UCP600英文版

UCP600中英文对照版

《跟单信用证统一惯例》(UCP600)中英文对照版Article 1 Application of UCP第一条统一惯例的适用范围The Uniform Customs and Practice for Documentary Credits, 2007 Revis ion, ICC Publication no. 600 (“UCP”) are rules that apply to any do cumentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of t he credit expressly indicates that it is subject to these rules. The y are binding on all parties thereto unless expressly modified or ex cluded by the credit.跟单信用证统一惯例,2007年修订本,国际商会第600号出版物,适用于所有在正文中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证)。

除非信用证中另有规定,本惯例对一切有关当事人均具有约束力。

Article 2 Definitions第二条定义For the purpose of these rules:就本惯例而言:Advising bank means the bank that advises the credit at the request of the issuing bank.通知行意指应开证行要求通知信用证的银行。

Applicant means the party on whose request the credit is issued.申请人意指发出开立信用证申请的一方。

UCP600中英文对照2019

《跟单信用证统一惯例(UCP600)》Article 1 Application of UCP第一条统一惯例的适用范围The Uniform Customs and Practice for Documentary Credits, 2007 Revision, ICC Publication no. 600 (“UCP”) are rules that apply to any documentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of the credit expressly indicates that it is subject to these rules. They are binding on all parties thereto unless expressly modified or excluded by the credit.跟单信用证统一惯例,2007年修订本,国际商会第600号出版物,适用于所有在正文中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证)。

除非信用证中另有规定,本惯例对一切有关当事人均具有约束力。

Article 2 Definitions第二条定义For the purpose of these rules:就本惯例而言:Advising bank means the bank that advises the credit at the request of the issuing bank.通知行意指应开证行要求通知信用证的银行。

Applicant means the party on whose request the credit is issued. 申请人意指发出开立信用证申请的一方。

UCP600中英文对照版

《跟单信用证统一惯例》(UCP600)中英文对照版Article 1 Application of UCP第一条统一惯例的适用范围The Uniform Customs and Practice for Documentary Credits, 2007 Revis ion, ICC Publication no. 600 (“UCP”) are rules that apply to any do cumentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of t he credit expressly indicates that it is subject to these rules. The y are binding on all parties thereto unless expressly modified or ex cluded by the credit.跟单信用证统一惯例,2007年修订本,国际商会第600号出版物,适用于所有在正文中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证)。

除非信用证中另有规定,本惯例对一切有关当事人均具有约束力。

Article 2 Definitions第二条定义For the purpose of these rules:就本惯例而言:Advising bank means the bank that advises the credit at the request of the issuing bank.通知行意指应开证行要求通知信用证的银行。

Applicant means the party on whose request the credit is issued.申请人意指发出开立信用证申请的一方。

UCP600中英文对照

《跟单信用证统一惯例(UCP600)》Article 1 Application of UCP第一条统一惯例的适用范围The Uniform Customs and Practice for Documentary Credits, 2007 Revision, ICC Publication no. 600 (“UCP”) are rules that apply to any documentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of the credit expressly indicates that it is subject to these rules. They are binding on all parties thereto unless expressly modified or excluded by the credit.跟单信用证统一惯例,2007年修订本,国际商会第600号出版物,适用于所有在正文中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证)。

除非信用证中另有规定,本惯例对一切有关当事人均具有约束力。

Article 2 Definitions第二条定义For the purpose of these rules:就本惯例而言:Advising bank means the bank that advises the credit at the request of the issuing bank.通知行意指应开证行要求通知信用证的银行。

Applicant means the party on whose request the credit is issued. 申请人意指发出开立信用证申请的一方。

UCP600中英对照

UCP600中英对照UCP600中英对照跟单信用证统一惯例中英文对照对照版(ICC UCP600 中英文对照版)Article 1 Application of UCP 第一条统一惯例的适用范围 The Uniform Customs and Practice for Documentary Credits, 2007 Revision, ICC Publication no. 600 (“UCP”) are rules that apply to any documentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of the credit expressly indicates that it is subject to these rules. They are binding on all parties thereto unless expressly modified or excluded by the credit. 跟单信用证统一惯例,2007 年修订本,国际商会第 600 号出版物,适用于所有在正文中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证)。

除非信用证中另有规定,本惯例对一切有关当事人均具有约束力。

Article 2 Definitions 第二条定义 For the purpose of these rules: 就本惯例而言: Advising bank means the bank that advisesthe credit at the request of the issuing bank. 通知行意指应开证行要求通知信用证的银行。

Applicant means the party on whose request the credit is issued. 申请人意指发出开立信用证申请的一方。

