公司理财公式总结

公司理财计算公式汇总

公司理财计算公式汇总

公司理财计算公式是指根据公司的财务数据和管理决策来计算和评估公司的经营状况和财务状况的数学公式和模型。

这些公式和模型可以帮助公司评估风险、制定投资决策、优化资本结构、分析盈利能力等。

下面是一些常用的公司理财计算公式汇总。

1.企业资产负债表计算公式:

-总资产=负债+净资产

-资产负债率=负债/总资产

-净资产收益率=净利润/净资产

2.企业利润表计算公式:

-总成本=固定成本+变动成本

-净利润=总收入-总成本

-毛利率=(总收入-总成本)/总收入

3.现金流量表计算公式:

-现金净流入=营业收入-营业支出

-现金比率=现金/负债

4.投资回报率计算公式:

-资本回报率=净利润/资本

-投资回收期=投资金额/年现金流入

5.风险评估公式:

-波动率=标准差/平均值

-风险价值=1.65*标准差*投资额

6.资本结构优化计算公式:

-杠杆比率=负债/股东权益

-资本成本=(利息支出+股东配资收益)/资本

-资本结构优化指数=杠杆比率*资本成本

7.盈利能力分析公式:

-毛利润率=(销售收入-变动成本)/销售收入

-净利润率=净利润/销售收入

-资产周转率=销售收入/总资产

以上只是一部分常用的公司理财计算公式,实际应根据具体情况选择

合适的公式和模型。

同时,需要注意的是,这些公式和模型只是辅助工具,公司理财决策还需要考虑行业趋势、市场需求、竞争对手等因素,综合考

虑才能做出更准确的判断和决策。

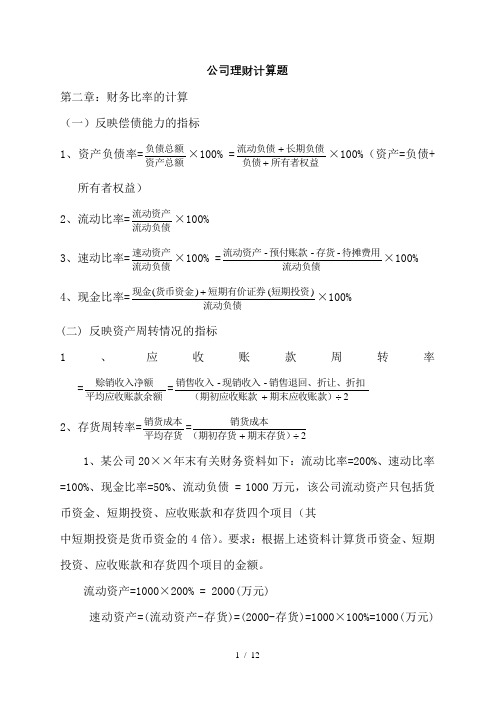

公司理财计算题公式

公司理财计算题公式公司的理财计算是指通过对资金的运作,以获取最佳的财务收益为目标的一种财务管理方式。

在进行公司理财计算时,通常需要使用一些公式来帮助分析和决策。

本文将介绍一些常用的公司理财计算公式,并解释其用途和计算方法。

一、财务指标计算公式1. ROE(Return on Equity,股东权益回报率)计算公式ROE = 净利润 / 股东权益ROE是衡量公司投资回报水平的重要指标,用于评估公司利润与股东投入资本之间的关系。

2. ROI(Return on Investment,投资回报率)计算公式ROI = (当前价值 - 初始价值) / 初始价值ROI用于衡量投资项目的收益率,是评估投资项目效果的重要指标。

3. EPS(Earnings per Share,每股收益)计算公式EPS = 净利润 / 发行股数EPS用于评估公司每股盈利水平,是投资者重要的参考指标之一。

二、财务比率计算公式1. 流动比率(Current Ratio)计算公式流动比率 = 流动资产 / 流动负债流动比率用于衡量公司的流动性状况,其数值大于1可以表示公司有足够的流动资金支付短期债务。

2. 速动比率(Quick Ratio)计算公式速动比率 = (流动资产 - 存货) / 流动负债速动比率相对于流动比率更加严格,不计算公司存货的价值,用于评估企业的现金流动能力。

3. 资产负债率(Debt-to-Asset Ratio)计算公式资产负债率 = 负债总额 / 总资产资产负债率用于评估公司财务风险,其数值越高,说明公司债务相对较多。

三、投资评估计算公式1. 现值(Present Value)计算公式现值 = 未来现金流 / (1 + 折现率)^n现值用于计算未来现金流折现后的价值,以便进行投资决策。

2. 内部收益率(Internal Rate of Return,IRR)计算公式内部收益率是使得净现值等于0的贴现率,用于衡量投资项目的收益率水平。

公司理财公式汇总推荐文档

公司理财公式汇总推荐文档公司理财公式汇总在公司的理财活动中,有许多重要的公式可以帮助管理者更好地进行财务决策和分析。

下面是一些常用的公司理财公式的汇总。

1. 企业价值公式(Enterprise Value,EV):企业价值=市值+净债务企业价值是指投资者需要为了收购整个企业所需支付的金额,它由公司的市值和净债务组成。

净债务是指公司的债务减去现金和短期投资。

2. 销售增长率(Sales Growth Rate):销售增长率=(本年度销售收入-上一年度销售收入)/上一年度销售收入销售增长率用于衡量公司销售额的增长速度,可以帮助管理者评估公司的业绩表现。

3. 毛利率(Gross Profit Margin):毛利率=毛利/销售收入毛利率是指销售收入中的毛利占比,可以帮助管理者评估公司的盈利能力和成本控制能力。

4. 净利润率(Net Profit Margin):净利润率=净利润/销售收入净利润率衡量公司在每销售一美元商品后的利润,可以帮助管理者评估公司的盈利能力。

5. 资产回报率(Return on Assets,ROA):资产回报率=净利润/总资产资产回报率用于评估公司资产的利用效率和盈利能力,可以帮助管理者评估公司的绩效。

6. 资本回报率(Return on Equity,ROE):资本回报率=净利润/股东权益资本回报率衡量企业投资者对其投资的回报,也是评估公司盈利能力的重要指标。

7. 盈利倍数(Price-Earnings Ratio,P/E ratio):盈利倍数=公司市值/净利润盈利倍数用于衡量投资者愿意为每一单位的净利润支付的金额,可以帮助管理者了解公司在市场上的估值。

8. 现金流量回报率(Cash Flow Return on Investment,CFROI):现金流量回报率=净现金流量/投资金额现金流量回报率用于评估投资项目的回报情况,可以帮助管理者决策是否进行该投资。

9. 负债收益率(Debt to Equity Ratio,D/E ratio):负债收益率=总负债/股东权益负债收益率用于衡量公司财务杠杆的使用情况,可以帮助管理者评估公司的偿债能力和财务风险。

公司理财的公式总结范文

一、货币的时间价值1. 单利终值:FP = IP(1 + in)2. 单利现值:PF = IP / (1 + in)3. 复利终值:FP = IP(1 + i)^n 或 P(F/P, i, n)4. 复利现值:PF = IP / (1 + i)^n 或 F(P/F, i, n)二、资本成本1. 权益资本成本:Ke = Rf + β(Rm - Rf)2. 债务资本成本:Kd = (1 - T)Rd3. 混合资本成本:WACC = Ke Wk + Kd (1 - T) Wd三、投资决策1. 净现值(NPV):NPV = Σ(Ct / (1 + i)^t)2. 内部收益率(IRR):IRR = i,使得NPV = 03. 投资回收期:t = Σ(Ct / CFt)四、财务比率分析1. 流动比率:流动比率 = 流动资产 / 流动负债2. 速动比率:速动比率 = (流动资产 - 存货) / 流动负债3. 负债比率:负债比率 = 总负债 / 总资产4. 杠杆比率:杠杆比率 = 负债 / 股东权益5. 毛利率:毛利率 = (销售收入 - 销售成本) / 销售收入6. 净利率:净利率 = 净利润 / 销售收入五、存货控制1. 经济订货量(EOQ):EOQ = √(2DS/H)2. 订货成本:订货成本 = (订货次数× 订货费用) + (库存持有成本× 平均库存量)3. 库存持有成本:库存持有成本 = 库存量× (存储成本 + 管理成本 + 损耗成本)六、折旧1. 年数总和法:折旧 = (原值 - 残值) × (n - t + 1) / (n × (n + 1) / 2)2. 双倍余额递减法:折旧 = (原值 - 残值) × 2 / n3. 线性折旧法:折旧 = (原值 - 残值) / n七、风险与收益1. 预期收益率:E(R) = Σ(ωi × Ri)2. 方差:σ^2 = Σ(ωi × (Ri - E(R))^2)3. 标准差:σ = √σ^24. 投资组合的系数:β = Σ(ωi × βi)通过以上对公司理财常用公式的总结,有助于我们更好地理解和应用公司理财的理论和方法,为实际工作中的决策提供有力支持。

