浙江财经国际结算双语案例分析

国际结算案例分析

1.分析要点

对新客户出口一般不接受T/T等汇款方式,

不利于控制风险 事先办理出口信用保险 分批发货、逐笔收款,降低收款风险 及时采取保全措施

2014-4-29

3

2.D/D结算案例

我国甲公司与香港乙商社签订了一笔出口合同,

由港商以D/D预付货款。 临近装船时,港商来电称资金周转困难,要求先 装船发货,随后即付款,以免耽误交货。我方不 同意,坚持应先付款。 第二天,港商便传真发来汇款凭证(即期银行汇 票)。我方于是发货寄单,并电告对方。 1个月后,仍未收到货款。 试问: 为什么会出现这种结果?

2014-4-29

6

3.分析要点

代收行错误放单 尚未到期票据只是抵押,非真实付款

2014-4-29

7

4.L/C结算案例1

我国某外贸公司进口一批钢材,货物分两批

装运,以即期信用证支付,每批分别开证。 第一批货物装运、交单议付、付款均正常。 我外贸公司收到该批货物后,发现货物品质 与合同不符,于是要求开证行(付款行)对 第二份信用证项下的单据拒付。 试问:开证行(付款行)应拒付吗?为什么?

2014-4-29 14

7.分析 向B银行提出索赔,因为后者提供了错误的证实

信息

2014-4-29

15

8.结算单据案例

某年10月10日,某公司将一套出口信用证单据交Y

银行收款,开证行/付款行为沙特S银行。 Y银行审核后认为单据相符,于当日交快递公司寄 出,预计10月底能收汇。 但超过预计收汇期后还没有贷记头寸,Y银行通过 快递公司了解到开证行已于10月17日签收了此快递 单。Y银行发电查询,11月17日开证行回复称已签 收所查快递单,但收件内容是一块长120cm、宽 21cm的布料,并未收到Y银行查询电中所述单据。 Y银行意识到单据被错寄,于是要求快递公司协查。 同时Y银行通过船运公司了解到申请人用银行担保 提走货物,证明开证行确实未收到正本单据。

《国际结算:理论·实务·案例(双语教材)》chapter 6 Collection

3. Collecting bank(代收行)

The bank that ag bank and get the payment from the

debtor is the Correspondent.

The obligation

(D/P,付款交单) Documents against acceptance

(D/A,承兑交单)

1. Documents against payment(D/P) The collecting bank is allowed to release the documents to the drawee only against full and immediate payment.

4. Payer (付款人)

The payer is the debtor who the draft has appointed and present the draft and documents to bank.

The obligation Follow the contract, and pay/accept the full amount of money in the specified currency for the title of documents to collect the goods without delay

5. Presenting bank(提示行)

The presenting bank refers to the collecting bank making presentation to the drawee, usually referring to the buyer’s bank.

Its major obligations:

《国际结算:理论·实务·案例(双语教材)》Chapter 4 Correspondent banking

President

Intel’ Banking Dept. Dept

Domestic Dept. Dept

Credit Line Div.

Correspondent Banking Div.

Operation Div.

Regional Manager Country Manager Country Manager

A Store = A − * (D − C ) B−C

WMRC (世界市场研究中心)

CR = PR 2 *0.25 + ER 2 *0.25 + LR 2 *0.25 +TR 2 *0.15 + OR 2 *0.1 + SR 2 *0.1

Country Risk A++ A+ A B B++ B+ B C D E Extremely Low Ignorable Low M d Moderate Medium Quite High High Very High Extremely High

Treasury Activities T A ti iti •Capital Market •Money Market •Foreign Exchange Deals and Derivatives

Syndications •Project Finance

Current Accounts I Investment t t Accounts A t Collection Service Accounts

Moody’s Moody s Investor Services (穆迪公 司银行评级模型)

¾ Focus on Liquidity, income structure, earnings and efficiency, asset quality and asset adequacy adequacy. ¾ Moody assigns Aaa, Aa, A, Baa, Ba, B, Caa, Ca and C for rating a financial status of a bank bank.

《国际结算:理论·实务·案例(双语教材)》CH3

$26 MM $3 MM $22.5 MM

Bank C $2.6 MM available Balance Resulting From Multi-Lateral Netting Bank A $0 5M $0.5M Bank B $4 5M $4.5M Bank C $3 1M $3.1M

FEDWIRE 美国联邦储备中央银行清算系统

CHIPS closes

FEDWIRE closes

10:00am 12:00am 12:30pm

4:30pm5:00pm 5:30pm

6:00pm

Cut-off for S/T CHIPS payments

Cut-off for S/T FEDWIRE payments

Cut-off for Book Transfers

The position of Dollar Clearing System

The dollar is the major international foreign exchange h currency, which hi h occupied i d over 50% of international payments CHIPS(纽约银行间的清算系统), FEDWIRE (美国联邦储备银行的清算系统), BOOK TRANSFER(内部转账), CHECKS(支票), AUTOMATED CLEARING HOUSE(ACH,自动 清算所)

3.2 EUR Clearing Systems

Euro

Euro is the name given by the European Council of Madrid to the new single p currency. y European

浙江财经国际结算双语审单练习附答案

Shipment as defined by UCP 500 Artcle 46From: Port of Hong KongFor transportation to: Puerto Armuelles,PanamaNote later than :June 9, 1994Transhipment □allowed □not allowed Credit available with Nominated Bank: Freely negotiable□by payment at sight □by deferred payment at:□by acceptance of drafts at:□by negotiationAgainst the documents detailed herein □and Beneficiary’s draft(s) on:Banko Binko, Panama, Rep. of PanamaPartial shipments □allowed □not allowed Amount : Approximately USD110,000.00Advising Bank Reference n International bank and Trust Co.Hong KongBeneficiaryElectronic Distributors Associates 217 Des Voeux Road, Central Hong KongApplicantImportadores Electronicos S.A.147 Avevida san Jose Panama, Rep. of PanamaExpiry date & place for presentation of docsExpiry date: June 17, 1994Place for presentation:Hong Kong Place and Date of issuing Panama, May 29, 1994Irrevocable Number 1234Documentary CreditName of Issuing Bank Banko BinkoPanama, Rep. Of Panama 请认真阅读本信用证!后面单据中的红色字表示不符点。

