美国纳斯达克最终版

美国的NASDAQ市场

美国的NASDAQ市场(一)美国的NASDAQ市场NASDAQ即全美证券交易商协会自动报价系统(National Association of Securities Dealers Automated Quotations,简称NASDAQ),是全美证券交易商协会(National Association Of Securities Dealers Inc·简称NASD)于1971年,在华盛顿建立并负责组织和管理的一个自动报价系统,是世界第一个电子股票市场。

其最大特色在于利用现代信息技术建立了自己的电子交易系统,现已成为全球最大的无形交易市场。

截止1997年底,美国所有高科技上市公司中,96%的因特网公司、92%的电脑软件公司、82%的电脑制造公司和81%的电子通讯和生物技术公司在NASDAQ市场上市。

在纽约证券交易所的大公司中,也有相当部分是经过NASDAQ市场培育出来的。

目前NASDAQ 已与AMEX合并成为世界第二大证券交易市场。

NADAQ实际上并非平常意义上的二板市场。

由于吸纳了众多著名的高科技企业,而这些高科技企业又成长迅速,因此,NASDAQ给人一种扶持创业企业的印象。

建立NASDAQ的初衷在于标准美国大规模的场外交易,所以NASDAQ一直被作为纽约证券交易所(NYSE的辅助和补充。

先进而庞大的电子信息技术已经使NASDAQ成为世界上最大的无形交易市场。

NASDAQ共有两个板块:全国市场(NationalMarket)和1992年建立的小型资本市场(SmallCapMarket)。

NASDAQ在成立之初的目标定位在中小企业,但只是因为企业的规模随着时代的变化而越来越大,所以到了今天,NASDAQ反而将自己分成了一块"主板市场"和一块"中小企业市场"。

NASDAQ拥有自己的做市商制度(MarketMaker),它们是一些独立的股票交易商,为投资者承担某一只股票的买进和卖出。

美国百年金融史之十大最恐怖股灾

美国百年金融史之十大最恐怖股灾,熊市如何结束(指数跌幅超过40%为基准):这里我们将精选实战对比美股过去十大熊市的底部形态和时间,以及与其对比的中国A股已经发生过熊市的底部状况。

美股的熊市次序是按照其恐怖程度大小来排列:美股最近一次大崩盘(图1):这是美股过去100多年中仅次于1929年的大股灾。

开始日:2000年3月7日结束日:2002年10月8日熊市历经:950天左右(31个月)纳斯达克指数终极顶点:5,133纳斯达克指数终极低点:1,108百分比跌幅:-78%美股历史大崩盘股灾倒数之十:大萧条的后遗症1932~1933年作为1929年美股超级牛市大崩盘触底后第一个实质性的反弹开始后的再次下跌,是熊市转牛后的一个恐慌,与其说是恐慌,还不如说是大萧条的后遗症在继续干扰大众的信心。

当时道指由1932年的40点反弹到1933年的80点,指数反弹了100%,只历经了3个月,再次大幅度下跌到50点左右回稳向上。

图2,1933年所构筑的底部的消耗了3个月,但是如果从1929~1932年这个大熊市来看,不算其下跌过程的时间,只采用到最低点后从新开始主升通道确认开始,也就是终极底部的构筑是消耗了整整10个月的时间,道指才从新进入了一个长期的安全区域内。

如果以1929年终极顶点的熊市开始到结束,跌幅达近90%;耗时33个月,而最终确认牛市开始还要再等13个月。

美股历史大崩盘股灾倒数之九:一战结束前夕开始日:1916年11月21日结束日:1917年12月19日熊市历经:393天左右(13个月)道琼斯指数终极顶点:110道琼斯指数终极低点:66百分比跌幅:-40%如果二十世纪三十年代听上去是一个很远时代的故事,那我们还要再看看恐怖系数排名美股大崩盘史上第九的1917年,这还是在第一次世界大战的前夕。

正如我们所看到的,当时道指的跌幅高达40%,如果1916年你买入1,000美元单位的指数基金,到1917年它只有600美元了。

什么是纳斯达克(NASDAQ)-

什么是纳斯达克(NASDAQ)?The National Association of Securities Dealers Automated Quotation system, is one of the largest markets in the world for the trading of stocks. The number of companies listed on NASDAQ is more than that on any of the other stock exchanges in the United States, including the New York Stock Exchange (NYSE) and the American Stock Exchange (AMEX). The majority of companies listed on NASDAQ are smaller than most of those on the NYSE and AMEX. NASDAQ has become known as the home of new technology companies, particularly computer and computer-related businesses. Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients. The brokers negotiate with market makers who concentrate on trading specific stocks to reach a price for the stock.纳斯达克(NASDAQ)是全美证券交易协会自动报价系统的首字母缩略词。

美国纳斯达克上市的条件

美国纳斯达克上市的条件美国纳斯达克交易所是全球最大的科技股交易所,吸引了众多科技公司的关注和追逐。

对于一家公司来说,能够在纳斯达克上市不仅是一种荣耀,更是一种标志着企业实力和发展潜力的象征。

然而,纳斯达克上市并非易事,需要满足一系列严格的条件。

本文将详细介绍美国纳斯达克上市的条件。

首先,公司的财务状况是纳斯达克上市的关键因素之一。

公司须满足资产净额、收入、市值等多个财务指标,以展示公司的盈利能力和成长潜力。

纳斯达克要求公司在过去三个财年中有至少两个财年实现盈利,并且公司的净资产不得低于750万美元。

此外,公司在最近三个财年中的总收入必须达到1100万美元或以上。

其次,公司的股东结构也是纳斯达克上市的重要考量因素。

纳斯达克规定公司必须至少有1,250名股东,且在上市时至少有1,100名股东。

其中,每个股东的每股持有量不得低于100股。

对于大股东而言,纳斯达克要求其所持股份不得超过公司总股本的50%。

这一要求旨在确保公司的股权分散,减少控股股东对公司运营的过分干预。

此外,公司还需要满足纳斯达克交易所对股票的市场价值和流通性的要求。

纳斯达克要求公司在上市时的市值不得低于8500万美元。

公司的股票需要满足一定的流通性要求,如公司的公共股份市值不得低于1500万美元,并且公共股份的股份数须至少达到1500万股。

除了上述核心的条件外,纳斯达克还对公司的治理结构、财务报告与透明度、市场声誉等方面进行审核。

公司需设置独立董事,建立科学的风险管理制度,并制定完善的内部控制制度。

公司的财务报告必须按照美国通用会计准则(GAAP)进行编制,并符合纳斯达克的披露要求。

此外,公司还需要拥有良好的市场声誉,遵守相关监管法规,并尽可能减少与诉讼纠纷的关联。

总结:美国纳斯达克上市的条件可谓严苛而全面,包括财务状况、股东结构、市值流通性等多个方面。

除此之外,公司还需要具备良好的治理结构、财务报告与透明度以及市场声誉。

这些条件要求企业具备一定的实力和潜力,以确保其能够在纳斯达克交易所上市后取得良好的发展。

纳斯达克上市流程及说明

申请在纳斯达克证券市场的程序及说明A、前期评估及签约一、客户填写先期调查的问卷资料,经传真或E-mail发送至MAGNUM集团国际公司。

二、根据客户问卷所填资料,免费进行评估,在72小时回覆能否协助客户上市作业;未通过的公司我们承诺确保资料的机密性,并作为再次填写问卷评估时之参考。

三、客户资料通过了先期评估,符合申请在纳期达克证券市场上市的要求,双方将就上市申请工作签订咨询协议,并注明保证成功上市的条款。

四、与此同时,客户需要聘用一名略懂财务并精通英文的员工,这对於在美国上市的公司来说非常重要。

因为在上市资料审查过程中,有时SEC会要求客户在48小时之内回答一些问题,所以我们必须直接联络客户,并及时协助回答SEC的问题。

B、海外公司上市准备工作一、依据咨询协议生效之日起,将为客户成立其在北美的母公司,并将为客户全部办理好相关法律手续。

二、由客户建议3个北美公司的名称,以备成立北美公司之用,这些公司名称必须使用北美化的名称而不是中式名称,同时由客户提供该北美公司的董事名单、董事长人名、财务及秘书人名(或由一人担任所有职位)。

