国际会计准则第8号之会计政策中英文对照

国际会计准则第8号本期净损益基本错误和会计政策的变更.doc

国际会计准则第8号--本期净损益、基本错误和会计政策的变更(1993年12月修订)目的本号准则的目的是对损益表中某些项目的分类、揭示和会计处理作出规定,以便使所有的企业均在一致的基础上编制和呈报损益表。

这不仅增强了与企业前期财务报表的可比性,而且也增强了与其他企业财务报表的可比性。

因此,本号准则要求对非常项目进行分类和揭示,并且揭示正常经营活动所产生的损益中的某些项目。

本号准则还对会计估计的变化、会计政策的变更以及基本错误的更改规定了处理方法。

范围1.本号准则应在损益表呈报由正常活动和非常项目产生的损益,以及在对会计估计的变化、基本错误的更改和会计政策的变更进行核算时予以采用。

2.本号准则替代于1977年批准的国际会计准则第8号“非常项目、前期项目和会计政策的变更”。

3.本号准则涉及对本期净损益中某些项目的揭示。

除了按其他国际会计准则,包括国际会计准则第5号“财务报表应揭示的信息”所要求的其他揭示外,还应作出这些揭示。

4.本号准则还涉及与中断经营有关的某些揭示,但不涉及与中断经营有关的确认与计量问题。

5.非常项目、基本错误和会计政策的变更的税务影响应按国际会计准则第12号“所得税会计”的要求进行核算和揭示。

国际会计准则第12号中提到的“特殊项目”,应视为本号准则所定义的“非常项目”。

定义6.本号准则所用的下列术语,具有特定的含义。

非常项目,是指由明显区别于企业正常活动的事项成交易所产生的收益或使用,因此不会经常或定期发生。

正常活动,是指企业所从事的作为其业务组成部分的所有活动,以及企业为促进这些活动的完成附带或因这些活动而产生的相关活动。

中断经营,是一项经营项目的出售或放弃的结果,该经营项目代表了企业一个独立、主要的业务种类,并且该经营项目的资产、净损益和活动能够从实物上、经营上和财务报告的目的上加以区分。

基本错误,是指本期发现的错误,它们是如此重大以致使以前某一期或若干期的财务报表在发布时,就不再被认为是可靠的。

安永《国际财务报告准则更新》中文版本 (2015年12月31日)

10

号》的修订

国际会计准则第19号:设定受益计划:雇员缴存金--对《国际会计准则第19号》的修订

11

国际会计准则第27号:单独财务报表中的权益法--对《国际会计准则第27号》的修订

11

国际财务报告准则改进

12

第二部分:不纳入国际财务报告准则解释委员会2015年下半年度议程的事项

15

第三部分:国际会计准则理事会现行项目

第二部分总结了自2015年7月1日起在《国际财务报告准则解释 委员会最新资讯》1上发布的某些议程决定。如欲了解2015年7 月1日前发布的拒纳通知,请参阅之前版本的《国际财务报告准 则更新》。在某些拒纳通知中,解释委员会提及了可提供充足指 引的现有公告。这些拒纳通知提供了对公告应用的观点,且在 《国际会计准则第8号》第12段“其他会计文献和可接受的行业 惯例”规定的范围内。

第一部分的开始部分列示了一份截至不同年末的强制采用时间 表。在该表中,公告按照其生效日期列示。需要注意的是,很多 公告包含允许主体提前采用的条款。

该表之后是对公告的讨论,除年度改进项目集中在第一部分结尾 处之外,其余均按照相关准则在国际财务报告准则合订本(蓝皮 书)中的先后顺序排列。

当准则或解释业已发布但主体尚未采用时,《国际会计准则第8 号--会计政策、会计估计变更和差错》要求主体披露已知的 (或可合理估计的)与理解新公告对财务报表的可能影响相关的 信息,或者说明不披露的原因。第一部分开始部分的表格有助于 识别在此披露要求范围内的公告。

编制者的挑战在于了解未来所需面对的一切。

本刊的目的

本刊概述了准则和解释(公告)即将发生的变化,还提供了若干 现行项目的最新进展情况,而非提供有关这些主题的深度分析或 讨论。更确切地说,其目的在于强调这些变化的关键方面。在作 出决策或采取行动之前,请参考公告正文。

国际会计准则第8号之会计政策中英文对照

国际会计准则第8 号之会计政策中英文对照会计变更以后财务报表能够提供更加可靠相关的会计信息来反映企业的业务、发生的事件或者情况对财务报表、财务业绩或现金流的影响。

下面是yjbys 小编为大家带来的关于国际会计准则的知识,欢迎阅读。

1.Changes in accounting policiesAn entity is permitted to change an accounting policy only if thechange:(i) is required by a standard or interpretation; or(ii) results in the financial statements providing reliable and morerelevant information about the effects of transactions, other events orconditions on the entity's financial position, financial performance, orcash flows. [IAS 8.14]Note that changes in accounting policies do not include applying anaccounting policy to a kind of transaction or event that did not occurpreviously or were immaterial. [IAS 8.16]1.会计政策变更企业只有在发生以下变化的时候允许变更会计政策:(1)会计准则或解释说明的要求(2)会计变更以后财务报表能够提供更加可靠相关的会计信息来反映企业的业务、发生的事件或者情况对财务报表、财务业绩或现金流的影响。

[IAS 8.14]注意,会计政策的变更不包括应用在之前没有发生过或者不重大的交易或事项。

国际会计准则会计科目中英对照

国际会计准则会计科目中英对照要说国际会计准则的会计科目中英对照,这事儿听起来是不是有点复杂?但其实你稍微了解一下,就能发现它并不难,甚至可以说挺有意思的。

想象一下,你去一家外国公司做生意,账本上有很多术语你不太明白,稍微转个弯,弄清楚它们的中英文对照,问题就迎刃而解了。

这就像你去外地旅游,碰到不懂的地方,发现一张“翻译单”就觉得一切都能轻松搞定了!要知道,了解这些会计术语可比你去超市找打折商品还省心呢。

看看什么是“资产”吧。

在中文里,资产就是公司拥有的有价值的东西,像现金、设备、库存等等。

那在英文里,资产可不是一眼就能看明白的东西哦。

它就叫“Assets”。

看!是不是简单得很?不过,资产又分很多种,流动资产(Current Assets)和非流动资产(NonCurrent Assets)就是其中两个大类。

流动资产你可以理解成那些一眼看得出来很快能变现的东西,比如现金、存货什么的。

非流动资产呢,就像是你家那台不怎么舍得卖的老电视,买了就很久都不会动的那种,换句话说,它就是那些长期使用的资产,像机器、厂房之类的。

再说说“负债”吧,负债,顾名思义就是公司欠别人的钱。

这可是每个公司都逃不掉的话题。

比如,你从银行贷款,或者向供应商赊账,负债就产生了。

这部分在英文里叫“Liabilities”,简直就是字面意思了,欠的东西得还嘛。

负债也分成短期负债和长期负债,就像你借了一些短期小额的钱,跟你借了十年的房贷不一样,短期负债(Current Liabilities)就是那种快要还掉的账,长期负债(NonCurrent Liabilities)嘛,大家就可以理解成更长时间才能偿还的债务了,反正每个月按期支付,稳稳的。

