外贸函电 第六章(支付2014)

外贸函电写作Chapter 6 Terms of Payment

• Terms of payment frequently used (支付方式) L/C ---confirmed, irrevocable L/C Remittance汇付 1. T/T (telegraphic transfer) 电汇是目前使用较多的一种汇款方式,其业务流程是:先由

• The buyer who places the order is not in charge or does not have the authority to open the L/C. This is often the case in a large company like chain store, in which the Finance Department, not the Import Department, is in charge of the L/C applications.

• 托收(Collection) 托收是出口商为了向进口商收取销售货款或劳务 价款,开立汇票委托银行代收的结算方式。出口商将作为货权凭 证的商业单据与汇票一起通过银行向进口商提示,进口商只有在 承兑或付款后才能取得货权凭证。 托收有光票托收和跟单托收之 分。跟单托收按交单条件的不同,又有“付款交单”和“承兑交 单”两种。而付款交单又有“即期付款交单”和“远期付款交单 ”之分,远期汇票的付款日期又有“见票后××天付款”“提单 日后××天付款”和出票日后××天付款”3种规定方法。但在 有的国家还有货到后××天付款的规定方法。所以,在磋商和订 立合同条款时,须按具体情况予以明确规定。兹分别示例如下: 付款交单——即期D/P at sight 买方应凭卖方开具的即期跟单汇 票,于见票时立即付款,付款后交单。 付款交单——远期D/P after sight 买方对卖方开具的见票后××天付款的跟单汇票,于 提示时应即予承兑,并应于汇票到期日即予付款,付款后交单。 承兑交单D/A 买方对卖方开具的见票后天付款的跟单汇票,于 提示时应即承兑,并应于汇票到期日即予付款。承兑后交单。承 兑交单并不意味买方到期一定付款,这取决于买方的信誉。

外贸函电6-PPT课件

remittance

remitter (importer) (1)签约 payee (exporter)

(4)通知,付款 (2) 申请、付款

remitting bank (importer’s bank)

(3)委托

paying bank (exporter’s bank)

Procedure of remittance

Collection

Collection can be divided into Clean Collection and Documentary Collection. Documentary Collection : Documents against Payment (D/P) or Documents against Acceptance (D/A). D/P at sight D/P D/P after sight

Chapter Six

Terms of Payment

Part 1 Information related

国际商品(货物)的结算主要包括两方面内容: 1.国际贸易结算的信用工具credit instruments

2.国际贸易结算的方式modes

Bill of Exchange 汇票

1) The Parties of Bill of Exchange Payee 受款人

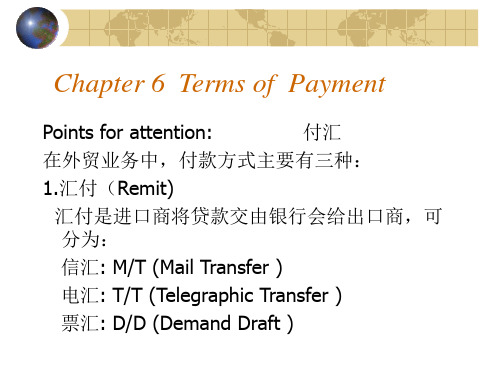

Remittance 汇付 Collection 托收 Letter of credit 信用证

Remittance

Remittance includes Mail Transfer (M/T), Telegraphic Transfer (T/T) and Demand Draft (D/D). Remittance is often used in payment in advance(预付货款) cash with order (随订单付现)CWO cash on delivery (交货付现) COD open account trade(记账交易)

外贸函电与单证第6章 -

在对外贸易中最常用的是信用证付款,此外还较常用托收和汇付的付款形 式。 汇付形式有信付、电汇和票汇,信付是银行通过信笺来转帐的方式,具有 收费低的特点。 电汇是银行通过电报或电传进行转帐的方式,比信汇速度快但费用教高。 票汇是指进口方先从进口地银行够得一张支票,叫做“银行即期汇票”, 然后将此票寄给出口方(收款人),出口方向出口地银行(受票人)出示 这一票据以获得票款。与信汇和电汇不同的是,票汇是可以转让的。

