中小企业板医药生物行业上市公司融资结构分析

我国医药行业上市公司资本结构分析

我国医药行业上市公司资本结构分析我国医药行业是国家经济发展的重要组成部分,服务于全国和世界各地的经济和健康发展。

随着经济的发展,整个行业已进入新的发展阶段,在这个阶段,公司的资本结构显得越来越重要。

目前,我国上市公司的资本结构仍然存在许多问题,因此,对这些公司的资本结构进行分析和改善是必要的。

首先,要明确我国医药行业上市公司资本结构的特点。

首先,这些公司多属于大企业,其资本结构多以股票投资为主。

其次,这些公司中有许多与计算机、信息技术、生物技术等领域有着密切联系的企业,这一项也成为了资本结构过程中不可忽视的投资方式。

尽管如此,我国医药行业上市公司的资本结构依然存在着许多问题。

第一,它们的资金结构过于集中,大部分的资金和资本都集中在民营企业,这使得民营企业受到了非常重要的影响,给行业发展带来了负面影响。

另一方面,由于公司资源分配不公,焦点医药企业往往比其他企业获得更多的资金和资源,这种不公平的现象也影响了企业的激励机制及经营秩序。

最后,这些上市公司的资本结构极其复杂,投资者把各种资本和资源都投入其中,而无法将资源有效地分配到各个部门,导致融资效率低下。

为了解决这些问题,我国医药行业上市公司应该采取一些改革措施。

首先,应加大对民营企业的支持,采取一定政策手段,进一步支持民营企业发展,帮助其在资本结构中发挥更大的作用。

其次,调整资源分配,让每一个企业都能获得足够的资金和资源,有效促进企业发展和经营。

最后,加强投资管理,完善融资渠道,引入更多的投资机构,完善资本结构,提高融资效率。

经过上述分析,我们可以看出,促进我国医药行业上市公司资本结构改善,实现行业发展必须全面深化改革,引入更多投资,调整资源分配、重新调整资本结构、加强投资管理,有效提高融资效率,实现行业发展和财富共享。

