会计学 企业决策的基础 财务会计分册 版 章答案

《会计基础》各章练习题答案

《会计基础》各章练习题答案第一章总论一、单选题1、A2、D3、C4、D5、B6、C7、A8、C9、C 10、C 11、C 12、A 13、A 14、A 15、D 16、A 17、A 18、D 19、A 20、B 21、A 22、C23、B 24、C 25、B 26、D 27、D 28、A 29、A 30、C 31、D 32、D 33、A34、B 35、C 36、C 37、C 38、C 39、B 40、C 41、D 42、D 43、C 44、B45、C 46、C 47、A 48、D 49、B 50、C 51、C 52、B 53、A 54、B 55、B56、D 57、C 58、C 59、B 60、D 61、B 62、D 63、C 64、D 65、C 66、A67、D 68、D 69、B 70、D 71、A 72、C 73、C 74、D 75、B 76、D 77、C78、C 79、B 80、B二、多选题1、ABC2、BD3、CD4、ABCD5、AD6、ABD7、ABC8、BD9、AB 10、ABC 11、ABC 12、ABD 13、AB 14、ABCD 15、BCD 16、ABC 17、BCD18、AB 19、ABCD 20、BD 21、ABCD 22、ABCD 23、BCD 24、AD 25、ABD26、ABC 27、BCD 28、ABC 29、ABD 30、AD 31、ABC 32、BCD 33、ABCD34、BCD 35、ABD 36、ACD 37、ABD 38、AD 39、ABC 40、ABD 41、ABC42、ACD 43、ABCD 44、ACD 45、ABCD 46、ABC 47、ABC 48、ABCD 49、BD50、ABC 51、BC 52、BC 53、BC 54、ABC 55、ABC 56、ABCD 57、ABCD 58、AB 59、ABCD 60、BD 61、BCD 62、ABC 63、ACD 64、BCD 65、BCD 66、A D 67、BD 68、BC 69、AC三、判断题1、N2、Y3、Y4、N5、Y6、Y7、Y8、Y9、Y 10、Y 11、Y 12、N13、Y 14、N 15、N 16、Y 17、N 18、Y 19、Y 20、N 21、Y 22、N23、N 24、Y 25、Y 26、N 27、Y 28、Y 29、Y 30、Y 31、N 32、Y 33、Y34、Y 35、N 36、N 37、Y 38、N 39、N 40、Y 41、Y 42、N 43、N 44、N45、N 46、Y 47、N 48、Y 49、Y 50、Y 51、Y 52、Y 53、Y 54、Y 55、Y56、N 57、Y 58、N 59、N 60、Y 61、Y 62、Y 63、Y 64、N 65、N 66、Y67、Y 68、N 69、Y 70、N 71、Y 72、Y 73、Y 74、N 75、Y 76、N 77、Y78、Y 79、N 80、Y 81、Y 82、Y 83、Y 84、Y 85、Y 86、Y 87、N 88、N89、Y 90、Y 91、N 92、Y 93、N 94、N 95、N 96、Y第二章会计要素与会计等式一、单选题1、B2、A3、B4、C5、B6、A7、A8、A9、D 10、C 11、B 12、D 13、A 14、C 15、D 16、C 17、D 18、C 19、D 20、D 21、B 22、B23、D 24、B 25、B 26、B 27、B 28、D 29、B 30、B 31、A 32、D 33、C34、D 35、A 36、D 37、C 38、C 39、B 40、D 41、A 42、D 43、A 44、A45、D 46、B 47、C 48、B 49、C 50、B 51、D 52、D 53、C 54、C 55、A56、A 57、D 58、A 59、D 60、D 61、C 62、A 63、A 64、A 65、C 66、C67、B 68、D 69、D二、多选题1、AB2、BC3、BCD4、AB5、AD6、ABC7、ABC8、BC9、AB10、AD 11、AD 12、ABD 13、ABCD 14、ABCD 15、ABC 16、CD 17、ABC18、ABD 19、ACD 20、ABCD 21、AC 22、BD 23、ABCD 24、BC 25、CD26、AD 27、BC 28、CD 29、AB 30、AB 31、AC 32、BCD 33、ABC34、ACD 35、ABC 36、ABC 37、ABCD 38、ABCD 39、ABD 40、BD 41、ACD42、CD 43、ABD 44、ABCD 45、AC 46、ABC 47、AD 48、ABC 49、BC 50、ACD 51、AD 52、ABC 53、CD 54、AD 55、BCD 56、CD 57、ABD 58、BD 59、CD 60、AB 61、BC 62、CD 63、ABC 64、ABD 65、ABCD 66、BCD 67、ABC68、CD 69、ACD 70、AB 71、ACD 72、AD 73、ACD 74、ACD 75、AC 76、ABC 77、ABC 78、ABC 79、ABD三、判断题1、N2、N3、N4、Y5、Y6、N7、N8、Y9、Y 10、N11、N 12、Y 13、N 14、N 15、Y 16、N 17、N 18、Y 19、N 20、Y 21、Y22、N 23、N 24、Y 25、Y 26、Y 27、Y 28、N 29、Y 30、Y 31、N 32、Y33、N 34、N 35、N 36、N 37、Y 38、N 39、Y 40、Y 41、Y 42、N 43、N44、Y 45、N 46、N 47、N 48、N 49、N 50、N 51、Y 52、Y 53、N 54、Y55、N 56、Y 57、N 58、Y 59、Y 60、Y 61、Y 62、Y 63、Y 64、Y 65、N66、N 67、N 68、N 69、N 70、Y 71、Y 72、N 73、Y 74、Y 75、Y 76、N第三章会计科目与账户一、单选题1、D2、C3、D4、B5、B6、C7、D8、C9、B 10、B 11、B 12、D 13、D 14、D 15、B 16、C 17、C 18、A 19、A 20、B 21、A 22、B23、C 24、D 25、A 26、C 27、D 28、C 29、B 30、B 31、B 32、D 33、A34、C 35、B 36、A 37、C 38、D 39、C 40、C 41、D 42、C 43、C 44、C45、C 46、B 47、C 48、D 49、B 50、D 51、C 52、D 53、A 54、D 55、A56、A 57、C二、多选题1、AC2、ABD3、ACD4、ABD5、BC6、CD7、ABC8、ABC9、AC 10、ACD 11、ABD 12、AD 13、ACD 14、ABC 15、BCD 16、ABD17、BCD 18、ABD 19、ABD 20、ACD 21、ABCD 22、AD 23、ABCD 24、ABC 25、ABC 26、ABD 27、BD 28、BD 29、AB 30、AC 31、BD 32、BCD33、AD 34、AC 35、ABCD 36、BCD 37、ACD 38、AB 39、ABC 40、AC 41、ABCD 