跨国公司财务管理基础 (3)

第九章跨国公司财务管理

华汇公司根据销售计划预测6个月后有2000万美 元的外汇净流出.为了保值,该公司买入6个月 的美元买入期权

2021/1/8

40

2.货币互换

通常是指市场中持有不同币种的两个交易主体 按事先约定在期初交换等值货币,在期末再换回 各自本金并相互支付相应利息的市场交易行为

保护资产和收益的价值,免受财务风险的侵蚀

2021/1/8

5

三 跨国公司财务管理的职能

筹措和运用资金 融资:尽可能用最低的长期成本,从公司内部 的外部筹集资金 投资:运用职能又称投资决策,即合理分配和 运用资金,以使公司与股东的利润最大化

2021/1/8

6

四、财务管理的组织形式

集权型 分权型 集权——分权型

2021/1/8

13

第二节 跨国公司的筹资 决策

跨国经营中筹集资金的活动

2021/1/8

14

一、全球融资的战略目标

融资成本最低化 融资风险最小化 公司资本结构最优化

2021/1/8

15

1、融资成本最小化

减少税负 绕过当地政府的信贷与资本管制 利用政府补贴与优惠

2021/1/8

16

2、融资风险最小化

2021/1/8

8

集权型财务管理模式示意图

A子公司的 现金管理

母公司 财务经理

B子公司的 现金管理

A子公司的存货 和应收账款管理

B子公司的存货 和应收账款管理

A子公司的 融资

2021/1/8

A子公司的 资本支出

B子公司的 资本支出

B子公司的 融资

跨国公司财务管理讲义课件

D公司建立健全的内部控制体系,预 防财务报表粉饰行为的发生,确保公 司财务报告的真实性和可靠性。

THANK YOU

感谢观看

危机公关

在危机发生时及时进行危机公 关,尽可能减少负面影响,恢

复企业形象。

05

跨国公司财务管理最佳实 践与案例分析

A跨国公司的财务管理最佳实践分享

全球化视野

A公司具有全球化视野,关注全球市 场和宏观经济,以适应不同国家和地 区的财务政策。

财务风险管理

A公司重视财务风险管理,建立了一 套完善的财务预警和应对机制,以降 低潜在的财务风险。

内部控制体系

建立健全的内部控制体系,确保 公司财务报告的可靠性。

内部审计监督

通过内部审计对公司的财务管理进 行监督和评价,提高财务信息的透 明度。

外部审计合作

与外部审计机构保持良好合作关系 ,共同提高财务报告的质量和信誉 。

04

跨国公司风险管理

跨国公司面临的主要风险类别与来源

政治风险

由于东道国政治环境不稳定,可能对跨国 公司的经营产生重大影响,如政权更迭、 暴力事件、政策变动等。

司制定税务筹划提供支持。

D跨国公司的财务报告编制最佳实践分享

遵循国际会计准则

D公司的财务报告编制遵循国际会计准 则,以确保财务报告的准确性和可比性

。

财务数据分析与报告

D公司定期进行财务数据分析与报告 ,为管理层提供决策支持,同时满足

投资者和分析师的需求。

提高信息披露质量

D公司重视信息披露质量,通过充分 、透明的信息披露,提高公司的信誉 和投资者信心。

财务报告质量控制

确保财务报告的编制符合 法规要求,提高信息质量 。

跨国公司财务管理通用课件

优化业务流程

数字化转型有助于跨国公司优化 财务管理流程,简化操作步骤, 减少人工干预和错误。通过自动 化和智能化的处理,企业能够提 高财务处理的准确性和效率,降 低运营成本。

共享服务中心建设

集中化处理

提高效率

共享服务中心是一种集中的财务 管理模式,通过将分散在全球各 地的财务处理和管理职能集中到 一个中心,实现标准化、专业化 和高效化的处理。

运营资金管理策略的制定需要考虑的因素包括

市场需求、供应链管理、库存管理、应收账款管理等。

运营资金管理策略的制定需要遵循的原则包括 效率与效益的平衡、长期价值最大化、风险管理等。

03 跨国公司的风险 管理

汇率风险管理

总结词

汇率风险管理是跨国公司财务管理的重要环节,主要涉及对货币兑换过程中因 汇率波动而产生的风险的识别、评估和控制。

详细描述

跨国公司在经营过程中,由于涉及多种货币的交易,因此面临着汇率波动的风 险。为了降低汇率风险,跨国公司可以采用多种策略,如选择合适的计价货币、 利用外汇市场工具进行套期保值、分散外汇风险等。

