Chapter 8 Forecasting

财务报表Chapter讲诉

5.

6.

9-7

The Projection Process

Target Corporation Projected Income Statement

1. 2. 3. 4. 5.

Sales: $52,204 = $46,839 x 1.11455 Gross profit: $17,157 = $52,204 x 32.866% Cost of goods sold: $35,047 = $52,204 - $17,157 Selling, general, and administrative: $11,741 = $52,204 x 22.49% Depreciation and amortization: $1,410 = $22,272 (beginning-period PP&E gross) x 6.333% 6. Interest: $493 = $9,538 (beginning-period interest-bearing debt) x 5.173% 7. Income before tax: $3,513 = $17,157 - $11,741 - $1,410 - $493 8. Tax expense: $1,328 = $3,513 x 37.809% 9. Extraordinary and discontinued items: none 10. Net income: $2,185 = $3,513 - $1,328

Financial Statement Analysis

K R Subramanyam John J Wild

McGraw-Hill/Irwin

Copyright © 2009 by The McGraw-Hill Companies, Inc. All rights reserved.

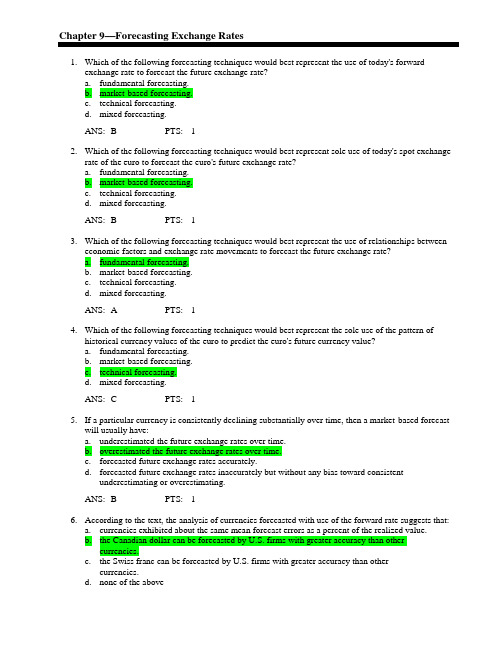

国际金融 International Finance Test Bank_09

Chapter 9—Forecasting Exchange Rates1. Which of the following forecasting techniques would best represent the use of today's forwardexchange rate to forecast the future exchange rate?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: B PTS: 12. Which of the following forecasting techniques would best represent sole use of today's spot exchangerate of the euro to forecast the euro's future exchange rate?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: B PTS: 13. Which of the following forecasting techniques would best represent the use of relationships betweeneconomic factors and exchange rate movements to forecast the future exchange rate?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: A PTS: 14. Which of the following forecasting techniques would best represent the sole use of the pattern ofhistorical currency values of the euro to predict the euro's future currency value?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: C PTS: 15. If a particular currency is consistently declining substantially over time, then a market-based forecastwill usually have:a. underestimated the future exchange rates over time.b. overestimated the future exchange rates over time.c. forecasted future exchange rates accurately.d. forecasted future exchange rates inaccurately but without any bias toward consistentunderestimating or overestimating.ANS: B PTS: 16. According to the text, the analysis of currencies forecasted with use of the forward rate suggests that:a. currencies exhibited about the same mean forecast errors as a percent of the realized value.b. the Canadian dollar can be forecasted by U.S. firms with greater accuracy than othercurrencies.c. the Swiss franc can be forecasted by U.S. firms with greater accuracy than othercurrencies.d. none of the aboveANS: B PTS: 17. Assume the following information:Predicted Value of Realized Value ofPeriod New Zealand Dollar New Zealand Dollar1 $.52 $.502 .54 .603 .44 .404 .51 .50Given this information, the mean absolute forecast error as a percentage of the realized value is about:a. 1.5%.b. 26%.c. 6%.d. 6.5%.e. none of the aboveANS: DSOLUTION: [|$.52 - $.50|/$.50 + |$.54 - $.60|/$.60 + |$.44 - $.40|/$.40 + |$.51 -$.50|/$.50)]/4= [.04 + .10 + .10 + .02]/4= .065 = 6.50%PTS: 18. If it was determined that the movement of exchange rates was not related to previous exchange ratevalues, this implies that a ____ is not valuable for speculating on expected exchange rate movements.a. technical forecast techniqueb. fundamental forecast techniquec. all of the aboved. none of the aboveANS: A PTS: 19. Which of the following is true?a. Forecast errors cannot be negative.b. Forecast errors are negative when the forecasted rate exceeds the realized rate.c. Absolute forecast errors are negative when the forecasted rate exceeds the realized rate.d. None of the above.ANS: D PTS: 110. Which of the following is true according to the text?a. Forecasts in recent years have been very accurate.b. Use of the absolute forecast error as a percent of the realized value is a good measure touse in detecting a forecast bias.c. Forecasting errors are smaller when focused on longer term periods.d. None of the above.ANS: D PTS: 111. A fundamental forecast that uses multiple values of the influential factors is an example of:a. sensitivity analysis.b. discriminant analysis.c. technical analysis.d. factor analysis.ANS: A PTS: 112. When the value from the prior period of an influential factor affects the forecast in the future period,this is an example of a(n):a. lagged input.b. instantaneous input.c. simultaneous input.d. B and CANS: A PTS: 113. Assume a forecasting model uses inflation differentials and interest rate differentials to forecast theexchange rate. Assume the regression coefficient of the interest rate differential variable is -.5, and the coefficient of the inflation differential variable is .4. Which of the following is true?a. The interest rate variable is inversely related to the exchange rate, and the inflationvariable is directly (positively) related to the interest rate variable.b. The interest rate variable is inversely related to the exchange rate, and the inflationvariable is directly related to the exchange rate.c. The interest rate variable is directly related to the exchange rate, and the inflation variableis directly related to the exchange rate.d. The interest rate variable is directly related to the exchange rate, and the inflation variableis directly related to the interest rate variable.ANS: B PTS: 114. Which of the following is not a limitation of fundamental forecasting?a. uncertain timing of impact.b. forecasts are needed for factors that have a lagged impact.c. omission of other relevant factors from the model.d. possible change in sensitivity of the forecasted variable to each factor over time.e. none of the aboveANS: B PTS: 115. Assume that interest rate parity holds. The U.S. five-year interest rate is 5% annualized, and theMexican five-year interest rate is 8% annualized. Today's spot rate of the Mexican peso is $.20. What is the approximate five-year forecast of the peso's spot rate if the five-year forward rate is used as a forecast?a. $.131.b. $.226.c. $.262.d. $.140.e. $.174.ANS: ESOLUTION: (1.05)5/(1.08)5- 1 = -13%; $.20[1 + (-13%)] = $.174PTS: 116. Assume that the forward rate is used to forecast the spot rate. The forward rate of the Canadian dollarcontains a 6% discount. Today's spot rate of the Canadian dollar is $.80. The spot rate forecasted for one year ahead is:a. $.860.b. $.848.c. $.740.d. $.752.e. none of the aboveANS: DSOLUTION: $.80 ⨯ [1 + (-6%)] = $.752PTS: 117. If today's exchange rate reflects all relevant public information about the euro's exchange rate, but notall relevant private information, then ____ would be refuted.a. weak-form efficiencyb. semistrong-form efficiencyc. strong-form efficiencyd. A and Be. B and CANS: D PTS: 118. According to the text, research generally supports ____ in foreign exchange markets.a. weak-form efficiencyb. semistrong-form efficiencyc. strong-form efficiencyd. A and Be. B and CANS: D PTS: 119. Assume that the U.S. interest rate is 11 percent, while Australia's one-year interest rate is 12 percent.Assume interest rate parity holds. If the one-year forward rate of the Australian dollar was used to forecast the future spot rate, the forecast would reflect an expectation of:a. depreciation in the Australian dollar's value over the next year.b. appreciation in the Australian dollar's value over the next year.c. no change in the Australian dollar's value over the next year.d. information on future interest rates is needed to answer this question.ANS: A PTS: 120. If the forward rate was expected to be an unbiased estimate of the future spot rate, and interest rateparity holds, then:a. covered interest arbitrage is feasible.b. the international Fisher effect (IFE) is supported.c. the international Fisher effect (IFE) is refuted.d. the average absolute error from forecasting would equal zero.ANS: B PTS: 121. Which of the following is not a forecasting technique mentioned in your text?a. accounting-based forecasting.b. technical forecasting.c. fundamental forecasting.d. market-based forecasting.ANS: A PTS: 122. The following regression model was estimated to forecast the value of the Malaysian ringgit (MYR):MYR t = a0 + a1INC t- 1 + a2INF t- 1 + μt,where MYR is the quarterly change in the ringgit, INF is the previous quarterly percentage change in the inflation differential, and INC is the previous quarterly percentage change in the income growth differential. Regression results indicate coefficients of a0 = .005; a1 = .4; and a2 = .7. The most recent quarterly percentage change in the inflation differential is -5%, while the most recent quarterlypercentage change in the