只有这样,我国医药行业才能在全面发展的新赛道上行驶,实现医药行业的创新和发展。

医药行业上市公司资本结构现状分析及建议

医药行业上市公司资本结构现状分析及建议医药行业是一个具有高投入、高风险、高回报的行业,因此资本结构对医药企业的发展至关重要。

本文将对医药行业上市公司的资本结构现状进行分析,并提出相应的建议。

一、资本结构现状分析1.资本结构构成:医药行业上市公司的资本结构主要由股本、债务和利润留存所组成。

股本是公司的基础,代表了投资者对公司的所有权。

债务是通过借贷获得的资金,主要通过发行债券等方式获取。

利润留存是由公司经营所产生的利润,用于再投资或分配给股东。

2.股本结构特点:医药行业上市公司的股本结构相对较为稳定,少数股东控制了公司的大部分股权。

这可能导致公司的决策权受到相对较少人的影响,降低了公司的经营灵活性。

3.债务结构特点:医药行业上市公司的债务结构相对较高,主要是由于医药行业的研发投入较大,需要大量的资金进行研发和生产。

另外,医药行业也较多采取兼并收购等方式进行扩张,需要大量的资本支持。

4.利润留存结构特点:医药行业上市公司的利润留存率相对较高,这反映了行业的盈利能力较强。

同时,医药行业的研发投入较大,公司需要将一部分利润用于研发和创新,以保持竞争力。

二、资本结构存在的问题1.财务风险:医药行业上市公司的债务结构较高,可能使公司面临较高的财务风险。

特别是在市场竞争加剧、产品上市速度较慢时,债务的偿还压力可能增加。

2.利润留存过高:医药行业上市公司的利润留存率较高,这可能限制了公司资本的流动性,导致公司资源不能更好地配置和利用。

3.股权集中现象:部分医药行业上市公司股权集中,少数股东控制了公司的股权,可能导致公司决策权受到局限。

三、资本结构优化建议1.加强财务管理:医药行业上市公司需要加强财务管理,合理控制债务比例和利润留存比例,确保公司财务的稳定和可持续发展。

可以考虑通过多元化融资渠道,如银行贷款、发行债券等方式获取资金。

2.增加股本流通性:医药行业上市公司可以考虑通过增发股票、引入战略投资者等方式增加股本流通性,降低股权集中度,提高公司的治理结构和决策效率。

中国医药细分行业融资情况

中国医药细分行业融资情况

近年来,随着人们健康意识的提高和国家对医疗卫生事业的重视,中国医药行业持续蓬勃发展。

而在这一行业中,各细分领域的融资情况尤为引人关注。

首先,生物医药领域成为投资者关注的焦点。

由于生物技术的突破和人们对个性化医疗的需求,生物医药领域的融资额持续走高。

众多初创企业通过融资获得研发资金,推动了一系列创新药物的研发。

同时,大型制药企业也纷纷加大在生物医药领域的投资,以寻求新的增长点。

其次,医疗器械领域同样表现不俗。

随着技术的进步,医疗器械的研发逐渐向高端、智能化方向发展。

投资者对这一领域表现出浓厚的兴趣,为众多医疗器械企业的研发和创新提供了资金支持。

此外,医疗信息化和数字化医疗也成为融资热点。

在信息化时代,医疗数据的价值逐渐被发掘,医疗信息化企业获得大量投资以推动医疗服务的数字化转型。

而数字化医疗的兴起,不仅方便了患者就医,也为企业提供了新的商业模式和融资机会。

值得注意的是,尽管医药细分行业融资情况总体向好,但也存在一些问题和挑战。

例如,部分领域竞争激烈,导致企业盈利难度增大;政策风险也对行业融资产生影响。

因此,投资者在决策时需综合考虑各方面因素,理性分析行业发展趋势。

综上所述,中国医药细分行业的融资情况呈现出多元化、活跃的特点。

各领域的企业在获得资金支持的同时,也面临着不同的挑战和机遇。

未来,随着技术的进步和市场的变化,医药行业的融资趋势仍将保持活跃态势。

医药生物行业中小板上市公司融资结构研究

医药生物行业中小板上市公司融资结构研究医药生物行业是一个具有高风险高回报特点的行业,其发展需要大量的资金投入。

为了满足公司的运营和发展需求,很多医药生物企业选择通过在中小板上市来融资。

中小板上市公司的融资结构主要包括股权融资和债权融资两种方式。

股权融资是指公司通过发行股票向投资者募集资金的方式。

在医药生物行业,大部分上市公司通过发行股票来融资。

股权融资的主要优势是可以提供持续的资金支持,公司可以通过增发股票的方式进行再融资,满足不同阶段的资金需求。

股权融资还可以提高公司的知名度和声誉,增加公司的市值,为公司的未来发展奠定基础。

债权融资是指公司通过发行债券或者借款的方式来融资。

债权融资的特点是有固定的借款期限和利率,公司需要按时偿还本金和利息。

在医药生物行业,债权融资往往被用于满足特定项目或者设备的资金需求。

相比于股权融资,债权融资的风险相对较低,但是公司需要承担固定的偿还压力。

除了股权融资和债权融资,医药生物上市公司还可以通过并购和境外融资等方式来获取资金。

并购是指公司通过收购其他公司的方式来扩大规模和资源。

医药生物行业的并购活动频繁,通过并购可以快速获得技术和产品优势。

境外融资是指公司通过在海外市场上市或者发行债券来融资。

境外融资可以获得更多的投资者和更大的资本市场。

医药生物行业中小板上市公司的融资结构也存在一些问题。

由于医药生物行业的风险较高,投资者对于上市公司的风险偏好较低,导致股票价格波动较大,公司融资能力受到限制。

由于医药生物行业的特殊性,公司融资往往需要满足一定的技术和产品要求,这对于一些刚刚起步的小型企业来说是一大挑战。

医药生物行业的政策和法规较为复杂,对公司融资形成一定的限制。

医药生物行业中小板上市公司的融资结构主要包括股权融资和债权融资,也可以通过并购和境外融资等方式来获取资金。

尽管面临一些问题,但是中小板上市公司的融资结构对于医药生物企业的发展起到了积极的推动作用。

我国医药行业上市公司资本结构分析

通过选取在上海和深圳证券交易所挂牌上市的 10 家具有代表性的医药企业 2003 年—2005 年的财 务报表作为研究样本, 运用比率分析法来研究我国 医药行业上市公司的资本结构及其相互间资本结构 的比较分析。其中指标选择为: 资产负债率, 该指 标反映企业总资产中由债权人提供资金的比重, 也 说明债权人利益的保障程度; 资产流动性, 用流动 比率来表示[3], 如表 1 所示。 2.2 资本结构分析

国经济评论,2002(2):76- 77. [3] 芦相君. 东北老工业基地企业集团资本结构分析 [J]. 集团

经济研究,2005(9):30- 31. [4] 沈静宇. 我国农业类上市公司资本结构分析 [J]. 社会科学

版:沈阳农业大学学报,2006,8(1):26- 29. [5] 李巧莎. 对中国上市公司的资本结构分析 [J]. 金融教学与

程中均比较谨慎, 不轻易借债进行借债投资。其中 保证有充足的资金投入, 应对企业资本构成的发展

有一半的公司资产负债率比较高, 沉重的债务利息 方向进行全局性、长期性和创造性的谋划。对资本

负担既降低了公司所有者的收益, 也增大了企业的 结构的战略化管理可以帮助公司制定长远的发展战

财务风险。

略, 支持公司的良性运行及稳定发展[5]。

过高, 表示企业流动资金呆滞, 影响资金利用效 股东财富最大化的财务管理目标。

果; 如果比率过低, 表示企业偿债能力较弱, 是财 务状 况 不 良 的 信 号[4]。 从 年 报 统 计 数 据 来 看 , 流 动 比率平均值为 1.495, 与公认值 接 近 , 说 明 医 药 行 业上市公司整体具有较强的短期偿债能力。 3 结论及建议

我国中小企业上市公司股权融资结构分析

我国中小企业上市公司股权融资结构分析摘要中小业是市场经济中重要的一部分,中小企业发展活跃,在国民经济中正扮演越来越重要的作用,并且逐渐形成新的经济增长点,中小企业为国民经济发展所作的贡献是不容忽视的,其在解决社会就业问题,推动技术创新等方面所做的贡献是巨大的。

但是中小企业由于自身原因、制度问题的制约,融资困难仍然是中小企业发展壮大的最大瓶颈。

中小企业融资困难主要表现为由于自身规模较小留存收益无法满足企业庞大的资金需求,企业的信誉、信贷等级不高,银行等金融机构放款门槛较高,中小企很难获得银行的借款。

此外,投资者对中小企业信心不足不会将资金投在自己不看好的企业,所以企业也难直接吸收投资者的资金。

但是中小企业上市公司作为上市公司它又存在着比未上市的中小企业更优的融资方式,可以通过股权融资方式来筹集资金。

如今我国的上市公司都存在着强烈的股权融资偏好,中小企业上市公司作为上市公司也不例外。

所以分析中小企业上市公司股权融资结构是一个非常有意义的课题,完善股权融资结构为企业创建合适的融资结构,筹集更多的资金,为企业强大的资金需求做好保障。

本文试图从股权融资结构来阐述股权融资对中小企业上市公司融资的影响以及对股权融资结构提出可行的对策及建议。

关键词中小企业股权融资融资结构解决对策AbstractSmall and medium industry is an important part of the market economy, the development of small and medium-sized enterprises active,is playing more and more important role in the national economy,and gradually form new economic point of growth,the small and medium-sized enterprises for the development of national economy contribution can not be ignored,in solving social employment,the promotion technical innovation is a great contribution to the.But the small and medium-sized enterprise due to the restriction of their own reasons,institutional issues,the financing difficulty is still the biggest bottleneck in the development of small and medium sized enterprises.The financing difficulty of small and medium-sized enterprises is mainly due to their small scale enterprise retained earnings can not meet the huge demand for funds,credit,credit rating of enterprises is not high,banks and other financial institutions lending threshold higher,small and medium enterprises difficult to obtain bank loans.In addition to small and medium-sized enterprises, investors lack of confidence will not invest in themselves are not optimistic about the enterprise,so the enterprise is difficult to directly absorb the investors.But the small and medium-sized enterprise listing Corporation as a listing Corporation,it has better than not listed on the financing of small and medium enterprises,to raise funds through equity financing.Now China's listing Corporation have a strong preference for equity financing,SME listing Corporation as a listing Corporation is no exception.So the analysis of small and medium enterprises listing Corporation equity financing structure is a very meaningful topic,perfect equity financing structure to create a suitable for the enterprise financing structure,raise more money,do a good job security for the enterprise strong demand for funds.This thesis triesto elaborate the equity financing for small and medium-sized enterprises listing Corporation financing and countermeasures and suggestions are put forward to structure feasible equity financing from equity financing structure.Keywords:Small and medium sized enterprises Equity financing The financing structure Countermeasures中小企业上市公司融资现状分析正文所谓股权融资就是企业股东让出企业的一部分控制权,增加新股东引进资金的融资方式。

企业资本结构论文:生物医药业上市公司资本结构问题研究

企业资本结构论文:生物医药业上市公司资本结构问题研究[摘要] 本文以2007-2009年生物医药业上市公司为样本,分析其资本结构特征,并提出相应的优化措施。

[关键词] 生物医药业;上市公司;资本结构生物医药业是关系国计民生,关系千家万户健康幸福的重要产业。

生物医药业上市公司虽然占全部上市公司的比重不大,但它却拥有我国生物医药业最先进的技术和人才资源。

生物医药业上市公司能否健康发展对我国整个生物医药业的发展起到至关重要的作用。

根据生物医药业生产经营特点及制药企业经营内容的不同,本文界定的生物医药业上市公司是指以商品性医药制品生产为主的,并在中国境内证券交易所挂牌交易的上市公司。

目前正处于生物医药技术大规模产业化的开始阶段,预计2020 年后将进入快速发展期,并逐步成为世界经济的主导产业之一。

由于中国经济持续快速发展以及老龄化社会的进一步加剧,生物医药行业在中国也进入了其发展的黄金时期。

作为资金和技术双密集型企业,融资问题无疑是企业发展的首要问题。

由于受我国资本市场发展滞后的影响,生物医药业上市公司资金来源较为单一,自有资金不足,直接融资能力差,制约了企业的发展。

随着中国加入WTO,外国资本的进入,医药制造行业内的竞争将进一步加剧,在企业内部如何建立一个低成本的融资渠道,如何形成安全可靠的资本结构,将会成为医药制造企业生存和发展的关键因素。

1 资本结构特征分析按照资本结构理论,由于负债的节税效应,适度的负债对于降低企业资本成本具有财务杠杆效应,并且从理论上讲,以股东财富最大化为目标的上市公司,在筹资决策上必然追求达到最优资本结构,实现企业价值最大化。

