会计学-企业决策的基础 答案教学资料

会计学-企业决策的基础 答案

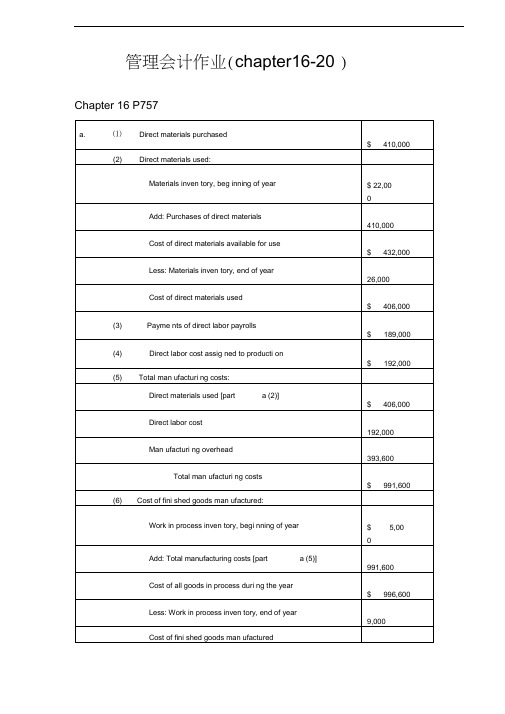

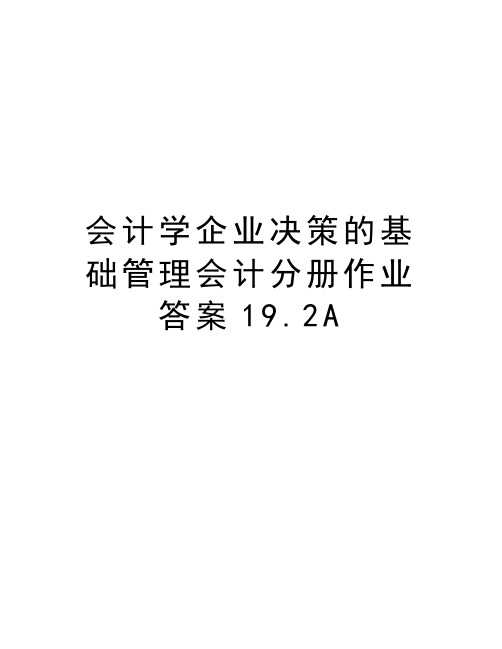

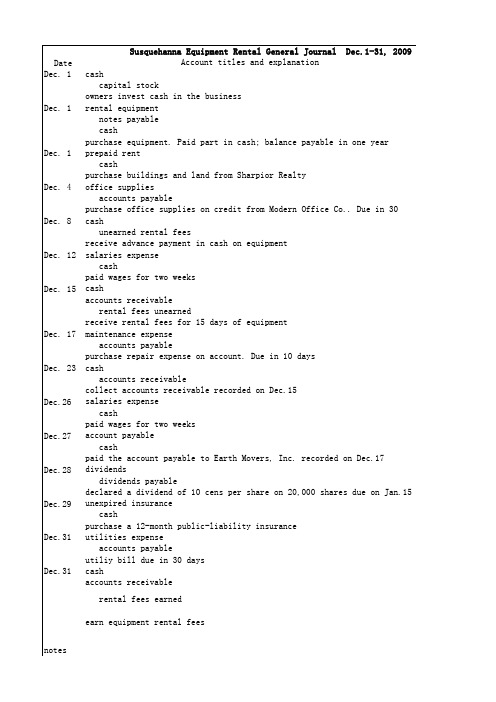

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line. Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1a. job costing (each project of a construction company is unique)b . both job and process costing (institutional clients may represent unique jobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3A4,000 EU @ $61.50 = $246,000 b4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume ?Fixed Costs + Target OperatingIncomeUnit Contribution Margin?$390,000 + $350,000= $20,000 units$37。

