非居民纳税人税收居民身份信息报告表(企业适用)——(工商税务)

《中华人民共和国非居民企业所得税年度纳税申报表(2019年版)》及填报说明.doc

六、实际应纳所得税额(28+29-30-31)

33

减:本年累计实际已缴纳的所得税额

34

七、本年应补(退)所得税额(32-33)

汇总纳税税款分配

35

主要机构、场所填报

本机构、场所本年应分摊所得税额(36+37+38)

36

其中:主要机构、场所直接分摊所得税额

37

主要机构、场所财政集中分配所得税额

38

2.第1行“利润总额”:填报当期财务会计报表中的利润总额。

3.第2行“境外所得”:填报纳税人当期取得的发生在境外但与境内机构、场所有实际联系的所得数额。当期为境外盈利的,以正数表示;当期为境外亏损的,以负数表示。

4.第3行“纳税调整增加额”:填报纳税人会计处理与税收规定不一致,进行纳税调整增加的数额。本行根据《纳税调整项目明细表》(表F210)“调增数额”列填报。

行次

项目

据实计算

申报金额

核定征收

申报金额

1

一、利润总额

2

减:境外所得

3

加:纳税调整增加额(填报F210)

4

减:纳税调整减少额(填报F210)

5

减:免税、减计收入及加计扣除

6

其中:项目①(减免性质代码)

7

项目②(减免性质代码)

8

项目③(减免性质代码)

9

项目④(减免性质代码)

10

项目⑤(减免性质代码)

11

主要机构、场所从事主体生产经营业务分摊所得税额

39

减:本机构、场所本年累计实际已缴纳的所得税额

40

本机构、场所本年应补(退)所得税额(35-39)

41

其他机构、场所填报

非居民享受税收协定待遇身份信息报告表(适用于企业)

附件 3Annex 3非居民享受协定待遇身份信息报告表(适用于企业)Personal Information of non-residnets claiming for treatment underDouble Taxation Agreement(DTA)(for enterprise) 填报日期 Date 年 月 日 Y/M/D填表说明:Note1.本表为《非居民享受税收协定待遇审批申请表》的附表,适用于在《非居民享受税收协定待遇申请表》第3栏中选择企业的纳税人。

This form is attached to the form "Non-resident's claim for treatment under Double Taxation Agreement(DTA) (for apprroval)". It is applicable to the taxpayer who selects "Enterprise" in Blank 3(Type of tax payer) in that form.2.本表第4栏中具有独立纳税地位的营利实体和不具有独立纳税地位的营利实体,按是否在缔约对方单独缴纳属于协定适用范围的所得税判定。

选择其他类型的,应在第5栏备注中说明具体特征和性质。

"Business entity with independent tax status" and "Business entity with dependent tax status" in Blank 4 is determined according to whether the taxpayer is independently liable in the other contracting party to income taxes covered by DTA. If "Others" is selected, please specify the charateristics and nature in Blank 5 (Additional information).3.本表各栏所称“所在地”指具有独立税收管辖权的国家或地区,第13栏和第19栏中的所在地按注册地或经常居住地填报。

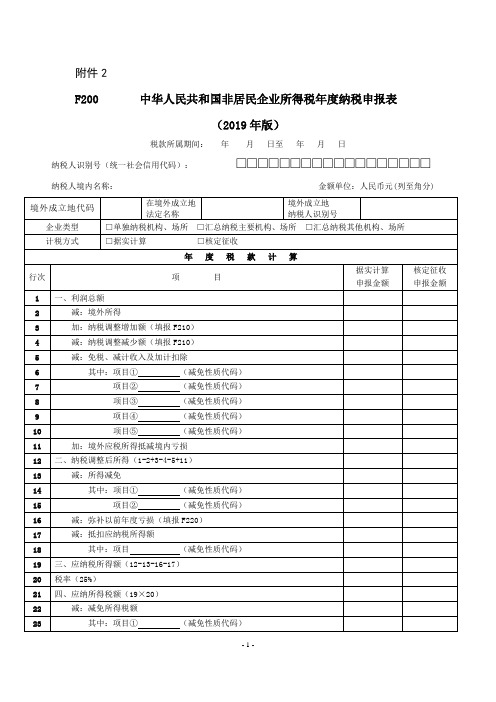

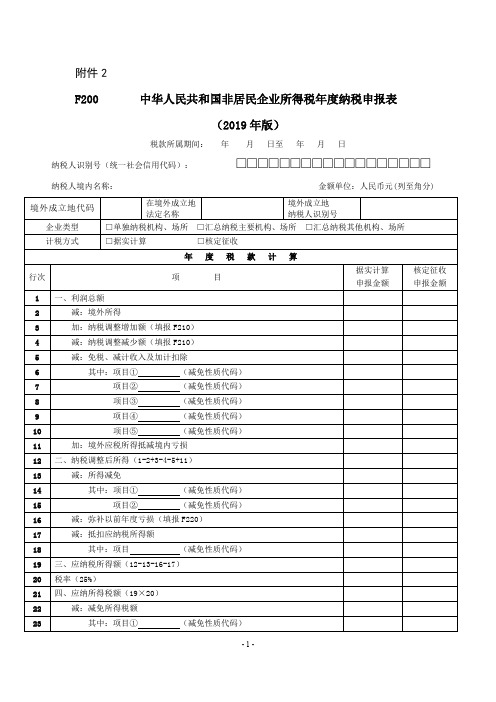

A06859《中华人民共和国非居民企业所得税年度纳税申报表(2019年版)(F200)》

A06859《中华人民共和国非居民企业所得税年度纳税申报表(2019年版)(F200)》F200 中华人民共和国非居民企业所得税年度纳税申报表(2019年版)税款所属期间:年月日至年月日纳税人识别号(统一社会信用代码):□□□□□□□□□□□□□□□□□□纳税人境内名称:金额单位:人民币元(列至角分)国家税务总局监制【表单说明】一、适用范围本表及附表由办理年终汇算清缴所得税申报的非居民企业机构、场所(以下简称“纳税人”)填报。

