备用信用证样本

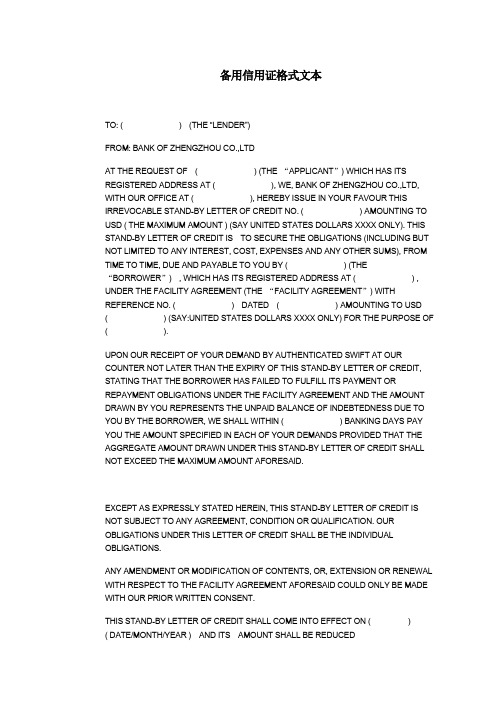

备用信用证格式文本-英文

备用信用证格式文本TO: ( ) (THE “LENDER”)FROM: BANK OF ZHENGZHOU CO.,LTDAT THE REQUEST OF ( ) (THE “APPLICANT”) WHICH HAS ITS REGISTERED ADDRESS AT ( ), WE, BANK OF ZHENGZHOU CO.,LTD, WITH OUR OFFICE AT ( ), HEREBY ISSUE IN YOUR FAVOUR THIS IRREVOCABLE STAND-BY LETTER OF CREDIT NO. ( ) AMOUNTING TO USD ( THE MAXIMUM AMOUNT ) (SAY UNITED STATES DOLLARS XXXX ONLY). THIS STAND-BY LETTER OF CREDIT IS TO SECURE THE OBLIGATIONS (INCLUDING BUT NOT LIMITED TO ANY INTEREST, COST, EXPENSES AND ANY OTHER SUMS), FROM TIME TO TIME, DUE AND PAYABLE TO YOU BY ( ) (THE “BORROWER”) , WHICH HAS ITS REGISTERED ADDRESS AT ( ) , UNDER THE FACILITY AGREEMENT (THE “FACILITY AGREEMENT”) WITH REFERENCE NO. ( ) DATED ( ) AMOUNTING TO USD ( ) (SAY:UNITED STATES DOLLARS XXXX ONLY) FOR THE PURPOSE OF ( ).UPON OUR RECEIPT OF YOUR DEMAND BY AUTHENTICATED SWIFT AT OUR COUNTER NOT LATER THAN THE EXPIRY OF THIS STAND-BY LETTER OF CREDIT, STATING THAT THE BORROWER HAS FAILED TO FULFILL ITS PAYMENT OR REPAYMENT OBLIGATIONS UNDER THE FACILITY AGREEMENT AND THE AMOUNT DRAWN BY YOU REPRESENTS THE UNPAID BALANCE OF INDEBTEDNESS DUE TO YOU BY THE BORROWER, WE SHALL WITHIN ( ) BANKING DAYS PAY YOU THE AMOUNT SPECIFIED IN EACH OF YOUR DEMANDS PROVIDED THAT THE AGGREGATE AMOUNT DRAWN UNDER THIS STAND-BY LETTER OF CREDIT SHALL NOT EXCEED THE MAXIMUM AMOUNT AFORESAID.EXCEPT AS EXPRESSLY STATED HEREIN, THIS STAND-BY LETTER OF CREDIT IS NOT SUBJECT TO ANY AGREEMENT, CONDITION OR QUALIFICATION. OUR OBLIGATIONS UNDER THIS LETTER OF CREDIT SHALL BE THE INDIVIDUAL OBLIGATIONS.ANY AMENDMENT OR MODIFICATION OF CONTENTS, OR, EXTENSION OR RENEWAL WITH RESPECT TO THE FACILITY AGREEMENT AFORESAID COULD ONLY BE MADE WITH OUR PRIOR WRITTEN CONSENT.THIS STAND-BY LETTER OF CREDIT SHALL COME INTO EFFECT ON ( )( DATE/MONTH/YEAR ) AND ITS AMOUNT SHALL BE REDUCEDCORRESPONDINGLY AS AND WHEN PAYMENTS THEREOF ARE MADE BY THE BORROWER PURSUANT TO THE FACILITY AGREEMENT OR BY US. THIS STAND-BY LETTER OF CREDIT SHALL EXPIRE AT OUR COUNTER ON THE EARLIER OF (I)( )( DATE/MONTH/YEAR ), (II)THE TIME WHEN THE SECURED SUMS UNDER THE FACILITY AGREEMENT AS ABOVE MENTIONED HAVE BEEN PAID IN FULL BY THE BORROWER, (III) THE TIME WHEN THERE IS NO AMOUNT REMAINING PAYABLE UNDER THIS STAND-BY LETTER OF CREDIT. UPON EXPIRY, THIS STAND-BY LETTER OF CREDIT SHALL AUTOMATICALLY BECOME NULL AND VOID WHETHER OR NOT IT IS RETURNED TO US FOR CANCELLATION.ALL NOTICES AND COMMUNICATIONS TO US SHALL BE SENT TO ( ) (SWIFT CODE) BY AUTHENTICATED SWIFT.ALL DEMANDS HEREUNDER MUST BE MARKED ''DRAWN UNDER BANK OF ZHENGZHOU CO.,LTD, STAND-BY LETTER OF CREDIT NO.( ) DATED( )''. PARTIAL DRAWINGS AND MULTIPLE DRAWINGS ARE ALLOWED.WE ENGAGE WITH YOU THAT ANY DEMAND UNDER AND IN COMPLIANCE WITH TERMS AND CONDITIONS OF THIS STAND-BY LETTER OF CREDIT SHALL BE DULY HONORED ON DUE PRESENTATION TO US.THIS STAND-BY LETTER OF CREDIT IS NOT TRANSFERABLE OR ASSIGNABLE AND IS SUBJECT TO UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (2007 REVISION) INTERNATIONAL CHAMBER OF COMMERCE PUBLICATION NO. 600.1BANK OF ZHENGZHOU CO.,LTD,1、此处适用的国际惯例也可选择INTERNATIONAL STANDBY PRACTICES ISP98。

