2021年最新中欧全面投资协定核心内容(附中英双语版)

中欧全面投资协定内容(一)

- 中国与欧盟达成全面投资协定的背景- 中欧全面投资协定的谈判历程中国和欧盟自2014年开始谈判全面投资协定,经过七年的谈判,双方最终于2020年12月达成一揽子协定。

- 协定内容的主要特点- 开放市场准入协定将减少欧洲企业在中国的市场准入壁垒,包括汽车制造、医药、金融等领域。

中国也将获得更便利的投资准入。

- 双向投资促进协定将保护双方企业的投资利益,避免不公平的待遇和歧视性措施。

同时,将建立双向投资促进机制,促进投资合作。

- 可持续发展承诺协定包括了环境、劳工权益等方面的可持续发展承诺,确保投资活动的社会责任和可持续性。

- 协定的影响及意义- 对中国经济的影响全面投资协定的签署将提升中国的国际形象,吸引更多外部投资,促进经济结构调整和升级。

- 对欧盟经济的影响欧盟企业将获得更多涉华机会,扩大市场份额,增加对华投资,从而带动欧盟经济的增长。

- 对全球经济的影响中欧全面投资协定的签署将为全球经济带来更多机遇与活力,推动经济全球化进程。

- 协定可能面临的挑战及解决方案- 可能出现的执行问题协定的落实可能会面临一些执行问题,包括对双方企业的监管和协定条款的解释等。

双方需要建立有效机制来解决这些问题。

- 国内反对声音在中国和欧洲,可能会出现一些反对意见,涉及到国内利益保护和政治因素等。

双方需要妥善沟通,平衡各方利益,化解矛盾。

- 全球经济环境变化全球经济环境的变化可能对协定的实施产生影响,双方需要灵活应对,调整战略,确保协定的长期稳定实施。

- 我对中欧全面投资协定的看法- 积极意义我认为这一协定的签署对中国和欧盟都具有重要的积极意义,可以促进双方经济的发展,增进双方的合作与交流。

- 挑战与机遇并存当然,协定的实施也会面临一些挑战,但我相信双方可以共同克服这些困难,实现互利共赢的局面。

- 结语中欧全面投资协定的签署标志着双方进一步深化经济合作的重要里程碑,对于推动全球经济的繁荣与稳定也具有重要意义。

希望双方能够共同努力,推动协定的顺利实施,为世界经济的发展做出更大贡献。

2021年最新中欧全面投资协定核心内容(英语版)

中欧全面投资协定核心内容(英语版)The cumulative EU foreign direct investment (FDI) flows from the EUto China over the last 20 years have reached more than €140 billion. For Chinese FDI into the EU the figure is almost €120 billion. EU FDI in China remains relatively modest with respect to the size and the potential of the Chinese economy.As regards investment, the EU-China Comprehensive Agreement on Investment (CAI) will be the most ambitious agreement that China has ever concluded with a third country.In addition to rules against the forced transfer of technologies, CAI will also be the first agreement to deliver on obligations for the behavior of state-owned enterprises, comprehensive transparency rules for subsidies and commitments related to sustainable development.The CAI will ensure that EU investors achieve better access to a fast growing 1.4 billion consumer market, and that they compete on a better level playing field in China. This is important for the global competitiveness and the future growth of EU industry. Ambitious opening by China to European investmentsFirstly, the CAI binds China's liberalisation of investments overthe last 20 years and, in that way, it prevents backsliding. This makes the conditions of market access for EU companies clear and independent of China's internal policies. It also allows the EU to resort to the dispute resolution mechanism in CAI in case of breach of commitments.In addition, the EU has negotiated further and new market access openings and commitments such as the elimination of quantitativerestrictions, equity caps or joint venture requirements in a number of sectors. These are restrictions that severely hamper theactivities of our companies in China. The overall package is far more ambitious than what China has committed to before.On the EU side, the market is already open and largely committed for services sectors under the General Agreement on Trade in Services (GATS). EU sensitivities, such as in the field of energy,agriculture, fisheries, audio-visual, public services, etc. are all preserved in CAI.Examples of market access commitments by China:•Manufacturing: China has made comprehensive commitments with only very limited exclusions (in particular, in sectors with significant overcapacity). In terms of the level of ambition, this would match the EU's openness. Roughly half of EU FDI is in the manufacturing sector (e.g. transport and telecommunication equipment, chemicals, health equipment etc.). China has not made such far-reaching market access commitments with any other partner.•Automotive sector:China has agreed to remove and phase out joint venture requirements. China will commit market access for new energy vehicles.•Financial services: China had already started the process of gradually liberalising the financial services sector and will grant and commit to keep that opening to EU investors. Joint venturerequirements and foreign equity caps have been removed for banking, trading in securities and insurance (including reinsurance), as well as asset management.•Health (private hospitals): China will offer new market opening by lifting joint venture requirements for private hospitals in keyChinese cities, including Beijing, Shanghai, Tianjian, Guangzhou and Shenzhen .•R&D (biological resources): China has not previously committed openness to foreign investment in R&D in biological resources. China has agreed not to introduce new restrictions and to give to the EU any lifting of current restrictions in this area that may happen in the future.•Telecommunication/Cloud services: China has agreed to lift the investment ban for cloud services. They will now be open to EUinvestors subject to a 50% equity cap.•Computer services: China has agreed to bind market access for computer services - a significant improvement from the currentsituation. Also, China will include a ‘technology neutrality'clause, which would ensure that equity caps imposed for value-added telecom services will not be applied to other services such asfinancial, logistics, medical etc. if offered online. •International maritime transport: China will allow investment in the relevant land-based auxiliary activities, enabling EU companies to invest without restriction in cargo-handling, container depots and stations, maritime agencies, etc. This will allow EU companies to organise a full range of multi-modal door-to-door transport,including the domestic leg of international maritime transport. •Air transport-related services: While the CAI does not address traffic rights because they are subject to separate aviationagreements, China will open up in the key areas of computerreservation systems, ground handling and selling and marketingservices. China has also removed its minimum capital requirement for rental and leasing of aircraft without crew, going beyond GATS.•Business services: China will eliminate joint venture requirements in real estate services, rental and leasing services, repair andmaintenance for transport, advertising, market research, management consulting and translation services, etc.•Environmental services: China will remove joint venture requirements in environmental services such as sewage, noise abatement, solidwaste disposal, cleaning of exhaust gases, nature and landscapeprotection, sanitations and other environmental services. •Construction services: China will eliminate the project limitations currently reserved in their GATS commitments.•Employees of EU investors: Managers and specialists of EU companies will be allowed to work up to three years in Chinese subsidiaries, without restrictions such as labour market tests or quotas.Representatives of EU investors will be allowed to visit freely prior to making an investment.Improving level playing field – making investment fairer•State owned enterprises (SOEs) - Chinese SOEs contribute to around30 percent of the country's GDP. CAI seeks to discipline thebehaviour of SOEs by requiring them to act in accordance withcommercial considerations and not to discriminate in their purchases and sales of goods or services. Importantly, China also undertakes the obligation to provide, upon request, specific information toallow for the assessment of whether the behaviour of a specificenterprise complies with the agreed the CAI obligations. If theproblem goes unresolved, we can resort to dispute resolution under the CAI.•Transparency in subsidies –The CAI fills one important gap in the WTO rulebook by imposing transparency obligations on subsidies in the services sectors. Also, the CAI obliges China to engage inconsultations in order to provide additional information on subsidies that could have a negative effect on the investment interests of the EU. China is also obliged to engage in consultations with a view to seek to address such negative effects.•Forced technology transfers –The CAI lays very clear rules against the forced transfer of technology. The provisions consist of the prohibition of several types of investment requirements thatcompel transfer of technology, such as requirements to transfertechnology to a joint venture partner, as well as prohibitions to interfere in contractual freedom in technology licencing. These rules would also include disciplines on the protection of confidentialbusiness information collected by administrative bodies (for instance in the process of certification of a good or a service) fromunauthorised disclosure. The agreed rules significantly enhance the disciplines in WTO.•Standard setting, authorisations, transparency –This agreement covers other long-standing EU industry requests. China willprovide equal access to standard setting bodies for our companies.China will also enhance transparency, predictability and fairness in authorisations. The CAI will include transparency rules forregulatory and administrative measures to enhance legal certainty and predictability, as well as for procedural fairness and the right to judicial review, including in competition cases.Embedding sustainable development in our investment relationship•In contrast to other agreements concluded by China, the CAI binds the parties into a value-based investment relationship grounded onsustainable development principles.The relevant provisions aresubject to a specifically tailored implementation mechanism toaddress differences with a high degree of transparency andparticipation of civil society.•China commits, in the areas of labour and environment, not to lower the standards of protection in order to attract investment, not to use labour and environment standards for protectionist purposes, as well as to respect its international obligations in the relevanttreaties. China will support the uptake of corporate socialresponsibility by its companies.•Importantly, the CAI also includes commitments on environment and climate, including to effectively implement the Paris Agreement on climate.•China also commits to working towards the ratification of the outstanding ILO (International Labour Organisation)fundamental Conventions and takes specific commitments in relation to the two ILO fundamental Conventions on forced labour that it has not ratified yet.Monitoring of implementation and dispute settlement•In the CAI, China agrees to an enforcement mechanism(state-to-state dispute settlement), as in our trade agreements.•This will be coupled with a monitoring mechanism at pre-litigation phase established at political level, which will allow us to raise problems as they arise (including via an urgency procedure).。

