代持股协议书(中英文版本)

(完整版)股份代持协议英文模板

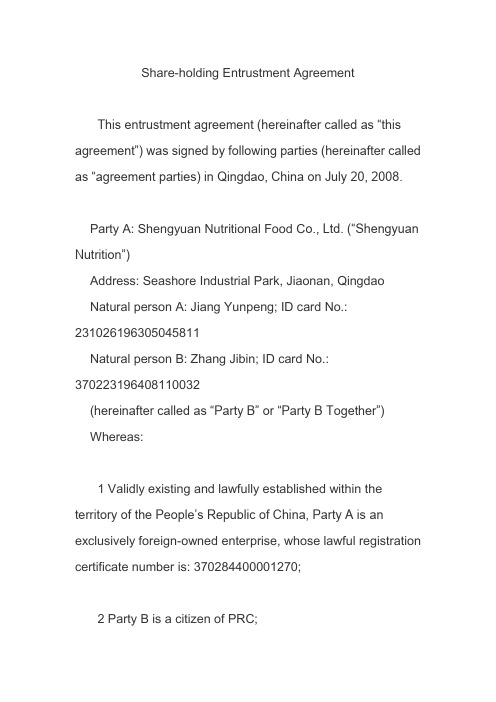

Share-holding Entrustment AgreementThis entrustment agreement (hereinafter called as “this agreement”) was signed by following parties (hereinafter called as “agreement parties) in Qingdao, China on July 20, 2008.Party A: Shengyuan Nutritional Food C o., Ltd. (“Shengyuan Nutrition”)Address: Seashore Industrial Park, Jiaonan, QingdaoNatural person A: Jiang Yunpeng; ID card No.: 231026************Natural person B: Zhang Jibin; ID card No.: 370223************(hereinafter called as “Party B” or “Party B Together”)Whereas:1 Validly existing and lawfully established within the territory of the People’s Republic of China, Party A is an exclusively foreign-owned enterprise, whose lawful registration certificate number is: 370284400001270;2 Party B is a citizen of PRC;3 Party A will entrust Party B to set up the company in mainland China to deploy pregnant woman detection center project (“project”). Party A will join force with the company of Party B and Party B Together (“Party B Company”) to sign “Exclusive Consulting and Service Agreement” and some other agreements to establish business relationship;4 Party B is required to use capital to deploy some matters including prophase operation of project.Therefore, after friendly consultations between both Parties on the principle of mutual benefit, the Parties hereby agree as follows:I Stock equity-holding on behalf of holders and relevant fund items1.1 Party A shall appropriate fund to Party B as per Party B’s written application since the a greement was signed. The sum shall be RMB15 m for each of Party B and the total shall be RMB30 m (“fund-holding on behalf of holders”). Party Bshall be responsible for utilizing this fund as registered capital to establish the company (hereinafter called as “this company”).1.2 This company will sign a series of agreements with Party A, including but not limited to “Exclusive Consulting and Service Agreement”, “Business Operation Agreement”, “Stock Equity Disposal Agreement” and “Stock Equity PledgeAgre ement”. Both Parties have basically agreed to the content framework (Annex One, Two, Three and Four) of these agreements.1.3 Being as the nominal holder of shares (hereinafter called as “shares-holding on behalf of the holder”) of this company, Party B shall perform relevant shareholders’ rights on behalf of the holder depending on Party A’s indication.1.4 The ownership of share-holding on behalf of the holder under the name of Party B belongs to Party A. Party B shall only set up this company and hold the shares of this company under the name of the trustee.II Authorization of entrustmentThe rights entrusted by Party A to Party B to perform on behalf of Party A include:12.1 Set up this company under the name of Party B;2.2 Register Party B to be the shareholder in the shareholder registration roster of this company;2.3 Perform shareholder’s rights as the shareholder of this company, including but not limited to charging dividend or bonus, participating the shareholder meeting, performing voting right and etc.;2.4 Perform shareholders’ other rights as per relevant laws, regulations and constitution of this company in registration location.III Party A’s rights and obligations3.1 Being as the actual investor of share-holding on behalf of the holder, Party A has the right to enjoy actual shareholder’s rights and has the right to obtain relevant investing income.3.2 Party A can issue commands to Party B at any moment with respect to Party A’s performing shareholders’ r ight and Party B shall execute Party A’s commands unconditionally.3.3 Party A has the right to transfer the share-holding on behalf of the holder and relevant shareholder’s equity to its own account or the account of any third Party designated by Party A when Party A thinks roper. Party B shall agree to the above-mentioned transference unconditionally and shall transact the transference as per Party A’s command.3.4 During the period of Party B’s holding share-holding on behalf of the holder, Party A shall shoulder all of relevant generated expenses of taxation (if any); Party A shall also shoulder the generated expenses of taxation when Party B transfers the share-holding on behalf of Party A to Party A or any third Party designated by Party A to hold as per Party A’s commands.3.5 Being as the actual holder of the share, Party A has the right to supervise and correct Party B’s improper behaviors of entrustment as per this agreement and also has the right to require Party B to compensate actual losses due to Party B’s improper behaviors.3.6 Party A has the right to notify cancelling entrusting Party B at any moment and request to transfer relevant share to Party A or new trustee selected by Party A or any third Party designated by the Party A in accordance with laws.IV Party B’s rights and obligations4.1 Party B will not enjoy any usufruct or disposal right (including but not limited to transference and pledge of shareholders’ equity) of shareholders’ equity formed by this share-holding on beha lf of the Party A, under Party B’s own name.4.2 Party B shall not transfer the authority of entrustment to the Third Party to hold above-mentioned share-holding on behalf of the Party A or enjoy shareholder’s equity at any moment or in any situation, un less Party B obtains Party A’s commands or Party A’s written consent.4.3 Under the condition of not obtaining Party A’s written authorization, Party B is not permitted to make transference and disposal or set guarantee of any form for share-holding on behalf of Party A and all of benefits held by itself, moreover, Party B is not permitted to implement any other behaviors possibly damaging Party A’s benefits.24.4 Party B shall deliver all of benefits generated from share-holding on behalf of Party A to Party A timely (incl. cash dividend, bonus or any other benefit allocations).4.5 Party B shall try its best to cooperate with Party A to transfer all of relevant procedures under its own name, when Party A plans to transfer share-holding on behalf of the holder to the third Party.V Term of entrustmentThe term of entrustment shall be a period starting from the effective date of this agreement and ending when Party A issues the written consent to Party B for termination.VI All of agreements and modification for agreements6.1 This agreement together with all of the mentioned or explicitly included agreements and/or all of agreementsreached by document drafting parties in terms ofsubject-matters of this agreement shall replace all of the oral, written agreements, contracts, understandings and address books reached by all parties previously with respect to subject-matters of this agreement.6.2 Any modification for this agreement will go into effect only after all parties have signed the written agreement. The modified agreements and supplementary agreements related to this agreement signed by all parties are the important parts of this agreement. These agreements have the same legal force with this agreement.VII Implementation of agreementThis agreement is in triplicate and each party holds one. This agreement will go into effect since Party A’s authorized representative affixes the signature and the official seal and Party B Together affixes the signature.VIII Jurisdiction of lawsSubscription, effectiveness, implementation and interpretation of this agreement together with settlement of disputes is ruled over by PRC laws and it is interpreted as per PRC laws.IX Settlement of disputes9.1 When all of relevant parties have disputes with respect to interpretation and implementation of items of this agreement, all parties shall settle disputes through friendly negotiation. Any party can submit the relevant disputes to China International Economic and Trade Arbitration Commission to make a settlement as per effective arbitration rules if the disputes can’t be settled through negotiation. The arbitration locale is Beijing. The arbitration language is Chinese. The arbitrament shall be final and it brings constraint for all parties.9.2 All parties shall still continue to fulfill their respective obligations as per regulations of this agreement based on friendship principle, unless there are some disputes.Party A: Shengyuan Nutrition Food Co., Ltd. (stamp)Authorized representative:/s/ Zhang Liang (signature)Party B:Jiang Yunpeng: /s/ Jiang Yunpeng (signature) Zhang Jibin: /s/ Zhang Jibin (signature)。