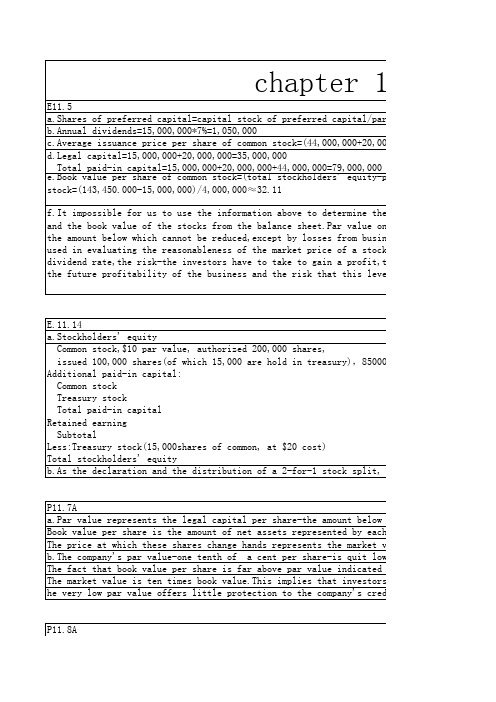

会计学企业决策的基础 课后习题 答案 chapter11

ermine the market value.We can only get the par value r value only represents the legal capital per sharefrom business operations.Although the book value is of a stock,the market value is also affected by the a profit,the interest rate and overexpectation as to this level of profitability may not be achieved.

Retained earning Total stockholders' equity

Retained Earnings,Jan,1,2009 Add:Net income earned in Dec,2009 subtotal Less:Dividends declare in Dec ,2009

ry),85000 outstanding

1,000,000

800,000 30,000 1,830,000 120,000 1,950,000 300,000 1,650,000 ck split, the amount of shares of common stock would

unt below which cannot be reduced,except by losses ed by each share of stock,which is the historical e market value of the stock,which represents the s quit low. However the corporation can set par value indicated either that the stock initially was issued investors believe that management and product lines any's creditors.On the other hand, a market value of

会计学 企业决策的基础 财务会计分册 版 章答案

Chapter 6Merchandising Activitie s Ex. 6.41PROBLEM 6.1AClaypool earned a gross profit rate of 32%, which is significantly higher than the industry average. Claypool’s sales were above the industry average, and it earned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.To have a higher-than-average cost of goods sold and still earn a much larger-than-average amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores. Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.PROBLEM 6.5Ac. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if itmust borrow money for a short period of time at an annual rate of 11%. Bytaking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only 0.6%interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount is greater than the cost of short-term borrowing.Chapter 7 Financial assetsChapter 8 Inventories and the cost of goods soldSupplementary ProblemChapter 91617。

会计学课件与参考答案-第七章决策会计-精品文档

13

2. 亏损产品是否停产的决策 亏损产品是否停产的决策是指企业在生产多 品种产品时,如果某一种产品出现了亏损,那么 是否继续按照原有规模生产该种产品。 3. 零部件自制或外购的决策分析 很多企业都存在着零部件自制或外购决策问 题的决策。有时是由于企业任务过多,有必要将 某些零星加工扩散到外部;有时则生产任务不足, 为充分利用自身的生产能力,就需将原来的外购 改成自制。

3、边际贡献分析法(Contribution Analysis Method)

所谓边际贡献法是指用有关方案的边际贡献总额指标作 为决策评价指标的一种方法。

12

三、 短期决策的内容 (一)生产决策 1. 新产品开发的决策分析 新产品开发的决策是指企业利用现有的剩 余生产能力,或利用过时的老产品腾出来的生 产能力,投产哪种或哪几种新产品的决策分析 方法。

6

决策程序图

反馈 1. 判定问题确定目标

6.核查与控制

2. 提出备选方案

5. 执行决策

3. 比较评价方案

4. 选择确定方案

7

第二节 短期经营决策

一、相关成本(Relevant Costs) 相关成本是与决策有关联的成本,也就是 进行决策分析时必须认真加以考虑的各种形式 的未来成本。 1、差别成本:(Differential Cost)几个备选方 案预期成本的差额. 相关概念:差别收入和差别利润。

4

3、程序化决策和非程序化决策

按决策组织活动的性态或解决问题的方式不同, 决策可分为程序化决策与非程序化决策。程序化决 策指可按照既定的程序来进行工作的决策。如经常 性的业务工作和管理工作。非程序化决策是属于新 规定的、非例行的、呈非程序化的决策。