income differential is 3%. Using this information, the forecast for thepercentage change in the ringgit is:a. 4.60%.b. -1.80%.c. 5.2%.d. -4.60%.e. none of the aboveANS: BSOLUTION: MYR t = .005 + (.4)(.03) + (.7)(-.05) = -1.80%PTS: 123. The following regression model was estimated to forecast the value of the Indian rupee (INR):INR t = a0 + a1INT t + a2INF t- 1 + μt,where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the U.S. and India, and INF is the inflation rate differential between the U.S. and India in the previous period. Regression results indicate coefficients of a0 = .003; a1 = -.5; and a2 = .8. Assume that INF t - 1 = 2%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:Probability Possible Outcome30% -2%40% -3%30% -4%The expected change in the Indian rupee in period t is:a. 3.40%.b. 0.40%.c. 3.10%.d. 1.70%.e. none of the aboveANS: ASOLUTION: E[INT t] = (-.02)(.3) + (-.03)(.4) + (-.04)(.3) = -3.00%INR t = .003 + (-.5)(-.03) + (.8)(.02) = 3.40%PTS: 124. Huge Corporation has just initiated a market-based forecast system using the forward rate as anestimate of the future spot rate of the Japanese yen (¥) and the Australian dollar (A$). Listed below are the forecasted and realized values for the last period:Currency Forecasted Value Realized ValueAustralian dollar $.60 $.55Japanese yen $.0067 $.0069According to this information and using the absolute forecast error as a percentage of the realized value, the forecast of the yen by Huge Corp. is ____ the forecast of the Australian dollar.a. more accurate thanb. less accurate thanc. more biased thand. the same asANS: ASOLUTION: Absolute forecast error for the Australian dollar = (|.60 - .55|)/.55 = 9.09%Absolute forecast error for the Japanese yen = (|.0067 - .0069|)/.0069 =2.90%Therefore, Huge Corp. has estimated the Japanese yen more accurately byapproximately 6.19%.PTS: 125. Gamma Corporation has incurred large losses over the last ten years due to exchange rate fluctuationsof the Egyptian pound (EGP), even though the company has used a market-based forecast based on the forward rate. Consequently, management believes its forecasts to be biased. The following regression model was estimated to determine if the forecasts over the last ten years were biased:S t = a0 + a1F t -1 + μt,where S t is the spot rate of the pound in year t and F t- 1 is the forward rate of the pound in year t -1.Regression results reveal coefficients of a0 = 0 and a1 = 1.3. Thus, Gamma has reason to believe that its past forecasts have ____ the realized spot rate.a. overestimatedb. underestimatedc. correctly estimatedd. none of the aboveANS: B PTS: 126. Which of the following is not a method of forecasting exchange rate volatility?a. using the absolute forecast error as a percentage of the realized value.b. using the volatility of historical exchange rate movements as a forecast for the future.c. using a time series of volatility patterns in previous periods.d. deriving the exchange rate's implied standard deviation from the currency option pricingmodel.ANS: A PTS: 127. If a foreign currency is expected to ____ substantially against the parent's currency, the parent mayprefer to ____ the remittance of subsidiary earnings.a. weaken; delayb. weaken; expeditec. appreciate; expedited. none of the aboveANS: B PTS: 128. If an MNC invests excess cash in a foreign county, it would like the foreign currency to ____; if anMNC issues bonds denominated in a foreign currency, it would like the foreign currency to ____.a. appreciate; depreciateb. appreciate; appreciatec. depreciate; depreciated. depreciate; appreciateANS: A PTS: 129. Severus Co. has to pay 5 million Canadian dollars for supplies it recently received from Canada.Today, the Canadian dollar has appreciated by 2 percent against the U.S. dollar. Severus hasdetermined that whenever the Canadian dollar appreciates against the U.S. dollar by more than 1percent, it experiences a reversal of 40 percent on the following day. Based on this information, the Canadian dollar is expected to ____ tomorrow, and Severus would prefer to make payment ____.a. depreciate by .8%; todayb. depreciate by .8%; tomorrowc. appreciate by .8%; todayd. appreciate by .8%; tomorrowANS: BSOLUTION: e t +1 = (2%) ⨯ (-40%) = -0.8%PTS: 130. Corporations tend to make only limited use of technical forecasting because it typically focuses on thenear future, which is not very helpful for developing corporate policies.a. Trueb. FalseANS: T PTS: 131. Sulsa Inc. uses fundamental forecasting. Using regression analysis, it has determined the followingequation for the euro:euro t = b0 + b1INF t- 1 + b2INC t- 1= .005 + .9INF t- 1 + 1.1INC t- 1The most recent quarterly percentage change in the inflation differential between the U.S. and Europe was 2 percent, while the most recent quarterly percentage change in the income growth differential between the U.S. and Europe was -1 percent. Based on this information, the forecast for the euro is a(n) ____ of ____%.a. appreciation; 3.4b. depreciation; 3.4c. appreciation; 0.7d. appreciation; 1.2ANS: DSOLUTION: euro t = .005 + .9(.02) + 1.1(-.01) = 1.2%PTS: 132. The U.S. inflation rate is expected to be 4 percent over the next year, while the European inflation rateis expected to be 3 percent. The current spot rate of the euro is $1.03. Using purchasing power parity, the expected spot rate at the end of one year is $____.a. 1.02b. 1.03c. 1.04d. none of the aboveANS: CSOLUTION:E(S t + 1) = $1.03(1.0097) = $1.04PTS: 133. If the one-year forward rate for the euro is $1.07, while the current spot rate is $1.05, the expectedpercentage change in the euro is ____%.a. 1.90b. 2.00c. -1.87d. none of the aboveANS: ASOLUTION: E(e) = 1.07/1.05 - 1 = 1.90%PTS: 134. If both interest rate parity and the international Fisher effect hold, then between the forward rate andthe spot rate, the ____ rate should provide more accurate forecasts for currencies in ____-inflation countries.a. spot; highb. spot; lowc. forward; highd. forward; lowANS: C PTS: 135. If a foreign country's interest rate is similar to the U.S. rate, the forward rate premium or discount willbe ____, meaning that the forward rate and spot rate will provide ____ forecasts.a. substantial; similarb. substantial; very differentc. close to zero; similard. close to zero; very differentANS: C PTS: 136. Factors such as economic growth, inflation, and interest rates are an integral part of ____ forecasting.a. technicalb. fundamentalc. market-basedd. none of the aboveANS: B PTS: 137. Silicon Co. has forecasted the Canadian dollar for the most recent period to be $0.73. The realizedvalue of the Canadian dollar in the most recent period was $0.80. Thus, the absolute forecast error as a percentage of the realized value was ____%.a. 9.6b. -9.6c. 8.8d. -8.8ANS: CSOLUTION:PTS: 138. The absolute forecast error of a currency is ____, on average, in periods when the currency is more____.a. lower; volatileb. higher; stablec. lower; stabled. none of the aboveANS: C PTS: 139. If the foreign exchange market is ____ efficient, then historical and current exchange rate informationis not useful for forecasting exchange rate movements.a. weak-formb. semistrong-formc. strong formd. all of the aboveANS: D PTS: 140. Foreign exchange markets are generally found to be at least ____ efficient.a. weak-formb. semistrong-formc. strong formd. none of the aboveANS: B PTS: 141. MNCs can forecast exchange rate volatility to determine the potential range surrounding theirexchange rate forecast.a. Trueb. FalseANS: T PTS: 142. If the pattern of currency values over time appears random, then technical forecasting is appropriate.a. Trueb. FalseANS: F PTS: 143. Inflation and interest rate differentials between the U.S. and foreign countries are examples ofvariables that could be used in fundamental forecasting.a. Trueb. FalseANS: T PTS: 144. A regression analysis of the Australian dollar value on the inflation differential between the U.S. andAustralia produced a coefficient of .8. Thus, for every 1% increase in the inflation differential, the Australian dollar is expected to depreciate by .8%.a. Trueb. FalseANS: F PTS: 145. The most sophisticated forecasting techniques provide consistently accurate forecasts.a. Trueb. FalseANS: F PTS: 146. If the forward rate is used as an indicator of the future spot rate, the spot rate is expected to appreciateor depreciate by the same amount as the forward premium or discount, respectively.a. Trueb. FalseANS: T PTS: 147. Research indicates that currency forecasting services almost always outperform forecasts based on theforward rate.a. Trueb. FalseANS: F PTS: 148. When measuring forecast performance of different currencies, it is often useful to adjust