中欧投资协定开启中欧合作新时代

应当履行的义务并对一些行业的补贴进行全透明的公示,这些都是史无前例的。

在公平竞争问题中,中欧双方依然有部分分歧,具体表现在,欧盟希望确保欧洲企业相对中国国有企业的非歧视性监管待遇,要求中国提高国家援助透明度。

而中方的立场显示中国不希望将国企政策被“公平竞争环境”原则一刀切,希望保障国有经济在社会主义体制中的重要地位不受动摇。

3.可持续发展《中欧投资协定》中纳入了与投资有关的环境、劳工问题,在环境问题上,中国在环境保护和气候问题对世界作出的贡献是巨大的,尤其是近年来中国的环境保护标准越来越高。

此外,中国还承诺有效执行《巴黎协定》。

本着以人民为中心的态度,中国承诺在劳工领域不降低保护标准以吸引投资,不为保护主义目的适用劳工标准并遵守有关条约中的国际义务,支持公司履行CSR,并对尚未批准的两项国际劳工组织关于强迫劳动的基本公约做出具体承诺。

此项议题将更加有利于促进可持续投资发展的全球导向。

4.争端解决机制在《中欧投资协定》中,将与在政治一级建立的诉讼前阶段的监督机制相结合,允许欧盟在违反承诺的情况下在该协定中诉诸争端解决机制,这使得欧盟能够在问题出现时提出问题(包括通过紧急程序进行)。

此外,将非诉方式作为提起仲裁的前置程序,基本采取国际投资争端解决中心仲裁及临时仲裁两种方式并行的制度设计,投资者可以择一适用,此一系列争端解决框架与传统的投资仲裁并行或前后衔接共同构建起一个完整的争端解决机制。

里程碑意义众所周知,投资意味着生产关系的介入,会让双方建立起一种长期而复杂的依存关系,投资关系一旦建立就会维持几十年甚至更久,这也就成为了国际关系中最不容易替代的深度依存。

《中欧投资协定》的签署对促进欧盟和中国之间实现资本自由流动,促进开放、自由、透明、包容的贸易和投资体系。

1.对欧盟的有益影响受疫情以及英国脱欧的事件影响,欧盟经济持续低迷,《中欧投资协定》的签署将为欧盟的经济复苏提供巨大的帮助,为欧盟企业进入中国市场扫除了许多准入限制以及政策上的干扰,甚至构建了一套解决争端的机制,在协定中对能源、农业、渔业、视听、公共服务等敏感行业也进行了一定程度的保护。

中欧全面投资协定实施展望研究报告

中欧全面投资协定实施展望研究报告中欧全面投资协定(Comprehensive Agreement on Investment, CAI)是中欧两大经济体之间的一项重要合作协议。

该协定的实施将对双方的经济发展和贸易投资产生深远的影响。

本文将对中欧全面投资协定的实施展望进行研究分析。

中欧全面投资协定的实施将进一步促进中欧之间的投资合作。

协定将为双方企业提供更加开放和稳定的投资环境,提高投资者的信心和安全感。

中欧双方将在市场准入、投资保护、可持续发展等方面达成共识,为企业投资提供更多的便利和保障。

这将有助于吸引更多的中欧企业进行跨境投资,推动双方经济的互利共赢。

中欧全面投资协定的实施将促进贸易自由化和便利化。

协定将进一步降低中欧之间的贸易壁垒,提高贸易自由化水平。

双方将通过减少非关税壁垒、加强知识产权保护等措施,促进贸易的顺利进行。

这将为中欧企业提供更加便利的贸易环境,推动贸易的增长和扩大。

第三,中欧全面投资协定的实施将促进经济结构的优化和升级。

协定将鼓励双方企业在创新、研发、高技术产业等领域进行合作,推动经济结构的优化和升级。

双方将加强知识产权保护,鼓励技术转让和创新合作,提高产业竞争力和创新能力。

这将有助于推动中欧经济的可持续发展,提高双方企业的竞争力和市场份额。

第四,中欧全面投资协定的实施将促进双方在可持续发展领域的合作。

协定将强调可持续发展的重要性,鼓励双方企业在环境保护、可再生能源、气候变化等方面进行合作。

双方将加强环境标准和绿色技术的交流,推动可持续发展的实施。

这将有助于双方应对全球环境挑战,推动经济的绿色发展。

中欧全面投资协定的实施还将加强中欧之间的政治和战略合作。

协定将为中欧两大经济体提供更加稳定和可预期的合作框架,加强双方的政治和战略互信。

这将为中欧在全球治理、国际事务等方面的合作提供更加坚实的基础,推动中欧关系的深入发展。

中欧全面投资协定的实施将对中欧两大经济体之间的经济发展和贸易投资产生积极而深远的影响。

中欧全面投资协定后续

中欧全面投资协定后续摘要:I.背景介绍- 中欧全面投资协定的意义- 协定的历史背景和谈判过程II.协定主要内容- 市场准入自由化- 公平竞争原则- 可持续发展的关注- 投资者保护机制III.协定对中欧双方的影响- 对中国经济的积极影响- 对欧洲经济的积极影响- 对全球经济的影响IV.协定后续进展- 签署仪式与时间- 协定的生效条件- 未来可能面临的挑战与机遇正文:I.背景介绍中欧全面投资协定(China-EU Comprehensive Agreement onInvestment,简称CAI)是中国与欧盟之间的一项重要协议,旨在促进双边投资自由化、便利化,为中欧企业提供更加稳定、可预测的投资环境。