浙江财经沈莉期末国际结算复习整理

1.Term bill(远期汇票):2.Documentary bill(跟单汇票):3.Bill of exchange(汇票):means an unconditional order in writing addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at sight or at a fixed or determinable future time a sum certain in money to ,or to the order of, a specified person or to the bearer.4.Required items of bill(汇票的必要记载事项):5.Promissory note(本票):means an unconditional promise in writing signed by the maker engaging to pay on demand or at a fixed or determinable future time a sum certain in money to pr to the order of a specified person or to bearer.6.Cheque(支票):means a bill of exchange which is drawn on a bank and is payable on demand.7.Mail remittance(信汇):The mail remittance is a remittance, at the request of a remitter, effected by a mail advice or payment order sent by a remitting bank to a paying bank authorizing the latter to pay a certain sum in money to a designated payee of the remittance.8.Documentary collection(跟单托收):the collection of financial documents accompanied by commercial documents and commercial documents not accompanied by financial documents.9.Irrevocable credit(不可撤销信用证):means a definite undertaking of confirming bank, in addition to that of the issuing bank, to honor or negotiating a complying presentation. When a confirmation is added to an irrevocable credit by another bank, the credit become a confirmed, irrevocable credit.10.Deferred payment credit(延期信用证):means under a deferred payment credit, the beneficiary does not receive payment when he presents the documents, but at a later date after B/L date or presentation of documents.11.Negotiation credit(议付信用证):means a negotiation credit refers to the credit under which the issuing bank authorizes other nominated banks to purchase the drafts and/or documents presented by the beneficiary.12.Anticipated credit(预支信用证):A credit with a clause which authorises the advising bank to make an advance payment to the beneficiary.13.Buyer’s usance credit(假远期信用证):according to the contract, payment to the seller at sight; time draft discounting charges and acceptance commission are for the buyer’s account.流程图Flow chart of cable/telex/SWIFT (Telegraphic Transfer, T/T )Buyer1Apply and buy foreign exchanges & paycommission2T/TRept.3PO + BT instructionby T/TPaying BankRemitting Bank4T/Tadv.Seller5Rept.6Pay 7Debit or credit AdviceCable and Telex need at least more than 2 days to processIn the SWIFT transfer, if you send money in the morning, it would enter payee’s a/c in the afternoonWith test key简答题1、Describe the similarities and difference of FOB.CFR.CIFSimilarities:(1)be used in marine transportation(2)deliver goods to port of loading(3)the risks shift to the buyer when the goods pass the ship’s rail(4)the buyer undertake risks after delivering goods)Difference:(1)FOB: the seller is not responsible for freight charges and insurance(2)CFR: the seller is only responsible for freight charges(3)CIF: the seller is responsible for freight charges and insurance, but the risk is undertaken by thebuyer3、跟单托收对进出口商的风险与保护Risks for exporter under documentary collection:1. Refuse to pay or accept time draft on some small inadvertent infraction of the sales contract.2. Demand deep cut down of price, or refuse to accept the goods.3. A heavy storage charge, fire insurance, demurrage and great expenses and time delay if court action is taken.Protection for exporter:Financial credit and operational style of importer.Market trend of importing country.Whether import license or foreign exchange has been approved by relative authority.Whether political situation in importing country is steady.Whether a case of need could be found once dishonor happens, who could help handle returned goods, e.g warehousing and insuring the goods, arranging shipment of returned goods, finding another buyer for exporter, etc. Risks for importer under collection:1. Might be fraudulent documents.2. Might be defective or dummy or not the model ordered by importer3. Late shipment,and miss the optimal selling seasons4.In advance payment , can not inspect goods beforehand.5. Dishonor would ruin importer’s reputation.Protection for importer:1.Investigate exporter’s reputation and deal only with creditworthy exporters.2.If it is time payment, payment time can be XX days/months after Bill of Lading date, which means that earlier delivery,earlier payment.3.Choose the most the favorable procedure of documents delivery basing on the credit standing, financial capability, market trend.e.g. if price is going high, use D/P. If price is going down,use D/AUse D/P at tenor as possible as you can to confirm if goods arrive at the harbor of your country.4、可转让LC与背对背LC的区别:The comparison of Transferable LC and Back-to-Back LC:Both credits involve a middleman as a sellerBoth credits involve the substitution of documentsTransferred Credit expires at the counter of transferring bankBack-to-back credit expires at the counter of 2nd Issuing bank.Distinction:●Transferred credit derives its existence and utilization from transferable LC●In back-to-back credit operations, there are two wholly independent credits with whollyindependent Issuing Bank undertaking.●In transferred credit, second beneficiary obtains payment undertaking of Issuing Bank in thetransferable LC.●In back-to-back credit, second beneficiary does not obtain Issuing bank’s undertaking ofpayment in the original credit●Transferred amount no longer exists in Transferable LC●In back-to-back credit transaction, two separate LCs coexist●Transferable credit is issued at the request of applicant with consent of Issuing Bank.●Back-to-back credit is not the intention of applicant and Issuing Bank in master credit5 开证行和指定银行对不符单据的处理方法6信用证下买卖双方风险与防范第八章最后几张ppt7银行对进出口商的融资最后一节课笔记英文不多。

《国际结算:理论·实务·案例(双语教材)》Chapter 9

the master or a named agent for or on behalf of the master.

¾ indicate that the goods have been dispatched, taken in charge or shipped on board at the place stated in the credit, by: pre-printed wording, or a stamp or notation indicating the date on which

Different kind of transaction calls for different kind of Documents.

Documents related to international settlement

Documents under the letter of credit are usually prepared by exporters and related to third parties. ¾ Commercial Documents (商业单据) ¾ Transportation Documents (运输单据) ¾ Insurance Documents (保险单据) ¾ Official Documents (官方单据)

¾ be the sole original transport document or, if issued in more than one original, be the full set as indicated on the transport document.

