《会计专业英语》模拟试题及答案

《会计专业英语》期末试题(A卷)答案(共五则)

《会计专业英语》期末试题(A卷)答案(共五则)第一篇:《会计专业英语》期末试题(A卷)答案2001会计专业英语试题答案1.(1)Journal entry—A chronological record of transactions, showing for each transaction the debits and credits to be entered in specific ledger accounts.(2)Going concern ——An assumption that a business entity will continue in operation indefinitely and thus will carry out its existing commitments.(3)Matching principle——The revenue earned druing an accounting period is offset with the expenses incurred in generating this revenue.(4)Working capital——Current assets minus current liabilities(5)Revenue expenditure——Any expenditure that will benefit only the current accounting period.2.每空1分,其中两个debit合计1分(1)(two).(debit).(debit).(equal).(2)(adjusting).(assign).(end).(p rior)(3)(liquid).(that).(at)3.题一10分,第一小段6分,第二小段4分。

题二8分(1)Financial statements show the financial position of a business and the results of its operations, presented in conformity with generally accepted accounting principles.These statements are intended for use by many different decision makers, for many different purposes.Tax returns show the computation of taxable income, legal concept by tax laws and regulations.In many cases, tax laws are similar to generally accepted accounting principles, but substantial differences do exist.(2)Auditors do not guarantee the accuracy of financial statements;they express only their expert opinion as to the fairness of the statements.However, CPA firms stake theirreputations on the thoroughness of their audits and the dependability of their audit reports.4.每小题6分,每小题包括三小句,每小句2分。

会计英语模拟练习题

会计英语模拟练习题### 会计英语模拟练习题#### 一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Organizational Chart2. The term "Double Entry Accounting" refers to:A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different currencies3. What is the purpose of adjusting entries?A. To correct past errorsB. To update the financial records for the current periodC. To prepare for the next accounting periodD. To predict future financial performance4. The accounting equation is:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Liabilities = Assets - Equity5. Which of the following is not a type of inventory valuation?A. FIFOB. LIFOC. Weighted AverageD. Net Present Value#### 二、填空题(每题2分,共20分)6. The process of recording financial transactions in the order they occur is known as __________.7. The __________ is a summary of the changes in a company's financial position over a period of time.8. A __________ is an expense that has been incurred but not yet paid.9. The __________ method of depreciation allocates the cost of a fixed asset over its useful life.10. The __________ is the difference between the opening and closing balances of an account.#### 三、简答题(每题15分,共40分)11. Explain the concept of "matching principle" in accounting and its importance.12. Describe the steps involved in preparing a balance sheet.#### 四、案例分析题(20分)13. Assume you are an accountant for a small business. The business has just completed its fiscal year. You have been provided with the following information:- Total revenue for the year: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000Calculate the net income of the business and prepare a brief income statement in English.Note: This is a simulated exercise intended for educational purposes only. The questions and answers provided are for illustrative purposes and may not reflect actual accounting practices or standards.。

会计专业英语复习题答案

会计专业英语复习题答案《会计专业英语》复习题参考答案Keys to ExercisesLesson 1Word and Term Study1. eReview Exercises &ProblemsA. 1. F 2. FB. (略)C. 参考译文:由一人拥有和控制的企业被称为个人独资企业。

这种企业形式比较简单,而且通常投资额较小。

个人独资企业的所有者对企业内所有的事务制定决策并拥有企业的全部利润。

合伙企业是由两个或以上的人(合伙人)共同拥有和控制的企业组织形式。

一般在合伙企业中,每个合伙人对企业债务都承担无限责任。

同时,合伙企业的寿命也是有限的,企业可能因为某个合伙人死亡或退休而终止。

公司是依照法律规定成立的独立法人组织。

公司由股东拥有,股东通过购买公司的股份为公司提供资本。

股东个人对公司的债务不承担无限责任。

大多数公司的经营业务由股东选出的董事会实施控制。

Lesson 2Word and Term Study1. dReview Exercises& ProblemsA. 1. F 2. TC. 参考译文:在会计恒等式中,资产必须等于负债和所有者权益之和。

因为债权人的财产要求权在企业清算时是优先于所有者支付的,所以在会计基本等式中,负债是排列在所有者权益前面的。

会计恒等式适用于所有的经济实体,无论其大小、业务性质或组织形式。

该等式适用于小型私人经济实体,如街边的杂货店,同样也适用于大公司。

这一等式为记录和总结企业的经济活动提供了基本框架。

Lesson 3Word and Term Study1. c2. e 4. b 5. aReview Exercises &ProblemsA. 1. d 4. c 5. cB. 2. Each transaction must be entered in two or more accounts with equal debit and credit amounts. The normal balances of the three account groups are as follows:Account group Normal BalanceAssets DebitLiabilities CreditOwner’s equity CreditC. Case Problem1.(1)June 2 Asset account debited and Owner’s equity account credited.5 An asset account debited, another asset account credited.7 An asset account debited, a liability account credited.15 An asset account debited, an owner’s equity account credited.20 An expenses account debited, an asset account credited.26 An asset account debited, another asset account credited.28 A liability account debited, an asset account credited.31 An owner’s equity account debited, an asset account credited.(2) June 2 Debit Cash, increased; Credit Capital, increased5 Debit Vehicle, increased; Credit Cash, decreased7 Debit Supplies, increased; Credit Accounts Payable, decreased15 Debit Accounts Receivable, increased; Credit Service Revenue, decreased20 Debit Advertising Expenses, increased; Credit Cash, decreased26 Debit Cash, increased; Credit Accounts Receivable, decreased28 Debit Accounts Payable, decreased; Credit Cash, decreased31 Debit O. Wilson, Drawings, increased(owner’s equity decreased); Credit Cash,decreasedD.参考译文:试算平衡表并不能证明所有的经济业务都已经入账,也不表明分类账的记录是正确的。