基于以上理由,本文以从沪深两市选取的74家生物医药业上市公司为对象,分析其资本结构特征以及是否充分利用负债的节税效应。

1.1资产负债率相对较低根据财务理论和企业财务管理的实践经验,适度增加负债能使公司获得所得税抵减和杠杆利益,从而比无债或低债的公司有着更高的市场价值。

医药生物行业中小板上市公司融资结构研究

金融

Байду номын сангаас

医药生物行业中小板上市公司融资结构研究

姻 周玥

(辽宁师范大学海华学院管理系,辽宁 沈阳 141013)

【摘 要】医药生物行业作为高新技术行业,医药生物公司对于 资金的需求是显而易见的。所以在中小板上市的公司中,有很 多都是医药生物行业的中小公司。这些公司都带有大量的独立 知识产权,但是却缺乏大量的资金用于产品设计与研发。所以 中小板无疑给这些中小医药生物公司提供了必要的融资渠道。 不过从中小板上市公司的融资结构来看,大部分中小板上市的 医药生物公司的融资结构都存在明显的偏好,这会给这些公司 带来不可预估的隐患。所以本文探讨了医药生物行业中小板上

(一)内源融资比例偏低 通过对智研咨询的调查数据进行分析可以发现,医药生物 行业中小板上市公司的融资结构中,内源融资的比例要远低于 外源融资。以康弘药业的郎沐新药的研制来讲,虽然相较于国 外的此类产品,郎沐 的效果更卓越,而且价格也更低。但研发过程也着实不易。 据了解,从申报开始,研发投入 10 年时间,投资金额 6-7 个亿。 可见,医药生物公司想要持续进行研发,依托于内源融资进行发 展的难度极大。对于医药生物行业的公司来讲,内源融资主要 来源于留存收益,其能够占到公司内源融资的 80%左右。当然, 这与医药生物行业本身的特性有着一定的联系。因为医药生物 行业的产品大多都具有研发周期长,投资见效慢等特点,所以医 药生物行业的公司想要通过自身的产品收益来达到资金流转的 目的是较为困难的。尤其是在中小板上市的中小公司大多都处 于发展的成长期,在很多地方都需要依托大量的资金来进行完 善,所以内源融资的可能性自然也就相对较低。

市公司的融资结构,希望给相关企业提供必要的参考和借鉴。 【关键词】医药生物行业;中小板;上市公司;融资结构

我国生物制药上市公司融资结构的特征分析

( 湖南文理学院, 湖南 常德 >$?""" ) 摘@ 要:在最近的 !" 多年里, 生物制药发展十分迅猛, 给投资者带来了丰厚的回报, 在制药领域占有越来越重要 的地位。我国生物制药上市公司存在着融资结构资产负债率总体水平偏低、 股权融资偏好的特点。其融资顺序为: 股 权融资、 商业银行信用、 商业信用融资、 留存收益和财政性融资。 关键词:生物制药; 融资; 融资结构 中图分类号: AB%"; C@ @ 文献标识码: 6@ @ 文章编号: $D#! E D$?> ( !""# ) "$ E "$"B E "%

!""# 年 $ 月 第 %! 卷第 $ 期

!

湖 南 文 理 学 院 学 报( 社 会 科 学 版 ) &’()*+, ’- .(*+* /*012)3045 ’- 6)43 +*7 8902*92 ( 8’90+, 8902*92 :7040’*)

&+*; !""# <’,; %! =’; $

我国生物制药上市公司融资结构的特征分析

[,] 发行股票上市, 实现了风险资本的退出 , 由此企业可以大量

利用资本市场融通资金。由表 ! 数据计算得出, 生物制药上 市公司的平均资产负债率较低, 低于全国上市公司 /#2 的平 均负债率。这说明上市公司在融资决策中对债务融资采取持 中偏低的策略, 且均在一定程度上利用了财务杠杆。 表 ,6 我国生物制药上市公司债券融资统计 年度 公司数 平均值 ( 万元) !--. !--, , !--! , !--# , !--. ,

!--3 年第 , 期6 6 6 6 6 6 刘刚毅6 我国生物制药上市公司融资结构的特征分析6 6 6 6 6 6 6 6 6 6 了分析的范围。 尽管使用市场价值来分析公司的资本结构更能体现公司价 值, 但是由于我国股市中 ! " # 的股份为非流通股, 无法计算其市 场价值, 因此, 本文仍采用账面价值计算上市公司的各种融资比 率, 所使用的财务数据均来源于上市公司年报。按照企业总资产 来源把企业的融资方式分为: 商业信用融资率 ( $%)& (应付账款 ’ 应付票据 ’ 预收账款 ’ 应付债券) " 总资产; 银行信用融资率 ( (%)& (短期借款 ’ 长期借款) " 总资产; 留存收益融资率 ( )%) & (盈余公积 ’ 未分配利润) " 总资产; 股权融资率 ( *%)& (股本 + 国家股 ’ 资本公积) " 总资产; 财政融资率 ( %%)& (应交税金 ’ 递延税款贷项 ’ 国家股) " 总资产。 上市公司权益和债务融资主要有股票融资、 债券融资和银行 贷款。从表 , 可以看出, 我国生物制药上市公司在 !--- + !--. 年 的 / 年间, 总共只有 0 家公司发行过债券, 且金额较小, 发行的品 种单一, 主要是普通企业债券和可转换公司债券。可转换公司债 券在一定条件下可转换为企业股票, 因而从某种意义上说, 发行 可转换债券是另一种形式的股票融资。从表 ! 计算可知, / 年中 我国生物制药上市公司股权融资率在所有的融资方式中占 ..1 0!2 , 银行信用融资占 !#1 332 , 其他融资方式占 ,!1 4,2 , 商业 信用占 ,-1 !52 , 留存收益占 51 3/2 , 财政融资率占 ,1 .02 。

中小企业板医药生物行业上市公司融资结构分析

中小企业板医药生物行业上市公司融资结构分析目录一、中小板医药生物行业上市公司融资结构特征 (3)二、中小板医药生物行业上市公司融资结构原因分析 (6)三、优化中小板生物医药行业上市公司融资结构的建议。

(9)【摘要】2004年5月,经国务院批准,中国证监会批复同意深圳证券交易所在主板市场内设立中小企业板块。

自成立以来,中小板发展迅速,截止至2011年6月,中小板已有588家,总市值和流通市值分别为3,692,430(百万元)和1,747,250(百万元)。

由此可见,我国作为中小板服务对象的中小企业在融资活动中直接融资所占比重在迅速上升,企业资本的形成和扩张已经越来越依赖于资本市场特别是证券市场。

中小企业板上市公司是一种在规模上介于一般中小企业和主板上市公司之间的一类公司,规模上的差异决定了其融资和一般中小企业及主板上市公司必然有差异,本文着眼于中小企业板上市公司的融资结构,并以中小企业板中的医药生物行业为例,对该行业上市公司2010年年报数据为样本进行研究。

截止至2011年6月,中小企业板医药生物行业共有30家上市公司,其中两家为2011年上市,没有2010年年报数据,因此,剔除这两家上市公司,研究其余28家上市公司2010年年报数据,同时与深圳证券交易所A股主板医药生物行业39家上市公司2010年年报数据作对比,分析其融资结构,发现中小板生物医药行业上市公司融资结构具有“股权融资比例高,存在较强的股权融资偏好”“债权融资比例较低,融资结构失衡”“内源融资比例基本相同”的特征。

