2021年中国银行业海外发展战略的思考

中国银行十四五发展规划及企业文化心得体会

中国银行十四五发展规划及企业文化心得体会2021年是“十四五”开局之年,为加快融入新发展格局,确保十四五良好开局,发挥服务地方经济“金融国家队”作用,中国银行认真研究,积极部署各项工作措施,突出支持某某市重点项目建设,全力以赴为当地经济发展提供坚强有力的金融服务保障。

新年伊始,某某市交通建设迎来项目建设的高潮期,某某中行,在了解到某某市域轨道交通工程建设急需资金时,该行对此项目实行早办贷、早审批、早投放。

1月15日,该行率先为某某市金义东轨道交通有限公司投放10亿元银团项目贷款,有效解决了企业项目前期资金需求,为进一步把某某市建成全国综合交通枢纽城市增添了新的动力。

同时,辖内某某中行紧跟分行的步伐,以创新驱动立足区域经济,发挥自身优势,全力支持某某市未来社区建设。

某某槐堂未来社区是浙江省第二批未来社区试点项目,是实践“八八战略”、奋力打造“重要窗口”的内在要求,项目紧邻某某横店高铁站,是实施某某城区横店一体化发展战略、推进高铁新城建设的核心区块,是某某市政府平台建设大会战的重要一环,也是城乡一体化发展的标杆示范区,它对城乡区域协调发展有引擎带动作用,是某某夯实高质量发展基础、提升竞争力的重点项目。

在获取某某未来社区项目需求后,某某中行立即组织党员先锋队,成立了项目服务小组,全力以赴支持该项目的建设工作,中国银行总行、省、市分行迅速反应、高效联动,半个多月就完成30亿元的授信审批,并于近日先期投放项目贷款5亿元,强力助推某某未来社区的建设。

据统计,开年以来,某某支行已新增公司贷款14.3亿元,有效支持了地方经济发展,为某某争创社会主义现代化先行市添砖加瓦。

下一步,中国银行始终秉承“担当、诚信、专业、创新、稳健、绩效”的价值观,继续把支持地方经济发展作为金融服务的核心和关键,积极践行地方金融机构的责任和担当,为地方经济社会实现高质量跨越发展贡献中行力量。

中国工商银行外部环境分析

中国工商银行外部环境分析1一、战略分析1、企业核心能力分析(一)境外机构建设迅速(二)国际金融业务的比重存有非常大的减少(三)经营收入比较稳定2、工商银行外部环境分析(一)、宏观环境分析(pest分析)(1)政治环境1.政策环境:随着崭新资本协议的实行,中国银行业在资本管理水平上与世界并驾齐驱,中国银行业遭遇代莱资本环境和挑战。

2.法律环境:一系列有关电子支付以及电子银行管理的法律法规的推出显示金融互联网化环境越加成熟,相应的立法工作都在稳步进行中。

(2)经济环境1.宏观经济:中国金融体系由间接融资向轻易融资、从单一银行体系向多元化市场体系过渡阶段,这将进一步提振中国银行业负债业务和中间业务的发展。

2.居民财富:2021年底,中国城乡居民人民币储蓄已达21.8万亿元。

随着居民财富的增加,对新兴互联网化银行业务的要求也会越来迫切,这将极大的促进现代银行业互联网化的进程。

3.电子商务:电子商务的迅猛发展所产生的非常大缴付支付市场需求将给银行增添无穷的商机。

然而网络经济的发展也为网上银行增添了挑战:市场竞争激化。

(3)社会环境1.网络基础设施的建设:中国不论是在网络基础设施建设方面,还是在网络普及方面都有了长足的进步。

2.消费行为习惯:现阶段,中国银行业互联网化后还处在初级阶段,业务及运营商均未获得普通居民的充份高度关注和介绍,随着市场的进一步扩散,存有更多的银行客户可以逐步采用互联网化服务渠道,该市场将获得更进一步的发展。

(4)技术环境1.信息技术已经成为银行业运作的基础,银行在效率大大提升的同时,对2信息技术和设施的依赖程度也远高于以往任何时候。

2.无线宽带的发展必然将改变用户的使用习惯和使用方式,银行业互联网化也将随着终端用户需求的变化做出相应的改变。

(二)、微观环境分析(五力模型分析)(1)行业内竞争者工商银行的行业内竞争者主要有国有独资银行、新兴股份制银行、城市商业银行和外资银行,他的对市场进行抢占,银行市场竞争激烈,工商银行将面临严峻考验。

