ACCA F8 知识点总结

ACCA F8科目考试重点分析

ACCA F8科目考试重点分析本文由高顿ACCA整理发布,转载请注明出处Part 1:理论知识部分(一)assurance engagement:五个要素四种鉴证业务及其提供的鉴证业务的水平这部分考试基本会在选择题或者是单纯的知识点书写的题目中出现,不太容易联系题目中的情景,因此要对这部分的知识熟记于心。

(二)Corporate Governance:Chairman&ceo : segregation of dutiesED&NED:BalanceNED supervise ED’s work Audit committee Remuneration committee Nomination committee Risk committee关于公司治理方面,一般以情景题的形式考察大家对于知识点的理解,因此在读题目的时候,凡是违背CG要求的都是公司治理的薄弱环节,提出的改善意见就是我们介绍的CG 的准则。

(三)Professional Ethics:IntegrityObjectivesCompetence and due careConfidentialProfessional behavior对应的在这部分要掌握的还有五个threat:FamiliaritySelf-interestSelf-reviewAdvocacyIntimidation与之相对应的safeguard:Disposal(股票等资产),independent third party review,report to audit committee,rotation,resignation,refuse这部分内容每年必考,首先对于五个基本的职业道德,你要会解释定义,另外,五种威胁你要会判断并且写出相应的safeguard。

Part 2:审计实践第一步:Acceptance of a clientLowballing的概念Client screening的概念Engagement letter:written form,terms of responsibilities of mgt and auditors, known by mgt and auditors.基础的概念要了解是什么意思,会写定义,对于审计鉴证业务约定书,要明确这个约定书的内容以及签订的目的第二步:Understanding the business需要掌握的知识点有:Fraud:区别fraud与human error的,明确mgt和external auditors对于fraud 的不同责任interim audit与final audit的区别Business risk与audit riskmateriality:定义,计算基准,benchmarkDocumentation: permanent和current audit files的区别这部分知识点经常在历年考题的Q3中出现,给你一个情景,让你找到这个被审计客户的audit risk并且写出审计人员的应对方案,我们说凡是涉及到企业的新的改变,比如上马一套新的应用系统,制定一个新的策略,都是我们审计需要关注的地方,都是audit risk容易产生的地方,尤其要对涉及到的相应的会计准则的处理非常熟悉。

【ACCA考前辅导】F8 考点分析(审计风险+风险评估程序)

【ACCA考前辅导】F8 考点分析(审计风险+风险评估程序)“定义和评估审计风险是审计程序中非常重要的一个部分,在F8历年的考试中,主要以两种形式出现,第一简答题,要求解释一些基本的概念,第二案例题,会给一些具体的案例来给予分析,要求学生写出风险点,以及审计师的应对,本文基于考官的文章,主要讲述了以下几方面的内容:”一:什么是审计风险,如何定义的?二:风险评估程序(Risk assessment procedures)(一)什么是审计风险。

The risk that the auditor expresses an inappropriate audit opinion when the financial statements are materially misstated. Audit risk is a function of material misstatement and detection risk.所谓的审计风险,是指审计师在客户的财务报告存在着重要的错报时,发表了不恰当的审计意见,它主要包括了两块的内容,1.财务报表本身的错报和漏报,2.在检查时出现的风险。

定义的内容在2008年12月的考试里,作为直接的简答题出现了,在之后的考试里,再没有出现过简答题,但作为Syllabus里所要求的一个的重要知识,依旧要求学生熟练的背诵,了解这句话的具体定义,这有助于帮助他们理解审计风险,并且应用到具体的案例题里面。

(二)风险评估程序(Risk assessment procedures)1. ISA 315 requires auditors to perform the following procedures to obtain an understanding of the entity and its environment, including its internal control:。

ACCA必考知识点

关于ACCA知识点中,F8的必考部分。

分为理论部分和情景题部分两大块。

下面中公财经小编就给大家详细介绍一下关于F8的必考知识点;理论部分(1) 5 elements of internal control system内控体系的五大要素-control environment(控制环境),control activities(控制行为),risk assessment(风险评估),control activities(控制的监督)与information system(信息系统)。

这五大要素需要会对其进行描述。

e.g.:Identify and briefly explain the FIVE components of an entity’s internal control. (5 marks)---2015年6月考题(2)limitations of Internal control systems内控体系的局限性(如:human errors in use of judgement, simple processing error, collusion between staff, control by-passed by management)(3) Methods for documenting internal control system记录内控体系的文档都有哪几种形式,以及各自的优缺点是什么-Narrative notes, flowchart, questionnaires (ICQ+ICEQ)Describe TWO methods for documenting the sales and despatch system; and for each explain an advantage and a disadvantage of using this method. (6 marks)---2013年12月份考题(4) Reasons for maintaining internal control system公司为什么需要建立及维护必要的内控体系(如:prevent misstatement in FS, safeguard assets, avoid breach laws and regulations, prevent fraud, increase working efficiency)情景题(1)Control Deficiency +Impact/Consequence +Recommendation or Identify and Explain Deficiency + Recommendation根据题目给出的情景,指出有什么控制缺陷,给公司造成的影响是什么,最后是给出解决问题的建议。

2019年ACCA F8核心考点知识内容总结

2019年ACCA F8核心考点知识内容总结

考试结束后又是一轮新考季的开始,很多学员已经开始为9月份考试做准备了,今天高顿ACCA研究院为大家带来关于F8审计的核心内容。

再送大家一个2019ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

F8课程是ACCA基础课程阶段唯一的一门关于审计的课程,它详细介绍了对财务报表的整个审计流程。

F8的考试时长是3小时,考试题型由原来5道简答题改为12个单选6道长题,单选题由8道两分选择题和4道一分选择题组成,长题由4道十分长题和2道二十分的长题组成。

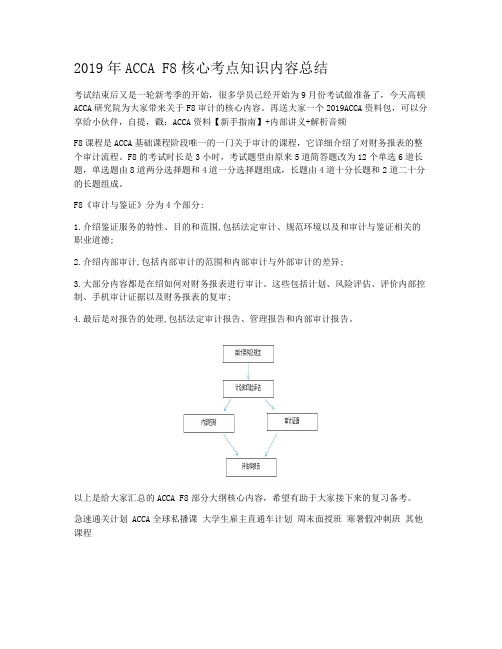

F8《审计与鉴证》分为4个部分:

