闭条件下的生产点生产,在这种情形下允许进行国际贸易仍然有利可图吗?为什么?你的答案与交换利益和专业化生产利益有怎样的联系?5.请评价下面的说法:“李嘉图模型假设每个国家固定的劳动禀赋在封闭条件下或者在自有条件下都是充分就业的。

该模型还假设技术水平(劳动生产率)不会改变。

因此,世界经济通过贸易不会生产出比自给自足更多的产品。

”(三) 计算题1. 假定A国和B国的劳动禀赋均为400。

A国生产1个单位的X商品需要5个单位的劳动,而生产1个单位的Y商品需要4个单位的劳动。

B国生产1个单位的X商品需要4个单位的劳动,而生产1个单位的Y商品需要8个单位的劳动(1)画出两个国家的生产可能性边界。

(2)哪个国家在哪种商品上有绝对优势?为什么?绝对优势理论表明了怎样的贸易方向?为什么?(3)根据绝对优势,如果允许自由贸易,专业化生产在多大程度上发生?为什么?每种商品各自生产多少?(4)不使用绝对优势定理而用相对优势定理回答(2)和(3)的问题。

2.假设A国和B国的劳动禀赋为:La=2000, Lb=2000; 两个国家生产X和Y两种产品的单位劳动使用量分别为:A lx=10; A ly=20; B lx=20;B ly=10(1)画出每个国家的生产可能性边界。

(2)哪个国家在哪种商品上有比较优势?为什么?国家A和B之间的贸易会使双方都受益吗?为什么或者为什么不?(3)现在假设A国只使用原来每种商品所使用劳动的一半来生产商品X和Y的方法,即Alx=5;Aly=10.画出新的生产可能性边界。

国际经济学第4章-特定要素与国际贸易Specific-Factors-and-International-Trade

四、收入分配和贸易所得

• 收入分配

# 日本: PM / PF ↑ 资本所有者↑ 土地所有者↓

工人→

# 美国: PM / PF ↓ 资本所有者↓ 土地所有者↑

工人→

四、收入分配和贸易所得

• 收入分配:

Trade benefits the factor that is specific to the export sector of each country but hurts the factor specific to the import-competing sectors, with ambiguous effects on mobile factors. 贸易使出口部门特定要素的所有者受益,使进 口产品竞争部门特定要素的所有者受损,贸易 对流动要素所有者的影响不确定。

一、特定要素模型

• 价格变化对模型均衡的影响

# 总体价格水平变化(价格同比率变化) # 相对价格的变化

一、特定要素模型

• 价格变化对模型均衡的影响

# Changes in the overall price level have no real effects, that is, do not change any physical quantities in the economy.

小结

3.在特定要素模型中,每个国家出口部 门特定要素的拥有者从贸易中获利,而 与进口产品竞争部门的特定要素的拥有 者受损。流动要素的拥有者可能受益也 可能受损。

小结

4.当贸易获益者补偿受损者的损失后, 获益者仍然有所剩余时,可以认为贸易 从整体上带来了收益。

小结

5.大部分经济学家认为不应该把素模型中的国际贸易

• 两个国家:日本、美国 需求:日本 = 美国 劳动拥有量:日本 = 美国 资本拥有量:日本 > 美国 土地拥有量:日本 < 美国

第四章 特定要素与国际贸易(201209)

由以上假设可得到:生产函数:

Y Fy (K y ,L y )

X F (K x ,L ) x x

充分就业:

LL L x y

二、模型的均衡解

完全竞争条件下,两部门的要素报酬分别为:

wX=VMPLX=PX*MPLX rX=VMPKX=PX*MPKX wY=VMPLY=PY*MPLY rY=VMPKY=PY*MPKY

第 四 章

特定要素与国际贸易

本章结构

第一节 短期中的生产要素 第二节 特定要素模型

基本假设 模型的均衡解 商品价格与要素价格 短期与长期的比较 利益集团与贸易政策

第三节 国际贸易与收பைடு நூலகம்分配

第四章

共同点:

特定要素与国际贸易

本章与第三章的关系:

都是从要素禀赋差异的角度来解释国际贸易

土地也是特定要素。

3、边际产出与边际产品价值

如果以实物来表示某要素的边际生产力,则称 为该要素的边际生产实物量或边际物质产品(MPP), 简称边际产品或边际产出(MP)。 如果考虑边际产品的价格因素,用货币单位来 表示边际产品,就是边际产品价值(VMP),其数学 表达式为VMP= P•MP,其中P为产品的价格。 根据边际收益递减规律,当其他要素不变时, 一种要素连续增加所增加的收益是递减的,因此, 各种要素的边际生产力是递减的。

衡,两部门的生产也随之确定。在图中即劳动需求曲线的交点。

第三节

国际贸易与收入分配

一、商品价格与要素价格

假设 A国为资本相对丰裕的国家,X产品为资本密集型产品, 则A国的比较优势产品是X产品,因此开放条件下,该国生 产并且出口X产品,进口Y产品。这样,X 产品的国际相对 价格会上升。

国际商务11版 英文习题TBChap004

国际商务11版英文习题TBChap004概述本文档是对《国际商务11版》英文习题TBChap004的解答和分析。

该习题集主要涉及国际贸易的相关知识,包括货币汇率、国际收支平衡、国际金融市场等。

1. 货币汇率货币汇率是指一国货币兑换另一国货币的比率。

它反映了两国货币的相对价值。

货币汇率的变动对国际贸易有着重要影响,可以通过调整汇率来调节贸易差额。

货币汇率的决定因素包括经济基本面、利率差异、政府干预等。

根据题目要求,我们需要解答以下问题:1.1 什么是汇率?汇率是指一国货币兑换另一国货币的比率。

它反映了两国货币的相对价值。

汇率可以分为直接汇率和间接汇率两种形式。

1.2 汇率的决定因素有哪些?货币汇率的决定因素有:•经济基本面:包括经济增长率、通胀率、消费者信心等。

•利率差异:不同国家的利率水平差异会导致资本流动,进而影响汇率。

•政府干预:政府可以通过干预购买或出售外汇市场上的货币来影响汇率。

1.3 货币汇率的变动对国际贸易有什么影响?货币汇率的变动对国际贸易有着重要影响。

当一国货币贬值时,其商品在国际市场上的价格下降,有助于提高出口竞争力;相反,当一国货币升值时,其商品在国际市场上的价格上升,有助于增加进口竞争力。

因此,货币汇率的变动可以通过调节贸易差额来影响国际贸易。

此外,货币汇率的变动还会影响国际投资、国内通胀等。

2. 国际收支平衡国际收支平衡是指一国在一定时期内与其他国家进行的经济往来中,外汇收入与外汇支出之间的平衡状态。

国际收支平衡是衡量一个国家经济状况的重要指标。

针对题目要求,以下是对相关问题的解答:2.1 什么是国际收支平衡?国际收支平衡是指一个国家在一定时期内与其他国家进行的经济往来中,外汇收入与外汇支出之间的平衡状态。