ucp600英文版

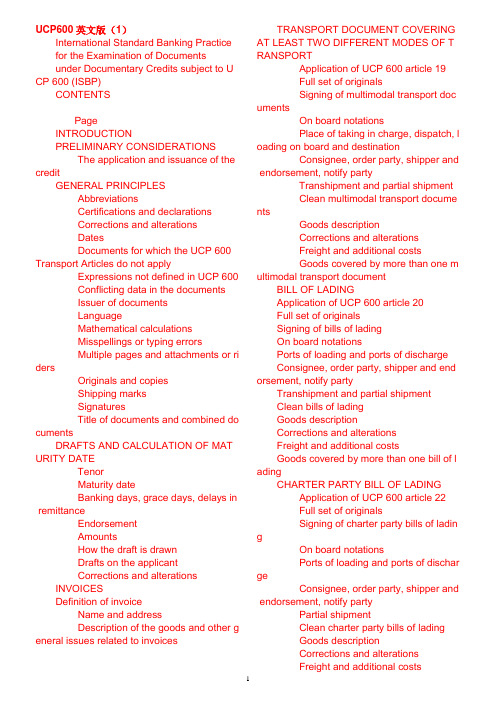

UCP600英文版(1)International Standard Banking Practicefor the Examination of Documentsunder Documentary Credits subject to U CP 600 (ISBP)CONTENTSPageINTRODUCTIONPRELIMINARY CONSIDERATIONSThe application and issuance of the creditGENERAL PRINCIPLESAbbreviationsCertifications and declarationsCorrections and alterationsDatesDocuments for which the UCP 600 Transport Articles do not applyExpressions not defined in UCP 600 Conflicting data in the documentsIssuer of documentsLanguageMathematical calculationsMisspellings or typing errorsMultiple pages and attachments or ri dersOriginals and copiesShipping marksSignaturesTitle of documents and combined do cumentsDRAFTS AND CALCULATION OF MAT URITY DATETenorMaturity dateBanking days, grace days, delays in remittanceEndorsementAmountsHow the draft is drawnDrafts on the applicantCorrections and alterationsINVOICESDefinition of invoiceName and addressDescription of the goods and other g eneral issues related to invoicesTRANSPORT DOCUMENT COVERING AT LEAST TWO DIFFERENT MODES OF T RANSPORTApplication of UCP 600 article 19Full set of originalsSigning of multimodal transport doc umentsOn board notationsPlace of taking in charge, dispatch, l oading on board and destinationConsignee, order party, shipper and endorsement, notify partyTranshipment and partial shipmentClean multimodal transport docume ntsGoods descriptionCorrections and alterationsFreight and additional costsGoods covered by more than one m ultimodal transport documentBILL OF LADINGApplication of UCP 600 article 20Full set of originalsSigning of bills of ladingOn board notationsPorts of loading and ports of dischargeConsignee, order party, shipper and end orsement, notify partyTranshipment and partial shipmentClean bills of ladingGoods descriptionCorrections and alterationsFreight and additional costsGoods covered by more than one bill of l adingCHARTER PARTY BILL OF LADINGApplication of UCP 600 article 22Full set of originalsSigning of charter party bills of ladin gOn board notationsPorts of loading and ports of dischar geConsignee, order party, shipper and endorsement, notify partyPartial shipmentClean charter party bills of ladingGoods descriptionCorrections and alterationsFreight and additional costs1AIR TRANSPORT DOCUMENTApplication of UCP 600 article 23Original air transport documentsSigning of air transport documentsGoods accepted for carriage, date of ship ment, and requirement for an actual date of di spatchAirports of departure and destinationConsignee, order party and notify partyTranshipment and partial shipmentClean air transport documentsGoods descriptionCorrections and alterationsFreight and additional costsROAD, RAIL OR INLAND WATERWAY TRANSPORT DOCUMENTSApplication of UCP 600 article 24Original and duplicate of road, rail or inland waterway transport documentsCarrier and signing of road, rail or in land waterway transport documentsOrder party and notify partyPartial shipmentGoods descriptionCorrections and alterationsFreight and additional costsINSURANCE DOCUMENT AND COVER AGEApplication of UCP 600 article 28Issuers of insurance documentsRisks to be coveredDatesCurrency and amountInsured party and endorsementCERTIFICATES OF ORIGINBasic requirementsIssuers of certificates of originContents of certificates of originINTRODUCTION [to be drafted]PRELIMINARY CONSIDERATIONSThe application and issuance of the credi t1) The terms of a credit are indepen dent of the underlying transaction even if a cr edit expressly refers to that transaction. To av oid unnecessary costs, delays, and disputes i n the examination of documents, however, th e applicant and beneficiary should carefully c onsider which documents should be required,by whom they should be produced and the ti me frame for presentation.2) The applicant bears the risk of any ambiguity in its instructions to issue or ame nd a credit. Unless expressly stated otherwise , a request to issue or amend a credit authoriz es an issuing bank to supplement or develop t he terms in a manner necessary or desirable t o permit the use of the credit.3) The applicant should be aware that UCP 600 contains articles such as 3, 14, 1 9, 20, 21, 23, 24, 28(i), 30 and 31 that define t erms in a manner that may produce unexpect ed results unless the applicant fully acquaints itself with these provisions. For example, a cr edit requiring presentation of a bill of lading a nd containing a prohibition against transhipm ent will, in most cases, have to exclude UCP 600 sub-article 20(c) to make the prohibition a gainst transhipment effective.4) A credit should not require presentation of documents that are to be issued or c ountersigned by the applicant. If a credit is iss ued including such terms, the beneficiary mus t either seek amendment or comply with them and bear the risk of failure to do so.5) Many of the problems that arise atthe examination stage could be avoided or re solved by careful attention to detail in the und erlying transaction, the credit application, and issuance of the credit as discussed.GENERAL PRINCIPLESAbbreviations6) The use of generally accepted abbreviations, for example “Ltd.” instead of “Limi ted”,“Int’l” instead of “International”,“Co.” inst ead of “Company”,“kgs” or “kos.” instead of “kilos”,“Ind” instead of “Industry”,“mfr” instead of “manufacturer” or “mt” instead of “metric t ons”– or vice versa – does not make a docu ment discrepant.7) Virgules (slash marks “/”) may have different meanings, and unless apparent in the context used, should not be used as a sub stitute for a word.Certifications and declarations8) A certification, declaration or the like may either be a separate document or con tained within another document as required b y the credit. If the certification or declaration a2ppears in another document which is signed a nd dated, any certification or declaration appe aring on that document does not require a se parate signature or date if the certification or declaration appears to have been given by th e same entity that issued and signed the docu ment.Corrections and alterations9) Corrections and alterations of info rmation or data in documents, other than doc uments created by the beneficiary, must appe ar to be authenticated by the party who issued the document or by a party authorized by the issuer to do so. Corrections and alterations i n documents which have been legalized, visa ed, certified or similar, must appear to be auth enticated by the party who legalized, visaed, certified etc., the document. The authenticatio n must show by whom the authentication has been made and include the signature or initial s of that party. If the authentication appears to have been made by a party other than the iss uer of the document, the authentication must clearly show in which capacity that party has authenticated the correction or alteration.10) Corrections and alterations in do cuments issued by the beneficiary itself, exce pt drafts, which have not been legalized, visa ed, certified or similar, need not be authentica ted. See also “Drafts and calculation of maturi ty date”.11) The use of multiple type styles or font sizes or handwriting in the same docume nt does not, by itself, signify a correction or alt eration.12) Where a document contains more than one correction or alteration, either eac h correction must be authenticated separately or one authentication must be linked to all co rrections in an appropriate way. For example, if the document shows three corrections num bered 1, 2 and 3, one statement such as “Cor rection numbers 1, 2 and 3 above authorized by XXX” or similar, will satisfy the requirement for authentication.Dates13) Drafts, transport documents and insurance documents must be dated even if a credit does not expressly so require. A requir ement that a document, other than those mentioned above, be dated, may be satisfied by r eference in the document to the date of anoth er document forming part of the same present ation (e.g., where a shipping certificate is issu ed which states “date as per bill of lading num ber xxx” or similar terms). Although it is expec ted that a required certificate or declaration ina separate document be dated, its compliance will depend on the type of certification or declaration that has been requested, its required wording and the wording that appears within i t. Whether other documents require dating wil l depend on the nature and content of the doc ument in question.14) Any document, including a certificate of analysis, inspection certificate and pre -shipment inspection certificate, may be dated after the date of shipment. However, if a cred it requires a document evidencing a pre-ship ment event (e.g., pre-shipment inspection cert ificate), the document must, either by its title o r content, indicate that the event (e.g., inspect ion) took place prior to or on the date of ship ment. A requirement for an “inspection certific ate” does not constitute a requirement to evid ence a pre-shipment event. Documents must not indicate that they were issued after the da te they are presented.15) A document indicating a date ofpreparation and a later date of signing is dee med to be issued on the date of signing.16) Phrases often used to signify time on either side of a date or event:a) “within 2 days after” indicates a period from the date of the event until 2 days aft er the event.b) “not later than 2 days after” doesnot indicate a period, only a latest date. If an advice must not be dated prior to a specific d ate, the credit must so state.c) “at least 2 days before” indicates that an event must take place not later than 2 days before an event. There is no limit as to h ow early it may take place.d) “within 2 days of” indicates a period 2 days prior to the event until 2 days after the event.17) The term “within” when used in connection with a date excludes that date in the calculation of the period.318) Dates may be expressed in differ ent formats, e.g. the 12th of November 2006 could be expressed as 12 Nov 06, 12Nov06, 12.11.2006, 12.11.06, 2006.11.12, 11.12.06, 121106, etc. Provided that the date intended can be determined from the document or from other documents included in the presentation , any of these formats are acceptable. To avoi d confusion it is recommended that the name of the month should be used instead of the nu mber.Documents for which the UCP 600 trans port articles do not apply19) Some documents commonly used in relation to the transportation of goods, e.g., Delivery Order, Forwarder’s Certificate of Receipt, Forwarder’s Certificate of Shipment, Forwarder’s Certificate of Transport, Forward er’s Cargo Receipt and Mate’s Receipt do not reflect a contract of carriage and are not tran sport documents as defined in UCP 600 articl es 19 - 25. As such, UCP 600 sub-article 14(c ) would not apply to these documents. Theref ore, these documents will be examined in the same manner as other documents for which t here are no specific provisions in UCP 600, i.e., under sub-article 14(f). In any event, docu ments must be presented not later than the e xpiry date for presentation as stated in the cre dit.20) Copies of transport documents a re not transport documents for the purpose of UCP 600 articles 19-25 and sub-article 14(c). The UCP 600 transport articles apply where t here are original transport documents present ed. Where a credit allows for the presentation of a copy transport document rather than an original, the credit must explicitly state the det ails to be shown. Where copies (non-negotiab le) are presented, they need not evidence sig nature, dates, etc.Expressions not defined in UCP 60021) Expressions such as “shipping d o cuments”,“stale documents acceptable”,“thi rd party documents acceptable”, and “exporti ng country” should not be used as they are no t defined in UCP 600. If used in a credit, their meaning should be made apparent. If not, the y have the following meaning under internatio nal standard banking practice:a) “shipping documents”– all documents (not only transport documents), except d rafts, required by the credit.b) “stale documents acceptable”– documents presented later than 21 days after t he date of shipment are acceptable as long a s they are presented no later than the expiry date for presentation as stated in the credit.c) “third party documents acceptable”– all documents, excluding drafts but includi ng invoices, may be issued by a party other th an the beneficiary. If it is the intention of the is suing bank that the