利率风险管理

总结词

利率风险管理主要针对的是因市场利率波动而给跨国公司带来的财务风险。

详细描述

利率波动会影响跨国公司的债务成本和资产价值,因此需要进行利率风险管理。 常见的利率风险管理策略包括固定利率贷款、利率上限和下限协议、利率期货和 期权等。

区块链技术在财务管理中的应用

要点一

透明度和可追溯性

区块链技术通过去中心化的账本记录 和管理,能够实现财务管理的高度透 明和可追溯。每个交易记录都被加密 并存储在区块链中,确保数据的真实 性和不可篡改性。

要点二

降低成本和风险

区块链技术能够降低跨国公司的财务 管理成本和风险。通过自动化和智能 化的处理,企业能够减少人工干预和 错误,降低操作成本和风险。同时, 区块链的透明度也有助于企业识别和 预防潜在的欺诈行为。

第八章跨国公司的财务管理

2020/11/27

第八章跨国公司的财务管理

第一节 跨国公司的资金管理

跨国公司资金来源之一——公司集团内部

公司内部贷款

背对背贷款

平行贷款

转移定价

提前与错后支付

管理费、提成费和许可费的调整

第八章跨国公司的财务管理

跨国公司资金来源之二——公司外部 资金来源

– 来自公司母国的资金 – 来自东道国的资金 – 来自国际社会的资金

措施各不相同,既给融资收益提供了机会,但也潜 伏着风险。

• 融资过程中两个变动较大的因素——通货膨胀和汇

率变化,应予以特别注意。

第八章跨国公司的财务管理

第二节 跨国经营中外汇风险的规避 外汇风险的类型交易风险 折算风险 经济来自险第八章跨国公司的财务管理

跨国经营中外汇风险的管理

加强外汇风险管理

•长期资金风险管理 •日常资金风险管理

转移定价的基础和方法

有形商品的转移定价策略

– 内部成本加调高(低)的转移定价体系 – 外部市场价格加调高(低)的转移定价体系

无形商品的转移定价策略

出售技术、提供咨询服务等

第八章跨国公司的财务管理

跨国公司转移定价的动机

减轻整个公司集团的所得税 利润调节 降低关税 降低或规避外汇风险 避免东道国的各种限制措施 增强子公司的竞争能力

调整生产经营战略

第八章跨国公司的财务管理

调整生产经营战略

分散化经营 营销管理策略 生产管理策略

第八章跨国公司的财务管理

第三节 跨国公司转移定价

转移定价的一般含义: 是指跨国公司根据全球战略目标,

在母公司与子公司之间或在子公司之间 转移商品、劳务时制定的价格政策。

跨国公司的财务报告分析(3篇)

