2018年信用证流程图英文word版本 (5页)

国际信用证英文流程

国际信用证英文流程Here's a sample of an international letter of credit process described in English, keeping it conversational and varied in tone:Okay, let's talk about the international letter of credit process in simple terms. First up, the buyer and seller agree on a deal, and the buyer asks their bank to issue a credit. This credit is basically a promise to pay the seller if all conditions are met.The issuing bank then sends this letter of credit to the seller's bank, who verifies its authenticity. Once verified, the seller can rest assured that they'll get paid as long as they fulfill the terms in the letter.Now, let's say the seller ships the goods. They'll provide documents like bills of lading and invoices to prove shipment. These documents go to the seller's bank for approval.The bank checks the documents carefully to ensure they match the requirements in the letter of credit. If everything's in order, they'll release the payment to the seller.On the other hand, if there's a discrepancy in the documents, the bank might reject the payment. This is why it's crucial for the seller to ensure their documents are accurate and complete.。

信用证 详解 理论 实务 中英文 操作PPT课件

*32B /CURRENCY CODE AMOUNT

* USD41084.34

*

US Dollar

*

41084.34

*41D/AVAILABLE WITH/BY-NAME, ADDRESS

* ANY BANK

* BY NEGOTIATION

*42C/DRAFTS AT

* SIGHT FOR 100 PCT OF THE INVOICE VALUE

* IF ANY OUTSIDE THE OPENING BANK

* WILL BE BORNE BY THE BENEFICIARY

*48 /PERIOD FOR PRESENTATION

* 15 DAYS

*49 /CONFIRMATION INSTRUCTIONS

* WITHOUT

*78 /INSTRUCTIONS TO PAY/ACC/NEG BK

信用证实例 4/6

* PACKING: BY STANDARD EXPORT PACKING

* MANUFACTURER: UNICAM LIMITED, U.K.

* SHIPPING MARK: (LZH)

*

WUHAN CHINA

*71B/CHARGES

* ALL BANKING CHARGES AND INTEREST

四、信用证的基本内容

对信用证内容的归纳

1. 对信用证本身的说明,包括:信用证的种类、信用 证号码、信用证的金额、信用证有效期限和地点、 交单期限;

2. 对当事人的规定,明确申请人、受益人、开证行、 指定行,说明对议付行有无限制;

3. 对货物的要求,明确品名、品质、数量、包装、价 格;

【最新2018】信用证英语-word范文 (20页)

本文部分内容来自网络整理,本司不为其真实性负责,如有异议或侵权请及时联系,本司将立即删除!== 本文为word格式,下载后可方便编辑和修改! ==信用证英语篇一:信用证的中英文对应信用证样本(中英文对照)信用证样本:以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并顺利支付的信用证TO:BANK OF CYPRUS LTDLETTERS OF CREDIT DEPARTMENTNTCOSIA COMMERCIAL OPERATIONS CENTERINTERNATIONAL DIVISION************TEL:******FAX:******TELEX:2451 & 4933 KYPRIA CYSWIFT:BCYPCY2NDATE:23 MARCH 201XAPPLICATION FOR THE ISSUANCE OF A LETTER OF CREDITSWIFT MT700 SENT TO:MT700转送至STANDARD CHARTERD BANKUNIT 1-8 52/F SHUN NIND SQUAREO1 WANG COMMERCIAL CENTRE,SHEN NANROAD EAST,SHENZHEN 518008 - CHINA渣打银行深圳分行深南东路5002号信兴广场地王商业大厦52楼1-8单元电话: 82461688:27: SEQUENCE OF TOTAL序列号1/1 指只有一张电文:40A: FORM OF DOCUMENTARY CREDIT跟单信用证形式IRREVOCABLE 不可撤消的信用证:20OCUMENTARY CREDIT NUMBER信用证号码00143-01-0053557:31C: DATE OF ISSUE开证日如果这项没有填,则开证日期为电文的发送日期。

:31DATE AND PLACE OF EXPIRY信用证有效期050622 IN CHINA 050622在中国到期:50: APPLICANT 信用证开证审请人******* NICOSIA 较对应同发票上是一致的:59: BENEFICIARY 受益人CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮州华利陶瓷洁具厂:32B: CURRENCY CODE,AMOUNT 信用证项下的金额USD***7841,89:41D:AVAILABLE WITH....BY.... 议付适用银行STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行:42CRAFTS AT 开汇票SIGHT 即期:42A RAWEE 付款人BCYPCY2NO10BANK OF CYPRUS LTD 塞浦路斯的银行名:43PARTIAL SHIPMENTS 是否允许分批装运NOT ALLOWED 不可以:43T:TRANSHIPMENT转运ALLOWED允许:44AOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM...装船港口SHENZHEN PORT深圳:44B:FOR TRANSPORTATION TO 目的港LIMASSOL PORT发票中无提及:44C: LATEST DATE OF SHIPMENT最后装船期050601:045A ESCRIPTION OF GOODS AND/OR SERVICES 货物/服务描述SANITARY WARE 陶瓷洁具F O B SHENZHEN PORT,INCOTERMS 201X fob深圳港,INCOMTERMS 201X:046A OCUMENTS REQUIRED 须提供的单据文件*FULL SET (AT LEAST THREE) ORIGINAL CLEAN SHIPPED ON BOARD BILLS OF LADING ISSUED TO THE ORDER OF BANK OF CYPRUS PUBLIC COMPANYLTD,CYPRUS,NOTIFY PARTIES APPLICANT AND OURSELVES,SHOWING全套清洁已装船提单原件(至少三份),作成以“塞浦路斯股份有限公司”为抬头,通知开证人和我们自己,注明*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THIS CREDIT.运费在目的港付注明该信用证号码*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIRAGENT STATING THE B/L NO(S) AND THE VESSEL(S) NAME CERTIFYINGTHAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDING A VALID SAFETYMANAGEMENT SYSTEM CERTIFICATE AS PER TERMS OF INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/201XBY AN APPROPRIATE CLASSIFICATION SOCIETY由船公司或代理出有注明B/L号和船名的证明书证明他们的船是:A)持有根据国际安全管理条款编码的有效安全管理系统证书; 和B)由相关分级协会根据201X年1月1日颁布的ICC条款分类的.*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COPIES DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO.HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输:。