中国银行业海外发展战略思考

中国银行业海外发展战略思考中国银行业的海外发展战略是指中国银行业机构在国际市场上实施的战略布局和发展目标。

随着中国经济的快速崛起和经济全球化的加速,中国银行业海外发展战略成为关注焦点。

本文将从背景分析、海外发展动因、发展策略和挑战四个方面进行思考。

一、背景分析1.中国经济的快速崛起。

中国经济在过去几十年里以惊人的速度增长,已超过许多发达国家。

这使得中国企业需要更多的金融支持和服务来满足其海外业务发展的需求。

2.跨境贸易和投资的增加。

中国是世界上最大的贸易国之一,其对外贸易和对外直接投资额也不断增加。

中国企业需要海外金融服务来支持其跨境贸易和投资活动。

3.经济全球化的加速。

随着全球化的不断深入,中国银行业需要在国际市场上扩大业务,以提供更多的金融服务和更好地服务中国企业在海外的发展。

4.国家政策的支持。

中国政府一直鼓励中国银行业在国际市场上扩大业务,支持中国企业走出去。

政府提供了一系列政策支持和优惠政策,为中国银行业的海外发展提供了良好的环境和机遇。

二、海外发展动因1.扩大市场份额。

中国银行业机构希望通过海外发展来扩大其市场份额,并与国际银行竞争。

海外市场的发展潜力巨大,中国银行业有机会在国际市场上实现更大的增长。

2.实现资源优化配置。

中国银行业拥有庞大的资金和人力资源,通过海外发展可以更好地配置这些资源,实现效益最大化。

同时,海外市场也提供了更多的投资机会和业务发展空间。

3.分散风险。

中国银行业在中国市场上具有较高的风险集中度,海外发展可以帮助银行业分散风险,降低系统风险,提高整体抗风险能力。

三、发展策略1.市场选择。

根据中国企业的海外需求和市场发展潜力,选择适合的海外市场进行发展。

可以选择一些重点国家和地区,如东南亚、非洲和拉美等,进行重点布局。

2.业务布局。

根据市场需求和金融服务的特点,合理布局业务板块。

可以包括贸易融资、投融资、跨境支付等业务。

3.合作伙伴选择。

可以通过战略合作、并购或设立合资企业等方式,与当地金融机构或企业建立合作关系。

2021年学习银行总体战略心得体会

A humble heart is a heart like a weed flower, not making fun of the outside world or caring about the world'sridicule.通用参考模板(页眉可删)2021年学习银行总体战略心得体会近来,我和同仁们一道认真学习了《中国光大银行20__—20__总体战略》,对广大银行整体战略规划有了更加明晰的认识。

20__年是实施银行三年战略总体战略的收官之年,作为一名对公客户经理,我同样产生一种紧迫感和危机感。

我想,作为广大一份子,最关键的是,要立足本职岗位,加强学习提升履职能力,真正行动起来,勇攀高峰,为广大银行某某分行发展尽心尽力贡献一份力量。

唯有如此,才算是为实现总体战略发挥一份建设性的作用。

具体来说,应做到以下几点。

加强学习,提高履职能力。

光大银行的发展目标是“三年改变面貌,五年形成自身特色,十年勇争同业前列”;发展愿景是“打造国内最具创新能力的银行”。

银行的目标定位对每名员工的学习能力、创新能力和履职能力提出了较高的要求。

我是一名对公客户经理岗位,负责联系客户、开发客户、营销产品及对公业务风险防控,在工作实践中越来越体会到:在激烈的市场竞争中,只有与时俱进地提升个人综合素质和工作能力才能出色完成任务,为银行发展做出一份积极的贡献。

因此应结合分行开展的各类培训活动、企业文化建设活动、队伍建设活动等,进一步加强自我学习。

一要强化对各类专业知识的学习。

对公客户经理每天要与企业事业单位和银行内部部门人员打交道,需要广泛了解信贷、会计、风险防控、市场营销、谈判学、沟通学等方面的知识,因此要强化各类知识的学习,不断完善知识结构。

二要加强对行业与企业的研究与了解。

大大小小的公司客户分布不同的行业,有的是我行的现实客户,有的是我行的潜力客户,国家的行业政策会对企业产生这样那样的影响,而企业自身也要经历或强或弱的不同阶段,产生这样那样的需求,我想还应对行业政策的学习了解,深入掌握企业的需要,有针对地发展新客户,拓展对公市场。

2021年半年度中国银行业回顾与展望:顺势而为 厚积薄发

2021年上半年,面对复杂多变的国内外环境,中国经济持续稳定恢复,银行业盈利重回增长轨道,继续与实体经济共同画出一道“微笑曲线”。

经济增长结构及货币政策回到疫情前2021年上半年,我国国内生产总值(GDP)同比增长12.70%,增速较2020 年全年(2.30%)显著反弹。

从GDP结构来看,净出口、投资与消费占比分别为19%、19%和62%,较2019年的12%、29%和59%基本回归到疫情前的格局。

2021年上半年,社会融资规模及广义货币(M2)增速均较2020年有所回落,货币政策基本回到疫情前的水平。

与此同时,人民银行进一步推动贷款市场报价利率(LPR)改革,促进金融体系向实体经济让利;并调整存款利率自律上限确定方式,促进银行降低负债成本。

金融监管加大重点领域风险防控2021年上半年,监管机构继续加大重点领域风险防控,包括持续压降委托贷款和信托贷款等影子银行规模、稳步推进中小金融机构风险处置模式探索、强化网络平台企业金融业务审慎监管、完善房地产金融调控机制等。

银行业强监管态势在2021年上半年也得到持续。

据统计,上半年银保监会及其派出机构对银行机构和相关责任人共开出1467张罚单,罚款额多达7.39亿元,共有329家银行及分支机构被处罚。

上市银行加速转型,发力中间业务在经济复苏和加大风险处置力度的背景下,我国57家上市银行的净利润从2020年几乎零增长,回暖至2021年上半年增长12.21%;总资产收益率(ROA)和加权平均净资产收益率(ROE)均有所回升。

上市银行业绩改善,一方面由于资产质量趋于稳定,贷款减值损失计提减少;另一方面银行积极推动业务转型,发力财富管理等中间业务,手续费及佣金收入增速高于利息净收入。

然而,金融向实体经济让利,让上市银行的生息资产收益率持续下行,导致在负债付息率相对稳定的情况下,净息差和净利差继续收窄。

浅谈中国银行业发展现状与未来发展

浅谈中国银行业发展现状与未来发展中国银行业发展现状与未来发展中国银行业作为国民经济的重要支柱之一,在过去几十年里取得了长足的发展。

本文将从中国银行业的现状和未来发展两个方面进行阐述。

一、中国银行业的现状1. 规模庞大:中国银行业是世界上最大的银行业之一,拥有庞大的资产规模和客户基础。

截至2021年底,中国银行业总资产超过200万亿元人民币,占全球银行业总资产的比重超过20%。

2. 业务多元化:中国银行业的业务范围涵盖了传统的商业银行业务,如存贷款、支付结算等,同时也拓展了资本市场业务、保险业务、信托业务等多个领域,形成了多元化的经营模式。