外汇收入包括出口收入、外商直接投资、国际援助等;外汇支出包括进口支付、对外援助等。

国际收支平衡可以分为三种情况:顺差、逆差和平衡。

2.2 国际收支平衡对一个国家有什么影响?国际收支平衡对一个国家有着重要影响。

(免费)国际经济学--第4章 特定要素与国际贸易

只有劳动是可变要素,在商品价格已知的条件下,只要知道劳动在 两个部门间如何分配(进而知道劳动的边际产出),就可确定要素 市场的均衡和要素价格

二 模型均衡解

(封闭条件下)劳动的分配和劳动价格的确定

VMPLX代表X部门对劳动的需求曲线, VMPLY代表Y部门对 劳动的需求曲线 当两部门的劳动报酬相同时,劳动在两部门的分配就达到均衡

X部门资本实际报酬的变化

相对于X产品,X部门的实际报酬可表示为

rX MPKX PX

X部门劳动投入增加,则其特定要素资本的边际产出增加

rX MPKX PX

观察:X部门资本的名义报酬rX如何变化?

X部门资本的名义报酬rX也是上升的

一 商品价格与要素价格

X部门资本实际报酬的变化

相对于Y产品,X部门的实际报酬可表示为

w MPLX PX

贸易后,Y部门的劳动投入减少,则MPLY上升,则该国以Y商 品价格衡量的劳动实际收入上升

w MPLY PY

一 商品价格与要素价格

X部门资本实际报酬的变化

当X部门由于商品价格上升导致劳动流入时,其特定要素—— 资本的边际产出(MPKX)将上升

一 商品价格与要素价格

wX

VMPLX′

VMPLY

wY

贸易后均衡点为E‘,X部门劳 动使用量为OXL’,Y部门劳动 使用量OYL‘ 总结:贸易后X部门的劳动投 入增加,Y部门的劳动投入下 降,该国工资水平w上升

VMPLX

E′

W’ W

E

OX

L

L′

OY

L

一 商品价格与要素价格

劳动实际报酬的变化

贸易后X部门的劳动投入增加,则MPLX下降,则该国以X商 品价格衡量的劳动实际收入下降

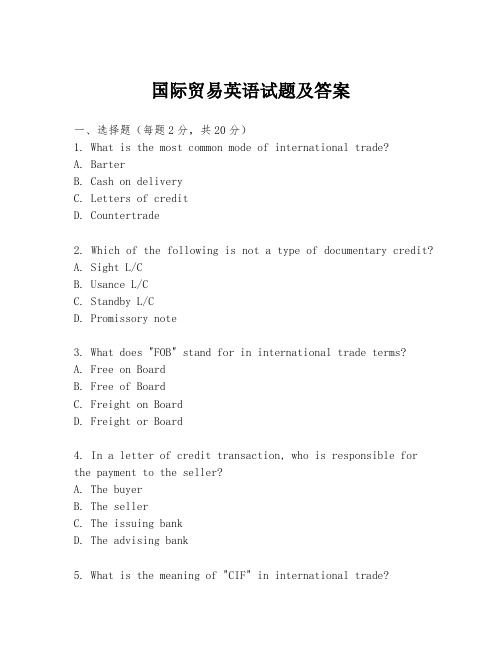

国贸英语试题及答案

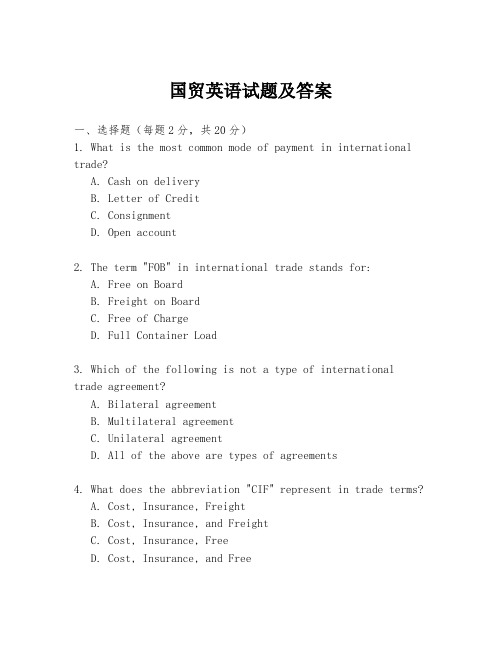

国贸英语试题及答案一、选择题(每题2分,共20分)1. What is the most common mode of payment in international trade?A. Cash on deliveryB. Letter of CreditC. ConsignmentD. Open account2. The term "FOB" in international trade stands for:A. Free on BoardB. Freight on BoardC. Free of ChargeD. Full Container Load3. Which of the following is not a type of international trade agreement?A. Bilateral agreementB. Multilateral agreementC. Unilateral agreementD. All of the above are types of agreements4. What does the abbreviation "CIF" represent in trade terms?A. Cost, Insurance, FreightB. Cost, Insurance, and FreightC. Cost, Insurance, FreeD. Cost, Insurance, and Free5. The process of negotiating the terms of a trade deal is known as:A. Trade negotiationB. Trade arbitrationC. Trade mediationD. Trade settlement6. Which of the following is a risk associated with international trade?A. Currency fluctuationB. Market saturationC. Product obsolescenceD. All of the above7. The term "Tariff" refers to:A. A tax on imported or exported goodsB. A list of goods for tradeC. A method of paymentD. A trade agreement8. What is the primary purpose of a Letter of Credit (L/C)?A. To guarantee payment to the sellerB. To provide insurance for the goodsC. To facilitate the shipment of goodsD. To negotiate trade terms9. The "Incoterms" are a set of international commercial terms that:A. Define the responsibilities of exporters and importersB. Determine the value of goodsC. Set the prices of goodsD. Regulate the quality of goods10. Which of the following is not a form of international trade finance?A. FactoringB. ForfaitingC. HedgingD. All of the above are forms of trade finance答案:1. B2. A3. C4. A5. A6. A7. A8. A9. A 10. C二、填空题(每空1分,共10分)1. The term "EXW" in international trade means the buyer takes over the goods at the seller's ________.2. The International Chamber of Commerce (ICC) is responsible for publishing the ________.3. When a country imposes a high tariff on imported goods, it is known as a ________.4. The payment term "D/P" stands for "Documents against________."5. A "countertrade" involves a transaction where goods are exchanged for other goods or services, rather than for________.6. The risk of non-payment by the buyer is typically covered by ________.7. The "CPT" term in Incoterms means "Carriage Paid To," where the seller pays for the transport of goods up to the________.8. The "DDP" term in Incoterms stands for "Delivered Duty Paid," which means the seller is responsible for all costsand risks until the goods are delivered to the ________.9. The "FCA" term in Incoterms stands for "Free Carrier," where the risk is transferred to the buyer when the goods are handed over to the ________.10. A "forward contract" is a financial instrument used to hedge against the risk of ________.答案:1. premises2. Incoterms3. protectionism4. Payment5. cash6. credit insurance7. destination8. buyer's premises9. carrier 10. currency fluctuation三、简答题(每题5分,共20分)1. Explain the difference between "CIF" and "CIP" in international trade terms.2. What are the advantages and disadvantages of using aLetter of Credit in international trade?3. Describe the process of a typical international trade transaction from the seller's perspective.4. What is meant by "trade finance" and why is it importantin international trade?答案:1. CIF (Cost, Insurance, and Freight) is a term where the seller covers the cost of the goods, insurance, and freight to the port of destination. CIP (Carriage and Insurance Paid to) is similar but only requires the seller to pay for the carriage and insurance to the destination, not the full freight cost.2. Advantages of using a。

