6-附件:原产地证书格式以及填制说明 Original

原产地证申请指南-填制说明

填制说明:1、本表一式两份;《产地证注册登记表》的各项内容需填制齐全。

2、注册编号栏由检验检疫机构填写。

3、国外公司信息栏填写外商投资企业的外国公司信息。

4、申请人签署证书中英文印章是指申请企业名称的中英文对照印章;5、原产地证申报员系指申请企业的法人代表或其指定的人员(1-3人),并应经检验检疫机构培训、考试合格,其手签笔迹指本人的亲笔签名。

6、主要生产、加工设备清单栏:生产企业必填。

7、申请原产地证产品清单栏:填写拟出口的产品。

原产地证注册手续一.生产企业申请步骤:1.查厂(签证商品含进口成份时):(1)预约查厂:申请单位到我局检务处产地科或下属局产地证科办理预约查厂手续,申请单位需填写预约查厂登记表一式两联,由我局确定查厂日期、时间和会同地点,同时领取注册登记表格一套。

(2)实地查厂:申请单位按预约查厂登记表上约定的时间派员到指定地点接我局查厂工作人员到工厂实地调查,调查内容一般包括:企业的营业执照,生产设备,申请FORM A产品的原料来源和厂内加工工序。

调查完毕,我局调查人员填写查厂记录,并由企业负责人签字。

2.注册登记:企业须提供以下资料:A、填写完整的注册登记表一套;签署证书印章应为中英文对照)和手签人员手签笔迹;B、工商营业执照正本和复印件一份;C、进出口企业资格证书和复印件一份;D、组织机构代码证和复印件一份;E、查厂记录及有关原材料的国产证明(;F、从事来料加工、来件装配及补偿贸易的单位还得提交承办对外加工装配业务或补偿贸易的协议,合同付本及本批产品成本明细单等有关文件。

检验检疫机构经过审核和调查,对符合注册登记条件的予以注册登记。

3.注册时需按规定缴纳500元注册费。

4.二、贸易公司申请步骤:贸易公司申办产地证书注册除某些特殊商品外一般不需要进行生产实地调查。

(1)贸易公司办理注册需提供的资料:A、工商营业执照正本和复印件一份B、进出口企业资格证书和复印件一份C、填写完整的注册登记表一套D、企业法人身份证复印件,申报员身份证原件和复印件。

原产地证明书格式

原产地证明书格式

原产地证明书格式是用于证明货物的原产地的一种文件。

它是国际贸易中非常

重要的文件之一,用于确保货物的原产地符合相关贸易协定的规定。

以下是原产地证明书的标准格式:

1. 证书标题:在证书的顶部中心位置,写上“原产地证明书”字样。

2. 证书编号:在证书的右上角,写上证书的编号,以便于追踪和管理。

3. 出口商信息:在证书的左上角,写上出口商的名称、地址和联系方式。

4. 进口商信息:在证书的左上角,写上进口商的名称、地址和联系方式。

5. 货物描述:在证书的正文部分,详细描述货物的名称、规格、数量、重量等

信息。

6. 原产地证明:在证书的正文部分,明确声明货物的原产地。

可以是一个国家

或地区的名称。

7. 货物价值:在证书的正文部分,写上货物的价值。

可以是FOB价值或CIF

价值。

8. 签发日期:在证书的右下角,写上证书的签发日期。

9. 签发单位:在证书的右下角,写上证书的签发单位的名称和地址。

10. 签字和盖章:在证书的底部,出口商和签发单位的代表签字,并盖上公章。

11. 其他附加要求:根据具体的贸易协定或国家要求,可能需要在证书中包含

其他信息,如货物的生产过程、材料来源等。

以上是原产地证明书的标准格式,根据具体的贸易要求和国家规定,可能会有一些细微的差异。

为了确保证书的有效性,建议在填写证书时仔细核对所有信息,并遵守相关的法律和规定。

原产地证明书格式

原产地证明书格式一、证明书的概述原产地证明书是国际贸易中常见的一种商业文件,用于证明货物的原产地。

它是一种重要的贸易凭证,可以帮助进口国对货物的原产地进行确认,以便享受相关的关税优惠政策或符合其他贸易要求。

本文将介绍原产地证明书的标准格式,包括证明书的标题、内容要求、填写要点等。

二、证明书的标题原产地证明书的标题应准确明确,一般为“原产地证明书”或“Certificate of Origin”。

标题应居中排列,使用粗体字体,并在正文下方留出适当的空白。

三、证明书的内容要求1. 证明书的头部在证明书的头部,应包含以下信息:(1) 证明书编号:每份原产地证明书都应有唯一的编号,以便于追溯和管理。

(2) 证明书的日期:填写证明书的日期,以年、月、日的格式表示。

(3) 出口国和进口国:明确标注出口国和进口国的名称。

(4) 出口商和进口商:填写出口商和进口商的名称、地址、联系方式等相关信息。

2. 证明书的正文证明书的正文应包含以下内容:(1) 货物的描述:详细描述出口货物的品名、规格、型号、数量等信息。

(2) 货物的原产地:明确标注货物的原产地,可以是一个国家或地区。

(3) 出口商声明:出口商应在证明书上签署声明,确认所列货物的原产地信息的真实性和准确性。

(4) 证明机构的认证:由相关的认证机构对证明书进行认证,并在证明书上盖章或签署认证人员的姓名和职务。

(5) 其他附加信息:根据需要,可以在证明书中添加其他必要的附加信息,如包装方式、运输方式等。

3. 证明书的尾部在证明书的尾部,应包含以下信息:(1) 出口商签名和日期:出口商应在证明书上签署自己的姓名和日期。

(2) 证明机构的章或签名:由相关的认证机构在证明书上盖章或签署认证人员的姓名和职务。

(3) 证明书的有效期:填写证明书的有效期,一般为3个月或根据贸易协议的规定。

(4) 证明书的备考:在证明书的尾部,可以留出空白的备考栏,方便填写其他必要的信息。

原产地证书格式以及填制

原产地证书格式以及填制第一篇:原产地证书格式以及填制附件:原产地证书格式以及填制说明OriginalPage 2 ofOverleaf InstructionCertificate No.: Serial number of Certificate of Origin assigned by the issuing body.Box 1:State the full legal name, address(including country)of the exporter and the exporter should be in the beneficiary country.Box 2:State the full legal name, address(including country)of the producer and the producer should be in the beneficial country.If more than one producer’s good is included in the certificate, list the additional producers, including name, address(including country).If the exporter or the producer wishes the information to be confidential, it is acceptable to state “Available to the authorized bo dy upon request”.If the producer and the exporter are the same, please complete field with “SAME”.If the producer is unknown, it is acceptable to state “UNKNOWN”.Box 3:State the full legal name, address(including country)of the consignee, and the consignee should be in the customs territory of China.Box 4:Complete the means of transport and route and specify the departure date, transport vehicle No., port of loading and discharge.Box 5:Any additional information such as Customer’s Order Number, Letter of Credit Number, etc.may be included.Box 6:State the item number.Box 7:State the shipping marks and numbers on the packages.Box 8:Number and kind of package shall be specified.Provide a full description of each good.The description should be sufficiently detailed to enable the products to be identified by the Customs Officers examining them andrelate it to the invoice description and to the HS description of the good.If goods are not packed, state “in bulk”.When the description of the goods is finished, add “***”(three stars)or “ ”(finishing slash).Box 9:For each good described in Box 9, identify the HS tariff classification of China to six digits.Box 10:If the goods qualify under the Rules of Origin, the exporter must indicate in Box 10 of this form the origin criteria on the basis of which he claims that his goods qualify for preferential tariff treatment, in the manner shown in the following table: Box 11:Gross weight in kilograms should be shown here.Other units of measurement e.g.volume or number of items which would indicate exact quantities may be used when customary.Box 12:Invoice number, date of invoices and invoiced value should be shown here.Box 13:The field must be completed, signed and dated by the exporter for exports from the beneficiary country.Box 14:The field must be completed, signed, dated and stamped by the issuing body.Box 15:The field must be completed, signed, dated and stamped by the Customs authority of the beneficiary country.In case where there is not enough space on the first page of a Certificate of Origin for multiple lines of goods, additional pages can be used.The Certificate number will be the same as that shown on the first page.The main characteristics including box 6 to box 15 will be presented, together with the stamp of the issuing body and the Customs authority of the beneficiary country.中文参考:正本第1页(共页)第2页(共页)背页填制说明证书编号:授权签证机构签发原产地证书的序列号。

原产地证明书格式

原产地证明书格式一、概述原产地证明书是国际贸易中常用的一种商业文件,用于证明货物的原产地。

它通常由出口国的有关机构或者商会出具,并由出口商提交给进口国的海关或者相关机构。

原产地证明书对于享受关税减免、免税或者优惠待遇具有重要意义,因此,准确填写和规范格式的原产地证明书对于顺利进行国际贸易至关重要。

二、原产地证明书的格式原产地证明书的格式普通包括以下几个部份:1. 证明书抬头在证明书的顶部中央位置,应写明“原产地证明书”字样,并注明证明书的有效期限。

2. 证明人信息在证明书的左上角,应填写证明人的名称、地址、电话和传真号码等联系方式。

3. 出口商信息在证明书的右上角,应填写出口商的名称、地址、电话和传真号码等联系方式。

4. 进口商信息在证明书的左下角,应填写进口商的名称、地址、电话和传真号码等联系方式。

5. 货物描述在证明书的正文部份,应详细描述出口货物的名称、规格、数量、单价和总价值等信息。

6. 原产地证明在证明书的正文部份,应明确注明货物的原产地。

原产地可以是一个国家或者地区,也可以是多个国家或者地区。

7. 附件在证明书的附件部份,可以附上与货物原产地有关的证明文件或者其他支持材料,如产地证明、生产工艺证明等。

8. 签章和日期在证明书的底部,应有证明人的签章和日期。

三、填写注意事项在填写原产地证明书时,需要注意以下几点:1. 准确无误填写原产地证明书时,应确保所有信息准确无误,包括证明人信息、出口商信息、进口商信息、货物描述等。

任何错误或者遗漏都可能导致证明书被拒绝或者无效。

2. 清晰可读填写原产地证明书时,应使用清晰、易读的字体和打印方式,确保证明书的内容清晰可辨。

3. 语言要求原产地证明书通常需要填写双语(如英文和进口国语言)或者多语言版本。

在填写时,应确保语言表达准确、流畅,并符合进口国的语言要求。

4. 文件齐全在提交原产地证明书时,应确保附带所有必要的证明文件和支持材料,以增加证明书的可信度和有效性。

原产地证明书格式

原产地证明书格式一、概述原产地证明书是国际贸易中常见的一种商业文件,用于证明货物的原产地。

它是国际贸易中的重要凭证之一,对于进出口企业来说具有很大的意义。

本文将详细介绍原产地证明书的标准格式及相关要求。

二、原产地证明书的标准格式原产地证明书的标准格式一般包括以下几个主要部分:1. 证书抬头在原产地证明书的顶部,应写明“原产地证明书”字样,并注明该证书的编号和日期。

2. 申请人信息接下来,应填写申请人的相关信息,包括申请人的名称、地址、联系电话等。

3. 出口商信息在原产地证明书中,需要填写出口商的相关信息,包括出口商的名称、地址、联系电话等。

4. 进口商信息同样地,在原产地证明书中,需要填写进口商的相关信息,包括进口商的名称、地址、联系电话等。

5. 商品描述在原产地证明书中,需要详细描述所涉及的商品信息,包括商品的名称、规格、数量、单价等。

6. 原产地证明原产地证明是原产地证明书的核心内容,需要详细说明货物的原产地。

一般情况下,原产地证明应包括以下几个要素:a) 原产地的名称:填写货物的原产地,可以是国家或地区的名称。

b) 原产地的定义:简要说明原产地的定义及适用规则。

c) 原产地的证明:描述货物的原产地证明方式,可以是生产证明、采购证明、加工证明等。

d) 原产地的签发地:填写原产地证明书签发地的名称。

7. 证明书签发单位在原产地证明书的底部,需要填写证明书签发单位的名称、地址、联系电话等。

8. 证明书签发日期和有效期在原产地证明书的底部,需要填写证明书的签发日期和有效期。

签发日期为证明书签发的具体日期,有效期为证明书的有效期限。

三、原产地证明书的相关要求除了以上的标准格式外,原产地证明书还需要满足以下一些相关要求:1. 语言要求原产地证明书通常需要用进出口国家的官方语言填写,如中文、英文等。

