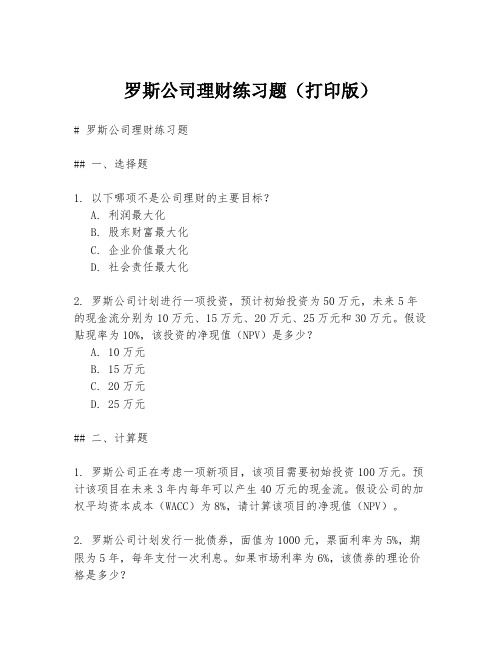

罗斯公司理财题库cha19

公司理财罗斯习题集

财务综合分析

通过分析净资产收益率、总资产周转率和权益乘数等指标,评估企业的财务状况和经营绩效。

杜邦分析法

通过对流动比率、存货周转率、应收账款周转率等指标进行加权平均,评估企业的财务状况和经营绩效。

沃尔评分法

通过计算税后净营业利润减去资本成本后的剩余经济价值,评估企业的价值创造能力。

有效市场假说

有效市场假说认为市场是有效的,即市场价格反映了所有可获得的信息,因此无法通过分析信息获资金管理

现金管理

交易动机、预防动机、投机动机。 持有现金的动机 现金管理的目标 现金管理的方法 安全性、流动性、收益性。 建立最佳现金余额、加速收款、延迟付款。

财务趋势分析

衡量企业营业收入的增长情况,计算公式为(本期营业收入-上期营业收入)除以上期营业收入。

营业收入增长率

净利润增长率

总资产增长率

股东权益增长率

衡量企业净利润的增长情况,计算公式为(本期净利润-上期净利润)除以上期净利润。

衡量企业资产规模的增长情况,计算公式为(本期总资产-上期总资产)除以析

财务比率分析

流动比率 速动比率 资产负债率 利息保障倍数 衡量企业短期偿债能力,计算公式为流动资产除以流动负债。 衡量企业长期偿债能力,计算公式为负债总额除以资产总额。 衡量企业快速偿债能力,计算公式为(流动资产-存货)除以流动负债。 衡量企业支付利息的能力,计算公式为息税前利润除配与股利政策