42、AD 43、AC 44、ABCD 45、ABCD 46、ABD 47、ABCD 48、ABCD 49、BCD 50、ABC三、判断题1、N2、Y3、Y4、N5、Y6、N7、N8、Y9、Y 10、Y 11、Y 12、Y 13、N 14、N 15、Y 16、N 17、Y 18、N 19、Y 20、N 21、Y 22、Y23、N 24、Y 25、N 26、N 27、N 28、N 29、N 30、N 31、N 32、N 33、N34、N 35、N 36、N 37、N 38、N第四章会计记账方法一、单选题1、D2、D3、C4、D5、B6、A7、D8、C9、C 10、B 11、B 12、C 13、D 14、D 15、C 16、B 17、D 18、D 19、A 20、A 21、A22、D 23、C 24、D 25、C 26、C 27、C 28、D 29、C 30、B 31、D32、C 33、B 34、A 35、A 36、C 37、D 38、A 39、D 40、B 41、B 42、B 43、D 44、A 45、D 46、B 47、C 48、A 49、B 50、A 51、D 52、D 53、C 54、A 55、B 56、D 57、A 58、A 59、C二、多选题1、ABC2、ABD3、ABD4、ABCD5、ABD6、ABD7、ABD8、BD9、ABC 10、ABCD 11、ABD 12、BCD 13、ABCD 14、CD 15、BD16、AB 17、ABCD 18、ABD 19、ABC 20、BD 21、ABCD 22、BC 23、CD24、CD 25、ABC 26、ABC 27、AC 28、ABCD 29、ABC 30、AB 31、ABCD32、AC 33、AC 34、ABC 35、AD 36、ABD 37、ABC三、判断题1、Y2、N3、Y4、N5、Y6、Y7、Y8、Y9、Y 10、N 11、Y 12、Y13、N 14、Y 15、N 16、N 17、Y 18、N 19、Y 20、Y 21、N 22、Y23、N 24、Y 25、Y 26、Y 27、Y 28、N 29、N 30、N 31、N 32、N 33、N34、N 35、N 36、N 37、N 38、N 39、N 40、N 41、Y 42、N第五章借贷记账法下主要经济业务的账务处理一、单选题1、C2、A3、D4、A5、D6、B7、A8、A9、C 10、A 11、B 12、C 13、B 14、B 15、C 16、C 17、B 18、A 19、C 20、A 21、D 22、D23、B 24、D 25、A 26、A 27、B 28、A 29、D 30、D 31、A 32、C 33、B34、A 35、D 36、D 37、B 38、A 39、B 40、A 41、A 42、C 43、C 44、B45、B 46、B 47、C 48、D 49、A 50、A 51、D 52、C 53、A 54、C 55、A56、D 57、C二、多选题1、AC2、BD3、AC4、ACD5、ABD6、ABCD7、ABCD8、ACD 9、BD 10、ABC 11、ABCD 12、ACD 13、AC 14、AB 15、ABD16、BC 17、ACD 18、BC 19、ACD 20、AC 21、ABC 22、ABCD 23、CD 24、BCD 25、AC 26、ABCD 27、ABC 28、BD 29、ABCD 30、ABCD 31、AB 32、ABD33、ACD 34、AC 35、ABCD 36、ABCD 37、ABCD 38、ACD 39、BC 40、AC41、ABCD 42、ABCD 43、CD:44、ABC 45、ABD 46、BD 47、ABCD 48、AC 49、AC三、判断题1、Y2、Y3、N4、Y5、Y6、Y7、Y8、N9、Y 10、Y 11、N 12、N 13、Y 14、Y 15、N 16、N 17、Y 18、N 19、N 20、Y 21、N 22、N23、Y 24、N 25、Y 26、N 27、N 28、Y 29、N 30、N 31、Y 32、Y 33、N34、Y 35、Y 36、N 37、Y 38、Y 39、Y 40、Y 41、N 42、Y 43、Y 44、Y45、Y 46、Y 47、N 48、Y 49、N 50、N 51、Y 52、N 53、N 54、Y 55、N56、Y 57、Y 58、Y 59、Y 60、Y 61、N 62、N 63、N 64、N 65、N 66、N67、N 68、Y 69、Y 70、N 71、Y 72、Y 73、Y 74、Y 75、N第六章会计凭证一、单选题1、A2、C3、C4、A5、C6、C7、B8、C9、D 10、D 11、BCD 12、D 13、A 14、D 15、C 16、D 17、B 18、A 19、D 20、B 21、B 22、D23、D 24、C 25、B 26、B 27、D 28、B 29、A 30、A 31、C 32、C 33、C34、C 35、D 36、B 37、D 38、B 39、A 40、B二、多选题1、ABD2、ACD3、BCD4、AD5、CD6、ABC7、ABD8、ABCD9、ABCD 10、ABD 11、ABC 12、ABCD 13、ABCD 14、AD 15、AD 16、BC17、ACD 18、ABCD 19、ABD 20、AD 21、ABD 22、ABCD 23、ACD 24、ABD 25、AD 26、ABCD 27、ACD 28、AB 29、ACD 30、AC 31、ACD 32、BD 33、ACD 34、ABC 35、ABC 36、ACD 37、ABCD 38、ABCD 39、ABCD 40、AB 41、AB 42、ABD 43、ABCD 44、BD 45、ABD 46、ABCD 47、AB 48、ABD 49、AB 50、CD 51、CD 52、AB 53、BC 54、ACD 55、ABD三、判断题1、Y2、Y3、Y4、N5、Y6、Y7、N8、N9、Y 10、Y 11、N 12、Y 13、Y 14、N 15、N 16、N 17、Y 18、N 19、Y 20、N 21、N 22、N23、N 24、N 25、N 26、N 27、Y 28、N 29、N 30、N 31、N 32、N 33、Y34、Y 35、Y 36、N 37、N 38、N 39、N 40、Y 41、Y 42、N 43、N第七章会计账簿一、单选题1、C2、D3、A4、A5、D6、A7、C8、D9、C 10、A 11、A 12、A 13、A 14、D 15、A 16、D 17、B 18、C 19、C 20、B 21、C 22、D23、B 24、B 25、A 26、B 27、C 28、B 29、C 30、C 31、B 32、B 33、B34、C 35、A 36、C 37、C 38、D 39、D 40、C 41、A 42、A 43、B 44、C45、B 46、D 47、D 48、C 49、A 50、B二、多选题1、CD2、ABCD3、ABD4、ABCD5、ACD6、ABD7、ABCD8、AC9、ACD 10、ABCD 11、ACD 12、BC 13、ACD 14、AB 15、AC 16、ABC 17、ABC18、ABCD 19、ACD 20、ACD 21、ABCD 22、BCD 23、BD 24、ACD 25、AD26、ABCD 27、AB 