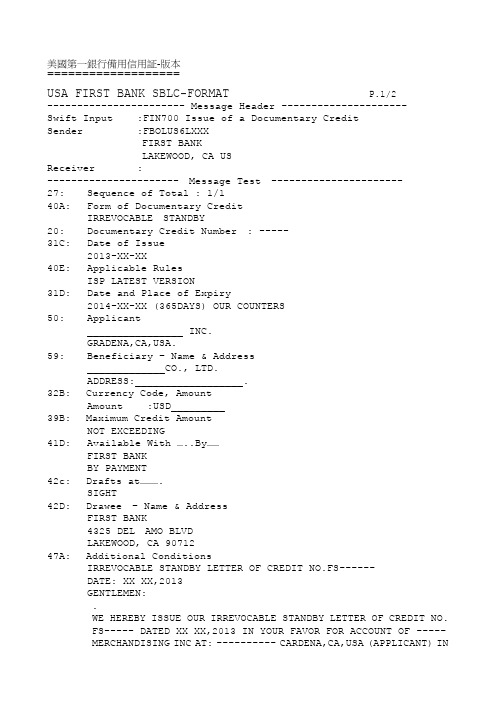

美国第一银行备用信用证-版本

美國第一銀行備用信用証-版本===================USA FIRST BANK SBLC-FORMAT P.1/2----------------------- Message Header ---------------------Swift Input :FIN700 Issue of a Documentary CreditSender :FBOLUS6LXXXFIRST BANKLAKEWOOD, CA USReceiver :---------------------- Message Test ----------------------27: Sequence of Total : 1/140A: Form of Documentary CreditIRREVOCABLE STANDBY20: Documentary Credit Number : -----31C: Date of Issue2013-XX-XX40E: Applicable RulesISP LATEST VERSION31D: Date and Place of Expiry2014-XX-XX (365DAYS) OUR COUNTERS50: Applicant________________ INC.GRADENA,CA,USA.59: Beneficiary – Name & Address_____________CO., LTD.ADDRESS:__________________.32B: Currency Code, AmountAmount :USD_________39B: Maximum Credit AmountNOT EXCEEDING41D: Available With …..By……FIRST BANKBY PAYMENT42c: Drafts at……….SIGHT42D: Drawee – Name & AddressFIRST BANK4325 DEL AMO BLVDLAKEWOOD, CA 9071247A: Additional ConditionsIRREVOCABLE STANDBY LETTER OF CREDIT NO.FS------DATE: XX XX,2013GENTLEMEN:.WE HEREBY ISSUE OUR IRREVOCABLE STANDBY LETTER OF CREDIT NO.FS----- DATED XX XX,2013 IN YOUR FAVOR FOR ACCOUNT OF -----MERCHANDISING INC AT: ---------- CARDENA,CA,USA (APPLICANT) INTHE AMOUNT OF USD ------(US DOLLARS -----ONLY) AVAILABLE BY YOURDRAFT(S) AT SIGHT DRAWN ON FIRST BANK ACCOMPANIED BY THEFOLLOWING.DOCUMENTS:(1) BE NEFICIARY’S SIGNED STATEMENT CERTIFYING THAT THE AMUNTCLAIMED IS IN ACCORDANCE WITH THE TERMS AND CONDITIONS OFAGREEMENT NO.----- DATED XX-XX-2013.(2) ORIGINAL AUTHENTICATED SWIFT ADVICE (AMENDMENT MT707) FROML/C ISSUING BANK (FIRST BANK) TO ADVISING BANK INDICATINGTHAT APPLICANT CONFIRMS RECEIPT OF FUNDS OF AMOUNT FROMBENEFICIARY NOT LESS THAN THE AMOUNT OF CLAIM.(3) ORIGINAL COPY OF SIGNED AGREEMENT NO.---- MUST BE ATTACHED..PARTIAL DRAWINGS ARE PERMITTED..EACH DRAFT MUST STATE THAT IT IS DRAWN UNDER FIRST BANK,INTERNATIONAL DEPT. 4325 DEL AMO BLVD, LAKEWOOD CA 90712,LETTER OF CREDIT NO. FS---- DATE JUL XX, 2013..THIS CREDIT EXPIRES ON XX XX,2014 AT FIRST BANK,INTERNATIONAL OPERATIONS,4325 DEL AMO BLVD,LAKEWOOD CA90712..THE ORIGINAL OF THIS CREDIT MUST ACCOMPANY ALL DRAFT(S) ANDDOCUMENTS..WE HEREBY ENGAGE WITH YOU THAT YOUR DRAFT(S) DRAWN UNDER AND IN COMPLIANCE WITH THE TERMS OF THE LETTER OF CREDIT, TOGETHER WITH THE DOCUMENTS SPECIFIED HEREIN, WILL BE DULY HONORED IF PRESENTED ON OR BEFORE THE EXPIRATION DATE HEREOF..THE STANDBY LETTER OF CREDIT IS SUBJECT TO THE VERSION OF THE ICC INTERNATIONAL STANDBY PRACTICES ISP98, INTERNATIONALCHAMBER OF COMMERCE, PARIS, FRANCE, WHICH IS IN EFFECT ON THE DATE OF ISSUE.71B: Details of chargesALL CHARGES OTHER THAN THOSE OF THE ISSUING BANK ARE FOR ACCOUNT OF THE BENEFICIARY.49: Confirmation InstructionsWITHOUT----------------------- Message Trailer --------------------。

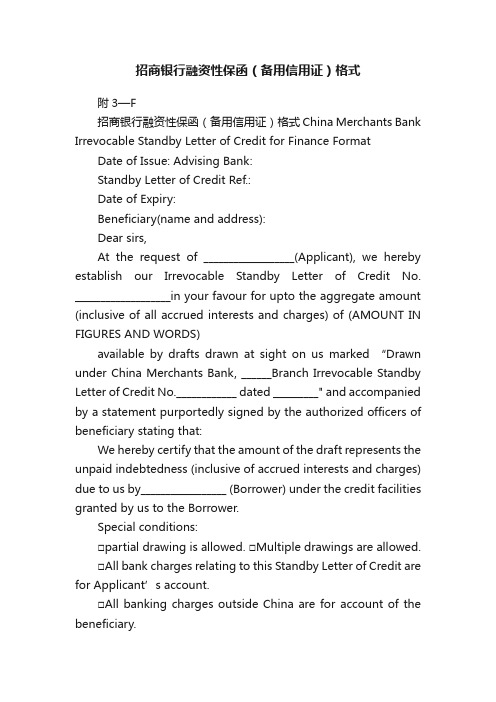

招商银行融资性保函(备用信用证)格式

招商银行融资性保函(备用信用证)格式附3—F招商银行融资性保函(备用信用证)格式China Merchants Bank Irrevocable Standby Letter of Credit for Finance Format Date of Issue: Advising Bank:Standby Letter of Credit Ref.:Date of Expiry:Beneficiary(name and address):Dear sirs,At the request of __________________(Applicant), we hereby establish our Irrevocable Standby Letter of Credit No. ___________________in your favour for upto the aggregate amount (inclusive of all accrued interests and charges) of (AMOUNT IN FIGURES AND WORDS)available by drafts drawn at sight on us marked “Drawn under China Merchants Bank, ______Branch Irrevocable Standby Letter of Credit No.____________ dated _________" and accompanied by a statement purportedly signed by the authorized officers of beneficiary stating that:We hereby certify that the amount of the draft represents the unpaid indebtedness (inclusive of accrued interests and charges) due to us by_________________ (Borrower) under the credit facilities granted by us to the Borrower.Special conditions:□partial drawing is allowed. □Multiple drawings are allowed.□All bank charges relating to this Standby Letter of Credit are for Applicant’s account.□All banking charges outside China are for account of the beneficiary.□This Standby Letter of Credit is non-transferable.This Standby Letter of Credit will expire on _________ (Expiry Date) at our counters. The above-mentioned drafts and statements must reach us at (address of the branch) ,China on or before the expiry date.We hereby agree and undertake that drafts drawn under and in compliance with the terms and conditions of this credit will be duly honoured upon presentationThis Standby Letter of Credit is subject to the International Standby Practices (ISP 98).China Merchants Bank Irrevocable Standby Letter of Credit for Finance Format中国招商银行不可撤销的备用信用证融资格式Date of Issue:发行日期:Advising Bank:通知行:Standby Letter of Credit Ref.:备用信用证Ref。