5

四、决策的程序

会计学-企业决策的基础答案

管理会计作业(chapter16-20 ) Chapter 16 P757b. HILLSDALE MANUFACTURING CORP.Schedule of the Cost of Fini shed Goods Man ufacturedChapter 16 P761Costs of fini shed goods man ufactured:Total inven tor y$ 149,00Chapter 17 P802a.Department One overhead application rate based onmachi ne-hours:Departme nt Two overhead applicati on rate based on direct labor hours:Manu facturi ng Overhead = $337,500= $ per direct labor hourDirect Labor Hours15,000Manu facturi ngOverheadMachi ne-Hours =$420,000 12,000= $35 per machi ne-hourChapter 17 P805d. The Custom Cuts product line is very labor intensive in comparison to the BasicChunks product line. Thus, the company s current practice of using direct labor hours to allocate overhead results in the assig nment of a disproporti on ate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed perce ntage above the manu facturi ng costs assig ned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line iscurre ntly priced at an artificially low price in the marketplace. This probably expla ins why sales of Basic Chunks remai n strong while sales of Custom Cuts are on the decline.e. The ben efits the compa ny would achieve by impleme nting an activity-based costi ngsystem include: (1) a better identification of its operating inefficiencies, (2)a better understanding of its overhead cost structure, (3) a better understanding of the resourcerequireme nts of each product line, (4) the pote ntial to in crease the selling price of BasicChunks to makeit more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having tosacrifice product quality.Chapter 18 P835a job costi ng (each project of a con struct ion compa ny is unique)B. Ex.b both job and process costi ng (in stituti onal clie nts may represe nt unique jobs)c job cost ing (each set of equipme nt is uniq uely desig ned and manu factured)d process costing (the dog houses are uniformly manufactured in high volumes)e process costi ng (the vitam ins and suppleme nts are uni formly manu factured inhigh volumes)Chapter 18 P841b4,000 EU @ $ = $54,000Chapter 18 P845a. (1) $49 [($192,000 + $48,000 + $54,000) - 6,000 un its](2) $109 [($480,000 + $108,000 + $66,000) - 6,000 un its](3) $158 ($49 + $109)(4) $32 ($192,000 - 6,000 un its)(5) $18 ($108,000 - 6,000 un its)b. In evaluating the overall efficiency of the Engine Department, managementwould look at the mon thly per- unit cost in curred by that departme nt, which is the cost of assembli ng and in stalli ng an engine ($109 in part a).Chapter 20 P918d. No. With a unit sales price of $94, the break-even sales volume in units is 54,000un its:Un it co ntributio n margin = $94 - $84 variable costs = $10$540,000 Break-eve n sales volume (in un its) =—' ) $10= 54,000 un its Uni ess Thermal Tent has the ability to manufacture 54,000 un its (or lower fixedand/or variable costs), setting the unit sales price at $94 will not enableThermal Tent to break eve n.Chapter 20 P918Chapter 20 P920Sales volume required to maintain curre nt operati ng in come:$390,000 + $350,000=$20,000 un its。

会计学企业决策的基础 课后习题 答案 chapter

Total paid-in capital=15,000,000+20,000,000+44,000,000=79,000,000 e.Book value per share of common stock=(total stockholders' equity-preferred stock)/shares stock=(143,450.000-15,000,000)/4,000,000≈32.11

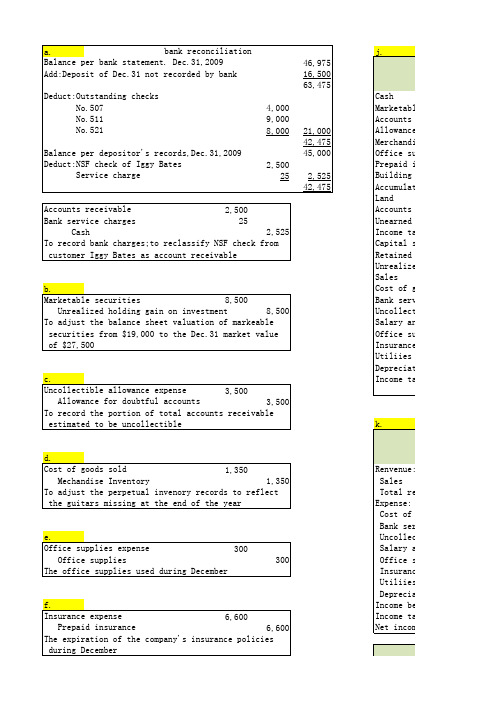

会计学——企业决策的基础(英文版)课后习题答案 comprehensive problem2

240,200 78,425 318,625 0 318,625

42,475 33,500 112,600 248,650 900

986,000 64,800 1,488,925

70,000 4,800 81,000 155,800 1,000,000 318,625 14,500 1,333,125 1,488,925

k.