在经营年度内无论盈利或者亏损,都应当按照有关规定报送本表和相关资料。

二、表头项目1.“税款所属期间”:填报税款所属年度的起止日期。

纳税人当年实际经营期间不足一个纳税年度的,填报当年实际经营期间的起止日期。

2.“纳税人识别号(统一社会信用代码)”:填报税务机关核发的纳税人识别号或有关部门核发的统一社会信用代码。

3.“纳税人境内名称”:填报营业执照、税务登记证等证件载明的纳税人名称。

三、有关项目填报说明(一)基本信息1.“境外成立地代码”:填报纳税人成立地国家(或地区)三字母代码(ISO 3166-1标准)。

2.“在境外成立地法定名称”:填报纳税人在其成立地国家(或地区)的法定名称。

3.“境外成立地纳税人识别号”:填报纳税人在其成立地国家(或地区)的纳税人识别号。

4.“企业类型”:纳税人根据情况勾选,填报人为单独申报纳税的非居民企业机构、场所的,勾选“单独纳税机构、场所”;填报人为汇总纳税非居民企业机构、场所中的主要机构、场所的,勾选“汇总纳税主要机构、场所”;填报人为汇总纳税非居民企业机构、场所中除主要机构、场所以外的其他机构、场所的,勾选“汇总纳税其他机构、场所”。

5. “计税方式”:纳税人根据情况勾选,据实申报纳税的填报人,勾选“据实计算”;采取核定征收方式申报纳税的填报人,勾选“核定征收”。

已经勾选“核定征收”的填报人,需要填报本表附表《非居民企业机构、场所核定计算明细表》(表F400)。

国家税务总局公告2015年第60号:修订后的《非居民纳税人享受税收协定待遇管理办法》发布(老会计人的经验)

国家税务总局公告2015年第60号:修订后的《非居民纳税人享受税收协定待遇管理办法》发布(老会计人的经验)相关政策——国家税务总局公告2015年第60号国家税务总局关于发布《非居民纳税人享受税收协定待遇管理办法》的公告2015年8月27日,国家税务总局发布了《非居民纳税人享受税收协定待遇管理办法》(以下称《办法》),为便于纳税人和税务机关理解和执行,现对《办法》解读如下:一、《办法》出台背景为贯彻落实《国务院关于取消非行政许可审批事项的决定》(国发〔2015〕27号),推进税务部门简政放权、放管结合、优化服务,改进非居民纳税人享受协定待遇管理,国家税务总局在广泛听取各有关方面意见,多次实地调研的基础上,对《非居民享受税收协定待遇管理办法(试行)》(国税发〔2009〕124号)进行了全面修订,制定了本《办法》。

相关政策——《国家税务总局关于如何理解和认定税收协定中“受益所有人”的通知》(国税函〔2009〕601号)国税函[2010]290号关于《非居民享受税收协定待遇管理办法(试行)》有关问题的补充通知二、《办法》要点解读(一)扩大适用范围《办法》在国税发〔2009〕124号规定适用的税收协定条款范围基础之上,将适用范围扩大至税收协定的国际运输条款和国际运输协定。

