andUncoveredInterestRateParity(国际金融(香港.pptx

购买力平价理论与利率平价理论

购买力平价理论与利率平价理论1. 购买力平价理论(Theory of Purchasing Power Parity,简称PPP理论)1916年瑞典经济学家卡塞尔(Gustav Cassel)在总结前人学术理论的基础上,系统地提出:两国货币的汇率主要是由两国货币的购买力决定的。

这一理论被称为购买力平价理论(Theory ofPurchasing Power Parity,简称PPP理论)。

购买力评价说分为两种形式:绝对购买力平价(AbsolutePPP)和相对购买力平价(Relative PPP)。

绝对购买力平价讣为:一国货币的价值及对它的需求是由单位货币在国内所能买到的商品和劳务的量决定的,即由它的购买力决定的,因此两国货币之间的汇率可以表示为两国货币的购买力之比。

而购买力的大小是通过物价水平体现出来的。

根据这一关系式,本国物价上涨将意味着本国货币相对外国货币的贬值。

相对购买力平价弥补了绝对购买力平价一些不足的方面。

它的主要观点可以简单地表述为:两国货币的汇率水平将根据两国通胀率的差异而进行相应地调整。

它表明两国间的相对通货膨胀决定两种货币间的均衡汇率。

从总体上看,购买力平价理论较为合理地解释了汇率的决定基础,虽然它忽略了国际资本流劢等其他因素对汇率的影响,该学说至尽仍受到西方经济学者的重视,在基础分析中被广泛地应用于预测汇率走势的数学模型。

购买力平价理论是以研究和比较各国不同的货币之间购买力关系的理论。

瑞典学者较早就研究了购买力平价方面的问题。

瑞典于1745--1777年曾脱离铸币平价而实行过浮劢汇率,此后汇率剧烈波劢。

政府企图通过干预保持汇率的稳定,但屡遭失败。

另外,由于瑞典参加了长达7年的英法战争,使国内通货膨胀加剧。

在这种背景下,以克里斯蒂尔尼为代表的非官方经济学家提出了汇率贬值是因货币购买力下降所致的观点。

这是购买力平价的早期观点。

购买力平价理论讣为,人们对外国货币的需求是由于用它可以购买外国的商品和劳务,外国人需要其本国货币也是因为用它可以购买其国内的商品和劳务。

如何理解利率平价理论(uncovered)中利率和汇率的关系

如何理解利率平价理论(uncovered)中利率和汇率的关系?【周召的回答(6票)】:在汇率不管制的情况下,利率高的国家远期不贬值才见鬼了呢利率高,外汇流入增加,根据供求,本币即期汇率当然走高,但远期游资热钱总要撤离的吧?那么在未来的某个时间,一定会有大量的本币遭到抛售,在这种预期下本币的远期汇率当然要下降,即贬值。

这涉及到一个外汇掉期抵补套利的问题。

以天朝为例,想想看,如果中国资本项不是管制的,外资进出自由,特别是在国外量化宽松利率降无可降的情况下,而国内利率又高涨,肯定会有大量的游资想进入中国,而中国过去8年来又处于汇率上升通道,也就是说,理论上就可以从国外借便宜的钱来中国赚高利息,然后人民币又在升值,远期汇率上升撤出中国时汇率又升了又可以赚一道,赤裸裸地套利。

【runzeZheng的回答(15票)】:很好的问题。

汇率和利率的几个平价关系理论和假说很复杂,一般只有抛补的(Covered)利率平价才是成立的。

未抛补的(Uncovered)利率平价其实是一个假说,而且实际上很少成立。

1. 先解释“未抛补利率平价假说” Uncovered Interest Rate Parity Hypothesis未抛补利率平价假说可以表示为:其中表示某期限的外国利率,表示某期限的本国利率;表示1元本币能兑换多少外币,上升表示1元本币能换到的外币增加了、也就是外币贬值,上标e表示预期未来的情况,而表示在式子中对应的利率到期时,即期汇率的变化百分比。

恰如题主所问:假如外币利率高,未抛补利率平价岂不是告诉我们外币未来要贬值(注意是未来要贬值,贬值的时间=利率的期限)?是的,的确如此,否则有超额报酬!假设现在即期利率是1本币=100外币;一年期外国利率=4%,一年期本国利率=1%。

投资100元本币、比较两种投资策略:1) 存国内一年,一年后获得100*(1+1%)=101元;2) 存国外一年,现在换成10,000元外币,一年后变成外币10,400元,而一年后的即期汇率是。

国际金融(双语)复习大纲

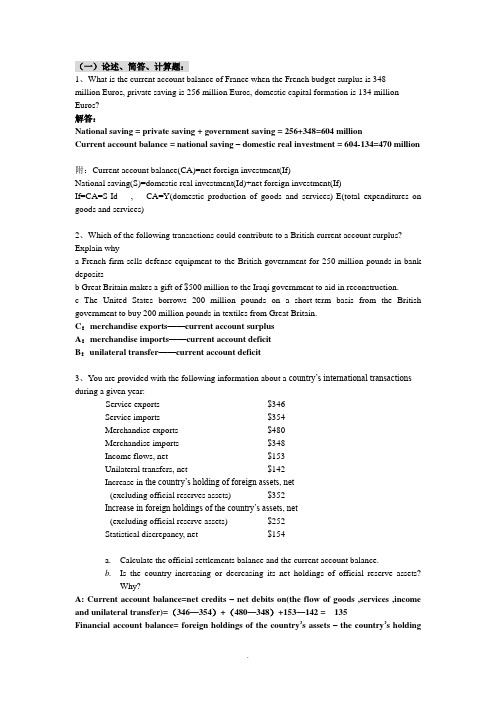

(一)论述、简答、计算题:1、What is the current account balance of France when the French budget surplus is 348million Euros, private saving is 256 million Euros, domestic capital formation is 134 million Euros?解答:National saving = private saving + government saving = 256+348=604 millionCurrent account balance = national saving – domestic real investment = 604-134=470 million附:Current account balance(CA)=net foreign investment(If)National saving(S)=domestic real investment(Id)+net foreign investment(If)If=CA=S-Id , CA=Y(domestic production of goods and services)-E(total expenditures on goods and services)2、Which of the following transactions could contribute to a British current account surplus? Explain whya French firm sells defense equipment to the British government for 250 million pounds in bank depositsb Great Britain makes a gift of $500 million to the Iraqi government to aid in reconstruction.c The United States borrows 200 million pounds on a short-term basis from the British government to buy 200 million pounds in textiles from Great Britain.C:merchandise exports——current account surplusA:merchandise imports——current account deficitB:unilateral transfer——current account deficit3、You are provided with the following information about a country’s international transactions during a given year:Service exports $346Service imports $354Merchandise exports $480Merchandise imports $348Income flows, net $153Unilateral transfers, net $142Increase in the country’s holding of foreign assets, net(excluding official reserves assets) $352Increase in foreign holdings of the country’s assets, net(excluding official reserve assets) $252Statistical discrepancy, net $154a.Calculate the official settlements balance and the current account balance.b.Is the country increasing or decreasing its net holdings of official reserve assets?Why?A: Current account balance=net credits – net debits on(the flow of goods ,services ,income and unilateral transfer)=(346—354)+(480—348)+153—142 = 135Financial account balance= foreign holdings of the country’s assets – the country’s holdingof foreign assets =—352 + 252 = —100So, official settlement balance(B)=CA balance + financial account balance= 135 —100=35B: Current account balance = 132—8+153—142=135B = CA + FA = 135 + (—100)= 35B + OR + Statistical discrepancy = 0OR = —1894、For each case below, state whether the euro has appreciated or depreciated and give an exampleof an event that could cause the change in the exchange rate.a.The spot rate goes from 450 euros/Mexican peso to 440 euros/Mexican peso.b.The spot rate goes from 0.011 Mexican pesos/euro to 0.006 Mexican pesos/euro.c.The spot rate goes from 1.48 euros/British pound to 1.51 euros/British pound.d.The spot rate goes from 0.73 British pounds/euro to 0.75 British pounds/euro.A: indirect quotation, euro appreciatedB: direct quotation, euro depreciatedC: indirect quotation, euro depreciatedD: direct quotation, euro appreciated5、What are the two forms of interbank foreign exchange trading? Compare and contrasthe similarities and differences of the two forms.Form 1 Interbank trading is conducted directly between the traders at different banksForm 2 Interbank trading are conducted through foreign exchange brokerSimilarities: Both are making the foreign exchange trades.Differences:①Form1,the traders know to whom they are quoting exchange rates for possible。