利润分配的原则与程序

依法分配原则、弥补亏损原则、先提取法定公积金原则、提取任意公积金原则、股东平等原则。

利润分配原则

弥补亏损提取法定公积金、提取任意公积金、支付股利。

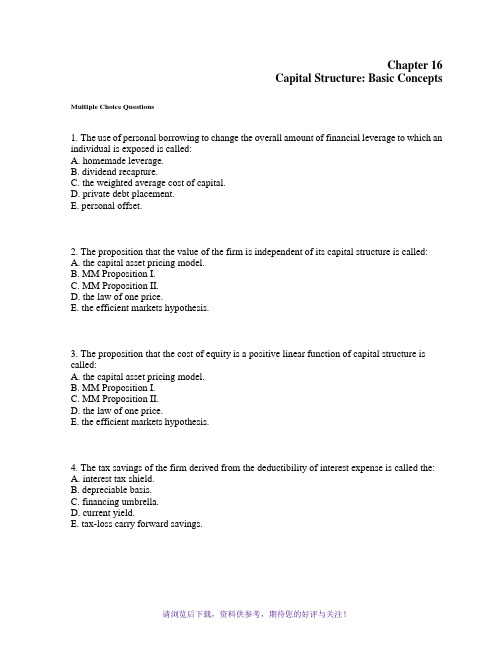

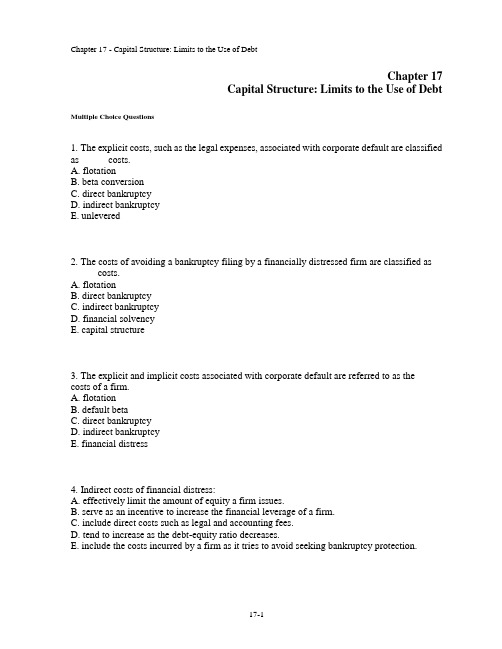

英文版罗斯公司理财习题答案ChapWord版

CHAPTER 8MAKING CAPITAL INVESTMENT DECISIONSAnswers to Concepts Review and Critical Thinking Questions1.In this context, an opportunity cost refers to the value of an asset or other input that will be used in aproject. The relevant cost is what the asset or input is actually worth today, not, for example, what it cost to acquire.2. a.Yes, the reduction in the sales of the company’s other products, referred to as erosion, andshould be treated as an incremental cash flow. These lost sales are included because they are a cost (a revenue reduction) that the firm must bear if it chooses to produce the new product.b. Yes, expenditures on plant and equipment should be treated as incremental cash flows. Theseare costs of the new product line. However, if these expenditures have already occurred, they are sunk costs and are not included as incremental cash flows.c. No, the research and development costs should not be treated as incremental cash flows. Thecosts of research and development undertaken on the product during the past 3 years are sunk costs and should not be included in the evaluation of the project. Decisions made and costs incurred in the past cannot be changed. They should not affect the decision to accept or reject the project.d. Yes, the annual depreciation expense should be treated as an incremental cash flow.Depreciation expense must be taken into account when calculating the cash flows related to a given project. While depreciation is not a cash expense that directly affects cash flow, it decreases a firm’s net income and hence, lowers its tax bill for the year. Because of this depreciation tax shield, the firm has more cash on hand at the end of the year than it would have had without expensing depreciation.e.No, dividend payments should not be treated as incremental cash flows. A firm’s decision topay or not pay dividends is independent of the decision to accept or reject any given investment project. For this reason, it is not an incremental cash flow to a given project. Dividend policy is discussed in more detail in later chapters.f.Yes, the resale value of plant and equipment at the end of a project’s life should be treated as anincremental cash flow. The price at which the firm sells the equipment is a cash inflow, and any difference between the book value of the equipment and its sale price will create gains or lossesthat result in either a tax credit or liability.g.Yes, salary and medical costs for production employees hired for a project should be treated asincremental cash flows. The salaries of all personnel connected to the project must be included as costs of that project.3.Item I is a relevant cost because the opportunity to sell the land is lost if the new golf club is produced. Item II is also relevant because the firm must take into account the erosion of sales of existing products when a new product is introduced. If the firm produces the new club, the earnings from the existing clubs will decrease, effectively creating a cost that must be included in the decision.Item III is not relevant because the costs of Research and Development are sunk costs. Decisions made in the past cannot be changed. They are not relevant to the production of the new clubs.4.For tax purposes, a firm would choose MACRS because it provides for larger depreciationdeductions earlier. These larger deductions reduce taxes, but have no other cash consequences.Notice that the choice between MACRS and straight-line is purely a time value issue; the total depreciation is the same; only the timing differs.5.It’s probably only a mild over-simplification. Current liabilities will all be paid, presumably. Thecash portion of current assets will be retrieved. Some receivables won’t be collected, and some inventory will not be sold, of course. Counterbalancing these losses is the fact that inventory sold above cost (and not replaced at the end of the project’s life) acts to increase working capital. These effects tend to offset one another.6.Management’s discretion to set the firm’s capital structure is applicable at the firm level. Since anyone particular project could be financed entirely with equity, another project could be financed with debt, and the firm’s overall capital structure remains unchanged, financing cost s are not relevant in the analysis of a project’s incremental cash flows according to the stand-alone principle.7.The EAC approach is appropriate when comparing mutually exclusive projects with different livesthat will be replaced when they wear out. This type of analysis is necessary so that the projects havea common life span over which they can be compared; in effect, each project is assumed to existover an infinite horizon of N-year repeating projects. Assuming that this type of analysis is valid implies that the project cash flows remain the same forever, thus ignoring the possible effects of, among other things: (1) inflation, (2) changing economic conditions, (3) the increasing unreliability of cash flow estimates that occur far into the future, and (4) the possible effects of future technology improvement that could alter the project cash flows.8.Depreciation is a non-cash expense, but it is tax-deductible on the income statement. Thusdepreciation causes taxes paid, an actual cash outflow, to be reduced by an amount equal to the depreciation tax shield, t c D. A reduction in taxes that would otherwise be paid is the same thing as a cash inflow, so the effects of the depreciation tax shield must be added in to get the total incremental aftertax cash flows.9.There are two particularly important considerations. The first is erosion. Will the “essentialized”book simply displace copies of the existing book that would have otherwise been sold? This is of special concern given the lower price. The second consideration is competition. Will other publishers step in and produce such a product? If so, then any erosion is much less relevant. A particular concern to book publishers (and producers of a variety of other product types) is that the publisher only makes money from the sale of new books. Thus, it is important to examine whether the new book would displace sales of used books (good from the publisher’s perspective) or new books (not good). The concern arises any time there is an active market for used product.10.Definitely. The damage to Porsche’s reputation is definitely a factor the company needed to consider.If the reputation was damaged, the company would have lost sales of its existing car lines.11.One company may be able to produce at lower incremental cost or market better. Also, of course,one of the two may have made a mistake!12.Porsche would recognize that the outsized profits would dwindle as more products come to marketand competition becomes more intense.