大家可能会好奇,资产和负债都弄明白了,那企业的“所有者权益”到底是啥?哎,这个其实就是公司老板心头的宝,所有者权益就是公司资产减去负债后的净值。

在英文里呢,叫“Equity”,大家记住这个词,以后听到就知道那是公司“净资产”的代名词。

ifrs8国际财务报告准则8号

IFRS8 International Financial Reporting Standard8Operating SegmentsIn April2001the International Accounting Standards Board(IASB)adopted IAS14Segment Reporting,which had originally been issued by the International Accounting Standards Committee in August1997.IAS14Segment Reporting replaced IAS14Reporting Financial Information by Segment,issued in August1981.In November2006the IASB issued IFRS8Operating Segments to replace IAS14.IAS1 Presentation of Financial Statements(as revised in2007)amended the terminology used throughout IFRSs,including IFRS8.Other IFRSs have made minor consequential amendments to IFRS8.They include Improvements to IFRSs(issued April2009),IAS24Related Party Disclosures(issued November 2009),IFRS10Consolidated Financial Statements(issued May2011),IAS19Employee Benefits (issued June2011)and Annual Improvements to IFRSs2010–2012Cycle(issued December2013).IFRS Foundation A287IFRS8C ONTENTSfrom paragraph INTRODUCTION IN1 INTERNATIONAL FINANCIAL REPORTING STANDARD8OPERATING SEGMENTSCORE PRINCIPLE1 SCOPE2 OPERATING SEGMENTS5 REPORTABLE SEGMENTS11 Aggregation criteria12 Quantitative thresholds13 DISCLOSURE20 General information22 Information about profit or loss,assets and liabilities23 MEASUREMENT25 Reconciliations28 Restatement of previously reported information29 ENTITY-WIDE DISCLOSURES31 Information about products and services32 Information about geographical areas33 Information about major customers34 TRANSITION AND EFFECTIVE DATE35 WITHDRAWAL OF IAS1437 APPENDICESA Defined termB Amendments to other IFRSsFOR THE ACCOMPANYING DOCUMENTS LISTED BELOW,SEE PART B OF THIS EDITIONAPPROVAL BY THE BOARD OF IFRS8ISSUED IN NOVEMBER2006BASIS FOR CONCLUSIONSAPPENDICESA Background information and basis for conclusions of the US FinancialAccounting Standards Board on SFAS131B Amendments to the Basis for Conclusions on other IFRSsDISSENTING OPINIONSIMPLEMENTATION GUIDANCEAPPENDIXAmendments to other Implementation GuidanceA288IFRS FoundationIFRS8 International Financial Reporting Standard8Operating Segments(IFRS8)is set out inparagraphs1–37and Appendices A and B.All the paragraphs have equal authority. Paragraphs in bold type state the main principles.Definitions of terms are given in the Glossary for International Financial Reporting Standards.IFRS8should be read in the context of its core principle and the Basis for Conclusions,the Preface to International Financial Reporting Standards and the Conceptual Framework for Financial Reporting.IAS8 Accounting Policies,Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.IFRS Foundation A289IFRS8IntroductionReasons for issuing the IFRSIN1International Financial Reporting Standard8Operating Segments sets out requirements for disclosure of information about an entity’s operating segmentsand also about the entity’s products and services,the geographical areas inwhich it operates,and its major customers.IN2Achieving convergence of accounting standards around the world is one of the prime objectives of the International Accounting Standards Board.In pursuit ofthat objective,the Board and the Financial Accounting Standards Board(FASB)in the United States have undertaken a joint short-term project with theobjective of reducing differences between International Financial ReportingStandards(IFRSs)and US generally accepted accounting principles(US GAAP)that are capable of resolution in a relatively short time and can be addressedoutside major projects.One aspect of that project involves the two boardsconsidering each other’s recent standards with a view to adopting high qualityfinancial reporting solutions.The IFRS arises from the IASB’s consideration ofFASB Statement No.131Disclosures about Segments of an Enterprise and RelatedInformation(SFAS131)issued in1997,compared with IAS14Segment Reporting,which was issued in substantially its present form by the IASB’s predecessorbody,the International Accounting Standards Committee,in1997.IN3The IFRS achieves convergence with the requirements of SFAS131,except for minor differences listed in paragraph BC60of the Basis for Conclusions.Thewording of the IFRS is the same as that of SFAS131except for changes necessaryto make the terminology consistent with that in other IFRSs.Main features of the IFRSIN4The IFRS specifies how an entity should report information about its operating segments in annual financial statements and,as a consequential amendment toIAS34Interim Financial Reporting,requires an entity to report selectedinformation about its operating segments in interim financial reports.It alsosets out requirements for related disclosures about products and services,geographical areas and major customers.IN5The IFRS requires an entity to report financial and descriptive information about its reportable segments.Reportable segments are operating segments oraggregations of operating segments that meet specified criteria.Operatingsegments are components of an entity about which separate financialinformation is available that is evaluated regularly by the chief operatingdecision maker in deciding how to allocate resources and in assessingperformance.Generally,financial information is required to be reported on thesame basis as is used internally for evaluating operating segment performanceand deciding how to allocate resources to operating segments.IN6The IFRS requires an entity to report a measure of operating segment profit or loss and of segment assets.It also requires an entity to report a measure ofA290IFRS FoundationIFRS8segment liabilities and particular income and expense items if such measuresare regularly provided to the chief operating decision maker.It requiresreconciliations of total reportable segment revenues,total profit or loss,totalassets,liabilities and other amounts disclosed for reportable segments tocorresponding amounts in the entity’s financial statements.IN7The IFRS requires an entity to report information about the revenues derived from its products or services(or groups of similar products and services),aboutthe countries in which it earns revenues and holds assets,and about majorcustomers,regardless of whether that information is used by management inmaking operating decisions.However,the IFRS does not require an entity toreport information that is not prepared for internal use if the necessaryinformation is not available and the cost to develop it would be excessive.IN8The IFRS also requires an entity to give descriptive information about the way the operating segments were determined,the products and services provided bythe segments,differences between the measurements used in reporting segmentinformation and those used in the entity’s financial statements,and changes inthe measurement of segment amounts from period to period.IN9An entity shall apply this IFRS for annual periods beginning on or after 1January2009.Earlier application is permitted.If an entity applies this IFRSfor an earlier period,it shall disclose that fact.Changes from previous requirementsIN10The IFRS replaces IAS14Segment Reporting.The main changes from IAS14are described below.Identification of segmentsIN11The requirements of the IFRS are based on the information about the components of the entity that management uses to make decisions aboutoperating matters.The IFRS requires identification of operating segments onthe basis of internal reports that are regularly reviewed by the entity’s chiefoperating decision maker in order to allocate resources to the segment andassess its performance.IAS14required identification of two sets ofsegments—one based on related products and services,and the other ongeographical areas.IAS14regarded one set as primary segments and the otheras secondary segments.IN12A component of an entity that sells primarily or exclusively to other operating segments of the entity is included in the IFRS’s definition of an operatingsegment if the entity is managed that way.IAS14limited reportable segmentsto those that earn a majority of their revenue from sales to external customersand therefore did not require the different stages of vertically integratedoperations to be identified as separate segments.Measurement of segment informationIN13The IFRS requires the amount reported for each operating segment item to be the measure reported to the chief operating decision maker for the purposes ofallocating resources to the segment and assessing its performance.IAS14IFRS Foundation A291IFRS8required segment information to be prepared in conformity with the accountingpolicies adopted for preparing and presenting the financial statements of theconsolidated group or entity.IN14IAS14defined segment revenue,segment expense,segment result,segment assets and segment liabilities.The IFRS does not define these terms,but requiresan explanation of how segment profit or loss,segment assets and segmentliabilities are measured for each reportable segment.DisclosureIN15The IFRS requires an entity to disclose the following information:(a)factors used to identify the entity’s operating segments,including thebasis of organisation(for example,whether management organises theentity around differences in products and services,geographical areas,regulatory environments,or a combination of factors and whethersegments have been aggregated),and(b)types of products and services from which each reportable segmentderives its revenues.IN16IAS14required the entity to disclose specified items of information about its primary segments.The IFRS requires an entity to disclose specified amountsabout each reportable segment,if the specified amounts are included in themeasure of segment profit or loss and are reviewed by or otherwise regularlyprovided to the chief operating decision maker.IN17The IFRS requires an entity to report interest revenue separately from interest expense for each reportable segment unless a majority of the segment’s revenuesare from interest and the chief operating decision maker relies primarily on netinterest revenue to assess the performance of the segment and to make decisionsabout resources to be allocated to the segment.IAS14did not require disclosureof interest income and expense.IN18The IFRS requires an entity,including an entity with a single reportable segment,to disclose information for the entity as a whole about its products andservices,geographical areas,and major customers.This requirement applies,regardless of the entity’s organisation,if the information is not included as partof the disclosures about segments.IAS14required the disclosure of secondarysegment information for either industry or geographical segments,tosupplement the information given for the primary segments.A292IFRS FoundationIFRS8 International Financial Reporting Standard8Operating SegmentsCore principle1An entity shall disclose information to enable users of its financial statements to evaluate the nature and financial effects of the businessactivities in which it engages and the economic environments in which itoperates.Scope2This IFRS shall apply to:(a)the separate or individual financial statements of an entity:(i)whose debt or equity instruments are traded in a public market(a domestic or foreign stock exchange or an over-the-countermarket,including local and regional markets),or(ii)that files,or is in the process of filing,its financial statementswith a securities commission or other regulatory organisation forthe purpose of issuing any class of instruments in a publicmarket;and(b)the consolidated financial statements of a group with a parent:(i)whose debt or equity instruments are traded in a public market(a domestic or foreign stock exchange or an over-the-countermarket,including local and regional markets),or(ii)that files,or is in the process of filing,the consolidated financialstatements with a securities commission or other regulatoryorganisation for the purpose of issuing any class of instrumentsin a public market.3If an entity that is not required to apply this IFRS chooses to disclose information about segments that does not comply with this IFRS,it shall notdescribe the information as segment information.4If a financial report contains both the consolidated financial statements of a parent that is within the scope of this IFRS as well as the parent’s separatefinancial statements,segment information is required only in the consolidatedfinancial statements.Operating segments5An operating segment is a component of an entity:(a)that engages in business activities from which it may earn revenues andincur expenses(including revenues and expenses relating to transactionswith other components of the same entity),IFRS Foundation A293IFRS8(b)whose operating results are regularly reviewed by the entity’s chiefoperating decision maker to make decisions about resources to beallocated to the segment and assess its performance,and(c)for which discrete financial information is available.An operating segment may engage in business activities for which it has yet toearn revenues,for example,start-up operations may be operating segmentsbefore earning revenues.6Not every part of an entity is necessarily an operating segment or part of an operating segment.For example,a corporate headquarters or some functionaldepartments may not earn revenues or may earn revenues that are onlyincidental to the activities of the entity and would not be operating segments.For the purposes of this IFRS,an entity’s post-employment benefit plans are notoperating segments.7The term‘chief operating decision maker’identifies a function,not necessarily a manager with a specific title.That function is to allocate resources to and assessthe performance of the operating segments of an entity.Often the chiefoperating decision maker of an entity is its chief executive officer or chiefoperating officer but,for example,it may be a group of executive directors orothers.8For many entities,the three characteristics of operating segments described in paragraph5clearly identify its operating segments.However,an entity mayproduce reports in which its business activities are presented in a variety ofways.If the chief operating decision maker uses more than one set of segmentinformation,other factors may identify a single set of components asconstituting an entity’s operating segments,including the