公司理财贝塔系数与标准差的计算公式

公司理财贝塔系数与标准差的计算公式一、引言理财贝塔系数和标准差是衡量公司投资风险和收益的重要指标。

通过计算理财贝塔系数和标准差,公司可以更好地评估投资组合的收益和风险水平,从而制定更合理的投资策略。

本文将分别介绍公司理财贝塔系数和标准差的计算公式,帮助读者更好地理解和运用这两个指标。

二、理财贝塔系数的计算公式理财贝塔系数是衡量公司投资风险的重要指标。

理财贝塔系数的计算公式如下所示:1. 计算公司股票的日收益率Ri与市场的日收益率Rm的协方差Cov(Ri,Rm)。

2. 计算市场的日收益率Rm的方差Var(Rm)。

3. 计算理财贝塔系数的公式为:β = Cov(Ri,Rm) / Var(Rm)。

通过以上公式,可以计算出公司的理财贝塔系数。

理财贝塔系数越高,表明公司股票相对于市场更具有波动性,风险也更高;反之,理财贝塔系数越低,风险也相对较低。

公司可以根据理财贝塔系数的大小,来制定相应的投资策略。

三、标准差的计算公式标准差是衡量公司投资组合风险的重要指标。

标准差的计算公式如下所示:1. 计算公司股票的日收益率Ri的平均值μ。

2. 计算每个交易日的收益率Ri与平均值μ之差的平方。

3. 将以上差的平方累加起来,得到总和。

4. 将总和除以交易日的数量n-1(n为交易日的总数),再开平方根,得到标准差σ。

通过以上公式,可以计算出公司股票的标准差。

标准差越大,代表公司的股票价格波动越大,风险也相应较高;反之,标准差越小,代表股票价格波动较小,风险也相对较低。

公司可以根据标准差的大小来评估投资组合的风险水平,从而制定更合理的投资策略。

四、结论理财贝塔系数和标准差是公司评估投资风险和收益的重要指标。

通过本文介绍的计算公式,公司可以更好地理解和运用这两个指标,从而更加科学地评估投资组合的风险和收益水平。

希望本文对读者能有所启发,增进对理财贝塔系数和标准差的理解。

五、理财贝塔系数和标准差的实际应用理财贝塔系数和标准差的计算公式并不只是理论上的概念,它们在实际的金融和投资实践中有着重要的应用价值。

罗斯公司理财(财务管理)公式大合集

罗斯公司理财(财务管理)公式大合集1、单利:I=P*i*n2、单利终值:F=P(1+i*n)3、单利现值:P=F/(1+i*n)4、复利终值:F=P(1+i)^n或:P(F/P,i,n)5、复利现值:P=F/(1+i)^n或:F(P/F,i,n)6、普通年金终值:F=A{(1+i)^n-1]/i或:A(F/A,i,n)7、年偿债基金:A=F*i/[(1+i)^n-1]或:F(A/F,i,n)8、普通年金现值:P=A{[1-(1+i)^-n]/i}或:A(P/A,i,n)9、年资本回收额:A=P{i/[1-(1+i)^-n]}或:P(A/P,i,n)10、即付年金的终值:F=A{(1+i)^(n+1)-1]/i或:A[(F/A,i,n+1)-1]11、即付年金的现值:P=A{[1-(1+i)^-(n+1)]/i+1}或:A[(P/A,i,n-1)+1]12、递延年金现值:第一种方法:P=A{[1-(1+i)^-n]/i-[1-(1+i)^-s]/i}或:A[(P/A,i,n)-(P/A,i,s)]第二种方法:P=A{[1-(1+i)^-(n-s)]/i*[(1+i)^-s]}或:A[(P/A,i,n-s)*(P/F,i,s)]13、永续年金现值:P=A/i14、折现率:i=[(F/p)^1/n]-1(一次收付款项)i=A/P(永续年金)普通年金折现率先计算年金现值系数或年金终值系数再查有关的系数表求i,不能直接求得的通过内插法计算。