for theirrelative sizes. Thus, percentages, rather than nominal amounts, are often used to compute forecast errors.a. Trueb. FalseANS: T PTS: 149. The closer graphical points are to the perfect forecast line, the better is the forecast.a. Trueb. FalseANS: T PTS: 150. Foreign exchange markets appear to be strong-form efficient.a. Trueb. FalseANS: F PTS: 151. A motivation for forecasting exchange rate volatility is to obtain a range surrounding the forecast.a. Trueb. FalseANS: T PTS: 152. Two methods to assess exchange rate volatility are the volatility of historical exchange ratemovements and the exchange rate's implied standard deviation from the currency option pricingmodel.a. Trueb. FalseANS: T PTS: 153. Market-based forecasting involves the use of historical exchange rate data to predict future values.a. Trueb. FalseANS: F PTS: 154. Fundamental models examine moving averages over time and thus allow the development of aforecasting rule.a. Trueb. FalseANS: F PTS: 155. A forecasting technique based on fundamental relationships between economic variables and exchangerates, such as inflation, is referred to as technical forecasting.a. Trueb. FalseANS: F PTS: 156. Usually, fundamental forecasting is used for short-term forecasts, while technical forecasting is usedfor longer-term forecasts.a. Trueb. FalseANS: F PTS: 157. If points are scattered evenly on both sides of the perfect forecast line, then the forecast appears to bevery accurate.a. Trueb. FalseANS: F PTS: 158. If foreign exchange markets are strong-form efficient, then all relevant public and private informationis already reflected in today's exchange rates.a. Trueb. FalseANS: T PTS: 159. Exchange rates one year in advance are typically forecasted with almost perfect accuracy for the majorcurrencies, but not for currencies of smaller countries.a. Trueb. FalseANS: F PTS: 160. The potential forecast error is larger for currencies that are more volatile.a. Trueb. FalseANS: T PTS: 161. A forecast of a currency one year in advance is typically more accurate than a forecast one week inadvance since the currency reverts to equilibrium over a longer term period.a. Trueb. FalseANS: F PTS: 162. In general, any key managerial decision that is based on forecasted exchange rates should relycompletely on one forecast rather than alternative exchange rate scenarios.a. Trueb. FalseANS: F PTS: 163. Monson Co., based in the U.S., exports products to Japan denominated in yen. If the forecasted valueof the yen is substantially ____ than the forward rate, Monson Co. will likely decide ____ thepayments.a. higher; to hedgeb. lower; not to hedgec. higher; not to hedged. none of the aboveANS: C PTS: 164. When a U.S.-based MNC wants to determine whether to establish a subsidiary in a foreign country, itwill always accept that project if the foreign currency is expected to appreciate.a. Trueb. FalseANS: F PTS: 165. The following is not a limitation of technical forecasting:a. It's not suitable for long-term forecasts of exchange rates.b. It doesn't provide point estimates or a range of possible future values.c. It cannot be applied to currencies that exhibit random movements.d. It cannot be applied to currencies that exhibit a continuous trend for short-term forecast.ANS: D PTS: 166. The following regression model was estimated to forecast the percentage change in the AustralianDollar (AUD):AUD t = a0 + a1INT t + a2INF t- 1 + μt,where AUD is the quarterly change in the Australian Dollar, INT is the real interest rate differential in period t between the U.S. and Australia, and INF is the inflation rate differential between the U.S. and Australia in the previous period. Regression results indicate coefficients of a0 = .001; a1 = -.8; and a2 = .5. Assume that INF t- 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:Probability Possible Outcome20% -3%80% -4%There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.a. 4.5%; 6.1%;b. 6.1%; 4.5%c. 4.5%; 5.3%d. None of the aboveANS: CSOLUTION: Probability 20% = .001 + (-.8)(-.03) + (.5)(.04) = 4.5%Probability 80% = .001 + (-.8)(-.04) + (.5)(.04) = 5.3%PTS: 167. Purchasing power parity is used in:a. technical forecasting.b. fundamental forecasting.c. market-based accounting.d. all of the above.ANS: B PTS: 168. If speculators expect the spot rate of the yen in 60 days to be ____ than the 60-day forward rate on theyen, they will ____ the yen forward and put ____ pressure on the yen's forward rate.a. higher; buy; upwardb. higher; sell; downwardc. higher; sell; upwardd. lower; buy; upwardANS: A PTS: 169. If speculators expect the spot rate of the Canadian dollar in 30 days to be ____ than the 30-day forwardrate on Canadian dollars, they will ____ Canadian dollars forward and put ____ pressure on theCanadian dollar forward rate.a. lower; sell; upwardb. lower; sell; downwardc. higher; sell; upwardd. higher; sell; downwardANS: B PTS: 170. Assume that U.S. annual inflation equals 8%, while Japanese annual inflation equals 5%. If purchasingpower parity is used to forecast the future spot rate, the forecast would reflect an expectation of:a. appreciation of yen's value over the next year.b. depreciation of yen's value over the next year.c. no change in yen's value over the next year.d. information about interest rates is needed to answer this question.ANS: A PTS: 171. Assume that U.S. interest rates are 6%, while British interest rates are 7%. If the international Fishereffect holds and is used to determine the future spot rate, the forecast would reflect an expectation of:a. appreciation of pound's value over the next year.b. depreciation of pound's value over the next year.c. no change in pound's value over the next year.d. not enough information to answer this question.ANS: B PTS: 172. If the foreign exchange market is ____ efficient, then technical analysis is not useful in forecastingexchange rate movements.a. weak-formb. semistrong-formc. strong formd. all of the aboveANS: D PTS: 173. If today's exchange rate reflects any historical trends in Canadian dollar exchange rate movements, butnot all relevant public information, then the Canadian dollar market is:a. weak-form efficient.b. semistrong-form efficient.c. strong-form efficient.d. all of the above.ANS: A PTS: 174. Leila Corporation used the following regression model to determine if the forecasts over the last tenyears were biased:S t = a0 + a1F t- 1 + μt,where S t is the spot rate of the yen in year t and F t- 1 is the forward rate of the yen in year t -1.Regression results reveal coefficients of a0 = 0 and a1 = .30. Thus, Leila Corporation has reason to believe that its past forecasts have ____ the realized spot rate.a. overestimatedb. underestimatedc. correctly estimatedd. none of the aboveANS: A PTS: 175. Assume that U.S. interest rate for the next three years is 5%, 6%, and 7% respectively. Also assumethat Canadian interest rates for the next three years are 3%, 6%, 9%. The current Canadian spot rate is $.840. What is the approximate three-year forecast of Canadian dollar spot rate if the three-yearforward rate is used as a forecast?a. $.840b. $.890c. $.856d. $.854ANS: CSOLUTION: {[(1.05)(1.06)(1.07)]/[(1.03)(1.05)(1.08)]} ⨯ $.84 = $.856PTS: 176. Which of the following is not one of the major reasons for MNCs to forecast exchange rates?a. to decide in which foreign market to invest the excess cash.b. to decide where to borrow at the lowest cost.c. to determine whether to require the subsidiary to remit the funds or invest them locally.d. to speculate on the exchange rate movements.ANS: D PTS: 177. Sensitivity analysis allows for all of the following except:a. accountability for uncertainty.b. focus on a single point estimate of future exchange rates.c. development of a range of possible future values.d. consideration of alternative scenarios.ANS: B PTS: 178. If graphical points lie above the perfect forecast line, than the forecast overestimated the future value.a. Trueb. FalseANS: F PTS: 179. A regression model was applied to explain movements in the Canadian dollar's value over time. Thecoefficient for the inflation differential between the U.S. and Canada was -0.2. The coefficient of the interest rate differential between the U.S. and Canada produced a coefficient of 0.8. Thus, theCanadian dollar depreciates when the inflation differential ____ and the interest rate differential ____.a. increases; increasesb. decreases; increasesc. increases; decreasesd. increases; decreasesANS: C PTS: 180. If the pattern of currency values over time appears random, then technical forecasting is appropriate.a. Trueb. FalseANS: F PTS: 181. Market-based forecasting is based on fundamental relationships between economic variables andexchange rates.。