信用证(L/C)样本共12页word资料

信用证(L/C)样本2019-05-30 18:41对于很多外贸新手来说,信用证(L/C)是个不小的问题,相信有不少人可能都没见过。

对我来说,信用证也是新的东西,也需要学习。

在此,从其它地方搬来样本,供大家参考、学习。

对于原创者,表示感谢!正题:其实所有的信用证条款都大同小异,具体款项都是那些,下面列出一个样本供大家参考.有一个问题需要新手注意,一般韩国开过来的信用证经常用假远期,这也是韩国人的精明之处,可以用假信用证向开证行押汇,狡猾狡猾地!!信用证样本1SAMPLE LETTER OF CREDIT/1(See Instructions on Page 2)Name and Address of BankDate: __________________Irrevocable letter of Credit No. ______________Beneficiary: Commodity Credit Corporation Account Party: Name of Exporte rAddress of ExporterGentlemen:We hereby open our irrevocable credit in your favor for the sum or sums not to exceed a total of _______________dollars ($__________), to be made available by your req uest for payment at sight upon the presentation of your draft accompanied by the following statement:(Insert applicable statement)/2This Letter of Credit is valid until _____________________/3, provided, however, that th is Letter of Credit will be automatically extended without amendment for _________ ________/4 from the present or any future expiration date thereof, unless at least th irty (30) days prior to any such expiration date the Issuing Bank provides written n otice to the Commodity Credit Corporation at the U.S. Department of Agriculture, 14th and Independence Avenue, S.W., Room 4503, South Building, Stop 1035, Was hington, D.C. 20250-1035, of its election not to renew this Letter of Credit for such additional ______________________/5 period. The notice required hereunder will be d eemed to have been given when received by you.This letter of Credit is issued subject to the Uniform Customs and Practice for Doc umentary Credits, 1993 Revision, International Chamber of Commerce Publication No. 500(Name of Bank)By: _______________________________________________________________-2-INSTRUCTIONS FOR LETTER OF CREDIT ISSUED FOR DEIP BID1. Send to: Treasurer, CCCU.S. Department of Agriculture14th & Independence Avenue, S.W.Room 4503 South BuildingStop 1035Washington, DC 20250-10352. If the letter of credit is to apply to any Dairy Export Incentive Program (DEIP) I nvitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in ac cordance with the terms and conditions of one or more Dairy Export Incentive Pro gram (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 149 4, and the applicable DEIP Invitation(s) issued by CCC.”If the letter of credit is to apply to a single DEIP Invitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in ac cordance with the terms and conditions of one or more Dairy Export incentive Pro gram (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 149 4, and DEIP Invitation No. ________________.If the letter of credit is to apply to more than one specific DEIP Invitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in ac cordance with the terms and conditions of one or more Dairy Export incentive Pro gram (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 149 4, and DEIP Invitation Nos. ________________, ___________________, and _________________ .”3. Insert the last date of the month in which the 90th day after the date of the le tter of credit falls (e.g., if the date of the letter of credit is March 15, 2019, the date to be inserted would be Jun 30, 2019).4. Insert a time period of either “one (1) year” or a specific number of whole month(s) which total less than one year (e.g., “one (1) month,”“two (2) months ,” etc.).5. Insert the same time period as inserted in the previous space (e.g., “one (1) y ear,”“one (1) month,” etc.).信用证样本2Issue of a Documentary Credit (开证行,一般为出口商的往来银行,须示开证行的信用程度决定是否需要其他银行保兑confirmation见49)BKCHCNBJA08E SESSION: 000 ISN: 000000 BANK OF CHINA LIAONING NO. 5 ZHONGSHAN SQUARE ZHONGSHAN DISTRICT DALIAN CHINADestination Bank (通知行advising bank见57A)KOEXKRSEXXX MESSAGE TYPE: 700 KOREA EXCHANGE BANK SEOUL 178.2 KA, ULCHI RO, CHUNG-KO (一般由受益人指定往来银行为通知行,如愿意通知,其须谨慎鉴别信用证表面真实性;应注意信用证文本的生效形式和内容是否完整,如需小心信用证简电或预先通知和由开证人直接寄送的信用证或信用证申请书,因其还未生效,且信用证一般通过指定通知行来通知,可参考《出口实务操作》page237)40A Type of Documentary Credit (跟单信用证类型)IRREVOCABLE (信用证性质为不可撤消。

国际贸易英语信用证演示文稿

small and the finance involved is small too.