国际贸易习题英文

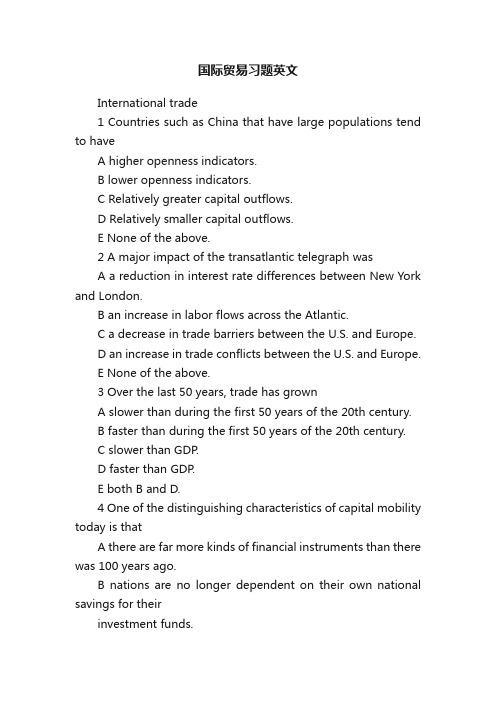

国际贸易习题英文International trade1 Countries such as China that have large populations tend to haveA higher openness indicators.B lower openness indicators.C Relatively greater capital outflows.D Relatively smaller capital outflows.E None of the above.2 A major impact of the transatlantic telegraph wasA a reduction in interest rate differences between New York and London.B an increase in labor flows across the Atlantic.C a decrease in trade barriers between the U.S. and Europe.D an increase in trade conflicts between the U.S. and Europe.E None of the above.3 Over the last 50 years, trade has grownA slower than during the first 50 years of the 20th century.B faster than during the first 50 years of the 20th century.C slower than GDP.D faster than GDP.E both B and D.4 One of the distinguishing characteristics of capital mobility today is thatA there are far more kinds of financial instruments than there was 100 years ago.B nations are no longer dependent on their own national savings for theirinvestment funds.C the bulk of foreign capital flows are tied to labor flows.D there are better managed are rarely cause financial problems.E None of the above.5 The main reason why economists overwhelmingly support more openmarket is because tradeA creates jobs.B directly benefits everyone in the country.C increase the profit margins of firms.D leads to a better allocation of resources inside countries.E All of the above.6 Which of the following kinds of agreements between two or morecountries would be an example of a shallow integration measure?A an agreement to accept another nation’s certification of architects.B an agreement to unify customs forms in order to speed up cross border traffic.C an agreement to use the same environmental standards.D an agreement to impose the same limits on cartels and monopolies.E an agreement to limit subsidies offered to domestic businesses.7 Which of the following kinds of agreements between two or morecountries would be an example of a deep integration measure?A an agreement to reduce tariffs and quotas.B an agreement to unify customs forms in order to speed up cross border traffic.C an agreement to impose the same limits on cartels and monopolies.D an agreement to reduce exports.E an agreement to limit imports.8 Which region of the world experienced a decade long crisis and stagnantor even negative growth rates during the 1980s?A Latin American.B East Asia.C The U.S. and Canada.D Europe.E The European Union.9 According to the text, which of the following would NOT be a reason toconvince economists that the benefits of trade outweigh the costs?A the casual empirical evidence of historical experience.B the evidence of statistical comparisons of countries.C trade benefits consumers in terms of lower prices and increased variety of goods.D trade makes possible increased innovation, access to new technology and economies of scale.E the associated costs are minor and negligible.10 In most high-income countries, the most highly protected goods frominternational trade includeA those goods produced with highly sensitive technology.B cars and aircraft.C processed foods, textiles and apparel.D software.E military ammunitions.11 Institutions areA the same thing as organizations.B associations of individuals or groups.C always embodied in a written set of rules.D a set of rules governing behavior, whether written or not.E only relevant on international issues.12 Which of the following was NOT a creation of the Bretton WoodsconferenceA IMFB IBRDC World BankD WTOE None of the above.13 One of the most important and most visible roles of the IMF is toA hold regular negotiations over tariff reductions.B investigate countries that are charged with being unfair traders.C provide loans to countries that need capital to develop their economies.D intercede by invitation when countries cannot pay their international debts.E serve as a forum for negotiating free trade agreements between groups of nations.14 The original mission of the World Bank was toA provide capital to under-developd countries.B provide capital to firms around the world.C provide financial assistance for the reconstruction of war damaged nations.D provide a safe place for people around the world to put their money.E help countries manage their exchange rates.15 The primary mission the World Bank today is toA provide capital to under-developd countries.B provide capital to firms around the world.C provide financial assistance for the reconstruction of war damaged nations.D provide a safe place for people around the world to put their money.E help countries manage their exchange rates.16 Until the Uruguay Round of the trade negotiations, which of thefollowing sectors were not included in the rules for international trade:A steel and agricultureB automobiles and electronicsC agriculture and apparelD steel and textileE automobiles and agriculture17 An example of a nontariff barrier isA a tax on imports.B a tax on exports.C a physical limit on imports.D both A and BE both A and C18 When the U.S. gives MFN status to China, it means thatA China is treated better than other U.S. trading partners.B China is treated the same as other U.S. trading partners.C China is treated worse than other U.S. trading partners.D China is better by all the nations in the WTO.E China is legally bound to reciprocate.19 One reason markets may fail to provide the optimal quantity of publicgoods is the problem ofA determining what the public wants.B nontariff barriers.C nondiscrimination.D free riders.E economic integration.20 The international institution that serve as a lender of last resort is calledA the IBRDB the WTOC the IMFD the World BankE the GATT21 IMF conditionality refers to theA technical assistance the IMF gives.B the minimum size of a national debt problem that a country must have before the IMF gets involved.C the minimum sized loan the IMF will make.D the maximum sized loan the IMF will make.E the changes a country must make in order to receive IMF assistance.22 With a partial trade agreementA goods and services are allowed to cross boundarieswithout tariffs.B two or more countries agree to liberalize trade in a selected group of categories.C two or more countries set common tariffs towards non-members.D two or more countries allow the free mobility of inputs such as labor and capital.E two or more countries agree on establishing a common currency.23 Which of the following is not a criticism of international institutionssuch as the IMF, the WTO, or the World Bank?A they lack openness in their decision making process.B they foster corruption and discrimination.C they fail to understand the effects of their policies on the vulnerable.D they make decisions without accountability for results.E none of the above.24 The economic philosophy that favors strict limits on imports and strongsupport for exports is calledA zero sum.B autarky.C mercantilism.D comparative advantageE absolute advantage25 If a nation has no absolute advantage, thenA it cannot gain from trade.B it still gains from trade.C it can only gain from trade if it raises its productivity levels.D it can only gain from trade if it reduces wages paid.E it can only gain from trade if it produces outside its production possibility curve.26 If the world price for a good is above a nation’s pre-trade equilibriumprice, then the nationA will export the good.B will import the good.C will neither export nor import the good.D cannot gain from trade.E both C and D.27 According to the comparative advantage theory, the most importantbenefit of trade isA more jobs.B a more efficient allocation of resources.C trade surpluses.D increased exports.E both A and D.28 The U.S.’s comparative advantage