《国际结算:理论·实务·案例(双语教材)》CH1-2

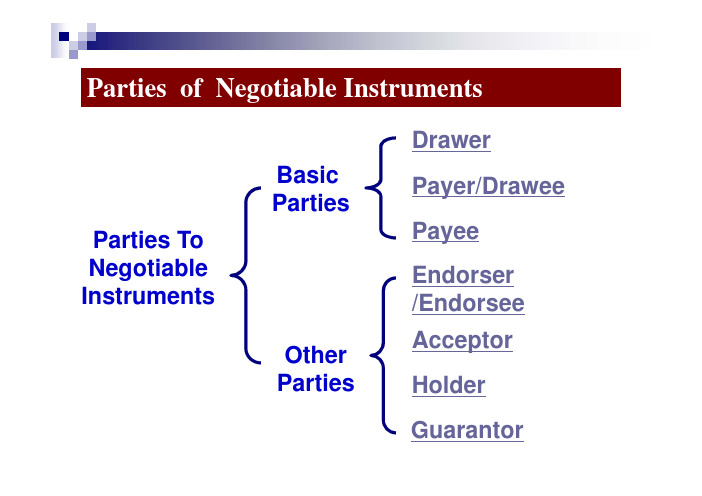

D Parties of Negotiable InstrumentsBasicDrawerParties To PartiesPayer/DraweePayeeParties ToNegotiable EndorserInstrumentsOther /Endorsee AcceptorParties HolderGuarantorCommercial Demand Draft Classifications of Negotiable Instruments Bill of Exchange Commercial Draft Banker’s e a d a t Usance Draft g Banker’s Draft Order Check Negotiable InstrumentsCh k Order Check Bearer CheckOpen CheckCheck Crossed CheckSpecial Crossing CheckOpen Check Promissory Note Special Crossing CheckConducts of Negotiable InstrumentsI Endorsement Endorsement Present for acceptanceg……Issuance Endorsement EndorsementPresent for paymentDrawer Payee Firstendorseedrawee Secondendorsee…Lastholder………AcceptancePaymentdishonorRecourse G uarantee汇票支票本票出票人与付款人之间不必出票人与付款人之间约定自己付款的票据1.出票人与付款人之间,不必先有资金关系。

2.当事人:出票人、付款人、收款人 1.出票人与付款人之间,在签发前必先有资金关系。

《国际结算:理论·实务·案例(双语教材)》chapter 5 Remittance

Field Name in Chinese

M

20

Transaction Reference Number 发报行编码

M 32a Value Date, Currency Code, Account

起息日、货币(代码)和金额

M

50

Ordering Customer

汇款人(客户)

O

52a Ordering Institution

:50: Ordering Customer

Amount

:52A: Ordering Institution

S Sender :53A: Sender’s Correspondent :54A: Receiver’s Correspondent R Receiver :57A: Account With Institution

3. Paying bank

The paying bank

Paying bank or receiving banckourrrsueesapflloeynirdsestnhtetoof the bank entrusted by the remittingrebmaittninkg btaonk.pay a certain sum of money to a beneficiary.

:72: Sender to Receiver Information

M/T

M/T refers to the remitting bank, at the request of the remitter, transfers the funds by means of sending/posting a payment instruction to the paying bank, asking the latter to pay a certain sum of money to the payee.

财务知识——国际结算案例

一价定律: 在自由贸易的条件下,两个国家生产和消费的同一种商品,其价格上的差异不会超过运输成本,汇率将移动到使两个国家同一种商品的价格相同的水平上(当以此汇率转换时)。 下表列示了1995年8月“巨无霸”在美国和8个国家的价格(第2栏), 表中同时列出了1995年8月各国货币对美元的汇率,以1美元外国货币的数量表示(第3栏)。

-15%

加拿大(CAD)

C$2.27

1.36

$1.67

1.19

+14%

法国(FRF)

Fr15.4

5.06

$3.04

8.10

-38%

德国(DEM)

DM3.9

1.48

$2.64

2.05

-28%

意大利(ITL)

L3700

1623

$2.28

1947

-17%

日本(JPY)

¥322

96.9

$3.32

169.5

-43%

一.国际结算案例

案例 1 假设中国机械设备进出口公司向美国史密斯公司出口机器设备(一台),价值2万美元。

1

分析:

结论:通过上述业务活动,国际间由于贸易发生的债权债务关系得到顺利清偿。由此可见,动态的外汇定义概括了外汇原理的基本特征

2

案例 2

11

德国

美国

避免汇率下跌损失

避免汇率上涨损失

出口10万$商品

进口10万$商品

$1∶1.20€ 10万$=120,000 €

$1∶1.15€ 10万$=115,000 €

$1∶1.25€ 10万$=125,000 €

+5000收入

- 5000收入

$1∶1.20€ 10万$=120,000 €

国际结算案例解析整编

国际结算案例解析整编目录1. 国际结算概述 (2)1.1 国际结算的定义与重要性 (3)1.2 国际结算的主要类型 (4)2. 国际贸易背景 (5)2.1 世界贸易组织 (6)2.2 国际贸易的基本流程 (8)2.3 国际贸易支付条件 (8)3. 国际结算工具 (9)4. 案例分析 (11)4.1 信用证案例 (12)4.1.1 订单与信用证的签署 (13)4.1.2 提单与单据的提交 (14)4.1.3 信用证的清偿与处理 (15)4.2 托收案例 (15)4.2.1 交易背景与支付条件 (16)4.2.2 单据准备与提交 (18)4.2.3 托收结果与后续处理 (19)4.3 汇款案例 (20)4.3.1 基础交易与汇款指令 (21)4.3.2 汇款流程与资金跟踪 (22)4.3.3 汇款业务的风险控制 (23)5. 国际结算风险管理 (25)5.1 信用风险 (26)5.2 市场风险 (28)5.3 操作风险 (29)6. 实践中的问题与解决方案 (30)6.1 信用证中的争议解决 (31)6.2 支付与资金管理的策略 (33)6.3 法规与合规性问题 (34)7. 总结与展望 (35)7.1 国际结算发展现状 (36)7.2 国际结算的未来趋势 (37)7.3 个人/企业应具备的国际结算知识 (39)1. 国际结算概述在世界经济日益全球化的今天,国际结算作为国际贸易中货款借贷的清算活动,已经成为国际经济合作和经贸往来不可或缺的一部分。

