美联储资产负债表相关数据2002-2010年

中央银行:美联储资产负债表演变及其政策内涵

一、危机前美联储资产负债表(2007.8)

资产 (亿美元)

证券 政府短期债券

7800 2770

政府长期债券

5039

回购协议 贷款 黄金 外汇和其他资产 总计

360 0.28 110 467 8737

负债(亿美元)

90% 通货

8074

93%

银行准备金

184

2%

逆回购

1.传统贴现窗口 –降低再贴现率 –07年6月1.49亿美元 –08年10月1119亿美元

2.定期拍卖贷款TAC –交易对象为银行 –扩展了质押品

–国债、优质企业债 –联邦机构债 –机构担保抵押债券MBS

3.商业票据融资便利CPFF

美联储

贷款

本息

CPFF LLC

资金

CP

商业票据发行人

4.定期资产支持证券融资便利TALF • 向合格证券持有者融资

– 学生贷款支持证券 – 消费贷款支持证券 – 中小企业贷款支持证券等 • 鼓励投资合格ABS • 推动相关贷款一级市场

(三)特定机构贷款支持

•Maiden Lane LLC

贝尔斯登

•Maiden Lane Ⅱ LLC AIG

•Maiden Lane Ⅲ LLC

图:贝尔斯登 AIG

四、危机后美联储负债结构变化

2008.3-5

2009.3——2012.12

–2009年QE1启动后增持 • 危机救助转向实施量化宽松

BACK

2. 大规模购买新型债券

• 联邦机构债 –房地美、房利美和吉利美债券

• 机构担保MBS债券 –由券商发行三家机构担保的MBS

• 美联储优先购买上述பைடு நூலகம்类债券

美国历年国际投资头寸一览表(1976-2010

美国历年国际投资头寸一览表(1976-2010美国商务部经济分析局当地时间2011年6月28日发布了2010年末美国国际投资头寸表初步数据。

数据显示,2010年末美国国际投资净头寸为负24709.89亿美元,比上年末增长3.1%。

2010年末,美国净负债比上年增加745.63亿美元。

其中,金融衍生工具减少2542.89亿美元,价格变化增加814.79亿美元,汇率变动减少396.33亿美元,其他变动增加1378.80亿美元。

2010年末,美国对外金融总资产、对外金融总负债和对外金融净负债均居世界第一位。

初步统计,2010年末,美国对外金融总资产203153.59亿美元,比上年末增长9.9%;对外金融总负债227863.48亿美元,比上年末增长9.1%;对外金融净负债24709.89亿美元,同比增加3.1%。

在对外金融资产中,金融衍生工具资产36529.09亿美元,不包括金融衍生工具的海外资产166624.50亿美元,分别占对外金融资产的18%和82%。

在非金融衍生工具资产中,官方储备资产4886.73亿美元,政府其他资产752.35亿美元;私人资产160985.42亿美元,分别占对外金融资产的2.4%、0.4%和79.2%。

在私人金融资产中,对外直接投资44294.26亿美元,证券投资62228.64亿美元,其他投资54462.52亿美元,分别占对外金融资产的21.8%、30.6%和26.8%。

在对外金融负债中,金融衍生工具负债35424.88亿美元,非金融衍生工具负债192438.60亿美元,分别占对外金融负债的15.5%和84.5%。

在非金融衍生工具负债中,对外国政府负债48636.23亿美元,其他对外负债143802.37亿美元,分别占对外金融负债的21.3%和63.1%。

在其他负债中,外国对美直接投资26589.32亿美元,对美国债投资10645.94亿美元,对美证券投资58600.93亿美元,对美元投资3420.90亿美元,其他投资44545.28亿美元,分别占对外金融负债的11.7%、4.7%、25.7%、1.5%和19.5%。

中美中央银行资产负债表的比较研究

中美中央银行资产负债表的比较研究作者:高冲来源:《新经济》2014年第04期摘要:随着金融危机的爆发,各国政府都开始采取各种措施,力求最大程度的消除金融危机带来的影响,避免受到波及。

各国中央银行是负责各国社会金融体系稳定,进行货币政策抉择的当局,因此在危机来临的过程中,理应首当其冲。

回顾金融危机来临之时,我国人民银行出台了一系列货币政策以应对危机,并且彰显了与其他国家在管理理念以及价值理念等多方面的不同。

本文主要以金融危机爆发为基本契机,对中美两国中央银行资产负债表的不同进行对比研究,希望对于中国人民银行今后资产负债表的完善提供有效的依据,为人民银行正确决策的制定提供参考。

关键词:中美中央银行资产负债表比较资产负债表,不只用于企业内部控制、还用于经营方向的指导以及防止弊端的出现,同时还能让报表的使用者在最短的时间里看到整个企业的财务状况,从而为企业的经营决策提供必要的依据。

次贷危机的到来,对各个国家的中央银行都发起了一次挑战,在这一风暴中,不同国家的中央银行为了降低金融风暴对国家经济的影响,都采取了一系列措施,想要力挽狂澜。

中美两国由于价值观念的不同,在最后的决策上也有着明显的不同,两国资产负债表的不同之处就是最好的证明。

在下文论述中,主要是围绕中美两国中央银行资产负债表存在的主要不同展开了具体论述,希望能为我国人民银行今后货币政策的高效施行提供一些借鉴。

一、中美两国中央银行资产负债表的差异比较在应对危机的过程中,由于价值观念以及管理理念的不同,中美两国中央银行采取的措施大相径庭,而作为决策重要依据之一的资产负债表,两国中央银行在进行制定的过程中也存在着较大的区别。

(一)透明度差异中美两国中央银行资产负债表的格式基本相同,都是按照统一口径向国际货币基金组织出版的《货币与金融统计手册》中的格式来进行制作的。

但是就两国中央银行资产负债表的子科目来说,就存在较大差异了。

美联储为了有效应对突发的金融风险,特设了许多属于资产方的新子科目,政策的透明度有了极大程度的提高;而就中国人民银行资产负债表的内容来看,科目设立与日本银行资产负债表的设置较为一致,透明度不高。

中美央行资产负债表对比

中美央行资产负债表对比(总4页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--中美央行资产负债表分析及对比在次贷危机向全球金融危机演变的过程中,在危机不断加深、变广的过程中,各国政府都在想尽办法通过各种政策措施来缓解或消除危机的影响。

中央银行,作为负责金融体系稳定的货币政策当局,在危机中自然是首当其冲,展开了大规模的救市活动。

作为美国货币政策当局的美联储首当其冲没在常规货币政策—降息效果不明显的情况下,采取超常规的“定量宽松”的货币政策,即通过创新金融工具,以及向具有系统重要性的实体企业提供融资等方式向市场注入大量流动性,用于救助陷入困境的金融机构,以期提振市场信心,刺激经济增长。

“定量宽松”货币政策的实施客观上对金融市场和实体经济产生了积极影响,有效防止了市场崩溃和经济急速衰退。

与此同时,由于金融市场的相对封闭,中国受危机影响相对有限,中国政府亦高度警惕,推出了4万亿刺激计划,中国人民银行也做出了降息等政策反应。

两国货币政策的差异对金融市场产生了不同影响,彰显了不同的管理理念和价值取向,对各自央行资产负债表的影响也存在较大不同。

资产负债表项目构成不同,从资产项目来看,中美两国央行总资产大体可以分为:国内信贷、国外资产和其他资产,但具体构成却并不完全相同。

首先来看中国人民银行的总资产构成,其国外资产包括外汇、货币性黄金和其他国外资产;国内信贷包括对政府(基本上是中央政府)、其他存款性公司、其他金融性和非金融性公司的债权。

再来看美联储的情况。

对其总资产作类似的分类,国外资产来自于其资产负债表中的其他资产和黄金账户;国内信贷包含的项目较多,包括证券、回购协议、对各种机构的贷款以及几家公司的债权;其他资产包括硬币、银行房产等余项。