供应链管理(英文课件)Chapter8-Supply Chain Integration

• minimizing inventory, transportation, and production costs.

– Supply Chain Planning processes are applied.

costs – more emergency production changeovers

Pull-Based Supply Chains

• Production and distribution are demand driven

– Coordinated with true customer demand rather than forecast demand.

Push-Based Supply Chains

• Longer reaction time to changing marketplace:

– Inability to meet changing demand patterns. – Obsolescence of supply chain inventory as

• Advantages and disadvantages of push and pull supply chains:

– new supply chain strategy that takes the best of both. – Push–pull supply chain strategy

Impact of the Push-Pull Strategy

• Pull portion

– High uncertainty – Simple supply chain structure – Short cycle time – Focus on service level. – Achieved by deploying a flexible and

Chap2( Forecasting )2013-03-28(第5周 )

Southeast University

Dept. of Industrial Engineering

4

The Time Horizon in Forecasting The long term is measured in months or years; It is one part of the overall firm’s manufacturing strategy; Problems for long term forecasting include long term planning of capacity needs; long term sales patterns, and growth trend.

a phenomenon is some function of some variables

Objective-derived from analysis of data

Time Series Methods-forecast

of future values of some economic or physical phenomenon is derived from a collection of their past observations

Production Planning and Control

Chapter Two Forecasting

Department of Industrial Engineering Southeast University

Southeast University

Dept. of Industrial Engineering

1

Chapter Two

Forecasting

经济决策定量方法复习

5

Chapter 3: Inventory Decisions

1. The Mathematical Model

The following parameters are used to establish a mathematical model for this problem k : Fixed cost per order, A : Annual number of items demanded, c : Unit cost of procuring an item, T : Time between orders, h : Annual cost per dollar value of holding items in inventory.