它涉及货物、技术、服务和无形资产等国际交易的货币收付,是通过信用证、电汇、信汇等方式进行货币交易的最终结算。

国际结算是一个复杂的过程,它涉及货币兑换、汇率风险、信用风险、法律和监管环境等多方面的因素。

结算的目的是确保买卖双方之间的交易能够顺利完成,并且货款和货物能够准确无误地按照合同要求进行移交。

在此过程中,信用证的使用是最常见的结算方式之一。

信用证是由开证行根据进口商的请求,对出口商授予的一种信用承诺,允许其在规定条件下从指定银行获得付款。

《国际结算:理论·实务·案例(双语教材)》Chapter 11

Chapter 11Chapter11International Trade FinanceImportance of financing in aninternational settlement transactionLetter of Credit issuance(开立信用证)Inward Bill(进口押汇)Shipping guarantee(提货担保)International Trade FinanceTrust receipts(信托收据)Financing from export promotion agency(出口促进机构融资)C di d d i(信用卡透支)Facility on import financeTrade Finance Credit card overdrawing(信用卡透支)P ki l(打包贷款)Packing loan(打包贷款)Outward bills(出口押汇)Bill Discounting(票据贴现)Factoring(保理)Factoring (保理)Forfeiting(福费廷)Export-tax-return loanFacilities on export finance(出口退税抵押贷款)Export guarantee and insurance(出口担保和保险)11.1 Importance of financing in an 111Importance of financing in an international settlement transaction Financing is very important for both the buyer and the seller in an international settlement transaction in that it can ease the transaction, transaction in that it can ease the transaction, reach an agreement and increase sales opportunities.t itia Facilities on import financea Facilities on export finance11.2 Facility on import financeLetter of Credit issuance(开立信用证)Inward Bill(进口押汇)pp g gShipping guarantee(提货担保)Trust receipts(信托收据)Financing from export promotion agencyFinancing from export promotion agency(出口促进机构融资)Credit card overdrawing(信用卡透支)1. Letter of credit issuanceBy issuing a documentary credit, the bank is obliged to pay upon the documents complied with the L/Cp pA documentary credit issuance can be regarded as afinancing arrangement for the customerfinancing arrangement for the customerBased on the creditworthiness of the applicant,the issuing bank will approve a credit line for him,under thehimapproved credit line,the issuing bank will charge no deposit for issuing a L/C from importer.d it f i i f i tCredit Line Granted by BankCompany B Company A Company B 30000 Dollars50000000 DollarsCompany C 5000D ll 5000 DollarsCredit Line ManagementC A l i•State-owned, collectively owned, private ¾Company Analysis ,y ,p •Industry position•History in the industry y y •History with the bank •Corporate strategy p gy •Internal control •Management‘s track record of honoring and Management s track record of honoring and dishonoring obligation•Academic background and experience g p•Decision making process: centralized or decentralized.Capacity to Repay¾Capacity to RepayThe bank must study carefully the auditedfinancial statements, in-house and unaudited financial statementfinancial statement¾Trade AnalysisMarket price and seasonal goods or not•Market, price and seasonal goods or not.•Buyers/suppliers powerDistribution channel•Distribution channel•Goods to be warehoused and insuredCurrency convertibility•Currency convertibility•Any quota requirement and restrictionShi t d it d ti ti•Shipment and its destination2. Inward billsAn inward bill (imported bill purchased) is the issuingbank effects payment to the beneficiary upon presentation of the required documents before the applicant actually pays.p,p yz Under the operation of the L/C, the importer can only obtain the documents of goods title upon the payment.However banks can deal with the importer’s bills andz However, banks can deal with the importer s bills and documents when the importer has difficulties in effectingpaymentt3. Shipping guarantee3Shipping guaranteeWhen the goods arrived at destination before they y g documents, the buyer may obtain a bank guarantee from issuing bank and submit it to the carrier in order to obtain the goods for sale.to obtain the goods for sale.The banks must require the importer to fulfill these ÕTransfer the fund as per the invoice in copy into an escrow The banks must require the importer to fulfill these obligation:Transfer the fund as per the invoice in copy into an escrow account of the issuing bankPresent copies of bill of lading ÕPresent copies of bill of ladingÕWaive the right of rejecting the documents even if there are di idiscrepancies ÕRedeem the shipping guarantee from the shipping company by original bill of lading to return to the bank within 7 working days after the arrival of the original bill of lading ÕBe fully responsible for any loss of the shipping guarantee issued by the bank yShipping Guarantee Flow4. Trust Receipts (T/R)4Trust Receipts(T/R)y p yBefore the buyer effects the payment to the issuing bank, the buyer may borrow the documents from the issuing bank against T/R and obtain the from the issuing bank against T/R and obtain the goods from the carrier.¾A trust receipt is a kind ofimport financing facilityi t fi i f ilit¾The importer will fulfill hisobligation for payment underbli ti f t dthe L/C after he sells thegoods.5. Financing from export promotion agencyFinancing support from export trade promotioni i th ll’t f i iagency services in the seller’s country of origin may include the buyer credit from the seller’s bankwhich makes the late payment of the buyer possible.6. Credit card overdrawingCredit cards can be used by the buyer as a meansof payment for international trade, and at the same of payment for international trade and at the sametime, they can also be used as an option of financingby means of overdrawing for payment. But thelimitations are: some sellers in some countries may ynot accept the credit card payment , and the creditcard payment is only available within a certain card payment is only available within a certain “credit limit”.11.3 Facilities on export finance 113F iliti t fiW Packing loan(打包贷款)Outward billsW Outward bills(出口押汇)W Bill Discounting(票据贴现)W Factoring (保理)W Forfeiting(福费廷)W Export-tax-return loan(出口退税抵押贷款)Export guarantee and insuranceW Export guarantee and insurance (出口担保和保险)g1. Packing loanExporters use the credit as a collateral to apply for a loan, and the funds will be only used forp p g gpreparing the goods under the credit.Packing loan is an export financing provided by banks for exporters preparing goods before shipmentfor exporters preparing goods before shipmentThe exporter must present its credit to the bank from which he gets the loan, and the bank will negotiate the documents and deduct the amount for the purpose of packing goodsThe amount for packing loan is70%-80%of the L/C The amount for packing loan is 70%-80% of the L/CThe procedure of Packing Loan Th d f P ki Lg pThe bank should take the following points into account before making a packing loan to his customer:¶Credit investigation on issuing bank and importer ¶Careful study on L/CBe careful of transferable credit¶¶Know the trade and the marketSupervision and risk mitigation¶Supervision and risk mitigation¶Comparison between packing loan and anticipatory L/Cti i t L/C2. Outward billsOutward bills (export bills purchased) refers afinancing facility that the bank will purchase the financing facility that the bank will purchase theexport bill and documents upon the request of aexporter if the documents presented comply with if i the terms and conditions of the L/C.Four factors are considered by the bank before F f t id d b th b k b fit decides to purchase the bill:Credits of iss ing banksÂCredits of issuing banksÂConformity of documents with L/C“Soft Clauses” of creditgÂInvestigation on trade and tradersThe procedure of Outward bills The procedure of Outward bills3. Bill Discounting3Bill DiscountingBill discount is an act of bill, and is a kind of financing. The bill to be discounted must be a time financing The bill to be discounted must be a time bill, and it can be discounted after its acceptance.4. Factoring4F t iFactoring contract means a contract concluded“Factoring contract”means a contract concludedbetween the supplier and the factor pursuant withwhichÎThe supplier may assign to the factor receivables;Th f t i t f fi i f th llÎThe factor is to perform financing for the seller, maintenance of accounts, collection of receivables andprotection against default in payment by the buyers;ÎNotice of the assignment of the receivables is to be given in writing to the debtorsThe operation of Factoring1.Goods & InvoiceBuyer Seller2. Copiesof Invoice 3. a. Prepayments b. Credit Cover 5. DebitCollection6. Payment 4. Send InvoiceImport Export7. a. Paymentb. Credit Cover FactoringFactoring b C ed t Co eFunction of factoringU FinanceU Sales ledger administrationU Collection of A/RU Credit cover5. ForfeitingForfeiting is the term generally used to denote the purchase of obligation falling due at somefuture date arising from deliveries of goods and future date, arising from deliveries of goods andservice-mostly export transactions-withoutrecourse to any previous holder of the obligation.Procedure of Forfeiting Procedure of Forfeiting1Contract Drawing Draft2. Issue Note 1. Contract /Drawing Draft Importer Exporter6. Payment 4.Discount Note or Draft3.DeliverNote orf InstallmentwithoutRecourse Draft F f i i B k I ’B k5. Guarantee Note or Draft Forfeiting BankImporter’s BankRisk in forfeiting gThe risks of export finance connected with anyf b d fi i ll d fi d type of cross-border financing are usually defined as political, transfer, commercial and currency risks.Advantages for exportersRelieves the balance sheet of contingent liabilities;D Relieves the balance sheet of contingent liabilities;D Improves liquidity of possible losses through only partial state or private insurance cover and the negation of possible liquidity problems which are negation of possible liquidity problems which are unavoidable during the claim period withi nsurance coverD There is no interest rate riskD There is no risk of fluctuations in the exchange rate nor changes in the status of the debtort h i th t t f th d btComparison between factoring and forfeitingp g gItems Factoring ForfeitingNature New and comprehensive method oftSimilarities paymentContent Risk protection and trade financingMethod Purchase of export receivablesPurchase target Consumer goodsreceivables Capital goods receivablesPurchase percentage Entire or partialPurchase percentage Entire or partial EntireReceivable nature General receivables Bills or certificateBank guarantee No Import bank Differences guaranteePurchase nature With or withoutdiscourse Without discourseOth i With t Other services With WithoutRisk control and transfer Credit ranking Syndicated ormarket transfer(negotiable)Basic method O/A, D/A Clean collection,L/C6. Export-tax-return loanThis is a short-term loan offered by a bank to the seller by using its export-tax-returny g preceivables or account as collateral.This type of export financing may be necessary when the export tax return needs some time to be when the export-tax return needs some time to be completed by the taxation authority and the seller needs immediate money even after the payment needs immediate money even after the payment has been completed in an international settlement transaction.transaction7. Export guarantee and insuranceIn order to promote export, many government In order to promote export many government have established some financial institutions providing export guarantee and insurance, e.g. in idi d i i China, we have China Import and Export Bank; in U.K., they have Export Credit Guarantee Bureau; in France, they have The Foreign Trade Bureau;in France,they have The Foreign Trade Insurance Corporation, etc. They are actually “liti l”t t d fi i l i tit ti “political” or state-owned financial institutions established to encourage and support national export.A bank guarantee may also be defined as anA b k t l b d fi d independent obligation where the guarantor ( a bank/ financial institution/ surety) has to make a special agreement with its customer, ensuring that special agreement with its customer,ensuring that it will be refunded by him for any payment to be effected under the contract of guarantee.ff t d d th t t f t(一)开证额度的使用案例介绍假设进口企业A在银行B开户。