1.介绍鉴证服务的特性、目的和范围,包括法定审计、规范环境以及和审计与鉴证相关的职业道德;

2.介绍内部审计,包括内部审计的范围和内部审计与外部审计的差异;

3.大部分内容都是在绍如何对财务报表进行审计。

这些包括计划、风险评估、评价内部控制、手机审计证据以及财务报表的复审;

4.最后是对报告的处理,包括法定审计报告、管理报告和内部审计报告。

以上是给大家汇总的ACCA F8部分大纲核心内容,希望有助于大家接下来的复习备考。

急速通关计划 ACCA全球私播课大学生雇主直通车计划周末面授班寒暑假冲刺班其他课程。

acca f8知识要点汇总(下)

Part 12. Subsequent Event期后事项定义: Events after the reporting period: events, both favourable and unfavourable, that occurs between the end of the reporting period and the date when the financial statements are authorised for issue.区分调整非调整,主要看时间节点:事件发生在报告期后及财报正式公布前;是否对报告期内数值有影响?Adjusting events调整项目★背诵-定义Events which provide evidence of conditions which existed at the end of the reporting period. Non‐adjusting events 非调整事项★背诵-定义Events that relate to conditions which arose after the end of the reporting period✓Resolution of a court case未决诉讼✓Bankruptcy of a major customer主要客户破产 ✓Evidence of NRV of inventories库存的NRV测试 ✓Discovery of fraud or errors that show the financial statements were incorrect财报错误:舞弊和错误 ✓Destruction of major asset, e.g. by flood or fire自然灾害✓Major share transactions大宗股权交易✓Announcement of a plan to close part of a business关闭公司或部门,包括裁员Change the amounts in the financial statements 上述情况都会影响财报的正确性 Disclose non‐adjusting event in a note to the financial statements在财报的notes中披露即可●Auditor's responsiblityPeriod between the year‐end date and the date the auditor’s report is signed财年结束后,至审计报告签署前 The auditor shall perform audit procedures designed to obtain sufficient appropriate audit evidence that all events occurring between the date of the financial statements and the date of the auditor’s report that require adjustment of, or disclosure in, the financial statements have been identified.审计师有积极的责任执行审计程序,来辨别财报是否正确,该披露的是否披露?The auditor is not, however, expected to perform additional audit procedures on matters to which previously applied audit procedures have provided satisfactory conclusions.如果审计师对当年的财务报告已经比较满意了,那么不会再执行额外的审计程序(这句话比较难理解!)Period between the date the auditor’s report is signed and the date the financial statements are issued审计报告已签署,至财报公布前 The auditor has no obligation to perform any audit procedures regarding the financial statements after the date of the auditor’s report.签署审计报告后,审计师没有责任来主动发现问题。

ACCA必考知识点:F8考试划重点帮你顺利通过考试

3月份的考试已经结束了,ACCA考试成绩查询还没有出来。

不知道小伙伴么考的怎么样。

不知道大家在考前划的各种各样的重点有没有考到呢。

中公财经小编在这里把F8阶段的acca考试重点给大家整理了一下,经验之谈。

希望能够对大家有所帮助;我们知道从去年的ACCA F8改革之后,前面的30分变成了10分*3题的基于情景的选择题,而这部分题目每题所占分值比较小,所以比较适合用来考察大家对于一些零散的知识点.在更改考纲前曾经热门的5个道德准则,不再出现在大题重点。

而五个道德准则,只能在选择题中留有余地、以及多集中于第一章、第二章的一些有关于审计本身和审计相关的一些概念性知识,例如审计相关的法律法规、专业团体、审计与其他鉴证业务的辨析等等。

另外,对于管理层声明书的理解也会在选择题中有所涉及。

主题一、Risk Assessment在Risk Assessment部分,由于在2016年的12月已经考过了关于财务指标的计算,所以至少在未来的一年中Ratio的计算出现的概率都非常低了,综合去年最后两次的考试来看,这次3月的全球考,在Risk Assessment部分较大概率会出现关于审计风险的辨析(Risk identification)和风险的应对(Risk response)以及关于内审(Internal Audit)的概念辨析,还有其与外审的异同,所以大家对于内审这个章节的知识应该稍微侧重一些。

主题二、Internal control在Internal control的Cycle这一部分,去年9月份和12月的两次考试,主要集中在Cash、Sales、以及Payroll这三个内控循环,所以理所当然,「神秘黑视力」会认为在今年3月的考试中,其余的Purchase cycle、Inventory cycle的内控循环会有更大概率出现在一部分,重点压Purchase cycle。

本次的考试中一般都会是考察我们对于其内控循环的缺陷辨析(Deficiency identification),以及要求我们提出相应地改进或解决方案(Recommend)。

ACCA F8知识点:Substantive Procedures

ACCA F8知识点:Substantive Procedures【高顿ACCA小编】2015年ACCA考试即将开始,我们将第一时间公布考试相关内容,请各位考生密切关注高顿ACCA,预祝大家顺利通过ACCA考试。

