International Labor Cost 3-30-2011

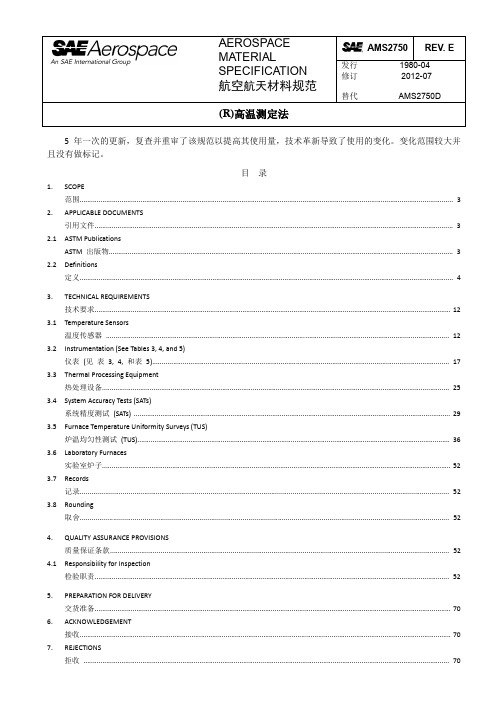

SAEAMSE高温测定法中英文对照版

FIGURE 3 INSTRUMENTATION TYPE REQUIREMENTS

图3

仪表类型要求........................................................................................................................................................................... 27

Байду номын сангаасAE

AMS 2750E 中文译版

Page: 2 / 73

8. NOTES

注释.................................................................................................................................................................................................... 70

3.7 Records 记录............................................................................................................................................................................................. 52

AEROSPACE MATERIAL SPECIFICATION 航空航天材料规范

(R)高温测定法

AMS2750 REV. E

2024年3月《认证通用基础》真题

2024年3月《认证通用基础》试题1.WTO/TBT协议规定了各成员国合格评定的原则的目的是为了()。

A.减少合格评定活动对贸易的负面影响B.增加各成员国的贸易壁垒C.提高合格评定活动的约束性D.提升合格评定活动对贸易的影响参考答案:A【考题解析】参考《合格评定》P9为减少合格评定活动对贸易的负面影响,WTO/TBT协议规定了各成员国合格评定的原则。

2.认证是有关产品、过程、管理体系、人员的()。

A.第一方声明B.第二方声明C.第三方声明D.公共性评价和检查参考答案:C【考题解析】《合格评定》P37认证是有关产品,过程、体系和人员的第三方证明。

3.合格评定活动中对选取和确定活动及其结果的适宜性、充分性和有效性进行的验证是()。

A.证明B.检验C.验收D.复核参考答案:D【考题解析】参看《合格评定》P21复核(review);针对合格评定对象满足规定要求的情况,对选取和确定活动及其结果的适宜性、充分性和有效性进行的验证。

4.在现场审核时应尽量减少审核活动与受审核方工作的()。

A.交流B. 互动C.相互干扰D.时间重要参考答案:C【考题解析】参看审核概论P85其缺点是:一个过程往往涉及多个部门,审核过程中会出现一个部门重复往返接受审核的情况,效率较低。

在部门较多的情况下,受审核方的各部门会全程等候,对受审核方的正常工作过程干扰较大。

5.GB/T27021.1,IDTISO/IEC17021—1《合格评定管理体系审核机构要求第1部分:要求》规定:"应对整个认证周期制订审核方案,以清晰地识别所需要的审核活动,使客户的管理体系符合认证所依据标准或其他规范B. 监督C. 确定D.复核与证明参考答案:A【考题解析】参看《合格评定基础》P81:选取阶段是要确定采用何种要求和方法,选取何种信息来实施对合格评定的对象的评价,怎样从申请中确定评价的范围和对象等。