2. 签章要求原产地证明书需要由出口国的相关政府机构或授权的商会等机构签发,并加盖公章或官方印章。

3. 证明材料要求原产地证明书需要附上相关的证明材料,如生产证明、采购证明、加工证明等,以证明货物的原产地。

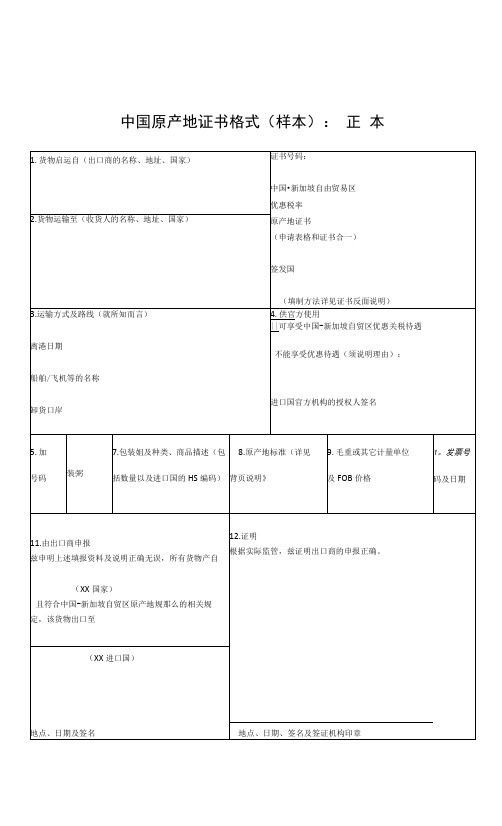

中国原产地证书格式样本正本

中国原产地证书格式(样本):正本背页说明第一栏:应填写中国出口商的法人全称、地址(包括国家)。

第二栏:应填写新加坡收货人的法人全称、地址(包括国家)。

第三栏:应填写运输方式、路线,并详细说明离港日期、运输工具的编号及卸货口岸。

第四栏:不管是否给予优惠关税待遇,进口方海关必须在相应栏目标注(J )。

第五栏:应填写工程号码。

第六栏:应填写唆头及包装号码。

第七栏:应详细列明包装数量及种类。

详细列明每种货物的商品描述,以便于海关关员查验时识别。

商品描述应与发票所述及《协调制度》的商品描述相符。

如果是散装货,应注明“散装”。

在商品描述末尾加上“***”(三颗星)或“ \ ”(斜杠结束号)。

第七栏的每种货物应填写《协调制度》六位数编码。

第八栏:假设货物符合原产地规那么,出口商必须按照以下表格中规定的格式,在第八栏中标明其货物享受优惠关税待遇所依据的原产地标准:如体积、数量等,以准确反映其数量。

FOB价格应在此栏中注明。

第十栏:应填写发票号码及开发票的日期。

第十一栏:本栏必须由出口商填写、签名并填写日期。

应填写签名的地点及日期。

第十二栏:本栏必须由签证机构的授权人员填写、签名、填写签证日期并盖章。

China's Certificate of Origin:Original (Copies)Box 1: State the full legal name, address (including country) of the exporter in China.Box 2: State the full legal name, address (including country) of the consignee in Singapore.Box 3: Complete the means of transport and route and specify the departure date, transport vehicle, port of discharge.Box 4: The customs authorities of the importing country must indicate (、) in the relevant boxes whether or not preferential tariff treatment is accorded.Box 5: State the item number.Box 6: State the shipping marks and numbers on the packages.Box 7: Number and type of packages shall be specified. Provide a full description of each good. The description should be sufficiently detailed to enable the products to be identified by the Customs Officers examining them and relate it to the invoice description and to the HS description of the good. If goods are not packed, state *'in bulk”. When the description of the goods is finished, add “***” (three stars) or ” \ (finishing slash). For each good described in Box 7, identify the HS tariff classification to six digits.Box 8: If the goods qualify under the Rules of Origin, the exporter must indicate in Box 8 of this form the origin criteria on the basis of which he claims that his goods qualify for preferential tariff treatment, in the manner shown in the following table:Box 9: Gross weight in Kilos should be shown here. Other units of measurement e.g. volume or number of items which would indicate exact quantities may be used when customary; the FOB value shall be indicated here.Box 10: Invoice number and date of invoices should be shown here.Box 11: The field must be completed, signed and dated by the exporter. Insert the place, date of signature.Box 12: The field must be completed, signed, dated and stamped by the authorisedperson of the certifying authority.。

原产地证明书格式

原产地证明书格式一、概述原产地证明书是国际贸易中常用的一种商业文件,用于证明货物的原产地以及货物是否符合特定的原产地要求。

本文将详细介绍原产地证明书的标准格式,包括必填项、填写要求以及注意事项。

二、原产地证明书的标准格式1. 证明书抬头在原产地证明书的顶部,应填写“原产地证明书”字样,并使用粗体字或者加粗方式进行突出。

2. 证明书编号在原产地证明书的右上角,应填写证明书的编号,以便于查阅和管理。

3. 出口商信息在原产地证明书的第一部分,应填写出口商的相关信息,包括出口商名称、地址、电话和传真等联系方式。

4. 进口商信息在原产地证明书的第二部分,应填写进口商的相关信息,包括进口商名称、地址、电话和传真等联系方式。

5. 货物描述在原产地证明书的第三部分,应填写货物的详细描述,包括货物名称、规格、数量等信息。

6. 原产地证明要求在原产地证明书的第四部分,应填写原产地证明的要求,包括货物的原产地证明方式、原产地规定的要求以及相关证明文件的要求等。

7. 原产地证明内容在原产地证明书的第五部分,应填写原产地证明的具体内容,包括货物的原产地、生产厂家的名称和地址、生产日期等。

8. 证明书签发日期在原产地证明书的底部,应填写证明书的签发日期,并由出口商或相关机构的授权人签字和盖章。

三、填写要求和注意事项1. 填写要求填写原产地证明书时,应使用清晰、规范的字体,确保填写内容的准确性和可读性。

所有填写项均应填写完整,不得有遗漏或空白。

2. 注意事项(1)确保证明书的编号与实际出口货物相符,并进行相应的记录和管理。

(2)核实并准确填写出口商和进口商的相关信息,以便于双方联系和沟通。

(3)货物描述应准确详细,包括货物的名称、规格、数量等,以便于进口商清楚了解货物的特征和数量。

(4)仔细阅读原产地证明要求,并按照要求填写相关内容,确保证明书符合原产地要求。

(5)核实并准确填写货物的原产地、生产厂家的名称和地址、生产日期等信息,确保证明书的真实性和可信度。

一般原产地证明书(含详解)

