会计学的发展外文参考文献和翻译

会计专业外文文献及译文

外文文献及翻译题目:The Important Of Financial Risk 题目: 财务风险重要性分析The Important Of Financial RiskAbstract:This paper examines the determinants of equity price risk for a large sample of non-financial corporations in the United States from 1964 to 2008. We estimate both structural and reduced form models to examine the endogenous nature of corporate financial characteristics such as total debt, debt maturity, cash holdings, and dividend policy. We find that the observed levels of equity price risk are explained primarily by operating and asset characteristics such as firm age, size, asset tangibility, as well as operating cash flow levels and volatility. In contrast, implied measures of financial risk are generally low and more stable than debt-to-equity ratios. Our measures of financial risk have declined over the last 30 years even as measures of equity volatility (e.g. idiosyncratic risk) have tended to increase. Consequently, documented trends in equity price risk are more than fully accounted for by trends in the riskiness of firms’ assets. Taken together, the results suggest that the typical U.S. firm substantially reduces financial risk by carefully managing financial policies. As a result, residual financial risk now appears negligible relative to underlying economic risk for a typical non-financial firm.Keywords:Capital structure financial risk risk management corporate financeIntroductionThe financial crisis of 2008 has brought significant attention to the effects of financial leverage. There is no doubt that the high levels of debt financing by financial institutions and households significantly contributed to the crisis. Indeed, evidence indicates that excessive leverage orchestrated by major global banks (e.g., through the mortgage lending and collateralized debt obligations) and the so-called “shadow banking system” may be the underlying cause of the recent economic and financial dislocation. Less obvious is the role of financial leverage among nonfinancial firms. To date, problems in the U.S. non-financial sector have been minor compared to the distress in the financial sector despite the seizing of capital markets during the crisis. For example, non-financial bankruptcies have been limited given that the economic decline is the largest since the great depression of the 1930s. In fact, bankruptcy filings of non-financial firms have occurred mostly in U.S. industries (e.g., automotive manufacturing, newspapers, and real estate) that faced fundamental economic pressures prior to the financial crisis. This surprising fact begs the question,。

财务会计论文英文参考文献_论文格式_

财务会计论文英文参考文献下面是小编为你精心编辑整理的财务会计论文英文参考文献,希望对你有所帮助,更多精彩内容,请点击上方相关栏目查看,谢谢!⑴aicpa,1994,"improving business reporting:a customs focus".⑵fasb,,"improving business reporting:insights into enhancing voluntary disclosures".⑶storey and teague,1995,"foundation of accounting theory and policy",the dryden press.⑷previts and merino,1979,"a history of accounting in american",john wilet&son press.⑸scott,1997,"financial accounting theory",prentice-hall publishing company..⑺upton,,"business and financial reporting,challenges from the new economy",fasb.⑻zeff and dharan,1994,"readings and notes on financial accounting:issues and controversies", mcgraw-hill company.外文经典文献:watts , ross , and jerold l. zimmerman. toward a positive theory of determination of accounting standards .the accounting review (jan 1978)watts , ross , and jerold l. zimmerman. positive accounting theory: a ten year perspective. the accounting review (jan 1990) sorter , george h. an event approach to basic accounting theory . the accounting review (jan 1969)wallman,1995.9,1996.6,1996.12,1997.6,"the future of accounting and financial reporting " (i ,ii,iii,iv),accounting horizon.jenson ,m.c. , and w.h. meckling . theory of the firm: managerial behavior, agency costs and ownership structure .journal of financial economics (oct .1976)robert sprouse “developing a concept framework for financial reporting” accounting review, 1988(12) schuetze ,,walter p.”what is an asset ?” account ing horizons,1993(9)samuelson ,richard a. ,”the concept of assets in accounting theory” accounting horizons,1996(9)aaa ,”american accounting association on accounting and auditing measurement:1989-1990” accounting horizons 1991(9) l.todd johnson and kimberley r.petrone “is goodwill an asset?” accounting horizons1998(9)linsmeier, thomas j. and boatsman ,james r. ,”aaa’s financial accounting standard response to iasc ed60 intangible assets” accounting horizons 1998(9)linsmeier, thomas j. and boatsman,jamesr.”response to iasc exposure draft ,’provisions,contingent liabilities and contingent assets’ ” accounting horizons1998(6)l.todd johnson and robert. swieringa “derivatives, hedging and comprehensive income” accounting horizons 1996(11) stephen a. .ze ff ,”the rise of economics concequences”, the journal of accountancy 1978(12)david solomons “the fasb’s conceptual framework:an evaluation ” the journal of accountancy 1986(6)paul miller , “conceptual framework:myths or realities” the journal of accountancy 1985(3)part i financial accounting theorysuggested bedtime readings:1. c.j. lee, lecture note on accounting and capital market2. r. watts and j. zimmerman: positive accounting theory3. w. beaver: revolution of financial reportingalthough these three books are relatively "low-tech" in comparison with the reading assignments, but they provide much useful institutional background to the course. moreover, these books give a good survey of accounting literature, especially in the empirical area.1. financial information and asset market equilibrium*grossman, s. and j. stiglitz, "on the impossibility of informationally efficient markets," american economic review (1980), 393-408.*diamond, d. and r. verrecchia, "information aggregation in a noisy rational expectations economy," journal of financial economics, (1981), 221-35.*milgrom, p. "good news and bad news: representation theorems and applications," bell journal of economics, (1981): 380-91.grinblatt, m. and s. ross, "market power in a securities market with endogenous information," quarterly journal of economics, (1985), 1143-67.2. financial disclosure* verrecchia, r. "discretionary disclosure," journal of accounting and economics (1983),179-94.2dye, r., "proprietary and nonproprietary disclosure," journal of business, 59 (1986), 331-66.dye, r., "mandatory versus voluntary disclosures: the cases of financial and real externalities," accounting review, (1990), 1-24.bhushan, r., "collection of information about public traded firms: theory and evidence," journal of economics and accounting, (1989), 183-206.diamond, d. "optimal release of information by firms," journal of economic theory (1985), 1071-94.。