从融资结构出发,本文从资本市场等多方面分析形成该融资结构的原因,并提出优化建议。

【关键词】融资结构中小企业板股权融资债券市场【Abstract】In May,2004,after approving by State Department, China Securities Regulatory Commission replied and agreed to Shenzhen Stock Exchange’s setting SME Board in Main Board Market. Since its inception, the SME Board has developed quickly. By June,2010, SME Board has been haven 558 listed companies, and its total market value is 3,692,430 million Yuan, also the circulation market value is 1,747,250 million Yuan. This shows that the SMEs, which the SME Board severs, has raise its ratio of direct financing dramatically in financing activities, meanwhile, the formation and expansion of enterprise capital is becoming more and more relying on Capital Market, especially Stock Market. The listed companies of SME Board is companies of which the scale is between unlisted SME and listed companies of Main Board Market, which determines that SME’sfinancing differs from the others. This paper concerns about the financing structure of SME, and sets Biopharmaceutical industry of SME Board as an example, discusses its listed companies’s 2010 annual report. By June,2010, the Biopharmaceutical industry of SME Board has been haven 30 listed companies, 2 of which was listed in January and March,2010, without 2010 annual report. Therefore, delete these 2 listed companies, study the other 28 ones, and compare with 39 2010 annual report of the Biopharmaceutical industry’s listed companies, which from the Shenzhen Stock Exchange’s A-share Main Board Market, discuss its financing structure, finding that the Biopharmaceutical industry of SME Board has the following features: the ration of equity financing is high, showing strong preference for equity financing; the ration of debt financing is low and the financing structure is imbalance; the ration of internal financing is similiarn to Main Board Market ones. From financing structure, this paper discusses the reason of the financing structure’s formation from different aspects, like capital market, and gives several advices to optimize the structure.[Key Words] Financing Structure, SME Board, Equity Financing, Bond Market一、中小板医药生物行业上市公司融资结构特征参考国内学界研究融资结构通常采用的方法,本文对相关指标的统计口径作出以下界定。

医药生物行业中小板上市公司融资结构研究

医药生物行业中小板上市公司融资结构研究近年来,医药生物行业发展迅猛,越来越多的中小板上市公司开始涉足这一领域。

随着行业的发展,医药生物公司也面临着日益增长的资金需求。

对于这些中小板上市公司的融资结构进行研究,对于了解公司的发展和运营情况具有重要意义。

从整体来看,医药生物行业中小板上市公司的融资结构主要包括股权融资和债权融资两大部分。

股权融资是指企业通过发行股票来融资,包括公开发行股票和定向发行股票。

债权融资是指企业通过债券、贷款等形式筹集资金。

在医药生物行业,由于其具有较高的研发成本和周期,股权融资相对较多,债权融资相对较少。

具体来看,股权融资是医药生物行业中小板上市公司融资结构的重要组成部分。

这主要是因为医药生物行业的公司在产品研发和临床试验等方面需要大量资金支持,而股权融资能够为公司提供更为丰富的资金来源。

股权融资还能够为公司引入战略投资者,提高公司的知名度和市场影响力。

而在债权融资方面,由于医药生物行业的公司通常具有较大的风险和不确定性,债权融资相对较少。

但随着公司的发展和成熟,一些大型医药生物公司会逐渐引入债权融资,以多元化资金来源,降低公司的融资成本。

1. 需要大量资金支持:医药生物行业的研发成本高昂,而临床试验、注册申报等环节也需要大量的资金支持。

中小板上市公司在融资结构上更倾向于采取股权融资,以满足资金需求。

2. 产品研发周期长:医药生物行业的产品研发周期普遍较长,而且风险也较大。

在融资结构上,这些公司需要考虑资金来源的稳定性和长期性,更倾向于选择股权融资。

3. 风险偏好较大:作为创新型行业,医药生物行业的公司通常具有较大的风险偏好。

他们更愿意选择股权融资,以吸引更多战略投资者的支持。

4. 目标市场广阔:医药生物行业的产品广泛应用于医疗、保健等多个领域,市场潜力巨大。

中小板上市公司更倾向于选择股权融资,以获得更多的资金支持和市场影响力。

1. 产业政策:医药生物行业的发展受到国家产业政策的直接影响。

我国生物医药上市公司资本结构的现状分析

杨 帆

(兰 州 商 学 院金 融 学 院

【 摘 要】 着我 国“ 随 十二 五” 划将 生物 医药产 业定位 于战略新 兴产 业 规 之后 , 生物 医药产业越 来越 受到 投 资界 各 类 投 资 者的 关 注 。本 文从 研 究 生物 医药上 市公 司的 资本结 构入 手 , 其分 析 了这 些公 司的 资产 负 尤 债率 情 况。通过 本 文的分析 , 以期希 望 产 业界 和 投 资界 了解我 国生 物 医药上 市公 司的 资本结 构的现 状 , 并给 予优 化 生物 医药上 市公 司资 本 结构 的一 些建议 , 以此提过 我 国生物 医药上 市公 司的价值 。 【 关键 词】 资本 结构 ; 资产 负债率 ; 生物 医药上市 公 司

70 2 ) 30 O

为 色 的表 现 。所 以 , 文 将 生 物 医药 行 业 作 为 研 究 对 象 。 此 二 、 国 生 物 医 药 行 业 上 市 公 司资 本 结 构 现 状 我

( ) 本 选取 一 样

不 管 在 产 业 界 , 是 在 学 术 界 , 业 的资 本 机 构 一 直 是 一 个 非 还 企 常热 门的话题 。因为一个企业 的资本结构关 系到企业 的生存及发 展, 合理 的资本结构可 以增 加企业的市场价值 , 而不 良的资本 结构 会拖累企业正常的生产经营 , 严重的甚至会使企业走 向破产 。