包括选取方案、选取评价方法和要素、选取体系的要求数量、抽样方案要求、选取评价的对象等。

对外经贸大学翻译硕士考研真题及答案解析

育明教育孙老师整理,来育明教育赠送资料,更多真题可咨询孙老师。

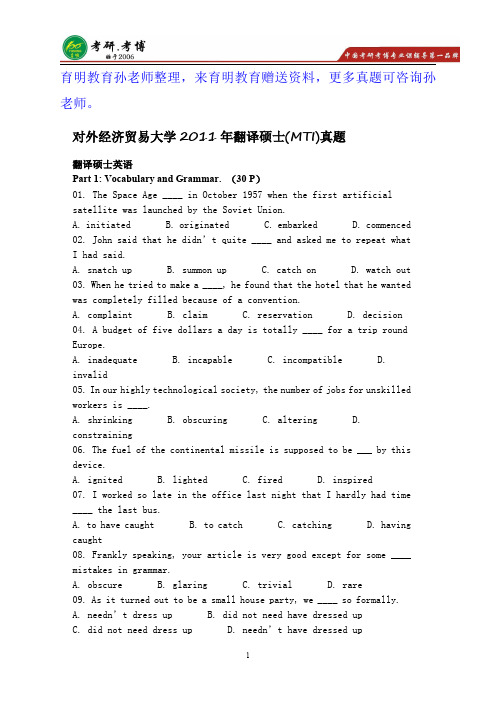

对外经济贸易大学2011年翻译硕士(MTI)真题翻译硕士英语Part1:Vocabulary and Grammar.(30P)01.The Space Age____in October1957when the first artificialsatellite was launched by the Soviet Union.A.initiatedB.originatedC.embarkedmenced02.John said that he didn’t quite____and asked me to repeat whatI had said.A.snatch upB.summon upC.catch onD.watch out03.When he tried to make a____,he found that the hotel that he wantedwas completely filled because of a convention.plaintB.claimC.reservationD.decision04.A budget of five dollars a day is totally____for a trip roundEurope.A.inadequateB.incapableC.incompatibleD.invalid05.In our highly technological society,the number of jobs for unskilledworkers is____.A.shrinkingB.obscuringC.alteringD.constraining06.The fuel of the continental missile is supposed to be___by thisdevice.A.ignitedB.lightedC.firedD.inspired07.I worked so late in the office last night that I hardly had time____the last bus.A.to have caughtB.to catchC.catchingD.havingcaught08.Frankly speaking,your article is very good except for some____mistakes in grammar.A.obscureB.glaringC.trivialD.rare09.As it turned out to be a small house party,we____so formally.A.needn’t dress upB.did not need have dressed upC.did not need dress upD.needn’t have dressed up10.Certain species disappeared or became____as new forms arose that were better adapted to the Earth’s changing environment.A.feebleB.extinctC.massiveD.extinguished11.I apologize if I____you,but I assure you it was unintentional.A.offendB.had offendedC.should have offendedD. might have offended12.Franklin D.Roosevelt argued that the depression stemmed from the American economy’s____flaws.A.underliningB.vulnerableC.vulgarD. underlying13.Although a teenager,Fred could resist____what to do and what not to do.A.to be toldB.having been toldC.being toldD.to have been told14.I am afraid that you have to alter your____views in light of the tragic news that has just arrived.A.indifferentB.distressingC.optimisticD. pessimistic15.Greater efforts to increase agricultural production must be made if food shortage____avoided.A.is to beB.can beC.will beD.has been16.Stop shouting!I can’t hear the football____.A.judgmentB.interpretationmentaryD. explanation17.Doing your homework is a sure way to improve your test scores,and this is especially true____it comes to classroom tests.A.beforeB.asC.sinceD.when18.Every member of society has to make a____to struggle for the freedom of the country.A.pledgeB.warrantyC.resolveD.guarantee19.David tends to feel useless and unwanted in a society that gives so much____to those who compete well.A.prestigeB.regimeC.superiorityD.legislation20.The terrorists might have planted a bomb on a plane in Athens,set to____when itarrived in New York.A.go offB.get offe offD.carry off21.The younger person’s attraction to stereos cannot be explained only____familiarity with technology.A.in quest ofB.by means ofC.in terms ofD.by virtue of22.By signing the lease we made a___to pay a rent of$150a week.A.conceptionmissionmitmentD. confinementPart2:Identify Stylistic Problems.(18P)01.By the time Julia Roberts was23,she had won two academy award nominations,she had also become the world’s most popular female actress.A.run onma spliceC.correctD.fragment02.Since then,Roberts has appeared in fourteen films.Most recently,“My Best Friend’s Wedding”and“The Conspiracy Theory.”A.fragmentB.choppyC.correctma splice03.She didn’t plan to become an actress.She wanted to be six feet tall.She wanted to be a veterinarian.She wanted to be happy and make others happy.A.fragmentma spliceC.choppyD.correct04.Although Julia Roberts has had much professional success.In spite of her trouble with several failed relationships.A.fragmentB.choppyma spliceD.correct05.Julia Roberts lives in Manhattan,not far from the apartment she once shared with her sister in Greenwich Village.A.fragmentma spliceC.correctD.run on06.She came to New York when she was seventeen.Because her older sister lived there and she was influenced by her sister.A.fragmentB.run onC.choppyma splice07.Roberts was raised in Georgia.Her parents ran a theater school there. Her sister and brother are also actors.The family was always short of money.A.fragmentB.choppyC.correctD.run on08.When Julia was four years old,her parents divorced.After eighteen years of marriage.A.fragmentB.run onC.choppyD.correctPart3:Reading Comprehension(30P)Passage AMany United States companies have,unfortunately,made the search for legal protection from import competition into a major line of work.Since 1980the United States International Trade Commission(ITC)has received about280complaints alleging damage from imports that benefit from subsidies by foreign governments.Another340charge that foreign companies“dumped”their products in the United States at“less than fair value.”Even when no unfair practices are alleged,the simple claim that an industry has been injured by imports is sufficient grounds to seek relief.Contrary to the general impression,this quest for import relief has hurt more companies than it has helped.As corporations begin to function globally,they develop an intricate web of marketing,production,and research relationships.The complexity of these relationships makes it unlikely that a system of import relief laws will meet the strategic needs of all the units under the same parent company. Internationalization increases the danger that foreign companies will use import relief laws against the very companies the laws were designed to protect.Suppose a United States-owned company establishes an overseas plant to manufacture a product while its competitor makes the same product in the United States.If the competitor can prove injury from the imports—and that the United States Company received a subsidy from a foreign government to build its plant abroad—the United States Company’s products will be uncompetitive in the United States,since they would be subject to duties.Perhaps the most brazen case occurred when the ITC investigated allegations that Canadian companies were injuring the United States salt industry by dumping rock salt,used to device roads.The bizarre aspect of the complaint was that a foreign conglomerate with United States operations was crying for help against a United States company with foreign operations.The“United States”company claiming injury was a subsidiary of a Dutch conglomerate,while the“Canadian”companies included a subsidiary of a Chicago firm that was the second-largest domestic producer of rock salt.01.The passage is chiefly concerned with______.A.arguing against the increased internationalization of United States corporationsB.warning that the application of laws affecting trade frequently has unintended consequencesC.demonstrating that foreign-based firms receive more subsidies from their governments than United States firms receive from the United States governmentD.advocating the use of trade restrictions for“dumped”products but not for other imports02.It can be inferred from the passage that the minimal basis for a complaint to the International Trade Commission is which of the following?A.A foreign competitor has received a subsidy from a foreign government.B.A foreign competitor has substantially increased the volume of products shipped to the United States.C.A foreign competitor is selling products in the United States at less than fair market value.D.The company requesting import relief has been injured by the sale of imports in the United States.03.The last paragraph performs which of the following functions in the passage?A.It summarizes the discussion thus far and suggests additional areas of research.B.It presents a recommendation based on the evidence presented earlier.C.It cites a specific ease that illustrates a problem presented more generally in the previous paragraph.D.It introduces an additional area of concern not mentioned earlier.04.The passage warns of which of the following dangers?panies in the United States may receive no protection from imports unless they actively seek protection from import competition.panies that seek legal protection from import competition may incur legal costs that far exceed any possible gain.panies that are United States owned but operate internationally may not be eligible for protection from import competition under the laws of the countries in which their plants operate.panies that are not United States owned may seek legal protection from import competition under United States import relief laws.05.According to the passage,the International Trade Commission isinvolved in which of the following?A.Investigating allegations of unfair import competitionB.Granting subsidies to eompanies in the United States that have been injured by import competitionC.Recommending legislation to ensure fair tradeD.Identifying international corporations that wish to build plants in the United StatesPassage BSince the late1970s,in the face Of a severe loss of market share in dozens of industries,manufacturers in the United States have been trying to improve productivity—and therefore enhance their international competitiveness—through cost-cutting programs.(Cost-cutting here is defined as raising labor output while holding the amount of labor constant.)However,from1978through1982,productivity—the value of goods manufactured divided by the amount of labor input—did not improve;and while the results were better in the business upturn of the three years following,they ran25percent lower than productivity improvements during earlier,post-1945upturns.At the same time,it became clear that the harder manufactures worked to implement cost-cutting,the more they lost their competitive edge.With this paradox in mind,I recently visited25companies;it became clear to me that the cost-cutting approach to increasing productivity is fundamentally flawed.Manufacturing regularly observes a“40,40, 20”rule.Roughly4o percent of any manufacturing-based competitive advantage derives from long-term changes in manufacturing structure (decisions about the number,size,location,and capacity of facilities)and in approaches to materials.Another40percent comes from major changes in equipment and process technology.The final20percent rests on implementing conventional cost-cutting.This rule does not imply that cost-cutting should not be tried.The well-known tools of this approach—including simplifying jobs and retraining employees to work smarter,not harder—do produce results.But the tools quickly reach the limits of what they can contribute.Another problem is that the cost-cutting approach hinders innovation and discourages creative people.As Abernathy’s study of automobile manufacturers has shown,an industry can easily become prisoner of itsown investments in cost-cutting techniques,reducing its ability to develop new products.And managers under pressure to maximizecost-cutting will resist innovation because they know that more fundamental changes in processes or systems will wreak havoc with the results on which they are measured.Production managers have always seen their job as one of minimizing costs and maximizing output.This dimension of performance has until recently sufficed as a basis of evaluation,but it has created a penny-pinching,mechanistic culture in most factories that has kept away creative managers.Every company I know that has freed itself from the paradox has done so,in part,by developing and implementing a manufacturing strategy. Such a strategy focuses on the manufacturing structure and on equipment and process technology.In one company a manufacturing strategy that allowed different areas of the factory to specialize in different markets replaced the conventional cost-cutting approach; within three years the company regained its competitive advantage. Together with such strategies,successful companies are also encouraging managers to focus on a wider set of objectives besides cutting costs.There is hope for manufacturing,but it clearly rests on a different way of managing.01The author of the passage is primarily concerned with______.A.summarizing a thesisB.recommending a different approachparing points of viewD.making a series of predictions02It can be inferred from the passage that the manufacturers mentioned in paragraph1expected that the measures they implemented would______.A.encourage innovationB.keep labor output constantC.increase their competitive advantageD.permit business upturns to be more easily predicted03.The primary function of the first paragraph of the passage is to ______.A.present a historical context for the author’s observationsB.anticipate challenges to the prescriptions that followC.clarify some disputed definitions of economic termsD.summarize a number of long-accepted explanations04.The author refers to Ahernathy’s study most probably in order to ______.A.qualify an observation about one rule governing manufacturingB.address possible objections to a recommendation about improving manufacturing competitivenessC.support an earlier assertion about method of increasing productivityD.suggest the centrality in the Unit States economy of a particular manufacturing industry05.The author’s attitude toward the culture in most factories is best described as______.A.cautiousB.criticalC.disinterestedD. respectfulPassage CIt can be argued that much consumer dissatisfaction with marketing strategies arises from an inability to aim advertising at only the likely buyers of a given product.There are threegroups of consumers who are affected by the marketing process.First, there is the market segment—people who need the commodity in question. Second,there is the program target—people in the market segment with the“best fit”characteristics for a specific product.Lots of people—may need trousers,but only a few qualify as likely buyers of very expensive designer trousers.Finally,there is the program audience—all people who are actually exposedto the marketing program without regard to whether they need or want the product.These three groups are rarely identical.An exception occurs in cases where customers for a particular industrial product may be few and easily identifiable.Such customers,allsharing a particular need,are likely to form a meaningful target,for example,all companies with a particular application of the product in question,such as high-speed fillers ofbottles at breweries.In such circumstances,direct selling(marketing that reaches only the program target)is likely to be economically justified,and highly specialized trade media existto expose members of the program target—and only members of the program target—to the marketing program.Most consumer-goods markets are significantly different.Typically, there are many rather than few potential customers.Each represents a relatively small percentage of potential sales.Rarely do members of a particular market segment group themselves neatly into a meaningful program target.There are substantial differences among consumers with similar demographic characteristics.Even with all the past decade’s advances in information technology, direct selling of consumer goods is rare,and mass marketing—-a marketing approach that aims at a wide audience-remains the only economically feasible mode.Unfortunately,there are few media that allow the marketer to direct a marketing program exclusively to the program target.Inevitably,people get exposed to a great deal of marketing for products in which they have no interest and so they become annoyed.01.The passage suggests which of the following about highly specialized trade media?A.They should be used only when direct selling is not economically feasible.B.They can be used to exclude from the program audience people who are not part of the program target.C.They are used only for very expensive products.D.They are rarely used in the implementation of marketing programs for industrial products.02.The passage suggests which of the following about direct selling?A.It is used in the marketing of most industrial products.B.It is often used in cases where there is a large program target.C.It is not economically feasible for most marketing programs.D.It is used only for products for which there are many potential customers.03.The author mentions“trousers”in paragraph1most likely in order to______.A.make a comparison between the program target and the program audienceB.emphasize the similarities between the market segment and the program targetC.provide an example of the way three groups of consumers are affected by a marketing programD.clarify the distinction between the market segment and the program target04.“the product in question”in Line5,Paragraph2means______.A.“the product in the previous question”B.“the product under discussion”C.“the product on sale”D.“the product in doubt”05.It can be inferred from the passage that which of the following is true for most consumer-goods markets?A.The program target and the program audience are not usually identical.B.The program audience and the market segment are usually identical.C.The market segment and the program target are usually identical.D.The program target is larger than the market segment.Cloze TestMost economists in the United States seem captivated by the spell of the free market.__16__.A price that is determined by the seller or, for that matter,established by anyone other than the aggregate of consumers seems pernicious.__17__.In fact,price-fixing is normal in all industrialized societies because the industrial system itself provides,as an effortless consequence of its own development,the price-fixing that it requires.Modern industrial planning requires and rewards great size.Hence,a comparatively small number of large firms will be competing for the same group of consumers.That each large firm will act with consideration of its own needs and thus avoid selling its products for more than its competitors charge is commonly recognized by advocates of free-market economic theories.__18__.Each large firm will thus avoid significant price-cutting,because price-cutting would be prejudicial to the common interest in a stable demand for products. Most economists do not see price-fixing when it occurs because they expect it to be brought about by a number of explicit agreements among large firms;it is not.Moreover,those economists who argue that allowing the free market to operate without interference is the most efficient method of establishing prices have not considered the economies of non-socialist countries other than the United states.These economies employ intentional price-fixing,usually in an overt fashion.Formalprice-fixing by cartel and informal price-fixing by agreements coveringthe members of an industry are common-place.__19__,the countries thathave avoided the first and used the second would have suffereddrastically in their economic development.There is no indication thatthey have.Socialist industry also works within a framework of controlled prices.In the early1970’s,the Soviet Union began to give firms and industriessome of the flexibility in adjusting prices that a more informalevolution has accorded the capitalist system.__20__;rather,Sovietfirms have been given the power to fix prices.A.But each large firm will also act with full consideration of the needsthat it has in common with the other large firms competing for the samecustomersB.Consequently,nothing seems good or normal that does not accord withthe requirements of the free marketC.Economists in the United States have hailed the change as a returnto the free market.But Soviet firms are no more subject to pricesestablished by a free market over which they exercise little influencethan are capitalist firmsD.Accordingly,it requires a major act of will to think of price-fixing(the determination of prices by the seller)as both“normal”andhaving a valuable economic functionE.Were there something peculiarly efficient about the free market andinefficient about price-fixing-o.Part4:Writing.(30P)Write an English essay of250-300words describing Maslow’s hierarchyof human needs and analyze this model with ONE example.Your writingwill be assessed for language,format,structure and content.育明教育考研专业课第一品牌,考研信息可咨询育明教育官网政治【学科概述】不用因为政治纷繁复杂的知识点而担心政治会不过线,只要肯下功夫,60分是很容易达到的。