28、ABCD 29、AD 30、ACD 31、ABCD 32、ABCD 33、ABC34、ABC 35、ABCD 36、AC 37、ABCD 38、ABD 39、ABCD 40、ABC 41、ACD42、ABCD 43、ABD 44、AB 45、BC 46、AC 47、AB 48、ABD 49、ABCD 50、ACD 51、AC 52、BC 53、AD 54、ABCD 55、ABC 56、ABD 57、AB 58、B 59、ABC三、判断题1、Y2、N3、Y4、Y5、N6、N7、Y8、N9、Y 10、N 11、Y 12、N 13、N 14、N 15、Y 16、N 17、Y 18、Y 19、N 20、N 21、Y 22、Y23、N 24、Y 25、N 26、N 27、N 28、N 29、Y 30、Y 31、N 32、Y 33、N34、N 35、Y 36、Y 37、Y 38、N 39、Y 40、N 41、Y 42、N 43、N 44、Y45、Y 46、N 47、N 48、N 49、N 50、Y 51、Y 52、N 53、Y 54、N 55、N56、Y 57、Y 58、Y 59、Y 60、Y 61、Y 62、N 63、N 64、N 65、N 66、Y67、N 68、N 69、Y 70、Y 71、N 72、N 73、Y 74、N 75、Y 76、Y 77、Y78、Y 79、N 80、Y 81、Y 82、N第八章账务处理程序一、单选题1、C2、D3、D4、A5、D6、C7、D8、A9、C 10、A11、D 12、C 13、A 14、B 15、A 16、C 17、B 18、A 19、A 20、D 21、B22、A 23、D 24、D 25、A 26、B 27、C 28、C 29、D 30、C 31、A 32、D33、A 34、D 35、D 36、C 37、D 38、B 39、B 40、D 41、A 42、B 43、B44、D 45、A 46、A 47、C二、多选题1、ABD2、BC3、AB4、BC5、C6、AB7、BD8、ABC9、BCA 10、BD 11、ACD 12、ABC 13、ABC 14、AD 15、AC 16、ABCD 17、AB18、CD 19、AC 20、BCD 21、BC 22、CD 23、ABC 24、ABCD 25、AC 26、ACD27、ACD 28、ABCD 29、AB 30、BD 31、ABD 32、ABC 33、ABC 34、AD 35、ABCD 36、ABD 37、CD 38、ACD三、判断题1、N2、N3、N4、Y5、N6、Y7、N8、Y9、N 10、Y11、Y 12、Y 13、Y 14、N 15、N 16、Y 17、N 18、Y 19、Y 20、Y 21、N22、N 23、Y 24、N 25、N 26、Y 27、Y 28、Y 29、Y 30、N 31、Y 32、Y33、Y 34、N 35、N 36、Y 37、Y 38、Y 39、N 40、N 41、Y 42、Y 43、N44、Y 45、N 46、Y 47、N 48、Y 49、Y 50、N 51、N 52、N 53、N 54、N55、Y 56、N 57、N 58、Y 59、N 60、N 61、Y 62、Y 63、Y 64、Y 65、N66、N 67、N 68、Y 69、Y 70、Y 71、N 72、N 73、N 74、Y 75、Y第九章财产清查一、单选题1、C2、A3、D4、A5、B6、B7、C8、B9、D 10、B 11、C 12、D 13、B 14、B 15、D 16、C 17、A 18、D 19、C 20、A 21、C 22、A23、C 24、A 25、D 26、C 27、C 28、B 29、A 30、C 31、C 32、C 33、C34、B(100.5)35、A 36、D 37、C 38、D 39、D 40、D 41、B 42、C 43、C 44、A 45、D 46、D 47、D 48、A 49、C 50、C 51、B 52、D 53、B 54、C 55、D 56、C 57、B二、多选题1、ABCD2、ABCD3、ACD4、BD5、BC6、BD7、ABCD8、ACD9、BD 10、ABCD 11、ABCD 12、BC 13、ABD 14、ACD 15、ABCD 16、ABCD 17、ACD 18、ABCD 19、ABD 20、ABCD 21、ABCD 22、CD 23、ABC 24、BCD 25、BCD 26、ABCD 27、BCD 28、BC 29、ABCD 30、ACD 31、ABD 32、ABCD 33、ABCD 34、ABCD 35、CD 36、AB 37、BD 38、ABCD 39、BC 40、ABC 41、AC 42、BC 43、ABCD 44、BC 45、ABCD 46、BCD 47、BCD 48、CD 49、ABCD 50、ABC 51、ABCD 52、AC三、判断题1、N2、Y3、N4、Y5、N6、Y7、Y8、Y9、N 10、N 11、N 12、N 13、Y 14、Y 15、N 16、Y 17、Y 18、Y 19、N 20、Y 21、N 22、N23、Y 24、Y 25、Y 26、Y 27、Y 28、N 29、N 30、Y 31、Y 32、Y 33、N34、Y 35、Y 36、Y 37、N 38、N 39、Y 40、N 41、Y 42、N 43、Y 44、Y45、Y 46、Y 47、N 48、N 49、Y 50、Y 51、Y 52、N 53、Y 54、Y 55、N56、N 57、Y 58、Y 59、Y 60、Y 61、Y 62、N 63、Y 64、Y 65、Y 66、N67、Y 68、N 69、N 70、Y 71、Y 72、Y 73、N 74、Y 75、N 76、N 77、Y78、N 79、Y 80、N 81、Y 82、Y 83、N 84、N 85、N 86、Y 87、Y 88、Y89、N 90、Y 91、N 92、Y 93、N 94、N第十章财务会计报告一、单选题1、C2、D3、C4、A5、B6、B7、C8、B9、A 10、D 11、B 12、C 13、C 14、B 15、A 16、D 17、B 18、D 19、C 20、D 21、A 22、B23、A 24、C 25、B 26、D 27、B 28、A 29、C 30、B二、多选题1、BC2、BC3、ABC4、ABCD5、ACD6、BD7、AC8、ABD9、BCD 10、ACD 11、AD 12、AD 13、ABCD 14、BC 15、ABD 16、BCD 17、ABC 18、BCD 19、AB 20、ACD 21、ABC 22、ABCD 23、AC 24、ABC 25、ABC 26、ABCD 27、BD 28、AC 29、ABD 30、ABCD 31、ACD 32、ABC 33、ABCD 34、ABCD三、判断题1、N2、N3、N4、N5、N6、Y7、Y8、Y9、Y 10、N11、Y 12、N 13、Y 14、Y 15、Y 16、Y 17、N 18、Y 19、Y 20、N 21、Y22、Y 23、Y 24、N 25、N 26、N 27、Y 28、N 29、N 30、N 31、Y 32、Y33、Y 34、N 35、N 36、Y 37、Y大题3-1(1)18000 (2)30000 (3)42000 (4)30000 (5)5000。