第1篇随着经济全球化的不断深入,越来越多的企业选择跨国经营,以寻求更广阔的市场和更多的资源。

跨国公司的财务报告分析对于投资者、监管机构和公司管理层来说至关重要。

本文将以ABC公司为例,对其财务报告进行分析,旨在揭示其财务状况、经营成果和现金流量的特点,以及潜在的风险和机遇。

一、公司概况ABC公司成立于20世纪90年代,是一家集研发、生产和销售为一体的高新技术企业。

公司主要业务涉及电子产品、医疗器械和化工产品等领域。

经过多年的发展,ABC公司已成为全球知名企业,业务遍及亚洲、欧洲、美洲等多个国家和地区。

二、财务报表分析1. 资产负债表分析(1)资产结构分析从ABC公司的资产负债表来看,其资产主要由流动资产、固定资产和无形资产构成。

其中,流动资产占比最高,达到60%以上。

这表明公司具有较强的短期偿债能力。

固定资产占比约为30%,说明公司具有一定的生产能力和扩张潜力。

无形资产占比相对较低,但近年来有所上升,反映出公司对技术创新的重视。

(2)负债结构分析ABC公司的负债主要包括流动负债和长期负债。

流动负债占比约为70%,说明公司在短期内需要偿还的债务较多。

长期负债占比约为30%,表明公司具有一定的长期债务负担。

从负债构成来看,公司负债水平相对合理,但仍需关注短期偿债压力。

2. 利润表分析(1)营业收入分析ABC公司的营业收入呈现持续增长态势,近年来增速保持在10%以上。

这主要得益于公司产品结构的优化和全球市场的拓展。

从地域分布来看,亚洲市场贡献了公司约60%的营业收入,欧洲和美洲市场分别占比约25%和15%。

(2)毛利率分析ABC公司的毛利率保持在20%以上,表明公司具有较强的盈利能力。

从产品类别来看,电子产品的毛利率最高,达到25%;医疗器械和化工产品的毛利率分别为18%和22%。

这说明公司在核心业务领域具有较高的竞争优势。

(3)费用分析ABC公司的费用主要包括销售费用、管理费用和研发费用。

近年来,公司销售费用和研发费用增速较快,但管理费用增速相对较慢。

跨国公司财务管理基础 (3)