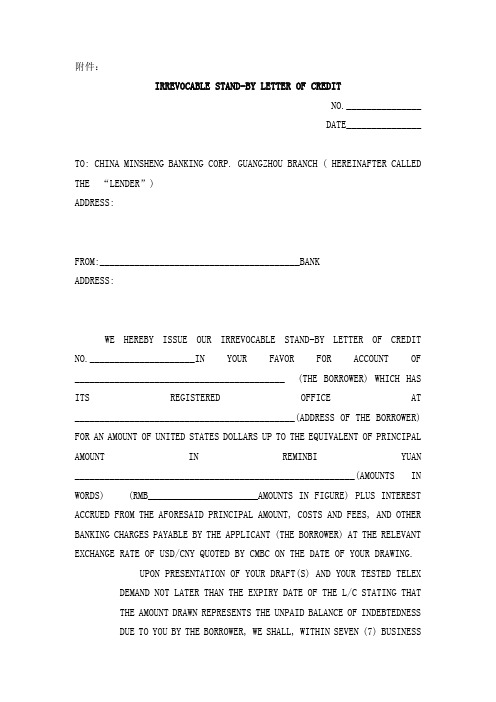

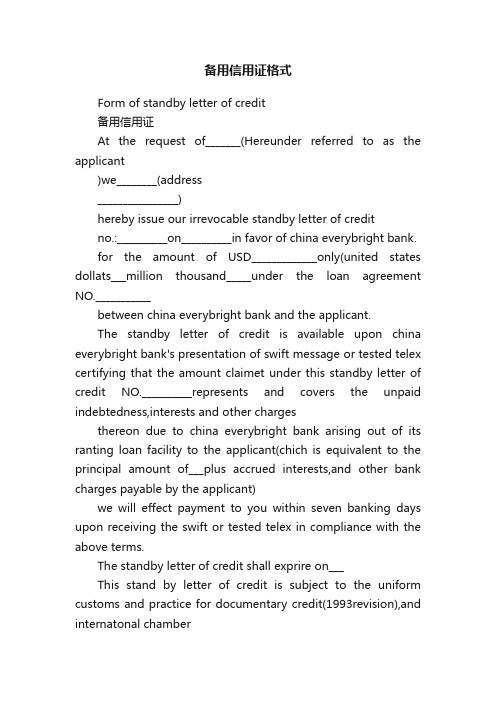

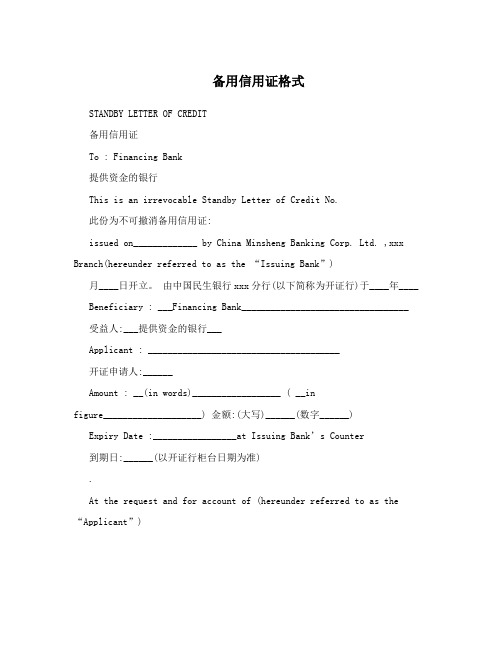

备用信用证格式

附件:IRREVOCABLE STAND-BY LETTER OF CREDITNO._______________DATE_______________TO: CHINA MINSHENG BANKING CORP. GUANGZHOU BRANCH ( HEREINAFTER CALLED THE “LENDER”)ADDRESS:FROM:________________________________________BANKADDRESS:WE HEREBY ISSUE OUR IRREVOCABLE STAND-BY LETTER OF CREDIT NO._____________________IN YOUR FAVOR FOR ACCOUNT OF __________________________________________ (THE BORROWER) WHICH HAS ITS REGISTERED OFFICE AT ____________________________________________(ADDRESS OF THE BORROWER) FOR AN AMOUNT OF UNITED STATES DOLLARS UP TO THE EQUIVALENT OF PRINCIPAL AMOUNT IN REMINBI YUAN ________________________________________________________(AMOUNTS IN WORDS) (RMB______________________AMOUNTS IN FIGURE) PLUS INTEREST ACCRUED FROM THE AFORESAID PRINCIPAL AMOUNT, COSTS AND FEES, AND OTHER BANKING CHARGES PAYABLE BY THE APPLICANT (THE BORROWER) AT THE RELEVANT EXCHANGE RATE OF USD/CNY QUOTED BY CMBC ON THE DATE OF YOUR DRAWING.UPON PRESENTATION OF YOUR DRAFT(S) AND YOUR TESTED TELEX DEMAND NOT LATER THAN THE EXPIRY DATE OF THE L/C STATING THATTHE AMOUNT DRAWN REPRESENTS THE UNPAID BALANCE OF INDEBTEDNESSDUE TO YOU BY THE BORROWER, WE SHALL, WITHIN SEVEN (7) BUSINESSDAYS PAY YOU THE AMOUNT SPECIFIED IN YOUR DRAFT(S) DRAWN ON US.EXCEPT AS EXPRESSLY STATED HEREIN, THIS UNDERTAKING IS NOT SUBJECTED TO ANY AGREEMENT, CONDITION OR QUALIFICATION. THE OBLIGATION OF THE ISSUING BANK UNDER THIS LETTER OF CREDIT SHALL BE THE INDIVIDUAL OBLIGATION OF THE BANK.THIS LETTER OF CREDIT WILL COME INTO EFFECT ON __________________, AND EXPIRE ON ________________ AT THE COUNTER OF CHINA MINSHENG BANKING CORP.ALL DRAFTS DRAWN HEREUNDER MUST BE MARKED DRAWN UNDER__________________________________________________(THE ISSUING BANK) STAND-BY LETTER OF CREDIT NO.__________________________________DATED____________________.WE ENGAGE WITH YOU THAT DRAFTS DRAWN UNDER AND IN COMPLIANCE WITH TERMS OF THIS CREDIT SHALL BE DULY HONORED ON DUE PRESENTATION TO US.THIS STAND-BY LETTER OF CREDIT IS SUBJECT TO UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION) I.C.C. PUBLICATION NO. 500.BEST REGARDS.BY: _______________________NAME:_____________________TITLE: _____________________FOR AND ON BEHALF OF________________________________________________BANK。

备用信用证格式

备用信用证格式Form of standby letter of credit备用信用证At the request of_______(Hereunder referred to as the applicant)we________(address________________)hereby issue our irrevocable standby letter of creditno.:__________on__________in favor of china everybright bank.for the amount of USD_____________only(united states dollats___million thousand_____under the loan agreement NO.___________between china everybright bank and the applicant.The standby letter of credit is available upon china everybright bank's presentation of swift message or tested telex certifying that the amount claimet under this standby letter of credit NO.__________represents and covers the unpaid indebtedness,interests and other chargesthereon due to china everybright bank arising out of its ranting loan facility to the applicant(chich is equivalent to the principal amount of___plus accrued interests,and other bank charges payable by the applicant)we will effect payment to you within seven banking days upon receiving the swift or tested telex in compliance with the above terms.The standby letter of credit shall exprire on___This stand by letter of credit is subject to the uniform customs and practice for documentary credit(1993revision),and internatonal chamberof commerce publication NO.500.在要求_______(以下统称为申请人)we________(地址________________)在此问题,我们不可撤销的备用信用证,信用证号码.:__________on__________(填写银行)中国everybright银行。