英国股权代持协议书范本

英国股权代持协议书范本甲方(委托人):_____________________地址:_________________________________法定代表人(或授权代表):_____________乙方(代持人):_____________________地址:_________________________________法定代表人(或授权代表):_____________鉴于甲方有意委托乙方代持其在____________________公司的股权,乙方同意接受甲方的委托,代为持有甲方的股权。

根据《中华人民共和国合同法》及相关法律法规的规定,甲乙双方本着平等自愿、诚实信用的原则,经协商一致,达成如下协议:第一条股权代持内容1.1 甲方委托乙方代持的股权为甲方在____________________公司持有的____%的股份。

1.2 乙方同意接受甲方的委托,代为持有上述股权,并按照甲方的指示行使股东权利。

第二条股权代持期限2.1 本协议的代持期限为自本协议生效之日起至____年____月____日止。

2.2 如甲方需要延长代持期限,应至少提前____个月书面通知乙方,经乙方同意后,双方可签订补充协议。

第三条股权代持费用3.1 甲方应向乙方支付代持费用,具体金额为每年____英镑。

3.2 代持费用应在每年的____月____日前支付给乙方。

第四条甲方的权利与义务4.1 甲方有权随时了解代持股权的经营状况和财务状况。

4.2 甲方应确保其委托代持的股权不存在任何法律纠纷或权利瑕疵。

4.3 甲方应按照本协议的约定支付代持费用。

第五条乙方的权利与义务5.1 乙方应按照甲方的指示行使股东权利,不得擅自处分代持股权。

5.2 乙方应妥善保管代持股权相关的所有文件和资料。

5.3 乙方应根据甲方的要求,及时向甲方报告代持股权的经营状况和财务状况。

第六条股权转让6.1 如甲方决定转让代持股权,应至少提前____个月书面通知乙方。

美国股权代持协议书

美国股权代持协议书甲方(股权代持方):[甲方全名]地址:[甲方地址]身份证/护照号码:[甲方身份证/护照号码]乙方(股权实际持有方):[乙方全名]地址:[乙方地址]身份证/护照号码:[乙方身份证/护照号码]鉴于甲方同意代持乙方在美国的股权,乙方作为实际持有方,双方本着平等自愿的原则,经协商一致,达成如下股权代持协议:1. 股权代持内容甲方同意代持乙方在美国[具体公司名称]的股权,股权比例为[具体比例]%。

甲方将作为名义股东,按照乙方的指示行使股东权利。

2. 股权代持期限本协议自签署之日起生效,有效期至[具体日期]。

除非双方另有书面约定,否则到期后本协议自动终止。

3. 股权收益分配股权代持期间,股权所产生的所有收益(包括但不限于股息、红利等)均归乙方所有。

甲方应在收到收益后的[具体时间]个工作日内,将收益转交给乙方。

4. 股权处置在代持期间,甲方应按照乙方的指示处置股权,包括但不限于转让、质押等。

甲方未经乙方书面同意,不得擅自处置股权。

5. 保密条款甲方应对本协议内容及乙方的股权信息保密,不得向第三方泄露。

违反保密条款的一方,应赔偿对方因此遭受的一切损失。

6. 违约责任如甲方违反本协议约定,未按乙方指示行使股东权利或未及时转交股权收益,应赔偿乙方因此遭受的损失。

7. 争议解决本协议的解释、适用及争议解决均适用美国法律。

双方因本协议产生的任何争议,应首先通过友好协商解决;协商不成时,任何一方均可向甲方所在地的有管辖权的法院提起诉讼。

8. 其他本协议一式两份,甲乙双方各执一份,具有同等法律效力。

本协议的任何修改和补充均需双方书面同意。

甲方签字:_________ 日期:____年__月__日乙方签字:_________ 日期:____年__月__日(注:以上内容仅供参考,具体条款应根据实际情况和法律要求进行调整。

)。

全版个人代持股权协议英文版

全版个人代持股权协议英文版Full Version Personal Shareholding AgreementThis document serves as an agreement between the parties involved in the personal shareholding arrangement. The purpose of this agreement is to outline the terms and conditions governing the ownership and transfer of shares.Parties InvolvedThe parties involved in this agreement include the shareholder(s) and any designated representatives or trustees.Shareholding DetailsThe agreement specifies the total number of shares held by each shareholder, the class of shares, and any voting rights associated with the shares.Transfer of SharesAny transfer of shares must be approved by all parties involved in the agreement. The process for transferring shares, including any required documentation, is outlined in this agreement.Rights and ResponsibilitiesEach shareholder has certain rights and responsibilities outlined in the agreement. These may include voting rights, dividend entitlements, and obligations to disclose any relevant information.Dispute ResolutionIn the event of a dispute between the parties, a process for resolution is outlined in the agreement. This may involve mediation, arbitration, or other methods as agreed upon by the parties.ConfidentialityAll information exchanged between the parties in relation to the shareholding agreement is to be kept confidential and not disclosed to any third parties without consent.Termination of AgreementThe agreement may be terminated by mutual consent of the parties involved or in the event of a breach of the terms outlined in the agreement.Governing LawThis agreement is governed by the laws of the jurisdiction in which the shares are held. Any legal disputes arising from the agreement will be resolved in accordance with these laws.Amendment of AgreementAny amendments to the agreement must be agreed upon by all parties involved and documented in writing.This full version personal shareholding agreement is designed to provide a comprehensive framework for the ownership and transfer of shares between parties involved. It is important for all parties to fully understand and adhere to the terms outlined in the agreement to ensure a smooth and successful shareholding arrangement.。

外资代持股协议书模板

外资代持股协议书模板《外资代持股协议书》本《外资代持股协议书》(以下简称“本协议”)由以下双方(以下简称“双方”)于日期签订:甲方(代持股方):名称:地址:法定代表人:乙方(实际出资方):名称:地址:法定代表人:鉴于:1. 甲方愿意以其名义代乙方持有目标公司的股份(以下简称“代持股份”);2. 乙方愿意将目标公司的股份交由甲方代持,并按照本协议的约定向甲方支付股份代持费用;3. 双方同意按照本协议的条款和条件进行合作。

基于上述情况,双方达成如下协议:第一条代持股份的种类和数量1.1 甲方同意代持乙方持有的目标公司的股份,股份的种类为普通股,股份的数量为股。

第二条代持股份的期限2.1 本协议的有效期限为年,自本协议签订之日起计算。

除非双方另有约定,否则本协议到期后自动终止。

2.2 在本协议有效期内,甲方不得转让或出售代持股份,也不得将代持股份用于担保或抵押。

第三条股份代持费用3.1 乙方应按照本协议的约定向甲方支付股份代持费用。

股份代持费用的具体金额和支付方式由双方另行协商确定。

第四条股份代持的变更和终止4.1 在本协议有效期内,如乙方需要将代持股份转让或出售给第三方,应提前通知甲方,并按照双方协商确定的方式进行。

4.2 在本协议有效期内,如乙方需要终止代持股份,应提前通知甲方,并按照双方协商确定的方式进行。

第五条保密条款5.1 双方同意对在本协议履行过程中获得的对方商业秘密和机密信息予以保密,未经对方同意不得向第三方披露。

第六条争议解决6.1 凡因本协议引起的或与本协议有关的一切争议,双方应友好协商解决。

协商不成的,任何一方均可向有管辖权的人民法院提起诉讼。

第七条其他条款7.1 本协议未尽事宜,双方可另行协商并签订补充协议。

7.2 本协议一式两份,双方各执一份,具有同等法律效力。

甲方(盖章):乙方(盖章):日期:。

香港公司代持股权的协议书

香港公司代持股权的协议书本协议书(以下简称“协议”)由以下各方于 [协议签署日期] 在香港签署:甲方:[委托方名称]地址:[委托方地址]乙方:[代持方名称]地址:[代持方地址]鉴于:1. 甲方是一家注册于香港的公司,希望委托乙方代持其股权;2. 乙方同意接受甲方的委托,并按照本协议的规定进行代持股权。