协定的谈判始于2014 年,经过多轮谈判,双方于2020 年底完成了协定谈判。

中欧全面投资协定对于深化中欧经济合作关系、推动全球经济治理体系变革具有重要意义。

II.协定主要内容中欧全面投资协定主要包括以下四个方面:1.市场准入自由化:协定将取消或降低双方相互投资的壁垒,扩大市场准入,提高投资自由化水平。

同时,双方将承诺公平对待对方企业,给予对方企业与本国企业同等的待遇。

2.公平竞争原则:协定规定,中欧双方应遵循公平竞争原则,确保企业在投资过程中享有公平竞争的机会。

此外,双方还将加强知识产权保护,打击商业秘密泄露和非法仿制等行为。

3.可持续发展的关注:协定强调双方在投资过程中要关注环境保护、劳动者权益、社会责任等方面,推动实现可持续发展的目标。

4.投资者保护机制:协定为中欧双方投资者提供了一套公平、高效、透明的争端解决机制,有助于维护投资者的合法权益。

III.协定对中欧双方的影响1.对中国的影响:中欧全面投资协定将为我国企业进入欧洲市场提供更多机会,有助于推动“一带一路”倡议与欧洲投资计划的对接。

同时,协定将有助于吸引欧洲投资,推动我国产业结构升级和优化。

2.对欧洲的影响:中欧全面投资协定将为欧洲企业在中国市场提供更加稳定的商业环境,有助于扩大欧洲在中国的市场份额。

《中欧投资协定》核心内容

《中欧投资协定》核心内容编者按:在过去的20年里,欧盟对中国的外国直接投资(FDI)已经超过了1400亿欧元。

就中国对欧盟的外国直接投资而言,这一数字也接近1200亿欧元。

相对于中国经济的规模和潜力,欧盟在中国的外国直接投资仍然相对较小。

在投资方面,《中欧全面投资协定》将是中国有史以来与第三国签订的最雄心勃勃的协定。

除了禁止强制转让技术的规则外,中国在该协定中首次纳入履行国有企业行为义务、全面透明的补贴规则以及可持续发展有关的承诺。

《中欧全面投资协定》将确保欧盟投资者更好地进入中国这个拥有14亿消费者且快速增长的市场,并确保欧盟投资者在中国享有更好的公平竞争环境。

这对欧盟产业的全球竞争力和未来增长非常重要。

中国向欧洲开放市场准入,展现巨大雄心首先,《中欧全面投资协定》要求中国过去20年的投资自由化,并以此防止倒退。

协定明确了欧盟企业的市场准入条件,且不受中国内部政策的影响。

同时,该协定也允许欧盟在中国违反承诺的情况下,诉诸协定下的争端解决机制。

此外,欧盟通过谈判取得中国在市场准入上进一步的开放和承诺,如取消一些行业的数量限制、股权上限或合资要求。

上述限制严重阻碍了欧盟企业在中国的活动。

该协定的整体方案比中国之前所承诺的要更加雄心勃勃。

在欧盟方面,根据《服务贸易总协定》(GATS),市场已经开放,并在很大程度上对服务行业作出了承诺。

在敏感领域,如能源、农业、渔业、视听、公共服务等领域,欧盟都在《中欧全面投资协定》中作出保留。

中国作出包括以下在内的市场准入承诺:制造业:中国作出了全面的承诺,且仅有非常有限的例外条款(特别是在产能严重过剩的行业)。

就雄心勃勃的程度而言,这将与欧盟的开放程度相匹配。

欧盟外国直接投资中大约有一半是在制造业(如运输和电信设备、化工、医疗设备等)。

中国还没有与其他任何伙伴作出如此深远的市场准入承诺。

汽车行业:中国已同意移除并逐步取消合资企业的要求。

中国将承诺对新能源汽车的市场准入。

中欧投资协定通过欧洲议会审议深化中欧合作共赢发展

中欧投资协定通过欧洲议会审议深化中欧合作共赢发展中欧投资协定(China-EU Investment Agreement)于2020年12月30日通过欧洲议会审议,成为中欧两大经济体间的重要合作文件,被普遍认为是深化中欧合作、实现共赢发展的重要里程碑。

本文将对中欧投资协定的背景、主要内容以及对中欧合作的意义进行探讨。

一、背景中欧投资协定的谈判始于2013年,并于2020年9月达成初步协议。

这一协定的签署和通过对于中国和欧洲来说都具有重要意义。

首先,中国是世界第二大经济体,欧盟是世界上最大的跨国组织之一,两者之间的投资往来对于稳定和促进全球经济增长具有重要的推动作用。

其次,中欧投资协定的实施有助于进一步加强中国与欧盟之间的经贸联系,促进双方在贸易、投资等领域的合作,为中欧企业提供更加稳定和透明的经营环境。

二、主要内容中欧投资协定主要包含市场准入、可持续发展、竞争政策和争端解决四个方面的内容。

具体来说,协定旨在消除市场准入壁垒,提供更加公平和透明的经营环境;推动可持续发展,包括环保、劳工权益保护等方面的合作;加强竞争政策的协调和合作;建立有效的争端解决机制,为企业提供更加可靠和稳定的投资保护。

首先,协定将进一步降低市场准入壁垒,为中欧企业提供更广阔的市场空间。

该协定将取消或放宽投资限制,降低外资准入门槛,鼓励更多的投资和合作。

这将加强中欧之间的贸易联系,促进投资和经济增长。

其次,中欧投资协定强调可持续发展,包括环境保护、劳工权益保护等方面的合作。

协定要求中欧双方在投资过程中遵守环保规定,减少对环境的影响,并保护劳工的权益。

这将有助于推动可持续发展目标的实现,促进两地企业的可持续增长。

第三,协定加强了中欧竞争政策的协调和合作。

双方将就反垄断政策、国家援助等进行合作,加强透明度和公平竞争,为企业创造公平的竞争环境。

这将有助于提高市场竞争力,促进中欧两地企业创新和发展。

最后,中欧投资协定建立了有效的争端解决机制,保护企业权益。

中欧投资金融合作协议

中欧投资金融合作协议随着全球经济的不断发展,中欧之间的合作日益紧密,尤其是在投资和金融领域的合作成为双方关系中的重要组成部分。

为了进一步加强中欧之间的投资金融合作,提升双方经济的发展潜力,中欧双方决定达成中欧投资金融合作协议。

一、背景与目的中欧投资金融合作协议旨在促进中欧之间的投资与金融合作,加深双方的互信与合作伙伴关系,共同推动双方经济的健康发展。

通过协议的签署,双方将在投资领域加强沟通与合作,提供更好的投资环境与规则,增加双向投资的便利性和可靠性,共同推动双方企业的发展和创新。

二、合作措施1.投资环境优化为了吸引更多的投资,中欧双方将努力优化投资环境,提供稳定、可预见和透明的投资政策。

双方将共同致力于降低投资壁垒,简化投资审批程序,加强知识产权保护,减少非关税壁垒以及其他贸易限制,为投资者提供更便利的投资环境。

2.金融合作加强中欧双方将在金融领域展开广泛的合作。

双方将加强银行、证券、基金和保险等领域的交流与合作,共同开发金融产品,提升双方金融业的竞争力。

双方还将促进金融机构之间的合作,加强信息共享,为企业提供更多的融资渠道和金融服务。

3.创新与科技合作中欧作为经济发达的地区,注重创新与科技领域的合作。

为此,双方将加强在科技创新、人工智能、数字经济等领域的交流与合作,共同推动经济的升级与转型。

双方将建立创新合作基金,支持中欧企业之间的科技创新合作项目。

4.人才交流与培训为了满足合作的需求,中欧双方将加强人才交流与培训。

双方将互派专业人员进行交流与培训,促进相互了解与学习。

双方还将共同建设人才培养基地,培养高素质的专业人才,为中欧合作注入新的动力。

三、合作机制与评估为确保协议的有效实施,中欧将建立合作机制与评估体系。

双方将定期召开联席会议,对合作进展进行评估与总结,并及时解决合作中的问题与困难。

双方还将设立合作基金,支持协议实施过程中的相关项目。

四、有效期与修订中欧投资金融合作协议的有效期为十年,并自动延长。

中欧投资谈判协议书

中欧投资谈判协议书中欧投资谈判协议书第一章总则第一条为深化中欧双方的经贸合作,加强双方的投资交流,促进经济发展,中欧双方达成了此投资谈判协议。

第二条本投资谈判协议包括双方共同确定的原则、投资领域和方式等内容。

第二章原则第三条本投资谈判协议的原则包括互惠、优先、公平和可持续发展。

1. 互惠原则:中欧双方在投资中享有相互平等、互利互惠的待遇。

2. 优先原则:中欧双方在投资中优先考虑双方利益最大化的方式。

3. 公平原则:中欧双方在投资中保持公平竞争,确保投资环境公开透明、法制健全。

4. 可持续发展原则:中欧双方在投资中注重环境保护、资源利用与经济协调发展。

第三章投资领域和方式第四条本投资谈判协议涵盖的投资领域包括但不限于制造业、金融、信息技术、能源等。

第五条中欧双方鼓励双向投资,支持企业在对方国家开展投资活动。

第六条投资方式包括但不限于设立合资企业、合作项目、购买股份等。

第四章投资保护第七条本投资谈判协议提供保护投资的法律框架和机制,确保投资的稳定性和安全性。

第八条中欧双方承诺保护投资者的合法权益,并根据国际通行的原则和规范提供合理补偿。

第五章投资促进第九条中欧双方将采取措施促进双方企业投资,包括但不限于简化投资审批程序、提供便利措施等。

第十条中欧双方将加强投资信息交流和合作,促进双方企业之间的合作机会。

第六章争端解决第十一条若双方在本投资谈判协议的执行过程中发生争端,应通过友好协商解决。

第十二条若协商无法达成一致,双方同意采取国际仲裁等方式解决争端。

第七章其他规定第十三条本投资谈判协议自签署之日起生效,有效期十年,双方可以协商延长。

第八章附则第十四条本投资谈判协议的解释权归中欧双方所有。

第十五条其他未尽事宜,可另行协商解决。

总结本中欧投资谈判协议是为促进中欧投资合作而达成的协议,内容包括原则、投资领域和方式、投资保护、投资促进、争端解决等。

双方将秉持互惠、优先、公平、可持续发展原则,推动投资合作。

双方亦将加强投资信息交流、简化投资审批程序、提供合理补偿等措施,以促进双方企业的投资活动。

中欧全面投资协定(中文版)