从负债项目来看,中美两国央行总负债大致包括:国内债券、国外债券、其他负债和自有资金。

主要不同体现在国内负债项目上,人民银行资产负债表中国内负债包括储备货币、发行货币、金融性公司存款、准备金存款、发行债券、政府存款,美联储资产负债表中的国内负债包括:流通中现金、存款机构的准备金、商业银行库存现金、支票存款与现金、联邦政府负债。

中美央行资产负债表的演进及比较分析

摘要:2007年美国次贷危机以来,央行资产负债表的重要性有所上升。

中美两国央行资产负债表规模和结构的调整,在一定程度上体现和反映了两国货币政策框架转型和政策工具调整的意图。

2007~2014年美联储资产负债表的扩张,更多源于主动的大规模的资产购买计划,而中国则更多源于外汇占款的被动投放。

2015年以后,美联储开启了货币政策正常化进程,资产负债表开始逐步缩减。

而中国结构性货币政策开始取代外汇占款渠道成为基础货币投放的新渠道,标志着中国央行资产负债表结构发生了重要变化。

两国央行资产负债表变动趋势有相似之处,但调整的动因和操作方式差异较大。

未来,美联储仍将按照既定计划主动缩减资产负债表,而中国央行将侧重于结构调整以及降低外汇占款等境外资产的占比,结构性货币政策工具等投放流动性的作用将上升。

关键词:央行资产负债表;演进特征;比较分析IMF在2002年提出了资产负债表分析方法(Balance Sheet Approach, BSA), 通过编制一国各部门资产负债表来分析其系统性风险状况。

央行资产负债表是用于记录特定时点上,一国或地区中央银行资金收支活动所形成的债权和债务存量关系的工具。

央行资产负债表决定了一国基础货币的规模,央行通过其资产负债表的调节来加强基础货币的可控性。

央行积极主动管理其资产负债表,保持适度的资产负债表规模和结构,既可以反映出中央银行实施货币政策调控行为的各项政策安排,也是进一步实施货币政策的重要手段。

Rule(2016)指出,央行资产负债表是理解央行货币政策执行情况的关键手段。

李扬等(2015)提出,2008年金融危机前后,美国和中国央行资产负债表规模和结构的调整,反映了两国货币政策调控机制的变化。

美国次贷危机爆发后,全球央行的资产负债表规模经历了较大幅度的扩张,2007~2014年增加了两倍。

2014年年底,全球央行资产负债表规模达到22万亿美元。

其中,2014年年底美国和中国央行资产规模分别为4.5万亿美元和5.5万亿美元,两国央行资产规模合计占全球央行资产规模的45%左右。

美联储资产负债表

次贷危机以来美联储资产负债表的变化作者:唐欣语发布时间:2009-05-04 09:33 来源:21世纪经济报道2007年下半年以来,美国次贷危机愈演愈烈,美联储为应对金融危机采取了大量拯救措施,为市场提供流动性,恢复市场信心。

这导致美联储资产负债表的规模与结构发生显著变化,本文欲予以分析。

危机发生前的2007年6月底,美联储资产负债表非常简洁:在资产方,联储持有的美国财政部证券占据大头(2007年6月底占比为87.9%);在负债方,流通中的货币占据大头(2007年6月底占比为90%),但金融危机改变了这一切。

联储资产负债表的规模迅速膨胀,总规模由2007年6月的8993亿美元上升到目前的21217亿美元,不到两年时间增长了1.36倍。

资产方的结构分析首先,美联储在减持美国财政部债券。

2007年6月底联储持有财政债券为7904亿美元,2009年4月8日为5055.2亿美元,减持了36%;相应地,财政债券在资产方的占比也从87.9%下降到目前的37.6%()。

联储减持财政债券,主要是因为通过公开市场操作投放的货币不具有指向性,而救市必须“专款专用”,因此它通过减持国债回笼资金,再通过其它专项计划投放给特定机构。

这可以理解为:联储一手通过多种创新工具向市场投放流动性,一手用卖出国债的方式回收流动性。

其次,新资产项目显著增多、数额巨大。

第一,在“证券”项目(附表1中1.1项)下,从2009年1月起开始设置“MBS(抵押贷款债券)”栏,用于反映联储收购的由房利美、房地美、吉利美担保的MBS。

该收购计划于2008年11月宣布,计划收购总量将达到MBS市场的1/9,即5000亿美元,意在提高MBS市场的流动性,压低MBS的利率,从而压低长期住房抵押贷款利率,重整楼市,促进美国经济复苏。

目前此项目余额为2364亿美元,占资产方余额的11.2%。

第二,新设“定期拍卖信贷”(Term Auction Credit)项目(附表1中1.3项),用于反映“定期拍卖便利”(Term Auction Facility,简称TAF)所投放的信贷。

中美两国资产负债表的分析

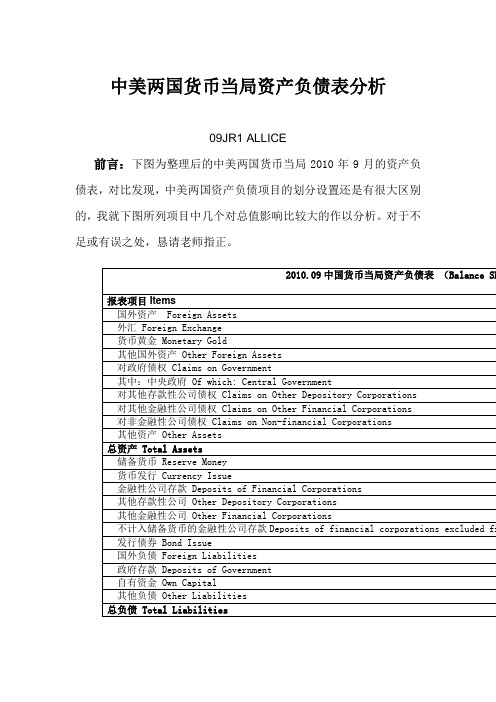

中美两国货币当局资产负债表分析09JR1 ALLICE前言:下图为整理后的中美两国货币当局2010年9月的资产负债表,对比发现,中美两国资产负债项目的划分设置还是有很大区别的,我就下图所列项目中几个对总值影响比较大的作以分析。

对于不足或有误之处,恳请老师指正。

2010.09中国货币当局资产负债表(Balance Sh报表项目Items国外资产 Foreign Assets外汇 Foreign Exchange货币黄金 Monetary Gold其他国外资产 Other Foreign Assets对政府债权 Claims on Government其中:中央政府 Of which: Central Government对其他存款性公司债权 Claims on Other Depository Corporations对其他金融性公司债权 Claims on Other Financial Corporations对非金融性公司债权 Claims on Non-financial Corporations其他资产 Other Assets总资产 Total Assets储备货币 Reserve Money货币发行 Currency Issue金融性公司存款 Deposits of Financial Corporations其他存款性公司 Other Depository Corporations其他金融性公司 Other Financial Corporations不计入储备货币的金融性公司存款Deposits of financial corporations excluded fr 发行债券 Bond Issue国外负债 Foreign Liabilities政府存款 Deposits of Government自有资金 Own Capital其他负债 Other Liabilities总负债 Total LiabilitiesAssets ,and the Capital of the Fe ItemTotal assetsSelected assetsSecurities held outrightU.S. Treasury Securities (美国财物部证券)Federal agency debt securitiesMortgage-backed securities(住房抵押贷款证券)Memo: Overmight securities lendingMemo: Net commitments to purchase mortgage-backed securitiesLending to depository institutionsCentral bank liquidity swapsLending through other credit facilitiesNet portfolio holdings of commercial paper Funding LLCTerm Asset-Backed Securities Loan FacilityNet portfolio holdings of TALF LLCSupport for specific institutionsCredit extended to American International Group ,Inc , netNet portfolio holdings of Maiden Lane LLCNet portfolio holdings of Maiden Lane II LLCNet portfolio holdings of Maiden Lane III LLCPreferred interests in AIA Aurora LLC and ALICO holdings LLCTotal liabilitiesSelected liabilitiesFederal reserve notes in circulation (联邦储备纸币流通)Term deposits held by depository institutionsother deposits held by depository institutions (其他存款的存款机构)U.S.Treasury ,general accountU.S.Treasury ,supplementary financing accountOther depositsTotal capital(*less than $500 million )资料取自:2010年中国货币当局资产负债表(Balance Sheet of Monetary Authority)百度文库美联储政府网站/monetarypolicy/bst.htm总资产方面由上图可以看到, 2010年9月中国货币当局资产总额248 683.87亿元人民币,而美国为23 020亿美元,据资料统计2011年9月中美汇率平均约为6.7,因此,美国货币当局所列的总资产折合人民币: 23 020*6.7=154 234亿元,相较之下,少于中国9万多亿人民币。