基于上述情况,各方本着平等自愿的原则,达成如下协议:1. 委托内容1.1 甲方委托乙方代持其在以下公司的股权(以下简称“股权”):[公司名称]。

1.2 乙方同意接受并履行上述委托。

2. 代持期限2.1 本次委托的代持期限为 [起始日期] 至 [终止日期]。

2.2 若在代持期限届满前,甲方或乙方提前30天以书面形式通知对方终止本协议,则本协议提前终止。

3. 代持义务3.1 乙方作为代持方,应根据甲方的指示,行使和履行与股权相关的权利和义务。

3.2 乙方应保证代持的股权不会受到任何非法、违规行为的侵害。

4. 委托费用4.1 甲方应按照双方商定的费用标准向乙方支付代持费用。

4.2 代持费用的支付方式和时间由双方另行协商确定。

5. 保密条款5.1 双方同意对本协议及其涉及的商业、财务和技术信息保密。

5.2 未经对方书面同意,任何一方不得向第三方透露本协议的内容。

6. 不可抗力6.1 若因不可抗力事件导致本协议无法履行,双方不承担违约责任。

6.2 不可抗力事件包括但不限于自然灾害、战争、政府行为等不可预见、不可避免且无法克服的事件。

7. 协议解除7.1 除非另有约定,否则本协议解除后,乙方应立即将代持的股权返还给甲方。

7.2 协议解除后,双方之间的其他权利和义务均不受影响。

8. 法律适用和争议解决8.1 本协议适用香港法律。

8.2 因本协议引起的或与本协议有关的争议,应通过友好协商解决。

若协商不成,任何一方可向香港仲裁委员会提起仲裁。

9. 其他9.1 本协议一式两份,甲乙双方各执一份,具有同等法律效力。

9.2 本协议的任何修改或补充应以书面形式经双方协商一致后生效。

变更股权代持协议书

变更股权代持协议书(中英文版)英文文档内容:Change Shareholder Nominee AgreementThis Shareholder Nominee Agreement (the "Agreement") is made and entered into as of [Date], by and between [Shareholder"s Name], a [Shareholder"s Resident Country] resident ("Shareholder"), and [Company Name], a company incorporated under the laws of [Company"s Resident Country] ("Company").BACKGROUND:WHEREAS, the Shareholder currently holds [Number] shares (the "Shares") of the Company"s common stock, par value [Par Value], representing [Percentage] of the issued and outstanding shares of the Company"s common stock;WHEREAS, the Shareholder desires to change the nominee on the Shares from [Current Nominee] to [New Nominee];OW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, the parties hereto agree as follows:1.Change of Nominee.The Shareholder hereby appoints [New Nominee] as the nominee for the Shares, effective as of the date hereof.The Shareholder hereby revokes any prior appointment of a nominee with respect to the Shares and confirms that [New Nominee] isthe sole nominee for the Shares.2.Representations and Warranties.The Shareholder represents and warrants to the Company that:(a) The Shareholder has the legal capacity to enter into this Agreement and to perform his or her obligations hereunder;(b) The Shareholder is the record owner of the Shares and has good and marketable title thereto, free and clear of any liens, encumbrances, or claims;(c) The appointment of [New Nominee] as the nominee for the Shares does not violate any agreement, instrument, or decree to which the Shareholder is a party or is subject;(d) The Shareholder is not a party to any voting agreement, voting trust, or other arrangement with respect to the Shares that is inconsistent with this Agreement; and(e) The execution and delivery of this Agreement and the performance of the Shareholder"s obligations hereunder do not conflict with, result in a breach of, or constitute a default under any law, rule, regulation, order, judgment, or decree to which the Shareholder is subject, or any agreement, instrument, or obligation to which the Shareholder isa party.erning Law.This Agreement shall be governed by and construed in accordance with the laws of the State of [Governing Jurisdiction],without regard to its conflict of laws principles.4.Entire Agreement.This Agreement (including the exhibits hereto) constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.5.Amendments and Modifications.This Agreement may be amended or modified only by a written instrument executed by all parties hereto.6.Notices.All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be given by email, facsimile, or overnight courier, and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, by first class mail, registered or certified, postage prepaid, and properly addressed as follows: To Shareholder:[Shareholder"s Address][Shareholder"s Contact Information]To Company:[Company"s Address][Company"s Contact Information]IN WITNESS WHEREOF, the parties have executed this ShareholderNominee Agreement as of the date first above written.[Shareholder"s Name][Company Name]中文文档内容:股权代持协议书变更本股权代持协议书(以下简称“本协议”)由以下双方于[日期] 签署:一方为[股东姓名],居住于[股东居住国家] (以下简称“股东”);另一方为[公司名称],一家根据[公司居住国家] 法律成立的公司(以下简称“公司”)。

外资公司代持股协议书模板

协议编号:_______签订日期:_______年_______月_______日甲方(代持股方): [甲方全称]地址:[甲方地址]法定代表人:[甲方法定代表人姓名]联系电话:[甲方联系电话]乙方(实际控制方): [乙方全称]地址:[乙方地址]法定代表人:[乙方法定代表人姓名]联系电话:[乙方联系电话]鉴于:1. 甲方愿意代为持有乙方在[公司名称](以下简称“目标公司”)的股份,以实现乙方的投资目的。

2. 乙方确认其拥有目标公司股份的实际所有权,并同意由甲方代为持有。

3. 双方本着平等、自愿、诚实信用的原则,达成如下协议:第一条代持股比例1. 甲方代为持有目标公司[具体比例]%的股份。

2. 甲方代持股的比例可根据双方协商一致后签订的补充协议进行调整。

第二条代持股期限1. 本协议的有效期为[具体期限],自双方签字盖章之日起生效。

2. 协议期满后,如双方无异议,本协议自动续期。

第三条股权权益1. 甲方作为代持股方,享有以下权益:a. 享有乙方在目标公司中应得的分红权、表决权、优先购买权等。

b. 享有本协议约定的其他权益。

2. 乙方作为实际控制方,承担以下义务:a. 按时足额向甲方支付其应得的分红。

b. 保障甲方在目标公司中的权益不受侵害。

第四条股权转让1. 未经甲方书面同意,乙方不得转让其持有的目标公司股份。

2. 甲方如需转让其代持的股份,应提前[具体期限]通知乙方,并经乙方同意。

3. 股权转让的具体事宜,双方应另行签订股权转让协议。

第五条违约责任1. 如一方违反本协议约定,给另一方造成损失的,应承担违约责任。

2. 违约方应赔偿守约方因此遭受的全部损失。

第六条争议解决1. 双方因履行本协议发生争议,应友好协商解决。

2. 协商不成的,任何一方均可向目标公司所在地的人民法院提起诉讼。

第七条其他1. 本协议一式两份,双方各执一份,具有同等法律效力。

2. 本协议未尽事宜,由双方另行协商解决。

甲方(代持股方):(盖章)法定代表人(签字):乙方(实际控制方):(盖章)法定代表人(签字):附件:1. 目标公司章程2. 乙方持有的目标公司股份证明3. 其他与本协议相关的文件注:本协议书仅供参考,具体条款请根据实际情况进行调整。