一般原产地证明书(含详解)第一篇:一般原产地证明书(含详解)一般原产地证明书一般原产地证明书填写说明证书编号(Certificate No.)•此栏不得留空,否则此证书无效。

出口方(Exporter)•填写出口商的英文名称、英文地址及所属国家(地区)。

其中出口方是指具有对外贸易出口经营权的单位,也就是指经外贸主管部门正式批准,并经工商管理局注册批准的专业外贸公司、工贸公司、一部分自营出口的企业、中外合资企业、外商独资等企业的正式名称,一般填写有效合同的卖方,要同出口发票上的公司名称一致。

地址部分要填写详细地址,包括街道名称、门牌号码等。

此栏要注意不能填境外的中间商,即使信用证有此规定也不行。

如果经由其他国家或地区需填写转口名称时,可在出口商后面加英文“VIA”然后填写转口商名称、地址和国家地区。

收货人(Consignee)••填写进口商的英文名称、英文地址及所属国家(地区)。

通常是合同的买方或信用证规定的提单通知人。

如果来证要求所有单证收货人留空,应加注“T o Whom It May Concern”或“T o Order”,但不得留空。

若需填写转口商名称,可在收货人后面加英文“VIA”,然后加填转口商名称、地址和国家(地区)。

运输方式和路线(Means of transport and route)••此栏尽发货人所知,填写运输方式(海运、空运等)、起运港和目的地(目的港),应注意与等其他单据保持一致。

如需中途转运,也应注明。

如:o From Shanghai to Liverpool on July 1, 2008 By Vessel.(所有货物于2008年7月1日通过海运,从上海港运往利物浦港。

)目的地国(地区)(Country/region of destination)•货物最终运抵目的地的国家、地区或港口,一般应与最终收货人或最终目的地港的国家或地区一致,不能填写中间商国别。

仅供签证机构使用(For certifying authority use only)•为签证机构使用栏,正常情况下,出口公司应将此栏留空,由签证机构根据需要在此加注。

产地证的填制说明

常用原产地证书的填制说明一、普惠制原产地证书(FORMA)本证书采用联合国贸发会统一的证书格式,一正二副。

正本为绿色,第一副本为白色,第二副本为黄色。

证书采用英文或法文填制,证书共有12栏,各栏填制要求如下:标题栏:普惠制产地证书标题栏(右上角),填上出入境检验检疫局所编定的证书号。

在证书横线上方填上“中华人民共和国”,国名必须填打英文全称,不得简化。

Issued in THE PEOPLE'S REPUBLIC OF CHINA (我们国内印制的证书,已将此印上,无须再填打。

)第一栏:出口商名称、地址、国家注:此栏带有强制性,应填明详细地址,包括街道名、门牌号码等。

中国地名的英文译音应采用汉语拼音。

不能出现香港、台湾、澳门及其他受惠国等名称和地址。

第二栏:收货人的名称、地址、国家注:(1)该栏应填给惠国最终收货人名称(即信用证上规定的提单通知人或特别声明的受货人),如最终收货人不明确,可填发票抬头人。

但不可填中间转口商的名称。

欧洲联盟、挪威对此栏是非强制性要求,如果商品直接运往上述给惠国,而且进口商要求将此栏留空时,则可以不填详细地址,但需填“TO ORDER”。

第三栏:运输方式及路线(就所知而言)注:一般应填装货、到货地点(始运港、目的港)及运输方式(如海运、陆运、空运)。

转运商品应加上转运港,如VIA HONGKONG。

该栏还要填明预定自中国出口的日期,日期必须真实,不得捏造。

对输往内陆给惠国的商品,如瑞士、奥地利,由于这些国家没有海岸,因此如系海运,都须经第三国,再转运至该国,填证时应注明。

例:ON/AFTER NOV. 6,1995 BY VESSEL FROM TIANJIN TO HAMBURG VIA HONGKONG IN TRANSIT TO SWITZERLAND.第四栏:供官方使用。

此栏由签证当局填具,申请签证的单位应将此栏留空。

正常情况下此栏空白。

特殊情况下,签证当局在此栏加注,如:(1)货物已出口,签证日期迟于出货日期签发“后发”证书时,此栏盖上“ISSUED RETROSPECTIVEL Y”红色印章。

原产地证填制说明

原产地证填制说明一、第1栏:出口方此栏不得留空,填写出口方的名称、详细地址及国家(地区)。

出口商名称是指在中国工商行政管理局注册批准的名称,应与第11栏签章相符。

若经其它国家或地区需填写转口商名称时,可在出口商后面加填英文VIA,然后再填写转口商名称、地址和国家。

例如:SINOCHEM INTERNATIONAL ENGINEERING &TRADING CORP. NO. 40, FUCHENG ROAD, BEIJING, CHINAVIA HONGKONG DAMING CO., LTD.NO. 656, GUANGDONG ROAD, HONGKONG二、第2栏:收货方应填写最终收货方的名称、详细地址及国家(地区),通常是外贸合同中的买方或信用证上规定的提单通知人。