d. Cost of goods sold 1,350 Mechandise Inventory 1,350 To adjust the perpetual invenory records to reflect the guitars missing at the end of the year

e. Office supplies expense 300 Office supplies The office supplies used during December

300

f. Insurance expense 6,600 Prepaid insurance 6,600 The expiration of the company's insurance policies during December

会计学企业决策的基础管理会计分册作业答案19.2A

Problem19.2Aa.The target cost for KAP1= target price-profitmargin=$120-15%×$120=$120×85%=$102The target cost for QUIN=$220×85%=$187b. Total manufacturing for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+[2,000,000÷(25,000+15,000)×25,000]=$2,750,000b.So the total manufacturing cost per unit of KAP1=$2,750,000÷25,000=$110>$102 The same as KAP1, the total manufacturing cost for QUIN=$2,550,000So the total manufacturing cost per unit of QUIN=$2,550,000÷15,000=$170<$187 So QUIN is earning the desired return.c. Because the overhead costs are assigned on the basis of the direct labor hours, so we need to recalculate it.The total manufacturing cost for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+ [2,000,000÷(24/12×25,000+60/12×15,000)*24/12×25,000=$2,300,000c.So the total manufacturing cost per unit of KAP1=$2,300,000÷25,000=$92<$102 The same as KAP1, the total manufacturing cost for QUIN=$3,000,000So the total manufacturing cost per unit of QUIN=$3,000,000÷15,000=$200>$187 So QUIN is earning the desired return.d. Using the activity-based costing method, the total manufacturing cost for KAP1= 400,000*1/5+600,000*2/3+500,000*2/6+200,000*5/8+300,000*3/5+($30+$24)×25,0 00+(24÷2×3×25,000)=$910,000d.So the total manufacturing cost per unit of KAP1=$96.4<$102The same as the KAP1, the total manufacturing cost for QUIN=$2,890,000So the total manufacturing cost per unit of QUIN=$2,890,000÷15,000=$192.67>$187 So KAP1 is earning the desired return.e. Because the activities of machining, purchase orders and shipping to customers are value-added activities, so the proportion of fixed overhead=(600,000+500,000+300,000)÷2,000,000=70%In attempting to reach the target cost for QUIN, we would like to improve the activity of machine set-ups first because its proportion of all overhead cost is relatively big and it is easiest for the manufacturer to make the adjustment to lower down the target cost.f. Impact: the manufacturing cost of KAP1 increased and that of QUIN decreased. The new manufacturing cost per unit of KAP1=$106>$102The new manufacturing cost per unit of QUIN=$176.67<$187So QUIN is earning the desired return.g. If the machine was purchased, the manufacturing cost of KAP1=$2,370,000and the new manufacturing cost per unit of KAP1=$2,370,000÷25,000=$94.8<$102 And the manufacturing cost of QUIN=$2,730,000The new manufacturing cost per unit of QUIN=$2,730,000÷15,000=$183<$187 Both of the KAP1 and QUIN are earning the desired return, so the machine should be purchased.。

