公司金融 导论

《公司金融》课程笔记

《公司金融》课程笔记第一章公司金融导论1.1 企业组织形式企业组织形式是指企业在法律上和组织上的形式。

根据企业组织形式的不同,企业可以分为个体工商户、合伙企业、有限责任公司和股份有限公司等。

1.1.1 个体工商户个体工商户是指个人以自己的名义从事商业、工业、手工业等经营活动的自然人。

个体工商户的经营风险由个人承担,个人财产与企业财产没有明确界限。

1.1.2 合伙企业合伙企业是指两个或两个以上的合伙人共同出资、共同经营、共享收益、共担风险的企业。

合伙企业的合伙人对企业的债务承担无限连带责任。

1.1.3 有限责任公司有限责任公司是指股东以其认缴的出资额为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业。

有限责任公司的股东人数不得超过50人。

1.1.4 股份有限公司股份有限公司是指股东以其认购的股份为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业。

股份有限公司的股东人数没有限制。

1.2 公司理财活动的主要环节和目标1.2.1 主要环节公司理财活动的主要环节包括投资、融资、运营资金管理、股利分配等。

1.2.2 目标公司理财的目标是实现企业价值最大化或股东财富最大化。

为了实现这一目标,企业需要进行有效的投资决策、融资决策、运营资金管理决策和股利分配决策。

1.3 委托代理与公司治理1.3.1 委托代理问题委托代理问题是指股东与经理人之间的利益冲突。

股东希望经理人追求企业价值最大化,而经理人可能追求自己的利益最大化。

1.3.2 公司治理机制公司治理机制是指通过一系列制度安排来解决委托代理问题,包括董事会、监事会、经理人激励机制、信息披露制度等。

1.4 企业的社会责任企业的社会责任是指企业在追求利润的同时,应承担的社会责任,如环境保护、员工福利、公益活动等。

企业应遵守法律法规,遵循商业道德,为社会和利益相关者创造价值。

第二章财务现金流与财务预测2.1 公司理财与现金流现金流在公司理财中具有重要性,它反映了企业的财务状况和经营成果。

1公司金融导论mup

金融学

货币银行学 国际金融学

何谓金融学?

2024/7/11

3

Webster字典:“To Finance”定义为“筹集或提 供资本(To Raise Or Provide Funds or Capital For)” ;

《华尔街日报》在其新开的公司金融(Corporate Finance)的固定版面中将(公司)金融定义为“为 业务提供融资的业务(Business Of Financing Businesses)” ;

《新帕尔格雷夫货币金融大辞典》(The New Palgrave Dictionary Of Money And Finance):” 金融以其不同的中心点和方法论而成为经济学的 一个分支,其中心点是资本市场的运营、资本资 产的供给和定价。 ”其方法论是使用相近的替代 物给金融契约和工具定价。罗斯概括了“Finance” 的四大课题:“有效率的市场”、“收益和风 险”、“期权定价理论”和“公司金融”。

公司理论应该是公司金融学的基础,而公司理论在很大程度上是 个法律问题。

过去的研究者往往给定公司的存在,而被动地讨论金融问题,公 司金融被视同为财务管理。

2024/7/11

9

当前公司金融最有意义的课题: 从法律的角度研究公司金融。 以资本成本为核心研究公司金融。 资本结构 公司治理 公司价值评估

2024/7/11

14

第11章 套利定价理论(APT)211 11.1 因素模型:公告.意外和期望收益211 11.2 风险:系统性和非系统性212 11.3 系统风险和贝塔系数213 11.4 投资组合与因素模型215 11.5 贝塔系数与期望收益218 11.6 资本资产定价模型和套利定价模型220 11.7 资产定价的实证研究方法221 第12章 风险.资本成本和资本预算227 12.1 权益资本成本227 12.2 贝塔的估计229 12.3 贝塔的确定232 12.4 基本模型的扩展234 12.5 伊士曼化学公司的资本成本估计237 12.6 降低资本成本240