董事会成员不能有犯罪纪录。

三、我们建议客户在进行上述工作的基础上,至少成立两个免税岛公司,其中一个为北美上市公司(母公司)的全资子公司用於合理避税,另一个应用於客户大股东个人合理避税。

四、成立的北美公司将用作向美国证交会(SEC)申请上市之用,并协助完成以下申请文件。

1、有关证券和交易条例及其修订案所规定的政策及程序;2、SEC的惯例和规则;3、商业计划书;4、财务报表审计报告;5、注册登记文件。

五、当客户签订咨询协议书并交纳履约保证金后,中国公司随即开始初期的文件准备工作。

同时,我们将选定审计师着手准备审计工作。

在上述五项内容中财务报表审计需要的时间最长,因此我们首先确定审计工作。

一般情况下,如果客户迅速回答审计师的询问,初次客户现场审计可能在3-4周内完成。

而审计报告将於随后的2个月内完成。

纳斯达克上市条件(英文版)

`Listing Standards & Fees October 2010TABLE OF CONTENTSNASDAQ GLOBAL SELECT MARKET® (1)INITIAL LISTING (1)FINANCIAL AND QUALITATIVE REQUIREMENTS (1)LIQUIDITY REQUIREMENTS (3)NASDAQ® INTERMARKET TRANSFERS (4)CONTINUED LISTING (5)ENTRY FEES (5)ANNUAL FEES (6)FEES FOR LISTING A NEW CLASS OF SECURITIES (7)FORMS (7)NASDAQ GLOBAL MARKET® (8)INITIAL LISTING (8)CONTINUED LISTING (9)ENTRY FEES (9)ANNUAL FEES (10)FEES FOR LISTING A NEW CLASS OF SECURITIES (11)FORMS (11)NASDAQ CAPITAL MARKET® (12)INITIAL LISTING (12)CONTINUED LISTING (13)ENTRY FEES (13)ANNUAL FEES (14)FEES FOR LISTING A NEW CLASS OF SECURITIES (14)FORMS (15)DUAL LISTINGS (16)LISTING REQUIREMENTS (16)ENTRY FEES (16)ANNUAL FEES (16)LISTING OF ADDITIONAL SHARES FEES (16)FORMS (16)OTHER SECURITIES (17)LISTING REQUIREMENTS (17)FEES (18)FORMS (19)CLOSED-END FUNDS (20)LISTING REQUIREMENTS (20)ENTRY FEES (20)ANNUAL FEES (20)FORMS (21)CORPORATE GOVERNANCE REQUIREMENTS (22)OTHER LISTING REQUIREMENTS (26)LISTING OF ADDITIONAL SHARES (28)FEES (28)STOCK SPLITS, DIVIDENDS AND RIGHTS OFFERINGS (29)FEES (29)CHANGE IN COMPANY RECORD (30)SUBSTITUTION LISTING EVENTS (31)WRITTEN INTERPRETATION OF NASDAQ LISTING RULES (32)NASDAQ GLOBAL SELECT MARKETINITIAL LISTINGCompanies must meet all of the criteria under at least one of the three financial standards and the applicable liquidity requirements below.FINANCIAL AND QUALITATIVE REQUIREMENTSNASDAQ Global Select Market Initial Listing Requirements11 These requirements apply to all companies, other than closed-end management investment companies. A closed end management investment company, including a business development company, is not required to meet the financial requirements of Rule 5315(f)(3). If the common stock of a company is included in The NASDAQ Global Select Market, any other security of that same company, such as other classes of common or preferred stock, which qualifies for listing on The NASDAQ Global Market shall also be included in The NASDAQ Global Select Market. A company whose business plan is to complete an initial public offering and engage in a merger or acquisition with one or more unidentified companies within a specific period of time, as described in IM-5101-2, is not eligible to list on The NADAQ Global Select Market.2 In calculating income from continuing operations before income taxes for purposes of Rule 5315(f)(3)(A), NASDAQ will rely on a company’s annual financial information as filed with the Securities and Exchange Commission (SEC) in the company’s most recent periodic report and/or registration statement. If a company does not have three years of publicly reported financial data, it may qualify under Rule 5315(f)(3)(A) if it has: (i) reported aggregate income from continuing operations before income taxes of at least $11 million and (ii) positive income from continuing operations before income taxes in each of the reported fiscal years. A period of less than three months shall not be considered a fiscal year, even if reported as a sub period in the company’s publicly reported financial statements.3 In calculating cash flows for purposes of Rule 5315(f)(3)(B), NASDAQ will rely on the net cash provided by operating activities reported in the statements of cash flows, as filed with the SEC in the company’s most recent periodic report and/or registration statement, excluding changes in working capital or in operating assets and liabilities. A period of less than three months shall not be considered a fiscal year, even if reported as a stub period in the company’s publicly reported financial statements.4 In the case of a company listing in connection with its initial public offering, compliance with the market capitalization requirements of Rules 5315(f)(3)(B) and 5315(f)(3)(C) will be based on the company’s market capitalization at the time of listing.5 The bid price requirement is not applicable to a company listed on The NASDAQ Global Market that transfers its listing to The NASDAQ Global Select Market.6 A company that also satisfies the requirements of Rule 5405(b)(1) or 5405(b)(2) is required to have three market makers. Otherwise, the company is required to have four market makers. An electronic communications network (ECN) is not considereda market maker for the purpose of these rules.7 In addition to the above quantitative requirements, companies must comply with all corporate governance requirements as set forth in the Rule 5600 Series.LIQUIDITY REQUIREMENTSCompanies must meet all of the criteria in their specific category. The charts below are presented in two separate groups: (i) new company listings and (ii) closed-end management investment companies.NASDAQ Global Select Market Initial Listing Requirements1 Companies affiliated with another company listed on The NASDAQ Global Select Market. For purposes of Rule 5315, a company is affiliated with another company if that other company, directly or indirectly though one or more intermediaries, controls, is controlled by, or is under common control of the company. For purposes of these rules, control means having the ability to exercise significant influence. Ability to exercise significant influence will be presumed to exist where the parent or affiliated company directly or indirectly owns 20% or more of the other company’s voting securities, and also can be indicated by representation on the board of directors, participation in policy making processes, material intercompany transactions, interchange of managerial personnel, or technological dependency.2 Round lot and total shareholders include both beneficial holders and holders of record.3 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company.1 As defined by the Investment Company Act of 19402 Round lot and total shareholders include both holders of beneficial interest and holders of record.3 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company.NASDAQ INTERMARKET TRANSFERSEach October, NASDAQ will review the qualifications of all securities listed on The NASDAQ Global Market that are not included in The NASDAQ Global Select Market. Any security that meets the requirements for initial listing on The NASDAQ Global Select Market contained in Rule at the time of this review will be transferred to the Global Select Market the following January, provided it meets 5315 the continued listing criteria at that time. An issuer will not owe any application or entry fees in connection with such a transfer.At any time, an issuer may apply to transfer a security listed on The NASDAQ Global Market to The NASDAQ Global Select Market. Such an application will be approved and effected as soon as practicable if the security meets the requirements for initial listing contained in Rule 5315. An issuer will not owe any application or entry fees in connection with such a transfer.At any time, an issuer may apply to transfer a security listed on The NASDAQ Capital Market to The NASDAQ Global Select Market. Such an application will be approved and effected as soon as practicable if the security meets the requirements for initial listing contained in Rule 5315. An issuer transferring from The NASDAQ Capital Market to The NASDAQ Global Select Market generally will not owe any applicable or entry fees in connection with such transfer.CONTINUED LISTINGCompanies must meet all of the criteria under at least one of the three standards below.NASDAQ Global Select Market Continued Listing Requirements11 Companies must meet the bid price and total shareholders requirements as set forth in Rule 5450(a) and at least one of the Standards in Rule 5450(b).2 The term, “listed securities”, is defined as “securities listed on NASDAQ or another national securities exchange.”3 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company.4 Total shareholders include both holders of beneficial interest and holders of record.5 An electronic communications network (ECN) is not considered a market maker for the purpose of these rules.6 In addition to the above quantitative requirements, companies must comply with all corporate governance requirements as set forth in the Rule 5600 Series.ENTRY FEES• Entry fees are based upon the aggregate number of shares to be listed at the time of initial listing, regardless of class.• Fees are assessed on the date of entry in The NASDAQ Global Select Market, except for $25,000, which represents a non-refundable application fee. This fee must be submitted with the company’s application.• For non-U.S. issuers, entry fees are levied only on those shares or American Depositary Receipts (ADRs) issued and outstanding in the United States.