transport or other docume nts may show a shipper other than the benefi ciary, the clause is not necessary because it i s already permitted by sub-article 14(k).d) “exporting country”– the countrywhere the beneficiary is domiciled, and/or the country of origin of the goods, and/or the cou ntry of receipt by the carrier and/or the countr y from which shipment or dispatch is made.Conflicting data in the documents22) Documents presented under a credit must not appear to contain data that could be considered as conflicting with each other. The requirement is not that the data content be identical, merely that the data appearing o n documents not conflict.Issuer of documents23) If a credit indicates that a document is to be issued by a named person or entit y, this condition is satisfied if the document ap pears to be issued by the named person or e ntity. It may appear to be issued by a named person or entity by use of its letterhead, or, if t here is no letterhead, the document appears t o have been completed and/or signed by, or o n behalf of, the named person or entity.Language24) Under international standard banking practice, it is expected that documents is sued by the beneficiary will be in the language of the credit. When a credit states that documents in two or more languages are acceptab le, a nominated bank or confirming bank may, in its advice of the credit, limit the number of acceptable languages as a condition of its en gagement in the credit or confirmation.Mathematical calculations425) Detailed mathematical calculatio ns in documents will not be checked by banks . Banks are only obliged to check total values against the credit and other required docume nts.Misspellings or typing errors26) Misspellings or typing errors that do not affect the meaning of a word or the se ntence in which it occurs, do not make a docu ment discrepant. For example, a description o f the merchandise as “mashine” instead of “m achine”,“fountan pen” instead of “fountain pe n” or “modle” instead of “model” would not ma ke the document discrepant. However, a desc ription as “model123” instead of “model321”would not be regarded as a typing error and would constitute a discrepancy.Multiple pages and attachments or riders27) Unless the credit or a document provides otherwise, pages which are physicall y bound together, sequentially numbered or c ontain internal cross references, however na med or entitled, are to be examined as one d ocument, even if some of the pages are regar ded as an attachment. Where a document co nsists of more than one page, it must be poss ible to determine that the pages are part of the same document.28) If a signature or endorsement is r equired to be on a document consisting of mo re than one page, the signature is normally pl aced on the first or last page of the document, but unless the credit or the document itself in dicates where a signature or endorsement is t o appear, the signature or endorsement may appear anywhere on the document.Originals and copies29) Documents issued in more than one original may be marked “Original”,“Dupli cate”,“Triplicate”,“First Original”,“Second Ori ginal”, etc. None of these markings will disqua lify a document as an original.30) The number of originals to be pr esented must be at least the number required by the credit, the UCP 600, or, where the doc ument itself states how many originals have b een issued, the number stated on the docume nt.31) It can sometimes be difficult to d etermine from the wording of a credit whetherit requires an original or a copy, and to deter mine whether that requirement is satisfied by an original or a copy.For example, where the credit requires:a) “Invoice”,“One Invoice” or “Invoice in 1 copy”, it will be understood to be a requirement for an original invoice.b) “Invoice in 4 copies”, it will be satisfied by the presentation of at least one origin al and the remaining number as copies of an i nvoice.c) “One copy of Invoice”, it will be satisfied by presentation of a copy of an invoice.However, it is standard banking practice to ac cept an original instead of a copy in this const ruction.32) Where an original would not be accepted in lieu of a copy, the credit must prohi bit an original, e.g. “photocopy of invoice – ori ginal document not acceptable in lieu of photo copy”, or the like.33) In addition to UCP 600 article 17,the ICC Banking Commission Policy Stateme nt, document 470/871(Rev), titled “The deter mination of an “Original” document in the cont ext of UCP 500 sub-Article 20(b)” is recomme nded for further guidance on originals versus copies and remains valid under UCP 600.Shipping marks34) The purpose of a shipping mark is to enable identification of a box, bag or pack age. If a credit specifies the details of a shippi ng mark, the document(s) mentioning the mar ks must show these details, but additional info rmation is acceptable provided it is not incons istent with the credit terms.35) Shipping marks contained in some documents often include information in ex cess of what would normally be considered “s hipping marks”, and could include information such as the type of goods, warnings as to the handling of fragile goods, net and/or gross w eight of the goods, etc. The fact that some do cuments show such additional information, w hile others do not, is not a discrepancy.36) Transport documents covering containerized goods will sometimes only showa container number under the heading “Shipping marks”. Other documents that show a deta5iled marking will not be considered to be inco nsistent for that reason.Signatures37) Even if not stated in the credit, dr afts, certificates and declarations by their natu re require a signature. Transport documents a nd insurance documents must be signed in ac cordance with the provisions of UCP 600.38) The fact that a document has a b ox or space for a signature does not necessar ily mean that such box or space must be com pleted with a signature. For example, banks d o not require a signature in the area titled “Sig nature of shipper or their agent” or similar phr ases, commonly found on transport document s such as air waybills or road transport docum ents. If the content of a document indicates th at it requires a signature to establish its validit y (e.g., “This document is not valid unless sig ned” or similar terms), it must be signed.39) A signature need not be handwrit ten. Facsimile signatures, perforated signatur es, stamps, symbols (such as chops) or any e lectronic or mechanical means of authenticati on are sufficient. However, a photocopy of a s igned document does not qualify as a signed original document, nor does a signed docume nt transmitted through a fax machine, absent an original signature. A requirement for a doc ument to be “signed and stamped”, or a simila r requirement, is also fulfilled by a signature a nd the name of the party typed, or stamped, o r handwritten, etc.40) A signature on a company letterh ead paper will be taken to be the signature of that company, unless otherwise stated. The c ompany name need not be repeated next to t he signature.Title of documents and combined docum ents41) Documents may be titled as called for in the credit, bear a similar title, or be unt itled. For example, a credit requirement for a “Packing List” may also be satisfied by a docu ment containing packing details whether titled “Packing Note”,“Packing and Weight List”, et c., or an untitled document. The content of a document must appear to fulfil the function of the required document.42) Documents listed in a credit should be presented as separate documents. If a credit requires a packing list and a weight list, such requirement will be satisfied by present ation of two separate documents, or by prese ntation of two original copies of a combined p acking and weight list, provided such docume nt states both packing and weight details.DRAFTS AND CALCULATION OF MAT URITY DATETenor43) The tenor must be in accordancewith the terms of the credit.a) If a draft is drawn at a tenor otherthan sight, or other than a certain period after sight, it must be possible to establish the mat urity date from the data in the draft itself.b) As an example of where it is possible to establish a maturity date from the data i n the draft, if a credit calls for drafts at a tenor60 days after the bill of lading date, where the date of the bill of lading is 12 July 2007, thetenor could be indicated on the draft in one of the following ways:i. “60 days after bill of lading date 12July 2007”, orii. “60 days after 12 July 2007”, oriii. “60 days after bill of lading date” a nd elsewhere on the face of the draft state “bil l of lading date 12 July 2007”, oriv. “60 days date” on a draft dated the same day as the date of the bill of lading, orv. “10 September 2007”, i.e. 60 days after the bill of lading date.c) If the tenor refers to xxx days afterthe bill of lading date, the on board date is de emed to be the bill of lading date even if the o n board date is prior to or later than the date of issuance of the bill of lading.d) UCP 600 article 3 provides guidance that where the words “from” and “after” are used to determine maturity dates of drafts, t he calculation of the maturity commences the day following the date of the document, shipm ent, or other event, i.e., 10 days after or from March 1 is March 11.e) If a bill of lading showing more than one on board notation is presented under a credit which requires drafts to be drawn, for e xample, at 60 days after or from bill of lading6date, and the goods according to both or all o n board notations were shipped from ports wit hin a permitted geographical area or region, t he earliest of these on board dates will be use d for calculation of the maturity date. Example : the credit requires shipment from European port, and the bill of lading evidences on board vessel “A” from Dublin August 16 and on boa rd vessel “B” from Rotterdam August 18. The draft should reflect 60 days from the earliest o n board date in a European port, i.e., August16.f) If a credit requires drafts to be dra wn, for example, at 60 days after or from bill o f lading date, and more than one set of bills of lading are presented under one draft, the dat e of the last bill of lading will be used for the c alculation of the maturity date.44) While the examples refer to bill of lading dates, the same principles apply to all transport documents.Maturity date45) If a draft states a maturity date b y using an actual date, the date must have be en calculated in accordance with the requirem ents of the credit.46) For drafts drawn “at XXX days si ght”, the maturity date is established as follow s:a) in the case of complying documen ts, or in the case of non-complying document s where the drawee bank has not provided a r efusal of documents, the maturity date will be XXX days after the date of receipt of docume nts by the drawee bank.b) in the case of non-complying docu ments where the drawee bank has provided a notice of refusal of documents and subseque nt approval, at the latest XXX days after the d ate of acceptance of the draft by the drawee b ank. The date of acceptance of the draft must be no later than the date the issuing bank ac cepts the waiver of the applicant. Where the i ssuing bank provides a notice of refusal but s ubsequently decided to accept the documents , the date of the notice of refusal will be taken as the date from which acceptance is to occur . .47) In all cases the drawee bank mu st advise the maturity date to the presenter. The calculation of tenor and maturity dates, as shown above, would also apply to credits desi gnated as being available by deferred payme nt, i.e., where there is no requirement for a dr aft to be presented by the beneficiary.Banking days, grace days, delays in remi ttance48) Payment must be available in immediately available funds on the due date at t he place where the draft or documents are pa yable, provided such due date is a banking da y in that place. If the due date is a non-banking day, payment will be due on the first banking day following the due date unless the creditstates otherwise. Delays in the remittance of f unds, such as grace days, the time it takes to remit funds, etc., must not be in addition to the stated or agreed due date as defined by thedraft or documents.Endorsement49) The draft must be endorsed, if necessary.Amounts50) The amount in words must accurately reflect the amount in figures if both are s hown, and indicate the currency, as stated in t he credit.7。