15、名义利率与实际利率的换算:i=(1+r/m)^m-1式中:r为名义利率;m为年复利次数16、期望投资报酬率=资金时间价值(或无风险报酬率)+风险报酬率17、期望值:(P43)18、方差:(P44)19、标准方差:(P44)20、标准离差率:(P45)21、外界资金的需求量=变动资产占基期销售额百分比x销售的变动额-变动负债占基期销售额百分比x销售的变动额-销售净利率x收益留存比率x预测期销售额22、外界资金的需求量的资金习性分析法:(P55)23、债券发行价格=票面金额x(P/F,i1,n)+票面金额x i2(P/A,i1,n)式中:i1为市场利率;i2为票面利率;n为债券期限如果是不计复利,到期一次还本付息的债券:债券发行价格=票面金额x(1+ i2 x n)x(P/F,i1,n)24、放弃现金折扣的成本=CD/(1-CD)x 360/N x 100%式中:CD为现金折扣的百分比;N为失去现金折扣延期付款天数,等于信用期与折扣期之差25、债券成本:Kb=I(1-T)/B0(1-f)=B*i*(1-T)/B0(1-f)式中:Kb为债券成本;I为债券每年支付的利息;T为所得税税率;B为债券面值;I 为债券票面利率;B0为债券筹资额,按发行价格确定;f为债券筹资费率26、银行借款成本:Ki=I(1-T)/L(1-f)=i*L*(1-T)/L(1-f)或:Ki=i(1-T)(当f忽略不计时)式中:Ki为银行借款成本;I为银行借款年利息;L为银行借款筹资总额;T为所得税税率;i为银行借款利息率;f为银行借款筹资费率27、优先股成本:Kp=D/P0(1-T)式中:Kp为优先股成本;D为优先股每年的股利;P0为发行优先股总额28、普通股成本:Ks=[D1/V0(1-f)]+g式中:Ks为普通股成本;D1为第1年股的股利;V0为普通股发行价;g为年增长率29、留存收益成本:Ke=D1/V0+g30、加权平均资金成本:Kw=ΣWj*Kj式中:Kw为加权平均资金成本;Wj为第j种资金占总资金的比重;Kj为第j种资金的成本31、筹资总额分界点:BPi=TFi/Wi式中:BPi为筹资总额分界点;TFi为第i种筹资方式的成本分界点;Wi为目标资金结构中第i种筹资方式所占比例32、边际贡献:M=(p-b)x=m*x式中:M为边际贡献;p为销售单价;b为单位变动成本;m为单位边际贡献;x为产销量33、息税前利润:EBIT=(p-b)x-a=M-a34、经营杠杆:DOL=M/EBIT=M/(M-a)35、财务杠杆:DFL=EBIT/(EBIT-I)36、复合杠杆:DCL=DOL*DFL=M/[EBIT-I-d/(1-T)]37:每股利润无差异点分析公式:[(EBIT-I1)(1-T)-D1]/N1=[(EBIT-I2)(1-T)-D2]/N2当EBIT大于每股利润无差异点时,利用负债集资较为有利;当EBIT小于每股利润无差异点时,利用发行普通股集资较为有利38、经营期现金流量的计算:经营期某年净现金流量=该年利润+该年折旧+该年摊销+该年利息+该年回收额39、非折现评价指标:投资利润率=年平均利润额/投资总额x100%不包括建设期的投资回收期=原始投资额/投产若干年每年相等的现金净流量包括建设期的投资回收期=不包括建设期的投资回收期+建设期40、折现评价指标:净现值(NPV)=-原始投资额+投产后每年相等的净现金流量x年金现值系数净现值率(NPVR)=投资项目净现值/原始投资现值x100%获利指数(PI)=1+净现值率内部收益率=IRR(P/A,IRR,n)=I/NCF式中:I为原始投资额41、短期证券收益率:K=(S1-S0+P)/S0*100%式中:K为短期证券收益率;S1为证券出售价格;S0为证券购买价格;P为证券投资报酬(股利或利息)42、长期债券收益率:V=I*(P/A,i,n)+F*(P/F,i,n)式中:V为债券的购买价格43、股票投资收益率:V=Σ(j=1~n)Di/(1+i)^j+F/(1+i)^n44、长期持有股票,股利稳定不变的股票估价模型:V=d/K式中:V为股票内在价值;d为每年固定股利;K为投资人要求的收益率45、长期持有股票,股利固定增长的股票估价模型:V=d0(1+g)/(K-g)=d1/(K-g)式中:d0为上年股利;d1为第一年股利46、证券投资组合的风险收益:Rp=βp*(Km - Rf)式中:Rp为证券组合的风险收益率;βp为证券组合的β系数;Km为所有股票的平均收益率,即市场收益率;Rf为无风险收益率47、机会成本=现金持有量x有价证券利率(或报酬率)48、现金管理相关总成本+持有机会成本+固定性转换成本49、最佳现金持有量:Q=(2TF/K)^1/2式中:Q为最佳现金持有量;T为一个周期内现金总需求量;F为每次转换有价证券的固定成本;K为有价证券利息率(固定成本)50、最低现金管理相关总成本:(TC)=(2TFK)^1/251、应收账款机会成本=维持赊销业务所需要的资金x资金成本率52、应收账款平均余额=年赊销额/360x平均收账天数53、维持赊销业务所需要的资金=应收账款平均余额x变动成本/销售收入54、应收账款收现保证率=(当期必要现金支出总额-当期其它稳定可靠的现金流入总额)/当期应收账款总计金额55、存货相关总成本=相关进货费用+相关存储成本=存货全年计划进货总量/每次进货批量x每次进货费用+每次进货批量/2 x单位存货年存储成本56、经济进货批量:Q=(2AB/C)^1/2式中:Q为经济进货批量;A为某种存货年度计划进货总量;B为平均每次进货费用;C为单位存货年度单位储存成本57、经济进货批量的存货相关总成本:(TC)=(2ABC)^1/258、经济进货批量平均占用资金:W=PQ/2=P(AB/2C)^1/259、年度最佳进货批次:N=A/Q=(AC/2B)^1/260、允许缺货时的经济进货批量:Q=[(2AB/C)(C+R)/R]^1/2式中:S为缺货量;R为单位缺货成本61、缺货量:S=QC/(C+R)62、存货本量利的平衡关系:利润=毛利-固定存储费-销售税金及附加-每日变动存储费x储存天数63、每日变动存储费=购进批量x购进单价x日变动储存费率或:每日变动存储费=购进批量x购进单价x每日利率+每日保管费用64、保本储存天数=(毛利-固定存储费-销售税金及附加)/每日变动存储费65、目标利润=投资额x投资利润率66、保利储存天数=(毛利-固定存储费-销售税金及附加-目标利润)/每日变动存储费67、批进批出该商品实际获利额=每日变动储存费x(保本天数-实际储存天数)68、实际储存天数=保本储存天数-该批存货获利额/每日变动存储费69、批进零售经销某批存货预计可获利或亏损额=该批存货的每日变动存储费x[平均保本储存天数-(实际零售完天数+1)/2]=购进批量x购进单价x变动储存费率x[平均保本储存天数-(购进批量/日均销量+1)/2]=购进批量x单位存货的变动存储费x[平均保本储存天数-(购进批量/日均销量+1)/2]70、利润中心边际贡献总额=该利润中心销售收入总额-该利润中心可控成本总额(或:变动成本总额)71、利润中心负责人可控成本总额=该利润中心边际贡献总额-该利润中心负责人可控固定成本72、利润中心可控利润总额=该利润中心负责人可控利润总额-该利润中心负责人不可控固定成本73、公司利润总额=各利润中心可控利润总额之和-公司不可分摊的各种管理费用、财务费用等74、定基动态比率=分析期数值/固定基期数值75、环比动态比率=分析期数值/前期数值76、流动比率=流动资产/流动负债77、速动比率=速动资产/流动负债78、现金流动负债比率=年经营现金净流量/年末流动负债*100%79、资产负债率=负债总额/资产总额80、产权比率=负债总额/所有者权益81、已获利息倍数=息税前利润/利息支出82、长期资产适合率=(所有者权益+长期负债)/(固定资产+长期投资)83、劳动效率=主营业务收入或净产值/平均职工人数84、周转率(周转次数)=周转额/资产平均余额85、周转期(周转天数)=计算期天数/周转次数=资产平均余额x计算期天数/周转额86、应收账款周转率(次)=主营业务收入净额/平均应收账款余额其中:主营业务收入净额=主营业务收入-销售折扣与折让平均应收账款余额=(应收账款年初数+应收账款年末数)/2应收账款周转天数=(平均应收账款x360)/主营业务收入净额87、存货周转率(次数)=主营业务成本/平均存货其中:平均存货=(存货年初数+存货年末数)/2存货周转天数=(平均存货x360)/主营业务成本88、流动资产周转率(次数)=主营业务收入净额/平均流动资产总额其中:流动资产周转期(天数)=(平均流动资产周转总额x360)/主营业务收入总额89、固定资产周转率=主营业务收入净额/固定资产平均净值90、总资产周转率=主营业务收入净额/平均资产总额91、主营业务利润率=利润/主营业务收入净额92、成本费用利润率=利润/成本费用93、总资产报酬率=(利润总额+利息支出)/平均资产总额94、净资产收益率=净利润/平均净资产x100%95、资本保值增值率=扣除客观因素后的年末所有者权益/年初所有者权益96、社会积累率=上交国家财政总额/企业社会贡献总额上交的财政收入包括企业依法向财政交缴的各项税款。

公司理财公式总结

公司理财公式总结经营一家公司需要良好的财务管理,以确保企业的发展和可持续性。

在这篇文章中,我们将总结一些重要的公司理财公式,以帮助您更好地管理您的企业财务。

1.利润率:利润率是衡量公司盈利能力的指标。

它可以通过将公司的净利润除以销售额来计算。

高利润率意味着公司的盈利能力强,而较低的利润率可能意味着公司在销售过程中遇到了一些问题。

利润率=净利润/销售额2.资产周转率:资产周转率是衡量公司资产利用效率的指标。

它可以通过将公司的销售额除以资产总额来计算。

高资产周转率表示公司有效地利用了其资产,而低资产周转率可能意味着公司需要优化其资产利用效率。

资产周转率=销售额/资产总额3.负债比率:负债比率是衡量公司负债水平的指标。

它可以通过将公司的总负债除以总资产来计算。

较低的负债比率意味着公司的负债水平较低,而较高的负债比率可能意味着公司需要更多的资金来偿还债务。

负债比率=总负债/总资产4.流动比率:流动比率是衡量公司流动性的指标。

它可以通过将公司的流动资产除以流动负债来计算。

较高的流动比率表示公司能够满足其短期债务,而较低的流动比率可能意味着公司面临现金流问题。

流动比率=流动资产/流动负债5.经营现金流量比率:经营现金流量比率是衡量公司经营现金流量的指标。

它可以通过将公司的经营活动现金流量除以净利润来计算。

较高的经营现金流量比率表示公司的经营活动产生了足够的现金流入,而较低的经营现金流量比率可能意味着公司面临现金流问题。

经营现金流量比率=经营活动现金流量/净利润6.回报率:回报率是衡量投资回报的指标。

它可以通过将公司的利润除以投资额来计算。

较高的回报率表示投资获得了良好的回报,而较低的回报率可能意味着投资未能获得预期的回报。

回报率=利润/投资额以上是一些常用的公司理财公式,可以帮助您更好地了解和管理您的企业财务状况。

当然,并不是所有的公司都适用于相同的公式,因为每个公司的经营模式和行业上下文都不同。

因此,当使用这些公式时,确保根据您公司的具体情况进行调整和解释。

公司理财计算题公式总结与简答题

现值P= Fn·DFi,n = Fn /(1+i)n【公式中1/(1+i)n称为复利现值系数,简写作DFi,n】

3、年金:终值Fn = R·ACFi,n【ACFi,n是年金终值系数的简写,R为年金,n为年金个数】

320

8

普通股

400

15

合计

800

-

要求:计算该方案的加权平均资本成本。

加权平均资本成本= 6%× + 8%× + 15%× = 11.3%

2、某公司本年度拟投资1000万元于一个项目,其资金来源如下:(1)企业留存收益筹资100万元;(2)按面值发行期限为5年的债券300万元,每年年末付息一次,到期一次还本,年利率8%,筹资费率5%;(3)发行优先股筹资200万元,年股息率10%,筹资费用8万元;(4)发行普通股筹资400万元,分为40万股,每股市价10元,预期第一年的股利率为10%(即价格和收益的比率为10:1),筹资费率3%,股利年增长率为6%。要求:根据以上资料计算该项目的加权平均资本成本(最低回报率)。(该公司的企业所得税税率为30%)