• Entry fees paid by a company for all classes of securities listed on the Global Select Market, including entry fees previously paid by the company to list securities at an earlier date, shall not exceed $225,000. However, notwithstanding this fee cap, applications are subject to the $25,000 non-refundable fee.• NASDAQ does not charge application or entry fees for any company transferring from The NASDAQ Global Market to The NASDAQ Global Select Market.• NASDAQ does not charge application or entry fees for a company that transfers its listing from The NASDAQ Capital Market to The NASDAQ Global Select Market provided that the company listed on The NASDAQ Capital Market prior to January 1, 2007 or the company listed on The NASDAQ Capital Market on or after January 1, 2007 and did not qualify for The NASDAQ Global Select Market at the time of its initial listing on The NASDAQ Capital Market. Any other issuer must pay the entry fees for the Global Select Market, less the entry fees (but not the application fee) the company previously paid in connection with its listing on the Capital Market. The company is not required to pay the application fee in connection with the application to transfer its listing.• A company that submits an application to list on The NASDAQ Capital Market, but prior to listing, revises its application to seek listing on The NASDAQ Global Select Market, is not required to pay an additional application fee in connection with its revised application.• NASDAQ does not charge application or entry fees for any securities that are transferred from a national securities exchange to list exclusively on The NASDAQ Stock Market®.• NASDAQ does not charge entry or application fees for the securities of a company that is listed on another securities exchange but not listed on NASDAQ, if the issuer of such securities is acquired by an unlistedcompany and, in connection with the acquisition, the unlisted company lists exclusively on The NASDAQ Global Select Market.• NASDAQ does not charge entry or application fees for the securities of a company that is dually listed on the New York Stock Exchange and The NASDAQ Stock Market. Companies that dually list on other securities exchanges are subject to the applicable fees described in this section. (Please see Dual Listings on page 16.)NASDAQ Global Select Market Entry FeesANNUAL FEES• Annual fees are based on the company’s Total Shares Outstanding (TSO) for all classes of stock listed on the Global Select Market as of December 31st. NASDAQ uses the TSO reported in the company’s latest filing at the time of billing. For non-U.S. issues, TSO includes only those shares issued and outstanding in the United States.• In the first year of listing, the company’s annual fee will be prorated based on the date of listing and based on the TSO as reported in the company’s latest filing on record with NASDAQ as of the date of listing.• For a company transferring to The NASDAQ Global Select Market from The NASDAQ Capital Market, NASDAQ will apply a credit toward the balance of the company’s new annual fee based on the annual fee already paid.• Annual fees for American Depository Receipts listed on The NASDAQ Global Select Market are based on the number of ADRs listed. NASDAQ will apply fees based on ADRs, as reported in the issuer’s mostrecent periodic report required to be filed with the i ssuer’s appropriate regulatory authority or in morerecent information held by NASDAQ as of December 31st.NASDAQ Global Select Market Annual Fees**For issuers except ADRs, “other securities”, portfolio depository receipts, trust issued receipts, index fund shares and closed-end funds. For dually listed securities, please see Dual Listings on page 16. For a complete listing of the Global Select Market fees, refer to the NASDAQ Listing Rule 5900 Series.FEES FOR LISTING A NEW CLASS OF SECURITIESCompanies listed on NASDAQ must complete an application to list a new class of securities that is not currently listed on NASDAQ. When a current NASDAQ-listed company lists a new class of securities on The NASDAQ Global Select Market, it is assessed a variable fee based on the total number of shares outstanding of the new class of securities at the time of initial listing. Entry fees paid by a company for all classes of securities listed on the Global Select Market, including entry fees previously paid by the company to list securities at an earlier date, shall not exceed $225,000.Fees are assessed on the date of entry in The NASDAQ Global Select Market, except for $25,000, which represents a non-refundable application fee. This fee must be submitted with the company’s application. The company will also be assessed a pro-rated annual fee.FORMSApplications, listing agreements and payment forms are located at https://.NASDAQ GLOBAL MARKETINITIAL LISTINGCompanies must meet all of the criteria under at least one of the four standards below.NASDAQ Global Market Initial Listing Requirements11 Companies must meet the bid price, publicly held shares, and round lot holders requirements as set forth in Rule 5405(a) and at least one of the Standards in Rule 5405(b).2 Seasoned companies (those companies already listed or quoted on another marketplace) qualifying only under the Market Value Standard must meet the market value of listed securities and the bid price requirements for 90 consecutive trading days prior to applying for listing.3 The term, “listed securities”, is defined as “securities listed on NASDAQ or another national securities exchange.”4 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company.5 Round lot holders are shareholders of 100 shares or more. The number of beneficial holders is considered in addition to holders of record.6 An electronic communications network (ECN) is not considered a market maker for the purpose of these rules.7 In addition to the above quantitative requirements, companies must comply with all corporate governance requirements as set forth in the Rule 5600 Series.CONTINUED LISTINGCompanies must meet all of the criteria under at least one of the three standards below.NASDAQ Global Market Continued Listing Requirements11 Companies must meet the bid price and total shareholders requirements as set forth in Rule 5450(a) and at least one of the Standards in Rule 5450(b).2 The term, “listed securities”, is defined as “securities listed on NASDAQ or another national securities exchange.”3 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company.4 Total shareholders include both holders of beneficial interest and holders of record.5 An electronic communications network (ECN) is not considered a market maker for the purpose of these rules.6 In addition to the above quantitative requirements, companies must comply with all corporate governance requirements as set forth in the Rule 5600 Series.ENTRY FEES• Entry fees are based upon the aggregate number of shares to be listed at the time of initial listing, regardless of class.• Fees are assessed on the date of entry in The NASDAQ Global Market, except for $25,000, which represents a non-refundable application fee. This fee must be submitted with the company’s application.• For non-U.S. issuers, entry fees are levied only on those shares or American Depositary Receipts issued and outstanding in the United States.• Entry fees paid by a company for all classes of securities listed on the Global Market, including entry fees previously paid by the company to list securities at an earlier date, shall not exceed $225,000. However, notwithstanding this fee cap, applications are subject to the $25,000 non-refundable fee.• NASDAQ does not charge application or entry fees for a company that transfers its listing from The NASDAQ Capital Market to The NASDAQ Global Market provided that the company listed on The NASDAQ CapitalMarket prior to January 1, 2007 or the company listed on The NASDAQ Capital Market on or after January 1, 2007 and did not qualify for The NASDAQ Global Market at the time of its initial listing on The NASDAQ Capital Market. Any other issuer must pay the entry fees for the Global Market, less the entry fees (but not theapplication fee) the company previously paid in connection with its listing on the Capital Market. The company is not required to pay the application fee in connection with the application to transfer its listing.• A company that submits an application to list on The NASDAQ Capital Market, but prior to listing, revises its application to seek listing on The NASDAQ Global Market, is not required to pay the application fee inconnection with its revised application.• NASDAQ does not charge application or entry fees for any securities that are transferred from a national securities exchange to list exclusively on The NASDAQ Stock Market.• NASDAQ does not charge entry or application fees for the securities of a company that is listed on another securities exchange but not listed on NASDAQ, if the issuer of such securities is acquired by an unlistedcompany and, in connection with the acquisition, the unlisted company lists exclusively on The NASDAQ Global Market.