26

Period time Actual Sales

2

27

3

24

4

28

5

25

6

?

4

Chapter 3: Inventory Decisions

The Economic Order Quantity (EOQ) Model The simplest inventory model involves one type of item that has a known and constant demand and that is re-supplied instantaneously. No backordering of items is allowed.

11

Deterministic Model

Model 2:The EOQ Model with Planned Shortages

Let:

S: actual order quantity Q:fictitious order quantity or order quantity

江恩期货教程-中英文

江恩期货教程Gann Master Commodities Course 江恩生平及简历江恩(1878-1955):于1878年6月6日出生于美国德克萨斯州的路芙根市(Lufkin Texas),父母是爱尔兰裔移民。

少年时代的江恩在火车上卖报纸和送电报,还贩卖明信片、食品、小饰物等。

江恩被世人所津津乐道的辉煌事亦是1909年他在25个交易里赚了10倍!这一年再婚的江恩接受当时著名的《股票行情与投资文摘》杂志访问。

在杂志编辑的监督下,江恩在25个交易日里进行286次交易,其中264次获利,其余22次亏损,胜算高达92.3%。

而资本则增值了10倍。

平均交易间隔是20分钟。

在华尔街投机生涯中,江恩大约赚取了5000万美元的利润。

在今天,相当于5亿美元以上的数量。

虽然和其他的一些投资大师相比,他的财富数量并不算什么,但是我认为最重要的是他靠自己的新发现去赚取他应得的财富。

1902年,江恩在24岁时,第一次入市买卖棉花期货。

1906年,江恩到奥克拉荷马当经纪,既为自己炒,亦管理客户。

在1908年,江恩30岁时,他移居纽约,成立了自己的经纪业务。

同年8月8日,发展了他最重要的市场趋势预测方法,名为“控制时间因素” 。

经过多次准确预测后,江恩声名大噪。

最为人瞩目的是1909年10月美国“The Ticketr and Investment Digest”杂志编辑Richard .Wyckoff的一次实地访问。

在杂志人员的监察下,江恩在十月份的二十五个市场交易日中共进行286次买卖,结果,264获利,22次损失,获利率竟达92.3%。

据江恩一位朋友基利的回述:“1909年夏季,江恩预测9月小麦期权将会见1.20美元。

可是,到9月30日芝加哥时间十二时,该期权仍然在1.08美元之下徘徊,江恩的预测眼看落空。

江恩说:…如果今日收市时不见1.20美元,将表示我整套分析方法都有错误。

不管现在是什么价,小麦一定要见1.20美元。

财务分析与证券定价(英文)chapter(4)

Link to Previous Chapter

Chapter 14 brought the focus of forecasting to the profitability of operations

and growth in net operating assets. It also

developed simple forecasting schemes based solely on information in

How is financial statement analysis utilized in forecasting ?

How are proforma

future financial statements prepared ?

How is pro forma analysis

used in strategy decisions ?