中央银行学-第二章 中央银行的资产负债业务

§1 央行业务活动规范与分类

一. 央行业务活动的法律规范

1. 法定业务范围 货币发行和货币流通管理业务 存款准备金业务 为在央行开立帐户的金融机构办理再贴现及贷款业务 在公开市场从事有价证券的买卖业务 经营黄金外汇及管理业务 代理政府向金融机构发行、兑付国债和其他政府债券 经理国库业务 组织或协助组织金融机构间的清算业务 对全国的金融活动进行统计调查与分析预测,统一编制全 国金融统计数据、报表,定期予以公布 对金融机构和金融市场的相关监督管理 央行财务收支的会计核算和内部监督管理 法律允许的其他业务

1998,恢复交易 业务类型

回购业务

正回购和逆回购 现券买断和现券卖断

现券交易 央行票据

39

§3 央行的资产业务

四.外汇储备资产业务

1. 含义

央行代表国家管理国际储备。 调节国际收支 稳定币值 稳定汇率

2. 意义

40

§3 央行的资产业务

四.外汇储备资产业务

结束混乱,制定政策,加强实力 建立一定的发行准备制度

我国基本无发行准备,靠计划发行

信用保证

适度弹性

伸缩性和灵活性

18

§2 央行的负债业务

一.货币发行业务

4. 货币发行的准备制度

发行准备

评价

现金准备:黄金,外汇… •现金准备:没弹性,不灵活 证券准备:短期公债,商业票据, 政府公债

本期流通中的通货变动净额=本期各项资产变动净额- 本期各项负债变动净额-资本变动净额

15

§1 央行制度的产生与发展

要点小结

1. 央行业务活动原则

非盈利性,流动性,公开性,主动性, 不经营一般银行业务。 银行性业务,管理性业务

中央银行的资产负债表与货币政策——中国和美国的比较

中央银行的资产负债表与货币政策∗——中国和美国的比较 一、引 言近几十年来,纵观世界各国,许多奉行自由市场经济的国家在遭遇到经济金融危机时,政府都无一例外地出手,采取各种措施对危机进行控制和救助,市场无形之手总会向政府有形之手做出让步。

美国的中央银行--美国联邦储备系统(简称美联储)现任主席伯南克(Bernanke ,2008)认为,要准确地评估危机管理的效果有多大是非常困难的, 但有一点可以肯定, 即如果没有中央银行的介入, 危机要严重得多,影响也会深远得多。

金融危机会导致经济萧条,中央银行一般采取宽松的货币政策应对,常规的方法有:第一、中央银行作为最后贷款人,通过公开市场操作、再贴现或再贷款,向金融机构提供流动性援助。

在金融市场发达的国家,中央银行应对危机的常规手段主要是通过参与市场供求运作,提供短期的流动性。

一般来说,中央银行为了最大限度地降低在流动性供给过程中其所承受的风险,会要求借入资金的金融机构提供合格资产作为抵押。

最后贷款人是现代中央银行的一个重要职责, 中央银行随时准备为出现流动性短缺的银行体系注入高能货币。

第二、降低利率和法定存款准备金率。

(1)中央银行可以降低贴现利率或再贷款利率。

有能力调控的短期利率有隔夜同业拆借利率、证券市场回购利率和逆回购利率等,通过公开市场业务引导货币市场利率接近中央银行的目标利率。

以美国为例,联邦基金率是指美国同业拆借市场的利率,也是基准利率,其最主要的是隔夜拆借利率。

美联储瞄准并调节同业拆借利率就能直接影响商业银行的资金成本,并且将同业拆借市场上的资金余缺传递给工商企业,进而影响消费、投资和国民经济。

作为同业拆借市场的最大的参加者,其作用机制应该是这样的:美联储降低其拆借利率,商业银行之间的拆借就会转向商业银行与美联储之间,因为向美联储拆借的成本低,整个市场的拆借利率都将随之下降。

(2)降低商业银行上缴中央银行的法定存款准备金率。

目的是放松融资条件,为商业银行提供成本更低和数量更多的资金,由此来支持经济成长。

资产负债表对宏观经济的影响分析

资产负债表对宏观经济的影响分析2017年,美联储公布3月份货币政策例会纪要显示,只要美国经济增长表现继续符合美联储预期,大多数美联储官员认为今年晚些时候可能适合开始缩减资产负债表。

这是美联储首次就缩减资产负债表的时机作出明确表态。

如果首次听到“缩表”这个词儿,可能会感到莫名其妙。

那么,缩表到底是什么?会对美国经济,全球经济造成什么样的影响?“表”是指中央银行的资产负债表,“缩表”意思是中央银行主动缩减资产负债表规模的行为。

对于中央银行来说,有左侧资产的增进,才能有右侧负债的跟进,而资产的规模则决定着央行货币政策的空间与尺度。

2008年之后,为提振经济复苏,美联储开启三轮量化宽松,印钞购买债券,为实体经济注入流动性,同时资产负债表大幅膨胀,而资产负债表的规模,大致对应着基础货币的规模,货币成倍数放大,就得到广义货币供应量。

“缩表”意味着要将资产与负债两端降下来,实现货币政策正常化,回收流动性,从国际上将美元抽回,加速新兴经济体资本外流,更重要的会对高杠杆高负债国家造成更大冲击。

下图是2002年迄今美联储资产负债表规模变动情况。

图 1 美国GDP与美联储资产变动从2009年到2014年,美联储进入市场大量购买国债和MBS,将其资产负债表规模从2007年的9000亿美元急剧扩张到2014年底的4.5万亿美元左右。