会计英文文献及翻译

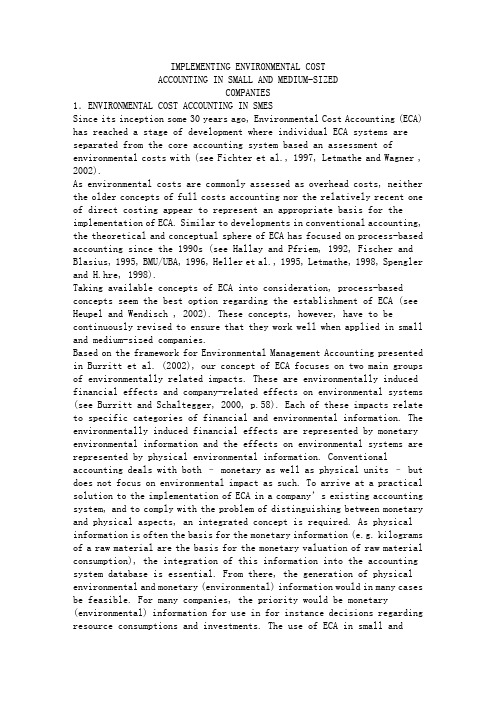

IMPLEMENTING ENVIRONMENTAL COSTACCOUNTING IN SMALL AND MEDIUM-SIZEDCOMPANIES1.ENVIRONMENTAL COST ACCOUNTING IN SMESSince its inception some 30 years ago, Environmental Cost Accounting (ECA) has reached a stage of development where individual ECA systems are separated from the core accounting system based an assessment of environmental costs with (see Fichter et al., 1997, Letmathe and Wagner , 2002).As environmental costs are commonly assessed as overhead costs, neither the older concepts of full costs accounting nor the relatively recent one of direct costing appear to represent an appropriate basis for the implementation of ECA. Similar to developments in conventional accounting, the theoretical and conceptual sphere of ECA has focused on process-based accounting since the 1990s (see Hallay and Pfriem, 1992, Fischer and Blasius, 1995, BMU/UBA, 1996, Heller et al., 1995, Letmathe, 1998, Spengler and H.hre, 1998).Taking available concepts of ECA into consideration, process-based concepts seem the best option regarding the establishment of ECA (see Heupel and Wendisch , 2002). These concepts, however, have to be continuously revised to ensure that they work well when applied in small and medium-sized companies.Based on the framework for Environmental Management Accounting presented in Burritt et al. (2002), our concept of ECA focuses on two main groups of environmentally related impacts. These are environmentally induced financial effects and company-related effects on environmental systems (see Burritt and Schaltegger, 2000, p.58). Each of these impacts relate to specific categories of financial and environmental information. The environmentally induced financial effects are represented by monetary environmental information and the effects on environmental systems are represented by physical environmental information. Conventional accounting deals with both – monetary as well as physical units – but does not focus on environmental impact as such. To arrive at a practical solution to the implementation of E CA in a company’s existing accounting system, and to comply with the problem of distinguishing between monetary and physical aspects, an integrated concept is required. As physical information is often the basis for the monetary information (e.g. kilograms of a raw material are the basis for the monetary valuation of raw material consumption), the integration of this information into the accounting system database is essential. From there, the generation of physical environmental and monetary (environmental) information would in many cases be feasible. For many companies, the priority would be monetary (environmental) information for use in for instance decisions regarding resource consumptions and investments. The use of ECA in small andmedium-sized enterprises (SME) is still relatively rare, so practical examples available in the literature are few and far between. One problem is that the definitions of SMEs vary between countries (see Kosmider, 1993 and Reinemann, 1999). In our work the criteria shown in Table 1 are used to describe small and medium-sized enterprises.Table 1. Criteria of small and medium-sized enterprisesNumber of employees TurnoverUp to 500employees Turnover up to EUR 50mManagement Organization- Owner-cum-entrepreneur -Divisional organization is rare- Varies from a patriarchal management -Short flow of information style in traditional companies and teamwork -Strong personal commitmentin start-up companies -Instruction and controlling with- Top-down planning in old companies direct personal contact- Delegation is rare- Low level of formality- High flexibilityFinance Personnel- family company -easy to survey number of employees- limited possibilities of financing -wide expertise-high satisfaction of employeesSupply chain Innovation-closely involved in local -high potential of innovationeconomic cycles in special fields- intense relationship with customersand suppliersKeeping these characteristics in mind, the chosen ECA approach should be easy to apply, should facilitate the handling of complex structures and at the same time be suited to the special needs of SMEs.Despite their size SMEs are increasingly implementing Enterprise Resource Planning (ERP) systems like SAP R/3, Oracle and Peoplesoft. ERP systems support business processes across organizational, temporal and geographical boundaries using one integrated database. The primary use of ERP systems is for planning and controlling production and administration processes of an enterprise. In SMEs however, they are often individually designed and thus not standardized making the integration of for instance software that supports ECA implementation problematic. Examples could be tools like the “eco-efficiency” approach of IMU (2003) or Umberto (2003) because these solutions work with the database of more comprehensive software solutions like SAP, Oracle, Navision or others. Umberto software for example (see Umberto, 2003) would require large investments and great background knowledge of ECA – which is not available in most SMEs.The ECA approach suggested in this chapter is based on an integrative solution –meaning that an individually developed database is used, and the ECA solution adopted draws on the existing cost accounting procedures in the company. In contrast to other ECA approaches, the aim was to create an accounting system that enables the companies to individually obtain the relevant cost information. The aim of the research was thus to find out what cost information is relevant for the company’s decision on environmental issues and how to obtain it.2.METHOD FOR IMPLEMENTING ECASetting up an ECA system requires a systematic procedure. The project thus developed a method for implementing ECA in the companies that participated in the project; this is shown in Figure 1. During the implementation of the project it proved convenient to form a core team assigned with corresponding tasks drawing on employees in various departments. Such a team should consist of one or two persons from the production department as well as two from accounting and corporate environmental issues, if available. Depending on the stage of the project and kind of inquiry being considered, additional corporate members may be added to the project team to respond to issues such as IT, logistics, warehousing etc.Phase 1: Production Process VisualizationAt the beginning, the project team must be briefed thoroughly on the current corporate situation and on the accounting situation. To this end, the existing corporate accounting structure and the related corporate information transfer should be analyzed thoroughly. Following the concept of an input/output analysis, how materials find their ways into and out of the company is assessed. The next step is to present the flow of material and goods discovered and assessed in a flow model. To ensure the completeness and integrity of such a systematic analysis, any input and output is to be taken into consideration. Only a detailed analysis of material and energy flows from the point they enter the company until they leave it as products, waste, waste water or emissions enables the company to detect cost-saving potentials that at later stages of the project may involve more efficient material use, advanced process reliability and overview, improved capacity loads, reduced waste disposal costs, better transparency of costs and more reliable assessment of legal issues. As a first approach, simplified corporate flow models, standardizedstand-alone models for supplier(s), warehouse and isolated production segments were established and only combined after completion. With such standard elements and prototypes defined, a company can readily develop an integrated flow model with production process(es), production lines or a production process as a whole. From the view of later adoption of the existing corporate accounting to ECA, such visualization helps detect, determine, assess and then separate primary from secondary processes. Phase 2: Modification of AccountingIn addition to the visualization of material and energy flows, modeling principal and peripheral corporate processes helps prevent problems involving too high shares of overhead costs on the net product result. The flow model allows processes to be determined directly or at least partially identified as cost drivers. This allows identifying and separating repetitive processing activity with comparably few options from those with more likely ones for potential improvement.By focusing on principal issues of corporate cost priorities and on those costs that have been assessed and assigned to their causes least appropriately so far, corporate procedures such as preparing bids, setting up production machinery, ordering (raw) material and related process parameters such as order positions, setting up cycles of machinery, and order items can be defined accurately. Putting several partial processes with their isolated costs into context allows principal processes to emerge; these form the basis of process-oriented accounting. Ultimately, the cost drivers of the processes assessed are the actual reference points for assigning and accounting overhead costs. The percentage surcharges on costs such as labor costs are replaced by process parameters measuring efficiency (see Foster and Gupta, 1990).Some corporate processes such as management, controlling and personnel remain inadequately assessed with cost drivers assigned to product-related cost accounting. Therefore, costs of the processes mentioned, irrelevant to the measure of production activity, have to be assessed and surcharged with a conventional percentage.At manufacturing companies participating in the project,computer-integrated manufacturing systems allow a more flexible and scope-oriented production (eco-monies of scope), whereas before only homogenous quantities (of products) could be produced under reasonable economic conditions (economies of scale). ECA inevitably prevents effects of allocation, complexity and digression and becomes a valuable controlling instrument where classical/conventional accounting arrangements systematically fail to facilitate proper decisions. Thus, individually adopted process-based accounting produces potentially valuable information for any kind of decision about internal processing or external sourcing (e.g. make-or-buy decisions).Phase 3: Harmonization of Corporate Data – Compiling and Acquisition On the way to a transparent and systematic information system, it is convenient to check core corporate information systems of procurement and logistics, production planning, and waste disposal with reference to their capability to provide the necessary precise figures for the determined material/energy flow model and for previously identified principal and peripheral processes. During the course of the project, a few modifications within existing information systems were, in most cases, sufficient to comply with these requirements; otherwise, a completely new softwaremodule would have had to be installed without prior analysis to satisfy the data requirements.Phase 4: Database conceptsWithin the concept of a transparent accounting system, process-based accounting can provide comprehensive and systematic information both on corporate material/ energy flows and so-called overhead costs. To deliver reliable figures over time, it is essential to integrate a permanent integration of the algorithms discussed above into the corporate information system(s). Such permanent integration and its practical use may be achieved by applying one of three software solutions (see Figure 2).For small companies with specific production processes, an integrated concept is best suited, i.e. conventional andenvironmental/process-oriented accounting merge together in one common system solution.For medium-sized companies, with already existing integrated production/ accounting platforms, an interface solution to such a system might be suitable. ECA, then, is set up as an independent software module outside the existing corporate ERP system and needs to be fed data continuously. By using identical conventions for inventory-data definitions within the ECA software, misinterpretation of data can be avoided.Phase 5: Training and CoachingFor the permanent use of ECA, continuous training of employees on all matters discussed remains essential. To achieve a long-term potential of improved efficiency, the users of ECA applications and systems must be able to continuously detect and integrate corporate process modifications and changes in order to integrate them into ECA and, later, to process them properly.。