国际结算案例分析 第4组

• (5)收到信用证理应认真地、逐字逐句地加以审 核,而我方工作竟如此疏忽大意。 • (6)发生争议时理应做好货物的保全工作,而本 案的货物最后竟然被港口海关拍卖处理,我方对 争议的处理工作是如此的不到位,应引以为戒。

案例二

• 案情:某甲开立100英镑的支票给乙,叫他向丙银 行取款,乙拿到支票后拖延很久不去取款,恰在 此时,丙银行倒闭,甲在丙银行的账户里的存款 分文无着。乙在未获支票款项的情况下,找到了 甲,要甲负责。甲以支票已过期为由拒绝对以负 责。

•

在远期付款交单的条件下,如果付款日期晚于到货日期, 进口商为了抓住有利时机转售货物,可以采取两种做法: 一是在付款到期日之前付款赎单,扣除提前付款日至原付 款到期日之间的利息,作为进口商享受的一种提前付款的 现金折扣。另一种做法是代收行对于资信较好的进口商, 允许其凭信托收据借取货运单据,先行提货,于汇票到期 时再付清货款,这是代收行自己向进口商提供的信用便利, 而与出口商无关。因此,如代收行借出单据后,到期不能 收回货款,则应由代收行负责。但如系出口商指示代收行 借单,就是由出口商主动授权银行凭信托收据借单给进口 商,即所谓远期付款交单凭信托收据借单方式,也就是进 口商承兑汇票后凭信托收据先行借单提货,日后如进口商 到期拒付的风险,应由出口商自己承担。

• 分析:甲可以对乙拒绝负责,但理由并不是因为

支票过期。支票不同于即期汇票,即期汇票的持 票人如不在合理的时间内向付款人提示付款,出 票人和所有背书人均得到解除责任。但支票的持 票人如不在合理时间内提示付款,出票人仍必须 对支票负责,除非持票人的延迟提示而使出票人 受了损失。在上例中,由于乙的晚提示致使甲受 了损失。那么甲就可不对该支票负责,因为乙如 果及时去取款,甲就不会受到损失,所以他可对 支票不负责任。如果丙银行倒闭清理时,所有债 权人尚能分到一定比例的偿付金,那么,甲作为 存户债权人应把所分到的偿付金付还给乙,如甲 按30%的比例分到了偿付金,他应按同样的比例付 给乙,而对其余的70%可不负责任。 Nhomakorabea答案

整理后的国际结算案例

一、国际结算工具案例分析案例1 关于支票过期的处理某甲开立100英镑的支票给乙,叫他向丙银行取款,乙拿到支票后拖延很久不去取款,恰在此时,丙银行倒闭,甲在丙银行的账户里的存款分文无着。