Key to 6.2

1. (1) cash payment transfer

(2) telegraphic

(3) make little difference delivery

(4) cash against

(5) adhere to usual practice you

(6)draw……on

(7) 按60天付款交单方式支付 (8) 远期汇票

4 . ( 1 ) Wepropose payment by T/T when the shipment i s ready. (2) Wecan’t accept your request for payment by Document against Acceptance. (3) Weare not in a position to entertain your business at your price since i t i s f a r below our cost p r i c e . ( 4 ) I t i s against our usual practices to accept Document of Acceptance payment. (5) Wew i l l be grateful i f you could extend t h i s favor to us. (6) Wet r u st that the delay has not caused your much inconvenience. (7) As a r u l e , we accept payment by conformed, irrevocable l e t t e r of credit. (8) Please make arrangement of opening the l e t t e r of credit on time . (9) Considering the good relationship between us, we w i l l entertain yo requet for payment by Document of Acceptance t h i s time. (10) Please send documents to us d i r e c t l y and we w i l l remit.

外贸函电第6单元

An order should at least contain the following points:

1. description of the goods, such as specification, size, quantity , quality and article number (if any); ) 2. prices(unit prices as well as total prices); ( ) 3. terms of payment; 4. mode of packing; 5. time of transportation, port of destination and time of shipment etc. .

Sample letter:

Dear Sirs Thank you for your offer of 12th July sending us patterns of cotton prints. We find both quality and prices satisfactory and are pleased to give you an order for the following items on the understanding that they will be supplied from current stock at the prices named: Quantity Pattern No. Prices 300 yards 72 33p per yard 450 yards 82 38p per yard 300 yards 84 44p per yard CIF Lagos Our usual terms of payment are cash against documents and we hope they will be acceptable to you. Meanwhile should you wish to make inquiries concerning our financial standing. You may refer to our bank the National Bank of Nigeria, Lagos. Please send us your confirmation of sales in duplicate. Yours faithfully

外贸函电unit 6

你们七月十七日的来信已收悉。尽管我们很高兴地 得知你们希望成交的愿望,但很遗憾不能考虑你们 鹿特丹成本保险加运费每公吨255美元的还盘。 供你们参考,你们相邻地区的其他买主都在以我们 的报价购买,我们不得不指出你们的递价明显与现 行市场不符。市场有上扬的趋势,并且这一趋势近 期内没有改变的可能性。 鉴于上述情况,建议你们立刻接受我们每公吨270美 元的报价。

We will keep your inquiry and as soon as we are in a position to accept new orders, we will contact you by cable. 我们将记住你们的询价,一旦能接受新订单,定与 你方电报联系。 Please be assured of our continued cooperation. 请相信我方将继续合作。

Dear sirs, Thank you very much for you letter of July 17. While we appreciate your good wish to push the sales of our shirts, we are regretful to say that we are unable to entertain your counter - offer of US $ 255 per metric ton CIF Rotterdam. As our goods are ordered at our quoted price in your neighboring districts,we have to point out that your counteroffer is out of line with the ruling price. For your information, the market is on an upward trend, which will not be changed recently. Under such circumstance, we hope you will reconsider our offer of US $270 per metric ton CIF Rotterdam, and cable us as soon as possible.

外贸函电-付款方式概要

付款是商务交易的重要部分。所有商务活动的结果都应该是 对所提供的货物或服务获得价值。如果付款不能保证,那么 所有的一切都没有意义。在商业上有许多付款方式,而国际 贸易中的付款方式更复 杂,国外账户的支付也有许多形式。 国际贸易中最常用的支付方法是信用证(简称 L/C),这是 一种可靠而安全的支付方法,便于卖方与 陌生的买方交易, 并对买卖双方都有保障。开证的程序始于买方。他通知他的 往来银行开立以卖方为受 益人的信用证,并以购货的金额为 该信用证金额。买方的往来银行(开证行)把信用证寄给他 在卖方国 家的往来行,告知信用证金额、受益人为谁、所使 用的货币、必备单证以及其他特定要求。