习题:

1、某公司发行面值为100元、票面利率为8%的5年期公司债券1000万元,每年年末付息一次,到期一次还本,发行时市场利率为6%,请计算该债券的发行价格为多少?

发行价格=100×8%×ADF0.06,5 +100×DF0.06,5 = 8×4.212+100×0.747= 108.40(元)

2、某公司从租赁公司租入一套设备,价值为1000万元,租期为8年,合同约定租赁年利率为6%,手续费为设备价值的2%,租金每年年末支付一次。要求用等额年金法计算该公司每年年末应支付的租金是多少?

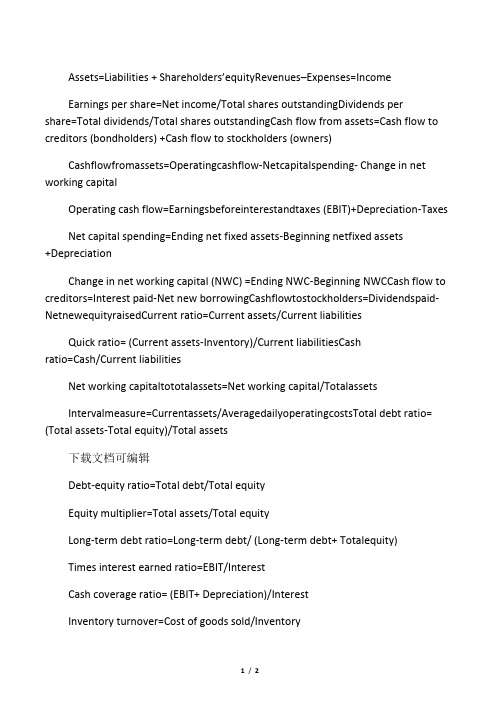

公司理财公式

Assets=Liabilities + Shareholders’equityRevenues–Expenses=IncomeEarnings per share=Net income/Total shares outstandingDividends pershare=Total dividends/Total shares outstandingCash flow from assets=Cash flow to creditors (bondholders) +Cash flow to stockholders (owners)Cashflowfromassets=Operatingcashflow-Netcapitalspending- Change in net working capitalOperating cash flow=Earningsbeforeinterestandtaxes (EBIT)+Depreciation-TaxesNet capital spending=Ending net fixed assets-Beginning netfixed assets+DepreciationChange in net working capital (NWC) =Ending NWC-Beginning NWCCash flow to creditors=Interest paid-Net new borrowingCashflowtostockholders=Dividendspaid-NetnewequityraisedCurrent ratio=Current assets/Current liabilitiesQuick ratio= (Current assets-Inventory)/Current liabilitiesCashratio=Cash/Current liabilitiesNet working capitaltototalassets=Net working capital/TotalassetsIntervalmeasure=Currentassets/AveragedailyoperatingcostsTotal debt ratio= (Total assets-Total equity)/Total assets下载文档可编辑Debt-equity ratio=Total debt/Total equityEquity multiplier=Total assets/Total equityLong-term debt ratio=Long-term debt/ (Long-term debt+ Totalequity)Times interest earned ratio=EBIT/InterestCash coverage ratio= (EBIT+ Depreciation)/InterestInventory turnover=Cost of goods sold/InventoryDays’sales in inventory=365 days/Inventory turnoverReceivables turnover=Sales/Accounts receivableDays’sales in receivables=365 days/Receivables turnoverNWC turnover=Sales/NWCFixed asset turnover=Sales/Net fixed assetsTotal asset turnover=Sales/Total assetsProfit margin=Net income/SalesReturn on assets (ROA) =Net income/Total assetsReturn on equity (ROE) =Net income/Total equityPE ratio=Price per share/Earnings per shareMarket-to-book ratio=Market value per share/Book value pershareROE= (Net income/Sales)*(Sales/Assets)*(Assets/Equity)ROE=Profit margin*Total asset turnover*Equity multiplierDividend payout ratio=Cash dividends/Net income下载文档可编辑Internal growth rate= (ROA*b)/ (1-ROA*b)Sustainable growth rate= (ROE*b)/ (1-ROE*b)Capitalintensityratio=Totalassets/Sales=1/Totalassetturnover若出现任何拼写错误,概不负责。

公司理财公式总结

公司理财公式总结公司理财公式总结公司理财公式是在公司财务管理中应用的一系列公式,用于帮助企业分析、评估和决策。

这些公式提供了一种计算和量化企业财务指标的方法,为管理层提供有关公司财务状况和经营绩效的重要信息。

在以下文章中,我将总结一些常用的公司理财公式,并介绍它们的作用和用途。

1. 资本回报率(Return on Investment, ROI)ROI是衡量公司投资回报的重要指标,计算公式如下:ROI = (净利润 / 资本投资)× 100%其中,净利润为公司的净收入减去所有费用和税收,资本投资为公司的固定资产和流动资产之和。