第10讲Covered and Uncovered Interest Rate Parity(国际金融(香港大学,WONG Ka Fu)11.0汇总

Expected rate of return on a foreign asset Et { [(et+1 / et ) (Pt+1* + Dt+1* ) / Pt* ] - 1 } = Et [(et+1 / et ) (Pt+1* + Dt+1* ) ] / Pt* - 1

19

RHS = [Et (et+1 ) - et ] / et + Rt*

Suppose Et (et+1 ) and et fixed, larger Rt* implies larger RHS

20

Uncovered Interest Parity

Suppose we care only about expected return (say, we are risk neutral) Deposit in home currency if and only if the rate of return on the deposit in home currency is not less than the deposit in foreign currency Rt [Et (et+1 ) - et ] / et + Rt* Equilibrium if Rt = [Et (et+1 ) - et ] / et + Rt*

uncovered interest parity 公式

uncovered interest parity 公式

无套利利率平价(Uncovered Interest Parity,UIP)是一种国际金融理论,用于描述汇率和利率之间的关系。

根据无套利利率平价理论,投资者在国际货币市场上没有套利机会,即外汇市场利率与利率之间的差异应该等于预期汇率变动的比例。

无套利利率平价公式可以表示为:

\[ E(S_{t+1}) = S_t \times \left(1 + \frac{r_d}{100}\right) \times \left(1 + \frac{r_f}{100}\right) \]

其中:

- \( E(S_{t+1}) \) 是未来某一时刻的预期汇率;

- \( S_t \) 是当前时刻的即期汇率;

- \( r_d \) 是国内货币的利率;

- \( r_f \) 是外国货币的利率。

这个公式表达了以下关系:未来预期汇率等于当前汇率乘以国内货币利率和外国货币利率之比。

需要注意的是,虽然无套利利率平价理论在理论上是成立的,但实际情况中存在许多因素可能导致汇率和利率之间的偏差。

因此,在实际操作中,投资者需要综合考虑各种因素,而不仅仅依赖于无套利利率平价理论。

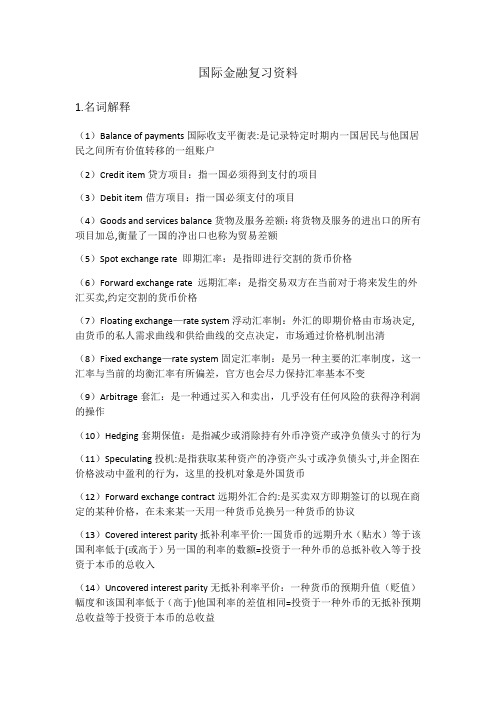

国际金融复习资料

国际金融复习资料1.名词解释(1)Balance of payments国际收支平衡表:是记录特定时期内一国居民与他国居民之间所有价值转移的一组账户(2)Credit item贷方项目:指一国必须得到支付的项目(3)Debit item借方项目:指一国必须支付的项目(4)Goods and services balance货物及服务差额:将货物及服务的进出口的所有项目加总,衡量了一国的净出口也称为贸易差额(5)Spot exchange rate 即期汇率:是指即进行交割的货币价格(6)Forward exchange rate 远期汇率:是指交易双方在当前对于将来发生的外汇买卖,约定交割的货币价格(7)Floating exchange—rate system浮动汇率制:外汇的即期价格由市场决定,由货币的私人需求曲线和供给曲线的交点决定,市场通过价格机制出清(8)Fixed exchange—rate system固定汇率制:是另一种主要的汇率制度,这一汇率与当前的均衡汇率有所偏差,官方也会尽力保持汇率基本不变(9)Arbitrage套汇:是一种通过买入和卖出,几乎没有任何风险的获得净利润的操作(10)Hedging套期保值:是指减少或消除持有外币净资产或净负债头寸的行为(11)Speculating投机:是指获取某种资产的净资产头寸或净负债头寸,并企图在价格波动中盈利的行为,这里的投机对象是外国货币(12)Forward exchange contract远期外汇合约:是买卖双方即期签订的以现在商定的某种价格,在未来某一天用一种货币兑换另一种货币的协议(13)Covered interest parity抵补利率平价:一国货币的远期升水(贴水)等于该国利率低于(或高于)另一国的利率的数额=投资于一种外币的总抵补收入等于投资于本币的总收入(14)Uncovered interest parity无抵补利率平价:一种货币的预期升值(贬值)幅度和该国利率低于(高于)他国利率的差值相同=投资于一种外币的无抵补预期总收益等于投资于本币的总收益(15)Eurocurrency deposit欧洲货币存款:不受存款计值货币发行国政府管制的银行存款(16)Bandwagon顺势效应:认为汇率近期的变动趋势会继续,并且推断该趋势会持续至未来(17)Law of one price一价定律:认为一种商品如果能在完全竞争的国际市场上自由买卖,那么该种商品在不同地方使用同一种货币表示的价格应当相等(18)Absolute purchasing power parity绝对购买力平价:指一组或一篮子可贸易产品在不同国家以同种货币表示的价格是相同的(19)Relative purchasing power parity相对购买力平价:指一段时间内,两国间产品价格水平的差异会被同期内汇率的变化抵消(20)Overshooting汇率超调:在短期内汇率会被过度调整到超过长期均衡的水平,之后慢慢地回到该均衡水平上(21)Clean float 清洁浮动:如果政府允许市场决定汇率,则汇率会自由地移动到市场的均衡点(22)Dirty float肮脏浮动:汇率基本上是浮动的,但同时政府又通过干预试图影响市场汇率(23)Adjusting peg可调整钉住:当一国的国际收支情况出现严重或“基础性"失衡时,政府便会调整钉住汇率(24)Crawling peg爬行钉住:当一国通货膨胀率相对较高时,仍坚持将本国产品的国际价格钉住一个低通货膨胀率国家的货币,就会严重违背购买力平价,并削弱本国产品的国际价格竞争力,一国仍愿意保持某种形式的钉住汇率,这或许是由于它认为浮动汇率的波动性太大(25)Gold standard 金本位制:以含金量作为各国币值定值依据(26)Rescue package救援计划:受到金融危机冲击时,各国政府通常会寻求新的贷款组成求原计划,以帮助度过危机(27)Moral hazard 道德风险:当有人能够提供这种保险时,债券及债务双方便不再担忧金融危机,这样他们就会更多地借出和借入(28)Debt restructuring债务重组:指债务条件的两种变化,债务延期,即在债务到期时,将偿债期延长至未来的某个时点,债务总金额维持不变,但借款人可以在更长时期内偿债,债务削减,即减少债务总量(29)IS curve:表明了在保持国内产品市场均衡的状态下国内产出水平和利率的所有组合(30)LM curve:表明了在保持货币市场均衡的状态下,所有的产出水平和利率的组合(31)FE curve :表明了一国国际收支平衡时的所有利率和产出水平的组合2.课后习题(1)“A country is better off running a current account surplus ratherthan a current account deficit”Do you agree or disagree ?Explain. (2)“Consider a country whose assets are not held by other countries as official international reserve. If this country has a surplus in its official settlement balance,then the monetary authority of the country is decreasing its holdings of official reserve assets.”Do you agree or disagree?Explain。