图 2 美国基础货币存量与环比增速从基础货币的环比增速来看,自从08年量化以来,货币增速波动率明显增大。

但近年随着国内经济转暖,就业上升,失业率稳定,美联储也希望尽早将货币政策回归正常,同时回收因QE而投放的过多流动性,强美元以引资本回流。

由于美元在全球货币体系中处于核心地位,各新兴经济体的汇率都主要盯住美元。

无论是美联储加息抑或缩表,对新兴经济体的汇率会造成冲击。

同时对于所有美元计价物来说,美元总量的变少会导致美元更贵,而资产价格更低。

所以美联储缩表会导致所有资产的重估。

实际上,缩表要比加息的影响大得多,加息从狭义上来看只是通过刺激美元强势,引导资本回流的一个间接工具。

解析美国联邦储备系统运作模式

解析美国联邦储备系统运作模式席卷全球的金融危机起源于美国次贷危机。

作为美国最主要的金融监管机构之一,美国联邦储备系统(以下简称美联储)在应对金融危机过程中发挥了巨大作用。

了解它的职责和运作模式有助于我们更好地认识美国如何应对金融危机,并可加深对美国货币政策和制度的了解。

一. 美联储的组织职责及结构美联储作为美国的中央银行,负责货币政策的制定与实施。

在全球所有中央银行里,美联储的组织结构是最特殊的。

1.组织职责。

美联储是根据《联邦储备法》于1913年成立的。

主要职责包括:制定并负责实施相关货币政策;对银行机构实行监管;维持金融系统稳定等。

2.组织结构。

美联储由联邦储备银行、联邦储备委员会、联邦公开市场委员会、联邦咨询委员会及大约4800家成员商业银行组成。

(1)联邦储备银行。

美国按照1913年《联邦储备法》,将全国划分为12个储备区,每区设立一个联邦储备银行。

主要职责包括:支票清算;货币发行;管理和发放本区商业银行贴现贷款;组织关于货币政策操作的课题研究等。

按资产衡量,三家最大的联邦储备银行分别是纽约、芝加哥和旧金山联邦储备银行,它们共同控制联邦储备体系50%以上的资产。

其中,纽约联邦储备银行拥有整个体系25%的资产,是最重要的联邦储备银行。

(2)联邦储备委员会。

联邦储备系统的核心机构是联邦储备委员会。

该委员会由七名委员组成,主席和副主席各一名,委员五名,由总统任命,并经参议院批准。

委员的任期长达14年,不得连任。

为防止某一地区利益被过度强调,委员(通常是职业经济学家)要求来自不同联邦储备区。

委员会主席从7名委员中选出,任期4年,可以连任。

主要职责包括:制定货币政策;对公开市场操作享有投票权;制定法定准备金率;制定联邦基金贷款贴现率。

(3)联邦公开市场委员会。

联邦公开市场委员会是联邦储备系统中另一个重要机构。

它由十二名成员组成,包括:联邦储备委员会全部七名成员,纽约联邦储备银行行长,其它四个名额由另外11个联邦储备银行行长轮流担任。

各国央行资产负债表的项目结构比较

各国央行资产负债表的项目结构比较目前,各国中央银行资产负债表的格式和主要项目虽然基本一致,但各项目的比重结构却不相同,反映了各中央银行资产负债业务重点和特点的差异。

下面给出中国、美国、欧洲、日本中央银行的资产负债表,通过对各中央银行资产负债表的结构比较,可以更好地了解各个中央银行资产负债业务活动的异同点。

表1:2003年和2004年中国人民银行资产负债表(单位:亿元人民币)表2:2003年12月31日美国联邦储备银行资产负债表(单位:百万美元)资料来源:美联储网站。

表3:2003年12月31日欧洲中央银行资产负债表(单位:百万欧元)资料来源:欧洲中央银行网站http://www.ecb.int。

表4:2003年12月31日日本银行资产负债表(单位:亿日元)资料来源:日本银行网站http://www.boj.or.jp。

综观表1、2、3、4四家中央银行2003年的资产负债表,可以看出中国和外国在主要项目上有较大的差异。

在中国人民银行的资产负债表中,资产结构中最主要的是国外资产,其中外汇储备2003年末为29841.8亿元,占全部资产总额的48.13%;第二位的资产项目是对存款货币银行的债权,目前主要是通过提供信用贷款的方式形成的,2003年底余额为10619.47亿元,占全部资产总额的17.13%;第三位的资产项目是对其他金融机构债权,2003年底余额为7255.95亿元,占全部资产总额的11.7%;第四位的资产项目是对中央政府债权,2003年底为2901.02亿元,占全部中央银行资产总额的4.68%。

在负债结构中,最主要的是对金融机构负债,2003年底余额为22558.04亿元,占全部负债总额的36.38%,其中,对存款货币银行的负债22274.41亿元,与中央银行对存款货币银行债权相抵,净负债11654.94亿元;第二位的负债项目是发行货币,2003年底余额为21240.48亿元,占全部负债的比重为34.26%。

美联储资产负债表分析

一、资产类项目分析1.总资产增长率对比通过对美联储和中国人民银行近八年来总资产增长速度的统计,我们发现,中国人民银行的总资产增长率大部分年份为正值,说明中国人民银行的总资产基本上呈现不断增长的趋势,相比而言,美联储在2008年以外的年份里,总资产增长率较低,且时正时负,说明美联储的总资产增长态势不是很明显。

但是,值得注意的是,在2008年金融危机爆发之际,美联储总资产增长率在3、4季度迅速拉升,全年总资产增长率高于100%,相比而言,中国人民银行并没有表现出太大的变化来,依然保持以外的增长率在增长。

由统计数据可知,金融危机对于美国的冲击迫使美联储大幅度增加流动性供给,而我国由于金融危机冲击较小,得以保持较低的增长率。

2.美联储各类资产总额分析在金融危机之前,各项资产所占比例变化不大,但金融危机改变了这一切。

2007年下半年以来,美国次贷危机愈演愈烈,为市场提供流动性,恢复市场信心美联储为应对金融危机采取了大量拯救措施,从图表中我们可以清晰地看出在次贷危机期间各项资产都有一个较大的变化。

联储一手通过多种创新工具向市场投放流动性,一手用卖出国债的方式回收流动性。

1.在金融危机之后可以从国内信贷的结构变化看出,直接持有债券的比例大幅下降。

2.新资产项目显著增多、数额巨大。

可以在其他资产的变化中看出自从09年央行流动性互换的新项目被提出,在金融危机之后的恢复阶段,几乎占了所有的其他资产,为恢复期做出了巨大的贡献。

3.国内信贷变化分析从上图可以看出,美国资产的重头集中于国内信贷部分,自金融危机爆发至今,其国内信贷增长趋势与资产项目增长趋势极为相似,其中直接持有证劵部分的增长与国内信贷的增长有很大的相关性,分析原因如下:1.美国政府持续推行QE量化宽松政策。

扩大货币发行,减少银行压力,放松银根,来向市场注入大量的流动性以复苏经济。

在金融危机全面爆发之后,美联储通过一系列救市政策增加相当规模的基础货币供应,除去低利率效应,其中1.25万亿美元MBS、3000亿美元美国国债和1750亿美元机构证券就向市场直接注入1.725万亿美元。

美国近五年国际收支分析

美国近五年国际收支平衡简表(单位:百万美元)2003年2004年2005年2006年2007年一经常项目贷1658669 1988065 2354279 2827314 3281284借-2136760 -2545838 -3010914 -3558237 -3930749 差额-478091 -557773 -656635 -730923 -649465 货物和服务贷1338213 1574326 1819016 2142164 2463505借-1789819 -2114837 -2458225 -2838254 -3082014 差额-451606 -540511 -639209 -696090 -618509 收益贷320456 413739 535263 685150 817779借-275147 -346519 -462905 -627956 -736030 差额45309 67220 72358 57194 81749 经常转移借-71794 -84482 -89784 -92027 -112705二资本和金融项目借-667415 -2015944 -877435 -2533521 -2585533贷1712054 3039532 2724621 4085053 4054048 差额1044639 1023588 1847186 1551532 1468515 资本项目借-3480 -2369 -4036 -3880 -1843 金融项目1直接投资借-149564 -316223 -36235 -241244 -333271贷63750 145966 112638 241961 237542 差额-85814 -170257 76403 717 -95729 2证券投资借-146722 -170549 -251199 -365204 -288731贷537034 790042 796020 1053560 961005 差额390312 619493 544821 688356 672274 3其他投资借-366126 -1523998 -566330 -1915473 -1939293贷833201 1705769 1272387 2301593 2444443 差额467075 181771 706057 386120 505150 三储备资产借-1523 -2805 -19635 -7720 -22395贷278069 397755 543576 487939 411058 差额276546 394950 523941 480219 388663 四净误差与遗漏-6000 95030 32313 -47078 -41287小组成员:张刚、罗振宇、管亚飞、于海峰、黄晓峰、麦鸿斌、王梦雅、江健、熊贝贝美国经常性项目近五年走势图一、美国巨额经常项目赤字产生的原因(一) 美国的巨额财政赤字美国在结束了“新经济”的盛宴后,在2001 年出现了经济衰退,导致国民收入这一税收基数增长缓慢,虽然自2003 年下半年起出现了强劲的复苏势头,但前期连续两年的增长乏力已经给赤字累计造成了重要影响。

美联储资产负债表解读

美联储资产负债表解读MILASS我们都知道,一国(或地区)的法定货币是由该国(或地区)的货币发行机构发行,而这个发行机构通常是该国(或地区)的中央银行(非中央银行发行的情况,本文不累述)。