ROI的计算可以帮助管理层评估投资项目的盈利能力,决定是否继续投资或寻找更具回报率的机会。

2. 盈利性指标(Profitability Ratios)盈利性指标是评估公司盈利能力的公式集合,常见的指标包括毛利率、净利润率和营业利润率。

它们有助于管理层了解公司的利润表现和盈利能力。

- 毛利率 = (销售收入 - 成本)/ 销售收入 × 100%毛利率用于衡量公司销售产品或服务的利润能力。

- 净利润率 = 净利润 / 销售收入 × 100%净利润率是衡量公司销售收入与净利润之间关系的指标,反映了公司经营利润的能力。

- 营业利润率 = 营业利润 / 销售收入 × 100%营业利润率用于分析公司销售收入与营业利润之间的关系。

3. 偿债能力指标(Solvency Ratios)偿债能力指标用于评估公司的债务偿还能力和财务健康状况。

- 流动比率 = 流动资产 / 流动负债流动比率用于判断公司能否及时偿还债务。

一般来说,流动比率高于1表示公司有足够的流动性来偿还债务。

- 速动比率 = (流动资产 - 存货) / 流动负债速动比率排除了存货对流动性的影响,更准确地衡量了公司的偿债能力。

- 有息负债率 = 有息负债 / 资本结构有息负债率用于评估公司负债在总资本中的比例。

公司理财公式总结

A s s e t s=L i a b i l i t i e s+S t o c k h o l d e r s’E q u i t y Assets = (Current + Fixed) AssetsNet Working Capital= Current Assets – Current LiabilitiesRevenues - Expenses = IncomeSales or Revenues(-) Cost of goods sold(=) Gross profit毛利(-) Administrative/marketing costs行政管理/营销成本, Depreciation折旧(=) Operating Profit营业利润(-) Interests, Taxes(=) Net income净收益(-) Dividends to preferred stocks(=) Earning available to common shareholdersCash Flow From Assets (CFFA) = Cash Flow to Creditors + Cash Flow to StockholdersCash Flow From Assets = Operating Cash Flow营运现金流量– Net Capital Spending净资本支出– Changes in NWC净营运资本的变化OCF (I/S)营运现金流= EBIT息税前利润+ depreciation – taxes = $547 NCS净资本支出( B/S and I/S) = ending net fixed assets – beginning net fixed assets + depreciation = $130Changes in NWC (B/S) = ending NWC – beginning NWC = $330CFFA = 547 – 130 – 330 = $87CF to Creditors (B/S and I/S) = interest paid – net new borrowing = $24 CF to Stockholders (B/S and I/S) = dividends paid –net new equity raised = $63CFFA = 24 + 63 = $87Current Ratio 流动比率= CA / CL 2,256 / 1,995 = 1.13 timesQuick Ratio 速动比率= (CA – Inventory) / CL (2,256 – 301) / 1,995 = .98 timesCash Ratio 现金比率= Cash / CL 696 / 1,995 = .35 timesNWC to Total Assets = NWC / TA (2,256 – 1,995) / 5,394 = .05Interval Measure区间测量= CA / average daily operating costs 2,256 / ((2,006 + 1,740)/365) = 219.8 daysTotal Debt Ratio资产负债率 = (TA –TE) / TA (5,394 –2,556) / 5,394 = 52.61% Debt/Equity资本负债率 = TD / TE (5,394 – 2,556) / 2,556 = 1.11 times Equity Multiplier权益乘数= TA / TE = 1 + D/E1 + 1.11 = 2.11Long-term debt ratio长期债务率 = LTD / (LTD + TE)843 / (843 + 2,556) = 24.80%Times Interest Earned利息保障倍数= EBIT息税前利润Earnings Before Interest and Tax / Interest 1,138 / 7 = 162.57 timesCash Coverage现金涵盖比率= (EBIT + Depreciation) / Interest(1,138 + 116) / 7 = 179.14 timesInventory Turnover存货周转 = Cost of Goods Sold / Inventory2,006 / 301 = 6.66 timesDays’ Sales in Inventory 销售库存的天数= 365 / Inventory Turnover365 / 6.66 = 55 daysReceivables Turnover应收帐款周转率= Sales / Accounts Receivable 5,000 / 956 = 5.23 timesDays’ Sales in Receivabl es = 365 / Receivables Turnover 365 / 5.23 = 70 daysTotal Asset Turnover = Sales / Total Assets5,000 / 5,394 = .93It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assetsNWC Turnover = Sales / NWC 5,000 / (2,256 – 1,995) = 19.16 times Fixed Asset Turnover = Sales / NFA 5,000 / 3,138 = 1.59 timesProfit Margin利润率= Net Income / Sales 689 / 5,000 = 13.78%Return on Assets资产收益率(ROA) = Net Income / Total Assets 689 / 5,394 = 12.77%Return on Equity股本回报率 (ROE) = Net Income / Total Equity 689 / 2,556 = 26.96%PE Ratio市盈率= Price per share每股价格/ Earnings per share每股收益87.65 / 3.61 = 24.28 timesMarket-to-book ratio市价与账面值比率=market value per share / book value per share每股市价/每股账面价值 87.65 / (2,556 / 190.9) = 6.55 times ROE = PM * TAT * EMFuture ValuesFV = PV(1 + r)t PV = FV / (1 + r)tFV = future valuePV = present valuer = period interest rate, expressed as a decimal (用小数表示) t = number of periodsPerpetuity 永续年金: PV = C / rAnnuities 年金: ⎥⎥⎥⎥⎦⎤⎢⎢⎢⎢⎣⎡+-=r r C PV t )1(11 Growing Annuity 增长年金永久 g r CPV -=APR 年度成本百分率 EAR Effective Annual Rate1 m APR 1 EAR m-⎥⎦⎤⎢⎣⎡+=此处均为年利率,有时候给了年利率要换成月、季利率、天利率!!!自己体会!!!!Bond Value = PV of coupons 息票+ PV of par 票面价值Bond Value = PV of annuity 年金+ PV of lump sum 总金额Current Yield 现价息率= annual coupon / priceYield to maturity = current yield + capital gains yield 资本利得收益率 (1 + R) = (1 + r)(1 + h), whereR = nominal rater = real rateh = expected inflation rateApproximation 近似法 R = r + hrequired return g P D g P g)1(D R 0100+=++=where D1/P0 is the dividend yield 股息率and g is the capital gains yield 资本利得收益率average accounting return AAR = Average Net Income/Average Book Value E R the cost of equityg P D R E +=01见ppt14的9 Risk-free rate, RfMarket risk premium 市场风险溢价, E(RM) – RfSystematic risk of asset 系统性风险的资产, ?BetawE = E/V = percent financed with equitywD = D/V = percent financed with debtE = market value of equity = # of outstanding shares times price per shareD = market value of debt = # of outstanding bonds times bond price V = market value of the firm = D + E100%= D/V + E/VWACC = w E R E + w D R D (1-T C )after-tax cost of debt R D (1-T C )。

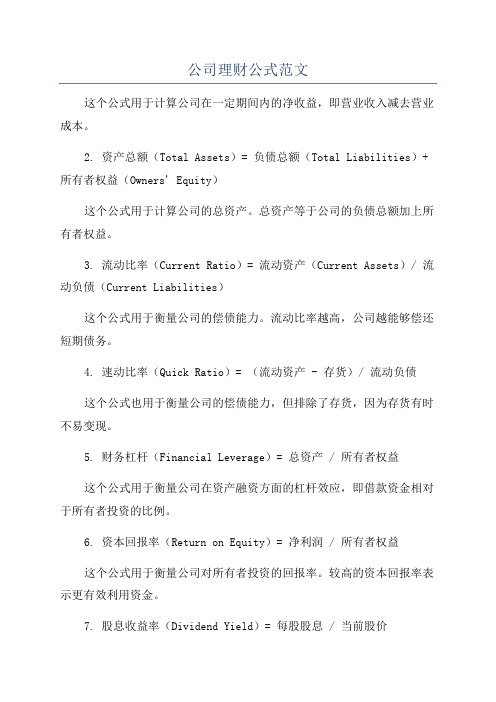

公司理财公式范文

公司理财公式范文这个公式用于计算公司在一定期间内的净收益,即营业收入减去营业成本。

2. 资产总额(Total Assets)= 负债总额(Total Liabilities)+ 所有者权益(Owners' Equity)这个公式用于计算公司的总资产。

总资产等于公司的负债总额加上所有者权益。

3. 流动比率(Current Ratio)= 流动资产(Current Assets)/ 流动负债(Current Liabilities)这个公式用于衡量公司的偿债能力。

流动比率越高,公司越能够偿还短期债务。

4. 速动比率(Quick Ratio)= (流动资产 - 存货)/ 流动负债这个公式也用于衡量公司的偿债能力,但排除了存货,因为存货有时不易变现。

5. 财务杠杆(Financial Leverage)= 总资产 / 所有者权益这个公式用于衡量公司在资产融资方面的杠杆效应,即借款资金相对于所有者投资的比例。

6. 资本回报率(Return on Equity)= 净利润 / 所有者权益这个公式用于衡量公司对所有者投资的回报率。

较高的资本回报率表示更有效利用资金。

7. 股息收益率(Dividend Yield)= 每股股息 / 当前股价这个公式用于衡量公司发放给股东的股息相对于股价的比例。

8. 折现现金流量(Discounted Cash Flow)= Σ(现金流量 / (1+ 投资回报率)^ n)这个公式用于计算预期现金流量的现值,并用于评估投资项目的可行性。

9. 内部回报率(Internal Rate of Return)= 使得折现现金流量等于零的投资回报率这个公式用于计算投资项目的预期年化回报率,以评估投资项目的可行性。

10. 久期(Duration)= Σ PV(每期的现金流入量 * 期数)/ Σ PV(每期的现金流入量)这个公式用于计算债券的久期,以评估债券的价格和利率变动对债券投资组合价值的影响。

