学期《中级财务会计》期中考试

中级财务会计期中测试1 答案

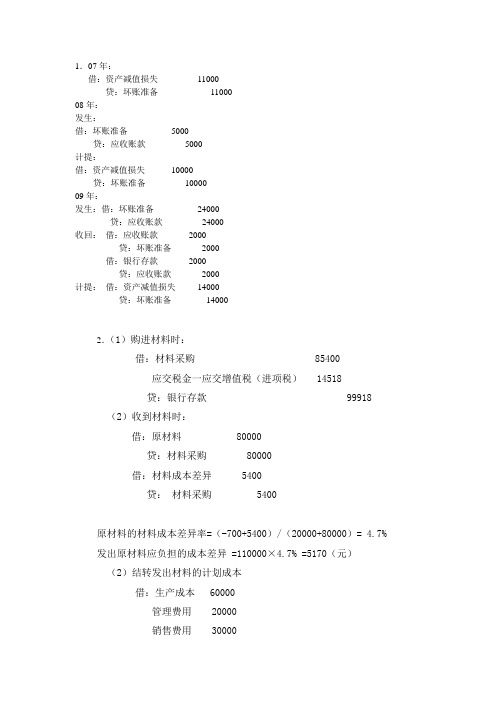

1.07年:借:资产减值损失11000贷:坏账准备1100008年:发生:借:坏账准备5000贷:应收账款5000计提:借:资产减值损失10000贷:坏账准备1000009年:发生:借:坏账准备24000贷:应收账款24000收回:借:应收账款2000贷:坏账准备2000借:银行存款2000贷:应收账款2000计提:借:资产减值损失14000贷:坏账准备140002.(1)购进材料时:借:材料采购 85400应交税金一应交增值税(进项税) 14518贷:银行存款 99918 (2)收到材料时:借:原材料 80000贷:材料采购 80000借:材料成本差异 5400贷:材料采购 5400原材料的材料成本差异率=(-700+5400)/(20000+80000)= 4.7% 发出原材料应负担的成本差异 =110000×4.7% =5170(元)(2)结转发出材料的计划成本借:生产成本 60000管理费用 20000销售费用 30000贷:原材料 110000结转发出材料应该负担的成本差异:借:生产成本 2820管理费用 940销售费用 1410贷:材料成本差异 51703. (1)借:交易性金融资产----A公司股票(成本)234 000 投资收益 1 000应收股利 6 000贷:银行存款241 000(2)借:银行存款 6 000 贷:应收股利 6 000(3)借:交易性金融资产----A公司股票(公允价值变动)11 000 贷:公允价值变动损益11 000 借:公允价值变动损益11 000 贷:本年利润11 000(4)借:银行存款240 000 投资收益 5 000贷:交易性金融资产----A公司股票(成本)234 000 交易性金融资产----A公司股票(公允价值变动)11 000借:公允价值变动损益11 000 贷:投资收益11 0004、购入时:借:持有至到期投资——面值1000000——利息调整100000贷:银行存款110000007年末:投资收益=1100000*6.36%=69960应收利息=1000000*12%=120000借:应收利息120000贷:持有至到期投资——利息调整50040 投资收益69960 借:银行存款120000贷:应收利息12000007年末摊余成本=1100000+69960-120000=104996008年末:借:应收利息120000贷:持有至到期投资——利息调整49960 投资收益70040借:银行存款120000贷:应收利息120000收回投资成本:借:银行存款1000000贷:持有至到期投资——面值10000005、4月8日:借:可供出售金融资产——成本 364000 贷:银行存款 364000 07年12月31日:借:可供出售金融资产——公允价值变动 36000 贷:资本公积 36000 08年2月24日:借:银行存款 170000投资收益 30000贷:可供出售金融资产——成本 182000——公允价值变动 18000 借:资本公积 18000贷:投资收益 1800008年12月31日:公允价值变动额=(10-8.5)*20000=30000借:资本公积 30000贷:可供出售金融资产——公允价值变动 300006.(1)2007年1月1日购入B公司股权借:长期股权投资——成本 4000000贷:银行存款 4000000(2)购买日,调整初始投资成本A公司享有B公司可辨认净资产的公允价值的份额=10500000*40%=4200000 A公司应调整投资成本=4200000-4000000=200000借:长期股权投资——成本 200000贷:营业外收入 200000。

中级财务会计期中考试题及答案

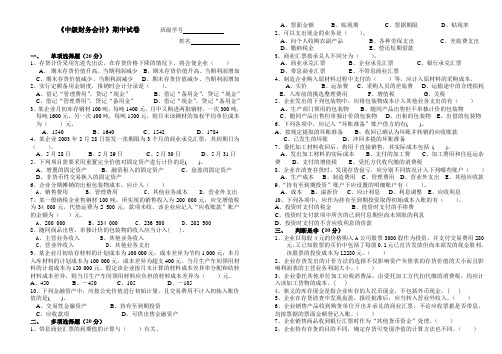

中级财务会计期中考试题及答案中级财务会计期中测试题及答案一、单项选择题(共20小题,每题1分,共计20分)二、多项选择题(共10小题,每题2分,共计20分)三、判断并改错题(共10小题,每小题2分,共计20分)四、业务计算题(共2小题,第一题10分,第二题10分,共计20分)五、综合题(共10小题,每题2分,共计20分)一、单项选择题(共10小题,每题1分,共计10分)1. 2014年1月2日,甲公司以货币资金取得乙公司30%的股权,初始投资成本为2000万元,投资时乙公司各项可辨认资产.负债的公允价值与其账面价值相同,可辨认净资产公允价值及账面价值的总额均为7000万元,甲公司取得投资后即派人参与乙公司生产经营决策,但无法对乙公司实施控制。

乙公司2014年实现净利润500万元,假定不考虑所得税因素,该项投资对甲公司2014年度损益的影响金额为( D)。

A.50B.100C.150D.2502.2014年2月2日,甲公司支付830万元取得一项股权投资作为交易性金融资产核算,支付价款中包括已宣告尚未领取的现金股利20万元,另支付交易费用5万元。

甲公司该项交易性金融资产的入账价值为( A )。

A.810B.815C.830D.8353.下列关于投资性房地产核算的表述中,正确的是( D)。

A.采有成本模式计量的投资性房地产不需要确认减值损失B.采用公允价值模式计量的投资性房地产可转换为成本模式计量C.采用公允价值模式计量的投资性房地产,公允价值的变动金额应计入资本公积D.采用成本模式计量的投资性房地产,符合条件时可转换为公允价值模式计量4.根据规定,下列经济业务中,不能用现金支付的是( A )。

A.支付物资采购货款1200元B.支付零星办公用品购置费600元C.支付离退休人员工资3000元D.支付职工差旅费2000元5.下列固定资产中,应计提折旧的是( B )。

A.未提足折旧提前报废的固定资产B.闲置的机器设备C.已提足折旧继续使用的固定资产D.经营租赁租入的房屋6.下列各项关于无形资产会计处理的表述中,正确的是( D )。

中级财务会计期中考试题及答案

中级财务会计期中测试题及答案一、单项选择题(共20小题,每题1分,共计20分)二、多项选择题(共10小题,每题2分,共计20分)三、判断并改错题(共10小题,每小题2分,共计20分)四、业务计算题(共2小题,第一题10分,第二题10分,共计20分)五、综合题(共10小题,每题2分,共计20分)一、单项选择题(共10小题,每题1分,共计10分)1. 2014年1月2日,甲公司以货币资金取得乙公司30%的股权,初始投资成本为2000万元,投资时乙公司各项可辨认资产.负债的公允价值与其账面价值相同,可辨认净资产公允价值及账面价值的总额均为7000万元,甲公司取得投资后即派人参与乙公司生产经营决策,但无法对乙公司实施控制。