今天为大家带来的是ACCA F8知识点:Substantive Procedures1 Nature, Timing and Extent1.1 NatureSubstantive analytical procedures are generally more applicable to large volumes of transactions that tend to be predictable over time and are often used in conjunction with a strong control environment and where audit evidence has been obtained from testing the effectiveness of controls (e.g. computer information systems). See Session 16 for further detail on substantive analytical review.Tests of detail on transactions are used to obtain audit evidence regarding the assertions related to transactions (i.e. COCOA—completeness, occurrence, classification, cut-off and accuracy). These will be on manual systems or CISs where it is easy to trace a transaction through the system.Tests of details of transactions trace a transaction through a system, for example to ensure that a despatch is correctly recorded as a sale or that a purchase entry recorded in the daybook is supported by a purchase invoice, goods received note and purchase order.If no reliance is placed on controls, the level (i.e. sample size) of transaction testing will be high. If reliance can be placed on controls, the level of transaction testing will be lower (and usually conducted as a hybrid test (see s.3) alongside the control testing).The auditor may assess that audit risk can be reduced to an acceptable level by reliance on controls and substantive analytical review, rather than transaction testing (as above).Tests of detail on balances are used to obtain evidence about the assertions related to account balances (i.e. CARE— completeness, accuracy and valuation, rights and obligations and existence).1.2 TimingSubstantive transaction procedures may be carried out at an earlier date than the entity's year-end and the final audit (i.e. at an interim audit). If carried out at an interim date, further tests must be carried out to cover the remaining period. These tests (substantive and/or tests of control) must be sufficient to ensure that the risk of misstatement does not increase during this period.Unlike tests of control, where prior-year audit evidence may be relied on under certain circumstances, prior-year substantive evidence will be insufficient to address a risk of material misstatement in the current period.1.3 ExtentGenerally, the greater the risk of material misstatement, the greater the extent of substantive procedures.For any one substantive procedure, the extent of testing usually relates to sample sizes (e.g. increasing the extent means increasing the sample size).However, the extent of substantive procedures may also be considered in terms of: selecting large (e.g. material) or unusual items from a population; or stratifying the population into homogeneous subpopulations for sampling.It is not unusual in many substantive testing approaches that all items greater than the materiality level (taking into account performance materiality) are selected for testing. If an error is found, that error is likely to be material to the financial statement assertions.2. Hybrid ApproachIn some cases, a single test approach can be used as a test of control and a substantive procedure at the same time. This is called a dual-purpose or hybrid test.本文由高顿ACCA编辑整理,转载请注明出处。

ACCA知识点:F8理解审计战略和审计计划

ACCA知识点:F8理解审计战略和审计计划在ACCA考试中,F8当中理解审计战略和审计计划一直是大纲中最为重要,也是难点最多的一部分知识点。

那么今天就为同学们总结一下F8当中理解审计战略和审计计划的习题讲解,这部分内容体系比较复杂重要,所以帮助大家做些题目逐渐了解这章内容。

Audit is a subject where sharp minds can excel. What is really demanded of us is understanding ‘materiality’. As simple as it sounds, it can be the reason why many students might fail paper F8. The first question was about Audit Strategy. And ‘materiality’ was definitely a part of it. Do you know the role of the audit strategy and audit plan in defining materiality?Audit strategy and materialityAn audit strategy outlines the OBJECTIVES of the audit that is to be performed – like crafting the skeleton of a body. The details are yet to be filled in.Once the internal control environment and the risk assessment system of the entity is understood, the independent auditor then needs to define an OVERALL materiality level. This consists of two important components:Performance Materiality, andTolerable Misstatement ErrorThe auditor defines each of the two components. The performance materiality aswell as the tolerable misstatement error differs from organisation to organisation, market to market and economy to economy.Audit plan and materialityThe audit plan is an important document. ISA 300 is the governing standard here. The audit plan provides guidance on:The directionThe supervision, andThe review of audit proceduresWhile going through ISA 320 – Audit Materiality in the study text, I ran a few searches online, discovering that the US regulates its audit procedures under Statements on Auditing Standards (SAS). These are a collection of Generally Accepted Auditing Standards (GAAS).I opened SAS 122, section 320, which was titled Materiality in Planning and Performing an Audit. There, I found what I was looking for – the audit plan:Helps give the auditor insight regarding the effect of the nature of an organisation in defining materiality.Helps outline situation-based factors influencing the materiality.Allows the auditor to take in account several other factors to establisheffective materiality levels.Lets the auditor document any changes/revisions in the materiality level initially defined by the auditor if crucial evidence is found later on at the performance stage.Takes into account any possible changes to the performance materiality level following any change/revision in the overall materiality level.As part of the ACCA student network, we all need to understand the basics of audit firmly to excel in our careers. I believe ACCA studies do not just keep you confined to one book in your bag, but demand you to research on your own.I would love to hear your thoughts on this. Let me know if this article has helped you on your path to success in Paper F8.获取更多ACCA考试知识点可关注永和九年,岁在癸丑,暮春之初,会于会稽山阴之兰亭,修禊事也。