13. lead to 导致,引导某人……。 例:(1)He leads us to a wrong road.(他引我们入歧途。) (2)His fault leads to a wrong conclusion.(他的错误使他得出了错误 的结论。) 14. Cash against Documents/付款交单。 例:We shall be glad if you will agree to ship the goods to us as before on Cash Against Documents basis. (如果你能和过去一样同意按付款交单的方式给我方 发货,我将不胜感激。) 15. draw on…向……开汇票。 例:We have drawn on you a 30 day draft.(我们已向你方开立了 30 天期的汇票。) 16. at three months’ sight 三个月期的,即三个月后付款。

1. normally (=as a rule)通常,一般说来,正常情况下, 正常地, 一般 地。例:It is not normally this cold in this season.(在这个季节通常不 这么冷。) 2. confirmed, irrevocable letter of credit 例:A confirmed, irrevocable letter of credit is required. (要求用保兑的、不可撤销的信用证付款。) 3. cost 成本,费用,花费。动词或名词。 例:This costs me ¥1,000. (这花了我 1000 元。) 4. credit 意思同 Letter of Credit 信用证。 5. tie up(资金)积压。 例:Payment by L/C will tie up my money.(信 用证付款会积压我的资金。)

外贸英语函电--支付条款课件

5. exception n. 例外

6. departure n. 离开,违背(后接介词from) 1) It is a gross departure from promise. 这严重地违反了你方的诺言。 2)We can get the goods ready before the ship’s departure. 我们能在起航前将货物备妥。

出口人持票向指定的银行收取货款。

• payment in advance预付货款,cash with order随定单付现 • cash on delivery交货付现, open account trade记帐交易

Introduction

• Collection托收

• 出口方发货之后,开立以进口方为付款人的商 业汇票并附上有关单据,委托当地银行通过进 口地所在地银行向进口方代收货款。 • D/P付款交单:代收行在收到进口方货款后,将 汇票等单据交付给出口方。 • D/A承兑交单:代收行收到进口方承兑的远期汇 票之后,将跟单汇票交给付款人,进口方于汇 票到期日付清货款。

2) This way of settling the case would set an awkward precedent. 这样解决此案将开创一个难以处理的先例。

• Analyzing the letter

• Paragraph 1: identifying the reference • Paragraph 2: accepting the proposal, giving the reasons • Paragraph 3: making it clear that the concession does not apply to future transactions • Paragraph 4: detailing the enclosure

外贸函电第六章

真通知你方。 由于我方急需此货,我方认为有必要重申在信用证有效期内按时

装运的重要性,装运方面的任何延误都将给我方以后的交易带来损失。

谨上,

Specimen Letters(样函2)

• 见教材p98(letter 6-1)

不管是合同还是确认书,一般都是一式两份,经过双方签字(会签),各 执一份,据以执行,这种行为在进出口业务中,称之为签订合同。

6.2 Writing Steps

A satisfactory order letter should include : 1. express pleasure in receiving the offer; 2. confirm the conclusion of the business and point out the full details of article number, quantity, specification, quality, unit price, total value, shipment, packing, insurance and terms of payment as agreed upon in preliminary negotiations between the exporter and the importer; 3. hope for further orders;

(2)对所订货 Our products are selling well in many areas。)

(3)保证对订 单迅速、 认真地处理

We appreciate the business you have been able to give us and assure you that your order will receive our most careful attention. (感谢你公司照顾我们这笔交易,我们保证一定慎重 办理贵方订单。)

2014年自考外贸函电

外贸函电III. Letter-writing practice:Please translate the following letter into English:先生,兹告售货确认书2567和2568号项下货物备妥已有一个时期。