• NASDAQ does not charge entry or application fees for the securities of a company that is dually listed on the New York Stock Exchange and The NASDAQ Stock Market. Companies that dually list on other securities exchanges are subject to the applicable fees described in this section. (Please see Dual Listings on page 16.)NASDAQ Global Market Entry FeesANNUAL FEES• Annual fees are based on the company’s Total Shares Outstanding (TSO) for all classes of stock listed on the Global Market as of December 31st. NASDAQ uses the TSO reported in the company’s latest filing at the time of billing. For non-U.S. issuers, TSO includes only those shares issued and outstanding in the United States.• In the first year of listing, the company’s annual fee will be prorated based on the date of listing and based on the TSO as reported .in the company’s latest filing on record with NASDAQ as of the date of listing.• For a company transferring to The NASDAQ Global Market from The NASDAQ Capital Market, NASDAQ will apply a credit toward the balance of the company’s new annual fee based on the annual fee already paid.• Annual fees for American Depository Receipts listed on The NASDAQ Global Market are based on the number of ADRs listed. NASDAQ will apply fees based on ADRs, as reported in the issuer’s most recent periodic report required to be filed with the issuer’s appropriate regulatory authority or in more recent information held by NASDAQ as of December 31st.NASDAQ Global Market Annual Fees** For issuers except ADRs, “other securities”, portfolio depository receipts, trust issued receipts, index fund shares and closed-end funds. For dually listed securities, please see Dual Listings on page 16. For a complete listing of the Global Market fees, refer to the NASDAQ Listing Rule 5900 Series.FEES FOR LISTING A NEW CLASS OF SECURITIESCompanies listed on NASDAQ must complete an application to list a new class of securities that is not currently listed on NASDAQ. When a current NASDAQ-listed company lists a new class of securities on The NASDAQ Global Market, it is assessed a variable fee based on the total number of shares outstanding of the new class of securities at the time of initial listing. Entry fees paid by a company for all classes of securities listed on the Global Market, including entry fees previously paid by the company to list securities at an earlier date, shall not exceed $225,000.Fees are assessed on the date of entry in The NASDAQ Global Market, except for $25,000, which represents a non-refundable application fee. This fee must be submitted with the company’s application. The company will also be assessed a pro-rated annual fee.FORMSApplications, listing agreements and payment forms are located at https://..NASDAQ CAPITAL MARKETINITIAL LISTINGCompanies must meet all of the criteria under at least one of the three standards below.NASDAQ Capital Market Initial Listing Requirements11 Companies must meet the bid price, publicly held shares, round lot holders, and market makers requirements as set forth in Rule 5505(a) and at least one of the Standards in Rule 5505(b).2 Seasoned companies (those companies already listed or quoted on another marketplace) qualifying only under the Market Value of Listed Securities Standard must meet the market value of listed securities and the bid price requirements for 90 consecutive trading days prior to applying for listing.3 The term, “listed securities”, is defined as “securities listed on NASDAQ or another national securities exchange.”4 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company. In the case of ADRs, at least 400,000 shall be issued.5 Round lot holders are shareholders of 100 shares or more. The number of beneficial holders is considered in addition to holders of record.6 An electronic communications network (ECN) is not considered a market maker for the purpose of these rules.7 In addition to the above quantitative requirements, companies must comply with all corporate governance requirements as set forth in the Rule 5600 Series.CONTINUED LISTINGCompanies must meet all of the criteria under at least one of the three standards below.NASDAQ Capital Market Continued Listing Requirements11 Companies must meet the bid price, publicly held shares, market value of publicly held shares, public holders, and market makers requirements as set forth in Rule 5550(a) and at least one of the Standards in Rule 5550(b).2 The term, “listed securities”, is defined as “securities listed on NASDAQ or another national securities exchange.”3 Publicly held shares is defined as total shares outstanding, less any shares held directly or indirectly by officers, directors or any person who is the beneficial owner of more than 10% of the total shares outstanding of the company.4 Public holders of a security include both beneficial holders and holders of record, but does not include any holder who is directly or indirectly an executive officer, director, or the beneficial holder of more than 10% of the total shares outstanding.5 An electronic communications network (ECN) is not considered a market maker for the purpose of these rules.6 In addition to the above quantitative requirements, companies must comply with all corporate governance requirements as set forth in the Rule 5600 Series.ENTRY FEES• Entry fees are based upon the aggregate number of shares to be listed at the time of initial listing, regardless of class.• Fees are assessed on the date of entry in The NASDAQ Capital Market, except for $5,000, which represents a non-refundable application fee. This fee must be submitted with the company’s application.• For non-U.S. issuers, entry fees are levied only on those shares or American Depositary Receipts issued and outstanding in the United States.• Entry fees paid by a company for all classes of securities listed on the Capital Market, including entry fees previously paid by the company to list securities at an earlier date, shall not exceed $75,000. However, notwithstanding this fee cap, applications are subject to the $5,000 non-refundable fee.• A company that submits an application to list on The NASDAQ Global Select Market or The NASDAQ Global Market, but prior to listing, revises its application to seek listing on The NASDAQ Capital Market, is not required to pay the application fee in connection with its revised application.• NASDAQ does not charge application or entry fees for any securities that are transferred from a national securities exchange to list exclusively on The NASDAQ Stock Market.• NASDAQ does not charge entry or application fees for the securities of a company that is listed on another securities exchange but not listed on NASDAQ, if the issuer of such securities is acquired by an unlistedcompany and, in connection with the acquisition, the unlisted company lists exclusively on The NASDAQ Capital Market.• NASDAQ does not charge entry or application fees for the securities of a company that is dually listed on the New York Stock Exchange and The NASDAQ Stock Market. Companies that dually list on other securities exchanges are subject to the applicable fees described in this section. (Please see Dual Listings on page 16.)NASDAQ Capital Market Entry FeesANNUAL FEES• Annual fees are based on the company’s Total Shares Outstanding (TSO) for all classes of stock listed on the Capital Market as of December 31st. NASDAQ uses the TSO reported in the company’s latest filing at the time of billing. For non-U.S. issuers, TSO includes only those shares issued and outstanding in the United States.• In the first year of listing, the company’s annual fee will be prorated based on the date of listing and based on the TSO as reported in the company’s latest filing on record with NASDAQ as of the date of listing.• For a company transferring to The NASDAQ Capital Market from The NASDAQ Global Select Market or Global Market, NASDAQ will apply a credit toward the balance of the company’s new annual fee based on the annual fee already paid.• Annual fees for American Depository Receipts listed on The NASDAQ Capital Market are based on the aggregate number of all classes of ADRs listed. NASDAQ will apply fees based on ADRs, as reported in the issuer’s most recent periodic report required to be filed with the issuer’s appropriate regulatory authority or in more recent information held by NASDAQ as December 31st.NASDAQ Capital Market Annual Fees** For dually listed securities, please see Dual Listings on page 16. For a complete listing of the Capital Market fees, refer to the NASDAQ Listing Rule 5900 Series.FEES FOR LISTING A NEW CLASS OF SECURITIESCompanies listed on NASDAQ must complete an application to list a new class of securities that is not currently listed on NASDAQ. When a current NASDAQ-listed company lists a new class of securities on The NASDAQ Capital Market, it is assessed a variable fee based on the total number of shares outstanding of the new class of。