国外股权代持合同范本

国外股权代持合同范本a. 本合同旨在明确甲方与乙方之间关于股权代持关系的权利、义务及责任。

b. 甲方同意将其在目标公司中的部分股权委托给乙方代持,乙方接受甲方的委托,代为行使股权相关权利。

c. 双方本着平等、自愿、诚实信用的原则,达成如下协议。

第二条股权代持内容b. 代持股权的具体比例、数量及出资额由双方另行协商确定。

c. 乙方在代持期间,应按照甲方的意愿行使股权相关权利,包括但不限于出席股东会、董事会、监事会等。

第三条代持期限a. 本合同代持期限自签订之日起至甲方收回代持股权之日止。

b. 如甲方在代持期限内收回代持股权,乙方应积极配合,确保甲方收回代持股权的顺利进行。

c. 如代持期限届满,甲方未收回代持股权,乙方应继续代持,直至甲方收回代持股权。

第四条代持股权的权利与义务① 参与目标公司的决策;② 收取目标公司的分红;③ 优先购买目标公司其他股东转让的股权;④ 依法转让代持股权。

① 依法行使代持股权,维护甲方的合法权益;② 不得损害甲方的利益,不得擅自处分代持股权;③ 如代持股权涉及纠纷,乙方应积极配合甲方解决。

第五条保密条款a. 双方对本合同内容以及代持股权的相关信息负有保密义务。

b. 未经对方同意,任何一方不得向任何第三方泄露本合同内容以及代持股权的相关信息。

c. 如因违反保密义务导致对方遭受损失的,违约方应承担相应的法律责任。

第六条违约责任a. 如一方违反本合同约定,给对方造成损失的,应承担违约责任。

b. 违约方应赔偿对方因此遭受的直接损失和间接损失。

c. 如违约行为构成犯罪的,违约方还应承担相应的刑事责任。

第七条争议解决a. 双方在履行本合同过程中发生的争议,应友好协商解决。

b. 如协商不成,任何一方均可向有管辖权的人民法院提起诉讼。

第八条其他a. 本合同一式两份,甲乙双方各执一份,自双方签字之日起生效。

b. 本合同未尽事宜,由双方另行协商解决。

c. 本合同自签订之日起至代持期限届满之日止,为有效期限。

香港公司代持股权的协议书

香港公司代持股权的协议书一、前言鉴于甲乙双方对投资领域的共同理解和共识,为了共同发展,甲方愿意将其在香港公司(以下简称“目标公司”)中的部分股权委托乙方代为持有,乙方愿意接受甲方的委托。

现双方为了明确双方的权利和义务,经友好协商,特订立本协议。

二、股权代持2.1 代持股权甲方同意将其持有目标公司的全部或部分股权(以下简称“代持股权”)委托乙方代为持有。

代持股权的具体数额、性质和比例,由双方在附录A中明确。

2.2 股权转让2.2.1 甲方应保证其对代持股权享有合法、完整的所有权,该代持股权不存在任何权利瑕疵或者权利负担。

2.2.2 甲方应在签署本协议后,按照本协议约定向乙方交付代持股权的相关文件。

2.2.3 甲方应在需要的时候,配合乙方进行股权转让、变更登记等手续。

三、股权代持的期限3.1 代持期限本协议项下的股权代持期限为____年,自本协议签署之日起计算。

3.2 续期代持期限届满前,双方可以根据实际情况协商一致延长代持期限。

四、股权代持的收益和费用4.1 收益分配代持股权所产生的利润、分红等收益,包括但不限于股息、红利、股权转让收益等,归甲方所有。

乙方应按照本协议约定的比例和时间,将收益支付给甲方。

4.2 费用承担4.2.1 甲方应承担与代持股权相关的税费、手续费等费用。

4.2.2 乙方应承担因履行本协议而产生的其他费用。

五、权利和义务5.1 甲方权利和义务5.1.1 甲方应保证其对代持股权享有合法、完整的所有权,该代持股权不存在任何权利瑕疵或者权利负担。

5.1.2 甲方应在需要的时候,配合乙方进行股权转让、变更登记等手续。

5.2 乙方权利和义务5.2.1 乙方应妥善保管代持股权的相关文件,并确保代持股权的安全。

5.2.2 乙方应按照本协议约定,将代持股权所产生的收益支付给甲方。

六、违约责任6.1 双方应严格履行本协议的约定,如一方违约,应承担违约责任。

七、争议解决本协议项下的争议,应优先通过友好协商解决。

股权代持协议书英文范本

股权代持协议书英文范本Equity Holding AgreementThis Equity Holding Agreement (the "Agreement") is entered into as of the ______ day of ______, 20__, by and between______ (the "Principal"), with its principal place of business at ______, and ______ (the "Nominee"), with its principal place of business at ______ (collectively referred to as the "Parties").WHEREAS, the Principal is desirous of having the Nominee hold certain shares of stock (the "Shares") on behalf of the Principal; andWHEREAS, the Nominee is willing to hold the Shares on behalf of the Principal and to perform certain services in connection therewith.NOW, THEREFORE, in consideration of the mutual promises and covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:ARTICLE 1: Definitions1.1 "Agreement" means this Equity Holding Agreement,including any exhibits, schedules, or other attachments hereto.1.2 "Shares" means the shares of stock in ______ (the "Company"), which the Nominee shall hold on behalf of the Principal.ARTICLE 2: Representations and Warranties2.1 The Principal represents and warrants to the Nominee that:2.1.1 The Principal is the legal and beneficial owner of the Shares and has the full power and authority to enter intothis Agreement and to grant the rights and privileges herein granted.2.1.2 The Shares are free and clear of any liens, encumbrances, or other claims.2.1.3 The Principal has not entered into any agreement or understanding with any third party that would conflict withthe terms of this Agreement.2.2 The Nominee represents and warrants to the Principal that:2.2.1 The Nominee has the legal capacity to enter into this Agreement and to perform its obligations hereunder.2.2.2 The Nominee will not use the Shares for any purposeother than as directed by the Principal.ARTICLE 3: Holding of Shares3.1 The Nominee shall hold the Shares in the name of the Nominee, but as the agent and nominee for the Principal.3.2 The Nominee shall not have any right, title, or interest in the Shares other than as a nominee for the Principal.3.3 The Nominee shall exercise all voting rights and other rights attached to the Shares in accordance with the written instructions of the Principal.ARTICLE 4: Duties of the Nominee4.1 The Nominee shall:4.1.1 Hold the Shares in a manner consistent with the best interests of the Principal.4.1.2 Promptly inform the Principal of any communications received from the Company or any third party with respect to the Shares.4.1.3 Provide the Principal with copies of all notices, reports, and other documents received from the Company or any third party with respect to the Shares.4.2 The Nominee shall not be liable for any losses or damages resulting from the failure to exercise any voting rights or other rights attached to the Shares, unless such failure is due to the gross negligence or willful misconduct of the Nominee.ARTICLE 5: Compensation5.1 The Principal shall compensate the Nominee for itsservices under this Agreement at a rate of ______ per annum, payable quarterly in advance.5.2 The Nominee shall be entitled to reimbursement for all reasonable expenses incurred in connection with the performance of its duties under this Agreement.ARTICLE 6: Termination6.1 This Agreement may be terminated by either Party upon______ days' written notice to the other Party.6.2 Upon termination of this Agreement, the Nominee shall promptly transfer the Shares to the Principal or its designee.ARTICLE 7: Confidentiality7.1 Each Party agrees to hold in confidence and not todisclose to any third party any information received from the other Party in connection with this Agreement, except as required by law or as necessary to perform its obligations under this Agreement.ARTICLE 8: Governing Law8.1 This Agreement shall be governed by and construed in accordance with the laws of the State of ______.ARTICLE 9: Miscellaneous9.1 This Agreement may be amended only by a written instrument signed by both Parties.9.2 The failure of either Party to enforce any provision of this Agreement shall not constitute a waiver of such provision or of the right to enforce such provision.9.3 If any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.9.4 This Agreement constitutes the entire agreement between the Parties with respect to the subject matter hereof and supersedes all prior negotiations, understandings, and agreements.IN WITNESS WHEREOF, the Parties have。