( ) 本 分析 二 司 的融 资结 构 问题 。15 9 8年和 16 年 , 93 诺贝尔 经济 学 奖获 得 者莫 迪 利 亚尼 和 米勒 先 后发 现 了 MM 定理 , 志着现代公司融资结构理论 的形成 。他们认为 , 标 在完 善 的 资 本 市 场 的假 设 下 ( 括 无 交 易 成 本 、 息 充 分 自由 、 贷 平 包 信 借 等 、 产 任 意 分 割 、 破 产 风 险 等 内容 ) () I 不 存 在 税 收 , 企 资 无 ,13 果  ̄ 则 、 的价值 与资本结构无 关 , 被称 为 MM 定理 l ( ) 果有税 负 这 ;2如 存在 , 企业价值 与企 业举债 量成线 性关 系, 则 举债 越多 , 企业 价值 越高 , 被称之 为 MM 定 理 2 这 。MM 定 理 1 说明企业无论债务融资 经营 , 还是 权 益 融资 经 营, 企 业 的经 营状 况是 无关 紧要 的 ; 对 而 MM 定理 2则说 明企 业应充 分利 用债务 资本 的节税优 势 , 业应 企 尽最大 ¨能负债经营 , 丁 最好 为 10 0%负债融资 。具体说来就是 由于 债 权 人 投 资 足 为 了 索 取 同 定 的利 息 收 入 , 股 东 则 是 为 了获 取 企 而 业 剩 余 收 入 , 债 权 人 的 收益 在 一定 范 围 内 有 法 律 上 的 保 证 , 股 且 而 东则不享受这种权 力, 因此 , 权 资 本 要 比债 务 资 本 承 担 更 大 的 风 股 险, 相应 的其成本也要 高于债务成本 。由于利 息费用为税前支付 , 从而可以产生 l税好处 , 节 这样 使债务 融资成 本进一 步降低 。企业 选 择 权 益 资 本 或 债 务 资 本 及 其 不 同 的 组 合 , 目的 在 于 使 企 业 融 其 资的成本最小从而使企业价值最大 , 这便是企业融资决策 的本 质。 MM 定理就是从这一角度分 析 的 , 是 , 但 一旦放 松假 设条 件 , 现 使 实的环境 与独立 的企_ 制度结合起 来 , 、 I k 就使简单 的成本最小 化问 题变得复杂 。其关键因素包 括 : 易成本 的存在 妨碍 了不 同投 资 交 T具的收益的均衡 ; 收政 策扭 曲了资本 的价格 务利息税 前支 税 付, 股票红利税后 支付)股东 与经理之 间, ; 债权人 与股东和经 理之 间的委托代理关系所产生的代理成本对融资成本 的重叠及交 互影 响 ; 务融资所带来 的企业破 产的威胁 以及债务 和权益成本对 控 债 制 权 的 不 同影 响 放 大 了 融 资 成 本 的 “ 能 ” 由 于 这 些 因 素 的 影 功 。 响, 这样便使 资本结构 由融资成本最小 化变成 _ 『为达到公 司价值 最 大 化 , 何 权 衡 影 响 资 本 结 构 的 诸 因 素 而 进 行 资 本 结 构 最 优 化 如 的选 择 问 题 。这 种 最 优 化 包 括 了对 税 收 的合 理 利 用 , 理 成 本 的 代 减少 , 司控制权 的维持等 内容 , 公 是综合各 因素后 的最小成 本 。这 便 是 现 代 公 司 融 资 理 论 所 关 注 的资 本 结 构 的本 质 所 在 。 本文的研究对象是在 巾国股票市 场上市 的生物 医药类 企业 。 生 物 医 药 被 确 定 为 我 同“{二 五 规 划 ” 七 大 战 略 新 兴 产 业 , 我 一 的 在 国的J业 巾具有重大的战略意义 。“ : 十二 五规划” 确定了生物 医药 发展 的承点 . 括基 冈药 物 、 白药物 、 抗克 隆药 物 、 包 蛋 单 治疗 性疫 小分子化学药物等 。同时 , 罔家将 拿出 10多亿元来 支持重 大 0 新 特 药 的 研 制 。 由于 生 物 医 药 行 业 进 入 快 速 发 展 时期 , 受 家 并 政策 扶持 , 同时, 生物医药板块也是我 国证券 l场上的r 支 r 力 市 一 再 加 l 物 医药 上 市 公 司存 最 近 几年 中 , 巾 国 股 市 中有 着 较 生 在

我国中小企业上市公司融资结构分析

我国中小企业上市公司融资结构分析————————————————————————————————作者:————————————————————————————————日期:论文题目我国中小企业上市公司融资结构分析班级 04级国贸二班姓名高雨勤学号 20042927EMAIL:gaoyuqin515@目录第一章绪论第一节选题的来源和意义第二节相关研究的评述第三节主要概念的辨析与界定、研究的思路和方法第二章融资结构的理论阐述第一节传统的资本结构理论第二节现代资本结构理论第三节现代资本结构理论第三章我国中小企业上市公司融资结构现状第一节我国中小企业上市公司情况综述第二节各行业融资结构分析-—以2007年年度会计报告为基础数据第四章对我国中小企业上市公司融资结构现状的分析第一节对我国中小企业上市公司融资结构现状的理论分析第二节我国中小企业融资现状的原因第三节我国中小企业上市公司融资结构现状的弊端第五章对我国中小企业上市公司融资结构优化的建议第一章绪论第一节选题的来源和意义中小企业融资问题一直都是关注的焦点。

在我国金融体制改革过程中,中小企业融资难成为一个不争的事实,但是,在社会发展过程中,中小企业为国民经济发展所作的贡献是不容忽视的,其在解决社会就业问题,提供就业岗位方面所起的重要作用也是有目共睹的,因此,历年来,无数的学者、专家进行了调查研究,为解决中小企业融资难问题献计献策。

中小企业融资难有几个原因。

首先是中小企业自身的原因.中小企业由于经营效益较差,负债率较高,无法满足取得商业银行贷款的基本条件;经营效益的低下,导致中小企业无法偿还以前的债务,银行拒绝再次贷款;无法及时还贷和逃避债务行为造成了中小企业的整体信用短缺,融资问题更加困难。

另外,银行实行贷款抵押担保制度是加剧中小企业贷款难的重要原因。

中小企业由于规模小,不动产资源很少,也难以足值抵押,所以无法通过抵押向银行借款;找到合适的担保人对中小企业来说也很困难,担保人的效益影响着银行的决策,效益好的企业考虑到风险不愿为别人提供担保,效益一般的企业所提供的担保得不到银行的认同。

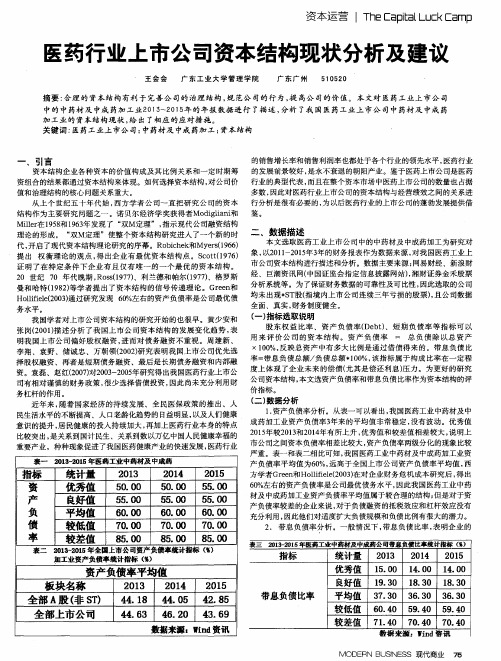

医药行业上市公司资本结构现状分析及建议

医药行业上市公司资本结构现状分析及建议

王 会 会 广 东 工 业 大学 管 理 学 院 广东广州 5 1 0 5 2 0

摘要: 合理 的 资本结构 有利 于完善 公 司的治理 结构 , 规 范公 司的行 为 , 提 高公 司的价 值 。本文对 医药工业上 市公 司

( 一) 指标Βιβλιοθήκη 取说 明 股 东 权 益 比率 、资 产 负 债 率 ( De b t ) 、短 期 负债 率 等 指 标 可 以 用来评 价公司的资本结构 。资产负债率 = 总 负 债 除 以 总 资 产 ×1 0 0 %, 反 映总 资 产 中有 多大 比例是 通 过借 债 得来 的。带 息 负 债 比 率= 带 息负 债 总额 / 负 债总 额 + 1 o 0 %, 该指 标属 于构 成 比率 在 一定 程 度上 体 现 了企 业 未 来的 偿 债( 尤 其 是偿 还 利 息) 压 力 。 为更 好 的研 究 公司 资本 结构 , 本文 选资 产负 债率 和带息 负债 比率 作为 资本 结构 的评 价指 标 。