nature of thebusiness activities of each component,the existence of managers responsible forthem,and information presented to the board of directors.9Generally,an operating segment has a segment manager who is directly accountable to and maintains regular contact with the chief operating decisionmaker to discuss operating activities,financial results,forecasts,or plans for thesegment.The term‘segment manager’identifies a function,not necessarily amanager with a specific title.The chief operating decision maker also may bethe segment manager for some operating segments.A single manager may bethe segment manager for more than one operating segment.If thecharacteristics in paragraph5apply to more than one set of components of anorganisation but there is only one set for which segment managers are heldresponsible,that set of components constitutes the operating segments.10The characteristics in paragraph5may apply to two or more overlapping sets of components for which managers are held responsible.That structure issometimes referred to as a matrix form of organisation.For example,in someentities,some managers are responsible for different product and service linesworldwide,whereas other managers are responsible for specific geographicalareas.The chief operating decision maker regularly reviews the operatingresults of both sets of components,and financial information is available forboth.In that situation,the entity shall determine which set of componentsconstitutes the operating segments by reference to the core principle.A294IFRS FoundationIFRS8 Reportable segments11An entity shall report separately information about each operating segment that:(a)has been identified in accordance with paragraphs5–10or results fromaggregating two or more of those segments in accordance withparagraph12,and(b)exceeds the quantitative thresholds in paragraph13.Paragraphs14–19specify other situations in which separate information aboutan operating segment shall be reported.Aggregation criteria12Operating segments often exhibit similar long-term financial performance if they have similar economic characteristics.For example,similar long-termaverage gross margins for two operating segments would be expected if theireconomic characteristics were similar.Two or more operating segments may beaggregated into a single operating segment if aggregation is consistent with thecore principle of this IFRS,the segments have similar economic characteristics,and the segments are similar in each of the following respects:(a)the nature of the products and services;(b)the nature of the production processes;(c)the type or class of customer for their products and services;(d)the methods used to distribute their products or provide their services;and(e)if applicable,the nature of the regulatory environment,for example,banking,insurance or public utilities.Quantitative thresholds13An entity shall report separately information about an operating segment that meets any of the following quantitative thresholds:(a)Its reported revenue,including both sales to external customers andintersegment sales or transfers,is10per cent or more of the combinedrevenue,internal and external,of all operating segments.(b)The absolute amount of its reported profit or loss is10per cent or moreof the greater,in absolute amount,of(i)the combined reported profit ofall operating segments that did not report a loss and(ii)the combinedreported loss of all operating segments that reported a loss.(c)Its assets are10per cent or more of the combined assets of all operatingsegments.Operating segments that do not meet any of the quantitative thresholds may beconsidered reportable,and separately disclosed,if management believes thatinformation about the segment would be useful to users of the financialstatements.IFRS Foundation A295IFRS814An entity may combine information about operating segments that do not meet the quantitative thresholds with information about other operating segmentsthat do not meet the quantitative thresholds to produce a reportable segmentonly if the operating segments have similar economic characteristics and share amajority of the aggregation criteria listed in paragraph12.15If the total external revenue reported by operating segments constitutes less than75per cent of the entity’s revenue,additional operating segments shall beidentified as reportable segments(even if they do not meet the criteria inparagraph13)until at least75per cent of the entity’s revenue is included inreportable segments.16Information about other business activities and operating segments that are not reportable shall be combined and disclosed in an‘all other segments’categoryseparately from other reconciling items in the reconciliations required byparagraph28.The sources of the revenue included in the‘all other segments’category shall be described.17If management judges that an operating segment identified as a reportable segment in the immediately preceding period is of continuing significance,information about that segment shall continue to be reported separately in thecurrent period even if it no longer meets the criteria for reportability inparagraph13.18If an operating segment is identified as a reportable segment in the current period in accordance with the quantitative thresholds,segment data for a priorperiod presented for comparative purposes shall be restated to reflect the newlyreportable segment as a separate segment,even if that segment did not satisfythe criteria for reportability in paragraph13in the prior period,unless thenecessary information is not available and the cost to develop it would beexcessive.19There may be a practical limit to the number of reportable segments that an entity separately discloses beyond which segment information may become toodetailed.Although no precise limit has been determined,as the number ofsegments that are reportable in accordance with paragraphs13–18increasesabove ten,the entity should consider whether a practical limit has been reached. Disclosure20An entity shall disclose information to enable users of its financial statements to evaluate the nature and financial effects of the businessactivities in which it engages and the economic environments in which itoperates.21To give effect to the principle in paragraph20,an entity shall disclose the following for each period for which a statement of comprehensive income ispresented:(a)general information as described in paragraph22;A296IFRS FoundationIFRS8(b)information about reported segment profit or loss,including specifiedrevenues and expenses included in reported segment profit or loss,segment assets,segment liabilities and the basis of measurement,asdescribed in paragraphs23–27;and(c)reconciliations of the totals of segment revenues,reported segmentprofit or loss,segment assets,segment liabilities and other materialsegment items to corresponding entity amounts as described inparagraph28.Reconciliations of the amounts in the statement of financial position forreportable segments to the amounts in the entity’s statement of financialposition are required for each date at which a statement of financial position isrmation for prior periods shall be restated as described inparagraphs29and30.General information22An entity shall disclose the following general information:(a)factors used to identify the entity’s reportable segments,including thebasis of organisation(for example,whether management has chosen toorganise the entity around differences in products and services,geographical areas,regulatory environments,or a combination of factorsand whether operating segments have been aggregated);(aa)the judgements made by management in applying the aggregation criteria in paragraph12.This includes a brief description of theoperating segments that have been aggregated in this way and theeconomic indicators that have been assessed in determining that theaggregated operating segments share similar economic characteristics;and(b)types of products and services from which each reportable segmentderives its revenues.Information about profit or loss,assets and liabilities23An entity shall report a measure of profit or loss for each reportable segment.An entity shall report a measure of total assets and liabilities for each reportablesegment if such amounts are regularly provided to the chief operating decisionmaker.An entity shall also disclose the following about each reportablesegment if the specified amounts are included in the measure of segment profitor loss reviewed by the chief operating decision maker,or are otherwiseregularly provided to the chief operating decision maker,even if not included inthat measure of segment profit or loss:(a)revenues from external customers;(b)revenues from transactions with other operating segments of the sameentity;(c)interest revenue;(d)interest expense;(e)depreciation and amortisation;IFRS Foundation A297IFRS8(f)material items of income and expense disclosed in accordance withparagraph97of IAS1Presentation of Financial Statements(as revised in2007);(g)the entity’s interest in the profit or loss of associates and joint venturesaccounted for by the equity method;(h)income tax expense or income;and(i)material non-cash items other than depreciation and amortisation.An entity shall report interest revenue separately from interest expense for eachreportable segment unless a majority of the segment’s revenues are frominterest and the chief operating decision maker relies primarily on net interestrevenue to assess the performance of the segment and make decisions aboutresources to be allocated to the segment.In that situation,an entity may reportthat segment’s interest revenue net of its interest expense and disclose that ithas done so.24An entity shall disclose the following about each reportable segment if the specified amounts are included in the measure of segment assets reviewed bythe chief operating decision maker or are otherwise regularly provided to thechief operating decision maker,even if not included in the measure of segmentassets:(a)the amount of investment in associates and joint ventures accounted forby the equity method,and(b)the amounts of additions to non-current assets1other than financialinstruments,deferred tax assets,net defined benefit assets(see IAS19Employee Benefits)and rights arising under insurance contracts. Measurement25The amount of each segment item reported shall be the measure reported to the chief operating decision maker for the purposes of making decisions aboutallocating resources to the segment and assessing its performance.Adjustmentsand eliminations made in preparing an entity’s financial statements andallocations of revenues,expenses,and gains or losses shall be included indetermining reported segment profit or loss only if they are included in themeasure of the segment’s profit or loss that is used by the chief operatingdecision maker.Similarly,only those assets and liabilities that are included inthe measures of the segment’s assets and segment’s liabilities that are used bythe chief operating decision maker shall be reported for that segment.Ifamounts are allocated to reported segment profit or loss,assets or liabilities,those amounts shall be allocated on a reasonable basis.26If the chief operating decision maker uses only one measure of an operating segment’s profit or loss,the segment’s assets or the segment’s liabilities inassessing segment performance and deciding how to allocate resources,segmentprofit or loss,assets and liabilities shall be reported at those measures.If the 1For assets classified according to a liquidity presentation,non-current assets are assets that include amounts expected to be recovered more than twelve months after the reporting period.A298IFRS FoundationIFRS8chief operating decision maker uses more than one measure of an operatingsegment’s profit or loss,the segment’s assets or the segment’s liabilities,thereported measures shall be those that management believes are determined inaccordance with the measurement principles most consistent with those used inmeasuring the corresponding amounts in the entity’s financial statements.27An entity shall provide an explanation of the measurements of segment profit or loss,segment assets and segment liabilities for each reportable segment.At aminimum,an entity shall disclose the following:(a)the basis of accounting for any transactions between reportablesegments.(b)the nature of any differences between the measurements of thereportable segments’profits or losses and the entity’s profit or loss beforeincome tax expense or income and discontinued operations(if notapparent from the reconciliations described in paragraph28).Thosedifferences could include accounting policies and policies for allocationof centrally incurred costs that are necessary for an understanding of thereported segment information.(c)the nature of any differences between the measurements of thereportable segments’assets and the entity’s assets(if not apparent fromthe reconciliations described in paragraph28).Those differences couldinclude accounting policies and policies for allocation of jointly usedassets that are necessary for an understanding of the reported segmentinformation.(d)the nature of any differences between the measurements of thereportable segments’liabilities and the entity’s liabilities(if not apparentfrom the reconciliations described in paragraph28).Those differencescould include accounting policies and policies for allocation of jointlyutilised liabilities that are necessary for an understanding of thereported segment information.(e)the nature of any changes from prior periods in the measurementmethods used to determine reported segment profit or loss and theeffect,if any,of those changes on the measure of segment profit or loss.(f)the nature and effect of any asymmetrical allocations to reportablesegments.For example,an entity might allocate depreciation expense toa segment without allocating the related depreciable assets to thatsegment.Reconciliations28An entity shall provide reconciliations of all of the following:(a)the total of the reportable segments’revenues to the entity’s revenue.(b)the total of the reportable segments’measures of profit or loss to theentity’s profit or loss before tax expense(tax income)and discontinuedoperations.However,if an entity allocates to reportable segments itemsIFRS Foundation A299。