全篇的代持股份协议书英文版

全篇的代持股份协议书英文版Document Title: Shareholding AgreementThis document serves as a legally binding agreement between the parties involved in holding shares on behalf of others. The agreement outlines the responsibilities, rights, and obligations of the shareholders in managing the shares on behalf of the beneficial owners.1. Parties Involved:- The parties involved in this agreement are the shareholders who will hold the shares on behalf of the beneficial owners. The shareholders are responsible for managing the shares in accordance with the instructions and wishes of the beneficial owners.2. Shareholding Responsibilities:- The shareholders agree to hold the shares in trust for the beneficial owners and to act in their best interests at all times. They are responsible for voting on behalf of the beneficial owners and managing any dividends or income generated from the shares.3. Rights and Obligations:- The shareholders have the right to receive any dividends or income generated from the shares, but they must distribute these funds to the beneficial owners in accordance with the terms of the agreement. The shareholders also have the obligation to keep accurate records of the shares and provide regular updates to the beneficial owners.4. Transfer of Shares:- The shareholders are not allowed to transfer or sell the shares to any third party without the express consent of the beneficial owners. Any transfer or sale of shares must be done in accordance with the instructions of the beneficial owners.5. Termination of Agreement:- This agreement can be terminated by mutual consent of all parties involved or in the event of a breach of the terms outlined in the agreement. Upon termination, the shares will be transferred back to the beneficial owners in accordance with their instructions.6. Governing Law:- This agreement shall be governed by the laws of the jurisdiction in which the shares are held. Any disputes arising from this agreement shall be resolved through arbitration in accordance with the laws of the jurisdiction.By signing this agreement, the parties involved acknowledge and agree to abide by the terms and conditions outlined herein.Signed on this ___ day of ____, 20__.[Signature of Shareholder][Printed Name of Shareholder][Signature of Beneficial Owner][Printed Name of Beneficial Owner]。

股份代持协议英文模板

Share-holding Entrustment AgreementThis entrustment agreement (hereinafter called as “this agreement”) was signed by following parties (hereinafter called as “agreement parties) in Qingdao, China on July 20, 2008.Party A: Shengyuan Nutritional Food C o., Ltd. (“Shengyuan Nutrition”)Address: Seashore Industrial Park, Jiaonan, QingdaoNatural person A: Jiang Yunpeng; ID card No.: 231026************Natural person B: Zhang Jibin; ID card No.: 370223************(hereinafter called as “Party B” or “Party B Together”)Whereas:1 Validly existing and lawfully established within the territory of the People’s Republic of China, Party A is an exclusively foreign-owned enterprise, whose lawful registration certificate number is: 370284400001270;2 Party B is a citizen of PRC;3 Party A will entrust Party B to set up the company in mainland China to deploy pregnant woman detection center project (“project”). Party A will join force with the company of Party B and Party B Together (“Party B Company”) to sign “Exclusive Consulting and Service Agreement” and some other agreements to establish business relationship;4 Party B is required to use capital to deploy some matters including prophase operation of project.Therefore, after friendly consultations between both Parties on the principle of mutual benefit, the Parties hereby agree as follows:I Stock equity-holding on behalf of holders and relevant fund items1.1 Party A shall appropriate fund to Party B as per Party B’s written application since the a greement was signed. The sum shall be RMB15 m for each of Party B and the total shall be RMB30 m (“fund-holding on behalf of holders”). Party Bshall be responsible for utilizing this fund as registered capital to establish the company (hereinafter called as “this company”).1.2 This company will sign a series of agreements with Party A, including but not limited to “Exclusive Consulting and Service Agreement”, “Business Operation Agreement”, “Stock Equity Disposal Agreement” and “Stock Equity PledgeAgre ement”. Both Parties have basically agreed to the content framework (Annex One, Two, Three and Four) of these agreements.1.3 Being as the nominal holder of shares (hereinafter called as “shares-holding on behalf of the holder”) of this company, Party B shall perform relevant shareholders’ rights on behalf of the holder depending on Party A’s indication.1.4 The ownership of share-holding on behalf of the holder under the name of Party B belongs to Party A. Party B shall only set up this company and hold the shares of this company under the name of the trustee.II Authorization of entrustmentThe rights entrusted by Party A to Party B to perform on behalf of Party A include:12.1 Set up this company under the name of Party B;2.2 Register Party B to be the shareholder in the shareholder registration roster of this company;2.3 Perform shareholder’s rights as the shareholder of this company, including but not limited to charging dividend or bonus, participating the shareholder meeting, performing voting right and etc.;2.4 Perform shareholders’ other rights as per relevant laws, regulations and constitution of this company in registration location.III Party A’s rights and obligations3.1 Being as the actual investor of share-holding on behalf of the holder, Party A has the right to enjoy actual shareholder’s rights and has the right to obtain relevant investing income.3.2 Party A can issue commands to Party B at any moment with respect to Party A’s performing shareholders’ r ight and Party B shall execute Party A’s commands unconditionally.3.3 Party A has the right to transfer the share-holding on behalf of the holder and relevant shareholder’s equity to its own account or the account of any third Party designated by Party A when Party A thinks roper. Party B shall agree to the above-mentioned transference unconditionally and shall transact the transference as per Party A’s command.3.4 During the period of Party B’s holding share-holding on behalf of the holder, Party A shall shoulder all of relevant generated expenses of taxation (if any); Party A shall also shoulder the generated expenses of taxation when Party B transfers the share-holding on behalf of Party A to Party A or any third Party designated by Party A to hold as per Party A’s commands.3.5 Being as the actual holder of the share, Party A has the right to supervise and correct Party B’s improper behaviors of entrustment as per this agreement and also has the right to require Party B to compensate actual losses due to Party B’s improper behaviors.3.6 Party A has the right to notify cancelling entrusting Party B at any moment and request to transfer relevant share to Party A or new trustee selected by Party A or any third Party designated by the Party A in accordance with laws.IV Party B’s rights and obligations4.1 Party B will not enjoy any usufruct or disposal right (including but not limited to transference and pledge of shareholders’ equity) of shareholders’ equity formed by this share-holding on beha lf of the Party A, under Party B’s own name.4.2 Party B shall not transfer the authority of entrustment to the Third Party to hold above-mentioned share-holding on behalf of the Party A or enjoy shareholder’s equity at any moment or in any situation, un less Party B obtains Party A’s commands or Party A’s written consent.4.3 Under the condition of not obtaining Party A’s written authorization, Party B is not permitted to make transference and disposal or set guarantee of any form for share-holding on behalf of Party A and all of benefits held by itself, moreover, Party B is not permitted to implement any other behaviors possibly damaging Party A’s benefits.24.4 Party B shall deliver all of benefits generated from share-holding on behalf of Party A to Party A timely (incl. cash dividend, bonus or any other benefit allocations).4.5 Party B shall try its best to cooperate with Party A to transfer all of relevant procedures under its own name, when Party A plans to transfer share-holding on behalf of the holder to the third Party.V Term of entrustmentThe term of entrustment shall be a period starting from the effective date of this agreement and ending when Party A issues the written consent to Party B for termination.VI All of agreements and modification for agreements6.1 This agreement together with all of the mentioned or explicitly included agreements and/or all of agreementsreached by document drafting parties in terms ofsubject-matters of this agreement shall replace all of the oral, written agreements, contracts, understandings and address books reached by all parties previously with respect to subject-matters of this agreement.6.2 Any modification for this agreement will go into effect only after all parties have signed the written agreement. The modified agreements and supplementary agreements related to this agreement signed by all parties are the important parts of this agreement. These agreements have the same legal force with this agreement.VII Implementation of agreementThis agreement is in triplicate and each party holds one. This agreement will go into effect since Party A’s authorized representative affixes the signature and the official seal and Party B Together affixes the signature.VIII Jurisdiction of lawsSubscription, effectiveness, implementation and interpretation of this agreement together with settlement of disputes is ruled over by PRC laws and it is interpreted as per PRC laws.IX Settlement of disputes9.1 When all of relevant parties have disputes with respect to interpretation and implementation of items of this agreement, all parties shall settle disputes through friendly negotiation. Any party can submit the relevant disputes to China International Economic and Trade Arbitration Commission to make a settlement as per effective arbitration rules if the disputes can’t be settled through negotiation. The arbitration locale is Beijing. The arbitration language is Chinese. The arbitrament shall be final and it brings constraint for all parties.9.2 All parties shall still continue to fulfill their respective obligations as per regulations of this agreement based on friendship principle, unless there are some disputes.Party A: Shengyuan Nutrition Food Co., Ltd. (stamp)Authorized representative:/s/ Zhang Liang (signature)Party B:Jiang Yunpeng: /s/ Jiang Yunpeng (signature) Zhang Jibin: /s/ Zhang Jibin (signature)。

