中国金融体系

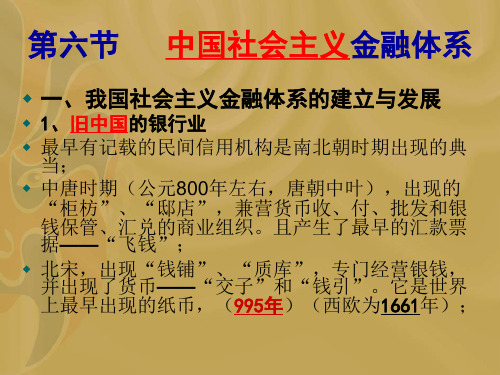

第六节 中国社会主义金融体系

六是金融宏观调控机制的完善

中国自1984年以来,金融宏观调控机制 金融宏观调控机制的变化可以区分为以 金融宏观调控机制 下三个阶段:1984-1993年,中央银行直接调控处于主导地 位;1994-1997年是货币政策从直接调控向间接调控过渡的 时期;1998年以后,中央银行取消了信贷规模控制,对商业 银行实行资产负债比例管理,中国的金融宏观调控政策由直 接调控转向间接调控。

优点: 优点: 集中统一,有利于加强金融宏观控制

弊端: 弊端 统得过多过死,不利于调动各极 银行的积极性,抑制了银行对国民经 济应当发挥的积极调节作用,整个金 融体系缺乏应有的活力。

二、中国金融改革历程:1978-2009 中国金融改革历程:1978金融改革历程

1、准备与起步 准备与起步阶段:1978-1984 准备与起步 三个主要特征。 2、转变与探索 转变与探索阶段:1985-1996 转变与探索 改革的主要内容与特点主要有六个方面。 3、深化与完善 深化与完善阶段;1997-至今 深化与完善 改革的主要特点和内容可以概括为八点。

一是推行小额信贷与农业保险,促进农村金融多元 化发展; 二是正视非正规金融的合理性,允许其合法存在;

三是发展与收入相关的贷款,抵御低收入阶 层风险; 这种创新方式是指,不再是根据拥有的资产 的多少,而是根据未来的收入发放贷款。 四是建立个人发展帐户,邦助穷人进行资产 建设。

三是逐步实现人民币利率和汇率市场化 四是建立与完善金融监管协调机制

七是金融法制建设、社会信用体系得到了完善 八是金融总量的不断增加

中国目前金融体系的现状格局 现状格局: 现状格局 一是中国人民银行 “一行三会(证监会、银监会、保监会)一 局”格局 二是商业银行 五大国有商业银行 区域性商业银行 外资银行(外商独资银行、中外合资银行、 外国银行分行、外国银行代表处)

中国金融监管体系

中国金融监管体系1. 简介中国金融监管体系是指由中国政府成立和管理的一系列金融监管机构和相关法规组成的综合体系。

该体系的目标是确保金融市场的稳定、公平和透明,保护金融机构和投资者的权益,预防和化解金融风险,推动金融业的健康发展。

2. 主要监管机构中国金融监管体系涵盖了多个监管机构,下面介绍其中一些主要的机构:2.1 中国人民银行(PBOC)中国人民银行是中国的中央银行,负责制定和实施货币政策。

其主要职责包括保持货币的稳定,维护金融体系的安全,促进经济的稳定和发展。

人民银行通过制定货币供应量和利率等政策手段,调控金融市场的流动性,并负责管理国家的外汇储备。

2.2 中国银行保险监督管理委员会(CBIRC)中国银行保险监督管理委员会是中国的银行和保险业的监管机构。

其主要职责是制定并实施银行和保险业的监管政策,监督和管理银行和保险业的运营。

CBIRC负责批准和监控金融机构的设立和经营,确保金融机构的合规性和风险可控。

2.3 中国证券监督管理委员会(CSRC)中国证券监督管理委员会是中国的证券市场的监管机构。

其主要职责是监管和管理证券市场,包括发行、交易和持有证券的行为。

CSRC负责审核和批准上市公司的发行申请,监督交易所的运营,并保护投资者的合法权益。

2.4 其他监管机构除了上述的主要监管机构外,中国还设立了其他一些监管机构,如国务院银行业监督管理机构、中国保险业监督管理委员会等。

这些机构各自负责监管和管理特定领域的金融机构和业务。

3. 法律法规为了确保金融市场的健康发展和保护投资者的权益,中国还制定了一系列法律法规。

下面是一些相关的法律法规:3.1 《中华人民共和国金融机构法》该法律规定了金融机构的设立、组织形式、经营范围和监管制度等方面的内容,旨在维护金融机构的合法权益和稳定金融市场。

3.2 《中华人民共和国证券法》该法律规定了证券市场的设立、运行和监管等方面的内容,保护投资者的合法权益,促进证券市场的稳定和发展。

中国金融体系介绍

1956年8月出生,汉族,内蒙古察右后旗人,法学博士。 现任中国证券监督管理委员会主席、党委书记。 郭树清同志1988年9月任国家计委经研中心综合组副组长 1993年4月起先后担任国家经济体制改革委员会综合规划和试