nasdaq 退市规则

nasdaq 退市规则

纳斯达克退市规则,也称为纳斯达克市场维持规则,是纳斯达克交易所制定的一套规则,用于监管上市公司的财务状况和市值。

根据这些规则,如果一个公司不符合纳斯达克的退市标准,交易所将有权将其股票从纳斯达克交易所摘牌。

以下是纳斯达克退市规则的一些主要方面:

1. 股票价格要求:纳斯达克要求上市公司的股票价格在连续

30个交易日中不低于1美元。

如果公司股票价格连续30个交

易日低于1美元,则可能面临摘牌风险。

2. 市值要求:纳斯达克要求上市公司的市值(市值=股票价格

×流通股数)不低于350万美元。

如果公司市值低于350万美元,纳斯达克可能会考虑将其摘牌。

3. 公司财务状况要求:纳斯达克要求上市公司必须维持一定的财务状况,包括连续两年的盈利能力和净资产要求。

如果公司连续两年的财务状况不符合纳斯达克的要求,可能会面临退市风险。

4. 审核委员会决定:最终是否摘牌由纳斯达克的上市审查委员会决定。

该委员会会定期审查上市公司的财务状况和市值,并根据纳斯达克退市规则作出决策。

需要注意的是,纳斯达克还有其他退市规则和程序,例如申请延迟摘牌程序和法定股东权益计划等,以提供给上市公司解决

潜在退市风险的机会。

不同的规则和程序适用于不同的情况,上市公司应根据自身情况咨询纳斯达克交易所或专业顾问人员。

斯塔尔报告斯塔尔报告全文

斯塔尔报告斯塔尔报告全文斯塔尔报告一:美国可能将在金融、政治、军事上都遭到重创!中国的A股将站上__点!这几天心里颇不宁静。

我在1月30日接受红德网采访时曾高调唱空美元和美股,警告说美元可能跌至70-75,美股可能跌至__点。

结果这个话说了不到三天,也就是2月2日,黑色星期五,美股就开始大跌,跌去666点;2月5日,更是黑得不得了的黑色星期一,美股竟然跌去1000多点,盘中甚至大跌1600点,创下美股历史上单日最大跌幅(仅指所跌点数)。

最要命的是,美股的暴跌,也波及到其他市场。

连我们的A 股也被拖累大跌,股民们损失惨重。

于是上看到有很多人骂我,骂我的人远远超过赞扬我的人。

昨天一时气愤,就在我自己的个人公众号里发了两句牢骚,甚至说出自己该得诺贝尔经济奖之类的话,现在想来也还是后悔。

想我已经人到中年,最后不过还是热血青葱少年一枚。

何苦来哉!昨天晚上美股又暴跌1000多点,特朗普和美国政府企图挽救美股的美梦再次破产,罗杰斯认为美股会先走强再走弱的观点今天看来也是笑话。

就如我曾批评耶伦一样,作为金融人,最大的错误就是和趋势作对。

因为那是螳臂当车,蚍蜉撼树!美国在金融遭遇重创去年7月份,我写了一篇文章《2018,金融风暴卷土重来,帝国崩塌》。

我相信,中国的大部分金融人都通过各种渠道读过这篇文章,可能也有读过文章但不知道是我写的。

在这篇文章里,我在披露金融危机具有十年一次的周期性时曾说过这么一句话:金融危机到底有没有周期性?这是金融界的哥赫巴德猜想,也是金融研究中王冠上的明珠。

这句话可能很多人并没有注意。

其实这就是金融基础研究,也是最具挑战的研究。

因为谁先洞察了金融危机的周期性,谁就可以掌握主动,谁就赢得先机。

这也是我们在去年下半年为什么要强行收缩海外投资的根本原因,可惜王健林等是不明白的。

有人在天涯社区发帖,希望我公布研究模型。

我不知道他的动机,但我只能说,这是咱家吃饭的家伙,也算是国之重器,肯定不能轻易示人。

绿诺幻灭记

绿诺幻灭记过去的30天应该被记住。

从11月10日到12月9日的30天里,一家顶着中国概念和新能源产业光环的纳斯达克上市公司被揭露存在财务造假行为,并最终被纳斯达克勒令退市。

虽然丑闻主角—大连绿诺环境工程科技有限公司(RINO. Nasdaq,下文简称绿诺)此前籍籍无名,但这场风波却有可能从根本上破除此前海外投资者对中国概念股不加鉴别的迷恋和追捧,人们或许还会进一步追问:在最近5年里涌现的诸多新能源概念的新创企业里,还有多少是被过度包装了呢?如果用里氏地震来形容这场风波,它所引发的震荡已经超过了2007年江西赛维LDK太阳能公司(LDK.NY)的“库存门”事件(详情请于查阅《赛维浮沉》一文),彼时赛维LDK艰难地保住了声誉。

但这一次,一股质疑小盘中国概念股的潮流已经伤及多家上市公司,比如保定的东方纸业(ONP.AMEX)、深圳的旅程天下(UTA.NY)、苏州阿特斯太阳能(CSIQ.NASDAQ)和陕西绿色农业(CGA.NY)等公司,绿诺是最先倒下的一个。

2010年12月3日,纳斯达克向绿诺给出了退市通知。

一周后的12月9日,绿诺被摘牌并转至粉单市场,股价从被质疑时的15.52美元一路暴跌至3.15美元。

从3日到《环球企业家》发稿时止,《环球企业家》记者数度通过短信、电话和登门拜访的方式向绿诺创始人及CEO邹德军提出采访要求,均被婉拒。

11日,当《环球企业家》记者再次出现在绿诺董事办公室门口时,邹慌不择路地起初想立刻躲进办公室,但或许觉得不妥,又快速地从记者身边跑过,消失在走廊尽头。

“他现在没有任何心情谈论任何事情。

”邹的妻子—绿诺董事长邱建萍阻拦了《环球企业家》记者,但同样拒绝提供更多信息。

邹德军的仓皇是可以理解的,他现在极需应付的是来自美国资本市场的后续调查。

四家受托于美国投资商和纳斯达克市场的审计公司人员已经在大连驻扎数天,对邹进行连续不断的询问。

为此,邹已不得不暂停手头多数项目施工及商务谈判。

华尔街——精选推荐

华尔街金融的代名词华尔街-------资金无眠读后感华尔街是美国资本市场和经济实力的象征,它早已不是一个单纯的地理名词。

现在,绝大多数金融机构与这条500米长的街道不再发生直接的物理关联,华尔街人也完全成为了一种精神归属,资本已经进入无眠时代。

不仅是2008年席卷全球的金融风暴,贪婪与疯狂似乎是上天专门为华尔街设下的魔咒,它始终弥漫在华尔街的每一处空间。

华尔街在不断为他人创造着财富,但又在不断地剥夺着他人的财富,华尔街在固守着自己的生存法则,但又在不断冲破传统的束缚。

华尔街是矛盾的结合体,它在自身双面性的较量中,不断遭到毁灭,又不断得到重生。

吴敬琏说“华尔街的地位,他是全球最大的最重要的金融中心,在于背景是金融在整个经济中的作用,金融的全球化在整个经济全球化的地位。

”可以说,现在的华尔街的钟声牵动的不止是华尔街,他牵动的是整个世界,资本进入无眠时代。

华尔街的人才工资,竞争压力大,华尔街的创新意识,纪录片中的例子是应用计算机做出交易决策,这使得交易更容易,骑士公司,是电子交易成功的典范,但同时也带来了问题,2010年5月6日道琼斯指数5分钟下跌了998点。