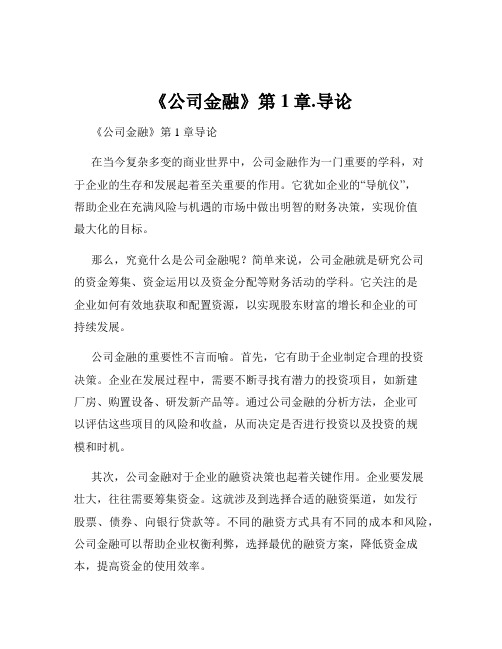

《公司金融》第1章.导论

《公司金融》第1章.导论《公司金融》第 1 章导论在当今复杂多变的商业世界中,公司金融作为一门重要的学科,对于企业的生存和发展起着至关重要的作用。

它犹如企业的“导航仪”,帮助企业在充满风险与机遇的市场中做出明智的财务决策,实现价值最大化的目标。

那么,究竟什么是公司金融呢?简单来说,公司金融就是研究公司的资金筹集、资金运用以及资金分配等财务活动的学科。

它关注的是企业如何有效地获取和配置资源,以实现股东财富的增长和企业的可持续发展。

公司金融的重要性不言而喻。

首先,它有助于企业制定合理的投资决策。

企业在发展过程中,需要不断寻找有潜力的投资项目,如新建厂房、购置设备、研发新产品等。

通过公司金融的分析方法,企业可以评估这些项目的风险和收益,从而决定是否进行投资以及投资的规模和时机。

其次,公司金融对于企业的融资决策也起着关键作用。

企业要发展壮大,往往需要筹集资金。

这就涉及到选择合适的融资渠道,如发行股票、债券、向银行贷款等。

不同的融资方式具有不同的成本和风险,公司金融可以帮助企业权衡利弊,选择最优的融资方案,降低资金成本,提高资金的使用效率。

再者,公司金融还能帮助企业进行有效的营运资金管理。

营运资金是企业日常经营活动中流动资产与流动负债的差额。

合理地管理营运资金,确保企业有足够的资金来满足日常生产经营的需要,同时避免资金的闲置和浪费,对于企业的稳定运营至关重要。

在公司金融中,有几个核心的概念和理论是我们必须要了解的。

首先是货币的时间价值。

这一概念告诉我们,今天的一元钱比未来的一元钱更有价值。

因为今天的一元钱可以用于投资,在未来获得更多的回报。

因此,在进行财务决策时,我们必须要考虑货币的时间价值,将未来的现金流折算成现值进行比较和分析。

其次是风险与收益的权衡。

一般来说,高收益往往伴随着高风险。

企业在追求高收益的同时,必须要充分评估所面临的风险,并采取相应的风险管理措施,以确保企业的财务安全。

另外,资本结构理论也是公司金融的重要组成部分。

公司金融导论课件

1.2.2 每股盈余最大化

❖ 含义

▪ 对于股份公司而言,一家公司的所有权用普通股股票 来证明,每一股表示它的持有者拥有该公司代表流通 在外的普通股总数分之一的所有权

▪ 公司的每股盈余(Earnings Per Share,简称EPS)等 于公司的税后净利除以流通在外的普通股数

▪ 该观点认为,公司股东的财富取决于每股盈余而非盈 利总额,因此公司金融的目标应努力使得每股盈余达 到最大

❖ 优点

▪ 所有权和经营权合一,个人决策,较能随机应变 ▪ 单独出资,不受他人干扰 ▪ 无须向社会公布企业的财务报表,可以保持业务机密,

有利于竞争 ▪ 企业组建简单、费用低,只要向政府的工商管理部门

申请营业执照即可

4

1.1.1 个体企业

❖ 缺点

▪ 个体企业的资本由个人单独出资,财力有限,很难筹 集到大笔资金用于企业的经营与发展

16

1.2.1 利润最大化

❖ 缺陷

▪ 没有充分考虑利润取得的时间性

• 货币的时间价值问题

▪ 忽视了投入与产出的关系

• 单纯比较不同投入资本所创造的利润总额,相互之间缺乏共同 的比较基础

▪ 忽略了未来获取利润时所承担的风险

• 利润越大风险也越• 忽略当前成本支出大而将来收益更大的项目

其他意外事件无法避免,因此常影响业务的稳定 ▪ 由于所负责任太大,使合伙人彼此常存戒心,难于和

衷共济 ▪ 财力仍然有限,不容易作大规模的策划与发展

思考:合伙企业和个体企业有哪些异同

7

1.1.3 公司

❖ 概念

▪ 公司制企业是一个独立的法人,是以公司身份出现的 法人,是最重要的一种企业组织形式

▪ 这类企业的所有权和管理权实现了分离

公司金融导论课件

1.2.4 企业公司金融目标:理论与现实的协调

❖ 债权人为保护自己的权益,采取设立债权保护条款:

1.有关营运资本的保护条款 2.股利和股票回购方面的限制性条款 3.资本支出的限制性条款 4.其他条款:如限制担保、并购、高层管理人员加薪等条

款。

28

1.3 公司金融的内容

29

1.3.1 筹资决策

❖ 优点

▪ 所有权和经营权合一,个人决策,较能随机应变 ▪ 单独出资,不受他人干扰 ▪ 无须向社会公布企业的财务报表,可以保持业务机密,

有利于竞争 ▪ 企业组建简单、费用低,只要向政府的工商管理部门

申请营业执照即可

4

1.1.1 个体企业

❖ 缺点

▪ 个体企业的资本由个人单独出资,财力有限,很难筹 集到大笔资金用于企业的经营与发展

▪ 在目前条件下,与其他公司金融目标相比,股票价格 最大化目标在理论上是最完善、最合理的

▪ 因此,目前绝大多数公司金融论著都假设企业公司金 融的目标是使其股东财富(或企业价值)最大化

思考:股东财富最大化目标与其他两个目标相比, 其优越性体现在哪里

22

1.2.4 企业公司金融目标:理论与现实的协调

❖ 所有权与经营权的分离

11

1.1.3 公司

❖ 优点

▪ 股东的责任仅仅限于其所投资的股份数 ▪ 股份可以自由转让,易于变现,企业的股票有很好的

流动性 ▪ 可集合大量资本,具有较多的增长机会 ▪ 由于股票可以自由转让,公司业务不致受股东个人兴

趣、健康及寿命的影响,因此公司能保持经营的连续 性 ▪ 公司所有权和经营权的分离使企业能聘用技术专长与 管理专家,提高经营管理的效率

❖ 公司制企业的治理结构

即:“三会一层” 最高权力机构——股东大会 最高决策机构——董事会 最高监督机构——监事会 最高管理机构——经理层

1 公司金融导论

公司金融导论.重要概念与技能❑作为《公司金融》开篇,我们将研究什么是公司金融?公司金融有哪些核心问题?❑从投资者和管理者的视角来看待并作出公司投融资的相关决策❑了解各种商业组织形式的财务应用❑了解公司金融的目标,了解财务总监(CFO)的职能❑理解三重代理问题:1.股东和管理层之间的冲突,2.股东和债权人之间的冲突,3.大股东和中、小股东之间的冲突本章结构1.1 什么是公司金融1.2 企业组织1.3 现金流的重要性1.4 公司金融的目标1.5 代理问题与公司的控制1.1 什么是公司金融?公司金融强调以下三类问题:1.公司应选择什么样的长期投资项目?2.对选定的投资项目,公司应从哪里筹措资金以满足投资需求?3.公司的利润如何分配,如何满足各类投资者的需求?企业的资产负债表模型流动资产固定资产1有形的2无形的资产总价值所有者权益短期负债长期负债投资者拥有的总价值资本预算决策流动资产固定资产1 有形的2 无形的所有者权益短期负债长期负债应选择什么样的长期投资项目?资本结构决策怎样为选定的投资项目筹措资金?流动资产固定资产1 有形的2 无形的所有者权益短期负债长期负债短期经营资产的管理怎样管理和筹措短期经营活动需要的资产?净营运资本流动资产固定资产1 有形的2 无形的所有者权益短期负债长期负债1.2 企业组织形式•个体经营者•合伙企业•普通合伙•有限合伙•公司公司与合伙企业的比较公司合伙企业流动性股份转让容易交易数量受很大限制融资能力融资便利,融资成本低,融资渠道多样融资相对困难,融资成本高,融资渠道少税双重征税由合伙人根据收益缴税再投资与股利支付在股利支付方面有很大选择余地通常所有的现金净盈利都分配给合伙人负债有限责任一般合伙人通常承担无限责任,有限合伙人只承担有限责任持续性可无限存续存续期通常有限来自公司的现金流(C)1.3 现金流的重要性税(D )政府留存现金(F)Invests in assets (B)股利与债务支付(E)Current assets Fixed assetsShort-term debtLong-term debt Equity shares企业最终必须产生出现金净流量来自企业的现金流必须超过来自金融市场的现金流.公司投资的资产(B )流动资产固定资产公司发行证券收到现金(A)金融市场短期负债长期负债所有者权益1.4 公司金融的目标•以下哪个才是正确的目标?•利润最大化•市场份额最大化•股东价值最大化•利益相关者共同利益最大化(公司有哪些利益相关者?)财务总监(CFO)财务总监的主要目标是通过以下措施来增加企业的价值:1.选择能使价值增值的项目;2.进行聪明的财务决策。

公司金融导论

流 流流 流பைடு நூலகம்流 流流 流

长长 流 流

固固 流 流 1.有 有 固 固流 流 2.无 有 固固流 流

所 有 所 所所

资产总价值

福州大学管理学院 18

投资者拥有的总价值

School of Management

接上

利润最大化 股东财富最大化 企业价值最大化 *企业经济增加值最大化 企业经济增加值最大化 资本利润率最大化或每股利润最大化 返回

福州大学管理学院

21

School of Management

接上

不足: 不足:

股东财富最大化需要通过股票市价最大化来实现,而影响股价变 动的因素很多,带有很大的波动性,易使股东权益财富最大化失 去公正的标准和统一衡量的客观尺度。 经理阶层和股东之间在公司金融目标上往往存在分歧。 股东财富最大化,对规范公司行为、统一员工认识缺乏应有的号 召力。 可能会忽视公司应承担的社会责任,加剧公司与社会的矛盾,不 利于公司的长远发展。 返回

返回

福州大学管理学院

8

School of Management

公司

公司(Corporation):是最主要的企业组织形式, 公司(Corporation):是最主要的企业组织形式,是依 ):是最主要的企业组织形式 照法律登记设立的,以其全部法人财产,依法自主经营、 照法律登记设立的,以其全部法人财产,依法自主经营、 自负盈亏的独立法人。 自负盈亏的独立法人。 类型 优越性、 优越性、缺点 公司拥有许多与自然人一样的法律权利。 公司拥有许多与自然人一样的法律权利。 “法人”、“法定代表人”、“法人代表”。 法人” 法定代表人” 法人代表” “公司”与“企业”的区别 公司” 企业” P2 返回

第一章公司金融导论

利润最 大化

股东财富最 大化

(定位) 定位)

(一)利润最大化目标的不足 (Maximization of profit) )

1.没有考虑利润实现的时间因素 没有考虑利润实现的时间因素 2.利润额作为绝对数指标,没有反映 利润额作为绝对数指标, 利润额作为绝对数指标 产出与资本投入间的对应关系 3.没有考虑风险因素 没有考虑风险因素 4.财务决策者带有短期行为倾向 财务决策者带有短期行为倾向

4.股东财富最大化目标定位优缺点 股东财富最大化目标定位优缺点

优点:考虑了风险因素 优点: 克服企业经营的短期行为 容易量化 缺点:只适用于上市公司 缺点: 不重视其他利益相关者 股票价格受多种因素影响

(三)股东财富最大化目标的基 本假设

股东目标与公司经营者目标完全 一致 债权人权益能得到完全保护

–与资本市场有关的运作机制。

• 中口径Finance 中口径

–货币的流通、信用的授予、投资的运作、 银行的服务等

中国人对金融的理解

宽口径的金融

窄口径的金融

•

公司金融: 公司金融:是专门研究公司如何筹

集资金和营运资金的学科。 集资金和营运资金的学科。

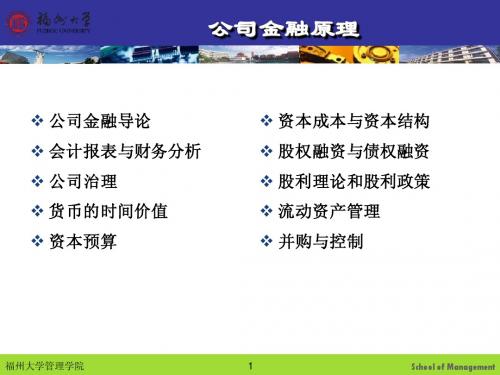

《公司金融》课程结构 公司金融》

基本理论部分 第1、2、3、7章

(二)金融市场构成要素

1.市场主体 市场主体 2.金融工具及金融资产 金融工具及金融资产 3.交易组织及其机制 交易组织及其机制

(三)金融市场种类

1.货币市场(money market)和资本市场 货币市场( 货币市场 )和资本市场(capital market) 2.一级市场 一级市场(primary market)和二级市场 和二级市场(secondary 一级市场 和二级市场 market) 3.现货市场(spot market)和期货市场 现货市场( 现货市场 )和期货市场(future market)

金融课件 第一章 公司金融导

Page 20

Page 7

Dt P t 1 r t 1

Page 8

n

第一章 公司金融导论

以下三个基本因素决定了公司股票的价值:

(1)公司在当前和未来通过生产经营所能产生的净现金流量。在其他情 况条件相同的情况下,净现金流量越多越好。 (2)现金流入的时间。现金流量流入的时间越早越好,因为所获得现金 可以进行投资。 (3)现金流量的风险。在其他条件相同的情况下,现金流量获取的不确 定性越大,股票的价值就越小,因为投资者需要得到风险补偿。 实现股票价值最大化必须在控制风险的前提之下最大限度地增加现金 流量。

Page 12

※管理者的品质

理性:在公司不同的发展阶段采取不同的发展战略

第一阶段:选择正确的发挥方向,确定适中的投资规模,制定高效的市场行销模 式

第二阶段:全面考虑盈余的分配,适当举债,并选择其他有效的融资渠道

第三阶段:合理地分配盈余,规划公司扩大规模的计划和调度好发展资金 第四阶段:考虑多余的现金用于再投资的收益率能否超过公司股权资本成本,并 决定是否用保留的盈利再投资