公司理财计算题公式

公司理财计算题公式公司理财计算是企业财务管理的重要内容之一。

它涉及到企业的资金运作、投资决策、资金筹措以及风险管理等方面。

在进行公司理财计算时,常用的一些公式包括现值公式、未来值公式、净现值公式、内部收益率公式、财务杠杆指标公式等。

1. 现值公式:现值是指将未来的一笔预期收入或支出折算到当前时间所得到的数值。

现值公式的一般形式为:PV = CF / (1 + r)^n其中,PV表示现值,CF表示未来的现金流量,r表示贴现率,n表示未来现金流量的时间跨度。

2. 未来值公式:未来值是指将当前的一笔资金投资到时间未来时点后的所得到的累计值。

未来值公式的一般形式为:FV = PV × (1 + r)^n其中,FV表示未来值,PV表示现在的一笔资金,r表示每期的报酬率,n表示投资的期数。

3. 净现值公式:净现值是指将一笔投资的未来现金流量与其当前的投资成本进行对比,判断该投资是否具有盈利能力。

净现值公式的一般形式为:NPV = CF0 + CF1 / (1 + r) + CF2 / (1 + r)^2 + ... + CFn / (1 + r)^n 其中,NPV表示净现值,CFi表示第i期的现金流量,r表示贴现率。

4. 内部收益率公式:内部收益率是指使得净现值等于0的贴现率。

内部收益率公式的一般形式为:NPV = CF0 + CF1 / (1 + IRR) + CF2 / (1 + IRR)^2 + ... + CFn / (1 + IRR)^n = 0其中,IRR表示内部收益率,CFi表示第i期的现金流量。

5. 财务杠杆指标公式:财务杠杆指标用于衡量企业使用债务资金投资的效果和风险。

常用的财务杠杆指标包括资产负债率、产权比率、权益乘数、利息保障倍数等。

以上是公司理财计算中常用的一些公式和指标。

在实际运用中,根据具体情况需要,还可以结合其他衡量指标,综合考虑风险、收益等因素。

为了更加准确地进行公司理财计算,可以利用电子表格软件,如Excel等,编制相应的计算模型,并对模型进行灵活性测试和风险分析,以提高决策的科学性和有效性。

公司理财公式汇总

公司理财公式汇总在现代企业管理中,理财是一项重要的工作,对于企业的发展和运营至关重要。

理财公式是在公司理财中广泛使用的数学公式,用于计算和分析企业的财务状况和经营情况。

下面将介绍一些常用的公司理财公式。

1.利润公式利润是企业在一定时期内的净收入,是衡量企业经营业绩的重要指标。

利润公式如下:利润=收入-费用其中,收入包括销售收入、投资收益等,费用包括产品成本、运营费用等。

2.毛利润率公式毛利润率是指企业每销售一单位产品或提供一单位服务所获得的利润与销售额的比值,是衡量企业盈利能力的重要指标。

毛利润率公式如下:毛利润率=(销售收入-销售成本)/销售收入*100%3.净利润率公式净利润率是指企业每销售一单位产品或提供一单位服务所获得的净利润与销售额的比值,是衡量企业盈利能力的重要指标。

净利润率公式如下:净利润率=净利润/销售收入*100%4.资产收益率公式资产收益率是指企业利润与企业资产之间的关系,是衡量企业利润与资产配置效率的重要指标。

资产收益率公式如下:资产收益率=净利润/总资产*100%5.偿债能力公式偿债能力是指企业清偿债务的能力,是衡量企业的财务风险的重要指标。

常用的偿债能力公式包括:(1)流动比率=流动资产/流动负债(2)速动比率=(流动资产-存货)/流动负债(3)利息保障倍数=利润总额/利息费用6.库存周转率公式库存周转率是衡量企业库存管理效率的重要指标,表示企业单位时间内将库存转化为销售收入的能力。

库存周转率公式如下:库存周转率=销售成本/平均库存额7.期限结构公式期限结构是指不同借贷期限之间的利率差异。

期限结构公式如下:期限结构=短期借贷利率-长期借贷利率8.当期利润现金含量公式当期利润现金含量是指企业当期利润所占的现金比重。

当期利润现金含量公式如下:当期利润现金含量=当期现金流量净额/当期净利润*100%以上是一些常见的公司理财公式,它们可以帮助企业正确评估和掌握自身财务状况,进一步优化财务决策,提高企业盈利能力和偿债能力。

公司理财公式【范本模板】

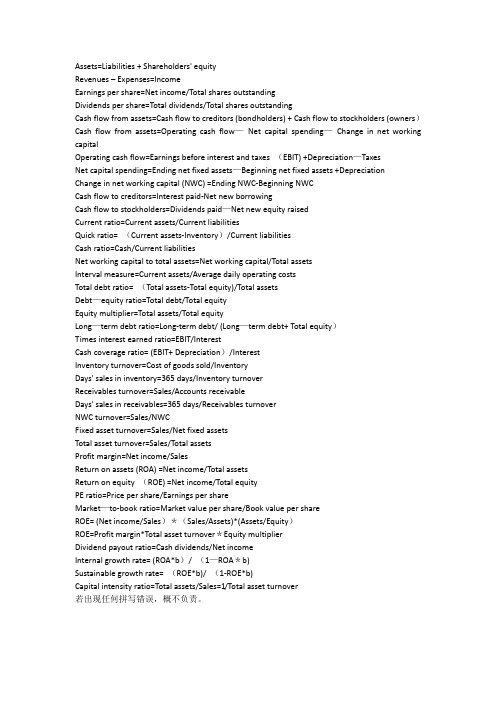

Assets=Liabilities + Shareholders' equityRevenues – Expenses=IncomeEarnings per share=Net income/Total shares outstandingDividends per share=Total dividends/Total shares outstandingCash flow from assets=Cash flow to creditors (bondholders) + Cash flow to stockholders (owners)Cash flow from assets=Operating cash flow—Net capital spending—Change in net working capitalOperating cash flow=Earnings before interest and taxes (EBIT) +Depreciation—TaxesNet capital spending=Ending net fixed assets—Beginning net fixed assets +Depreciation Change in net working capital (NWC) =Ending NWC-Beginning NWCCash flow to creditors=Interest paid-Net new borrowingCash flow to stockholders=Dividends paid—Net new equity raisedCurrent ratio=Current assets/Current liabilitiesQuick ratio= (Current assets-Inventory)/Current liabilitiesCash ratio=Cash/Current liabilitiesNet working capital to total assets=Net working capital/Total assetsInterval measure=Current assets/Average daily operating costsTotal debt ratio= (Total assets-Total equity)/Total assetsDebt—equity ratio=Total debt/Total equityEquity multiplier=Total assets/Total equityLong—term debt ratio=Long-term debt/ (Long—term debt+ Total equity)Times interest earned ratio=EBIT/InterestCash coverage ratio= (EBIT+ Depreciation)/InterestInventory turnover=Cost of goods sold/InventoryDays' sales in inventory=365 days/Inventory turnoverReceivables turnover=Sales/Accounts receivableDays' sales in receivables=365 days/Receivables turnoverNWC turnover=Sales/NWCFixed asset turnover=Sales/Net fixed assetsTotal asset turnover=Sales/Total assetsProfit margin=Net income/SalesReturn on assets (ROA) =Net income/Total assetsReturn on equity (ROE) =Net income/Total equityPE ratio=Price per share/Earnings per shareMarket—to-book ratio=Market value per share/Book value per shareROE= (Net income/Sales)*(Sales/Assets)*(Assets/Equity)ROE=Profit margin*Total asset turnover*Equity multiplierDividend payout ratio=Cash dividends/Net incomeInternal growth rate= (ROA*b)/ (1—ROA*b)Sustainable growth rate= (ROE*b)/ (1-ROE*b)Capital intensity ratio=Total assets/Sales=1/Total asset turnover若出现任何拼写错误,概不负责。