点司司长、宏观调控体制司司长。1996年2月任国家经济 体制改革委员会党组成员、秘书长兼机关党委副书记。 1998年3月任国务院经济体制改革办公室党组成员兼机关党委 副书记。 1998年7月任贵州省副省长。 2001年3月任中国人民银行副行长、党委委员,国家外汇管理 局局长、党组书记。 2005年3月任中国建设银行董事长、党委书记,中国信达资产管 理公司党委书记,中国建银投资有限责任公司党委书记。 2011年10月任中国证券监督管理委员会主席、党委书记。 郭树清同志是第十七届中央候补委员、第十届全国政协委员。

2:主要职责

(1)制定和实施货币政策,保持币值稳定 (2)依法对金融机构进行监督管理,维护金融业的

合法,稳健运行(保监会、银监会、证监会) (3)维护支付,清算系统的正常运行 (4)持有,管理,经营国家外汇储备、黄金储备 (5)经理国库和负责金融统计业务 (6)代表我国政府从事有关的国际金融活动

中国人民银行行长 周小川

(1)起草有关保险业的法律、法规,制定保险业 的规章;

(2)审批和管理保险机构的设立、变更和终止

(3)制定、修改或备案保险条款和保险费率,维 护保险市场秩序

(4)监督、检查保险业务经营活动

(5)依法对保险机构业务及其从业人员的违法违 规活动进行处罚

项俊波

男,1957年1月出生,北京大学法学博士,研究员。 曾任南京审计学院副院长、国家审计署审计管理司副司长、

周小川,男,1948年出生

1975年毕业于北京化工学院 1985年获清华大学博士学位 1986年11月至1991年9月任国家经济 体制改革委员会委员 1986年12月至1989年12月任对外经 济贸易部部长助理 1991年9月至1995年9月任中国银行 副行长 1995年10月任国家外汇管理局局长 1996年10月至1998年2月任中国人民 银行副行长兼国家外汇管理局局长 1998年2月任中国建设银行行长 2000年2月任中国证券监督管理委员 会主席 2002年12月任中国人民银行党委书 记、行长 2003年1月任货币政策委员会主席

中国特色现代金融六大体系

中国特色现代金融六大体系

中国特色现代金融体系包括六大体系,这是在中国金融改革和发展的过程中形成的一个理论框架,以适应中国国情和经济特点。

这六大体系是:中央银行体系:

包括中国人民银行(PBOC),作为中国的中央银行,负责货币政策的制定和实施,以及维护金融稳定。

商业银行体系:

包括大型国有商业银行(如工商银行、建设银行、农业银行等)、股份制商业银行、城市商业银行等。

商业银行在金融体系中扮演着资金中介和信贷渠道的角色。

证券市场体系:

包括证券交易所、券商、基金管理公司等。

中国证券市场的发展涵盖了股票市场、债券市场、期货市场等,旨在提供融资、投资和风险管理工具。

保险体系:

包括人寿保险公司、财产保险公司、再保险公司等。

保险体系的发展旨在提供风险保障和财富管理服务。

外汇市场体系:

包括外汇交易市场、外汇储备管理等。

外汇市场体系旨在维护国际收支平衡、保持人民币汇率的稳定,并促进对外贸易和投资。

非银行金融体系:

包括信托公司、金融租赁公司、资产管理公司、互联网金融等。

非银行金融体系的发展旨在拓宽金融服务渠道,促进金融创新和多元化。

这六大体系共同构成了中国特色现代金融体系,以满足国家经济转型和发展的需要。

在实践中,中国金融改革也在不断进行,以适应经济发展的变化和国际金融环境的挑战。

这些金融体系的协调发展有助于推动中国经济的稳健增长和金融体系的稳定运行。

中国现行金融机构体系的构成

中国现行金融机构体系的构成下载温馨提示:该文档是我店铺精心编制而成,希望大家下载以后,能够帮助大家解决实际的问题。

文档下载后可定制随意修改,请根据实际需要进行相应的调整和使用,谢谢!并且,本店铺为大家提供各种各样类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,如想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by the editor. I hope that after you download them, they can help you solve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you!In addition, our shop provides you with various types of practical materials, such as educational essays, diary appreciation, sentence excerpts, ancient poems, classic articles, topic composition, work summary, word parsing, copy excerpts, other materials and so on, want to know different data formats and writing methods, please pay attention!标题:中国现行金融机构体系的构成1. 介绍中国的金融机构体系是中国经济的重要组成部分,其构成直接影响着国家经济的稳定和发展。