会计学企业决策的基础

会计学企业决策的基础在现代企业中,会计学扮演着至关重要的角色。

它不仅是按照一定标准记录企业交易的基础,还能为企业提供大量的财务信息,帮助企业管理者做出正确的企业决策。

本文将介绍会计学在企业决策中的重要性以及相关底层原则和概念。

会计学在企业决策中的重要性企业决策是企业发展过程中必不可少的一部分。

它可以帮助企业管理者做出正确的选择和决策,以实现企业利润最大化和可持续发展。

而会计学正是帮助企业管理者做出正确判断和决策的重要工具之一。

下面我们将详细介绍会计学在企业决策中的作用。

提供财务信息会计学的首要任务是提供精确、客观的财务信息,让企业管理者能够了解企业的经营状况和财务状况。

通过会计学记录企业的交易信息,可以及时得到企业的资产、负债、收入和支出等财务状况。

企业管理者可以通过这些信息来判断企业是否正常运营,是否需要调整经营决策。

分析经营状况会计学不仅可以提供财务信息,还可以通过财务分析来帮助企业管理者了解企业的长期和短期财务状况。

企业管理者可以通过利润表、资产负债表和现金流量表等报表来分析企业状况,从而评估企业财务稳定性、赢利能力和成长性等因素。

预测未来趋势会计学的应用还可以帮助企业管理者预测未来趋势。

通过对过去和当前的财务状况进行分析,企业管理者可以预测未来企业的发展趋势。

这对于企业的长期规划和策略制定非常重要。

会计学的基本原则和概念要正确理解会计学在企业决策中的作用,有必要了解会计学的一些基本原则和概念。

会计主体和会计客体会计主体是指进行会计记录和报告的组织和个人,如企业、个体工商户等。

会计客体是指需要记录的经济活动,如企业的交易、收入和支出等。

会计等式会计等式是会计学中的基本概念之一。

它是指资产=负债+所有者权益。

通过这个等式,企业管理者可以了解企业的资产来源和运用情况,包括企业的负债情况和所有者权益。

会计要素会计要素是指企业在经济活动中发生的一系列基本事项。

包括资产、负债、所有者权益、收入和费用等。

会计学-企业决策的基础 答案

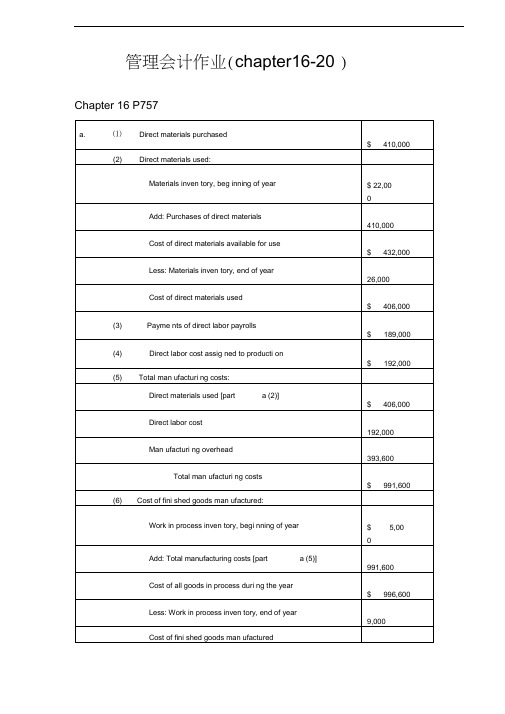

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line. Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1a. job costing (each project of a construction company is unique)b . both job and process costing (institutional clients may represent unique jobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3A4,000 EU @ $61.50 = $246,000 b4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume ?Fixed Costs + Target OperatingIncomeUnit Contribution Margin?$390,000 + $350,000= $20,000 units$37。

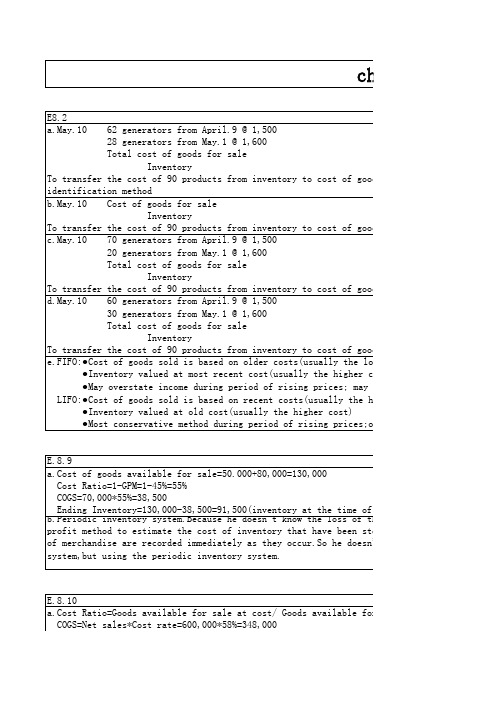

会计学 企业决策的基础 课后习题答案 chapter

20 generators from May.1 @ 1,600 Total cost of goods for sale

chapter8

st of goods sold account by the specific

st of goods sold account by the average-cost

st of goods sold account by the FIFO method

500 generators from January 9 @ 32

Total cost of goods for sale

Inventory

To transfer the cost of 1000 products from inventory to cost of goods sold account by the

Inventory To transfer the cost of 90 products from inventory to cost of goods sold account by the LI e.FIFO:●Cost of goods sold is based on older costs(usually the lower costs)

Inventory To transfer the cost of 90 products from inventory to cost of goods sold account by the FI d.May.10 60 generators from April.9 @ 1,500