3. 政策支持:中国政府一直以来都高度重视银行业的发展,并出台了一系列政策措施来支持银行业的改革和发展。

例如,推动利率市场化改革、加强金融监管等。

4. 技术创新:随着科技的不断进步,中国银行业也在积极推进数字化转型。

互联网金融、移动支付、区块链等新技术的应用,为银行业带来了更多的发展机遇。

二、中国银行业的未来发展1. 加强风险管理:随着中国经济的不断发展和金融市场的不断变化,银行业面临着更加复杂的风险挑战。

未来,中国银行业需要加强风险管理能力,建立健全的风险管理体系,提高风险防范和应对能力。

2. 推动创新发展:中国银行业应积极推动科技创新,加快数字化转型进程。

通过引入人工智能、大数据、云计算等新技术,提升金融服务的智能化水平,为客户提供更加便捷、高效的金融服务。

3. 深化金融改革:中国银行业需要进一步深化金融改革,推动利率市场化、汇率市场化等改革措施的落地。

同时,加强金融监管,提高金融市场的透明度和稳定性,促进金融市场的健康发展。

4. 推进国际化发展:中国银行业应积极参与全球金融市场的竞争和合作,推进国际化发展。

加强与其他国家银行业的合作,提高国际金融服务能力,为“一带一路”建设和中国企业的海外发展提供支持。

综上所述,中国银行业在过去几十年里取得了长足的发展,成为世界上最大的银行业之一。

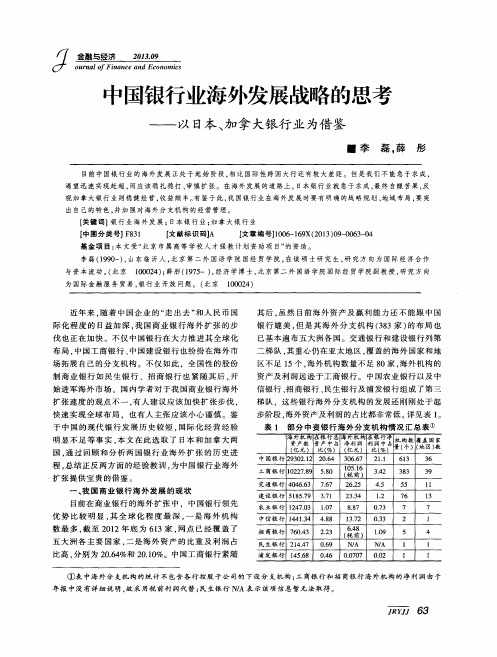

中国银行业海外发展战略的思考——以日本、加拿大银行业为借鉴

.

21 . 1

61 3

3 6

工 商银 行 1 0 2 2 7 1 0 5 . 1 6 8 9 5 . 8 O ( 税 前) 3 . 4 2

交 通 银 行 4 0 4 6 . 6 3 7 . 6 7 2 6 . 2 5 4 . 5

梯 队 ,这 些 银行 海 外 分 支机 构 的发展 还 刚刚 处 于起

快 速 实 现 全球 布 局 ,也有 人 主 张 应该 小 心 谨 慎 。鉴

于 中 国 的 现代 银 行 发展 历 史 较 短 。 国际 化 经 营 经验 明显 不 足 等事 实 , 本 文 在 此选 取 了 E t 本 和 加 拿 大两 国. 通 过 回顾 和分 析两 国银 行 业 海 外 扩 张 的历 史 进 程, 总 结 正反 两 方 面 的 经验 教 训 , 为 中 国银 行 业 海外 扩 张 提供 宝贵 的借 鉴 。

【 中图分类号】 F 8 3 1

【 文献标识码】 A

[ 文章编号1 1 0 0 6 — 1 6 9 X( 2 0 1 3 ) 0 9 — 0 0 6 3 — 0 4

基金项 目: 本文受“ 北 京 市属 高 等 学校 人 才 强 教 计 划 资 助 项 目” 的资 助 。 李磊( 1 9 9 0 一 ) , 山东 临 沂 人 , 北 京 第 二 外 国 语 学 院 国经 贸 学 院 , 在读硕 士研 究生, 研 究方 向 为 国 际 经 济 合 作 与 资本 流 动 。 ( 北 京 1 0 0 0 2 4 ) ; 薛彤( 1 9 7 5 一) , 经济学博士, 北 京 第 二 外 国语 学 院 国 际经 贸 学院 副 教 授 , 研 究方 向

我国商业银行实施国际化战略的思考

我国商业银行实施国际化战略的思考(作者:___________单位: ___________邮编: ___________)内容摘要:商业银行国际化是一种必然趋势。

随着我国融入国际化程度的进一步加深,如何实施国际化战略是中国商业银行谋求生存和发展急需思考与解决的问题:包括海外机构设置的地区分布重点、设立方式和经营途径的选择。