但往往由于贸易的需要,信用证规定所有单证收货人一栏留空,在这种情况下,此栏应加注“TO ORDER”或“***”,但不得留空。

三、第3栏:运输方式和路线此栏填写两项内容:运输方式(如海运、空运、陆运)及运输路线。

海运、陆运应填写装货港,到货港。

如经转运,还应注明转运地。

注意装货港必须在中国境内。

多式联运要分阶段说明。

由于中山暂无飞机场,因此不能从中山直接显示为“空运”(BY AIR)。

如由中山陆运至香港,再空运至德国,应注明“FROM ZHONGSHAN, CHINA TO HONGKONG CHINA BY TRUCK, THEN FROM HONGKONG,CHINA TO GENOA ITALY BY AIR”。

如不确定何时出运,建议不用显示出运日期。

无论信用证及提单情况如何,都不能在产地证中显示起运港为香港(即FROM HONGKONG TO ……)。

正确的运输方式表达,只能够是通过国内某港口或城市到香港,然后经香港再转运到国外。

四、第4栏:目的地国家(地区)此栏填写货物最终运抵目的地的国家或地区,即货物最终进口国(地区),一般应与最终收货人所在国家(地区)一致,或最终目的港国别一致,不能填写中间商国家名称。

原产地证明书格式

原产地证明书格式第一篇:原产地证明书格式original 篇二:原产地证书(样本)篇三:原产地证明书样本及申请书一般原产地证明书/加工装配证明书申请书证书号 : 申请人郑重声明:本人被正式代表本企业办理和签署本申请书。

本申请书及一般原产地证明书,加工装配证明书所列内容正确无误,如发现弄虚作假,冒充证书所列货物,擅改证书,自愿接受签证机关的处罚并负法律篇四:产地证明书的格式和填制要求产地证明书的格式和填制要求江苏汇鸿中鼎李若宾编一、通用填制要求1、产地证书的编号(certificate no.)此栏不得留空,否则证书无效。

2、出口方(exporter)填写出口公司的详细地址、名称和国家(地区)名。

若经其他国家或地区,需填写转口商名称时,可在出口商后面填英文via,然后再填写转口商名称、地址和国家。

3、收货方(consignee)填写最终收货人名称、地址和国家(地区)名。

通常是外贸合同中的买方或信用证上规定的提单通知人。

如信用证规定所有单证收货人一栏留空,在这种情况下,此栏应加注“to whom it may concern”或“to order”,但此栏不得留空。

若需填写转口商名称时,可在收货人后面加填英文via,然后再写转口商名称、地址、国家。

4、运输方式和路线(means of transport and route)填写装运港和目的港、运输方式。

若经转运,还应注明转运地。

例如:通过海运,由上海港经香港转运至汉堡港,应填为:from shanghai to hamburg by vessel via hongkong.5、目的地国家(地区)(country/region of destination)填写目的地国家(地区)。

一般应与最终收货人或最终目的港(地)国别相一致,不能填写中间商国家名称。

6、签证机构用栏(for certifying authority use only)由签证机构在签发后发证、补发证书或加注其他声明时使用。

原产地证明书格式

原产地证明书格式一、概述原产地证明书是国际贸易中常用的一种商业文件,用于证明货物的原产地。

该证明书是根据国际贸易法规定的,由出口国的相关机构或商会出具,以确保货物的原产地符合贸易协定或贸易协议的要求。

本文将详细介绍原产地证明书的标准格式及其内容要求。

二、原产地证明书的标准格式原产地证明书的标准格式通常包括以下几个部分:1. 证明书标题在证明书的顶部居中位置,应标明“原产地证明书”字样,字体大小适中,突出显示。

2. 证明书编号在证明书的右上角,应注明证明书的编号,以便于追溯和管理。

3. 出口商信息出口商信息应包括出口商的名称、地址、联系人以及联系方式,以确保证明书的真实性和可靠性。

4. 进口商信息进口商信息应包括进口商的名称、地址、联系人以及联系方式,以便于进口国对进口商进行核实。

5. 货物描述货物描述应详细列出货物的名称、规格、数量、重量等相关信息,以确保证明书与实际货物相符。

6. 原产地证明原产地证明是原产地证明书的核心内容,应详细描述货物的原产地。

其中,包括原产地国家或地区的名称,以及货物在该国或地区的生产过程和加工过程。

7. 证明人签名和日期原产地证明书应由相关机构或商会的授权人员签署,并注明签署日期。

签名应清晰可辨,以确保证明书的真实性和合法性。

8. 附加说明根据需要,原产地证明书还可以包括一些附加说明,如特殊要求、贸易协定的条款等。

三、原产地证明书的内容要求为了确保原产地证明书的有效性和可靠性,其内容应符合以下要求:1. 真实性和准确性原产地证明书上的所有信息应真实、准确地反映货物的原产地和相关信息。