有关会计专业的英文文献

以下是一些与会计专业相关的英文文献的例子:1. "The Role of Accounting in Corporate Governance: A Review of the Literature" - 作者:Scott, William R.这篇文献回顾了会计在企业治理中的作用,讨论了会计信息对企业决策和监管的重要性。

2. "IFRS Adoption and Financial Statement Effects: A Review of the Literature" - 作者:Nobes, Christopher这篇文献回顾了企业采用国际财务报告准则(IFRS)对财务报表的影响研究,探讨了IFRS对会计质量、报表透明度和投资者决策的影响。

3. "The Impact of Auditing on Corporate Governance: A Review of the Literature" - 作者:Abbott, Lawrence J.这篇文献回顾了审计在企业治理中的影响研究,讨论了审计对公司经营绩效、风险管理和内部控制的重要性。

4. "Earnings Management: A Literature Review" - 作者:Healy, Paul M.这篇文献回顾了盈余管理的研究文献,讨论了企业为达到特定目标而操纵财务报表的行为,以及其对投资者、监管机构和公司治理的影响。

5. "The Value Relevance of Accounting Information: A Review of the Literature" - 作者:Ohlson, James A.这篇文献回顾了会计信息的价值相关性研究,探讨了财务报表信息对股票价格、市场价值和投资者决策的影响。