关键词:商业银行国际化区位优势随着世界经济一体化趋势的推进,各国银行业纷纷取消法律限制。

银行业跨国并购,在全球范围内不断扩张,加速了资本流动和金融创新浪潮的兴起,促进了国际金融一体化发展,展示出金融自由化和金融国际化的趋势。

面对这样的外部环境,我国银行业必须实施国际化战略。

我国商业银行实施国际化战略的必要性银行业对外开放:我国商业银行国际化的内在压力根据WTO有关协议,我国银行业承诺将在2006年底全面对外开放,允许外资银行在我国各地设立分支机构并享有国民待遇。

随着逐步取消对外资银行在华的限制,入世之后外资银行在华开设的分支机构越来越多,业务范围也越来越广。

截止2002年9月末,外资银行在华营业机构为181家,允许经营人民币业务的银行为45家,外资银行人民币资产总额为477.97亿元,其中贷款总额达385亿元。

2002年1-7月,外资银行人民币业务实现盈利1.84亿元,当月净增长13.58%;外汇业务实现盈利11.19亿美元,当月净增21.43%。

目前在华的外资银行办理的出口结算已占内地市场份额的40%。

同时,外资银行在华的攻势也越来越犀利,有以汇丰为代表的全面进攻型和以拳头产品为主要盈利点两种类型。

汇丰在中国11个主要城市开设网点后,2002年年底前又推出其网上银行业务,再加上它在试点地区的人民币业务,可以说在汇丰的中国业务表上,几乎包括了所有目前外资银行可以开展的业务。

一些没有将落脚点放在全面客户市场争夺的外资银行,则更注重借助其在国际上的品牌优势。

2002年11月,获得向中国内地企业提供外汇业务和人民币业务许可的摩根大通宣布,其将于2003年初在中国内地的4个城市推出包括资本市场融资、财务顾问、司库服务和现金管理服务等一系列的风险管理金融工具及服务,现在已基本得到了落实。

新形势下中国银行业国际化路径——银行国际化 如何更上一层楼

资 和 资本 使 用 的 “ 融工 程 师 ” 培 金 ,

逐 步 过 渡到 成 立代 表 处 、 分行 实 施 独 资 经 营。 最终 达 到 既 能在 海 外 站

养 合格 的金 融 人 才是 根 本性 的战 略

任 务。首 先 , 需造 就具 有高 素质专 业

水 平 的复 合 型 人 才 ,既精 通 金 融 理

论 和 国 际金 融 业务 ,又熟 练 掌 握 计

稳 脚 跟 , 取 相应 市 场 份额 , 保 证 获 又 总行 对 海外 机 构进 行 严 格 管控 的 目

标。 如何 才 能顺 势 而 为 ,走 出切 合 本 行 实 际 的路 子? 先行 一步 银 行 的 实践还 提示 : 1积 极 配 合 国 内企 业 客 户 的 国 . 际化进 程 实现 银 行 与 企 业 的 良性 互 动 , 应 该 是 银行 走 出国 际 化 的第 一 步 。

为 国际 金 融 中 心 ,离 本行 客 户 的远

三

。 。 。 — —

圈

围

T pc o i

其 次 ,并 购严 格 遵 守 银 行 的 国 际化 发展 战 略。在确 定并购 对 象时 , 经过 严 格 的 审核 程 序 ,充 分考 虑 并 购 对 象在 地理 位 置 、 场份 额 、 业 市 行 前景、 户群 、 客 管理 风 格 、 总体 风 险 和财 务 状 况 、成 本 和 收益 等 方面 是 否符合 自身 的整体 发展 战略 。同时 , 注重 业 务 的 互补 和 服 务 功 能 的多 元 化 ,并 购 对 象选 择 了具 有一 定 客 户 资源 的商 业 银 行 、投 资银 行 和 保 险 公 司等 金 融 机 构 ,通 过并 购 不 同 业 务 类型 的金 融 机构 ,逐 步 实现 综 合 经 营 ,提 升银 行 的整体 综 合 经 营 能