资 组合 的结果 都通 过资本 结构 来体 现 。如 何选 择 资本结 构 , 对 公 司价 值 和治理 结构 的核 心 问题 关系 重大 。 从 上 个 世纪 五 十年 代 始 , 西方 学者 公 司 一 直把 研 究 公 司 的资 本 结 构作 为 主要 研 究 问题 之一 。诺 贝 尔经 济学 奖 获得 者Mo d i g l i a n i 和 Mi l l e r 在1 9 5 8 和1 9 6 3 年发 现 了 “ 双 M定理 ” , 指示 现 代公 司融 资结 构 理 论 的形 成 。 “ 双 M定理 ”使整 个 资本 结 构研 究进 入 了一 个新 的时 代, 开启 了 现代 资本结 构理 论研 究 的序 幕 。R o b i c h e k 和 My e r s ( 1 9 6 6 ) 提 出 权衡理论的观点, 得 出企 业 有 最 优 资本 结 构 点 。S c o t t ( 1 9 7 6 ) 证 明 了在 特 定 条 件 下 企 业 有 且 仅 有 唯 一 的 一个 最 优 的 资 本 结 构 。 2 0 世纪 7 0 年代 晚期 , R o s s ( 1 9 7 7 ) 、利 兰德 和 帕尔( 1 9 7 7 ) 、格 罗斯 曼 和哈 特 ( 1 9 8 2 ) 等 学 者提 出 了资本 结 构 的信 号 传 递 理论 。G r e e n 和 Ho l l i f i e l e ( 2 0 0 3 ) 通过 研究 发 现 6 0 %左右 的资 产 负债率 是 公司最 优 债 务水 平 。 我 国学者 对上 市 公 司资 本结 构 的研 究开 始 的也 很早 。 黄少 安和 张 岗( 2 0 0 1 ) 描 述分 析 了我 国上 市 公 司 资 本结 构 的 发展 变 化 趋 势 , 表 明我 国上 市公 司 偏 好股 权 融 资 , 进 而对 债 务融 资 不 重 视 。周 建 新 、 李翔 、袁野 、储诚 忠 、万 朝领 ( 2 0 0 2 ) 研 究表 明我 国上 市 公 司优 先选 择 股 权融 资 、再者 是 短期 债务 融 资 、最后 是 长期 债务 融 资和 内部 融 资 。袁 磊 、赵 红( 2 0 0 7 ) 对2 0 0 3 - 2 0 0 5 年研 究得 出我 国 医药行 业上 市公 司有 相对 谨慎 的 财务 政策 , 很 少选 择借 债 投 资 , 因此 尚未 充分 利 用财 务 杠杆 的作 用 。 近年 来 , 随着 国 家经 济 的 持续 发 展 、 全 民医 保政 策 的 推 出 、人 民生活 水平 的不 断提高 、人 口老 龄化趋 势 的 日益 明显 , 以及 人们健 康 意 识 的提 升 , 居 民健康 的 投入 持续 加大 , 再 加上 医药行 业 本身 的特 点 比较 突出 , 是 关系 到国计 民生 、关 系到 数 以万 亿 中国人 民健 康幸福 的 重 要产 业 ,种种 现象促 进 了我 国医药健 康产 业 的快速 发展 , 医药 行业

中国医药细分行业融资情况

中国医药细分行业融资情况中国医药行业一直以来都是一个备受关注的领域,随着人们健康意识的提高以及国家对医疗健康事业的重视,医药行业发展迅速。

在这个庞大的医药行业中,又涉及到许多不同的细分领域,每个领域都有着独特的发展现状和融资情况。

首先,药品研发领域是医药行业中最为重要的一个环节。

中国的药品研发水平在近年来有了很大的提升,越来越多的国内医药企业开始注重研发投入,寻求创新药物的研发。

在融资方面,这些企业往往通过各种途径来筹集资金,包括私募股权融资、银行贷款、企业债券发行等。

此外,一些研发机构也会通过与投资机构的合作来获取融资,例如与风险投资公司合作,共同推动药物研发的进展。

其次,医疗器械行业也是医药细分行业中备受关注的领域。

随着人们对医疗健康的需求不断增长,医疗器械的市场需求也在不断扩大。

在中国,医疗器械企业在融资方面通常会选择通过股权融资的方式,包括上市、IPO等。

通过股权融资,医疗器械企业能够获得更多的资金支持,进一步推动企业的发展和研发创新。

此外,中国的医疗服务行业也在蓬勃发展。

医疗服务行业主要包括医疗机构、医疗保健服务等。

在融资方面,医疗机构往往会选择通过发行债券、银行贷款等方式来筹集资金。

此外,一些医疗服务企业也会通过与保险公司的合作来获得资金支持,推动企业的发展。

另外,中国的医药电商也是医药行业中一个快速发展的领域。

医药电商通过互联网技术,将医药产品和服务直接推向消费者,提供更加便捷的购药方式。

在融资方面,医药电商通常会通过私募股权融资来筹集资金,吸引风险投资机构的参与,推动企业的发展。

总的来说,中国医药细分行业的融资情况多种多样,企业选择的融资方式也各有不同。

在国家对医疗健康事业的重视下,医药行业的融资环境逐渐改善,更多的资金进入行业,推动医药企业的创新发展。

未来,随着科技的不断进步和人们对健康的不断追求,医药行业的融资情况将继续保持良好的发展态势,为人们的健康提供更好的保障。

我国上市公司融资结构分析

我国上市公司融资结构分析随着我国经济的快速发展,上市公司融资结构也逐渐成为了一个备受关注的话题。

融资结构的好坏关系到上市公司的长远发展,并且对整个市场经济的健康发展也有着不可忽视的影响。

一、上市公司融资结构的组成上市公司融资结构通常包括以下几个方面:1. 股票融资。

上市公司股票融资是一种集资方式,它的基本模式是向公众发行股票(一般指可转换公司债),从而吸收资金。

2. 债券融资。

债券融资是指上市公司向社会发行借款凭证(通常是公司债券),并承诺在一定期限内按照一定利率支付利息和本金。

这是一种相对稳定的融资方式。

3. 银行贷款。

银行贷款是上市公司通过向银行借款来筹集资金的一种方式。

这种融资方式通常用于短期经营资金的周转和紧急融资。

4. 合作伙伴投资。

这是指上市公司与其他企业或投资者合作,共同投资某一项具有良好前景的项目。

二、上市公司融资结构的特点1. 多元化融资。

上市公司融资可采取多样化的融资方式,在股票融资、债券融资、银行贷款、合作伙伴投资等多个领域都存在融资的机会。

2. 资金效率高。

现代上市公司一般采用资产、负债和所有者权益三方面的资源来融资,因此在资金效率方面表现出色。

3. 风险较高。

上市公司的融资立足于市场,并且一些融资方式还受到市场波动的影响,因此存在着较高的风险。

4. 压力大。

上市公司融资结构与市场的竞争直接相关,因此每一种融资方式的成功与否都会受到社会和股东的关注。

在这种压力下,上市公司需要不断发展、创新,以应对各种挑战。

三、上市公司融资结构的分析1. 资产负债率分析资产负债率是指公司债务在总资产中的比例,通常越低说明上市公司的财务风险越小。

上市公司应该尽可能的把自身的负债规模控制在合理范围内,保持充足的流动性,否则就会陷入负债过重的境地。

2. 股权集中度分析股权集中度指公司的股权中,前十大股东持股比例在总股本中的占比,通常股权集中度越高就越容易产生僵局。

因此,上市公司应该尽可能的减少股权集中度,加强股东间的平衡,以免出现危机。

医药生物行业中小板上市公司融资结构研究

医药生物行业中小板上市公司融资结构研究近年来,医药生物行业在我国的快速发展受到了政策的大力支持,使得该行业成为了资本市场上备受瞩目的行业之一。

然而,医药生物行业的发展需要巨额资金的支持,其中上市融资是一种主要手段。

本文以中小板上市公司为研究对象,对医药生物行业上市公司的融资结构进行探究。

I. 融资渠道中小板上市公司常用的融资渠道主要包括:股权融资、债券融资、公开增发、定向增发。

而在医药生物行业中,股权融资是主要的融资手段,其中包括:IPO、增发、配股。

这一点从下表中得出:从上表可以看出,IPO是中小板上市公司最主要的融资手段,占据了所有融资手段的近六成。

同时,中小板上市公司倾向于采用定向增发和公开增发来募集资金,其中定向增发较为普遍,在近十年的可比公司中占比392.15%,而公开增发占比较少。

1. 资本结构资本结构是上市公司融资结构的基础,从下表可以看出,中小板上市公司资本结构以股本为主,占比近八成,而其他资本构成的占比较小。

2. 财务结构财务结构是衡量一家公司财务健康状况的重要指标之一。

从下表可以发现,中小板上市公司的财务结构以负债为主,近九成资金来源于负债。

这说明了中小板上市公司融资依赖更多地依托外部资本,随着公司的规模和实力的提升,需要加强内部资金积累,以更好地实现公司的长期发展。

1. 融资金额从下表可以看出,中小板上市公司的融资金额较为稳定,IPO的融资金额较大,但是在其他融资手段中,定向增发的融资金额较多,达到了534.08亿元,公开增发额度相对较少,仅有67.12亿元。