中国金融体系的构成

中国金融体系的构成

中国金融体系是由多个不同但相互关联的部分组成的,主要包括银行、证券、保险、期货市场等。

以下将对这些部分进行详细解释。

1. 银行

银行是中国金融体系中最为重要的部分之一。

中国的银行可以分为商业银行、政策性银行和城市信用社等。

商业银行主要从事吸收存款、发放贷款、结算和外汇业务等。

政策性银行则主要承担国家政策性贷款、发展基础设施和支持国家战略产业等。

城市信用社则主要面向城市小微企业和个人提供金融服务。

2. 证券市场

证券市场是指一种通过证券交易来进行的融资渠道。

中国的证券市场主要由股票市场和债券市场构成。

股票市场可以进一步细分为主板市场、中小板市场和创业板市场等。

债券市场则包括债券发行市场和债券交易市场两个方面,主要面向企业和政府机构等提供融资渠道。

3. 保险市场

保险市场是指为保障人们风险而设立的金融市场。

中国的保险市场主要由人寿保险和财产保险两个部分组成。

人寿保险主要面向个人和家庭提供寿险、健康险等保险服务。

财产保险则主要面向企业提供财产保险、责任保险等服务。

4. 期货市场

期货市场是指一种通过交易期货合约来进行投资的金融市场。

中国的期货市场主要包括商品期货市场和金融期货市场两个方面。

商品期货市场主要面向农产品、金属、能源等商品进行期货交易。

金融期货市场则主要面向金融产品如股票、债券等进行期货交易。

总之,中国金融体系由银行、证券、保险和期货市场等多个部分构成,这些部分相互关联,共同构成了中国金融市场。

说说中国的金融体系

说说中国的金融体系中国的金融体系一直以来都备受关注,其发展和变革对于国内外经济的稳定和增长起着重要的作用。

本文将从三个方面探讨中国金融体系的现状和未来发展趋势。

一、中国金融体系的组成中国的金融体系由各类金融机构和市场组成,包括商业银行、证券公司、保险公司、财务公司、基金公司等。

这些机构在中国经济中扮演着重要的角色,它们为实体经济提供融资、风险管理和投资渠道等服务。

此外,中国还设立了金融市场,包括证券市场、期货市场、债券市场等,这些市场为投资者和融资者提供了交易平台,促进了资源配置和资本流动。

二、中国金融体系的改革与挑战中国金融体系改革是为了适应市场经济的发展和国际经济规则的变化。

在改革开放的过程中,中国金融体系经历了多次重大改革,如银行业的改革、证券市场的开放,以及汇率形成机制的改革等。

这些改革促进了金融体系的稳定和发展,提高了金融机构的竞争力和服务水平。

然而,中国金融体系仍面临一些挑战。

首先是金融风险的控制。

随着金融市场的发展和创新,金融风险也相应增加。

例如,贷款违约、股市波动、金融诈骗等问题频发,对金融安全和社会稳定构成了威胁。

其次是金融监管的加强。

在金融市场快速发展的背景下,金融监管需要不断跟进和加强,以防止金融乱象和市场失控。

此外,金融创新的加快也给监管带来了新的挑战,需要建立更加有效的监管机制来应对不断涌现的金融产品和交易方式。

三、中国金融体系的未来发展趋势中国金融体系的未来发展将继续按照市场化、国际化和智能化的方向推进。

首先,中国将进一步加强金融市场的开放和国际化程度。

随着中国经济的不断崛起和全球经济的深度融合,中国金融市场将对外开放更大空间,吸引更多外资和机构进入。

其次,金融科技的发展将进一步推动金融体系的智能化和创新。

人工智能、大数据和区块链等新技术将被广泛应用于金融业务的开展,提高金融服务的效率和便利性。

再次,中国将加强金融监管的科技支持能力,运用监管科技手段提高监管精确度和操作效率,有效控制金融风险。

简述我国的金融体系

简述我国的金融体系我国的金融体系是指由各类金融市场、金融机构和金融监管机构组成的一个系统。

这个系统通过提供金融产品和服务,促进经济发展,维护金融稳定,满足人民群众的金融需求。

我国金融体系包括了各类金融市场。

金融市场是金融机构和个人进行金融交易的场所。

我国的金融市场主要包括货币市场、债券市场、股票市场和期货市场等。

货币市场是短期资金融通的市场,主要有银行间市场和证券市场的货币市场。

债券市场是企业和政府发行债券的市场,有助于融资和投资。

股票市场是企业股票交易的市场,提供了股票融资和股票投资的平台。

期货市场是金融衍生品交易的市场,有助于风险管理和价格发现。

我国的金融体系还包括了各类金融机构。

金融机构是从事金融业务的实体,包括商业银行、证券公司、保险公司、信托公司等。

商业银行是最主要的金融机构,提供储蓄、贷款、支付结算等服务。

证券公司是股票、债券等证券交易的中介机构,提供证券承销、交易和投资咨询等服务。

保险公司是提供保险保障和风险管理的机构,有助于个人和企业分担风险。

信托公司是提供信托服务的机构,为客户提供财富管理和信托计划。

我国的金融体系还包括了金融监管机构。

金融监管机构是负责对金融市场和金融机构进行监管的机构,主要包括中国人民银行、银保监会、证监会和国务院金融稳定发展委员会等。

中国人民银行是我国的中央银行,负责货币政策的制定和执行。

银保监会是负责对商业银行和保险公司进行监管的机构。

证监会是负责对证券市场和证券公司进行监管的机构。

国务院金融稳定发展委员会是负责协调金融政策和维护金融稳定的机构。