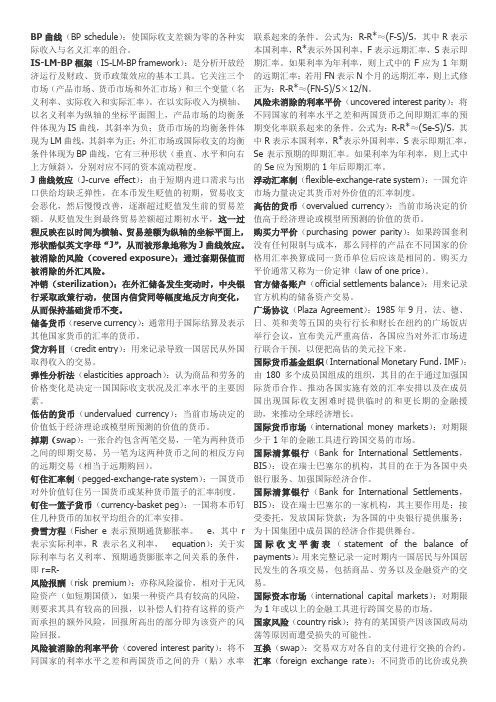

国际金融词汇

BP曲线(BP schedule):使国际收支差额为零的各种实际收入与名义汇率的组合。

IS-LM-BP框架(IS-LM-BP framework):是分析开放经济运行及财政、货币政策效应的基本工具。

它关注三个市场(产品市场、货币市场和外汇市场)和三个变量(名义利率、实际收入和实际汇率)。

在以实际收入为横轴、以名义利率为纵轴的坐标平面图上,产品市场的均衡条件体现为IS曲线,其斜率为负;货币市场的均衡条件体现为LM曲线,其斜率为正;外汇市场或国际收支的均衡条件体现为BP曲线,它有三种形状(垂直、水平和向右上方倾斜),分别对应不同的资本流动程度。

J曲线效应(J-curve effect):由于短期内进口需求与出口供给均缺乏弹性,在本币发生贬值的初期,贸易收支会恶化,然后慢慢改善,逐渐超过贬值发生前的贸易差额。

从贬值发生到最终贸易差额超过期初水平,这一过程反映在以时间为横轴、贸易差额为纵轴的坐标平面上,形状酷似英文字母“J”,从而被形象地称为J曲线效应。

被消除的风险(covered exposure):通过套期保值而被消除的外汇风险。

冲销(sterilization):在外汇储备发生变动时,中央银行采取政策行动,使国内信贷同等幅度地反方向变化,从而保持基础货币不变。

储备货币(reserve currency):通常用于国际结算及表示其他国家货币的汇率的货币。

贷方科目(credit entry):用来记录导致一国居民从外国取得收入的交易。

弹性分析法(elasticities approach):认为商品和劳务的价格变化是决定一国国际收支状况及汇率水平的主要因素。

低估的货币(undervalued currency):当前市场决定的价值低于经济理论或模型所预测的价值的货币。

掉期(swap):一张合约包含两笔交易,一笔为两种货币之间的即期交易,另一笔为这两种货币之间的相反方向的远期交易(相当于远期购回)。

钉住汇率制(pegged-exchange-rate system):一国货币对外价值钉住另一国货币或某种货币篮子的汇率制度。

第四章 《国际金融》PPT课件

Application of PPP

• Choosing the right initial exchange rate for a newly independent country;

• Forecasting medium- and long-term real exchange rates;

✓ 也可以理解为:汇率水平(E)和相对价格水平( P*/ P ) 的乘积。

✓ 注意,这里的E是现实世界已知的名义汇率,区别于上面 的根据购买力计算出来的名义汇率e。

✓ 测试购买力平价偏离的程度; a. 如果绝对形式的PPP成立的话,真实汇率应该为1,

但大多时候都不等于1。 b. 如果相对形式的PPP成立的话,真实汇率应该为一

e0

P0 P0*

• 一般化为:

e1

P1 P1 *

P1P0

* *

• 也可以表示为:e *

• One country’s inflation rate can only be higher (lower) than another’s to the extent that its exchange rate depreciates (appreciates).

• There is little empirical support for absolute purchasing power parity.

– The prices of identical commodity baskets, when converted to a single currency, differ substantially across countries.

• Speculation: the activity of holding a good or security in the hope of profiting from a future rise in its price.

利率平价理论(1)

利率平价理论假定:资金在国际间移动不存在任何限制与交易成本(一)抛补利率平价理论:(covered interest-rate parity,简称CIP)设id为本国货币市场以投资期计算的利率if为外国货币市场以投资期计算的利率S为直接标价法下的外汇即期汇率(spot exchange rate)F为直接标价法下的外汇远期汇率(forward exchange rate)假定投资者不愿意承担汇率变动的风险投资者有两种投资选择:投资本国,到期收入:1+id投资外国,同时做远期避险,到期时的本币收入:1/S×(1+if)×F 这种对比的结果,便是投资者确定投资方向的依据。

由于通过远期外汇市场固定了汇率,在任何动荡中投资收益都是有保证的,当然这也意味着投资者失去了由于市场出现有利变动时带来的益处。

如果(1+i d)>F/S×(1+i f),资金流入如果(1+i d)<F/S×(1+i f),资金流出如果(1+i d)=F/S×(1+i f),均衡状态,抛补的利率平价形成F=(1+i d)/(1+i f)×SF-S=(i d-i f)/(1+i f)×S≈S×(i d-i f)A.(F-S)/S≈i d-i f=△eB.如果i d>i f,F-S>0,外汇远期汇率升水如果i d<i f,F-S<0,外汇远期汇率贴水它们表明:汇率的远期升、贴水率大约等于两种货币的利率差。

利率低的国家的货币,其远期汇率必然升水;利率高的国家的货币,其远期汇率必然贴水。

抛补的利率平价具有很高的实践价值,被作为指导公式广泛运用于交易之中,在外汇交易中处于市场创造者地位的大银行基本上就是根据各国的利率差异来确定远期汇率的升贴水额。

在实证检验中,除了外汇市场激烈动荡的时期,抛补的利率平价基本上都能比较好地成立。

当然,实际汇率变动与抛补的利率平价间也存在着一定的偏离,这一偏离常被认为反映了交易成本、外汇管制以及各种风险等因素。

cul国际金融习题yax

国际收支帐号记录的几具体个案例(A国为本国)1.A国出口商向B国出口价值6000美元的商品,并得到B国6000美元的银行存款;2.A国消费者向B国企业购买了价值为12000美元的商品,A国居民付款是向B国企业开立在A国的银行账户中转入12000美元;3.A国居民向B国的居民捐献价值1000美元的商品;4.A国企业向B国企业提供价值2000美元的航运服务,B国企业将其在A国银行的部分存款转入A国航运企业在A国银行开设的帐号;5.B国企业向A国的股权持有人支付2500美元的红利。

具体通过B国企业设立在A国银行的帐号开出支票来支付;6.A国居民购买了B国公司发行的公司债券,价值5000美元。

支付方式是:A国居民从他在A国银行账户中转出这笔款项到B国公司在A国银行开设的帐户;7.工商银行向中国人民银行出售800美元,人民银行在花旗银行的美元账户中的存款增加,同时工商银行在花旗银行的美元账户存款余额减少。

以A国为本国,根据上述材料,做BOP statement。

关于汇率的问题:1. 假定你想把美元换成英镑,三个中间商的报价如下($/₤): A:1.6432/38; B:1.6433/36; C:1.6434/37。

你应该从那个中间商买英镑?2. 银行间美元和英镑的报价为$/₤=1.6433/36。

如果某银行希望每兑换一英镑能挣2个基点的盈利,它该如何向零售客户报价?带有买卖价差的套算汇率计算套算汇率:通过第三种货币所计算出来的两种货币之间的汇率例2.1: 美元、英镑和欧元之间的报价如下:$/€:0.9836/39€/₤: 1.5473/1.5480计算$/₤的买入套算汇率和卖出套算汇率,以及₤/$的买入套算汇率和卖出套算汇率?空间套利:纽约市场报丹麦克朗兑美元汇率8.0750 kr/$,伦敦市场报价8.0580 kr/$。

不考虑交易成本,100万美元的套汇利润是多少?具体的套汇策略如何实施?三角套利:纽约市场的丹麦克朗兑美元汇率8.0750 kr/$,英镑兑美元汇率报0.6615 £/$;当天伦敦市场的丹麦克朗兑英镑汇率12.1025 kr/£。

国际金融实务_(四)即期、远期和掉期外汇交易

例子: 已知A/B =1.0114/24, A/C =7.7920/30 求B/C=? 解B/C=( A/C )÷( A/B )= (7.7920÷1.0124)/(7.7930÷1.0114) =7.6966/7.7052 同边相乘;反边相除 思考:已知A/B =1.0114/24, A/C =7.7920/30 C/D=6.2030/50 求:B/D=?