ACCA F8 知识点总结

ACCA考试《审计与认证业务F8》知识点总结ISA 315 (REVISED),IDENTIFYING AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT THROUGH UNDERSTANDING THE ENTITY AND ITS ENVIRONMENTOne of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal controlThe International Auditing and Assurance Standards Board (IAASB)issues International Standard on Auditing (ISA)for international use. From time to time, ISAs are revised to provide updated standards to auditors. In order to enhance the overall quality of audit, IAASB published a consultation draft on a proposed revision to ISA 315. The objective in revising ISA 315 is to enhance the performance of external auditors by applying the knowledge and findings of an entity’s internal audit function in the risk assessment process, and to strengthen the framework for evaluating the use of internal auditors work to obtain audit evidence.In March 2012, ISA 315 (Revised)was approved and released. One of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal control.OBJECTIVES IN ESTABLISHING INTERNAL CONTROLSGenerally speaking, internal control systems are designed, implemented and maintained by the management and personnel in order to provide reasonable assurance to fulfil the objectives – that is, reliability of financial reporting, efficiency and effectiveness of operations, compliance with laws and regulations and risk assessment of material misstatement. The manner in which the internal control system is designed, implemented and maintained may vary with the entity’s business nature, size and complexity, etc. Auditors focus on both the audit of financial statements and internal controls that relates to the three objectives that may materially affect financial reporting.In order to identify the types of potential misstatements and to determine the nature, timing and extent of audit testing, auditors should obtain an understanding of relevantinternal controls, evaluate the design of the controls, and ascertain whether the controls are implemented and maintained properly.The major components of internal control include control environment, entity’s risk assessment process, information system (including the related business processes, control activities relevant to the audit, relevant to financial reporting, and communication)and monitoring of controls.ACCACONTROL ENVIRONMENTThe control environment consists of the governance and management functions and the attitudes, awareness and actions of the management about the internal control. Auditors may obtain an understanding of the control environments through the following elements.1. Communication and enforcement of integrity and ethical values It is important for the management to create and maintain honest, legal and ethical culture, and to communicate the entity’s ethical and behavioral standards to its employees through policy statements and codes of conduct, etc.2. Commitment to competence It is important that the management recruits competent staff who possess the required knowledge and skills at competent level to accomplish tasks.3. Participation by those charged with governance An entity’s control consciousness is influenced significantly by those charged with governance; therefore, their independence from management, experience and stature, extent of their involvement, as well as the appropriateness of their actions are extremely important.4. Management’s philosophy and operating style Management’s philosophy and operating style consists of a broad range of characteristics, such as management’s attitude to response to business risks, financial reporting, information processing, and accounting functions and personnel, etc. For example, does the targeted earning realistic? Does the management apply aggressive approach where alternative accounting principles or estimates are available? These management’s philosophy and operating style provide a picture to auditors about the management’s attitude about the internal control.5. Organisational structure The organisational structure provides the framework on how the entity’s activities are planned, implemented, controlled and reviewed.6. Assignment of authority and responsibility With the established organisational structure or framework, key areas of authority andreporting lines should then be defined. The assignment of authority and responsibility include the personnel that make appropriate policies and assign resources to staff to carry out the duties. Auditors may perceive the implementation of internal controls through the understanding of the organisational structure and the reporting relationships.7. Human resources policies and practices Human resources policies and practices generally refer to recruitment, orientation, training, evaluation, counselling, promotion, compensation and remedial actions. For example, an entity should establish policies to recruit individuals based on their educational background, previous work experience, and other relevant attributes. Next, classroom and on-the-job training should be provided to the newly recruited staff. Appropriate training is also available to existing staff to keep themselves updated. Performance evaluation should be conducted periodically to review the staff performance and provide comments and feedback to staff on how to improve themselves and further develop their potential and promote to the next level by accepting more responsibilities and, in turn, receiving competitive compensation and benefits.With the ISA 315 (Revised),external auditors are now required to make inquiries of the internal audit function to identify and assess risks of material misstatement. Auditors may refer to the management’s responses of the identified deficiencies of the internal controls and determine whether the management has taken appropriate actions to tackle the problems properly. Besides inquiries of the internal audit function, auditors may collect audit evidence of the control environment through observation on how the employees perform their duties, inspection of the documents, and analytical procedures. After obtaining the audit evidence of the control environment, auditors may then assess the risks of material misstatement.ENTITY’S RISK ASSESSMENT PROCESSAuditors should assess whether the entity has a process to identify the business risks relevant to financial reporting objectives, estimate the significance of them, assess the likelihood of the risks occurrence, and decide actions to address the risks. If auditors have identified such risks, then auditors should evaluate the reasons why the risk assessmentprocess failed to identify the risks, determine whether there is significant deficiency in internal controls in identifying the risks, and discuss with the management.THE INFORMATION SYSTEM, INCLUDING THE RELEVANT BUSINESS PROCESSES, RELEVANT TO FINANCIAL REPORTING AND COMMUNICATIONAuditors should also obtain an understanding of the information system, including the related business processes, relevant to financial reporting, including the following areas:? The classes of transactions in the entity’s operations that are significant to the financial statements. The procedures that transactions are initiated, recorded, processed, corrected as necessary, transferred to the general ledger and reported in the financial statements.? How the information system captures events and conditions that are significant to the financial statements.? The financial reporting process used to prepar e the entity’s financial statements.? Controls surrounding journal entries.? Understand how the entity communicates financial reporting roles, responsibilities and significant matters to those charged with governance and external – regulatory authorities.CONTROL ACTIVITIES RELEVANT TO THE AUDITAuditors should obtain a sufficient understanding of control activities relevant to the audit in order to assess the risks of material misstatement at the assertion level, and to design further audit procedures to respond to those risks. Control activities, such as proper authorisation of transactions and activities, performance reviews, information processing, physical control over assets and records, and segregation of duties, are policies and procedures that address the risks to achieve the management directives are carried out.MONITORING OF CONTROLSIn addition, auditors should obtain an understanding of major types of activities that the entity uses to monitor internal controls relevant to financial reporting and how the entityinitiates corrective actions to its controls. For instance, auditors should obtain an understanding of the sources and reliability of the information that the entity used in monitoring the activities. Sources of information include internal auditor report, and report from regulators.LIMITATIONS OF INTERNAL CONTROL SYSTEMSEffective internal control systems can only provide reasonable, not absolute,to achieve the entity’s financial reporting obje ctive due to the inherent limitations of control – for example, management override of internal controls. Therefore, auditors should identify and assess the risks of material misstatement at the financial statement level and assertion level for classes of transactions, account balances and disclosures.CONCLUSIONAs internal auditors have better understanding of the organisation and expertise in its risk and control, the proposed requirement for the external auditors to make enquiries of internal audit function in ISA 315 (Revised)will enhance the effectiveness and efficiency of audit engagements. External auditors should pay attention to the components of control mentioned above in order to make effective andefficient enquiries. An increase in the work of internal audit functions is also expected because of such proposed requirement.Raymond Wong, School of Accountancy, The Chinese University of Hong Kong, and Dr Helen Wong, Hong Kong Community College, Hong Kong Polytechnic UniversityReference ISA 315 (Revised),Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment。

ACCA F8知识点Logical thinking in audit procedure

Logical thinking in audit procedureAra Shen沈璐萍各位学员,大家好,新的考季又开始了,考前我们来简单梳理下审计流程中关键步骤的逻辑思路。

ACCA的Fundamental模块里,F8一直是一个比较诡异的“滑铁卢”,绝大部分学员在朝着Professional阶段大门一路高歌而去时,会在F8这门课上突遭不适,而这绝大部分中的99.99%都是在校学生党。

为什么?当然是因为学生党缺乏经验,相信课堂上老师们都有提及,但需要强调的是,学生党不仅是对现实审计了解不足,更重要的是欠缺经验累积形成的审计思考方式,而这种逻辑思考,才是帮助学员脱离死记硬背,从而学而知之的万金油。

审计作为一门高应用型学科,经验积累在所难免,但对于广大学生党学员,现下似乎难以做到。

因此我们在这里更多的是帮助学员们或多或少建立起一种审计逻辑思考方式。

现实审计中我们也经常遇到新的情况,无法用曾经的审计案例生搬硬套,此时我们就需要用逻辑方法来解决新的问题,而同学们可以将考试中的案例都当作现实中可能遇到的新情况,用学习了的审计方法去解决她。

至于有工作经验或形成方法论的学员们,可以关上文章,自行看题了。

废话说了有点多,切入正题。

审计是流程,流程就有步骤,大体如下:接受委托——>审计计划——>内控测试——>实质性程序——>审计报告前两个以及最后一个步骤本文空间有限就不详述了,我们重点来看,在学习到内控测试和实质性程序时,会遇到F8的重点内容:六大循环。

说白了就是通常审计关注的六大块企业活动,我们以大家喜闻乐见的Sales cycle为例子,来看看企业赚钱的过程中,我们作为一个第三方的公证人,如何验证他的真实公允。