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the tax shield approach to calculating OCF, we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = [($5 × 2,000 – ($2 × 2,000)](1 – 0.35) + 0.35($10,000/5)OCF = $4,600So, the NPV of the project is:NPV = –$10,000 + $4,600(PVIFA17%,5)NPV = $4,7172.We will use the bottom-up approach to calculate the operating cash flow for each year. We also mustbe sure to include the net working capital cash flows each year. So, the total cash flow each year will be:Year 1 Year 2 Year 3 Year 4 Sales Rs.7,000 Rs.7,000 Rs.7,000 Rs.7,000Costs 2,000 2,000 2,000 2,000Depreciation 2,500 2,500 2,500 2,500EBT Rs.2,500 Rs.2,500 Rs.2,500 Rs.2,500Tax 850 850 850 850Net income Rs.1,650 Rs.1,650 Rs.1,650 Rs.1,650OCF 0 Rs.4,150 Rs.4,150 Rs.4,150 Rs.4,150Capital spending –Rs.10,000 0 0 0 0NWC –200 –250 –300 –200 950Incremental cashflow –Rs.10,200 Rs.3,900 Rs.3,850 Rs.3,950 Rs.5,100The NPV for the project is:NPV = –Rs.10,200 + Rs.3,900 / 1.10 + Rs.3,850 / 1.102 + Rs.3,950 / 1.103 + Rs.5,100 / 1.104NPV = Rs.2,978.333. Using the tax shield approach to calculating OCF, we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = (R2,400,000 – 960,000)(1 – 0.30) + 0.30(R2,700,000/3)OCF = R1,278,000So, the NPV of the project is:NPV = –R2,700,000 + R1,278,000(PVIFA15%,3)NPV = R217,961.704.The cash outflow at the beginning of the project will increase because of the spending on NWC. Atthe end of the project, the company will recover the NWC, so it will be a cash inflow. The sale of the equipment will result in a cash inflow, but we also must account for the taxes which will be paid on this sale. So, the cash flows for each year of the project will be:Year Cash Flow0 – R3,000,000 = –R2.7M – 300K1 1,278,0002 1,278,0003 1,725,000 = R1,278,000 + 300,000 + 210,000 + (0 – 210,000)(.30)And the NPV of the project is:NPV = –R3,000,000 + R1,278,000(PVIFA15%,2) + (R1,725,000 / 1.153)NPV = R211,871.465. First we will calculate the annual depreciation for the equipment necessary for the project. Thedepreciation amount each year will be:Year 1 depreciation = R2.7M(0.3330) = R899,100Year 2 depreciation = R2.7M(0.4440) = R1,198,800Year 3 depreciation = R2.7M(0.1480) = R399,600So, the book value of the equipment at the end of three years, which will be the initial investment minus the accumulated depreciation, is:Book value in 3 years = R2.7M – (R899,100 + 1,198,800 + 399,600)Book value in 3 years = R202,500The asset is sold at a gain to book value, so this gain is taxable.Aftertax salvage value = R202,500 + (R202,500 – 210,000)(0.30)Aftertax salvage value = R207,750To calculate the OCF, we will use the tax shield approach, so the cash flow each year is:OCF = (Sales – Costs)(1 – t C) + t C DepreciationYear Cash Flow0 – R3,000,000 = –R2.7M – 300K1 1,277,730.00 = (R1,440,000)(.70) + 0.30(R899,100)2 1,367,640.00 = (R1,440,000)(.70) + 0.30(R1,198,800)3 1,635,630.00 = (R1,440,000)(.70) + 0.30(R399,600) + R207,750 + 300,000Remember to include the NWC cost in Year 0, and the recovery of the NWC at the end of the project.The NPV of the project with these assumptions is:NPV = – R3.0M + (R1,277,730/1.15) + (R1,367,640/1.152) + (R1,635,630/1.153)NPV = R220,655.206. First, we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation charge = €925,000/5Annual depreciation charge = €185,000The aftertax salvage value of the equipment is:Aftertax salvage value = €90,000(1 – 0.35)Aftertax salvage value = €58,500Using the tax shield approach, the OCF is:OCF = €360,000(1 – 0.35) + 0.35(€185,000)OCF = €298,750Now we can find the project IRR. There is an unusual feature that is a part of this project. Accepting this project means that we will reduce NWC. This reduction in NWC is a cash inflow at Year 0. This reduction in NWC implies that when the project ends, we will have to increase NWC. So, at the end of the project, we will have a cash outflow to restore the NWC to its level before the project. We also must include the aftertax salvage value at the end of the project. The IRR of the project is:NPV = 0 = –€925,000 + 125,000 + €298,750(PVIFA IRR%,5) + [(€58,500 – 125,000) / (1+IRR)5]IRR = 23.85%7.First, we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation = £390,000/5Annual depreciation = £78,000Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so:Aftertax salvage value = MV + (BV – MV)t cVery often, the book value of the equipment is zero as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes:Aftertax salvage value = MV + (0 – MV)t cAftertax salvage value = MV(1 – t c)We will use this equation to find the aftertax salvage value since we know the book value is zero. So, the aftertax salvage value is:Aftertax salvage value = £60,000(1 – 0.34)Aftertax salvage value = £39,600Using the tax shield approach, we find the OCF for the project is:OCF = £120,000(1 – 0.34) + 0.34(£78,000)OCF = £105,720Now we can find the project NPV. Notice that we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value.NPV = –£390,000 – 28,000 + £105,720(PVIFA10%,5) + [(£39,600 + 28,000) / 1.15]NPV = £24,736.268.To find the BV at the end of four years, we need to find the accumulated depreciation for the firstfour years. We could calculate a table with the depreciation each year, but an easier way is to add the MACRS depreciation amounts for each of the first four years and multiply this percentage times the cost of the asset. We can then subtract this from the asset cost. Doing so, we get:BV4 = $9,300,000 – 9,300,000(0.2000 + 0.3200 + 0.1920 + 0.1150)BV4 = $1,608,900The asset is sold at a gain to book value, so this gain is taxable.Aftertax salvage value = $2,100,000 + ($1,608,900 – 2,100,000)(.40)Aftertax salvage value = $1,903,5609. We will begin by calculating the initial cash outlay, that is, the cash flow at Time 0. To undertake theproject, we will have to purchase the equipment and increase net working capital. So, the cash outlay today for the project will be:Equipment –€2,000,000NWC –100,000Total –€2,100,000Using the bottom-up approach to calculating the operating cash flow, we find the operating cash flow each year will be:Sales €1,200,000Costs 300,000Depreciation 500,000EBT €400,000Tax 140,000Net income €260,000The operating cash flow is:OCF = Net income + DepreciationOCF = €260,000 + 500,000OCF = €760,000To find the NPV of the project, we add the present value of the project cash flows. We must be sure to add back the net working capital at the end of the project life, since we are assuming the net working capital will be recovered. So, the project NPV is:NPV = –€2,100,000 + €760,000(PVIFA14%,4) + €100,000 / 1.144NPV = €173,629.3810.We will need the aftertax salvage value of the equipment to compute the EAC. Even though theequipment for each product has a different initial cost, both have the same salvage value. The aftertax salvage value for both is:Both cases: aftertax salvage value = $20,000(1 – 0.35) = $13,000To calculate the EAC, we first need the OCF and NPV of each option. The OCF and NPV for Techron I is:OCF = – $34,000(1 – 0.35) + 0.35($210,000/3) = $2,400NPV = –$210,000 + $2,400(PVIFA14%,3) + ($13,000/1.143) = –$195,653.45EAC = –$195,653.45 / (PVIFA14%,3) = –$84,274.10And the OCF and NPV for Techron II is:OCF = – $23,000(1 – 0.35) + 0.35($320,000/5) = $7,450NPV = –$320,000 + $7,450(PVIFA14%,5) + ($13,000/1.145) = –$287,671.75EAC = –$287,671.75 / (PVIFA14%,5) = –$83,794.05The two milling machines have unequal lives, so they can only be compared by expressing both on an equivalent annual basis, which is what the EAC method does. Thus, you prefer the Techron II because it has the lower (less negative) annual cost.。