over Japan in the production ofrock-n-roll music implies that (for a similar quality of music) theA opportunity cost of production is less in Japan.B absolute cost of production is less in the U.S..C absolute cost of production is less in Japan.D opportunity cost of production is less in the U.S..E none of the above.29 When comparing the U.S. and Mexican car assembly industries, thedisadvantage of higher U.S. wages is offset byA Mexican trade barriers.B trade adjustment assistance in the U.S..C higher productivity in the U.S..D a lower opportunity cost in Mexico.E “Buy American” advertising campaigns in the U.S..30 Trade based on comparative advantage mayA increase competition and innovation.B bring a variety of choices from consumers.C promote efficient allocation of resources.D all of the above.E none of the above.The next three questions use the following table.Suppose that all goods are made with two factors, labor and capital. The table below shows the total endowments of each factor in the U.S. and Canada. Factor endowments The U.S.Canadaworkers10010machines20431 Relative to the U.S., Canada isA labor abundant.B labor scarce.C capital scarce.D none of the above.E not enough information to tell.32 According to the Stolper-Samuelson Theorem, the income distributioneffects of free trade in the U.S. are likely to favorA capitalB laborC either capital or labor, depending on U.S. productivity.D neither capital nor labor.E not enough information to tell.33 According to the H-O Theorem, U.S. exports should be goods thatA intensively use labor input.B intensively use capital input.C use either labor or capital input, depending on the good.D use labor and capital in about equal proportions.E not enough information to tell.34 The H-O Theorem predictsA who benefits and who loses from trade.B which factors are abundant.C the income distribution effects of trade.D which goods will be exported.E the importance of intraindustry trade.35 The Stolper-Samuelson Theorem predictsA the level of productivity in export industries.B which factors are abundant.C the income distribution effects of trade.D which goods will be exported.E the importance of intraindustry trade.36 After trade opens, the short run impact on the income of the specificfactor that is relatively scarce will beA a decrease.B an increase.C indeterminate.D zero.E either an increase or zero effect.37 After trade opens, the short run impact on the income of the variablefactor will beA a decrease.B an increase.C indeterminate, depending on the consumption bundle of the owners of the variable factor.D zero.E indeterminate, depending on the productivity of the variable factor.38 Which of the following is not a proposition of the H-O model?A A country has a comparative advantage in the production of that commodity which uses more intensively the country’s more abundant resource.B The effect of international trade is to tend to equalize factor prices between the trading nations.C If Mexico is an unskilled labor abundant country, then Mexico has acomparative advantage in the production of goods that use more unskilled labor intensively.D If the U.S. is an skilled labor abundant country, then the U.S. has a comparative advantage in the production of goods that use more skilled labor intensively.E none of the above.39 In general, the effect of international trade on the number of jobs inChinaA is much greater than macroeconomic policies.B is much less than macroeconomic policies.C cannot be compared to macroeconomic policies.D is about the same as macroeconomic policies.E is greater than macroeconomic policies but concentrated in just one or two industries.40 Wage inequality has been on the rise in virtually all high-incomeindustrial economies since 1970s. The causes are probably numerous but the leading explanation for the greatest share of the increase in inequality isA the growth of trade with developing countries.B the growth of trade with other high-income industrial countries.C technological change which increased the relative demand for skilled workers.D technological change which increased the relative demand for unskilled workers.E technological change which decreased the relative demand for skilled workers.41 “Intraindustry trade” refers toA international trade of products made within the same industry.B international trade of products made across different industries.C trade that occurs as a result of comparative advantage.D the exchange of non-similar items.E trade that mostly occurs within developing countries.42 Intraindustry trade usually depends on what characteristics of theindustry?A dis-economies of scale and undifferentiated products.B nontariff barriers and large scale foreign investment.C quota auctions and low effective rates of protection.D economies of scale and differentiated products.E both B and D.43 One reason that a large share of the trade between high-incomeindustrial economies is intraindustry trade is becauseA it is more advantageous than interindustry trade.B high-income industrial economies produce in the first stage of the product cycle.C high-income industrial economies are wealthier than developing countries.D high-income industrial economies have very similar resource endowments in absolute terms.E high-income industrial economies have very similar resource endowments in proportional terms.44 Strategic trade policy is concerned withA maintaining a competitive edge in strategic defense industries.B capturing excess profit from foreign producers.C capturing the benefits of learning effects.D overcoming social returns that are too low.E developing a strategy for using traded goods effectively.45 The main reason why strategic trade policies are not put into practicemore often is becauseA too few industries have the appropriate structure of increasing costs.B the information requirements are too great.C market failure are rare.D social costs are a poor measure of economic costs.E few industries are path dependent.46 Which of the following is not a problem in the implementation ofindustrial policies?A choosing the industry to target.B knowing the optimum amount of resources to provide the targeted industry.C the encouragement of rent seeking by firms in other industries.D the benefits are partly captured by foreign firms.E All of the above are problems.47 An internal economies of scale is defined asA one whose size or scale effects are not located in the industry but in the firm.B one with falling costs over a specific level of output.C one with falling costs over a relatively large range of output.D one with falling costs over a relatively large range of output but definite declining profits.E none of the above.48 Which of the following is true about monopolistic competition?A It is both the firm and the industry.B It involves a handful of firms producing the entire market.C It is competition among many firms producing similar but differentiated products.D The pattern of production and trade is difficult to predict.E It enjoys no economies of scale.49 Market failures occur wheneverA private returns may be greater than social returns.B private returns may be less than social returns.C the free market produces less than what is socially optimal.D monopolies exist in a market.E all of the above.50 Suppose that China decided to subsidize a major research anddevelopment effort by Chinese firms in the semiconductor industry.Under the current rules of the WTO, the effort of China isA allowed as long as the subsidies are a small percent of the total cost.B allowed as long as the subsidies do not involve a direct payment to the industry.C are not allowed.D are neither allowed nor disallowed.E allowed as long as the subsidies are for developing a “precompetitive”technology.。