民间审计的主旨是在确保Audit risk在审计师可接受的范围内,在Sales环节,我们首先会通过Test of control来验证Sales流程没有重大fraud及error,确保Audit risk 中的RMM在可接受范围内;如果合格,我们就执行正常的实质性程序,如果TOC不合格,则后续的实质性程序就会增加,以降低Detection risk。

ACCA F8知识要点汇总(下)

Period between the date the auditor’s report is signed and the date the financial statements are issued 审计报告已签署,至财报公布前

The auditor has no obligation to perform any audit procedures regarding the financial statements after the date of the auditor’s report.签署审计报 告后,审计师没有责任来主动发现问题。但如果审计师获悉了一些情 况,这些事件会影响财务报告和审计报告的正确性,那么需要跟客户商 量是否修改财务报告;如果管理层准备修改,则审计师需要执行相应的

signed 财年结束后,至审计报告签署前

the financial statements and the date of the auditor’s report that require adjustment of, or disclosure in, the financial statements have been identified.审计师有积极的责任执行审计程序,来辨别财报是否正确, 该披露的是否披露?

agree this amount to any supporting documentation to confirm the value.

是否可收回

Dec 2011 Q5 例题分析:Resolution of a court case 注意:诉讼必须发生在财报年底之前,但可以不判

背景

思路

年中有诉讼,期后有个和解信,公司乐意接受。

Change the amounts in the financial statements 上述 情况都会影响财报的正确性 Auditor's responsiblity

ACCA-F8-知识点总结

ACCA考试《审计与认证业务F8》知识点总结ISA 315 (REVISED),IDENTIFYING AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT THROUGH UNDERSTANDING THE ENTITY AND ITS ENVIRONMENTOne of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal controlThe International Auditing and Assurance Standards Board (IAASB)issues International Standard on Auditing (ISA)for international use. From time to time, ISAs are revised to provide updated standards to auditors. In order to enhance the overall quality of audit, IAASB published a consultation draft on a proposed revision to ISA 315. The objective in revising ISA 315 is to enhance the performance of external auditors by applying the knowledge and findings of an entity’s internal audit function in the risk assessment process, and to strengthen the framework for evaluating the use of internal auditors work to obtain audit evidence.In March 2012, ISA 315 (Revised)was approved and released. One of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal control.OBJECTIVES IN ESTABLISHING INTERNAL CONTROLSGenerally speaking, internal control systems are designed, implemented and maintained by the management and personnel in order to provide reasonable assurance to fulfil the objectives – that is, reliability of financial reporting, efficiency and effectiveness of operations, compliance with laws and regulations and risk assessment of material misstatement. The manner in which the internal control system is designed, implemented and maintained may vary with the entity’s business nature, size and complexity, etc. Auditors focus on both the audit of financial statements and internal controls that relates to the three objectives that may materially affect financial reporting.In order to identify the types of potential misstatements and to determine the nature, timing and extent of audit testing, auditors should obtain an understanding of relevantinternal controls, evaluate the design of the controls, and ascertain whether the controls are implemented and maintained properly.The major components of internal cont rol include control environment, entity’s risk assessment process, information system (including the related business processes, control activities relevant to the audit, relevant to financial reporting, and communication)and monitoring of controls.ACCACONTROL ENVIRONMENTThe control environment consists of the governance and management functions and the attitudes, awareness and actions of the management about the internal control. Auditors may obtain an understanding of the control environments through the following elements.1. Communication and enforcement of integrity and ethical values It is important for the management to create and maintain honest, legal and ethical culture, and to communicate the entity’s ethical and behavioral sta ndards to its employees through policy statements and codes of conduct, etc.2. Commitment to competence It is important that the management recruits competent staff who possess the required knowledge and skills at competent level to accomplish tasks.3. Participation by those charged with governance An entity’s control consciousness is influenced significantly by those charged with governance; therefore, their independence from management, experience and stature, extent of their involvement, as well as the appropriateness of their actions are extremely important.4. Management’s philosophy and operating style Management’s philosophy and operating style consists of a broad range of characteristics, such as management’s attitude to response to business risks, financial reporting, information processing, and accounting functions and personnel, etc. For example, does the targeted earning realistic? Does the management apply aggressive approach where alternative accounting principles or estimates are available? These management’s philosophy and operating style provide a picture to auditors about the management’s attitude about the internal control.5. Organisational structure The organisational structure provides the framework on how the entity’s a ctivities are planned, implemented, controlled and reviewed.6. Assignment of authority and responsibility With the established organisational structure or framework, key areas of authority andreporting lines should then be defined. The assignment of authority and responsibility include the personnel that make appropriate policies and assign resources to staff to carry out the duties. Auditors may perceive the implementation of internal controls through the understanding of the organisational structure and the reporting relationships.7. Human resources policies and practices Human resources policies and practices generally refer to recruitment, orientation, training, evaluation, counselling, promotion, compensation and remedial actions. For example, an entity should establish policies to recruit individuals based on their educational background, previous work experience, and other relevant attributes. Next, classroom and on-the-job training should be provided to the newly recruited staff. Appropriate training is also available to existing staff to keep themselves updated. Performance evaluation should be conducted periodically to review the staff performance and provide comments and feedback to staff on how to improve themselves and further develop their potential and promote to the next level by accepting more responsibilities and, in turn, receiving competitive compensation and benefits.With the ISA 315 (Revised),external auditors are now required to make inquiries of the internal audit function to identify and assess risks of material misstatement. Auditors may refer to the management’s responses of the identified deficiencies of the internal controls and determine whether the management has taken appropriate actions to tackle the problems properly. Besides inquiries of the internal audit function, auditors may collect audit evidence of the control environment through observation on how the employees perform their duties, inspection of the documents, and analytical procedures. After obtaining the audit evidence of the control environment, auditors may then assess the risks of material misstatement.ENTITY’S RISK ASSESSMENT PROCESSAuditors should assess whether the entity has a process to identify the business risks relevant to financial reporting objectives, estimate the significance of them, assess the likelihood of the risks occurrence, and decide actions to address the risks. If auditors have identified such risks, then auditors should evaluate the reasons why the risk assessmentprocess failed to identify the risks, determine whether there is significant deficiency in internal controls in identifying the risks, and discuss with the management.THE INFORMATION SYSTEM, INCLUDING THE RELEVANT BUSINESS PROCESSES, RELEVANT TO FINANCIAL REPORTING AND COMMUNICATIONAuditors should also obtain an understanding of the information system, including the related business processes, relevant to financial reporting, including the following areas:? The classes of transactions in the ent ity’s operations that are significant to the financial statements. The procedures that transactions are initiated, recorded, processed, corrected as necessary, transferred to the general ledger and reported in the financial statements.? How the information system captures events and conditions that are significant to the financial statements.? The financial reporting process used to prepare the entity’s financial statements.? Controls surrounding journal entries.? Understand how the entity communicates financial reporting roles, responsibilities and significant matters to those charged with governance and external – regulatory authorities.CONTROL ACTIVITIES RELEVANT TO THE AUDITAuditors should obtain a sufficient understanding of control activities relevant to the audit in order to assess the risks of material misstatement at the assertion level, and to design further audit procedures to respond to those risks. Control activities, such as proper authorisation of transactions and activities, performance reviews, information processing, physical control over assets and records, and segregation of duties, are policies and procedures that address the risks to achieve the management directives are carried out.MONITORING OF CONTROLSIn addition, auditors should obtain an understanding of major types of activities that the entity uses to monitor internal controls relevant to financial reporting and how the entityinitiates corrective actions to its controls. For instance, auditors should obtain an understanding of the sources and reliability of the information that the entity used in monitoring the activities. Sources of information include internal auditor report, and report from regulators.LIMITATIONS OF INTERNAL CONTROL SYSTEMSEffective internal control systems can only provide reasonable, not absolute, assurance to achieve the entity’s financial reporting objective due to the inherent limitations of internal control – for example, management override of internal controls. Therefore, auditors should identify and assess the risks of material misstatement at the financial statement level and assertion level for classes of transactions, account balances and disclosures.CONCLUSIONAs internal auditors have better understanding of the organisation and expertise in its risk and control, the proposed requirement for the external auditors to make enquiries of internal audit function in ISA 315 (Revised)will enhance the effectiveness and efficiency of audit engagements. External auditors should pay attention to the components of internal control mentioned above in order to make effective andefficient enquiries. An increase in the work of internal audit functions is also expected because of such proposed requirement.Raymond Wong, School of Accountancy, The Chinese University of Hong Kong, and Dr Helen Wong, Hong Kong Community College, Hong Kong Polytechnic UniversityReference ISA 315 (Revised),Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment[文档可能无法思考全面,请浏览后下载,另外祝您生活愉快,工作顺利,万事如意!]。