狭义的法定货币是指中央银行发行的钞票。

广义的法定货币又分基础货币和广义货币(M2或M3,各国定义的标准有一定差异)。

基础货币的供应是由中央银行来实现的,而派生货币供应(广义货币除去基础货币)则是由商业银行来实现。

一般来讲,基础货币的发行是需要保证物背书的,这些保证物可以是贵金属、金融票据、外国货币以及实物等资产。

也就是说,央行通过购买这些资产来发行基础货币。

而在实际操作过程当中,我们发现央行充当了最后贷款人的角色,央行通过再贴现、再贷款等方式直接向金融机构、甚至是政府部门进行资金融通,发行基础货币。

中央银行在履行货币发行、执行货币政策等职能时,这些业务活动所形成的债权债务,就构成了央行的资产负责表。

下面笔者就以美国联邦储备银行的资产负债表为例,来和大家探讨全球结算货币——美元的发行。

在此之前,我们先来看看中央银行资产负债表的基本概念和内容。

一.定义中央银行资产负债表的定义是:中央银行在履行职能时,业务活动所形成的债权债务存量表。

中央银行资产负债业务的种类、规模和结构都综合地反映在资产负债表上。

二.内容中央银行资产负债表的内容包括:1.负债项目(1)流通中的货币作为发行的银行,发行货币是中央银行的基本职能,也是中央银行的主要资金来源,中央银行发行的货币通过再贴现、再贷款、购买有价证券和收购黄金、外汇投入市场,成为流通中的货币,成为中央银行对公众的负债。

(2)各项存款包括政府和公共机构存款、商业银行等金融机构存款。

作为国家的银行,政府通常会赋予中央银行代理国库的职责,政府和公共机构存款由中央银行办理。

作为银行的银行,中央银行的金融机构存款包括了商业银行缴存准备金和用于票据清算的活期存款。

(3)其他负债包括对国际金融机构的负债或中央银行发行债券。

中美资产负债表对比

行资产总额的4.68%。 负债结构中 最主要的是对金融机构负债,2003年底余额为22558.04亿元,

的36.38%,其中,对存款货币银行的负债22274.41亿元,与中央银 行债权相抵,净负债11654.94亿元;

0.54 1.55 4.68

17.13

337.24 682.90 2969.62 2969.62 9376.35

0.43对金融机构负债

0.87存金款货币银行准备 3.78特金定存款机构准备 3.78其金他金融机构准备

11.92非金融机构存款

22558.04 22274.41

280.31 3.32

9042.84

PPT文档演模板

中美资产负债表对比

• 通过横向比较可以看出,美联储在资产表中比中国人民 更加细化,其中,有“黄金证书账户”,“SDRs证书账 中国人民银行完全没有涉及的项目,其他资产上,则主 证券等;而中国人民银行则主要分为外国资产、对存款 融机构债权等。从负债表来看,美联储主要有联邦储备 项目;而中国人民银行则主要分为储备货币、政府存款