TEXAS TECH UNIVERSITY SECOND SUMMER 2012 RAWLS COLLEGE OF BUSINESSAREA OF FINANCEFIN 4328 – 001– 62167 – International FinanceDr. DanışoğluHomework #3Due on Tuesday, July 31, 20121. On Monday morning, an investor takes a short position in four pound futures contracts that mature on Thursday afternoon. The initial price of the futures contracts is $1.780/£ for a contract size of £62,500. The following are the closing prices for Monday through Thursday:The initial margin for the position is $1,200 and the maintenance margin is $500. At the end of any day, if the value of the margin account is above $1,200, the investor will withdraw this excess amount. Perform marking-to-market to the investor’s position and indicate whether there will be any margin calls.On Thursday, the investors delivers £62,500 and receives £62,500 x $1.780/£ = $111,250.2. Suppose that Company A buys a Swiss franc futures contract at a price of $0.83/SFr. The contract size is SFr125,000. If the spot rate for the Swiss franc at the date of settlement is SFr1=$0.8250, wha t is Company A’s gain or loss on this contract?Bought at a value of $0.83/SFr x SFr125,000 = $103,750Sold at a value of $0.8250/SFr x SFr125,000 = $103,125Loss of $103,125 - $103,750 = -$6253. Kayalar, a Turkish company, will be collecting an accounts receivable next month in the total amount of €1.25 million. It is interested in protecting these receipts against a drop in the value of the pound. The following are the hedging alternatives that Kayalar can use:1) Protect the value of the receivables by selling 30-day euro futures at a price of TL1.6513 per euro and acontract size of €62,500.2) Protect the value of the receivables by buying euro put options with a strike price of TL1.6612/€ at a premium of2.0 cents per euro and a contract size of €31,250.If the current spot price of the euro is TL1.6560/€, and the euro is expected to trade in the range of TL1.6250/€to TL1.7010/€. Kayalar believes that the most likely price of the euro at the end of the month will be TL1.6400/€.a. Determine the number of (1) futures contracts and (2) option contracts Kayalar needs in order to protect its receivables. With a futures contract size of €62,500, Kayalar will need 20 futures contracts (=€1,250,000 / €62,500) to protect its anticipated royalty receipts of €1.25 million.Since the option contract size is half that of the futures contract, or €31,250, Kayalar will need 40 put options to hedge its receipts.b. Determine Kayalar ’s profit s and losses for (1) the put option position and (2) the futures position within the range of expected exchange rates given above. Assume that there are no transaction costs or margin requirements. Provide a diagram of the profit and loss for (1) the put option position and (2) the futures position on the same graph.OPTION Inflow OutflowPut premium Exercise costProfitFUTURES Inflow OutflowProfit1.6250TL 2,076,500–25,000 –2,031,250 ________ TL 20,250TL 2,064,125 –2,031,250 _________ TL 32,875 1.6400TL 2,076,500–25,000 –2,050,000 _________ TL 1,500TL 2,064,125 –2,050,000 _________ TL 14,125 1.6513TL 2,076,500–25,000 –2,064,125 _________ –TL 12,625TL 2, 064, 1255 –2,064,125 ________ TL 0 1.6612–– –25,000__________ –TL 25,000TL 2,064,125 TL 2,076,500 _________–TL 12,3751.7010–– –25,000_________ –TL 25,000TL 2,064,125 –2,126,250 _________ –TL 62,125TL32,875Gain (Loss) on Kayalar’s Futures and Options PositionsEuro priceTL1.62 TL1.63 TL1.64 TL1.65 TL1.66 TL1.67 TL1.68 TL1.69 TL1.70TL(25,000)TL(62,125)4. Gondor and Rohan Banks are each planning to issue $10 million in debt. In order to lower their borrowing costs and obtain the preferred type of financing, they are negotiating an interest rate swap. –lkjGondor Bank wants to borrow on a fixed-rate basis as result of its current balance sheet structure. On the other hand, Rohan Bank wants to borrow on a floating-rate basis as a result of its current balance sheet structure.The following table provides the borrowing rates that are available in the market to these two banks:Sssume that the following swap terms are available from the local swap dealer, Mr. Samwise Gamgee:Assume further that each bank ends up borrowing the $10 million in the market where it has a comparative advantage in terms of the interest rate to be paid.a. Indicate which swap position Gondor should take and explain how this position would help the bank meet its objective. Calculate the effective cost of borrowing for Gondor Bank after the swap.Gondor pays more than Rohan in both markets. However, Gondor pays a risk premium of 0.55% in the fixed-rate market and a risk premium of 0.25% in the floating-rate market. Therefore, Gondor has a comparative advantage in the floating-rate market and that is where it is going to borrow.When Gondor borrows on a floating-rate basis on its balance sheet, it will choose to be a buyer in the swap market. In other words, it will choose Alternative 1 and pay fixed and receive floating.Effective cost of borrowing for Gondor:Pay LIBOR + 0.50% on the balance sheetPay 8.10% to the swapReceive LIBOR from the swapEffective cost of borrowing = 8.60% (fixed and represents a saving of 0.10% from the fixed-rate borrowing alternative at 8.70%)b. Indicate which swap position Rohan should take and explain how this position would help the bank meet its objective. Calculate the effective cost of borrowing for Rohan Bank after the swap.Rohan pays less than Gondor in both markets. However, Rohan pays 0.55% less in the fixed-rate market and 0.25% less in the floating-rate market. Therefore, Rohan has a comparative advantage in the fixed-rate market and that is where it is going to borrow.When Rohan borrows on a fixed-rate basis on its balance sheet, it will choose to be a seller in the swap market. In other words, it will choose Alternative 2 and pay floating and receive fixed.Effective cost of borrowing for Rohan:Pay 8.15% on the balance sheetPay LIBOR to the swapReceive 8.03% from the swapEffective cost of borrowing = LIBOR + 0.12% (floating and represents a saving of 0.13% from the floating-rate borrowing alternative at LIBOR + 0.25%)5. The following table presents the borrowing terms available for Swiss francs and dollars for two companies:ABC Company prefers to borrow dollars on a floating rate basis and XYZ Company prefers to borrow Swiss francs on a fixed rate basis.If these companies take advantage of their comparative advantages in the debt market and then negotiate a currency/interest rate swap agreement between them, determine the maximum and minimum amount of borrowing cost savings that ABC Company could obtain from such a swap.ABC Company can borrow fixed-rate Swiss francs at 5.25% and floating-rate dollars at LIBOR + 3/8%. Meanwhile XYZ Company can borrow fixed-rate Swiss francs at 5.75% and floating-rate dollars at LIBOR flat. The logical set of transactions under these circumstances would be (1) ABC borrows fixed-rate francs, (2) XYZ borrows floating-rate dollars, and (3) the companies then swap the payment streams.The maximum benefit to ABC arises when it provides fixed-rate francs to XYZ at 5.75% (XYZ is no worse off under this scenario) and receives floating-rate dollars at LIBOR, which is XYZ's cost of funds (XYZ is again no worse off under this scenario). This swap will cut ABC's cost of funds to LIBOR - 0.5%, which is a savings of 0.875%. At worst, ABC will receive no benefit from the swap (otherwise it will not enter into it). Thus, the range of possible cost savings to ABC from engaging in a currency swap with XYZ is from 0% up to 0.875%.。

财务管理跨国公司财务管理ppt课件

此外,即使一些资产存在,但是一些消费者被人为限制在这 些资产市场之外。这些都导致了不完全市场的存在。

10

ቤተ መጻሕፍቲ ባይዱ

不完全市场的一般均衡(GEI)模型是A-D模型的扩展。 其主要研究在某些金融产品市场缺失的情况下,金融资产和商

Geanakoplos(1990)、Magi l和Shafer(1991)讨论了许多市场不完 全带来的后果,如典型代理人和单一商品模型的限制,公司目标的 冲突,金融资产和实物资产的重要区别等。