financial statements

Link to Chapter 10

Chapters 11 and 12 laid out the analysis of Financial statements that uncovers

the drivers of residual

earnings

This Chapter

Convert Forecasts to a

4

V alu ation

Trading on the Valuation

5

Outside Investor Com pare Value with Price to BUY, SELL or HOLD

Inside Investor Com pare Value with Cost to ACCEPT or REJECT Strategy

国际财务管理英文版第版马杜拉答案Chapter

Chapter 3International Financial Markets Lecture OutlineMotives for Using International Financial Markets Motives for Investing in Foreign MarketsMotives for Providing Credit in Foreign MarketsMotives for Borrowing in Foreign MarketsForeign Exchange MarketHistory of Foreign ExchangeForeign Exchange TransactionsExchange QuotationsForeignInterpretingCurrency Futures and Options MarketsInternational Money MarketOrigins and DevelopmentStandardizing Global Bank RegulationsInternational Credit MarketSyndicated LoansInternational Bond MarketEurobond MarketDevelopment of Other Bond MarketsComparing Interest Rates Among CurrenciesInternational Stock MarketsIssuance of Foreign Stock in the U.S.Issuance of Stock in Foreign MarketsComparison of International Financial MarketsHow Financial Markets Affect an MNC’s ValueChapter ThemeThis chapter identifies and discusses the various international financial markets used by MNCs. These markets facilitate day-to-day operations of MNCs, including foreign exchange transactions, investing in foreign markets, and borrowing in foreign markets.Topics to Stimulate Class Discussion1. Why do international financial markets exist?2. How do banks serve international financial markets?3. Which international financial markets are most important to a firm that consistently needsshort-term funds? What about a firm that needs long-term funds?Critical debateShould firms that go public engage in international offerings?Proposition Yes. When a firm issues shares to the public for the first time in an initial public offering (IPO), it is naturally concerned about whether it can place all of its shares at a reasonable price. It will be able to issue its shares at a higher price by attracting more investors. It will increase its demand by spreading the shares across countries. The higher the price at which it can issue shares, the lower is its cost of using equity capital. It can also establish a global name by spreading shares across countries.Opposing view No. If a firm spreads its shares across different countries at the time of the IPO, there will be less publicly traded shares in the home country. Thus, it will not have as much liquidity in the secondary market. Investors desire shares that they can easily sell in the secondary market, which means that they require that the shares have liquidity. To the extent that a firm reduces its liquidity in the home country by spreading its share across countries, it may not attract sufficient home demand for the shares. Thus, its efforts to create global name recognition may reduce its name recognition in the home country.With whom do you agree? State your reasons. Use InfoTrac or some other search engine to learn more about this issue. Which argument do you support? Offer your own opinion on this issue.ANSWER: The key is that students recognize the tradeoff involved. A firm that engages in a relatively small IPO will have limited liquidity even when all of the stock is issued in the home country. Thus, it should not consider issuing stock internationally. However, firms with larger stock offerings may be in a position to issue a portion of their shares outside the home country. They should not spread the stocks across several countries, but perhaps should target one or two countries where they conduct substantial business. They want to ensure sufficient liquidity in each of the foreign countries where they sell shares.Stock Markets are inefficientPropositionI cannot believe that if the value of the euro in terms of, say, the British pound increases three days in a row, on the fourth day there is still a 50:50 chance that it will go up or down in value. I think that most investors will see a trend and will buy, therefore the price is morelikely to go up. Also, if the forward market predicts a rise in value, on average, surely it is going to rise in value. In other words, currency prices are predictable. And finally, if it were so unpredictable and therefore unprofitable to the speculator, how is it that there is such a vast sum of money being traded every day for speculative purposes – there is no smoke without fire.The simple answer is that if that is what you believe, buy currencies that have viewOpposingincreased three days in a row and on average you should make a profit, buy currencies where the forward market shows an increase in value. The fact is that there are a lot of investors with just your sort of views. The market traders know all about such beliefs and will price the currency so that such easy profit (their loss) cannot be made. Look at past currency rates for yourself, check all fourth day changes after three days of rises, any difference is going to be not enough to cover transaction costs or trading expenses and the slight inaccuracy in your figures which are likely to be closing day mid point of the bid/ask spread. No, all currency movements are related to information and no-one knows if tomorrows news will be better or worse than expected.With whom do you agree? Could there be undiscovered patterns? Could some movements not be related to information? Could some private news be leaking out?ANSWER: Clearly there are no obvious patterns. Discussion on the impossibility of obvious patterns is worth emphasizing. However, does market inefficiency necessarily involve patterns, could market manipulation be occasional. There is worrying evidence from share price movements that there is unusual movement before announcements on many occasions, so the ideathat traders do not occasionally collude and move the price without supporting economic evidence is not an unreasonable view. Proof is however difficult as we have to separate anticipation from prior knowledge, the lucky speculator from the speculator who was in the know.Answers to End of Chapter Questions1. Motives for Investing in Foreign Money Markets. Explain why an MNC may invest fundsin a financial market outside its own country.ANSWER: The MNC may be able to earn a higher interest rate on funds invested in a financial market outside of its own country. In addition, the exchange rate of the currency involved may be expected to appreciate.2. Motives for Providing Credit in Foreign Markets. Explain why some financial institutionsprefer to provide credit in financial markets outside their own country.ANSWER: Financial institutions may believe that they can earn a higher return by providing credit in foreign financial markets if interest rate levels are higher and if the economic conditions are strong so that the risk of default on credit provided is low. The institutions may also want to diversity their credit so that they are not too exposed to the economic conditions in any single country.3. Exchange Rate Effects on Investing. Explain how the appreciation of the Australian dollaragainst the euro would affect the return to a French firm that invested in an Australian money market security.ANSWER: If the Australian dollar appreciates over the investment period, this implies that the French firm purchased the Australian dollars to make its investment at a lower exchange rate than the rate at which it will convert A$ to euros when the investment period is over.Thus, it benefits from the appreciation. Its return will be higher as a result of this appreciation.4. Exchange Rate Effects on Borrowing. Explain how the appreciation of the Japanese yenagainst the UK pound would affect the return to a UK firm that borrowed Japanese yen and used the proceeds for a UK project.ANSWER: If the Japanese yen appreciates over the borrowing period, this implies that the UK firm converted yen to pounds at a lower exchange rate than the rate at which it paid for yen at the time it would repay the loan. Thus, it is adversely affected by the appreciation. Its cost of borrowing will be higher as a result of this appreciation.5. Bank Services. List some of the important characteristics of bank foreign exchange servicesthat MNCs should consider.ANSWER: The important characteristics are (1) competitiveness of the quote, (2) the firm’s relationship with the bank, (3) speed of execution, (4) advice about current market conditions, and (5) forecasting advice.6. Bid/ask Spread. Delay Bank’s bid price for US dollars is £0.53 and its ask price is £0.55.What is the bid/ask percentage spread?ANSWER: (£0.55– £0.53)/£0.55 = .036 or 3.6%7. Bid/ask Spread. Compute the bid/ask percentage spread for Mexican peso in which the askrate is 20.6 New peso to the dollar and the bid rate is 21.5 New peso to the dollar.ANSWER: direct rates are 1/20.6 = $0.485:1 peso as the ask rate and 1/21.5 = $0.465:1 peso as the bid rate so the spread is[($0.485 – $0.465)/$0.485] = .041, or 4.1%. Note that the spread is fro the Mexiccan peso not the dollar.8. Forward Contract. The Wolfpack ltd is a UK exporter that invoices its exports to the UnitedStates in dollars. If it expects that the dollar will appreciate against the pound in the future, should it hedge its exports with a forward contract? Explain..ANSWER: The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. Yet, in this case, the Wolfpack Corporation should not hedge because it would benefit from appreciation of the dollar when it converts the dollars to pounds.9. Euro. Explain the foreign exchange situation for countries that use the euro when theyengage in international trade among themselves.ANSWER: There is no foreign exchange. Euros are used as the medium of exchange.10. Indirect Exchange Rate. If the direct exchange rate of the euro is worth £0.685, what is theindirect rate of the euro? That is, what is the value of a pound in euros?ANSWER: 1/0.685 = 1.46 euros.11. Cross Exchange Rate. Assume Poland’s currency (the zloty) is worth £0.17 and theJapanese yen is worth £0.005. What is the cross (implied) rate of the zloty with respect to yen?ANSWER: £0.17/£0.005 = 34 zloty:1 yen12. Syndicated Loans. Explain how syndicated loans are used in international markets.ANSWER: A large MNC may want to obtain a large loan that no single bank wants to accommodate by itself. Thus, a bank may