序言自1975年中欧建交以来,中欧交流与合作不断扩大,特别是通过1985年的《EU-中国贸易合作协定》,以及2003年中欧全面战略伙伴关系的建立;确认始于2007年的EU-中国高级别经贸对话作为双边贸易和投资关系所有相关事宜的战略论坛的重要性;承诺在开放、互惠和互利的基础上建立经济关系,确保不歧视、公平竞争、透明以及可预测和基于规则的投资环境;寻求建立清晰、互利的投资规则,减少或消除相互投资的障碍;承认缔约方有权采取和执行措施,以实现合法的公共政策目标;重申对1945年6月26日在旧金山签署的《联合国宪章》的承诺,并考虑到1948年12月10日由联合国大会通过的《世界人权宣言》阐明的原则;决心根据可持续发展的目标加强它们的经济、贸易和投资关系,并以支持高度保护环境和劳工权利的方式促进投资,包括应对气候变化和强迫劳动,同时考虑到相关国际标准和协定;致力于鼓励企业尊重企业的社会责任或负责任的商业行为;认识到国际投资透明度对所有利益攸关方的重要性;在《世贸组织协定》和它们加入的其他多边、区域和双边协定和安排规定的各自权利和义务的基础上。

第一节:目标和一般定义第1条目标1.双方重申各自在世贸组织协定下的承诺,并承诺创造更好的环境,以促进和发展双方之间的贸易和投资,据此为投资自由化制定必要的安排。

2.双方重申有权在其领土内进行管理,以实现合法的政策目标,例如保护公共健康、社会服务、公共教育、安全、环境,包括应对气候变化、公共道德、社会安全或消费者保护、隐私和数据保护或促进和保护文化多样性。

第2条定义就本协议而言:“在行使政府权力时开展的活动”是指既不在商业基础上也不与一个或多个经济经营者竞争的活动;“商业考虑”是指价格、质量、可用性、可销售性、运输以及购买或销售的其他条款和条件,或通常在企业的商业决策中、在相关的商业或工业中考虑的其他因素,这些因素是以利润为基础的,并受到市场力量的约束;“承保企业”指通过设立在一方境内设立的企业,如本条所定义,由另一方的投资者进行,并且在本协议生效之日或之后根据适用的法律进行;“经济活动”包括工业、商业和专业性质的活动以及工匠的活动,但不包括行使政府权力的活动;“设立”是指分别在中国或欧盟设立(包括收购)一家企业,目的是建立或保持持久的经济联系;“有效”是指在本协议生效之日有效;“可自由兑换货币”是指可以与在国际外汇市场上广泛交易并在国际交易中广泛使用的货币自由兑换的货币;“可自由使用的货币”是指国际货币基金组织根据其协议条款确定为可自由使用的货币;“缔约一方的投资者”是指寻求、正在或已经在另一方境内进行投资的一方、一方的自然人或企业(分公司或代表处除外);尽管有前款规定,在欧盟或中国境外设立并分别由欧盟成员国或中国的国民控制的航运公司,如果其船舶按照各自的立法在该成员国或中国注册并悬挂一个成员国或中国的国旗,也应是本协定条款的受益者。

中国与欧盟达成全面投资协定加强经贸合作关系

中国与欧盟达成全面投资协定加强经贸合作关系近日,中国与欧盟宣布达成全面投资协定,为中欧两大经济体的合作关系注入了新的动力。

这一协定的签署将促进双方在经贸领域的合作,为企业提供更好的市场准入和更稳定的投资环境。

协定的达成标志着中国与欧盟之间的经济关系将进一步深化。

作为全球最大的贸易伙伴,中国和欧盟贸易往来一直保持着稳定增长。

然而,在市场准入、投资保护等方面还存在着一些限制。

通过全面投资协定的签署,双方将逐步解决这些问题,推动经贸合作关系迈上新台阶。

协定的签署将为中欧企业提供更好的市场准入。

根据协定内容,双方将逐步降低市场准入限制,减少投资壁垒。

这将使得中欧企业能够更自由地进入对方市场,拓宽合作的机会和空间。

同时,协定还明确了投资者的权益保护和争端解决机制,为企业提供更稳定、可预测的投资环境,增强投资者的信心。

此外,全面投资协定的签署也将助推双方经济的互补性发展。

中国作为世界最大的制造业国家,具有庞大的市场和较低的生产成本。

而欧盟则以其高端制造业和先进的技术闻名于世。

通过加强经贸合作,双方可以实现资源和市场的优势互补,促进产业链的协同发展。

协定的签署对于世界经济的稳定与发展也具有重要意义。

当前,全球经济面临着不确定性和变数。

中国和欧盟作为世界上最大的经济体之一,承担着重要的国际责任。

双方的合作将为全球经济注入新的动力,增强市场的信心,促进国际贸易的自由化和便利化。

然而,达成全面投资协定只是一个开始,实施协议需要双方共同努力。

在这个过程中,双方需要加强沟通,解决分歧,增进互信。

同时,还需要建立监管机制,确保协定的贯彻和执行。

只有通过共同努力,中欧的经贸合作才能更好地发展,为双方乃至全球经济带来更多利益。

综上所述,中国与欧盟达成全面投资协定标志着中欧经贸合作关系迈向了新的阶段。

这一协定的签署将促进双方在市场准入、投资保护等方面的合作。

通过互利共赢的合作,中欧双方将进一步巩固彼此的经贸关系,助推全球经济的繁荣与稳定。

中欧全面投资协定后续

中欧全面投资协定后续摘要:I.背景介绍- 中欧全面投资协定的历史背景和重要性- 协定的主要内容和目标II.协定后续进展- 双方已完成谈判并达成共识- 协定还需经过各自的法律程序进行批准- 预计协定将在2021年正式生效III.协定对中欧双方的意义- 有助于深化中欧经济合作关系- 为中国企业投资欧洲市场提供更多机会- 有助于欧洲企业进入中国市场- 对全球经济治理和多边主义的积极贡献IV.面临的挑战和问题- 双方在某些领域的分歧和争议- 需要解决的市场准入和技术转让问题- 国内企业和政府对协定生效的担忧V.展望未来- 协定生效后的影响和效果- 双方在后续执行中需要解决的问题- 中欧全面投资协定对全球经济秩序的影响正文:中欧全面投资协定是中欧之间的一项重要协议,旨在促进双边投资和深化经济合作关系。