12

GEI模型的分析框架是非常吸引人的,但是GEI研究对数学较高 的要求使其未得到广泛的重视。木文提出GEI分析方法,其目的就 在于试图通过一个可计算GEI均衡的分析方法建立起GEI理论和它的 应用之间的联系。这种GEI均衡算法将提供一种有效而简洁的GEl均 衡预测方法,这种方法将能很好地计算均衡价格、市场行为和福利 的分配。这种可计算的分析框架将为我们分析诸如税收、关税政策 提供关键的分析工具。

13

3.产品周期理论 /question/129908331 产品生命周期理论是美国哈佛大学教授雷蒙德·弗农

(Raymond Vernon)1966年在其《产品周期中的国际投资与国际贸易》 一文中首次提出的。 产品生命周期(product life cycle),简称 PLC,是产品的市场寿命,即一种新产品从开始进入市场到被市场 淘汰的整个过程。费农认为:产品生命是指市上的的营销生命,产 品和人的生命一样,要经历形成、成长、成熟、衰退这样的周期。 就产品而言,也就是要经历一个开发、引进、成长、成熟、衰退的 阶段。

14

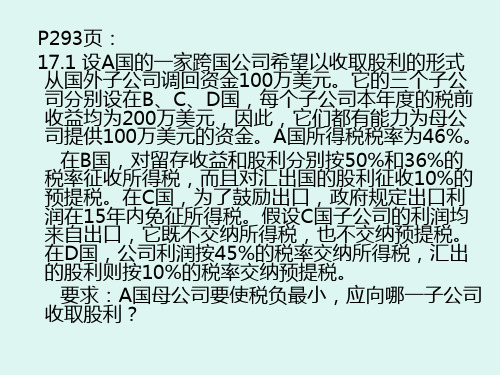

跨国公司财务管理课后习题答案

万

$36万

万

$86万

C

$100 0

万

0

$46万 $46万 0

$236

万

D

$100 $90万

$10

万

$0②

$100万 $90万

$200 万

从上表分析可知:从B国汇回100万美元的股利,发生的税收成本最低

②应交A国所得税的计算:

税前利润

2000000

应交东道国所得税

200x45%=900000

税后利润

项目

当天下班现 金余额

核定现金余 额

预期收回 (+)或支

出(-) +1天

德国总公司 DM6000 5000

+3000

巴基斯坦分 公司

DM5000 1000

-2000

意大利分公 司

DM5000 1000

+5000

+2天

——

+1000

-3000

+3天

-5000

-3000

+2000

要求:请根据该公司的政策要求设计资金转移计划。

要求:A国母公司要使税负最小,应向哪一子公司 收取股利?

解:

子公 司

股利额

东道国所 东道国预 得税(如 提税 果已经支 付了股利)

A国所 得税

பைடு நூலகம்

税款合 东道国所 计(如 得税(如 果支付 果没有支 了股利) 付股利)

全球税 负(如 果支付 了股利)

B

$100 $50万

$10万 $0① $96万 $100万 $186

利息费用: 2000000x(9%-6.4%)x90/360=13000元

跨国公司财务管理

n.解释1、外汇风险:即因外汇市场变动引起汇率旳变动,致使以外币计价旳资产上涨或者下降旳也许性。

在跨国公司旳国际活动中,以外币计价旳资产、负债、收入、费用、钞票流量旳本币价值由于各国货币市场汇率旳变动而产生损益,进而影响跨国公司本期利润和将来钞票流量旳风险。

2、国际结算:是指国际间由于政治、经济、文化、外交、军事等方面旳交往或联系而发生地以货币表达债权债务旳清偿行为或资金转移行为,它是货币旳跨国收付业务,是国际综合经济活动。

3、转让定价:又称转移定价,也称调拨定价、划拨价格,重要指跨国集团母公司和子公司之间进行内部交易时采用旳一种价格制度。

其一般做法是:高税国公司向其低税国关联公司销售货品、提供劳务、转让无形资产时制定低价;低税国公司向其高税国关联公司销售货品、提供劳务、转让无形资产时制定高价。

这样,利润就从高税国转移到低税国,从而达到最大限度减轻其税负旳目旳。

4、对外直接投资:又称国际直接投资。

是指一国投资者为获得国外公司经营管理上旳有效控制权而输出资本、设备、技术和管理等资产旳经济行为。

问答题1、跨国公司财务管理涉及哪些内容?跨国公司重要内容涉及:财务风险管理(政治风险、筹资风险、投资风险、外汇风险)、筹资管理(方式更多,渠道更广)、投资管理(短期投资和长期投资)、营运资金管理(存量和流量管理)、纳税管理(加强税务筹划)(1)财务风险管理:在复杂旳环境中开展跨国理财活动旳跨国公司,由于受诸多不拟定性因素旳影响所面临旳也许收益或潜在旳损失,就是跨国公司旳财务管理风险。