(二)、远期外汇交易的标价

(一)直接标出远期汇率 直接标价法是指银行按照期限的不同直接报出 某种货币的远期外汇交易的买入价和卖出价。 (二)差额报价法 差额报价法是指银行只报出货币远期汇率和即 期汇率的差价,这个差价称为远期汇水,通常表 现为升水、贴水和平价。 (三)用年率表示升水率和贴水率。 升水率或贴水率一般都用年率来表示,也就是 升水年率,或贴水年率。

• • • • • • • • •

远期汇率=即期汇率+-升(贴)水 计算公式:(同+、反-)也叫(顺+、逆-) 例子1:即期汇率A/B=7.7810/20 3个月远期差价 30/50 小数都是左小右大,同+、顺+ 则三个月远期汇率为A/B=7.7840/70 练习:即期汇率A/B=7.7810/20 3个月远期差价(掉期率)50/30 则三个月远期汇率为A/B=

国际金融 名词解释

International Finance一. Terminology1. Balance of payments一个国家和地区在一定时间内,本国居民和非居民交易的货币价值的总和。

2.Cross exchange rates一种非美元货币对另外一种非美元货币的汇率,往往就需要通过这两种对美元的汇率进行套算,这种套算出来的汇率就称为交叉汇率。

3.Real exchange rates实际汇率:实际汇率是指名义汇率乘以外国的物价指数,再除以本国的物价指数P*:外国物价水平P :国内物价水平4.Effective exchange rates有效汇率:为了把不同的双边汇率变化合计为一种衡量方法,经济学家针对货币篮子计算多边汇率变化,用贸易权重来构建一个货币篮子中每种货币的所有双边汇率的平均值。

所得到的结果就是有效汇率。

5.Absolute purchasing power parity绝对购买力平价:所有国家的一般物价水平以一种货币计算时是相等的,汇率取决于两国一般物价水平绝对水平的比,即不同货币的购买力之比。

6.Relative purchasing power parity相对购买力平价:尽管汇率水平不一定能反映两国物价绝对水平的对比,但是可以反映两国物价的相对变动,即汇率的升值和贬值是由两国的通货膨胀率的差异决定的。

7.Covered interest rate parity抛补的利率平价(选取了3种解释,大家看看)定义1:通过签订远期外汇合同,按照合同中预先规定的期远期汇率进行交易,以达到套期保值的目的。

由于套利者利用远期外汇市场固定了未来交易时的汇率,避免了汇率风险的影响,整个套利过程可以顺利实现。

定义2:远期外汇市场的投资者在以即期汇率将本币兑换为外币的同时,立即以远期汇率将外币资产卖掉,兑换为远期本币资产。

定义3:所谓抛补利率平价指的是,在即期将本币兑换为外币的同时,在远期外汇市场上,卖出远期外汇,以锁定将来的汇率。

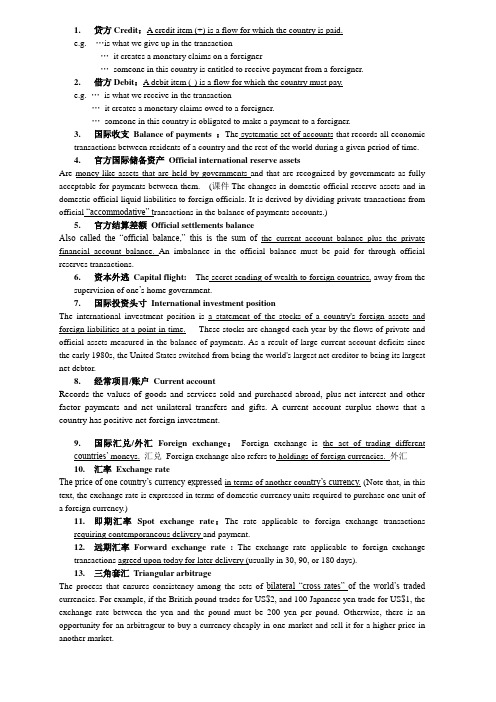

国际金融 英文版 定义 术语

1.贷方Credit:A credit item (+) is a flow for which the country is paid.e.g. …is what we give up in the transaction…it creates a monetary claims on a foreigner…someone in this country is entitled to receive payment from a foreigner.2.借方Debit:A debit item (-) is a flow for which the country must pay.e.g. …is what we receive in the transaction…it creates a monetary claims owed to a foreigner.…someone in this country is obligated to make a payment to a foreigner.3.国际收支Balance of payments :The systematic set of accounts that records all economictransactions between residents of a country and the rest of the world during a given period of time.4.官方国际储备资产Official international reserve assetsAre money-like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them. (课件The changes in domestic official reserve assets and in domestic official liquid liabilities to foreign officials. It is derived by dividing private transactions from official “accommodative” t ransactions in the balance of payments accounts.)5.官方结算差额Official settlements balanceAlso called the “official balance,” this is the sum of the current account balance plus the private financial account balance. An imbalance in the official balance must be paid for through official reserves transactions.6.资本外逃Capital flight: The secret sending of wealth to foreign countries, away from thesupervision of one’s home government.7.国际投资头寸International investment positionThe international investment position is a statement of the stocks of a country's foreign assets and foreign liabilities at a point in time. These stocks are changed each year by the flows of private and official assets measured in the balance of payments. As a result of large current account deficits since the early 1980s, the United States switched from being the world's largest net creditor to being its largest net debtor.8.经常项目/账户Current accountRecords the values of goods and services sold and purchased abroad, plus net interest and other factor payments and net unilateral transfers and gifts. A current account surplus shows that a country has positive net foreign investment.9.国际汇兑/外汇Foreign exchange:Foreign exchange is the act of trading differentcountries’ moneys. 汇兑Foreign exchange also refers to holdings of foreign currencies. 外汇10.汇率Exchange rateThe price of one country’s currency expressed in terms of another coun try’s currency. (Note that, in this text, the exchange rate is expressed in terms of domestic currency units required to purchase one unit ofa foreign currency.)11.即期汇率Spot exchange rate:The rate applicable to foreign exchange transactionsrequiring contemporaneous delivery and payment.12.远期汇率Forward exchange rate : The exchange rate applicable to foreign exchangetransactions agreed upon today for later delivery (usually in 30, 90, or 180 days).13.三角套汇Triangular arbitrageThe process that ensures consistency among the sets of bilateral “cross rates” of the world’s traded currencies. For example, if the British pound trades for US$2, and 100 Japanese yen trade for US$1, the exchange rate between the yen and the pound must be 200 yen per pound. Otherwise, there is an opportunity for an arbitrageur to buy a currency cheaply in one market and sell it for a higher price in another market.14.套汇ArbitrageThe process of buying and selling to make a nearly riskless pure profit ensures that rates in different locations are essentially the same, and that rates and cross-rates are related and consistent among themselves.15.外汇风险Exchange rate risk:W hen the value of an economic agent’s income, wealth, ornet worth changes as exchange rates change unpredictably in the future.16.套期保值Hedging: T he act of exactly matching assets and liabilities, such as foreigncurrencies, so as to avoid exchange rate risk. is the act of balancing your assets and liabilities in a foreign currency to become immune to risk resulting from future changes in the value of foreign currency.17.投机Speculating:Deliberately assuming a net asset (long) position or net liability (short)position in an asset, such as a foreign currency, in the hope of profiting from price changes. Speculating means taking a long or a short position in a foreign currency, thereby gambling on its future exchange value. There are a number of ways to hedge or speculate in foreign currency. Speculating means committing oneself to an uncertain future value of one’s net worth in terms of home currency.18.远期外汇合同Forward foreign exchange contractis an agreement to exchange one currency for another on some date in the future at a price set now ( the forward exchange rate) is an agreement to buy or sell a foreign currency for future delivery at a price ( the forward exchange rate) set now19.远期汇率Forward exchange rateare the price that are agreed today for exchanges of moneys that will take place at a specified time in the future, such as 30, 90 or 180days from now.20.多头头寸Long positionsholding net assets in foreign currency。