会计学毕业论文中英文资料外文翻译文献

会计学中英文资料外文翻译外文原文Title:Future of SME finance(Background – the environment for SME finance has changedFuture economic recovery will depend on the possibility of Crafts, Trades and SMEs to exploit their potential for growth and employment creation.SMEs make a major contribution to growth and employment in the EU and are at the heart of the Lisbon Strategy, whose main objective is to turn Europe into the most competitive and dynamic knowledge-based economy in the world. However, the ability of SMEs to grow depends highly on their potential to invest in restructuring, innovation and qualification. All of these investments need capital and therefore access to finance.Against this background the consistently repeated complaint of SMEs about their problems regarding access to finance is a highly relevant constraint that endangers the economic recovery of Europe.Changes in the finance sector influence the behavior of credit institutes towards Crafts, Trades and SMEs. Recent and ongoing developments in the banking sector add to the concerns of SMEs and will further endanger their access to finance. The main changes in the banking sector which influence SME finance are:•Globalization and internationalization have increased the competition and the profit orientation in the sector;•worsening of the economic situations in some institutes (burst of the ITC bubble, insolvencies) strengthen the focus on profitability further;•Mergers and restructuring created larger structures and many local branches, which had direct and personalized contacts with small enterprises, were closed;•up-coming implementation of new capital adequacy rules (Basel II) will also change SME business of the credit sector and will increase its administrative costs;•Stricter interpretation of State-Aide Rules by the European Commission eliminates the support of banks by public guarantees; many of the effected banks arevery active in SME finance.All these changes result in a higher sensitivity for risks and profits in the finance sector.The changes in the finance sector affect the accessibility of SMEs to finance.Higher risk awareness in the credit sector, a stronger focus on profitability and the ongoing restructuring in the finance sector change the framework for SME finance and influence the accessibility of SMEs to finance. The most important changes are: •In order to make the higher risk awareness operational, the credit sector introduces new rating systems and instruments for credit scoring;•Risk assessment of SMEs by banks will force the enterprises to present more and better quality information on their businesses;•Banks will try to pass through their additional costs for implementing and running the new capital regulations (Basel II) to their business clients;•due to the increase of competition on interest rates, the bank sector demands more and higher fees for its services (administration of accounts, payments systems, etc.), which are not only additional costs for SMEs but also limit their liquidity;•Small enterprises will lose their personal relationship with decision-makers in local branches –the credit application process will become more formal and anonymous and will probably lose longer;•the credit sector will lose more and more its “public function” to provide access to finance for a wide range of economic actors, which it has in a number of countries, in order to support and facilitate economic growth; the profitability of lending becomes the main focus of private credit institutions.All of these developments will make access to finance for SMEs even more difficult and / or will increase the cost of external finance. Business start-ups and SMEs, which want to enter new markets, may especially suffer from shortages regarding finance. A European Code of Conduct between Banks and SMEs would have allowed at least more transparency in the relations between Banks and SMEs and UEAPME regrets that the bank sector was not able to agree on such a commitment.Towards an encompassing policy approach to improve the access of Crafts, Trades and SMEs to financeAll analyses show that credits and loans will stay the main source of finance forthe SME sector in Europe. Access to finance was always a main concern for SMEs, but the recent developments in the finance sector worsen the situation even more. Shortage of finance is already a relevant factor, which hinders economic recovery in Europe. Many SMEs are not able to finance their needs for investment.Therefore, UEAPME expects the new European Commission and the new European Parliament to strengthen their efforts to improve the framework conditions for SME finance. Europe’s Crafts, Trades and SMEs ask for an encompassing policy approach, which includes not only the conditions for SMEs’ access to lending, but will also strengthen their capacity for internal finance and their access to external risk capital.From UEAPME’s point of view such an encompassing approach should be based on three guiding principles:•Risk-sharing between private investors, financial institutes, SMEs and public sector;•Increase of transparency of SMEs towards their external investors and lenders;•improving the regulatory environment for SME finance.Based on these principles and against the background of the changing environment for SME finance, UEAPME proposes policy measures in the following areas:1. New Capital Requirement Directive: SME friendly implementation of Basel IIDue to intensive lobbying activities, UEAPME, together with other Business Associations in Europe, has achieved some improvements in favour of SMEs regarding the new Basel Agreement on regulatory capital (Basel II). The final agreement from the Basel Committee contains a much more realistic approach toward the real risk situation of SME lending for the finance market and will allow the necessary room for adaptations, which respect the different regional traditions and institutional structures.However, the new regulatory system will influence the relations between Banks and SMEs and it will depend very much on the way it will be implemented into European law, whether Basel II becomes burdensome for SMEs and if it will reduce access to finance for them.The new Capital Accord form the Basel Committee gives the financial marketauthorities and herewith the European Institutions, a lot of flexibility. In about 70 areas they have room to adapt the Accord to their specific needs when implementing it into EU law. Some of them will have important effects on the costs and the accessibility of finance for SMEs.UEAPME expects therefore from the new European Commission and the new European Parliament:•The implementation of the new Capital Requirement Directive will be costly for the Finance Sector (up to 30 Billion Euro till 2006) and its clients will have to pay for it. Therefore, the implementation – especially for smaller banks, which are often very active in SME finance –has to be carried out with as little administrative burdensome as possible (reporting obligations, statistics, etc.).•The European Regulators must recognize traditional instruments for collaterals (guarantees, etc.) as far as possible.•The European Commission and later the Member States should take over the recommendations from the European Parliament with regard to granularity, access to retail portfolio, maturity, partial use, adaptation of thresholds, etc., which will ease the burden on SME finance.2. SMEs need transparent rating proceduresDue to higher risk awareness of the finance sector and the needs of Basel II, many SMEs will be confronted for the first time with internal rating procedures or credit scoring systems by their banks. The bank will require more and better quality information from their clients and will assess them in a new way. Both up-coming developments are already causing increasing uncertainty amongst SMEs.In order to reduce this uncertainty and to allow SMEs to understand the principles of the new risk assessment, UEAPME demands transparent rating procedures –rating procedures may not become a “Black Box” for SMEs:•The bank should communicate the relevant criteria affecting the rating of SMEs.•The bank should inform SMEs about its assessment in order to allow SMEs to improve.The negotiations on a European Code of Conduct between Banks and SMEs , which would have included a self-commitment for transparent rating procedures by Banks, failed. Therefore, UEAPME expects from the new European Commission andthe new European Parliament support for:•binding rules in the framework of the new Capital Adequacy Directive, which ensure the transparency of rating procedures and credit scoring systems for SMEs;•Elaboration of national Codes of Conduct in order to improve the relations between Banks and SMEs and to support the adaptation of SMEs to the new financial environment.3. SMEs need an extension of credit guarantee systems with a special focus on Micro-LendingBusiness start-ups, the transfer of businesses and innovative fast growth SMEs also depended in the past very often on public support to get access to finance. Increasing risk awareness by banks and the stricter interpretation of State Aid Rules will further increase the need for public support.Already now, there are credit guarantee schemes in many countries on the limit of their capacity and too many investment projects cannot be realized by SMEs.Experiences show that Public money, spent for supporting credit guarantees systems, is a very efficient instrument and has a much higher multiplying effect than other instruments. One Euro form the European Investment Funds can stimulate 30 Euro investments in SMEs (for venture capital funds the relation is only 1:2).Therefore, UEAPME expects the new European Commission and the new European Parliament to support:•The extension of funds for national credit guarantees schemes in the framework of the new Multi-Annual Programmed for Enterprises;•The development of new instruments for securitizations of SME portfolios;•The recognition of existing and well functioning credit guarantees schemes as collateral;•More flexibility within the European Instruments, because of national differences in the situation of SME finance;•The development of credit guarantees schemes in the new Member States;•The development of an SBIC-like scheme in the Member States to close the equity gap (0.2 – 2.5 Mio Euro, according to the expert meeting on PACE on April 27 in Luxemburg).•the development of a financial support scheme to encourage the internalizations of SMEs (currently there is no scheme available at EU level:termination of JOP, fading out of JEV).4. SMEs need company and income taxation systems, which strengthen their capacity for self-financingMany EU Member States have company and income taxation systems with negative incentives to build-up capital within the company by re-investing their profits. This is especially true for companies, which have to pay income taxes. Already in the past tax-regimes was one of the reasons for the higher dependence of Europe’s SMEs on bank lending. In future, the result of rating will also depend on the amount of capital in the company; the high dependence on lending will influence the access to lending. This is a vicious cycle, which has to be broken.Even though company and income taxation falls under the competence of Member States, UEAPME asks the new European Commission and the new European Parliament to publicly support tax-reforms, which will strengthen the capacity of Crafts, Trades and SME for self-financing. Thereby, a special focus on non-corporate companies is needed.5. Risk Capital – equity financingExternal equity financing does not have a real tradition in the SME sector. On the one hand, small enterprises and family business in general have traditionally not been very open towards external equity financing and are not used to informing transparently about their business.On the other hand, many investors of venture capital and similar forms of equity finance are very reluctant regarding investing their funds in smaller companies, which is more costly than investing bigger amounts in larger companies. Furthermore it is much more difficult to set out of such investments in smaller companies.Even though equity financing will never become the main source of financing for SMEs, it is an important instrument for highly innovative start-ups and fast growing companies and it has therefore to be further developed. UEAPME sees three pillars for such an approach where policy support is needed:Availability of venture capital•The Member States should review their taxation systems in order to create incentives to invest private money in all forms of venture capital.•Guarantee instruments for equity financing should be further developed.Improve the conditions for investing venture capital into SMEs•The development of secondary markets for venture capital investments inSMEs should be supported.•Accounting Standards for SMEs should be revised in order to ease transparent exchange of information between investor and owner-manager.Owner-managers must become more aware about the need for transparency towards investors•SME owners will have to realise that in future access to external finance (venture capital or lending) will depend much more on a transparent and open exchange of information about the situation and the perspectives of their companies.•In order to fulfil the new needs for transparency, SMEs will have to use new information instruments (business plans, financial reporting, etc.) and new management instruments (risk-management, financial management, etc.).外文资料翻译题目:未来的中小企业融资背景:中小企业融资已经改变未来的经济复苏将取决于能否工艺品,贸易和中小企业利用其潜在的增长和创造就业。