客观上规定跨国公司具体分析、评估国际形势和各国状况,以应付复杂旳理财环境,提高财务决策旳对旳性和及时性。

风险管理单薄会给公司带来巨大损失。

(2)筹资管理:是跨国公司财务管理最基本旳活动之一。

在筹资管理方面,跨国公司应做好如下工作:对旳拟定投资需要量,在此前提下,合理拟定筹资数额,安排资金构造;拟订两个以上可行旳筹资方案,并对其进行经济分析,从中选出最优筹资方案;优化资金构造,减少资金成本,防备筹资风险。

《跨国公司财务管理》复习题--

《跨国公司财务管理》复习题--《跨国公司财务管理》复习题--————————————————————————————————作者:————————————————————————————————日期:题型及分值(初步意向,仅供参考)一. 简答题(20分)二. 看表答题(20分)三. 计算题(40分)四.案例分析题(20分)《跨国公司财务管理》复习题2014-6Ch1----P131.跨国公司:1986年,联合国在《跨国公司行为守则》中对跨国公司作了新的界定:由在两个以上国家的实体所组成的公营、私营或混合所有制形式的企业;该企业在一个决策体系中运营,通过一个或一个以上的决策中心实现企业内部协调一致的政策和共同战略;该企业中各实体通过所有权或其他方式相联结,使各实体之间得以分享知识、资源和分担责任。

2. 跨国公司的主要特征:——简答题1、一般都有一个实力雄厚的大型公司为主体,通过对外直接投资或收购当地企业的方式,在许多国家建立有子公司或分公司;2、一般都有一个完整的决策体系和最高的决策中心,各子公司或分公司虽各自都有自己的决策机构,都可以根据自己经营的领域和不同特点进行决策活动,但其决策必须服从于最高决策中心;3、一般都从全球战略出发安排自己的经营活动,在世界范围内寻求市场和合理的生产布局,定点专业生产,定点销售产品,以牟取最大的利润;4、一般都因有强大的经济和技术实力,有快速的信息传递,以及资金快速跨国转移等方面的优势,所以在国际上都有较强的竞争力;5、许多大的跨国公司,由于经济、技术实力或在某些产品生产上的优势,或对某些产品、或在某些地区,都带有不同程度的垄断性。