乙公司2014年实现净利润500万元,假定不考虑所得税因素,该项投资对甲公司2014年度损益的影响金额为( D)。

A.50B.100C.150D.2502.2014年2月2日,甲公司支付830万元取得一项股权投资作为交易性金融资产核算,支付价款中包括已宣告尚未领取的现金股利20万元,另支付交易费用5万元。

甲公司该项交易性金融资产的入账价值为( A )。

A.810B.815C.830D.8353.下列关于投资性房地产核算的表述中,正确的是( D)。

A.采有成本模式计量的投资性房地产不需要确认减值损失B.采用公允价值模式计量的投资性房地产可转换为成本模式计量C.采用公允价值模式计量的投资性房地产,公允价值的变动金额应计入资本公积D.采用成本模式计量的投资性房地产,符合条件时可转换为公允价值模式计量4.根据规定,下列经济业务中,不能用现金支付的是( A )。

A.支付物资采购货款1200元B.支付零星办公用品购置费600元C.支付离退休人员工资3000元D.支付职工差旅费2000元5.下列固定资产中,应计提折旧的是( B )。

A.未提足折旧提前报废的固定资产B.闲置的机器设备C.已提足折旧继续使用的固定资产D.经营租赁租入的房屋6.下列各项关于无形资产会计处理的表述中,正确的是( D )。

中财期中试卷(国会专业).doc

江西财经大学13-14第一学期期中考试卷试卷代码:02435 授课课时:64课程名称:Intermediate account ing 适用对象:国际会计专业本科班Part I True/Fa I se (There are FIVE sentences in this part. Mark with T if you take it as right and with F if you take it as wrong. 20X2'二40')1.Earnings management generally makes income statement information moreuseful for predicting future earnings and cash flows.panies frequently report income tax as the last item before netincome on the income statement.3.Income before income taxes is computed by deducting interest expensefrom income from operations.4.Discontinued operations and gains and losses are both reported net oftax in the income statement.5. A company recognizes a change in estimate by making a retrospectiveadjustment to the financial statements.6.Prior period adjustments can either be added or subtracted in theRetained Earnings Statement.panies only restrict retained earnings to comply with contractualrequirements or current necessity.prehensive income includes all changes in equity during a periodexcept those resulting from distributions to owners.9.Significant financing and investing activities that do not affect cashare not reported in the statement of cash flows or any other place.10.Under IFRS non-cash activities are reported as either investing orfinancing activities in the body of the statement of cash flows.11.Financial statement readers often assess liquidity by using thecurrent cash debt coverage ratio.12.Free cash flow is net income less capital expenditures and dividends.13.Because of the cost principle, fair values may not be disclosed in thestatement of financial position.14.IFRS requires specific note disclosures on inventories that aredisaggregated into classifications such as merchandise, productionsupplies, work in process, and finished goods.panies may use parenthetical explanations, notes, cross references,and supporting schedules to disclose pertinent information.16.The time value of money refers to the fact that a dollar receivedtoday is worth less than a dollar promised at some time in the future.pound interest uses the accumulated balance at each year end tocompute interest in the succeeding year.18.The present value of an annuity due table is used when payments aremade at the end of each period.19.In order to provide information that is useful in decision making andcapital allocation, the International Financial Reporting Standards(IFRS) requires all companies to use a common currency.ers of the financial information provided by a company use thatinformation to make capital allocation decisions.Part I I Multiple choice (30X T =30')1.The financial statements most frequently provided include all of the following except thea.statement of financial position.b.income statement.c.statement of cash flows.d.statement of retained earnings.2.Which of the following represents a form of communication through financial reporting but not through financial statements?a.Statement of financial position.b.President,s letter.c.Income statement.d.Notes to financial statements.3.Which of the following has the highest authoritative support?a.International Financial Reporting Standards.b.International Accounting Standards.c.Interpretations of the IFRIC.d.Framework for Financial Reporting.4.Which of the following is not a major challenge facing the accounting profession?a.Nonfinancial measurements.b.Timeliness.c.Accounting for hard assets.d.Forward-looking information.5.What is a possible danger if politics plays too big a role in developing IFRS?a.Financial reporting standards that are not truly generally accepted.b.Individuals may influence the standards.er groups become active.d.The IASB delegates its authority to elected officials.6.What is ^expectation gap〃?a.The difference between what the public thinks the accountant is not doing and what the accountant knows they don,t do.b.The difference between what the public thinks the accountant is doing and what Congress says the accountant is doing.c.The difference between what the public thinks the accountant is doing and what the accountant thinks they can do.d.The difference between what the accountant is doing and what the Courts say the accountant should be doing.7.Which of the following is an ethical concern of accountants?a.Earnings manipulation.b.Conservative accounting.c.Industry practices.d.None of the above.8.What is a major objective of financial reporting?a.Provide information that is useful to management in making decisions.b.Provide information that clearly portray nonfinancial transactions.c.Provide information that is useful to assess the amounts, timing, anduncertainty of perspective cash receipts.d.Provide information that excludes claims to the resources.9.Accrual accounting is used becausea.cash flows are considered less important.b.it provides a better indication of ability to generate cash flows thanthe cash basis.c.it recognizes revenues when cash is received and expenses when cash ispaid.d.none of the above.10.The International Accounting Standards Board, s (IASB' s) ConceptualFramework includes all of the following except:a.Objective of financial reporting.b.Supplementary informationc.Elements of financial statements.d.Qualitative characteristics of accounting information.11.The second level in the International Accounting Standards Board, s(IASB' s) Conceptual Frameworka.Identifies the objective of financial reporting.b.Identifies recognition, measurement, and disclosure concepts used inestablishing and applying accounting standards.c.Provides the elements of financial statements.d.Includes assumptions, principles, and constraints.12.Which of the following is a fundamental quality of useful accountinginformation?parability.b.Relevance.d.Materiality.13.Which of the following is a fundamental quality of useful accountinginformation?a.Conservatism.parability.c.Faithful representation.d.Consistency.14.What is meant by comparability when discussing financial accountinginformation?rmation has predictive or feedback value.rmation is reasonably free from error.rmation that is measured and reported in a similar fashion acrosscompanies.rmation is timely.15.Postinga.Accumulates the effects of ledger entries and transfers them to the generaljournal.b.Is done only for income statement activity; activity related to thestatement of financial position does not require posting.c.Is done once per year.d.Transfers journal entries to the ledger accounts.16.Which of the following is an ingredient of relevance?pleteness.b.Representational faithfulness.c.Neutrality.d.Predictive value.17.Which of the following is an ingredient of faithful representation?a.Predictive value.b.Timeliness.d.Feedback value.pany A issuing its annual financial reports within one month of the end of the year is an example of which enhancing quality of accounting information?a.Neutrality.b.Timeliness.c.Predictive value.d.Representational faithfulness.19.Which of the following is not a basic element of financial statements?a.Assets.b.Statement of financial position.c.Equity.d.Income.20.Valuing assets at their liquidation values rather than their cost is inconsistent with thea.periodicity assumption.b.matching principle.c.materiality constraint.d.historical cost principle.21.Which of the following are the two components of the revenuea . In the period whentheexpenses arepaid.b . In the period whentheexpenses areincurred.c . Inthe periodwhenthe vendor invoice isreceived.d . Inthe periodwhenthe relatedrevenueisrecognized.recognition principle?a.Cash is received and the amount is material.b.It is probable that future economic benefits will flow to the companyand it is possible to reliably measure the amount.c.Production is complete and there is an active market for the product.d.Cash is realized or realizable and production is complete.22.What is the general approach as to when product costs are recognizedas expenses?23.An optional step in the accounting cycle is the preparation ofa.adjusting entries.b.closing entries.c. a statement of cash flows.d. a post-closing trial balance.24.Basic steps in the recording process include all of the followingexcepta.Transfer the journal information to the appropriate account in thestatement of financial position.b.Analyze each transaction for its effect on the accounts.c.Enter the transaction information in a journal.d.All of the choices are correct regarding the basic steps in the recordingprocess.25.The trial balance will not balance when a companya.Fails to journalize a transaction.b.Omits posting a correct journal entry.c.Posts a journal entry twice.d.Debits two statement of financial position accounts and no incomestatement accounts.26.Accounts maintained within the ledger that appear on the statement offinancial position include all of the following excepta.Salaries expense.b.Interest payable.c.Supplies.d.Share capital - ordinary.27.Which of the following is not considered cash for financial reportingpurposes?a.Petty cash funds and change fundsb.Money orders, certified checks, and personal checksc.Coin, currency, and available fundsd.Postdated checks and I. 0. U.,s28.If a company employs the gross method of recording accountsreceivable from customers, then sales discounts taken should be reported asa. a deduction from sales in the income statement.b.an item of "other income and expense" in the income statement.c. a deduction from accounts receivable in determining the net realizablevalue of accounts receivable.d.sales discounts forfeited in the cost of goods sold section of theincome statement.29.Why do companies provide trade discounts?a.To avoid frequent changes in catalogs.b.To induce prompt payment.c.To easily alter prices for different customers.d.Both a. and c.30.All of the following are problems associated with the valuation ofaccounts receivable except fora.uncollectible accounts.201 12012€21,000789,600201,600151,20063,000 €1.226.400€ 487,200205,800302,40029,40086,000 115,600 €1.226.4 00b.returns.c.cash discounts under the net method.d.allowances granted.Part I I I Case ana lysis (3X10'二30')1.Statement of cash flows preparationSelected financial statement information and additional data for Stanislaus Co. is presented below. Prepare a statement of cash flows for the yearending December 31, 2012December 31Land € 58,800Equipment ............................................................... 504,000Inventory ............................................................. 168,000Accounts receivable (net) .......................................... 84,000Cash ........................................................................... 42,000TOTAL .................................................... €856.800Share capital-ordinary............................................ €420,000Retained earnings ...................................................... 67,200Notes payable - Long-term ...................................... 168,000Notes payable - Short-term ........................................ 67,200Accounts payable ....................................................... 50,400Accumulated depreciation ......................................... 84,000TOTAL ..................................................... €856.800Additional data for 2012: income was € 235, 200.2.Depreciation was € 31, 600.nd was sold at its original cost.4.Dividends of € 96, 600 were paid.5.Equipment was purchased for € 84, 000 cash.6. A long-term note for € 201,600 wa s used to pay for an equipment purchase.7.Share capital - ordinary was issued to pay a € 67, 200 long-term notepayable.2.Entries for bad debt expenseThe trial balance before adjustment of Risen Company reports the followingbalances:Dr. _____ C E Accounts receivable$100,00Allowance for doubtful accounts$2,50 Sales (all on credit)750,000Sales returns and allowances40,000 Instructions(a) Prepare the entries for estimated bad debts assuming that doubtfulaccounts are estimated to be (1) 6% of gross accounts receivable and (2) 1% of net sales.(b) Assume that all the information above is the same, except that theAllowance for Doubtful Accounts has a debit balance of $2, 500 insteadof a credit balance. How will this difference affect the journalentries in part (a)?3.Amortization of discount on noteOn December 31, 2010, Green Company finished consultation services and accepted in exchange a promissory note with a face value of $400,000, a due date of December 31, 2013, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%.The following interest factors are provided:Table Factors For Three PeriodsFuture Value of 1Present Value of 1Future Value of Ordinary Annuity of 1Present Value of Ordinary Annuity of 1Instructions(a)Determine the present value of the note.(b)Prepare a Schedule of Note Discount Amortization for Green Companyunder the effective interest method. (Round to whole dollars.) Interest Rate___ 5% 10% 1.15763 1.33100.86384 .75132 3.15250 3.31000 2.72325 2.48685。