企业财务会计习题集参考答案

企业财务会计习题集第一章习题参考答案(一)填空题1.对外2.投资者债权人政府机关职工供应商3.资金筹集资金运用资金耗用收入与分配4.会计科目账簿5.两个两个以上6.书面依据7.连续地系统地完整地8.财务状况经营成果9.空间范围10.连续的长短相同11.权责发生制(二)单项选择题1.A2.B3.C4.B5.B6.C7.B8.C9.D10.A11.B12.C13.B14.A15.C(三)多项选择题1.CD2.ABD3.ABC4.AB5.ABC6.ABCD7.ABCDE8.ABC9.ABCDE10.ABCDE(四)判断题1.√2.×3.√4.×5.×6.×7.×8.×9.√10.×第二章习题参考答案(一)填空题1.库存现金银行存款其他货币资金2.内部控制制度3.现金管理暂行条例4.坐支5.实地盘点6.库存现金长款库存现金短款7.基本存款户一般存款户临时存款户专用存款户8.商业承兑汇票银行承兑汇票9.出现未达账项记账错漏10.银行存款余额调节表(二)单项选择题1.C2.D3.A4.B5.C6.C7.B8.C9.D10.D(三)多项选择题1.ABCD2.ABCD3.ABC4.BC5.ABC6.ABCD7.ABCD8.ACD9.AC10.ABCD(四)判断题1.√2.×3.×4.×5.√6.×(五)实训题实训一1.借:库存现金 1 500贷:银行存款 1 5002.借:其他应收款——王丹700贷:库存现金7003.借:管理费用500库存现金200贷:其他应收款——王丹7004.借:应付职工薪酬——职工福利300贷:库存现金3005.借:库存现金 5 000贷:银行存款 5 0006.借:应付职工薪酬——工资5 000贷:库存现金5 000实训二1.借:银行存款11 700贷:主营业务收入10 000应交税费——应交增值税(销项税额) 1 700 2.借:原材料 6 000应交税费——应交增值税(进项税额) 1 020贷:银行存款7 020 3.借:应付账款——A公司60 000贷:银行存款60 0004.借:银行存款80 000贷:应收账款——利华公司80 0005.借:库存现金 4 000贷:银行存款 4 000实训三取得银行汇票时:借:其他货币资金——银行汇票存款50 000贷:银行存款50 000购入材料,收到供货单位发票时:借:原材料40 000 应交税费——应交增值税(进项税额) 6 800贷:其他货币资金——银行汇票存款46 800 退回余款时:借:银行存款 3 200贷:其他货币资金——银行汇票存款3 200实训四实训五1.批准前处理:借:待处理财产损溢——待处理流动资产损溢300贷:库存现金3002.批准后处理:借:其他应收款——出纳员50管理费用250贷:待处理财产损溢——待处理流动资产损溢300(六)综合实务题1.借:库存现金 3 000贷:银行存款 3 0002.借:其他应收款——备用金(李华) 2 000贷:库存现金 2 0003.借:银行存款80 000贷:应收账款——乙公司80 0004.借:应付账款——丙公司23 000贷:银行存款23 0005.借:待处理财产损溢——待处理流动资产损溢60贷:库存现金60 6.借:其他应收款——应收现金短缺款60贷:待处理财产损溢——待处理流动资产损溢60 7.借:库存现金80贷:待处理财产损溢——待处理流动资产损溢80 8.借:待处理财产损溢——待处理流动资产损溢80贷:营业外收入80 9.借:银行存款15 000贷:应收账款——A公司15 000第三章习题参考答案(一)填空题1.销售商品提供劳务增值税款包装费运杂费2.现金折扣3.账龄分析法销货百分比法应收账款余额百分比法个别认定法4.商业承兑汇票银行承兑汇票带息票据不带息票据5.贴现利率贴现利息差额(二)单项选择题1.B2.B3.C4.A5.B6.A7.B8.C9.A10.A11.C12.C13.A(三)多项选择题1.ACD2.ABCD3.BD4.AC5.AC6.BC7.BCD8.BCD(四)判断题1.×2.√3.×4.√5.×6.×7.×8.×9.√(五)实训题实训一1.销售产品时:借:应收账款117 000贷:主营业务收入100 000应交税费——应交增值税(销项税额)17 0002.客户于第3天支付货款时:借:银行存款105 300财务费用11 700贷:应收账款117 0003.客户于第10天付款时:借:银行存款117 000贷:应收账款117 000实训二1.销售产品时:借:应收票据351 000贷:主营业务收入300 000应交税费——应交增值税(销项税额)51 0002.票据贴现时:票据到期值=351 000 +351 000 ×12%×6÷12 =372 060(元)票据贴现息=372 060 ×10%×4 ÷12=12 402(元)贴现净额=372 060 -12 402 =359 658(元)借:银行存款359 658贷:财务费用8 658应收票据351 0003.票据到期时:借:应收账款372 060贷:银行存款372 060实训三1.借:资产减值损失——计提的减值准备2 500贷:坏账准备 2 5002.借:资产减值损失——计提的减值准备3 750贷:坏账准备 3 7503.借:坏账准备750贷:管理费用7504.借:坏账准备9 000贷:应收账款9 0005.借:应收账款 2 500贷:坏账准备 2 500借:银行存款 2 500贷:应收账款 2 5006.借:资产减值损失——计提的减值准备6 000贷:坏账准备 6 000实训四1.借:预付账款100 000贷:银行存款100 0002.借:库存商品200 000应交税费——应交增值税(进项税额)34 000贷:预付账款234 000 3.借:预付账款134 000贷:银行存款134 000(六)综合实务题1.(1)收到票据时:借:应收票据234 000贷:主营业务收入200 000应交税费——应交增值税(销项税额)34 000(2)年度终了(2007年12月31日),计提票据利息时:234 000 ×5%÷12 ×4=3 900(元)借:应收票据3 900贷:财务费用3 900(3)票据到期收回货款:收款金额=234 000 ×(1 +5%÷12 ×6)=239 850(元)2008年年末计提票据利息=234 000 ×5%÷12 ×2 =1 950(元)借:银行存款239 850贷:应收票据237 900财务费用1 9502.(1)赊销时:借:应收账款21 060贷:主营业务收入18 000应交税费——应交增值税(销项税额) 3 060(2)收到款项时:借:银行存款21 060贷:应收账款21 0603.(1)赊销时:借:应收账款117 000贷:主营业务收入100 000应交税费——应交增值税(销项税额)17 000(2)10天内收到款项时:借:银行存款115 000财务费用2 000贷:应收账款117 000(3)超过现金折扣的最后期限时:借:银行存款117 000贷:应收账款117 0004.(1)2005年年末,计提坏账准备:坏账准备提取额=2 400 000 ×5‰=12 000(元)借:资产减值损失——计提的减值准备12 000贷:坏账准备12 000(2)2006年3月,确认坏账3 200元无法收回:借:坏账准备3 200贷:应收账款3 200(3)2006年年末,计提坏账准备:坏账准备提取额=2 880 000 ×5‰-12 000 +3 200 =5 600(元)借:资产减值损失——计提的减值准备5 600贷:坏账准备5 600(4)2007年7月,公司上年已冲销的坏账又收回:借:应收账款3 200贷:坏账准备3 200同时:借:银行存款3 200贷:应收账款3 200(5)2007年年末,计提坏账准备:计提坏账准备=2 000 000 ×5‰-14 400 -3 200 =-7 600(元)借:坏账准备7 600贷:管理费用7 600第四章习题参考答案(一)填空题1.日常活动2.原材料在产品半成品库存商品商品周转材料3.采购成本加工成本其他成本4.外购自制接受投资委托加工接受捐赠盘盈5.先购入的存货先发出发出6.原材料在途物资7.材料采购材料成本差异8.库存产成品外购商品存放门市部准备出售的商品发出展览的商品寄存在外的商品9.一次转销法五五摊销法10.使用时间较短单位价值较低固定资产标准11.待处理财产损溢其他应收款管理费用营业外支出——非常损失(二)单项选择题1.A2.C3.A4.B5.C6.B7.D8.C9.B10.D(三)多项选择题1.AC2.BCD3.ABD4.BCDE5.ACDE6.ACD7.BC8.ACD9.BD(四)判断题1.×2.√3.×4.√5.×6.√7.×8.×9.×10.×(五)实训题说明:为了方便查阅答案,本教学参考书中图表序号与习题集中答题的图表序号保持一致。

会计学企业决策的基础 答案

管理会计作业(chapter16-20) Chapter 16 P757 16、5AChapter 16 P761 16、4BChapter 17 P802 17、3Aa、Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22、50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17、8Ad、The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line、Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line、If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace、This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline、e、The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality、Chapter 18 P835 18、1B、Ex、a、job costing (each project of a construction company is unique)18、1b、both job and process costing (institutional clients may representunique jobs)c、job costing (each set of equipment is uniquely designed andmanufactured)d、process costing (the dog houses are uniformly manufactured inhigh volumes)e、process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18、3A4,000 EU @ $61、50 = $246,000b4,000 EU @ $13、50 = $54,000Chapter 18 P845 18、2Ba、(1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b、In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a)、Chapter 20 P918 20、1Ad、No、With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even、Chapter 20 P918 20、2AChapter 20 P920 20、6ASales volume required to maintain current operating income:Sales Volume = Fixed Costs + Target OperatingIncomeUnit Contribution Margin= $390,000 + $350,000= $20,000 units $37。

会计学-企业决策的基础 答案教学资料

会计学-企业决策的基础答案管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based on machine-hours:Manufacturing Overhead= $420,000= $35 per machine-hourMachine-Hours 12,000Department Two overhead application rate based on direct labor hours:Manufacturing Overhead= $337,500= $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the BasicChunks product line. Thus, the company’s current practice of using direct laborhours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probablyexplains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costingsystem include: (1) a better identification of its operating inefficiencies, (2) a betterunderstanding of its overhead cost structure, (3) a better understanding of theresource requirements of each product line, (4) the potential to increase the sellingprice of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability todecrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1a. job costing (each project of a construction company is unique)B. Ex.18.1b. both job and process costing (institutional clients may represent uniquejobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d. process costing (the dog houses are uniformly manufactured in highvolumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3Ab4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume =Fixed Costs + Target Operating IncomeUnit Contribution Margin=$390,000 + $350,000= $20,000 units$37。