2020年整理公司理财公式总结.doc

Assets = Liabilities + Stockholders’ EquityAssets = (Current + Fixed) AssetsNet Working Capital= Current Assets – Current LiabilitiesRevenues - Expenses = IncomeSales or Revenues(-) Cost of goods sold(=) Gross profit毛利(-) Administrative/marketing costs行政管理/营销成本, Depreciation折旧(=) Operating Profit营业利润(-) Interests, Taxes(=) Net income净收益(-) Dividends to preferred stocks(=) Earning available to common shareholdersCash Flow From Assets (CFFA) = Cash Flow to Creditors + Cash Flow to StockholdersCash Flow From Assets = Operating Cash Flow营运现金流量–Net Capital Spending净资本支出–Changes in NWC净营运资本的变化OCF (I/S)营运现金流= EBIT息税前利润+ depreciation –taxes = $547NCS净资本支出( B/S and I/S) = ending net fixed assets –beginning net fixed assets + depreciation = $130Changes in NWC (B/S) = ending NWC – beginning NWC = $330CFFA = 547 – 130 – 330 = $87CF to Creditors (B/S and I/S) = interest paid – net new borrowing = $24CF to Stockholders (B/S and I/S) = dividends paid – net new equity raised = $63CFFA = 24 + 63 = $87Current Ratio 流动比率= CA / CL 2,256 / 1,995 = 1.13 timesQuick Ratio 速动比率= (CA – Inventory) / CL (2,256 – 301) / 1,995 = .98 timesCash Ratio 现金比率= Cash / CL 696 / 1,995 = .35 timesNWC to Total Assets = NWC / TA (2,256 – 1,995) / 5,394 = .05Interval Measure区间测量= CA / average daily operating costs 2,256 / ((2,006 + 1,740)/365) = 219.8 daysTotal Debt Ratio资产负债率= (TA – TE) / TA (5,394 – 2,556) / 5,394 = 52.61%Debt/Equity资本负债率= TD / TE (5,394 – 2,556) / 2,556 = 1.11 timesEquity Multiplier权益乘数= TA / TE = 1 + D/E1 + 1.11 = 2.11Long-term debt ratio长期债务率= LTD / (LTD + TE)843 / (843 + 2,556) = 24.80%Times Interest Earned利息保障倍數= EBIT息税前利润Earnings Before Interest and Tax / Interest 1,138 / 7 = 162.57 timesCash Coverage现金涵盖比率= (EBIT + Depreciation) / Interest(1,138 + 116) / 7 = 179.14 timesInventory Turnover存货周转= Cost of Goods Sold / Inventory2,006 / 301 = 6.66 timesDays’ Sales in Inventory 销售库存的天数= 365 / Inventory Turnover365 / 6.66 = 55 daysReceivables Turnover应收帐款周转率= Sales / Accounts Receivable 5,000 / 956 = 5.23 times Days’ Sales in Receivables = 365 / Receivables Turnover 365 / 5.23 = 70 daysTotal Asset Turnover = Sales / Total Assets5,000 / 5,394 = .93It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assetsNWC Turnover = Sales / NWC 5,000 / (2,256 – 1,995) = 19.16 timesFixed Asset Turnover = Sales / NFA 5,000 / 3,138 = 1.59 timesProfit Margin 利润率= Net Income / Sales 689 / 5,000 = 13.78%Return on Assets 资产收益率(ROA) = Net Income / Total Assets 689 / 5,394 = 12.77% Return on Equity 股本回报率 (ROE) = Net Income / Total Equity 689 / 2,556 = 26.96%PE Ratio 市盈率= Price per share 每股价格/ Earnings per share 每股收益 87.65 / 3.61 = 24.28 timesMarket-to-book ratio 市价与账面值比率=market value per share / book value per share 每股市价/每股账面价值 87.65 / (2,556 / 190.9) = 6.55 timesROE = PM * TAT * EMFuture ValuesFV = PV(1 + r)t PV = FV / (1 + r)tFV = future valuePV = present valuer = period interest rate, expressed as a decimal (用小数表示)t = number of periodsPerpetuity 永续年金: PV = C / rAnnuities 年金: ⎥⎥⎥⎥⎦⎤⎢⎢⎢⎢⎣⎡+-=r r C PV t )1(11 ⎥⎦⎤⎢⎣⎡-+=r r C FV t 1)1( Growing Annuity 增长年金⎥⎥⎦⎤⎢⎢⎣⎡⎪⎪⎭⎫ ⎝⎛++--=t r g g r CPV )1()1(1 永久 g r C PV -=APR 年度成本百分率 EAR Effective Annual Rate1 m APR 1 EAR m-⎥⎦⎤⎢⎣⎡+=此处均为年利率,有时候给了年利率要换成月、季利率、天利率!!!自己体会!!!!t t r)(1FV r r)(11-1C Value Bond ++⎥⎥⎥⎥⎦⎤⎢⎢⎢⎢⎣⎡+= Bond Value = PV of coupons 息票+ PV of par 票面价值Bond Value = PV of annuity 年金+ PV of lump sum 总金额Current Yield 现价息率= annual coupon / priceYield to maturity = current yield + capital gains yield 资本利得收益率 (1 + R) = (1 + r)(1 + h), whereR = nominal rater = real rateh = expected inflation rateApproximation 近似法 R = r + hg-R D g -R g)1(D P 100=+= required return g P D g P g)1(DR 0100+=++=where D1/P0 is the dividend yield 股息率and g is the capital gains yield 资本利得收益率average accounting return AAR = Average Net Income/Average Book ValueE R the cost of equityg P D R E +=01见ppt14的9Risk-free rate, RfMarket risk premium 市场风险溢价, E(RM) – RfSystematic risk of asset 系统性风险的资产, βBetawE = E/V = percent financed with equitywD = D/V = percent financed with debtE = market value of equity = # of outstanding shares times price per shareD = market value of debt = # of outstanding bonds times bond price V = market value of the firm = D + E100%= D/V + E/VWACC = w E R E + w D R D (1-T C )after-tax cost of debt R D (1-T C )))((f M E f E R R E R R -+=β。

公司理财常见公式汇总

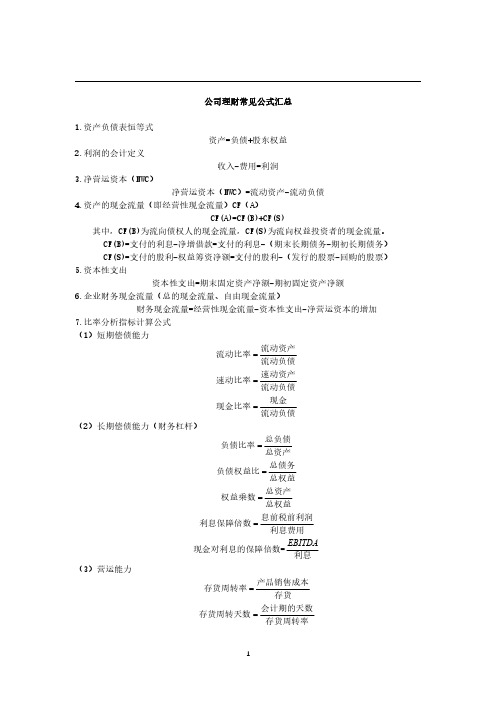

1.资产负债表恒等式 资产=负债+股东权益

2.利润的会计定义 收入-费用=利润

3.净营运资本(NWC) 净营运资本(NWC)=流动资产-流动负债

4.资产的现金流量(即经营性现金流量)CF(A) CF(A)=CF(B)+CF(S)

其中,CF(B)为流向债权人的现金流量,CF(S)为流向权益投资者的现金流量。 CF(B)=支付的利息-净增借款=支付的利息-(期末长期债务-期初长期债务) CF(S)=支付的股利-权益筹资净额=支付的股利-(发行的股票-回购的股票)

ArT

1 r

1

1

1 rT

3

(5)增长年金

PV

C 1 r

C 1 g 1 r2

......