第五页,共19页。

1. L/C: Definition

RESONS OF USING L/C: ① : foreign credit reports are often sketchy

第七页,共19页。

1. L/C: Definition

Specifically: it is an arrangement, whereby the buyer requires his bank to establish a credit in favor of the seller. The buyer’s bank undertakes,

⑧ Standby L/C

第十九页,共19页。

or authorizes its correspondent bank in

the exporter’s country, to pay the exporter a sum of money against presentation of specified shipping documents.

④ : beneficiary 受益人 Usually the exporter, who is entitled to receive

the L/C for the payment of the goods. : negotiating bank 议付银行

The bank who buy an exporter’s draft submitted to it under a L/C and then forward the draft and documents to the opening bank for reimbursement. Usually is the advising bank.

国内信用证基本流程英语版

国内信用证基本流程英语版英文回答:Domestic Letter of Credit (L/C) Process in China.Step 1: Application for L/C.The applicant (buyer) submits an application to the issuing bank, requesting the issuance of an L/C.The application includes details such as the beneficiary (seller), the amount, and the terms and conditions of the L/C.Step 2: Issuance of L/C.The issuing bank reviews the application and, if approved, issues the L/C.The L/C is a legally binding document that commits theissuing bank to pay the beneficiary upon fulfillment of the conditions specified in the L/C.Step 3: Negotiation of L/C.The beneficiary receives the L/C from the issuing bank and verifies its authenticity and compliance with the purchase order.Any discrepancies or amendments are negotiated between the beneficiary and the issuing bank.Step 4: Presentation of Documents.Once the goods have been shipped or services rendered, the beneficiary presents the required documents to the negotiating bank (usually the beneficiary's bank).These documents typically include an invoice, bill of lading, and insurance certificate.Step 5: Examination of Documents.The negotiating bank examines the documents to ensure that they comply with the terms and conditions of the L/C.If the documents are found to be in order, the negotiating bank credits the beneficiary's account.Step 6: Payment by Issuing Bank.The negotiating bank sends the documents to the issuing bank.The issuing bank reviews the documents and, if satisfied, releases payment to the negotiating bank.Step 7: Reimbursement.The negotiating bank reimburses the issuing bank for the payment made to the beneficiary.Step 8: Closure of L/C.Once the final payment has been made, the L/C is closed.The beneficiary has fulfilled its obligations under the L/C, and the issuing bank's liability has been discharged.Notes:Domestic L/Cs are governed by the Uniform Customs and Practice for Documentary Credits (UCP 600) issued by the International Chamber of Commerce (ICC).The UCP 600 sets out the standard terms and conditions for L/Cs.Parties can negotiate and incorporate additional terms and conditions into their L/C agreements.中文回答:国内信用证基本流程。

信用证流程图--

信用证流程图---标准化文件发布号:(9456-EUATWK-MWUB-WUNN-INNUL-DDQTY-KII信用证流程图开证申请人 1 受益人【进口商】【出口商】2 49 510 6付款行/开证行 3 .7 . 8 通知行/议付行信用证操作流程跟单信用证操作的流程简述如下:1.买卖双方在贸易合同中规定使用跟单信用证支付。