《跟单信用证统一惯例》(UCP600)中英文对照版

n第六条有效性、

有效期限及提

示A r地t i点c l e 7

4

Issuing Bank

Undertaking

第七条开证行

的承诺

Article 8

5 Confirming

Bank Undertaking 第八条保兑行 的承诺

Article 9

Advising of Credits and

1

Amendments

作者介绍

精彩摘录

这是《《跟单信用证统一惯例》(UCP600)中英文对照版》的读书笔记模板,可以替换为自己的精彩内容摘 录。

谢谢观看

Charter Party Bill

1

of Lading第

二十二条租船

合约提单

Article 23

Air Transport

2

Document第二

十三条空运单

据

Article 24

Road, Rail

or Inland

3 Waterway

Transport DA or ct ui mc el ne t s2 第5 二C o十u r四i e条r 公 路 、 铁R e路c e或i p内t 陆, 水 运PA ro单ts it据c l e 2 6

Article 20 Bill of Lading第二十

条提单

Article 19 Transport Document Covering at Least Two Different Modes

Article 21 Non-

Negotiable Sea Waybill第二十一 条非转让海运单

Article 22

4 R“eOcne iDpetc ko”r ,

《跟单信用证统一惯例》(UCP600)中英文对照版-Definitions【圣才出品】

Article 2 Definitions第二条定义For the purpose of these rules:就本惯例而言:Advising bank means the bank that advises the credit at the request of the issuing bank.通知行意指应开证行要求通知信用证的银行。

Applicant means the party on whose request the credit is issued.申请人意指发出开立信用证申请的一方。

Banking day means a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed.银行日意指银行在其营业地正常营业,按照本惯例行事的行为得以在银行履行的日子。

Beneficiary means the party in whose favour a credit is issued.受益人意指信用证中受益的一方。

Complying presentation means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice.相符提示意指与信用证中的条款及条件、本惯例中所适用的规定及国际标准银行实务相一致的提示。

Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honour or negotiate a complying presentation.保兑意指保兑行在开证行之外对于相符提示做出兑付或议付的确定承诺。

UCP600

一、UCP600简介英文原文:第一自然段注释:on the first of July: 7月1日。

UCP600 (Uniform Customs and Practice for Documentary Credits): 跟单信用证统一惯例国际商会第600号出版物 come into force: 生效,实施 draft: 起草,草拟 applicable: 适用的,适应的 legal framework: 法律体制(framework: 构架,结构)operate:运作,操作 internationally: 国际性的,在国际间 replace: 替代,取代 former: 前面的,从前的中文意思:《跟单信用证统一惯例》国际商会第600号出版物于2007年7月1日开始实施。

这是《跟单信用证统一惯例》最新版本(第六版),最早国际商会于1933年拟定了一套《跟单信用证统一惯例》作为信用证在国际间进行操作适用的法律体制。

《跟单信用证统一惯例》第600出版物替代了先前的《跟单信用证统一惯例》第500号出版物。

二、《跟单信用证统一惯例》修订的原因英文原文:The primary objective of the ICC, which was established in 1919, is facilitating the flow of international trade. It was in that spirit that the UCP were first introduced.注释:primary: 主要的,原来的,本来的 objective: 目标,宗旨 establish: 创立,建设,成立 facilitate: 促进,使容易,推进 flow: 流转, 流程, 流动 spirit: 精神,灵魂,影响,(法律、文件等的)精神实质中文意思:国际商会于1919年成立,其最初的宗旨是推进国际贸易的流动。

跟单信用证统一惯例UCP600最新条例(中英文版)

For the purpose of these rules: 就本惯例而言�

Advising bank means the bank that advises the credit at the request of the issuing bank. 通知行意指应开证行要求通知信用证的银行。

Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request. 保兑行意指应开证行的授权或请求对信用证加具保兑的银行。

Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation. 信用证意指一项约定�无论其如何命名或描述�该约定不可撤销并因此构成开证行对于相符 提示予以兑付的确定承诺。

Applicant means the party on whose request the credit is issued. 申请人意指发出开立信用证申请的一方。

Banking day means a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed. 银行日意指银行在其营业地正常营业�按照本惯例行事的行为得以在银行履行的日子。