国际会计准则中英文对照外文翻译文献

中英文对照外文翻译文献(文档含英文原文和中文翻译)译文:译文(一)世界贸易的飞速发展和国际资本的快速流动将世界经济带入了全球化时代。

在这个时代, 任何一个国家要脱离世界贸易市场和资本市场谋求自身发展是非常困难的。

会计作为国际通用的商业语言, 在经济全球化过程中扮演着越来越重要的角色, 市场参与者也对其提出越来越高的要求。

随着市场经济体制的逐步建立和完善,有些国家加入世贸组织后国际化进程的加快,市场开放程度的进一步增强,市场经济发育过程中不可避免的各种财务问题的出现,迫切需要完善的会计准则加以规范。

然而,在会计准则制定过程中,有必要认真思考理清会计准则的概念,使制定的会计准则规范准确、方便操作、经济实用。

由于各国家的历史、环境、经济发展等方面的不同,导致目前世界所使用的会计准则在很多方面都存在着差异,这使得各国家之间的会计信息缺乏可比性,本国信息为外国家信息使用者所理解的成本较高,在很大程度上阻碍了世界国家间资本的自由流动。

近年来,许多国家的会计管理部门和国家性的会计、经济组织都致力于会计准则的思考和研究,力求制定出一套适于各个不同国家和经济环境下的规范一致的会计准则,以增强会计信息的可比性,减少国家各之间经济交往中信息转换的成本。

译文(二)会计准则就是会计管理活动所依据的原则, 会计准则总是以一定的社会经济背景为其存在基础, 也总是反映不同社会经济制度、法律制度以及人们习惯的某些特征, 因而不同国家的会计准则各有不同特点。

但是会计准则毕竟是经济发展对会计规范提出的客观要求。

它与社会经济发展水平和会计管理的基本要求是相适应的,因而,每个国家的会计准则必然具有某些共性:1. 规范性每个企业有着变化多端的经济业务,而不同行业的企业又有各自的特殊性。

而有了会计准则,会计人员在进行会计核算时就有了一个共同遵循的标准,各行各业的会计工作可在同一标准的基础上进行,从而使会计行为达到规范化,使得会计人员提供的会计信息具有广泛的一致性和可比性,大大提高了会计信息的质量。

国际会计准则(1~41)中英文目录对照

国际会计准则(1~41)中英⽂⽬录对照国际会计准则(1~41)中英⽂⽬录对照1.IAS1:Presentation of Financial Statements《IAS1——财务报表的列报》2.IAS2:Inventories《IAS2——存货》3.IAS3:Consolidated Financial Statements《IAS3——合并财务报表》(已被IAS27和IAS28取代)4.IAS4:Depreciation Accounting《IAS4——折旧会计》(已被IAS16、IAS22和IAS38取代)5.IAS5:Information to Be Disclosed in Financial Statements《IAS5——财务报表中披露的信息》(已被IAS1取代)6.IAS6:Accounting Responses to Changing Prices《IAS6——物价变动会计》(已被IAS15取代)7.IAS7:Cash Flow Statements《IAS7——现⾦流量表》8.IAS8:Accounting Policies, Changes in Accounting Estimates and Errors 《IAS8——当期净损益、重⼤差错和会计政策变更》9.IAS9:Accounting for Research and Development Activities《IAS9——研发活动会计》(已被IAS38取代)10.IAS10:Events after the Balance Sheet Date《IAS10——资产负债表⽇后事项》11.IAS11:Construction Contracts《IAS11——建造合同》12.IAS12:Income Taxes《IAS12——所得税》13.IAS13:Presentation of Current Assets and Current Liabilities 《IAS13——流动资产和流动负债的列报》(已被IAS1取代)14.IAS14:Segment Reporting《IAS14——分部报告》15.IAS15:Information Reflecting the Effects of Changing Prices《IAS15——反映物价变动影响的信息》(2003年已被撤销)16.IAS16:Property, Plant and Equipment《IAS16——不动产、⼚场和设备》17.IAS17:Leases《IAS17——租赁》18.IAS18:Revenue《IAS18——收⼊》19.IAS19:Employee Benefits《IAS19——雇员福利》20.IAS20:Accounting for Government Grants and Disclosure of Government Assistance 《IAS20——政府补助会计和政府援助的披露》21.IAS21:The Effects of Changes in Foreign Exchange Rates《IAS21——汇率变动的影响》22.IAS22:Business Combinations《IAS22——企业合并》(已被IFRS3取代)23.IAS23:Borrowing Costs《IAS23——借款费⽤》24.IAS24:Related Party Disclosures《IAS24——关联⽅披露》25.IAS25:Accounting for Investments《IAS25——投资会计》(已被IAS39 和IAS40取代)26.IAS26:Accounting and Reporting by Retirement Benefit Plans《IAS26——退休福利计划的会计和报告》27.IAS27:Consolidated and Separate Financial Statements《IAS27——合并财务报表及对⼦公司投资会计》28.IAS28:Investments in Associates《IAS28——对联合企业投资会计》29.IAS29:Financial Reporting in Hyperinflationary Economies《IAS29——恶性通货膨胀经济中的财务报告》30.IAS30:Disclosures in the Financial Statements of Banks and Similar Financial Institutions 《IAS30——银⾏和类似⾦融机构财务报表中的披露》31.IAS31:Interests in Joint Ventures《IAS31——合营中权益的财务报告》32.IAS32:Financial Instruments: Disclosure and Presentation《IAS32——⾦融⼯具:披露和列报》33.IAS33:Earnings per Share《IAS33——每股收益》34.IAS34:Interim Financial Reporting《IAS34——中期财务报告》35.IAS35:Discontinuing Operations《IAS35——终⽌经营》(已被IFRS5取代)36.IAS36:Impairment of Assets《IAS36——资产减值》37.IAS37:Provisions, Contingent Liabilities and Contingent Assets 《IAS37——准备、或有负债和或有资产》38.IAS38:Intangible Assets《IAS38——⽆形资产》39.IAS39:Financial Instruments: Recognition and Measurement《IAS39——⾦融⼯具:确认和计量》40.IAS40:Investment Property《IAS40——投资性房地产》41.IAS41:Agriculture《IAS41——农业》国际会计准则中⽂版⽂件格式:Pdf可复制性:可复制TAG标签:会计学点击次数:更新时间:2010-03-30 15:23介绍国际会计准则中⽂版,国际会计准则在2008年做了更新,中⽂版不知道是否同步更新,这个对于会计从业⼈员的帮助很⼤,在⽹上找了很久中⽂版都是2003的⽼版本,不知道楼主上传的版本对我是否有⽤。