(完整word版)罗斯公司理财题库全集(word文档良心出品)

Chapter 21Leasing Multiple Choice Questions1. In a lease arrangement, the owner of the asset is:A. the lesser.B. the lessee.C. the lessor.D. the leaser.E. None of the above.2. In a lease arrangement, the user of the asset is:A. the lesser.B. the lessee.C. the lessor.D. the leaser.E. None of the above.3. Which of the following would not be a characteristic of a financial lease?A. They are not usually fully amortized.B. They usually do not have maintenance necessary for the leased assets.C. They usually do not include a cancellation option.D. The lessee usually has the right to renew the lease at expiration.E. All of the above are characteristics of financial leases.4. An independent leasing company supplies ___________ leases versus the manufacturer who supplies ________________ leases.A. leveraged; directB. sales and leaseback; sales-typeC. capital; sales-typeD. direct; sales-typeE. None of the above5. Which of the following is not a financial lease?A. A leveraged leaseB. An operating leaseC. A sale-and-leasebackD. Both A and B.E. None of the above.6. If the lessor borrows much of the purchase price of a leased asset, the lease is called:A. a leveraged lease.B. a sale-and-leaseback.C. a capital lease.D. a nonrecourse lease.E. None of the above.7. An operating lease's primary characteristics are:A. fully amortized, lessee maintains equipment and there is no cancellation clause.B. not fully amortized, lessor maintains equipment and there is a cancellation clause.C. fully amortized, lessor maintains equipment and there is a cancellation clause.D. not fully amortized, lessor maintains equipment and there is not cancellation clause.E. fully amortized, lessee maintains equipment and lessee can acquire assets at end of lease for fair market value.8. If a lease is for 35 years, it is regarded as a:A. financial lease.B. operating lease.C. capital lease.D. conditional sale.E. sale and leaseback.9. The city of Oakland sold some buildings and used the proceeds to improve its financial position. The city then leased the buildings back in order to continue to use these facilities. This is an example of:A. an operating lease.B. a short-term lease.C. a sale and leaseback.D. a fully amortized lease.E. None of the above.10. A financial lease has the following as its primary characteristics:A. is fully amortized, lessee maintains equipment and there is no renewal clause and no cancellation clause.B. is not fully amortized, lessor maintains equipment and there is a renewal clause but no cancellation clause.C. is fully amortized, lessor maintains equipment and there is a renewal clause and a no cancellation clause.D. is not fully amortized, lessor maintains equipment and there is a renewal clause.E. is fully amortized, lessee maintains equipment and there is a renewal clause and a no cancellation clause.11. An advantage of leasing is that the lessor does not own the asset and can cancel:A. only financial leases.B. only operating leases.C. only capital leases.D. any kind of leases anytime.E. None of the above.12. A leveraged lease typically involves a non-recourse loan in which:A. the lessee's payments go directly to the lender in case of default.B. the lessor is not obligated in case of default.C. the third party lenders have a first lien on the assets.D. All of the above.E. None of the above.13. For accounting purposes, which of the following conditions would automatically cause a lease to be a capital lease?A. The lessee can purchase the asset below fair market value at the end of the lease.B. The lease transfers ownership of the asset to the lessee by the end of the lease.C. The lease term is more than 75% of the asset's economic life.D. The present value of the lease payments is more than 90% of the asset's market value at lease inception.E. All of the above would lead to the lease being considered a capital lease.14. Capital leases would show up on the balance sheet of the firm in which manner for a six year machinery lease worth $700,000?A. Capital leases do not have to be put on the balance sheet; only financial leases do.B. Asset - Machinery $700,000; Liabilities - Long Term debt $700,000 because of debt displacement.C. Asset - Assets under Capital Lease $700,000; Liabilities - Obligations under Capital Lease $700,000.D. Assets - Assets under Capital Lease $700,000; Liabilities - Long Term Debt $700,000 because of debt displacement.E. None of the above.15. Prior to FASB 13, "Accounting for Leases", lease activity was only reported in financial footnotes. This off-balance-sheet-financing made firms with:A. capital leases appear financially stronger than firms that used debt to purchase the asset.B. operating leases appear financially stronger than firms that used debt to purchase the asset.C. leases of any type appear financially stronger than firms that used debt to purchase the asset.D. All of the above.E. None of the above.16. Which of the following is not an implication of FASB 13, Accounting for Leases?A. FASB 13 requires that the PV of the lease payments appear on the right hand side of the balance sheet.B. FASB 13 requires that the present value of the asset appear on the left hand side of the balance sheet.C. FASB 13 allows for off-balance-sheet financing for operating leases.D. All of the above.E. None of the above.17. The reason the IRS is most concerned about lease contracts is:A. firms that lease generally pay no taxes.B. that leasing usually leads to bankruptcy.C. that leases can be set up solely to avoid taxes.D. because leasing leads to off-balance-sheet-financing.E. All of the above.18. A lease with high payments early in its life which then decline to termination would:A. provide greater cash flow to the lessee in the beginning years.B. be evidence of tax avoidance and not acceptable to the IRS.C. be qualified as a capital lease under FASB 13.D. provide a lower residual value and thus ensure a bargain-purchase price option.E. All of the above.19. In valuing the lease versus purchase option, the relevant cash flows are the:A. tax shield from depreciation.B. investment outlay for the equipment.C. a decrease in the firm's operating costs that are not affected by leasing.D. All of the above are relevant.E. None of the above are relevant.20. The appropriate discount rate for valuing a financial lease is:A. the firm's after-tax weighted average cost of capital.B. the after-tax required return on assets of risks similar to the leased asset.C. the after-tax cost of secured borrowing.D. Either A or B.E. All of the above.21. The WACC is not used in the lease versus purchase decision because:A. the WACC was used in the decision to acquire the asset, this is only a financing decision.B. the WACC is used only when a lease alone is considered and not a lease versus purchase.C. the WACC does not include the lease cost of capital and therefore should not be used.D. tax rates of the lessor may be different than the lessee and therefore the WACC is incorrect.E. when a bank arranges a lease they do not consider the lessee's cost of capital.22. Firms that use financial leases must consider their debt-to-equity ratios as inadequate measures of financial leverage because:A. lenders are concerned about the firm's total liabilities and related cash flow.B. debt displacement occurs with leasing.C. less future debt can be raised for a growing firm when a lease is used.D. All of the above.E. None of the above.23. ______ would be evidence the lease is being used to avoid taxes and not a legitimate business purpose.A. Early balloon paymentsB. Late balloon paymentsC. Capitalizing a leaseD. Transfer of lease payments to a second ownerE. None of the above24. Debt displacement is associated with leases because:A. all assets not purchased with equity use debt financing.B. debt is always a cheaper source of financing and preferred to equity financing.C. FASB 13 and the IRS mandate debt displacement.D. lease financing is all debt and causes an imbalance in the optimal debt to equity ratio which reduces future debt financing.E. None of the above.25. A lease is likely to be most beneficial to both parties when:A. the lessor's tax rate is lower than the lessee's.B. the lessor's tax rate is higher than the lessee's.C. the lessor's tax rate is equal to the lessee's.D. a lease cannot be beneficial to both parties.E. a lease always has zero NPV, so both parties always break even.26. The price or lease payment that the lessee sets as their bound is known as:A. the present value of the tax shields.B. the reservation payment, L MIN.C. the present value of operating savings.D. the reservation payment, L MAX.E. None of the above.27. Which of the following is probably not a good reason for leasing instead of buying?A. Taxes may be reduced by leasing.B. Leasing may reduce transactions costs.C. Leasing may provide a beneficial reduction of uncertainty.D. All of the above are good reasons.E. All of the above are not good reasons.28. Which of the following is probably a good reason for leasing instead of buying?A. Leasing provides 100% financing.B. Leasing is not considered a form of debt financing.C. Leasing may increase EPS relative to buying.D. All of the above are good reasons.E. None of the above is a good reason.29. Some assets are leased more than others because:A. the value of the asset under a lease is not highly affected by term of use or maintenance decisions.B. a lease may be used to fool clients into "buying" high priced assets above market value.C. leasing allows sellers to attract clients with low prices as the basis for setting the contract.D. Both A and B.E. Both A and C.30. To meet IRS guidelines for leasing, the lease should:A. limit the lessee's right to issue debt or pay dividends while the lease is operative.B. not limit the lessee's right to issue debt or pay dividends while the lease is operative.C. pay a very high return to the lessor.D. transfer ownership of the asset at the end of the lease at below fair market value.E. be over 30 years.Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage value over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%.31. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in years 1-9?A. $-255B. $-955C. $-1,295D. $-1,850E. None of the above32. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in year 0?A. $-4,865B. $-700C. $6,950D. $7,650E. None of the above33. What is the NPV of the lease relative to the purchase?A. $-1,039.78B. $339.78C. $360.22D. $6,610.22E. None of the above34. What would the after-tax cash flow in year 9 be if the asset had a residual value of $500 (ignoring any possible risk differences)?A. $-605B. $-955C. $-1,455D. $-1,305E. None of the above35. This lease would be classified as a(n):A. operating lease because the asset will be obsolete.B. operating lease because there is no amortization.C. leveraged lease because it is being financed.D. capital lease because the lease life is greater than 75% of the economic life.E. sale and leaseback because the company gets full use of the asset.Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300,000 per year with the first payment occurring at lease inception. The system would cost $1,050,000 to buy and would be straight-line depreciated to a zero salvage value. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%.36. What is the appropriate discount rate for valuing the lease?A. 2.72%B. 5.28%C. 8.00%D. 12.12%E. None of the above.37. What is the after-tax cash flow from leasing in year 0?A. $300,000B. $495,000C. $852,000D. $948,000E. None of the above38. What is the after-tax cash flow in years 1 through 5?A. $-126,600B. $-198,000C. $-269,400D. $-287,250E. None of the above39. What is the NPV of the lease?A. $-111,690B. $-295,040C. $-305,388D. $-309,690E. None of the above40. What is the maximum lease payment that you would be willing to make?A. $170,655B. $175,000C. $187,842D. $210,307E. None of the above41. What is the minimum lease payment that the lessor would be willing to accept?A. $161,000B. $176,995C. $217,645D. $237,083E. None of the aboveYour firm is considering leasing a new laser light. The lease lasts for 3 years. The lease calls for 4 payments of $10,000 per year with the first payment occurring immediately. The computer would cost $45,000 to buy and would be straight-line depreciated to a zero salvage value over 3 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 10%. The corporate tax rate is 35%.42. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in years 1-3?A. $-32,775B. $-11,750C. $-1,750D. $-1,850E. None of the above43. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in year 0?A. $-35,000B. $-38,500C. $35,000D. $38,500E. None of the above44. What is the NPV of the lease relative to the purchase?A. $-6,500B. $7,380C. $4,678D. $12,400E. None of the above45. What would the after-tax cash flow in year 3 be if the asset had a residual value of $1,000 (ignoring any possible risk differences)?A. $-11,750B. $11,750C. $12,400D. $-12,400E. None of the above46. This lease would be classified as a(n):A. operating lease because the asset will be obsolete.B. operating lease because there is no amortization.C. leveraged lease because it is being financed.D. capital lease because the lease life is greater than 75% of the economic life.E. sale and leaseback because the company gets full use of the asset.Essay Questions47. Sardinas Sardines has assets valued at $10 million and equity of $10 million. The firm recently leased new equipment worth $1 million. Present the balance sheet under two conditions; the lease is judged to be an operating lease, and the lease is judged to be a capital lease.48. The Blank Button Company is considering the purchase of a new machine for $30,000. The machine is expected to save the firm $12,500 per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $6,500 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 34%, and its cost of debt is 10%. Calculate the NPV of the lease versus the purchase decision. Calculate the reservation payment of the lessee.49. The Plastic Iron Company has decided to acquire a new electronic milling machine. Plastic Iron can purchase the machine for $87,000 which has an expected life of 8 years and will be depreciated using 7 class MACRS rates of .1428, .2449, .1749, .125, .0892, .0892, .0892 and any remainder in year 8. Miller Leasing has offered to lease the machine to Plastic Iron for $14,000 a year for 8 years. Plastic Iron has an 18.64% cost of equity, 12% cost of debt, a 1:1 D/E ratio and faces a 34% marginal tax rate. Should they lease or buy? Show all work.50. What are some of the advantages and disadvantages of leasing?Chapter 21 Leasing Answer KeyMultiple Choice Questions1. In a lease arrangement, the owner of the asset is:A. the lesser.B. the lessee.C. the lessor.D. the leaser.E. None of the above.Difficulty level: EasyTopic: LESSORType: DEFINITIONS2. In a lease arrangement, the user of the asset is:A. the lesser.B. the lessee.C. the lessor.D. the leaser.E. None of the above.Difficulty level: EasyTopic: LESSEEType: DEFINITIONS3. Which of the following would not be a characteristic of a financial lease?A. They are not usually fully amortized.B. They usually do not have maintenance necessary for the leased assets.C. They usually do not include a cancellation option.D. The lessee usually has the right to renew the lease at expiration.E. All of the above are characteristics of financial leases.Difficulty level: MediumTopic: FINANCIAL LEASEType: DEFINITIONS4. An independent leasing company supplies ___________ leases versus the manufacturer who supplies ________________ leases.A. leveraged; directB. sales and leaseback; sales-typeC. capital; sales-typeD. direct; sales-typeE. None of the aboveDifficulty level: EasyTopic: TYPES OF LEASESType: DEFINITIONS5. Which of the following is not a financial lease?A. A leveraged leaseB. An operating leaseC. A sale-and-leasebackD. Both A and B.E. None of the above.Difficulty level: EasyTopic: TYPES OF LEASESType: DEFINITIONS6. If the lessor borrows much of the purchase price of a leased asset, the lease is called:A. a leveraged lease.B. a sale-and-leaseback.C. a capital lease.D. a nonrecourse lease.E. None of the above.Difficulty level: EasyTopic: TYPES OF LEASESType: DEFINITIONS7. An operating lease's primary characteristics are:A. fully amortized, lessee maintains equipment and there is no cancellation clause.B. not fully amortized, lessor maintains equipment and there is a cancellation clause.C. fully amortized, lessor maintains equipment and there is a cancellation clause.D. not fully amortized, lessor maintains equipment and there is not cancellation clause.E. fully amortized, lessee maintains equipment and lessee can acquire assets at end of lease for fair market value.Difficulty level: MediumTopic: OPERATING LEASEType: DEFINITIONS8. If a lease is for 35 years, it is regarded as a:A. financial lease.B. operating lease.C. capital lease.D. conditional sale.E. sale and leaseback.Difficulty level: MediumTopic: TYPES OF LEASESType: DEFINITIONS9. The city of Oakland sold some buildings and used the proceeds to improve its financial position. The city then leased the buildings back in order to continue to use these facilities. This is an example of:A. an operating lease.B. a short-term lease.C. a sale and leaseback.D. a fully amortized lease.E. None of the above.Difficulty level: EasyTopic: TYPES OF LEASEType: CONCEPTS10. A financial lease has the following as its primary characteristics:A. is fully amortized, lessee maintains equipment and there is no renewal clause and no cancellation clause.B. is not fully amortized, lessor maintains equipment and there is a renewal clause but no cancellation clause.C. is fully amortized, lessor maintains equipment and there is a renewal clause and a no cancellation clause.D. is not fully amortized, lessor maintains equipment and there is a renewal clause.E. is fully amortized, lessee maintains equipment and there is a renewal clause and a no cancellation clause.Difficulty level: EasyTopic: FINANCIAL LEASEType: CONCEPTS11. An advantage of leasing is that the lessor does not own the asset and can cancel:A. only financial leases.B. only operating leases.C. only capital leases.D. any kind of leases anytime.E. None of the above.Difficulty level: EasyTopic: ADVANTAGE TO LEASINGType: CONCEPTS12. A leveraged lease typically involves a non-recourse loan in which:A. the lessee's payments go directly to the lender in case of default.B. the lessor is not obligated in case of default.C. the third party lenders have a first lien on the assets.D. All of the above.E. None of the above.Difficulty level: MediumTopic: LEVERAGED LEASEType: CONCEPTS13. For accounting purposes, which of the following conditions would automatically cause a lease to be a capital lease?A. The lessee can purchase the asset below fair market value at the end of the lease.B. The lease transfers ownership of the asset to the lessee by the end of the lease.C. The lease term is more than 75% of the asset's economic life.D. The present value of the lease payments is more than 90% of the asset's market value at lease inception.E. All of the above would lead to the lease being considered a capital lease.Difficulty level: MediumTopic: CAPITAL LEASEType: CONCEPTS14. Capital leases would show up on the balance sheet of the firm in which manner for a six year machinery lease worth $700,000?A. Capital leases do not have to be put on the balance sheet; only financial leases do.B. Asset - Machinery $700,000; Liabilities - Long Term debt $700,000 because of debt displacement.C. Asset - Assets under Capital Lease $700,000; Liabilities - Obligations under Capital Lease $700,000.D. Assets - Assets under Capital Lease $700,000; Liabilities - Long Term Debt $700,000 because of debt displacement.E. None of the above.Difficulty level: EasyTopic: CAPITAL LEASEType: CONCEPTS15. Prior to FASB 13, "Accounting for Leases", lease activity was only reported in financial footnotes. This off-balance-sheet-financing made firms with:A. capital leases appear financially stronger than firms that used debt to purchase the asset.B. operating leases appear financially stronger than firms that used debt to purchase the asset.C. leases of any type appear financially stronger than firms that used debt to purchase the asset.D. All of the above.E. None of the above.Difficulty level: ChallengeTopic: FASB 13Type: CONCEPTS16. Which of the following is not an implication of FASB 13, Accounting for Leases?A. FASB 13 requires that the PV of the lease payments appear on the right hand side of the balance sheet.B. FASB 13 requires that the present value of the asset appear on the left hand side of the balance sheet.C. FASB 13 allows for off-balance-sheet financing for operating leases.D. All of the above.E. None of the above.Difficulty level: MediumTopic: FASB 13Type: CONCEPTS17. The reason the IRS is most concerned about lease contracts is:A. firms that lease generally pay no taxes.B. that leasing usually leads to bankruptcy.C. that leases can be set up solely to avoid taxes.D. because leasing leads to off-balance-sheet-financing.E. All of the above.Difficulty level: EasyTopic: TAX IMPLICATIONSType: CONCEPTS18. A lease with high payments early in its life which then decline to termination would:A. provide greater cash flow to the lessee in the beginning years.B. be evidence of tax avoidance and not acceptable to the IRS.C. be qualified as a capital lease under FASB 13.D. provide a lower residual value and thus ensure a bargain-purchase price option.E. All of the above.Difficulty level: MediumTopic: TAX IMPLICATIONSType: CONCEPTS19. In valuing the lease versus purchase option, the relevant cash flows are the:A. tax shield from depreciation.B. investment outlay for the equipment.C. a decrease in the firm's operating costs that are not affected by leasing.D. All of the above are relevant.E. None of the above are relevant.Difficulty level: MediumTopic: LEASE VS. BUYType: CONCEPTS20. The appropriate discount rate for valuing a financial lease is:A. the firm's after-tax weighted average cost of capital.B. the after-tax required return on assets of risks similar to the leased asset.C. the after-tax cost of secured borrowing.D. Either A or B.E. All of the above.Difficulty level: EasyTopic: APPROPRIATE DISCOUNT RATEType: CONCEPTS21. The WACC is not used in the lease versus purchase decision because:A. the WACC was used in the decision to acquire the asset, this is only a financing decision.B. the WACC is used only when a lease alone is considered and not a lease versus purchase.C. the WACC does not include the lease cost of capital and therefore should not be used.D. tax rates of the lessor may be different than the lessee and therefore the WACC is incorrect.E. when a bank arranges a lease they do not consider the lessee's cost of capital.Difficulty level: ChallengeTopic: APPROPRIATE DISCOUNT RATEType: CONCEPTS22. Firms that use financial leases must consider their debt-to-equity ratios as inadequate measures of financial leverage because:A. lenders are concerned about the firm's total liabilities and related cash flow.B. debt displacement occurs with leasing.C. less future debt can be raised for a growing firm when a lease is used.D. All of the above.E. None of the above.Difficulty level: MediumTopic: FINANCIAL LEASEType: CONCEPTS23. ______ would be evidence the lease is being used to avoid taxes and not a legitimate business purpose.A. Early balloon paymentsB. Late balloon paymentsC. Capitalizing a leaseD. Transfer of lease payments to a second ownerE. None of the aboveDifficulty level: MediumTopic: TAX IMPLICATIONSType: CONCEPTS24. Debt displacement is associated with leases because:A. all assets not purchased with equity use debt financing.B. debt is always a cheaper source of financing and preferred to equity financing.C. FASB 13 and the IRS mandate debt displacement.D. lease financing is all debt and causes an imbalance in the optimal debt to equity ratio which reduces future debt financing.E. None of the above.Difficulty level: ChallengeTopic: LEASES AND DEBTType: CONCEPTS25. A lease is likely to be most beneficial to both parties when:A. the lessor's tax rate is lower than the lessee's.B. the lessor's tax rate is higher than the lessee's.C. the lessor's tax rate is equal to the lessee's.D. a lease cannot be beneficial to both parties.E. a lease always has zero NPV, so both parties always break even.Difficulty level: ChallengeTopic: TAX IMPLICATIONSType: CONCEPTS26. The price or lease payment that the lessee sets as their bound is known as:A. the present value of the tax shields.B. the reservation payment, L MIN.C. the present value of operating savings.D. the reservation payment, L MAX.E. None of the above.Difficulty level: MediumTopic: RESERVATION PAYMENTType: CONCEPTS27. Which of the following is probably not a good reason for leasing instead of buying?A. Taxes may be reduced by leasing.B. Leasing may reduce transactions costs.C. Leasing may provide a beneficial reduction of uncertainty.D. All of the above are good reasons.E. All of the above are not good reasons.Difficulty level: MediumTopic: REASON FOR LEASINGType: CONCEPTS。