国际金融(托马斯·普格尔)复习资料整理

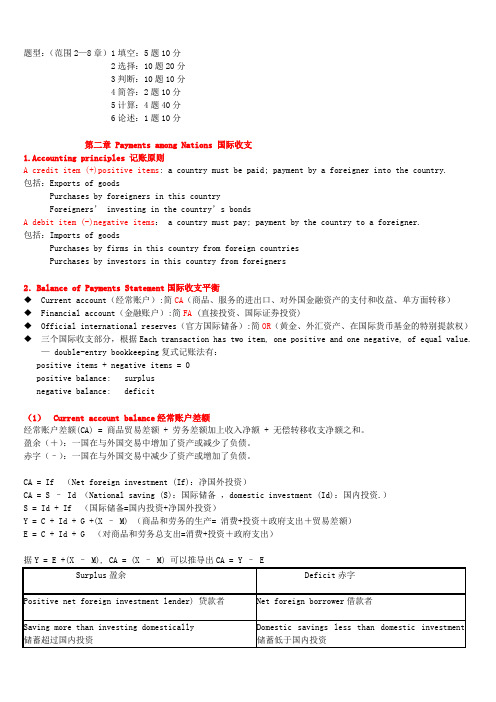

题型:(范围2—8章)1填空:5题10分2选择:10题20分3判断:10题10分4简答:2题10分5计算:4题40分6论述:1题10分第二章 Payments among Nations 国际收支1.Accounting principles 记账原则A credit item (+)positive items: a country must be paid; payment by a foreigner into the country.包括:Exports of goodsPurchases by foreigners in this countryForeigners’ investing in the country’s bondsA debit item (-)negative items: a country must pay; payment by the country to a foreigner.包括:Imports of goodsPurchases by firms in this country from foreign countriesPurchases by investors in this country from foreigners2.Balance of Payments Statement国际收支平衡◆Current account(经常账户):简CA(商品、服务的进出口、对外国金融资产的支付和收益、单方面转移)◆Financial account(金融账户):简FA (直接投资、国际证券投资)◆Official international reserves(官方国际储备):简OR(黄金、外汇资产、在国际货币基金的特别提款权)◆三个国际收支部分,根据Each transaction has two item, one positive and one negative, of equal value.—double-entry bookkeeping复式记账法有:positive items + negative items = 0positive balance: surplusnegative balance: deficit(1)Current account balance经常账户差额经常账户差额(CA) = 商品贸易差额 + 劳务差额加上收入净额 + 无偿转移收支净额之和。

2021~2022 CFA二级笔记3-derivatives(金融衍生品)-外汇远期和利率远期

CFA二级笔记3-derivatives(金融衍生品)-外汇远期和利率远期currency forwards and forward rate agreement(外汇远期和利率远期)一、外汇远期的定价和估值(一)外汇远期的定价外汇远期的定价原理:covered interest rate parity(有抵补的利率平价公式)啥是有抵补的利率平价公式呢?covered interest rate parity 的核心逻辑:拿着本国货币在本国投资的收益(投资方案一)和在外国投资的收益(投资方案二)是一样的投资方案一:拿着本国货币在本国投资投资方案二:将本国货币换成外国货币做投资1、将本国货币根据当前汇率换成外国货币,拿着外国货币在外国投资2、签订一份远期合约,约定一个远期汇率,到期卖外国货币(将外国货币换成本国货币)3、合约到期,将在外国的投资所得以约定的远期汇率换成本国货币covered interest rete parity 和 UNcovered interest rete parity的区别:covered的特点在于签订远期合约(通过远期合约hedge掉汇率风险)根据covered interest rate parity推导出最终定价公式:连续复利的定价公式:手稿笔记:引申结论:利率平价公式可得出的一个结论:哪个国家的利率高,哪个国家的货币就贬值;跟实务的现象相反;因为这个利率平价公式是基于无套利的前提(如果利率高,大批资本涌入,短暂性汇率升高,最终还是会回落到汇率低的情况)(二)外汇远期的估值非连续复利的估值公式:连续复利的估值公式:货币远期合约的估值,可以类比于股指远期合约的估值外币利率相当于dividend yield,本币利率相当于无风险利率1、即期汇率抵减外币收益2、远期汇率折现到t时刻错题:这道题的坑点:1.一年复利一次,即非连续复利,需要用非复利的公式2.估值时,用的0时刻远期汇率,而非t时刻的远期汇率二、利率远期(一)利率远期的定价a代表远期合约结束时间点b代表贷款结束时间点利率远期合约定的利率是a到b的贷款利率,即FR利率远期采用单利算法(基数是360天)forward rate agreement(FRA)远期利率协议的基本概念标的资产:远期利率(浮动的利率,Libor)多头头寸:受益于未来标的资产价格上升,对于多头头寸,是floating receiver(支付固定,借钱然后贷出去,赚浮动利率)空头头寸:受益于未来标的资产价格下跌,对于空头头寸,是fixed receiver(二)利率远期的估值估值逻辑:坑点:1.题目已给出原协议利率0.86%2.要重新计算新的协议利率(站在3个月的时候)答案:拓展知识:关于汇率的小知识:1、P/B P是计价货币,B是基准货币,跟实务操作相反2.直接标价法和间接标价法标价都是针对外国货币的标价直接标价法:7 人民币/美元代表1美元等于7人民币间接标价法:0.14 美元/人民币代表1人民币等于0.14美元。