2.买方通知当地银行(开证行)开立以卖方为受益人的信用证。

3.开证行请求另一银行通知或保兑信用证通知卖方信用证已开立。

4.通知行核对无误后转递给出口人。

5.卖方收到信用证,并确保其能履行信用证规定的条件后,即装运货物,备齐单据并开具汇票,在有效期内向当地银行议付。

6.银行审核无误后按发票金额扣除手续费后付款。

7.通知行或以外的银行将单据寄送开证行。

8.开证行审核单据无误后,以事先约定的形式,对已按照信用证付款、承兑或议付的银行偿付。

9.开证行通知进口人付款。

10.开证行在买方付款后交单,然后买方凭单取货。

对着看没课件的排版好但对着看还是能懂的。

本回答由提问者推荐评论(3)413总以为是你采纳率:18% 擅长:企业管理其他回答程序正确,说明你有基础的,我再话蛇添足一下:1.开立外币帐户。

自己选择银行,只有这家银行经营国际结算业务就行。

2.向开户行要L/C通知路线,然后提供给客户3.等你的开户行通知你收到信用证。

4.到银行拿信用证,审证。

看是否与合同条款相符,以及是否有无法办到的条款,如有,要求客户修改信用证。

没有的话,就按证备货。

5.发货后,备齐信用证要求的单据,到开户行交单。

开户行会帮你审单,如发现不符点,马上与客户联系,请求客户接受不符点。

如无,寄单到开证行(银行来寄)6.开证行收到单据后,如果审单无误,直接付款,然后要求开证人付款赎单。

如有不符点,一般会联系开证人,问开证人是否接受,接受则付款,不接受则拒付。

7.开户行通知你收到信用证项下货款,你到银行结汇8.通关的事不用操心,一般都是装运时交给货代一起做,费用很少,一般一票100元。

可转让信用证英文流程

可转让信用证英文流程The Process of Transferable Letter of Credit.The transferable letter of credit (L/C) is a unique financial tool commonly used in international trade. It allows the original beneficiary (the first beneficiary) to transfer all or part of the credit's value to another party (the second beneficiary) under certain conditions. This process ensures greater flexibility and efficiency in global trade transactions.Here is a detailed outline of the transferable L/C process:1. Agreement and Contract Formation.The process begins when the importer and exporter reach an agreement on the terms of the trade. This agreement is formalized through a contract, which outlines the specific details of the transaction, including the goods to be sold,the agreed-upon price, and any other relevant terms and conditions.2. Application for a Transferable L/C.Once the contract is established, the importer appliesto their bank (the opening bank) to open a transferable L/C in favor of the exporter. The application specifies the amount of the credit, the terms of payment, and other relevant details. The bank then issues the L/C, which is sent to the exporter's bank (the advising bank) for notification.3. Advising and Acceptance of the L/C.The advising bank reviews the L/C and notifies the exporter of its issuance. The exporter then accepts the L/C, confirming their agreement to the terms and conditions outlined in the document.4. Request for Transfer.If the exporter wishes to transfer the L/C to a second beneficiary, they submit a request to the advising bank. This request must be in accordance with the terms and conditions stated in the original L/C and must be approved by the opening bank.5. Approval and Transfer of the L/C.The opening bank reviews the request for transfer and, if satisfied, approves the transfer. The advising bank then issues a new L/C in favor of the second beneficiary, reflecting the updated terms and conditions. This new L/C is known as the transferred L/C.6. Performance of the Contract by the Second Beneficiary.The second beneficiary fulfills the contract by shipping the goods to the importer as specified in the transferred L/C. They then prepare the necessary documentation, such as invoices and shipping documents, to facilitate payment.7. Presentation of Documents and Payment.The second beneficiary submits the required documentsto the advising bank for presentation to the opening bank. The opening bank reviews the documents to ensure theycomply with the terms and conditions of the transferred L/C. If the documents are in order, the opening bank makes payment to the second beneficiary, either through the advising bank or directly.8. Notification to the First Beneficiary.After payment is made, the advising bank notifies the first beneficiary of the transfer and payment. The first beneficiary then converts the invoice and sends the necessary documents to the opening bank for their records.9. Closure of the L/C.Once the transaction is complete and all payments have been made, the L/C is closed. The opening bank issues aclosing advice to the advising bank, confirming the finalization of the transaction.In summary, the process of a transferable L/C involves several steps, from agreement formation and L/C issuance to request for transfer, approval, performance, document presentation, payment, notification, and closure. This process ensures smooth and efficient transactions in international trade, allowing for greater flexibility and convenience for all parties involved.。