海外公司代持股协议书范本

海外公司代持股协议书范本甲方(委托方):_______________________乙方(受托方):_______________________鉴于甲方希望在海外市场进行投资,但因法律、政策或其他原因无法直接持有海外公司股份,乙方愿意作为甲方的代理人,代为持有海外公司股份。

为明确双方权利义务,经友好协商,达成如下协议:第一条代持股权1.1 甲方委托乙方代为持有的海外公司股份为(以下简称“目标公司”)的股份,具体股份数额为____股,占目标公司总股份的____%。

1.2 乙方应按照甲方的指示,以乙方的名义在目标公司进行股份登记。

第二条股份购买2.1 甲方应向乙方支付股份购买款项,金额为____(货币单位),用于乙方购买目标公司股份。

2.2 乙方应在收到甲方款项后____个工作日内完成股份购买,并提供相应的购买凭证。

第三条股份管理3.1 乙方应根据甲方的指示,行使股东权利,包括但不限于投票权、分红权等。

3.2 乙方应将目标公司的所有股东会议记录、财务报告等重要文件及时提供给甲方。

第四条股份转让4.1 甲方有权随时要求乙方按照甲方指定的条件和价格转让代持股权。

4.2 乙方应在接到甲方转让指示后____个工作日内完成股份转让手续,并确保股份转让符合相关法律法规。

第五条保密条款5.1 双方应对本协议内容及在履行本协议过程中获得的对方商业秘密和个人信息保密。

5.2 未经对方书面同意,任何一方不得向第三方披露上述信息。

第六条违约责任6.1 如一方违反本协议约定,应承担违约责任,并赔偿对方因此遭受的一切损失。

6.2 违约方应支付违约金,违约金的数额为违约行为发生时股份市值的____%。

第七条争议解决7.1 本协议的解释、适用及争议解决均适用____国法律。

7.2 双方因本协议产生的任何争议,应首先通过友好协商解决;协商不成时,任何一方均可向____仲裁委员会提起仲裁。

第八条其他8.1 本协议的任何修改和补充均需双方书面同意。

股权代持协议书英文

股权代持协议书英文甲方(委托方):[甲方全称]乙方(代持方):[乙方全称]鉴于甲方有意通过乙方代为持有目标公司的股权,乙方愿意接受甲方的委托,代为持有该等股权。

为明确双方的权利和义务,经协商一致,特订立本协议如下:1. 股权代持内容1.1 甲方委托乙方代为持有目标公司[具体股权比例]的股权。

1.2 甲方作为实际出资人,享有该股权对应的所有权益,包括但不限于股息、红利、资产增值等。

1.3 乙方作为名义股东,仅在法律上代表甲方持有该等股权,不享有该股权的任何实际权益。

2. 股权代持期限2.1 本协议的股权代持期限自[起始日期]起至[终止日期]止。

2.2 在代持期限内,甲方有权随时要求乙方将代持的股权转回至甲方名下。

3. 甲方的权利和义务3.1 甲方有权随时了解代持股权的经营状况和财务状况。

3.2 甲方应按时向乙方支付代持费用,具体金额和支付方式由双方另行商定。

4. 乙方的权利和义务4.1 乙方应按照甲方的指示行使股东权利,包括但不限于出席股东会、投票表决等。

4.2 乙方不得擅自转让、质押或以其他方式处分代持的股权。

5. 保密条款5.1 双方应对本协议的内容及因履行本协议而知悉的对方的商业秘密和个人隐私予以保密。

5.2 保密义务不因本协议的终止而解除。

6. 违约责任6.1 如任何一方违反本协议的约定,应赔偿对方因此遭受的一切损失。

7. 争议解决7.1 本协议在履行过程中发生的任何争议,双方应首先通过友好协商解决。

7.2 如协商不成,任何一方均可向甲方所在地的人民法院提起诉讼。

8. 其他8.1 本协议的修改和补充应由双方协商一致,并以书面形式确认。

8.2 本协议自双方签字盖章之日起生效。

甲方代表(签字):_________ 日期:____年__月__日乙方代表(签字):_________ 日期:____年__月__日(注:以上内容为示例文本,具体条款应根据实际情况制定。

)。

代持股协议书(中英文版本)

代持股协议书委托人(甲方):身份证号码:住址:受托人(乙方):身份证号码:住址:甲、乙双方本着平等互利的原则,经平等协商,就甲方委托乙方代为持股相关事宜达成协议如下,以兹共同遵照执行:一、代持股基本情况1、甲方在中占公司总股本的股份,对应出资人民币万元,该股份由乙方代为持股;2、乙方在此声明并确认,代持股份的投资款系完全由甲方提供,只是由乙方以其自己的名义代为投入,故代持股份的实际所有人应为甲方;乙方系根据本协议代甲方持有代持股份;3、乙方在此进一步声明并确认,由代持股份产生的或与代持股份有关之收益归甲方所有,在乙方将上述收益交付给甲方之前,乙方系代甲方持有该收益。

二、甲方的权利与义务1、甲方作为代持股份的实际拥有者,以代持股份为限,根据章程规定享受股东权利,承担股东义务。

包括但不限于股东权益、重大决策、表决权、查账权等公司章程和法律赋予的全部权利;2、在代持期间,获得因代持股份而产生的收益,包括但不限于利润、现金分红等,由甲方按出资比例享有;3、如发生增资扩股之情形,甲方有权自主决定是否增资扩股;4、甲方作为代持股份的实际拥有者,有权依据本协议对乙方不适当的履行受托行为进行监督和纠正,并要求乙方承担因此而造成的损失。

三、乙方的权利与义务1、在代持股期限内,甲方有权在条件具备时,将相关股东权益转移到甲方或甲方指定的任何第三人名下,届时涉及到的相关法律文件,乙方须无条件同意并对此提供必要的协助及便利2、在代持股期间,乙方作为代持股份形式上的拥有者,以乙方的名义在工商股东登记中具名登记。

3、在代持股期间,乙方代甲方收取代持股份产生的收益,应当在收到该收益后5个工作日内,将其转交给甲方或打入甲方指定的账户;4、在代持股期间,乙方应保证所代持股份权属的完整性和安全性,非经甲方书面同意,乙方不得处置代持股份,包括但不限于转让,赠与、放弃或在该等股权上设定质押等;5、若因乙方的原因,如债务纠纷等,造成代持股权被查封,乙方应提供其他任何财产向法院、仲裁机构或其他机构申请解封;6、乙方应当依照诚实信用的原则适当履行受托义务,并接受甲方的监督。

ENTRUSTEDSHAREHOLDINGAGREEMENT代持股协议书

股权代持协议Entrusted Shareholding Agreement本协议由以下双方于年月日签订:The agreement is signed by both sides on _______Day, _______ Month,________Year.委托方Entrusting Party:受托方Commissioned Party:鉴于In consideration of:(1) 委托方在投资成立一家公司(以下简称“公司”),公司名称为,注册资金为,其中委托方认缴注册资金,拥有公司的的股权。