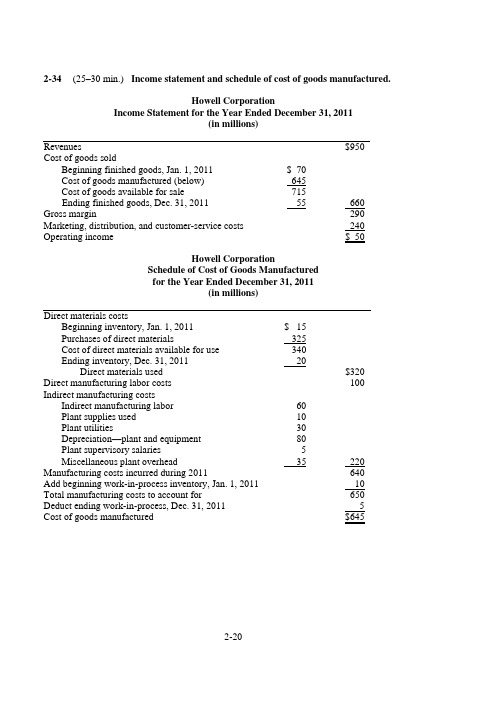

Answers to exercise 2-modified

2-34 (25–30 min.) Income statement and schedule of cost of goods manufactured.Howell CorporationIncome Statement for the Year Ended December 31, 2011(in millions)Revenues $950 Cost of goods soldBeginning finished goods, Jan. 1, 2011 $ 70Cost of goods manufactured (below) 645Cost of goods available for sale 715660 Ending finished goods, Dec. 31, 2011 55 Gross margin 290 Marketing, distribution, and customer-service costs 240 Operating income $ 50Howell CorporationSchedule of Cost of Goods Manufacturedfor the Year Ended December 31, 2011(in millions)Direct materials costsBeginning inventory, Jan. 1, 2011 $ 15Purchases of direct materials 325Cost of direct materials available for use 340Ending inventory, Dec. 31, 2011 20used $320 DirectmaterialsDirect manufacturing labor costs 100 Indirect manufacturing costslabor 60manufacturingIndirectused 10Plantsuppliesutilities 30PlantDepreciation––plant and equipment 80salaries 5Plantsupervisory220 Miscellaneous plant overhead 35 Manufacturing costs incurred during 2011 640Add beginning work-in-process inventory, Jan. 1, 2011 10 Total manufacturing costs to account for 650 Deduct ending work-in-process, Dec. 31, 2011 5Cost of goods manufactured $6452-35 (15–20 min.) Interpretation of statements (continuation of 2-32).1. The schedule in 2-34 can become a Schedule of Cost of Goods Manufactured and Sold simply by including the beginning and ending finished goods inventory figures in the supporting schedule, rather than directly in the body of the income statement. Note that the term cost of goods manufactured refers to the cost of goods brought to completion (finished) during the accounting period, whether they were started before or during the current accounting period. Some of the manufacturing costs incurred are held back as costs of the ending work in process; similarly, the costs of the beginning work in process inventory become a part of the cost of goods manufactured for 2011.2. The sales manager’s salary would be charged as a marketing cost as incurred by both manufacturing and merchandising companies. It is basically an operating cost that appears below the gross margin line on an income statement. In contrast, an assembler’s wages would be assigned to the products worked on. Thus, the wages cost would be charged to Work-in-Process and would not be expensed until the product is transferred through Finished Goods Inventory to Cost of Goods Sold as the product is sold.3. The direct-indirect distinction can be resolved only with respect to a particular cost object. For example, in defense contracting, the cost object may be defined as a contract. Then, a plant supervisor working only on that contract will have his or her salary charged directly and wholly to that single contract.4. Direct materials used = $320,000,000 ÷ 1,000,000 units = $320 per unitDepreciation on plant equipment = $80,000,000 ÷ 1,000,000 units = $80 per unit5. Direct materials unit cost would be unchanged at $320 per unit. Depreciation cost per unit would be $80,000,000 ÷ 1,200,000 = $66.67 per unit. Total direct materials costs would rise by 20% to $384,000,000 ($320 per unit × 1,200,000 units), whereas total depreciation would be unaffected at $80,000,000.6. Unit costs are averages, and they must be interpreted with caution. The $320 direct materials unit cost is valid for predicting total costs because direct materials is a variable cost; total direct materials costs indeed change as output levels change. However, fixed costs like depreciation must be interpreted quite differently from variable costs. A common error in cost analysis is to regard all unit costs as one—as if all the total costs to which they are related are variable costs. Changes in output levels (the denominator) will affect total variable costs, but not total fixed costs. Graphs of the two costs may clarify this point; it is safer to think in terms of total costs rather than in terms of unit costs.2.b. Customers needed to earn net income of $107,100:Total revenues÷ Sales check per customer $1,020,000 ÷ $8.50 = 120,000 customers3. Using the shortcut approach:Change in net income = ()Change in Unit number of contribution 1Tax rate customers margin ⎛⎞⎛⎞⎜⎟⎜⎟××−⎜⎟⎜⎟⎝⎠⎝⎠= (170,000 – 120,000) × $5.10 × (1 – 0.30)= $255,000 × 0.7 = $178,500New net income = $178,500 + $107,100 = $285,600Alternatively, with 170,000 customers,Operating income = Number of customers × Selling price per customer– Number of customers × Variable cost per customer – Fixed costs= 170,000× $8.50 – 170,000 × $3.40 – $459,000 = $408,000 Net income = Operating income× (1 – Tax rate) = $408,000 × 0.70 = $285,600The alternative approach is:Revenues, 170,000 × $8.50 $1,445,000Variable costs at 40% 578,000Contribution margin 867,000Fixed costs 459,000Operating income 408,000Income tax at 30% 122,400Net income $ 285,6003-23 (30 min.) CVP analysis, sensitivity analysis.1. SP = $30.00 × (1 – 0.30 margin to bookstore)= $30.00 × 0.70 = $21.00VCU = $ 4.00 variable production and marketing cost3.15 variable author royalty cost (0.15 × $21.00)$ 7.15CMU = $21.00 – $7.15 = $13.85 per copyFC = $ 500,000 fixed production and marketing cost3,000,000 up-front payment to Washington$3,500,0003-31 (20 min.) Contribution margin, gross margin and margin of safety.1.Mirabella CosmeticsOperating Income Statement, June 2011Units sold 10,000Revenues $100,000 Variable costsVariable manufacturing costs $ 55,000Variable marketing costs 5,000Total variable costs 60,000Contribution margin 40,000Fixed costsFixed manufacturing costs $ 20,000Fixed marketing & administration costs 10,000Total fixed costs 30,000Operating income $ 10,0002. Contribution margin per unit = $40,000$4 per unit 10,000 units= Breakeven quantity = Fixed costs $30,0007,500 units Contribution margin per unit $4 per unit== Selling price = Revenues $100,000$10 per unit Units sold 10,000 units== Breakeven revenues = 7,500 units × $10 per unit = $75,000Alternatively,Contribution margin percentage = Contribution margin $40,00040%Revenues $100,000== Breakeven revenues = Fixed costs $30,000$75,000Contribution margin percentage 0.40==3. Margin of safety (in units) = Units sold – Breakeven quantity= 10,000 units – 7,500 units = 2,500 units4. Units sold 8,000Revenues (Units sold × Selling price = 8,000 × $10)$80,000 Contribution margin (Revenues ×CM percentage = $80,000 ×40%)$32,000 Fixed costs 30,000Operating income 2,000Taxes (30% × $2,000) 600 Net income $ 1,4007-30 (30 min.) Flexible budget, direct materials and direct manufacturing laborvariances.1. Variance Analysis for Tuscany Statuary for 2011Actual Results (1) Flexible Budget Variances (2) = (1) – (3) Flexible Budget (3) SalesVolume Variances (4) = (3) – (5) StaticBudget (5) Units sold 5,500a 0 5,500 500 U 6,000aDirect materials $ 668,800 $ 8,800 U $ 660,000 b $ 60,000 F $ 720,000cDirect manufacturing labor 952,750a 9,750 F 962,500d 87,500 F 1,050,000eFixed costs 1,180,000a 20,000 F 1,200,000a 0 1,200,000aTotal costs $2,801,550 $20,950 F $2,822,500 $147,500 F $2,970,000a Givenb$120/unit × 5,500 units = $660,000 c $120/unit × 6,000 units = $720,000 d $175/unit × 5,500 units = $962,500 e $175/unit × 6,000 units = $1,050,0002.Actual Incurred(Actual InputQuantity × Actual Price) Actual Input Quantity × Budgeted Price Flexible Budget(Budgeted Input Quantity Allowed for Actual Output ×Budgeted Price) Direct materials a b cDirect manufacturing labor $952,750d$925,000e $962,500f a 70,400 pounds × $9.5/pound = $668,800 b 70,400 pounds × $10/pound = $704,000 c 5,500 statues × 12 pounds/statue × $10/pound = 66,000 pounds × $10/pound = $660,000 d 18,500 hours × $51.50/hour = $952,750 e 18,500 hours × $50/hour = $925,000 f 5,500 statues × 3.5 hours/statue × $50/hour = 19,250 hours × $50/hour = $962,5007-34(35 min.) Material cost variances, use of variances for performance evaluation1.Materials VariancesActual Costs Incurred(Actual InputQuantity× Actual Price) Actual Input Quantity× Budgeted PriceFlexible Budget(Budgeted Input QuantityAllowed for Actual Output× Budgeted Price)Direct Materials (8,400 × $19a)$159,600Purchases Usage(8,400 × $22) (7,900 × $22)$184,800 $173,800(800 × 8 × $22)(6,400 × $22)$140,800a $159,600 ÷8,400 = $192.The favorable price variance is due to the $3 difference ($22 – $19) between the standardprice based on the previous suppliers and the actual price paid through the on-linemarketplace. The unfavorable efficiency variance could be due to several factorsincluding inexperienced workers and machine malfunctions. But the likely cause here isthat the lower-priced titanium was lower quality or less refined, which led to more waste.The labor efficiency variance could be affected if the lower quality titanium caused theworkers to use more time.3.Switching suppliers was not a good idea. The $25,200 savings in the cost of titanium wasoutweighed by the $33,000 extra material usage. In addition, the $33,000U efficiencyvariance does not recognize the total impact of the lower quality titanium because, of the 8,400 pounds purchased, only 7,900 pounds were used. If the quantity of materials usedin production is relatively the same, Better Bikes could expect the remaining 500 lbs toproduce approximately 50 more units. At standard, 50 more units should take 50 × 8 =400 lbs. There could be an additional unfavorable efficiency variance of(500× $22) (50 × 8 × $22)$11,000 $8,8004.The purchasing manager’s performance evaluation should not be based solely on theprice variance. The short-run reduction in purchase costs was more than offset by higher usage rates. His evaluation should be based on the total costs of the company as a whole.In addition, the production manager’s performance evaluation should not be based solely on the efficiency variances. In this case, the production manager was not responsible for the purchase of the lower-quality titanium, which led to the unfavorable efficiency scores.In general, it is important for Stanley to understand that not all favorable material pricevariances are “good news,” because of the negative effects that can arise in the production process from the purchase of inferior inputs. They can lead to unfavorable efficiency variances for both materials and labor. Stanley should also that understandefficiency variances may arise for many different reasons and she needs to know these reasons before evaluating performance.5.Variances should be used to help Better Bikes understand what led to the current set offinancial results, as well as how to perform better in the future. They are a way tofacilitate the continuous improvement efforts of the company. Rather than focusing solely on the price of titanium, Scott can balance price and quality in future purchase decisions.6.Future problems can arise in the supply chain. Scott may need to go back to the previoussuppliers. But Better Bikes’ relationship with them may have been damaged and they may now be selling all their available titanium to other manufacturers. Lower quality bicycles could also affect Better Bikes’ reputation with the distributors, the bike shops and customers, leading to higher warranty claims and customer dissatisfaction, anddecreased sales in the future.7-35 (30 min.) Direct manufacturing labor and direct materials variances, missing data.1.Actual CostsIncurred(Actual InputQuantity× Actual Price) Actual Input Quantity × Budgeted Price Flexible Budget (Budgeted Input Quantity Allowed for Actual Output × Budgeted Price) Direct mfg. labor $739,900a $735,000b $742,500ca Given (or 49,000 hours × $15.10/hour)b49,000 hours × $15/hour = $735,000 c 5,500 units × 9 hours/unit × $15/hour = $742,5002. Unfavorable direct materials efficiency variance of $1,500 indicates that fewer pounds of direct materials were actually used than the budgeted quantity allowed for actual output.= $1,500 efficiency variance $3 per pound budgeted price= 500 poundsBudgeted pounds allowed for the output achieved = 5,500 × 30 = 165,000 poundsActual pounds of direct materials used = 165,000 − 500 = 164,500 pounds3. Actual price paid per pound = 579,500/190,000= $3.05 per pound4. Actual Costs Incurred Actual Input ×(Actual Input × Actual Price) Budgeted Price a baGiven b 190,000 pounds × $3/pound = $570,0008-32 (30 min.) 4-variance analysis, find the unknowns. Known figures denoted by an *Case A:Actual Costs IncurredActual InputQuantity× Budgeted RateFlexible Budget:Budgeted InputQuantity Allowedfor Actual Output× Budgeted RateAllocated:Budgeted InputQuantity Allowedfor Actual Output× Budgeted RateVariableManufacturingOverhead $120,000* (6,230 × $20)$124,600(6,200* × $20)$124,000*(6,200* × $20)$124,000*FixedManufacturingOverhead $84,920*(Lump sum)$88,200*(Lump sum)$88,200*(6,200* × $14a)$86,800*Total budgeted manufacturing overhead = $124,000 + $88,200 = $212,200 Case B:Actual Costs IncurredActual InputQuantity× Budgeted RateFlexible Budget:Budgeted InputQuantityAllowed forActual Output× Budgeted RateAllocated:Budgeted InputQuantityAllowed forActual Output× Budgeted RateVariableManufacturingOverhead $45,640 (1,141 × $42.00*)$47,922(1,200 × $42.00*)$50,400b(1,200 × $42.00*)$50,400variance8-348-35 FixedManufacturing Overhead $23,180* (Lump sum) $20,000* (Lump sum) $20,000* $24,000cTotal budgeted manufacturing overhead = $50,400 + $20,000 = $70,400aBudgeted FMOH rate = Standard fixed manufacturing overhead allocated ÷ Standard machine-hours allowed for actual output achieved = $86,800 ÷ 6,200 = $14 b Budgeted hours allowed for actual output achieved must be derived from the output level variance before this figure can be derived, or, since the fixed manufacturing overhead rate is $20,000 ÷ 1,000 = $20, and the allocated amount is $24,000, the budgeted hours allowed for the actual output achieved must be 1,200 ($24,000 ÷ $20). c 1,200 × ($20,000* ÷ 1,000*) = $24,000variance。