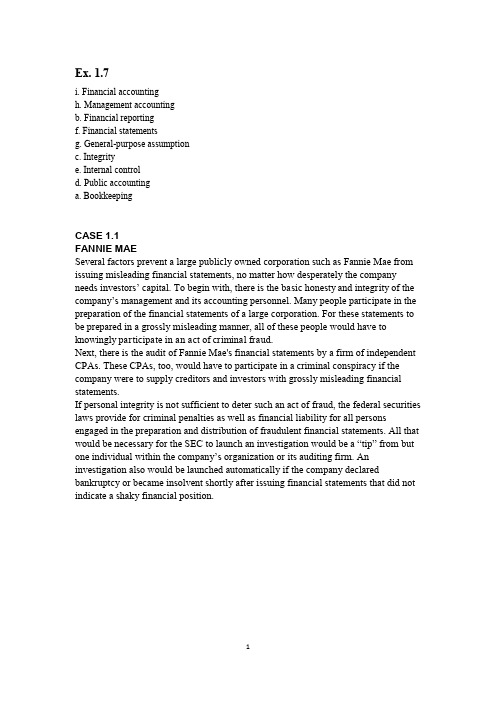

会计学 企业决策的基础 16版 1-5章 课后习题答案

Ex. 1.7i. Financial accountingh. Management accountingb. Financial reportingf. Financial statementsg. General-purpose assumptionc. Integritye. Internal controld. Public accountinga. BookkeepingCASE 1.1FANNIE MAESeveral factors prevent a large publicly owned corporation such as Fannie Mae from issuing misleading financial statements, no matter how desperately the company needs investors’ capital. To begin with, there is the basic honesty and integrity of the company’s management and its accounting personnel. Many people participate in the preparation of the financial statements of a large corporation. For these statements to be prepared in a grossly misleading manner, all of these people would have to knowingly participate in an act of criminal fraud.Next, there is the audit of Fannie Mae's financial statements by a firm of independent CPAs. These CPAs, too, would have to participate in a criminal conspiracy if the company were to supply creditors and investors with grossly misleading financial statements.If personal integrity is not sufficient to deter such an act of fraud, the federal securities laws provide for criminal penalties as well as financial liability for all persons engaged in the preparation and distribution of fraudulent financial statements. All that would be necessary for the SEC to launch an investigation would be a “tip” from but one individual within the company’s organization or its auditing firm. An investigation also would be launched automatically if the company declared bankruptcy or became insolvent shortly after issuing financial statements that did not indicate a shaky financial position.Problem 2.1 AProblem 3.8AExercise 4.2Exercise 4.14Problem 4.5AProblem 5.2AProblem 5.5A。

会计学企业决策的基础管理会计分册作业答案19.2A培训资料

会计学企业决策的基础管理会计分册作业答案19.2AProblem19.2Aa.The target cost for KAP1= target price-profit margin=$120-15%×$120=$120×85%=$102The target cost for QUIN=$220×85%=$187b. Total manufacturing for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+[2,000,000÷(25,000+15,000)×25,000]=$2,750,000b.So the total manufacturing cost per unit of KAP1=$2,750,000÷25,000=$110>$102 The same as KAP1, the total manufacturing cost for QUIN=$2,550,000So the total manufacturing cost per unit of QUIN=$2,550,000÷15,000=$170<$187 So QUIN is earning the desired return.c. Because the overhead costs are assigned on the basis of the direct labor hours, so we need to recalculate it.The total manufacturing cost for KAP1=($30+$24)×25,000+(24÷2×3×25,000)+ [2,000,000÷(24/12×25,000+60/12×15,000)*24/12×25,000=$2,300,000c.So the total manufacturing cost per unit of KAP1=$2,300,000÷25,000=$92<$102 The same as KAP1, the total manufacturing cost for QUIN=$3,000,000So the total manufacturing cost per unit of QUIN=$3,000,000÷15,000=$200>$187 So QUIN is earning the desired return.d. Using the activity-based costing method, the total manufacturing cost for KAP1= 400,000*1/5+600,000*2/3+500,000*2/6+200,000*5/8+300,000*3/5+($30+$24)×25,0 00+(24÷2×3×25,000)=$910,000d.So the total manufacturing cost per unit of KAP1=$96.4<$102The same as the KAP1, the total manufacturing cost for QUIN=$2,890,000So the total manufacturing cost per unit of QUIN=$2,890,000÷15,000=$192.67>$187 So KAP1 is earning the desired return.e. Because the activities of machining, purchase orders and shipping to customers are value-added activities, so the proportion of fixedoverhead=(600,000+500,000+300,000)÷2,000,000=70%In attempting to reach the target cost for QUIN, we would like to improve the activity of machine set-ups first because its proportion of all overhead cost is relatively big and it is easiest for the manufacturer to make the adjustment to lower down the target cost.f. Impact: the manufacturing cost of KAP1 increased and that of QUIN decreased. The new manufacturing cost per unit of KAP1=$106>$102The new manufacturing cost per unit of QUIN=$176.67<$187So QUIN is earning the desired return.g. If the machine was purchased, the manufacturing cost of KAP1=$2,370,000and the new manufacturing cost per unit of KAP1=$2,370,000÷25,000=$94.8<$102 And the manufacturing cost of QUIN=$2,730,000The new manufacturing cost per unit of QUIN=$2,730,000÷15,000=$183<$187 Both of the KAP1 and QUIN are earning the desired return, so the machine should be purchased.。