2. 融资效率融资效率是评价上市公司融资效果的重要指标之一。

从下表可以看出,中小板上市公司的融资效率总体较高,IPO、定向增发和公开增发的融资效率均超过了100%。

而增发、配股的融资效率较低,其中增发融资效率为79.67%。

医药生物行业中小板上市公司融资结构研究

医药生物行业中小板上市公司融资结构研究随着医药生物行业发展壮大,越来越多的中小型企业选择走向资本市场,其中小板上市公司成为主流。

本文旨在探讨小板上市公司融资结构的特点及其对公司发展的影响。

小板上市公司融资结构的特点主要表现在以下三个方面:1.股权融资为主小板上市公司的融资方式以股权融资为主,即通过向股东发行新股筹集资金。

在股权融资中,小板上市公司较少使用债券等其他融资方式。

这是因为小板上市公司通常规模较小,借款能力受到限制,选择通过股权融资来寻求融资渠道。

2.多元化的股东结构小板上市公司的股东结构多样化。

在股权融资过程中,小板上市公司通常筹集来自各类投资者的资金,包括风险投资、私募基金、保险公司、公募基金等。

这种多元化的股东结构,有助于降低公司的融资风险,并促进公司资本市场的稳定和扩大。

3.高杠杆率小板上市公司的资本结构中债务比例较高,杠杆率高于主板上市公司和科创板上市公司。

这是因为小板上市公司通常采用股权融资进行融资,但限于公司规模和业务发展阶段,部分公司难以实现利润扭亏,故需要增加债务来扩大资产规模和业务范围。

但需要注意的是,高杠杆率也带来了更高的财务风险。

二、小板上市公司融资结构的影响1.加速企业的成长通过股权融资,小板上市公司可以更快地筹集到资金来促进公司的扩张和发展。

资本市场的融资渠道不仅使公司加快了资金的周转,也为公司开展新业务和进行技术创新提供了良好的条件和动力。

此外,多元化的股东结构也为企业在战略制定和业务拓展中提供了更多的资源和支持。

2.增加财务风险由于小板上市公司杠杆率高,故财务风险也相应增加。

增加的债务可能会给公司带来更高的利息支出和偿还压力,一旦公司经营不善,有可能导致公司破产或者财务危机等风险。

因此,小板上市公司需要更加谨慎地管理自身的财务风险,防范金融风险的发生。

总的来说,小板上市公司的融资结构在企业发展和成长过程中发挥着重要的作用,同时也带来一定的财务风险。

因此,企业需要在融资时谨慎选择融资方式,根据自身的实际情况确定融资方案,合理控制债务比例和财务风险。

生物医药公司融资方案分析

生物医药公司融资方案分析目录第一章 (3)一、优势分析(S) (3)二、劣势分析(W) (4)三、机会分析(O) (5)四、威胁分析(T) (6)第二章资产证券化方案分析 (10)一、资产证券化模式设计 (10)二、资产证券化概念和特点 (19)第三章项目概况 (25)一、项目概述 (25)二、项目总投资及资金构成 (26)三、资金筹措方案 (27)四、项目预期经济效益规划目标 (27)五、项目建设进度规划 (28)第四章资金成本分析 (29)一、债务资金成本分析 (29)二、权益资金成本分析 (30)第五章 (32)一、项目风险分析 (32)二、项目风险对策 (34)第六章 (36)一、人力资源配置 (36)二、员工技能培训 (36)第七章 (38)一、股东权利及义务 (38)二、董事 (40)三、高级管理人员 (44)四、监事 (46)第八章 (49)一、公司发展规划 (49)二、保障措施 (53)第一章一、优势分析(S)(一)公司具有技术研发优势,创新能力突出公司在研发方面投入较高,持续进行研究开发与技术成果转化,形成企业核心的自主知识产权。

公司产品在行业中的始终保持良好的技术与质量优势。

此外,公司目前主要生产线为使用自有技术开发而成。

(二)公司拥有技术研发、产品应用与市场开拓并进的核心团队公司的核心团队由多名具备行业多年研发、经营管理与市场经验的资深人士组成,与公司利益捆绑一致。

公司稳定的核心团队促使公司形成了高效务实、团结协作的企业文化和稳定的干部队伍,为公司保持持续技术创新和不断扩张提供了必要的人力资源保障。

(三)公司具有优质的行业头部客户群体公司凭借出色的技术创新、产品质量和服务,树立了良好的品牌形象,获得了较高的客户认可度。

公司通过与优质客户保持稳定的合作关系,对于行业的核心需求、产品变化趋势、最新技术要求的理解更为深刻,有利于研发生产更符合市场需求产品,提高公司的核心竞争力。

(四)公司在行业中占据较为有利的竞争地位公司经过多年深耕,已在技术、品牌、运营效率等多方面形成竞争优势;同时随着行业的深度整合,行业集中度提升,下游客户为保障其自身原材料供应的安全与稳定,在现有竞争格局下对于公司产品的需求亦不断提升。

中小企业板块上市公司资本结构特征分析

中小企业板块上市公司资本结构特征分析郭岩陈延陈守东(吉林大学数量研究中心,长春,吉林130012)摘要:本文引入行业前景指标和企业的基本财务指标对资产负债率进行回归分析,研究企业的资产结构与企业特征之间的关系,分析了目前中小企业板块上市公司的财务结构存在的问题,结果表明:目前中小版块上市公司普遍存在资产负责率过低,而流动负债率偏高的现象,企业的资产结构与公司的经营规模,流动比率,资产回报率和主营业务收入增长率正相关,而与行业前景和管理效率负相关;企业所得税率对企业的债务结构影响不大。

关键字:中小板资本结构财务指标行业前景一、引言中小企业是市场经济体系中活跃的、发展前景良好的企业类型。

随着我国创新型经济和民营经济的发展,中国已经涌现出大批成长性中小企业和高新技术企业,他们对活跃城乡经济,缓解就业压力,保障社会稳定,吸纳剩余劳动力起着举足轻重的作用,同时也充当了我国各项社会、政治和经济改革稳定推进的“缓冲器”。

深圳证券交易所于5月27日正式启动中小企业板,首批八家中小企业公司6月25日在深交所中小企业板上市交易,为中小企业发展打通新的融资渠道。

新股上市当日,平均升幅为129.875%,平均换手率为69.37%,受到市场资金的关注,表现出投资者对中小企业板公司质量的信任,以及对中小企业板上市公司未来高成长性的预期。