任何虚假陈述或错误信息都可能导致证明书无效。

2. 完整性和清晰性原产地证明书应包含所有必要的信息,并以清晰的方式呈现。

所有的描述和数据应明确,以便于进口国的审核和核实。

3. 规范性和统一性原产地证明书应符合国际贸易法规定的标准格式,以确保在不同国家之间的通用性和一致性。

4. 可追溯性和管理性原产地证明书应注明编号,并在相关机构或商会进行管理和归档,以便于追溯和核实。

原产地证明书格式

原产地证明书格式一、概述原产地证明书是国际贸易中常用的一种证明文件,用于确认货物的原产地,以便享受相应的关税优惠或者符合进口国的要求。

本文将详细介绍原产地证明书的标准格式,包括主要内容、填写要求和样本。

二、主要内容1. 证明书抬头:在证明书的顶部中央,写上“原产地证明书”字样,字体应清晰可辨。

2. 出口国信息:包括出口国名称、出口国地址和出口国电话等联系信息。

3. 进口国信息:包括进口国名称、进口国地址和进口国电话等联系信息。

4. 出口商信息:包括出口商名称、出口商地址和出口商电话等联系信息。

5. 进口商信息:包括进口商名称、进口商地址和进口商电话等联系信息。

6. 货物描述:详细描述出口货物的名称、规格、数量和分量等信息。

7. 货物原产地证明:明确指出货物的原产地,可以是国家、地区或者特定工厂等。

8. 签发日期:证明书签发的日期,应确保与货物出口日期相符。

9. 证明机关:出具原产地证明书的机关名称、地址和联系方式。

10. 证明机关章:证明机关的公章或者印章,应清晰可辨。

三、填写要求1. 清晰可读:填写内容应使用清晰的字体,确保文字清晰可读。

2. 准确无误:填写内容应准确无误,避免浮现拼写错误或者信息不完整的情况。

3. 规范格式:按照标准格式填写,确保证明书的合法性和可信度。

4. 签名盖章:填写完成后,由证明机关的授权人员签字并盖章,确保证明书的有效性。

四、样本以下是原产地证明书的标准格式样本:---------------------------------------原产地证明书出口国信息:出口国名称:XXXX国出口国地址:XXXX街道XX号出口国电话:XXXX-XXXXXXXX进口国信息:进口国名称:XXXX国进口国地址:XXXX街道XX号进口国电话:XXXX-XXXXXXXX出口商信息:出口商名称:XXXX公司出口商地址:XXXX街道XX号出口商电话:XXXX-XXXXXXXX进口商信息:进口商名称:XXXX公司进口商地址:XXXX街道XX号进口商电话:XXXX-XXXXXXXX 货物描述:货物名称:XXXX产品规格:XXXX数量:XXXX分量:XXXX货物原产地证明:本货物产自XXXX国签发日期:XXXX年XX月XX日证明机关:证明机关名称:XXXX机关证明机关地址:XXXX街道XX号证明机关电话:XXXX-XXXXXXXX 证明机关章:(证明机关公章或者印章图片)---------------------------------------以上是原产地证明书的标准格式样本,根据实际情况填写相关信息即可。

原产地证明书样本

原产地证明书样本第一篇:原产地证明书样本原产地证明书样本原产地证书是证明货物的生产或制造地的文件,简称原产地证,原产地证书在国际贸易中往往被进口国用来作为实行区别关税待遇和实施国别贸易政策管理的重要依据,例如最惠国待遇、政府采购、保障措施的正确实施等等,因此具有待定的法律效力和经济作用。

下面是亚太贸易协定的原产地证明书,供大家参考。

SAMpLECERTIFICATEOFORIGINAsia-pacificTradeAgreement(Combineddeclarationandcertificate)1.Goodsconsignedfrom:(Exporter’sbusinename,address,country)ReferenceNo.Issuedin…………….(Country)2.Goodsconsignedto:(Consignee’sname,address,country)3.ForOfficialuse4.Meansoftransportandroute:5.Tariffitemnumber:6.Marksandnumberofpackages:7.Numbe randkindofpackages/descriptionofgoods:8.Origincriterion(seenotesoverleaf)9.Grossweightorotherquantity:10.Numberanddateofinvoices:11.Declarationbytheexporter:Theundersignedherebydeclaresthattheabovedetailsandstate mentsarecorrect:thatallthegoodswereproducedin……………………………….(Country)andthattheycomplywiththeoriginrequirementsspecifiedforth esegoodsintheAsia-pacificTradeAgreementforgoodsexportedto ……………………………….(Impo rtingCountry)……………………………….placeanddate,signatureofauthorizedSignatory12.CertificateItisherebycertifiedonthebasisofcontrolcarriedout,thatthedecl arationbytheexporteriscorrect.…………………………………placeanddate,signatureandStampofCertifyingAuthorityNotesforcompletingCertificateofOriginI.GeneralConditions:Toqualifyforpreference,productsmust:a)fallwithinadescriptionofproductseligibleforpreferenceinthe listofconcessionsofanAsia-pacificTradeAgreementcountryofdestination;b)complywithAsia-pacificTradeAgreementrulesoforigin.Eacharticleinaconsignment mustqualifyseparatelyinitsownright;andc)complywiththeconsignmentconditionsspecifiedbytheAsia-pacificTradeAgreementrulesoforigin.Ingeneral,productsmustbec onsigneddirectlywithinthemeaningofRule5hereoffromthecountr yofexportationtothecountryofdestination.II.Entriestobemadeinth eboxesBox1GoodsConsignedfromTypethename,addreandcountryoftheexporter.Thenamemustbethesameastheexporterdescribedintheinvoice.Box2GoodsConsi gnedtoTypethename,addreandcountryoftheimporter.Thenamemust bethesameastheimporterdescribedintheinvoice.Forthirdpartytra de,thewords“T oOrder”maybetyped.Box3ForOfficialUse Reservedforusebycertifyingauthority.Box4MeansofTransport andRouteStateindetailthemeansoftransportandroutefortheproductsex ported.IftheL/Ctermsetc.donotrequiresuchdetails,type“ByAir”or“BySea”.Iftheproductsaretransportedthroughathirdcountryt hiscanbeindicatedasfollows:e.g.“ByAir”“LaostoIndiaviaBangk ok”Box5TariffItemNumberTypethe4-digitHSheadingoftheindividualitems.Box6MarksandNumbersofp ackagesTypethemarksandnumbersofthepackagescoveredbytheCerti ficate.Thisinformationshouldbeidenticaltothemarksandnumbers onthepackages.Box7NumberandKindofpackages;DescriptionofG oodsTypeclearlythedescriptionoftheproductsexported.Thisshould beidenticaltothedescriptionoftheproductscontainedintheinvoice. AnaccuratedescriptionwillhelptheCustomsAuthorityofthecountr yofdestinationtocleartheproductsquickly.Box8OriginCriterion preferenceproductsmustbewhollyproducedorobtainedinthe exportingparticipatingStateinaccordancewithRule2oftheAsia-pacificTradeAgreementRulesofOrigin,orwherenotwhollyproduce dorobtainedintheexportingparticipatingStatemustbeeligibleund erRule3orRule4.a)productswhollyproducedorobtained:enterthel etter“A”inBox8.b)products notwhollyproducedorobtained:theentryinBox8shouldbeasfollows:1.Enterletter“B”inBox8,forproductswhichmeettheorigincrit eriaaccordingtoRule3.Entryofletter“B”wouldbefollowedbythes umofthevalueofmaterials,partsorproduceoriginatingfromnon-participatingStates,orundeterminedoriginused,expressedasaperc entageofthef.o.b.valueoftheproducts;(example“B”50percent);2.Enterletter“C”inBox8forproductswhichmeettheorigincrit eriaaccordingtoRule4.Entryofletter“C”wouldbefollowedbythes umoftheaggregatecontentoriginatingintheterritoryoftheexporti ngparticipatingStateexpressedasapercentageofthef.o.b.valueofth eexportedproduct;(example“C”60percent);3.Enterletter“D”inBox8forproductswhichmeetthespecialor igincriteriaaccordingtoRule10.Box9GroWeightorOtherQuantity Typethegroweightorotherquantity(suchaspieces,kg)ofthepro ductscoveredbytheCertificate.Box10NumberandDateofInvoices Statenumberanddateoftheinvoiceinquestion.Thedateofthein voiceattachedtotheApplicationshouldnotbelaterthanthedateofa pprovalontheCertificate.Box11DeclarationbytheExporter Th eterm“Exporter”referstotheshipperwhocaneitherbeatra deroramanufacturer.Typethenameoftheproducingcountryandthe importingcountryandtheplaceanddatewhenthedeclarationismad e.ThisboxmustbesignedbytheCompany’sauthorizedsignatory.B ox12CertificationThecertifyingauthoritywillcertifyinthisBox.原产地证书样本亚太贸易协定(中文文本仅供参考)(申报和证书合一)1.货物运自(出口人名称、地址、国家):编号:…………….….….….….签发(国家)2.货物运至(收货人名称、地址、国家):3.官方使用4.运输工具及路线5.税则号列6.包装唛头及编号7.包装件数及种类;货物名称8.原产地标准(见背页说明)9.毛重或者其他数量10.发票编号及日期11.出口人声明下列签字人证明上述资料及申明正确无讹,所有货物产自……………………………….(国家)且符合亚太贸易协定原产地规则的相关规定,该货物出口至……………………………….(进口国)…………………………….申报地点、日期及授权签字人的签字12.证明根据所实施的监管,兹证明上述出口商的申报正确…………………………………地点和日期,签字和签证机构印章背页填制说明一、总原则:享受关税减让优惠的货物必须符合以下条件:1.属于《亚太贸易协定》进口成员国关税减让优惠产品清单的范围。