乙在未获支票款项的情况下,找到了甲,要甲负责。

甲以支票已过期为由拒绝对以负责。

应由谁来承担责任?案例2 汇票金额大小不一致A银行向B银行开出不可撤销信用证,受益人交单后B银行通过快递将单据寄交A银行,A银行审单后发现下述不符点,遂对外拒付。

汇票上小写金额为USD905000.00,大写金额为HONG KONG DOLLARS NINE HUNDRED AND FIVE THOUSAND ONLY,金额不一致。

收到A银行的拒付电后,B银行认为所述不符点仅是打字手误,非实质性不符点。

应由谁来承担责任?案例3 对于支票期限的理解某甲开立100英镑的支票给乙,授权乙向丙银行取款,乙拿到支票后拖延很久不去取款,恰在此时,丙银行倒闭,甲在丙银行帐户里的存款分文无着。

乙在未获支票款项的情况下,找到了甲,要甲负责。

甲以支票已过期为由拒绝对乙负责。

应由谁来承担责任?案例4 汇款的偿付中国的甲银行发信汇通知书给纽约的乙银行,受益人是乙银行的客户。

由于甲银行和乙银行间没有账户关系,甲银行就电报通知其境外账户行丙银行,将资金调拨给乙银行。

在清算系统日益发达的今天,信汇方式会有市场吗?二、国际结算方式案例分析案例1 D/P远期付款方式的掌握X月X日,我国公司同南美客商B公司签订合同,由A公司向B公司出口货物一批,双方商定采用跟单托收结算方式了结贸易项下款项的结算。

我方的托收行是A′银行,南美代收行是B′银行,具体付款方式是D/P 90天。

但是到了规定的付款日,对方毫无付款的动静。

更有甚者,全部单据已由B公司承兑汇票后,由当地代收行B′银行放单给B公司。

于是A公司在A′银行的配合下,聘请了当地较有声望的律师对代收行B′银行,因其将D/P 远期作为D/A方式承兑放单的责任,向法院提出起诉。

国际结算案例15

事先,Y公司也曾通过媒体的报道了解到国际市场的乳胶手套价 格急剧下滑,但考虑有合约在先,开始并不同意J公司的要求, 后Y公司再三考虑: 夏季已到,乳胶手套在LA的码头上的集装箱内暴晒,温度 过高会老化、发粘; 就地转卖他人,整个市场行情不看好,难以成交; 如果运回,国内没有市场,而且将得不偿失。

案例1 后T/T汇付结算方式的风险 浙江某五金进出口公司Z,与俄罗斯E公司签约出口2个 TEU的后入水的水龙头。合同约定分两次装运,交货的 时间间隔为30天;付款方式为装运后30天的T/T方式 (Payment by T/T within 30 days after shipment of goods);还约定Z公司收到T/T后将单据通过快递 寄给E公司(宁波港至St.Petersburg的航程为45天左 右)。看来万无一失,Z公司并无太大的风险。 Z公司如约安排生产,并按装期将第一个TEU的货物从宁 波港装船,此后向E公司发出了S/A,30天付款的日子眼 看快到了,Z公司发电文催E公司汇付货款,开始E公司 还敷衍称自己只是进口代理,会敦促其客户付款,后来 干脆就回避,最后索性连电话也不接、电文也不回了。

案例2 预付品质保证金的欺诈案 深圳某服装F公司与南非N公司签约出口服装。 合同中的主要条款如下: 合同总价为400万美元,货物分8次装运,每次 50万美元;款式由N公司提供图样生产;部分 面料由N公司在国际市场代为采购;签约后的 1O日内,双方分别对开信用证用于购买原料和 服装;在货物装运前5日,N公司质检员前往产 地进行质检,验收合格后由来员签发“质量检 验报告”(C/I),并作为议付的单据之一; 签约后的2O日内,F公司需要向N公司预付合同 总金额2.5%的质量保证金,在第一批货物装 运后5日内退回。