我国的金融体系是一个庞大而复杂的系统,由各类金融市场、金融机构和金融监管机构组成。

这个体系在经济发展中起着重要的作用,通过提供金融产品和服务,促进资源配置,推动经济增长。

同时,金融体系也需要不断改革和完善,以适应经济发展的需要,提高金融服务的效率和质量。

简述我国的金融体系

简述我国的金融体系我国的金融体系扮演着支持经济发展和提供金融服务的重要角色。

金融体系由各类金融机构和市场组成,包括商业银行、证券市场、保险业等。

这些机构和市场相互联系,形成一个庞大的网络,为经济增长提供资金支持和风险管理。

首先,我国的金融体系的核心是银行业。

商业银行是我国金融体系最重要的组成部分,它们提供存款、贷款、支付结算等基础金融服务。

中国人民银行作为中央银行,负责制定货币政策和管理货币供应。

此外,还有发展中的农村信用社、信托公司等非银行金融机构,为金融体系增添了多样性与活力。

其次,证券市场也是我国金融体系的重要组成部分。

证券市场由上海证券交易所和深圳证券交易所等主要交易所组成,它们提供股票、债券等证券的发行和交易。

近年来,我国证券市场迅速发展,吸引了越来越多的国内外投资者参与。

同时,证券市场也为企业提供了更多融资渠道,促进了实体经济的发展。

另外,保险业是我国金融体系的重要组成部分。

保险公司提供人身保险和财产保险等各类保险服务,为个人和企业提供风险保障。

保险业的发展不仅为金融体系增加了多元化,也为经济发展提供了稳定的保险保障。

除了以上几个主要组成部分,还有其他金融机构和市场,如信托业、金融租赁和资产管理等,它们各自担负着特定的角色和功能,构成了我国完整的金融体系。

我国金融体系的发展取得了巨大的成就,为经济发展提供了强有力的支持。

然而,金融体系也面临一些挑战和问题。

首先,在金融体系中存在着资金配置不平衡的问题。

大部分资金流向了国有企业和房地产等行业,而小微企业、农村地区和实体经济却面临融资难题。

这导致了资源配置的不合理,影响了经济结构的优化和转型升级。

其次,金融风险管理仍然是一个重要的课题。

2015年的股市暴跌和2018年的P2P网贷行业风险事件都给金融体系带来了一定的冲击。

“影子银行”和非法集资等问题也亟需加强监管和风险防范。

此外,金融体系的创新和发展仍然面临一定的挑战。

虽然我国已经推出了一系列金融改革举措,但与发达国家相比,我国金融市场的活力和金融产品的创新还有差距。

我国现行金融体系

我国现行金融体系主要有以下组成:1、中国人民银行中国人民银行是我国的中央银行。

2、商业银行(1)国有独资商业银行(2)股份制商业银行(3)合作金融组织3、政策性银行政策性银行是专门从事国家政策性贷款业务的银行。

由一个国家的中央政府或地方政府设立。

在国家产业政策和规划的指导下,运用信贷手段对需要国家支持的某一行业或某一项目进行投资的银行。

(1)国家开发银行(2)中国进出口银行(3)中国农业发展银行4、我国非银行金融机构(1)保险公司是专门经营保险业务的经济组织。

(2)信托投资公司是接受委托投资的金融机构。

(3)财务公司是大型产业集团内部的融资机构。

(4)证券公司是专门从事各种有价证券经营及相关业务的金融企业。

(5)金融租赁公司是通过融物的形式起融资作用的金融企业。

(6)投资基金公司是通过向个人出售基金受益凭证筹集资金,然后委托他人进行多样化证券投资的金融机构。

(7)资产管理公司是剥离和处理国有银行呆账的金融机构。

5、外资金融机构我国金融机构体系是以作为货币当局的中国人民银行为核心,以国有独资商业银行和其他商业银行为主体,多种金融机构分工协作的体系。

就经济成分来看,占主导地位的是国家银行系统。

其中包括作为中央银行的中国人民银行、国有独资商业银行、政策性银行和其他国有经济成分的金融机构。

其次是为数众多的合作金融组织。

此外则是港澳地区和外国金融机构在中国的分支机构和代表处。

按现行政策,我国不准许私人经营金融事业。

主要原因是考虑到金融业的活动对整个经济的状况有重大的影响,个人的信誉能力有限,可能给金融业带来较大的风险。

中国金融体系

中国金融体系里有6个主要实体:人民银行、政府、商业银行、证券公司等金融投资机构、企业、个人。

理解金融体系只不过需要了解这6个实体的功能,及相互之间的关系。

一、人民银行百科上说,人民银行是国务院领导下的国家银行,又称“央行”。

国家银行是啥概念,就是说投资人是国家。

和其他银行不一样的地方在于国家银行不已盈利为目地,如果以盈利为目的,国家银行开动印钞机,国家银行富了,大家口袋里的钱贬值了也就穷了。

这当然不利于国家长期稳定发展。

俗话说“藏富于民”,民富才是国家昌盛的象征。

人民银行是“钱”的源头,可以被称作“lord of the money ”。

我们口袋里的钱,银行存款上的钱,房贷借的钱,公司付给我们的工资,源头都来自人民银行。

通俗的说,人民银行是“印钞机”和“钞票粉碎机”。

人民银行在市场需要更多资金时,可以启动“印钞”功能,向市场注入货币。

在市场上货币泛滥时,可以启动“钞票粉碎机”的功能,将货币回收。

人民银行往市场上投入钱的方法主要是对商业银行“再贴现”及“再贷款”,以及在公开市场上购买政府发行的国债。

二、政府各级政府和公司一样,需要资金来维持日常运营,也需要投资建公路铁路等基础设施。