The entrusting party has invested to set up a company (hereinafter referred to as the "company") in with the name of , and its registered capital was , in which the entrusting party paid in registeredcapital of , and owned 100% stock equity of the company.(2)根据本协议的约定,委托方委托受托方以受托方名义持有公司的股权,委托方是该股权的实际拥有人,受托方作为其股权的名义持有人;受托方同意接受委托方委托,名义上持有公司的股权。

According to the provisions of this agreement, the entrusting party entrusts the commissioned party to hold a stock equity of the companyin the name of the commissioned party, where the entrusting party is theactual owner of the stock equity, and the commissioned party as its stake holders in name; the commissioned party agrees to accept the entrusting of the entrusting party, and to hold a stake of the company nominally.双方经平等协商,根据《中华人民共和国公司法》、《中华人民共和国合同法》以及其它适用的法律和法规的规定,达成如下协议:Through equal consultation, according to “the People's Republic of China Company Law”, “the People's Republic of China Contract Law” and other applicable laws and regulations, both parties reach the following agreement:1.委托代持Entrusting1.1 双方确认,公司注册资金为美金,该款由委托方实际缴付。

全能型个人股份代持合同英文版

全能型个人股份代持合同英文版All-Purpose Individual Shareholding AgreementThis document serves as a legally binding agreement between [Name of Individual Shareholder] (hereinafter referred to as "Shareholder") and [Name of Company] (hereinafter referred to as "Company") for the purposes of holding shares on behalf of the Shareholder.Parties Involved- Shareholder: The individual who owns the shares but wishes to have them held by the Company.- Company: The entity that agrees to hold and manage the shares on behalf of the Shareholder.Terms of Agreement1. Appointment of Company: The Shareholder appoints the Company as the holder of the shares specified in this agreement.2. Obligations of the Company: The Company agrees to hold the shares in trust for the Shareholder and to exercise any rights associated with the shares in accordance with the Shareholder's instructions.3. Rights of the Shareholder: The Shareholder retains all ownership rights and benefits associated with the shares, including voting rights, dividends, and any other financial benefits.4. Duration of Agreement: This agreement shall remain in effect until terminated by either party with prior written notice.5. Confidentiality: Both parties agree to maintain the confidentiality of any information related to the shares and not disclose it to any third parties without the other party's consent.6. Governing Law: This agreement shall be governed by the laws of [Jurisdiction] and any disputes arising out of or in connection with this agreement shall be resolved through arbitration.Termination of Agreement- Either party may terminate this agreement by providing written notice to the other party.- Upon termination, the Company shall transfer the shares back to the Shareholder and provide any necessary documentation to effect the transfer.ConclusionThis All-Purpose Individual Shareholding Agreement outlines the terms and conditions under which the Company will hold shares on behalf of the Shareholder. Both parties agree to abide by the terms of this agreement and to act in good faith in all matters related to the shares.Signed on this ______ day of ______ (Month), ______ (Year).[Signature of Shareholder][Name of Shareholder][Signature of Company Representative][Name of Company Representative]。

海外股权代持协议书模板

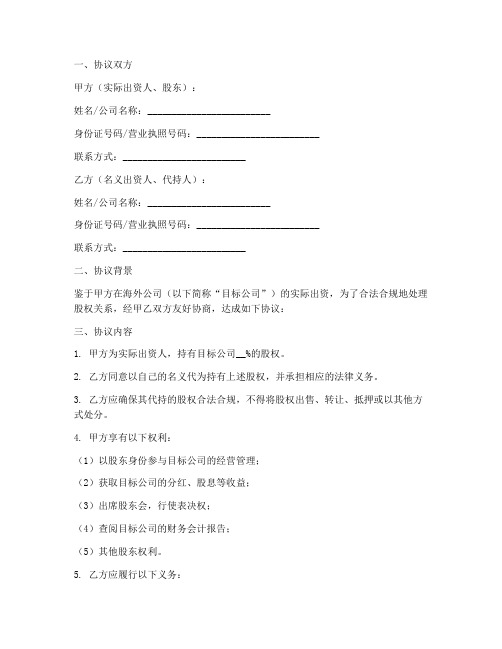

一、协议双方甲方(实际出资人、股东):姓名/公司名称:_________________________身份证号码/营业执照号码:_________________________联系方式:_________________________乙方(名义出资人、代持人):姓名/公司名称:_________________________身份证号码/营业执照号码:_________________________联系方式:_________________________二、协议背景鉴于甲方在海外公司(以下简称“目标公司”)的实际出资,为了合法合规地处理股权关系,经甲乙双方友好协商,达成如下协议:三、协议内容1. 甲方为实际出资人,持有目标公司__%的股权。

2. 乙方同意以自己的名义代为持有上述股权,并承担相应的法律义务。

3. 乙方应确保其代持的股权合法合规,不得将股权出售、转让、抵押或以其他方式处分。

4. 甲方享有以下权利:(1)以股东身份参与目标公司的经营管理;(2)获取目标公司的分红、股息等收益;(3)出席股东会,行使表决权;(4)查阅目标公司的财务会计报告;(5)其他股东权利。

5. 乙方应履行以下义务:(1)代为持有甲方股权,不得擅自处置;(2)按照甲方要求,向目标公司提供相关证明文件;(3)协助甲方行使其股东权利;(4)遵守相关法律法规,不得损害甲方权益。

6. 本协议的期限自签订之日起至甲方书面通知解除本协议之日止。

7. 本协议解除后,乙方应将代持的股权过户至甲方名下,并承担相应的过户费用。

8. 如因乙方违反本协议约定,导致甲方权益受损,乙方应承担相应的法律责任。

9. 本协议未尽事宜,双方可另行协商解决。

四、争议解决1. 本协议的签订、履行、解释及争议解决均适用中华人民共和国法律。

2. 双方在履行本协议过程中发生的争议,应友好协商解决;协商不成的,可向有管辖权的人民法院提起诉讼。

五、其他1. 本协议一式两份,甲乙双方各执一份,自双方签字(或盖章)之日起生效。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

代持股协议书委托人(甲方):身份证号码:住址:受托人(乙方):身份证号码:住址:甲、乙双方本着平等互利的原则,经平等协商,就甲方委托乙方代为持股相关事宜达成协议如下,以兹共同遵照执行:一、代持股基本情况1、甲方在中占公司总股本的股份,对应出资人民币万元,该股份由乙方代为持股;2、乙方在此声明并确认,代持股份的投资款系完全由甲方提供,只是由乙方以其自己的名义代为投入,故代持股份的实际所有人应为甲方;乙方系根据本协议代甲方持有代持股份;3、乙方在此进一步声明并确认,由代持股份产生的或与代持股份有关之收益归甲方所有,在乙方将上述收益交付给甲方之前,乙方系代甲方持有该收益。

二、甲方的权利与义务1、甲方作为代持股份的实际拥有者,以代持股份为限,根据章程规定享受股东权利,承担股东义务。

包括但不限于股东权益、重大决策、表决权、查账权等公司章程和法律赋予的全部权利;2、在代持期间,获得因代持股份而产生的收益,包括但不限于利润、现金分红等,由甲方按出资比例享有;3、如发生增资扩股之情形,甲方有权自主决定是否增资扩股;4、甲方作为代持股份的实际拥有者,有权依据本协议对乙方不适当的履行受托行为进行监督和纠正,并要求乙方承担因此而造成的损失。

三、乙方的权利与义务1、在代持股期限内,甲方有权在条件具备时,将相关股东权益转移到甲方或甲方指定的任何第三人名下,届时涉及到的相关法律文件,乙方须无条件同意并对此提供必要的协助及便利2、在代持股期间,乙方作为代持股份形式上的拥有者,以乙方的名义在工商股东登记中具名登记。