按上述售货确认书规定,货物应在五、六月间装运。

两周前我们曾发给你们一份电报,要求你们从速开立有关的信用证,电文如下:售货确认书2567、2568货已备妥,请立即开证。

但我们非常失望,我们迄今尚未收到任何回复。

你们可能记得,我们在前信中提到过有关开证的下列事项:1. 载明详细内容的信用证应在装运月期前一个月到达我方。

2. 若是即期装运的交易,则必须用电传或电报开证。

3. 开证时,请确保信用证中的规定与我们的合同相符。

装运期临近。

我们必须指出,除非你方信用证在本月底前到达我处,否则我们将无法在规定的限期内装运。

Dear Sirs,ment for quite some time. The goods should be shipped duringMay/June as stipulated in S/C. We sent you a cable two weeks ago requiring you to open the relative L/C without any delay reading:S/C No. 2567 and 2568 have been ready, please open the L/C immediately.However, much to our disappointment that we have not received any reply up to the time of writing.You may remember clearly that we identified in our previous letter the following of L/C:1.The L/C in details should reach us one month earlier than the time of shipment.2.If the goods are shipped immediately, the L/C will be issued by cable or telex.3.You ensure that the L/C should be strictly conform to the stipulation of our contractThe time of shipment is drawing near and we have to point out that we shall not in a position to make the shipment in due course unless your L/C reaches us before the end of this month.Yours faithfully,Asking for Amendment to L/CDear Sirs,We have received your L/C No. 145/88 issued by the Yemen Bank for Reconstruction & Development for the amount of $13 720 covering 16000 dozen Stretch Nylon Socks. On perusal, we find that transshipment and partial shipment are not allowed.As direct steamers to your port are few and far between, we have to ship via Hongkong more often than not. As to partial shipment, it would be our mutual benefit because we could ship immediately whatever we have on hand instead of waiting for the whole lot to be completed.We, therefore, are faxing this afternoon, asking you to amend the L/C to read: “TRANSHIPMENT AND PARTSHIPMENT ALL OWED”We shall be glad if you see to it that amendment is cabled without any delay, as our goods have been packed ready for shipment for quite some time.Yours faithfully敬启者:我们已收到由也门建设与发展银行开立的金额为13 720 美元的关于16 000 打弹力尼龙袜的第154、88 信用证。

高职财经外贸函电课件UnitSixPayment

延期付款 延期付款 现金付款 现付 延长付款 全付

interim payment non-payment partial payment payment in kind payment in account payment in advance pay by instalments account payable account receivable cash account

贷方账 借方账 流水账 信汇 电汇 票汇 n. 托收 n. 持票人 n. 付款人 n. 受款人

clean bill fictitious bill documentary bill sight draft time draft banker’s bill commercial bill D/P at sight

按你方要求,我方破例接受即期付 款交单,但下不为例。

4.The buyer shall pay the total value to the seller in advance by T/T before Feb. 21.

买 方 应 于 2 月 21 日 前 以 电 汇 方 式 预 付全部货款给卖方。

8.accommodate vt. 照顾、适应、提供 9.make up 弥补、配齐 10.grant vt. 答应、给予、授予、准予; (姑且)承认

11.involve vt. 牵涉、卷入、含有 12.up to 达到、等于 13.down ad. 现付地 14.facilitate vt. 使便利、促进

exchange (second of exchange Being unpaid) pay to the order of __________________the sum of____________________________________ ______________

外贸英语函电.Chapter6PPT课件

goodwill

Begin with a buffer Explain why the refusal

has to be made State the refusal Close positively

e.g.

1.Obviously, if you’d read your policy carefully, you’d be able to answer these questions yourself. Sometimes policy wording is a little hard to understand. I’m glad to clear up these questions for you.

e.g…

3.If you will take the machine to the authorized service center in your area, I am confident they can correct the defect at reasonable charge.

4.If I can be of additional service, please contact me.

Acknowledgment

Black & White Inc. P.O. Box 6789-098-B

We thank you for your order No._______ for _______

Because ______o_u_r__s_u_p_p_l_y_o_f__ra_w___m_a_t_e_r_ia_l_s_h_a_s__b_e_e_n_________ ______c_o_m__m__it_t_e_d_t_o_o__th_e_r__o_r_d_e_r_s _f_o_r _m__o_n_t_h_s_i_n______ ______a_d_v_a_n__c_e_, ___________________________, We are unable to accept your order at this time.