(完整版)会计专业英语模拟试题及答案

(完整版)会计专业英语模拟试题及答案《会计专业英语》模拟试题及答案一、单项选择题(每题 1 分,共 20 分)1.Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2) In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policiesand changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32.Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010he makes credit sales of $55 000 and receives cash of $46 500 from credit customers.A.$8 500 DrB.$8 500 CrC.$14 000 DrD.$14 000 Cr3.Should dividends paid appear on the face of a companycash flow statement?’A.YesB.NoC.Not sureD.Either4.Which of the following inventory valuation methods is likely to lead to the highestfigure for closing inventory at a time when prices are dropping?A.Weighted Average costB.First in first out (FIFO)st in first out (LIFO)D.Unit cost5.Which of following items may appear as non-currentassets in a companythe’statement of financial position?(1) plant, equipment, and property(2) company car(3) ?4000 cash(4) ?1000cheque A. (1), (3)B. (1), (2)C. (2), (3)D. (2), (4)6. Which of the following items may appear as current liabilities in a company ’s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trialbalance to agree?1. An item in the cash book $6,160 for payment of rent has not been entered in the rentpayable account.2.The balance on the motor expenses account $27,680 has incorrectly been listed in thetrial balance as a credit.3.$6,160 proceeds of sale of a motor vehicle has been posted to the debit of motorvehicles asset account.4.The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48.Theta prepares its financial statements for the year to 30 April each year. The companypays rent for its premises quarterly in advance on 1 January, 1 April, 1 July and 1 Octobereach year. The annual rent was $84,000 per year until 30 June 2010. It was increasedfrom that date to $96,000 per year. What rent expense and end of year prepayment shouldbe included in the financial statements for the year ended 30 April 2010?Expense PrepaymentA $93,000 $8,000B $93,000 $16,000C $94,000 $8,000D $94,000 $16,0009. At 30 September 2010, the following balances existed in the records of Lambda:Plant and equipment: $860,000Depreciation for plant and equipment: $397,000During the year ended 30 September 2010, plant with a written down value of $37,000 wassold for $49,000. The plant had originally cost $80,000. Plant purchased during the year cost $180,000. It is the company.s policy to charge a full year depreciation in the year ofacquisition of an asset and none in the year of sale, using a rate of 10% on the straight line basis. What net amount should appear in Lambda.s balance sheet at 30 September 2010for plant and equipment?A$563,000B$467,000C$510,000D$606,00010.A company’ s plant and machinery ledger account forthe year ended 30 September2010 was as follows:Plant and machinery–cost2009 $ 2010 $1 October balance b/f 381 200 1 June Disposal 36 0001 Dec cash 18 000 30 Sept balance c/f 363 200399 200399 20030 Sept balance b/f363 200The company ’ s policy is to charge depreciation at 20% per year on the straight line basis,with proportionate depreciation in years of purchase and disposal. What is the depreciation charge for the year ended 30 September 2010?A $74,440B $84,040C $72,640D $76,84011. Listed below are some characteristics of financial information.(1) True(2) Prudence(3) Completeness(4) CorrectWhich of these characteristics contribute to reliability?A (1), (3) and (4) onlyB (1), (2) and (4) onlyC (1), (2) and (3) onlyD (2), (3) and (4) only’ s 12. The plant and machinery cost account of a company is shown below. The companypolicy is to charge depreciation at 20% on the straight line basis, with proportionate depreciation in years of acquisition and disposal.Plant and machinery–cost2009 $ 2009 $1 Jan balance b/f 280 000 30 June disposal 14 0001Apr cash 48 0001Sept cash 36 000 31 Dec balance c/f 350 000364 000 364 000Balance b/f 350 000What should be the depreciation charge for the year ended 31 December 2009?A.$67,000B.$64,200C.$70,000D.$68,60013. In preparing its financial statements for the current year, a company ng’inventorysclosiwas understated by $300,000. What will be the effect of this error if it remains uncorrected?A The current year’ s profit will be overstated and next year’ s profit will be understB The current year ’s profit will be understated but there will be no effect on next year ’ sprofitC The current year’ s profit will be understated and next yearD The current year ’profits will be overstated but there will be no effect profit.’ s profit will be overst on next year s’14. In preparing a company’s cash flow statement, which, if any, of the following items could form part of the calculation of cash flow from financing activities?(1)Proceeds of sale of premises(2)Dividends received(3)Issue of sharesA 1 onlyB 2 onlyC 3 onlyD None of them.15. At 31 March 2009 a company had oil in hand to be used for heating costing $8,200 and an unpaid heating oil bill for $3,600. At 31 March 2010 the heating oil in hand was $9,300 and there was an outstanding heating oil bill of $3,200. Payments made for heating oil during the year ended 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the company’ s income statement for heating year?oilfor the A$23,900B$36,100C$45,300D$33,10016. In times of inflation In times of rising prices, what effect does the use of the historical cost concept have on a company’ s asset values and profit?A.Asset values and profit both undervaluedB.Asset values and profit both overvaluedC.Asset values undervalued and profit overvaluedD.Asset values overvalued and profit undervalued17. Beta purchased some plant and equipment on 01/07/2010 for $60,000. The estimatedresidual value of the plant in 10 years time is estimated to be $6,000. Beta ’ s policy is tocharge depreciation on the straight line basis, with a proportionate charge in the period of acquisition. What should the depreciation charge for the plant be in Beta ’accountingsperiod of 18 months to 30/09/2010 ?A.$5400B.$900C.$1350D.$67518.A company’ incomes statement for the year ended 31 December 2005 showed a netprofit of $83,600. It was later found that $18,000 paid for the purchase of a motor van hadbeen debited to the motor expenses account. It is the company depreciate’spolicymotorvans at 25 per cent per year on the straight line basis, with a full year rge in the year of ’ s cha acquisition. What would the net profit be after adjusting for this error?A. $97,100B. $70,100C. $106,100D. $101,60019. Which of the following statements are correct?(1)to be prudent, company charge depreciation annually on the fixed asset(2)substance over form means that the commercial effect of a transaction must alwaysbe shown in the financial statements even if this differs from legal form(3)in order to achieve the comparable, items should be treated in the same way year onyear A. 2 and 3 onlyB. All of themC.1 and2 only D.3 only20.which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant withit or notA. 2 and 3 onlyB. All of themC.1 and2 only D.3 only二、翻译题(共 30 分)1、将以下分录翻译成英文(每个 2 分,共 10 分)1. 借:固定财产清理30 000累计折旧10 000贷:固定财产40 0002. 借:银行存款10 500贷:交易性金融财产10 000投资利润5003.借:对付员工薪酬 1 000贷:库存现金 1 0004.借:银行存款 4 095贷:其余业务收入 3 500应交税费–应交增值税(销项税额)5955.借:对付单据40 000贷:银行存款40 0002、将以下报表翻译成中文(每空 1 分,共 20 分)1.ABC group the statement of financial position as at 31/Dec/2010?2.Non-current assets3.Intangible assets4.Property, plant and equipment5.Investment in associates6.Held-for-maturity investment7.Deferred income tax assets8.Current Assets9.Trade and other receivables10.Derivative financial instruments11.Cash and cash equivalents12.Assets of discontinued operation13.Assets in total14.Current Liabilities15.Accrued payroll16.Accrued dividend17.Accrued accounts18.Non-current Liabilities19.Liabilities in total Assets三、阅读题(共 30 分)Research and development (R&D)Accounting treatment of R&DUnder International Accounting Standards the accounting for R&D is dealt with under IAS 38, Intangible Assets. IAS 38 states that an intangible asset is to be recognised if, and onlyif, the following criteria are met: it is probable that future economic benefits from theasset will flow to the entity, the cost of the asset can be reliably measured.The above recognition criteria look straightforward enough, but in reality it can prove to be very difficult to assess whether or not these have been met. In order to make this recognition of intangibles more clear, IAS 38 separatesan R&D project into a research phase and a development phase.Research phaseIt is impossible to demonstrate whether or not a product or service at the research stagewill generate any probable future economic benefit. As a result, IAS 38 states that all expenditure incurred at the research stage should be written off to the statement of comprehensive income as an expense when incurred, and will never be capitalised as an intangible asset.Development phaseUnder IAS 38, an intangible asset arising from development must be capitalised if an entity can demonstrate all of the following criteria: the technical feasibility of completing the intangible asset (so that it will be available for use or sale); intention to complete and use or sell the asset; ability to use or sell the asset; existence of a market or, if to be used internally, the usefulness of the asset; availability of adequate technical, financial, and other resources to complete the asset; the cost of the asset can be measured reliably. If any of the recognition criteria are not met then the expenditure must be charged to the income statement as incurred. Note that if the recognition criteria have been met, capitalisation must take place. Once development costs have been capitalised, the asset should be amortisedin accordance with the accruals concept over its finite life. Amortisation must only begin when commercial production has commenced.Questions:1)Outline the criterias of recognition of intangible assets(5 分)2)Criterias to recognised as development (5分)3)Identify the accounting treatment of research phase( 10 分)4)Identify the accounting treatment of development phase(10 分)四、业务题(按要求用英文编制分录,每题 2 分,共 20 分)Johnny set up a business and in the first a few days of trading the followingtransactions occurred (ignore all the tax):1)He invests $80 000 of his money in his business bank account2)He then buys goods from Isabel, a supplier for $4 000 and pays by cheque, the goodsis delivered right after the payment3) A sale is made for $3 000–the customer pays by cheque4)Johnny makes another sale for $2 000 and the customer promises to pay in the future5)He then buys goods from another supplier, Kamen, for $2 000 on credit, goods isdelivered on time6)He pays a telephone bill of $800 by cheque7)The credit customer pays the balance on his account8)He returened some faulty goods to his supplier Kamen, which worth $400.9)Bank interest of $70 is received10)A cheque customer returned $400 goods to him for a refund参照答案1、单项选择题1-5 CCACB 6-10 DCDCD 11-15 ABCDD 16-20 CBABA2、翻译题1)中翻英1.Dr disposal of fixed assetDepreciation2.Dr BankCr Tradable financial assetInvestment income3.Dr accrued payrollCr cash4.Dr bankCr other operating revenueAccrued tax-VAT (output)5.Dr accrued notesCr bank2)英翻中1.编制单位: ABC 财产欠债表时间: 2010 年 12 月 31 日单位:欧元2.非流动财产3.无形财产4.固定财产5.长久股权投资6.拥有至到期投资7.递延所得税财产8.流动财产9.应收账款及其余应收款10.钱币资本11.非连续性经营财产12.财产总计13.欠债14.流动欠债15.对付员工薪酬16.对付股利17.对付账款18.非流动欠债19.欠债总计20.净财产3、阅读题1) Outline the criterias of recognition of intangible assets(5 分)IAS 38 states that an intangible asset is to be recognised if, and only if, the followingcriteria are met: it is probable that future economic benefits from the asset will flowto the entity, the cost of the asset can be reliably measured.2)Criterias to recognised as developmentthe technical feasibility of completing the intangible asset (so that it will be available for use or sale); intention to complete and use or sell the asset; ability to use or sell the asset;existence of a market or, if to be used internally, the usefulness of the asset; availability of adequate technical, financial, and other resources to complete the asset; the cost of the asset can be measured reliably.3)Identify the accounting treatment of research phase( 10 分)IAS 38 states that all expenditure incurred at the research stage should be written off to the statement of comprehensive income as an expense when incurred, and will never be capitalised as an intangible asset.4)Identify the accounting treatment of development phase(10分)intangible asset arising from development must be capitalised Once developmentcosts have been capitalised, the asset should be amortised in accordance with theaccruals concept over its finite life. Amortisation must only begin when commercialproduction has commenced.4、业务题1)Dr bankCr capital2)Dr finished goodsCr bank3)Dr bankCr sales revenue4)Dr accounts receivableCr sales revenue5)Dr finished goods Craccrued accounts6)Dr administrativeCr bank7)Dr bankCr accounts receivable8)Dr bank9)Dr bankCr financial expense10)Dr sales revenueCr bank11)。