浙江财经国际结算双语案例分析

Case Number 1 The Case of the Contingent Irrevocability of the CreditUCP500 Article 4 and sub-article 8(a)BackgroundType of Credit: IrrevocableApplication:UCP500Issuing Bank: Bank IAdvising Bank: Bank AAvailability: At sight with the Issuing BankExpiry: At the counters of the Issuing BankCircumstancesIssuing Bank:Bank I issued its irrevocable Credit and advised it to the Beneficiary through Bank A.Advising Bank: Bank A advised the Credit to the BeneficiaryCredit: Among the terms and conditions, the Credit asked for:1. Sight draft on the issuing bank2. Bills of lading issued to order of Bank I for account of the Applicant3. Special Conditions:(a) Payment of drafts drawn hereunder will be made only after therealization of the re-export proceeds program.Beneficiary: The Beneficiary shipped the goods and presented the documents required by the Credit to Bank A.Advising Bank: Bank A informed the Beneficiary that in view of the special conditions related to payment and because the Credit expired at the counters of theIssuing Bank, Bank A would only forward the documents to Bank I for theiraction.Beneficiary: After determining that Bank A had no obligation to negotiate, relying upon the standing of the Issuing Bank as a premier financial institution, and beingcomfortable that the Credit was subject to UCP500, the Beneficiaryinstructed Bank A to forward the documents to Bank I.Issuing Bank: Informed Bank A that while the documents presented under the Credit were compliant, they were not in a position to honor the drawing, as thenecessary funds had not been made available to them from the “re-exportproceeds program”. If and when such proceeds were made available, theywould pay the drawing under their credit.Beneficiary: The Beneficiary never received payment for the goods shipped, even though the documents presented under the Credit complied fully with the terms andconditions of the Credit. Bank I stated that while their Credit was irrevocable,it contained special conditions stating that irrevocability was subject toreceipt of the necessary funds from the “re-export proceeds program”. Sincesuch proceeds were not received, Bank I had no obligation to honor thedrawing. Bank I suggested that the Beneficiary try to recover directly fromthe Applicant.Queries:Please review, analyze the queries, give your opinion and be prepared to answer each query(1) Would your Bank have issued or confirmed such an Irrevocable Credit?(2) If your bank advised such a Credit to the Beneficiary, would it have warned theBeneficiary about its special conditions?Is it correct for Bank I to have issued this Credit subject to UCP500?Case Number 2 The Case of Payment Against Copies of the Transport Documents UCP500 Article 14BackgroundType of Credit: Irrevocable NegotiableApplication: UCP500Issuing Bank: Bank IAdvising Bank: Bank ANegotiating Bank: Freely NegotiableAvailability: at sightExpiry: At the counters of Negotiating BankCircumstancesIssuing Bank: Bank I issued its irrevocable freely negotiable Credit in favor of the Beneficiary and advised it through Bank A.Advising Bank: Bank A advised the Credit to the BeneficiaryBeneficiary: Upon shipment, the Beneficiary presented the documents to Bank A for negotiation, informing Bank A that the full set of the original bills of lading,endorsed in blank, had been forwarded directly to the Applicant due to theshort transit time and normal delays of document processing. TheBeneficiary requested Bank A to telex Bank I for authority to pay despite thefact that copies of the bills of lading were presented and not the originals asrequired by the Credit.Negotiating Bank: Bank A, after examining the documents and determining that the only discrepancy was that copies instead of the originals of the bills of ladingwere presented, telexed Bank I for permission to negotiate despite thenoted discrepancy.Issuing Bank: Upon receipt of the telex from Bank A, Bank I notified the Applicant of the presentation of the documents to Bank A by the Beneficiary and therequest to pay against copies of the bills of lading instead of the originalsas required by the Credit. The Applicant authorized the payment againstthe documents presented. Bank I telexed Bank A accordingly. Negotiating Bank: Bank A, after receipt of such payment authorization, paid the Beneficiary and forwarded the documents to Bank I requestingreimbursement.Issuing Bank: Two days after authorizing payment, Bank I received the documents from Bank A and determined that all other terms and conditions of the Credit,except for the requirement for presentation of the original bills of lading,were complied with. Accordingly, Bank I credited the account of Bank Aand debited the account of the Applicant.Issuing Bank: The day after the debit to their account, and lacking receipt of the full set oforiginal bills of lading, the Applicant requested Bank I to issue a“steamship indemnity” to enable him to obtain the merchandise from thecarrier, as the goods had already arrived. Bank I, acknowledging thatpayment had already been made to Bank A and that the Applicant’saccount had been charged in reimbursement, issued the “steamshipindemnity” as requested by the Applicant.Issuing Bank: One week after payment under the Credit and subsequent issuance of the “steamship indemnity” and rel ease of the goods by the carrier to theApplicant, Bank I received a “Collection Instruction Letter” from RemittingBank X on behalf of a Principal/Shipper (a party other than the Beneficiaryof the Credit), enclosing a sight draft, a commercial invoice and theoriginal bills of lading that were to have been presented under theDocumentary Credit. Bank I tried communicate with the Drawee (the samecompany as the Applicant for the Credit) but was unable to make contactsince the company had gone out of business and the principals could notbe found. Bank I informed Remitting Bank X of their inability to contact theDrawee for collection of the item and requested instructions as to thedisposition of the documents.Remitting Bank: Remitting Bank X notified its client of Bank I’s message and requested instructions.Principal: The Drawer of the Draft for collection informed Remitting Bank X that they determined that Bank A had issued a “steamship indemnity” in favor of thecarrier, enabling the importer to take title to the goods, despite their inability toproduce the original bills of lading. Since the Drawer of the collection Draftwas the holder of the full set of original bills of lading, the Drawer claimed thattitle to the goods was with them and Bank A had no authority to dispose oftheir property without its corresponding payment. Accordingly, the Drawer, inabsence of immediate payment of the collection by Bank A, would be makinga formal demand on the carrier for payment of the value of the goods releasedagainst the steamship indemnity, plus related expenses.Remitting Bank: Remitting Bank X informed Bank A accordingly.Issuing/Collecting Bank: Bank I realized that it had been duped by the Applicant anddecided that since it had already paid for the merchandise onbehalf of the Applicant, they were not obligated to pay for thesame goods twice, especially in view of the potential fraud thatwas committed to induce the banks to enter into such atransaction. Bank I informed Remitting Bank X of its position. Queries:Please review, analyze the queries, give your opinion and be prepared to answer each query.What is (are) your opinion(s) and the reason(s) for it (them)? For example, what kind of fraud is it ?How many payments for goods have they defrauded the Issuing Bank of ?。

国际结算的法律冲突案例(3篇)

第1篇一、案例背景随着全球化进程的加快,国际贸易和投资活动日益频繁,国际结算成为连接不同国家和地区的经济纽带。

然而,由于不同国家法律体系、货币制度以及商业习惯的差异,国际结算过程中常常出现法律冲突。

本文将分析一个典型的国际结算法律冲突案例,即美国与中国的跨境支付纠纷。

二、案例概述某美国公司(以下简称“美国公司”)与中国一家企业(以下简称“中国企业”)签订了一份出口合同,约定以美元结算。

合同履行过程中,中国企业按照约定完成了货物交付,但美国公司以资金周转困难为由,未能在约定的时间内支付货款。

随后,中国企业向美国公司发出催款通知,但美国公司仍未支付。

中国企业遂将美国公司诉至中国法院,要求其支付货款及违约金。

在美国公司答辩中,其提出以下抗辩理由:1. 美国公司所在地的法律规定,违约金不得超过合同金额的5%;2. 美国公司的银行账户在中国被冻结,导致其无法支付货款。

中国企业则认为:1. 根据合同约定,违约金不得超过合同金额的10%;2. 美国公司的银行账户被冻结是由于其自身原因,与合同履行无关。

三、法律冲突分析本案涉及的法律冲突主要包括以下两个方面:1. 违约金数额的法律冲突2. 银行账户冻结的法律冲突(一)违约金数额的法律冲突美国公司主张按照其所在地的法律,违约金不得超过合同金额的5%,而中国企业则认为按照合同约定,违约金不得超过合同金额的10%。