UCP600中英文版

ICC UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARYCREDITSUCP 600英文FOREWORD (3)INTRODUCTION (5)ARTICLE 1 APPLICATION OF UCP (12)ARTICLE 2 DEFINITIONS (12)ARTICLE 3 INTERPRETATIONS (14)ARTICLE 4 CREDITS V. CONTRACTS (16)ARTICLE 5 DOCUMENTS V. GOODS, SERVICES OR PERFORMANCE (16)ARTICLE 6 A V AILABILITY, EXPIRY DATE AND PLACE FOR PRESENTATION (17)ARTICLE 7 ISSUING BANK UNDERTAKING (17)ARTICLE 8 CONFIRMING BANK UNDERT AKING (19)ARTICLE 9 ADVISING OF CREDITS AND AMENDMENTS (20)ARTICLE 10 AMENDMENTS (22)ARTICLE 11 TELETRANSMITTED AND PRE-ADVISED CREDITS AND AMENDMENTS23 ARTICLE 12 NOMINATION (24)ARTICLE 13 BANK-TO-BANK REIMBURSEMENT ARRANGEMENTS (24)ARTICLE 14 STANDARD FOR EXAMINATION OF DOCUMENTS (26)ARTICLE 15 COMPLYING PRESENT ATION (28)ARTICLE 16 DISCREPANT DOCUMENTS, W AIVER AND NOTICE (29)ARTICLE 17 ORIGINAL DOCUMENTS AND COPIES (31)ARTICLE 18 COMMERCIAL INVOICE (32)ARTICLE 19 TRANSPORT DOCUMENT COVERING AT LEAST TWO DIFFERENT MODES OF TRANSPORT (32)ARTICLE 20 BILL OF LADING (35)ARTICLE 21 NON-NEGOTIABLE SEA W AYBILL (37)ARTICLE 22 CHARTER PARTY BILL OF LADING (40)ARTICLE 23 AIR TRANSPORT DOCUMENT (41)ARTICLE 24 ROAD, RAIL OR INLAND W ATERW AY TRANSPORT DOCUMENTS (43)ARTICLE 25 COURIER RECEIPT, POST RECEIPT OR CERTIFICATE OF POSTING (45)ARTICLE 26 "ON DECK", "SHIPPER'S LOAD AND COUN T", “SAID BY SHIPPER TO CONTAIN”AND CHARGES ADDITIONAL TO FREIGHT (46)ARTICLE 27 CLEAN TRANSPORT DOCUMENT (46)ARTICLE 28 INSURANCE DOCUMENT AND COVERAGE (47)ARTICLE 29 EXTENSION OF EXPIRY DATE OR LAST DAY FOR PRESENT ATION (49)ARTICLE 30 TOLERANCE IN CREDIT AMOUNT, QUANTITY AND UNIT PRICES (49)ARTICLE 31 PARTIAL DRA WINGS OR SHIPMENTS (50)ARTICLE 32 INST ALMENT DRA WINGS OR SHIPMENTS (51)ARTICLE 33 HOURS OF PRESENTATION (52)ARTICLE 34 DISCLAIMER ON EFFECTIVENESS OF DOCUMENTS (52)ARTICLE 35 DISCLAIMER ON TRANSMISSION AND TRANSLATION (52)ARTICLE 36 FORCE MAJEURE (53)ARTICLE 37 DISCLAIMER FOR ACTS OF AN INSTRUCTED PARTY (54)ARTICLE 38 TRANSFERABLE CREDITS (55)ARTICLE 39 ASSIGNMENT OF PROCEEDS (58)UCP600中文版UCP600第一条UCP的适用范围 (58)第二条定义 (59)第三条解释 (60)第四条信用证与合同 (61)第五条单据与货物、服务或履约行为 (61)第六条兑用方式、截止日和交单地点 (61)第七条开证行责任 (62)第八条保兑行责任 (62)第九条信用证及其修改的通知 (63)第十条修改 (64)第十一条电讯传输的和预先通知的信用证和修改 (65)第十二条指定 (65)第十三条银行之间的偿付安排 (65)第十四条单据审核标准 (66)第十五条相符交单 (67)第十六条不符单据、放弃及通知 (68)第十七条正本单据及副本 (69)第十八条商业发票 (69)第十九条涵盖至少两种不同运输方式的运输单据 (70)第二十条提单 (71)第二十一条不可转让的海运单 (72)第二十二条租船合同提单 (74)第二十三条空运单据 (75)第二十四条公路、铁路或内陆水运单据 (75)第二十五条快递收据、邮政收据或投邮证明 (77)第二十六条“货装舱面”、“托运人装载和计数”、“内容据托运人报称”及运费之外的费用。

精简600UCP的中英文版(doc 85页)

精简600UCP的中英文版(doc 85页)ICC UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARYCREDITSUCP 600英文中文FOREWORD (7)INTRODUCTION (9)ARTICLE 1 APPLICATION OF UCP (16)ARTICLE 2 DEFINITIONS (17)ARTICLE 3 INTERPRETATIONS (19)ARTICLE 4 CREDITS V. CONTRACTS (21)ARTICLE 5 DOCUMENTS V. GOODS, SERVICES OR PERFORMANCE (21)ARTICLE 6 A V AILABILITY, EXPIRY DATE AND PLACE FOR PRESENTATION (22)ARTICLE 7 ISSUING BANK UNDERTAKING 23 ARTICLE 8 CONFIRMING BANK UNDERTAKING (24)ARTICLE 9 ADVISING OF CREDITS AND AMENDMENTS (26)ARTICLE 24 ROAD, RAIL OR INLAND WATERWAY TRANSPORT DOCUMENTS (53)ARTICLE 25 COURIER RECEIPT, POST RECEIPT OR CERTIFICATE OF POSTING (55)ARTICLE 26 "ON DECK", "SHIPPER'S LOAD AND COUNT", “SAID BY SHIPPER TO CONTAIN”AND CHARGES ADDITIONAL TO FREIGHT (57)ARTICLE 27 CLEAN TRANSPORT DOCUMENT (57)ARTICLE 28 INSURANCE DOCUMENT AND COVERAGE (57)ARTICLE 29 EXTENSION OF EXPIRY DATE OR LAST DAY FOR PRESENTATION (60)ARTICLE 30 TOLERANCE IN CREDIT AMOUNT, QUANTITY AND UNIT PRICES (60)ARTICLE 31 PARTIAL DRAWINGS OR SHIPMENTS (61)ARTICLE 32 INSTALMENT DRAWINGS OR SHIPMENTS (63)ARTICLE 33 HOURS OF PRESENTATION (63)ARTICLE 34 DISCLAIMER ON EFFECTIVENESS OF DOCUMENTS (63)ARTICLE 35 DISCLAIMER ON TRANSMISSION AND TRANSLATION (64)ARTICLE 36 FORCE MAJEURE (65)ARTICLE 37 DISCLAIMER FOR ACTS OF AN INSTRUCTED PARTY (65)ARTICLE 38 TRANSFERABLE CREDITS (66)ARTICLE 39 ASSIGNMENT OF PROCEEDS . 70UCP600中文版UCP600第一条UCP的适用范围 (70)第二条定义 (71)第三条解释 (72)第四条信用证与合同 (73)第五条单据与货物、服务或履约行为 (73)第六条兑用方式、截止日和交单地点 (73)第七条开证行责任 (74)第八条保兑行责任 (74)第九条信用证及其修改的通知 (75)第十条修改 (76)第十一条电讯传输的和预先通知的信用证和修改 (77)第十二条指定 (77)第十三条银行之间的偿付安排 (78)第十四条单据审核标准 (78)第十五条相符交单 (80)第十六条不符单据、放弃及通知 (80)第十七条正本单据及副本 (81)第十八条商业发票 (81)第十九条涵盖至少两种不同运输方式的运输单据 (82)第二十条提单 (83)第二十一条不可转让的海运单 (84)第二十二条租船合同提单 (86)第二十三条空运单据 (87)第二十四条公路、铁路或内陆水运单据 (88)第二十五条快递收据、邮政收据或投邮证明. 89第二十六条“货装舱面”、“托运人装载和计数”、“内容据托运人报称”及运费之外的费用。