Lecture 3 - Multinational Corporations

classifications; ▪ Critically appraise the extent to which MNCs promote a

convergence of HRM strategies;

▪ ‘Acting locally-thinking globally’

▪ Multidirectional communication and mobility of managers and staff

P 1

Perlmutter’s typology

Regiocentricity

▪ Midway between ethnocentricity and Geocentricity (Harzing 2015)

2nd PHASE- (Growth and internationalization) Concentrates in developing and penetrating markets (home/abroad)

Adler and Ghadar’s model (1990) Phases of internationalization

▪ The complexity of the international business play an important role on implementing strategies which could affect the performance and success of the MNCs.

Domestic- focus on home market and export

2011年美国分行业增加值数据

2011年美国分行业增加值数据2011年美国分行业增加值数据美国商务部经济分析局2012年4月26日发布了2011年分行业增加值的初步数据。

数据显示,2011年,美国第一产业增加值1778亿美元,第二产业增加值28957亿美元,其中工业增加值23754亿美元,第三产业增加值120205亿美元。

三次产业比重为1.2:19.2:79.6,其中工业比重为15.7%。

2011年,美国农林渔猎增加值1778亿美元,占GDP的比重为1.2%,按可比价格计算,同比下降12.4%,对GDP实际增长的贡献率为-7.5%。

2011年,美国采矿业增加值2876亿美元,占GDP的比重为1.9%,按可比价格计算,同比增长6.3%,对GDP实际增长的贡献率为6.5%。

2011年,美国公用事业增加值2508亿美元,占GDP的比重为1.7%,按可比价格计算,同比下降6.2%,对GDP实际增长的贡献率为-5.6%。

2011年,美国建筑业增加值5203亿美元,占GDP的比重为3.4%,按可比价格计算,同比下降0.3%,对GDP实际增长的贡献率为-0.6%。

2011年,美国制造业增加值18370亿美元,占GDP的比重为12.2%,按可比价格计算,同比增长4.3%,对GDP实际增长的贡献率为30.2%。

2011年,美国批发贸易业增加值8449亿美元,占GDP的比重为5.6%,按可比价格计算,同比增长3.3%,对GDP实际增长的贡献率为10.3%。

2011年,美国零售业增加值9170亿美元,占GDP的比重为6.1%,按可比价格计算,同比增长2.0%,对GDP实际增长的贡献率为7.5%。

2011年,美国运输仓储业增加值4188亿美元,占GDP的比重为2.8%,按可比价格计算,同比增长0.3%,对GDP实际增长的贡献率为0.4%。

2011年,美国信息产业增加值6623亿美元,占GDP的比重为4.4%,按可比价格计算,同比增长5.1%,对GDP实际增长的贡献率为14.5%。

安装架空缆车的

設計、製造及 安裝架空纜車的 實務守則設計、製造及安裝架空纜車的實務守則香港㈵別行政區政府 機電工程署㆓零零㆓年版目錄頁數1. 前言 12. ㊜用範圍 13. 其他法例規定 24. ㆒般設計 35. 興建條件 36. 距離 47. 拯救 58. 路線照明裝置 69. 航空 710. 危險範圍 711. 路線跨越其他設施 712. 路線導軌 813. ㈲關強風和㆞震的考慮因素 814. 塔架滑輪荷載 815. 塔架㆖纜索的偏轉 916. 纜索的校準 917. 滑輪凸緣 918. 導軌纜纜鞍的溝 1019. 導纜裝置和接纜裝置 1020. 塔架㆖的保護裝置 1021. ㈲關驅動和制動的規定 1022. 纜索 1223. 纜索的㆒般規定 1424. 纜索的㈵別規定 1425. 尺寸 1626. 絞接和纜索的接駁方法 1627. 纜索的測試及核證 1728. 更換纜索 1829. ㈲關滑輪儲存鼓及捲纜軸尺寸的建議 1830. 纜索拉緊力調節系統 2031. 通訊 2132. 車站 2233. 控制及安全電路 2334. 塔架 2435. ㈲關車廂的考慮因素 2536. 車廂與纜索的連接 2737. 避雷裝置、接㆞和風速顯示器 2938. 須提交的㈾料 2939. 更改規定 30附錄I 術語及定義 31 附錄II 參數的定義 33 附錄III 參考㈾料 341. 前言(1)本實務守則由香港㈵別行政區機電工程署署長(以㆘簡稱「署長」)根據《架空纜車(安全)條例》(㆘稱「該條例」)第5條制訂。

本實務守則旨在就架空纜車的設計、製造和安裝的基本方面提供建議。

(2)在編㊢本實務守則的過程㆗,參考了若干個國家㈲關架空纜車的標準,本實務守則從世界各㆞廣泛參考經驗,㈵別㊟重各國現㈲的規例、建議和實務守則,並加以研究、採納和修訂,以㊜合本港的情況。

(3)㈲關電力工程須符合㆘列技術規格及要求:(a)機電工程署發出的《電力(線路)規例工作守則》的最新版本。

安徽省对外贸易中的国际劳工标准问题研究

安徽省对外贸易中的国际劳工标准问题研究作者:陈江来源:《中外企业家·下半月》 2011年第11期江(安徽经济管理学院,安徽合肥 230051)摘要:国际劳工标准与国际贸易挂钩已成为必然的趋势,在对外贸易迅速发展的安徽省,由于自身的贸易特点决定其对外贸易将受到国际劳工标准的影响,省内的外贸企业应该转变观念,认识国际劳工标准的重要性,找出积极应对的策略。