国际经济学题库09

国际经济学题库09专业姓名学号班级第一章国际贸易理论的微观基础一、名词解释1、国际贸易的交换利益2、国际贸易的专业化利益3、国际均衡价格4、生产可能性边界5、开放经济6、封闭经济7、贸易条件二、是非判断题1、国际经济学是研究稀缺资源在世界范围内的有效分配,以及在此过程中发生的经济活动和经济关系的科学。

2、国际经济学是经济学的分支学科,是建立在微观经济学和宏观经济学基础上的3、国际经济学经历了重商主义、自由贸易和现代国际经济学理论多层面发展的三个阶段。

它是伴随着国际经济活动的不断增加而逐渐完善起来的。

4、与一般经济学的研究方法相同,国际贸易理论在分析上也分为实证分析和规范分析两种。

5、国际贸易理论分析不涉及货币因素,考虑各国货币制度的差异与关系的影响。

6、大多数国际贸易理论都是一种静态或比较静态分析,时间因素在国际贸易理论中较多体现。

7、没有贸易价格差的存在,就不会发生国际贸易。

三、单项选择题1、国际经济学在研究资源配置时,作为划分界限的基本经济单位是A、企业B、个人C、政府D、国家2、从国际经济资源流动的难度看,最容易流动的要素是A、商品B、资本C、人员D、技术3、若贸易的开展导致社会无差异曲线向远离坐标原点的方向移动,则判定贸易对该国是A、有益B、有害C、不变D、不能判断4、消费点在同一条社会无差异曲线上移动,表示整个国家的福利水平A、增加B、减少C、不变D、不能判断5、在封闭经济条件下,下列不属于一国经济一般均衡的条件的是A、生产达到均衡B、消费达到均衡C、市场出清D、货币市场达到均衡6、国际贸易建立的基础是A、绝对价格B、相对价格C、不变价格D、以上三种都不是7、在封闭经济条件下,A国X商品的相对价格低于B国X商品的相对价格,我们称A国在X 商品上具有A、绝对优势B、比较优势C、没有优势D、以上三种都不是8、一国从国际贸易中所获利益的多寡取决于A、市场占有率B、技术优势C、竞争优势D、贸易条件四、简述题:1、试用图形分析国际贸易的交换利益和专业化利益。

特定要素与国际贸易

数字贸易成为新的发展趋势,特定要素在数字贸易中的作 用将更加重要,如数据流动、云计算、物联网等技术手段 的应用,将为国际贸易带来新的发展机遇。

全球价值链重构

全球价值链面临重构,特定要素在全球价值链中的地位和 作用将发生深刻变化,如知识产权、品牌、营销等特定要 素的重要性将进一步提升。

特定要素与国际贸易的挑战与机遇

贸易保护主义

贸易保护主义抬头给国际贸易带来挑战,特定要素的流动和配置可能面临更多的限制和障碍,需 要加强国际合作,推动贸易自由化便利化。

技术变革与人才竞争

技术变革和人才竞争对特定要素提出了更高的要求,需要加强人才培养和技术创新,提升特定要 素的质量和竞争力。

全球经济治理体系改革

全球经济治理体系面临改革,需要加强国际合作,推动全球经济治理体系朝着更加公正合理的方 向发展,为特定要素的流动和配置创造更加良好的环境。

03 国际贸易对特定要素的影 响

国际贸易对特定要素的需求影响

增加需求

国际贸易使得特定要素的需求增加,因为出口企业需要更多的特定要素来生产出口商品。

需求波动

国际贸易可能导致特定要素的需求波动,因为国际市场变化和贸易政策调整等因素可能影 响出口企业的生产计划。

需求结构变化

国际贸易可能导致特定要素的需求结构发生变化,因为不同国家和地区的消费者对商品的 需求偏好不同,出口企业需要针对不同市场需求调整生产结构,从而对特定要素的需求也 发生变化。