会计专业英语-模拟题

会计专业英语-模拟题《会计专业英语》模拟题一.单选题1.The Realization Principle indicates that revenue usually should be recognized and recorded in the accounting record().A.when goods are sole or services are rendered to customersB.when cash is collected from customersC.at the end of the accounting periodD.only when the revenue can be matched by an equal dollar amount of expenses[答案]:A2.The Matching Principle:().A.applies only to situations in which a cash payment occurs before an expense is recognizedB.applies only to situations in which a cash receipt occurs before revenue is recognizedC.is used in accrual accounting to determine the proper period for recognition of expensesD.is used in accrual accounting to determine the proper period in which to recognize revenue[答案]:C3.Xxx company paid $2850 on account. The effect of this transaction on the accounting equation is to ().A.decrease assets and decrease owner’s equityB.increase liabilities and d ecrease owner’s equityC.have no effect on total assetsD.decrease assets and decrease liabilities[答案]:D4.Which of the following concepts belongs to accountingassumption?().A.ConservationB.Money measurementC.MaterialityD.Consistency[答案]:B5.Which of these is/are an example of an asset account?___A.service revenueB.withdrawalsC.suppliesD.all of the above[答案]:C6.Which of these statements is false?().A.increase in assets and increase in revenues are recorded with a debitB.increase in liabiliti es and increase in owner’s equity are recorded with a c reditC.increase in both assets and withdrawals are recorded with a debitD.decreases in liabilities and increase in expenses are recorded with a debit[答案]:A7.Note payable has a normal beginning balance of $30 000. During the period, new borrowings total $63,000 and the ending balance in Note Payable is $41,000. Determine the payments on loans during the period. ______A.$74000B.$52000C.$134000D.[答案]:B8.Typical liability accounts include _____.A.accounts payable, bank loan, wages payable, drawingsB.Accounts payable, bank overdraft, wages payable, stationaryC.Accounts receivable, bank overdraft, wages payableD.Accounts payable, borrowing from the public, bank overdraft, wages payable.[答案]:D9.Which of these accounts has a normal debit balance?_____.A.Rent ExpenseB.WithdrawalsC.Service RevenueD.Both A and B have a normal debit balance[答案]:D二.判断题1.Accounting provides financial information that is only useful to business management.()[答案]:F2.The accounting process generates financial reports for both “internal” and “external” u sers.() [答案]:T3.The basic concept of double-entry accounting is that total debits must equal total credits for every business transaction.() [答案]:T4.A trial balance represents a listing of the ledger accounts and balances at a particular moment in time.()[答案]:T5.The ledger account provides a chronological order of transactions.()6.Post reference columns are found only in the journal, notin the ledger.()[答案]:F/doc/169122957.html,ually two signatures are required on a business check for it to be valid.() [答案]:T8.When a check is written by a business, the immediate effect is to reduce both the balance shown in the checkbook and the balance on the bank's records. ()[答案]:F9.The final amounts shown on both sides of the bank reconciliation statement are labeled "Adjusted Balances."() [答案]:T10.A leasehold is an example of a long-life asset.()[答案]:F11.The accounting reporting period agrees to the calendar year. ()[答案]:F12.An increase in permanent capital is recorded as a credit to the account. ()[答案]:T13.Dollar signs are used in the amount areas of the ledger accounts. ()[答案]:F14.If the trial balance shows that the ledger is in balance, this means that the individual business transactions were recorded to the appropriate ledger accounts. ()[答案]:F15.Every business transaction is first recorded in the journal. ()[答案]:T16.Internal control of operations is equally complex in a small and in a large organization. ()[答案]:F17.Two documents used in preparing a bank reconciliation statement are the bank statement and the checkbook stubs.() [答案]:T18.A common cause of inequality between the balances on the bank statement and in the checkbook is outstanding checks. ()19.Depreciation expense is usually recorded at least once a year. ()[答案]:T20.Amortization is the conversion of the cost of an intangible asset to an expense. ()[答案]:T21.Two methods of recognizing accelerated depreciation are the straight-line and the double-declining balance method.() [答案]:F22.Research and development costs represent an intangible asset. ()[答案]:T23.A present reduction in cash required to generate revenues is called “an expense”[答案]:F24.The revenue expenses are paid to influence the current operating result.[答案]:F25.Advertising expense is usually collected as period expense.[答案]:T26.There are only two parties to a check: the person who writes it (the drawee) and the person to whom it is written (the payee). ()[答案]:F27.Repair of a generator is a capital expenditure. ()[答案]:F28.Revenue increases owner's equity.()[答案]:T29.Revenue is recognized when we receive cash from the buyers.()[答案]:F30.Interest revenue should be measured based on the length of time. ()[答案]:T三.翻译题1.Sole Proprietorship Enterprises[答案]:独资企业2.Profit cost and capital cost principle[答案]:划分收益性支出与资本性支出3.Double entry system[答案]:复式记帐法4.Source documents[答案]:原始凭证5.Environmental accounting[答案]:环境会计6.Matching principle[答案]:配比原则7.Gross profit[答案]:毛利8.Perpetual inventory system[答案]:永序盘存制9.Intangible assets[答案]:无形资产10.fixed asset[答案]:固定资产11.Statement of cash flows[答案]:现金流量表12.Bank Reconciliation[答案]:银行余额调节表13.Low-valued and easily-damaged implements [答案]:低值易耗品14.Physical depreciation[答案]:有形损耗15.Short-term debt-paying ability[答案]:短期偿债能力16.Accelerated depreciation method[答案]:加速折旧法17.notes receivable[答案]:应收票据18.long-term solvency[答案]:长期偿债能力四.论述题1.完成下列等式:1. Accounting Equation:Assets =2. Perpetual inventory system:Ending Inv. =[答案]:1. Accounting Equation:Assets = Liabilities + Owner's Equity2. Perpetual inventory system:Ending Inv. =Beg. Inv.+ Purchases-Cost of goods sold。