国际金融英文版试题chapter51

INTERNATIONAL FINANCEAssignment Problems (5) Name: Student#:I. Choose the correct answer for the following questions (only correct answer) (3 credits for each question, total credits 3 x 20 = 60)1. When the supply of and demand for a foreign exchange in the foreign exchange market are exactly the same, the exchange rate is the __________.A. real exchange rateB. effective exchange rateC. equilibrium exchange rateD. cross exchange rate2. An increase in the demand for French goods and services will __________.A. induce a rightward shift in the demand for euroB. induce a leftward shift in the demand for euroC. result in a rightward movement along the demand curve for euroD. result in a leftward movement along the demand curve for euro3. If U.S. dem and for Japanese goods increases and Japan’s demand for U.S. products also rises at the same time, which of the following can you conclude in this situation?A. The U.S. dollar will appreciate against the yen.B. The U.S. dollar will depreciate against the yen.C. The U.S. dollar will not change relative to the yen.D. The U.S. dollar may appreciate, depreciate, or remain unchanged against theyen.4. If the price of a pair of Nike sneakers costs $85 in U.S, and the price of the same sneakers is €80 in Pari s, the spot rate is $1.35 per euro, the euro __________.A. is correctly valued according to PPPB. is correctly valued according to relative PPPC. is undervalued according to PPPD. is overvalued according to PPP5. If the expected exchange rate E (SB/A) according to the relative purchasing power parity is lower than the spot exchange rate (SB/A), we may conclude that __________.A. country B is expected to run huge BOP surplus with country AB. country A’s interest rate is going to be lower than that of country B’sC. the expected inflation rate in country A is higher than the expected inflation rate in country BD. the expected inflation rate in country A is lower than the expected inflation rate in country B6. Assume that PPP holds in the long run. If the price of a tradable good is $20 in the U.S. and 100 pesos in Mexico; and the exchange rate is 7 pesos/$ right now, which of the following changes might we expect in the future?A. an increase in the price of the good in the U.SB. a decrease in the price of the good in MexicoC. an appreciation of the peso in nominal termsD. a depreciation of the peso in nominal terms7. Which basket of goods would be most likely to exhibit absolute purchasing power parity?A. Highly tradable commodities, such as wheatB. The goods in the Consumer Price indexC. Specialized luxury goods, which are subject to different tax rates across countriesD. Locally produced goods, such as transportation services, which are not easily traded8. The absolute purchasing power parity says that the exchange rate between the two currencies should be determined by the __________ .A. relative inflation rate of the two currenciesB. relative price level of the two countriesC. relative interest rate of the two currenciesD. relative money supply of the two countries9. According to the relative PPP, if country A’s inflation rate is higher than country B’s inflation rate by 3%, __________.A. country A’s currency should depreciate against country B’s currency by 3%B. country A’s currency should appreciate against country B’s currency by 3%C. it is hard to say whether country A’s currency should appreciate or depreciate against country B’s currency. The exchange rate is influenced by many factorsD. none of the above is true10. If the law of one price holds for a particular good, we may conclude that __________.A. there is no trade barriers for the good among the different nationsB. the price of the good is the same ignoring the other expensesC. arbitrage for the good does not existD. all of the above are true11. An investor borrows money in one market, sells the borrowed money on the spot market, invests the proceeds of the sale inanother place and simultaneously buys back the borrowed currency on the forward market. This is called __________.A. uncovered interest arbitrageB. covered interest arbitrageC. triangular arbitrageD. spatial arbitrage12. Real return equalization across countries on similar financial instruments is called __________.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity13. In which of the following situations would a speculator wish to sell foreign currency on the forward market?14. According to IRP, if the interest rate in country A is higher than that in country B, the forward exchange rate, defined as F1A/B is expected to be __________.A. lower than the spot rate S0A/BB. the same as the spot rate S0A/BC. higher than the spot rate S0A/BD. necessary the same as the future spot rate S1A/B15. For arbitrage opportunities to be practicable, __________.A. arbitragers must have instant access to quotesB. arbitragers must have instant access to executionsC. arbitragers must be able to execute the transactions without an initial sum of money relying on their bank’s credit standingD. All of the above must be true.16. The __________ states that the forward exchange rate quoted at time 0 for delivery at time t is equal to what the spot rate is expected to be at time t.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity17. Assume expected value of the U.S. dollar in the future is lower than that now compared to the value of the Japanese yen. The U.S. inflation rate must be higher than Japan’s inflation rate according to __________.A. relative PPPB. Fisher equationC. International Fisher relationD. IRP18. According to covered interest arbitrage if an investor purchases a five-year U.S. bond that has an annual interest rateof 5% rather than a comparable British bond that has an annual interest rate of 6%, then the investor must be expecting the __________ to __________ at a rate at least of 1% per year over the next 5 years.A. British pound; appreciateB. British pound; revalueC. U.S. dollar; appreciateD. U.S. dollar; depreciate19. Covered interest arbitrage moves the market __________ equilibrium because __________.A. toward; investors are now more willing to invest in risky securitiesB. toward; purchasing a currency on the spot market and selling in the forward market narrows the differential between the twoC. away from; purchasing a currency on the spot market and selling in the forward market increases the differential between the twoD. away from; demand for the stronger currency forces up the interest rates on the weaker security20. If the forward exchange rate is an unbiased predictor of the expected future spot rate, which of the following is NOT true?A. The future spot rate will actually be equal to what the forward rate predictsB. The forward premium or discount reflects the expected change in the spot exchange rate.C. Speculative activity ensures that the forward rate does not diverge too far from the market’s consensus expectation.D. All of the above are true.II. Problems (40 credits)1. The Argentine peso was fixed through a currency board at Ps1.00/$ throughout the 1990s. In January 2019 the Argentine peso was floated. On January 29, 2019, it was trading at Ps3.20/$. During that one year period Argentina’s inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was2.2% annualized. (10 credits)a. What should have been the exchange rate in January 2019 if purchasing power parity held?b. By what percentage was the Argentine peso undervalued on an annualized basis?2. Assume that the interest rate paid by an American borrower on a ten-year foreign bond is 10% if the bond is sold in Denmark and 7% if the bond is sold in the Netherland. Will the expectedinflation rate in the Netherlands likely be higher than the expected inflation rate in Denmark? Will the Danish kroner be expected to increase in value against the Dutch guilder? Explain your answer. (5 credits)3. Suppose S = $1.25/₤and the 1-year forward rate is F = $1.20/₤. The real interest rate on a riskless government security is 2 percent in both England and the United States. The U.S. inflation rate is 5 percent. (5 credits)a. What is England’s nominal required rate of return on riskless government securities?b. What is England’s inflation rate if the equilibrium relationships hold?4. Akira Numata, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: (12 credits)5. On a particular day, the spot rate between Czech koruna (CKR) and the U.S. dollar is CKR30.35/$, while the interest rate ona one-year financial instrument in Czech is7.5% and 3.5% in U.S. (8 credits)a. What is your expected spot exchange rate a year later?b. You’re concerned your investment in the Czech Republic because of the economic uncertainty in that country. When you expect the future value of the koruna, you require a risk premium of 2%. What is the expected future spot rate supposed to be?Answers to Assignment Problems (5)Part II1. a. inflation differential (20% -2.2%) = 17.8%U.S. should have appreciated by 17.8%Implied exchange rate 1(1 + 17.8%) = Ps1.178/$b. (1.178 – 3.2 ) / 3.2 = -63.19%2. a. According to international Fisher equation: (1 + id) / (1 + if) = (1 + E[πd]) / (1 + E[πf])id: interest rate in Denmarkif: interest rate in Netherlandπd: Danish inflation rateπf Dutch inflation rateSince (1 + id) / (1 + if) = (1 +10%)/(1 + 7%) > 0So, (1 + E[πd]) / (1 + E[πf]) >0, which means the expected inflation rate in Denmark would be greater than that in Netherland.b. If Danish inflation is higher than Dutch inflation, Danish kroner will be expected to decrease in value against the Dutch guilder. (relative PPP theory)第 11 页。