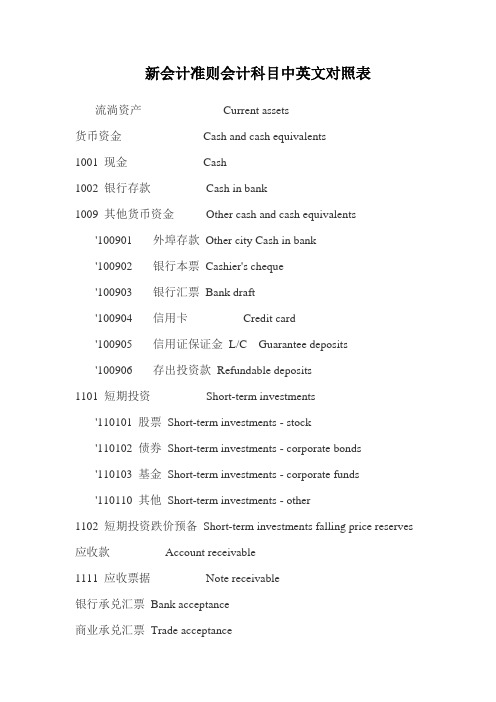

新会计准则会计科目中英文对照表

新会计准则会计科目中英文对照表流淌资产Current assets货币资金Cash and cash equivalents1001 现金Cash1002 银行存款Cash in bank1009 其他货币资金Other cash and cash equivalents '100901 外埠存款Other city Cash in bank'100902 银行本票Cashier's cheque'100903 银行汇票Bank draft'100904 信用卡Credit card'100905 信用证保证金L/C Guarantee deposits'100906 存出投资款Refundable deposits1101 短期投资Short-term investments'110101 股票Short-term investments - stock'110102 债券Short-term investments - corporate bonds'110103 基金Short-term investments - corporate funds'110110 其他Short-term investments - other1102 短期投资跌价预备Short-term investments falling price reserves 应收款Account receivable1111 应收票据Note receivable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance1121 应收股利Dividend receivable1122 应收利息Interest receivable1131 应收账款Account receivable1133 其他应收款Other notes receivable1141 坏账预备Bad debt reserves1151 预付账款Advance money1161 应收补贴款Cover deficit by state subsidies of receivable库存资产Inventories1201 物资采购Supplies purchasing1211 原材料Raw materials1221 包装物Wrappage1231 低值易耗品Low-value consumption goods1232 材料成本差异Materials cost variance1241 自制半成品Semi-Finished goods1243 库存商品Finished goods1244 商品进销差价Differences between purchasing and selling price 1251 托付加工物资Work in process - outsourced1261 托付代销商品Trust to and sell the goods on a commission basis 1271 受托代销商品Commissioned and sell the goods on a commission basis1281 存货跌价预备Inventory falling price reserves1291 分期收款发出商品Collect money and send out the goods bystages1301 待摊费用Deferred and prepaid expenses长期投资Long-term investment1401 长期股权投资Long-term investment on stocks'140101 股票投资Investment on stocks'140102 其他股权投资Other investment on stocks1402 长期债权投资Long-term investment on bonds '140201 债券投资Investment on bonds'140202 其他债权投资Other investment on bonds1421 长期投资减值预备Long-term investments depreciation reserves 股权投资减值预备Stock rights investment depreciation reserves债权投资减值预备Bcreditor's rights investment depreciation reserves 1431 托付贷款Entrust loans'143101 本金Principal'143102 利息Interest'143103 减值预备Depreciation reserves1501 固定资产Fixed assets房屋Building建筑物Structure机器设备Machinery equipment运输设备Transportation facilities工具器具Instruments and implement1502 累计折旧Accumulated depreciation1505 固定资产减值预备Fixed assets depreciation reserves房屋、建筑物减值预备Building/structure depreciation reserves机器设备减值预备Machinery equipment depreciation reserves1601 工程物资Project goods and material'160101 专用材料Special-purpose material'160102 专用设备Special-purpose equipment'160103 预付大型设备款Prepayments for equipment'160104 为生产预备的工具及器具Preparative instruments and implement for fabricate1603 在建工程Construction-in-process安装工程Erection works在安装设备Erecting equipment-in-process技术改造工程Technical innovation project大修理工程General overhaul project1605 在建工程减值预备Construction-in-process depreciation reserves 1701 固定资产清理Liquidation of fixed assets1801 无形资产Intangible assets专利权Patents非专利技术Non-Patents商标权Trademarks, Trade names著作权Copyrights土地使用权Tenure商誉Goodwill1805 无形资产减值预备Intangible Assets depreciation reserves专利权减值预备Patent rights depreciation reserves商标权减值预备trademark rights depreciation reserves1815 未确认融资费用Unacknowledged financial charges待处理财产损溢Wait deal assets loss or income1901 长期待摊费用Long-term deferred and prepaid expenses1911 待处理财产损溢Wait deal assets loss or income '191101待处理流淌资产损溢Wait deal intangible assets loss or income'191102待处理固定资产损溢Wait deal fixed assets loss or income二、负债类Liability短期负债Current liability2101 短期借款Short-term borrowing2111 应对票据Notes payable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance2121 应对账款Account payable2131 预收账款Deposit received2141 代销商品款Proxy sale goods revenue2151 应对工资Accrued wages2153 应对福利费Accrued welfarism2161 应对股利Dividends payable2171 应交税金Tax payable'217101 应交增值税value added tax payable'21710101 进项税额Withholdings on VAT'21710102 已交税金Paying tax'21710103 转出未交增值税Unpaid VAT changeover'21710104 减免税款Tax deduction'21710105 销项税额Substituted money on VAT'21710106 出口退税Tax reimbursement for export'21710107 进项税额转出Changeover withnoldings on VAT'21710108 出口抵减内销产品应纳税额Export deduct domestic sales goods tax'21710109 转出多交增值税Overpaid VAT changeover '21710110 未交增值税Unpaid VAT'217102 应交营业税Business tax payable'217103 应交消费税Consumption tax payable'217104 应交资源税Resources tax payable'217105 应交所得税Income tax payable'217106 应交土地增值税Increment tax on land value payable'217107 应交都市爱护建设税Tax for maintaining and building cities payable'217108 应交房产税Housing property tax payable'217109 应交土地使用税Tenure tax payable'217110 应交车船使用税Vehicle and vessel usage license plate tax(VVULPT) payable'217111 应交个人所得税Personal income tax payable2176 其他应交款Other fund in conformity with paying 2181 其他应对款Other payables2191 预提费用Drawing expense in advance其他负债Other liabilities2201 待转资产价值Pending changerover assets value2211 估量负债Anticipation liabilities长期负债Long-term Liabilities2301 长期借款Long-term loans一年内到期的长期借款Long-term loans due within one year一年后到期的长期借款Long-term loans due over one year2311 应对债券Bonds payable'231101 债券面值Face value, Par value'231102 债券溢价Premium on bonds'231103 债券折价Discount on bonds'231104 应计利息Accrued interest2321 长期应对款Long-term account payable应对融资租赁款Accrued financial lease outlay一年内到期的长期应对Long-term account payable due within one year 一年后到期的长期应对Long-term account payable over one year 2331 专项应对款Special payable一年内到期的专项应对Long-term special payable due within one year 一年后到期的专项应对Long-term special payable over one year2341 递延税款Deferral taxes 三、所有者权益类OWNERS' EQUITY资本Capita3101 实收资本(或股本) Paid-up capital(or stock)实收资本Paicl-up capital实收股本Paid-up stock3103 已归还投资Investment Returned公积3111 资本公积Capital reserve'311101 资本(或股本)溢价Cpital(or Stock) premium'311102 同意捐赠非现金资产预备Receive non-cash donate reserve'311103 股权投资预备Stock right investment reserves'311105 拨款转入Allocate sums changeover in'311106 外币资本折算差额Foreign currency capital'311107 其他资本公积Other capital reserve3121 盈余公积Surplus reserves'312101 法定盈余公积Legal surplus'312102 任意盈余公积Free surplus reserves'312103 法定公益金Legal public welfare fund'312104 储备基金Reserve fund'312105 企业进展基金Enterprise expension fund'312106 利润归还投资Profits capitalizad on return of investment 利润Profits3131 本年利润Current year profits3141 利润分配Profit distribution'314101 其他转入Other chengeover in'314102 提取法定盈余公积Withdrawal legal surplus'314103 提取法定公益金Withdrawal legal public welfare funds '314104 提取储备基金Withdrawal reserve fund'314105 提取企业进展基金Withdrawal reserve for business expansion'314106 提取职工奖励及福利基金Withdrawal staff and workers' bonus and welfare fund'314107 利润归还投资Profits capitalizad on return of investment'314108 应对优先股股利Preferred Stock dividends payable'314109 提取任意盈余公积Withdrawal other commonaccumulation fund'314110 应对一般股股利Common Stock dividends payable '314111 转作资本(或股本)的一般股股利Common Stock dividends change to assets(or stock)'314115 未分配利润Undistributed profit 四、成本类Cost4101 生产成本Cost of manufacture'410101 差不多生产成本Base cost of manufacture'410102 辅助生产成本Auxiliary cost of manufacture4105 制造费用Manufacturing overhead材料费Materials治理人职员资Executive Salaries奖金Wages退职金Retirement allowance补贴Bonus外保劳务费Outsourcing fee福利费Employee benefits/welfare会议费Coferemce加班餐费Special duties市内交通费Business traveling通讯费Correspondence费Correspondence水电取暖费Water and Steam税费Taxes and dues租赁费Rent治理费Maintenance车辆爱护费Vehicles maintenance油料费Vehicles maintenance培训费Education and training接待费Entertainment图书、印刷费Books and printing运费Transpotation保险费Insurance premium支付手续费Commission杂费Sundry charges折旧费Depreciation expense机物料消耗Article of consumption劳动爱护费Labor protection fees季节性停工缺失Loss on seasonality cessation4107 劳务成本Service costs五、损益类Profit and loss 收入Income业务收入OPERATING INCOME5101 主营业务收入Prime operating revenue产品销售收入Sales revenue服务收入Service revenue5102 其他业务收入Other operating revenue材料销售Sales materials代购代售包装物出租Wrappage lease出让资产使用权收入Remise right of assets revenue返还所得税Reimbursement of income tax其他收入Other revenue5201 投资收益Investment income短期投资收益Current investment income长期投资收益Long-term investment income计提的托付贷款减值预备Withdrawal of entrust loans reserves 5203 补贴收入Subsidize revenue国家扶持补贴收入Subsidize revenue from country其他补贴收入Other subsidize revenue5301 营业外收入NON-OPERATING INCOME非货币性交易收益Non-cash deal income现金溢余Cash overage处置固定资产净收益Net income on disposal of fixed assets出售无形资产收益Income on sales of intangible assets固定资产盘盈Fixed assets inventory profit罚款净收入Net amercement income支出Outlay业务支出Revenue charges5401 主营业务成本Operating costs产品销售成本Cost of goods sold服务成本Cost of service5402 主营业务税金及附加Tax and associate charge 营业税Sales tax消费税Consumption tax都市爱护建设税Tax for maintaining and building cities 资源税Resources tax土地增值税Increment tax on land value5405 其他业务支出Other business expense销售其他材料成本Other cost of material sale其他劳务成本Other cost of service其他业务税金及附加费Other tax and associate charge 费用Expenses5501 营业费用Operating expenses代销手续费Consignment commission charge 运杂费Transpotation保险费Insurance premium展览费Exhibition fees广告费Advertising fees5502 治理费用Adminisstrative expenses职工工资Staff Salaries修理费Repair charge低值易耗摊销Article of consumption办公费Office allowance差旅费Travelling expense工会经费Labour union expenditure研究与开发费Research and development expense福利费Employee benefits/welfare职工教育经费Personnel education待业保险费Unemployment insurance劳动保险费Labour insurance医疗保险费Medical insurance会议费Coferemce聘请中介机构费Intermediary organs咨询费Consult fees诉讼费Legal cost业务招待费Business entertainment技术转让费Technology transfer fees矿产资源补偿费Mineral resources compensation fees排污费Pollution discharge fees房产税Housing property tax车船使用税Vehicle and vessel usage license plate tax(VVULPT)土地使用税Tenure tax印花税Stamp tax5503 财务费用Finance charge利息支出Interest exchange汇兑缺失Foreign exchange loss各项手续费Charge for trouble各项专门借款费用Special-borrowing cost5601 营业外支出Nonbusiness expenditure捐赠支出Donation outlay减值预备金Depreciation reserves专门缺失Extraordinary loss处理固定资产净缺失Net loss on disposal of fixed assets 出售无形资产缺失Loss on sales of intangible assets 固定资产盘亏Fixed assets inventory loss债务重组缺失Loss on arrangement罚款支出Amercement outlay5701 所得税Income tax往常年度损益调整Prior year income adjustment。