会计学-企业决策的基础 答案

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa.Department One overhead application ratebased on machine-hours:Manufacturing Overhead$420,000=$35 per machine-hourMachine-Hours 12,00 0Department Two overhead application rate based on direct labor hours:Manufacturing Overhead$337,500=$22.50 per direct laborhourDirect Labor Hours 15,00 0Chapter 17 P805 17.8Ad .The Custom Cuts product line is very labor intensive in comparison to theBasic Chunks product line. Thus, the company’s current practice of using direct labor hours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e .The benefits the company would achieve by implementing an activity-basedcosting system include: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex. 18.1a.job costing (each project of a construction company is unique)b.both job and process costing (institutional clients may represent unique jobs)c.job costing (each set of equipment is uniquely designed and manufactured)d.process costing (the dog houses are uniformly manufactured in high volumes)e.process costing (the vitamins and supplements are uniformly manufactured in high volumes)Chapter 18 P841 18.3AInputs:•Beginning WIP•StartedOutputs:•Units completed•Ending WIP•Beginning WIP•Units started•Units completed•Ending WIP•Cost of beginning WIP•Cost added during the period•Cost of goods transferredtransferred•Add ending WIP$246,000b4,000 EU @ $13.50 =$54,000Chapter 18 P845 18.2Ba .(1)$49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2)$109 [($480,000 + $108,000 + $66,000) ÷6,000 units] (3)$158 ($49 + $109)(4)$32 ($192,000 ÷ 6,000 units)(5)$18 ($108,000 ÷ 6,000 units)b .In evaluating the overall efficiency of the Engine Department, managementwould look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad .No. With a unit sales price of $94, the break-even sales volume in unitsis 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units)$540,000$1054,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales VolumeFixed Costs + TargetOperating IncomeUnit Contribution Margin$390,000 + $350,000= $20,000 units $37。

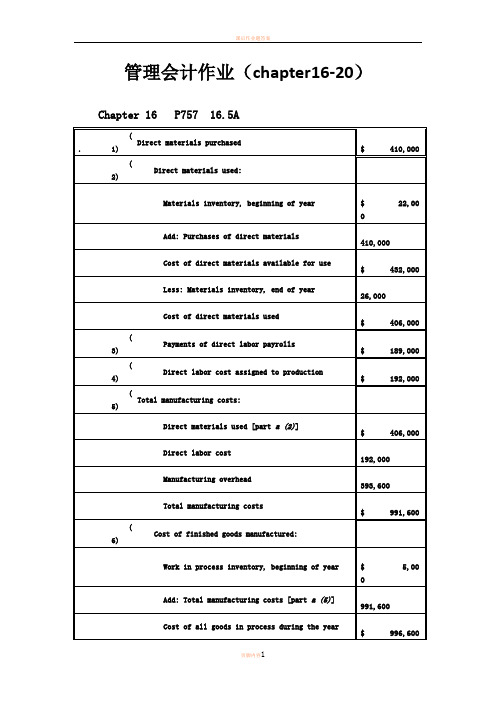

会计学——企业决策的基础(英文版)课后习题答案 comprehensive problem 1(完整版)

Susquehanna Equipment Rental General Journal Account titles and explanation

Dec.1-31, 2009

Dec. 1

Dec. 1

Dec. 4

Dec. 8

Dec. 12

Dec. 15

Dec. 17

Dec. 23

(a)advanced payment used during December

(e)earned of rental fees paid in advance on Dec.8

65,000 8,400 12,000 9,600 1,000 240,000 100,000 1,700

(f)1,500 (a)4,000 (d)400 (c)2,500

(b)interest expense accrued during December on note paybale (c)mo

(f)earned six days' rental fees on backhoe rented on Dec.23 (g)to ac

Susquehanna Equipment Rental adjuesting general journal Account titles and explanation Date rent expense Dec.31 prepaid rent advanced payment used during December