协定的谈判始于2013年,经过多轮谈判,双方于2020年底完成了谈判并达成共识。

根据协定,中欧双方将相互开放市场,提高投资准入水平,并为对方企业提供更加公平、透明和可预测的投资环境。

协定涵盖了投资保护、市场准入、知识产权、竞争政策等多个领域,旨在促进双方企业在对方国家进行投资和经营活动。

然而,协定生效还需经过各自的法律程序进行批准。

据欧盟委员会消息,欧盟将于2021年上半年开始审批程序,预计协定将在2021年正式生效。

中欧全面投资协定的签署将有助于深化中欧经济合作关系,为中国企业投资欧洲市场提供更多机会,同时也有助于欧洲企业进入中国市场。

此外,协定对全球经济治理和多边主义也具有积极贡献,体现了中欧双方共同维护开放型世界经济的决心。

尽管如此,协定在执行过程中仍面临一些挑战和问题。

首先,双方在某些领域的分歧和争议需要得到妥善解决。

其次,双方需要就市场准入和技术转让等问题展开进一步谈判。

此外,国内企业和政府对协定生效的担忧也不容忽视。

展望未来,中欧全面投资协定的生效将有助于进一步提升中欧经济合作水平,但双方在后续执行中需要解决的问题也不容忽视。

中欧全面投资协定内容

中欧全面投资协定内容中欧全面投资协定是中欧两大经济体之间达成的一项重要协议,旨在进一步促进中欧之间的投资和经贸合作。

该协定的内容涵盖了多个方面,包括市场准入、公平竞争、可持续发展、投资保护和争端解决等。

中欧全面投资协定将进一步促进市场准入。

双方将共同努力,消除投资壁垒和限制,提升市场准入的透明度和可预测性,为投资者提供公平、公正和非歧视的投资环境。

这将有助于吸引更多的中欧投资者进入对方市场,推动双边贸易和投资的增长。

协定强调公平竞争原则的重要性。

双方将致力于维护市场的竞争秩序,防止不正当竞争行为的发生。

双方将加强对反垄断和反补贴的监管,确保企业在公平的竞争环境中运营。

此外,协定还将加强知识产权保护,鼓励技术创新和转让,促进双方的科技合作。

第三,可持续发展是协定的重要内容之一。

双方承诺在投资过程中充分考虑环境、社会和治理因素,促进可持续发展的目标。

双方将加强环境保护、资源利用和气候变化等领域的合作,推动可持续能源和清洁技术的发展和应用。

投资保护也是协定的重要内容之一。

双方将确保投资者享有公平、公正和对等的待遇,保护投资者的合法权益。

双方将加强投资审批和监管机制,提升投资者的安全感和信心。

同时,协定还将建立起争端解决机制,为投资者提供有效的争端解决渠道。

中欧全面投资协定的签署将为中欧两大经济体之间的投资和经贸合作带来新的机遇。

协定的实施将促进双方贸易和投资的自由化和便利化,为企业创造更加稳定和可预测的投资环境。

这将有助于进一步加强中欧之间的经济联系,推动双方的共同发展。

中欧全面投资协定的签署将为中欧两大经济体之间的投资和经贸合作带来新的机遇。

协定的内容涵盖了市场准入、公平竞争、可持续发展、投资保护和争端解决等多个方面,旨在进一步促进中欧之间的投资和经贸合作。

协定的实施将为企业创造更加稳定和可预测的投资环境,推动双方的共同发展。

中欧投资协定内容及对世界格局的影响

为什么中欧投资协定的签订备受关注?

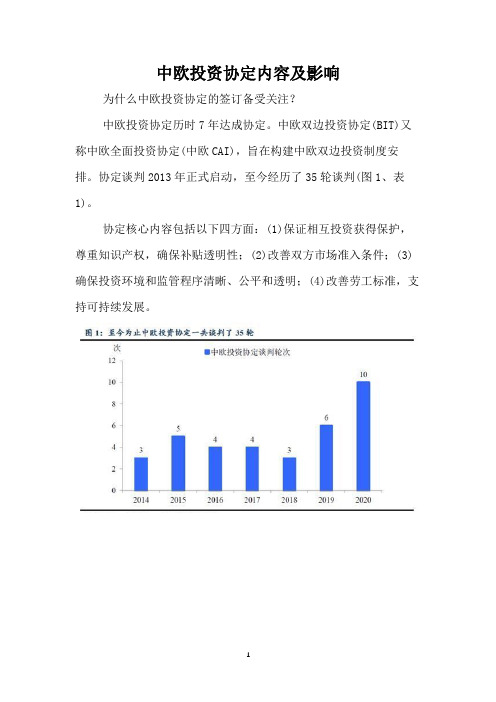

中欧投资协定历时7年达成协定。中欧双边投资协定(BIT)又称中欧全面投资协定(中欧CAI),旨在构建中欧双边投资制度安排。协定谈判2013年正式启动,至今经历了35轮谈判(图1、表1)。

协定核心内容包括以下四方面:(1)保证相互投资获得保护,尊重知识产权,确保补贴透明性;(2)改善双方市场准入条件;(3)确保投资环境和监管程序清晰、公平和透明;(4)改善劳工标准,支持可持续发展。

(3)欧盟投资保护主义上升。疫后欧方投资保护主义上升,呼吁加强医药、生物技术、基础设施等领域的安全考虑及投资审查;并且拟在5G领域制定网络安全框架。

促成谈判达成的关键性因素是什么?

12月28日,欧盟委员会表示CAI消除了外国在中国投资某些行业的障碍,如新能源汽车、云计算服务、金融服务和健康等,CAI也将是中国第一份履行国有企业行为义务和全面透么?

(1)公平竞争环境问题。主要体现在欧盟希望确保欧洲企业相对中国国有企业的非歧视性监管待遇,要求中国提高国家援助透明度。而中方的立场显示中国不希望将国企政策被“公平竞争环境”原则一刀切,力求保障国有经济在社会主义市场经济体制中的重要地位不受动摇。

(2)市场准入问题。欧盟要求改善中国在电信、计算机、生物技术和新能源汽车方面的市场准入。而中方也在争取进入欧盟市场投资某些行业(如电力和其他能源)的自由准入。

12月29日,中国发布《鼓励外商投资产业目录(2020年版)》,扩大外商投资范围(新增127个条目,包含人工智能、集成电路等高端制造领域),出台多项优惠政策(包括免征关税、减收企业所得税、优惠土地使用等方面)。

中欧双方当前投资情况如何?

规模扩张动力不足,投资结构较集中。总量上看,2016-2019年中国对欧盟直接投资金额维持在100亿美元左右,投资规模几乎停滞不前(图2);2019年欧盟对华投资金额73.1亿美元,同比下降29.9%(图4);均体现双边投资扩张乏力。结构上看,双方投资均集中于制造业、租赁商贸、科技服务业、批零与金融业,其中制造业占比超过50%(图3/5)。

中欧全面投资协定后续

中欧全面投资协定后续【原创版】目录1.RCEP 自贸协定的签署和中欧投资协定谈判的背景与意义2.RCEP 自贸协定的主要内容与目标3.中欧投资协定谈判的进展与挑战4.我国在推动签署 RCEP 和完成中欧投资协定谈判方面的立场与举措5.落实 RCEP 和中欧投资协定对我国经济发展的影响正文一、RCEP 自贸协定的签署和中欧投资协定谈判的背景与意义2020 年 11 月 12 日,据商务部报道,我国正积极推动年内签署RCEP 自贸协定,并力争完成中欧投资协定谈判。

RCEP(《区域全面经济伙伴关系协定》)是由东盟 10 个国家于 2012 年发起,邀请澳大利亚、中国、印度、日本、韩国、新西兰 6 个国家参加的自贸协定谈判。

此次签署 RCEP 和完成中欧投资协定谈判,对我国深度参与全球经济治理、推动构建开放型世界经济具有重要意义。

二、RCEP 自贸协定的主要内容与目标RCEP 自贸协定的主要内容包括货物贸易、服务贸易、投资、经济技术合作、知识产权、竞争政策、电子商务等章节。

其目标是达成一个现代的、全面的、高质量的、互惠的新的大型自贸协定,降低区域内的贸易和投资壁垒,推动区域经济一体化。

三、中欧投资协定谈判的进展与挑战中欧投资协定谈判自 2013 年启动以来,已经进行了多轮谈判。

双方在市场准入、投资保护、竞争政策等领域取得了积极进展,但仍存在一些挑战,例如在投资争议解决、知识产权保护等方面还需进一步协商。

四、我国在推动签署 RCEP 和完成中欧投资协定谈判方面的立场与举措我国一直积极参与 RCEP 和中欧投资协定谈判,推动区域经济一体化和双边经济合作。

我国在谈判中积极主张开放、包容、平衡的谈判原则,努力维护国家的核心利益和战略利益。

同时,我国也通过制度型开放、落实好中欧地理标志协定等方式,加快形成与国际投资、贸易规则相衔接的基本制度体系和监管模式。

五、落实 RCEP 和中欧投资协定对我国经济发展的影响RCEP 和中欧投资协定的签署和实施,将有助于我国进一步融入全球经济治理体系,提升我国在国际经济舞台上的地位和影响力。

中欧外交协议书

中欧外交协议书鉴于中华人民共和国和欧洲联盟(以下简称“双方”)在国际事务中的共同利益和相互尊重,以及推动双方在政治、经济、文化、科技等领域的全面合作,双方经友好协商,达成如下协议:第一条政治对话双方同意加强高层政治对话,定期举行首脑会议和外长级会晤,就共同关心的国际和地区问题交换意见,增进相互理解与信任。