2021年银行业展望:不觉春风换柳条

行业研究·专题报告2021年02月08日[Table_Title1]2021年银行业展望:不觉春风换柳条■两大政策环境:结构性去杠杆、融资结构调整。

2021年,在总体“稳杠杆”的基调下,一些风险领域依然有降杠杆任务,特别是房地产和地方隐性债务两大领域。

监管层要逐步拆解金融和房地产高度捆绑的关系,2021年可能是金融与房地产解绑的元年。

融资结构调整主要体现为提高直接融资比例,资本市场发展加速。

■银行业共同趋势:四大核心驱动力此消彼长。

一是资产增速放缓,贷款结构进一步优化。

在货币政策正常化的大背景下,银行业的资产增速将相应放缓至10%左右。

与此同时,经营性的中长期贷款将保持较快的增长以及占比的提升。

二是资产端收益率有上行空间,净息差有望企稳。

资产端,在LPR水平保持不变的情况下,银行由于结构性因素以及低基数效应依然可以获得更高的收益率;但是在政策约束下,上行幅度大概率小于2017年。

负债端,负债成本可能保持上行,但是社融-M2增速剪刀差有望转向收敛,将边际缓解负债成本压力。

三是非利息收入将恢复增长。

随着经济活动的复苏以及资本市场活跃,银行的非息收入将回归正常增长态势。

四是信用成本会出现技术性改善,但是资产质量面临新的压力。

其中,房地产受政策影响较大,其中大型房企可能会出现个别风险事件,而中小型房企可能整体受压;边缘城投及高负债国企面临的违约风险也值得高度关注。

■银行业结构性趋势:出现四大分化。

一是营业收入和净利润增速的分化。

银行营业收入增速在行业性反弹的趋势下将出现分化,其中股份行、城商行的表现将继续好于行业平均水平。

净利润从行政性压降走向报复性反弹,相应也会产生更大的分化,其中股份行、城商行、农商行回升较为明显,而国有大行相对滞后。

二是业务结构分化。

在融资性脱媒、技术性脱媒的双重压力下,部分银行率先探索业务转型,推动银行收入结构和资产结构的分化。

三是业务结构的分化反映到上市银行的股价上,体现为估值的进一步分化。

中国银行业发展战略浅析

中国银⾏业发展战略浅析2019-05-19摘要:从改⾰开放⾄今,我国商业银⾏得到了快速发展,中国银⾏、中国⼯商银⾏等也跻⾝世界银⾏的前列,随着经济的发展,中国银⾏业也⾯临⼀系列亟需解决的问题,对中国银⾏业的发展战略如不同商业银⾏的定位发展、国际化趋势以及⾼科技在银⾏业发展作⽤等进⾏分析。

关键词:中国商业银⾏;发展战略;中间业务⼀、商业银⾏的概念商业银⾏是以获取利润为经营⽬标,主要业务范围包括吸收公众、企业及机构的存款、发放贷款、票据及中间业务等。

⼆、商业银⾏的特征和功能商业银⾏拥有业务经营所需的⾃有资⾦,以获取最⼤利润为⽬标,依法合规经营,⾃负盈亏,照章纳税。

但由于它经营的商品是货币和货币资本的特殊性,具有信⽤中介、⽀付中介、⾦融服务和信⽤创造职能,不同于⼀般⾏业。

商业银⾏的职能如下:信⽤中介职能,通过银⾏的负债业务,把社会闲散资⾦集中到银⾏,再通过资产业务,投向经济各部门,实现资本的融通。

从吸收资⾦的成本与发放贷款利息收⼊的差额中,获取利益收⼊。

商业银⾏通过信⽤中介的职能实现资本盈余和短缺之间的融通,并不改变货币资本的所有权,只是改变货币资本的使⽤权。

信⽤中介职能使资⾦所有权不发⽣转移的前提下,有效率地配置资源,使剩余资⾦转化为货币资本,促使经济增长的潜⼒得以充分发挥,对促进国民经济的持续平衡发展起着重要的作⽤。

⽀付中介职能,是通过存款在帐户上的转移,客户⽀付,在存款的基础上,成为⼯商企业、团体和个⼈的货币保管者和⽀付⼈,以商业银⾏为中⼼,可以降低流通成本,加快结算过程和货币资⾦周转,同时可避免现⾦⽀付造成的局限性,形成以银⾏为中⼼的⾮现⾦⽀付系统,实现现代经济各项交易迅速快捷的清偿⽅式。

⾦融服务职能,随着经济的发展,⼯商企业的业务经营环境⽇益复杂化,银⾏信息灵通、联系⾯⼴,特别是电⼦计算机在银⾏业务中的⼴泛应⽤,使其具备了为客户提供信息服务的条件,如提供投资咨询服务、资信调查服务、发放⼯资,⽀付其他费⽤等。

踔厉奋斗,笃行不怠,全面开启“数字中银+”新篇章

踔厉奋斗,笃行不怠,全面开启“数字中银+”新篇章中国银行信息科技部总经理兼企业级架构建设办公室主任孟茜中国银行信息科技部总经理兼企业级架构建设办公室主任 孟茜发展数字经济是把握新一轮科技革命和产业变革新机遇的战略选择,是我国“十四五”时期的重大战略部署。

我国金融机构纷纷开启数字化“答卷”,重塑金融业生态和竞争格局。

2021年,中国银行紧跟时代步伐,深度融入数字中国建设,加快推进集团全面数字化转型,科学制定了“数字中银+”金融科技规划并全面推进实施,在金融科技治理、企业级架构建设、数字金融等方面取得了阶段性成果。

2022年,中国银行将保持战略定力,稳中求进,紧密围绕既定部署,培育新动能,以重点突破带动数字化转型整体提升,为集团业务高质量发展贡献科技力量。

一、2021年中国银行金融科技工作回顾“十四五”时期,数字经济将推动我国社会转型升级,培育经济增长新动能,筑牢国际竞争新优势,面对新客户、新领域、新竞争者,全面构建数字化能力成为银行高质量发展的迫切需要。

同时,为应对百年未有之大变局,坚持统筹安全与发展,解决关键技术领域“卡脖子”问题,推进金融业信息化核心技术安全可控,全力实施IT 架构转型成为维护金融基础设施安全的必然选择。

2021年,中国银行谋定而后动,以数字化转型为主轴,坚持固本强基,紧跟时代脉搏,搭建“技术+生态+体验+数据”新能力,为跨越式发展积蓄新势能。

1.谋篇布局,勾勒数字化转型新图景2021年,中国银行着力加强顶层设计、系统谋划,坚持问题导向、目标导向、结果导向,在统筹规划、体制机制、人才队伍建设等方面进行战略部署,构筑集团金融科技发展的“四梁八柱”,谋定集团数字化转型前进方向。

一是优化IT 治理体系。

中国银行强化统筹,整合信息科技管理委员会、互联网金融委员会、数据治理委员会,成立金融数字化委员会,统筹集团数字化发展;优化布局、全局统筹,成立企业级架构办公室,加快推进企业级架构建设工作,锻造数字化新军,构建新的核心竞争力;面向“一体”核心,设立总行级信息基础设施联合实验室,中银金科苏州分公司和武汉、成都、海南三个研发基地,支持重点区域协同发展;面向“两翼”联动,坚持“一盘棋”,实施“一行/司一策”服务,提升远程办公水平,开展“集团云”服务,试点数据互联互通,支持集约化经营;靶向发力,优化科技资源分配策略和项目管理流程,提升科技管理效能,确保战略任务稳步落地,使得项目立项效率提升50%,交付效率提升9.1%。