非居民纳税人享受税收协定和国际运输协定待遇适用统一规范的管理流程。

(二)取消行政审批《办法》取消了国税发〔2009〕124号对非居民纳税人享受税收协定股息、利息、特许权使用费、财产收益条款的行政审批。

《办法》规定非居民纳税人享受协定待遇的基本模式是:非居民纳税人自行申报的,自行判断是否符合享受协定待遇条件,如实申报并向主管税务机关报送相关报告表和资料。

在源泉扣缴和指定扣缴情况下,非居民纳税人自行判断符合享受协定待遇条件,需要享受协定待遇的,应主动向扣缴义务人提出并提供相关报告表和资料。

对符合享受协定待遇条件的非居民纳税人,扣缴义务人依协定规定扣缴,并将相关报告表和资料转交主管税务机关。

非居民纳税人享受税收协定待遇情况报告表(企业所得税B表)——(工商税务,报告书)英文

Reporting Form for Non-resident Taxpayer Claiming Tax Treaty Benefits(Form B for Enterprise Income Tax)(Applicable to Tax Treaty Benefits under the Articles of Permanent Establishment and BusinessProfits)国家税务总局监制【表单说明】I.This form is applicable to non-resident enterprise income taxpayer who receives income sourced in China,and claims tax treaty benefits under the articles of permanent establishment and business profits of a Double Taxation Agreement signed by China(including the DTAs with Hong Kong and Macau Special Administrative Regions).II.This form can be used for self-declaration or withholding declaration,as well as for the non-resident taxpayer’s application for tax refund.The non-resident taxpayer initiating the self-declaration for claiming tax treaty benefits,or applying for tax refund,shall complete two copies of the form:one form is to be submitted to the in-charge tax authority at the time of such declaration or application,and the other form is to be kept by the non-resident taxpayer.Where the non-resident taxpayer’s China sourced income is subject to withholding tax,administered at source or by means of a designated withholding agent,and the non-resident taxpayer is entitled to tax treaty benefits,the non-resident taxpayer shall complete three copies of the form:one is to be given to the withholding agent to submit to the in-charge tax authority at the time of the withholding declaration,one is to be kept by the withholding agent and another is to be kept by the non-resident taxpayer.III.Part I of the form shall be filled in by the withholding agent,and will not be required in the case of self-declaration.The rest of the form shall be filled in by the non-resident taxpayer.When filling in the form,the non-resident taxpayer can attach separate sheets to the form if necessary.VI.The non-resident taxpayer shall provide accurate and complete information to answer the questions contained in the form.Please write“N/A”in the form if a situation described in a question is not applicable for a non-resident taxpayer.For a multiple-choice question,please mark“√”in a corresponding box(“□”)or circle(“○”)for a choice that fits a non-resident taxpayer’s situation.If a non-resident taxpayer’s situation falls into the description of a question marked with“*”,answers shall be provided;otherwise,it can be skipped.V.This form is prepared in Chinese and English.In case of divergence in the two languages,the Chinese text shall prevail.Unless otherwise stated,it shall be completed in Chinese.VI.Instructions on how to fill in each item are as follows:(I)Basic Information of Withholding AgentName of withholding agent:The withholding agent should provide its full name as shown in its tax registration certificate.Tax identification number of withholding agent:The withholding agent should provide its identification number as shown in the tax registration certificate.(II)Basic Information of Non-resident TaxpayerChinese name of non-resident taxpayer:Fill in the full Chinese name used by the non-resident taxpayer in China.Name of non-resident taxpayer in resident state(region):Fill in the full English name of the non-resident taxpayer which is used in the non-resident taxpayer’s state(region)of residence.III.Types of Operation Activities by Non-resident Taxpayer in ChinaNon-resident taxpayer should make a selection based on the business activities.Please only fill out the questions related to the selected business activities in Part IV.(IV)Detailed Information on Operation Activities by Non-resident Taxpayer in ChinaQuestion 2,“Name of project,location of project,name of general contractor”:The projectname shall be consistent with that stated in the signed contract.For the name of the project general contractor,please fill in the name of the contractor responsible for the wholeconstruction,assembly or installation project.Question 3,“Time of construction,assembly or installation project or relevant supervisory activities by non-resident taxpayer in China”:If the non-resident taxpayer(general contractor)subcontracts part of the contracted construction projects to any otherenterprise(subcontractor),the time during which the subcontractor carries out construction activities on the building site shall be included in the time of the general contractor.If the date on which the subcontractor commences to implement the contract is prior to that of the general contractor,the date of commencement of the subcontractor shall be deemed to be the date of commencement of the general contractor.If the non-resident taxpayer consecutively contracts two or more work programs on one building site or project in China,the commencement of the first work program shall be the actual date to implement the contract and the conclusion of all the work programs shall be the date of completion of the contract.Question 4,“Project subcontract information”:Please list all the information about subcontracting projects by the non-resident taxpayer.Question 5,“Non-resident taxpayer provides services through employees or other personnel engaged”:For the number of staff employed in China or seconded to China by the non-resident taxpayer,please fill in the total number of the staffs employed in China or seconded to China by non-resident taxpayer.Please fill in the name of the key personnel for providing the services.Question 6,“Time schedule of the services provided by the non-resident taxpayer in China”:For “Actual date to implement the service contract in China”,please fill in the actual date on which the personnel dispatched from overseas or/and those employed in China start to provide services for the project;for“the estimated duration of the project”,please fill in the estimated duration of the project in the time unit specified in the tax treaty to be enjoyed by the non-resident taxpayer.Question 7,“The suspension of services provided by non-resident taxpayer in China”:Where the service activities provided by the non-resident taxpayer in China is or is estimated to be suspended,please fill in the beginning and ending date of the suspension as occurred or as estimated.Question 10,“Time schedule of usage of relevant device or equipment to explore or exploit natural resources,or engagement in related activities by non-resident taxpayer”:“The estimated duration of the work”,please fill in the estimated duration of the work in the time unit specified in the tax treaty to be enjoyed by the non-resident taxpayer.Question 12,“Are all the activities exercised through this fixed place of business of a preparatory or auxiliary character”:A place in which activities of“preparatory or auxiliary”nature are carried on has in general the following characteristics:(1)The activities of the place of business are not carried on independently and do not constitute an essential or significant part of the whole activities of the non-resident taxpayer;(2)Where the activities of the place of business are excluded from constituting a PE according to the scenarios listed in the DTA,the activities are only provided to the non-resident taxpayer instead of any other enterprises;and(3)The functions of the place are limited to administrative activities and do not directlyplay a profit-making role.Question 19,“Please briefly explain the legal basis and facts pattern which could support the statement that the non-resident taxpayer does not have a PE in China so that the business profit derived from China is not subject to Chinese Enterprise Income Tax.”:If the activities conducted by the non-resident taxpayer do not fall into the five scenarios listed in this form and according to the applicable DTA,no PE is constituted in China by the non-resident taxpayer,please quote the relevant provisions in DTA and explain the facts based on which the non-resident taxpayer could enjoy the treatment according to the DTA.(V)Income Received of the Same Type and Tax Treaty Benefits ClaimedQuestion 20,“Has the non-resident taxpayer received any income of the same type sourced in other regions within China over the past three years?”:If the non-resident taxpayer has any income of the same type sourced in other regions within China over the past three years,and this is under the jurisdiction of a different in-charge tax authority,“Yes”shall be selected,and Question 21 and 22 shall be answered.Please specify all tax treaty benefits claimed by the non-resident taxpayer for any income of the same type sourced in other regions within China over the past three years in Question 22.Supporting materials can be attached separately(VI)List of Documents AttachedNon-resident taxpayer can provide,on a voluntary basis,other materials to justify the non-resident taxpayer’s entitlement to the tax treaty benefits.When providing such materials,please identify all of them on the list.(VII)Additional NotesNon-resident taxpayer can provide other information that the non-resident taxpayer believes should be considered by the in-charge tax authority and may be beneficial to justify thenon-resident taxpayer’s entitlement to the tax treaty benefits.Please specify the special situations in the additional notes,if any.(VIII)DeclarationThe declaration shall be sealed by the non-resident taxpayer,and/or signed by the legal representative or authorized representative of the non-resident enterprise,and the date of the statement shall be provided.VII.Any information and materials provided by the non-resident taxpayer will be kept confidential by China’s tax authorities.来源:/ws/detail15238.html。

《非居民纳税人享受协定待遇信息报告表》(附填表说明)

【分类索引】 业务部门 国际税务司 业务类别 自主办理事项 表单类型 纳税人填报 设置依据(表单来源) 政策规定表单 【政策依据】 《国家税务总局关于发布<非居民纳税人享受协定待遇管理办法>的公告》(国家税务总局公告2019年第35号) 【表单】

contracting jurisdiction to prove the residence status of

non-resident taxpayer for the year or its previous year during which

the payment is received

14.享受协定待遇所得金额 Amount of the income with respect to which tax treaty benefits are claimed

11.享受协定名称 The applicable treaty

8.在居民国(地区) 的联系电话 Telephone number in resident jurisdiction 10.电子邮箱 E-mail address 12.适用协定条款名 称 Applicable articles of the treaty

17.我谨声明:根据缔约对方法律法规和税收协定居民条款,我为缔约对方税收居民,相关安排 和交易的主要目的不是为了获取税收协定待遇。我自行判断符合协定待遇条件,自行享受协定待 遇,承担相应法律责任。我将按规定归集和留存相关资料备查,接受税务机关后续管理。 I hereby declare: According to the laws, regulations of the other contracting jurisdiction and the article of resident of the tax treaty, I am a resident of the other contracting jurisdiction, the principal purpose of the relevant arrangement and transaction is not to obtain tax treaty benefits. Through self-assessment, I believe that I am in conformity with the conditions for claiming tax treaty benefits, so I will enjoy tax treaty benefits. Therefore, I take due legal responsibilities. I will collect and retain relevant materials for review in accordance with the regulations, and accept the follow-up administration of the tax authority.