会计专业英文笔试题及答案

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

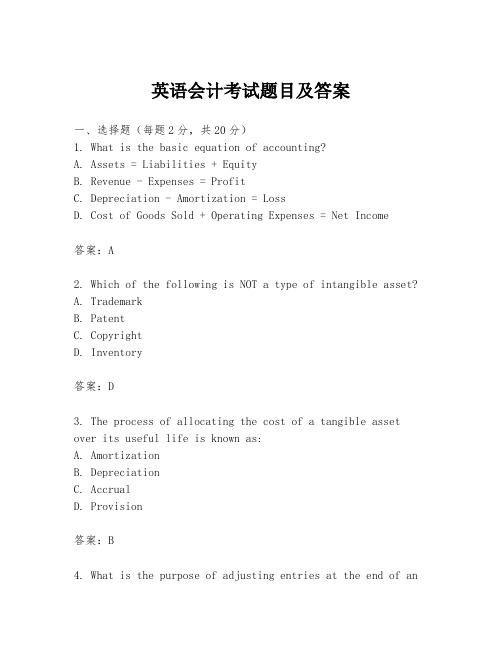

英语会计考试题目及答案

英语会计考试题目及答案一、选择题(每题2分,共20分)1. What is the basic equation of accounting?A. Assets = Liabilities + EquityB. Revenue - Expenses = ProfitC. Depreciation - Amortization = LossD. Cost of Goods Sold + Operating Expenses = Net Income答案:A2. Which of the following is NOT a type of intangible asset?A. TrademarkB. PatentC. CopyrightD. Inventory答案:D3. The process of allocating the cost of a tangible asset over its useful life is known as:A. AmortizationB. DepreciationC. AccrualD. Provision答案:B4. What is the purpose of adjusting entries at the end of anaccounting period?A. To increase the company's profitB. To ensure the financial statements are accurate and up-to-dateC. To reduce the company's tax liabilityD. To prepare for the next accounting period答案:B5. The term "Double Entry Bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording debits and credits for every transactionC. Keeping two sets of booksD. Using two different accounting software答案:B...二、简答题(每题10分,共30分)1. Explain the difference between "revenue recognition" and "matching principle".答案:Revenue recognition is the process of recognizing income in the accounting records as it is earned, regardless of when payment is received. The matching principle, on the other hand, is an accounting concept that requires expenses to be recognized in the same accounting period as the revenue they helped generate. This ensures that the financial statements reflect the actual performance of the business fora given period.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the assets of the entity after deducting liabilities....三、计算题(每题15分,共30分)1. Given the following information for XYZ Corp., calculate the net income for the year ended December 31, 2023:- Sales revenue: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000答案:Net Income = Sales Revenue - (Cost of Goods Sold + Operating Expenses + Depreciation Expense + Interest Expense) Net Income = $500,000 - ($300,000 + $100,000 + $20,000 + $10,000)Net Income = $500,000 - $440,000Net Income = $60,0002. If a company purchased a machine for $50,000 and expectsit to have a useful life of 5 years with no residual value, calculate the annual depreciation expense using the straight-line method.答案:Annual Depreciation Expense = (Cost of Asset - Residual Value) / Useful LifeAnnual Depreciation Expense = ($50,000 - $0) / 5Annual Depreciation Expense = $10,000...结束语:希望这份英语会计考试题目及答案对您的学习和复习有所帮助。