论中国银行业的国际化战略

论中国银行业的国际化战略【作者:中国建设银行副行长陈佐夫】随着世界经济的发展,经济全球化的速度也不断加快,一国的经济与他国的经济乃至全球的经济联系越来越紧密。

经济的全球一体化,必然带来金融的全球化。

随着中国经济融入世界,中国的金融业及中国的银行也必然走向世界。

一、中国的银行走向国际的必要性金融是现代经济的产物,在资本主义上升时期,随着资本的扩张和流动,金融业包括银行也追随着资本跨区域、跨国境地发展,成为经济全球化的加速器。

例如,世界顶级的金融服务机构汇丰银行始终如一地坚持全球化战略,1865年在香港开业后,经过140多年的发展,业务已经遍及亚、欧、美、非几大洲的近80个国家和地区,拥有9500多个分支机构,为客户提供遍及全球的全方位金融服务。

我国自改革开放以来,进出口贸易一直以两位数的比例在增长,2005年,我国进出口总额已超过14200亿美元,占我国GDP的60%。

可以说,中国的经济已经与世界经济密不可分。

在此形势下,作为服务业的银行,也必然要求走出国门、走向世界,为中国企业、中国的产品、中国公民提供贴身的金融服务。

这不仅仅是因为中国公民的乡土情结,也是为中国的企业提供便捷的金融服务,促使我国进出口企业进一步做大做强的重要条件。

随着我国加入WTO和中国金融市场的逐步开放,外国金融机构特别是外资银行纷纷在中国抢滩登陆、开展业务。

目前已有250余家外资银行在中国境内开办业务,其业务量以每年30%以上的速度在发展。

面对全球化的趋势,使用法律手段或非法律障碍来阻止外资银行的进入和发展已显得不合时宜。

保护我们的民族银行业,仅仅是一厢情愿,谁也挡不住外资银行的进入和发展。

但中国银行业也绝不能坐以待毙,除了采取措施尽快把自己的国内业务做实做强,努力提高其自身的抵御力和竞争力外,也要大胆地走出国门、走向国际,在国际市场上去竞争、去磨炼自己,去寻找新的利润增长点,在全球化的过程中找到自己的位置。

中国银行业走向国际,进入新的市场,也是维护我国金融安全所必需。

我国商业银行的海外并购之路

浅析我国商业银行的海外并购之路摘要:我国商业银行产生于计划经济的专业银行,经过多年的改革发展实现了市场化和商业化,并向着规范化的的国际标准靠拢,银行业的综合实力及竞争能力得到不断提高,在此情况下,拓展海外市场和制订国际化战略,也成为一些商业银行的共同目标。

在全球经济一体化的今天,国际化是我国商业银行发展的必然趋势,而跨国海外并购则是我国银行业国际化经营战略下的必然选择。

本文列举了我国商业银行参股、并购外资银行的一些案例,以此对我国商业银行海外并购的方式、特点及风险方面进行了分析。

关键词:商业银行;海外并购;发展战略;亚洲市场;新兴市场;欧美市场一、引言二十世纪八十年代,整个经济体制的改革和国民经济的发展对银行业提出了更高要求,专业银行在业务及体制上垄断、僵化等弊端逐渐显现,从而迫使我国摸索着走上一条金融改革之路。

九十年代开始,我国实行了一系列的改革举措,先后组建了三家政策性银行——国家开发银行、中国进出口银行及中国农业发展银行,实现了商业性金融与政策性金融职能分离,促使中国工商银行、中国建设银行、中国银行、中国农业银行四家专业银行向商业银行转变。

经过多年改革发展,我国商业银行正向着规范化的的国际标准靠拢,银行业的综合实力及竞争能力得到不断提高,在此情况下,拓展海外市场和制订国际化战略,也正成为一些中国商业银行的共同目标。

放眼世界,伴随着全球经济的发展,九十年代以来,新一轮并购浪潮在国际银行业兴起,机构大型化、全能化和全球化特点突出,全球经济一体化加速发展,金融全球化、银行跨国并购成了一种趋势,这种趋势也同样对目前我国处于转轨过程之中的旧有金融组织体制造成冲击,从而迫使我国商业银行不再局限于传统机构国际化模式,并进一步加强中国银行业在规模效率上的改进。

因此我国商业银行跨国并购对于从总体上提升中国银行业国际化竞争能力有着特殊的意义。

对于我国商业银行的海外并购发展战略,分析后可以发现个中的规律。

我国商业银行在跨国并购的市场选择和进入方式上都表现出其特别之处,首先,我国商业银行的跨国并购在宏观上一直配合着国内企业实行走出国门的发展战略,以体现国际化银行的战略措施;其次,通过海外并购,推动我国商业银行成为业务综合化的全能银行,有助于我国商业银行收入与风险方面保持平衡。

银行业未来三至五年发展前景预测

国外银行业发展相对成熟,市场竞争激烈,业务创新和服务 质量是银行竞争的重点。同时,国外银行也面临着监管压力 、经济波动等挑战。

政策法规对银行业影响

政策法规概述

政策法规是银行业发展的重要影响因素 ,包括货币政策、金融监管政策、银行 法等。

VS

对银行业的影响

政策法规的调整会对银行业的经营环境、 业务范围、风险管理等方面产生重要影响 。例如,货币政策的调整会影响银行的信 贷规模和利率水平;金融监管政策的加强 会促使银行加强风险管理和合规经营;银 行法的修改会完善银行业的法律制度,保 障银行业的健康发展。