说明电子交易是把双刃剑。

华尔街资金资本市场的作用:高效融资,分散风险。

华尔街资金的来源:主要是各类储蓄,储蓄主要来自养老基金,保险公司,这部分资金需要回报。

美国家庭与华尔街的关系:美国家庭三分之一的资产投资到了华尔街,通过养老基金、退休基金、社保基金等各种类型的基金形式。

这些普通的投资者一般都通过专业的投资机构来完成。

华尔街成为世界各地资金流入的其中的原因:流动性高,成交量大,交易成本相对低。

2008经济危机所带来的思考:当人类乘坐资本列车飞速前行的同时,也在品尝着金融危机的摧残。

最近的一次发生在2008年9月,以雷曼兄弟公司的破产为标志,美国多家银行破产,通用汽车破产、加拿大北电网络破产、冰岛政府濒临破产,全球大量人员失业,全球经济开始衰退。

人们开始反思,也许现在的金融体系存在问题。

美国纳斯达克上市条件美国纳斯达克上市条件

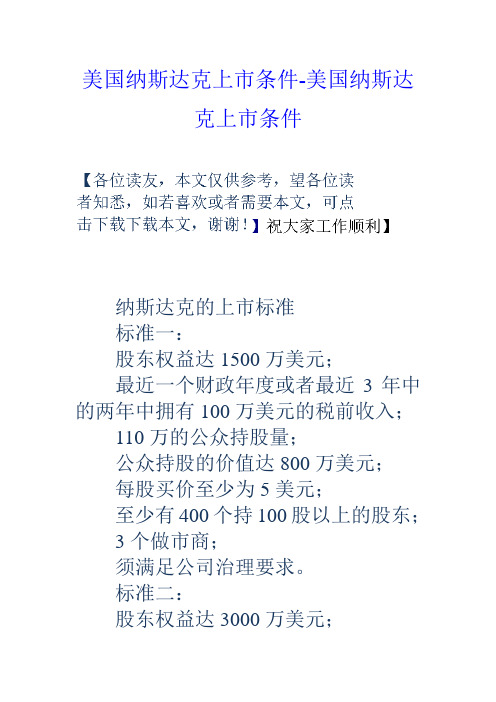

美国纳斯达克上市条件-美国纳斯达克上市条件纳斯达克的上市标准标准一:股东权益达1500万美元;最近一个财政年度或者最近3年中的两年中拥有100万美元的税前收入;110万的公众持股量;公众持股的价值达800万美元;每股买价至少为5美元;至少有400个持100股以上的股东;3个做市商;须满足公司治理要求。

标准二:股东权益达3000万美元;110万股公众持股;公众持股的市场价值达1800万美元;每股买价至少为5美元;至少有400个持100股以上的股东;3个做市商;两年的营运历史;须满足公司治理要求。

标准三:市场总值为7500万美元;或者,资产总额达及收益总额达分别达7500万美元;110万的公众持股量;公众持股的市场价值至少达到2000万美元;每股买价至少为5美元;至少有400个持100股以上的股东;4个做市商;须满足公司治理要求。

纳斯达克上市条件企业只要符合下页的三个条件及一个原则,就可以向美国NASDR申请挂牌。

先决条件经营生化、生技、医药、科技〈硬件、软件、半导体、网络及通讯设备〉、加盟、制造及零售连锁服务等公司,经济活跃期满一年以上,且具有高成长性、高发展潜力者。

消极条件有形资产净值在美金五百万元以上,或最近一年税前净利在美金七十五万元以上,或最近三年其中两年税前收入在美金七十五万元以上,或公司资本市值(MarketCapitalization) 在美金五千万元以上。

积极条件NASDR审查通过后,需有300人以上的公众持股(NON-IPO得在国外设立控股公司,原始股东并须超过300人)才能挂牌,所谓的公众持股依美国证管会手册(SEC Manual)指出,公众持股人之持有股数需要在整股以上,而美国的整股即为基本流通单位100股。

诚信原则纳斯达克流行一句俚语:「Any company can be listed, but time will tell the tale.」(任何公司都能上市,但时间会证明一切)。

美国纳斯达克上市标准

美国纳斯达克上市标准

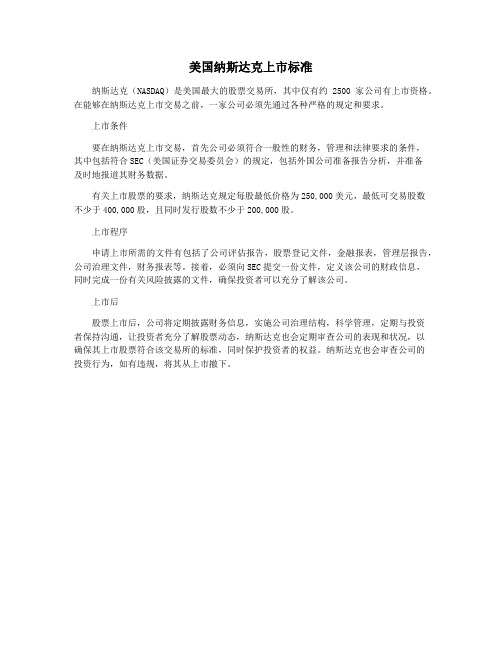

纳斯达克(NASDAQ)是美国最大的股票交易所,其中仅有约2500家公司有上市资格。

在能够在纳斯达克上市交易之前,一家公司必须先通过各种严格的规定和要求。

上市条件

要在纳斯达克上市交易,首先公司必须符合一般性的财务,管理和法律要求的条件,

其中包括符合SEC(美国证券交易委员会)的规定,包括外国公司准备报告分析,并准备

及时地报道其财务数据。

有关上市股票的要求,纳斯达克规定每股最低价格为250,000美元,最低可交易股数

不少于400,000股,且同时发行股数不少于200,000股。

上市程序

申请上市所需的文件有包括了公司评估报告,股票登记文件,金融报表,管理层报告,公司治理文件,财务报表等。

接着,必须向SEC提交一份文件,定义该公司的财政信息,

同时完成一份有关风险披露的文件,确保投资者可以充分了解该公司。

上市后

股票上市后,公司将定期披露财务信息,实施公司治理结构,科学管理,定期与投资

者保持沟通,让投资者充分了解股票动态,纳斯达克也会定期审查公司的表现和状况,以

确保其上市股票符合该交易所的标准,同时保护投资者的权益。

纳斯达克也会审查公司的

投资行为,如有违规,将其从上市撤下。

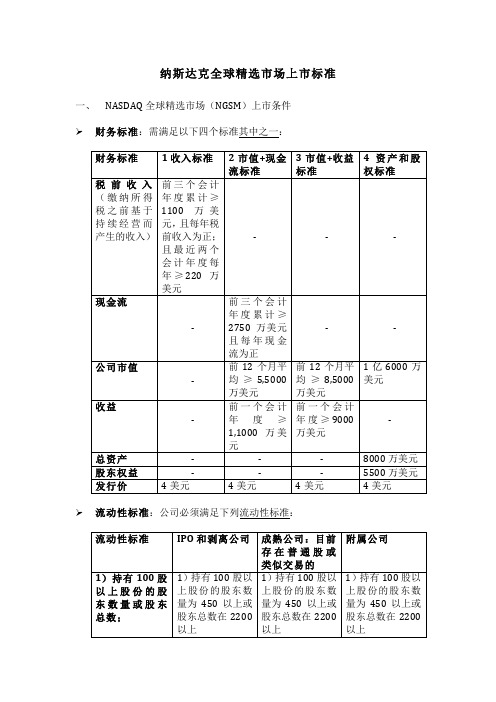

纳斯达克全球精选市场上市标准

同时要满足美国证监会的 10A-3 规则,独董要能阅读和理解基本的财 务报表。审计委员会至少由三名成员组成,且其中一人必须有金融行业

的丰富经验。 l 高管补贴:公司需要设立一个完全由独立董事构成的、两名成员以上

上市要求

1 权益标准

2 已发行证券市 3 净收入标准

值标准

股东权益

500 万美元

400 万美元

400 万美元

公 众 持 股 股 票 1500 万美元

1500 万美元

500 万美元

市值

经营历史

2年

-

-

上市证券市值

-

5000 万美元

基于持续经营

75 万美元

而产生的净收

入 (最近一个会

计年度或最近三

个会计年度中的

4 美元 400

3 -

4 美元 400

3 2年

4 美元 400

4 -

4 美元 400

4 -

三、 NASDAQ 资本市场(NCM)上市条件 在该层上市,公司的财务和流动性要求分为权益标准、已发行证券市值标准和净 收入标准三种,申请人只需满足三个标准中的任意一个。