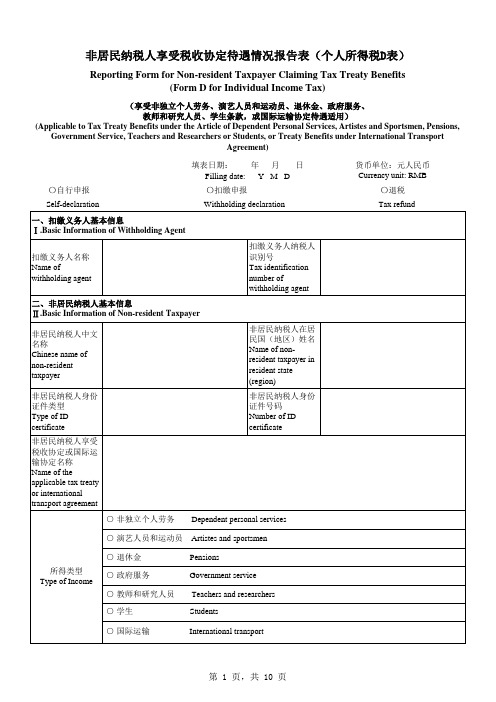

非居民纳税人享受税收协定待遇情况报告表(个人所得税D表)以及填报说明

Yes. Please indicate the specific type

aircraft or land vehicle operated in international traffic by an enterprise of the other of the traffic vehicle

Contracting State?

非居民纳税人享受税收协定待遇情况报告表(个人所得税D表)

Reporting Form for Non-resident Taxpayer Claiming Tax Treaty Benefits (Form D for Individual Income Tax)

(享受非独立个人劳务、演艺人员和运动员、退休金、政府服务、 教师和研究人员、学生条款,或国际运输协定待遇适用)

7.非居民纳税人从事的活动属于以下哪种情况

Type of activities exercised by the non-resident taxpayer

(1)□政府间文化交流计划

Cultural exchange program agreed upon by the governments of both Contracting States

(2)□ 由中国政府资金或公共资金资助 请说明资助者名称 Substantially supported by Government of China, or its public funds Please indicate the name of the sponsor

(3)□其他 Other cases

system or public welfare plan?

11.非居民纳税人在中国居住或计划居住时间 Actual or estimated residence period in China of the non-resident taxpayer

非居民纳税人享受税收协定待遇情况报告表(企业所得税B表)

(4)作业(包括试运行 作业)全部结束交付使用 日期或预计结束日期

The date of delivery of all the work (including trial work) or the estimated ending date

第 2 页,共 7 页

4.工程项目分包情况 Project subcontract information

1.非居民纳税人在中国从事工程具体类型(可多选) Types of projects engaged by non-resident taxpayer in China (multiple choices) □ 建筑工地 Building site □ 建筑、装配或安装工程 Construction, assembly or installation project □ 与建筑、装配或安装工程有关的监督管理活动 Supervisory activities in connection with construction, assembly or installation project □ 与建筑、装配或安装工程有关的咨询活动 Consultancy activities in connection with construction, assembly or installation project □ 其他 Others

2.工程项目名称 Name of project

工程项目地点 Location of project

工程项目总承包商名称 Name of general contractor

3.非居民纳税人在境内从事建筑、装配或安装工程,或相关监督管理活动时间情况 Time of construction, assembly or installation project or relevant supervisory activities by non-resident taxpayer in China

向非居民企业支付股息、红利的税收政策

向非居民企业支付股息、红利的税收政策根据《企业所得税法实施条例》第十七条规定,《企业所得税法》第六条第四项所称股息、红利等权益性投资收益,是指企业因权益性投资从被投资方取得的收入。

股息、红利等权益性投资收益,除国务院财政、税务主管部门另有规定外,按照被投资方作出利润分配决定的日期确认收入的实现。

第一:非居民企业取得的被投资企业在2008年以前实现的税后利润分红,不缴纳企业所得税。

《财政部、国家税务总局关于企业所得税若干优惠政策的通知》(财税〔2008〕1号)第四条规定,2008年1月1日以前外商投资企业形成的累积未分配利润,在2008年以后分配给外国投资者的,免征企业所得税。

2008年及以后年度外商投资企业新增利润分配给外国投资者的,依法缴纳企业所得税。

第二:2008年新《企业所得税法》实施后,非居民企业取得的分红需要按10%的税率缴税。

《企业所得税法》第三条第三款规定,非居民企业在中国境内未设立机构、场所的,或者虽设立机构、场所但取得的所得与其所设机构、场所没有实际联系的,应当就其来源于中国境内的所得缴纳企业所得税。

第四条第二款规定,非居民企业取得本法第三条第三款规定的所得,适用税率为20%。

第十九条规定,非居民企业取得股息、红利等权益性投资收益和利息、租金、特许权使用费所得,以收入全额为应纳税所得额。

《企业所得税法实施条例》第九十一条规定,非居民企业取得所得税法第三条第三项规定的所得,减按10%的税率征收企业所得税。

第三,虽然税法规定的税率是10%,但如果非居民企业所在国家或地区与我国签订有税收协定,协定的税率低于10%,则可以按协定的税率执行。

按照《内地和香港特别行政区关于对所得避免双重征税和防止偷漏税的安排》第十条第二款的规定,如果香港母公司持股比例超过25%,减按5%的优惠税率执行。

按照《中·澳(澳大利亚)税收协定》第十条的规定,所征税款不应超过股息总额的15%。

境外投资方要享受协定优惠税率,需向税务机关提交相关资料提出申请,经审查确认后才能享受;详细内容见《国家税务总局关于印发〈非居民享受税收协定待遇管理办法(试行)〉的通知》(国税发〔2009〕124号)。

d31836daf08e4a2bb23a6549a85e0ff6

附件2F200 中华人民共和国非居民企业所得税年度纳税申报表(2019年版)税款所属期间:年月日至年月日纳税人识别号(统一社会信用代码):□□□□□□□□□□□□□□□□□□纳税人境内名称:金额单位:人民币元(列至角分)国家税务总局监制F200《中华人民共和国非居民企业所得税年度纳税申报表(2019年版)》填报说明一、适用范围本表及附表由办理年终汇算清缴所得税申报的非居民企业机构、场所(以下简称“纳税人”)填报。