第二条经济合作1. 双方将促进贸易和投资自由化,通过谈判减少贸易壁垒,共同维护多边贸易体系。

2. 双方同意加强在金融、能源、基础设施建设等领域的合作,推动经济全球化的健康发展。

第三条文化交流1. 双方将加强文化、教育、科研等领域的交流与合作,促进相互了解和文化多样性。

2. 双方支持互派留学生和学者,举办文化节、艺术展览等活动,增进人民之间的友谊。

第四条科技合作双方将共同推动科技创新,加强在环境保护、新能源、生物技术等领域的研究与开发,促进科技成果转化。

第五条安全合作1. 双方同意在反恐、打击跨国犯罪等方面加强合作,共同维护国际安全。

2. 双方将加强网络安全合作,共同应对网络威胁,保护网络空间的和平与稳定。

第六条可持续发展双方将共同致力于实现联合国2030年可持续发展议程,推动环境保护和气候变化应对措施,促进绿色发展。

第七条争端解决双方同意通过友好协商解决在本协议执行过程中出现的任何争端,如协商未能解决,则可提交至国际仲裁机构。

第八条协议的修改和终止1. 本协议可根据双方共同意愿进行修改。

2. 任何一方均可在提前六个月书面通知对方的情况下终止本协议。

第九条生效和期限本协议自双方代表签字之日起生效,有效期为五年,除非双方另有约定。

本协议书用中文和英文两种文字写成,两种文本具有同等效力。

中华人民共和国代表:____________欧洲联盟代表:____________签字日期:____年____月____日签字地点:________________(以下为签字线,不包含在2000字限制内)。

中国与欧盟签署投资协议推动中欧经贸合作迈向新高度

中国与欧盟签署投资协议推动中欧经贸合作迈向新高度2020年12月30日,中国和欧盟正式签署了全面投资协定(CAI),这标志着中欧经贸合作迈向了一个新的高度。

这项协议旨在进一步促进双方的贸易与投资自由化,为两个经济体的发展提供更多机遇与空间。

本文将从几个重要方面分析此协议对于中欧经贸合作的影响。

首先,全面投资协定将进一步促进贸易自由化。

根据协定内容,中国将进一步放开市场准入,为欧盟企业提供更大的经营空间和机会。

同时,欧盟也将逐步消除对中国企业的投资限制,为中国企业在欧盟市场开展业务提供更多便利。

这将有助于加深双方在贸易领域的合作,并且为两个经济体的企业提供更大的发展空间。

其次,全面投资协定将为投资提供更多保护。

协定规定了中欧两国企业在投资过程中的权益保护机制,通过保护投资者的合法权益,减少了投资风险,提高了双方企业在对方市场的信心。

这将有助于进一步增加双方的投资活动,促进两个经济体的投资合作。

第三,全面投资协定将促进产业升级与技术创新。

根据协定内容,双方将进一步开展技术创新与产业合作,加强知识产权保护,并就相关合作提供更多的支持与便利。

这将有助于增强双方企业的创新能力,推动产业结构升级,促进经济的可持续发展。

此外,全面投资协定也将加强双方在可持续发展领域的合作。

协定规定了环境、劳动和企业社会责任等方面的合作机制,双方将加强沟通与交流,推动可持续发展理念在双方企业中的应用,共同应对全球性挑战。

这将有助于增进双方的互信与合作,推动经济的绿色发展。

最后,全面投资协定将为中国和欧盟提供更多合作的机会与空间。

作为世界上两个最大的经济体之一,中国和欧盟在经济与贸易领域有着巨大的合作潜力。

通过签署全面投资协定,双方将进一步深化合作,在更多领域展开务实合作,推动经济合作迈向更高水平。

综上所述,全面投资协定的签署将推动中国与欧盟的经贸合作迈向新的高度。

这项协议将进一步促进贸易自由化,提供更多的投资保护机制,促进产业升级与技术创新,加强在可持续发展领域的合作,并为双方提供更多的合作机会与空间。

中欧投资协定的内容、特性、达成前景及潜在影响

伊犁师范学院学报(社会科学版)Journal of Yili Normal University (Social Science Edition )2020年9月第38卷第3期Sept.2020Vol.38No.3中欧投资协定谈判是我国正着力达成的最重要国际经贸谈判之一,也是当前中欧经贸关系发展中的最优先事项。

这一协定的达成,有利于“一带一路”倡议对接欧盟发展战略,有利于构建我国高水平开放型经济新体制。

在新冠疫情叠加“逆全球化”风潮导致全球经济动荡背景下,如期达成中欧投资协定,将助推中欧乃至全球经济复苏,并释放双方捍卫开放、包容的全球经济体系的信号。

2020年6月22日,在第22届中欧峰会期间,双方领导人重申将致力于2020年内完成谈判;在2020年7月底结束的新一轮谈判中,中欧双方就公平竞争规则文本议题的谈判取得重大进展。

2020年内双方将就余下的文本问题和市场准入问题进行密集磋商,以尽快达成协定[1]。

2013年11月至今,中欧投资协定谈判已历经7年33轮会谈。

2019年4月,在第21届中欧峰会期间,双方承诺将在2020年达成高水平的投资协定,并建立高层沟通机制推进谈判进程[2]。

根据这一共识,双方此后明显增加了谈判频次,加快了谈判节奏。

疫情之下,这一谈判进程并未受到明显影响;2020年3月以来,双方通过“视频会议”方式进行了7轮谈判。

一、中欧投资协定的内容与特性传统的双边投资协定的内容主要涵盖投资保护领域,而近年出现的新一代国际投资协定越来越多地倾向于容纳市场准入、投资促进等资本自由化内容。

从欧盟委员会公布的谈判报告来看,中欧投资协定将涉及投资自由化、投资保护、公共利益护持及争端解决机制等四大议题领域,可见中欧投资协定契合了国际投资协定内容多元化的发展趋势。

(一)中欧投资协定将涵盖的主要内容第一,投资自由化,尤其是市场准入问题,这是中欧投资协定谈判中的难点。

在欧盟看来,与中国达成投资协定旨在达到两项目标——更广泛的市场准入与更公平竞争环境[3]。

中欧双边投资协议书

中欧双边投资协议书甲方(以下简称“甲方”)为位于中华人民共和国的法人实体,乙方(以下简称“乙方”)为位于欧洲联盟成员国的法人实体,双方本着平等互利的原则,经友好协商,就投资合作事宜达成如下协议:第一条投资目的与范围1.1 甲方同意在乙方所在国进行投资,以促进双方经济合作与发展。

1.2 乙方同意接受甲方的投资,并提供必要的支持与便利。

第二条投资金额与方式2.1 甲方将向乙方投资总额为____元人民币/欧元。

2.2 投资方式包括但不限于直接投资、股权投资、技术合作等。

第三条投资条件3.1 甲方的投资应符合乙方所在国的法律法规及政策要求。

3.2 乙方应为甲方提供必要的市场准入条件和投资环境。

第四条投资回报与风险4.1 甲方有权根据投资项目的实际运营情况获得相应的投资回报。

4.2 双方应共同承担投资风险,并制定相应的风险控制措施。

第五条投资项目的管理5.1 甲方有权参与投资项目的管理和决策。

5.2 乙方应保证甲方在投资项目中的合法权益。

第六条知识产权保护6.1 双方应尊重并保护彼此的知识产权。

6.2 任何一方未经对方书面同意,不得擅自使用或泄露对方的商业秘密。

第七条争议解决7.1 因执行本协议所发生的任何争议,双方应首先通过友好协商解决。

7.2 如协商不成,任何一方均可将争议提交至中国国际经济贸易仲裁委员会,按照其仲裁规则进行仲裁。

第八条协议的变更与终止8.1 本协议的任何变更或补充,须经双方协商一致,并以书面形式确认。

8.2 双方均可在提前____天书面通知对方后终止本协议。

第九条法律适用9.1 本协议的订立、解释、执行和争议解决均适用中华人民共和国法律。

第十条其他10.1 本协议以中英文两种文字书写,两种文本具有同等法律效力。

10.2 本协议一式两份,甲乙双方各执一份,自双方授权代表签字盖章之日起生效。

甲方代表(签字):_____________________乙方代表(签字):_____________________签订日期:____年____月____日签订地点:_____________________________。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

中欧全面投资协定核心内容(附英语版)背景简要分析:从技术层面看,中欧CAI达成后将取代中国与27个欧盟成员国中的26个国家(除爱尔兰以外的所有国家)之间订立的双边投资保护协定(Bilateral Investment Treaty, BIT)。