3、在代持股期间,乙方代甲方收取代持股份产生的收益,应当在收到该收益后5个工作日内,将其转交给甲方或打入甲方指定的账户;4、在代持股期间,乙方应保证所代持股份权属的完整性和安全性,非经甲方书面同意,乙方不得处置代持股份,包括但不限于转让,赠与、放弃或在该等股权上设定质押等;5、若因乙方的原因,如债务纠纷等,造成代持股权被查封,乙方应提供其他任何财产向法院、仲裁机构或其他机构申请解封;6、乙方应当依照诚实信用的原则适当履行受托义务,并接受甲方的监督。

四、代持股份的费用1、乙方为无偿代理,不得向甲方收取代持股份的代理费用;乙方在代持股期间的薪酬待遇由决定。

2、乙方代持股期间,因代持股份产生的相关费用及税费由甲方承担;在乙方将代持股份转为以甲方或甲方指定的任何第三人持有时,所产生的变更登记费用也由甲方承担。

五、代持股份的转让1、在代持股期间,甲方可转让代持股份。

甲方转让股份的,应当书面通知乙方,通知中应写明转让的时间、转让的价格、转让的股份数。

乙方在接到书面通知之后,应当依照通知的内容办理相关手续;2、若乙方为甲方代收股权转让款的,乙方应在收到受让方支付的股权转让款后5个工作日内将股权转让款转交给甲方。

但乙方不对受让股东的履行能力承担任何责任,由此带来的风险由甲方承担;3、因代持股份转让而产生的所有费用由甲方承担。

六、保密协议双方对本协议履行过程中所接触或获知的对方的任何商业信息均有保密义务,除非有明显的证据证明该等信息属于公知信息或者事先得到对方的书面授权。

该保密义务在本协议终止后仍然继续有效。

任何一方因违反保密义务而给对方造成损失的,均应当赔偿对方的相应损失。

七、协议的生效与终止1、本协议自签订之日起生效;2、甲方通知乙方将相关股东权益转移到甲方或甲方指定的任何第三人名下并完成相关办理手续时终止。

八、违约责任本协议正式签订后,任何一方不履行或不完全履行本协议约定条款的,即构成违约。

违约方应当负责赔偿其违约行为给守约方造成的一切直接和间接的经济损失。

九、适用法律及争议解决因履行本协议所发生的争议,甲乙双方应友好协商解决,协商不能解决的,在一方可向代持股公司注册地人民法院提起诉讼。

十、其他1、本协议自双方签署后生效;2、本协议一式两份,签署双方各执一份,均具有同等法律效力;3、本协议未尽事宜,可由双方以附件或签订补充协议的形式约定,附件或补充协议与本协议具有同等法律效力。

委托方(甲方):受托方(乙方):年月日年月日On behalf of the holding agreementClient (Party A):ID Card No.:Address:Trustee (Party B):ID Card No.:Address:Party A and Party B, on the principle of equality and mutual benefit, and through equal consultation, have reached an agreement on the matters related to Party A's entrustment to Party B to hold shares as follows, in order to jointly comply with the following:I. BASIC SITUATION OF SUPPLIANCE1. Party A is Share of total share capital Share corresponding to RMB contribution Ten thousand yuan, the shares are held by Party B;2. Party B hereby declares and confirms that the investment funds held on behalf of the shares shall be provided by Party A solely and only by Party B in its own name Therefore, the actual owner of the acting shares shall beParty A; Party B shall hold the acting shares on behalf of Party A in accordance with this Agreement;3. Party B hereby further declares and confirms that the proceeds arising from or relating to the holding of the shares shall be owned by Party A, and Party B shall hold the proceeds on behalf of Party A before Party B delivers the said proceeds to Party A.Party A's rights and obligations1. Party A, as the actual owner of the shares held on its behalf, is limited to holding the shares on its behalf, according to The articles of association provide for the enjoyment of shareholder rights and the undertaking of shareholder obligations. including, but not limited to, shareholders' rights and interests, major decision-making, voting rights, audit rights and other company articles of association and all rights conferred by law;During the period of 2. holding, the income generated by holding shares on behalf, including but not limited to profits, cash dividends, etc., shall be enjoyed by Party A in proportion to its capital contribution;3. such as Party A shall have the right to decide whether to increase capital or not in the case of capital increase.4. Party A, as the actual owner of the acting holding shares, has the right to supervise and correct Party B's improper performance of the fiduciary act in accordance with this Agreement, and to require Party B to bear the losses caused as a result.Party B's rights and obligations1. Party A shall have the right to transfer the rights and interests of the relevant shareholders to the name of Party A or any third party designated by Party A within the time limit for holding the shares on behalf of Party A. Party B shall agree unconditionally and provide necessary assistance and facilities in this regardDuring the period of 2. holding on behalf of the shares, Party B, as the owner of the form of holding on behalf of the shares, in the name of Party B in the registration of industrial and commercial shareholders.3. during the period of holding the shares on behalf of Party A, Party B shall, within 5 working days after receiving the proceeds, transfer the proceeds to Party A or enter the account designated by Party A;4. during the period of holding the shares on behalf, Party B shall guarantee the integrity and security of the ownership of the shares held on behalf of Party B. Without the written consent of Party A, Party B shall not dispose ofthe shares held on behalf of Party B, including, but not limited to, the transfer, gift, waiver or pledge on such shares;5. Party B shall provide any other property to apply to the court, arbitration institution or other institution for unsealing if it is seized due to Party B's reasons, such as debt disputes;6. Party B shall properly perform the fiduciary obligations in accordance with the principle of good faith and accept the supervision of Party A.IV. EXPENDITURE OF THE SHIPPING PARTY1. Party B is a non-reimbursable agent, Party A shall not be charged the agency fee for holding the shares on behalf of Party B.Decision. During2. period of holding shares on behalf of Party B, the related expenses and taxes arising from holding shares on behalf of Party B shall be borne by Party A; when Party B transfers the holding shares to be held by Party A or any third party designated by Party A, the change registration expenses incurred shall also be borne by Party A.V. TRANSFER OF CONTRIBUTIONSDuring the period of 1. holding, Party A may transfer the holding shares. Party A shall notify Party B in writing of the transfer of shares, indicating the time of the transfer, the price of the transfer and the number of shares transferred.After receiving the written notice, Party B shall go through the relevant formalities according to the contents of the notice;2. if Party B collects the equity transfer money for Party A, Party B shall transfer the equity transfer money to Party A within 5 working days after receiving the equity transfer money paid by the transferee. However, Party B shall not bear any responsibility for the performance of the assigned shareholders, and the risks arising therefrom shall be borne by Party A;All expenses incurred by the 3. as a result of the transfer of shares held on behalf shall be borne by Party A.VI. ConfidentialityThe parties to this Agreement shall be obliged to keep confidential any commercial information of the other party which they have contacted or obtained during the performance of this Agreement, unless there is clear evidence that such information is known or has been authorized in writing by the other party in advance. This confidentiality obligation remains in force after the termination of this Agreement. Any party who causes losses to the other party due to breach of confidentiality obligations shall compensate the other party for the corresponding losses.VII. Entry into force and termination of the Agreement1. This Agreement shall enter into force on the date of its signing;2. Party A notifies Party B to transfer the rights and interests of the relevant shareholders to the name of Party A or any third party designated by Party A and complete the relevant formalities.VIII. Liability for breach of contractAfter the formal signing of this Agreement, any party who fails to perform or does not fully perform the terms of this Agreement shall constitute a breach of contract. The defaulting party shall be liable for all direct and indirect economic losses caused to the compliance party by its breach.IX. Applicable law and dispute resolutionAs a result of the dispute arising from the performance of this Agreement, both parties shall settle the dispute through friendly negotiation. If the dispute can not be settled through negotiation, one party may bring a lawsuit in the people's court of the place where the company is registered.X. OTHER1. This Agreement shall enter into force upon signature by both parties;2. this agreement in duplicate, each party holds one copy, have the same legal effect;3. matters not covered by this Agreement may be agreed by both parties in the form of an annex or a supplementary agreement, which shall have the same legal effect as this Agreement.Client (Party A): Trustee (Party B): Month Date。