国际会计准则——ias8

IAS 18 International Accounting Standard 18RevenueThis version includes amendments resulting from IFRSs issued up to 31 December 2008.IAS 18 Revenue was issued by the International Accounting Standards Committee in December 1993. It replaced IAS 18 Revenue Recognition (issued in December 1982).Limited amendments to IAS 18 were made as a consequence of IAS 39 (in 1998), IAS 10 (in1999) and IAS 41 (in January 2001).In April 2001 the International Accounting Standards Board resolved that all Standards and Interpretations issued under previous Constitutions continued to be applicable unless and until they were amended or withdrawn.Since then IAS 18 and its Appendix have been amended by the following IFRSs:•IAS39Financial Instruments: Recognition and Measurement (as revised in December 2003)•IFRS4Insurance Contracts (issued March 2004)•IAS1Presentation of Financial Statements (as revised in September 2007)* amended the terminology used throughout IFRSs, including IAS 18•Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate(Amendments to IFRS 1 and IAS 27) (issued May 2008)*•Improvements to IFRSs (issued May 2008)*•IFRIC15Agreements for the Construction of Real Estate (issued July 2008).*As well as IFRIC 15 the following Interpretations refer to IAS 18:•SIC-13 Jointly Controlled Entities—Non-Monetary Contributions by Venturers(issued December 1998 and subsequently amended)•SIC-27 Evaluating the Substance of Transactions involving the Legal Form of a Lease (issued December 2001 and subsequently amended)•SIC-31 Revenue—Barter Transactions Involving Advertising Services(issued December 2001 and subsequently amended)•IFRIC12Service Concession Arrangements(issued November 2006 and subsequently amended)•IFRIC13Customer Loyalty Programmes (issued June 2007)..*effective date 1 January 2009© IASCF1205IAS 181206© IASCF C ONTENTSparagraphs INTERNATIONAL ACCOUNTING STANDARD 18REVENUEOBJECTIVESCOPE1–6DEFINITIONS7–8MEASUREMENT OF REVENUE9–12IDENTIFICATION OF THE TRANSACTION13SALE OF GOODS14–19RENDERING OF SERVICES20–28INTEREST, ROYALTIES AND DIVIDENDS29–34DISCLOSURE35–36EFFECTIVE DATE37–38APPENDIXIAS 18 International Accounting Standard 18 Revenue (IAS 18) is set out in paragraphs 1–38. All the paragraphs have equal authority but retain the IASC format of the Standard when it was adopted by the IASB. IAS 18 should be read in the context of its objective, the Preface to International Financial Reporting Standards and the Framework for the Preparation and Presentation of Financial Statements. IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.© IASCF1207IAS 18International Accounting Standard 18RevenueObjectiveIncome is defined in the Framework for the Preparation and Presentation of Financial Statements as increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. Income encompasses both revenue and gains. Revenue is income that arises in the course of ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties.The objective of this Standard is to prescribe the accounting treatment of revenue arising from certain types of transactions and events.The primary issue in accounting for revenue is determining when to recognise revenue. Revenue is recognised when it is probable that future economic benefits will flow to the entity and these benefits can be measured reliably. This Standard identifies the circumstances in which these criteria will be met and, therefore, revenue will be recognised. It also provides practical guidance on the application of these criteria.Scope1This Standard shall be applied in accounting f or revenue arising f rom the following transactions and events:(a)the sale of goods;(b)the rendering of services; and(c)the use by others of entity assets yielding interest, royalties and dividends.2This Standard supersedes IAS18 Revenue Recognition approved in 1982.3Goods includes goods produced by the entity for the purpose of sale and goods purchased for resale, such as merchandise purchased by a retailer or land and other property held for resale.4The rendering of services typically involves the performance by the entity of a contractually agreed task over an agreed period of time. The services may be rendered within a single period or over more than one period. Some contracts for the rendering of services are directly related to construction contracts, for example, those for the services of project managers and architects. Revenue arising from these contracts is not dealt with in this Standard but is dealt with in accordance with the requirements for construction contracts as specified in IAS11 Construction Contracts.5The use by others of entity assets gives rise to revenue in the form of:(a)interest—charges for the use of cash or cash equivalents or amounts due tothe entity;1208© IASCFIAS 18(b)royalties—charges for the use of long-term assets of the entity, for example,patents, trademarks, copyrights and computer software; and(c)dividends—distributions of profits to holders of equity investments inproportion to their holdings of a particular class of capital.6This Standard does not deal with revenue arising from:(a)lease agreements (see IAS 17 Leases);(b)dividends arising from investments which are accounted for under theequity method (see IAS 28 Investments in Associates);(c)insurance contracts within the scope of IFRS 4 Insurance Contracts;(d)changes in the fair value of financial assets and financial liabilities or theirdisposal (see IAS 39 Financial Instruments: Recognition and Measurement);(e)changes in the value of other current assets;(f)initial recognition and from changes in the fair value of biological assetsrelated to agricultural activity (see IAS 41 Agriculture);(g)initial recognition of agricultural produce (see IAS 41); and(h)the extraction of mineral ores.Definitions7The following terms are used in this Standard with the meanings specified:Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an entity when those inf lows result in increases in equity, other than increases relating to contributions f rom equity participants.Fair value is the amount f or which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction. 8Revenue includes only the gross inflows of economic benefits received and receivable by the entity on its own account. Amounts collected on behalf of third parties such as sales taxes, goods and services taxes and value added taxes are not economic benefits which flow to the entity and do not result in increases in equity. Therefore, they are excluded from revenue. Similarly, in an agency relationship, the gross inflows of economic benefits include amounts collected on behalf of the principal and which do not result in increases in equity for the entity. The amounts collected on behalf of the principal are not revenue.Instead, revenue is the amount of commission.Measurement of revenue9Revenue shall be measured at the f air value of the consideration received or receivable.**See also SIC-31 Revenue—Barter Transactions Involving Advertising Services© IASCF1209IAS 1810The amount of revenue arising on a transaction is usually determined by agreement between the entity and the buyer or user of the asset. It is measured at the fair value of the consideration received or receivable taking into account the amount of any trade discounts and volume rebates allowed by the entity.11In most cases, the consideration is in the form of cash or cash equivalents and the amount of revenue is the amount of cash or cash equivalents received or receivable. However, when the inflow of cash or cash equivalents is deferred, the fair value of the consideration may be less than the nominal amount of cash received or receivable. For example, an entity may provide interest free credit to the buyer or accept a note receivable bearing a below-market interest rate from the buyer as consideration for the sale of goods. When the arrangement effectively constitutes a financing transaction, the fair value of the consideration is determined by discounting all future receipts using an imputed rate of interest.The imputed rate of interest is the more clearly determinable of either:(a)the prevailing rate for a similar instrument of an issuer with a similarcredit rating; or(b) a rate of interest that discounts the nominal amount of the instrument tothe current cash sales price of the goods or services.The difference between the fair value and the nominal amount of the consideration is recognised as interest revenue in accordance with paragraphs 29 and 30 and in accordance with IAS39.12When goods or services are exchanged or swapped for goods or services which are of a similar nature and value, the exchange is not regarded as a transaction which generates revenue. This is often the case with commodities like oil or milk where suppliers exchange or swap inventories in various locations to fulfil demand on a timely basis in a particular location. When goods are sold or services are rendered in exchange for dissimilar goods or services, the exchange is regarded as a transaction which generates revenue. The revenue is measured at the fair value of the goods or services received, adjusted by the amount of any cash or cash equivalents transferred. When the fair value of the goods or services received cannot be measured reliably, the revenue is measured at the fair value of the goods or services given up, adjusted by the amount of any cash or cash equivalents transferred.Identification of the transaction13The recognition criteria in this Standard are usually applied separately to each transaction. However, in certain circumstances, it is necessary to apply the recognition criteria to the separately identifiable components of a single transaction in order to reflect the substance of the transaction. For example, when the selling price of a product includes an identifiable amount for subsequent servicing, that amount is deferred and recognised as revenue over the period during which the service is performed. Conversely, the recognition criteria are applied to two or more transactions together when they are linked in such a way that the commercial effect cannot be understood without reference to 1210© IASCFIAS 18 the series of transactions as a whole. For example, an entity may sell goods and, at the same time, enter into a separate agreement to repurchase the goods at a later date, thus negating the substantive effect of the transaction; in such a case, the two transactions are dealt with together.Sale of goods14Revenue f rom the sale of goods shall be recognised when all the f ollowing conditions have been satisfied:(a)the entity has transferred to the buyer the significant risks and rewards ofownership of the goods;(b)the entity retains neither continuing managerial involvement to the degreeusually associated with ownership nor effective control over the goods sold;(c)the amount of revenue can be measured reliably;(d)it is probable that the economic benef its associated with the transactionwill flow to the entity; and(e)the costs incurred or to be incurred in respect of the transaction can bemeasured reliably.15The assessment of when an entity has transferred the significant risks and rewards of ownership to the buyer requires an examination of the circumstances of the transaction. In most cases, the transfer of the risks and rewards of ownership coincides with the transfer of the legal title or the passing of possession to the buyer. This is the case for most retail sales. In other cases, the transfer of risks and rewards of ownership occurs at a different time from the transfer of legal title or the passing of possession.16If the entity retains significant risks of ownership, the transaction is not a sale and revenue is not recognised. An entity may retain a significant risk of ownership ina number of ways. Examples of situations in which the entity may retain thesignificant risks and rewards of ownership are:(a)when the entity retains an obligation for unsatisfactory performance notcovered by normal warranty provisions;(b)when the receipt of the revenue from a particular sale is contingent on thederivation of revenue by the buyer from its sale of the goods;(c)when the goods are shipped subject to installation and the installation is asignificant part of the contract which has not yet been completed by theentity; and(d)when the buyer has the right to rescind the purchase for a reason specifiedin the sales contract and the entity is uncertain about the probability ofreturn.17If an entity retains only an insignificant risk of ownership, the transaction is a sale and revenue is recognised. For example, a seller may retain the legal title to the goods solely to protect the collectibility of the amount due. In such a case, if the entity has transferred the significant risks and rewards of ownership, the© IASCF1211IAS 18transaction is a sale and revenue is recognised. Another example of an entity retaining only an insignificant risk of ownership may be a retail sale when a refund is offered if the customer is not satisfied. Revenue in such cases is recognised at the time of sale provided the seller can reliably estimate future returns and recognises a liability for returns based on previous experience and other relevant factors.18Revenue is recognised only when it is probable that the economic benefits associated with the transaction will flow to the entity. In some cases, this may not be probable until the consideration is received or until an uncertainty is removed.For example, it may be uncertain that a foreign governmental authority will grant permission to remit the consideration from a sale in a foreign country.When the permission is granted, the uncertainty is removed and revenue is recognised. However, when an uncertainty arises about the collectibility of an amount already included in revenue, the uncollectible amount or the amount in respect of which recovery has ceased to be probable is recognised as an expense, rather than as an adjustment of the amount of revenue originally recognised. 19Revenue and expenses that relate to the same transaction or other event are recognised simultaneously; this process is commonly referred to as the matching of revenues and expenses. Expenses, including warranties and other costs to be incurred after the shipment of the goods can normally be measured reliably when the other conditions for the recognition of revenue have been satisfied. However, revenue cannot be recognised when the expenses cannot be measured reliably; in such circumstances, any consideration already received for the sale of the goods is recognised as a liability.Rendering of services20When the outcome of a transaction involving the rendering of services can be estimated reliably, revenue associated with the transaction shall be recognised by reference to the stage of completion of the transaction at the end of the reporting period. The outcome of a transaction can be estimated reliably when all the following conditions are satisfied:(a)the amount of revenue can be measured reliably;(b)it is probable that the economic benef its associated with the transactionwill flow to the entity;(c)the stage of completion of the transaction at the end of the reportingperiod can be measured reliably; and(d)the costs incurred f or the transaction and the costs to complete thetransaction can be measured reliably.*21The recognition of revenue by reference to the stage of completion of a transaction is often referred to as the percentage of completion method. Under this method, revenue is recognised in the accounting periods in which the services are rendered. The recognition of revenue on this basis provides useful *See also SIC-27 Evaluating the Substance of Transactions in the Legal Form of a Lease and SIC-31 Revenue—Barter Transactions Involving Advertising Services.1212© IASCFIAS 18 information on the extent of service activity and performance during a period.IAS11 also requires the recognition of revenue on this basis. The requirements of that Standard are generally applicable to the recognition of revenue and the associated expenses for a transaction involving the rendering of services.22Revenue is recognised only when it is probable that the economic benefits associated with the transaction will flow to the entity. However, when an uncertainty arises about the collectibility of an amount already included in revenue, the uncollectible amount, or the amount in respect of which recovery has ceased to be probable, is recognised as an expense, rather than as an adjustment of the amount of revenue originally recognised.23An entity is generally able to make reliable estimates after it has agreed to the following with the other parties to the transaction:(a)each party’s enforceable rights regarding the service to be provided andreceived by the parties;(b)the consideration to be exchanged; and(c)the manner and terms of settlement.It is also usually necessary for the entity to have an effective internal financial budgeting and reporting system. The entity reviews and, when necessary, revises the estimates of revenue as the service is performed. The need for such revisions does not necessarily indicate that the outcome of the transaction cannot be estimated reliably.24The stage of completion of a transaction may be determined by a variety of methods. An entity uses the method that measures reliably the services performed. Depending on the nature of the transaction, the methods may include:(a)surveys of work performed;(b)services performed to date as a percentage of total services to be performed;or(c)the proportion that costs incurred to date bear to the estimated total costsof the transaction. Only costs that reflect services performed to date areincluded in costs incurred to date. Only costs that reflect servicesperformed or to be performed are included in the estimated total costs ofthe transaction.Progress payments and advances received from customers often do not reflect the services performed.25For practical purposes, when services are performed by an indeterminate number of acts over a specified period of time, revenue is recognised on a straight-line basis over the specified period unless there is evidence that some other method better represents the stage of completion. When a specific act is much more significant than any other acts, the recognition of revenue is postponed until the significant act is executed.© IASCF1213IAS 1826When the outcome of the transaction involving the rendering of services cannot be estimated reliably, revenue shall be recognised only to the extent of the expenses recognised that are recoverable.27During the early stages of a transaction, it is often the case that the outcome of the transaction cannot be estimated reliably. Nevertheless, it may be probable that the entity will recover the transaction costs incurred. Therefore, revenue is recognised only to the extent of costs incurred that are expected to be recoverable.As the outcome of the transaction cannot be estimated reliably, no profit is recognised.28When the outcome of a transaction cannot be estimated reliably and it is not probable that the costs incurred will be recovered, revenue is not recognised and the costs incurred are recognised as an expense. When the uncertainties that prevented the outcome of the contract being estimated reliably no longer exist, revenue is recognised in accordance with paragraph 20 rather than in accordance with paragraph 26.Interest, royalties and dividends29Revenue arising from the use by others of entity assets yielding interest, royalties and dividends shall be recognised on the bases set out in paragraph 30 when:(a)it is probable that the economic benef its associated with the transactionwill flow to the entity; and(b)the amount of the revenue can be measured reliably.30Revenue shall be recognised on the following bases:(a)interest shall be recognised using the effective interest method as set out inIAS39, paragraphs 9 and AG5–AG8;(b)royalties shall be recognised on an accrual basis in accordance with thesubstance of the relevant agreement; and(c)dividends shall be recognised when the shareholder’s right to receivepayment is established.31[Deleted]32When unpaid interest has accrued before the acquisition of an interest-bearing investment, the subsequent receipt of interest is allocated between pre-acquisition and post-acquisition periods; only the post-acquisition portion is recognised as revenue.33Royalties accrue in accordance with the terms of the relevant agreement and are usually recognised on that basis unless, having regard to the substance of the agreement, it is more appropriate to recognise revenue on some other systematic and rational basis.1214© IASCFIAS 18 34Revenue is recognised only when it is probable that the economic benefits associated with the transaction will flow to the entity. However, when an uncertainty arises about the collectibility of an amount already included in revenue, the uncollectible amount, or the amount in respect of which recovery has ceased to be probable, is recognised as an expense, rather than as an adjustment of the amount of revenue originally recognised.Disclosure35An entity shall disclose:(a)the accounting policies adopted for the recognition of revenue, includingthe methods adopted to determine the stage of completion of transactionsinvolving the rendering of services;(b)the amount of each significant category of revenue recognised during theperiod, including revenue arising from:(i)the sale of goods;(ii)the rendering of services;(iii)interest;(iv)royalties;(v)dividends; and(c)the amount o revenue arising rom exchanges o goods or servicesincluded in each significant category of revenue.36An entity discloses any contingent liabilities and contingent assets in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Contingent liabilities and contingent assets may arise from items such as warranty costs, claims, penalties or possible losses.Effective date37This Standard becomes operative for financial statements covering periods beginning on or after 1January 1995.38Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate (Amendments to IFRS 1 First-time Adoption of International Financial Reporting Standards and IAS 27 Consolidated and Separate Financial Statements), issued in M ay 2008, amended paragraph 32. An entity shall apply that amendment prospectively for annual periods beginning on or after 1 January 2009. Earlier application is permitted.If an entity applies the related amendments in paragraphs 4 and 38A of IAS 27 for an earlier period, it shall apply the amendment in paragraph 32 at the same time.© IASCF1215。