政府的资金来源主要是税务、国企收入、政务收费及债务。

税大家都很熟悉了,企业要缴纳企业所得税等,个人要缴个税。

国企占据各垄断行业,收入不错。

政务是行政单位的各种收费如违章停车的罚款。

还有一个重要来源是国债和地方债。

三、商业银行大家的钱都存在商业银行里吧(习惯把钞票塞棉鞋里的除外),没人不了解商业银行。

商业银行本质上也是公司,只不过运营的是钱而不是商品。

大家把自己积攒的钱存在银行里,银行把汇总的存款一批批贷款给各个企业,收利息,同时给存款人一点更少的利息,商业银行的主营业务其实就这么简单。

前几年房地产热时,银行一头给开发商提供贷款,一头给买房者提供贷款,生意好的不得了。

四、证券公司基金公司等金融投资机构。

银行利息这么低,甚至赶不上通货膨胀率,越来越多的人把钱投到预期回报率更高的产品上,例如股票、基金等。

中国的金融体系

中国的金融体系中国的金融体系是指中国国内金融机构,以及它们之间的相互关系和运作方式。

中国金融体系的发展经历了多个阶段,从计划经济时期的国有银行主导,到如今的多元化金融市场。

本文将对中国金融体系的特点、发展历程以及未来展望进行探讨。

一、金融体系特点1. 大型国有银行的主导地位中国的金融体系以大型国有银行为核心,这些银行在国内金融市场中拥有主导地位。

这种体系结构反映了中国政府在金融领域的干预和控制,以及对风险的控制和调节能力。

2. 多层次、多元化的市场随着改革开放的进程,中国金融市场逐步实现多层次和多元化。

除了传统的银行业务外,还涌现了证券市场、保险市场、期货市场等各类金融市场。

这种多元化的市场结构有助于提升中国金融体系的稳定性和竞争力。

3. 金融科技的迅速发展中国是全球领先的金融科技创新国家之一。

通过与互联网技术的融合,中国金融体系实现了数字化转型。

移动支付、互联网借贷以及区块链技术等应用已经深入到人们的生活中,为金融服务提供了更多便捷、高效的选择。

二、金融体系发展历程1. 计划经济时期在计划经济时期,中国金融体系主要由国有银行和政策性银行构成。

国家通过这些银行进行资源调配和金融指导,为国家重点项目提供融资支持。

但由于市场机制不完善,金融体系的效率和风险管理存在一定的局限性。

2. 改革开放初期改革开放初期,中国金融市场迎来了一系列重要改革。

成立了股票交易所和证券公司,开始试点经济体制改革。

此时,国有大型银行仍然是金融体系的主导力量,市场化程度有限。

3. 银行体系改革1990年代以后,中国启动了银行体系改革。

国有银行进行了股份制改革,引入了外资银行,并逐步建立起现代化的市场机制。

这一改革使得金融体系更加市场化和开放化。

4. 金融监管改革金融体系改革的同时,中国也加强了金融监管的力度。

实行了更加严格的风险管理和合规要求,设立了监管机构,并加强了对金融市场的监督和调控。

这些改革有助于提高金融体系的稳定性和透明度。

说中国的金融体系

说中国的金融体系中国的金融体系是世界上最大、最复杂的金融体系之一。

它由一系列金融机构和市场组成,涵盖了各种不同类型的金融产品和服务。

中国金融体系在近几十年的发展中取得了巨大的成就,成为全球经济的重要推动力量。

本文将对中国金融体系的特点、发展历程和面临的挑战进行详细阐述。

一、特点中国金融体系的特点之一是包容性。

中国有着庞大的人口和广阔的地域,金融机构需要为不同层级和地区的居民提供金融服务。

因此,中国的金融机构和市场不仅仅服务于大城市和经济发达地区,还致力于为农村地区和中小企业提供金融支持。

这种包容性的特点使得中国金融体系能够更好地满足人民的金融需求,促进经济的稳定增长。

其次,中国金融体系的特点是国家监管的强力介入。

在中国,金融市场不是完全自由的,而是受到政府的广泛监管和调控。

这种强力介入帮助中国的金融体系在经济波动时更加稳定,在金融危机中起到了重要作用。

同时,政府的监管也确保了金融机构和市场的正常运行,维护了金融体系的安全性和健康发展。

再次,中国金融体系的特点体现在不同金融市场的发展。

中国拥有股票市场、债券市场、银行市场、保险市场等多个金融市场,这些市场相互联系、相互支持。

在中国的金融体系中,股票市场主要为企业提供资金,债券市场则是政府和企业发行债券,吸引投资者;银行市场则扮演着向企业和个人提供贷款和储蓄的角色;保险市场则为企业和个人提供风险保障。

这些金融市场的相互配合使得中国的金融体系更加完善和多元化。

二、发展历程中国的金融体系发展可以追溯到改革开放以来的40多年。

改革开放后,中国逐步放开金融市场,吸引国内外资本进入。

在20世纪80年代,中国建立了股票市场和债券市场,开始向市场化方向转型。

随后,中国成立了国有商业银行,并通过巨额贷款支持国家的经济建设。

在1990年代,中国加入了世界贸易组织,进一步加快了金融市场的改革和开放。

与此同时,中国加强了对金融体系的监管和调控,以维护金融市场的稳定。

在21世纪初,中国的金融体系发展进入了一个新的阶段。

简述我国的金融机构体系

简述我国的金融机构体系我国金融机构体系是指在中国金融领域内,通过立法、监管、管理组织,建立起来的各种金融组织,包括金融监管机构、商业银行、非银行金融机构、证券公司、基金公司、保险公司以及其他各类金融机构。