信用证 托收汇 付流程 英文版

信用证托收汇付流程英文版信用证Free on Board or FOB, used in commerce to describe the value of goods at point of embarkation, excluding transportation and insurance costs. In an FOB shipping contract, the buyer of the goods pays the cost of shipping and assumes any risk of loss or damage. Export values are usually expressed FOB for customs and excise purposes, while imports areusually valued CIF (cost, insurance, and freight); the seller pays for shipping and assumes any risk.1. applicant request the issuing bank.2. issuing bank issue letter of credit to advising bank.3. advising bank advise L/C to the beneficiary.4. beneficiary prepare all the documents that the L/C mentioned and then present documents to presenting bank.5. presenting/negotiation bank checking document and then send to the L/C issuing bank or reimbursing bank.6. L/C issuing bank checking document and then remit funds to the presenting bank.The L/C payment procedure is usually as follows:a. You (the importer) applies to open the L/C to us (the seller) through a bank who can open the L/C in your country.b. The opening bank will inform The Bank in Thailand that the L/C has been opened.c. The Bank in Thailand will inform us that the L/C has been established.d. We'll check all the terms and conditions listed in the L/C. Ifall terms and conditions are acceptable, we'll arrange the shipment within the time specified in the L/C.e. After the goods are loaded onto the ship without any damage, the ship agent will issue the clean bill of lading to us.f. We will submit the clean bill of lading and other relevant documents to The Bank of Thailand to gather the payment. Only with clean bill of lading can you claim the ownership of the goods.g. The Bank in Thailand will send the clean bill of lading and relevant documents to your bank (the opening bank). h. The opening bank will inform you that all documents are received.i. You will go to the bank to make the payment to get the clean bill of lading and relevan documents. j. With all of these documents, you can clear the import Customs and pick up the goods after the goods arrive on the destination sea port.\CIFCOST, INSURANCE AND FREIGHT(... named port of destination)“Cost, Insurance and Freight" means that the seller delivers whe nthe goods pass the ship's rail in the port of shipment.The seller must pay the costs and freight necessary to bring the gdods to the named port of destination BUT the risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time of delivery, are transferred from the seller to the buyer. However, in CIF the seller also has to procure marine insurance against the buyer's risk of loss of or damage to the goods during the carriage.Consequently, the seller contracts for insurance and pays the insurance premium. The buyer should note that under the CIF term the seller is required to obligation insurance only on minimum cover1. Should the buyer wish to have the protection of greater cover, he wouldeither need to agree as such expressly with the seller or to make his own extra insurance arrangements.The CIF term requires the seller to clear the goods for export.This term can be used only for sea and inland waterway transport. If the parties intend to deliver the goods across the ship's rail, the CIP term should be used.CFRCOST AND FREIGHT( ... named port of destinaion)“Cost and Freight means that the seller delivers when the goodspass the ship' s rail in the port of shipment.The seller must pay the costs and freight necessary to bring the goods to the named port of destination BUT the risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time of delivery, we transferred from the seller to the buyer.The CFR term requires the seller to clear the goods for export.This term can he used only for sea and inland waterway transport. If the parties do not intend to deliver the goods across the ship's rail, the CPT term should be used.FOBFREE ON BOARD(... named port of shipment)“Free on Board" means that the seller delivers when the goods pass the ship''s rail at the named port of shipment. This meansthat the buyer has to bear all costs and risks of loss of or damage to the goods from that point. The FOB term requires the seller to clear the goods for export. This term can be used only for sea or inland waterway transport. If the parties do not intend to deliver the goods across the ship''s rail, the FCA term should he used.Paying Procedures Under Collection and L/CPaying Procedures under Collection:Figure 1 D/P sight1. After shipment of the goods on the contract, the exporter fillsup letter of collecting application and draws sight bill, then sends the bill with shipping documents to the remitting bank for collection.2. The remitting bank writes letter of entrusting collection, which it sends with the sight bill and the shipping documents to thecollecting bank for collection. 3. The collecting bank presents the documentary bill to the importer. 4. The importer pays the bill.5. The collecting bank gives the documents to the buyer.6. The collecting bank transfers account and notifies the remitting bank of the payment.7. The remitting bank transfers account and notifies the exporter of the payment.Paying Procedures under Collection:Figure 2 D/P after sight1. After shipment on the contract, the exporter fills up letter of collecting application and draws time bill, then sends the bill with shipping documents to the remitting bank for collection.2. The remitting bank writes letter of entrusting collection, which it sends with the time bill and the shipping documents to the collecting bank for collection.3. The collecting bank presents the documentarybill to the importer, who accepts the bill and gives it back to the collecting bank.4. The importer pays when the bill is due.5. The collecting bank gives documents to the importer.6. The collecting bank transfers account and notifies the remitting bank of the payment.7. The remitting bank transfers account and notifies the exporter of the payment.Paying Procedures under Collection:Figure 3 D/A1. After shipment on the contract, the exporter fills up letter of collecting application and draws time bill, then sends the bill with shipping documents to the remitting bank for collection.2. The remitting bank writes letter of entrusting collection, which it sends with the time bill and the shipping documents to the collecting bank for collection.3. The collecting bank presents the documentarybill to the importer, who accepts the bill. The collecting bank gets back the accepted bill and gives the documents to the importer. 4. The importer pays when the bill is due.5. The collecting bank transfers account and notifies the remitting bank of the payment.6. The remitting bank transfers account and notifies the exporter of the payment. 信用证Paying Procedures under L/C:1. The importer makes application to the opening bank, which opensL/C to the exporter with service charge.2. The opening bank sends L/C to the advising bank in theexporter’s country.3. The advising band sends L/C to the exporter.4. After shipment, the exporter gets ready all the shipping documents and draws bill of exchange,which the exporter sends to the negotiating bank during the validity of the L/C.5. The negotiating bank pays the exporter deducting services charge and interest.6. The negotiating bank sends the documentary bill to the opening bank for payment.7. The opening bank pays.8. The opening bank notifies the importer to get the documents against payment. 9. The importer pays for the documents and gets thetitle to the goods after payment. The business is done.Notes:1. collection托收2. principal委托人,本人,当事方3. remitting bank托收行4. collecting bank代收行5. payer付款人6. D/P sight即期付款交单7. D/P after sight远期付款交单8. beneficiary 受益人9. advising bank (notifying bank)通知行10. negotiating bank议付行11. opening bank开证行12. paying bank付款行applicant开证申请人 13.14. application申请书15. deduction扣除,扣除额汇付Three kinds of mainstream remittance methods:1: Silver postal remittance.To do a platform for foreign exchange margin usually operate with U.S. dollars, 2000 U.S. Post Office received the following additional transfer cost of 90 yuan custodian banks also charge the cost of around 11 U.S. dollars. Post a maximum of Health 2000 U.S. dollars, can be divided into multiple remittances.2: Bank transfer.Bank transfer charges are 200 yuan a general wire transfers, to transfer notes are generally 300 yuan, custodian banks charge the costof around 11 U.S. dollars. There is no hierarchy bank transfer restrictions, a maximum remittance ID 50000 dollars a year. Bank ofChina to do this business in general the most convenient.3: Credit Card Remittance.There is no fee transfer credit card withdrawals. Generally require1. To avoid fees.2. The maximum amount of each remittance limit of 5000 dollars.3. Visa (VISA), MasterCard (Mastercard) most effective.4. Debit Card (Debit) only applies to customers in the U.S. and overseas customers need to use the credit card (Credit).5. Income is generally the amount of real-time arrived, to a maximumof one working day canbe Daozhang.6. Credit card remittances in U.S. dollars to do clearing, holdingdual-currency credit card consumption, the formation of foreign exchange advances, you can use yuan to purchase foreign exchange to repay their own, the relevant exchange rate could check the card-issuing institution.Credit Card needed to meet the conditions that: 1) is aninternational credit card 2) launched an online consumer 3) is a credit card, you can advance the general domestic VISA or MasterCard cards can.The above three kinds of remittance methods have a special postoffice and bank transfer form filled out credit card to pay even more money directly to the Internet quickly and conveniently.。

信用证流程图

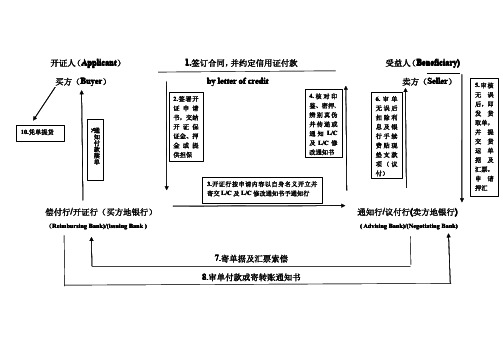

开证人(Applicant) 1.签订合同,并约定信用证付款受益人(Beneficiary) Buyer)偿付行/开证行(买方地银行)通知行/议付行(卖方地银行)(Reimbursing Bank)/(issuing Bank)(Advising Bank)/(Negotiating Bank)信用证L/C的业务流程在国际贸易结算中使用的跟单信用证有不同的类型,其业务程序也各有特点,但都要经过申请开证、开证、通知、交单、付款、赎单这几个环节。