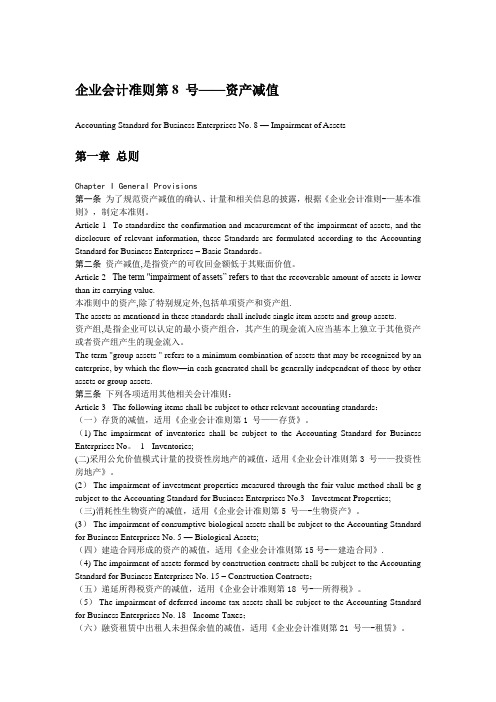

企业会计准则08 号--资产减值(中英文对照)【范本模板】

企业会计准则第8 号——资产减值Accounting Standard for Business Enterprises No. 8 — Impairment of Assets第一章总则Chapter I General Provisions第一条为了规范资产减值的确认、计量和相关信息的披露,根据《企业会计准则-—基本准则》,制定本准则。

Article 1 To standardize the confirmation and measurement of the impairment of assets, and the disclosure of relevant information, these Standards are formulated according to the Accounting Standard for Business Enterprises – Basic Standards。

第二条资产减值,是指资产的可收回金额低于其账面价值。

Article 2 The term "impairment of assets” refers to that the recoverable amount of assets is lower than its carrying value.本准则中的资产,除了特别规定外,包括单项资产和资产组.The assets as mentioned in these standards shall include single item assets and group assets.资产组,是指企业可以认定的最小资产组合,其产生的现金流入应当基本上独立于其他资产或者资产组产生的现金流入。

The term "group assets " refers to a minimum combination of assets that may be recognized by an enterprise, by which the flow—in cash generated shall be generally independent of those by other assets or group assets.第三条下列各项适用其他相关会计准则:Article 3 The following items shall be subject to other relevant accounting standards:(一)存货的减值,适用《企业会计准则第1 号——存货》。

最新国际会计准则IAS8

目录一、概述二、目的三、范围四、定义五、本期净损益六、非常项目七、正常活动的损益八、中断经营九、会计估计的变化十、基本错误十一、基准处理方法十二、会计政策的变更十三、国际会计准则的采用十四、生效日期二、目的本号准则的目的是对损益表中某些项目的分类、揭示和会计处理作出规定,以便使所有的企业均在一致的基础上编制和呈报损益表。

这不仅增强了与企业前期财务报表的可比性,而且也增强了与其他企业财务报表的可比性。

因此,本号准则要求对非常项目进行分类和揭示,并且揭示正常经营活动所产生的损益中的某些项目。

本号准则还对会计估计的变化、会计政策的变更以及基本错误的更改规定了处理方法。

三、范围1.本号准则应在损益表呈报由正常活动和非常项目产生的损益,以及在对会计估计的变化、基本错误的更改和会计政策的变更进行核算时予以采用。

2.本号准则替代于1977年批准的国际会计准则第8号“非常项目、前期项目和会计政策的变更”。

3.本号准则涉及对本期净损益中某些项目的揭示。

除了按其他国际会计准则,包括国际会计准则第5号“财务报表应揭示的信息”所要求的其他揭示外,还应作出这些揭示。

4.本号准则还涉及与中断经营有关的某些揭示,但不涉及与中断经营有关的确认与计量问题。

5.非常项目、基本错误和会计政策的变更的税务影响应按国际会计准则第12号“所得税会计”的要求进行核算和揭示。

国际会计准则第12号中提到的“特殊项目”,应视为本号准则所定义的“非常项目”。

四、定义6.本号准则所用的下列术语,具有特定的含义。

非常项目,是指由明显区别于企业正常活动的事项成交易所产生的收益或使用,因此不会经常或定期发生。

正常活动,是指企业所从事的作为其业务组成部分的所有活动,以及企业为促进这些活动的完成附带或因这些活动而产生的相关活动。

中断经营,是一项经营项目的出售或放弃的结果,该经营项目代表了企业一个独立、主要的业务种类,并且该经营项目的资产、净损益和活动能够从实物上、经营上和财务报告的目的上加以区分。

国际财务报告准则 IAS8 CAS28.