在经营年度内无论盈利或者亏损,都应当按照有关规定报送本表和相关资料。

二、表头项目1.“税款所属期间”:填报税款所属年度的起止日期。

纳税人当年实际经营期间不足一个纳税年度的,填报当年实际经营期间的起止日期。

2.“纳税人识别号(统一社会信用代码)”:填报税务机关核发的纳税人识别号或有关部门核发的统一社会信用代码。

3.“纳税人境内名称”:填报营业执照、税务登记证等证件载明的纳税人名称。

三、有关项目填报说明(一)基本信息1.“境外成立地代码”:填报纳税人成立地国家(或地区)三字母代码(ISO 3166-1标准)。

2.“在境外成立地法定名称”:填报纳税人在其成立地国家(或地区)的法定名称。

3.“境外成立地纳税人识别号”:填报纳税人在其成立地国家(或地区)的纳税人识别号。

4.“企业类型”:纳税人根据情况勾选,填报人为单独申报纳税的非居民企业机构、场所的,勾选“单独纳税机构、场所”;填报人为汇总纳税非居民企业机构、场所中的主要机构、场所的,勾选“汇总纳税主要机构、场所”;填报人为汇总纳税非居民企业机构、场所中除主要机构、场所以外的其他机构、场所的,勾选“汇总纳税其他机构、场所”。

5. “计税方式”:纳税人根据情况勾选,据实申报纳税的填报人,勾选“据实计算”;采取核定征收方式申报纳税的填报人,勾选“核定征收”。

已经勾选“核定征收”的填报人,需要填报本表附表《非居民企业机构、场所核定计算明细表》(表F400)。

非居民享受税收协定待遇身份信息报告表(适用于个人)

第三方名称 Name of the jurisdiction

20是否在第三方取得长期居留权 Does the taxpayer have the right to permenantly stay in a jurisdiction other than China & the other contracting party? □是 Yes□否 No

4 家庭成员姓名 Name of family

member

5 与纳税人关系 relationship with the taxpayer

6 经常居住地 habitual residence

7 备注 Additional information

构成缔约对方税收居民情况: Qualification as a fiscal resident of the other contracting party 8构成缔约对方税收居民的法律依据描述: Legal provisions prescribing the status of the taxpayer as a fiscal resident of the other contracting party

第三方名称 Name of the jurisdiction

第三方名称 Name of the jurisdiction

22最近连续12个月内是否在第三方连续或累计超过180天

Does the taxpayer stay in a jurisdiction other than China & the 第三方名称

21是否在第三方保有的投资额超过 缔约对方投资额 Does the amount of investment in a jurisdiction other than China & the other contracting party exceed that in the other contracting party? □是 Yes □否 No

非居民纳税人享受税收协定待遇情况报告表(企业所得税A表)

第 2 页,共 18 页

*7.非居民纳税人是否完全为税收协定缔约对方的政府所有? Is the non-resident taxpayer wholly-owned by the government of the other tax treaty contracting party?

8.贷款资金是否存在以下情况 Do any of the following circumstances apply in respect of the loaned monies?

4.非居民纳税人直接或间接拥有支付股息公司的股份比例合计 Percentage of total share capital held, directly and indirectly, by the non-resident taxpayer in the dividend paying company

提示:“受益所有人”是指对所得或所得据以产生的权利或财产具有所有权和支配权的人。如果非居民纳税人不是来源于中国的股 人,则不能享受税收协定待遇。 Note: A "beneficial owner" refers to a person that owns and has the right to dispose of the income or the rights or property from which suc is not the beneficial owner of the dividends, interest or royalties sourced in China is not entitled to the tax treaty benefits.

*18.非居民纳税人是否为税收协定缔约对方居民且在缔约对方上市的公司100%直接或间接拥有(不含通过不属于中国居民或 缔约对方居民的第三方国家或地区居民企业间接持有股份的情况)? Is the non-resident taxpayer held 100%, directly or indirectly, by a resident of the other tax treaty contracting party, which is a listed company in the other tax treaty contracting party as well (indirect shareholdings by residents of a third state or region, other than residents of China or the other tax treaty contracting party, is excluded )?

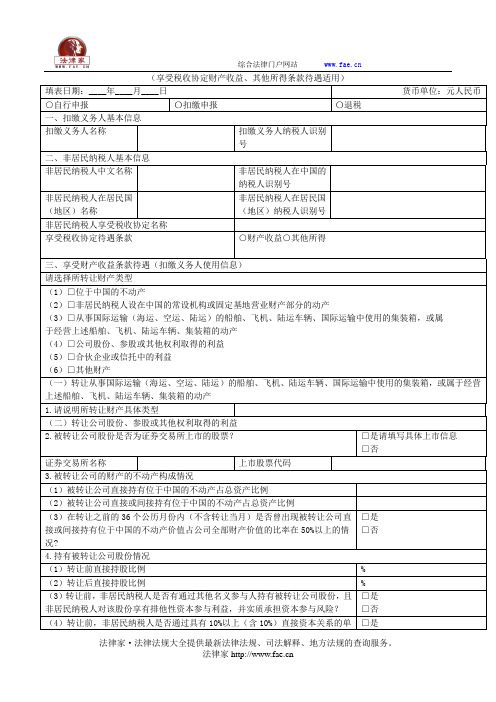

非居民纳税人享受税收协定待遇情况报告表(企业所得税C表)——(工商税务,通知书)

【表单说明】一、本表适用于取得来源于我国的财产收益所得、其他所得,需享受我国签署的避免双重征税协定(含与港澳避免双重征税安排)中的财产收益或其他所得条款的税收协定待遇的企业所得税非居民纳税人。

二、本表可用于自行申报或扣缴申报,也可用于非居民纳税人申请退税。

非居民纳税人自行申报享受协定待遇或申请退税的,应填写本表一式两份,一份在申报享受协定待遇或申请退税时交主管税务机关,一份由非居民纳税人留存;对非居民纳税人来源于中国的所得实施源泉扣缴的,非居民纳税人如需享受税收协定待遇,应填写本表一式三份,一份交由扣缴义务人在扣缴申报时交主管税务机关,一份由扣缴义务人留存备查,一份由非居民纳税人留存。

三、本表第一部分由扣缴义务人填写,如非居民纳税人自行申报纳税则无需填写。

本表其余部分由非居民纳税人填写。

非居民纳税人填报本表时可根据需要增加附页。

四、本表第三部分“享受财产收益条款待遇(扣缴义务人使用信息)”、第五部分“享受其他所得条款待遇”用于在源泉扣缴情况下,扣缴义务人核对非居民纳税人是否符合享受协定待遇条件;其他部分用于税务机关采集管理信息。