本文将就我国金融机构体系的主要组成部分进行介绍和分析。

一、金融监管机构金融监管机构是指我国的金融监管部门,包括中国人民银行、中国证监会、中国银保监会、中国外汇局等。

这些机构在确保金融市场秩序和金融机构安全运营方面起到至关重要的作用。

这些机构都是独立的监管机构,但是相互之间又存在着一定的联系,其作用不可替代。

中国人民银行是我国的中央银行。

其主要职责是制定并实施货币政策,促进金融市场发展,维护金融稳定。

同时,中国人民银行还起到金融监管的作用,对商业银行、保险公司等各类金融机构进行监管。

中国人民银行发行货币,具有严格的货币政策和货币管理权力。

中国证券监督管理委员会(简称证监会)是我国的证券行业监管机构。

其主要职责是维护证券市场的稳定和规范,保护投资者权益,促进资本市场发展。

证监会的职责包括制定证券法规、批准发行证券、监督证券交易等。

中国银行保险监督管理委员会(简称银保监会)是我国新成立的金融监管机构。

其主要职责是监督和管理银行和保险行业,保障金融机构安全、规范运营,保护金融消费者权益,加强金融风险管理。

银保监会整合了原中国银监会和中国保监会的职责,这也意味着银保监会将会采取更加综合的监管模式,为保障金融体系的安全和健康发展提供了保障。

二、商业银行商业银行是中国金融市场中最主要的金融机构之一。

商业银行在我国金融市场中扮演着重要的角色,不仅为实体经济提供了必要的融资支持,也为广大客户提供了各类金融服务和产品。

目前我国的商业银行主要分为四类,即国有商业银行、股份制商业银行、城市商业银行和农村信用社。

国有商业银行是指由中国政府出资持有股份的银行,主要包括中国工商银行、中国农业银行、中国银行、中国建设银行等;股份制商业银行是指由国家和地方政府、法人和自然人出资组成的银行,主要包括招商银行、交通银行、兴业银行、中国民生银行等;城市商业银行是指侧重于提供城市居民及商业客户金融服务的银行;农村信用社则是面向农村地区和农村居民的银行。

中国现行的金融体系是以中国人民银行为领导

中国现行的金融体系是以中国人民银行为领导,国有独资商业银行为主体,国家政策性银行和其他商业银行以及多种金融机构同时并存、分工协作的金融机构体系。

1、中国人民银行中国人民银行是中国的中央银行,负责制定和执行国家的金融政策,调节货币流通与信用活动。

对外代表国家,对内对整个金融活动进行监督与管理。

2、商业银行中国商业银行体系由三大部分组成,即国有独资商业银行、其他股份制商业银行和外资商业银行。

其中,国有独资银行是中国商业银行体系的主体。

3、政策性银行从1994年起,中国组建了3家直属国务院领导的政策性银行,即国家开发银行、中国农业发展银行及中国进出口银行。

4、非银行金融机构中国的非银行金融机构主要有信托投资公司、证券公司、保险公司、财务公司、租赁公司和信用合作社等。

目前中国的商业银行体系为:1、工、农、中、建四大国有商业银行体系;2、交通、中信、光大、华夏、招商、民生、深发展、浦发、兴业、恒丰等11家股份制商业银行体系(中国金融机构中最好的一类);3、上海银行、北京银行、渤海银行、浙商银行、徽商银行等具有典型的区域辐射和鲜明个性化的商业银行体系(未来可能还有晋商银行、秦商银行等)4、遍布在全国112个城市112家城市商业银行;5、遍布在全国星罗棋布的709家城市信用合作社(法人机构共有709家,但处于运营状态的只有412家)。

6、外资银行、合资银行;弊端:1、商业银行之间发展不均衡,银行业市场结构呈现比较明显的垄断特征,市场竞争还不太充分。

2、银行业的国际竞争力不足,商业银行的综合实力和竞争能力相对较弱。

3、我国商业银行的业务发展目前仍处于传统金融业务阶段,未能完全实现向现代金融业务的转变。

4、与发达国家的银行业比较,我国银行业整体上呈现国有独资商业银行“大而不强”,股份制商业银行“不强不大”的发展格局,并存在着许多抑制我国银行业综合竞争能力提高的问题。

简单来讲就是:1、产权性质趋同,国有化程度高2、资源配置无序,决策效率低下3、核心业务单一,经营范围较窄4、混业经营受限,市场资源割裂5、不良资产巨大,金融安全堪忧6、管理控制失效,风险防范不足楼上各位的回答都不准确我国的银行划分〈一〉中央银行即中国人民银行〈二〉商业银行中国农业银行中国工商银行中国银行中国建设银行交通银行光大银行等等〈三〉政策性银行中国国家开发银行:承担为国家大型重点项目提供专门项贷款;中国农业发展银行:承担国家粮油储备、农副产品合同收购和为农业基本建设发放专门项贷款,并代理财政支农资金的拨付及监督;中国进出口银行:为大宗进出口贸易提供专项贷款,其中主要是为大型成套机电设备进出口提供贷款。