acca f8知识要点汇总(下)

Part 12. Subsequent Event期后事项定义: Events after the reporting period: events, both favourable and unfavourable, that occurs between the end of the reporting period and the date when the financial statements are authorised for issue.区分调整非调整,主要看时间节点:事件发生在报告期后及财报正式公布前;是否对报告期内数值有影响?Adjusting events调整项目★背诵-定义Events which provide evidence of conditions which existed at the end of the reporting period. Non‐adjusting events 非调整事项★背诵-定义Events that relate to conditions which arose after the end of the reporting period✓Resolution of a court case未决诉讼✓Bankruptcy of a major customer主要客户破产 ✓Evidence of NRV of inventories库存的NRV测试 ✓Discovery of fraud or errors that show the financial statements were incorrect财报错误:舞弊和错误 ✓Destruction of major asset, e.g. by flood or fire自然灾害✓Major share transactions大宗股权交易✓Announcement of a plan to close part of a business关闭公司或部门,包括裁员Change the amounts in the financial statements 上述情况都会影响财报的正确性 Disclose non‐adjusting event in a note to the financial statements在财报的notes中披露即可●Auditor's responsiblityPeriod between the year‐end date and the date the auditor’s report is signed财年结束后,至审计报告签署前 The auditor shall perform audit procedures designed to obtain sufficient appropriate audit evidence that all events occurring between the date of the financial statements and the date of the auditor’s report that require adjustment of, or disclosure in, the financial statements have been identified.审计师有积极的责任执行审计程序,来辨别财报是否正确,该披露的是否披露?The auditor is not, however, expected to perform additional audit procedures on matters to which previously applied audit procedures have provided satisfactory conclusions.如果审计师对当年的财务报告已经比较满意了,那么不会再执行额外的审计程序(这句话比较难理解!)Period between the date the auditor’s report is signed and the date the financial statements are issued审计报告已签署,至财报公布前 The auditor has no obligation to perform any audit procedures regarding the financial statements after the date of the auditor’s report.签署审计报告后,审计师没有责任来主动发现问题。

ACCA考试知识点:F8审计流程知识点梳理

中公财经培训网:/对于很多小伙伴来说,F8阶段的考试以知识点繁多,考试细致而闻名,今年3月考季以39%的通过率稳坐F阶段通过率最低科目!不知道是否有小伙伴默默看过一次网课,依然满脸写着我是谁,我在干什么。

放心,你不是一个人!而且对于一门完全没有实务经验的人来说,这样很正常。

为什么会出现这种情况?并不是你不理解每一个知识点,归根到底是你并不了解自己所学的这门学科的内在逻辑。

知识点就像一个个散落的拼图,只有把它们联系在一起,才能看到完整的图案。

今天,中公财经小编就来带大家梳理一下我们审计这幅拼图。

上图就是完整的审计流程,你可以把它看成审计师和客户浪漫的相识相知怀疑和解之旅(如果顺利的话)。

Tendering,就是双方浪漫的开始,为了能够进一步确认关系,就需要增进了解,这样就有了client acceptance procedure。

当确认你就是我的唯一,就拿一张纸证明并宣誓,这个证明就是appointment and engagement letter。

随后,会通过audit planning更加深入的了解彼此,当在相处过程中发现一些似是而非的问题(ROMM),会通过更加细致的调查(substantive procedure)和确认(audit review),最终确认和解决。