关键词:国际劳工标准;国际贸易;安徽省中图分类号:F712文献标识码:A文章编号:1000-8772(2011)22-0255-02一、国际劳工标准与企业社会责任认证贸易自由化是国际贸易发展的趋势,符合世界各国的根本利益,有利于全人类的共同发展。

但是在现实的国际贸易中,一些发达国家凭借较高的技术实力和经济发展水平,以保护人类生存环境和健康为由,通过制定高于国际标准的标准,构筑起更为隐蔽的国际贸易壁垒。

这种以保护劳工权益和企业社会责任的贸易保护主义行为被称为蓝色贸易壁垒,也称为劳工标准贸易壁垒。

劳工标准贸易壁垒的核心内容是SA8000 ( Social Accountability8000) ,SA8000 标准是全球第一个针对企业社会责任的认证标准,其宗旨是“赋予市场经济以人道主义”,即确保供应商所供应的产品符合社会责任标准的要求,保护人类基本权益。

其内容包括:不应使用或支持使用童工;不得使用或支持使用强迫性劳动;应为员工提供安全健康的工作环境;组织工会的自由与集体谈判的权利;不得因种族、社会阶层、国籍、宗教、残疾、性别、性取向、工会会员或政治归属等理由而对员工有歧视行为;不得从事或支持体罚、精神或肉体胁迫以及语言侮辱以及对工作时间、工资和管理等九方面规定。

SA8000标准已经得到了欧美等发达国家的肯定和支持,长期以来,我国一直将蓝色条款问题的关注焦点投向多边贸易体制,而对民间的蓝色条款没有引起足够的重视。

SA8000标准于1997年已经推出,但是在2003年才引起国内媒体和学术界的关注。

(论文)深圳市公园管理模式研究

分类号:单位代码:10389密级:学号:**********福建农林大学专业硕士学位论文深圳市公园管理模式研究专业类别:管理学专业领域:研究方向:公共管理理论与实务研究生:黄伟立指导教师:郑庆昌教授完成时间:二O一三年四月独创性声明本人声明,所呈交的学位(毕业)论文,是本人在指导教师的指导下独立完成的研究成果,并且是自己撰写的。

尽我所知,除了文中作了标注和致谢中已作了答谢的地方外,论文中不包含其他人发表或撰写过的研究成果。

与我一同对本研究做出贡献的同志,都在论文中作了明确的说明并表示了谢意,如被查有侵犯他人知识产权的行为,由本人承担应有的责任。

学位(毕业)论文作者亲笔签名:日期:论文使用授权的说明本人完全了解福建农林大学有关保留、使用学位(毕业)论文的规定,即学校有权送交论文的复印件,允许论文被查阅和借阅;学校可以公布论文的全部或部分内容,可以采用影印、缩印或其他复制手段保存论文。

保密,在年后解密可适用本授权书。

□不保密,本论文属于不保密。

□学位(毕业)论文作者亲笔签名:日期:指导教师亲笔签名:日期:目录中文摘要 (I)ABSTRACT .............................................. 错误!未定义书签。

1.导言 (1)1.1研究背景 (1)1.2研究的目的和意义 (2)1.3研究思路及研究方法 (2)1.3.1 研究思路 (2)1.3.2 研究方法 (3)1.3.3 技术路线图 (4)1.4研究创新与不足 (4)2.主要理论依据 (5)2.1C管理模式 (6)2.2人性假设理论 (7)2.3权责利均衡理论 (8)3.深圳市公园管理现状与存在的问题 (9)3.1深圳市公园管理现状 (9)3.2深圳市公园管理存在的问题及分析 (14)4.国内外公园管理经验借鉴 (15)4.1北京市公园管理中心 (15)4.2香港的公园管理 (16)4.3新加坡花园城市 (17)5.深圳市公园新管理模式的管理理念 (18)5.1“人形”管理结构为基础 (18)5.2“以人为本”的运营原则 (19)5.3“道法自然”的管理思想 (20)6.“人型”管理结构 (21)6.1整合公园资源,建立专业决策团队 (21)6.2打造专业的组织结构 (22)6.3精简并优化基层服务 (23)7.深圳市公园管理新模式的管理工具 (24)7.1“以人为本”的网格人力资源管理 (25)7.2业务纵向一体化管理 (29)7.3财务横向管理 (30)8.深圳市公园管理新模式的绩效考核体系 (31)8.1公园管理的组织使命、组织目标、顾客需求 (31)8.2绩效考核设计方法 (32)8.3绩效考核的时间维度与空间维度 (34)8.4公园绩效考核实施 (34)9.深圳市公园管理新模式总结 (35)参考文献 (37)致谢 (40)中文摘要深圳市作为我国改革开放的排头兵,在城市生态建设、城市园林管理等方面一直非常重视。

CH3-2进出口商品价格与核算

–选择货币时要考虑汇率风险。

–在出口业务中,争取使用 “硬币”或称 “强币”。而在进口业务中,则应争取多使 用 “软币”或称“弱币”。

2024/9/22

11

货币名称

英镑

美元

港元

人民币

欧元

2024/9/22

日元

货币符号 £

US $ HK $

2024/9/22

32

盈亏额=收入 - 成本费用

出口外汇收入 出口人民币总成本 (FOB净价) (含税成本-退税+国内费用)

出口盈(亏)额 =(FOB×外汇买入价)-出口总成本 盈亏额>0 盈利 盈亏额<0 亏损

2024/9/22

33

盈亏额 A: 30万元 B: 50万元

投入成本 A: 100万元 B: 500万元

30

2.运费核实。 3.保险费核实。 4.佣金核实。 5.利润核实。

2024/9/22

31

6.盈亏核实 盈亏核实旳指标主要有下列几种: ☆ 换汇成本:P150 • 换汇成本=出口总成本(人民币)/出口

销售外汇净收入(美元) 出口总成本=含税成本-退税+国内费用 出口销售外汇净收入=FOB净价 换汇成本>银行外汇牌价 亏损; 换汇成本<银行外汇牌价 盈利

=-639.41元

出口盈亏率=出口盈亏额/出口总成本

=-639.41/8250

用字母表达

(2)“CIF香港每打24.00美元,折扣2%”,

即

“USD 24.00 Per Dozen CIF R2HongKong”

其中“R”为折扣“Rebate”旳缩写,

新版职业健康安全管理体系

新版职业健康安全管理体系目录前言 (I)引言 (III)1 范围 (1)2 规范性引用文件 (1)3 术语和定义 (1)4 职业健康安全管理体系要求 (4)4.1 总要求 (4)4.1.1 职业健康安全管理体系 (4)4.1.2 初始评审 (4)4.1.3 职业健康安全管理体系的范围 (5)4.2 职业健康安全方针 (5)4.3 策划 (6)4.3.1 危险源辨识、风险评价和控制措施的确定 (6)4.3.1.1 概述 (7)4.3.1.2 开发用于危险源辨识和风险评价的方法和程序 (7)4.3.1.3 危险源辨识 (8)4.3.1.4 风险评价 (9)4.3.1.4.1 概述 (9)4.3.1.4.2 风险评价的输入 (10)4.3.1.4.3 风险评价的方法 (10)4.3.1.4.4 风险评价需考虑的其他方面 (11)4.3.1.5 变更管理 (11)4.3.1.6 确定控制措施的需求 (11)4.3.1.7 记录结果并将结果形成文件 (12)4.3.1.8 持续评审 (12)4.3.2 法律法规和其他要求 (13)4.3.3 目标和方案 (14)4.3.3.1 建立目标 (14)4.3.3.2 方案 (15)4.4 实施和运行 (16)4.4.1 资源、作用、职责、责任和权限 (16)4.4.2 能力、培训和意识 (17)4.4.2.1 概述 (17)4.4.2.2 能力 (18)4.4.2.3 培训 (18)4.4.2.4 意识 (18)4.4.3 沟通、参与和协商 (19)4.4.3.1 概述 (19)4.4.3.2 沟通 (19)4.4.3.2.1 内部和外部沟通的程序 (19)4.4.3.2.2 内部沟通 (20)4.4.3.2.3 与承包方和其他访问者的沟通 (20)4.4.3.2.4 与外部相关方的沟通 (21)4.4.3.3 工作人员参与的程序 (21)4.4.3.4 与承包方和外部相关方的协商程序 (21)4.4.4 文件 (21)4.4.5 文件控制 (22)4.4.6 运行控制 (23)4.4.6.1 概述 (23)4.4.6.2 建立和实施运行控制措施 (24)4.4.6.3 规定运行准则 (25)4.4.6.4 保持运行控制措施 (26)4.4.7 应急准备和响应 (26)4.4.7.1 概述 (26)4.4.7.2 潜在紧急情况的识别 (26)4.4.7.3 应急响应程序的建立与实施 (27)4.4.7.4 应急响应设备 (28)4.4.7.5 应急响应培训 (28)4.4.7.6 应急程序的定期测试 (28)4.4.7.7 评审和修订应急程序 (28)4.5 检查 (29)4.5.1 绩效测量和监视 (29)4.5.1.1 概述 (29)4.5.1.2 监视和测量设备 (30)4.5.2 合规性评价 (31)4.5.3事件调查、不符合、纠正措施和预防措施 (31)4.5.3.1 事件调查 (31)4.5.3.2 不符合、纠正措施和预防措施 (32)4.5.4 记录控制 (33)4.5.5 内部审核 (34)4.5.5.1 概述 (34)4.5.5.2 建立审核方案 (34)4.5.5.3 内部审核活动 (35)4.5.5.4 启动审核 (35)4.5.5.5 审核员的选择 (35)4.5.5.6 文件评审和审核准备 (35)4.5.5.7 实施审核 (36)4.5.5.8 准备审核报告并进行沟通 (36)4.5.5.9 完成审核并开展审核后续活动 (37)4.6 管理评审 (37)附录A:GB/T 28001-2011、GB/T 24001-2004和GB/T 19001-2008之间的对应关系 (39)附录B:GB/T 28000系列标准与ILO-OSH:2001之间的对应关系 (41)附录C:在危险源辨识检查表中包含项目的示例 (44)附录D:风险评价工具和方法的示例比较 (45)前言GB/T 28000《职业健康安全管理体系》系列国家标准体系结构如下:--职业健康安全管理体系要求(GB/T 28001);--职业健康安全管理体系实施指南(GB/T 28002)。