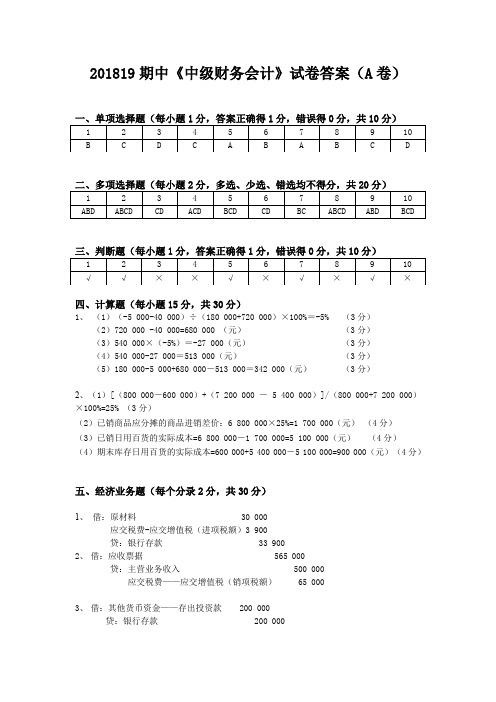

2020期中《中级财务会计》试卷A卷答案

201819期中《中级财务会计》试卷答案(A卷)四、计算题(每小题15分,共30分)1、(1)(-5 000-40 000)÷(180 000+720 000)×100%=-5% (3分)(2)720 000 -40 000=680 000 (元)(3分)(3)540 000×(-5%)=-27 000(元)(3分)(4)540 000-27 000=513 000(元)(3分)(5)180 000-5 000+680 000-513 000=342 000(元)(3分)2、(1)[(800 000-600 000)+(7 200 000 - 5 400 000)]/(800 000+7 200 000)×100%=25% (3分)(2)已销商品应分摊的商品进销差价:6 800 000×25%=1 700 000(元)(4分)(3)已销日用百货的实际成本=6 800 000-1 700 000=5 100 000(元)(4分)(4)期末库存日用百货的实际成本=600 000+5 400 000-5 100 000=900 000(元)(4分)五、经济业务题(每个分录2分,共30分)1、借:原材料 30 000应交税费-应交增值税(进项税额)3 900贷:银行存款 33 9002、借:应收票据 565 000贷:主营业务收入 500 000应交税费——应交增值税(销项税额) 65 0003、借:其他货币资金——存出投资款200 000贷:银行存款200 0004、借:应收账款 101 700贷:主营业务收入 90 000应交税费-应交增值税(销项税额)11 7005、借:银行存款 99 900财务费用 1 800贷:应收账款 101 7006、借:其他应收款——张三 6 000贷:库存现金 6 0007、借:交易性金融资产——成本 175 000应收股利 5 000投资收益 1 000应交税费-应交增值税(进项税额) 60贷:其他货币资金——存出投资款 181 0608、借:委托加工物资 20 000贷:原材料20 0009、借:委托加工物资11 000应交税费——应交增值税(进项税额)910贷:银行存款11 91010、借:库存商品 31 000贷:委托加工物资 31 00011、借:管理费用 5 650库存现金 350贷:其他应收款——张三 6 00012、借:其他货币资金——存出投资款 5 000贷:应收股利 5 00013、借:坏账准备 30 000贷:应收账款 30 00014、借:库存现金 500贷:待处理财产损溢——待处理流动资产损溢 50015、借:待处理财产损溢——待处理流动资产损溢 500贷:营业外收入 500。