02 特定要素对国际贸易的影 响

特定要素对贸易成本的影响

01

02

03

运输成本

特定要素如地理位置、基 础设施状况等会影响运输 成本,进而影响国际贸易 的成本。

交易成本

特定要素如语言、文化差 异等会影响交易成本,包 括信息获取、谈判和执行 等环节的成本。

国际贸易实务英文版课后练习题含答案

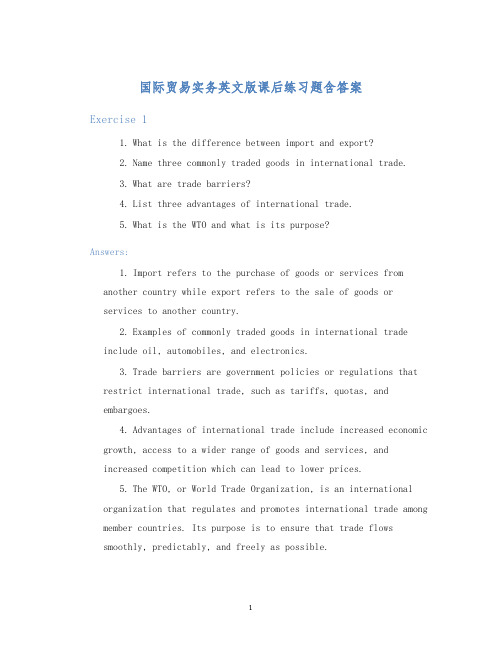

国际贸易实务英文版课后练习题含答案Exercise 11.What is the difference between import and export? three commonly traded goods in international trade.3.What are trade barriers?4.List three advantages of international trade.5.What is the WTO and what is its purpose?Answers:1.Import refers to the purchase of goods or services fromanother country while export refers to the sale of goods orservices to another country.2.Examples of commonly traded goods in international tradeinclude oil, automobiles, and electronics.3.Trade barriers are government policies or regulations thatrestrict international trade, such as tariffs, quotas, andembargoes.4.Advantages of international trade include increased economicgrowth, access to a wider range of goods and services, andincreased competition which can lead to lower prices.5.The WTO, or World Trade Organization, is an internationalorganization that regulates and promotes international trade among member countries. Its purpose is to ensure that trade flowssmoothly, predictably, and freely as possible.Exercise 21.What is the difference between an open economy and a closedeconomy?2.What is a balance of trade? three factors that can influence a country’s balanceof trade.4.What is a trade deficit?5.What are the consequences of a trade deficit?Answers:1.An open economy is one that engages in international tradeand allows foreign investment while a closed economy is one that does not engage in international trade or allow foreign investment.2.Balance of trade refers to the difference between acountry’s exports and its imports during a specific time period.3.Factors that can influence a country’s balance of tradeinclude political stability, currency exchange rates, and trade policies such as tariffs and subsidies.4.A trade deficit occ urs when a country’s imports exceed itsexports.5.The consequences of a trade deficit can include a decreasein a country’s currency value, increased borrowing from foreign countries, and a loss of jobs in the domestic economy.Exercise 31.What is the difference between absolute advantage andcomparative advantage?2.Give an example of a country that has an absolute advantagein producing a specific good.3.What is the basis for comparative advantage?4.Expln the concept of opportunity cost and how it relates tocomparative advantage.5.How can a country benefit from specializing in theproduction of goods in which it has a comparative advantage? Answers:1.Absolute advantage exists when a country can produce a goodmore efficiently than another country while comparative advantage exists when a country can produce a good at a lower opportunity cost than another country.2.For example, Saudi Arabia has an absolute advantage inproducing oil due to its abundance of natural resources andadvanced technology.3.The basis for comparative advantage is the idea thatcountries should specialize in producing goods in which they havea lower opportunity cost compared to other goods.4.Opportunity cost refers to the value of the next bestalternative that is given up in order to pursue a particularaction. It relates to comparative advantage because a countryshould produce the goods in which it has a comparative advantage and trade for goods in which it does not have a comparativeadvantage.5.A country can benefit from specializing in the production ofgoods in which it has a comparative advantage by increasingefficiency and productivity, leading to lower costs and increased competitiveness in international trade.。