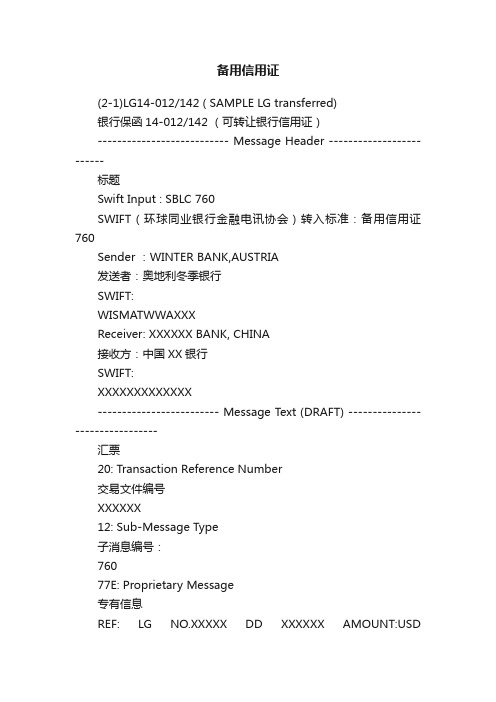

备用信用证

备用信用证(2-1)LG14-012/142 ( SAMPLE LG transferred)银行保函14-012/142 (可转让银行信用证)--------------------------- Message Header -------------------------标题Swift Input : SBLC 760SWIFT(环球同业银行金融电讯协会)转入标准:备用信用证760Sender :WINTER BANK,AUSTRIA发送者:奥地利冬季银行SWIFT:WISMATWWAXXXReceiver: XXXXXX BANK, CHINA接收方:中国XX银行SWIFT:XXXXXXXXXXXXX------------------------- Message Text (DRAFT) --------------------------------汇票20: Transaction Reference Number交易文件编号XXXXXX12: Sub-Message Type子消息编号:76077E: Proprietary Message专有信息REF: LG NO.XXXXX DD XXXXXX AMOUNT:USD000,000,000,00 ISSUED BY POITGB21XXX参考:LG NO.XXXXXDDXXXXXX量:美金000,000,000,00,发布点GB21XXX.DEAR SIRS, WE您好先生,WISMATWWAXXX ACCORDING THE INSTRUCTIONS OF THE FIRST我们依照某某公司WISMATWWAXXX的要求BENEFICIARY (TRANSFEROR) XXXXXXXXXXXXXXXXXXXXXXXX, TRANSFER OF THIS LG IN THE AMOUNT OF USD 000,000,000.00 TO THE SECOND BENEFICIARY (TRANSFEREE) AS FOLLOWING:.受益人(转让方)XXXXXXXXXXXXXXXXXXXXX,以美元结算下的数额USD000,000,000.00到第二受益人(受让人)QUOTE引用27: Sequence of Total总序列1/120: Transaction Reference Number交易文件编号XXXXXX23: Further Identification进一步跟进的Issue问题30: Date日期XXXXXXXXX某年某月某日40C: Applicable Rules适用规则OTHR其他77C: Details of Guarantee保证的详细细则LETTER OF GUARANTEE NO: 142/112/XXXXXX保证书:142/112/XXXXXXDATE OF ISSUE: 1403XX签发日期:1403XXDATE OF MATURITY: 1503XX到期日期:1503XXISSUER: POITGB21, POINT BANK , UK发送银行:英国点银行GB21ADDRESS OF THE ISSUER: 11 Church Road, Great Bookham, Surrey, KT23 3PB, UK 发送方地址:11教堂路,大波科海姆,萨里,英国KT23 3PBAPPLICANT: XXXXXXXXXXXXXX申请人:XXXXXXXXXXXXXXXSECOND BENEFICIARY'S BANK: XXXXXXXXXX BANK,CHINA 第二受益人银行:XXXXXXXXXXXX银行,中国SWIFT:(环球同业银行金融电讯协会)XXXXXXXXXXXXXXBENEFICIARY: XXXXXXXXX受益人:XXXXXXXXXXXACC NO. XXXXXXXXXXXXACC 编号.AMOUNT (FACE VALUE): USD 000,000,000.00金额(票面价值):USD000,000,000.00FOR THE VALUE RECEIVED, WE, THE UNDERSIGNED, POINTBANK LOCATEDAT 11 Church Road, Great Bookham, Surrey, KT23 3PB, UK, HEREBYIRREVOCABLY AND UNCONDITIONALLY, WITHOUT PROTEST ORNOTIFICATION, PROMISE TO PAY AGAINST THIS LETTER OF GUARANTEE TOTHE ORDER OF SECOND BENEFICIARY THEREOF, BEFORE OR AT THE DATE OF MATURITY, UPON RECEIPT OF SECOND BENEFICIARY’SFIRST WRITTEN DEMAND.OUR GUARANTEE IS VALID TILL 1503XX AND EXPIRES IN FULL ANDAUTOMATICALLY为获得彼此共同价值,我们签署英国点银行地址在11 Church Road, Great Bookham, Surrey, KT23 3PB, UK,不可撤销和无条件的,没有抗议或通知,支付承诺没有抗议,支付承诺对本第二受益人的要求,或之前,在到期日,第二受益人要求持有书面收据,我们的担保有效期至1503XX,而且将自动生效IF WE DO NOT RECEIVE THE REQUEST FOR PAYMENT, EITHER IN WRITINGOR BY SWIFT,ON OR BEFORE THAT DATE. CLAIMS AND RIGHTS RESULTING THIS L/G CANONLY BE ASSIGNED AND PRESENTED WITH OUR PRIOR WRITTEN CONSENT(MT 799)..如果我们没有收到付款要求,以书面形式SWIFT为准则,在该日期或之前,权力利益的产生,本保函只能分配和提交我方事先书面意,(MT799)SUCH PAYMENT SHALL BE MADE WITHOUT SET-OFF FREE AND CLEAR OFANYDEDUCTION, CHARGES, FEES, OR WITHHOLDING OF ANY ASSESSED BY THEGOVERNMENT, OR ANY POLITICAL SUBDIVISION OF AUTHORITY THEREOFOR THEREIN.此种支付应无抵消和自由,没有任何义务扣除,改变收费或扣缴方式,目前或是以后征收,自动扣交,截留或由及政府的评估或任何政府内权威部门的评估.THIS GUARANTEE IS AS CASH BACKED, IRREVOCABLE, NEGOTIABLE,DIVISIBLE, ASSIGNABLE WITHOUT PRESENTATION TO US AND WITHOUT THE PAYMENT OF ANY TRANSFER FEES..为了保证现金安全,不可撤销跟单信用证,可转让跟单信用证,可分开跟单信用证,介绍给我们,并不付任何手续费用,THIS GUARANTEE IS SUBJECT TO THE UNIFORM RULES FOR DEMANDGUARANTEES, ICC PUBLICATION NO.758.THIS IS AN OPERATIVE INSTRUMENT AND NO MAIL CONFIRMATION WILLFOLLOW..这种保证是在确定双方利益的前提下订立的,依据国际法条款(ICC)第NO.758。

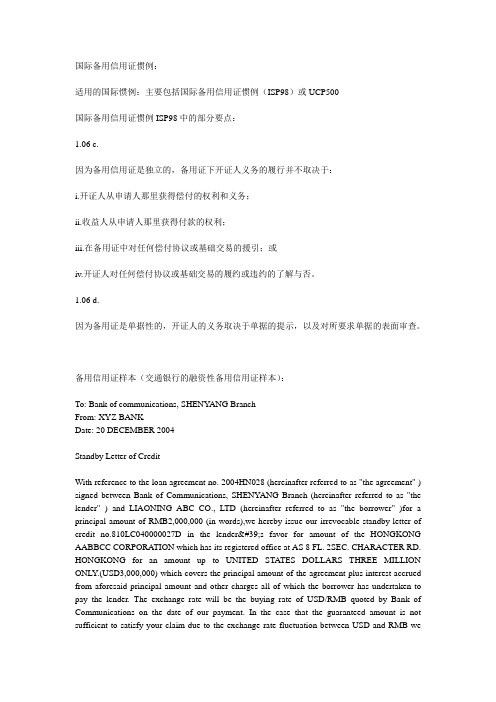

国际备用信用证惯例

国际备用信用证惯例:适用的国际惯例:主要包括国际备用信用证惯例(ISP98)或UCP500国际备用信用证惯例ISP98中的部分要点:1.06 c.因为备用信用证是独立的,备用证下开证人义务的履行并不取决于:i.开证人从申请人那里获得偿付的权利和义务;ii.收益人从申请人那里获得付款的权利;iii.在备用证中对任何偿付协议或基础交易的援引;或iv.开证人对任何偿付协议或基础交易的履约或违约的了解与否。