增加现金流量的方法:扩大销售、提高利润和增加资本投入。一个优 秀的公司往往能够很好地承担社会责任,不仅有心满意足的股东,也 有忠实的顾客和供应商、积极的经理和雇员,不仅能够为股东创造价 值,也能够为所有的利益相关者创造价值。

Page 9

※小资料:自由现金流

巴菲特认为,自由现金流是否充沛是衡量一家企业是否属于 “伟大”企业的主要标志之一。

Page 14

第一章 公司金融导论

五、公司金融决策的具体目标

成果目标:在控制风险的前提之下,努力提高资金的报酬率。 效率目标:合理使用资金,加速资金周转,提高资金的使用效率。 安全目标:保持较高的偿债能力和较低的财务风险,保证企业安

《公司金融导论》PPT幻灯片PPT

公司金融

➢ 1.个体业主制企业:一个人拥有的企业,它的设立非常简单.缺点是这类企 业承担无限责任,个人资产和企业资产之间没有差别.

➢ 2.合伙制企业:两个或两个以上的人创立的企业.特征为:(1)有限合伙人仅 仅承担与其出资额相应的责任(2)有限合伙人可以出售他们在企业中的 利益;(3)管理控制权归属于一般合伙人。

但是,公司金融理论出 现较晚。

(7)期权定价理论 (8)代理理论 (9)信号理论 (10)现代公司理论 (11)金融中介理论

公司金融

本章小结

实现股东财富最大化目标条件下的投资决策,融资决策和营运资本管 理组成了公司金融的基本内容。

公司金融的内容包括公司如何进行流动资产管理,如何进行长期资产 投资,公司短期投资如何组合,如何进行融资方式和融资结构选择.这些 公司金融交易和决策基于一定的公司金融原则。

2.管理者行为的控制

(1)管理者目标,因股东过于分散或分割,难有效地控制管理 者.(2)股东 控制管理者行为的理论和实践。

公司金融

笫三节 公司的金融活动

公司资产负债表模式

资产总价值

公司投资者的总价值

公司金融

1.公司主要金融活动 i.投资决策:在投资之前,须对固定资产形成之后可能产生的现金流入 进行预测,并据与此与固定资产投资所发生的现在流出进行比较,来决 定是否进行固定资产投资。 ii.融资决策:公司的价值V,则可写成

公司金融

二. 价值和经济效率原则

三. 公司金融交易原则

1.有价值的创意 1.风险-收益交易

原则

《公司金融》课件第1章 公司金融导论

Corporate Finance

第五节 代理问题与公司控制

一、公司治理:委托代理关系

委托代理关系是指市场交易中,由于信息不对称,处于信息劣势 的委托方与处于信息优势的代理方,相互博弈达成的合同法律关系。

Corporate Finance

目录

directory

案例引导 第一节 什么是公司金融 第二节 企业的组织形式与特征 第三节 公司运营中的金融活动 第四节 公司金融的目标 第五节 代理问题与公司控制

Corporate Finance

案例引导

万科成立于1984年,经过三十余年的发展,逐步成国内房地产顶级公司,其业务遍 布 65个城市。

当管理层偏离股东财富最大化目标则表明管理层与股东利益不一致,即存在代理问 题。而解决代理问题可以从激励和监督两个方面入手。对于万科集团来说,由于管理 层拥有的控制权,管理层和股东固有的利益冲突使其偏离股东价值最大化目标,产生 了严重的委托代理问题。

Corporate Finance

第一节 公司金融概述

Corporate Finance

四、公司金融的组织结构

➢ 公司的组织结构表明对于工作任务如何进行分工、分组和协调合作。在大型公司内 部,公司的组织结构包括股东大会、董事会、监事会三部分,股东大会是权利机关, 董事会是决策机关,监事会是监督机关。

股东大会

监事会

财务长

董事会

董事会主席和首席 执行官

副总裁和首席财务 官

Corporate Finance

三、公司制企业

种类与特征

股份有限公司

股份有限公司又称股份公司,通过发行股票筹集资 本,即公司资本为股份所组成的公司;股东以其认购的 股份为限对公司承担责任,公司以其全部资产对公司债 务承担责任的企业法人。

公司金融导论

演讲完毕,谢谢听讲!