中国人民银行

DEC ,2000 DEC ,2001

中国人民银行

总负债

39395.36

42270.64 总负债

储备货币

36491.48

39851.73 储备货币

发行货币

15938.31

16868.71

发行货币

对金融机构负债

16019.03

17089.13 对金融机构负债

准备金存款

16019.03

17089.13

全部负债业务的58.95%(含对金融机构负债、非金融机构存款、政 以存款货币银行的准备金存款为主,占全部负债业务的35.92%,2 一步上升为45.35%。

美联储资产负债表

FEDERAL RESERVE statistical releaseH.4.1Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve BanksDecember 16, 20101. Factors Affecting Reserve Balances of Depository InstitutionsMillions of dollarsAverages of daily figuresWednesday Dec 15, 2010Week ended Dec 15, 2010Change from week ended Dec 8, 2010Dec 16, 2009Reserve Bank credit, related items, andreserve balances of depository institutions at Federal Reserve BanksReserve Bank credit2,374,330+ 22,754+ 183,718 2,367,888Securities held outright 12,129,613+ 21,551+ 322,281 2,124,282U.S. Treasury securities 960,796+ 23,565+ 184,235 967,553Bills 218,423 0 0 18,423Notes and bonds, nominal 2889,827+ 21,724+ 182,178 896,578Notes and bonds, inflation-indexed 2 46,506+ 1,630+ 1,863 46,506Inflation compensation 36,041+ 212+ 194 6,046Federal agency debt securities 2 148,136- 42- 8,652 147,884Mortgage-backed securities 4 1,020,681- 1,972+ 146,697 1,008,845Repurchase agreements 5 0 0 0 0Term auction credit 0 0- 85,832 0Other loans45,216- 946- 41,555 45,752Primary credit 22- 16- 19,071 21Secondary credit 0 0- 212 0Seasonal credit28+ 1- 8 29Credit extended to American InternationalGroup, Inc., net 620,080- 637- 568 20,761Term Asset-Backed Securities Loan Facility 7 25,087- 293- 21,695 24,941Other credit extensions0 0 0 0Net portfolio holdings of Commercial PaperFunding Facility LLC 80 0- 14,032 0Net portfolio holdings of Maiden Lane LLC 9 27,425- 181+ 921 26,914Net portfolio holdings of Maiden Lane II LLC 10 16,123- 120+ 551 16,144Net portfolio holdings of Maiden Lane III LLC 11 23,099- 103+ 475 23,121Net portfolio holdings of TALF LLC 12647- 1+ 381 648Preferred interests in AIA Aurora LLC and ALICOHoldings LLC 13 26,057 0+ 1,057 26,057Float-1,734+ 91+ 119 -2,044Central bank liquidity swaps 14 60 0- 14,432 60Other Federal Reserve assets 15 107,823+ 2,461+ 13,782 106,954Gold stock11,041 0 0 11,041Special drawing rights certificate account 5,200 0 0 5,200Treasury currency outstanding 1643,539+ 14+ 850 43,539Total factors supplying reserve funds 2,434,110+ 22,768+ 184,5682,427,668Note: Components may not sum to totals because of rounding. Footnotes appear at the end of the table.1. Factors Affecting Reserve Balances of Depository Institutions (continued)Millions of dollarsAverages of daily figuresWednesday Dec 15, 2010Week ended Dec 15, 2010Change from week ended Dec 8, 2010Dec 16, 2009Reserve Bank credit, related items, andreserve balances of depository institutions at Federal Reserve BanksCurrency in circulation 16978,423+ 2,070+ 55,712 979,658Reverse repurchase agreements 1750,054- 562- 7,175 50,816Foreign official and international accounts 50,054- 562- 6,815 50,816Others0 0- 360 0Treasury cash holdings184- 10- 36 177Deposits with F.R. Banks, other than reserve balances 251,044+ 17,376+ 147,880 302,641Term deposits held by depository institutions 5,113 0+ 5,113 5,113U.S. Treasury, general account30,093+ 8,909- 46,648 91,641U.S. Treasury, supplementary financing account 199,961+ 2+ 184,961 199,961Foreign official 3,096+ 70+ 1,572 3,161Service-related2,361+ 1- 833 2,361Required clearing balances2,361+ 1- 770 2,361Adjustments to compensate for float 0 0- 62 0Other10,420+ 8,394+ 3,714 403Funds from American International Group, Inc. assetdispositions, held as agent 1826,774 0+ 26,774 26,774Other liabilities and capital 1973,844+ 777+ 4,32272,882Total factors, other than reserve balances,absorbing reserve funds1,380,323+ 19,652+ 227,477 1,432,949Reserve balances with Federal Reserve Banks1,053,787+ 3,116- 42,908994,719Note: Components may not sum to totals because of rounding.1.Includes securities lent to dealers under the overnight securities lending facility; refer to table 1A.2.Face value of the securities.pensation that adjusts for the effect of inflation on the original face value of inflation-indexed securities.4.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of the underlying mortgages.5.Cash value of agreements.6.Includes outstanding principal and capitalized interest net of unamortized deferred commitment fees and allowance for loan restructuring.Excludes credit extended to consolidated LLCs.7.Includes credit extended by the Federal Reserve Bank of New York to eligible borrowers through the Term Asset-Backed Securities Loan Facility.8.Includes the book value of the commercial paper, net of amortized costs and related fees, and other investments held by the Commercial PaperFunding Facility LLC.9.Refer to table 4 and the note on consolidation accompanying table 10.10.Refer to table 5 and the note on consolidation accompanying table 10.11.Refer to table 6 and the note on consolidation accompanying table 10.12.Refer to table 7 and the note on consolidation accompanying table 10.13.Refer to table 8.14.Dollar value of foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returnedto the foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank.15.Includes other assets denominated in foreign currencies, which are revalued daily at market exchange rates, accrued dividends on the FederalReserve Bank of New York’s (FRBNY) preferred interests in AIA Aurora LLC and ALICO Holdings LLC, and the fair value adjustment to credit extended by the FRBNY to eligible borrowers through the Term Asset-Backed Securities Loan Facility.16.Estimated.17.Cash value of agreements, which are collateralized by U.S. Treasury securities, federal agency debt securities, and mortgage-backed securities.18.Pending the closing of the recapitalization plan announced by American International Group, Inc. (AIG) on September 30, 2010, the cash proceedsfrom the disposition of certain AIG assets will be held by the FRBNY as agent. At the closing of the recapitalization plan, the proceeds will be used first to repay in full the credit extended to AIG by the FRBNY under the revolving credit facility and then to retire a portion of the FRBNY’s preferred interests in AIA Aurora LLC and ALICO Holdings LLC (preferred interests). Alternatively, if the recapitalization plan is terminated under the terms of the plan, then the proceeds from the initial public offering of AIA and the sale of ALICO will be used to redeem the preferred interests in accordance with the AIA Aurora LLC and ALICO Holdings LLC limited liability company agreements, and any excess proceeds from these transactions, as well as proceeds from the disposition of other assets, will be used to repay the credit extended to AIG under the revolving credit facility.19.Includes the liabilities of Maiden Lane LLC, Maiden Lane II LLC, Maiden Lane III LLC, and TALF LLC to entities other than the Federal ReserveBank of New York, including liabilities that have recourse only to the portfolio holdings of these LLCs. Refer to table 4 through table 7 and the note on consolidation accompanying table 10.Sources: Federal Reserve Banks and the U.S. Department of the Treasury.1A. Memorandum ItemsMillions of dollars Averages of daily figuresWednesday Dec 15, 2010Week ended Dec 15, 2010Change from week ended Dec 8, 2010Dec 16, 2009Memorandum itemMarketable securities held in custody for foreignofficial and international accounts 1 3,337,043- 3,554+ 388,541 3,340,442U.S. Treasury securities 2,606,769- 2,236+ 429,707 2,611,968Federal agency securities 2 730,274- 1,318- 41,167 728,474Securities lent to dealers 9,416- 951+ 522 10,734Overnight facility 39,416- 951+ 522 10,734U.S. Treasury securities8,331- 898+ 330 9,519Federal agency debt securities1,085- 54+ 1921,215Note: Components may not sum to totals because of rounding.1.Face value of the securities. Includes U.S. Treasury STRIPS and other zero-coupon bonds at face value and mortgage-backed securities at originalface value.2.Includes debt and mortgage-backed securities.3.Fully collateralized by U.S. Treasury securities.2. Maturity Distribution of Securities, Loans, and Selected Other Assets and Liabilities, December 15, 2010Millions of dollars Within 15days 16 days to 90 days 91 days to 1 year Over 1 year to 5 years Over 5 years to 10 years Over 10years All Remaining maturityOther loans 121 29 0 45,702 0 ... 45,752U.S. Treasury securities 2Holdings16,005 18,642 55,978 408,543 314,299 154,086 967,553Weekly changes+ 2,907- 3,867+ 2,416- 1,249+ 17,066+ 668+ 17,941Federal agency debt securities 3Holdings424 6,164 36,600 71,752 30,597 2,347 147,884Weekly changes- 294+ 1,953- 740- 1,213 0 0- 294Mortgage-backed securities 4Holdings0 0 0 25 21 1,008,800 1,008,845Weekly changes0 0 0 0 0- 13,807- 13,808Asset-backed securities held byTALF LLC 50 0 0 0 0 0 0Repurchase agreements 6 0 0 ... ... ... ... 0Central bank liquidity swaps 7600 0 0 0 60Reverse repurchase agreements 6 50,816 0 ... ... ... ... 50,816Term deposits 5,113 0 0.........5,113Note: Components may not sum to totals because of rounding.. . . Not applicable.1.Excludes the loans from the Federal Reserve Bank of New York (FRBNY) to Maiden Lane LLC, Maiden Lane II LLC, MaidenLane III LLC, and TALF LLC. The loans were eliminated when preparing the FRBNY’s statement of condition consistent with consolidation under generally accepted accounting principles.2.Face value. For inflation-indexed securities, includes the original face value and compensation that adjusts for the effect of inflation on theoriginal face value of such securities.3.Face value.4.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of theunderlying mortgages.5.Face value of asset-backed securities held by TALF LLC, which is the remaining principal balance of the underlying assets.6.Cash value of agreements.7.Dollar value of foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returned tothe foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank.3. Supplemental Information on Mortgage-Backed Securities Purchase ProgramMillions of dollarsWednesdayAccount nameDec 15, 2010Mortgage-backed securities held outright1 1,008,845 Commitments to buy mortgage-backed securities2 0 Commitments to sell mortgage-backed securities2 0Cash and cash equivalents3 01.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of theunderlying mortgages.2.Current face value. Generally settle within 180 days and include commitments associated with outright transactions, dollar rolls, and coupon swaps.3.This amount is included in other Federal Reserve assets in table 1 and in other assets in table 9 and table 10.4. Information on Principal Accounts of Maiden Lane LLCMillions of dollarsWednesdayAccount nameDec 15, 2010Net portfolio holdings of Maiden Lane LLC1 26,914Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 25,228Accrued interest payable to the Federal Reserve Bank of New York2 609Outstanding principal amount and accrued interest on loan payable to JPMorgan Chase & Co.3 1,3121.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of September 30, 2010. Any assets purchased after this valuation date are initially recorded at cost until their estimated fair value as of the purchase date becomes available.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 10.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends intable 9 and table 10.Note: On June 26, 2008, the Federal Reserve Bank of New York (FRBNY) extended credit to Maiden Lane LLC under the authority of section 13(3)of the Federal Reserve Act. This limited liability company was formed to acquire certain assets of Bear Stearns and to manage those assetsthrough time to maximize repayment of the credit extended and to minimize disruption to financial markets. Payments by Maiden Lane LLC fromthe proceeds of the net portfolio holdings will be made in the following order: operating expenses of the LLC, principal due to the FRBNY, interestdue to the FRBNY, principal due to JPMorgan Chase & Co., and interest due to JPMorgan Chase & Co. Any remaining funds will be paid to the FRBNY.5. Information on Principal Accounts of Maiden Lane II LLCMillions of dollarsWednesdayAccount nameDec 15, 2010Net portfolio holdings of Maiden Lane II LLC1 16,144Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 13,034Accrued interest payable to the Federal Reserve Bank of New York2 444Deferred payment and accrued interest payable to subsidiaries of American International Group, Inc.3 1,0701.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of September 30, 2010. Any assets purchased after this valuation date are initially recorded at cost until their estimated fair value as of the purchase date becomes available.