关于会计的英文文献英文

THE DEVELOPMENT OF INTERNAL AUDIT IN SAUDI ARABIA: AN INSTITUTIONAL THEORY PERSPECTIVEThe value of the internal audit functionPrevious studies have utilized a variety of approaches to determine appropriate criteria to evaluate the effectiveness of the internal audit function. For example, considered the degree of compliance with standards as one of the factors which affects internal audit performance. A 1988 research report from the IIA-United Kingdom(IIA-UK,1988)focused on the perceptions of both senior management and external auditors of the value of the internal audit function. The study identified the difficulty of measuring the value of services provided as a major obstacle to such an evaluation. Profitability, cost standards and the effectiveness of resource utilization were identified as measures of the value of services. In its recommendations it highlighted the need to ensure that internal audit work complies with SPPIA.In the US, Albrecht et al.(1988)studied the roles and benefits of the internal audit function and developed a framework for the purpose of evaluating internal audit effectiveness. They found that there were four areas that the directors of internal audit departments could develop to enhance effectiveness: an appropriate corporate environment, top management support, high quality internal audit staff and high quality internal audit work. The authors stressed that management and auditors should recognize the internal audit function as a value-adding function to the organization. In the UK, Ridley and D’Silva (1997) identified the importance of complying with professional standards as the most important contributor to the internal audit function adding value.Compliance with SPPIAA number of studies have focused specifically on the compliance of internal audit departments with SPPIA. Powell et al.(1992) carried out a global survey of IIA members in 11 countries to investigate whether there was evidence of a world-wide internal audit culture. They found an overall compliance rate of 82% with SPPIA.This high percentage prompted the authors to suggest that SPPIA provided evidence of the internationalization of the internal audit profession.A number of studies have focused on the SPPIA standard concerned with independence.Clark et al.(1981) found that the independence of the internal audit department and the level of authority to which internal audit staff report were the two most important criteria influencing the objectivity of their work. Plumlee (1985) focused on potential threats to internal auditor objectivity, particularly whether participation in the design of an internal control system influenced judgements as to the quality and effectiveness of that system. Plumlee found that such design involvement produced bias that could ultimately threaten objectivity.The relationship between the internal audit function and company management more generally is clearly an important factor in determining internal auditor objectivity. Harrell et al. (1989) suggested that perceptions of the views and desires of management could influence the activities and judgement of internal auditors. Also, they found that internal auditors who were members of the IIA were less likely to succumb to such pressure.Ponemon (1991) examined the question of whether or not internal auditors will report sensitive issues uncovered during the course of their work. He concluded that the three factors affecting internal auditor objectivity were their social position in the organization, their relationship with management and the existence of a communication channel to report wrongdoing.Internal audit research in Saudi ArabiaTo date there has been relatively little research about internal audit in the Saudi Arabian corporate sector, exceptions, however, are Asairy (1993)and Woodworth and Said (1996). Asairy (1993)sought to evaluate the effectiveness of internal audit departments in Saudi joint-stock companies. He studied departments in 38 companies using questionnaire responses from the directors of internal audit departments, senior company management, and external auditors. The result of this study revealed that one significant factor in the perceived success of internal audit was its independence from other corporate activities. The service provided by the internal audit department was affected by the support it received from the management, other employees andexternal auditors. The education, training, experience and professional qualifications of the internal auditors influenced the effectiveness of internal audit. On the basis of his study, Asairy (1993) recommended that all joint-stock companies, should have an internal audit function, and that internal auditing should be taught as a separate course in Saudi Universities.Woodworth and Said (1996)sought to ascertain the views of internal auditors in Saudi Arabia as to whether there were differences in the reaction of auditees to specific internal audit situations according to the nationality of the auditee. Based on 34 questionnaire responses from members of the IIA Dhahran chapter, they found there were no significant differences between the different nationalities. The internal auditors did not modify their audit conduct according to the nationality of the auditee and cultural dimensions did not have a significant impact on the results of the audit.Given the importance of complying with SPPIA, the professional and academic literature emphasizes the importance of the relationship between the internal audit department and the rest of the organization in determining the success or otherwise of internal audit departments (Mints,1972;Flesher,1996;Ridley & Chambers,1998 and Moeller & Witt,1999). This literature focuses on the need for co-operation and teamwork between the auditor and auditee if internal auditing is to be effective.Bethea (1992) suggests that the need for good human relations’ skills is important because internal auditing creates negative perceptions and negative attitudes. These issues are particularly important in a multicultural business environment such as Saudi Arabia where there are significant differences in the cultural and educational background of the auditors and auditees Woodworth and Said (1996).ResultsReasons for not having an internal audit departmentOf the 92 company interviews examining the reasons why companies do not have an internal audit function, the most frequent response from 52 companies (57%) was that reliance on the external auditor enabled the company to obtain the benefits that might be obtained from internal audit. Typically, interviewees argued that the external auditor is better, more efficient and saves money. Interviews with theexternal auditors revealed that client companies could not distinguish clearly between the work and roles of internal and external audit. For example, one external auditor said,there is a misperception of what the external auditor does, they think the external auditor does everything for the company and must discover any problem.Having said this, one external auditor doubted that an internal audit function would add value in all circumstances. When referring to the internal control system he stated,as long as they are happy with the final output, I think the internal audit function will not add value. External auditing eventually will highlight any significant internal control weakness.The second most frequent reason mentioned by interviewees (23 firms, 25%) for not operating an internal audit department was the cost/benefit trade-off. Specifically, 17 firms considered that the small size of the company and the limited nature of its activities meant that it would not be efficient for them to have an internal audit department. The external auditors interviewed were of the opinion that the readily identifiable costs as compared with the more difficult to measure benefits was a factor contributing to this decision.A number of other reasons were given by interviewees for not having an internal audit department. As a consequence of the high costs of conducting internal audit activities, 14 firms used employees who were not within a separate internal audit department to carry out internal audit duties. Eight companies did not think there was a need for internal audit because they believed their internal control systems were sufficient to obviate the need for internal audit. Five companies did not think that internal audit was an important activity and three felt that their type of the business did not require internal audit. Three respondents mentioned that they did not operate an internal audit department because professional people could not be found to run the department, and six companies did not provide a reason for not having an internal audit department. In 10 companies an internal audit department had been established but was no longer operating because of difficulties in recruiting qualified personneland changes in the organization structure. Having said this, eight companies without an internal audit department were planning to establish one in the future.The independence of internal audit departmentsCommentators and standard setters identify independence as being a key attribute of the internal audit department. From the questionnaire responses 60 (77%) of the internal audit departments stated that there was a written document defining the purpose, authority and responsibility of the department. In nearly all instances where there was such a document the terms of reference of the internal audit department had been agreed by senior management (93%), the document identified the role of the internal audit department in the organization, and its rights of access to individuals, records and assets (97%), and the document set out the scope of internal auditing (90%). Respondents were asked to assess the extent to which the relevant document was consistent with the specific requirements of SPPIA. In those departments where such a document existed 27 (45%) claimed full compliance with SPPIA, 23 (38%) considered their document to be partially consistent with SPPIA. In more thanone-third of the departments surveyed either no such document existed (n=18, 23%) or the respondent was not aware whether or not the document complied with SPPIA (n=10, 13%).SPPIA suggests that independence is enhanced when t he organization’s board of directors concurs with the appointment or removal of the director of the internal audit department, and that the director of the internal audit department is responsible to an individual of suitable seniority within the organization. It is noticeable that in 47 companies (60%) their responsibilities with regard to appointment, removal and the receipt of reports lay with non-senior management, normally a general manager. SPPIA recommends that the director of the internal audit department should have direct communication with the board of directors to ensure that the department is independent, and provides a means for the director of internal auditing and the board of directors to keep each other informed on issues of mutual interest. The interviews with directors of internal audit departments showed that departments tended to report to general managers rather than the board of directors. Further evidence of the lack ofaccess to the board of directors was provided by the questionnaire responses showing that in almost half the companies, members of the internal audit department have never attended board meetings and in only two companies did attendance take place regularly.Unrestricted access to documentation and unfettered powers of enquiry are important aspects of the independence and effectiveness of internal audit. The questionnaire responses revealed that 34 (44%) internal audit directors considered that they did not have full access to all necessary information. Furthermore, a significant minority (n=11, 14%) did not believe they were free, in all instances, to report faults, frauds, wrongdoing or mistakes. A slightly higher number (n=17, 22%) considered that the internal audit function did not always receive consistent support from senior management.SPPIA identifies that involvement in the design, installation and operating of systems is likely to impair internal auditor objectivity. Respondents were asked how often management requested the assistance of the internal audit department in the performance of non-audit duties. In 37 internal audit departments (47%) surveyed such requests were made sometimes, often or always, and only 27 (35%) departments never participated in these non-audit activities. The interviews revealed that in some organizations internal audit staff was used regularly to cover for staff shortages in other departments.。