再见,see you again

2020/11/6

公司金融导论

公司金融导论

5、深化时期(20C80S至今)

n 通货膨胀及其对利率的影响。 n 金融管制放松、金融机构由单一经营向多元化经营

转化问题。 n 电子通讯技术在信息传输和财务决策中大量应用。 n 新融资工具出现,如衍生性金融工具和垃圾债券等。 n 上述条件的变化使公司面临的市场需求、产品价格

以及成本预测等变得更加困难,这些不确定性的存 在使公司金融学的理论和实践都发生显著的变化。

公司金融导论

3、财务杠杆分析

n 财务管理的杠杆效应:由于特定费用(如固定 成本)的存在而导致的,当某一财务变量较小 幅度变动时,另一相关变量会以较大幅度变动。

n 如经营杠杆、财务杠杆、复合杠杆等 n 了解这些杠杆的原理,有助于企业合理地规避

风险,提高财务管理水平。

公司金融导论

四、ቤተ መጻሕፍቲ ባይዱ部分课时安排:

n 公司如何筹集资本性支出所需要的资金?这一问题 涉及资产负债表的右边。回答着一问题用到“资本 结构”,表示公司短期及长期负债与股东权益的比 例

n 公司应该如何管理它在经营中的现金流量?这一问 题涉及到资产负债表的上方。财务经理致力于管理 现金流量的缺口,与“净营运资本”密切相关

n 加上另外一个很重要的便是规避风险的问题

n 经济危机造成大量企业倒闭,股价暴跌,企业生产 不景气,资产变现能力差,因而公司金融学的重点 转向如何维持企业的生存上,如企业资产的保值、 变现能力、破产、清算以及合并与重组等。

n 这一时期国家加强了对微观经济活动的干预,如美 国分别于1933年和1934年颁布了《证券法》和《证 券交易法》,要求企业公布财务信息。这对公司财 务学的发展起了巨大的推动作用。

第1章 公司金融导论 《公司金融》PPT课件

▪ 因此,目前绝大多数公司金融论著都假设企业公司金 融的目标是使其股东财富(或企业价值)最大化

思考:股东财富最大化目标与其他两个目标相比, 其优越性体现在哪里

18

1.2.4 企业公司金融目标:理论与现实的协调

❖ 委托代理关系

• 由投资环境、筹资环境、劳动力环境、技术环境、信息环境、 市场环境等方面组成

▪ 就企业活动的社会观点看

• 由投资者、债权人、消费者、政府部门、社会团体等方面构成。

▪ 通常情况下,公司金融的环境包括

• 宏观经济环境 • 金融市场 • 经济法律环境 • 其他经济环境

30

1.4.1 公司金融环境的分析

更多的再投资用于有利可图的投资机会

10

1.2 公司金融的目标

11

1.2.1 利润最大化

❖ 含义

▪ 强调企业的利润额在一定的时间内达到最大

❖ 合理性

▪ 公司是盈利性经济组织,利润是企业生存和发展的必 要条件,追求利润是企业和社会经济发展的重要动力

▪ 利润代表了企业新创造的财富与价值,利润越大,企 业新创造的财富就越多

▪ 投资决策是指评估和选择资金的运用的过程 ▪ 投资是创造新财富的基本途径,因而投资决策对股东

财富最大化的影响也是第一位的

25

1.3.3 股利决策

❖ 股利决策

▪ 是指企业选择和确定其股利政策的过程 ▪ 其重要性体现在

• 股利支付率过高,会影响企业的再投资能力,甚至丧失投资机 会,从而导致未来收益减少,造成股价下跌

▪ 社会责任与股东财富最大化目标的一致性 ▪ 社会责任与股东财富最大化目标的矛盾

《公司金融导论》课件

借款或发行债券所需要支付的利息。

利息成本

发行股票或债券所产生的费用。

发行成本

税收成本

与筹资相关的税收支出。

违约风险

无法按时偿还借款的风险。

债务资本

公司所承担的债务总额。

要点一

要点二

权益资本

公司所发行的股票总额。

资本结构决策:确定债务和权益资本的合理比例。

债务资本成本

公司为债务融资所支付的利息率。

详细描述

应收账款管理主要关注如何通过合理的信用政策和收款策略,降低坏账风险,提高应收账款的回收率。这包括制定信用政策、评估客户信用、监控应收账款等方面。

总结词:存货管理是营运资金管理的另一个重要环节,它涉及到企业如何通过合理的库存控制和物流管理来降低库存成本和提高运营效率。

公司金融风险管理

06

总结词:操作风险是指因公司内部操作流程、人为错误或系统故障等因素导致的风险。

感谢您的观看

THANKS

《公司金融导论》ppt课件

公司金融概述财务报表与财务分析资本预算与投资决策筹资决策营运资金管理公司金融风险管理

目录

CONTENT

公司金融概述

01

成长阶段

20世纪初,随着资本市场的发展,公司金融开始关注资本结构和股利政策等问题。

创新发展阶段

近年来,随着金融市场的不断发展和企业竞争的加剧,公司金融研究领域也在不断创新和发展。

收益性原则

投资项目应控制在公司可承受的风险范围内。

风险可控原则

符合公司战略原则

资源匹配原则

01

02

04

03

投资项目应与公司的财务、技术和管理资源相匹配。

投资项目必须具有盈利潜力,预期收益率应超过资本成本。

第一章公司金融导论

第一章公司金融导论公司金融导论主要内容:公司金融的内涵;我国公司金融课程教学发展现状;公司金融课程教学内容;公司金融的内涵一、公司金融包含着什么内容?举例:某同学毕业后想创业,成立了一家化妆品销售公司。