Ø 财务和流动性标准:需满足以下三个标准其中之一:

成熟公司:目前 存在普通股或 类似交易的 1)持有 100 股以 上股份的股东数 量为 450 以上或 股东总数在 2200 以上

附属公司

1)持有 100 股以 上股份的股东数 量为 450 以上或 股东总数在 2200 以上

或 者 , 2) 股 东 总 数 和 过 去 12 个月里平均每 月的交易量

美国纳斯达克最终版

美国证券市场概况

美国拥有全球最大的资本市场,聚集着10兆亿美元的游资 股票日成交量达30多亿股,日成交金额达数万亿美元,占全球总成交量的55%以上。

美国证券市场

纽约 证券交易所

美国 证券交易所

NASDAQ 市场

中国企业海外上市融资的重要市场 采用美国会计准则,监管非常严格, 对信息披露要求很高 公司估值一般可获得高溢价 公司可在该市场获得很强的后续融 资能力

纳斯达克股票市场是世界主要股票市场成长速度最快的市场,而且它是首家电子化的 股票市场。美国市场上换手的股票中有超过半数的交易在纳斯达克上进行的,将近有 5400家公司的证券在这个市场上挂牌。

品牌—纳斯达克的三级市场体系

2006年2月15日,纳斯达克宣布为公共公司创建一个新的市场层级,它拥有世 界上最高的首次上市标准

涨跌幅度限制:美国股市无涨跌幅度限制,原股价涨跌单位为1/16美元,现 今多改为小数点制(最低为1美分)。 开户手续:买卖美国股票只需要在券商处开立一个证券户头,此证券户头同 时拥有银行户头的功能,若您将钱存进此户头但未购买股票,券商会付给您 利息,但要扣10%的税,如果想免税可选择自动转存短期基金,由券商代为 操作获利。

市场别

NASDAQ NASDAQ NASDAQ NASDAQ NASDAQ NASDAQ

交易代码

SINA SOHU NTES TOMO BIDU SNDA

取得资金($)

6800万 5890万 6975万 17496万 10910万 15240万

部分中国企业借壳上市融资概览

1.中国水饮料集团 2. 北大千方

4. 天狮国际

5. 中阀科技 6. 中华房屋 7.中国兆恒水电 8.广州康采恩医药

UT斯达康行贿事件:

乳业三聚氰胺“死灰复燃”:

2008年“三鹿事件”的罪魁祸首——三聚氰胺引发了国内乳业大地震,直接重创了国内乳制品产业的健康发展。2010年初,消失一年多的“三聚氰胺”阴影再次笼罩国内乳品市场。近日,全国食品安全整顿工作办公室曝光上海熊猫乳业有限公司、陕西金桥乳业有限公司等5家乳制品企业相关产品三聚氰胺超标。

事件分析:首先,作为全球汽车第一品牌,丰田公司在全球范围内主动进行问题车召回的勇气是值得肯定的。但是,在数百万辆汽车召回行为,显然会直接冲击到丰田品牌在全球用户心目中的美誉度,因此,丰田在扎实做好问题车召回工作的同时,一定要及时通过媒体等多种有效手段,与广大用户进行真诚沟通,以最大可能的维持丰田品牌的良好声誉。

丰田汽车召回案:

据报道,自1月28日起,天津一汽丰田召回2009年3月19日至2010年1月25日生产的75552辆RAV4车辆。基于同样的原因,丰田已在美国、欧洲进行了召回,召回总量逾800万辆,已超过丰田2009年781万辆的全球总销量。

丰田公司预计,今年年初至3月,其有史以来最大的汽车召回事件带来的成本和销售损失总计将达20亿美元;而另据有关媒体报道,美国政府考虑对日本汽车制造商丰田汽车公司罚款,作为对其大规模召回汽车的惩罚,丰田汽车召回事件的负作用已经开始显现出来。

雪碧“汞毒门”:

据报道,近日在北京市连续出现两次饮用雪碧汞中毒事件。就此,北京可口可乐饮料有限公司对媒体坚称“提供给消费者的饮料绝对安全可靠”,同时表示雪碧“生产过程绝无含汞环节”,公司正全力配合警方进行调查,核实饮料产品出处。但如此回应却存在明显的不足之处。

为彻底查清“问题雪碧”的包装安全性,位于天津开发区的中国包装科研测试中心对“问题雪碧”饮料罐进行密封性检测。由于此次汞中毒事件事关重大,市场也十分关注报告的最终结果,此次检测的最终结果将由北京警方于近日正式发布,并公之于众。

纳斯达克

效率高,增加了市场的公开性、流动性与有效性。相比之下,在纳斯达 克上市的要求是最严格而且复杂的,同时由于它的流动性很大,在该市 场上市所需进行的准备工作也最为繁重。

纳斯达克中国上市公司

中华网 新浪网 搜狐网 网易 TOM网 盛大网络 侨兴电话 空中网 前程无忧 金融界 携程网 亚信科技 掌上灵通 UT斯达康 九城关贸 第九城市 e龙 华票100股或以上的股东。

纳斯达克在成立之初的目标定位在中小企业,但只是因为企业的规模随

着时代的变化而越来越大,所以到了今天,纳斯达克反而将自己分成了

一块“主板市场”和一块“中小企业市场”。

非柜台交易市场 纳斯达克股票交易市场与美国柜台市场(OTC)和柜台公报板 (OTCBB)报价系统有明显的区别。虽然他们都受全国券商联合协会 (NASD)管理。OTC 证券是那些没有在纳斯达克或国内任何证券交易市 场上市的证券。OTCBB是一个报价媒介,显示OTC上市股票的即时报价、 最近成交价格和成交量等信息。OTCBB证券包括国内的、区域内的和国 外正式发行的凭证、单据、美国委托收款单。 OTCBB 是为约定成员们 提供的报价媒介,而不是一顷上市发行的服务,不可以与纳斯达克或美 国股票交易市场混淆,OTCBB证券是由做市商的委员会进行交易,并通 过一个高度复杂、封闭的计算机网络进行报价和成立回报。这一切是通 过纳斯达克工作站来实现。纳斯达克股票市场与那些在OTCBB市场上的 发行商没有业务上的联系,而且这些公司与纳斯达克股票市场股份有限 公司或是全国证券交易商协会没有文件或报告上的要求。 纳斯达克做市商制度 纳斯达克拥有自己的做市商制度,它们是一些独立的股票交易商, 为投资者承担某一只股票的买进和卖出。这一制度安排对于那些市值较 低、交易次数较少的股票尤为重要。这些做市商由NASD的会员担任,这 与TSE的保荐人构成方式是一致的。每一只在纳斯达克上市的股票,至 少要有两个以上的做市商为其股票报价,一些规模较大、交易较为活跃 的股票的做市商往往能达到40-45家。这些做市商包括美林、高盛、所 罗门兄弟等世界顶尖级的投资银行。NASDAQ现在越来越试图通过这种做 市商制度使上市公司的股票能够在最优的价位成交,同时又保障投资者 的利益。 纳斯达克在市场技术方面也有很强的实力,它采用高效的“电子交 易系统”(ECNs),在全世界共装置了50万台计算机终端,向世界各个 角落的交易商、基金经理和经纪人传送5000多种证券的全面报价和最新 交易信息。由于采用电脑化交易系统,纳斯达克的管理与运作成本低、