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 10.3.Book value. The deferred payment represents the portion of the proceeds of the net portfolio holdings due to subsidiaries of AmericanInternational Group, Inc. in accordance with the asset purchase agreement. The fair value of this payment and accrued interest payable are included in other liabilities and capital in table 1 and in other liabilities and accrued dividends in table 9 and table 10.Note: On December 12, 2008, the Federal Reserve Bank of New York (FRBNY) began extending credit to Maiden Lane II LLC under the authorityof section 13(3) of the Federal Reserve Act. This limited liability company was formed to purchase residential mortgage-backed securities from the U.S. securities lending reinvestment portfolio of subsidiaries of American International Group, Inc. (AIG subsidiaries). Payments by Maiden Lane II LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of Maiden Lane II LLC, principal due tothe FRBNY, interest due to the FRBNY, and deferred payment and interest due to AIG subsidiaries. Any remaining funds will be shared by the FRBNY and AIG subsidiaries.6. Information on Principal Accounts of Maiden Lane III LLCMillions of dollarsWednesdayAccount nameDec 15, 2010Net portfolio holdings of Maiden Lane III LLC1 23,121Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 13,526Accrued interest payable to the Federal Reserve Bank of New York2 538Outstanding principal amount and accrued interest on loan payable to American International Group, Inc.3 5,3581.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in anorderly market on the measurement date. Revalued quarterly. This table reflects valuations as of September 30, 2010. Any assets purchased after this valuation date are initially recorded at cost until their estimated fair value as of the purchase date becomes available.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent withconsolidation under generally accepted accounting principles. Refer to the note on consolidation accompanying table 10.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends intable 9 and table 10.Note: On November 25, 2008, the Federal Reserve Bank of New York (FRBNY) began extending credit to Maiden Lane III LLC under the authorityof section 13(3) of the Federal Reserve Act. This limited liability company was formed to purchase multi-sector collateralized debt obligations(CDOs) on which the Financial Products group of American International Group, Inc. (AIG) has written credit default swap (CDS) contracts. Inconnection with the purchase of CDOs, the CDS counterparties will concurrently unwind the related CDS transactions. Payments by Maiden LaneIII LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of Maiden Lane III LLC, principal dueto the FRBNY, interest due to the FRBNY, principal due to AIG, and interest due to AIG. Any remaining funds will be shared by the FRBNY andAIG.7. Information on Principal Accounts of TALF LLCMillions of dollarsWednesdayAccount nameDec 15, 2010Asset-backed securities holdings1 0Other investments, net 648Net portfolio holdings of TALF LLC 648Outstanding principal amount of loan extended by the Federal Reserve Bank of New York2 0Accrued interest payable to the Federal Reserve Bank of New York2 0Funding provided by U.S. Treasury to TALF LLC, including accrued interest payable3 1061.Fair value. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in an orderlymarket on the measurement date.2.Book value. This amount was eliminated when preparing the Federal Reserve Bank of New York’s statement of condition consistent with consolidationunder generally accepted accounting principles. Refer to the note on consolidation accompanying table 10.3.Book value. The fair value of these obligations is included in other liabilities and capital in table 1 and in other liabilities and accrued dividends in table 9and table 10.Note: On November 25, 2008, the Federal Reserve announced the creation of the Term Asset-Backed Securities Loan Facility (TALF) under the authority of section 13(3) of the Federal Reserve Act. The TALF is a facility under which the Federal Reserve Bank of New York (FRBNY) extends loans with a term of up to five years to holders of eligible asset-backed securities. The TALF is intended to assist financial markets in accommodating the credit needs of consumers and businesses by facilitating the issuance of asset-backed securities collateralized by a variety of consumer and business loans. The loans provided through the TALF to eligible borrowers are non-recourse, meaning that the obligation of the borrower can be discharged by surrendering the collateral to the FRBNY. The loans are extended for the market value of the security less an amount known as a haircut. As a result, the borrower bears the initial risk of a decline in the value of the security.TALF LLC is a limited liability company formed to purchase and manage any asset-backed securities received by the FRBNY in connection with the decision of a borrower not to repay a TALF loan. TALF LLC has committed, for a fee, to purchase all asset-backed securities received by the FRBNY in conjunction with a TALF loan at a price equal to the TALF loan plus accrued but unpaid interest. Losses on asset-backed securities held by TALF LLC will be offset in the following order: by the commitment fees collected by TALF LLC, by the interest received on investments of TALF LLC, by up to $4.3 billion in subordinated debt funding provided by the U.S. Treasury, and finally, by senior debt funding provided by the FRBNY. Payments by TALF LLC from the proceeds of its net portfolio holdings will be made in the following order: operating expenses of TALF LLC, principal due to the FRBNY, principal due to the U.S. Treasury, interest due to the FRBNY, and interest due to the U.S. Treasury. Any remaining funds will be shared by the FRBNY and the U.S. Treasury.8. Supplemental Information on the Federal Reserve Bank of New York’s Preferred Interests inAIA Aurora LLC and ALICO Holdings LLCMillions of dollarsWednesdayAccount nameDec 15, 2010Preferred interests in AIA Aurora LLC and ALICO Holdings LLC1 26,057Accrued dividends on preferred interests in AIA Aurora LLC and ALICO Holdings LLC2 271Preferred interests in AIA Aurora LLC1 16,676Accrued dividends on preferred interests in AIA Aurora LLC2 174Preferred interests in ALICO Holdings LLC1 9,380Accrued dividends on preferred interests in ALICO Holdings LLC2 98Note: Components may not sum to totals because of rounding.1.Book value.2.This amount is included in other Federal Reserve assets in table 1 and in other assets in table 9 and table 10.Note on preferred interests:In conjunction with the restructuring of the government’s assistance to American International Group, Inc. (AIG) announced March 2, 2009, the outstanding balance and amount available of revolving credit provided to AIG by the FRBNY has been reduced in exchange for preferred interests in two special purpose vehicles, AIA Aurora LLC and ALICO Holdings LLC. These two limited liability companies were created to directly or indirectly hold allof the outstanding common stock of American International Assurance Company Ltd. (AIA) and American Life Insurance Company (ALICO), two life insurance subsidiaries of AIG. AIG will retain control of AIA Aurora LLC and ALICO Holdings LLC, and the FRBNY will have certain consent, disposition, and conversion rights with respect to its preferred interests.Dividends accrue as a percentage of the FRBNY’s preferred interests in AIA Aurora LLC and ALICO Holdings LLC. On a quarterly basis, the accrued dividends are capitalized and added to the FRBNY’s preferred interests in AIA Aurora LLC and ALICO Holdings LLC.9. Consolidated Statement of Condition of All Federal Reserve Banks Millions of dollarsEliminations from consolidationWednesdayDec 15, 2010Change sinceWednesdayDec 8, 2010WednesdayDec 16, 2009Assets, liabilities, and capitalAssetsGold certificate account 11,037 0 0 Special drawing rights certificate account 5,200 0 0 Coin 2,144+ 28+ 99 Securities, repurchase agreements, term auctioncredit, and other loans 2,170,034+ 3,649+ 162,527 Securities held outright1 2,124,282+ 3,839+ 288,802 U.S. Treasury securities 967,553+ 17,941+ 190,988 Bills2 18,423 0 0 Notes and bonds, nominal2 896,578+ 16,099+ 188,929 Notes and bonds, inflation-indexed2 46,506+ 1,630+ 1,863 Inflation compensation3 6,046+ 211+ 195 Federal agency debt securities2 147,884- 294- 9,801 Mortgage-backed securities4 1,008,845- 13,808+ 107,614 Repurchase agreements5 0 0 0 Term auction credit 0 0- 85,832 Other loans 45,752- 190- 40,443 Net portfolio holdings of Commercial PaperFunding Facility LLC6 0 0- 14,039 Net portfolio holdings of Maiden Lane LLC7 26,914- 720+ 336 Net portfolio holdings of Maiden Lane II LLC8 16,144+ 24+ 566 Net portfolio holdings of Maiden Lane III LLC9 23,121+ 25+ 479 Net portfolio holdings of TALF LLC10 648+ 1+ 382 Preferred interests in AIA Aurora LLC and ALICOHoldings LLC11 26,057 0+ 1,057 Items in process of collection (89) 267+ 24- 58 Bank premises 2,223+ 6- 16 Central bank liquidity swaps12 60 0- 14,432 Other assets13 104,702+ 431+ 12,681 Total assets (89) 2,388,550+ 3,466+ 149,582 Note: Components may not sum to totals because of rounding. Footnotes appear at the end of the table.9. Consolidated Statement of Condition of All Federal Reserve Banks (continued) Millions of dollarsEliminations from consolidationWednesdayDec 15, 2010Change sinceWednesdayDec 8, 2010WednesdayDec 16, 2009Assets, liabilities, and capitalLiabilitiesFederal Reserve notes, net of F.R. Bank holdings 938,436+ 908+ 55,049 Reverse repurchase agreements14 50,816+ 797- 6,731 Deposits (0) 1,297,332+ 1,891+ 75,119 Term deposits held by depository institutions 5,113 0+ 5,113 Other deposits held by depository institutions 997,052- 64,204- 76,243 U.S. Treasury, general account 91,641+ 72,052- 40,516 U.S. Treasury, supplementary financing account 199,961+ 2+ 184,961 Foreign official 3,161+ 1+ 1,721 Other (0) 403- 5,961+ 82 Deferred availability cash items (89) 2,311- 13- 334 Other liabilities and accrued dividends15 42,929+ 122+ 22,002Total liabilities (89) 2,331,823+ 3,703+ 145,105Capital accountsCapital paid in 26,832+ 46+ 1,195 Surplus 25,939+ 6+ 4,474 Other capital accounts 3,957- 288- 1,192Total capital 56,728- 236+ 4,477 Note: Components may not sum to totals because of rounding.1.Includes securities lent to dealers under the overnight securities lending facility; refer to table 1A.2.Face value of the securities.pensation that adjusts for the effect of inflation on the original face value of inflation-indexed securities.4.Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Current face value of the securities, which is the remaining principal balance of theunderlying mortgages.5.Cash value of agreements, which are collateralized by U.S. Treasury and federal agency securities.6.Includes the book value of the commercial paper, net of amortized costs and related fees, and other investments held by the Commercial PaperFunding Facility LLC.7.Refer to table 4 and the note on consolidation accompanying table 10.8.Refer to table 5 and the note on consolidation accompanying table 10.9.Refer to table 6 and the note on consolidation accompanying table 10.10.Refer to table 7 and the note on consolidation accompanying table 10.11.Refer to table 8.12.Dollar value of foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returned tothe foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank.13.Includes other assets denominated in foreign currencies, which are revalued daily at market exchange rates, accrued dividends on the FederalReserve Bank of New York’s (FRBNY) preferred interests in AIA Aurora LLC and ALICO Holdings LLC, and the fair value adjustment to credit extended by the FRBNY to eligible borrowers through the Term Asset-Backed Securities Loan Facility.14.Cash value of agreements, which are collateralized by U.S. Treasury securities, federal agency debt securities, and mortgage-backed securities.15.Includes the liabilities of Maiden Lane LLC, Maiden Lane II LLC, Maiden Lane III LLC, and TALF LLC to entities other than the FederalReserve Bank of New York, including liabilities that have recourse only to the portfolio holdings of these LLCs. Refer to table 4 through table 7 and the note on consolidation accompanying table 10. Also includes funds from American International Group, Inc. asset dispositions, held as agent.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Assets: Other Factors Supplying Reserve Other Factorsand account: Liabilities and Capital:Reverse repurchase repurchase Assets: Other: Special Assets: Balances: Gold stock: week average Liabilities and Capital:Reversereserve funi Assets: Other Factors Supplying Reserve Balances:averageDrainingLiabilitiessupplying agreemen drawing rights certificate Capital: Other Factors currency outstanding: week average Liabilities Supplying and Capital: Liabilities: Liabilities:Balances: Currency Liabilities ReserveTreasury TotalReserve and Capital:Reverse week Balances: factors Liabilities: Other F 11043 2200 34566 751293 681523 20908 20908 0 361 11043 2200 35468 795310 723706 21635 21635 0 319 11044 2200 36435 838184 756900 30132 30132 0 268 11041 2200 36540 876436 792055 28577 28577 0 203 11041 2200 38198 903689 816824 30509 30509 0 230 11041 2200 38682 925274 825497 39120 39120 0 248 11041 2200 38674 2270407 888750 84442 84442 0 250 11041 5200 42690 2276237 929539 65714 65714 0 233 11041 5200 43539 2467301 983671 55763 55763 0 184