3.跨国公司兴起的原因:(1).现代跨国公司是科技革命、企业组织创新和管理技术发展的产物。

(2).经济全球化创造了跨国经营的有利条件,促进了跨国公司的发展。

(3).此外各国政府的法律、政策支持具有不可低估的作用。

4. 跨国公司在世界经济中的作用:(1)促进了全球的商品生产和流通目前跨国公司已经控制了世界工业生产总值的40-50%,国际贸易的60-70%。

《跨国公司财务管理》课件

降低财务风险

通过风险管理,降低汇率、利率等风 险。

支持企业战略目标

为企业的全球经营战略提供财务支持 。

跨国公司财务管理的挑战与机遇

01

02

03

挑战

各国会计准则和税法差异 、文化差异、政治经济环 境不稳定、信息不对称等 。

机遇

全球化经营带来规模经济 效应、资源共享、市场拓 展等。

应对策略

建立完善的财务管控制度 、培养国际化财务管理人 才、加强风险管理等。

03

跨国公司的资本结构与筹资管 理

资本结构理论

资本结构理论概述

资本结构是指企业各种资本的价值构成及其 比例关系,是企业一定时期筹资组合的结果 。

资本结构决策的影响因素

企业资本结构决策的影响因素包括企业财务目标、 税收政策、企业总体风险和财务风险等。

资本结构理论的发展

资本结构理论经历了MM理论、权衡理论、 优序融资理论等发展阶段,为企业筹资决策 提供了重要的理论支持。

税收筹划的时机

根据跨国公司业务发展阶段和投资计划,合理安排税收筹划。

跨国公司的税收筹划策略

组织结构优化

合理设置公司组织结构,降低税负和税务风 险。

合同条款的税收筹划

在合同中明确税务条款本运作手段,如并购、重组等,降低 税负。

跨国公司的税务风险管理

税务风险评估

投资组合监控与调整

定期对投资组合的表现进行监控和评估,根据市场环境和公司战略 的变化及时调整投资组合。

05

跨国公司的外汇风险管理

外汇风险的定义与类型

外汇风险定义

外汇风险是指因汇率变动而产生 的企业外汇敞口,进而造成企业 价值损失的可能性。

外汇风险类型

包括交易风险、折算风险和经济 风险。

跨国企业的财务管理与报告要求

跨国企业的财务管理与报告要求跨国企业的财务管理是一项复杂而又关键的任务,涉及到国际财务法规、跨国公司间的关联交易、外汇风险管理等方面。

为了满足跨国企业在不同国家之间开展业务的需求,财务管理必须具备一定的特点与报告要求。

一、财务管理的特点跨国企业的财务管理与单国企业相比有以下几个特点:1. 多国货币体系:跨国企业必须处理不同国家的货币体系,包括兑换汇率风险和财务报告的货币折算问题。