1.06 d.因为备用证是单据性的,开证人的义务取决于单据的提示,以及对所要求单据的表面审查。

备用信用证样本(交通银行的融资性备用信用证样本):To: Bank of communications, SHENY ANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENY ANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORA TION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STA TES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB wehereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENY ANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.本文内容来自贸易人家论坛[url][/url],更多精彩等着您!。

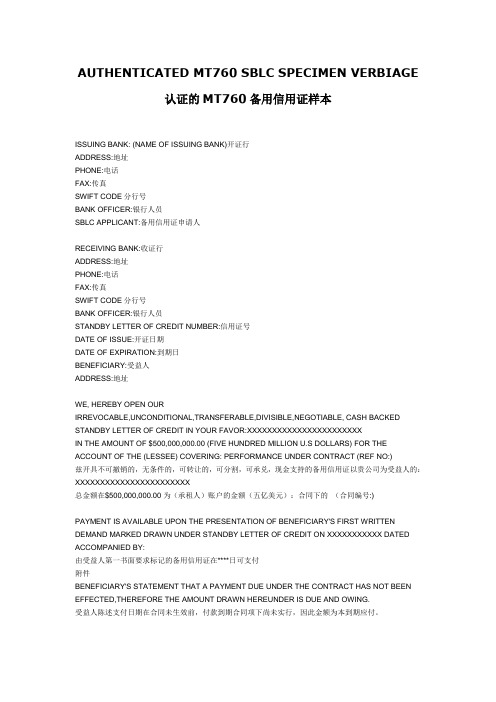

版本巴克莱银行备用证

AUTHENTICATED MT760 SBLC SPECIMEN VERBIAGE认证的MT760备用信用证样本ISSUING BANK: (NAME OF ISSUING BANK)开证行ADDRESS:地址PHONE:电话FAX:传真SWIFT CODE分行号BANK OFFICER:银行人员SBLC APPLICANT:备用信用证申请人RECEIVING BANK:收证行ADDRESS:地址PHONE:电话FAX:传真SWIFT CODE分行号BANK OFFICER:银行人员STANDBY LETTER OF CREDIT NUMBER:信用证号DATE OF ISSUE:开证日期DATE OF EXPIRATION:到期日BENEFICIARY:受益人ADDRESS:地址WE, HEREBY OPEN OURIRREVOCABLE,UNCONDITIONAL,TRANSFERABLE,DIVISIBLE,NEGOTIABLE, CASH BACKED STANDBY LETTER OF CREDIT IN YOUR FAVOR:XXXXXXXXXXXXXXXXXXXXXXXIN THE AMOUNT OF $500,000,000.00 (FIVE HUNDRED MILLION U.S DOLLARS) FOR THE ACCOUNT OF THE (LESSEE) COVERING: PERFORMANCE UNDER CONTRACT (REF NO:)兹开具不可撤销的,无条件的,可转让的,可分割,可承兑,现金支持的备用信用证以贵公司为受益人的:XXXXXXXXXXXXXXXXXXXXXXX总金额在$500,000,000.00为(承租人)账户的金额(五亿美元):合同下的(合同编号:)PAYMENT IS AVAILABLE UPON THE PRESENTATION OF BENEFICIARY'S FIRST WRITTEN DEMAND MARKED DRAWN UNDER STANDBY LETTER OF CREDIT ON XXXXXXXXXXX DATED ACCOMPANIED BY:由受益人第一书面要求标记的备用信用证在****日可支付附件BENEFICIARY'S STATEMENT THAT A PAYMENT DUE UNDER THE CONTRACT HAS NOT BEEN EFFECTED,THEREFORE THE AMOUNT DRAWN HEREUNDER IS DUE AND OWING.受益人陈述支付日期在合同未生效前,付款到期合同项下尚未实行,因此金额为本到期应付。

备用信用证格式

备用信用证格式STANDBY LETTER OF CREDIT备用信用证To : Financing Bank提供资金的银行This is an irrevocable Standby Letter of Credit No.此份为不可撤消备用信用证:issued on_____________ by China Minsheng Banking Corp. Ltd. ,xxx Branch(hereunder referred to as the “Issuing Bank”)月____日开立。

由中国民生银行xxx分行(以下简称为开证行)于____年____ Beneficiary : ___Financing Bank__________________________________ 受益人:___提供资金的银行___Applicant : _______________________________________开证申请人:______Amount : __(in words)__________________ ( __infigure____________________) 金额:(大写)______(数字______) Expiry Date :_________________at Issuing Bank’s Counter到期日:______(以开证行柜台日期为准).At the request and for account of (hereunder referred to as the “Applicant”)we, China Minsheng Banking Corp. Ltd. ,xxx Branch, hereby establish our irrevocable Standby Letter Of Credit No._______________ in favour of you (Financing Bank), for themaximum amount of ( __in figure__ USD xxx.xx_)_(in words Say United States Dollars xxx only) covering the principal sum with accrued interest, accrued default interest and other banking chargers which (hereinafter referred to as the “Borrower” ) owes to you as itsindebtedness pursuant to the Loan Agreements/ Banking Facilities reference No.between the Borrower and you.应_______(在此填写开证申请人)的要求,并由其自费, 我方中国民生银行xxx 分行,特此开立此不可撤消备用信用证,信用证号码:______经由你出资银行同意,最高金额为____,数字USDxxxx,_____(大写~共计美金xxxx元整)。

备用信用证详解及样本

备用信用证详解及样本什么是备用信用证,备用信用证的融资性质:备用信用证又称担保信用证,是指不以清偿商品交易的价款为目的,而以贷款融资,或担保债务偿还为目的所开立的信用证。

备用信用证是在美国发展起来的一种以融通资金、保证债务为目的的金融工具。

在十九世纪初,美国有关法例限制银行办理保函业务,然而随着各项业务的发展,银行确有为客户提供保证业务的需要,因而产生了备用信用证。

由此可见,备用信用证就是一种银行保函性质的支付承诺。

在备用信用证中,开证行保证在开证申请人未能履行其应履行的义务时,受益人只要凭备用信用证的规定向开证行开具汇票,并随附开证申请人未履行义务的声明或证明文件即可得到开证行偿付。

备用信用证只适用《跟单信用证统一惯例》(500号)的部分条款。

备用信用证有如下性质:1、不可撤销性。

除非在备用证中另有规定,或经对方当事人同意,开证人不得修改或撤销其在该备用证下之义务。

2、独立性。

备用证下开证人义务的履行并不取决于:a.开证人从申请人那里获得偿付的权利和能力;b.受益人从申请人那里获得付款的权利;c.备用证中对任何偿付协议或基础交易的援引;d.开证人对任何偿付协议或基础交易的履约或违约的了解与否。

3、跟单性。

开证人的义务要取决于单据的提示,以及对所要求单据的表面审查。

4、强制性。

备用证在开立后即具有约束力,无论申请人是否授权开立,开证人是否收取了费用,或受益人是否收到或因信赖备用证或修改而采取了行动,它对开证行都是有强制性的。

备用信用证(STANDBY L/C)的种类:根据在基础交易中备用信用证的不同作用主要可分为以下8类:1.履约保证备用信用证(PERFORMANCE STANDBY)——支持一项除支付金钱以外的义务的履行,包括对由于申请人在基础交易中违约所致损失的赔偿。

2.预付款保证备用信用证(ADV ANCE PAYMENT STANDBY)——用于担保申请人对受益人的预付款所应承担的义务和责任。

备用信用证(Standby LC)