五、非居民纳税人应如实完整填写本表所列问题。

如非居民纳税人没有问题所列情况,请在表格中填“无”。

本表所列选择题,请非居民纳税人在符合自身情况的选项对应的□或○中打勾“√”。

带有*标识的题目,请具有题目所描述情况的非居民纳税人填写,与题目所描述情况不符的非居民纳税人无需填写。

六、本表采用中英文双语制作,如中英文表述不一致,以中文为准。

如无特别说明,应使用中文填写。

七、本表各栏填写如下:(一)扣缴义务人基本信息1.扣缴义务人名称:由扣缴义务人填写税务登记证所载扣缴义务人的全称。

2.扣缴义务人纳税人识别号:由扣缴义务人填写扣缴义务人税务登记证上注明的“纳税人识别号”。

(二)非居民纳税人基本信息3.非居民纳税人中文名称:填写非居民纳税人在中国境内的中文全称。

4.非居民纳税人在居民国(地区)名称:填写非居民纳税人在其居民国(地区)的英文全称。

非居民企业所得税季度和年度纳税申报表(适用于核定征收企业) (不构成常设机构和国际运输免税申报)说明

附件6《中华人民共和国非居民企业所得税季度和年度纳税申报表(适用于核定征收企业)/(不构成常设机构和国际运输免税申报)》填报说明一、本表适用于核定征收企业所得税的非居民企业在季度、年度申报缴纳企业所得税时使用。

享受税收协定不构成常设机构待遇、享受税收协定或其他类协定的国际运输免税的非居民企业在季度、年度申报免税收入时也使用本表。

税收协定是指中华人民共和国政府对外签署的避免双重征税协定(含与香港、澳门特别行政区签署的税收安排,统称税收协定),其他类协定是指享受税收协定以外的其他类协定税收优惠,例如海运协定、航空协定、互免国际运输收入协议等。

二、企业应当按税法规定期限向主管税务机关报送本表,并同时报送主管税务机关要求报送的其他资料。

三、企业因确有困难,不能在规定期限内办理季度和年度所得税申报,应当在规定的申报期限内向主管税务机关提出书面延期申请,经主管税务机关核准,在核准的期限内办理,但要在纳税期内按照上期实际缴纳的税额或者税务机关核定的税额预缴税款,并在核准的延期内办理税款结算。

四、企业未按规定期限向主管税务机关报送本表及主管税务机关要求报送的其他资料的,依照《中华人民共和国税收征收管理法》及其实施细则的有关规定处理。

五、本表中所称国家有关税收规定除另有说明外,均指《中华人民共和国企业所得税法》及其实施条例的有关规定,以及国务院、国务院财政、税务主管部门根据税法制定的相关规定。