现以最常见的议付信用证为例,说明其业务程序。

议付信用证业务程序具体如下进出口双方签署买卖合同中规定以信用证方式支付货款。

于是:A.申请开证开证申请人即为合同的进口方,应按合同规定的期限向所在地银行申请开证。

申请开证时,申请人应填写并向银行递交开证申请书,开证申请书的内容包括两个方面:一是指示银行开立信用证的具体内容,该内容应与合同条款相一致,是开证行凭以向受益人或议付行付款的依据。

对于这一部分内容,申请人也可附上合同,由银行据以缮制信用证后交申请人确认。

二是关于信用证业务中申请人和开证行之间权利和义务关系的声明。

其基本内容包括:申请人承认在付清货款前开证行对单据及其代表的货物拥有所有权,必要时,开证行可以出售货物,以抵付进口人的欠款;承认开证行有权接受“表面上合格”的单据,对于伪造单据、货物与单据不符或货物中途灭失、受损、延迟到达,开证行概不负责;保证单据到达后如期付款赎单,否则,开证行有权没收申请人所交付的押金,以充当申请人应付价金的一部分;承认电讯传递中如有错误、遗漏或单据邮递损失等,银行不负责任。

开证申请书内容应完整明确,为防止混淆和误解,不要加注过多的细节.申请人申请开证时,应向开证行交付一定比例的押金或其他担保品,押金为信用证金额的百分之几到几十,其高低由开证行规定,与申请人的资信和市场行情有关。

对于资信良好的客户,有的银行会授以一定的开证额度,在规定额度内开证,可免交保证金。

信用证流程及业务操作-PPT课件

The expression "on or about" or similar will be interpreted as a stipulation … five calendar days before until five calendar days after the specified date, both start and end dates included. On or about May 10? The words "to", "until", "till", “from” and “between” when used to determine a period of shipment include the date or dates mentioned, and the words “before” and "after“ exclude the date mentioned. Shipment to be made before 12/31/07? Shipment to be made after 12/01/07? Shipment to be made until 12/31/07? The words “from” and "after" when used to determine a maturity date exclude the date mentioned.

ISBP681(2):The applicant bears the risk of any ambiguity in its instructions to issue or amend a credit. Unless expressly stated otherwise, a request to issue or amend a credit authorizes an issuing bank to supplement or develop the terms in a manner necessary or desirable to permit the use of the credit.

信用证流程英语简述

信用证流程英语简述英文回答:Letter of Credit is a banking arrangement where a bank (the issuing bank) acts on behalf of the buyer (the importer) to guarantee payment to the seller (the exporter) upon presentation of certain documents, typically including a bill of lading, invoice, and other required documents.The process of a Letter of Credit typically involves the following steps:1. Application: The importer applies to their bank fora Letter of Credit. The application specifies the terms and conditions of the Letter of Credit, including the amount, expiration date, and required documents.2. Issuance: The issuing bank reviews the application and, if approved, issues a Letter of Credit. The Letter of Credit is sent to the exporter.3. Confirmation: The exporter may request that the Letter of Credit be confirmed by a bank in its own country. This provides the exporter with additional assurance that payment will be made.4. Shipment: The exporter ships the goods to the importer and obtains a bill of lading and invoice.5. Presentation of Documents: The exporter presents the required documents, including the bill of lading, invoice, and any other required documents, to the issuing bank.6. Payment: The issuing bank reviews the documents and, if they conform to the terms of the Letter of Credit, makes payment to the exporter.The Letter of Credit process is a secure and convenient way to facilitate international trade. It provides both the buyer and seller with assurance that the transaction will be completed as agreed.中文回答:信用证是一种银行安排,银行(发行银行)代表买方(进口商)在卖方(出口商)出具提单、发票和其他所需的单据后,保证向卖方付款。