中级财务会计学期中考试卷

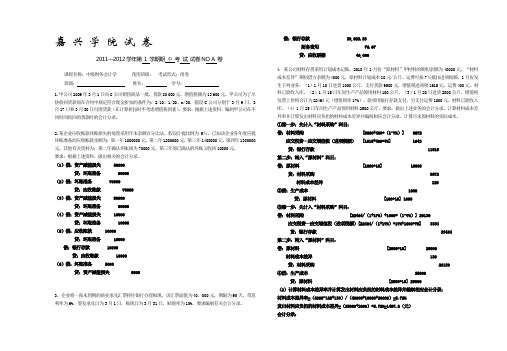

嘉兴学院试卷2011—2012学年第1 学期期中考试试卷NO A 卷课程名称:中级财务会计学使用班级:考试形式:闭卷班级:姓名:学号:1.甲公司2009年3月1日向C公司销售商品一批,货款80 000元,增值税额为13 600元。

甲公司为了尽快收回货款而在合同中规定符合现金折扣的条件为:2/10、1/20、n/30,假设C公司分别于3月9日、3月17日和3月30日付清货款(在计算折扣时不考虑增值税因素)。

要求:根据上述资料,编制甲公司在不同时间收回的货款时的会计分录。

2.某企业应收账款坏账损失的处理采用年末余额百分比法。

假设计提比例为5%。

已知该企业各年度应提坏账准备的应收账款余额为:第一年1000000元,第二年1200000元,第三年1400000元,第四年1300000元。

其他有关资料为:第二年确认坏账损失70000元,第三年原已确认的坏账又收回10000元。

要求:根据上述资料,做出相关的会计分录。

(1)借:资产减值损失 50000贷:坏账准备 50000(2)借:坏账准备 70000贷:应收账款 70000(3)借:资产减值损失 80000贷:坏账准备 80000(4)借:资产减值损失 10000贷:坏账准备 10000(5)借:应收账款 10000贷:坏账准备 10000借:银行存款 10000贷:应收账款 10000(6)借:坏账准备 5000贷:资产减值损失 50003. 企业将一张未到期的商业承兑汇票持往银行办理贴现,该汇票面值为40,000元,期限为90天,带息利率为6%,签发承兑日为3月1日,贴现日为3月31日,贴现率为10%。

要求编制有关会计分录。

借:银行存款 39,财务费用贷:应收票据 40,0004. 某公司材料存货采用计划成本记账,2010年1月份“原材料”甲材料的期初余额为40000元,“材料成本差异”期初借方余额为4000元,原材料计划成本10元/公斤。

运费可按7%抵扣进项税额。

《中级财务会计》期中考试题

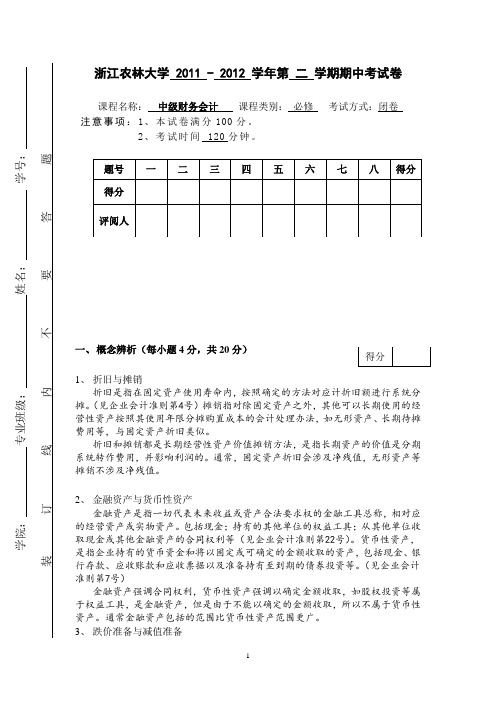

浙江农林大学 2011 - 2012 学年第 二 学期期中考试卷课程名称: 中级财务会计 课程类别: 必修 考试方式:闭卷 注意事项:1、本试卷满分100分。

2、考试时间 120分钟。

一、 概念辨析(每小题4分,共20分)1、 折旧与摊销折旧是指在固定资产使用寿命内,按照确定的方法对应计折旧额进行系统分摊。

(见企业会计准则第4号)摊销指对除固定资产之外,其他可以长期使用的经营性资产按照其使用年限分摊购置成本的会计处理办法,如无形资产、长期待摊费用等,与固定资产折旧类似。

折旧和摊销都是长期经营性资产价值摊销方法,是指长期资产的价值是分期系统转作费用,并影响利润的。

通常,固定资产折旧会涉及净残值,无形资产等摊销不涉及净残值。

2、 金融资产与货币性资产金融资产是指一切代表未来收益或资产合法要求权的金融工具总称,相对应的经营资产或实物资产。

包括现金;持有的其他单位的权益工具;从其他单位收取现金或其他金融资产的合同权利等(见企业会计准则第22号)。

货币性资产,是指企业持有的货币资金和将以固定或可确定的金额收取的资产,包括现金、银行存款、应收账款和应收票据以及准备持有至到期的债券投资等。

(见企业会计准则第7号)金融资产强调合同权利,货币性资产强调以确定金额收取,如股权投资等属于权益工具,是金融资产,但是由于不能以确定的金额收取,所以不属于货币性资产。

通常金融资产包括的范围比货币性资产范围更广。

3、 跌价准备与减值准备学院: 专业班级:姓名: 学号:装 订 线 内 不 要 答 题跌价准备与减值准备是指资产期末计价采用成本与可变现净值孰低或成本与预计可收回金额孰低时,根据谨慎性原则预提的资产减损储备。

跌价准备主要是针对具有交易市场的流动资产,如存货跌价准备,而减值准备主要针企业自己使用的长期资产,如固定资产减值准备、长期股权投资减值准备。

4、可变现净值与公允价值可变现净值是指资产按照其正常对外销售所能收到现金或者现金等价物的金额扣减该资产至完工时估计将要发生的成本、估计的销售费用以及相关税费后的金额。

中级财务会计学期中考试卷

嘉兴学院试卷2011—2012学年第1 学期期中考试试卷NO A 卷课程名称:中级财务会计学使用班级:考试形式:闭卷班级:姓名:学号:1.甲公司2009年3月1日向C公司销售商品一批,货款80 000元,增值税额为13 600元。

甲公司为了尽快收回货款而在合同中规定符合现金折扣的条件为:2/10、1/20、n/30,假设C公司分别于3月9日、3月17日和3月30日付清货款(在计算折扣时不考虑增值税因素)。

要求:根据上述资料,编制甲公司在不同时间收回的货款时的会计分录。

2.某企业应收账款坏账损失的处理采用年末余额百分比法。

假设计提比例为5%。

已知该企业各年度应提坏账准备的应收账款余额为:第一年1000000元,第二年1200000元,第三年1400000元,第四年1300000元。

其他有关资料为:第二年确认坏账损失70000元,第三年原已确认的坏账又收回10000元。

要求:根据上述资料,做出相关的会计分录。

(1)借:资产减值损失 50000贷:坏账准备 50000(2)借:坏账准备 70000贷:应收账款 70000(3)借:资产减值损失 80000贷:坏账准备 80000(4)借:资产减值损失 10000贷:坏账准备 10000(5)借:应收账款 10000贷:坏账准备 10000借:银行存款 10000贷:应收账款 10000(6)借:坏账准备 5000贷:资产减值损失 50003. 企业将一张未到期的商业承兑汇票持往银行办理贴现,该汇票面值为40,000元,期限为90天,带息利率为6%,签发承兑日为3月1日,贴现日为3月31日,贴现率为10%。