备用信用证(Standby L/C)国际商会“UCP 500”规定,该惯例也适用于备用信用征。

备用信用证的定义和前述信用证的定义并无不同,都是银行(开证行)应申请人的请求,向受益人开立的,在一定条件下凭规定的单据向受益人支付一定款项的书面凭证。

所不同的是,规定的单据不同。

备用信用证要求受益人提交的单据,不是货运单据,而是受益人出具的关于申请人违约的声明或证明。

传统的银行保函有可能使银行卷入商业纠纷,美、日等国的法律禁止银行开立保函。

于是美国银行采用备用信用证的形式,对国际经济交易行为提供担保。

随着银行保函在应用中性质的变化,特别是1992年国际商会《见索即付保函统一规则》的公布,银行保函和备用信用证的内容和作用已趋一致。

所不同的只是两者遵循的惯例不同。

备用信用证运用于“UCP 600”,而银行保函则适用于上述《规则》。

备用信用证是担保银行向贴现或贷款银行承诺到期为借款方偿还债务,如果借款方到期偿还了贷款,那么,备用信用证就备而不用,如果,借款方到期不归还贷款,那么,备用信用证就起作用,担保银行就要为借款方向贷款银行偿还贷款。

备用信用证有无条件兑付信用证和有条件兑付信用证。

备用信用证样本1:T Bank of communications, SHENYING BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONG KONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.备用信用证样本2:To: Bank of communications, SHENYANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that uponreceipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.。

第九章备用信用证-PPT文档资料

• 受益人----指定受益人、受让受益人 • 开证行:担保人 • 保兑人:独立,与开证行地位相同 • 通知行(案例下页) • 交单人

备用信用证通知的案例

• 背景介绍 • 业务类型:不可撤销备用信用证 • 开证行:I 银行 • 通知行:A银行 • 受益人:A银行辖属的F市银行(贷款银行) • 申请人:F市H公司(借款人) • 案情经过

• 一份备用信用证可同时注明依据ISP98和 UCP600开立,此时ISP98优先于UCP600, 即只有在ISP98未涉及或另有明确规定的情 况下,才可依据UCP600原则解释和处理有 关条款。

预付款备用信用证

• Advance SLC: • 对申请人应支付给受益人的预付金的责任

和义务进行担保。 • 国际工程承包:业主向承包人支付合同总

价的10%~25%的工程预付款; • 进出口贸易:进口商向出口商支付的预付

款。

融资备用信用证

• Financial SLC:对申请人履行的付款责任进 行担保。

• 样本:

• To: Bank of communications, SHENYING Branch • From: XYZ BANK • Date: 20 DECEMBER 2004

• Standby Letter of Credit

•

With reference to the loan agreement no. 2004HN028 (hereinafter

• 国际信贷融资安排:

融资银行 (受益人)

2、开立融资 备用信用证

3、开立透支账户

境外投资企业 (申请人)

1、申请开征

本国银行/东道国银 行(开证行)

• 履约备用信用证(Performance SLC):对 履约责任进行担保。

保函或备用信用证(758版本)

保函/备用信用证样本FORMAT OF STANDBY LETTER OF CREDIT MT760 (URDG 758)Dear SirsTo: BANK OF COMMUNICATIONS CO., LTD OFFSHORE BANKING UNIT Date :From Bank :Bank Address :SWIFT :Bank Officer #1 :Account Number :Account Name :Amount : USD100,000,000.00Date of Issue :Date of Expiration :Transaction Code :Receiving Bank Name : Bank of communications co., Ltd Offshore Banking UnitBank Address : 1st floor, No.188, Yinchengzhong Road, Pudong,Shanghai, China, P.C : 200120SWIFT CODE : COMMCN3XOBUBank Officer : MR SONG MENGBank Tel.: 86-532-82958583 ; 86-532-82958586Beneficiary Name : Bank of communications co., Ltd Offshore Banking Unit For account of YIJIA ENERGY HONGKONG CO., LIMITEDBeneficiary Legal Address : 1st floor, No.188, Yinchengzhong Road, Pudong,Shanghai,China, P.C : 200120Account Name : YIJIA ENERGY HONGKONG CO., LIMITEDAccount No : OSA90000051080100We herewith open our standby letter of credit No: xxxxxxx as followsFor value received by us, we, the undersigned, (Name of Issuing Bank and Address)hereby issues our irrevocable and unconditional transferable divisible, assignable andwithout protest or notification promises to pay against this Irrevocable standby letter ofcredit No XXXXXXXXXXX . in favor of BANK OF COMMUNICATIONS CO., LTDOFFSHORE BANKING UNIT, FOR ACCOUNT OF YIJIA ENERGY HONGKONG CO.,LIMITED. the bearer or holder thereof, at maturity in one (1) year and one (1) day, the sumof USD100,000,000.00…, in the lawful currencyof the xxxxxxxxxxxxxxx, upon presentation and surrender of this standby letter of credit at any of the counter of [Name of Issuing Bank], but not later than fifteen(15) days after by the maturity date.Such payment shall be made without set-of and clear of any deductions, charges, fees or with holdings of any nature, now or hereinafter imposed, levied, collected, withheld or assessed by the government of [country of issue] or any political subdivision or authority thereof or therein.This standby letter of credit is cash backed, transferable, divisible and assignable without presentation of it to us and may be relied upon for the purposes of obtaining credit lines or loans.or payment of any transfer or assignable fees.Except as otherwise expressly stated herein, this standby letter of credit is govenment and constructed in accordance with the laws of xxxxxxxxxxxxxxxx (country of issue)This standby letter of credit is governed by the Uniform Rules for Demand Guarantees as set forth by the International Chamber of Commerce in Paris, France latest revision of publication 500/600 URDG 758.Your demand for payment should reach us not before xxxxxxxxxxxxxxxx(date) but notlater than xxxxxxxxxxxxxxxx(date) after which date, this standby letter of credit expires in full and should be considered null and void.This standby letter of credit is a fully performed and operative instrument that can beconfirmed and verified bank-to-bank by SWIFT. No E-mail confirmation will follow. allcharges are for the account of this applicant."For and on behalf of [Name of Issuing Bank]Authorized bank officer 1 Authorized bank officer 2 Name: Name:Title: Title:Pin code: Pin code:。

备用信用证

见教材第170~173页。

二、银行保函和跟单信用证的异同 相同点: 两者都是银行作出的承诺,都属于银行信用形式; 两者都具有独立性,银行不能以申请人未履行对自 己的义务为由拒绝向受益人承担付款或赔偿责任; 两者都是单据化业务,银行根据受益人提交的单据 来决定是否需要履行付款或赔偿责任,不需要介入 具体的合同; 银行对单据的审核责任都仅限于表面相符。

(4)备用信用证都是独立性担保文件 这与跟单信用证相同。相比之下,银行保 函有从属性保函,虽然很少见。

第二节

备用信用证基本内容

一、备用信用证基本内容 见教材第164页备用信用证样本。

二、备用信用证关键内容 1、备用信用证索偿条件 经签署的声明文件,声明申请人未履行协 议规定的义务。 2、备用信用证索偿方法 授权通知行开立以我行为受票人,与备用 信用证等额的汇票。 3、备用信用证撤销条件 有效期到期日之前,收到通知行转达的、 申请人关于合同已得到执行的通知。

银行付款的对价情况不同。信用证项下的支付是有

对价的,而保函项下的支付有的有对价,有的没有 对价。

银行付款所要提交的单据和途径不同。信用证项下

的单据通赔通知书,以及其 它有关文件或单据。

跟单信用证、保函、备用信用证比较

备用信用证 形式 形式同L/C 信用基础 银行信用 独立性 跟单信用证 银行信用 银行保函 形式不同于L/C 银行信用

三、当事人与业务流程 1、备用信用证业务流程 申请人 申请开证

开证行

信 用 证

受益人

信用证

通知行

2、注意 (1)通知行是必须的 通知行通知信用证,并履行审核信用证的 义务。但受益人的索偿不通过通知行,而 是直接向开证行索偿。这样,通知行的责 任处于跟单信用证和银行保函之间。 但通知行还可能承担其它职责。见后。