截至2005年4月挂牌上市公司39家,筹集资金91.08亿元,总股本32.2亿元,流通股本9.6亿元。

中小企业板为中小企业提供了融资平台,为我国分步推进创业板市场建设以及推进我国多层次市场体系的建设的目标起到了重要作用。

为避免我国中小企业板块上市公司出现偏好股权融资、资本结构失衡,促使中小企业把握资本结构,提高上市公司的赢利能力、成长性及寻求自己的最佳资本结构,需要对中小企业上市公司的资本结构特性进行分析。

不同的行业企业、不同发展历史的企业。

其各自资本结构的选择是不尽相同的。

对于处于高度竞争行业的企业而言,在确定资本结构特别是债务结构时,必须考虑自身现金流的稳定性以保证债务的清偿,否则为了采取进取性策略而盲目扩大债务,可能引发竞争对乎为了挤垮对方而采取短期恶性竞争,这就可能导致该企业由于短期现金流不能满足债务清偿,继而引起无效的企业破产清算。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

中小企业板医药生物行业上市公司融资结构分析目录一、中小板医药生物行业上市公司融资结构特征 (3)二、中小板医药生物行业上市公司融资结构原因分析 (6)三、优化中小板生物医药行业上市公司融资结构的建议。

(9)【摘要】2004年5月,经国务院批准,中国证监会批复同意深圳证券交易所在主板市场内设立中小企业板块。

自成立以来,中小板发展迅速,截止至2011年6月,中小板已有588家,总市值和流通市值分别为3,692,430(百万元)和1,747,250(百万元)。

由此可见,我国作为中小板服务对象的中小企业在融资活动中直接融资所占比重在迅速上升,企业资本的形成和扩张已经越来越依赖于资本市场特别是证券市场。

中小企业板上市公司是一种在规模上介于一般中小企业和主板上市公司之间的一类公司,规模上的差异决定了其融资和一般中小企业及主板上市公司必然有差异,本文着眼于中小企业板上市公司的融资结构,并以中小企业板中的医药生物行业为例,对该行业上市公司2010年年报数据为样本进行研究。

截止至2011年6月,中小企业板医药生物行业共有30家上市公司,其中两家为2011年上市,没有2010年年报数据,因此,剔除这两家上市公司,研究其余28家上市公司2010年年报数据,同时与深圳证券交易所A股主板医药生物行业39家上市公司2010年年报数据作对比,分析其融资结构,发现中小板生物医药行业上市公司融资结构具有“股权融资比例高,存在较强的股权融资偏好”“债权融资比例较低,融资结构失衡”“内源融资比例基本相同”的特征。

从融资结构出发,本文从资本市场等多方面分析形成该融资结构的原因,并提出优化建议。

【关键词】融资结构中小企业板股权融资债券市场【Abstract】In May,2004,after approving by State Department, China Securities Regulatory Commission replied and agreed to Shenzhen Stock Exchange’s setting SME Board in Main Board Market. Since its inception, the SME Board has developed quickly. By June,2010, SME Board has been haven 558 listed companies, and its total market value is 3,692,430 million Yuan, also the circulation market value is 1,747,250 million Yuan. This shows that the SMEs, which the SME Board severs, has raise its ratio of direct financing dramatically in financing activities, meanwhile, the formation and expansion of enterprise capital is becoming more and more relying on Capital Market, especially Stock Market. The listed companies of SME Board is companies of which the scale is between unlisted SME and listed companies of Main Board Market, which determines that SME’sfinancing differs from the others. This paper concerns about the financing structure of SME, and sets Biopharmaceutical industry of SME Board as an example, discusses its listed companies’s 2010 annual report. By June,2010, the Biopharmaceutical industry of SME Board has been haven 30 listed companies, 2 of which was listed in January and March,2010, without 2010 annual report. Therefore, delete these 2 listed companies, study the other 28 ones, and compare with 39 2010 annual report of the Biopharmaceutical industry’s listed companies, which from the Shenzhen Stock Exchange’s A-share Main Board Market, discuss its financing structure, finding that the Biopharmaceutical industry of SME Board has the following features: the ration of equity financing is high, showing strong preference for equity financing; the ration of debt financing is low and the financing structure is imbalance; the ration of internal financing is similiarn to Main Board Market ones. From financing structure, this paper discusses the reason of the financing structure’s formation from different aspects, like capital market, and gives several advices to optimize the structure.[Key Words] Financing Structure, SME Board, Equity Financing, Bond Market一、中小板医药生物行业上市公司融资结构特征参考国内学界研究融资结构通常采用的方法,本文对相关指标的统计口径作出以下界定。

首先,外源融资包括留存收益(未分配利润+盈余公积)和累计折旧。

其次,外源融资分为股权融资、债券融资和其他融资。

股权融资包括流通股本和资本公积;债券融资以短期借款、长期借款、债券融资、商业信用为主,其中商业信用包括应付账款、预收账款和应付票据;其他融资包括政府补助等。

(一)医药生物行业上市公司融资结构总特征。

表 1 2010年中小板医药生物行业上市公司融资结构从表1可得中小板医药生物行业上市公司融资结构以外源融资为主,占比71.86%,表明我国上市公司更依赖于外部融资。

三种主要融资方式中,内源融资占28.12%,股权融资占52%,债券融资占12.52%,股权融资占比最大,超过50%,内源融资居中,债权融资最少,这与现代资本结构理论中内源融资---股权融资---债权融资的融资结构相悖。

上述融资结构主要呈现以下具体特征:1. 内源融资比例偏低。

从表中分析发现,医药生物上市公司的内源融资远低于外源融资,占比基本上是外源融资占比的1/3,公司更依赖于外源融资。

其中,内源融资与外源融资中的股权融资差异尤为明显。

“内源融资是指公司经营活动结果产生的资金,是指企业不断将自己的储蓄转化为投资的过程。

与相对于外源融资而言内源融资具有相对低成本、风险小的优点,并可以避免普通股融资可能带来的所有权和控制权稀释,不对称信息等问题。

”1但是内源融资比例偏低。

表 2 医药生物内源融资结构内源融资包括留存收益和累计折旧,从表2中可发现其主要以留存收益为主,即以公司经营活动的盈利为主。

2. 股权融资比例高,存在强烈的股权融资偏好。

融资方式中,股权融资占比52%,占总资产的最大份额,远高于内源融资和债权融资。

资本成本是企业进行融资时首先要考虑的因素,一般而言,以上三种融资方式中,股权融资的权益资本成本是最高的,除了要支付股息外,还有对公司股价的影响,“Suppose you thought your firm ’s stock was overvalued.1 王丹《资本结构理论与我国上市公司融资结构分析》It makes sense to raise money at inflated prices, but a problem crops up. If you try to sell equity, investors will realize that the shares are probably overvalued, and your stock price will take a hit. In other words, if you try to raise money by selling equity, you run the risk of signaling to investors that the price is too high. In fact, in the real world, companies rarely sell new equity, and the market reacts negatively to such sales when they occur.”2而债券融资的债务资本成本较低,但是我国股票市场的发展速度远远快于债券市场,医药生物行业的上市公司中,股权融资比例最大,且没有一个公司发行公司债。

3.债权融资比例偏低,结构失衡关于融资比例,从表1可以看出,医药生物上市公司的债券融资比例很低,只有12.52%,远低于其余两种融资方式。

表 2 医药生物行业上市公司债券融资结构从表2可以看出,债券融资以商业信用和短期借款为主,企业很少通过长期债务融资,债务期限结构明显失衡。

第一,短期借款是企业债务资金的最主要来源,占比超过50%,说明银行仍是非常重要的资金来源。