该同学要做的事情:1. 申请注册成立公司;2. 聘用员工;3. 购买一定量的产品作为库存;4. 租赁装修店面;该同学必须考虑的事情:公司是自己独资成立还是合伙成立?成立一个公司需要多少钱?从哪里获得?产品投资方案有多个如何选择?获得一笔资金的成本问题,如何使其更小?如何管理现金和存货?如何有效的管理员工?公司财务管理的目标是什么?公司如有盈利该如何分配才合理?随着公司的成长还可能遇到一系列的问题:企业筹资融资、多元化投资、上市发行股票发行债券、公司治理、股利分配等决策、并购重组、海外上市以及这些决策对企业价值的影响。

二、什么是公司金融?公司金融:又称公司财务或公司理财,研究一个企业经营中的资金或资源问题。

融资决策投资决策股利决策三、我国公司金融课程教学发展现状公司金融是一门研究公司资金融通的课程。

西方经济学界一般将其和投资学一起归属于微观金融领域。

目前在我国高校的金融学教学中公司金融是金融学专业的基础课程。

四、公司金融课程教学内容课程重点内容主要有:财务比率分析、投资项目评价方法、投资项目风险分析、筹资方式与发行方式、资本成本和资本结构、股利政策、流动资产和流动负债管理、公司并购与重组等等;第二章企业组织形式主要内容:企业的几种组织形式;公司金融的目标;什么是企业?企业:依法设立的以营利为目的、从事商品的生产经营和服务活动的独立核算经济组织。

企业是市场经济的基本经济主体。

什么是企业、什么是公司?问题:1.__国有大型企业,是否是公司?2.印刷教材的保利达印务有限公司是否是企业?3.我们学校的小卖部,水果铺,盒饭铺是否是公司或企业?企业按组织形式划分1、独资企业2、合伙制企业3、公司制企业个人独资企业一个人出资设立的企业,又称业主制企业。

公司金融-导论

第二节 公司金融活动及价值创造过程

资产负债表

流动资产 营运资本

流动负债

长期负债 长期资产 (固定资产、无形资产) 股东权益

投 资

融 资

一、公司金融活动和财务经理职责

(一)投资决策(长期资产投资、固定资产投资)

原因:资源的稀缺性,投资的不可逆、不确定性 决策指标:资本预算 净现值(NPV)——现金流入现值和现金流出现值的 差量。若NPV>0,则投资。

第一部分为价值评估(第一到三章) 第二部分为投资决策(第四到六章) 第三部分为融资决策(第七到九章) 第四部分为财务规划和营运资本管理(第十到十三章) 第五部分为公司金融的一些特殊问题(第十四到十七章)

第一部分为价值评估。公司的一切金融活动是否有价 值,取决于它是否创造了公司价值,是否实现了公司 价值增值。因此,公司需要利用一定的手段来估计和 评估公司价值以及公司价值增值。

第五章 投资风险调整方法

第六章 实物期权和资本预算

第三部分为融资决策。不只要解决公司的资金缺口, 更要有助于实现公司价值增值。

第七章长期融资

第八章 资本结构

第九章 股利政策

第四部分财务规划和营运资本管理。系统阐述实现财 务目标的方法;考虑营运资本投入和筹集。

第十章 会计报表分析

(三)用资决策(营运资本管理)

流动资产管理:现金、应收账款、存货等, 如何配置取决于流动资产管理水平、生产经营 周期、销售政策、收账政策等。 流动负债管理:短期融资、短期借款、应付账款 等

一般合伙制:所有合伙人按协议规定的比例提供资金 和工作。(缴个人所得税、无限责任) 有限合伙制:至少一人为一般合伙人,有限合伙人不 参与管理,责任仅限其出资额。(有限合伙人有限责 任、无管理控制权)

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Board of Directors Chairman President Chief Executive Officer CEO Chief Operation Officer / COO Chief Financial Officer / CFO Treasurer

Current Assets

Fixed Assets 1 Tangible 2 Intangible

What longterm investments should the firm engage in?

Shareholders’ Equity

The Balance-Sheet Model of the Firm

–

2.

• • •

对现金流的重视

权责发生制;收付实现制 现金流具有时间价值 现金流具有风险性

随着公司形式的变迁,对公司本身的研究将和公司金融的 研究密不可分。公司理论的基本问题将逐渐转向公司金融 问题,法律研究和金融研究在这一领域将日益融合。 当前公司金融最有意义的课题: 3.