会计英语考试题目及答案

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

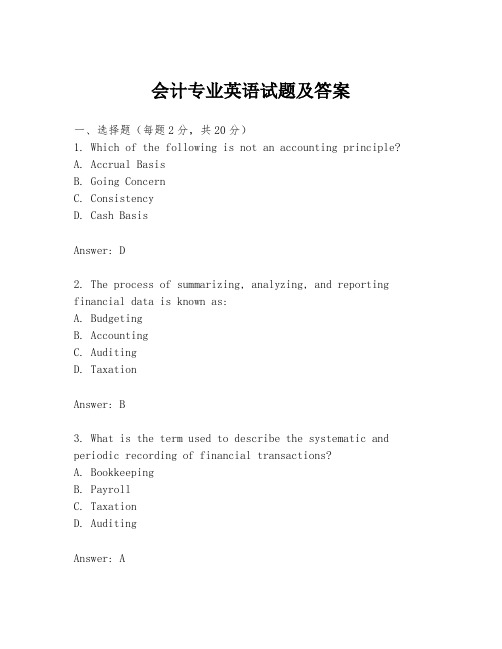

会计专业英语试题及答案

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

会计专业英语试题含答案

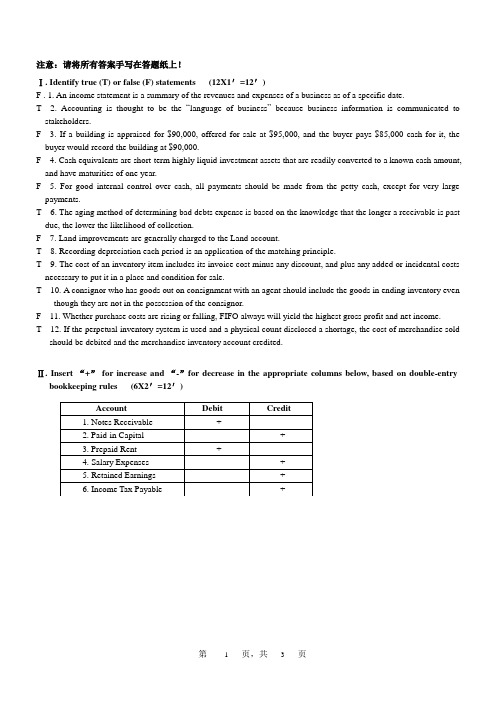

注意:请将所有答案手写在答题纸上!Ⅰ. Identify true (T) or false (F) statements (12X1′=12′)F . 1. An income statement is a summary of the revenues and expenses of a business as of a specific date.T 2. Accounting is thought to be the “language of business”because business information is communicated to stakeholders.F 3. If a building is appraised for $90,000, offered for sale at $95,000, and the buyer pays $85,000 cash for it, the buyer would record the building at $90,000.F 4. Cash equivalents are short-term highly liquid investment assets that are readily converted to a known cash amount, and have maturities of one year.F 5. For good internal control over cash, all payments should be made from the petty cash, except for very large payments.T 6. The aging method of determining bad debts expense is based on the knowledge that the longer a receivable is past due, the lower the likelihood of collection.F 7. Land improvements are generally charged to the Land account.T 8. Recording depreciation each period is an application of the matching principle.T 9. The cost of an inventory item includes its invoice cost minus any discount, and plus any added or incidental costs necessary to put it in a place and condition for sale.T 10. A consignor who has goods out on consignment with an agent should include the goods in ending inventory even though they are not in the possession of the consignor.F 11. Whether purchase costs are rising or falling, FIFO always will yield the highest gross profit and net income.T 12. If the perpetual inventory system is used and a physical count disclosed a shortage, the cost of merchandise sold should be debited and the merchandise inventory account credited.Ⅱ. Insert “+” for increase and “-”for decrease in the appropriate columns below, based on double-entry bookkeeping rules (6X2′=12′)Ⅲ. Translate the accounting terms from English to Chinese (No. 1-6) and from Chinese to English (No. 7-10) (10X2′=20′)1. General journal (总分类账)2. Accounting elements (会计要素)3. Closing entries(结账分录)4. CICPA(中国注册会计师协会)5. Net realizable value(可变现净值)6. Accrual-basis accounting (应计制会计)7. 非流动负债(non-current liabilities)8. 历史成本(Historical cost)9. 分类账(ledger)10. 经营周期(Operating cycle)Ⅳ. Short answer questions (3X6′=18′)1.What is accounting?Accounting may be described as the process of identifying, measuring, recording,and communicating economic information to permit informed judgments anddecisions by users of that information2.What is depreciation of plant assets? What is the basic purpose of depreciation?Depreciation, as the term is used in accounting, is the allocation of the cost of atangible plant asset to expense in the periods in which services are received from theasset. In short, the basic purpose of depreciation is to achieve the matching principlethat is, to offset the revenue of an accounting period with the costs of the goodsand services being consumed in the effort to generate that revenue.3.Identify the tools of financial statement analysis.The analysis of financial data employs various techniques to emphasize thecomparative and relative significance of the data presented and to evaluate theposition of the firm. Three commonly used tools are as following.Horizontal analysisevaluates a series of financial statement data over a periodof time.Verticalanalysis evaluates financial statement data by expressing each item in afinancial statement as a percent of a base amount.Ratio analysisexpresses the relationship among selected items of financialstatement data.Ⅴ. Problem Solving (38′)1. Analyze the effects of business transactions on the Accounting Equation. (2X5′=10′)Transaction (1): paid a $6,500 premium on July 1 for one year’s insurance in advance.Transaction (2): bought office equipment from Brown Company on account $2,800.2. Prepare journal entries for the two transactions in No. 1 above-mentioned. (2X5′=10′)3. Samuel Co. Ltd issued a $15,000, 6%, 9-month note payable. How much is the interest payment at maturity?(Calculating process is required) (6′)4. Assume the financial position data of Sue Company consist of the following items: (2X6′=12′)Sue CompanyBalance Sheet (Partial)January 31, 2011Required: Calculate its current ratio and acid-test ratio. Calculating steps are needed.。

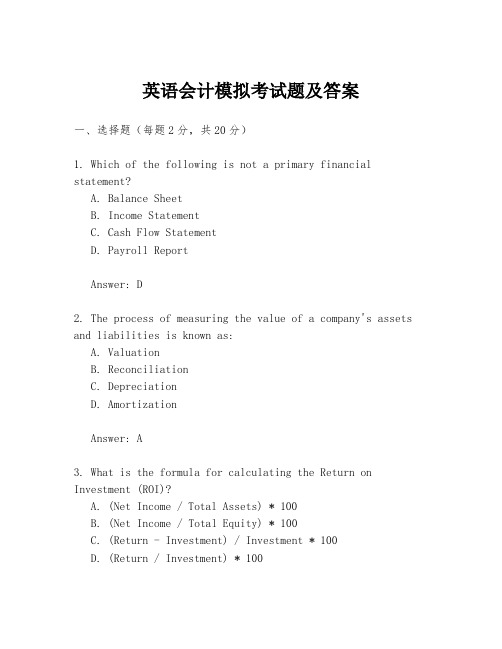

英语会计模拟考试题及答案

英语会计模拟考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a primary financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D2. The process of measuring the value of a company's assets and liabilities is known as:A. ValuationB. ReconciliationC. DepreciationD. AmortizationAnswer: A3. What is the formula for calculating the Return on Investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Return - Investment) / Investment * 100D. (Return / Investment) * 100Answer: D4. Which of the following is an example of a contingent liability?A. Accounts PayableB. Unearned RevenueC. Warranty ObligationsD. Notes PayableAnswer: C5. The accounting equation is:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Equity = Assets + LiabilitiesAnswer: A二、填空题(每空1分,共10分)6. The term "double-entry" in accounting refers to thepractice of recording each transaction in at least ________ accounts.Answer: two7. When a company pays off its debts, it is known as ________.Answer: debt reduction8. The accounting principle that requires companies to report revenues and expenses in the period in which they are earnedor incurred is called the ________.Answer: matching principle9. The process of estimating the useful life of an asset is known as ________.Answer: depreciation10. A budget is a financial plan that outlines a company's expected ________ and expenses for a specific period.Answer: revenues三、简答题(每题5分,共30分)11. Explain the difference between an asset and a liability.Answer: An asset is a resource controlled by a company as a result of past events and provides future economic benefits.A liability is an obligation or debt that arises from past events, which the company has little or no discretion to avoid, and involves the transfer of assets or services toother entities in the future.12. What is the purpose of an income statement?Answer: The purpose of an income statement is to summarize a company's revenues, gains, expenses, and lossesduring a specific period, providing information on the company's profitability.13. Describe the accounting cycle.Answer: The accounting cycle is a systematic process that includes identifying, recording, and summarizing business transactions. It starts with the analysis of transactions, journalizing, posting to ledger accounts, preparing an adjusted trial balance, closing entries, and finally, preparing financial statements.14. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specific point in time, showing the company's assets, liabilities, and equity.15. Explain the concept of depreciation.Answer: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It is a non-cash expense that reflects the consumption of the asset's economic benefits over time.四、计算题(每题10分,共40分)16. Calculate the depreciation expense for a machine that costs $100,000 with a useful life of 5 years and no residual value using the straight-line method.Answer: Depreciation Expense = (Cost - Residual Value) / Useful Life = ($100,000 - $0) / 5 = $20,000 per year.17. If a company has revenues of $500,000 and expenses of $300,000, what is the net income?Answer: Net Income = Revenues - Expenses = $500,000 - $300,000 = $200,000.18. A company has total assets of $1,200,000 and total liabilities of $600,000. What is the equity?Answer: Equity = Total Assets - Total Liabilities = $1,200,000 - $600,000 = $600,000.19. Calculate the return on investment (ROI) for an investment of $50,000 that returns $10,000.Answer: ROI = (Return / Investment) * 100 = ($10,000 / $50,000) * 100。