关于会计的英文文献原文(带中文翻译)

The Optimization Method of Financial Statements Based on Accounting Management TheoryABSTRACTThis paper develops an approach to enhance the reliability and usefulness of financial statements. International Financial Reporting Standards (IFRS) was fundamentally flawed by fair value accounting and asset-impairment accounting. According to legal theory and accounting theory, accounting data must have legal evidence as its source document. The conventional “mixed attribute” accounting system should be re placed by a “segregated” system with historical cost and fair value being kept strictly apart in financial statements. The proposed optimizing method will significantly enhance the reliability and usefulness of financial statements.I.. INTRODUCTIONBased on international-accounting-convergence approach, the Ministry of Finance issued the Enterprise Accounting Standards in 2006 taking the International Financial Reporting Standards (hereinafter referred to as “the International Standards”) for reference. The Enterprise Accounting Standards carries out fair value accounting successfully, and spreads the sense that accounting should reflect market value objectively. The objective of accounting reformation following-up is to establish the accounting theory and methodology which not only use international advanced theory for reference, but also accord with the needs of China's socialist market economy construction. On the basis of a thorough evaluation of the achievements and limitations of International Standards, this paper puts forward a stand that to deepen accounting reformation and enhance the stability of accounting regulations.II. OPTIMIZA TION OF FINANCIAL STATEMENTS SYSTEM: PARALLELING LISTING OF LEGAL FACTS AND FINANCIAL EXPECTA TIONAs an important management activity, accounting should make use of information systems based on classified statistics, and serve for both micro-economic management and macro-economic regulation at the same time. Optimization of financial statements system should try to take all aspects of the demands of the financial statements in both macro and micro level into account.Why do companies need to prepare financial statements? Whose demands should be considered while preparing financial statements? Those questions are basic issues we should consider on the optimization of financial statements. From the perspective of "public interests", reliability and legal evidence are required as qualitative characters, which is the origin of the traditional "historical cost accounting". From the perspective of "private interest", security investors and financial regulatory authoritieshope that financial statements reflect changes of market prices timely recording "objective" market conditions. This is the origin of "fair value accounting". Whether one set of financial statements can be compatible with these two different views and balance the public interest and private interest? To solve this problem, we design a new balance sheet and an income statement.From 1992 to 2006, a lot of new ideas and new perspectives are introduced into China's accounting practices from international accounting standards in a gradual manner during the accounting reform in China. These ideas and perspectives enriched the understanding of the financial statements in China. These achievements deserve our full assessment and should be fully affirmed. However, academia and standard-setters are also aware that International Standards are still in the process of developing .The purpose of proposing new formats of financial statements in this paper is to push forward the accounting reform into a deeper level on the basis of international convergence.III. THE PRACTICABILITY OF IMPROVING THE FINANCIAL STATEMENTS SYSTEMWhether the financial statements are able to maintain their stability? It is necessary to mobilize the initiatives of both supply-side and demand-side at the same time. We should consider whether financial statements could meet the demands of the macro-economic regulation and business administration, and whether they are popular with millions of accountants.Accountants are responsible for preparing financial statements and auditors are responsible for auditing. They will benefit from the implementation of the new financial statements.Firstly, for the accountants, under the isolated design of historical cost accounting and fair value accounting, their daily accounting practice is greatly simplified. Accounting process will not need assets impairment and fair value any longer. Accounting books will not record impairment and appreciation of assets any longer, for the historical cost accounting is comprehensively implemented. Fair value information will be recorded in accordance with assessment only at the balance sheet date and only in the annual financial statements. Historical cost accounting is more likely to be recognized by the tax authorities, which saves heavy workload of the tax adjustment. Accountants will not need to calculate the deferred income tax expense any longer, and the profit-after-tax in the solid line table is acknowledged by the Company Law, which solves the problem of determining the profit available for distribution.Accountants do not need to record the fair value information needed by security investors in the accounting books; instead, they only need to list the fair value information at the balance sheet date. In addition, because the data in the solid line table has legal credibility, so the legal risks of accountants can be well controlled. Secondly, the arbitrariness of the accounting process will be reduced, and the auditors’ review process will be greatly simplified. The independent auditors will not have to bear the considerable legal risk for the dotted-line table they audit, because the risk of fair value information has been prompted as "not supported by legalevidences". Accountants and auditors can quickly adapt to this financial statements system, without the need of training. In this way, they can save a lot of time to help companies to improve management efficiency. Surveys show that the above design of financial statements is popular with accountants and auditors. Since the workloads of accounting and auditing have been substantially reduced, therefore, the total expenses for auditing and evaluation will not exceed current level as well.In short, from the perspectives of both supply-side and demand-side, the improved financial statements are expected to enhance the usefulness of financial statements, without increase the burden of the supply-side.IV. CONCLUSIONS AND POLICY RECOMMENDATIONSThe current rule of mixed presentation of fair value data and historical cost data could be improved. The core concept of fair value is to make financial statements reflect the fair value of assets and liabilities, so that we can subtract the fair value of liabilities from assets to obtain the net fair value.However, the current International Standards do not implement this concept, but try to partly transform the historical cost accounting, which leads to mixed using of impairment accounting and fair value accounting. China's accounting academic research has followed up step by step since 1980s, and now has already introduced a mixed-attributes model into corporate financial statements.By distinguishing legal facts from financial expectations, we can balance public interests and private interests and can redesign the financial statements system with enhancing management efficiency and implementing higher-level laws as main objective. By presenting fair value and historical cost in one set of financial statements at the same time, the statements will not only meet the needs of keeping books according to domestic laws, but also meet the demand from financial regulatory authorities and security investorsWe hope that practitioners and theorists offer advices and suggestions on the problem of improving the financial statements to build a financial statements system which not only meets the domestic needs, but also converges with the International Standards.基于会计管理理论的财务报表的优化方法摘要本文提供了一个方法,以提高财务报表的可靠性和实用性。

