the impact of RMB appreciation on Xiamen's export

China Economic and Strategy Update and Quantifying the Impact of RMB Appreciation

Beijing Shanghai Guangzhou Shenzhen

125

Affordability trends in most cities

100

suggest that demand would support 75

gradual price increases over the medium-term.

Index, % yoy 14 12

Price Index (lhs) Space Complet ed Space Sold

% yoy 35 30

pre-sale rules) exacerbated the supply

Jun-03

Dec-03

FAI yoy growth (3mma) Prof (3mma)

Jun-04

Dec-04

Jun-05

China’s Import Growth

% yoy, 3mma

300 250 200 150 100

50 0

-50

Mar-01 Dec-01

Steel Iron Ore

Sep-02 Jun-03

The austerity program implemented since mid-2004 (including credit and land supply tightening and stricter

China: Residential floor space completed and property price index

50 1998

1999

2000

2001

2002

2003

Source: Calculated w ith data from CEIC Note: Affordability index defined as per capita income/property price, 1999-10-0.

关于钱的影响的英语作文模板

The Impact of MoneyMoney, a ubiquitous presence in our lives, holds immense influence over our thoughts, actions, and society. It serves as a medium of exchange, a store of value, and a measure of wealth, shaping our daily interactions and determining our life choices.Economically, money drives the wheels of trade and commerce, facilitating the exchange of goods and services. It encourages competition and innovation, driving businesses to offer better products and services to attract customers. However, this dependence on money can sometimes lead to unethical practices such as corruption and exploitation.Socially, money plays a significant role in defining our social status and relationships. It can be a tool for building social connections and networks, but it can also create divides andconflicts. The pursuit of money can sometimes overshadow other values, leading to materialism and a narrow focus on wealth accumulation.Individually, money affects our sense of self-worth and happiness. While having enough money to meet basic needs is essential, the constant chase for more can lead to stress anddissatisfaction. A healthy balance between material wealth and spiritual fulfillment is crucial for a fulfilling life.In conclusion, while money undoubtedly holds power and influence, its impact depends on how we use and view it. A responsible and ethical approach towards money can help us create a more inclusive, equitable, and fulfilling society.。

The Impact of Hot Money on Chinese Real Estate Price

The Impact of Hot Money on Chinese Real Estate Price【Abstract】Because of the expectation of RMB appreciation and the extremely high return rate of Chinese real estate market,more and more hot money rushed into China. As a result,the real estate price level is getting higher and higher,the bubble economy is getting worse,and the Chinese real estate is accumulating numerous risks. This study tried to find out the relation between the hot money and Chinese real estate price level with the help of empirical method. The study not only analyzed the impact of hot money on Chinese real estate price level and its harmful influence over the economy,but also proposed some suggestions to supervise the real estate market.【Key words】Hot money;Real estate price;RMB appreciation1 Why does the hot money keep rushing into ChinaBeginning with the No.171 document in July,2006,Chinese authority has adopted series of policies to control the inflow of hot money and the foreign investment to the real estate industry. However,according to the data from the national bureau of statistics of China,the inflow speed of the foreign capital to the real estate industry has become even faster. Hereafter are the two main reasons of this phenomenon.1.1 The expectation of RMB appreciationOn July 21st,2005,the authority began to reform the formation mechanism of RMB exchange rate,and RMB one-off appreciated against US dollar by 2% to be 1:8.11. By November 27th,2012,the exchange rate had become 1:6.2852,and RMB has cumulatively appreciated against US dollar by more than 25%.(Source of data:the web site of People’s Bank of China. )The international evidence has shown that the currency appreciation will impact and shock the real estate market. For example,since the assignment of Plaza Accord,the Japanese Yen kept appreciation. As a result,numerous hot money flowed into the Japanese real estate market. The continuous appreciation of RMB strengthened the expectation of further appreciation,hence more and more hot money flowed into Chinese real estate market. Along with the enhancement of RMB appreciation,the price level of real estate asset became more attractive. When a foreign investor comes to China,the real estate market will be his first target.1.2 The extremely high profit of Chinese real estate marketThe nature of capital is profit pursuing. The extremely high profit of Chinese real estate industry is the key reason of the hot money’s entrance. The hot money can get far more return than it can get from other countries,especially in the giant cities such as Beijing,Shanghai and Shenzhen,the return rate can be as high as 20% per year,some other cities may have even higher return rate,which is far more higher than the average return rate of 6~7% in the United States real estate industry. Since the nature of the capital is to pursuit high profit and high return rate,the hot money will try to find the opportunity of speculation. Currently,Chinese real estate market offers the great opportunity of speculation,which turns out to be the motivation of the hot money inflow.4 Policies should be adopted to control the international hot moneyinflowAlthough the capital items are still under regulation in China,the hot money can always find its channel to flow into the real estate industry. With the booming Chinese economy,high profit of real estate industry and the expectation of RMB appreciation,Chinese real estate industry has become the best choice of international hot money. How to control the inflow of hot money effectively has become an urgent problem. Hereafter are some policies the authority should adopt.4.1 Restrict the inflow of hot money to the real estate industryEconomists often use the concept of utility to price common goods,however,the utility is an order of feeling,which can be mistaken easily,and the utility can not represent the actual value of the goods. This will make the price of the asset fluctuate away from its real value and then the asset bubble will appear. If the bubble is broken,there will be a financial crisis. What’s more,in order to get more profit,some foreign real estate investors will forestall and take advantage of the market flaw,so that they can drive the price up to the level far more than the real value. The hot money is a kind of speculating capital,and the hot money focuses its investment in top grade apartments and mansions for the sake of high profit. Meanwhile the supply of economical apartments will decline because of their low return rate,and this will drive their prices up to the level unaffordable for the middle and low income households. On the one hand,the common household can not afford the real estate;on the other hand,there are numerous vacant apartments without anybody living in. so it is very necessary for the government to adopt some macro policies to control the inflow of hot money to the real estate market.4.2 Fortify the tax regulation on the industry of real estateFirst,impose a higher value-added tax rate. The real estate speculation actions gain extra profit by the transference of the right of the real estates,so the value-added tax rate should be driven up according with the density of speculation actions. But in China,the value-added tax rate is too low,and this stimulates the hot money to speculate in the field of Chinese real estate market. Hence a higher value-added tax rate should be imposed on the real estate industry in order to control the speculation of the international hot money. Secondly,we can also control the speculation by the way of imposing special property tax as well as cancel the tax preferential treatment of foreign capital investing the real estate industry. Besides,Tobin Tax has been proved to be an effective method to deal with the short term capital inflow,because the Tobin Tax can raise the cost of the short term capital inflow. The key part of the tax policies is to lower the return rate of real estate industry and change the speculators’expectation of the up-growing real estate price so that the speculators will leave the real estate market by themselves.【Reference】[1]Li Youhuan. The impact of foreign hot money on Chinese real estate market and countermeasure[J]. Finance and Economy,2008(2).[2]Qin Si,He Lei. The impact of foreign hot money on real estate market of China[J]. Economy and Management,2010(1).[3]Liu Gang,Bai Qinxian. Hot money inflow,asset price fluctuation andChinese financial security[J]. Contemporary finance & Economy,2008(11).[4]Du Hui,Zhang Jiankun. The impact of hot money Chinese real estate industry and countermeasure[J]. China Real Estate,2006(12).。