要求编制有关会计分录。

借:银行存款 39,923.33财务费用 76.67贷:应收票据 40,0004. 某公司材料存货采用计划成本记账,2010年1月份“原材料”甲材料的期初余额为40000元,“材料成本差异”期初借方余额为4000元,原材料计划成本10元/公斤。

2010-2011第二学期期中考试讲解-精介绍

5.双倍余额递减法计算折旧开始时并不考虑预计的净残值。( ) 答案:√ 四、计算业务题 1.某工业企业为增值税一般纳税企业,材料按计划成本计价核算。甲材 料计划单位成本为每公斤10元。该企业2007年4月份有关资料如下: (1) “原材料”账户月初余额4 000元,“材料成本差异”账户月初借方 余额500元。 (2)4月15日,从外地A公司购入甲材料6 000公斤,增值税专用发票注 明的材料价款为61 000元,增值税额10 370元,企业已用银行存款 支付上述款项,材料尚未到达。 借:材料采购 61 000 应交税费—应交增值税(进)10 370 贷:银行存款 71 370 (3)4月20日,从A公司购入的甲材料到达,验收入库时发现短缺20公斤, 经查明为途中定额内自然损耗。按实收数量验收入库。 借:原材料 59 800 材料采购 59 800 借:材料成本差异 1 200 贷:材料采购 1 200

3.甲企业2009年2月26日购入待安装的生产设备一台,价款600万元和增 值税税款102万元均尚未支付。安装工程于3月1日开工,领用企业生产的产 品一批,实际成本为40万元,计税价格50万元,适用的增值税税率为17%; 工程人员工资及福利费55万元,支付其他相关费用5万元,安装工程2009 年9月20日完成并交付使用。该设备估计可使用5年,预计净残值20万元, 该企业采用双倍余额递减法计提折旧。 要求:(1)计算该设备的入账价值;并编制相应会计分录; (2)分别计算该企业2009年度、2010年度应计提的折旧额; 借:工程物资 600 应交税费—应交增值税(销)102 贷:应付账款 702

借:无形资产

贷:银行存款

300

300

20×3年12月31日的摊销金额=300÷10÷12=2.5万元 借:管理费用 贷:累计摊销 2.5 2.5

财务会计期中考试卷

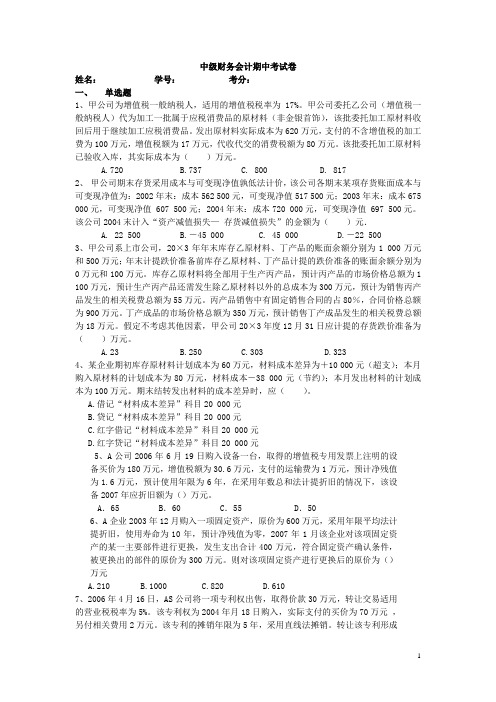

中级财务会计期中考试卷姓名:学号:考分:一、单选题1、甲公司为增值税一般纳税人,适用的增值税税率为17%。

甲公司委托乙公司(增值税一般纳税人)代为加工一批属于应税消费品的原材料(非金银首饰),该批委托加工原材料收回后用于继续加工应税消费品。

发出原材料实际成本为620万元,支付的不含增值税的加工费为100万元,增值税额为17万元,代收代交的消费税额为80万元。

该批委托加工原材料已验收入库,其实际成本为()万元。

A.720B.737C. 800D. 8172、甲公司期末存货采用成本与可变现净值孰低法计价,该公司各期末某项存货账面成本与可变现净值为:2002年末:成本562 500元,可变现净值517 500元;2003年末:成本675 000元,可变现净值 607 500元;2004年末:成本720 000元,可变现净值 697 500元。

该公司2004末计入“资产减值损失—存货减值损失”的金额为()元.A. 22 500B.-45 000C. 45 000D.-22 5003、甲公司系上市公司,20×3年年末库存乙原材料、丁产品的账面余额分别为1 000万元和500万元;年末计提跌价准备前库存乙原材料、丁产品计提的跌价准备的账面余额分别为0万元和100万元。

库存乙原材料将全部用于生产丙产品,预计丙产品的市场价格总额为1 100万元,预计生产丙产品还需发生除乙原材料以外的总成本为300万元,预计为销售丙产品发生的相关税费总额为55万元。

丙产品销售中有固定销售合同的占80%,合同价格总额为900万元。

丁产成品的市场价格总额为350万元,预计销售丁产成品发生的相关税费总额为18万元。

假定不考虑其他因素,甲公司20×3年度12月31日应计提的存货跌价准备为()万元。

A.23B.250C.303D.3234、某企业期初库存原材料计划成本为60万元,材料成本差异为+10 000元(超支);本月购入原材料的计划成本为80万元,材料成本-38 000元(节约);本月发出材料的计划成本为100万元。

财务会计会考题库

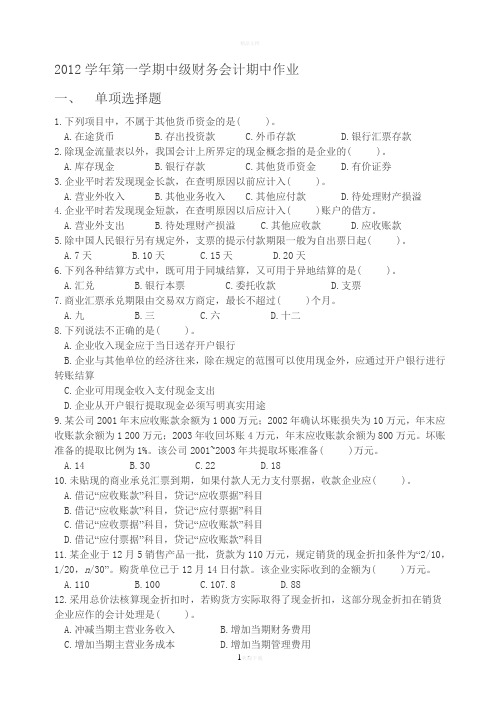

2012学年第一学期中级财务会计期中作业一、单项选择题1.下列项目中,不属于其他货币资金的是( )。

A.在途货币B.存出投资款C.外币存款D.银行汇票存款2.除现金流量表以外,我国会计上所界定的现金概念指的是企业的( )。

A.库存现金B.银行存款C.其他货币资金D.有价证券3.企业平时若发现现金长款,在查明原因以前应计入( )。

A.营业外收入B.其他业务收入C.其他应付款D.待处理财产损溢4.企业平时若发现现金短款,在查明原因以后应计入( )账户的借方。

A.营业外支出B.待处理财产损溢C.其他应收款D.应收账款5.除中国人民银行另有规定外,支票的提示付款期限一般为自出票日起( )。

A.7天B.10天C.15天D.20天6.下列各种结算方式中,既可用于同城结算,又可用于异地结算的是( )。

A.汇兑B.银行本票C.委托收款D.支票7.商业汇票承兑期限由交易双方商定,最长不超过( )个月。

A.九B.三C.六D.十二8.下列说法不正确的是( )。

A.企业收入现金应于当日送存开户银行B.企业与其他单位的经济往来,除在规定的范围可以使用现金外,应通过开户银行进行转账结算C.企业可用现金收入支付现金支出D.企业从开户银行提取现金必须写明真实用途9.某公司2001年末应收账款余额为1 000万元;2002年确认坏账损失为10万元,年末应收账款余额为1 200万元;2003年收回坏账4万元,年末应收账款余额为800万元。