这一争议体现了不同国家法律对违约金数额的规定存在差异。

美国法认为,违约金应当以实际损失为基础,不得超过实际损失的数额。

而中国法则允许当事人约定违约金,且违约金可以高于实际损失。

因此,在违约金数额的法律冲突中,中国法院更倾向于尊重当事人的约定。

(二)银行账户冻结的法律冲突美国公司认为,其银行账户在中国被冻结是其无法支付货款的主要原因。

这一争议涉及到不同国家法律对银行账户冻结的处理方式。

美国法认为,银行账户冻结应当遵循一定的法律程序,如需冻结,必须获得法院的判决。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Case Number 1 The Case of the Contingent Irrevocability of the CreditUCP500 Article 4 and sub-article 8(a)BackgroundType of Credit: IrrevocableApplication:UCP500Issuing Bank: Bank IAdvising Bank: Bank AAvailability: At sight with the Issuing BankExpiry: At the counters of the Issuing BankCircumstancesIssuing Bank:Bank I issued its irrevocable Credit and advised it to the Beneficiary through Bank A.Advising Bank: Bank A advised the Credit to the BeneficiaryCredit: Among the terms and conditions, the Credit asked for:1. Sight draft on the issuing bank2. Bills of lading issued to order of Bank I for account of the Applicant3. Special Conditions:(a) Payment of drafts drawn hereunder will be made only after therealization of the re-export proceeds program.Beneficiary: The Beneficiary shipped the goods and presented the documents required by the Credit to Bank A.Advising Bank: Bank A informed the Beneficiary that in view of the special conditions related to payment and because the Credit expired at the counters of theIssuing Bank, Bank A would only forward the documents to Bank I for theiraction.Beneficiary: After determining that Bank A had no obligation to negotiate, relying upon the standing of the Issuing Bank as a premier financial institution, and beingcomfortable that the Credit was subject to UCP500, the Beneficiaryinstructed Bank A to forward the documents to Bank I.Issuing Bank: Informed Bank A that while the documents presented under the Credit were compliant, they were not in a position to honor the drawing, as thenecessary funds had not been made available to them from the “re-exportproceeds program”. If and when such proceeds were made available, theywould pay the drawing under their credit.Beneficiary: The Beneficiary never received payment for the goods shipped, even though the documents presented under the Credit complied fully with the terms andconditions of the Credit. Bank I stated that while their Credit was irrevocable,it contained special conditions stating that irrevocability was subject toreceipt of the necessary funds from the “re-export proceeds program”. Sincesuch proceeds were not received, Bank I had no obligation to honor thedrawing. Bank I suggested that the Beneficiary try to recover directly fromthe Applicant.Queries:Please review, analyze the queries, give your opinion and be prepared to answer each query(1) Would your Bank have issued or confirmed such an Irrevocable Credit?(2) If your bank advised such a Credit to the Beneficiary, would it have warned theBeneficiary about its special conditions?Is it correct for Bank I to have issued this Credit subject to UCP500?Case Number 2 The Case of Payment Against Copies of the Transport Documents UCP500 Article 14BackgroundType of Credit: Irrevocable NegotiableApplication: UCP500Issuing Bank: Bank IAdvising Bank: Bank ANegotiating Bank: Freely NegotiableAvailability: at sightExpiry: At the counters of Negotiating BankCircumstancesIssuing Bank: Bank I issued its irrevocable freely negotiable Credit in favor of the Beneficiary and advised it through Bank A.Advising Bank: Bank A advised the Credit to the BeneficiaryBeneficiary: Upon shipment, the Beneficiary presented the documents to Bank A for negotiation, informing Bank A that the full set of the original bills of lading,endorsed in blank, had been forwarded directly to the Applicant due to theshort transit time and normal delays of document processing. TheBeneficiary requested Bank A to telex Bank I for authority to pay despite thefact that copies of the bills of lading were presented and not the originals asrequired by the Credit.Negotiating Bank: Bank A, after examining the documents and determining that the only discrepancy was that copies instead of the originals of the bills of ladingwere presented, telexed Bank I for permission to negotiate despite thenoted discrepancy.Issuing Bank: Upon receipt of the telex from Bank A, Bank I notified the Applicant of the presentation of the documents to Bank A by the Beneficiary and therequest to pay against copies of the bills of lading instead of the originalsas required by the Credit. The Applicant authorized the payment againstthe documents presented. Bank I telexed Bank A accordingly. Negotiating Bank: Bank A, after receipt of such payment authorization, paid the Beneficiary and forwarded the documents to Bank I requestingreimbursement.Issuing Bank: Two days after authorizing payment, Bank I received the documents from Bank A and determined that all other terms and conditions of the Credit,except for the requirement for presentation of the original bills of lading,were complied with. Accordingly, Bank I credited the account of Bank Aand debited the account of the Applicant.Issuing Bank: The day after the debit to their account, and lacking receipt of the full set oforiginal bills of lading, the Applicant requested Bank I to issue a“steamship indemnity” to enable him to obtain the merchandise from thecarrier, as the goods had already arrived. Bank I, acknowledging thatpayment had already been made to Bank A and that the Applicant’saccount had been charged in reimbursement, issued the “steamshipindemnity” as requested by the Applicant.Issuing Bank: One week after payment under the Credit and subsequent issuance of the “steamship indemnity” and rel ease of the goods by the carrier to theApplicant, Bank I received a “Collection Instruction Letter” from RemittingBank X on behalf of a Principal/Shipper (a party other than the Beneficiaryof the Credit), enclosing a sight draft, a commercial invoice and theoriginal bills of lading that were to have been presented under theDocumentary Credit. Bank I tried communicate with the Drawee (the samecompany as the Applicant for the Credit) but was unable to make contactsince the company had gone out of business and the principals could notbe found. Bank I informed Remitting Bank X of their inability to contact theDrawee for collection of the item and requested instructions as to thedisposition of the documents.Remitting Bank: Remitting Bank X notified its client of Bank I’s message and requested instructions.Principal: The Drawer of the Draft for collection informed Remitting Bank X that they determined that Bank A had issued a “steamship indemnity” in favor of thecarrier, enabling the importer to take title to the goods, despite their inability toproduce the original bills of lading. Since the Drawer of the collection Draftwas the holder of the full set of original bills of lading, the Drawer claimed thattitle to the goods was with them and Bank A had no authority to dispose oftheir property without its corresponding payment. Accordingly, the Drawer, inabsence of immediate payment of the collection by Bank A, would be makinga formal demand on the carrier for payment of the value of the goods releasedagainst the steamship indemnity, plus related expenses.Remitting Bank: Remitting Bank X informed Bank A accordingly.Issuing/Collecting Bank: Bank I realized that it had been duped by the Applicant anddecided that since it had already paid for the merchandise onbehalf of the Applicant, they were not obligated to pay for thesame goods twice, especially in view of the potential fraud thatwas committed to induce the banks to enter into such atransaction. Bank I informed Remitting Bank X of its position. Queries:Please review, analyze the queries, give your opinion and be prepared to answer each query.What is (are) your opinion(s) and the reason(s) for it (them)? For example, what kind of fraud is it ?How many payments for goods have they defrauded the Issuing Bank of ?。