会计专业英语章节练习题及答案(共17章)chapter 3

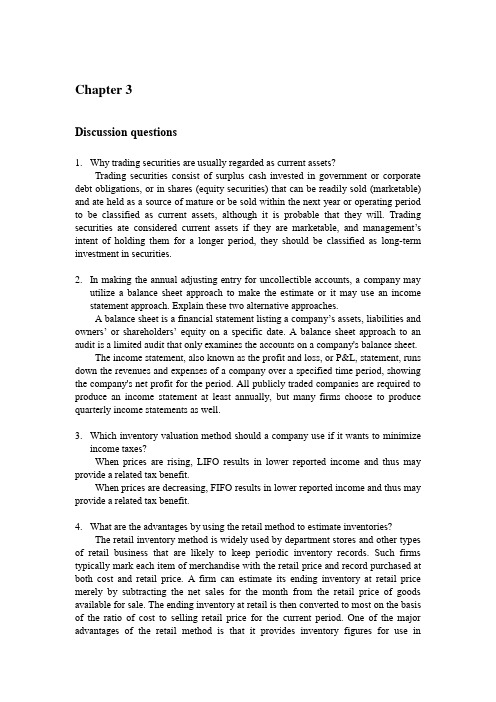

Chapter 3Discussion questions1.Why trading securities are usually regarded as current assets?Trading securities consist of surplus cash invested in government or corporate debt obligations, or in shares (equity securities) that can be readily sold (marketable) and ate held as a source of mature or be sold within the next year or operating period to be classified as current assets, although it is probable that they will. Trading securities ate considered current assets if they are marketable, and management’s intent of holding them for a longer period, they should be classified as long-term investment in securities.2.In making the annual adjusting entry for uncollectible accounts, a company mayutilize a balance sheet approach to make the estimate or it may use an income statement approach. Explain these two alternative approaches.A balance sheet is a financial statement listing a company’s assets, liabilities and owners’ or shareholders’ equity on a specific date. A balance sheet approach to an audit is a limited audit that only examines the accounts on a company's balance sheet.The income statement, also known as the profit and loss, or P&L, statement, runs down the revenues and expenses of a company over a specified time period, showing the company's net profit for the period. All publicly traded companies are required to produce an income statement at least annually, but many firms choose to produce quarterly income statements as well.3.Which inventory valuation method should a company use if it wants to minimizeincome taxes?When prices are rising, LIFO results in lower reported income and thus may provide a related tax benefit.When prices are decreasing, FIFO results in lower reported income and thus may provide a related tax benefit.4.What are the advantages by using the retail method to estimate inventories?The retail inventory method is widely used by department stores and other types of retail business that are likely to keep periodic inventory records. Such firms typically mark each item of merchandise with the retail price and record purchased at both cost and retail price. A firm can estimate its ending inventory at retail price merely by subtracting the net sales for the month from the retail price of goods available for sale. The ending inventory at retail is then converted to most on the basis of the ratio of cost to selling retail price for the current period. One of the major advantages of the retail method is that it provides inventory figures for use inpreparing interim statements.Exercises1.In general terms, financial assets appear in the balance sheet at:A.Face valueB.Current valueC.Market valueD.Estimated future sales valueAnswer: B2. On January 1, CL Company had a $3100credit balance in the Allowance forDoubtful Accounts. During the year, sales totaled $78000 and &6900 of accounts receivable were written off as uncollectible. A December 31 aging of accounts receivable indicated the amount probably uncollectible to be $5300. (No recoveries of accounts previously written off were made during the year.) CL Company’s financial statements for the current year should include:A.Uncollectible accounts expense of $9100B.Uncollectible accounts expense of $5300C.Allowance for Doubtful Accounts with a credit balance of $1500D.Allowance for Doubtful Accounts with a credit balance of $8400Answer: A3. Why do companies prefer the LIFO inventory method during a period of risingprices?A.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventoryAnswer: B4. Which of the following statements is true?A. Separation of duties is not an important element of internal control forinventories.B. The perpetual system is used primarily for low-unit-cost inventory.C. An annual physical count of inventory is needed regardless of the type ofinventory system used.D. All the above are true.Answer: C5. If a firm purchases $100000 of bonds of Z Company at 101 plus accrued interestof $2000 and pays broker’s commissions of $50, the amount debited to Investment in Z Company Bonds may be:A. $100000B. $101050C. $103000D. none of the aboveAnswer: C6. ABC Company needs to determine the approximate amount of inventory at theend of each month without taking a physical inventory of merchandise. From the following information, you are required to determine the cost of the July 31The cost of the July 31inventory is determined as follows:Ending inventory of July 31 at retail selling price=$640,000-$375,000=$364,800 Ratio of cost to selling retail price=$435,200/$640,000=68%Ending inventory of July 31 at cost=$364,000×68%=$248,064。

会计英语的考试题目及答案

会计英语的考试题目及答案会计英语考试题目及答案一、选择题(每题2分,共20分)1. What is the term used to describe the process of recording financial transactions in a company's books?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Sales Report答案:D3. The process of ensuring that the financial records are accurate and complete is known as:A. BookkeepingB. AccountingC. AuditingD. Reporting答案:C4. What is the primary purpose of an income statement?A. To show the financial position of a company at a specific point in time.B. To show the changes in equity of a company over a period of time.C. To show the profitability of a company over a period of time.D. To show the cash inflows and outflows of a company over a period of time.答案:C5. Which of the following is not a principle of accounting?A. Accrual BasisB. ConsistencyC. MaterialityD. Fair Value答案:D6. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twice in different accounts.B. Recording transactions in two different ways.C. Recording debits and credits for every transaction.D. Recording transactions in two different books.答案:C7. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Liabilities - Equity = AssetsD. Equity - Assets = Liabilities答案:A8. What is the purpose of depreciation in accounting?A. To increase the value of an asset.B. To allocate the cost of a tangible asset over its useful life.C. To sell an asset.D. To calculate the profit of a company.答案:B9. Which of the following is a non-current liability?A. Accounts PayableB. Wages PayableC. Long-term DebtD. Taxes Payable答案:C10. The term "revenue recognition" refers to the process of:A. Recognizing expenses when they are paid.B. Recognizing revenues when they are earned.C. Recognizing assets when they are acquired.D. Recognizing liabilities when they are incurred.答案:B二、简答题(每题5分,共20分)1. Explain the difference between "cash basis" and "accrual basis" accounting.答案:Cash basis accounting records transactions when cash is received or paid, whereas accrual basis accounting records transactions when they are earned or incurred, regardless of the cash flow.2. What is the purpose of a balance sheet?答案:The purpose of a balance sheet is to present thefinancial position of a company at a specific point in time, showing what the company owns (assets), what it owes (liabilities), and the net worth of the company's owners (equity).3. Define "depreciation" in the context of accounting.答案:Depreciation is the systematic allocation of the costof a tangible asset over its useful life, reflecting the consumption of the asset's economic benefits over time.4. What is the importance of an audit in the financial reporting process?答案:An audit provides an independent assessment of the accuracy and completeness of a company's financial statements, enhancing their credibility and reliability for stakeholders.三、案例分析题(每题15分,共30分)1. Assume you are an accountant for a company that has just sold a product for $10,000 on credit. Prepare the journalentry for this transaction under both cash basis and accrual basis accounting.答案:Under cash basis, no journal entry is made until cashis received. Under accrual basis, the journal entry would be: Dr. Accounts Receivable $10,000Cr. Revenue $10,0002. A company has the following transactions in January: purchased office supplies for $500 in cash, received $2,000for services provided in December, and accrued $1,500 in wages for January. Prepare the adjusting entries for these transactions at the end of January.答案:The adjusting entries would be:Dr. Office Supplies Expense $500Cr. Office Supplies $500 (for cash purchase)Dr. Accounts Receivable $2,000Cr. Revenue $2,000 (for services provided in December)Dr. Wages Payable $1,500Cr. Wages Expense $1,500 (for accrued wages)四、论述题(每题15分,共30分)1. Discuss the role of ethics in accounting and provide examples of ethical dilemmas that an accountant might face. 答案。