外贸函电支付方式范文

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户姓名]:嗨呀,咱这生意谈得差不多了,现在就差这支付方式没好好唠唠呢。

你看啊,咱们常用的支付方式有好几种。

先说这电汇(T/T)吧,就像你给远方的朋友直接打钱一样方便。

要是你能在发货前就把款给我们电汇过来,那可就太省心啦。

这就好比你提前买了电影票,我们就可以安心准备货物,保证准时给你发货。

对于我们来说,资金立马到账,我们也能更好地安排生产、采购原材料啥的。

而且这电汇手续费相对来说也比较合理,就像你坐公交,花点小钱就能到达目的地一样。

再说说信用证(L/C)吧。

这个信用证就像是一个有信用的中间人担保。

你向银行申请开证,银行就像一个公正的裁判,按照咱们商量好的条款来操作。

虽然办理信用证的手续可能稍微麻烦点,就像你要参加一个很正规的比赛得填不少表格一样,但它对咱们双方都有保障呀。

对我们来说,只要按照信用证的要求把货物准备好,提交单据,就能拿到钱,心里踏实。

对你来说,也不用担心我们收到钱不发货之类的事儿。

还有托收(Collection)这种方式呢。

托收就有点像你委托别人去办事。

你把单据交给银行,银行帮你去收钱。

不过这个托收啊,相对来说风险就稍微大一点,有点像放风筝,线有点长,不太好控制。

但是它手续简单呀,如果咱们之间信任度很高的话,也不失为一种选择。

我觉得咱可以根据这次交易的具体情况来选择支付方式。

要是你订单比较急,电汇就很合适;要是你想更安全保险一点,信用证也是个很棒的选择;要是咱们是老伙伴,彼此信任得很,托收也能让咱的交易更便捷。

你那边对支付方式是咋想的呀?希望咱们能尽快达成一致,这样就可以顺利推进这笔生意啦。

祝好![你的名字] [具体日期]。

国际贸易实务第六章-支付

国际贸易实务讲义

第一节:支付工具

国际贸易实务讲义

汇票(Bill of Exchange,Draft) 汇票是国际货款结算中使用最多的票据 汇票的含义

票据是以支付一定金额为目的,可以转让流通的证券。

Байду номын сангаас

一个向另一个人签发的,要求其见票时或在将来的固定时间或可以确定的时间,对某人或其指定人或持票人支付一定金额的无条件书面支付命令 ——英国票据法

(二)汇票的种类

国际贸易实务讲义

3.按付款时间 即期汇票 远期汇票 见票后若干天付款 Pay at 30 days after sight. 出票后若干天付款 Pay at 30 days after date of draft. 运输单据日后若干天付款 Pay at 30 days after date of B/L. 指定日期付款 Pay at 10th July,2012.

1.按出票人不同 银行汇票(Banker,s Draft) 出票人是银行 商业汇票(Commercial Draft) 出票人是商号或个人

2.按有无随附货运单据 光票(Clean Draft)或净票、白票 不附带任何货运单据 跟单汇票( Documentary Draft ) 随附货运单据 较为常用

国际贸易实务讲义

6.贴现(Discount) 贴现是指远期汇票经承兑后,汇票持有人在汇票尚未到期前在贴现市场上转让,受让人扣除贴现息后将票款付给出让人的行为。或银行购买未到期票据的业务。 7.拒付(Dishonour)或退票 持票人作付款提示时遭到拒绝付款 持票人作承兑提示时遭到拒绝承兑 付款人拒不见票、死亡、破产,以致付款事实上已不可能 8.追索(Recourse) 汇票遭到拒付,持票人具有对其前手要求偿还汇票金额及费用的权利

外贸函电支付方式范文

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户公司名称]:您好呀!我是[您的公司名称]的[您的名字]。

今天想跟您聊聊咱们这笔生意的支付方式这个小事情呢。

您知道的,在国际贸易里,支付方式就像一座桥梁,得又稳又安全,这样咱们两边才能顺利地完成交易。

我们公司通常接受几种支付方式,我给您详细说说哈。

另外一个方式呢,是信用证(L/C)。

这就像是一份来自银行的超级保证书。

您让您那边的银行开个信用证给我们,这就等于告诉我们:“放心干活吧,银行给你们担保呢!”我们按照信用证里规定的条款把货物准备好,然后提交相应的单据,只要单据都符合要求,银行就会把钱付给我们啦。