会计学-企业决策的基础答案

管理会计作业(chapter16-20 ) Chapter 16 P757b. HILLSDALE MANUFACTURING CORP.Schedule of the Cost of Fini shed Goods Man ufacturedChapter 16 P761Costs of fini shed goods man ufactured:Total inven tor y$ 149,00Chapter 17 P802a.Department One overhead application rate based onmachi ne-hours:Departme nt Two overhead applicati on rate based on direct labor hours:Manu facturi ng Overhead = $337,500= $ per direct labor hourDirect Labor Hours15,000Manu facturi ngOverheadMachi ne-Hours =$420,000 12,000= $35 per machi ne-hourChapter 17 P805d. The Custom Cuts product line is very labor intensive in comparison to the BasicChunks product line. Thus, the company s current practice of using direct labor hours to allocate overhead results in the assig nment of a disproporti on ate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed perce ntage above the manu facturi ng costs assig ned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line iscurre ntly priced at an artificially low price in the marketplace. This probably expla ins why sales of Basic Chunks remai n strong while sales of Custom Cuts are on the decline.e. The ben efits the compa ny would achieve by impleme nting an activity-based costi ngsystem include: (1) a better identification of its operating inefficiencies, (2)a better understanding of its overhead cost structure, (3) a better understanding of the resourcerequireme nts of each product line, (4) the pote ntial to in crease the selling price of BasicChunks to makeit more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having tosacrifice product quality.Chapter 18 P835a job costi ng (each project of a con struct ion compa ny is unique)B. Ex.b both job and process costi ng (in stituti onal clie nts may represe nt unique jobs)c job cost ing (each set of equipme nt is uniq uely desig ned and manu factured)d process costing (the dog houses are uniformly manufactured in high volumes)e process costi ng (the vitam ins and suppleme nts are uni formly manu factured inhigh volumes)Chapter 18 P841b4,000 EU @ $ = $54,000Chapter 18 P845a. (1) $49 [($192,000 + $48,000 + $54,000) - 6,000 un its](2) $109 [($480,000 + $108,000 + $66,000) - 6,000 un its](3) $158 ($49 + $109)(4) $32 ($192,000 - 6,000 un its)(5) $18 ($108,000 - 6,000 un its)b. In evaluating the overall efficiency of the Engine Department, managementwould look at the mon thly per- unit cost in curred by that departme nt, which is the cost of assembli ng and in stalli ng an engine ($109 in part a).Chapter 20 P918d. No. With a unit sales price of $94, the break-even sales volume in units is 54,000un its:Un it co ntributio n margin = $94 - $84 variable costs = $10$540,000 Break-eve n sales volume (in un its) =—' ) $10= 54,000 un its Uni ess Thermal Tent has the ability to manufacture 54,000 un its (or lower fixedand/or variable costs), setting the unit sales price at $94 will not enableThermal Tent to break eve n.Chapter 20 P918Chapter 20 P920Sales volume required to maintain curre nt operati ng in come:$390,000 + $350,000=$20,000 un its。

{财务管理财务会计}会计基础分章节习题含答案.

{财务管理财务会计}会计基础分章节习题含答案《会计基础》分章节练习题第一章总论1第二章会计要素与会计科目6第三章会计等式与复式记账13第四章会计凭证20第五章会计账簿28第六章账务处理程序35第七章财产清查39第八章财务会计报告46第九章会计档案53第十章主要经济业务事项账务处理58第一章总论一、单项选择题1、下列不属于会计核算的环节的是()。

A.确认B.记录C.报告D.报账【正确答案】:D【答案解析】:会计核算包括确认、计量、记录和报告等环节,报账属于会计核算的工作。

【该题针对“会计核算”知识点进行考核】2、下列不属于会计核算三项工作的是()。

A.记账B.算账C.报账D.查账【正确答案】:D【答案解析】:会计核算的三项工作是记账、算账和报账。

【该题针对“会计核算”知识点进行考核】3、下列说法中正确的是()。

A.成本是对象化了的费用B.出售固定资产形成企业的收入C.经济利益的流入必然是由收入形成的D.费用就是成本【正确答案】:A【答案解析】:出售固定资产确认的是“营业外收入”,营业外收入不是企业的收入;经济利益的流入还可能是营业外收入导致的;成本是对象化了的费用,但费用不一定是成本。

4、以下说法不正确的是()。

A.固定资产是企业的财物B.商标权不是企业的财物C.财物必须具有实物形态D.包装物应作为固定资产核算【正确答案】:D【答案解析】:5、下列属于有价证券的是()。

A.外埠存款B.股票C.信用证存款D.信用卡存款【正确答案】:B【答案解析】:其他三项都属于款项。

6、企业在一定时期内通过从事生产经营活动而在财务上取得的结果称为()。

A.财务状况B.盈利能力C.经营业绩D.财务成果【正确答案】:D【答案解析】:财务成果是指企业在一定时期内通过从事生产经营活动而在财务上取得的结果,具体表现为盈利或亏损。

7、债务是指由于过去的交易、事项形成的企业需要以()等偿付的现时义务。

A.资产或劳务B.资本或劳务C.资产或债权D.收入或劳务【正确答案】:A【答案解析】:债务是指由于过去的交易、事项形成的企业需要以资产或劳务等偿付的现时义务。

会计学:企业决策的基础财务会计分册(机械工业出版社,英文原书第15版)课后练习答案chapter05

Exercises 5.1 5.2 5.3 5.4 5.5 5.6 5.7 5.8 5.9 5.10 5.11 5.12 5.13 5.14 5.15

Topic Accounting terminology Financial statement preparation Financial statement preparation Closing and after-closing trial balance Closing and after-closing trial balance Real World: Circuit City Adequate Disclosure Closing entries of profitable firms Closing entries of unprofitable firms Adjusting versus closing entries Profitability and liquidity measures Profitability and liquidity measures Interim results Interim results Effects of accounting errors Real World: Home Depot, Inc. Using an annual report