原产地证书格式

附件2原产地证书格式Overleaf InstructionBox 1:State the full legal name and address of the exporter in China or Ecuador.Box 2:State the full legal name and address of the importer in China or Ecuador, if known. If unknown, add “***” (three stars).Box 3:Complete the means of transport and route and specify the departure date, transport vehicle number, and port of loading and discharge, as far as known. If unknown, add“***” (three stars).Box 4:Customer’s Order Number, Letter of Credit Number, among others, may be included. If the Certificate of Origin has not been issued before or at the time of shipment, theauthorized body should mark “ISSUED RETROSPECTIVEL Y” here. In the case wherea good is invoiced by a non-Party operator, the full legal name of the non-Partyoperator and the producer of the goods shall be indicated in this box.Box 5:State the item number.Box 6:State the shipping marks and numbers on packages, when such marks and numbers exist.The number and kind of packages shall be specified. Provide a full description of eachgood. The description should be sufficiently detailed to enable the products to beidentified by the Customs Officers examining them and relate it to the invoicedescription and to the HS description of the good. If goods are not packed, state “inbulk”. When the description of the goods is finished, add “***” (three stars) or “ \ ”(finishing slash).Box 7:For each good described in Box 6, identify the HS tariff classification to a six-digit code.Box 8:For each good described in Box 6, state which criterion is applicable, in accordance with the following instructions. The rules of origin are contained in Chapter 4 (Rules ofOrigin and Implementation Procedures) and Annex 4 (Product Specific Rules ofOrigin).Box 9:State quantity with units of measurement for each good described in Box 6. Other units of measurement, e.g. volume or number of items, which would indicate exact quantitiesmay be used where customary.Box 10:The number and date of invoice (including the invoice issued by a non-Party operator) should be shown here.Box 11:The box must be completed by the producer or exporter. Insert the place date and signature of authorized person.Box 12:The box must be completed, dated, signed or stamped by the authorized person of the authorized body.中文参考背页说明第1栏:注明中国或者厄瓜多尔出口商(生产商)详细的依法登记的名称和地址。

6-附件:原产地证书格式以及填制说明 Original

附件:原产地证书格式以及填制说明OriginalPage 2 ofOverleaf InstructionCertificate No.: Serial number of Certificate of Origin assigned by the issuing body.Box 1: State the full legal name, address (including country) of the exporter and the exporter should be in the beneficiary country.Box 2: State the full legal name, address (including country) of the producer and the producer should be in the beneficial country. If more than one producer’s good is included in the certificate, list the additional producers, including name, address (including country). If the exporter or the producer wishes the information to be confidential, it is acceptable to state “Available to the authorized body upon request”. If the producer and the exporter are the same, please complete field with “SAME”. If the producer is unknown, it is acceptable to state "UNKNOWN".Box 3: State the full legal name, address (including country) of the consignee, and the consignee should be in the customs territory of China.Box 4: Complete the means of transport and route and specify the departure date, transport vehicle No., port of loading and discharge.Box 5: Any additional information such as Customer’s Order Number, Letter of Credit Number, etc. may be included. Box 6: State the item number.Box 7: State the shipping marks and numbers on the packages.Box 8: Number and kind of package shall be specified. Provide a full description of each good. The description should be sufficiently detailed to enable the products to be identified by the Customs Officers examining them and relate it to the invoice description and to the HS description of the good. If goods are not packed, state “in bulk”. When the description of the goods is finished, add “***” (three stars) or “ \ ” (finishing slash).Box 9: For each good described in Box 9, identify the HS tariff classification of China to six digits.Box 10: If the goods qualify under the Rules of Origin, the exporter must indicate in Box 10 of this form the origin criteria on the basis of which he claims that his goods qualify for preferential tariff treatment, in the manner shown in the following table:Box 11: Gross weight in kilograms should be shown here. Other units of measurement e.g. volume or number of items which would indicate exact quantities may be used when customary.Box 12: Invoice number, date of invoices and invoiced value should be shown here.Box 13: The field must be completed, signed and dated by the exporter for exports from the beneficiary country.Box 14: The field must be completed, signed, dated and stamped by the issuing body.Box 15: The field must be completed, signed, dated and stamped by the Customs authority of the beneficiary country.In case where there is not enough space on the first page of a Certificate of Origin for multiple lines of goods, additional pages can be used. The Certificate number will be the same as that shown on the first page. The main characteristics including box 6 to box 15 will be presented, together with the stamp of the issuing body and the Customs authority of the beneficiary country.中文参考:正本第1页(共页)第2页(共页)背页填制说明证书编号:授权签证机构签发原产地证书的序列号。