不过呢,这个信用证办理起来可能稍微麻烦一点,就像走一个有点复杂的迷宫,但是它的安全性可是相当高的哟,就像给咱们的交易穿上了一层厚厚的铠甲。

我们还可以考虑托收这种方式,不过这个就有点像把命运交到了一个中间人的手里。

托收分为付款交单(D/P)和承兑交单(D/A)。

付款交单就是您那边的代收行要等您付了款才能把单据给您,您拿到单据才能提货。

这就好比您得先交钱才能拿到宝贝的钥匙。

承兑交单呢,是您先承兑汇票,然后就能拿到单据去提货,之后再付款。

不过这个承兑交单对我们来说风险稍微大一点,就像把小宝贝暂时借给您,然后等您后面付钱,我们心里总是有点小忐忑呢。

我觉得呀,对于咱们这次的合作,电汇是个挺不错的选择。

简单又快捷,对咱们双方都很方便。

不过呢,如果您有其他的想法或者建议,欢迎随时跟我说说哦。

咱们就像好朋友一样,商量出一个最适合咱们俩的支付方式,然后顺顺利利地把这笔生意做成,之后还可以继续愉快地合作呢!期待您的回复呀!祝您生活愉快![您的名字] [具体日期]。

外贸函电 第六章(支付2014)

即期付款交单方式付款信函

Dear Sirs,

We wish to place with you an order for 100 leather handbags.

For this particular order we would like to pay by D/P at sight. Involved about USD2 000, this order is comparatively a little one. It goes without saying that we very much appreciate the support you have extended us in the past. It will be highly appreciated if you can do us a special favor this time. We look forward to your favourable reply. Yours faithfully,

When the consignment is shipped the Company is to draw on your correspondents at 60 d/s. The documents to accompany the draft are the bill of lading, commercial and consular invoices and insurance policy. Kindly ask your correspondents to see that the insurance policy gives full cover before they accept the draft. Yours faithfully

第六章外贸函电

We would like to call your attenr of February 3. 我们想提请你方注意我公司在2月3日信中提到 的问题。

We think it necessary to invite your attention to the fact that our stocks of men’s shirts are running low owing to strong demand. 有必要提请你方注意,由于近来需求旺盛,我 方男式衬衫存货越来越少。

除了在introduction已介绍的信用证种类外,信 用证还有以下种类:

sight L/C( =L/C at sight= letter of credit available by draft at sight)即期信用证 time L/C, term L/C , usance L/C 远期信用证

to ask for amendment to or extension of an L/C and the sentence patterns, expressions.

Introduction

Letter of credit (L/C)is a chief method of payment in international trade. It is a written document given by a bank to the exporter at the request of the importer, promising to make payment for a certain amount under a certain condition. And it is a reliable and safe payment mode facili- tating trade with unknown buyers and giving protection to both sellers and buyers.

函电 Chapter 6 Terms of Payment

在其他付款方式中,银行职能作托收和汇付的 工作,对进口商不付货款不予负责;而在信用 证的情况下,开证行以自己的信用为交易垫付 付款。 就卖方的利益来说,信用证(L/C)比付款交 单(D/P)好,D/P at sight 比D/P after sight 好,而付款交单(D/P)又比承兑交单(D/A) 好。在国际贸易中,只在进口商财务状况良好, 或过去一系列业务中进口商付款可靠,从而取 得出口商信任,才可以接受托收的支付方式。

日下订单: 条牛仔裤, 你5月6日下订单:订购 月 日下订单 订购1000条牛仔裤,按对方 条牛仔裤 按对方123号目录中列明 号目录中列明 的价格每条40美元 要求6月 前装运 美元, 前装运。 的价格每条 美元,要求 月10前装运。该单货物金额达四万美 你方目前流动资金有些吃紧,故提出用60天期的信用证支付 天期的信用证支付。 元,你方目前流动资金有些吃紧,故提出用 天期的信用证支付。 Dear Sirs, We are placing an order with you for 1,000 pairs of jeans at the price listed in your catalogue No. 123, USD 40 per pair, and shipment not later than June the 10th. The order involves USD 40,000, and our current cash flow is insufficient; therefore, we would like to pay for this order by a sixty-day L/C. 60 days L/C We greatly appreciate your support in the past and hope for your extending help. Upon receipt of your confirmation, we will open the relevant L/C. Yours faithfully Tom