加强合作与创新

积极寻求与其他金融机构、科技企业的合作,共同推动银行业创新发 展。

THANKS

感谢观看

优化人才结构

加大对高素质、专业化人才的引进力度,优化人才队伍结构。

完善激励机制

建立科学合理的薪酬体系和绩效考核机制,激发员工积极性和创 造力。

紧跟政策导向,把握市场机遇

关注政策动向

密切关注国家宏观经济政策和金融监管政策的变化,及时调整业务 策略和发展方向。

把握市场趋势

深入了解客户需求和市场变化,把握金融科技、绿色金融等新兴领 域的发展机遇。

06

总结:银行业未来三至五年发展 策略建议

制定科学合理的发展战略

明确发展目标

根据银行自身资源、市场环境和客户需求,制定 清晰、可量化的发展目标。

优化业务结构

调整和优化业务结构,加大对优势业务和潜力业 务的投入,降低对高风险和低效益业务的依赖。

强化品牌建设

提升品牌形象和知名度,增强客户对银行的信任 度和忠诚度。

市场创新

风险防控

金融市场业务将不断创新,推出更多 符合市场需求的金融产品和服务。

海外分行演讲稿

海外分行演讲稿

尊敬的各位领导、同事们:

大家好!很荣幸能够在这里和大家分享关于海外分行的一些情况和展望。

作为

海外分行的一名员工,我深知我们所面临的挑战和机遇,也深信我们的团队能够应对挑战、抓住机遇,取得更大的成绩。

首先,我想和大家分享一下我们海外分行目前的业务情况。

作为中国银行海外

布局的重要组成部分,海外分行一直致力于为客户提供全方位的金融服务。

我们在海外市场的业务涵盖了企业金融、个人金融、国际贸易、投资理财等多个领域,为广大客户提供了全面的金融解决方案。

同时,我们也不断加强与当地金融机构和企业的合作,拓展了海外市场的影响力和竞争力。

其次,我想和大家分享一下我们海外分行未来的发展展望。

随着中国经济的不

断发展和国际化进程的加快,海外分行将迎来更多的发展机遇。

我们将继续深化与当地金融机构和企业的合作,加大对海外市场的投入和布局,不断提升服务水平和产品创新能力,为客户提供更加优质的金融服务。

同时,我们也将积极应对国际金融市场的变化,加强风险管理和合规监管,确保海外分行的稳健经营和可持续发展。

最后,我想强调的是,海外分行的发展离不开每一位员工的共同努力。

作为海

外分行的一名员工,我们应该时刻牢记使命,不忘初心,勇于担当,努力工作,为海外分行的发展贡献自己的力量。

同时,我们也要加强团队合作,密切配合,共同推动海外分行的发展,为客户创造更大的价值。

在未来的发展道路上,海外分行将面临各种各样的挑战和困难,但我坚信,在

领导的正确指引下,有着一支富有激情和活力的团队,我们一定能够战胜一切困难,取得更加辉煌的成绩!

谢谢大家!。

日本银行业在调整方向

日本银行业在调整方向

戴常明

【期刊名称】《国际商务译丛》

【年(卷),期】1990(000)006

【总页数】4页(P76-79)

【作者】戴常明

【作者单位】无

【正文语种】中文

【中图分类】F833.133

【相关文献】

1.从新《防卫计划大纲》看日本安全战略的调整方向 [J], 储召锋

2.日本水稻生产成本的变动趋势及持续降低的调整方向:规模扩大与技术创新 [J], 李东坡;南石晃明;长命洋佑

3.中国银行业海外发展战略的思考——以日本、加拿大银行业为借鉴 [J], 李磊;薛彤

4.从新防卫大纲看日本安全战略的调整方向 [J], 胡继平;

5.日本无机化工适时调整方向 [J],

因版权原因,仅展示原文概要,查看原文内容请购买。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

兰州商学院长青学院欧阳光明(2021.03.07)本科生毕业论文(设计)论文(设计)题目:中国银行业海外发展战略的思考系别:财政金融系专业 (方向):金融学年级班:2006级金融(二)班学生姓名:马鑫指导教师:马润平2010年5月18日中国银行业海外发展战略的思考摘要经济全球化与金融一体化已成为不可逆转的时代潮流,银行的国际化也成为银行业发展的必然趋势。

随着中国经济的进一步对外开放和金融体制改革的深入,中国银行业面临参与国际竞争的外在压力和实现全球化的内在要求。

但中国的银行业在制度环境、人员素质、资金技术实力等方面与发达国家的著名银行相比差距甚远,实现国际化不可能一蹴而就,而是一个渐进式的过程。

当前,我国四大国有商业银行股份制改革已取得了重大突破,中行、建行、工行都成功地引进了境外战略投资者,深化完善法人治理结构,建立现代金融企业制度,中行、建行成功地在香港率先上市,中行又成功地在上海上市,接着,工行在上海和香港同时成功上市。