Liabilities and Capital: Liabilities and Capital: Other Factors Draining Group, Inc. ReserveTotal factors, other agent: week a Liabilities and Capital:Funds from American International ReserveOther liabilities and capital: as than reserve Liabilities: Liabilities and Capital: Other Factors Draining asset dispositions, held week average Other Factors Draining Reserve Balances: Balances: Balances: Reserve balances wit 0 20441 739417 11876 0 20589 784624 10686 0 26619 828834 9350 0 32649 867385 9052 0 36824 896822 6867 0 42832 919600 5674 0 51316 1422586 847821 0 66834 1209500 1066737 26896 73457 1440202 1027099

Download Page Series Description 2002-12-25 2003-12-31 2004-12-29 2005-2009-12-30 2010-12-29

Factors Affecting Reserve Balances (H.4.1) for Oct 13, 2011

Assets: Other Factors Supplying ReserveHeld Outright:held outright:Assets:Held average U.S. Treas Assets: Securities Held Outright: Securities U.S. Treasury securities:Outright: Outright Assets: Securities Securities Held Outright: U.S. Treasury week Held Bills: we Assets: Balances: Reserve Bank credit: week securities: securiti Assets: Securities Held week average Treasury Assets: Securities Securities average Outright: U.S. 703484 629410 629400 226682 389219 12242 1256 746599 666402 666402 244569 406173 13994 1666 788506 717727 717727 262892 436429 16108 2298 826656 744207 744207 271270 449595 19983 3358 852249 778951 778951 277019 467864 30105 3964 873351 754605 754605 241856 470984 36911 4855 2218492 496227 475961 18423 410491 41071 5975 2217306 1846037 776583 18423 707649 44643 5869 2407522 2159177 1010285 18423 937566 48125 6172

Liabilities and Capital: Liabilities and Capital:Deposits with F.R. Banks, Capital:Deposits with otherFactorsreserveBalances Liabilities and Capital: Liabilities and Capital:Deposits with F.R. Banks, reserveandF.R. Banks, Capital:balances Other Factors DrainingLiabilities Balances: Deposits with Liabilities balances:than other thanheld b Liabilities: Liabilities:and Capital:Deposits with F.R.Factorsreserveand DrainingLiabilitie Reserve Liabilities and other than Capital: Liabilities Term deposits reserv Liabilities: Liabilities and other than Capital:balances: balances: Liabilities: OtherBanks, other Other Factors Drain F.R. Banks, Draining Reserve U.S. Trea Other than reserve Reserv 16185 0 4678 0 114 11181 10452 729 212 18375 0 5850 0 99 12108 11829 278 319 14915 0 4631 0 80 9968 9968 0 237 13900 0 4853 0 84 8661 8648 13 303 12435 0 5240 0 92 6837 6837 0 266 11904 0 4910 0 97 6614 6614 0 283 397826 0 114229 263600 505 4386 4386 0 15106 147180 0 118523 11428 2340 3025 3025 0 11863 300230 5113 87472 199963 4149 2355 2355 0 1179

Assets: Securities Held Outright: Federal agency debtLiquidity Facilities: Loans: averageLiquidity Facilities: Loans: Season Assets: Securities Held Outright: Mortgage-backed and Credit Facilities: Loans: Assets: Liquidity Facilities: Loa Assets: Other: Repurchase agreements:securities: week Assets: Credit and Credit and Credit Fa Assets: Liquidity andsecurities: Liquidity and Credit Facilities: Loans: Secondary credit: w Assets: Credit week average week and Primary credit: week average Assets: week average Assets: Liquidity average 10 0 34321 59 0 0 46 0 0 0 0 38679 65 32 0 33 0 0 0 0 31071 54 9 0 45 0 0 0 0 42179 125 51 0 74 0 0 0 0 33036 149 64 0 85 0 0 0 0 39536 4828 4802 0 26 0 0 20266 0 80000 187770 86550 18 4 38924 0 159879 909575 0 88133 18743 956 39 20771 47624 147460 1001432 0 45112 52 15 24 20278 24743