六、本表用中文填写。

七、本表有关栏目的填写如下:1.税款所属期间:按公历年度日期填写,季度申报时填写自公历每季度1日起至该季度末止;年度申报时填写当年1月1日起至当年12月31日。

企业在季度中间或年度中间开业或者终止经营活动,应当以其实际经营期为一个纳税季度或纳税年度。

2.纳税人识别号:填写税务登记证上所注明的“纳税人识别号”或主管税务机关颁发的临时纳税人纳税识别号。

3.金额单位:精确到小数点后两位,四舍五入。

4.纳税人名称:填写企业税务登记证上的纳税人名称或临时税务登记的纳税人名称。

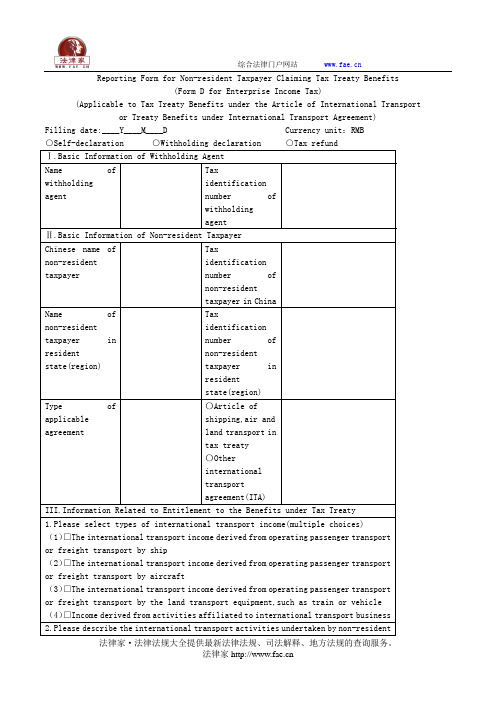

非居民纳税人享受税收协定待遇情况报告表(企业所得税D表)——(工商税务,报告书)英文

Reporting Form for Non-resident Taxpayer Claiming Tax Treaty Benefits(Form D for Enterprise Income Tax)(Applicable to Tax Treaty Benefits under the Article of International Transport or Treaty Benefits under International Transport Agreement)Filling date:____Y____M____D Currency unit:RMB【表单说明】I.This form is applicable to non-resident enterprise income taxpayer who receives international transport income sourced in China,and claims treaty benefits under the article of international transport of a Double Taxation Agreement(DTA,including the DTAs with Hong Kong and Macau Special Administrative Regions)or an International Transport Agreement(ITA)signed by China.II.This form can be used for self-declaration or withholding declaration,as well as for the non-resident taxpayer’s application for tax refund.The non-resident taxpayer initiating the self-declaration for claiming tax treaty or international transport agreement benefits,or applying for tax refund,shall complete two copies of the form:one form is to be submitted to the in-charge tax authority at the time of such declaration or application,and the other form is to be kept by the non-resident taxpayer.Where the non-resident taxpayer’s China sourced income is subject to withholding tax,administered at source or by means of a designated withholding agent,and the non-resident taxpayer is entitled to tax treaty or international transport agreement benefits,the latter shall complete three copies of the form:one is to be given to the withholding agent to submit to the in-charge tax authority at the time of the withholding declaration,one is to be kept by the withholding agent and another is to be kept by the non-resident taxpayer.III.Part I of the form shall be filled in by the withholding agent,and will not be required in the case of self-declaration.The rest of the form shall be filled in by the non-resident taxpayer.When filling in the form,the non-resident taxpayer can attach separate sheets to theform if necessary.IV.The non-resident taxpayer shall provide accurate and complete information to answer the questions contained in the form.Please write“N/A”in the form if a situation described in a question is not applicable for a non-resident taxpayer.For a multiple-choice question,please mark“√”in a corresponding box(“□”)or circle(“○”)for a choice that fits a non-resident taxpayer’s situation.If a non-resident taxpayer’s situation falls into the description of a question marked with“*”,answers shall be provided;otherwise,it can be skipped.V.This form is prepared in Chinese and English.In case of divergence in the two languages,the Chinese text shall prevail.Unless otherwise stated,it shall be completed in Chinese.VI.Instructions on how to fill in each item are as follows:(I)Basic Information of Withholding AgentName of withholding agent:The withholding agent should provide its full name as shown in its tax registration certificate.Tax identification number of withholding agent:The withholding agent should provide its identification number as shown in the tax registration certificate.(II)Basic Information of Non-resident TaxpayerChinese name of non-resident taxpayer:Fill in the full Chinese name used by the non-resident taxpayer in China.Name of non-resident taxpayer in resident state(region):Fill in the full English name of the non-resident taxpayer which is used in the non-resident taxpayer’s state(region)of residence.Type of applicable agreement:Please select based on the type of applicable tax treaty or ITA to be enjoyed,and fill in Part III or Part IV accordingly.(III)Information Related to Entitlement to the Benefits under Tax TreatyQuestion 2,“Please describe the international transport activities undertaken by non-resident taxpayer.If the income obtained by the non-resident taxpayer contains the income arising from the activities affiliated to the international transport,please describe the types of activities affiliated to the international transport in detail.”:For example,income derived from engaging in freight transport by ship,income derived from engaging in passenger transport by ship,rental income derived from leasing ships on charter fully equipped,rental income derived from leasing ships on a bare boat basis,rental income derived from lease of container,income derived rom selling passenger tickets for others,income derived from transporting passengers from downtown to airport,etc.Question 4,“The situation of transport routes and ports of call alongside”:Please list out the operation routes and all the ports of call where the passengers,goods and mails are transported within the territory of China.(IV)Information Related to Entitlement to the Benefits under Other International Transport AgreementQuestion 5,“The name of the applicable ITA”:Please fill in the full name of applicable ITA.Question 6,“Please list out the relevant article under which the taxpayer would be entitled to enjoy the treatment under ITA”:Please specify the name of the article and its serial number as well as quote the content of relevant articles.Question 7,“Please briefly state the facts based on which the taxpayer could claim for the treatment under ITA”:Please fill in the specific facts based on which the taxpayer could be entitledto enjoy relevant ITA.Question 8,“The situation of transport routes and ports of call alongside”:Please list out the operation routes and all the ports of call where the passengers,goods and mails were transported within the territory of China.(V)Income Received of the Same Type and Benefits Claimed under Tax Treaty or ITA by Non-resident TaxpayerQuestion 9,“Has the non-resident taxpayer received any income of the same type sourced in other regions within China over the past three years?”:If the non-resident taxpayer has any income of the same type sourced in other regions within China over the past three years,and this is under the jurisdiction of a different in-charge tax authority,“Yes”shall be selected,and Question 10 and 11 shall be answered.Please specify all tax treaty or international transport agreement benefits claimed by the non-resident taxpayer for any income of the same type sourced in other regions within China over the past three years in Question 11.Supporting materials can be attached separately.(VI)List of Documents AttachedNon-resident taxpayer can provide,on a voluntary basis,other materials to justify the non-resident taxpayer’s entitlement to the tax treaty or international transport agreement benefits.When providing such materials,please identify all of them on the list.(VII)Additional NotesNon-resident taxpayer can provide other information that the non-resident taxpayer believes should be considered by the in-charge tax authority and may be beneficial to justify thenon-resident taxpayer’s entitlement to the tax treaty or international transport agreement benefits.Please specify the special situations in the additional notes,if any.(VIII)DeclarationThe declaration shall be sealed by the non-resident taxpayer,and/or signed by the legal representative or authorized representative of the non-resident enterprise,and the date of the statement shall be provided.VII.Any information and materials provided by the non-resident taxpayer will be kept confidential by China’s tax authorities.来源:/ws/detail15234.html。

非居民企业所得税汇总纳税信息清册

非居民企业所得税汇总纳税信息清册

【表单说明】

1.本表依据《国家税务总局财政部中国人民银行关于非居民企业机构场所汇总缴纳企业所得税有关问题的公告》(国家税务总局公告2019年第12号)设置。

2.本表适用汇总纳税的各机构、场所在首次办理汇总缴纳企业所得税申报时或报送的信息资料发生变更时,以及主管税务机关发现该非居民企业不符合汇总纳税条件时使用。

基础项目:

1.企业类型:分为“汇总纳税主要机构、场所”、“汇总纳税主要机构、场所具有主体生产经营职能的部门”、“汇总纳税其他机构、场所”。

2.跨地区转移类型:分为“跨省、自治区、直辖市、计划单列市”、“跨地市”、“跨县区”、“跨地市(比例预缴)”、“跨县区(比例预缴)”、“非跨地区税收转移”

3.就地缴纳标识:分为“是”、“否”。

4.“不就地缴纳原因”:分为“不具有主体生产经营职能的内部辅助性或服务性机构、场所”、“新设立的机构、场所”、“当年撤销的机构、场所、“其他”。

5.“季度预缴预算科目”、“季度预缴预算级次”根据税费种认定情况自动带出。

6.“年度汇算清缴预算科目”录入,并根据会统校验规则带出“年度汇算清缴预算级次”。

7.“行政区划”:精确到市级。

中华人民共和国非居民企业所得税年度纳税申报表——(工商税务,申报书)

(适用于据实申报企业)金额单位:人民币元(列至角分)税款所属期间:____年____月____日至____年____月____日纳税人识别号:□□□□□□□□□□□□□□□国家税务总局监制填表说明一、本表及附表适用于能够提供完整、准确的成本、费用凭证,如实计算应纳税所得额的非居民企业所得税纳税人。

非居民企业(以下简称“企业”)正常经营的,自年度终了之日起五个月内向主管税务机关报送;在年度中间终止经营活动的,应当自实际终止经营之日起六十日内向主管税务机关报送。

在纳税年度内无论盈利或者亏损,都必须按照企业所得税法的规定报送本表和相关资料。

二、企业应当按税法规定期限向主管税务机关报送本表,并同时报送主管税务机关要求报送的其他资料。

三、企业因确有困难,不能在规定期限内办理年度所得税申报,应当在规定的申报期限内向主管税务机关提出书面延期申请,经主管税务机关核准,可以适当延期。

四、企业未按规定期限向主管税务机关报送本表、会计报表及主管税务机关要求报送的其他资料的,依照《中华人民共和国税收征收管理法》及其实施细则的有关规定,予以处罚。

五、本表中所称国家有关税收规定除另有说明外,均指《中华人民共和国企业所得税法》及其实施条例的有关规定,以及国务院、国务院税务主管部门根据税法制定的相关规定。

六、本表是在企业账载会计利润总额核算的基础上,依法进行纳税调整相关项目后申报企业应纳税所得额,并依法计算年度应纳所得税。

本表及附表的账载金额是指企业根据现行国家统一会计制度的规定,记载在相应报表、总账、明细账上的汇总或明细金额;依法申报金额是指企业按照现行税收法律、行政法规、规章和规范性文件的规定,对账载金额进行调整后的申报金额。