三一海外国际服务人员薪酬绩效管理制度(审核版)

1 目的发挥薪酬体系的杠杆与调节功能,建立公平、公正、合理的激励机制,调动国际服务人员的积极性。

2 范围适用于长驻国外和临时(服务时长2个月以内)从事产品服务的服务工程师、安装工程师、配件工程师及服务经理、服务主任等服务管理者。

3 具体管理办法薪酬由职等工资、业绩工资、海外工作津贴构成。

安装工程师薪酬=职等工资×月度绩效系数+海外工作津贴×国外天数/当月考勤天数服务工程师及配件工程师薪酬=(职等工资+业绩工资)×月度绩效系数+海外工作津贴×国外天数/当月考勤天数服务管理者薪酬=(职等工资+业绩工资)×月度绩效系数+海外工作津贴×国外天数/当月考勤天数3.1职等工资3.1.1服务工程师、安装工程师、配件工程师分别按照《国际服务工程师技能认证办法》、《技术工人技能认证办法》、《国际配件工程师技能等级评定管理办法》确定技能等级,并根据技能等级确定职等工资,职等工资标准如表1所示。

3.1.2服务经理、服务主任等服务管理者依据行政级别及技能等级确定最终职等工资,职等工资标准如表2所示。

3.2 业绩工资服务工程师及服务管理者业绩工资=(保底业绩工资×国外天数/当月考勤天数+)×调整系数。

配件工程师业绩工资=保底业绩工资×国外天数/当月考勤天数+仓库绩效工资3.2.1保底业绩工资为1000元/月。

3.2.2订单工资是根据订单数量及订单费用标准确定,计算方法见附件1;仓库绩效工资由月库存周转率和仓库帐实相符率决定,计算方法见附件2。

3.2.3调整系数是对因服务工程师服务、服务主任及服务经理管辖国家或区域内设备量不同而造成业绩工资差异的调整,调整系数标准见附表3。

3.2.4服务工程师及服务管理者业绩工资封顶上限为5000元/月;配件工程师封顶上限为3000元/月。

3.3海外工作津贴海外工作津贴反映所在国家安全级别、疾病及艰苦水平。

就业质量内涵及测量-新增文献

创作编号:BG7531400019813488897SX创作者:别如克*就业质量内涵及测量:基于国际对比的研究田永坡满子会**[摘要] 近年来提出的就业质量这一概念不断被丰富完善,本文借助已有的研究文献,对就业质量的相关概念进行界定并讨论,从国际对比的角度分析就业质量评价指标体系及相关学者对美国、加拿大、欧盟等国家和地区的测量结果。

在总结各国就业质量特点的基础上,针对我国实际情况提出未来就业质量测度的发展方向。

[关键词] 就业质量国际对比实证结果一、就业质量的概念就业质量是对劳动者在就业过程中就业状况优劣程度、各方面满意程度进行的一个多维度衡量,自20世纪90年代以来,一些学者和组织陆续提出了与就业质量相关的概念。

1999年,国际劳工组织(International Labour Organization简称ILO)在第87届国际劳工会议上第一次提出了“体面劳动(Decent Work)”的概念,给出了就业质量的一个初始性定义,认为体面工作是“促进男女在自由、公平、安全和具备人格尊严的条件下获得体面的、生产性的、可持续工作机会。

”①这一概念涵盖了就业数量和就业质量两方面的内容,但从狭义上来说,主要反映的是就业质量的状况,因此被作为就业质量的定义广泛引**作者田永坡系中国人事科学研究院副研究员;满子会系中国政法大学硕士研究生。

①ILO. “Decent work, Report of the Direct General”. International Labor Conference. 87th Session, Geneva, 1999. /public/english/standards/relm/ilc/ilc87/rep-i.htm用。

欧盟将工作质量(Quality of work)的提升作为社会政策议程的“指导原则”,提出工作质量是一个包含工作特点和广泛劳动市场在内的多维度概念,所谓工作质量即良好的工作,不仅意味着关注和考虑有薪就业的存在,而且关注有薪就业的特点。

国际劳工标准对我国商品出口的影响

题目:国际劳工标准对我国商品出口的影响及对策专业国际贸易届别 2 0 1 1届学号0990********姓名李威指导老师刘宇(讲师)湖北澳新教育专修学院教务处印制2010年11月摘要在经济全球化的浪潮下,国际社会日益重视和关注国际劳工标准。

中国作为世界上最大的发展中国家,必须面对和正视国内的劳工现状,并逐步改善国内的劳工条件,提高国内的劳工待遇。

劳工标准是否应该与国际贸易挂钩、是否应该纳入WT0的多边贸易体制之中?这个问题在发达国家和发展中国家之间的争议由来已久,而且观点各异。

从未来发展趋势来看,在西方发达国家的积极推动下,将劳工标准国际贸易与挂钩已经是大势所趋,而且有着一定的现实和制度基础。

本文以国际劳工标准的内涵与性质及中国劳工现状着手分析了国际劳工标准对中国出口的影响,着力阐述了面对国际劳工标准SA8000我国应采取的对策,具有很强理论和现实意义。

关键词:国际劳工标准 WTO SA8000ABSTRACTIn the tide of economic globalization,international tabor standards are becoming the attention of the international community and attention.As the world's largest developing country,China must face and face domestic tabor situation, and gradually improve the domestic Labour conditions, to raise domestic tabor treatment. Tabor standard whether it should and international trade hook, whether it should be included in WT0 multilateral trade system of? This problem in developed countries and developing countries, but also has the dispute between the different views. From the future developing trend, in the western developed countries under the stimulus of, will Labour standards and international trade link is the trend of The Times, but also has certain practical basis and system basis.In this paper, the content of international labor standards and the nature and status of Chinese workers begin analysis of the international labor standards on China's exports, focus on the face of international labor standards described SA8000 measures to be taken in China, with strong theoretical and practical significance.Key words:International tabor standards WTO SA8000目录摘要 (I)ABSTRACT (II)目录 (III)引言 (1)1 国际劳工标准的内涵与性质 (2)1.1 国际劳工标准与蓝色贸易制度 (2)1.2 国际劳工标准的功能与性质 (3)2 中国劳工现状与国际劳工标准的联系 (5)2.1 中国劳工现状 (5)2.2 我国劳工使用中存在的问题 (5)3 国际劳工标准对中国出口的影响 (7)3.1 短期影响 (7)3.2 长期影响 (8)4 中国面对劳工标准全球化趋势的对策建议 (10)4.1 我国应该重视将劳工标准与贸易挂钩的趋势 (10)4.2 加强广泛的国际合作与交流 (10)4.3 加快批准国际劳工组织公约的步伐 (11)4.4 加强劳工权益的保障,提高劳工标准 (11)4.5 面对SA8000标准我国的对策 (11)结语 (14)参考文献 (15)后记 (16)引言国际贸易是商品经济在全球范围发展的必然产物,贸易秩序的健康有序发展赖于相应的贸易体制的管制。

题外

题外:关于SA8000国际劳工标准与我国劳动法的衔接国际劳工标准对各国劳动立法具有很重要的影响。

加入WTO后,我国进入了世界经济贸易的舞台,国际劳工标准将会对我国的立法、社会政策的制定、经济和贸易产生越来越大的影响。

例如,在WTO谈判中,社会条款是否写入国际贸易协议一直是个悬而未决的问题,在这种情况下,许多跨国公司通过制定行业守则来推行国际劳工标准,最为典型的是SA8000企业社会责任标准(社会道德责任标准)。

SA8000的实质是发达国家将国际劳工标准与国际贸易挂钩的产物,其几乎涵盖了所有核心的国际劳工标准,一些跨国公司将SA8000与订单联系起来,不符合标准的则取消订单,这对我国的出国加工企业有很大的影响。

作为外贸出口大国,我国对此问题应当予以足够的重视,并主动应对。

同时,在劳动立法中,注意与国际劳工标准相衔接,对于与我国已批准的国际劳工标准存在差距的方面,应当结合我国的实际情况, 通过修改法律逐步予以完善ISO标准是指由『国际标准化组织(International Organization for Standardization, ISO) 』制订的标准。

美国SA8000标准社会道德责任标准Social Accountability 8000或简称SA8000。

自1997年问世以来,受到了公众极大的关注,在美欧工商界引起了强烈反响。

专家们认为,SA8000是ISO9000、ISO14000之后出现的又一个重要的国际性标准,并迟早会转化为ISO标准;通过SA8000认证将成为国际市场竞争中的又一重要武器。

有远见的组织家应未雨绸缪,及早检查本组织是否履行了公认的社会责任,在组织运行过程中是否有违背社会公德的行为,是否切实保障了职工的正当权益,以把握先机,迎接新一轮的世界性的挑战。

组织年度报告和公司宣传册中关于道德责任的陈述逐年增多,这一现象表明,管理与社会责任相结合的需求日益增大。

尽管许多组织在运营中并无不道德行为,但却无从评判。

出口美国纺织服装法规

纺织服装标示 纺织服装燃烧性能要求 儿童服装机械安全性能要求 消费品安全改进法案

为了保护消费者的合法利益,建立合法公平的商业环境, 美国对大众消费产品纺织品服装、羊毛产品和毛皮产品的标 签进行了立法规定,相关的法律包括: 纺织品纤维成分鉴别法案(Textile Products Identification Act—Textile Act) 羊毛产品标签法案(Wool Products Labeling Act—Wool Act) 毛皮产品标签法案(Fur Products Labeling Act—Fur Act )

(g)特种动物毛,棉纤维等的标注。 (h)纤维的商标(Fiber trademarks ):当使用纤维 的商品名时,另外要增加纤维的学名,如“80% Cotton, 20% Lycra® Spandex”。如果用学名,又有纤维的商品 名,可以先列学名,后列商品名,如“80% Cotton,20% Spandex,Made in the USA,Lycra® Spandex, Lycra® for Fit”。 (i)未知纤维:如果不能确定产品由什么纤维做成,如 全部或部分来自于废料、下脚料等,可以指出。如“100% unknown fibers—rags”,“100% miscellaneous pieces of undetermined fiber content”,“45% Rayon, 30% Acetate,25% Unknown fiber content”等。