这是人与人的相处,也是你和F8的相知。

更加用心的去体会审计,就会有更加深刻的理解哦。

这一期的文章就到这里,期待我们下次的相遇。

ACCAF8考试重点Mike

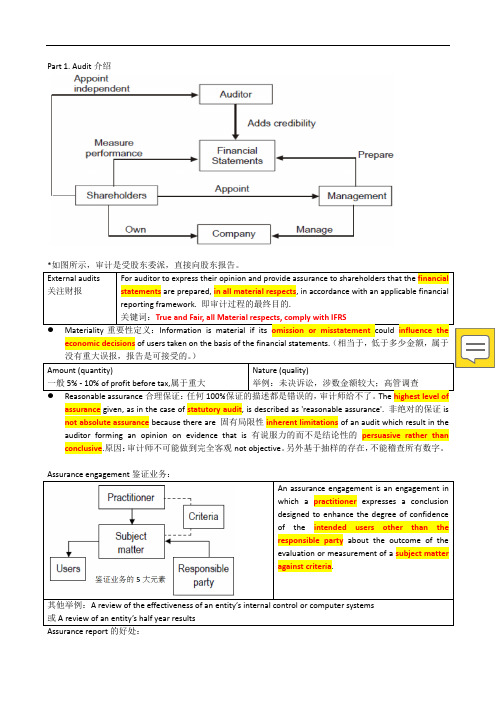

1. Audit 定义‐背诵: External audits provide assurance to shareholders that the financial statements are prepared, in all material respects , in accordance with an applicable financial reporting framework.2. Assurance engagement 定义‐背诵:An assurance engagement is an engagement in which a practitioner expresses a conclusion designed to enhance the degree of confidence of the intended users other than the responsible party about the outcome of the evaluation or measurement of a subject matter against criteria . 3. Assurance engagement 5要素,选择题‐知道:(审计是鉴证业务的一种)* A second element is a suitable subjectmatter. The subject matter is the datathat the responsible party has preparedand which requires verification.* Suitable criteria are required in anassurance engagement. The subjectmatter is compared to the criteria inorder for it to be assessed and an opinionprovided.✓ Sufficient appropriate evidence has to be obtained by the practitioner in order to give therequired level of assurance.✓ An assurance report is the opinionthat is given by the practitioner to the intended user andthe responsible party .EngagementLevel of Assurance Examples External audit法令审计 Reasonable assurance Highest levelPositive expressionIn our opinion , the financial statements present fairly, in all material respects, in accordance with International Financial Reporting Standards. Review 审阅Limited assuranceModerate levelNegative expression Based on our work described in this report, nothing has come to our attention that causes us to believe that the financialstatements do not present fairly , in allmaterial respects, in accordance with IFRS4. Ture and Fair 选择题‐知道:尽管ISA 对真实公允没有定义,但我们可以如下理解:✓ True ‐ Information is factual and conforms with reality in that there are no factual erros. Inaddition it is assumed that to be true it must comply with accounting standards and any relevant legislation . Lastly true includes data being correctly transferred from accounting records to the financial statement.信息符合事实,遵守会计准则和法规。

ACCA F8知识要点汇总 (上)

Positive expression

Financial Reporting Standards.

Review

Led on our work described in this report, nothing has

审阅

Moderate level

come to our attention that causes us to believe that the

assurance given, as in the case of statutory audit, is described as 'reasonable assurance'. 非绝对的保证 is

not absolute assurance because there are 固有局限性 inherent limitations of an audit which result in the

statements are materially misstated'.审计风险是指当 FS 有重大误报时,审计师发表了不恰当的审计观

点。

The auditor shall obtain sufficient appropriate audit evidence to reduce audit risk to an acceptably low

Risk‐based approach to audit 风险导向型审计: Analyse 分析客户商业、交易和系统中,可能导致重大误报的

风险。直接测试风险区域 testing risky area。

Audit risk is the 'risk that the auditor expresses an inappropriate audit opinion when the financial

最新ACCA-F8--大神带你全面复习+重难点梳理+必考知识点讲解

ACCA F8 | 大神带你全面复习+重难点梳理+必考知识点讲解东方立品F8讲师孟超F8 审计与鉴证业务,无疑是F阶段最难以把握的一科,很多同学都在这门课面前望而却步。

尤其是对于中国考生来讲,在一个非母语环境里,突破英语阅读及写作方面的障碍,在缺乏实战经验的前提下,硬生生的参加一个这么抽象的考试科目,的确不容易。

2017年9月考季F8的全球通过率创了历史新低,仅有37%,这进一步说明了F8是一门不好驾驭的课程。

但是从我自身的学习和多年的教学感受出发,我认为F8的难,不是知识点本身的难,而是难在对知识点的融会贯通、综合分析方面,难在能够灵活运用知识点解决实际问题方面。

而从学习的经历来看,过程并不困难,因为都是理解性的知识,并且很多也都符合常识认知和逻辑规律,计算极少、没有做表、没有模型。

下面我来给各位考生做一个考前的总结和提示,助力各位考生对F8建立信心,大胆迈向考场,赢得最后的胜利。

Audit and Assurance 全章节的内容都可以归纳到这一张图里。

图中各角色权利义务明确,各部分之间逻辑关系清晰,环环相扣。

这个逻辑关系图是全章节的缩影,考前冲刺可以用这张图进行发散思维,回顾总结所学知识。

下面我将按照Syllabus的五部分,进行分块总结。

1、Part A部分,Audit framework and regulation主要是关于审计基本概念、理论和原理的介绍,主要包括了Audit,Assurance Engagement ,Corporate Governance,Professional Ethics ,Conceptual Framework,Internal Audit 的相关内容。

这部分内容比较零散,相互之间比较独立,算是记忆性的内容,主要是对后面章节系统化的内容做好知识铺垫,其中Professional Ethics知识点较固定,较简单,容易掌握,因此也是同学们势在必得的分数。

ACCA F8知识点:非流动资产周期控制

ACCA F8知识点:非流动资产周期控制今天和浦江.财经一起来看看ACCA F8科目中,非流动资产周期控制这个重要知识点。

控制目标Control ObjectivesControl objectives for the non-current asset cycle include the control objectives for the purchases cycle, plus the following:1、To ensure that all material capital acquisitions and disposals are approved by management and/or the board.确保所有有形资本的购买和处理都是可控的2、To ensure that only capital expenditure is recognised as an asset.确保只有资本支出被确认为资产3、To ensure that tangible and intangible non-current assets are properly depreciated or amortised.确保有形和无形的固定资产能被正确地折旧或摊销4、To ensure that impairments are identified and accounted for.确保减值损失能被确认和计量举例Internal Control Examples and Sample Tests of ControlsInternal controls and tests of controls include the internal controls and tests of controls for thepurchases cycle, plus the following:。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