七、本表用中文填写。

八、本表有关栏目的填写如下:1.税款所属期间:正常经营的企业,填写公历年度,自公历1月1日起至12月31日止;企业在年度中间开业的,应填报实际开始经营之日至同年12月31日;企业在年度中间终止经营活动的,应填报公历1月1日至实际终止经营之日。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

非居民纳税人税收居民身份信息报告表

(企业适用)

填报日期:____年____月____日

○自行申报

○扣缴申报

【表单说明】

一、本表适用于需享受我国对外签署的避免双重征税协定(含与港澳避免双重征税安排)或国际运输协定待遇的企业所得税非居民纳税人。

二、本表可用于自行申报或扣缴申报,也可用于非居民纳税人申请退税。

非居民纳税人自行申报享受协定待遇或申请退税的,应填写本表一式两份,一份在申报享受协定待遇或申请退税时交主管税务机关,一份由非居民纳税人留存;对非居民纳税人来源于中国的所得实施源泉扣缴或指定扣缴管理的,非居民纳税人如需享受协定待遇,应填写本表一式三份,一份交由扣缴义务人在扣缴申报时交主管税务机关,一份由扣缴义务人留存备查,一份由非居民纳税人留存。

三、本表第一部分由扣缴义务人填写,如非居民纳税人自行申报纳税则无需填写。

本表其余部分由非居民纳税人填写。

非居民纳税人填报本表时可根据需要增加附页。

四、本表第三部分“扣缴义务人使用信息”用于在源泉扣缴或指定扣缴情况下,扣缴义务人核对非居民纳税人是否符合享受协定待遇条件;其他部分用于税务机关采集管理信息。

五、非居民纳税人应如实完整填写本表所列问题。

如非居民纳税人没有问题所列情况,请在表格中填“无”。

本表所列选择题,请非居民纳税人在符合自身情况的选项对应的□或○中打勾“√”。

带有*标识的题目,请具有题目所描述情况的非居民纳税人填写,与题目所描述情况不符的非居民纳税人无需填写。

六、本表采用中英文双语制作,如中英文表述不一致,以中文为准。

如无特别说明,应使用中文填写。

七、本表各栏填写如下:

(一)扣缴义务人基本信息

1.扣缴义务人名称:由扣缴义务人填写税务登记证所载扣缴义务人的全称。

2.扣缴义务人纳税人识别号:由扣缴义务人填写扣缴义务人税务登记证上注明的“纳税人识别号”。

(二)非居民纳税人基本信息

3.非居民纳税人中文名称:填写非居民纳税人在中国境内的中文全称。

4.非居民纳税人在居民国(地区)名称:填写非居民纳税人在其居民国(地区)的英文全称。

5.非居民纳税人的居民国(地区):填写非居民纳税人为其税收居民的独立税收管辖区的名称。

如果非居民纳税人是香港、澳门税收居民,请填写“香港特别行政区”或“澳门特别行政区”。

(三)扣缴义务人使用信息

6.问题1,非居民纳税人在缔约对方的组织类型:“具有独立纳税地位的营利实体”和“不具有独立纳税地位的营利实体”,按非居民纳税人是否在缔约对方单独缴纳属于协定适用范围的所得税判定。

组织类型选择“其他”的,须填写问题2,简要说明非居民纳税人的组织类型、具体特征和性质。

7.问题3,请引述非居民纳税人构成缔约对方税收居民的缔约对方国内法律依据:填写缔约对方国家(或地区)如何定义和判定其税收居民的国内法律条文。

请写明法律条文所属法律法规名称和条款序号,并引

述相关法律条文。

8.问题4,请简要说明非居民纳税人构成缔约对方税收居民的事实情况:在此栏中填写非居民纳税人符合需享受协定的缔约对方国家(或地区)国内构成税收居民的法律标准的具体事实。

例如缔约对方国内法采取注册地标准判定税收居民的,非居民纳税人应说明企业注册地、注册时间等注册情况。

9.问题5,声明:由非居民纳税人的法定代表人或其授权代表负责人签字并/或加盖企业公章,并填写签字当日日期。

(四)税务机关管理使用信息

10.问题7,非居民纳税人注册地(国家或地区):填写非居民纳税人注册登记的独立税收管辖区名称。

如非居民纳税人在香港、澳门注册登记,应填写“香港特别行政区”或“澳门特别行政区”。

非居民纳税人实际管理机构所在地(国家或地区)、非居民纳税人总机构所在地(国家或地区),也应填写相关独立税收管辖区名称。

11.问题9,享受税收协定股息、利息、特许权使用费、财产收益条款税收协定待遇的非居民纳税人,请填写直接或间接持有本企业权益额达到10%以上的股东情况:根据非居民纳税人申报享受税收协定待遇时的股东情况填写。

12.问题10,非居民纳税人从中国取得的所得在居民国(地区)的纳税情况:法定税率根据居民国(地区)国内法的规定填写。

如非居民纳税人享受了居民国(地区)国内减免税优惠,请写明非居民纳税人所享受减免税优惠的法律条文所属法律法规名称和条款序号,并引述相关法律条文。

如非居民纳税人未享受居民国(地区)国内减免税优惠,在“享受居民国(地区)国内减免税优惠的法律依据及条文描述”栏填“无”。

13.问题11,根据第三国(地区)法律规定,非居民纳税人同时还构成哪些国家(地区)的税收居民:如果依据中国和非居民纳税人需享受协定缔约对方国家(地区)之外的第三国(地区)法律规定,非居民纳税人同时构成该第三国(地区)的税收居民,请写明该第三国(地区)名称,如涉及多个国家或地区的,请全部列明。

(五)备注

14.可填写非居民纳税人认为主管税务机关需要了解的其他有助于核查其居民身份的信息。

如非居民纳税人有特殊情况,也请在备注中注明。

(六)声明

15.由非居民纳税人的法定代表人或其授权代表负责人签字并/或加盖企业公章,并填写声明日期。

八、中国税务机关将对非居民纳税人提交的信息资料保密。

来源:/ws/detail15208.html。