(完整版)国际金融课后习题答案

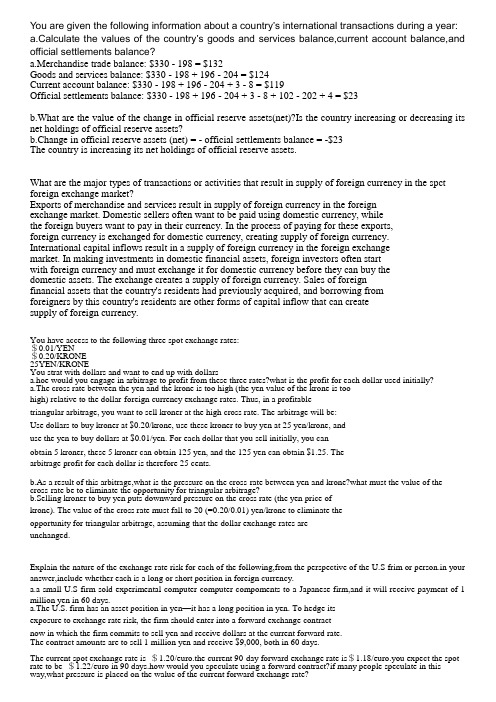

You are given the following information about a country’s international transactions during a year: a.Calculate the values of the country’s goods and services balance,current account balance,and official settlements balance?a.Merchandise trade balance: $330 - 198 = $132Goods and services balance: $330 - 198 + 196 - 204 = $124Current account balance: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settlements balance: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23b.What are the value of the change in official reserve assets(net)?Is the country increasing or decreasing its net holdings of official reserve assets?b.Change in official reserve assets (net) = - official settlements balance = -$23The country is increasing its net holdings of official reserve assets.What are the major types of transactions or activities that result in supply of foreign currency in the spct foreign exchange market?Exports of merchandise and services result in supply of foreign currency in the foreignexchange market. Domestic sellers often want to be paid using domestic currency, whilethe foreign buyers want to pay in their currency. In the process of paying for these exports,foreign currency is exchanged for domestic currency, creating supply of foreign currency.International capital inflows result in a supply of foreign currency in the foreign exchangemarket. In making investments in domestic financial assets, foreign investors often startwith foreign currency and must exchange it for domestic currency before they can buy thedomestic assets. The exchange creates a supply of foreign currency. Sales of foreignfinancial assets that the country's residents had previously acquired, and borrowing fromforeigners by this country's residents are other forms of capital inflow that can createsupply of foreign currency.You have access to the following three spot exchange rates:$0.01/YEN$0.20/KRONE25YEN/KRONEYou strat with dollars and want to end up with dollarsa.hoe would you engage in arbitrage to profit from these three rates?what is the profit for each dollar used initially?a.The cross rate between the yen and the krone is too high (the yen value of the krone is toohigh) relative to the dollar-foreign currency exchange rates. Thus, in a profitabletriangular arbitrage, you want to sell kroner at the high cross rate. The arbitrage will be:Use dollars to buy kroner at $0.20/krone, use these kroner to buy yen at 25 yen/krone, anduse the yen to buy dollars at $0.01/yen. For each dollar that you sell initially, you canobtain 5 kroner, these 5 kroner can obtain 125 yen, and the 125 yen can obtain $1.25. Thearbitrage profit for each dollar is therefore 25 cents.b.As a result of this arbitrage,what is the pressure on the cross-rate between yen and krone?what must the value of the cross-rate be to eliminate the opportunity for triangular arbitrage?b.Selling kroner to buy yen puts downward pressure on the cross rate (the yen price ofkrone). The value of the cross rate must fall to 20 (=0.20/0.01) yen/krone to eliminate theopportunity for triangular arbitrage, assuming that the dollar exchange rates areunchanged.Explain the nature of the exchange rate risk for each of the following,from the perspective of the U.S frim or person.in your answer,include whether each is a long or short position in foreign currency.a.a small U.S firm sold experimental computer computer compoments to a Japanese firm,and it will receive payment of 1 million yen in 60 days.a.The U.S. firm has an asset position in yen—it has a long position in yen. To hedge itsexposure to exchange rate risk, the firm should enter into a forward exchange contractnow in which the firm commits to sell yen and receive dollars at the current forward rate.The contract amounts are to sell 1 million yen and receive $9,000, both in 60 days.The current spot exchange rate is $1.20/euro.the current 90-day forward exchange rate is$1.18/euro.you expect the spot rate to be $1.22/euro in 90 days.how would you speculate using a forward contract?if many people speculate in this way,what pressure is placed on the walue of the current forward exchange rate?Relative to your expected spot value of the euro in 90 days ($1.22/euro), the currentforward rate of the euro ($1.18/euro) is low—the forward value of the euro is relativelylow. Using the principle of "buy low, sell high," you can speculate by entering into aforward contract now to buy euros at $1.18/euro. If you are correct in your expectation,then in 90 days you will be able to immediately resell those euros for $1.22/euro,pocketing a profit of $0.04 for each euro that you bought forward. If many peoplespeculate in this way, then massive purchases now of euros forward (increasing thedemand for euros forward) will tend to drive up the forward value of the euro, toward acurrent forward rate of $1.22/euro.The following rates are available in the markets:Current spot exchange rate:$0.500/SFrCurrent 30-day forward exchange rate:$0.505/SFrAnnualized interest rate on 30-day dollar-denominated bonds:12%(1.0% for 30 days)Annualized interest rate on 30-day Swiss franc-denominated bonds:6%(0.5% for 30 days)a.Is the swiss franc at a forward premium or discount?a.The Swiss franc is at a forward premium. Its current forward value ($0.505/SFr) is greaterthan its current spot value ($0.500/SFr).b.should a U.S-based investor make a covered investment in swiss franc-denominated 30-day bonds,rather than investing 30-day dollar-denominated bonds?Explain.b.The covered interest differential "in favor of Switzerland" is ((1 + 0.005) (0.505) / 0.500)- (1 + 0.01) = 0.005. (Note that the interest rate used must match the time period of theinvestment.) There is a covered interest differential of 0.5% for 30 days (6 percent at anannual rate). The U.S. investor can make a higher return, covered against exchange raterisk, by investing in SFr-denominated bonds, so presumably the investor should make thiscovered investment. Although the interest rate on SFr-denominated bonds is lower thanthe interest rate on dollar-denominated bonds, the forward premium on the franc is largerthan this difference, so that the covered investment is a good idea.c.Because of covered interest arbitrage,what pressures are placed on the various rates?if the only rate that actually changes is forward exchange rate,to what value will it bu driven?c.The lack of demand for dollar-denominated bonds (or the supply of these bonds asinvestors sell them in order to shift into SFr-denominated bonds) puts downward pressureon the prices of U.S. bonds—upward pressure on U.S. interest rates. The extra demandfor the franc in the spot exchange market (as investors buy SFr in order to buySFr-denominated bonds) puts upward pressure on the spot exchange rate. The extrademand for SFr-denominated bonds puts upward pressure on the prices of Swissbonds—downward pressure on Swiss interest rates. The extra supply of francs in theforward market (as U.S. investors cover their SFr investments back into dollars) putsdownward pressure on the forward exchange rate. If the only rate that changes is theforward exchange rate, this rate must fall to about $0.5025/SFr. With this forward rate andthe other initial rates, the covered interest differential is close to zero.Why is testing whether uncovered interest parity holds for actual rates more difficult than testing whether covered interest parity holds?In testing covered interest parity, all of the interest rates and exchange rates that areneeded to calculate the covered interest differential are rates that can observed in the bondand foreign exchange markets. Determining whether the covered interest differential isabout zero (covered interest parity) is then straightforward (although some more subtleissues regarding timing of transactions may also need to be addressed). In order to testuncovered interest parity, we need to know not only three rates—two interest rates and thecurrent spot exchange rate—that can be observed in the market, but also one rate—theexpected future spot exchange rate—that is not observed in any market. The tester thenneeds a way to find out about investors' expectations. One way is to ask them, using asurvey, but they may not say exactly what they really think. Another way is to examinethe actual uncovered interest differential after we know what the future spot exchange rateactually turns out to be, and see whether the statistical characteristics of the actualuncovered differential are consistent with an expected uncovered differential of aboutzero (uncovered interest parity)the following rates currently exist:spot exchange rate:$1.000/euro.Annual interest rate on 180-day euro-denominated bonds:3%Annual interest rate on 180-day U.S dollar-denominated bonds:4%Ibvestors currently expect the spot exchange rate to be about$1.005/euro in180 days.a.show that uncovered interest parity holds(approximately)at these ratesa.The euro is expected to appreciate at an annual rate of approximately ((1.005 -1.000)/1.000)⊕(360/180)⊕100 = 1%. The expected uncovered interest differential isapproximately 3% + 1% - 4% = 0, so uncovered interest parity holds (approximately).What is likely to be the effect on the spot eschange rate if the interest rate on 180-day dollar-denominated bonds declines to 3%? If the euro interest rate and the expected future spot rate are unchanged,and if uncovered interest parity is reestablished,what will the new current spot exchange rate be?has the dollar appreciated or depreciated?b.If the interest rate on 180-day dollar-denominated bonds declines to 3%, then the spotexchange rate is likely to increase—the euro will appreciate, the dollar depreciate. At theinitial current spot exchange rate, the initial expected future spot exchange rate, and theinitial euro interest rate, the expected uncovered interest differential shifts in favor ofinvesting in euro-denominated bonds (the expected uncovered differential is now positive,3% + 1% - 3% = 1%, favoring uncovered investment in euro-denominated bonds. Theincreased demand for euros in the spot exchange market tends to appreciate the euro. Ifthe euro interest rate and the expected future spot exchange rate remain unchanged, thenthe current spot rate must change immediately to be $1.005/euro, to reestablish uncoveredinterest parity. When the current spot rate jumps to this value, the euro's exchange ratevalue is not expected to change in value subsequently during the next 180 days. Thedollar has depreciated immediately, and the uncovered differential then again is zero (3%+ 0% - 3% = 0)You observe the following current rates:Spot exchange rate:$0.01/yenAnnual interest rate on 90-day U.S dollar-denominated bonds:4%Annual interest rate on 90-day yen-denominated bonds:4%a.if uncovered interest parity holds,what spot exchange rate do investors expect to exist in 90 days?a.For uncovered interest parity to hold, investors must expect that the rate of change in thespot exchange-rate value of the yen equals the interest rate differential, which is zero.Investors must expect that the future spot value is the same as the current spot value,$0.01/yen.b.a close U.S presidential has just been decided.the candidate whom international investors view as the stronger and more probusiness person won.because of this,investors expect the exchange rate to be$0.0095/yen in 90 days.what will happen in the foreign exchange market?b.If investors expect that the exchange rate will be $0.0095/yen, then they expect the yen todepreciate from its initial spot value during the next 90 days. Given the other rates,investors tend to shift their investments toward dollar-denominated investments. Theextra supply of yen (and demand for dollars) in the spot exchange market results in adecrease in the current spot value of the yen (the dollar appreciates). The shift toexpecting that the yen will depreciate (the dollar appreciate) sometime during the next 90days tends to cause the yen to depreciate (the dollar to appreciate) immediately in thecurrent spot market.To aid in its efforts to get reelected,the current government of o country decides to increase the growth rate of the domestic money supply by two percentage points.the increased growth rate becomes”permanene”because once started it is difficult to reverse.a.according to the monetary approach,how will this affect the long-run trend for the exchange rate value of the country’s currency?a.Because the growth rate of the domestic money supply (M s ) is two percentage pointshigher than it was previously, the monetary approach indicates that the exchange ratevalue (e) of the foreign currency will be higher than it otherwise would be—that is, theexchange rate value of the country's currency will be lower. Specifically, the foreigncurrency will appreciate by two percentage points more per year, or depreciate by twopercentage points less. That is, the domestic currency will depreciate by two percentagepoints more per year, or appreciate by two percentage points less.b.explain why the nominal exchange rate trend is affected,referring to PPPb.The faster growth of the country's money supply eventually leads to a faster rate ofinflation of the domestic price level (P). Specifically, the inflation rate will be twopercentage points higher than it otherwise would be. According to relative PPP, a fasterrate of increase in the domestic price level (P) leads to a higher rate of appreciation of theforeign currency.A country has a marginal propensity to save of 0.15 and a marginal propensity to import of 0.4 real domestic spending now decreases by$2 billiona.according to the spending multiplier(for a small open economy),,by how much will domestic product and income change?a.The spending multiplier in this small open economy is about 1.82 (= 1/(0.15 + 0.4)). Ifreal spending initially declines by $2 billion, then domestic product and income willdecline by about $3.64 billion (= 1.82⋅$2 billion)b.what is the change in the country’s imports?b. If domestic product and income decline by $3.64 billion, then the country's imports willdecline by about $1.46 billion (= $3.64 billion⋅0.4).c.if this country is large,what effect will this have on foreign product and income?explainc. The decrease in this country's imports reduces other countries' exports, so foreign productand income decline.d.will the change in foreign product and income tend to counteract or reinforce the change in the first country’s domestic product and income?explaind. The decline in foreign product and income reduce foreign imports, so the first country'sexports decrease. This reinforces the change (decline) in the first country's domesticproduct and income—an example of foreign-income repercussions.。