中国金融机构体系的构成与发展

中国金融机构体系的构成与发展金融机构是指在现代金融体系中,为实现货币资金的储蓄、分配、流通、转移等功能而设立的专门组织。

中国的金融机构体系主要包括商业银行、证券公司、保险公司等。

本文将从中国金融机构体系的构成、发展以及面临的挑战等方面进行阐述。

首先,中国金融机构体系的构成主要包括商业银行、证券公司、保险公司等,这些机构构成了中国金融市场的基础。

商业银行是中国金融市场的主要组成部分,主要承担货币储蓄和货币信贷的功能。

证券公司是股票、债券等证券交易的中介机构,通过证券市场为企业提供融资服务。

保险公司则提供各种保险产品,为个人和企业提供风险保障。

其次,中国金融机构体系的发展经历了多个阶段。

开放以前,中国的金融机构体系以国有银行为主导,市场化程度较低。

开放以后,中国开始引入外资银行,鼓励金融创新,加强金融监管,进一步拓展了金融机构的种类和规模。

近年来,中国金融机构体系进一步完善,不仅有国内的商业银行、证券公司、保险公司等机构,还有外资银行、基金公司、信托公司等金融机构。

然而,中国金融机构体系也面临着一些挑战。

首先,金融领域存在的风险问题需要得到有效管理。

过去几年,中国金融市场出现了一些风险事件,例如股市暴涨暴跌,P2P网贷平台问题等,这些问题对金融机构的稳定经营造成了一定的压力。

其次,金融机构的服务质量和效率问题也需要解决。

在国内银行业中,虽然有大型国有银行的竞争力相对较强,但小型商业银行的服务质量和效率相对较低,客户满意度不高。

此外,金融科技的发展也在改变着金融机构的业务模式,传统金融机构需要进行转型以适应新的市场环境。

为了应对这些挑战,中国金融机构体系可以采取一系列措施。

首先,加强金融监管,健全金融风险防控体系。

加强金融监管,完善金融法律法规,建立健全的风险管理和控制机制,加强金融机构的合规监管,提高金融机构的风险防控能力。

其次,加强金融创新,提高金融机构的服务质量和效率。

推动金融科技和金融机构的深度融合,引入新的科技手段和模式,提高金融机构的服务能力和效率,提升客户体验。

中国的金融体系的方式

中国的金融体系的方式金融体系被认为是一个国家经济发展的重要组成部分,它涵盖了金融市场、金融机构和金融监管等多个方面。

中国的金融体系已经在过去几十年中经历了巨大的变革和发展。

本文将介绍中国金融体系的方式,并探讨其影响和挑战。

1. 金融市场中国的金融市场包括股票市场、债券市场、货币市场和期货市场等。

这些市场既提供了资金融通的渠道,又为企业和个人提供了融资和投资的机会。

在金融市场中,中国采取了合理规范的制度和机制,以确保市场公平、公正和透明。

2. 金融机构中国的金融机构包括商业银行、证券公司、保险公司和基金公司等。

这些机构在金融体系中扮演着重要角色,它们的发展和运营对于经济的稳定和增长至关重要。

中国的金融机构在推动经济转型升级、服务实体经济、防范金融风险等方面发挥着积极的作用。

3. 金融监管中国的金融监管机构包括中国人民银行、中国证监会、中国银保监会等。

这些监管机构负责制定和实施金融监管政策,监督和管理金融市场和金融机构,以维护金融体系的稳定和安全。

中国的金融监管制度逐渐完善,有力地提升了金融体系的抗风险能力。

4. 影响和挑战中国的金融体系方式在促进国内经济发展和国际金融合作方面发挥了积极作用。

然而,它也面临一些挑战。

首先,金融机构发展不平衡和不充分的问题仍然存在,金融服务的覆盖和质量有待进一步提升。

其次,金融风险管理和监管仍然面临着挑战,需要进一步加强。

最后,金融体系的国际化程度相对较低,国际金融市场的开放程度也有待提高。

总结中国的金融体系的方式取得了显著成就,在经济发展和金融稳定方面发挥了重要作用。

然而,随着国内外环境的变化和经济结构的调整,金融体系仍面临一些挑战和问题。

因此,中国需要持续改革和创新金融体系,进一步提高金融服务水平,加强金融风险管理和监管,积极推进金融国际化进程,以适应和引领经济发展的新要求。

中国现有金融管理体系

中国现有金融管理体系

中国现有金融管理体系主要由中国人民银行、中国银行保险监督管理委员会、中国证券监督管理委员会、国务院外汇管理局以及其他部门组成。

其中,中国人民银行是中国的中央银行,主要负责货币政策制定和执行,维护金融稳定。

中国银行保险监督管理委员会则是中国的银行保险监管机构,主要负责监管银行、保险公司等金融机构。

中国证券监督管理委员会则是中国的证券监管机构,主要负责监管证券市场和证券公司等机构。

国务院外汇管理局,则是负责中国的外汇管理和监管。

除此之外,还有其他部门负责监管金融市场、金融机构等方面。

这些部门之间协调配合,共同维护中国金融市场的稳定和安全。

- 1 -。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

7

政策性银行-中国农业发展银行

Policy Bank-Agricultural Development Bank

国有农业政策性银行 State-owned, policy bank for agriculture 运营资金目前主要用于粮棉油收购等流动资金 贷款 Mainly to provide current fund for procurement of grain, cotton, oil, etc 资金来源主要是中国人民银行的再贷款 Source of funding: Re-loan from People's Bank of China

– Financial market is featured as being transitional and innovative.