Communication, analysis

© The McGraw-Hill Companies, Inc., 2008 Overview

© The McGraw-Hill Companies, Inc., 2008 Overview

CHAPTER 5 THE ACCOUNTING CYCLE: REPORTING FINANCIAL RESULTS

会计学企业决策的基础管理会计分册作业答案19.2A

Problem19.2Aa.The target cost for KAP1= target price-profitmargin=$120-15%×$120=$120×85%=$102The target cost for QUIN=$220×85%=$187b. Total manufacturing for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+[2,000,000÷(25,000+15,000)×25,000]=$2,750,000b.So the total manufacturing cost per unit of KAP1=$2,750,000÷25,000=$110>$102 The same as KAP1, the total manufacturing cost for QUIN=$2,550,000So the total manufacturing cost per unit of QUIN=$2,550,000÷15,000=$170<$187 So QUIN is earning the desired return.c. Because the overhead costs are assigned on the basis of the direct labor hours, so we need to recalculate it.The total manufacturing cost for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+ [2,000,000÷(24/12×25,000+60/12×15,000)*24/12×25,000=$2,300,000c.So the total manufacturing cost per unit of KAP1=$2,300,000÷25,000=$92<$102 The same as KAP1, the total manufacturing cost for QUIN=$3,000,000So the total manufacturing cost per unit of QUIN=$3,000,000÷15,000=$200>$187 So QUIN is earning the desired return.d. Using the activity-based costing method, the total manufacturing cost for KAP1= 400,000*1/5+600,000*2/3+500,000*2/6+200,000*5/8+300,000*3/5+($30+$24)×25,0 00+(24÷2×3×25,000)=$910,000d.So the total manufacturing cost per unit of KAP1=$96.4<$102The same as the KAP1, the total manufacturing cost for QUIN=$2,890,000So the total manufacturing cost per unit of QUIN=$2,890,000÷15,000=$192.67>$187 So KAP1 is earning the desired return.e. Because the activities of machining, purchase orders and shipping to customers are value-added activities, so the proportion of fixed overhead=(600,000+500,000+300,000)÷2,000,000=70%In attempting to reach the target cost for QUIN, we would like to improve the activity of machine set-ups first because its proportion of all overhead cost is relatively big and it is easiest for the manufacturer to make the adjustment to lower down the target cost.f. Impact: the manufacturing cost of KAP1 increased and that of QUIN decreased. The new manufacturing cost per unit of KAP1=$106>$102The new manufacturing cost per unit of QUIN=$176.67<$187So QUIN is earning the desired return.g. If the machine was purchased, the manufacturing cost of KAP1=$2,370,000and the new manufacturing cost per unit of KAP1=$2,370,000÷25,000=$94.8<$102 And the manufacturing cost of QUIN=$2,730,000The new manufacturing cost per unit of QUIN=$2,730,000÷15,000=$183<$187 Both of the KAP1 and QUIN are earning the desired return, so the machine should be purchased.。

会计学企业决策的基础管理会计分册作业答案19.2A培训资料

会计学企业决策的基础管理会计分册作业答案19.2AProblem19.2Aa.The target cost for KAP1= target price-profit margin=$120-15%×$120=$120×85%=$102The target cost for QUIN=$220×85%=$187b. Total manufacturing for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+[2,000,000÷(25,000+15,000)×25,000]=$2,750,000b.So the total manufacturing cost per unit of KAP1=$2,750,000÷25,000=$110>$102 The same as KAP1, the total manufacturing cost for QUIN=$2,550,000So the total manufacturing cost per unit of QUIN=$2,550,000÷15,000=$170<$187 So QUIN is earning the desired return.c. Because the overhead costs are assigned on the basis of the direct labor hours, so we need to recalculate it.The total manufacturing cost for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+ [2,000,000÷(24/12×25,000+60/12×15,000)*24/12×25,000=$2,300,000c.So the total manufacturing cost per unit of KAP1=$2,300,000÷25,000=$92<$102 The same as KAP1, the total manufacturing cost for QUIN=$3,000,000So the total manufacturing cost per unit of QUIN=$3,000,000÷15,000=$200>$187 So QUIN is earning the desired return.d. Using the activity-based costing method, the total manufacturing cost for KAP1= 400,000*1/5+600,000*2/3+500,000*2/6+200,000*5/8+300,000*3/5+($30+$24)×25,0 00+(24÷2×3×25,000)=$910,000d.So the total manufacturing cost per unit of KAP1=$96.4<$102The same as the KAP1, the total manufacturing cost for QUIN=$2,890,000So the total manufacturing cost per unit of QUIN=$2,890,000÷15,000=$192.67>$187 So KAP1 is earning the desired return.e. Because the activities of machining, purchase orders and shipping to customers are value-added activities, so the proportion of fixedoverhead=(600,000+500,000+300,000)÷2,000,000=70%In attempting to reach the target cost for QUIN, we would like to improve the activity of machine set-ups first because its proportion of all overhead cost is relatively big and it is easiest for the manufacturer to make the adjustment to lower down the target cost.f. Impact: the manufacturing cost of KAP1 increased and that of QUIN decreased. The new manufacturing cost per unit of KAP1=$106>$102The new manufacturing cost per unit of QUIN=$176.67<$187So QUIN is earning the desired return.g. If the machine was purchased, the manufacturing cost of KAP1=$2,370,000and the new manufacturing cost per unit of KAP1=$2,370,000÷25,000=$94.8<$102 And the manufacturing cost of QUIN=$2,730,000The new manufacturing cost per unit of QUIN=$2,730,000÷15,000=$183<$187 Both of the KAP1 and QUIN are earning the desired return, so the machine should be purchased.。

会计学 企业决策的基础 财务会计分册16版6-9章答案

Chapter 6Merchandising Activitie s Ex. 6.41PROBLEM 6.1AClaypool earned a gross profit rate of 32%, which is significantly higher than the industry average. Claypool’s sales were above the industry average, and it earned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.To have a higher-than-average cost of goods sold and still earn a much larger-than-average amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores. Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.PROBLEM 6.5Ac. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if itmust borrow money for a short period of time at an annual rate of 11%. Bytaking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only 0.6%interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount is greater than the cost of short-term borrowing.Chapter 7 Financial assetsChapter 8 Inventories and the cost of goods soldSupplementary ProblemChapter 91617。

会计学-企业决策的基础答案

会计学-企业决策的基础答案(总14页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--管理会计作业(chapter16-20)Chapter 16 P757Chapter 16 P761Chapter 17 P802a.Department One overhead application rate based onmachine-hours:Manufacturing Overhead=$420,000 =$35 per machine-hourMachine-Hours12,000Department Two overhead application rate based on direct labor hours:Manufacturing Overhead=$337,500=$ per direct labor hourDirect Labor Hours15,000Chapter 17 P805d.The Custom Cuts product line is very labor intensive in comparison to the BasicChunks product line. Thus, the company’s current practice of using direct labor hours to allocate overhead results in the assignment of a disproportionateamount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e.The benefits the company would achieve by implementing an activity-basedcosting system include: (1) a better identification of its operating inefficiencies,(2) a better understanding of its overhead cost structure, (3) a betterunderstanding of the resource requirements of each product line, (4) thepotential to increase the selling price of Basic Chunks to make it morecomparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price ofCustom Cuts without having to sacrifice product quality.Chapter 18 P835B. Ex. a.job costing (each project of a construction company is unique)b.both job and process costing (institutional clients may representunique jobs)c.job costing (each set of equipment is uniquely designed andmanufactured)d.process costing (the dog houses are uniformly manufactured in highvolumes)e.process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841b4,000 EU @ $ = $54,000Chapter 18 P845a.(1)$49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2)$109 [($480,000 + $108,000 + $66,000) ÷?6,000 units](3)$158 ($49 + $109)(4)$32 ($192,000 ÷ 6,000 units)(5)$18 ($108,000 ÷ 6,000 units)b.In evaluating the overall efficiency of the Engine Department, managementwould look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918d.No. With a unit sales price of $94, the break-even sales volume in units is 54,000units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units)=$540,000$10=54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918Chapter 20 P920Sales volume required to maintain current operating income:Sales Volume ?Fixed Costs + Target Operating IncomeUnit Contribution Margin?$390,000 + $350,000= $20,000 units$37。