农行已完成了内部财务重组和不良资产剥离等提前准备工作,预计也会在今年第三季度上市。

从我国国有商业银行的资本、资产、盈利规模来看,有的已跻身于国际大银行二十强之列,一些股份制商业银行国际业务也有长足的发展。

工行、建行甚至在全球名列前茅。

但从国际化程度看,无论从业务品种、跨境服务,海外直接投资(海外设置分支机构、投资海外企业)以及集团的管理水平,都大大落后于世界级的跨国银行,有的还处在起步阶段。

同时,国内外经济金融面临的形势又十分复杂,国际金融危机影响仍然存在,中国银行业在海外经营发展面临的困难和全球性挑战压力明显加大。

[关键词]海外发展战略海外并购本土化ABSTRACTEconomic globalization and financial integration has become an irreversible trend of the times, international banks have become an inevitable trend in the banking sector development. With the further opening up of China's economy and the deepening of financial reform, China's banking sector is facing external pressure to participate in international competition and globalization of the inherent requirements. But China's banking system, the environment, quality of personnel, capital and technology strength, with the developed countries, a far cry compared to well-known banks, internationalization can not be achieved, but a gradual process.At present, China's four major state-owned joint-stock reform of commercial banks have made a major breakthrough, Bank of China, Construction Bank, working row Chenggong to introduce strategic investors outside the country, deepening and perfecting corporate governance structure, establish modern financial enterprise system, Bank of China, Construction Bank successfully listed in Hong Kong in the first, Bank of China successfully listed in Shanghai and then, ICBC successfully listed in Shanghai and Hong Kong simultaneously. Agricultural Bank of China has completed the internal financial restructuring and other bad assets in advance preparations are also expected in the third quarter. China's state-owned commercial banks from the capital, assets, profitability scale of view, some international banks have been among the 20 strong list, the number of joint-stock commercial banks have significant international business development. ICBC, CCB and even among the best. But look atthe international level, in terms of business lines, cross-border services, foreign direct investment (to establish a branch abroad, overseas investment enterprises) and the Group's management, have lagged far behind the world-class multinational banks, some still in early stage. Meanwhile, the domestic and international economic and financial situation and the complexity facing the international financial crisis continues, China's banking sector in the development of overseas business difficulties and the challenges of global pressures significantly increased.[Key words] Overseas DevelopmentOverseas M & A Localization目录一、海外机构(1)(一)海外机构的概念(1)(二)我国银行业的海外发展(1)二、中国银行业海外机构战略发展情况与分析(2)(一)认清国内外经济金融形势,准确把握海外发展机遇期(2)(二)我国银行业海外发展的原因和现况(3)1、我国银行业海外发展的原因(4)2、我国银行业海外发展的现状(4)三、我国银行业海外机构健康发展的对策和思考(7)(一)我国银行业应加大海外并购(7)1、注重业务互补和服务功能的多元化(8)2、注重对收购对象的选择(9)3、注重利用海外战略投资者的国际经营经验(9)4、注重并购后的整合(9)(二)我国银行业应逐步实现海外机构发展的本土化(9)(三)积极推进新兴市场和产品创新战略(12)(四)加强银行业国际化风险意识(13)(五)建设高素质的人才队伍是落实海外发展战略的根本保证(13)四、结束语(14)参考文献(15)中国银行业海外发展战略的思考经济全球化与金融一体化已成为不可逆转的时代潮流,银行的国际化也成为银行业发展的必然趋势。

随着中国经济的进一步对外开放和金融体制改革的深入,中国银行业面临参与国际竞争的外在压力和实现全球化的内在要求。

同时,国内外经济金融面临的形势又十分复杂,国际金融危机影响仍然存在,中国银行业在海外经营发展面临的困难和全球性挑战压力明显加大。

在当前新形势下,如何审时度势,科学地、积极稳妥地制定适合自身的海外发展战略,是摆在我国银行高管层的重要课题。

一、海外机构(一)海外机构的概念从经营管理方式来看,海外机构是泛指我国香港、澳门和国外或地区所有的分支机构的整体概念。

只有对海外机构的概念界定清晰,才能制定相应的整体海外发展战略。

(二)我国银行业的海外发展由于历史和业务发展的原因,中国银行是目前国内银行中最国际化的商业银行。

1929年,中国银行在伦敦设立中国金融业第一家海外分行。

此后在世界各大金融中心相继开设分支机构,截至2008年底,中国银行已在全球29个国家和地区建立800多家分支机构,并与1500家国外代理行及47,000家分支机构保持了代理业务关系。

2009年上半年,充分依托集团整体优势,进一步加强海内外业务联动,全力满足国内“走出去”企业的金融服务需求,积极开展跨境贸易人民币结算业务试点。

加快推进以亚太地区为重点的机构延伸和中后台集中工作。

投行、基金、保险、投资、租赁等业务条线充分发挥各自优势,积极寻找市场机会,大力拓展优质业务,市场竞争力不断增强。

上半年,海外机构实现税后利润15.02亿美元,同比增长28%。

除中国银行外,我国其他国有商业银行近十多年来也纷纷跨出国门,在国外设立分文机构,发展国际化经营。

截至2008年末,工商银行已在境外15个国家和地区设有21家营业性机构,分支机构134家,与122个国家和地区的1358家境外银行建立了代理行关系,境外网络已具规模;中国建设银行开展国际业务已经十余年,目前,建设银行已在海外设有香港、法兰克福、新加坡三个分行和四个代表处。

建设银行已与世界上600家银行建立了代理行关系,其业务往来遍及五大洲的近80个国家。

但是与中国银行不同的是,工行、建行等业务发展方向重点都放在国内。

二、中国银行业海外机构战略发展情况与分析(一)认清国内外经济金融形势,准确把握海外发展机遇期2007年受金融危机的影响全球主要经济体陷入困境,国际银行业盈利水平出现明显下降。

进入2008年第四季度以后,世界经济形势险象环生,国际金融危机持续扩散蔓延,世界经济严重衰退。