原产地证附样本

原产地证附样本原产地证是用来证明货物的原产国或地区的一种证明文件,也称为产地证、产地证明书,是国际贸易中必备的一种文件。

原产地证不仅对于出口方可以享受一些减免或优惠税收政策,对于进口方也可以了解到所进口的货物的原产地,因而在国际贸易中具有非常重要的作用。

原产地证的样本如下:[企业标志或名称]原产地证明书COMMERCIALINVOICECERTIFICATEOFORIGIN第:__号1.出口商(名称、详细地址、国家):[出口商的名称、详细地址和国家名称]2.受益人(名称、详细地址、国家):[受益人的名称、详细地址和国家名称]3.运输方(名称、详细地址、国家):[运输方的名称、详细地址和国家名称]4.船名/航班号:[船名或航班号]5.本证明书的处理人:[处理本证明书的人员姓名和职务]6.描述的货物:[详细描述货物,包括数量、品牌、型号等]7.销售契约/号码:[销售契约或号码]8.货源:[原材料或部件的原产地以及原产地国家的名称]9.加工或生产:[是否在其他国家进行加工或转换,如果是,需要提供相关证据] 10.海关编号:[了解所进口货物所需的海关编码]11.出口日期:[货物出口的日期]12.运输途径/方法:[货物运输的途径和方法]13.数量(例如重量、容量):[具体的货物数量,例如重量、容量等]14.币种和价格条件:[货物的币种和价格条件]15.备注:[备注信息,例如特殊要求或其他补充说明]----------------------------------------出口商签名和日期注:此原产地证明书是按照(国家/地区)的法律要求填写的,其中的信息如实填写。

以上是原产地证样本的简单介绍,原产地证是根据国家或地区的法律法规规定的,因此实际在填写原产地证时还需根据当地法律要求进行具体操作。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

附件:原产地证书格式以及填制说明Original

Page 2 of

Overleaf Instruction

Certificate No.: Serial number of Certificate of Origin assigned by the issuing body.

Box 1: State the full legal name, address (including country) of the exporter and the exporter should be in the beneficiary country.

Box 2: State the full legal name, address (including country) of the producer and the producer should be in the beneficial country. If more than one producer’s good is included in the certificate, list the additional producers, including name, address (including country). If the exporter or the producer wishes the information to be confidential, it is acceptable to state “Available to the authorized body upon request”. If the producer and the exporter are the same, please complete field with “SAME”. If the producer is unknown, it is acceptable to state "UNKNOWN".

Box 3: State the full legal name, address (including country) of the consignee, and the consignee should be in the customs territory of China.

Box 4: Complete the means of transport and route and specify the departure date, transport vehicle No., port of loading and discharge.

Box 5: Any additional information such as Customer’s Order Number, Letter of Credit Number, etc. may be included. Box 6: State the item number.

Box 7: State the shipping marks and numbers on the packages.

Box 8: Number and kind of package shall be specified. Provide a full description of each good. The description should be sufficiently detailed to enable the products to be identified by the Customs Officers examining them and relate it to the invoice description and to the HS description of the good. If goods are not packed, state “in bulk”. When the description of the goods is finished, add “***” (three stars) or “ \ ” (finishing slash).

Box 9: For each good described in Box 9, identify the HS tariff classification of China to six digits.

Box 10: If the goods qualify under the Rules of Origin, the exporter must indicate in Box 10 of this form the origin criteria on the basis of which he claims that his goods qualify for preferential tariff treatment, in the manner shown in the following table:

Box 11: Gross weight in kilograms should be shown here. Other units of measurement e.g. volume or number of items which would indicate exact quantities may be used when customary.

Box 12: Invoice number, date of invoices and invoiced value should be shown here.

Box 13: The field must be completed, signed and dated by the exporter for exports from the beneficiary country.

Box 14: The field must be completed, signed, dated and stamped by the issuing body.

Box 15: The field must be completed, signed, dated and stamped by the Customs authority of the beneficiary country.

In case where there is not enough space on the first page of a Certificate of Origin for multiple lines of goods, additional pages can be used. The Certificate number will be the same as that shown on the first page. The main characteristics including box 6 to box 15 will be presented, together with the stamp of the issuing body and the Customs authority of the beneficiary country.

中文参考:正本

第1页(共页)

第2页(共页)

背页填制说明

证书编号:授权签证机构签发原产地证书的序列号。

第1栏:填写受惠国出口商的名称、地址(包括国家)。

第2栏:在知道实际生产商的情况下,填写受惠国生产商的名称、地址(包括国家)。

如果出口货物由一家以上生产商生产,仅填写最后实际性加工生产的生产商的名称、地址(包括国家)。

如果生产商和出口商相同,应填写“同上”。

如果不知道生产商,可填写“不知道”。

第3栏:填写中国关境收货人的名称、地址。

第4栏:填写运输方式及路线、离港日期、运输工具编号、装货港口和卸货港口。

第5栏:可以填写顾客订货单号码,信用证号码等其他信息。

第6栏:填写货物项目号。

第7栏:填写唛头及包装号。

第8栏:填写货品名称、包装数量及种类。

如果是散装货,应注明“散装”。

在商品描述末尾加上“***”(三颗星)或“\”(结束斜线符号)。

第9栏:填写货物对应的《协调制度》六位数编码。

第10栏:若货物符合原产地规则,出口商必须按照下表所示方式,在本证书第10栏中申明其

第11栏:毛重应填写“千克”,数量应填写数量单位,体积可填写升或立方米等

第12栏:应填写发票号码、开发票日期以及发票价格。

第13栏:本栏目必须由出口商填写、签名并填写日期。

第14栏:本栏必须由授权签证机构的授权人员填写地点、签证日期并盖章。

第15栏:本栏必须由受惠国海关当局的授权人员填写地点、签证日期并盖章。

当原产地证书一页填制不下多项商品时,可以附页填制。

第二页应列出原产地证书第一页所列的第6至15栏内容,并标注原产地证书号码,该号码与第一页证书号码相同,同时必须有签证机构的印章和出口国海关印章。

证书编号:。