国际贸易双语课程习题集

《国际贸易》双语课程习题集Chapter 1 Introduction1. Important Concepts:SpecializationExchange rateImport quotaExport industriesGlobalizationRelatively closed economyImport-competing industries2. Choices:(1) International transactions constitute an extension of domestic transactions. In both cases, trade offers the benefits of .a. specializationb.industrializationc.globaliz ationd.tariff(2) There are a few of the differences between domestic and foreign trade. Which one is NOT included?a.Exchange Ratesmercial Policiesc.Marketing Considerationsd.Aggregate Measures(3) Commodity trade is not the only component of international transactions that has expanded rapidly. So dointernationaltransactions.a.industrial productsb.agriculturalproducts c.service d.raw materials3. Review Questions(1) Distinguish between (a) export industries,(b) import-competing industries, and (c) nontraded goods. Give examples of each.(2) Japanese labor productivity is roughly the sameas that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States is still considerably more productive in the service sector. But most services are nontraded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?(3) Evaluate the statement, "The United States is a closed economy, hence foreign trade is of no consequence to it."Chapter 2 International trade theories1. Important ConceptsComparative advantageAbsolute advantageFactor proportions (or endowment) theoryProduct cycleInter-industry tradeIntra-industry tradeCapital-intensive productsCapital-abundant countryMonopolistic competitionFactor price equalizationLeontief scarce-factor paradox2. Choices(1) The principle of comparative advantage was enunciated early in the nineteenth century by the Englisheconomist .a. David Ricardo b. David Hume c. Adam Smith d. Mordechai E. Kreinin(2) While comparative advantage determines the direction of trade, absoluteadvantage determines and therefore the relative living standards of the two countries.a. allocation of resourcesb. inflationc. the country 's(3) Country A has an absolute advantage over country B in commodity X if it can produce the commodity cheaper is the concept of .a. comparative advantage advantageb. absolutec. relativeadvantage petitive advantageChapter 3 International trade policies1. Important ConceptsDemand considerationDynamic gains from tradeCountry "in isolation"Anti-inflationary trade2. Choices(1) Japan primarily exports manufactured goods, while importing raw materials such as food and oil.Find out the negative impactions on Japan's terms of trade of the following events .a. A war in the Middle East disrupts oil supply.b. Korea develops the ability to produce automobiles that it can sell in Canada and the United States.c. U.S. engineers develop a fusion reactor that replaces fossil fuel electricity plants.d. A harvest failure in Russia.e. A reduction in Japan's tariffs on imported beef and citrus fruit.(2) A national government can introduce a variety of restrictions upon international transactions that cannot be imposed on domestic transactions. These could include .a. different domestic policiesb.voluntary export restraintc.statistical datad.relative immobility of productive factors3. Review QuestionsWhat is meant by strategic trade policy? What are its limitations? How can export subsidies bring about an increase in the share of global profitsms? obtained by “our ” firChapter 4 Tariffs1. Important ConceptsTariff protectionAd valorem tariffSpecific tariffEffective tariff2. Choices(1) Which one is NOT the type of tariff?a. ad valorem tariffb. specific tariffc. export tariffd. compound duty(2) The rule, which guards against discrimination in international trade, is known as .a. WTOb. MFNc. GATTd. IMF(3) The elimination of tariff in a customs union will cause the effect of .a. trade improvementb. tradediversionc. trade creationd. trade competationhigh enough to keep out all imports of the (4) A tariff rate isproduct which we calla. revenue tariffb. prohibitive tariffc. protective tariffd. specific tariffChapter 5 Non-tariff Trade Barriers and the New Protectionism1. Important ConceptsImport quotasQuota rentsQuality upgradingAntidumping duty2. Choices(1) sets an absolute limit on the quantity of a productthat may enter the country.a. An export quotab. An import quotac.Tariff d. Voluntary export restraints(2) International trade in certain primary commodities ( namely raw materials or agricultural products ) is governed by .a. WTOb. EUc. OECDd. ICAs(3) It is customary to distinguish amongthree types of dumping.Which one does NOT belong to those?a. anti-dumpingb. sporadic dumpingc. predatory dumpingd. persistent dumping(4) A country sets an absolute limit on the quantity of a product that may enter it is the concept of ___________________ .a. quota rentsb. indirect taxesc. auctioning import license import quotasd.3. Review Questions(1) Evaluate the following statements:a. As instruments of protection go, a tariff is less harmfulto a country than an quota, and a quota is less harmful thanb. Protection is an expensive and inefficient way to create jobs.c. International commodity agreements constitute the best way of helping LDCscombat the effect of violent price fluctuations on their economies.d. The Multifibre Agrement represents an excellent way to organize international trade. We should apply it to steel and other industries. (2) "Import quotas on capital-intensive industrial goods and subsidies for the import of capital equipment were meant to create manufacturing jobs in many developing countries. Unfortunately, they have probably helped create the urbanChapter 6 Economic Integration and WTO1. Explain the following terms:Trade creation of a customs union.Trade diversion of a customs union.2. What are the conflicts between the WTOand the environmentalmovement?3. Choices(1) International and regional forums for trade and financial negotiation include some organizations except .a. WTOb. EUc. World Bankd. OECD(2) What is unique about inrernational economics _________________a. exchange ratesb. relative immobility of productive factorsc. marketing considerationsd. commercial policies(3) Which of the following actions would be legal under GATT .a. A U.S. tariff of 20 percent against any country that exports more than twice as much to the United States as it imports in return.b. A subsidy to U.S. wheat exports, aimed at recapturing some of the markets lost to the European Union.c. A U.S. tariff on Canadian lumber exports, not matched by equivalent reductions on other tariffs.d. A Canadian tax on lumber exports, agreed to at the demand of the United States to placate U.S. lumber producers.e. A program of subsidized research and development in areasrelated to hightechnology goods such as electronics and semiconductors.f. Special government assistance for workers who lose theirjobs because of import competition.Chapter 7 International Trade and E-Commerce1. What is the process of e-commerce ?2. Briefly review the key innovations that culminated in thedigital revolution. What is the basic technological process that made the revolution possible?3. What is convergence? How is convergence affecting Sony? Kodak?Nokia?4. What is the innovator's dilemma? What is the difference betweensustaining technology and disruptive technology? Briefly review Christensen's five principles of disruptive innovation.5. What key issues must be addressed by global companies thatengage in e-commerce?6. What is the meaning of DFI? List some of the factors that inducecompanies to invest abroad.Chapter8 procedure of international trade1. Please list at least three essential constituents of adefinite offer.2. According to the text, what characteristics does an indefinite offer have?3. Please briefly describe the export process.4. Why is it of great importance for the exporter to check theL/C against the sales contracts very carefully after receiving the L/C? 5. What documents should usually be submitted when negotiating through the bank?6. Please briefly describe the import process.7. Why is the shipping advice so important on CFR?8. What information should be included in a packing list?9. Please list at least six kinds of documents used in international trade?10. What are the major functions of an B/L11. What are the contents and functions of commercial invoice?12. What is the function of documentation in export and import practices?Chapter9 International Trade Terms oceanic transportation?1. What's trade terms?2. Please briefly describe the thirteen trade terms inIncoterms 2000.3. What are the obligations of the buyer under the termsof CIF, FOB and CFR?4. What are the obligations of the seller under the termsof FCA, CPT and CIP?5. Which trade term is suitable to inland waterway and6. Please briefly describe three international trade practices.7. Please describe the formation domestic expenses andforeign expenses.8. Please list at least four derived forms of CFR.9. What's the meaning of main freight?10. What's difference between symbolic delivery andphysical delivery?11. What's the relationship among FOB, CFR and CIF?12. What's Commission ?13. Please describe the formula about conversion among FOB,CFR and CIF.Chapter10 terms of commodity1. How to name goods exported ?2. What's quality of commo dity?3. Please describe types of quality.4. How to weight different commodities?5. What's more or less clause?6. Please describe functions of sales packing and shipping packing.7. Why is shipping mark important in international transportation?8. Please describe the standardized format of shipping mark suggested by ISO.9. When choosing appropriate cargo packing, what factors should one take into consideration?Chapter11 international cargo transportation1. List at least 4 major type of transportation.2. What are the characteristics of Liner shipping?3. How to compute freight of Liner shipping?4. Who will undertake the loading and unloading charges in chartering a vessel?5. What's International Multimodal transportation.6. What are the Features of containerization?7. What's demurrage and dispatch?8. what 's the function of bill of lading?9. Please explain the clean bill of lading.10. What 's the difference between Hague Rules and Hamburg Rules?Chapter12 international cargo transportation insurance1. Please describe the scope of cargo transportation insurance.2. What's the difference between Perils of sea and extraneous risks?3. Please list at least 6 major type of fortuitousaccidents.4. Which risk did TITANIC encounter? Can this kindof risk be avoided?5. Did all the cargoes sunk with the ship? What type of loss they belonged to ?(actual loss, constructive loss, particular loss or general loss).6. What measures were taken after TITANICWhat was the nature of the Expense caused encountered the risk?by the measures? Did the insurance compensate for it?7. Who relieve the survivor on TITANIC ? what wasthe nature of this kind of expense? Who must undertake it?8. What's actual total loss and what is thedifference between Constructive total loss and actual total loss?9. What's General Average and what is thedifference between Particular Average and General Average?10. Please explain sue and labor expense and salvage charge11. What's coverage of CIC ?12. What's the relationship between CIC and ICC?13. How to compute the insurance value of the goodsand it 's insurance premium ?14. Please describe the content of insurance policy.Chapter13 international payments1. What payment instruments are used in international trade? Please list at least 5 of them.2. What's the difference between a commercial d raft and a banker 's draft?3. What is the advantage and disadvantage of transferring money through DD compared with TT?4. How many stages are there in handling a draft?5. What's the difference between draft and Promissory note?6. What are the Characteristics of remittance?7. when will you release documents if you are the exporter under collection?8. Please describe the difference amongD/P at sight , D/P after sight and D/A.9. What's D/P ? T/R?10. What are the characteristics of letter of credit?11. Will the issuing bank undertake payment if the applicant goes bankrupt?12. Will the bank deal with the transaction according tocontract or L/C if they aren 't in accordance with each other?13. What will happen if the documents are not inconsistent with theL/C?14. Please describe the chief contents of L/C.。