UCP600 新规定 英文版

UNIVERSITY OF MANCHESTERLLMINTERNATIONAL BUSINESS LAWPAYMENT IN INTERNATIONAL SALESPART 2THE LEGAL STATUS OF THE U.C.P.Some writers in some jurisdictions have taken the line that so generally used are the UCP that they constitute (1) a codification of usage and (2) a uniform law of international character operative of its own force to all contracts of letters of credit - see Eismann, Bontoux and Rowe …Le Credit documentaire dans le commerce exterieure (1985). These are big and bold assertions. On the first point Professor Kozolchyk in .. disagrees pointing out that …The text of the UCP is neither systematic nor comprehensive enough to warrant the legal characterisation of …code‟. Professor Goode endorses this view.On the second point that the UCP automatically apply to all contracts of letters of credit the traditional approach of the common law is that the terms of the UCP only apply if either expressly or by implication they are incorporated into the particular contract, and indeed this is the approach taken by Article 1 of the UCP itself. Goode however points out the particular circumstances of the rules which will almost invariably lead to the conclusion that there is an intention to incorporate them in a particular contract.(1) They represent usages which have gained international acceptance among bankers so that in themselves they are strong evidence of banking custom and practice, which of itself will usually be taken to be impliedly incorporated into the contract. Sometimes, of course, the UCP seeks to introduce a more convenient practice rather than simply state traditional custom (they are revised from time to time to achieve this) but once the new rule has been in place for a year or two of time it can be reasonably be assumed, in the absence of evidence to the contrary that the practice will have become broadly uniform as the result of the rule, so that if at the relevant time the rules have been in operation for a reasonable period, they will have become indicative of prevailing practice.(2) Goode goes on;…But we can reasonably go a stage further and, instead of treating the UCP merely as evidence of usage impliedly incorporated into the contract, regard them as directly incorporated byimplication into the contract on the basis that their adoption is as much a matter of course thatthe parties must be taken to have intended to contract with reference to them even if thecontract does not state this in terms and even if one of the parties (e.g. a non-banking party suc h as buyer or seller) was not aware of the UCP‟.Once incorporated under English law the Rules become part of the terms of the contract and must, therefore, be reconciled with the other terms (especially the express terms) and apply subject to(1) mandatory English legislation and (2) the mandatory rules of English contract law. In short under English law they simply operate as a term of the contract subject to English law generally.Indira Carr also has some points to make on the general relevance of the UCP provisions on cases coming before the English courts (p.476);Lack of incorporation of the UCP into a contract of carriage …for the most part, will not effect the rights and liabilities of the parties greatly under the credit, since English courts do take mercantile customs and practices into account. Moreover, the rules of the UCP, for the most part, reflect those of common law, apart from a few differences. For instance, under Art 37 of the UCP, …the description of the goods in the commerc ial invoice must correspond exactly with the description in the credit‟. There is, however, no corresponding requirement at common law since, it seems, a commercial invoice need not contain a description of the goods. The UCP also allows certain tolerances in quantity, credit amount and unit price in Art 39, which is not the case in common law. Since the UCP does not have the force of law in England, it will apply subject to any express terms. If an express term in the contract contradicts the UCP terms, the former prevails. As Mustill J. stated in Royal Bank of Scotland plc v Cassa di Risparmio delle Provincie Lombard.“....it must be recognised that [the UCP] terms do not constitute a statutory code. As their title makes clear, they contain a formulation of customs and practices, which the parties to a letter of credit can incorporate into their contracts by reference. If it is found that the parties have explicitly agreed such a term, then the search need go no further, since any contrary provision in UCP must yield to the parties‟ expressed intention.”The UCP, it must be added, is not comprehensive. It does not, for instance, address the effect of fraud or illegality on the documentary credit arrangement.NATURE AND ENFORCEABILITY OF T HE BANK‟S PROMISEIn banking usage and custom the letter of credit becomes binding on the issuing bank on issue and on the confirming bank on confirmation. There is no decided judicial case on this but this isGoode‟s view and is generally accepted by o ther writers. Of course if the letter of credit is rejected by the seller because it does not conform to the contract of sale, it ceases to have any effect.A theoretical problem arises under traditional rules of English law which require that something be provided by the other party to the contract for the promise to pay him (technically called consideration) but the seller provides nothing to the banks in return for his credit. Various theories have been put forward to try to bridge the gap and to find (create) a consideration but they are all artificial and unconvincing. As Goode points out;…The defects in these various theories show the undesirability of trying to force all commercial instruments and devices into a strait-jacket of traditional rules of law. Professor Ellinger (Documentary Letters of Credit p. 122) has rightly argued that the letter of credit should be treated as a sui generis instrument embodying a promise which by mercantile usage isenforceable without consideration. Professor Kozolchyk (Letters of Credit pp.138-143) takes the description a stage further, treating a letter of credit as a new type of mercantilecurrency embodying an abstract promise of payment, which, like the bill of exchange,possesses a high, though not total, immunity from attack on the ground of breach of duty of seller to buyer‟.FUNDAMENTAL CHARACTERISTICS OF LETTERS OF CREDITCarr p.478 rightly emphasises two characteristics as fundamental to letters of credit in establishing their importance in international commerce namely;(1) the autonomy of letters of credit; and(2) the doctrine of strict compliance.The autonomy of letters of credit will be considered first.THE CREDIT IS AUTONOMOUSThe point of the credit is to create a guaranteed assurance of payment to the seller so that they create an abstract payment obligation independent of and detached from the underlying contract of sale between the seller and buyer AND ALSO detached from the banker/customer contract between the buyer and t he issuing bank. In Goode‟s words;…It is thus a cardinal rule of documentary credits that the conditions of the bank‟s duty to pay are to be found exclusively in the terms of the letter of credit, and that the right and duty to make payment do not in any way depend on performance by the seller of his obligations underthe contract of sale. In general, therefore, a breach of those obligations by the seller, e.g. by shipment of goods which fail to correspond to the contract description, are of unsatisfactory quality or fall short of the contract quantity, does not entitle the buyer to instruct the bank to withhold payment under the credit if the terms of the letter of credit have been fully complied with.‟This is expressly spelled out by the UCP Art 3(a). Article 3(a) expressly provides;…Credits, by their nature, are separate transactions from the sales or other contract(s) on which they may be based and banks are in no way concerned with or bound by such contract(s), even if any reference whatsoever to such contract(s) is included in the credit. Consequently, the undertaking of a bank to pay, accept and pay draft(s) or negotiate and/or to fulfil any other obligation under the credit, is not subject to claims or defences by the applicant resulting from his relationship with the issuing bank or the beneficiary.‟The same principle is well established at common law - see Hamzeh Males and Sons v British Imex Industries Ltd. [1958] 2 QB 127; United City Merchant (Investments) Ltd v Royal Bank of Canada [1983] 1 AC 168 at pp. 182-3. In the Hamzeh Males Case Jenkins L.J. pointed out the practical necessity for this. He said (p.129);…A vendor of goods selling against a confirmed letter of credit is selling under the assurance that nothing will prevent him from receiving the price. That is of no mean advantage when goods manufactured in one country are being sold in another. It is, furthermore, to beobserved that vendors are often reselling goods bought from third parties. When they are doing that, and when they are being paid by a confirmed letter of credit, their practice is... to finance the payments necessary to be made to their suppliers against the letter of credit.That system of financing these operations, as I see it, would break down completely if adispute as between the vendor and the purchaser was to have the effect of …freezing‟, if I may use that expression, the sum in respect of which the letter of credit was opened.‟The emphasis placed by the English courts on the autonomy of the letter of credit is well illustrated by the Court of Appeal decision in Power Cuber International Ltd. v National Bank of Kuwait [1981] 1 WLR 1233. Here Power Cuber, a US company, sold machinery to a firm in Kuwait. The buyer arranged the issue of an irrevocable letter of credit in favour of the seller by the National Bank of Kuwait who instructed the Bank of America to advise the sellers of the credit. On delivery, the buyers raised a counterclaim against the sellers, and obtained a provisional attachment order from the courts in Kuwait, restraining the bank from paying the seller on the credit. The bank, which had a registered office in London, was sued by the sellers in the English courts. At first instance, and in the Court of Appeal, it was held that the order obtained in Kuwaitdid not affect the bank‟s obligation to pay the seller on the credit, since the bank is not concerned with any dispute that arises from the contract of sale.Where the principle of autonomy is strictly obse rved the effect, as Indira Carr points out is …to place the buyer at the beneficiary‟s mercy.‟An issue arises as to whether the wording of Article 3(a) means that in no circumstances can the issuing bank become embroiled in the underlying sale contract. It must be remembered that the UCP are only incorporated by reference or by general custom and must therefore give way to any express term of the credit itself - see Royal Bank of Scotland v Cassa di Risparmio delle Provincie Lombard (1992) Financial Times, 21st. January. However, to avoid the strong implication at both common law and the UCP that the bank is not concerned with the underlying sale contract it would take very clear words indeed in the letters of credit for this responsibility to be assumed.In practice as Carr points out it would be extremely rare to find a bank willing to get involved beyond the level of payment against documents (p.480).Similarly the Issuing Bank cannot set out issues between themselves and their customers as an answer to an action on a letter of credit such as a right of set off with the buyer or that the buyer has not provided promised funds. Nor can the seller as beneficiary rely on any contractual terms in the buyer/bank relationship e.g. that the bank will provide a credit which it has not in fact issued (UCP article 3(b)).THE BANKS UNDERTAKE AS PRINCIPALAlthough the issuing bank opens the account on the instructions of the buyer it does so in its own right as principal and not as agent for the buyer, so that the buyer has no status with regard to the credit. This has the following consequences listed by Goode;(1)…B is not entitled to give instructions to IB to refuse payment under the credit, or to vary theterms of the credit without S‟s consent, for IB is already committed to S under the letter of credit. B can, it is true, obtain an injunction to prevent IB from paying againstnonconforming documents or with knowledge of fraud, but this is merely because in thatsituation IB has neither the right nor the duty to pay, and does not imply that B has any power to interpose himself directly into a separate contract generated by the letter of credit.(2) B cannot be sued under the letter of credit if IB fails to honour its obligations to S. Bwill, of course, incur a liability for breach of the sale contract, but he can raise any defences that would ordinarily be available to him in an action brought by S for the price. In otherwords, the autonomy of the credit insulates S from the underlying contract of sale in hisrelations with IB but not in his relations with B himself(3) If IB, in breach of its mandate, accepts a tender of non-conforming documents, B has nolocus standi to assert that, in the relation between IB and S, such acceptance is ineffective.Put another way, B cannot himself reject the documents vis-a vis S, but only vis-a vis IB.‟Similar considerations apply in the case of a confirming bank for, whilst the obligation is undertaken as agent of the issuing bank, the confirmation promises is given as principal unlike the position where it merely advises the issue of the credit.THE BANKS OPERATE ON THE BASIS OF DOCUMENTS NOT FACTSThis supports the autonomy rule. The banks are, in the absence of strong evidence of fraud or illegality concerned only to ensure that the documents presented to it conform on their face to the terms of the letters of credit, and not to check the veracity of the statements contained in those documents or to examine the goods the subject of the sale contract. In the words of the UCP, article 4;…In credit operations all parties concerned deal with documents, and not with goods, services and/or other performances to which the contract may relate.