但是,中欧CAI谈判的目标并不限于此,从这一谈判被命名为中欧CAI而非中欧BIT已经显示出双方旨在改变以往“简式”BIT 的传统,即仅包括投资保护内容,而寻求达成包括投资自由化目标在内的更富有雄心的综合性双边投资保护协定。

投资自由化目标在中欧CAI 谈判中主要体现为与市场准入相关的条款安排,因此,与市场准入相关条款内容的谈判将决定着中欧CAI能否在年内按期完成。

有鉴于此,下文拟在分析中欧双方在市场准入方面的主要诉求的基础上,探讨中欧双方磋商的难点并提出政策建议。

欧盟对华投资在市场准入方面的主要障碍在市场准入方面,欧盟主要寻求在金融业、电信、信息通信技术、制造业、工程和生物技术等关键领域更好的市场准入和公平竞争环境。

在推进中欧CAI谈判过程中,欧盟委员会分别于2015年和2018年发布了其委托独立咨询公司对中欧CAI可持续性影响进行评估的报告。

2018年发布的评估报告基于以下三个不同标准选出六个产业部门进行分析:一是欧盟对外投资规模;二是未来一段时间内中国可能会吸引欧盟投资的产业部门;三是劳动强度及其对劳动力的影响。

六个产业部门是运输设备、采矿和能源开采、化工、食品和饮料制造、金融和保险以及通信和电子设备。

经研究认为,在运输设备方面,欧盟运输设备公司在中国投资时面临的主要市场准入障碍是合资要求;在采矿和能源开采方面,欧盟企业在中国面临的问题是一些子行业对外国投资开放,而其他子行业则完全封闭;在化工行业方面,欧盟投资者在中国面临的主要障碍是跨国公司受与国内公司不同的规则约束。

在食品和饮料制造行业,欧盟公司面临的问题是需要中国合伙人持有多数股份,申请多个许可证书;在金融保险方面,市场准入问题包括所有权限制、股本上限和分支机构网络扩张限制;在通讯与电子设备方面,报告认为政府鼓励通信和电子设备行业的外国企业来华投资,但另一方面,对广泛的外国ICT产品和服务也有严格的限制,目的是实现国产替代,这导致了巨大的市场准入壁垒。

该报告认为,中国如减少对上述这六个关键行业外国产品和服务的限制和投资壁垒,所有这些行业均将从中欧CAI中受益,而欧盟在这些行业产出的增加则会导致欧盟低技能和高技能就业人数的增加,并且一些产业部门的开放,还会使欧盟之外的国家也受益,例如汽车业。

此外,欧盟和中国的中小企业也将从中欧CAI中受益,因为它们通常会因投资相关障碍而面临不成比例的成本,欧盟和中国的本地中小企业都有望获得积极的市场准入和生产率溢出效应。