《会计专业英语》期末测试卷及答案2套

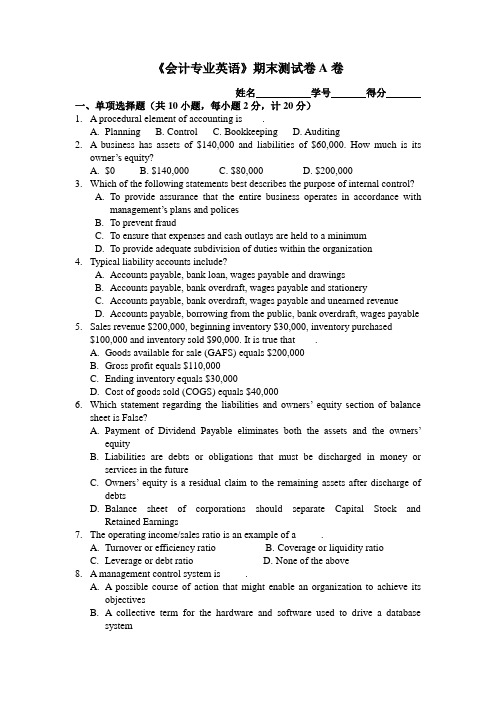

《会计专业英语》期末测试卷A卷姓名学号得分一、单项选择题(共10小题,每小题2分,计20分)1. A procedural element of accounting is____.A.PlanningB. ControlC. BookkeepingD. Auditing2. A business has assets of $140,000 and liabilities of $60,000. How much is itsowner’s equit y?A.$0B. $140,000C. $80,000D. $200,0003.Which of the following statements best describes the purpose of internal control?A.To provide assurance that the entire business operates in accordance withmanagement’s plans and policesB.To prevent fraudC.To ensure that expenses and cash outlays are held to a minimumD.To provide adequate subdivision of duties within the organization4.Typical liability accounts include?A.Accounts payable, bank loan, wages payable and drawingsB.Accounts payable, bank overdraft, wages payable and stationeryC.Accounts payable, bank overdraft, wages payable and unearned revenueD.Accounts payable, borrowing from the public, bank overdraft, wages payable5.Sales revenue $200,000, beginning inventory $30,000, inventory purchased$100,000 and inventory sold $90,000. It is true that____.A.Goods available for sale (GAFS) equals $200,000B.Gross profit equals $110,000C.Ending inventory equals $30,000D.Cost of goods sold (COGS) equals $40,0006.W hich statement regarding the liabilities and owners’ equity section of balancesheet is False?A.Payment of Dividend Payable eliminates both the assets and the owners’equityB.Liabilities are debts or obligations that must be discharged in money orservices in the futureC.Owners’ equity is a residual claim to the remaining assets after discharge ofdebtsD.Balance sheet of corporations should separate Capital Stock andRetained Earnings7.The operating income/sales ratio is an example of a_____.A.Turnover or efficiency ratioB. Coverage or liquidity ratioC.Leverage or debt ratioD. None of the above8. A management control system is_____.A.A possible course of action that might enable an organization to achieve itsobjectivesB. A collective term for the hardware and software used to drive a databasesystemC. A set up that measures and corrects the performance of activities ofsubordinates in order to make sure that the objectives of an organization are being met and their associated plans arebeing carried outD.A system that controls and maximizes the profits of an organizationpany A manufactures and sells only one product, the selling price per unit ofproducts is $20, and the variable cost per unit is $15, the total fixed cost for the year is $80,000. Then the break-even sales for Company A is_____.A. $400,000B.16, 000C.320, 000D. $240,00010.The total estimate sales for the coming year is 250,000 units. The estimatedinventory at the beginning of the year is 22,500 units, and the desired inventory at the end of the year is 30,000 units. The total production indicated in the production budget is_____.A. 242,500 unitsB. 280,000 unitsC. 257,000 unitsD. 302,500 units二、多项选择题(共5小题,每小题4分,计20分)1.Which of the following are fixed costs?A.Telephone billB.Annual salary of the chief accountantC.The management accountant's annual membership fee to ACCA (paid by thecompany)D.Wages of warehousemen2.For commercial bank, which two parts does the operating revenue mainlyinclude?A.Asset RevenueB. Rental RevenueC. Service RevenueD. Bond Revenue3.Which of these are the audit objectives?A.ValidityB. CompletenessC. TimingD. Valuation4.Which of the following statements regarding materiality and misstatements iscorrect?A.Materiality decisions are made relative to the size of the organization beingaudited.B. A lower materiality level would increase the extent of audit proceduresperformed.C.At the planning stage, the auditor should design specific procedures to detectmaterial qualitative misstatements.D.Likely aggregate misstatements include the net effect of uncorrectedmisstatements in opening equity.5.The audit report should include the following basic contents_____.A. The titleB. The introductory paragraphC. The scope paragraphD. The opinion paragraph三、判断题(正确写“T”,错误写“F”。

会计专业英语答案

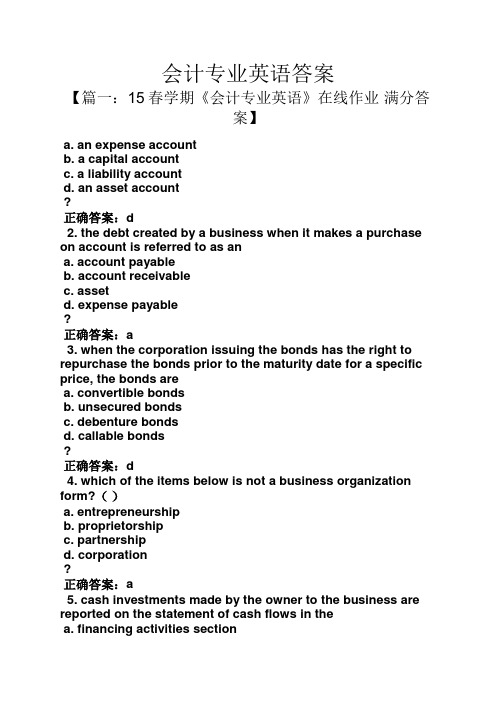

会计专业英语答案【篇一:15春学期《会计专业英语》在线作业满分答案】a. an expense accountb. a capital accountc. a liability accountd. an asset account?正确答案:d2. the debt created by a business when it makes a purchase on account is referred to as ana. account payableb. account receivablec. assetd. expense payable?正确答案:a3. when the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds area. convertible bondsb. unsecured bondsc. debenture bondsd. callable bonds?正确答案:d4. which of the items below is not a business organization form?()a. entrepreneurshipb. proprietorshipc. partnershipd. corporation?正确答案:a5. cash investments made by the owner to the business are reported on the statement of cash flows in thea. financing activities sectionb. investing activities sectionc. operating activities sectiond. supplemental statement?【篇二:《会计专业英语》期末试题(a卷)答案】txt>1. (1) journal entry—a chronological record of transactions, showing for each transaction the debits and credits to be entered in specific ledger accounts.(2) going concern ——an assumption that a business entity will continue in operation indefinitely and thus will carry out its existing commitments.(3) matching principle——the revenue earned druing an accounting period is offset with the expenses incurred in generating this revenue.(4) working capital——current assets minus current liabilities(5) revenue expenditure——any expenditure that will benefit only the current accounting period.2. 每空1分,其中两个debit合计1分(1) (two). (debit). (debit). (equal). (2) (adjusting). (assign). (end). (prior) (3) (liquid). (that). (at)3.题一10分,第一小段6分,第二小段4分。