从法律的角度研究公司金融;以资本成本为核心研究公司金融;资本结 构;公司治理;公司价值评估

Corporate Finance 公司金融

Semester 2, 2008-2009 吴辉凡

General Information

办公室: 办公楼南楼1407 电话: 37215327(O) E-mail: 内部邮箱, Wu_HuiFan@

阿甘正传

• Life was like a box of chocolate ,you never know what you're gonna get. • 人生就像一盒巧克 力,总会有各种意 外发生。

Cash Flows between Firms and Markets

• Market value of the firm ≠ Book value of the firm because of growth assets. • In what situation will the firm create values for the investors? F>A

问题

• 你对“公司金融”了解多少? • 你对这门课程有什么期望?

金融学学科体系图

金融学 微观金融学 金融决策学 证券投资学 公司银行学 保险学 微观银行学 宏观金融学

货币政策分析

金融工程学

金融风险管 理

金融资产定价

金融监管学

国际金融学

两个中心问题

公司金融 VS.财务管理

• Corporate Finance

译作公司金融、公司理财、公司财务, 译作公司金融、公司理财、公司财务,内容包括资金 筹集、资本预算、资本结构、税收、资本成本、 筹集、资本预算、资本结构、税收、资本成本、股利 政策、公司并购和公司治理等问题。 政策、公司并购和公司治理等问题。

If how you slice the pie affects the size of the pie, then the capital structure decision matters.

The Balance-Sheet Model of the Firm

The Net Working Capital Investment Decision (净营运资金)

Current Assets

Fixed Assets 1 Tangible 2 Intangible Shareholders’ Equity

The Balance-Sheet Model of the Firm

The Capital Budgeting Decision(资本预算)

Current Liabilities Long-Term Debt

Corporate Finance or Business finance?

公司金融学的特点

1.

–

以资本成本(Cost Of Capital)理论为核心研究公司金融学

公司金融中的基本假设是,投资者向企业融资,他们期望有一定的 投资回报,这种回报就成了公司的融资成本。公司价值是用资本成 本折现的一系列的现金流。 如何投资(项目价值决策);如何融通资金(资本结构决策);为投资 人提供多少回报(股利政策决策)。

What is Corporate Finance?

Corporate Finance addresses the following three questions(公司金融探讨以下三个方面问题 公司金融探讨以下三个方面问题) 公司金融探讨以下三个方面问题

1. What long-term investments should the firm engage in?(公司应该投资于什么样的长期资产项目) 2. How can the firm raise the money for the required investments?(公司如何筹集投资支出所需

要的资金)

3. How much short-term cash flow does a company need to pay its bills?(公司需要多大的现

金流来应对支出)

The Balance-Sheet Model of the Firm

Total Value of Assets: Total Firm Value to Investors: Current Liabilities Long-Term Debt

The Capital Structure Decision(资本结构)

Current Liabilities Long-Term Debt Current Assets

How can the firm raise the money for the required Fixed Assets investments? 1 Tangible

Financial markets

Ultimately, the firm must be a cash generating activity.

Government

The cash flows from the firm must exceed the cash flows from the financial markets.

• Financial Management (财务管理)

目前国内的财务管理隶属于会计学领域,偏重财务分 析和财务控制。

1.2 财务总监与总会计师

To create value, the financial manager should: •Try to make smart investment decisions. •Try to make smart financing decisions.

Shareholders’ Equity

Corporate Financial Decisions

• Capital Budgeting (投资决策) 投资决策) 投资决策 – The process of planning and managing a firm's investments in fixed assets. It is concerned with the size, timing, and riskiness of cash flows. • Financing Decision (融资决策) 融资决策) – The mix of debt and equity used by a firm. – What are the least expensive sources of funds? – Is there a best mix? – When and where to raise funds? • Working Capital Management (营运资金管理) 营运资金管理) – Managing short-term assets and liabilities. – How much cash and inventory to keep around? – What is our credit policy? – Where will we obtain short-term loans?

• 什么是公司金融?财务经理的作用是什么? • 公司金融的目标是什么?

1.1 What is Corporate Finance?

• Corporate finance is a specific area of finance that analyzes the financial decisions of corporations.

Firms

Stocks and Bonds Money Bob

Investors securities Sue money

Primary Market Secondary Market

2 公司目标

• 公司的目标是什么?

公司目标:财富最大化

In traditional corporate finance, the objective in decision making is to maximize the value of the firm(公司财富最大 化). A narrower objective is to maximize stockholder wealth(股 东财富最大化). When the stock is traded and markets are viewed to be efficient, the objective is to maximize the stock price(股票价格最大化).

首席财务官 通过资源配置实现企业 的战略目标和长期发展

对外会计报告 总会计师、 公司财务?