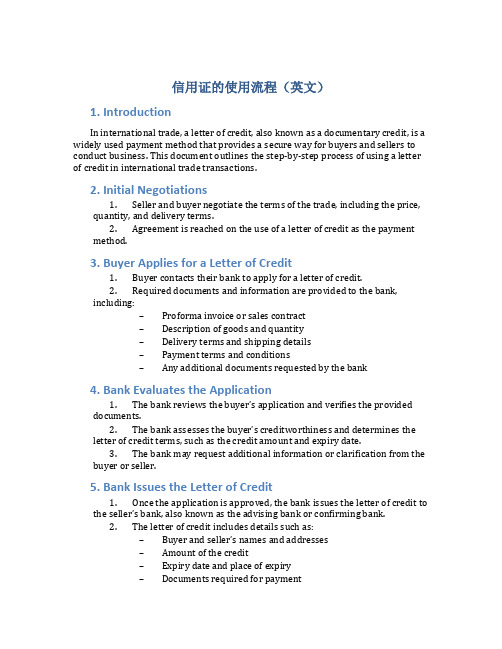

信用证的使用流程英文

信用证的使用流程(英文)1. IntroductionIn international trade, a letter of credit, also known as a documentary credit, is a widely used payment method that provides a secure way for buyers and sellers to conduct business. This document outlines the step-by-step process of using a letter of credit in international trade transactions.2. Initial Negotiations1.Seller and buyer negotiate the terms of the trade, including the price,quantity, and delivery terms.2.Agreement is reached on the use of a letter of credit as the paymentmethod.3. Buyer Applies for a Letter of Credit1.Buyer contacts their bank to apply for a letter of credit.2.Required documents and information are provided to the bank,including:–Proforma invoice or sales contract–Description of goods and quantity–Delivery terms and shipping details–Payment terms and conditions–Any additional documents requested by the bank4. Bank Evaluates the Application1.The bank reviews the buyer’s application and verifies the provideddocuments.2.The bank assesses the buyer’s creditworthiness and determines theletter of credit terms, such as the credit amount and expiry date.3.The bank may request additional information or clarification from thebuyer or seller.5. Bank Issues the Letter of Credit1.Once the application is approved, the bank issues the letter of credit tothe seller’s bank, also known as the advising bank or confirming bank.2.The letter of credit includes details such as:–Buyer and seller’s names and addresses–Amount of the credit–Expiry date and place of expiry–Documents required for payment–Any special conditions or instructions6. Advising Bank Notifies the Seller1.The advising bank receives the letter of credit and verifies its authenticity.2.The advising bank informs the seller about the letter of credit and provides instructions on how to proceed with the trade transaction.3.The seller may request amendments to the letter of credit if necessary.7. Seller Ships the Goods1.The seller prepares the goods for shipment according to the terms and conditions stated in the letter of credit.2.The seller obtains the required documents, such as:–Commercial invoice–Bill of lading or airway bill–Packing list–Certificate of origin–Inspection certificate, if applicable8. Seller Presents Documents to the Bank1.The seller submits the required documents to their bank, also known as the negotiating bank.2.The bank examines the documents to ensure compliance with the terms of the letter of credit.3.If the documents are in order, the bank forwards them to the buyer’s bank for payment.9. Bank Reviews and Processes the Documents1.The buyer’s bank reviews the submitted documents and checks for any discrepancies.2.If the documents are compliant, the bank processes the payment to the seller.3.If discrepancies are found, the bank notifies the buyer and requests instructions on how to proceed.10. Buyer Makes Payment to the Bank1.Upon receiving the payment request from the seller’s bank, the buyer is obligated to make payment according to the terms of the letter of credit.2.The buyer’s bank debits the buyer’s account for the payment amount and transfers the funds to the seller’s bank.11. Bank Releases the Documents to the Buyer1.After receiving the payment, the seller’s bank releases the documentsto the buyer.2.The buyer can now obtain possession of the goods by presenting thereleased documents to the relevant authorities or shipping company.12. ConclusionThe usage of a letter of credit provides security and assurance for both buyers and sellers in international trade transactions. By following the outlined process, parties can effectively manage the payment and documentation aspects of their trade deals, ensuring successful and smooth transactions.。

信用证流程资料ppt课件

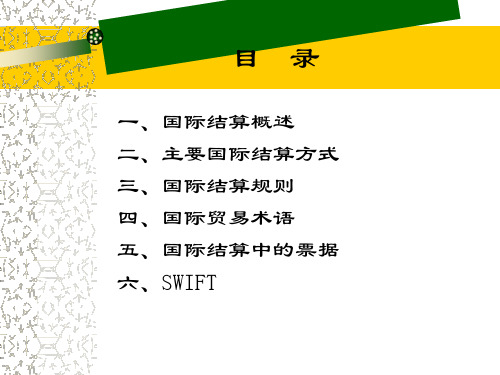

目录

一、国际结算概述 二、主要国际结算方式 三、国际结算规则 四、国际贸易术语 五、国际结算中的票据 六、SWIFT

为深入学 习习近 平新时 代中国 特色社 会主义 思想和 党的十 九大精 神,贯彻 全国教 育大会 精神, 充分发 挥中小 学图书 室育人 功能

2、国际结算方式—信用证

种类(付款方式) – 即期付款信用证(credit available by

sight payment) – 延期付款信用证(credit available by

deferred payment) – 承兑信用证(credit available by

acceptance) – 议付信用证(credit available by

为深入学 习习近 平新时 代中国 特色社 会主义 思想和 党的十 九大精 神,贯彻 全国教 育大会 精神, 充分发 挥中小 学图书 室育人 功能

进口代收

严格按照托收行指示释放单据 付款交单:收到进口商款项后释放单据 承兑交单:收到进口商付款承诺后是否单据 • 审核付款人的资格 具有进出口经营权 在外汇管理局公布的对外付汇名录内

国际结算方式风险梯

最小保证

出口商 最大保证

汇款——货到付款 最大保证

(赊销 O/A) 托收——远期承兑交单

进口商

(D/A)

托收——即期付款交单

(D/P)

信用证 汇款——预付货款

最小保证

国际结算方式将直接影响贸易融资风险度!