罗斯公司理财题库全集

Chapter 19 Dividends and Other Payouts Answer KeyMultiple Choice Questions1. Payments made out of a firm's earnings to its owners in the form of cash or stock are called:A. dividends.B. distributions.C. share repurchases.D. payments-in-kind.E. stock splits.Difficulty level: EasyTopic: DIVIDENDSType: DEFINITIONS2. Payments made by a firm to its owners from sources other than current or accumulated earnings are called:A. dividends.B. distributions.C. share repurchases.D. payments-in-kind.E. stock splits.Difficulty level: EasyTopic: DISTRIBUTIONSType: DEFINITIONS3. A cash payment made by a firm to its owners in the normal course of business is called a:A. share repurchase.B. liquidating dividend.C. regular cash dividend.D. special dividend.E. extra cash dividend.Difficulty level: EasyTopic: REGULAR CASH DIVIDENDSType: DEFINITIONS4. A cash payment made by a firm to its owners when some of the firm's assets are sold off is called a:A. liquidating dividend.B. regular cash dividend.C. special dividend.D. extra cash dividend.E. share repurchase.Difficulty level: EasyTopic: LIQUIDATING DIVIDENDSType: DEFINITIONS5. The date on which the board of directors passes a resolution authorizing payment of a dividend to the shareholders is the _____ date.A. ex-rightsB. ex-dividendC. recordD. paymentE. declarationDifficulty level: EasyTopic: DECLARATION DATEType: DEFINITIONS6. The date before which a new purchaser of stock is entitled to receive a declared dividend, but on or after which she does not receive the dividend, is called the _____ date.A. ex-rightsB. ex-dividendC. recordD. paymentE. declarationDifficulty level: EasyTopic: EX-DIVIDEND DATEType: DEFINITIONS7. The date by which a stockholder must be registered on the firm's roll as having share ownership in order to receive a declared dividend is called the:A. ex-rights date.B. ex-dividend date.C. date of record.D. date of payment.E. declaration date.Difficulty level: EasyTopic: DATE OF RECORDType: DEFINITIONS8. The date on which the firm mails out its declared dividends is called the:A. ex-rights date.B. ex-dividend date.C. date of record.D. date of payment.E. declaration date.Difficulty level: EasyTopic: DATE OF PAYMENTType: DEFINITIONS9. The ability of shareholders to undo the dividend policy of the firm and create an alternative dividend payment policy via reinvesting dividends or selling shares of stock is called (a):A. perfect foresight model.B. MM Proposition I.C. capital structure irrelevancy.D. homemade leverage.E. homemade dividends.Difficulty level: MediumTopic: HOMEMADE DIVIDENDSType: DEFINITIONS10. The market's reaction to the announcement of a change in the firm's dividend payout is likely the:A. information content effect.B. clientele effect.C. efficient markets hypothesis.D. MM Proposition I.E. MM Proposition II.Difficulty level: MediumTopic: INFORMATION CONTENT EFFECTType: DEFINITIONS11. The observed empirical fact that stocks attract particular investors based on the firm's dividend policy and the resulting tax impact on investors is called the:A. information content effect.B. clientele effect.C. efficient markets hypothesis.D. MM Proposition I.E. MM Proposition II.Difficulty level: EasyTopic: CLIENTELE EFFECTType: DEFINITIONS12. A _____ is an alternative method to cash dividends which is used to pay out a firm's earnings to shareholders.A. mergerB. acquisitionC. payment-in-kindD. stock splitE. share repurchaseDifficulty level: EasyTopic: SHARE REPURCHASEType: DEFINITIONS13. A payment made by a firm to its owners in the form of new shares of stock is called a _____ dividend.A. stockB. normalC. specialD. extraE. liquidatingDifficulty level: EasyTopic: STOCK DIVIDENDSType: DEFINITIONS14. An increase in a firm's number of shares outstanding without any change in owners' equity is called a:A. special dividend.B. stock split.C. share repurchase.D. tender offer.E. liquidating dividend.Difficulty level: EasyTopic: STOCK SPLITSType: DEFINITIONS15. The difference between the highest and lowest prices at which a stock has traded is called its:A. average price.B. bid-ask spread.C. trading range.D. opening price.E. closing price.Difficulty level: EasyTopic: TRADING RANGEType: DEFINITIONS16. In a reverse stock split:A. the number of shares outstanding increases and owners' equity decreases.B. the firm buys back existing shares of stock on the open market.C. the firm sells new shares of stock on the open market.D. the number of shares outstanding decreases but owners' equity is unchanged.E. shareholders make a cash payment to the firm.Difficulty level: EasyTopic: REVERSE SPLITSType: DEFINITIONS17. The last date on which you can purchase shares of stock and still receive the dividend is the date _____ business day(s) prior to the date of record.A. zeroB. oneC. threeD. fiveE. sevenDifficulty level: EasyTopic: DIVIDEND PAYMENTSType: CONCEPTS18. Leslie purchased 100 shares of GT, Inc. stock on Wednesday, June 7th. Marti purchased 100 shares of GT, Inc. stock on Thursday, July 8th. GT declared a dividend on June 20th to shareholders of record on July 12th and payable on August 1st. Which one of the following statements concerning the dividend paid on August 1st is correct given this information?A. Neither Leslie nor Marti are entitled to the dividend.B. Leslie is entitled to the dividend but Marti is not.C. Marti is entitled to the dividend but Leslie is not.D. Both Marti and Leslie are entitled to the dividend.E. Both Marti and Leslie are entitled to one-half of the dividend amount.Difficulty level: MediumTopic: DIVIDEND PAYMENTSType: CONCEPTS19. All else equal, the market value of a stock will tend to decrease by roughly the amount of the dividend on the:A. dividend declaration date.B. ex-dividend date.C. date of record.D. date of payment.E. day after the date of payment.Difficulty level: MediumTopic: DIVIDEND PAYMENTSType: CONCEPTS20. Which one of the following is an argument in favor of a low dividend policy?A. the tax on capital gains is deferred until the gain is realizedB. few, if any, positive net present value projects are available to the firmC. a preponderance of stockholders have minimal taxable incomeD. a majority of stockholders have other investment opportunities that offer higher rewards with similar risk characteristicsE. corporate tax rates exceed personal tax ratesDifficulty level: MediumTopic: FACTORS FOR LOW DIVIDENDSType: CONCEPTS21. The fact that flotation costs can be significant is justification for:A. a firm to issue larger dividends than its closest competitors.B. a firm to maintain a constant dividend policy even if it frequently has to issue new shares of stock to do so.C. maintaining a constant dividend policy even when profits decline significantly.D. maintaining a high dividend policy.E. maintaining a low dividend policy and rarely issuing extra dividends.Difficulty level: MediumTopic: FACTORS FOR LOW DIVIDENDSType: CONCEPTS22. Which of the following may tend to keep dividends low?I. a state law restricting dividends in excess of retained earningsII. a term contained in bond indenture agreementsIII. the desire to maintain constant dividends over timeIV. flotation costsA. II and III onlyB. I and IV onlyC. II, III, and IV onlyD. I, II, and III onlyE. I, II, III, and IVDifficulty level: MediumTopic: FACTORS FOR LOW DIVIDENDSType: CONCEPTS23. Ignoring capital gains as an alternative, the tax law changes in 2003 tend to favor a:A. lower dividend policy.B. constant dividend policy.C. zero-dividend policy.D. higher dividend policy.E. restrictive dividend policy.Difficulty level: EasyTopic: FACTORS FOR HIGH DIVIDENDSType: CONCEPTS24. Which of the following are factors that favor a high dividend policy?I. stockholders desire for current incomeII. tendency for higher stock prices for high dividend paying firmsIII. investor dislike of uncertaintyIV. high percentage of tax-exempt institutional stockholdersA. I and III onlyB. II and IV onlyC. I, III, and IV onlyD. II, III, and IV onlyE. I, II, III, and IVDifficulty level: MediumTopic: FACTORS FOR HIGH DIVIDENDSType: CONCEPTS25. An investor is more likely to prefer a high dividend payout if a firm:A. has high flotation costs.B. has few, if any, positive net present value projects.C. has lower tax rates than the investor.D. has a stock price that is increasing rapidly.E. offers high capital gains which are taxed at a favorable rate.Difficulty level: EasyTopic: FACTORS FOR HIGH DIVIDENDSType: CONCEPTS26. The information content of a dividend increase generally signals that:A. the firm has a one-time surplus of cash.B. the firm has few, if any, net present value projects to