会计学-企业决策的基础 答案

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line. Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1a. job costing (each project of a construction company is unique)b . both job and process costing (institutional clients may represent unique jobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3Ab4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume =Fixed Costs + Target OperatingIncomeUnit Contribution Margin=$390,000 + $350,000= $20,000 units$37c.Current AfterCapacity Expansion(20,000Units)(25,000 Units) Total contribution margin ($37 per unit) $ 740,000 $ 925,000Less: Fixed costs390,000530,000*Operating income at full capacity $ 350,000$ 395,000*$390,000 + additional depreciation per year on newmachinery, $140,000 (20% of $700,000).盛年不重来,一日难再晨。

会计学财务会计分册答案

会计学财务会计分册答案【篇一:会计学:企业决策的基础exercises-chapter4答案】4–2ex. 4–3ex. 4–4solutions to exercisesa. book valueb. materialityc. matching principled. uecorded revenuee. adjusting entriesf. unearned revenueg. prepaid expensesh.none (this is an example of ―depreciation expense.‖)income statementbalance sheetadjustingentryab ne i d ne i d c i ne i i ne i d ne i d ne i d e ne i d d ne d fi ne i ne d ia. rent expense....................................................................................... 240,000prepaidrent ...........................................................................240,000to record rent expense for may ($1,200,000 ? 5 months =$240,000 per month). b. unearned ticketrevenue .................................................................. 148,800ticketrevenue .......................................................................148,800to record earning portion of season ticket revenue relating to may home games.a. (1) interestexpense (375)interest payable (375)$50,000 x 9% annual rate x 1/12 = $375. (2) accounts receivable .................................................................... 10,000consulting fees earned ...................................................10,000to record ten days of unbilled consulting fees at $1,000 perday.b.c.ex. 4–5 a. the balance of twa’s advance ticket sales account represents unearned revenue—that is, amounts collected from customers prior to rendering the related services (air travel). as twa has an obligation to render these services, the advanced ticket sales account appears among the liabilities in twa’s balance sheet.b. twa normally reduces the balance of this liability account by rendering services tocustomers—that is, by providing flights for which the customers have purchased tickets. on some occasions, however, twa reduces the balance of this liability by making cash refunds to customers.ex. 4–6ex. 4–7a. 1. interestexpense ................................................................................. 1,200 interestpayable ......................................................................1,200to record interest accrued on bank loan during december.2. depreciation expense: office building ............................................ 1,100accumulated depreciation: office building ........................1,100to record depreciation on office building ($330,000 ? 25years ?1?12 = $1,100).3. accountsreceivable ........................................................................... 64,000marketing revenue earned...................................................64,000 to record accrued marketing revenue earned in december.4. insuranceexpense (150)prepaid insurance (150)to record insurance expense (1,800 ? 12 months = $150).5. unearned revenue ............................................................................. 3,500marketing revenue earned...................................................3,500to record portion of unearned revenue that had become earnedin december.6. salariesexpense ................................................................................. 2,400 salariespayable ......................................................................2,400to record accrued salaries in december.b. ? $1,200 ? $1,100 ? $150 ? $2,400). a. the total interest expense over the life of the note is $5,400 ($120,000 ? .09 ?6?12 =$5,400).the monthly interest expense is $900 ($5,400 ? 6 = $900). b. the liability to the bank at december 31, 2002, is $121,800 (principal, $120,000 + $1,800accrued interest). c. 2002oct. 31 cash .................................................................................... 120,000notes payable ........................................................120,000obtain from bank six-month loan with interest at 9%a year.d. dec. 31 interestexpense ................................................................ 900interest payable .. (900)to accrue interest expense for december on notepayable ($120,000 ? 9% ? 1?12).e. the liability to the bank at march 31, 2003, is $124,500, consisting of $120,000 principalplus $4,500 accrued interest for five months.a. may 1cash ....................................................................................notes payable ........................................................ obtained a three-month loan from national bank at12% interest per year. may 31 interestexpense ................................................................interestpayable .....................................................to record interest expense for may on note payable tonational bank ($300,000 ? 12% ? 1?12 = $3,000).b. may 1 prepaidrent ......................................................................cash ..................... ................................................... paid rent for six months at $30,000 per month. may 31 rentexpense .....................................................................prepaidrent ..........................................................to record rent expense for the month of may.c. may 2cash ....................................................................................unearne d admissions revenue ............................ sold season tickets to the 70-day racing season. may 31 unearned admissions revenue ........................................admissionsrevenue .............................................to record admissions revenue from the 20 racing daysin may ($910,000 ? 20?70 = $260,000).d. may 4 no entry required.e. may 6 prepaidprinting ................................................................cash .................... .................................................... printed racing forms for first 30 racing days. may 31 printingexpense ...............................................................prepaidprinting ....................................................to record printing expense for 20 racing days in may.f. may 31 concessions receivable.....................................................concessions revenue ............................................ earned 10% of refreshment sales of $165,000 duringmay.300,0003,000180,00030,000910,000260,00012,0008,00016,500300,0003,000180,00030,000910,000260,00012,0008,00016,500ex. 4–8ex. 4–9something to consider:effects of omission of may 31 adjusting entry for rent expense on may 31 financialstatements:revenue not affected expenses understated (by may’s rent of $30,000) net income overstated (because may rent expense was not recognized) assets overstated (prepaid rent should be reduced by portion expired inmay)liabilities not affected owners’ eq uity overstated (because net income is overstated)a. materiality refers to the relative importance of an item. an item is material if knowledgeof it might reasonably influence the decisions of users of financial statements. if an item is immaterial, by definition it is not relevant to decision makers.accountants must account for material items in the manner required by generally accepted accounting principles. however, immaterial items may be accounted for in the most convenient and economical manner.b. whether a specific dollar amount is ―material‖ depends upon the (1) size of the amountand (2) nature of the item. in evaluating the size of a dollar amount, accountants consider the amount in relation to the size of the organization.based solely upon dollar amount, $2,500 is not material in relation to the financial statements of a large, publicly owned corporation. for a small business however, this amount could be material.in summary, one cannot say whether $2,500 is a material amount. the answer depends upon the related circumstances.c. two ways in which the concept of materiality may save time and effort for accountantsare:1. adjusting entries may be based upon estimated amounts if there is little or nopossibility that the use of an estimate will result in material error. for example, an adjusting entry to reflect the amount of supplies used may be based on an estimate of the cost of supplies remaining on hand.2. adjusting entries need not be made to accrue immaterial amounts of uecordedexpenses or uecorded revenue. for example, no adjusting entries normally are made to record utility expense payable at year-end.【篇二:《基础会计》练习册及答案】>第一讲总论(一)单项选择题1、会计的基本职能为----c-------。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 6Merchandising Activitie s Ex. 6.4

1

PROBLEM 6.1A

Claypool earned a gross profit rate of 32%, which is significantly higher than the industry average. Claypool’s sales were above the industry average, and it earned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.

To have a higher-than-average cost of goods sold and still earn a much larger-than-average amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores. Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.

PROBLEM 6.5A

c. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if it

must borrow money for a short period of time at an annual rate of 11%. By

taking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only 0.6%

interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount is greater than the cost of short-term borrowing.

Chapter 7 Financial assets

Chapter 8 Inventories and the cost of goods sold

Supplementary Problem

Chapter 9

16

17。