NImydaq使用说明

NI myDAQ

NI myDAQ 是一种使用 NI LabVIEW 软件仪器的低成本便携式数据采集 (DAQ) 设备, 学生可使用它测量和分析实际信号。 NI myDAQ 适用于电子设备学习及进行传感器测 量。通过与计算机上的 NI LabVIEW 配合,学生可分析和处理采集到的信号并随时随 地控制简单的进程。

Analog Input AI AUDIO IN

Sw itch

Digitalto-Analog Converter Digital Multimeter VΩ

Analog Outpu

t AO AUDIO OUT

A

NI myDAQ

System ICs by

VΩ

A

60 V 20 Vrms MAX

HI

COM

1A MAX

HI

目录

安全信息 ............................................................................................................................ 2 电磁兼容性守则 ................................................................................................................ 2 NI myDAQ 硬件概述 ........................................................................................................ 3 模拟输入 (AI) ............................................................................................................ 4 模拟输出 (AO)........................................................................................................... 4 数字输入 / 输出 (DIO) ............................................................................................... 4 电源 ............................................................................................................................ 4 数字万用表 (DMM)............................................................................................... 5 NI myDAQ 软件概述 ........................................................................................................ 5 NI ELVISmx 驱动软件 .............................................................................................. 5 NI LabVIEW 和 NI ELVISmx Express VI ............................................................... 5 NI myDAQ 和 NI Multisim ....................................................................................... 5 入门 ................................................................................................................................... 6 连接信号至 NI myDAQ .................................................................................................... 6 设置 NI myDAQ 设备 ............................................................................................... 6 连接信号 .................................................................................................................... 8 连接模拟输入信号 ..................................................................................................... 9 替换 NI myDAQ DMM 保险丝................................................................................. 11

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

美国证券市场概况

美国拥有全球最大的资本市场,聚集着10兆亿美元的游资 股票日成交量达30多亿股,日成交金额达数万亿美元,占全球总成交量的55%以上。

美国证券市场

纽约 证券交易所

美国 证券交易所

NASDAQ 市场

中国企业海外上市融资的重要市场 采用美国会计准则,监管非常严格, 对信息披露要求很高 公司估值一般可获得高溢价 公司可在该市场获得很强的后续融 资能力

首次上市费用

最高$150.000 最高$150.000

最低$150.000 最低$100.000 $125.000

纳斯达克在各个已发行股份水平 上的首次上市费用都比NYSE底。 在纳斯达克首次公开募股5千万股 票的首次上市费用是同等规模公 司在NYSE上市的1/2。

已发行股份总额(百万)

$180.00 $160.00 $140.00 $120.00

$100.00

$60.00 $40.00 $20.00

品牌—纳斯达克是产业领导者的市场

在纳斯达克上市的公司来自各个经济别类

工业

能源和公用事业 金融

消费

电信

LEVEL 3

原材料

卫生保健

信息技术

50%福布斯100最快增长企业 80%福布斯最有价值品牌

为什么要去美国上市?

法律 政策

1、 拥有三大股票交易市场 2、 融资机构规模数量巨大 3 、股市的交易、活动频繁 4 、资本市场无涨跌停板规 定 5 、无货币管制、进出自由 6 、鼓励外国公司投资行为 7 、税法规定 非美国投资者 证券盈利无需纳税

英文简称

NYSE AMEX NGM NSCM OTCBB

股票数目

约3500 约1500 约5000 约1800 约3200

粉单市场

Pink Sheets

约5000

美国主要证券市场上市条件一览表

项目 最低资产净值 NYSE 6000万美元 250万美元/三 年650万美元 110万股 NGM 1500万美元 NSCM 500万美元 AMEX 400万美元

红线代表美国股 票交易所指数, 显示美交所大盘 情况

这个结果充分体现了纳斯达克股票市场的活力! 从1971年至今的30多年的时间中……

纳斯达克历史走势图

纳斯达克证券交易所

NASDAQ (National Association of Securities Dealers Automated Quotation) 简称:纳斯达克 全称:全美证券商协会自动报价系统 纳斯达克始建于1971年,是一个完全采用电子交易、为新兴产业提供竞争舞台、自我 监管、面向全球的股票市场。纳斯达克是世界最大的股票电子交易市场。

市场做市商数

2000国外5000

Specialist

400

3

300

3

400-800

Specialist

美国各主要证交所历史数据比较

黑线代表纳斯达 克综合指数,是 过去30多年中增 长最快的股票综 合指数

蓝线代表Dow Jones指数,是 最常用的股票指 数之一

黄线代表标准普 尔500指数通常 被用来衡量股票 市场表现

美国多层次资本市场

纽交所 纳斯达克精选 和全球市场 美交所 纳斯达克小型 资本市场 AMEX NASDAQ CM NYSE NASDAQ GS NASDAQ GM

OTCBB市场 OTCBB 粉单市场 Pink Sheet

美国证券市场

各股票市场的挂牌股票数目

股票交易所市场

纽约证券交易所 美国证券交易所 纳斯达克全球市场 纳斯达克小资本市场 电子版市场

纳斯达克 全球市场

NASDAQ-GM

纳斯达克 全球精选 市场

NASDAQ-GS

纳斯达克 资本市场

NASDAQ-CM

纳斯达克股票交易市场 (NASDAQ)

纽交所纳斯达克上市费用比较

纳斯达克全国市场 NYSE 首次上市费用

$140.00

$120.00 $100.00 $60.00 $40.00 $20.00 0 10 20 30 40 50 60 70

纳斯达克全球精选市场为那些满足最严格首次上市财务标 准的公司而创建,这样严格的标准从未见诸任何股票市场

纳斯达克全球市场之前名为纳斯达克全国 市场,新名称更加准确的反映了上市公司 的全球领导地位和国际延展力

纳斯达克资本市场之前名为小型资本 市场,它于2005年重命名以反映这个 市场的核心目标,既筹集资本

纳斯达克股票市场是世界主要股票市场成长速度最快的市场,而且它是首家电子化的 股票市场。美国市场上换手的股票中有超过半数的交易在纳斯达克上进行的,将近有 5400家公司的证券在这个市场上挂牌。

品牌—纳斯达克的三级市场体系

2006年2月15日,纳斯达克宣布为公共公司创建一个新的市场层级,它拥有世 界上最高的首次上市标准

企业优势

1 、均可获得上市融资机会 可自主选择融资渠道 2 、发行新股融资不限制发行 由董事会决定向监管部门 上报即可 3 、股票可抵押,获现金贷款 4 、向公众发行债券进行融资 5、 管理层可持股或拥有期权 6 、股票过锁定期可流通交易 7 、管理层个人利益最大化

税前纯利要求

最低发行股数

100万美元

110万股

75万美元

100万股

75万美元

100万股

最低发行市值

最低营业年限 最少独立董事 最低挂牌股价

6000万美元

否 董事会一半以上 5美元

800万美元

否 董事会一半以上 5美元

500万美元

否 董事会一半以上 4美元

300万美元

否 至少3人以上 3美元

最低股东人数

美国股市的起源

1792年5月17日,24名纽约经纪人 在纽约华尔街68号外的一棵梧桐树下签署 了梧桐树协议,协议规定了经纪人的“联 盟与合作”规则,约定以后每天都在此进 行股票等证券的交易,这也是纽约交易所 的诞生日。1817年,这个组织起草了一 项章程,并把名字更改为“纽约证券交易 委员会”。1863年,它正式更名为纽约 证券交易所。这便是美国股市的起源。

年上市费用

年上市费用

纳斯达克上市公司每年支付的费 用大大低于在NYSE上市的同等 股份数额的公司

每股$.00093 至最高$500.000 最高$75.000 最低$38.000 $29.820 $21.225 0 10 20 30 40 50 60 70 80 90 100 110 120 130 已发行股份总额(百万) $51.750