‟In short if the documents appear to be in order the bank is both entitled and obliged to pay. This is checked by matching the wording of the offered documents against the wording of the letter of credit. The bank has to ask itself, (1) whether all of the documents required by the credit have been produced and (2) are they correctly worded. On the second point if the documents differ from the language of the letter of credit the bank is entitled to withhold payment even if the deviation is purely terminological and of no significant practical effect. This is well brought out in the leading case of J.H.Rayner & Co Ltd v Hambros Bank Ltd. [1943] KB 37 in which the credit called for documents covering the shipment of coromandel groundnuts but the bill of lading tendered by S referred to machine-shelled groundnut kernels. Everyone in the trade knew that the latter description was a synonym for the former. Nevertheless, the bank‟s refusal to pay was upheld by the Court of Appeal.…...it is quite impossible to suggest that a banker is to be affected with knowl edge of the customs and customary terms of every one of the thousands of trades for whose dealings he may issue letters of credit.‟ Another good illustration of this is Moralice (London) Ltd. v ED and F Man [1954] 2 Lloyd‟s Rep 526.In connection with the emphasis purely on documentation Goode (p.975) points out a difficulty in the actual practice of the English courts and the strict terms of the UCP.…The documentary character of letters of credit is not always understood by exporters or even their banks, so that it is quite common for credits to be issued which include non-documentary conditions, such as shipment on a Liner Conference vessel. These will not be establishable by the usual shipping documents. The approach of the English courts under the 1983revision and its predecessors has been to construe such stipulations as if they called forreasonable documentary evidence of the stated condition,(Banque de l‟Indochine et de Suez SA v J.H. Rayner (Mincing Lane) Ltd [1982] 2 Lloyd‟s Rep 476, per Parker J at 480; [1983]1 Lloyd‟s Rep 228, per Sir John Donaldson MR at 230-231; The Messiniaki Tolmi [1986] 1Lloyd‟s Rep 455. per Legatt J at 462, affirmed [1988] 2 Lloyd‟s Rep 217, a sensible approach which accorded with banking practice).‟However, art 13(c) of UCP 500 starkly provides that if a credit contains conditions without stating the documents to be presented under them, banks will deem such conditions as not stated and will disregard them. Though art 13(c) reflects an understandable desire to introduce greater discipline into the issue of letters of credit, it has potentially serious consequences. It would seem to preclude the interpretative approach previously adopted by English courts and raises questions as to the possible liability of a bank which, at the request of its customer, incorporates non-documentary conditions which it knows or should know are entirely nugatory.The obligation is to accept only documents which are originals (15BP, para 3.2) because this ensures that the bank gets its hands on the actual document of title. However a copy can be so good that it is difficult to determine whether or not it is a copy and to meet this problem a bank is protected if it accepts a document which appears to be original. In England what constitutes an original has been the subject of two Court of Appeal decisions. First in Glencore International AG v Bank of China [1996] 1 Lloyds Rep 135 the Court of Appeal applied Article 206 of the UCP to hold that a photocopy did not constitute an original even if itself signed, unless it was marked as an original. In Kredietbank Antwerp v Midland Bank plc [1999] Lloyds Rep 219 the court concluded that if the document was in fact an original there was NO requirement to mark it as original. Subsequent to the events giving rise to those decisions, the Banking Commission of the ICC has produced a helpful policy statement explaining that the …marked as original‟ proviso is satisfied by any mark on a document or any recital in the text of a document that indicates that the issuer of the document intends it to be treated as an original rather than a copy; and a document that is signed by hand or facsimile is treated as an original even if, as regards all the other elements, it is a photocopy or draft.In the view of Goode.… On this basis the result in Glencore would now be different. Given that banks rely heavily on opinions of the Banking Commission to interpret the UCP and that these are treated as the best evidence of what bankers are to understand by particular UCP provisions, it would not be inconsistent with the doctrine of stare decisis for future courts to take account of the policy statement in interpreting Art. 20b and, indeed, David Steel J. did just that in Credit Industriel et Commercial v China Merchants Bank [2002] 2 All ER (Comm) 427.VERIFICATION OF DOCUMENTS LIMITED TO APPARENT GOOD ORDERIt is not practicable for the banks to ensure the accuracy genuineness or authenticity of the documents any more than the state of the goods. Consequently the duty laid upon them is to exercise reasonable care to ensure that the documents appear to be in order - see in particular Article 13 of the UCP. The principle was upheld in the common law by the Privy Council in Cian Singh and Co Ltd v Banque de L‟Indochine [1974] 2 All ER 754 in which the bank paid out on a document on which the signature was forged after comparing the signature with that which purported to be the signature on the passport of the signatory. In doing so it was held to have complied with its mandate under the credit and was therefore entitled to be reimbursed by the customer. A similar test was applied in the American Accord.THE DOCTRINE OF STRICT COMPLIANCEAt common law the issue of compliance is strict with the law insisting that the documents strictly comply with the requirements of the credit. As it has been put judicially in Equitable Trust Co of New York v Dawson Partners Ltd [1927] Ll.L Rep 49 at p. 52; …There is no room for documents which are almost th e same or will do just as well‟.The doctrine applies to all of the contracts in the letter of credit arrangement. Thus;(1) the credit itself must strictly conform to the requirements of the contract of sale;(2) the seller wishing to obtain payment under the terms of the credit;(3) the paying bank wishing to obtain reimbursement from the issuing bank; and(4) the issuing bank wishing to be reimbursed by the buyer which opened the credit.In principle the fact that the discrepancy is minor or that stipulations in the letter of credit appear to the bank to serve no useful purpose are irrelevant - see Seaconsar Far East Ltd v Bank MarkaziJambouri Islami Iran [1993] 1 Lloyd‟s Rep 236, per Lloyd LJ at 239; Commercial Banking Co of Sydney Ltd v Jalsard Pty Ltd [1973] AC 279, per Lord Diplock at 286.However internationally there is variation in the degree of strictness depending on the parties and the circumstances. In Professor Kozolchyk‟s survey of the application of the rule of strict compliance in different jurisdictions showed, in particular, that …courts were inclined to take more seriously a banker‟s objection of non-compliance raised against a beneficiary‟s tender of documents than a customer‟s objection raised against the issuing bank‟s veri fication, - see Letters of Creditp.82.Clearly the rule of strict compliance is vitally important to bankers since it is their protection.If they precisely carry out the mandate of the credit there can be no successful allegation that they have failed in their duties. Unfortunately sellers tend to take a very cavalier attitude to the requirement. One estimate is that 60% of all documents tendered do not conform to the credit, are rejected, and then have to be represented having been corrected. Goode points out at p.977 that a major study by Professor Ronald Mann in the United States gave an even higher nonconforming rate, with only 27% of 500 presentations conforming to the credit but, astonishingly, only one case in which the buyer had not waive d the discrepancy (…The Role of Letters of Credit in Payment Transactions‟, 98 Mich L Rev 2494 (2000)). A study by SITPRO of letters of credit practice in the UK would seem to indicate a much higher rejection rate, at an estimated cost to business of £113 million a year. Among the principal grounds of rejection were expiry of the credit, late presentation of documents (e.g. more than the specified period of time after shipment date - see UCP art 43), inconsistent data, incorrect data, absence of documents and failure to name the carrier or signing capacity (SITPRO, Report on the Use of Export Letters of Credit 2001/2002. Appendix 1).Nevertheless an actual practice which so conflicts with the strict requirements necessarily impacts on the development of the law. In practice bankers are anxious to assist their clients and buyers may waive their rights by overlooking irrelevant details and allowing the credit to be paid so that credits are commonly accepted which do not, in fact, comply absolutely with the strict requirement doctrine. The English courts in cases such as Hansson v Hamlet & Horley Ltd [1922] 2 AC 36, per Lord Sumner at 46: British Imex Industries Ltd. v Midland Bank Ltd [1957] Lloyd‟s Rep 591, per Salmon at 597, have drawn a distinctio n between minor deviations which are significant to the transactions and trivial ones which are not, treating acceptance in the latter situation as strict compliance. This, however, is unconvincing. The evaluation of significance is done ex post facto and the parties need clear guidance at the time of decision to accept or reject.The matter has now had an impact on the UCP which after its most recent revision now contains a provision aimed at the problem in Article 13(a) which provides ; …Complianc e of the stipulated documents on their face with the terms and conditions of Credit shall be determined by international standard banking practice as reflected in these Articles‟.An additional and important reference point is the ISBP, which must be read consistently with the UCP but provides a useful elaboration of international standard banking practice.The UCP has further modified the common law approach to the doctrine of strict compliance. Though article 37(c) requires that the description of the goods in the commercial invoice must correspond with the credit, other documents may (describe) the goods in general terms not inconsistent with the description of the goods in the credit. The UCP also allows various tolerances in credit amount, weight and value of the goods under Art 39:(1) The words …about‟, …approximately‟, …circa‟ or similar expressions used in connection with the amount of the credit or the quantity or the unit price stated in the credit are to be construed as allowing a difference not to exceed 10% more or 10% less than the amount or the quantity or the unit price to which they refer. This allows the parties to introduce up to 10% variation by deliberate wording of the credit.(2) Unless a credit stipulates that the quantity of the goods specified must not be exceeded or reduced, a tolerance of 5% more or 5% less will be permissible, always provided that the amount of the drawing does not exceed the amount of the credit. The tolerance does not apply when the credit stipulates the quantity in terms of a stated number of packing units or individual items.(3) Unless a credit which prohibits partial shipments stipulates otherwise, or unless sub-Art (b) above is applicable, a tolerance of 5% less in the amount of the drawing will be permissible, provided that the credit stipulates the quantity of the goods, such quantity of goods is shipped in full, and if the credit stipulates a unit price, such price is not reduced. This provision does not apply when expressions referred to in sub-Art (a) above are used in the credit.Also remember that buyers are practical business people and may give instructions to disregard small non-conformities in the interest of business efficiency. Further, as will be seen non-conformity may be waived by conduct.In general their is a correlation between a banks entitlement to refuse payment and its duty not to do so. However, this does not always follow and as will be seen later it sometimes has a choice as to whether or not to pay. Thus it is not the bank‟s duty to investigate allegations or suspicions of fraud. It is entitled to pay in the absence of compelling evidence of fraud, but is equally free to withhold payment on mere suspicion, provided that in any proceedings brought against it by the beneficiary, the bank is then able to establish fraud.CONTRACTUAL RELATIONS WITHIN A CONFIRMED CREDITIn a straightforward confirmed credit which has not itself been negotiated, and has not given rise to a bill of exchange which has been negotiated, the issue of the confirmed credit involves no less than five different and separate contractual relations namely;(1) between B and S under the contract of sale;(2) between B and IB;(3) between IB and AB;(4) between IB and S;(5) between AB and S.Contract no.1 stands separate and apart and is the subject of the LLM unit LAWS 63052, International Sale of Goods. The interlocking contracts 2-5 are the contracts which are the subject of this unit and will almost invariably be expressed to be governed by the UCP. The principles of the UCP will, therefore almost invariably apply to all of them. However there are also particular rules separately applicable to each of these contracts. Where bills of exchange (in the form of bank drafts) are accepted and/or negotiated pursuant to the letters of credit further relationships will be created but these will not be discussed here.Ambiguous instructions from the buyer and the linkage of documentsOne thing which needs stressing at this stage is that the instructions from the buyer and their implementation up the chain of contractual connection should be unambiguous. Nevertheless the banks will need to exercise care in dealing with documents which the credit links to the funds.With regard to unambiguity and clarity in the instructions the UCP emphasises this in Article 5 which provides;(a) Instructions for the issuance of a credit, the credit itself, instructions for an amendment thereto, and the amendment itself, must be complete and precise.In order to guard against confusion and misunderstanding, banks should discourage any attempt:(i) to include excessive detail in the credit or in any amendment thereto;(ii) to give instructions to issue, advise or confirm a credit by reference to a credit previously issued (similar credit) where such previous credit has been subject to accepted amendment(s),and/or unaccepted amendment(s).(b) All instructions for the issuance of a credit and the credit itself and, where applicable, allinstructions for an amendment thereto and the amendment itself, must state precisely the。