中文版协定核心内容:在过去的20年中,从欧盟流入中国的欧盟累计外国直接投资(FDI)已超过1400亿欧元。

对于中国对欧盟的直接投资,这一数字接近1200亿欧元。

就中国经济的规模和潜力而言,欧盟在中国的外国直接投资仍然相对较少。

在投资方面,中欧全面投资协定(CAI)将是中国与第三国缔结的最雄心勃勃的协定。

除了禁止强制转让技术的规则外,CAI还将成为首个履行对国有企业行为的义务,对补贴的全面透明规则以及与可持续发展有关的承诺的协议。

CAI将确保欧盟投资者更好地进入快速增长的14亿消费市场,并确保他们在中国的公平竞争环境中竞争。

这对于全球竞争力和欧盟工业的未来发展非常重要。

中国雄心向欧洲投资开放首先,CAI约束了中国过去20年的投资自由化,从而防止了回落。

这使欧盟公司的市场准入条件变得清晰且独立于中国的内部政策。

它还允许欧盟在违反承诺的情况下在CAI中诉诸争端解决机制。

此外,欧盟还就更多领域的新的市场准入开放和承诺进行了谈判,例如取消了数量限制,股本上限或合资企业要求。

这些限制严重阻碍了我们公司在中国的业务。

总体方案比中国以前承诺的要远大得多。

在欧盟方面,根据《服务贸易总协定》(GATS),服务市场已经开放并为服务行业做出了很大的承诺。

欧盟在能源,农业,渔业,视听,公共服务等方面的敏感性都保留在CAI中。

中国的市场准入承诺示例:•制造业:中国做出的全面承诺只有很少的排除在外(特别是在产能严重过剩的行业中)。

就雄心壮志而言,这将与欧盟的开放度相匹配。

欧盟外国直接投资的大约一半用于制造业(例如运输和电信设备,化学药品,医疗设备等)。

中国没有与任何其他合作伙伴做出如此深远的市场准入承诺。

••汽车行业:中国已同意取消和淘汰合资企业规定。

中国将致力于新能源汽车的市场准入。

••金融服务:中国已经开始逐步开放金融服务业,并将承诺并承诺继续向欧盟投资者开放。

银行,证券和保险交易(包括再保险)以及资产管理的合资企业要求和外国股权上限已被删除。

••卫生(私立医院):中国将通过解除对北京,上海,天健,广州和深圳等中国主要城市的私立医院的合资要求来提供新的市场开放。

••研发(生物资源):中国以前从未承诺开放外国对生物资源研发的投资。

中国已同意不采取新的限制措施,并给予欧盟任何可能在未来取消的当前限制。

•电信/云服务:中国已同意取消对云服务的投资禁令。

现在,它们将向欧盟投资者开放,但其股本上限为50%。

••计算机服务:中国已同意对计算机服务的市场准入进行约束,这比当前情况有了很大的改善。

另外,中国将包括“技术中立”条款,该条款将确保对增值电信服务施加的股本上限不会应用于在线提供的其他服务,例如金融,物流,医疗等。

••国际海上运输:中国将允许对相关的陆上辅助活动进行投资,使欧盟公司可以不受限制地投资于货物装卸,集装箱堆场和车站,海事机构等。

这将允许欧盟公司组织全方位的多式联运的门到门运输,包括国际海运的国内航线。

••与航空运输相关的服务:尽管CAI由于受制于单独的航空协议而未涉及交通权,但中国将在计算机预订系统,地面处理以及销售和营销服务等关键领域开放。

中国还取消了对没有机组人员的飞机出租和租赁的最低资本要求,这超出了《服务贸易总协定》的范围。

••商业服务:中国将取消对房地产服务,租赁和租赁服务,运输的维修和保养,广告,市场研究,管理咨询和翻译服务等领域的合资要求。

••环保服务:中国将取消对环境服务的合资要求,例如污水,减噪,固体废物处置,废气清洁,自然和景观保护,环境卫生和其他环境服务。

••建设服务:中国将消除其GATS承诺中目前保留的项目限制。

••欧盟投资者的雇员:欧盟公司的经理和专家将被允许在中国子公司工作长达三年,而不受劳动力市场测试或配额等限制。

允许欧盟投资者的代表在投资之前自由访问。

改善公平竞争环境–使投资更公平•国有企业(SOE) -中国国有企业贡献了该国GDP的30%左右。

CAI试图通过要求国有企业根据商业考虑采取行动,而不是对其商品或服务的购买和销售进行歧视,从而对国有企业的行为进行纪律处分。

重要的是,中国还承担根据要求提供特定信息的义务,以便评估特定企业的行为是否符合商定的CAI义务。

如果问题仍未解决,我们可以诉诸CAI解决争端。

••补贴的透明度–CAI通过对服务部门的补贴施加透明度义务来填补WTO规则中的一个重要空白。

此外,CAI要求中国进行磋商,以便提供有关补贴的更多信息,这些补贴可能对欧盟的投资利益产生负面影响。

中国也有义务进行磋商,以寻求消除这种负面影响。

••强制技术转让–CAI针对禁止技术转让制定了非常明确的规则。

这些规定包括禁止几种迫使技术转让的投资要求,例如将技术转让给合资伙伴的要求,以及禁止在技术许可中干扰合同自由的要求。

这些规则还将包括保护行政机构(例如,在商品或服务的认证过程中)收集的机密商业信息免遭未经授权的披露的纪律。

商定的规则大大加强了WTO的纪律。

••标准制定,授权,透明度–该协议涵盖了欧盟其他长期存在的要求。

中国将为我们的公司提供平等使用标准制定机构的机会。

中国还将提高授权的透明度,可预测性和公平性。

CAI将包括监管和行政措施的透明度规则,以提高法律的确定性和可预测性,以及程序公平性和司法复审权(包括在竞争案件中)。

•将可持续发展纳入我们的投资关系•与中国缔结的其他协议相反,CAI将双方约束为建立在可持续发展原则基础上的基于价值的投资关系。

有关规定受制于专门量身定制的执行机制,以高度透明和民间社会参与的方式解决分歧。

••中国承诺在劳工和环境领域不降低保护标准以吸引投资,不为保护主义目的使用劳工和环境标准,并遵守有关条约中的国际义务。

中国将支持公司履行企业社会责任。

••重要的是,CAI还包括对环境和气候的承诺,包括有效执行《巴黎气候协定》。

••中国还致力于争取批准尚未批准的国际劳工组织(国际劳工组织)基本公约,并对尚未批准的两项国际劳工组织关于强迫劳动的基本公约作出具体承诺。

监督执行和争端解决•在CAI中,中国同意与我们的贸易协议一样的执行机制(州与州之间的争端解决)。

••这将与在政治一级建立的诉讼前阶段的监督机制相结合,这将使我们能够在问题出现时提出问题(包括通过紧急程序进行)。

•英文版协定内容:The cumulative EU foreign direct investment (FDI) flows from the EU to China over the last 20 years have reached more than €140 billion.For Chinese FDI into the EU the figure is almost €120 billion. EU FDI in China remains relatively modest with respect to the size and the potential of the Chinese economy.As regards investment, the EU-China Comprehensive Agreement on Investment (CAI) will be the most ambitious agreement that China has ever concluded with a third country.In addition to rules against the forced transfer of technologies, CAI will also be the first agreement to deliver on obligations for the behavior of state-owned enterprises, comprehensive transparency rules for subsidies and commitments related to sustainable development.The CAI will ensure that EU investors achieve better access to a fast growing 1.4 billion consumer market, and that they compete on a better level playing field in China. This is important for the global competitiveness and the future growth of EU industry. Ambitious opening by China to European investmentsFirstly, the CAI binds China's liberalisation of investments overthe last 20 years and, in that way, it prevents backsliding. This makes the conditions of market access for EU companies clear and independent of China's internal policies. It also allows the EU to resort to the dispute resolution mechanism in CAI in case of breach of commitments.In addition, the EU has negotiated further and new market access openings and commitments such as the elimination of quantitative restrictions, equity caps or joint venture requirements in a number of sectors. These are restrictions that severely hamper theactivities of our companies in China. The overall package is far more ambitious than what China has committed to before.On the EU side, the market is already open and largely committed for services sectors under the General Agreement on Trade in Services (GATS). EU sensitivities, such as in the field of energy, agriculture, fisheries, audio-visual, public services, etc. are all preserved in CAI.Examples of market access commitments by China:•Manufacturing: China has made comprehensive commitments with only very limited exclusions (in particular, in sectors with significant overcapacity). In terms of the level of ambition, this would match the EU's openness. Roughly half of EU FDI is in the manufacturing sector (e.g. transport and telecommunication equipment, chemicals, health equipment etc.). China has not made such far-reaching market access commitments with any other partner.•Automotive sector:China has agreed to remove and phase out joint venture requirements. China will commit market access for new energy vehicles.•Financial services: China had already started the process of gradually liberalising the financial services sector and will grant and commit to keep that opening to EU investors. Joint venturerequirements and foreign equity caps have been removed for banking, trading in securities and insurance (including reinsurance), as well as asset management.•Health (private hospitals): China will offer new market opening by lifting joint venture requirements for private hospitals in keyChinese cities, including Beijing, Shanghai, Tianjian, Guangzhou and Shenzhen .•R&D (biological resources): China has not previously committed openness to foreign investment in R&D in biological resources. China has agreed not to introduce new restrictions and to give to the EU any lifting of current restrictions in this area that may happen in the future.•Telecommunication/Cloud services: China has agreed to lift the investment ban for cloud services. They will now be open to EUinvestors subject to a 50% equity cap.•Computer services: China has agreed to bind market access for computer services - a significant improvement from the currentsituation. Also, China will include a ‘technology neutrality'clause, which would ensure that equity caps imposed for value-added telecom services will not be applied to other services such asfinancial, logistics, medical etc. if offered online.•International maritime transport: China will allow investment in the relevant land-based auxiliary activities, enabling EU companies to invest without restriction in cargo-handling, container depots and stations, maritime agencies, etc. This will allow EU companies to organise a full range of multi-modal door-to-door transport,including the domestic leg of international maritime transport.•Air transport-related services: While the CAI does not address traffic rights because they are subject to separate aviationagreements, China will open up in the key areas of computerreservation systems, ground handling and selling and marketingservices. China has also removed its minimum capital requirement for rental and leasing of aircraft without crew, going beyond GATS. •Business services: China will eliminate joint venture requirements in real estate services, rental and leasing services, repair andmaintenance for transport, advertising, market research, management consulting and translation services, etc.•Environmental services: China will remove joint venture requirements in environmental services such as sewage, noise abatement, solidwaste disposal, cleaning of exhaust gases, nature and landscapeprotection, sanitations and other environmental services. •Construction services: China will eliminate the project limitations currently reserved in their GATS commitments.•Employees of EU investors: Managers and specialists of EU companies will be allowed to work up to three years in Chinese subsidiaries, without restrictions such as labour market tests or quotas.Representatives of EU investors will be allowed to visit freely prior to making an investment.Improving level playing field – making investment fairer•State owned enterprises (SOEs) - Chinese SOEs contribute to around30 percent of the country's GDP. CAI seeks to discipline thebehaviour of SOEs by requiring them to act in accordance withcommercial considerations and not to discriminate in their purchases and sales of goods or services. Importantly, China also undertakes the obligation to provide, upon request, specific information toallow for the assessment of whether the behaviour of a specificenterprise complies with the agreed the CAI obligations. If theproblem goes unresolved, we can resort to dispute resolution under the CAI.•Transparency in subsidies –The CAI fills one important gap in the WTO rulebook by imposing transparency obligations on subsidies in the services sectors. Also, the CAI obliges China to engage inconsultations in order to provide additional information on subsidies that could have a negative effect on the investment interests of the EU. China is also obliged to engage in consultations with a view to seek to address such negative effects.•Forced technology transfers –The CAI lays very clear rules against the forced transfer of technology. The provisions consist of the prohibition of several types of investment requirements thatcompel transfer of technology, such as requirements to transfertechnology to a joint venture partner, as well as prohibitions to interfere in contractual freedom in technology licencing. These ruleswould also include disciplines on the protection of confidentialbusiness information collected by administrative bodies (for instance in the process of certification of a good or a service) fromunauthorised disclosure. The agreed rules significantly enhance the disciplines in WTO.•Standard setting, authorisations, transparency –This agreement covers other long-standing EU industry requests. China willprovide equal access to standard setting bodies for our companies.China will also enhance transparency, predictability and fairness in authorisations. The CAI will include transparency rules forregulatory and administrative measures to enhance legal certainty and predictability, as well as for procedural fairness and the right to judicial review, including in competition cases.Embedding sustainable development in our investment relationship•In contrast to other agreements concluded by China, the CAI binds the parties into a value-based investment relationship grounded onsustainable development principles.The relevant provisions aresubject to a specifically tailored implementation mechanism toaddress differences with a high degree of transparency andparticipation of civil society.•China commits, in the areas of labour and environment, not to lower the standards of protection in order to attract investment, not to use labour and environment standards for protectionist purposes, as well as to respect its international obligations in the relevanttreaties. China will support the uptake of corporate socialresponsibility by its companies.•Importantly, the CAI also includes commitments on environment and climate, including to effectively implement the Paris Agreement on climate.•China also commits to working towards the ratification of the outstanding ILO (International Labour Organisation)fundamental Conventions and takes specific commitments in relation to the two ILO fundamental Conventions on forced labour that it has not ratified yet.Monitoring of implementation and dispute settlement•In the CAI, China agrees to an enforcement mechanism(state-to-state dispute settlement), as in our trade agreements.•This will be coupled with a monitoring mechanism at pre-litigation phase established at political level, which will allow us to raise problems as they arise (including via an urgency procedure).。