美国国内的制造商应在产品销售前加贴护理说明,进口商 必须确保进口的相关商品在美国销售之前加贴护理说明, 但在商品进入美国时不一定加贴。 1. 适用范围 该法规适用于纺织服装及面料的制造商和进口商,包括

管理或控制相关产品制造或进口的组织和个人。要求纺织 服装及面料的制造商和进口商在销售中,应按照规定使用 护理标签,以及提供规范的维护说明;并且要求在护理标 签中标注洗涤、漂白、干燥、熨烫方式以及要求的警示语 句。

duiAAA名词解释

一、名词解释二、二、填空题:(每空11、纳税人的国籍是识别国际税收涉及的课税主体的标志2、国家税收的出现是国际税收产生的前提。

3、两个国家同时实行同一种税收管辖权就不会发展对同一跨国纳税人的国际双重征税4、跨国纳税人对居住国(国籍国)承担有限纳税义务。

5、经合发组织范本》侧重于地域管辖权的优先地位,较有利于发展中国家的利益。

三、计算题:1、假设A国一公司通过其设在B国的常设机构销售给B国一批计算机,取得跨国营业所得50又通过B国某独立贸易公司销售游戏机,取得跨国营业所得18万元,适用税率为30%,按照引力原则该公司应纳所得税多少元?2、假设外国某总公司在本国当年应税所得为4000万元,它设在中国的分公司当年应税所得为2000万元,已按33%的税率缴纳了所得税660万元,若其居住国规定的所得税税率为超额累进税率,年所得不超过5000万元的为30%,,5000至5500万元的为40%,超过5500万元的为50%,请计算:(1)在全额免税法下该公司应纳本国公司所得税多少?(2)在累进免税法下该公司应纳本国公司所得税多少?(4)全额免税方法下该公司共缴纳所得税多少?(5)累进免税方法下该公司共缴纳所得税多少?(本题10分)3、假设一台资机构在中国的总公司当年应税所得为5000万元,所得税税率33%,设在某国的分公司当年应税所得2000万元,如果该国所得税税率为30%,享受税额减半的优惠,则计算:(1)已缴当地政府所得税税额多少?(2)抵免限额为多少?(3)居住国允许直接抵免的已缴非居住国的所得税税额多少?(4)居住国政府在税收饶让直接抵免下应征所得税税额多少?(本题10分1、应纳所得税额=(50十18)30%2、(1)全额免税法下该公司应纳本国公司所得税=4000X30%=1200累进免说法下该公司应纳本国公司所得税==(5000×30%+500*40%+500*50%)4000/60000=1306。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