银行体系主导的间接融资模式仍占中国融资结构的90%,直接融 资方式亟待发展 90% of the financing is made through indirect financing controlled by banking system, with direct financing lacking.

1994-2003,国有独资商业银行改革

1994,政策性金融与商业性金融分离 1997,受亚洲金融危机启示,成立四家资产管理公司,接收并处置商业银行 不良贷款;发行特别国债补充商业银行资本金,等等 Reform of State-owned commercial banks 1994,Separation of policy financing and commercial financing 1997, with lessons from Asian financial crisis, formed 4 capital asset management corporation to deal with bad loan in commercial banks, to issue special national bond to supplement capital asset of commercial banks, etc.

中国金融改革进程概述及基本制度 简介 5

2000-2003年国家开发银行资产状况

(Asset by National Development Bank Unit: million RMB)

1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 计 负债合计 不良资产比率 资本充足率

China Construction Bank

中国金融改革进程概述及基本制度 简介 9

中国银行业改革的几个阶段 China's Banking System Reform by Phases

o o 1984-1994,银行专业化改革:形成各司其职的二元化银行体系

o Specialization reform: dual function with division of responsibility among banks

筹融资特点:Main features in investment and financing

营运资金主要来源于向境内发行人民币金融债券 Main financing source being domestically issued financial bond

中国金融改革进程概述及基本制度 简介

主要服务对象:Areas of services

机电产品和高新技术产品的出口 Export of machinery, electronic and high tech products 推动具有"比较优势"的企业对外发展 Assisting enterprises with comparative advantage to develop on international market.

中国金融改革进程概述及基本制度 简介

3

金融决策体系的基本框架

Decision Making System of China's Financial Sector

中国人民银行 People's bank of China 财政部 Ministry of finance 国家发展改革委员会— National development and reform commission 商务部— Ministry of commerce 中国银行业监督管理委员会— China banking regulatory commission 中国证券监督管理委员会— China securities regulatory commission 中国保险监督管理委员会 China insurance regulatory commission

中国金融改革进程概述及基本制度 简介 4

政策性银行-政策性银行 国家开发银行 Policy Bank--National Development Bank

主要职能:向政府经济发展计划和产业政策支 持的重点项目提供长期融资,以支持和促进经 济发展.项目例如:三峡工程,西气东送等 Function: Providing long-term financing support for key projects promoted by government economic plan, e.g. three gorges, gas transfer, etc. 变化:正力图从一个政策性银行向开发性金融 机构发展 Change underway: from policy bank to financial institution promoting development

政策性银行

Policy Bank

商业银行

Commercial Bank

中国证券市场

China's Securities Market

WTO与中国金融业

WTO and China's Financial Sector

中国金融改革进程概述及基本制度 简介

2

概述 Overview

中国施行改革开放政策20多年来,相对于其他许多领域来说,金 融业的改革由于其复杂型和敏感性,是相对滞后的 Over the past two decades, financial sector reform has been lagged behind due to sensitivity and complexity issues. 中国金融市场具有明显的转轨市场和新兴市场特征

中国金融改革进程概述及基本制度 简介

6

政策性银行-中国进出口银行 政策性银行 Policy Bank-China Import & Export Bank 政府全资拥有的国家出口信用机构

– The institution fully owned by government, – Providing export credit,

中国金融改革进程概述及基本制度 简介 11

股份制改革进展情况 Progress in recent share holding system reform

中国银行和中国建设银行已在2004年完成股份公司的 设立,目前正作配套改革,下一步目标是到境内外资 本市场上市

By 2004, Bank of China and the Construction Bank established their joint-stock companies. Currently, systematic reform is underway and the next step is to go public on international stock market.

o

2004年至今,商业银行实行国家控股的股份制改革

o 2004, State dominated share holding system reform in commercial bank.

中国金融改革进程概述及基本制度 简介

10

国有商业银行股份制改革 Development of Share-holding System in State Owned Commercial Banks

中国金融改革进程概述及基本制度 简介 8

商业银行

主体是四家国有商业银行 four national banks 中国工商银行

China Industrial and Commercial Bank

中国农业银行

China Agriculture Bank

中国银行

Bank of China

中国建设银行

目的:从根本上改革国有商业银行体制,补充资本金, 改善公司治理 Purpose: radically restructure state-owned commercial bank system, increase capital asset and improve corporate governance 形式:选择境内外战略投资者,改变单一股权结构, 实现投资主体多元化,但保持国家控股 Form: Attract strategic investors both domestically and internationally and diversify ownership structure, but maintain dominance of state share. 步骤:财务重组—公司治理改革—资本市场上市 Steps: Financial restructuring--corporate governance reform--go public in stock market

China's Financial Sector: Basic Form and Reform