会计英语试题及答案

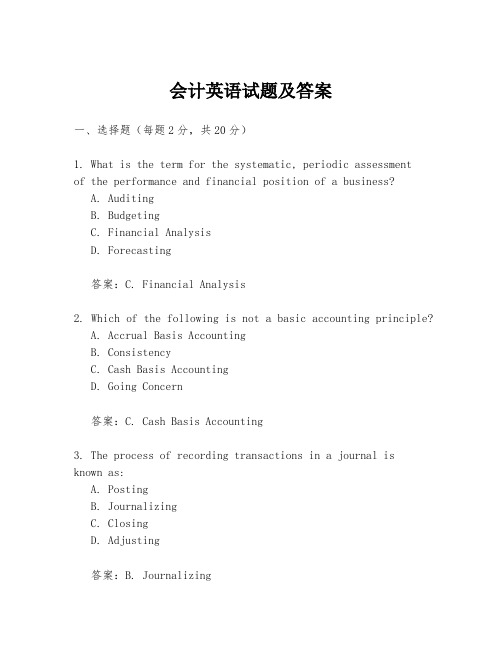

会计英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the systematic, periodic assessmentof the performance and financial position of a business?A. AuditingB. BudgetingC. Financial AnalysisD. Forecasting答案:C. Financial Analysis2. Which of the following is not a basic accounting principle?A. Accrual Basis AccountingB. ConsistencyC. Cash Basis AccountingD. Going Concern答案:C. Cash Basis Accounting3. The process of recording transactions in a journal isknown as:A. PostingB. JournalizingC. ClosingD. Adjusting答案:B. Journalizing4. What does the term "Double Entry" refer to in accounting?A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different periods答案:B. Recording transactions in two different accounts5. The financial statement that provides a snapshot of a company's financial condition at a specific point in time is:A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Changes in Equity答案:B. Balance Sheet二、填空题(每题2分,共20分)6. The __________ is the accounting equation that shows the relationship between assets, liabilities, and equity.答案:Accounting Equation7. In accounting, the term __________ refers to theallocation of the cost of a tangible asset over its useful life.答案:Depreciation8. The __________ is the process of summarizing the transactions recorded in the ledger accounts and presentingthem in a more condensed form.答案:Trial Balance9. __________ is the method of accounting where revenues and expenses are recognized when they are earned or incurred, not necessarily when cash is received or paid.答案:Accrual Accounting10. The __________ is the financial statement that shows the changes in a company's cash and cash equivalents during a period.答案:Cash Flow Statement三、简答题(每题10分,共30分)11. Explain the purpose of a balance sheet in a business context.答案:The purpose of a balance sheet is to provide stakeholders with a snapshot of a company's financialposition at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess the company's liquidity, solvency, and overall financial health.12. What are the main differences between an income statement and a statement of cash flows?答案:The income statement reports a company's financial performance over a period, focusing on revenues and expenses to determine net income. The statement of cash flows, on the other hand, shows the inflows and outflows of cash during thesame period, highlighting how the company generates and uses cash.13. Describe the concept of "matching principle" in accounting.答案:The matching principle in accounting requires that expenses be recognized in the same accounting period as the revenues they helped generate. This principle ensures that the financial statements reflect the actual economic activity of the period, providing a more accurate picture of the company's financial performance.四、计算题(每题15分,共30分)14. Given the following trial balance figures, calculate the total current assets and total current liabilities.| Account | Debit ($) | Credit ($) ||||-|| Cash | 12,000 | || Accounts Receivable | | 8,000 || Inventory | | 15,000 || Prepaid Expenses | 2,000 | || Accounts Payable | | 5,000 || Wages Payable | 1,000 | || Total Current Liabilities | | 6,000 |答案:Total current assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses = 12,000 + 8,000 + 15,000 +2,000 = 37,000Total current liabilities = Accounts Payable + Wages Payable + Total Current Liabilities = 5,000 + 1,000 + 6,000 = 12,00015. If a company has a net income of $50,000 and an increase in retained earnings of $75,000, calculate the dividends paid by the company.答案:Dividends paid = Increase in retained earnings - Net income = 75,000 -。

会计英语实训考试题及答案

会计英语实训考试题及答案一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Revenue – Expenses = Net IncomeC. Assets = Liabilities – EquityD. Liabilities = Assets – Equity答案:A2. Which of the following is not an accounting principle?A. ConsistencyB. MaterialityC. TimelinessD. Flexibility答案:D3. What is the purpose of adjusting entries?A. To correct past errorsB. To update the financial records for the current periodC. To prepare for the next accounting periodD. To estimate future revenues答案:B4. What is the term for the process of recording transactions in the general journal?A. JournalizingB. PostingC. ClosingD. Adjusting答案:A5. Which of the following is a type of liability?A. Common stockB. Retained earningsC. Accounts payableD. Dividends payable答案:C6. What is the accounting term for the cost of goods sold?A. COGSB. CGSC. COSD. SGA答案:A7. What is the purpose of a trial balance?A. To summarize the financial statementsB. To prove the accuracy of the accounting recordsC. To calculate the net incomeD. To determine the value of assets答案:B8. What is the accounting term for the amount of money a company owes to its suppliers?A. Accounts receivableB. Accounts payableC. Notes payableD. Accrued liabilities答案:B9. What is the term for the process of transferring journal entries to the ledger accounts?A. JournalizingB. PostingC. ClosingD. Adjusting答案:B10. Which of the following is not a financial statement?A. Balance sheetB. Income statementC. Cash flow statementD. Budget答案:D二、简答题(每题10分,共30分)1. Explain the difference between revenue and income.答案:Revenue refers to the inflow of cash or other assets from normal business operations. Income, on the other hand,is the net result of revenues and gains minus the expensesand losses. It is a measure of profitability over a period of time.2. What are the steps involved in the accounting cycle?答案:The accounting cycle involves the following steps: 1) Identifying and recording transactions, 2) Journalizing, 3) Posting to the ledger accounts, 4) Preparing a trial balance, 5) Adjusting entries, 6) Posting adjustments, 7) Preparing an adjusted trial balance, 8) Closing entries, and 9) Preparing financial statements.3. What is the purpose of depreciation in accounting?答案:Depreciation is the systematic allocation of thecost of a tangible asset over its useful life. It is used to match the expense of using the asset with the revenue it generates over time, in accordance with the matchingprinciple.三、案例分析题(每题25分,共50分)1. Assume you are the accountant for a company that has just purchased a piece of equipment for $50,000. The equipment is expected to have a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.答案:The annual depreciation expense using the straight-line method is calculated as follows:Cost of the equipment = $50,000Useful life = 5 yearsAnnual depreciation expense = (Cost of the equipment –Residual value) / Useful lifeAnnual depreciation expense = ($50,000 – $0) / 5 = $10,0002. A company has the following transactions for the month of January:- Purchased inventory on credit for $20,000.- Sold inventory on credit for $30,000.- Paid cash for office supplies of $1,000.- Received cash from customers for $25,000.- Paid cash for salaries of $15,000.Prepare the journal entries for these transactions.答案:a) Purchase of inventory on credit:Dr. Inventory $20,000Cr. Accounts Payable $20,000b) Sale of inventory on credit:Dr. Accounts Receivable $30,000Cr. Sales Revenue $30,000c) Payment for office supplies。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。