会计学毕业论文外文文献及翻译

LNTU---Acc附录A国际会计准则第 37 号或有负债和或有资产目的本准则的目的是确保将适当的确认标准和计量基础运用于准备、或有负债和或有资产,并确保在财务报表的附注中披露充分的信息,以使使用者能够理解它们的性质、时间和金额。

范围1.本准则适用于所有企业对以下各项之外的准备、或有负债和或有资产的会计核算:(1)以公允价值计量的金融工具形成的准备、或有负债和或有资产:(2)执行中的合同(除了亏损的执行中的合同)形成的准备、或有负债和或有资产;(3)保险公司与保单持有人之间签订的合同形成的准备、或有负债和或有资产;(4)由其他国际会计准则规范的准备、或有负债和或有资产。

2.本准则适用于不是以公允价值计量的金融工具(包括担保)。

3.执行中的合同是指双方均未履行任何义务或双方均同等程度地履行了部分义务的合同。

本准则不适用于执行中的合同,除非它是亏损的。

4.本准则适用于保险公司的准备、或有负债和或有资产,但不适用于其与保单持有人之间签订的合同形成的准备、或有负债和或有资产。

5.如果其他国际会计准则规范了特定的准备、或有负债和或有资产,企业应运用该准则而不是本准则,例如,关于以下项目的准则也规范了特定的准备:(1)建造合同(参见《国际会计准则第11号建造合同》);(2)所得税(参见《国队会计准则第12号所得税》);(3)租赁(参见《国际会计准则第17 号租赁》),但是,《国际会计准则第17 号》未对已变为亏损的经营租质的核算提出具体要求,因而本准则应适用于这些情况;(4)雇员福利(参见《国际会计准则第19号一雇员福利》)。

6.一些作为准备处理的金额可能与收入的确认有关,例如企业提供担保以收取费用,本准则不涉及收入确认,《国际会计准则第18 号收入》明确了收入确认标准,并就确认标准的应用提供了实务指南,本准则不改变《国际会计准则第18 号》的规定。

7.本准则将准备定义为时间或金额不确定的负债,在某些国家,“准备”也与一些项目相联系使用,例如折旧,资产减值和坏账:这些是对资产账面金额的调整,本准则不涉及。

外文参考文献(带中文翻译)