• •

Errors

•Paragragh 5:Introduction to Prior period errors •Prior period errors are omissions from, and misstatements in, • • •

the entity’s financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that: (a) was available when financial statements for those periods were authorised for issue; and (b) could reasonably be expected to have been obtained and taken into account in the preparation and presentation of those financial statements. Such errors include the effects of mathematical mistakes, mistakes in applying accounting policies, oversights or misinterpretations of facts, and fraud.

many items in financial statements cannot be measured with precision but can only be estimated. Estimation involves judgements based on the latest available, reliable information. For example, estimates may be required of: (a) bad debts; (b) inventory obsolescence; (c) the fair value of financial assets or financial liabilities; (d) the useful lives of, or expected pattern of consumption of the future economic benefits embodied in, depreciable assets; and (e) warranty obligations. The use of reasonable estimates is an essential part of the preparation of financial statements and does not undermine their reliability.

国际会计准则中英对照(去 Logo)精编版

IFRS and IAS Summaries(2011) 《国际财务报告准则》及《国际会计准则》

摘要(2011)

This extract has been prepared by IFRS Foundation staff and has not been approved by the IASB. For the requirements reference must be made to International Financial Reporting Standards. 本摘要由国际财务报告准则基金会职员编制,未经国际会计准则理事会正式批准。涉及相关要求必须遵照《国际 财务报告准则》。

1

2011

and potential investors, lenders and other creditors cannot require reporting entities to provide information directly to them and must rely on general purpose financial reports for much of the financial information they need. Consequently, they are the primary users to whom general purpose financial reports are directed.

国际会计准则第8号

国际会计准则第8号首先,IAS8要求企业在编制财务报表时,选择和应用会计政策应当遵守已颁布的国际会计准则。

如果其中一特定问题没有相关的国际会计准则,企业应参考和适应与该问题相关的其他准则。

此外,在编制财务报表时,企业应保持会计政策的一致性,除非:(1)相关的国际会计准则对会计政策变更有明确要求;或者(2)会计政策的更改能够提供更准确和可靠的信息或者更符合财务报表用户的需要。

其次,IAS8规定了如何处理会计估计和会计错误。

会计估计是指在编制财务报表时,由于涉及到主观判断或不确定性,需要使用合理的估计方法来计量或者核算一项款项金额。

在会计估计发生变更时,企业应采用严谨的会计估计方法,并要在财务报表中说明变更的会计估计原因和影响。

会计错误是指在编制财务报表期间,由于计算、分类或披露错误导致财务报表信息的不准确性。

在发现会计错误时,企业应进行更正,并在财务报表中说明错误的性质、金额以及相关调整的原因。

IAS8还强调了会计政策、会计估计和会计错误的披露要求。

企业应在财务报表中披露关于会计政策的详细信息,包括会计政策的选择原则、会计估计的主要假设和参数,以及可能对财务报表产生重大影响的未来事件和事项。

此外,企业还应对会计估计变更的原因和影响进行披露,并解释会计政策变更的原因和影响。

对于已更正的会计错误,企业应披露错误的性质、原因、金额以及相关调整的影响。

最后,IAS8明确了审阅会计政策的要求。

企业应在财务报表中说明其采用的会计政策,并评估会计政策选择的适当性和准确性。

审阅者应对企业所采用的会计政策的合理性进行评估,并确保会计政策选择的一致性和准确性。

总结起来,国际会计准则第8号规定了企业在选择、应用和披露会计政策、会计估计和会计错误时应遵循的原则。

这些准则的目的是提高财务报表的可比性和准确性,并为财务报表使用者提供可靠的信息,从而增加对企业财务状况和经营绩效的理解和判断。

国际财务报告准则第 8号——经营分部》 (IFRS 8)

向德勤全球的客户和员工发布德勤全球国际财务报告准则国际财务报告准则第8号经营分部ifrs8领导小组国际财务报告准则全球办公室国际会计准则理事会iasb于2006年11月30日发布了国际财球国际财务报告准则领导人务报告准则第8号经营分部ifrs8该准则取代了kenwild国际会计准则第14号分部报告ias14并对报告期始kwilddeloittecouk于2009年1月1日或以后日期的年度财务报表生效准则也允许被国际财务报告准则卓越中心提前采用

送其个别(或合并)财务报表。 但是,如果母公司的单独及合并财务报表编列于同一份财务报告中,则分部信息仅需基于合并 财务报表列报。 经营分部 IFRS 8将经营分部定义如下: 经营分部是主体的组成部分:

l 从事可赚取收入和发生费用(包括与同一主体内的其他组成部分进行交易而发生的相关收 入和费用)的经营活动;

IAS Plus网站 目前访问我们 网站的人数已超过五百四十万。 我们的目标是在互联网上提供国 际财务报告相关新闻的最佳综合 资讯。敬请定期查阅。

《国际财务报告准则第 8 号——经营分部》(IFRS 8)

国际会计准则理事会(IASB)于2006年11月30日发布了《国际财 务报告准则第8号——经营分部》(IFRS 8),该准则取代了 《国际会计准则第14号——分部报告》(IAS 14)并对报告期始 于2009年1月1日或以后日期的年度财务报表生效,准则也允许被 提前采用。IFRS 8一经生效,国际财务报告准则与美国公认会计 原则下的分部报告将实现趋同(除一些细微的差异外)。

及计量基础的信息;及 l 将分部总收入、报告分部损益、分部资产、分部负债及其他重大项目调节为主体财务报表

中相应项目的调节表。 此外,即使仅有一个报告分部,主体也需要按规定对整个主体的信息进行披露,这些披露信息 包括关于每一产品和服务或产品和服务组的信息。 IFRS 8要求按地区对收入和特定的非流动资产进行分析——且如果信息重要,需要进一步按个 别境外国家披露重大的收入/资产,而不论经营分部如何识别。如果无法取得必要的信息进行上 述分析且获取该信息的成本过高,则必须披露这一事实。 IFRS 8同时要求披露与主要顾客交易的信息。如果与单一外部顾客的交易产生的收入总额占主 体收入的10%或以上,则必须披露来自每一个此类顾客的收入总额以及报告此类收入的分部。 主体既无需披露主要顾客的特征,也无需披露各分部报告从该顾客赚取的收入金额。据此,已 知的同一控制下的一组主体应作为单一顾客处理;而政府及已知由政府控制的主体亦应作为单 一顾客处理。 对《国际会计准则第 34 号——中期财务报告》(IAS 34)的修订 IFRS 8 将进一步扩展中期报告日的分部信息要求。鉴于报告的金额将与内部报告的金额一致, 理事会认为现时有可能在无需过多成本或延迟的情况下,在中期报告中扩展分部信息。 对《国际会计准则第 36 号——资产减值》(IAS 36)的修订 IAS 36 规定,商誉的减值测试应当在与商誉相关的现金产出单元的减值测试中进行。在识别减 值测试中商誉所属的单元(单元组)时,IAS 36 通过参照主体的报告分部限制该等单元或单元 组的规模。IFRS 8 取代 IAS 14 后,最大限制将参照根据 IFRS 8 认定的主体经营分部来确定— 这可能与过往根据 IAS 14 确定的限制有所不同。 生效日期和过渡性规定 IFRS 8 对报告期始于 2009 年 1 月 1 日或以后日期的年度财务报表生效,允许提前采用。如果主 体提前采用 IFRS 8, 亦应同时采用 IAS 34 的修订版(及其他相应修订)。除非无法取得有关 信息或获取该信息的成本过高,否则为了符合 IFRS 8 的要求,过渡期作为比较信息列报的前期 分部信息必须予以重述。 IFRS 8 与 SFAS 131 之间尚存的差异 IFRS8的结论基础指出 IFRS 8 与 SFAS 131 之间尚存在如下的三项差异: l 根据国际财务报告准则,非流动资产包括无形资产-但 SFAS 131 后附的指引似乎限定该准

国际会计准则中英对照(去 Logo)

IFRS and IAS Summaries(2011)《国际财务报告准则》及《国际会计准则》摘要(2011)This extract has been prepared by IFRS Foundation staff and has not been approved by the IASB. For the requirements reference must be made to International Financial Reporting Standards.本摘要由国际财务报告准则基金会职员编制,未经国际会计准则理事会正式批准。

涉及相关要求必须遵照《国际财务报告准则》。

中英文对照 English with Chinese TranslationIFRS and IAS Summaries(2011)《国际财务报告准则》及《国际会计准则》摘要(2011)This extract has been prepared by IFRS Foundation staff and has not been approved by the IASB. For the requirements reference must be made to International Financial Reporting Standards.本摘要由国际财务报告准则基金会职员编制,未经国际会计准则理事会正式批准。

涉及相关要求必须遵照《国际财务报告准则》。

The Conceptual Framework for Financial Reporting 2011 as issued at 1 January 2011财务报告的概念框架2011截至2011年1月1日发布This extract has been prepared by IFRS Foundation staff and has not been approved by the IASB. For the requirements reference must be made to the Conceptual Framework for Financial Reporting 2010.本摘要由国际财务报告准则基金会职员编制,未经国际会计准则理事会正式批准。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

国际会计准则第8 号之会计政策中英文对照会计变更以后财务报表能够提供更加可靠相关的会计信息来反映企业的业务、发生的事件或者情况对财务报表、财务业绩或现金流的影响。

下面是yjbys 小编为大家带来的关于国际会计准则的知识,欢迎阅读。

1.Changes in accounting policies

An entity is permitted to change an accounting policy only if the

change:

(i) is required by a standard or interpretation; or

(ii) results in the financial statements providing reliable and more

relevant information about the effects of transactions, other events or

conditions on the entity's financial position, financial performance, or

cash flows. [IAS 8.14]

Note that changes in accounting policies do not include applying an

accounting policy to a kind of transaction or event that did not occur

previously or were immaterial. [IAS 8.16]

1.会计政策变更

企业只有在发生以下变化的时候允许变更会计政策:

(1)会计准则或解释说明的要求

(2)会计变更以后财务报表能够提供更加可靠相关的会计信息来反映企业的业务、发生的事件或者情况对财务报表、财务业绩或现金流的影响。

[IAS 8.14]

注意,会计政策的变更不包括应用在之前没有发生过或者不重大的交易或事项。

[IAS 8.16]

If a change in accounting policy is required by a new IASB standard。