尹翔硕《国际贸易教程》笔记和习题详解(特定要素模型)【圣才出品】

专注考研考证第4章 特定要素模型4.1 复习笔记一、基本假设1.假设有三种要素:L 、C K 和W K ;两种产品:布和麦。

劳动在部门间可以自由流动,资本不可流动,是特定要素。

2.有两个国家:本国和外国。

都用三种要素生产两种产品。

要素在国际间完全同质,并且给定。

L 、C K 和W K 为本国要素,L *、C K *和W K *为外国要素。

3.不同国家有不同的要素禀赋。

两国不仅劳动与资本的比例不同,而且两种特定资本的比例也不同。

4.生产的规模报酬不变,要素充分就业,并且一种要素的边际生产率递减。

5.技术给定,并且相同,即两国的单位要素投入相同。

6.消费者偏好相同,有相同的需求曲线和社会无差异曲线。

在给定商品价格下,两国对两种产品的消费比例相同。

7.市场完全竞争,消费者追求效用最大化,生产者追求利润最大化。

8.劳动在国内部门间可流动,在国家间不可流动,资本都不可流动。

9.商品自由贸易,没有壁垒,没有运输成本。

二、没有贸易时的均衡1.特定要素情况下的要素组合和工资/租金比例专注考研考证特定要素情况下的效率轨迹线与完全流动要素下是不同的,因为两者的组合不同(图4-1)。

图4-1 特定要素情况下的工资/租金比例在特定要素情况下,除了一点(图4-1中的P点)外,两部门的工资/租金比例都不同,这是因为当只有劳动是可流动要素时,随着劳动在某一部门的增加,其边际生产率就不断下降,工资也就不断减少。

2.劳动的边际生产率和生产可能性边界只有当两部门的劳动投入达到边际生产率相同的时候,两部门的工资才相等。

由于劳动的边际生产率递减(如图4-2所示),即生产的机会成本递增,生产可能性边界是凹向原点的(如图4-3所示)。

由于特定要素生产的效率不如完全流动要素那么高,其生产可能性边界会比一般H-O模型的生产可能性边界小。

均衡取决于社会无差异曲线与生产可能性边界的切点。

图4-2 劳动的边际产出专注考研考证图4-3 特定要素模型中的生产可能性边界三、国际分工和贸易均衡1.比较优势假定CK和CK*分别为本国和外国织布部门的特定资本,W K和W K*分别为本国和外国种麦部门的特定资本。

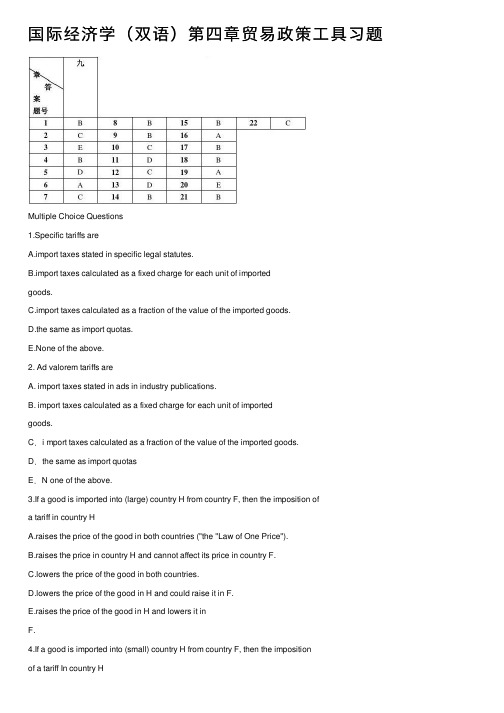

国际经济学(双语)第四章贸易政策工具习题