For release 10:00 a.m. (EST) Tuesday, March 8, 2011 Technical Information: (202) 691-5654 • ilchelp@ • /ilc Media Contact: (202) 691-5902 • PressOffice@USDL-11-0303INTERNATIONAL COMPARISONS OF HOURLY COMPENSATION COSTS IN MANUFACTURING, 2009Manufacturing hourly compensation costs in the United States in 2009 were lower than in 12 European countries and Australia, but higher than in 20 other countries covered by the Bureau of Labor Statistics (see chart 1). U.S. hourly compensation costs rose about 4 percent from the previous year to $33.53. The 8 countries with the highest costs in Europe were 30-60 percent higher than the U.S. level, but costs in Canada and Japan were about 10 percent lower than the United States (see table 1).Chart 1. Hourly compensation costs in manufacturing, U.S. dollars, 2009Norway Denmark Belgium Austria Germany Switzerland Finland Netherlands France Sweden Ireland Italy Australia United States United States United Kingdom Japan Canada 0 20 53.89 49.56 49.40 48.04 46.52 44.29 43.77 43.50 40.08 39.87 39.02 34.97 34.62 33.53 30.78 30.36 29.60 40 60 Spain Greece Israel Singapore New Zealand Korea, Republic of Portugal Slovakia Czech Republic Argentina Estonia Hungary Brazil Taiwan Poland Mexico Philippines 0 27.74 19.23 18.39 17.50 17.44 14.20 11.95 11.24 11.21 10.14 9.83 8.62 8.32 7.76 7.50 5.38 1.50 20 40 60-2-Changes in a country’s compensation costs in U.S. dollars are roughly equivalent to the change in compensation costs in a country’s national currency plus the change in the value of the country’s currency relative to the U.S. dollar. This relationship is illustrated in chart 2, where the bars in the right panel for each country can be summed to equal the bars in the left panel. In 2009, modest increases or declines in hourly compensation costs in national currency combined with depreciations in national currency relative to the U.S. dollar produced declines in U.S. dollar-denominated hourly compensation costs for 27 out of 33 foreign countries.Chart 2. Annual percent change in hourly compensation costs in manufacturing and exchange rates, 2008-2009Pct. change in hourly compensation (U.S. dollars) Pct. change in hourly compensation (National currency) Pct. change in value of foreign currency relative to U.S. dollarJapan United States United Slovakia Argentina Switzerland Austria Spain Ireland Denmark Greece Brazil Finland Italy Portugal Netherlands Belgium Philippines Germany Estonia France Israel Australia Singapore Norway Czech Republic New Zealand Canada Sweden Taiwan Hungary Mexico Korea, Republic of United Kingdom Poland -25 -15 -5 0 5 15 25 -25 -15 -5 0 5 15 25Japan United States States Slovakia Argentina Switzerland Austria Spain Ireland Denmark Greece Brazil Finland Italy Portugal Netherlands Belgium Philippines Germany Estonia France Israel Australia Singapore Norway Czech Republic New Zealand Canada Sweden Taiwan Hungary Mexico Korea, Republic of United Kingdom Poland-3-China and IndiaBLS has developed estimates of hourly compensation costs for employees in the Chinese and Indian manufacturing sectors. 1, 2 Due to various data gaps and methodological issues, compensation costs for China and India are not directly comparable to each other or with the data for other countries found in this release, and therefore are presented separately. 3 For China, BLS approximates average hourly compensation costs in manufacturing by filling important data gaps for hours worked per year and for benefit components of labor compensation. Further, the concepts and coverage of Chinese statistics on manufacturing employment and wages often do not follow international standards and can be difficult to understand. Largely because of these data gaps and challenges, BLS estimates for China cannot be considered as robust as the manufacturing statistics for the other countries in this news release. 4 For India, BLS estimates of compensation costs refer to organized (or formal) manufacturing only, rather than to total manufacturing in the country. Unorganized sector manufacturing workers account for approximately 80 percent of total manufacturing employment in India and earn substantially less than their organized sector counterparts. For this reason, employers’ average compensation costs in organized manufacturing overstate average compensation costs for Indian manufacturing as a whole.Chart 3. Hourly compensation costs in manufacturing for China and India, in U.S. dollars, 2003-2008China India2008 2007 2006 2005 2004 20030.00 0.25 0.50 0.81 0.73 0.66 0.62 0.75 1.00 1.25 1.061.362008 2007 2006 2005 2004 2003NA1.17 0.95 0.91 0.85 0.81 0.00 0.25 0.50 0.75 1.00 1.25 1.501.50(1) For the most recent BLS work on China, see Judith Banister and George Cook, “China’s employment and compensation costs in manufacturing through 2008,” Monthly Labor Review, forthcoming March 2011, on the Internet at /opub/mlr. (2) For the most recent BLS work on India, see Jessica R. Sincavage, “Labor costs in India’s organized manufacturing sector,” Monthly Labor Review, May 2010, pp. 3–22, on the Internet at /opub/mlr/2010/05/art1full.pdf. (3) For a discussion of the limitations associated with comparing compensation costs for China and India, see Sincavage, “Labor costs in India’s organized manufacturing sector.” (4) For additional information on employment and compensation costs in China, see /ilc/china.htm.-4-Chart 4. Benefit components of hourly compensation costs as a percent of total compensation, 2009Social insurance expenditures1Brazil Sweden France Italy Belgium Slovakia Greece Czech Republic Mexico3 Estonia Spain Hungary Austria United States United States Netherlands Germany Finland United Kingdom Australia Canada Portugal Norway3 Japan Korea, Republic of 3 Argentina Israel Poland Ireland Switzerland Taiwan3 Singapore Denmark Philippines New Zealand 0 10 20 Percent(1) Social insurance expenditures include labor-related taxes net of subsidies. (2) Directly-paid benefits are primarily pay for leave time, bonuses, and pay in kind. (3) For Mexico, Norway, Republic of Korea, and Taiwan, separate measures of directly-paid benefits are not available.Directly-paid benefits2304050Chart 4 shows the benefit components of manufacturing employers’ compensation costs as a percent of total costs. (See table 3 for data in U.S. dollars.) Economies are ordered based on social insurance expenditures as a-5-percent of total compensation. In countries with the highest ratio of social insurance costs, such as Brazil, Sweden, and France, social insurance makes up approximately one-third of total compensation costs. In the United States, social insurance costs account for about 24 percent of total compensation, while in the Asian countries social insurance is less than 20 percent. Directly-paid benefits comprise pay for leave time, bonuses, and pay in kind. The percentage of compensation that is directly-paid benefits tends to be higher in many European countries (due in large part to leave pay) and in Japan (where seasonal bonuses are a large portion of costs). Directly-paid benefits are a relatively smaller portion of costs in countries such as the United States, Australia, Canada, and the United Kingdom. The total benefits portion of compensation costs can be seen by combining social insurance with directly-paid benefits. Total benefits surpass 40 percent in 15 countries. In contrast, the ratio of benefit costs in the United States is about 31 percent.Changes in this news releaseNew country estimates for Estonia: For the first time, this news release includes data for Estonia. Revised estimates for Mexico: Compensation cost estimates for Mexico in this release are significantly higher due to a change in the primary data source used. This change was made to bring the employment coverage of BLS estimates for Mexico more in line with that for other countries. Additional indicators and time series data: Full time series of compensation costs in U.S. dollars and in national currencies, indexes of costs, and the components of compensation are available at /web/ichcc.supp.toc.htm. Production worker and trade-weighted data: Compensation costs for production workers and for tradeweighted country groupings are no longer shown in this news release. These data are available in the time series tables at /web/ichcc.supp.toc.htm. 2009 is the final year for which updated production worker data will be available.Send us your inquiries or feedback We appreciate your inquiries and feedback. Feel free to email ILCHelp@ or call (202) 691-5654. Subscribe to ILC’s e-newsletter The e-newsletter provides links to the latest ILC releases, which usually occur once or twice per month. Email mailto:ILCPR@ with “subscribe” in the subject line.-6-Table 1. Hourly compensation costs in manufacturing, U.S. dollars, and as a percent of costs in the United StatesHourly Compensation Costs in U.S. dollars Norway Denmark Belgium Austria Germany Switzerland Finland Netherlands France Sweden Ireland Italy Australia United States United Kingdom Japan Canada Spain Greece Israel Singapore New Zealand Korea, Republic of Portugal Slovakia Czech Republic Argentina Estonia Hungary Brazil Taiwan Poland Mexico Philippines 1997 (1) 26.97 24.64 28.23 27.38 29.26 28.33 22.17 23.44 24.99 25.11 17.15 19.67 19.12 22.67 18.24 22.28 18.89 13.91 NA 12.32 12.15 12.37 9.42 6.38 2.86 3.24 7.43 NA 3.05 7.11 7.04 3.13 3.30 1.14 2009 53.89 49.56 49.40 48.04 46.52 44.29 43.77 43.50 40.08 39.87 39.02 34.97 34.62 33.53 30.78 30.36 29.60 27.74 19.23 18.39 17.50 17.44 14.20 11.95 11.24 11.21 10.14 9.83 8.62 8.32 7.76 7.50 5.38 1.50 1997 (1) 119 109 125 121 129 125 98 103 110 111 76 87 84 100 80 98 83 61 NA 54 54 55 42 28 13 14 33 NA 13 31 31 14 15 5 U.S.=100 2009 161 148 147 143 139 132 131 130 120 119 116 104 103 100 92 91 88 83 57 55 52 52 42 36 34 33 30 29 26 25 23 22 16 4NA=data not available. (1) With the exception of Estonia and Greece, 1997 is the first year data are available for all countries.-7-Table 2. Average annual percent change in hourly compensation costs in manufacturing and exchange rates1997-2009 U.S. dollar change (1) Japan United States Slovakia Argentina Switzerland Austria Spain Ireland Denmark Greece Brazil Finland Italy Portugal Netherlands Belgium Philippines Germany Estonia France Israel Australia Singapore Norway Czech Republic New Zealand Canada Sweden Taiwan Hungary Mexico Korea, Republic of United Kingdom Poland 2.6 3.3 12.1 2.6 3.8 4.8 5.9 7.1 6.0 NA 1.3 5.8 4.9 5.4 5.3 4.8 2.4 3.9 NA 4.0 3.4 5.1 3.1 5.9 10.9 2.9 3.8 3.9 0.8 9.0 4.2 3.5 4.5 7.6 National currency change 0.5 3.3 8.1 14.5 1.3 3.0 4.1 5.7 4.2 NA 6.7 4.1 3.1 3.6 3.5 2.9 6.6 2.1 NA 2.2 4.5 4.5 2.9 4.9 6.5 3.4 2.2 3.9 2.0 9.8 8.9 6.1 4.8 7.1 Exchange rate change (2) 2.2 0.0 3.8 -10.4 2.4 1.8 1.7 1.3 1.8 0.9 -5.0 1.7 1.7 1.7 1.8 1.8 -3.9 1.8 NA 1.8 -1.1 0.5 0.2 1.0 4.2 -0.5 1.6 0.0 -1.1 -0.7 -4.4 -2.4 -0.4 0.4 U.S. dollar change (1) 9.2 4.1 3.3 2.0 1.2 0.5 0.4 -0.9 -1.0 -1.8 -1.9 -2.0 -2.2 -2.4 -2.7 -2.8 -3.1 -3.5 -5.0 -5.1 -5.8 -6.2 -7.2 -7.4 -8.1 -8.8 -9.5 -9.6 -10.7 -11.8 -12.0 -12.7 -13.9 -20.12008-2009 National currency change -1.0 4.1 6.0 20.3 1.7 6.2 6.1 4.7 4.2 3.8 7.0 3.5 3.3 3.2 2.8 2.7 4.3 1.9 0.0 0.3 3.3 1.0 -4.5 3.3 4.3 2.6 -3.1 5.1 -6.4 3.7 6.6 1.3 1.9 3.5 Exchange rate change (2) 10.4 0.0 -2.6 -15.3 -0.5 -5.4 -5.4 -5.4 -5.0 -5.4 -8.3 -5.4 -5.4 -5.4 -5.4 -5.4 -7.0 -5.4 -5.0 -5.4 -8.8 -7.2 -2.8 -10.4 -11.9 -11.1 -6.6 -14.0 -4.5 -14.9 -17.5 -13.8 -15.6 -22.8NA=data not available. (1) U.S. dollar changes are approximately equal to national currency changes plus exchange rate changes for each country. (2) Exchange rates are value of foreign currency relative to the U.S. dollar.-8-Table 3. Components of hourly compensation costs in manufacturing, U.S. dollars, 2009Hourly Compensation Costs Social Insurance(1) 9.91 5.04 14.72 12.16 10.37 6.57 9.45 10.05 12.51 12.69 5.96 10.63 7.13 7.90 6.46 5.42 5.99 7.29 5.31 2.98 2.45 0.52 2.52 2.41 3.22 3.06 1.77 2.58 2.24 2.70 1.14 1.18 1.45 0.13 Total Direct Pay Directly-Paid Benefits(2) 8.99 9.68 10.17 9.24 8.97 8.69 8.36 4.99 4.22 5.36 5.15 3.27 2.60 3.18 7.56 2.92 5.47 3.54 1.39 3.41 2.40 11.68(4) 2.09 1.93 1.50 1.42 0.88 1.58 1.18 6.61(4) 1.77 3.93 0.25(4)Total Norway Denmark Belgium Austria Germany Switzerland Finland Netherlands France Sweden Ireland Italy Australia United States United Kingdom Japan Canada Spain Greece Israel Singapore New Zealand Korea, Republic of Portugal Slovakia Czech Republic Argentina Estonia Hungary Brazil Taiwan Poland Mexico Philippines 53.89 49.56 49.40 48.04 46.52 44.29 43.77 43.50 40.08 39.87 39.02 34.97 34.62 33.53 30.78 30.36 29.60 27.74 19.23 18.39 17.50 17.44 14.20 11.95 11.24 11.21 10.14 9.83 8.62 8.32 7.76 7.50 5.38 1.50Pay for Time Worked(3) 43.97(4) 35.53 25.00 25.72 26.90 28.75 25.62 25.09 22.58 22.96 27.70 19.19 24.22 23.03 21.14 17.39 20.69 14.99 10.38 14.02 11.65 14.52 7.44 6.10 6.64 6.96 6.36 4.81 4.45 4.55 1.13(1) Social insurance includes labor-related taxes net of subsidies. (2) Directly-paid benefits are primarily pay for leave time, bonuses, and pay in kind. (3) Pay for time worked is wages and salaries for time actually worked. (4) Data relate to total direct pay.-9-TECHNICAL NOTESThe international comparisons of hourly compensation costs in manufacturing are prepared to assess differences in employer labor costs among countries. BLS compensation data permit more meaningful comparisons of employer labor costs than data based solely on average earnings. Definitions of average earnings differ considerably by country and do not include many items of labor cost that frequently make up a large portion of total cost. BLS compensation data include nearly all labor costs incurred by employers. Below is a summary of the concepts used in this release. For more detailed information, see /ilc/#compensation. Definitions. Hourly compensation costs include (1) total hourly direct pay (all payments made directly to the worker, before payroll deductions of any kind) (2) social insurance expenditures (employer payments to secure entitlement to social benefits for employees) and (3) labor-related taxes. The data relate to all employees in manufacturing, including part-time and temporary workers. The selfemployed, unpaid family workers, contract workers, and workers in private households are excluded. Hourly Compensation Costs Total Hourly Direct Pay Pay for Time Worked• • • • • •Directly-Paid Benefits•Employer Social Insurance Expenditures and Labor-related TaxesBasic wages Piece rate Overtime premiums Shift, holiday, or night work premiums Cost-of-living adjustments Bonuses and premiums paid each pay period• • • •Pay for time not worked (vacations, holidays, and other leave, except sick leave) Seasonal and irregular bonuses Allowances for family events, commuting, etc. Payments in kind Severance pay explicitly not linked to a collective agreement• • • • • • • • •Retirement and disability pensions Health insurance Income guarantee insurance and sick leave Life and accident insurance Occupational injury and illness compensation Unemployment insurance Severance pay linked to a collective agreement Other social insurance expenditures Taxes (net of subsidies) on payrolls or employmentMethodology. In general, total compensation for each economy is calculated by adjusting earnings series to include items of direct pay, social insurance, and labor-related taxes and subsidies not included in earnings. For economies for which earnings data are not available on a per hour worked basis, BLS makes adjustments in order to approximate compensation per hour worked. Compensation costs are converted to U.S. dollars using the average daily exchange rate for the reference year.- 10 -Earnings statistics are typically obtained from establishment surveys. Data on the other components of hourly compensation are typically obtained from periodic labor cost surveys, censuses of manufacturers, employer confederations, and other sources. For the United States, the results and methods used differ somewhat from those used for other BLS series on U.S. compensation costs. The statistics are adjusted, where possible, to account for major differences in worker coverage; differences in industrial classification systems; and changes over time in survey coverage, sample benchmarks, or frequency of surveys. More information on exceptions to these methods, as well as data sources used, can be found in “Country Notes and Sources” located at /ilc/#compensation. Data availability. Detailed time series with data for all years from 1996 can be found at /web/ichcc.supp.toc.htm. The compensation measures in this news release are based on statistics available to BLS as of December 2010. These measures may be subsequently revised as data are collected to update compensation measures for submanufacturing industries. Data for sub-manufacturing industries are available at /ilc/flshcaeindnaics.htm.。