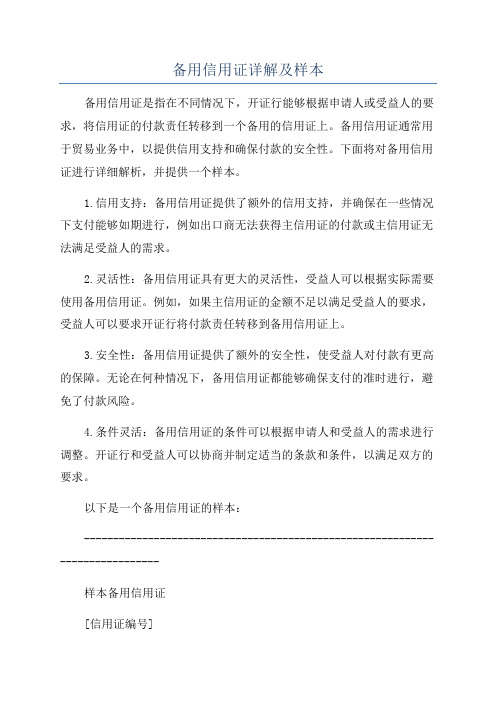

备用信用证详解及样本

备用信用证详解及样本备用信用证是指在不同情况下,开证行能够根据申请人或受益人的要求,将信用证的付款责任转移到一个备用的信用证上。

备用信用证通常用于贸易业务中,以提供信用支持和确保付款的安全性。

下面将对备用信用证进行详细解析,并提供一个样本。

1.信用支持:备用信用证提供了额外的信用支持,并确保在一些情况下支付能够如期进行,例如出口商无法获得主信用证的付款或主信用证无法满足受益人的需求。

2.灵活性:备用信用证具有更大的灵活性,受益人可以根据实际需要使用备用信用证。

例如,如果主信用证的金额不足以满足受益人的要求,受益人可以要求开证行将付款责任转移到备用信用证上。

3.安全性:备用信用证提供了额外的安全性,使受益人对付款有更高的保障。

无论在何种情况下,备用信用证都能够确保支付的准时进行,避免了付款风险。

4.条件灵活:备用信用证的条件可以根据申请人和受益人的需求进行调整。

开证行和受益人可以协商并制定适当的条款和条件,以满足双方的要求。

以下是一个备用信用证的样本:-----------------------------------------------------------------------------样本备用信用证[信用证编号]贸易条款:1.开证行:[开证行名称和地址]2.申请人:[申请人名称和地址]3.受益人:[受益人名称和地址]4.付款行:[付款行名称和地址]5.有效期:[有效期限]6.金额:[备用信用证金额]7.付款条件:即期信用证,受益人提交符合信用证条款的单据后,开证行将在三个工作日内付款。

单据要求:1.发票:一式三份符合国际贸易规则的发票,包括商品名称、数量、单价和金额等详细信息。

2.装箱单:一式三份的装箱单,详细说明货物包装和运输情况。

3.提单:一式三份正本的清洁提单,表明货物已经发运,并详细说明货物的品名、数量和运输方式。

4.保险单:一式三份的货物保险单,表明货物在运输途中的保险情况,并提供合适的险别和金额。

备用信用证PPT课件

.

15

一、几种常见备用信用证

备用信用证

投标备用信用证 履约备用信用证 预付款备用信用证 融资备用信用证 商业备用信用证

用于担保申请人中标后履行合同责任和义务。若投标人 未能履行合同,开证行需按照备用信用证的规定向受益

人履行赔款义务。

用于担保履行责任而非担保付款,包括对申请人在基础 交易中违约所造成的损失进行赔偿的保证。

• 发展:种类逐渐增加,从违约付款型转向 直接付款型,从而使备用信用证成为一种 全面的金融工具。

.

3

一、备用信用证的定义

根据国际商会第515号出版物《国际商会跟单信 用证操作指南》,备用信用证(Standby Letter of Credit)是一种跟单信用证或安排,它代表了 开证人对受益人的一下责任:

.

10

(六)转开行

指接受反担保行的要求,向受益人开出备用 信用证的银行。转开信用证通常是根据受益 人国家或政府的规定及受益人的要求进行, 其目的是使海外担保变成国内担保,一旦发 生争议和纠纷,不仅索赔迅速,而且可以利 用本国的法律进行仲裁。

.

11

二、备用信用证的业务流程

(1)在申请人履约的情形下:

保函的付款依据 都是银行根据申请人的要求向

是有关合同或某 受益人出具的书面保证文件,

项承诺未被履行, 都是以银行信用来弥补商业信

备用信用证(standbylc)[新版]

![备用信用证(standbylc)[新版]](https://img.taocdn.com/s3/m/f4b7760a53d380eb6294dd88d0d233d4b14e3fa4.png)

备用信用证(Standby L/C)国际商会“UCP 500”规定,该惯例也适用于备用信用征。

备用信用证的定义和前述信用证的定义并无不同,都是银行(开证行)应申请人的请求,向受益人开立的,在一定条件下凭规定的单据向受益人支付一定款项的书面凭证。

所不同的是,规定的单据不同。

备用信用证要求受益人提交的单据,不是货运单据,而是受益人出具的关于申请人违约的声明或证明。

传统的银行保函有可能使银行卷入商业纠纷,美、日等国的法律禁止银行开立保函。

于是美国银行采用备用信用证的形式,对国际经济交易行为提供担保。

随着银行保函在应用中性质的变化,特别是1992年国际商会《见索即付保函统一规则》的公布,银行保函和备用信用证的内容和作用已趋一致。

所不同的只是两者遵循的惯例不同。

备用信用证运用于“UCP 600”,而银行保函则适用于上述《规则》。

备用信用证是担保银行向贴现或贷款银行承诺到期为借款方偿还债务,如果借款方到期偿还了贷款,那么,备用信用证就备而不用,如果,借款方到期不归还贷款,那么,备用信用证就起作用,担保银行就要为借款方向贷款银行偿还贷款。

备用信用证有无条件兑付信用证和有条件兑付信用证。

备用信用证样本1:T Bank of communications, SHENYING BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONG KONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.备用信用证样本2:To: Bank of communications, SHENYANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due t o the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication N o.500.0。

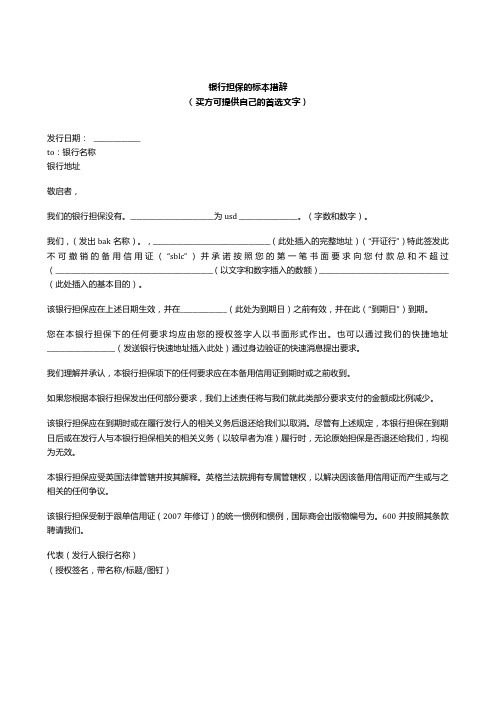

备用信用证HSBC汇丰版本

银行担保的标本措辞(买方可提供自己的首选文字)发行日期:_______________to:银行名称银行地址敬启者,我们的银行担保没有。

___________________________为usd ___________________。

(字数和数字)。

我们,(发出bak名称)。

,______________________________________(此处插入的完整地址)(“开证行”)特此签发此不可撤销的备用信用证(“sblc”)并承诺按照您的第一笔书面要求向您付款总和不超过(___________________________________________________(以文字和数字插入的数额)__________________________________________(此处插入的基本目的)。