外文资料原文涂敏之会计学 8051208076Title:Future of SME finance(c)Background – the environment for SME finance has changedFuture economic recovery will depend on the possibility of Crafts, Trades and SMEs to exploit their potential for growth and employment creation.SMEs make a major contribution to growth and employment in the EU and are at the heart of the Lisbon Strategy, whose main objective is to turn Europe into the most competitive and dynamic knowledge-based economy in the world. However, the ability of SMEs to grow depends highly on their potential to invest in restructuring, innovation and qualification. All of these investments need capital and therefore access to finance.Against this background the consistently repeated complaint of SMEs about their problems regarding access to finance is a highly relevant constraint that endangers the economic recovery of Europe.Changes in the finance sector influence the behavior of credit institutes towards Crafts, Trades and SMEs. Recent and ongoing developments in the banking sector add to the concerns of SMEs and will further endanger their access to finance. The main changes in the banking sector which influence SME finance are:•Globalization and internationalization have increased the competition and the profit orientation in the sector;•worsening of the economic situations in some institutes (burst of the ITC bubble, insolvencies) strengthen the focus on profitability further;•Mergers and restructuring created larger structures and many local branches, which had direct and personalized contacts with small enterprises, were closed;•up-coming implementation of new capital adequacy rules (Basel II) will also change SME business of the credit sector and will increase its administrative costs;•Stricter interpretation of State-Aide Rules by the European Commission eliminates the support of banks by public guarantees; many of the effected banks are very active in SME finance.All these changes result in a higher sensitivity for risks and profits in the financesector.The changes in the finance sector affect the accessibility of SMEs to finance.Higher risk awareness in the credit sector, a stronger focus on profitability and the ongoing restructuring in the finance sector change the framework for SME finance and influence the accessibility of SMEs to finance. The most important changes are: •In order to make the higher risk awareness operational, the credit sector introduces new rating systems and instruments for credit scoring;•Risk assessment of SMEs by banks will force the enterprises to present more and better quality information on their businesses;•Banks will try to pass through their additional costs for implementing and running the new capital regulations (Basel II) to their business clients;•due to the increase of competition on interest rates, the bank sector demands more and higher fees for its services (administration of accounts, payments systems, etc.), which are not only additional costs for SMEs but also limit their liquidity;•Small enterprises will lose their personal relationship with decision-makers in local branches –the credit application process will become more formal and anonymous and will probably lose longer;•the credit sector will lose more and more i ts “public function” to provide access to finance for a wide range of economic actors, which it has in a number of countries, in order to support and facilitate economic growth; the profitability of lending becomes the main focus of private credit institutions.All of these developments will make access to finance for SMEs even more difficult and / or will increase the cost of external finance. Business start-ups and SMEs, which want to enter new markets, may especially suffer from shortages regarding finance. A European Code of Conduct between Banks and SMEs would have allowed at least more transparency in the relations between Banks and SMEs and UEAPME regrets that the bank sector was not able to agree on such a commitment.Towards an encompassing policy approach to improve the access of Crafts, Trades and SMEs to financeAll analyses show that credits and loans will stay the main source of finance for the SME sector in Europe. Access to finance was always a main concern for SMEs, but the recent developments in the finance sector worsen the situation even more.Shortage of finance is already a relevant factor, which hinders economic recovery in Europe. Many SMEs are not able to finance their needs for investment.Therefore, UEAPME expects the new European Commission and the new European Parliament to strengthen their efforts to improve the framework conditions for SME finance. Europe’s Crafts, Trades and SMEs ask for an encompassing policy approach, which includes not only the conditions for SMEs’ access to l ending, but will also strengthen their capacity for internal finance and their access to external risk capital.From UEAPME’s point of view such an encompassing approach should be based on three guiding principles:•Risk-sharing between private investors, financial institutes, SMEs and public sector;•Increase of transparency of SMEs towards their external investors and lenders;•improving the regulatory environment for SME finance.Based on these principles and against the background of the changing environment for SME finance, UEAPME proposes policy measures in the following areas:1. New Capital Requirement Directive: SME friendly implementation of Basel IIDue to intensive lobbying activities, UEAPME, together with other Business Associations in Europe, has achieved some improvements in favour of SMEs regarding the new Basel Agreement on regulatory capital (Basel II). The final agreement from the Basel Committee contains a much more realistic approach toward the real risk situation of SME lending for the finance market and will allow the necessary room for adaptations, which respect the different regional traditions and institutional structures.However, the new regulatory system will influence the relations between Banks and SMEs and it will depend very much on the way it will be implemented into European law, whether Basel II becomes burdensome for SMEs and if it will reduce access to finance for them.The new Capital Accord form the Basel Committee gives the financial market authorities and herewith the European Institutions, a lot of flexibility. In about 70 areas they have room to adapt the Accord to their specific needs when implementing itinto EU law. Some of them will have important effects on the costs and the accessibility of finance for SMEs.UEAPME expects therefore from the new European Commission and the new European Parliament:•The implementation of the new Capital Requirement Directive will be costly for the Finance Sector (up to 30 Billion Euro till 2006) and its clients will have to pay for it. Therefore, the implementation – especially for smaller banks, which are often very active in SME finance –has to be carried out with as little administrative burdensome as possible (reporting obligations, statistics, etc.).•The European Regulators must recognize traditional instruments for collaterals (guarantees, etc.) as far as possible.•The European Commission and later the Member States should take over the recommendations from the European Parliament with regard to granularity, access to retail portfolio, maturity, partial use, adaptation of thresholds, etc., which will ease the burden on SME finance.2. SMEs need transparent rating proceduresDue to higher risk awareness of the finance sector and the needs of Basel II, many SMEs will be confronted for the first time with internal rating procedures or credit scoring systems by their banks. The bank will require more and better quality information from their clients and will assess them in a new way. Both up-coming developments are already causing increasing uncertainty amongst SMEs.In order to reduce this uncertainty and to allow SMEs to understand the principles of the new risk assessment, UEAPME demands transparent rating procedures –rating procedures may not become a “Black Box” for SMEs: •The bank should communicate the relevant criteria affecting the rating of SMEs.•The bank should inform SMEs about its assessment in order to allow SMEs to improve.The negotiations on a European Code of Conduct between Banks and SMEs , which would have included a self-commitment for transparent rating procedures by Banks, failed. Therefore, UEAPME expects from the new European Commission and the new European Parliament support for:•binding rules in the framework of the new Capital Adequacy Directive,which ensure the transparency of rating procedures and credit scoring systems for SMEs;•Elaboration of national Codes of Conduct in order to improve the relations between Banks and SMEs and to support the adaptation of SMEs to the new financial environment.3. SMEs need an extension of credit guarantee systems with a special focus on Micro-LendingBusiness start-ups, the transfer of businesses and innovative fast growth SMEs also depended in the past very often on public support to get access to finance. Increasing risk awareness by banks and the stricter interpretation of State Aid Rules will further increase the need for public support.Already now, there are credit guarantee schemes in many countries on the limit of their capacity and too many investment projects cannot be realized by SMEs.Experiences show that Public money, spent for supporting credit guarantees systems, is a very efficient instrument and has a much higher multiplying effect than other instruments. One Euro form the European Investment Funds can stimulate 30 Euro investments in SMEs (for venture capital funds the relation is only 1:2).Therefore, UEAPME expects the new European Commission and the new European Parliament to support:•The extension of funds for national credit guarantees schemes in the framework of the new Multi-Annual Programmed for Enterprises;•The development of new instruments for securitizations of SME portfolios;•The recognition of existing and well functioning credit guarantees schemes as collateral;•More flexibility within the European Instruments, because of national differences in the situation of SME finance;•The development of credit guarantees schemes in the new Member States;•The development of an SBIC-like scheme in the Member States to close the equity gap (0.2 – 2.5 Mio Euro, according to the expert meeting on PACE on April 27 in Luxemburg).•the development of a financial support scheme to encourage the internalizations of SMEs (currently there is no scheme available at EU level: termination of JOP, fading out of JEV).4. SMEs need company and income taxation systems, whichstrengthen their capacity for self-financingMany EU Member States have company and income taxation systems with negative incentives to build-up capital within the company by re-investing their profits. This is especially true for companies, which have to pay income taxes. Already in the past tax-regimes was one of the reasons for the higher dependence of Europe’s SMEs on bank lending. In future, the result of rating w ill also depend on the amount of capital in the company; the high dependence on lending will influence the access to lending. This is a vicious cycle, which has to be broken.Even though company and income taxation falls under the competence of Member States, UEAPME asks the new European Commission and the new European Parliament to publicly support tax-reforms, which will strengthen the capacity of Crafts, Trades and SME for self-financing. Thereby, a special focus on non-corporate companies is needed.5. Risk Capital – equity financingExternal equity financing does not have a real tradition in the SME sector. On the one hand, small enterprises and family business in general have traditionally not been very open towards external equity financing and are not used to informing transparently about their business.On the other hand, many investors of venture capital and similar forms of equity finance are very reluctant regarding investing their funds in smaller companies, which is more costly than investing bigger amounts in larger companies. Furthermore it is much more difficult to set out of such investments in smaller companies.Even though equity financing will never become the main source of financing for SMEs, it is an important instrument for highly innovative start-ups and fast growing companies and it has therefore to be further developed. UEAPME sees three pillars for such an approach where policy support is needed:Availability of venture capital•The Member States should review their taxation systems in order to create incentives to invest private money in all forms of venture capital.•Guarantee instruments for equity financing should be further developed.Improve the conditions for investing venture capital into SMEs•The development of secondary markets for venture capital investments in SMEs should be supported.•Accounting Standards for SMEs should be revised in order to easetransparent exchange of information between investor and owner-manager.Owner-managers must become more aware about the need for transparency towards investors•SME owners will have to realise that in future access to external finance (venture capital or lending) will depend much more on a transparent and open exchange of information about the situation and the perspectives of their companies.•In order to fulfil the new needs for transparency, SMEs will have to use new information instruments (business plans, financial reporting, etc.) and new management instruments (risk-management, financial management, etc.).外文资料翻译涂敏之会计学 8051208076题目:未来的中小企业融资背景:中小企业融资已经改变未来的经济复苏将取决于能否工艺品,贸易和中小企业利用其潜在的增长和创造就业。

会计类英文参考文献