财务管理必须能够适应不同货币之间的兑换,灵活应对汇率波动。

2. 国际税务法规:跨国企业在不同国家开展业务,需要遵守各国的税法法规,包括税率、征税方式、跨国利润的分配等。

财务管理需要了解和遵守各国的税收政策,并制定相应的税务策略以最大限度地降低税务风险。

3. 跨国公司间的关联交易:跨国企业内部进行的交易常常涉及到跨国公司间的关联交易,包括跨国货物与服务的采购、销售、许可费用等。

财务管理必须确保这些关联交易的价格公正合理,并满足各国的税务法规。

4. 外汇风险管理:跨国企业在跨国业务中面临着外汇风险,包括汇率波动的风险、国际贸易的支付风险等。

财务管理必须能够有效地管理外汇风险,采取适当的对冲措施,保护跨国企业的财务安全。

二、财务报告的要求跨国企业的财务报告要求如下:1. 合规性:跨国企业的财务报告必须符合各国的财务报告准则和国际财务报告准则(IFRS)等相关规定。

财务报告应具备合规性,确保真实、准确、全面地反映企业的财务状况和经营成果。

2. 比较性:财务报告应具备比较性,能够反映不同期间和不同公司之间的财务情况。

跨国企业的财务报告需要考虑到各国的会计政策和规定的差异,确保可比性。

3. 透明度:财务报告应具备透明度,能够为投资者和利益相关者提供清晰的财务信息,使其能够了解企业的财务状况和经营情况。

财务报告应包括必要的注释和解释,让读者能够理解财务数据的背景和含义。

4. 可读性:财务报告应具备可读性,采用简洁明了的语言和图表,使读者容易理解。

跨国公司财务管理基础

跨国公司财务管理基础跨国公司财务管理是一门综合性的学科,涉及到多个领域和专业知识,对于跨国公司的稳健经营和财务风险管理至关重要。

本文将从跨国公司财务管理的基础内容入手,探讨其重要性以及相关策略。

一、跨国公司财务管理的概述跨国公司财务管理是指在国际经济环境中,通过各种手段实现跨国公司资金、风险和利润的有效配置、调控和管理的过程。

跨国公司财务管理涉及到多个因素,包括汇率风险、出口信贷、国际税务等,需要企业根据自身情况进行合理的规划和决策。

二、跨国公司财务管理的重要性1. 融资需求:跨国公司在全球范围内拓展业务需要大量资金投入,合理的财务管理可以帮助企业高效运作和获得稳定的融资渠道。

2. 风险管理:国际市场的不确定性使得跨国公司面临更多的金融风险,财务管理能够帮助企业制定风险管理策略并降低风险水平。

3. 利润最大化:跨国公司经营海外市场需要解决多种挑战,包括汇率波动、政策风险等,良好的财务管理可以帮助企业优化利润结构和最大化利润。

三、跨国公司财务管理的策略1. 汇率风险管理:跨国公司财务管理中重要的一环是管理汇率风险。

企业可以通过使用金融衍生产品如远期合同和期权等来对冲汇率波动带来的风险。

2. 跨国融资:跨国公司在全球金融市场上寻找融资渠道可以降低融资成本,扩大企业经营规模。

公司可以选择发行国际债券、吸引外国投资等方式来获取资金。

3. 分析海外市场:企业在进入海外市场前需要对目标市场进行充分的分析,包括法律、政策和市场环境等方面的调研,以便制定出符合实际情况的财务决策和战略规划。

4. 国际税务筹划:合理的国际税务筹划可以帮助企业降低税负,合规经营。

企业可以通过合理安排跨国公司的利润和债务结构,通过税务合规方式降低税负。

5. 资本预算决策:跨国公司在做出投资决策时,应综合考虑汇率风险、政治风险、市场风险等因素。

同时,合理的资本预算决策可以为企业提供可行性和可持续性的发展。

结语跨国公司财务管理基础的学习和应用对跨国企业的发展至关重要,良好的财务管理可以帮助企业降低风险、优化利润并实现可持续发展。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

With a floating exchange rate:

– Economic shocks are more easily absorbed – But, the exchange rate may exhibit excessive volatility

Chapter 3: The International Monetary System

Managed (“dirty”) Float

– Central banks intervene to reduce economic volatility.

– Three categories of intervention

1. Smoothing out daily fluctuations – central bank buys or sells currency to smooth exchange rate adjustments. 2. Leaning against the wind – measures taken to moderate or prevent short- or medium-term exchange rate fluctuations caused by random events. 3. Unofficial pegging – a country pegs the value of its currency to a foreign currency to protect the value of its exports.

Economic stability ≡ stable exchange rate Stable exchange rate (not necessarily) ≡ fixed exchange rate

With a fixed exchange rate:

– If monetary policies are inconsistent with the fixed rate currency crises will ensue – Scope of the monetary policies will be limited it may not be easy to absorb economic shocks

5

3.A Exchange Rate Systems (5)

பைடு நூலகம்

Fixed-Rate System

– Governments maintain target exchange rates.

– Central banks buy/sell currency to increase (“revalue”)/decrease (“devalue”) exchange rates when exchange rates threaten to deviate from their stated par values by more than an agreed-on percentage. – Monetary policy becomes subordinate to exchange rate policy. – Group’s joint inflation rate should be accepted by all the members

US prices rise

Foreign prices fall

US exports fall, imports rise

Balance of payments equilibrium End of gold flow

Gold as the medium of exchange

– – Durable, storable, portable, easily recognized, divisible, easily standardized Also, fixed in quantity for the short-term (therefore, not susceptible to manipulation)

– Government controls dominate the allocative function of the foreign exchange market

Hybrid System – current international system consisting of free-float, managed-float, and pegged currencies.

Classical Gold Standard (1821-1914)

– Characterized by price-specie-flow mechanism • Changes in the price level in one country were offset by an automatic balance of payments (“BOP”) adjustment.

3

3.A Exchange Rate Systems (3)

Free (“clean”) Float

– Exchange rates are determined by currency supply and demand with no government intervention. – As economic parameters change, market participants adjust their current and expected future currency needs. – Shifts in currency needs in turn shift currency supply and demand schedules, as seen in Chapter 2.

Because the value of gold is fairly stable over time, the gold standard ensured longrun price stability for both individual countries and groups of countries. – – Fiat money: nonconvertible paper money, backed by the faith of the governments Governments often abuse:

• Acquisition of gold is costly

–

Money supply ≡ available supply of gold

Chapter 3: The International Monetary System

7

3.B International Monetary System (2)

Hybrid system

Chapter 3: The International Monetary System

2

3.A Exchange Rate Systems (2)

International Monetary System:

– Set of policies, institutions, practices, regulations, and mechanisms that determine the rate at which one currency is exchanged for another

– It is argued that if US, Germany and Japan made a target-zone arrangement, exchange rate volatility in international markets can be minimized.

Chapter 3: The International Monetary System

Chapter 3: The International Monetary System 4

3.A Exchange Rate Systems (4)

Target Zone Arrangement

– Countries agree to adopt economic policies that maintain their exchange rates within a specific range.

D. Emerging Market Currency Crises

Chapter 3: The International Monetary System

1

3.A Exchange Rate Systems (1)

Free float

Managed float

Target-zone arrangement Fixed-rate system

6

Chapter 3: The International Monetary System

3.B International Monetary System (1)

Gold Standard – participating countries fixed the prices of their currencies in terms of a specified amount of gold.