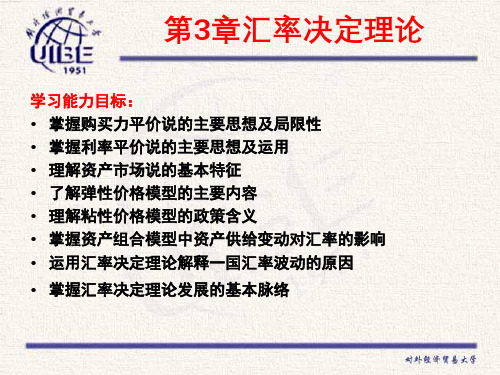

人民大2024国际金融(第三版)PPT第3章汇率决定理论

子集。 • 绝对ppp不成立的主要原因:一是不同国家居民在商品消费偏好上的差异

导致了产品的巨大差异性; 二是不同同家的设立物价指数时,各种商品 的权重不可对是相等的,甚至一国在不同时期权重也是不相同的; 三是 市场不可能是完全竞争的,关说、贸易壁垒及交易成本仍然存在

后者指已经进入支付阶段的借贷。

2.流动借贷是汇率决定的主要因素

戈逊认为只有流动借贷的变化才会影响外汇供求

流动债权 >流动债务

外汇供给 >外汇需求

外汇汇率下降

流动债权< 流动债务

外汇供给 <外汇需求

外汇汇率上升

戈逊所说的流动借贷,实际上就是早期的狭义国际收支概念,所以又被称为“国 际收支说”,这一理论实际上就是汇率的供求决定论。

国际收支说的早期形式:国际借贷说

3.对国际借贷说的简要评价 贡献:

较好的解释了金本位制下的汇率变动问题,符合当时的现实经济运行.即 使现在,国际收支仍是影响汇率变化最直接的原因之一 局限性:

第一,国际借贷说说明了汇率是如何被决定的(外汇的供求),但并 没有给出影响汇率变动的或者说影响外汇供求的具体因素,从而影响了 这一理论的应用价值。

第3节利率平价理论

• 随着生产和资本国际化的发展,资本在国际间的移动越来越大,并 日益成为影响汇率决定的一个重要因素,利率平价理论于是应运而 生。

• 凯恩斯于1923年在其《货币改革论》一书中首次系统地建立了古 典利率平价理论,之后,英国经济学家保罗·艾因齐格(Paul Einzing)在其1931年《远期外汇理论》和1937年《外汇史》中进 一步提出了动态的利率平价理论,揭示了即期汇率、远期汇率、利 率、国际资本流动之间的相互影响,从而形成了现代利率平价理论。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Rate of Return on a foreign asset

Foreign asset in home currency [ et+1 ( Pt+1* + Dt+1* ) - etPt* ] / ( etPt* ) = [ et+1 ( Pt+1* + Dt+1* ) / ( etPt* ) ] - 1 = (et+1 / et ) [ ( Pt+1* + Dt+1* ) / Pt* ] - 1

1 HD = x FD = 1/e FD, i.e., e HD = 1 FD P vs. eP*

2

Time

Return on home asset

t

For example, t=January, t+1=February

Buy Asset: pay Pt

May receive dividend Dt+1 between time t and time t+1

14

Rate of return of home deposit

Et (Pt+1 + Dt+1) / Pt - 1 Pt+1 = 1 Pt = 1 Dt+1 = Rt= home interest rate Et (1 + Rt) / 1 - 1 = Rt

15

Expected return and expected rate of return

t+1 Sell asset: get Pt+1

Return = Pt+1+Dt+1 -Pt Rate of Return = (Pt+1+Dt+1 - Pt)/Pt

3

Return on a home asset

Pt+1 - Pt dividends or any interest payments to the asset holder Dt+1 Pt+1 - Pt + Dt+1

13

Expected return and expected rate of return

Expected return on a home asset: Et (Pt+1 + Dt+1 - Pt ) = Et (Pt+1 + Dt+1) - Pt

Expected rate of return on a home asset: Et [(Pt+1 + Dt+1) / Pt - 1 ] = Et (Pt+1 + Dt+1) / Pt - 1

Covered and Uncovered Interest Rate Parity

WONG Ka Fu 26th January 2000

1

Comparing Local and Foreign Prices

Prices within a country

Prices across countries P (in home currency) P* (in foreign currency)

8

Expectations

Lottery 1 0.5 probability to win 1000 0.5 probability to win 0

Expect to win 0.5 ×1000 + 0.5 ×0 = 500

9

Expectations

Lottery 2 0.2 probability to win 1000 0.3 probability to win 500 0.5 probability to win 0

Some unknown quantities become known: Pt+1 = 1 Pt = 1 Dt+1 = Rt= home interest rate Pt+1*= 1 Pt* = 1 Dt+1*= Rt*= foreign interest re t is et+1

5

Time

Return on foreign asset

t

For example, t=January, t+1=February

Buy Asset: pay etPt*

May receive dividend Dt+1* between time t and time t+1

t+1

Sell asset: get et+1Pt+1*

Return = et+1(Pt+1* +Dt+1* )/ - etPt*

Rate of Return = [et+1(Pt+1* +Dt+1* )/ - etPt* ]/ etPt*

6

Return on a foreign asset

A foreign investor invests in a foreign asset Pt+1* - Pt* + Dt+1* = Pt+1* + Dt+1* - Pt* A home investor invests in a foreign asset et+1 (Pt+1* + Dt+1* ) - etPt*

Lottery 4

f(y) probability to win y

Expect to win Et(y) = E(y| information available at time t)

= y f(y) y dy

12

Replacing assets with deposits greatly simplifies the algebra:

4

Rate of Return on a home asset

Return / cost of asset at time of purchase / year Home asset in home currency ( Pt+1 + Dt+1 - Pt )/ Pt = [ ( Pt+1 + Dt+1 ) / Pt ] - 1

Expect to win 0.2 ×1000 + 0.3 ×500 + 0.5 ×0 = 350

10

Expectations

Lottery 3

Pi = f(yi) probability to win yi

Expect to win

Et(y) = i Pi yi = i f(yi) yi

11

Expectations