该银行担保应在上述日期生效,并在_______________(此处为到期日)之前有效,并在此(“到期日”)到期。

您在本银行担保下的任何要求均应由您的授权签字人以书面形式作出。

也可以通过我们的快捷地址______________________(发送银行快速地址插入此处)通过身边验证的快速消息提出要求。

我们理解并承认,本银行担保项下的任何要求应在本备用信用证到期时或之前收到。

如果您根据本银行担保发出任何部分要求,我们上述责任将与我们就此类部分要求支付的金额成比例减少。

该银行担保应在到期时或在履行发行人的相关义务后退还给我们以取消。

尽管有上述规定,本银行担保在到期日后或在发行人与本银行担保相关的相关义务(以较早者为准)履行时,无论原始担保是否退还给我们,均视为无效。

本银行担保应受英国法律管辖并按其解释。

英格兰法院拥有专属管辖权,以解决因该备用信用证而产生或与之相关的任何争议。

该银行担保受制于跟单信用证(2007年修订)的统一惯例和惯例,国际商会出版物编号为。

600并按照其条款聘请我们。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

备用信用证样本(交通银行的融资性备用信用证样本):To: Bank of communications, SHENYANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no. in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STA TES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. dated 20 DECEMBER 2004.This standby letter of? is? credit? will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.案例来说明备用信用证是如何帮助公司融资的以及其中相应的风险。

中国公司A在上海投资某大型项目时碰到了资金短缺的问题,面临着选择:要么在短时间内筹集到资金并投入该项目,要么放弃该项目,但是如果选择放弃,A公司先期投入的资金则全部转为不可弥补的损失。

经过深思熟虑,A公司决定向B银行贷款,继续该项目。

B银行发放贷款的前提是借款人必须向银行提供与贷款相同数额的担保。

但是,A公司没有可供担保的财产。

这时候,C公司出现了。

C公司是一家美国的投资公司。

在其为客户提供的融资工具中,备用信用证是被经常使用的一种方式。

C公司为A公司设计的方案是这样的:假设A公司需要100万美元。

C公司与A公司事先签订一个委托开证协议,由A公司委托C公司开出备用信用证,A公司支付一般相当于开证金额1%-3%左右的手续费。

根据开证协议,C公司按时向其位于美国的开证银行D申请开立100万美元的备用信用证,受益人是A公司在国内的开户银行或者贷款银行B。

与此同时,A 公司与B银行就贷款问题达成协议,即由A公司将该备用信用证抵押给B银行,B银行向A公司提供相当于信用证金额的贷款,也就是100万美元。

备用信用证以最快的方式到达B银行,B银行审查信用证,确认无误后向A公司发放贷款。

这样的安排对B银行有很大优势,因为B银行有美国D银行的信用担保。

如果A公司在贷款期满时没有能力偿还或者故意不偿还贷款,B银行可以凭该备用信用证要求D银行履行信用证义务,即代替A公司偿还。

对A公司来说,其贷款成本可能高于一般的商业贷款,因为有一笔额外的开证手续费需要支付。

但是这种方式对于短时间内需要大量资金的公司而言,无疑是个好办法。

D银行在该交易中不大可能有风险,因为开证行开证的前提是申请人C公司必须在开证行存入足够的开证保证金,或者C公司已经向D银行提供了相应的担保。

对于C公司,情况比较复杂一点。

首先这是一项业务,所以C公司会尽力取得A公司的信任并且配合A公司做好工作。

其次,C公司会考虑是否能够获得预期利润,所以通常在协议中要求A公司先支付手续费,然后再安排开证。

第三,也是最重要的,C公司非常关心A公司是否有能力偿还B银行的贷款。

如果A公司在贷款期满不履行还款义务,B银行和D银行都不会有损失,最后倒霉的是C公司。

因此,从理论上说,C公司应该具备足够的知识和技能来预测A公司的还款能力。

但是在实践中,C公司很可能是第一次与A公司接触,从协商谈判、签订协议到实际交易的时间又比较短,无法了解A公司的真实财务情况。

所以,C公司从一开始就不会完全相信A公司的还款承诺或还款计划。

从保护自身利益出发,C公司最先想到的办法就是,明明知道但又装作不知道A公司会将该备用信用证用于贷款抵押,同时又在开证协议或者协议附件中明确限定:该备用信用证不得用于为获得贷款而抵押给银行,否则A公司承担一切责任。

如此一来,难点和分歧就产生了:一方面,C公司明确知道A公司要该信用证是为了能够抵押给银行从而取得贷款,另一方面C公司却又要求A公司不得抵押该信用证。

A公司非常矛盾,如果同意了C公司的要求,等于承担了一切交易风险,甚至还会将B银行拖入困境,而D银行则会安然无恙,理由是:C 公司拿到手续费,A公司获得贷款,如果C公司将该信用证权利限制的内容通知D银行,或者D银行自己获得有关该信用证权利限制的内容,那么D银行将撤销该信用证,继而把所有的风险留给B银行和A公司。

A公司如果不同意C公司的要求,就无法进行信用证抵押贷款,这显然与其需要融资的初衷相违背。

[评论] 魏亚熙随着我国市场经济的发展,金融市场还没完全规范,金融产品缺乏,因国内一些企业金融知识贫乏,给一些不法分子以融资为题材实施诈骗活动的机会。

企业融资是一项复杂的系统工作,天上决不会掉馅饼,企业应时刻保持清醒的头脑,在融资前要清楚:1、企业是否有融资条件。

2、中介公司和投资公司的实力,有否成功案例。

3、是否要收取各种名目的前期费用(包括写计划书、计划书翻译、律师见证费、备用信用证开证费、调汇费、考察费、审计评估费),如果有要万分谨慎,因为真实的项目投资方在投资未成功之前是决不向项目方收取任何费用的,可行性报告、商业计划书必须是项目方自己编写的,投资者最不希望看得是由其他机构编写的计划书,否则投资方不真实,企业应提高警惕。

另外备用信用证融资特别应注意合同软条款,如不得将信用证永远其它,是指不得抵押贷款,否则违约,开证行可无条件撤销备用信用证,受益人结果损失已付开证费、开证方效益费用。

因此融资企业应特别注意,在备用信用证融资过程中应与自己银行紧密联系,规避备用证融资诈骗风险。

骗取衡水农行一百亿美元备用信用证案时间:2005-09-20 作者:【案情】被告人:梅直方,男,1949年11月15日出生,美国籍,原系美国纽约市亚联(集团)有限公司董事长,住美国纽约市214街38-29号。

1993年6月5日因本案被监视居住,同年6月16日被逮捕。

被告人:李卓明,男,1950年5月18日出生,美国籍,原系美国纽约市亚联(集团)有限公司秘书兼财务主管,住美国纽约州高麦区查当理路8号。

1993年6月5日因本案被监视居住,同年6月16日被逮捕。

被告人:常景山,男,1939年5月29日出生,中国籍,原系海南中水长城国际投资集团副总经理兼贸易部业务经理,住河北省石家庄市建民小区6号楼4单元302号。

1993年6月2日因本案被监视居住,同年7月27日被逮捕。

被告人:于芝来,男,1944年4月5日出生,中国籍,原系海南华丰贸易公司驻天津办事处负责人,住天津市河北区黄纬路二贤里17楼501号。