create a syndicate whereby several other banks also participate in the loan.13. Loan Rates. Explain the process used by banks in the Eurocredit market to determine the rateto charge on loans.ANSWER: Banks set the loan rate based on the prevailing LIBOR, and allow the loan rate to float (change every 6 months) in accordance with changes in LIBOR.14. International Markets. What is the function of the international money market? Brieflydescribe the reasons for the development and growth of the European money market. Explain how the international money, credit, and bond markets differ from one another.ANSWER: The function of the international money market is to efficiently facilitate the flow of international funds from firms or governments with excess funds to those in need of funds.Growth of the European money market was largely due to (1) regulations in the U.S. that limited foreign lending by U.S. banks; and (2) regulated ceilings placed on interest rates of dollar deposits in the U.S. that encouraged deposits to be placed in the Eurocurrency market where ceilings were nonexistent.The international money market focuses on short-term deposits and loans, while the international credit market is used to tap medium-term loans, and the international bond market is used to obtain long-term funds (by issuing long-term bonds).15. Evolution of Floating Rates. Briefly describe the historical developments that led to floatingexchange rates as of 1973.ANSWER: Country governments had difficulty in maintaining fixed exchange rates. In 1971, the bands were widened. Yet, the difficulty of controlling exchange rates even within these wider bands continued. As of 1973, the bands were eliminated so that rates could respond to market forces without limits (although governments still did intervene periodically).16. International Diversification. Explain how the Asian crisis would have affected the returnsto a UK. firm investing in the Asian stock markets as a means of international diversification.[See the chapter appendix.]ANSWER: The returns to the UK firm would have been reduced substantially as a result of the Asian crisis because of both declines in the Asian stock markets and because of currency depreciation. For example, the Indonesian stock market declined by about 27% from June 1997 to June 1998. Furthermore, the Indonesian rupiah declined against the U.S. dollar by 84%.17.Eurocredit Loans.a.With regard to Eurocredit loans, who are the borrowers?b. Why would a bank desire to participate in syndicated Eurocredit loans?c. What is LIBOR and how is it used in the Eurocredit market?ANSWER:a. Large corporations and some government agencies commonly request Eurocredit loans.b. With a Eurocredit loan, no single bank would be totally exposed to the risk that theborrower may fail to repay the loan. The risk is spread among all lending banks within the syndicate.c. LIBOR (London interbank offer rate) is the rate of interest at which banks in Europe lendto each other. It is used as a base from which loan rates on other loans are determined in the Eurocredit market.18. Foreign Exchange. You just came back from Canada, where the Canadian dollar was worth£0.43. You still have C$200 from your trip and could exchange them for pounds at the airport, but the airport foreign exchange desk will only buy them for £0.40. Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for £0.055 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 1500 New Pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain.ANSWER: Exchange with the tourist. If you exchange the C$ for pesos at the foreign exchange desk, the C$200 is multiplied by £0.40 and then divided by £0.055 ie a ratio of £0.40/0.055 = 7.27 pesos to the C$. The total pesos would be 200 x 7.27 = 1454 pesos, a little less than is being offered by the tourist.19. Foreign Stock Markets. Explain why firms may issue stock in foreign markets. Why mightMNCs issue more stock in Europe since the conversion to a single currency in 1999?ANSWER: Firms may issue stock in foreign markets when they are concerned that their home market may be unable to absorb the entire issue. In addition, these firms may have foreign currency inflows in the foreign country that can be used to pay dividends on foreign-issued stock. They may also desire to enhance their global image. Since the euro can be used in several countries, firms may need a large amount of euros if they are expanding across Europe.20. Stock Market Integration. Bullet plc a UK firm, is planning to issue new shares on theLondon Stock Exchange this month. The only decision still to be made is the specific day on which the shares will be issued. Why do you think Bullet monitors results of the Tokyo stock market every morning?ANSWER: The UK stock market prices sometimes follow Japanese market prices. Thus, the firm would possibly be able to issue its stock at a higher price in the UK if it can use the Japanese market as an indicator of what will happen in the UK market. However, this indicator will not always be accurate.Advanced Questions21. Effects of September 11. Why do you think the terrorist attack on the U.S. was expected tocause a decline in U.S. interest rates? Given the expectations for a potential decline in U.S.interest rates and stock prices, how were capital flows between the U.S. and other countries likely affected?ANSWER: The attack was expected to cause a weaker economy, which would result in lower U.S. interest rates. Given the lower interest rates, and the weak stock prices, the amount of funds invested by foreign investors in U.S. securities would be reduced.22. International Financial Markets. Carrefour the French Supermarket chain has established retail outlets worldwide. These outlets are massive and contain products purchased locally as well as imports. As Carrefour generates earnings beyond what it needs abroad, it may remit those earnings back to France. Carrefour is likely to build additional outlets especially in China.a. Explain how the Carrefour outlets in China would use the spot market in foreign exchange.ANSWER:The Carrefour stores in China need other currencies to buy products from other countries, and must convert the Chinese currency (yuan) into the other currencies in the spot market to purchase these products. They also could use the spot market to convert excess earnings denominated in yuan into euros, which would be remitted to the French parent.b. Explain how Carrefour might utilize the international money markets when it isestablishing other Carrefour stores in Asia.ANSWER: Carrefour may need to maintain some deposits in the Eurocurrency market that can be used (when needed) to support the growth of Carrefour stores in various foreign markets. When some Carrefour stores in foreign markets need funds, they borrow from banks in the Eurocurrency market. Thus, the Eurocurrency market serves as a deposit or lending source for Carrefour and other MNCs on a short-term basis. (Eurocurrency refers to international currencies, most likely the dollar, not just the euro!)c. Explain how Carrefour could use the international bond market to finance theestablishment of new outlets in foreign markets.ANSWER: Carrefour could issue bonds in the Eurobond market to generate funds needed to establish new outlets. The bonds may be denominated in the currency that is needed; then, once the stores are established, some of the cash flows generated by those stores could be used to pay interest on the bonds.23.Interest Rates. Why do interest rates vary among countries? Why are interest rates normallysimilar for those European countries that use the euro as their currency? Offer a reason why the government interest rate of one country could be slightly higher than that of the government interest rate of another country, even though the euro is the currency used in both countries.ANSWER: Interest rates in each country are based on the supply of funds and demand for funds for a given currency. However, the supply and demand conditions for the euro are dictated by all participating countries in aggregate, and do not vary among participating countries. Yet, the government interest rate in one country that uses the euro could be slightly higher than others that use the euro if it is subject to default risk. The higher interest rate would reflect a risk premium.Blades plc Case Study。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 8 ForecastingKey TermsDemand management,200Demand management is the function of recognizing and managing all demands for products.Order processing,200The activity required to administratively process a customer’s order and make it ready for shipment or production.Trend,202General upward or downward movement of a variable over time.Seasonality,202A repetitive pattern of demand from year to year (or other repeating time interval) with some periods considerably higher than others.Random variation,202A fluctuation in data that is caused by uncertain or random occurrences.Stable,203The demand patterns which retain the same general shape are called stable.Qualitative techniques,206Qualitative techniques are projections based on judgment, intuition, and informed opinions.Extrinsic forecasting techniques, 206Extrinsic forecasting techniques are projections based on external (extrinsic) indicators which relate to the demand for a company’s products.Economic indicators, 206An index of total business activities at the regional, national, and global levels. They describe economic conditions prevailing during a given time period.Intrinsic forecasting techniques,207Intrinsic forecasting techniques use historical data to forecast.Moving average,209An arithmetic average of certain number (n) of the most recent observations. As each new observation is added, the oldest observation is dropped. The value of n ( the number of periods to use for the average) reflects responsiveness versus stability in the same way that the choice of smoothing constant does in exponential smoothing. There are two types of moving average, simple and weighted.Exponential smoothing forecast,210A type of weighted moving average forecasting technique in which past observations are geometrically discounted according to their age. The heaviest weight is assigned to the most recent data. The smoothing istermed exponential because data points are weighted in accordance with an exponential function of their age. The technique makes use of a smoothing