坏账准备的提取比例为1%。

该公司2001~2003年共提取坏账准备( )万元。

A.14B.30C.22D.1810.未贴现的商业承兑汇票到期,如果付款人无力支付票据,收款企业应( )。

A.借记“应收账款”科目,贷记“应收票据”科目B.借记“应收账款”科目,贷记“应付票据”科目C.借记“应收票据”科目,贷记“应收账款”科目D.借记“应付票据”科目,贷记“应收账款”科目11.某企业于12月5销售产品一批,货款为110万元,规定销货的现金折扣条件为“2/10,1/20,n/30”。

《中级财务会计》期中考试题

《中级财务会计》期中考试题一、单选题1、市场参与者在计量日发生的有序交易中,出售一项资产所能收到或者转移一项负债所需支付的价款,所指的计量属性是()A、历史成本B、可变现净值C、现值D、公允价值2、下列业务中,体现谨慎性质量要求的是()A、融资租入固定资产视同自有固定资产入账B、对未决仲裁确认预计负债C、对售后回购不确认收入D、对低值易耗品采取一次摊销法3、企业将准备用于有价证券投资的现金存入证券公司指定的账户时,应借记的会计科目是()A、银行存款B、短期投资C、其他应收款D、其他货币资金4、某股份有限公司于2016年3月30日以每股12元的价格购入某上市公司股票50万股,作为交易性金融资产核算。

购买该股票支付手续费等10万元。

5月25日,收到该上市公司按每股0.5元发放的现金股利。

12月31日该股票的市价为每股11元。

2016年12月31日该股票投资的账面价值为( )万元。

A.550 B.575 C.585 D.6105、下列关于交易性金融资产的说法中,错误的是()。

A.当指定可以消除或明显减少由于金融资产或金融负债的计量基础不同所导致的相关利得或损失在确认或计量方面不一致的情况时,某项金融工具直接指定为以公允价值计量且其变动计入当期损益的金融资产B.企业取得的交易性金融资产,按其公允价值入账C.在活跃市场中没有报价、公允价值不能可靠计量的权益工具投资,可以指定为以公允价值计量且其变动计入当期损益的金融资产D. 取得交易性金融资产的目的,主要是为了近期内出售6、未发生减值的持有至到期投资如为分期付息、一次还本债券投资,应于资产负债表日按票面利率计算确定的应收未收利息,借记“应收利息”科目,按持有至到期投资期初摊余成本和实际利率计算确定的利息收入,贷记“投资收益”科目,按其差额,借记或贷记()科目。

A.持有至到期投资(利息调整)B.持有至到期投资(成本)C.持有至到期投资(应计利息)D.持有至到期投资(债券溢折价)7、企业发放工资支取现金,应通过()办理。

中级财务会计考试题-1

济南大学2009 ~2010 学年第二学期(期中)考试试卷( 卷)课 程 中级财务会计 授课教师 吴兰飞 考试时间 2010 年 月 日 考试班级 学 号 姓 名一、 单项选择题1、 企业外购存货的采购成本,通常不包括( )。

A 、 途中保险费B 、 运输途中的合理损耗C 、 入库前的挑选整理费用D 、 市内零星货物运杂费2、 根据我国企业会计准则的规定,企业购货时取得的现金折扣,应当( )。

A 、 冲减购货成本B 、 冲减管理费用C 、 冲减财务费用D 、 冲减资产减值损失3、 如果购入的存货超过正常信用条件延期支付价款,实质上具有融资性质的,企业所购存货的入账价值应当是( )。

A 、 合同约定的购买价款B 、 购买价款的现值金额C 、 相同存货的市场价格D 、 类似存货的市场价格4、 企业因购入存货超过正常信用条件延期支付价款而登记入账的未确认融资费用,在分期摊销时,应当计入( )。

A 、 原材料成本B 、 管理费用C 、 财务费用D 、 营业外支出5、 企业委托加工存货所支付的下列款项中,不能计入委托加工存货成本的是( )。

A 、 支付的加工费B 、 支付的往返运杂费C 、 支付的增值税D 、 支付的消费税6、 企业以一台设备换入一批原材料,并支付部分补价,该补价应计入( )。

A 、 原材料成本B 、 管理费用C 、 财务费用D 、 营业外支出7、 企业以固定资产换入一批原材料,换出固定资产的公允价值高于其账面价值的差额,计入( )。

A 、 营业外收入B 、 其他业务收入C 、 资本公积D 、 公允价值变动损益8、 企业以库存商品换入一批原材料,换出的库存商品应按其公允价值确认( )。

A 、 主营业务收入B 、 营业外收入C 、 资本公积D 、 公允价值变动损益 9、 某企业以长期股权投资换入一批商品,支付相关税费1500元。

换出股权投资的账面余额为80000元,已计提长期股权投资减值准备20000元,公允价值为62000元;换入商品可抵扣的增值税进项税额为9000元。

财务会计期中卷

《中级财务会计》期中试卷班级学号姓名一、单项选择题(20分)1、存货计价采用先进先出法,在存货价格下降的情况下,将会使企业()A、期末存货价值升高、当期利润减少B、期末存货价值升高、当期利润增加C、期末存货价值减少、当期利润减少D、期末存货价值减少、当期利润增加2、实行定额备用金制度,报销时会计分录是()。

A、借记“管理费用”,贷记“现金”B、借记“备用金”,贷记“现金”C、借记“管理费用”,贷记“备用金”D、借记“现金”,贷记“备用金”3、某企业月初库存钢材100吨,每吨1400元,月中又购进两批钢材,一次300吨,每吨1600元,另一次100吨,每吨1500元,则月末该钢材的加权平均单位成本为()元。

A、1540B、1640C、1542D、17844、某企业2003年2月28日签发一张期限为3个月的商业承兑汇票,其到期日为()。

A、5月28日B、5月29日C、5月30日D、5月31日5、下列项目需要采用重置完全价值对固定资产进行计价的是( )。

A、增置的固定资产B、融资租入的固定资产C、盘盈的固定资产D、非货币性交易换入的固定资产6、企业分期摊销的出租包装物成本,应计入()A、销售费用B、管理费用C、其他业务成本D、营业外支出7、某一般纳税企业售钢材100吨,所实现的销售收入为200 000元,应交增值税为34 000元,代垫运费为2 500元,款项未收。

该企业应记入“应收账款”账户的金额为()元。

A、200 000B、234 000C、236 500D、202 5008、随同商品出售,单独计价的包装物的收入应当计入( )。

A、主营业务收入B、其他业务收入C、营业外收入D、其他业务支出9、某企业月初结存材料的计划成本为100 000元,成本差异为节约1 000元;本月入库材料的计划成本为100 000元,成本差异为超支400元。