pursue.C. management believes that the future earnings of the firm will be strong.D. the firm has more cash than it needs due to sales declines.E. future dividends will be lower.Difficulty level: MediumTopic: INFORMATION CONTENTType: CONCEPTS27. Of the following factors, which one is considered to be the primary factor affecting a firm's dividend decision?A. personal taxes of company stockholdersB. consistent dividend policyC. attracting retail investorsD. attracting institutional investorsE. sustainable changes in earningsDifficulty level: MediumTopic: DIVIDEND SURVEY RESULTSType: CONCEPTS28. Financial managers:A. are reluctant to cut dividends.B. tend to ignore past dividend policies.C. tend to prefer cutting dividends every time quarterly earnings decline.D. prefer cutting dividends over incurring flotation costs.E. place little emphasis on dividend policy consistency.Difficulty level: EasyTopic: DIVIDEND SURVEY RESULTSType: CONCEPTS29. If you ignore taxes and transaction costs, a stock repurchase will:I. reduce the total assets of a firm.II. increase the earnings per share.III. reduce the PE ratio more than an equivalent stock dividend.IV. reduce the total equity of a firm.A. I and III onlyB. II and IV onlyC. I, II, and IV onlyD. I, III, and IV onlyE. I, II, III, and IVDifficulty level: MediumTopic: STOCK REPURCHASEType: CONCEPTS30. From a tax-paying investor's point of view, a stock repurchase:A. is equivalent to a cash dividend.B. is more desirable than a cash dividend.C. has the same tax effects as a cash dividend.D. is more highly taxed than a cash dividend.E. creates a tax liability even if the investor does not sell any of the shares he owns.Difficulty level: MediumTopic: STOCK REPURCHASEType: CONCEPTS31. All else equal, a stock dividend will _____ the number of shares outstanding and _____ the value per share.A. increase; increaseB. increase; decreaseC. not change; increaseD. decrease; increaseE. decrease; decreaseDifficulty level: EasyTopic: STOCK DIVIDENDSType: CONCEPTS32. A small stock dividend is defined as a stock dividend of less than _____%.A. 10 to 15B. 15 to 20C. 20 to 25D. 25 to 30E. 30 to 35Difficulty level: EasyTopic: STOCK DIVIDENDSType: CONCEPTS33. Nu Tech, Inc. is a technology firm with good growth prospects. The firm wishes to do something to acknowledge the loyalty of its shareholders but needs all of its available cash to fund its rapid growth. The market price of its stock is currently trading in the middle of its preferred trading range. The firm could consider:A. issuing a liquidating dividend.B. a stock split.C. a reverse stock split.D. issuing a stock dividend.E. a special cash dividend.Difficulty level: MediumTopic: STOCK DIVIDENDType: CONCEPTS34. Which of the following are valid reasons for a firm to reduce or eliminate its cash dividends?I. The firm is on the verge of violating a bond restriction which requires a current ratio of 1.8 or higher.II. A firm has just received a patent on a new product for which there is strong market demand and it needs the funds to bring the product to the marketplace.III. The firm can raise new capital easily at a very low cost.IV. The tax laws have recently changed such that dividends are taxed at an investor's marginal rate while capital gains are tax exempt.A. I and III onlyB. II and IV onlyC. II, III, and IV onlyD. I, II, and IV onlyE. I, II, III, and IVDifficulty level: MediumTopic: STOCK DIVIDENDSType: CONCEPTS35. A stock split:A. increases the total value of the common stock account.B. decreases the value of the retained earnings account.C. does not affect the total value of any of the equity accounts.D. increases the value of the capital in excess of par account.E. decreases the total owners' equity on the balance sheet.Difficulty level: MediumTopic: STOCK SPLITSType: CONCEPTS36. Stock splits are often used to:A. adjust the market price of a stock such that it falls within a preferred trading range.B. decrease the excess cash held by a firm.C. increase both the number of shares outstanding and the market price per share simultaneously.D. increase the total equity of a firm.E. adjust the debt-equity ratio such that it falls within a preferred range.Difficulty level: EasyTopic: STOCK SPLITSType: CONCEPTS37. Which of the following tend to increase the appeal of a firm's stock to the average investor?I. a cessation of dividends by a firm which has a long history of increasing dividendsII. the distribution of a special dividend by a dividend-paying firmIII. a reverse stock split for a low-priced stockIV. the declaration of a stock dividend by a growth firmA. I and III onlyB. II and IV onlyC. I, II, and IV onlyD. II, III, and IV onlyE. I, II, III, and IVDifficulty level: MediumTopic: STOCK SPLITSType: CONCEPTS38. Wydex, Inc. stock is currently trading at $82 a share. The firm feels that its primary clientele can afford to spend between $2,000 and $2,500 to purchase a round lot of 100 shares. The firm should consider a:A. reverse stock split.B. liquidating dividend.C. stock dividend.D. stock split.E. special dividend.Difficulty level: MediumTopic: STOCK SPLITType: CONCEPTS39. A one-for-four reverse stock split will:A. increase the par value by 25%.B. increase the number of shares outstanding by 400%.C. increase the market value but not affect the par value per share.D. increase a $1 par value to $4.E. increase a $1 par value by $4.Difficulty level: MediumTopic: REVERSE STOCK SPLITSType: CONCEPTS40. A reverse stock split is sometimes used as a means of:A. decreasing the liquidity of a stock.B. decreasing the market value per share of stock.C. increasing the number of stockholders.D. keeping a firm's stock eligible for trading on a stock exchange.E. raising cash from current stockholders.Difficulty level: EasyTopic: REVERSE STOCK SPLITSType: CONCEPTS41. Which of the following lists events in chronological order from earliest to latest?A. date of record, declaration date, ex-dividend date.B. date of record, ex-dividend date, declaration date.C. declaration date, date of record, ex-dividend date.D. declaration date, ex-dividend date, date of record.E. ex-dividend date, date of record, declaration date.Difficulty level: MediumTopic: DIVIDEND DATESType: CONCEPTS42. In an efficient market, ignoring taxes and time value, the price of stock should:A. decrease by the amount of the dividend immediately on the declaration date.B. decrease by the amount of the dividend immediately on the ex-dividend date.C. increase by the amount of the dividend immediately on the declaration date.D. increase by the amount of the dividend immediately on the ex-dividend date.E. Both B and C.Difficulty level: MediumTopic: EX-DIVIDEND DATESType: CONCEPTS43. On the date of record the stock price drop is:A. a full adjustment for the dividend payment.B. a partial adjustment for the dividend payment because of the tax effect.C. zero because it happens on the ex-dividend date.D. zero because it happens on the payment date.E. None of the above.Difficulty level: MediumTopic: DATE OF RECORDType: CONCEPTS44. The use of homemade dividends allows stockholders to change the:A. return pattern of the firm by leveraging their position like the firm.B. cash payout received by selling off shares to receive current dividends or purchasing additional shares with the dividends, as desired.C. value of the company by sending dividend requirement letters to the home office of the corporation.D. Both A and C.E. Both B and C.Difficulty level: MediumTopic: HOMEMADE DIVIDENDSType: CONCEPTS45. Homemade dividends are described by Modigliani and Miller to be the:A. dividend one pays oneself to avoid risky stocks.B. re-arrangement of the firm's dividend stream as management needs.C. re-arrangement of the firm's dividend stream by investors buying or selling their holdings in the stock.D. present value of all dividends to be paid.E. None of the above.Difficulty level: MediumTopic: HOMEMADE DIVIDENDSType: CONCEPTS46. The dividend-irrelevance proposition of Miller and Modigliani depends on the following relationship between investment policy and dividend policy:A. The level of investment does not influence or matter to the dividend decision.B. Once dividend policy is set the investment decision can be made as desired.C. The investment policy is set before the dividend decision and not changed by dividend policy.D. Since dividend policy is irrelevant there is no relationship between investment policy and dividend policy.E. Miller and Modigliani were only concerned about capital structure.Difficulty level: MediumTopic: DIVIDEND IRRELEVANCEType: CONCEPTS47. Dividends are relevant and dividend