C 1 g T 1 1 rT

r

C g

1

1 1

g r

T

18.净现值(NPV)计算公式

计算 =−

1

=1

式中:NPV 表示净现值; 表示初始投资额, 表示第 i 年的现金流量;r 表示折现率,

n 表示投资项目的寿命周期。

=算

算 =

算

1

(4)三种系数的关系

总杠杆系数=经营杠杆系数 财务杠杆系数

27.债券的估值

(1)一般债券价值

V

C

1

1

1 r

T

r

1

F r

T

(2)零息债券价值

(3)永久债券价值

算 = ᦙ1 ㌳

利息额 C 算 = 折现率 = r

28.债券到期收益率 (1)普通债券

P

C

1

1

1 r

T

r

1

F r

公司理财公式总结

Total Asset Turnover = Sales / Total Assets 5,000 / 5,394 = .93

It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets NWC Turnover = Sales / NWC 5,000 / (2,256– 1,995) = 19.16 mes Fixed Asset Turnover = Sales / NFA 5,000 / 3,138 = 1.59 mes Profit Margin利润率= Net Income / Sales6 89 / 5,000 = 13.78% Return on Assets资产收益率(ROA) = Net Income / Total Assets 689 / 5,394 = 12.77% Return on Equity股本回报率 (ROE) = Net Income / Total Equity 689 / 2,556 = 26.96% PE Ra o市盈率= Price per shar每e 股价格/ Earnings per shar每e 股收益 87.65 / 3.61 = 24.28

Perpetuity 永续年金: PV = C / r

PV C r Annui es 年金:

=

êé1 ê

-

(1

1 +

ù

)t

ú ú

r ê

ú

êë

úû

t

FV C r = êé(1 + ) - 1úù

r ë

û

Growing Annuity增长年金

PV r C g gr =

公司理财计算公式汇总

公司理财计算公式汇总公司理财计算公式是指根据公司的财务数据,运用数学和财务理论公式计算出的具体指标和数据。

这些公式可以帮助公司对财务状况、盈利能力、偿债能力、投资回报等进行精确的评估和分析。

下面是一些常用的公司理财计算公式的汇总。

1.利润表计算公式利润率=净利润/总营业收入毛利率=(销售收入-销售成本)/销售收入营业利润率=营业利润/总营业收入净利润率=净利润/总营业收入2.资产负债表计算公式总资产=长期资产+短期资产总负债=长期负债+短期负债净资产=总资产-总负债资产负债率=总负债/总资产权益比率=净资产/总资产3.现金流量表计算公式经营活动现金流量=净利润+非经营性损益投资活动现金流量=购置固定资产、无形资产和其他长期资产支付的现金+资本性支出收到的现金+收回投资所收到的现金筹资活动现金流量=借款收到的现金+股东投入资金+收到其它与筹资活动有关的现金净现金流量=经营活动现金流量+投资活动现金流量+筹资活动现金流量4.盈利能力计算公式总资产收益率=净利润/总资产净资产收益率=净利润/净资产股东权益报酬率=净利润/股东权益5.偿债能力计算公式流动比率=流动资产/流动负债速动比率=(流动资产-存货)/流动负债利息保障倍数=利润总额/利息费用6.投资回报率计算公式投资回报率=(净利润+利息)/投资额资本回报率=净利润/股东权益7.估值计算公式市盈率=市值/净利润市净率=市值/净资产除了以上列举的公式,还有一些特定领域的公司理财计算公式,例如财务风险评估、资本结构优化等。

这些公式通常需要根据公司的具体情况和特定需求进行定制。

公司理财计算公式的应用可以帮助公司更好地了解财务指标、风险和机会,指导决策制定和管理决策。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Assets = (Curre nt + Fixed) Assets

Net Working Capital二 Current Assets -Current Liabilities

Reve nues - Expe nses = In come

Sales or Reve nu es(-) Cost of goods sold(=) Gross prof毛禾U (-) Admi

nistrative/marketi ng

costs行政管理/营销成本,Depreciation折旧(=)Operating Profit 营业利润(-)Interests,

Taxes

(=)Net in come 净收益(-)Divide nds to preferred stocks(=) Earni ng available to com mon

shareholders

Cash Flow From Assets (CFFA) = Cash Flow to Creditors + Cash Flow to Stockholders Cash Flow From Assets = Operati ng Cash Flowt 运现金流量—Net Capital Spending 净资本支出-Cha nges in NWC净营运资本的变化

OCF (l/S)营运现金流二 EBIT 息税前利润+ depreciation - taxes = $547

NCS 净资本支出(B/S and I/S) = ending net fixed assets- beginning net fixed assets +

depreciation = $130

Cha nges in NWC (B/S) = en di ng NWC -begi nning NWC = $330

CFFA = 547 -130 -330 = $87

CF to Creditors (B/S and I/S) = interest paid-net new borrowing = $24 CF to Stockholders (B/S and I/S) = divide nds paid -net new equity raised = $63

CFFA = 24 + 63 = $87

Curre nt Ratio 流动比率=CA / CL 2,256 / 1,995 = 1.13 times

Quick Ratio 速动比率=(CA Tnventory) / CL (2,256 -301) / 1,995 = .98 times Cash Ratio 现金比率=Cash / CL 696 / 1,995 = .35 times NWC to Total Assets = NWC / TA (2,256 -1,995) / 5,394 = .05

Interval Measure 区间测量= CA / average daily operating costs 2,256 / ((2,006 +

1,740)/365) = 219.8 days

Total Debt Ratio资产负债率二(TA—TE) / TA (5,394 —2,556)/ 5,394 = 52.61% Debt/Equity 资本负债率二 TD / TE (5,394 -2,556) / 2,556 = 1.11 times

Equity Multiplier 权益乘数= TA / TE = 1 + D/E

1 + 1.11 = 2.11

Long-term debt ratio 长期债务率二 LTD / (LTD + TE)

843 / (843 + 2,556) = 24.80%

Times Interest Earnec h息保障倍数二 EBIT 息税前利润Earnings Before Interest and Tax /

Interest 1,138 / 7 = 162.57 times

Cash Coverage现金涵盖比率二(EBIT + Depreciation) / Interest

(1,138 + 116) / 7 = 179.14 times

Inven tory Turno ver 存货周转=Cost of Goods Sold / Inven tory

2,006 / 301 = 6.66 times

Days' Sales in Inven tory售库存的天数=365 / Inven tory Turno ver

365 / 6.66 = 55 days

Receivables Turnover应收帐款周转率二 Sales / Accounts Receivable 5,000 / 956 = 5.23

times

Days' Sales in Receivaebsl= 365 / Receivables Turnover 365 / 5.23 = 70 days

Total Asset Turnover = Sales / Total Assets

5,000 / 5,394 = .93

It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets NWC Turnover = Sales / NWC 5,000 / (2,256 —1,995) = 19.16 times Fixed Asset Turnover = Sales / NFA 5,000 / 3,138 = 1.59 times

Profit Margin 利润率二 Net In come / Sales 689 / 5,000 = 13.78%

Retur n on Assets 资产收益率(ROA) = Net In come / Total Assets 689 / 5,394 = 12.77% Retur n on Equity 股本回报率(ROE) = Net In come / Total Equity 689 / 2,556 = 26.96% PE Ratio 市盈率二 Price per share 每股价格 / Earni ngs per share 每股收益 87.65 / 3.61

=

24.28 times

Market-to-book ratio 市价与账面值比率 二market value per share / book value per

share

股市价 / 每股账面价值 87.65 / (2,556 / 190.9) = 6.55 times

ROE = PM * TAT * EM

Future Values

FV = PV(1 + r)t PV = FV / (1 + r)t

FV = future value

PV = prese nt value

r = period in terest rate, expressed as a decimal 用小数表示)

t = nu mber of periods

Perpetuity 永续年金:PV = C / r

Growing Annuity 增长年金

永久 PV — r g

APR 年度成本百分率

EAR Effective Ann ual Rate

m APR Annuities 年金:PV

1

(1 r )t r

1 —— 1此处均为年利率,有时候给了年利率要换成月、季利率、 m

天利率!! !自己体会! ! !!

Bond Value = PV of coupo ns 息票 + PV of par 票面价值

Bo nd Value = PV of ann uity 年金 + PV of lump sum 总金额

Curre nt Y ield 现价息率二 annual coup on / price

Yield to maturity = current yield + capital gains yield 资本利得收益率

(1 + R) = (1 + r)(1 + h), where

R = nominal rate

r = real rate

h = expected inflation rate

Approximation 近似法 R = r + h

the capital gains yield 资本利得收益率

average acco un ti ng retur n AAR = Average Net In come/Average Book Value

R E the cost of equity

Risk-free rate, Rf

Market risk premium 市场风险溢价,E(RM) - Rf

Systematic risk of asset 系统性风险的资产,Beta

wE = E/V = perce nt finan ced with equity

wD = D/V = perce nt finan ced with debt

E = market value of equity = # of outsta nding shares times price per share

D = market value of debt = # of outstanding bonds times bond price

EAR

V = market value of the firm = D + E 100%= D/V + E/V

WACC = W E R E + W D R D(1-T C)

after-tax cost of debt R D(1-T C)。