当月生产车间领用材料的计划成本为150 000元。

假定该企业按月末计算的材料成本差异率分配和结转材料成本差异,则当月生产车间领用材料应负担的材料成本差异为()元。

中级财务会计期中

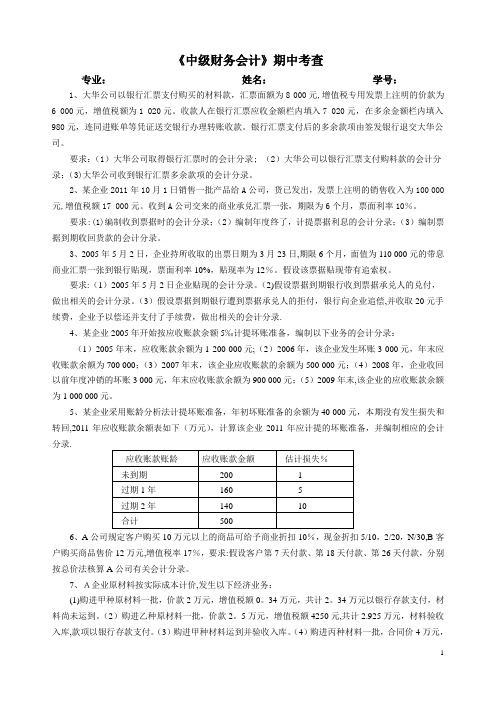

《中级财务会计》期中考查专业:姓名:学号:1、大华公司以银行汇票支付购买的材料款,汇票面额为8 000元,增值税专用发票上注明的价款为6 000元,增值税额为1 020元。

收款人在银行汇票应收金额栏内填入7 020元,在多余金额栏内填入980元,连同进账单等凭证送交银行办理转账收款。

银行汇票支付后的多余款项由签发银行退交大华公司。

要求:(1)大华公司取得银行汇票时的会计分录; (2)大华公司以银行汇票支付购料款的会计分录;(3)大华公司收到银行汇票多余款项的会计分录。

2、某企业2011年10月1日销售一批产品给A公司,货已发出,发票上注明的销售收入为100 000元,增值税额17 000元。

收到A公司交来的商业承兑汇票一张,期限为6个月,票面利率10%。

要求:(1)编制收到票据时的会计分录;(2)编制年度终了,计提票据利息的会计分录;(3)编制票据到期收回货款的会计分录。

3、2005年5月2日,企业持所收取的出票日期为3月23日,期限6个月,面值为110 000元的带息商业汇票一张到银行贴现,票面利率10%,贴现率为12%。

假设该票据贴现带有追索权。

要求:(1)2005年5月2日企业贴现的会计分录。

(2)假设票据到期银行收到票据承兑人的兑付,做出相关的会计分录。

(3)假设票据到期银行遭到票据承兑人的拒付,银行向企业追偿,并收取20元手续费,企业予以偿还并支付了手续费,做出相关的会计分录.4、某企业2005年开始按应收账款余额5‰计提坏账准备,编制以下业务的会计分录:(1)2005年末,应收账款余额为1 200 000元;(2)2006年,该企业发生坏账3 000元,年末应收账款余额为700 000;(3)2007年末,该企业应收账款的余额为500 000元;(4)2008年,企业收回以前年度冲销的坏账3 000元,年末应收账款余额为900 000元;(5)2009年末,该企业的应收账款余额为1 000 000元。

秋学期财会专业《中级财务会计》期中考试试卷

2015年秋学期财会专业《中级财务会计(2)》期中考试试卷命题人:时间:90分钟分值:100分一、单项选择题(每题2分)1.我国财务报告的主要目标是( )。

A.向财务报告使用者提供决策有用的信息B.向财务报告使用者建议投资的方向C.向财务报告使用者明示企业风险程度D.向财务报告使用者建议提高报酬的途径2.会计信息要有用,就必须满足一定的质量要求。

比如,企业应当以实际发生的交易或者事项为依据进行确认、计量和报告,体现的会计信息质量要求是( )。

A.可靠性B.相关性C.可比性D.重要性3.下列项目中,属于利得的是( )。

A.销售商品流入经济利益B.投资者投入资本C.出租建筑物流入经济利益D.出售固定资产流入经济利益4.资产和负债按照在公平交易中,熟悉情况的交易双方自愿进行资产交换或者债务清偿的金额计量,所指的计量属性是( )。

A.历史成本B.可变现净值C.现值D.公允价值5.在会计计量中,一般采用的会计计量属性是( )。

A.历史成本B.重置成本C.公允价值D.现值6.下列项目中,属于反映企业财务状况的会计要素是( )。

A.资产B.收入C.费用D.利润7.下列各项业务中,能使企业资产和所有者权益总额同时增加的是( )。

A.分派股票股利B.提取盈余公积C.资本公积转增资本D.交易性金融资产公允价值增加8.下列各项业务中,将使企业负债总额减少的是( )。

A.计提应付债券利息B.将债务转为资本C.融资租入固定资产D.发行股票9.下列业务中,体现重要性质量要求的是( )。

A.融资租入固定资产视同自有固定资产入账B.对未决仲裁确认预计负债C.对售后回购不确认收入D.对低值易耗品采取一次摊销法10.下列项目中,属于费用的是( )。

A.对外捐赠支出B.企业开办费C.债务重组损失D.出售无形资产损失二:名词解释(每题4分)1:长期负债2:短期薪酬3:消费税四:简答(每题6分)1:应税货物视同销售有哪些?2:职工薪酬包括的内容有哪些?3:写出长期借款利息的分录三:业务题(8分、6分、6分、6分、6分、6分、12分)1:合安公司03年7月1日为投资固定资产借款1000万元,年利率为3.6%,借款期限为2年半,合同规定每年年底归还借款利息,借款期满一次性偿还本金.款项借入后当即用于综合楼建造。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