policy irrelevant when:A. cash dividends are always constant and dividend policy is changed as management needs.B. cash dividends are increased for one year while others are held constant, thus causing an increase in stock price, and dividend policy establishes the trade-off between dividends at different dates.C. cash dividends are always constant and dividend policy establishes the trade-off between dividends at different dates.D. cash dividends are increased for one payment while others are held constant and dividend policy is changed as management needs.E. None of the above.Difficulty level: MediumTopic: DIVIDEND RELEVANCEType: CONCEPTS48. A reverse split is when:A. the stock price gets too high for investors to purchase in round lots.B. the stock becomes too liquid and highly marketable.C. the stock price moves into the popular trading range.D. several old shares, such as 4, are replaced by 1 new share.E. None of the above.Difficulty level: EasyTopic: REVERSE SPLITType: CONCEPTS49. A firm announces that it is willing to purchase a number of shares back at various prices and shareholders have the option to indicate how many shares they are willing to sell at various prices. This process is called a:A. dividend creation model.B. secondary market transaction.C. free market sale.D. Dutch auction.E. None of the above.Difficulty level: EasyTopic: DUTCH AUCTIONType: CONCEPTS50. Characteristics of a sensible dividend policy include:A. over time pay out all free cash flowsB. set the current regular dividend consistent with a long-run target payout ratioC. use repurchases to distribute transitory cash flow increasesD. A and BE. All of the aboveDifficulty level: EasyTopic: CHARACTERISTICS OF SENSIBLE DIVIDEND POLICYType: CONCEPTS51. You owned 200 shares last year and received a stock dividend of 5% at the end of last year. The number of shares you now have is _____ and your wealth has increased by ______%.A. 10; 5B. 210; 5C. 210; 0D. 50,000; 5E. 50,000; 0# shares = 200(1.05) = 210The only change is in value per share.Difficulty level: EasyTopic: STOCK DIVIDENDSType: PROBLEMS52. The Rent It Company declared a dividend of $.60 a share on October 20th to holders of record on Monday, November 1st. The dividend is payable on December 1st. You purchased 100 shares of Rent It Company stock on Wednesday, October 27th. How much dividend income will you receive on December 1st from the Rent It Company?A. $0B. $1.50C. $6.00D. $15.00E. $60.00Dividend received = $.60 ⨯ 100 = $60.00Difficulty level: MediumTopic: STOCK DIVIDENDType: PROBLEMS53. You purchased 200 shares of ABC stock on July 15th. On July 20th, you purchased another 100 shares and then on July 22st you purchased your final 200 shares of ABC stock. The company declared a dividend of $1.10 a share on July 5th to holders of record on Friday, July 23rd. The dividend is payable on July 31st. How much dividend income will you receive on July 31st from ABC?A. $0B. $220C. $330D. $440E. $550Dividend received = $1.10 ⨯ (200 + 100) = $330Difficulty level: MediumTopic: STOCK DIVIDENDType: PROBLEMS54. The KatyDid Co. is paying a $1.25 per share dividend today. There are 120,000 shares outstanding with a par value of $1.00 per share. As a result of this dividend, the:A. retained earnings will decrease by $150,000.B. retained earnings will decrease by $120,000.C. common stock account will decrease by $150,000.D. common stock account will decrease by $120,000.E. capital in excess of par value account will decrease by $120,000.Decrease in retained earnings = $1.25 ⨯ 120,000 = $150,000Difficulty level: MediumTopic: STOCK DIVIDENDType: PROBLEMS55. On May 18th, you purchased 1,000 shares of BuyLo stock. On June 5th, you sold 200 shares of this stock for $21 a share. You sold an additional 400 shares on July 8th at a price of $22.50 a share. The company declared a $.50 per share dividend on June 25th to holders of record as of Thursday, July 10th. This dividend is payable on July 31st. How much dividend income will you receive on July 31st as a result of your ownership of BuyLo stock?A. $100B. $200C. $300D. $400E. $500Dividend received = $.50 ⨯ (1,000 - 200) = $400Difficulty level: MediumTopic: STOCK DIVIDENDType: PROBLEMS56. You own 300 shares of Abco, Inc. stock. The company has stated that it plans on issuing a dividend of $.60 a share one year from today and then issuing a final liquidating dividend of $2.20 a share two years from today. Your required rate of return is 9%. Ignoring taxes, what is the value of one share of this stock today?A. $2.36B. $2.40C. $2.62D. $2.80E. $2.85Value per share = ($.60 ÷ 1.091) + ($2.20 ÷ 1.092) = $2.40Difficulty level: MediumTopic: HOMEMADE DIVIDENDSType: PROBLEMS57. Priscilla owns 500 shares of Delta stock. It is January 1, 2006, and the company recently issued a statement that it will pay a $1.00 per share dividend on December 31, 2006 and a $.50 per share dividend on December 31, 2007. Priscilla does not want any dividend this year but does want as much dividend income as possible next year. Her required return on this stock is 12%. Ignoring taxes, what will Priscilla's homemade dividend per share be in 2007?A. $0B. $.50C. $1.50D. $1.62E. $1.68Homemade dividend = ($1.00 ⨯ 1.12) + $.50 = $1.62Difficulty level: MediumTopic: HOMEMADE DIVIDENDSType: PROBLEMS58. A firm has a market value equal to its book value. Currently, the firm has excess cash of $600 and other assets of $5,400. Equity is worth $6,000. The firm has 500 shares of stock outstanding and net income of $900. What will the new earnings per share be if the firm uses its excess cash to complete a stock repurchase?A. $1.20B. $1.50C. $1.80D. $2.00E. $2.40Price per share = $6,000 ÷ 500 = $12; Number of shares repurchased = $600 ÷ $12 = 50 shares; New EPS = $900 ÷ (500 - 50) = $2.00Difficulty level: MediumTopic: STOCK REPURCHASEType: PROBLEMS59. A firm has a market value equal to its book value. Currently, the firm has excess cash of $800 and other assets of $5,200. Equity is worth $6,000. The firm has 600 shares of stock outstanding and net income of $700. The firm has decided to spend all of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed?A. 480 sharesB. 500 sharesC. 520 sharesD. 540 sharesE. 560 sharesPrice per share = $6,000 ÷ 600 = $10; Number of shares repurchased = $800 ÷ $10 = 80; New number of shares outstanding = 600 - 80 = 520Difficulty level: MediumTopic: STOCK REPURCHASEType: PROBLEMS60. A firm has a market value equal to its book value. Currently, the firm has excess cash of $500 and other assets of $9,500. Equity is worth $10,000. The firm has 250 shares of stock outstanding and net income of $1,400. What will the stock price per share be if the firm pays out its excess cash as a cash dividend?A. $36B. $38C. $40D. $42E. $44Price per share = ($10,000 - $500) ÷ 250 = $38Difficulty level: MediumTopic: CASH DIVIDENDType: PROBLEMS61. A firm has a market value equal to its book value. Currently, the firm has excess cash of $400 and other assets of $7,600. Equity is worth $8,000. The firm has 200 shares of stock outstanding and net income of $900. The firm has decided to pay out all of its excess cash as a cash dividend. What will the earnings per share be after the dividend is paid?A. $0.25B. $0.45C. $2.50D. $3.80E. $4.50Earnings per share = $900 ÷ 200 = $4.50Difficulty level: MediumTopic: CASH DIVIDENDType: PROBLEMS62. Murphy's, Inc. has 10,000 shares of stock outstanding with a par value of $1.00 per share. The market value is $8 per share. The balance sheet shows $32,500 in the capital in excess of par account, $10,000 in the common stock account, and $42,700 in the retained earnings account. The firm just announced a 10% (small) stock dividend. What will the balance in the retained earnings account be after the dividend?A. $34,700B. $35,700C. $42,700D. $49,700E. $50,700Retained earnings = [(10,000 shares ⨯ .10) ⨯ $8 ⨯ -1] + $42,700 = $34,700Difficulty level: MediumTopic: SMALL STOCK DIVIDENDType: PROBLEMS63. Murphy's, Inc. has 10,000 shares of stock outstanding with a par value of $1.00 per share. The market value is $8 per share. The balance sheet shows $32,500 in the capital in excess of par account, $10,000 in the common stock account and $42,700 in the retained earnings account. The firm just announced a 10% (small) stock dividend. What will the market price per share be after the dividend?A. $7.20B. $7.27C. $7.33D. $8.00E. $8.80Market price per share = (10,000 shares ⨯ $8) ÷ (10,000 shares ⨯ 1.10) = $7.27; Note that the total market value of the firm does not change.Difficulty level: MediumTopic: SMALL STOCK DIVIDENDType: PROBLEMS。

罗斯公司管理系统理财题库全集