为深入学 习习近 平新时 代中国 特色社 会主义 思想和 党的十 九大精 神,贯彻 全国教 育大会 精神, 充分发 挥中小 学图书 室育人 功能

信用证的流程-PPT课件

7)承兑行(Accepting Bank)

适用于承兑的信用证,开证行指定 一家银行并授权它在单据相符时,承兑 受益人提示的远期汇票,并负责在到期 日付款给受益人,它就是承兑行。

8)议付行(Negotiating Bank)

适用于议付的信用证,开证行指定一定银 行并授权它在单据相符时,议付买单,垫款付 给受益人,它就是被指定议付行。 议付的信用证可以不指定议付行,允许任 何银行自由议付,受益人可以选择一家银行把 信用证和单据交给它要求议付,它就是议付行。

5>about shipment(关于运输)

• • • • • • • 选择项:分批装运;转运 From________ For transportation to___________ Not later than__________ 避免缩写如P.R.C. 避免模糊用语Middle East Ports 写明国家

信用证结算流程图

申请人 (进口商) ( 7 ) 付 款 赎 单

(

(1)订立合同

受益人 (出口商)

(

2

( 4

5

开 证 申 请

2.

开证行/付款行

)

)

) 通 知 (3)开证 (6)索偿、偿付

交 单 议 付

3. 开证 4. 通知 5. 交单;议付

6. 索偿、偿付 7. 付款赎单

通知行/议付行

思考问题

如果申请人倒闭,开证行是否要付款?

• 某银行于2019年3月1日开出一份信用证,金 额为3万美元,有效期到2019年5月31日,通知 行应开证行要求保兑了信用证.2019年4月15 日信用证金额增加了20万美元,有效期延展 至2019年8月31日.试问:该保兑行是否必须 对增加额及展期进行保兑?如果保兑行不愿 再加保兑,该保兑行应如何行事?

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

本文部分内容来自网络整理,本司不为其真实性负责,如有异议或侵权请及时联系,本司将立即删除!

== 本文为word格式,下载后可方便编辑和修改! ==

信用证流程图英文

篇一:信用证业务流程图

信用证业务流程图及简介

①买卖双方经过磋商,约定以信用证方式进行结算;

②进口方向开证行递交开证申请书,约定信用证内容,并支付押金或提供保证人;③开证行接受开证申请书后,根据申请开立信用证,正本寄给通知行,指示七转递或通知出口方;

④由通知行转递信用证或通知出口方信用证已到。

通知行在开证行要求或授权

下对信用证加以保兑;

⑤出口方认真核对信用证是否与合同相符,如果不符,可要求进口商通过开证

行进行修改;待信用证无误后,出口商根据信用证备货、装运、开立汇票并缮

制各类单据,船运公司将装船的提单交予出口商;

⑥出口商将单据和信用证在信用证有效期内交予议付行;

⑦议付行审查单据符合信用证条款后接受单据并付款,若单证不付,可以拒付;

⑧议付行将单据寄送开证行货指定的付款行,向其索偿;

⑨开证行收到单据后,应核对单据是否符合信用证,如正确无误,即应偿付议

付行代垫款项,同事通知开证申请人备款赎单;

⑩进口方付款赎单,如发现不符,可拒付款项并退单。

进口人发现单证不符,

也可拒绝赎单?开证行将单据交予进口商;

?进口商凭单据提货。

篇二:信用证业务流程

跟单信用证操作的流程简述如下:

1.买卖双方在贸易合同中规定使用跟单信用证支付。

2.买方通知当地银行(开证行)开立以卖方为受益人的信用证。

3.开证行请求另一银行通知或保兑信用证。

4.通知行通知卖方,信用证已开立。

5.卖方收到信用证,并确保其能履行信用证规定的条件后,即装运货物。

6.卖方将单据向指定银行提交。

该银行可能是开证行,或是信用证内指定的付款、承兑或议付银行。

7.该银行按照信用证审核单据。

如单据符合信用证规定,银行将按信用证规定进行支付、承兑或议付。

8.开证行以外的银行将单据寄送开证行。

9.开证行审核单据无误后,以事先约定的形式,对已按照信用证付款、承兑或议付的银行偿付。

10.开证行在买方付款后交单,然后买方凭单取货。

信用证的开立

1.开证的申请进出口双方同意用跟单信用证支付后,进口商便有责任开证。

第一件事是填写开证申请表,这张表为开证申请人与开证行建立了法律关系,因此,开证申请表是开证的最重要的文件。

2.开证的要求信用证申请的要求在统一惯例中有明确规定,进口商必须确切地将其告之银行。

信用证开立的指示必须完整和明确。

申请人必须时刻记住跟单信用证交易是一种单据交易,而不是货物交

易。

银行家不是商人,因此申请人不能希望银行工作人员能充分了解每一笔交易中的技术术语。

即使他将销售合同中的所有条款都写入信用证中,如果受益人真的想欺骗,他也无法得到完全保护。

这就需要银行与申请人共同努力,运用常识来避免开列对各方均显累赘的信用证。

银行也应该劝阻在开立信用证时其内容套用过去已开立的信用证(套证)。

3.开证的安全性银行接到开证申请人完整的指示后,必须立即按该指示开立信用证。

另一方面,银行也有权要求申请人交出一定数额的资金或以其财产的其他形式作为银行执行其指示的保证。

按现行规定,中国地方、部门及企业所拥有的外汇通常必须存入中国的银行。

如果某些单位需要跟单信用证进口货物或技术,中国的银行将冻结其帐户中相当于信用证金额的资金作为开证保证金。

如果申请人在开证行没有帐号,开证行在开立信用证之前很可能要求申请人在其银行存入一笔相当于全部信用证金额的资金。

这种担保可以通过抵押或典押实现(例如股票),但银行也有可能通过用于交易的货物作为担保提供融资。