《跟单信用证统一惯例》(UCP600)中英文对照版-Insurance Document and C

Article 28 Insurance Document and Coverage第二十八条保险单据及保险范围a. An insurance document, such as an insurance policy, an insurance certificate or a declaration under an open cover, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies.a. 保险单据,例如保险单或预约保险项下的保险证明书或者声明书,必须看似由保险公司或承保人或其代理人或代表出具并签署。

Any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter.代理人或代表的签字必须标明其系代表保险公司或承保人签字。

b. When the insurance document indicates that it has been issued in more than one original, all originals must be presented.b. 如果保险单据表明其以多份正本出具,所有正本均须提交。

c. Cover notes will not be accepted.c. 暂保单将不被接受。

d. An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover.d. 可以接受保险单代替预约保险项下的保险证明书或声明书。

跟单信用证统一惯例UCP600最新条例(中英文版)

跟单信用证统一惯例�U C P600�A r t i c l e1A p p l i c a t i o n o f U C P第一条统一惯例的适用范围T h e U n i f o r m C u s t o m s a n d P r a c t i c e f o r D o c u m e n t a r y C r e d i t s,2007R e v i s i o n,I C C P u b l i c a t i o n n o. 600(“U C P”)a r e r u l e s t h a t a p p l y t o a n y d o c u m e n t a r y c r e d i t(“c r e d i t”)(i n c l u d i n g,t o t h e e x t e n t t o w h i c h t h e y m a y b e a p p l i c a b l e,a n y s t a n d b y l e t t e r o f c r e d i t)w h e n t h e t e x t o f t h e c r e d i t e x p r e s s l y i n d i c a t e s t h a t i t i s s u b j e c t t o t h e s e r u l e s.T h e y a r e b i n d i n g o n a l l p a r t i e s t h e r e t o u n l e s s e x p r e s s l y m o d i f i e d o r e x c l u d e d b y t h e c r e d i t.跟单信用证统一惯例�2007年修订本�国际商会第600号出版物�适用于所有在正文中标明按本惯例办理的跟单信用证�包括本惯例适用范围内的备用信用证�。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。