091学期《中级财务会计》期中考试试卷考试时间:3.5小时Question One (13 points)Listed below are several information characteristics and accounting principles and assumptions. Match the letter of each with the appropriate phrase that states its application. (Items a through k may be used more than once or not at all.)a. Economic entity assumption g. Matching principleb. Going concern assumption h. Full disclosure principlec. Monetary unit assumption i. Relevance characteristicd. Periodicity assumption j. Reliability characteristice. Historical cost principle k. Consistency characteristicf. Revenue recognition principle___ 1. Stable-dollar assumption (do not use historical cost principle).___ 2. Earning process completed and realized or realizable.___ 3. Presentation of error-free information with representational faithfulness.___ 4. Yearly financial reports.___ 5. Accruals and deferrals in adjusting and closing process. (Do not use going concern.)___ 6. Useful standard measuring unit for business transactions.___ 7. Notes as part of necessary information to a fair presentation.___ 8. Affairs of the business distinguished from those of its owners.___ 9. Business enterprise assumed to have a long life.___ 10. Valuing assets at amounts originally paid for them.___ 11. Application of the same accounting principles as in the preceding year.___ 12. Summarizing significant accounting policies.___ 13. Presentation of timely information with predictive and feedback value.Question Two (6 points)The trial balance before adjustment of Pratt Company reports the following balances:Dr. Cr.Accounts receivable $100,000Allowance for doubtful accounts $ 2,500Sales (all on credit) 750,000Sales returns and allowances 40,000Required:(a) Prepare the entries for estimated bad debts assuming that doubtful accounts areestimated to be (1) 6% of gross accounts receivable and (2) 1% of net sales.(b) Assume that all the information above is the same, except that the Allowance for DoubtfulAccounts has a debit balance of $2,500 instead of a credit balance. Prepare the journal entry to record the bad debt expense?Question Three (9 points)The following trial balance was taken from the books of Fisk Corporation on December 31, 2007.Account Debit Credit Cash $ 12,000 Accounts Receivable 40,000Note Receivable 7,000Allowance for Doubtful Accounts $ 1,800 Merchandise Inventory 44,000Prepaid Insurance 4,800Furniture and Equipment 125,000Accumulated Depreciation--F. & E. 15,000 Accounts Payable 10,800 Common Stock 44,000 Retained Earnings 55,000 Sales 280,000Cost of Goods Sold 111,000Salaries Expense 50,000Rent Expense 12,800Totals $406,600 $406,600At year end, the following items have not yet been recorded.a. Insurance expired during the year, $2,000.b. Estimated bad debts, 1% of gross sales.c. Depreciation on furniture and equipment, 10% per year.d. Interest at 6% is receivable on the note for one full year.e. Rent paid in advance at December 1, $6,000 for half a yearf. Accrued salaries at December 31, $5,800.Required:(a) Prepare the necessary adjusting entries.(b) Prepare the necessary closing entries.Question Four (6 points)On May 1, Carter, Inc. factored $800,000 of accounts receivable with Rapid Finance on a without recourse basis. Under the arrangement, Carter was to handle disputes concerning service, and Rapid Finance was to make the collections, handle the sales discounts, and absorb the credit losses. Rapid Finance assessed a finance charge of 6% of the totalaccounts receivable factored and retained an amount equal to 2% of the total receivables to cover sales discounts.Required:(a) Prepare the journal entry required on Carter 's books on May 1.(b) Prepare the journal entry required on Rapid Finance’s books on May 1.(c) Assume Carter factors the $800,000 of accounts receivable with Rapid Finance on a withrecourse basis instead. The recourse provision has a fair value of $14,000. Prepare the journal entry required on Carter’s books on May 1.Question Five (6 points)Dent Company manufactures one product. On December 31, 2005, Dent adopted thedollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO inventory method was $180,000. Inventory data are as follows:Inventory at Price indexYear year-end prices (base year 2005)2006 $252,000 1.052007 368,000 1.152008 387,500 1.25InstructionsCompute the inventory at December 31, 2006, 2007, and 2008, using the dollar-value LIFO method for each year.Question Six (9 points)On January 1, a store had inventory of $48,000. January purchases were $46,000 and January sales were $90,000. On February 1 a fire destroyed most of the inventory. The rate of gross profit was 25% of cost. Merchandise with a selling price of $5,000 remained undamaged after the fire. Compute the amount of the fire loss, assuming the store had no insurance coverage. Label all figures.Question Seven (5 points)Accounts receivable in the amount of $250,000 were assigned to the Fast Finance Company by Nance, Inc., as security for a loan of $200,000. The finance company charged a 4% commission on the face amount of the loan, and the note bears interest at 9% per year. During the first month, Nance collected $130,000 on assigned accounts. This amount was remitted to the finance company along with one month's interest on the note.Required:Make all the entries for Nance Inc. associated with the transfer of the accounts receivable and the remittance to the finance company.Question Eight (6 points)A machine which cost $200,000 is acquired on October 1, 2006. Its estimated salvage value is $20,000 and its expected life is eight years.Required:Calculate depreciation expense for 2006 and 2007 by each of the following methods, showing the figures used.(a) Double-declining balance(b) Sum-of-the-years'-digitsQuestion Nine (8 points)Ferry Corporation follows a policy of a 10% depreciation charge per year on all machinery and a 5% depreciation charge per year on buildings. The following transactions occurred in 2007:March 31, 2007—Negotiations which began in 2006 were completed and a warehouse purchased 1/1/98 (depreciation has been properly charged throughDecember 31, 2006) at a cost of $3,200,000 with a fair market value of$2,000,000 was exchanged for a second warehouse which also had a fairmarket value of $2,000,000. The exchange had no commercial substance.Both parcels of land on which the warehouses were located were equal invalue, and had a fair value equal to book value.June 30, 2007— Machinery with a cost of $240,000 and accumulated depreciation through January 1 of $180,000 was exchanged with $150,000 cash for a parcel ofland with a fair market value of $230,000.Required:Prepare all appropriate journal entries for Ferry Corporation for the above dates.Question Ten (7 points)On March 1, Gatt Co. began construction of a small building. The following expenditures were incurred for construction:March 1 $ 75,000 April 1 $ 74,000May 1 180,000 June 1 270,000July 1 100,000The building was completed and occupied on July 1. To help pay for construction $50,000 was borrowed on March 1 on a 12%, three-year note payable. The only other debt outstanding during the year was a $500,000, 10% note issued two years ago.Required:(a) Calculate the weighted-average accumulated expenditures.(b) Calculate avoidable interest.Question Eleven (5 points)The management of Yastrzemski Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $1,200,000 with depreciation to date of $300,000 as of December 31, 2007. On December 31, 2007, management projected its future net cash flows from this equipment to be $700,000 and its fair value to be $600,000. The company intends to use this equipment in the future.Required:(a) Prepare the journal entry (if any) to record the impairment at December 31, 2007.(b) Where should the gain or loss (if any) on the write-down be reported in the income statement?(c) At December 31, 2008, the equipment’s fair value increased to $700,000. Prepare the journal entry (if any) to record this increase in fair value.Question Twelve (8 points)Buhner Company constructed a building at a cost of $3,000,000 and occupied it beginning in January 1988. It was estimated at that time that its life would be 40 years, with no salvage value.In January 2008, a new roof was installed at a cost of $500,000, and it was estimated then that the building would have a useful life of 25 years from that date. The cost of the old roof was $200,000.Required:(a) What amount of depreciation should have been charged annually from the years 1988 to2007?(Assume straight-line depreciation.)(b) What entry should be made in 2008 to record the replacement of the roof?(c) Prepare the entry in January 2008, to record the revision in the estimated life of thebuilding, ifnecessary.(d) What amount of depreciation should be charged for the year 2008?Question Thirteen (7 points)At 12/31/06, the end of Feeney Company's first year of business, inventory was $4,100 and $2,800 at cost and at market, respectively.Following is data relative to the 12/31/07 inventory of Feeney:Original Net Net Realizable AppropriateCost Replacement Realizable Value Less InventoryItem Per Unit Cost Value Normal Profit ValueA $ .65 $ .45B .45 .40C .70 .75D .75 .65E .90 .85Selling price is $1.00/unit for all items. Disposal costs amount to 10% of selling price and a "normal" profit is 30% of selling price. There are 1,000 units of each item in the 12/31/07 inventory.Required:(a) Prepare the entry at 12/31/06 necessary to implement the lower-of-cost-or-marketprocedure assuming Feeney uses a contra account for its balance sheet.(b) Complete the last three columns in the 12/31/07 schedule above based upon thelower-of-cost-or-market rules.(c) Prepare the entry(ies) necessary at 12/31/07 based on the data above.Question Fourteen (8 points)On December 31, 2007, Brown Company finished consultation services and accepted in exchange a promissory note with a face value of $400,000, a due date of December 31, 2010, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%. The following interest factors are provided:Interest Rate Table Factors For Three Periods 5% 10%Future Value of 1 1.15763 1.33100Present Value of 1 .86384 .75132Future Value of Ordinary Annuity of 1 3.15250 3.31000Present Value of Ordinary Annuity of 1 2.72325 2.48685 Required:(a) Determine the present value of the note.(b) Prepare a Schedule of Note Discount Amortization for Brown Company under theeffective interest method. (Round to whole dollars.) (Use the format below)Schedule of Note Discount AmortizationCash Effective Unamortized PresentInterest Interest Discount Discount Value Date (5%) (10%) Amortized Balance of Note12/31/0712/31/0812/31/0912/31/10(c) Prepare the entry for the interest receipt as of Dec. 31, 2008.。