constant to apply to the difference between the most recent forecast and the critical sales data, thus avoiding the necessity of carrying historical sales data.Seasonal index,212A number used to adjust data to seasonal demand. This index is an estimate of how much the demand during the season will be above or below the average demand for the product.Desasonalized demand,212The average demand for all periods is a value that averages out seasonality. This is called the deseasonalized demand.Forecast error,216Forecast error is the difference between actual demand and forecast demand.Bias,216Bias exists when the cumulative actual demand varies from the cumulative forecast.Mean absolute deviation (MAD),218The average of the absolute values of the deviation of observed values from some expected value. MAD can be calculated based on observations and the arithmetic mean of those observations. An alternative is to calculate absolute deviations of actual sales data minus forecast data. These data can be averaged in the usual arithmetic way or with exponential smoothing.Normal distribution,219A particular statistical distribution where most of the observations fall fairly close to one mean, and a deviation from the mean is as likely to be plus as it is to be minus. When graphed, the normal distribution takes the form of a bell-shaped curve.Tracking signal,220The ration of the cumulative algebraic sum of the deviations between the forecasts and the actual values to the mean absolute deviation. Use to signal when the validity of the forecasting model might be in doubt. Tracking signal can be sued to monitor the quality of the forecast.Production lead time,222Production lead time is the stacked lead time for a product. It includes time for purchasing of raw materials to arrive, manufacturing, assembly, delivery, and sometimes the design of the product.Demand lead time,222Demand lead time is the customer’s lead time.. It is the time from when a customer places an order until the goods are delivered.Questions1. What is demand management? What functions does it include?1) The function of recognizing all demands for goods and services to support the marketplace. It involves prioritizing demand when supply is lacking. Proper demand management facilitates the planning and use ofresources for profitable business results. 2) In marketing, the process of planning, executing, controlling, and monitoring the design, pricing, promotion, and distribution of products and services to bring about transactions that meet organizational and individual needs.2. Why must we forecast?Forecasting is inevitable in developing plans to satisfy future demand. Most firms cannot wait until orders are actually received before they start to plan what to produce. Customers usually demand delivery in reasonable time, and manufacturers must anticipate future demand for products or services and plan to provide the capacity and resources to meet the demand.3. What factors influence the demand for a firm’s products?The factors influence the demand for a firm’s products are as follows:⑴General business and economic conditions.⑵Competitive factors.⑶Market trends such as changing demand.⑷The firm’s own plans for advertising, promotion, pricing, and product changes.4. Describe the purpose of forecasting for strategic business planning, production planning, and master production scheduling.The strategic business plan is a statement of the major goals and objectives the company expects to achieve over the next two to ten years or more.Production management is concerned with the following:The quantities of each product group that must be produced in each period.The desired inventory levels.The resources of equipment, labor, and material needed in each period.The availability of the resources needed.The master production schedule (MPS) is a plan for the production of individual end items. It breaks down the production plan to show, for each period, the quantity of each end item to be made.5. The text describes three characteristics of demand. Name and describe each.The three characteristics of demand are as follows:Demand patterns –If historical data for demand are plotted against a time scale, they will show any shape of consistent patterns that exist.Stable versus dynamic – The shapes of the demand patterns for some products or services change over time whereas other do not.Dependent versus independent demand – Demand for a product or service is independent when it is not related to the demand for any other product or service. Dependent demand for a product or service occurs where the demand for the item is derived from that of a second item.6. Describe trend, seasonality, random variation, and cycle as applied to forecasting.Trend – The trend can be level, having no change from period to period, or it can rise or fall. Seasonality – Seasonality is usually thought of as occurring on a yearly basis, but it can also occur on weekly or even daily basis.Random variation – Random variation occurs where many factors affect demand during specific periods and occur on a random basis.Cycle – Over a span of several years and even decades, wavelike increases and decreases in the economy influence demand.7. The text discusses four principles of forecasting. Name and describe each.⑴Forecasts are usually wrong. Forecasts attempt to look into the unknown future and, except by sheer luck, will be wrong to some degree. Errors are inevitable and must be expected.⑵Every forecast should include an estimate of error. Every forecast should include an estimate of error often expressed as a percentage (plus and minus) of the forecast or as a range between maximum and minimum values.⑶Forecasts are more accurate for families or groups. This means that forecasts are more accurate for large groups of items than for individual items in a group.⑷Forecasts are more accurate for nearer timer periods. The near future holds less uncertainty than the far future.8. Name and describe the three principles of data collection.⑴Record data in the same terms as needed for the forecast. There are three dimensions to this:a. If the purpose is to forecast demand on production, data based on demand, not shipments, are needed.b. The forecast period, in weeks, months, or quarters, should be the same as the schedule period.c. The items forecast should be the same as those controlled by manufacturing.⑵Record the circumstances relating to the data.⑶Record the demand separately for different customer groups.9. Describe the characteristics and differences between qualitative, extrinsic, and intrinsic forecasting techniques.Qualitative techniques are projections based on judgment, intuition, and informed opinions. By their nature, they are subjective.Extrinsic forecasting techniques are projections abased on external (extrinsic) indicators which relate to the demand for a company’s products.Intrinsic forecasting techniques use historical data to forecast.10. Describe and give the advantages and disadvantages of (a) moving averages and (b) exponential smoothing.Moving averages are best used for forecasting products with stable demand where there is little trend or seasonality. Moving averages are also useful to filter out random fluctuations. One drawback to using moving averages is the need to retain several periods of history for each item to be forecast. This will require a great deal of computer storageExponential smoothing provides a routine method for regularly updating item forecasts. It works quite well when dealing with stable items. Generally, it has been found satisfactory for short-range forecasting. It is not satisfactory where the demand is low or intermittent.11. What is a seasonal index? How is it calculated?It is a number used to adjust data to seasonal demand. The formula is as follows:Seasonal index = period average demand / average demand for all periods12. What is meant by the term deseasonalized demand?The average demand for all periods is a value that averages out seasonality. This is called the deseasonalized demand. The formula can be describe as:Season index = period average demand / deseasonalized demand13. What is meant by the term tracking the forecast? In which two ways can forecasts go wrong? Tracking the forecast is the process of comparing actual demand with the forecast. The purpose of tracking the forecast is to be able to react to forecast error by planning around it or by reducing it.Bias exists when the cumulative actual demand varies from the cumulative forecast.The variability will depend upon the demand pattern of the product.14. What is bias error in forecasting? What are some of the causes?Bias exits when the cumulative actual demand varies from the cumulative forecast. This means the forecast average demand has been wrong.Bias is a systematic error in which the actual demand is consistently above or below the forecast demand.15. What is random variation?It is a fluctuation in data that is caused by uncertain or random occurrences.16. What is the mean absolute deviation (MAD) ? Why is it useful in forecasting?MAD is the average of the absolute values of the deviations of observed values from some expected value. MAD can be calculated based on observations and the arithmetic mean of those observations. An alternative is to calculate absolute deviations of actual sales data minus forecast data. This data can be averaged in the usual arithmetic way or with exponential smoothing.Total error would be useless to measure the variation. One way to measure the variability is to calculate the total error ignoring the plus and minus signs and take the average. This is called mean absolute deviation:Mean implies an average,Absolute means without reference to plus and minus,Deviation refers to the error.MAD = sum of absolute deviations / number of observations17. What action should be taken when unacceptable error is found in tracking a forecast?When an unacceptably large error or bias is observed, it should be investigated to determine its cause.18. What is the P/D ratio? How may it be improved?“P”, or production lead time, is the stacked lead time for a product. “D”, or demand lead time, is the customer’s lead time.There are five ways to improve this index:⑴Reduce P time.⑵Force a match between P and D.a. Make the customer’s D time equal to your P time.b. Sell what you forecast.⑶Simplify the product line.⑷Standardize products and processes.⑸Forecast more accurately.。