外贸函电课后复习unit 6

Unit 6 Sales Confirmation and Purchase Contract1.重点信函:售货与销售确认书(合同),包括的内容有:A.约首。

指合同的序言部分,包括合同的名称、订约双方当事人的名称和地址(要求写明全称)。

除此之外,还常常写明双方签约合同的意愿和执行合同的保证。

序言对双方均有约束力,因此在规定序言时应慎重考虑。

B.正文。

这部分是合同的主体,包括交易的各项条款,如品名、品质规格、数量、价格、支付条件、包装、交货时间和地点、运输及保险条款,以及检验、索赔、不可抗力和仲裁条款等。

上述各条款明确了双方当事人的权利和义务。

C.约尾。

一般列明合同的份数,使用的文字及其效力,订约的时间和地点,以及合同生效的时间,最后是双方的签字。

订约合同的地点往往要涉及合同所依据的法律的问题,因此不能随便填写。

我国出口合同的订约地点一般都写我国进出口公司的所在地或者写中国。

2. 重要词汇和短语(复习本单元中的Notes):转船分批装运装运港目的港品质检验证书复验有权向卖方就所遭受的损失提出索赔检验报告由买方负担保额保费投保范围数量异议货到目的港后3个月内由买方负责不可抗力延迟交货不能交货仲裁争议通过友好方式协商解决适宜海运的原产地(生产国别)付款行全套清洁已装船提单装箱单在合同规定的时间内未经征得买方同意船名开船日期与…相符退货载货船只海啸运输过程中以我方为抬头开证行备妥待运package number general terms and conditions China Import and Export Commodity Inspection Quarantine Bureau upon the strength of the undelivered part of the Contract S/C P/C China Council for the Promotion of International Trade Foreign Trade Arbitration Commission provisional rules measurement FOB CFR CIF“The undersigned Sellers and Buyers have agreed to close the following”“The Sellers bear all costs and risks before it passes over the vessel’s rail and is released from the tackle.”“数量及金额允许有5%的增减”“仲裁是终局的,对双方都具有约束力。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

学习目标

了解国际贸易实务中付款环节的基本知识 熟悉掌握涉及支付环节的各类信函 熟悉信用证支付方式以及常用词句 练习 关键词

支付方式(Terms of payment);信用证(Letter of Credit);付 款交单(Documents against Payment)(D/P);承兑交单(Documents against Acceptance) (D/A);汇付(Remittance)

When the consignment is shipped the Company is to draw on your correspondents at 60 d/s. The documents to accompany the draft are the bill of lading, commercial and consular invoices and insurance policy. Kindly ask your correspondents to see that the insurance policy gives full cover before they accept the draft. Yours faithfully

ห้องสมุดไป่ตู้

即期付款交单方式付款信函

Dear Sirs,

We wish to place with you an order for 100 leather handbags.

For this particular order we would like to pay by D/P at sight. Involved about USD2 000, this order is comparatively a little one. It goes without saying that we very much appreciate the support you have extended us in the past. It will be highly appreciated if you can do us a special favor this time. We look forward to your favourable reply. Yours faithfully,

在贸易实务中,托收按照是否附有货运单据可以分为:光票托 收 跟单托收。跟单托收相对被普遍使用。

跟单托收

跟单托收可分为:

付款交单D/P(Documents against Payment)在D/P条件下,代 收行在买方支付了全部票据金额以后才能将有关票据交给买方 ,这样卖方的货款得到了有效的保障。 承兑交单 D/A ( Documents against Acceptance )。在 D/A 下, 代收行在买方承兑有关汇票后就可以将有关单据交付买方,这 时卖方已经交出了货物的物权凭证,一旦买方的信用出现危机 ,到期不付款,卖方手中仅有一张已承兑汇票能约束买方的义 务,仍可能遭受钱、货两空的损失,对于出口商来说选用D/A一 定要慎重。

电汇付款信函

Dear Mr. Smith,

We are pleased to acknowledge your order for our new paints. The payment arrangements you proposed to meet outstanding accounts are quite acceptable. All the items included in your order can be supplied from stock and will be packed and shipped immediately after your remittance by T/T is received. Yours sincerely, 尊敬的史密斯先生:

一、结算方式

在国际贸易中,不同的支付方式对于贸易双方而言,在贸 易结算中的风险以及经营中的资金负担都是不相同的。 主要的 结算方式有:

汇款(remittance)

T/T

M/T

D/D

托收(collection)

D/P

at sight

D/P after sight

D/A

信用证(Letter

通知卖方信用证已开出

Dear Sirs, Re: Order No.7766

We write to inform you that we have now opened an irrevocable letter of credit in your favor for £ 300,000 covering 10000 (ten thousand) waterproof raincoats under our Order No. 7766 with the Bank of Japan, Tokyo. The credit is valid until August 9 and will be confirmed to you by the Bank’s London office, Gresham Street, EC2P 2EB. It is understood that the goods will be shipped by S.S. “Cathay”, sailing from London on July 24. The Letter of credit authorizes you to draw at 60 days’ on the bank in London for the amount of your invoice after shipment is made. Before accepting the draft, the bank will require you to produce the following documents: Bills of Lading in triplicate, Commercial and Consular Invoices, Packing List, and Insurance policy. We will expect your consignment about the end of August. Please notify us when the goods are shipped. Yours faithfully,

很高兴收到您对我们新油漆的定单。 您提议的结清账目的付款方式是可接受的。您定单中所列所有 货品均有现货可供。一俟收到您的电汇将立即将货物打包运输。 谨上

托收(collection)

托收是指由债权人开立汇票,委托银行通过其海外分支行或代 理行,向国外债务人收取货款或劳务价值的一种结算方式。跟单 托收通过用单据代表货物控制货物所有权,将结算风险及资金负 担在进出口双方之间进行了平衡。 对于出口商来说,出口商通过控制货权单据来控制货物,不付 款或承兑就不会交单。一般不会受到“银货两空”的损失,比赊 销安全。 对于进口商来说,只要付款或承兑,马上就能取得单据,从而 得到货物的所有权,比预付货款方式安全。

of Credit)

汇款(remittance)

汇款是指汇款人(债务人)主动将款项交给银行,委托其使用 某种结算工具,通过其在国外的分支行或代理行,将款项付给国 外收款人的一种结算方式。它是最简单的结算方式,也是其他各 种结算方式的基础。 汇款按照使用的结算工具不同,可分为: 电汇 信汇 票汇 汇款方式在国际贸易实务中有两种运用方式: 预付货款。预付货款对于出口商而言较为有利。

信用证(Letter of Credit)

信用证(L/C)是开证行根据买方(开证申请人)的请求,开给卖方 的一种保证承担支付货款的书面凭证。这种方式把应由买方承 担的付款义务转化为银行的付款义务,从而加入了银行信用, 由于银行承担了第一性的付款责任,有审单的义务,使得结算 的程序更为严格、规范,对于买卖双方而言,结算的风险进一 步得到控制;资金融通也更为便利。因此,该种方式被贸易各 方广泛接受。 例句: We have made arrangement with Bank of Japan, Tokyo, to open a credit in your favor. The credit is valid until May 31, and will be confirmed by the Bank’s London Office. 我们已与日本银行东京分行安排开立了以你方为受益人的信 用证。该证有效期截止至5月31日,并将由该行的伦敦办事处保 兑。

货到付款。货到付款则对于进口商较为有利。

买方要求用较简单的付款方式付款

Dear Mr. Zhang,

We’ve studied the specifications and price-list of your new paints and now wish to place an order with you. Enclosed is our Order No. 267. As we are in urgent need of several of the items, we shall be glad if you will ship the order as soon as you possibly can. In the past, we have dealt with you on sight L/C basis. Now, we would like to propose a different way of payment, i.e., when the goods purchased by us are ready for shipment and the freight space booked, you let us know and we will remit you the full amount by T/T. The reasons are we can thus more confidently assure our buyers of the time of delivery and save a lot of expenses in opening a letter of credit. As we feel this would not make much difference to you but would facilitate our sales, we hope you will grant our request. We look forward to your confirmation of our order and your affirmative reply to our new arrangements of payment. Yours faithfully,