Date Dec.31

Debit 43,200

to accrue salaries owed to employees but unpaid as of month-end

会计学-企业单位决策的基本答案解析

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application ratebased on machine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on directlabor hours:ManufacturingOverhead= $337,500=$22.50 per direct laborhourDirect LaborHours 15,000Chapter 17 P805 17.8Ad . The Custom Cuts product line is very labor intensive in comparison to the Basic Chunks product line. Thus, the company’s current practice of using direct labor hours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturingcosts assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e . The benefits the company would achieve by implementing an activity-based costing system include: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex. a job costing (each project of a construction company is18.1 . unique)b . both job and process costing (institutional clients may represent unique jobs)c . job costing (each set of equipment is uniquely designed and manufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e . process costing (the vitamins and supplements are uniformly manufactured in high volumes)Chapter 18 P841 18.3A•Beginning WIP•Started•Units completed•Ending WIP•Beginning WIP •Units started•Units completed •Ending WIP•Cost of beginning WIP•Cost added during the period•Cost of goods transferred•Add ending WIPa4,000 EU @ $61.50 = $246,000b4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba . (1)$49 [($192,000 + $48,000 + $54,000) ÷6,000 units](2)$109 [($480,000 + $108,000 + $66,000) ÷6,000 units](3)$158 ($49 + $109)(4)$32 ($192,000 ÷6,000 units)(5)$18 ($108,000 ÷6,000 units)b . In evaluating the overall efficiency of the Engine Department, management would look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad . No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) =$540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume Fixed Costs + Target OperatingIncomeUnit Contribution Margin$390,000 + $350,000= $20,000 units $37。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

会计学-企业决策的基

础答案

管理会计作业(chapter16-20)Chapter 16 P757 16.5A

Chapter 16 P761 16.4B

Chapter 17 P802 17.3A

a. Department One overhead application rate based on machine-

hours:

Manufacturing Overhead

= $420,000

= $35 per machine-hour

Machine-Hours 12,000

Department Two overhead application rate based on direct labor hours:

Manufacturing Overhead

= $337,500

= $22.50 per direct labor hour

Direct Labor Hours 15,000

Chapter 17 P805 17.8A

d. The Custom Cuts product line is very labor intensive in comparison to the Basic

Chunks product line. Thus, the company’s current practice of using direct labor

hours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably

explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.

e. The benefits the company would achieve by implementing an activity-based costing

system include: (1) a better identification of its operating inefficiencies, (2) a better

understanding of its overhead cost structure, (3) a better understanding of the

resource requirements of each product line, (4) the potential to increase the selling

price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to

decrease the selling price of Custom Cuts without having to sacrifice product quality.

Chapter 18 P835 18.1

a. job costing (each project of a construction company is unique)

B. Ex.

18.1

b. both job and process costing (institutional clients may represent unique

jobs)

c. job costing (each set of equipment is uniquely designed and

manufactured)

d. process costing (the dog houses are uniformly manufactured in high

volumes)

e. process costing (the vitamins and supplements are uniformly

manufactured in high volumes)

Chapter 18 P841 18.3A

b4,000 EU @ $13.50 = $54,000

Chapter 18 P845 18.2B

a. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units]

(2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units]

(3) $158 ($49 + $109)

(4) $32 ($192,000 ÷ 6,000 units)

(5) $18 ($108,000 ÷ 6,000 units)

b. In evaluating the overall efficiency of the Engine Department, management would

look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).

Chapter 20 P918 20.1A

d. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:

Unit contribution margin = $94 - $84 variable costs = $10

Break-even sales volume (in units) = $540,000

$10

= 54,000 units

Unless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.

Chapter 20 P918 20.2A

Chapter 20 P920 20.6A

Sales volume required to maintain current operating income:

Sales Volume =

Fixed Costs + Target Operating Income

Unit Contribution Margin

=

$390,000 + $350,000

= $20,000 units

$37。