ACCA考试《审计与认证业务F8》知识点总结ISA 315 (REVISED),IDENTIFYING AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT THROUGH UNDERSTANDING THE ENTITY AND ITS ENVIRONMENTOne of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal controlThe International Auditing and Assurance Standards Board (IAASB)issues International Standard on Auditing (ISA)for international use. From time to time, ISAs are revised to provide updated standards to auditors. In order to enhance the overall quality of audit, IAASB published a consultation draft on a proposed revision to ISA 315. The objective in revising ISA 315 is to enhance the performance of external auditors by applying the knowledge and findings of an entity’s internal audit function in the risk assessment process, and to strengthen the framework for evaluating the use of internal auditors work to obtain audit evidence.In March 2012, ISA 315 (Revised)was approved and released. One of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal control.OBJECTIVES IN ESTABLISHING INTERNAL CONTROLSGenerally speaking, internal control systems are designed, implemented and maintained by the management and personnel in order to provide reasonable assurance to fulfil the objectives – that is, reliability of financial reporting, efficiency and effectiveness of operations, compliance with laws and regulations and risk assessment of material misstatement. The manner in which the internal control system is designed, implemented and maintained may vary with the entity’s business nature, size and complexity, etc. Auditors focus on both the audit of financial statements and internal controls that relates to the three objectives that may materially affect financial reporting.In order to identify the types of potential misstatements and to determine the nature, timing and extent of audit testing, auditors should obtain an understanding of relevantinternal controls, evaluate the design of the controls, and ascertain whether the controls are implemented and maintained properly.The major components of internal cont rol include control environment, entity’s risk assessment process, information system (including the related business processes, control activities relevant to the audit, relevant to financial reporting, and communication)and monitoring of controls.ACCACONTROL ENVIRONMENTThe control environment consists of the governance and management functions and the attitudes, awareness and actions of the management about the internal control. Auditors may obtain an understanding of the control environments through the following elements.1. Communication and enforcement of integrity and ethical values It is important for the management to create and maintain honest, legal and ethical culture, and to communicate the entity’s ethical and behavioral sta ndards to its employees through policy statements and codes of conduct, etc.2. Commitment to competence It is important that the management recruits competent staff who possess the required knowledge and skills at competent level to accomplish tasks.3. Participation by those charged with governance An entity’s control consciousness is influenced significantly by those charged with governance; therefore, their independence from management, experience and stature, extent of their involvement, as well as the appropriateness of their actions are extremely important.4. Management’s philosophy and operating style Management’s philosophy and operating style consists of a broad range of characteristics, such as management’s attitude to response to business risks, financial reporting, information processing, and accounting functions and personnel, etc. For example, does the targeted earning realistic? Does the management apply aggressive approach where alternative accounting principles or estimates are available? These management’s philosophy and operating style provide a picture to auditors about the management’s attitude about the internal control.5. Organisational structure The organisational structure provides the framework on how the entity’s a ctivities are planned, implemented, controlled and reviewed.6. Assignment of authority and responsibility With the established organisational structure or framework, key areas of authority andreporting lines should then be defined. The assignment of authority and responsibility include the personnel that make appropriate policies and assign resources to staff to carry out the duties. Auditors may perceive the implementation of internal controls through the understanding of the organisational structure and the reporting relationships.7. Human resources policies and practices Human resources policies and practices generally refer to recruitment, orientation, training, evaluation, counselling, promotion, compensation and remedial actions. For example, an entity should establish policies to recruit individuals based on their educational background, previous work experience, and other relevant attributes. Next, classroom and on-the-job training should be provided to the newly recruited staff. Appropriate training is also available to existing staff to keep themselves updated. Performance evaluation should be conducted periodically to review the staff performance and provide comments and feedback to staff on how to improve themselves and further develop their potential and promote to the next level by accepting more responsibilities and, in turn, receiving competitive compensation and benefits.With the ISA 315 (Revised),external auditors are now required to make inquiries of the internal audit function to identify and assess risks of material misstatement. Auditors may refer to the management’s responses of the identified deficiencies of the internal controls and determine whether the management has taken appropriate actions to tackle the problems properly. Besides inquiries of the internal audit function, auditors may collect audit evidence of the control environment through observation on how the employees perform their duties, inspection of the documents, and analytical procedures. After obtaining the audit evidence of the control environment, auditors may then assess the risks of material misstatement.ENTITY’S RISK ASSESSMENT PROCESSAuditors should assess whether the entity has a process to identify the business risks relevant to financial reporting objectives, estimate the significance of them, assess the likelihood of the risks occurrence, and decide actions to address the risks. If auditors have identified such risks, then auditors should evaluate the reasons why the risk assessmentprocess failed to identify the risks, determine whether there is significant deficiency in internal controls in identifying the risks, and discuss with the management.THE INFORMATION SYSTEM, INCLUDING THE RELEVANT BUSINESS PROCESSES, RELEVANT TO FINANCIAL REPORTING AND COMMUNICATIONAuditors should also obtain an understanding of the information system, including the related business processes, relevant to financial reporting, including the following areas:? The classes of transactions in the ent ity’s operations that are significant to the financial statements. The procedures that transactions are initiated, recorded, processed, corrected as necessary, transferred to the general ledger and reported in the financial statements.? How the information system captures events and conditions that are significant to the financial statements.? The financial reporting process used to prepare the entity’s financial statements.? Controls surrounding journal entries.? Understand how the entity communicates financial reporting roles, responsibilities and significant matters to those charged with governance and external – regulatory authorities.CONTROL ACTIVITIES RELEVANT TO THE AUDITAuditors should obtain a sufficient understanding of control activities relevant to the audit in order to assess the risks of material misstatement at the assertion level, and to design further audit procedures to respond to those risks. Control activities, such as proper authorisation of transactions and activities, performance reviews, information processing, physical control over assets and records, and segregation of duties, are policies and procedures that address the risks to achieve the management directives are carried out.MONITORING OF CONTROLSIn addition, auditors should obtain an understanding of major types of activities that the entity uses to monitor internal controls relevant to financial reporting and how the entityinitiates corrective actions to its controls. For instance, auditors should obtain an understanding of the sources and reliability of the information that the entity used in monitoring the activities. Sources of information include internal auditor report, and report from regulators.LIMITATIONS OF INTERNAL CONTROL SYSTEMSEffective internal control systems can only provide reasonable, not absolute, assurance to achieve the entity’s financial reporting objective due to the inherent limitations of internal control – for example, management override of internal controls. Therefore, auditors should identify and assess the risks of material misstatement at the financial statement level and assertion level for classes of transactions, account balances and disclosures.CONCLUSIONAs internal auditors have better understanding of the organisation and expertise in its risk and control, the proposed requirement for the external auditors to make enquiries of internal audit function in ISA 315 (Revised)will enhance the effectiveness and efficiency of audit engagements. External auditors should pay attention to the components of internal control mentioned above in order to make effective andefficient enquiries. An increase in the work of internal audit functions is also expected because of such proposed requirement.Raymond Wong, School of Accountancy, The Chinese University of Hong Kong, and Dr Helen Wong, Hong Kong Community College, Hong Kong Polytechnic UniversityReference ISA 315 (Revised),Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and ItsEnvironment。