金融英语1班第三组

页数 9

Disadvantages

RMB appreciation will not only make the money flow into the virtual economy(虚拟经济), but also expanding the asset bubble(泡沫) that could eventually lead to bursting(爆炸) of (爆炸) the bubble, then lead to financial and currency crisis. Once the RMB appreciation, the huge foreign exchange reserves will face the threat of shrinking(萎缩 (萎缩). This is a serious problem we have to face.

页数 8

Disadvantages

China accepts the most foreign direct investment in the world. After appreciation of RMB, the investment costs will increase and they will choose other developing countries. the appreciation of RMB will reflect in domestic employment, domestic employment will face more pressure.

页数 5

The causes of RMB appreciation External causes: The Balance of payments’ double surplus and the increasing of foreign exchange reserves became direct reason to cause RMB appreciation.

人民币对美元汇率的影响英语作文

人民币对美元汇率的影响英语作文The exchange rate between the Chinese currency, Renminbi (RMB), and the US dollar has been a topic of interest in the global economic market. The RMB's value relative to the US dollar has fluctuated over the years, and these changes have implications for both countries. In this essay, I will discuss the impact of the RMB's exchange rate on the US dollar.Firstly, a weaker RMB makes Chinese exports cheaper and more competitive in the international market. This can lead to an increase in demand for Chinese goods, as foreign buyers are more likely to choose the cheaper Chinese products over more expensive alternatives. The increased demand for Chinese products can result in an influx of foreign currency into China, which can strengthen the country's economy.However, a weaker RMB can also hurt the US economy. This is because the US imports many products from China, and a weaker RMB means that these products become even cheaper for Americans to purchase. This can lead to a rise in imports, which can damage US companies that are trying to compete with Chinese imports. Furthermore, a weaker RMB can also lead to a decline in Chinese demand for US products, as they become more expensive.On the other hand, a stronger RMB can benefit the US economy. This is because a stronger RMB makes Chinese products more expensive, which reduces the demand for Chinese imports in the US market. This can lead to an increase in domestic production and sales, which can help to create jobs and stimulate economic growth in the US.In conclusion, the exchange rate between the RMB and the US dollar can have significant impacts on both countries' economies. A weaker RMB can benefit China by increasing export demand and strengthening the economy, but it can harm the US by increasing imports and reducing demand for US products. A stronger RMB can benefit the US by promoting domestic production and sales, but it can hurt China's export-oriented economy.。

人民币升值对中国经济的影响(英文版)

International FinanceEffects of RMB Appreciation on theChinese economicNAME:CHEN SISTUDENT NUMBER:GBX1307JOSAI UNIVERSITY1.The impacts on the economy of ChinaThe positive impact on the economy of RMB Appreciation1.1.2 It is helpful to reduce burden of the debt. Since the implementof reform and opening policy, China has borrowed a lot of foreign debt in order to accelerate economic development. According to data published by the State Administration of Foreign Exchange,China's foreign debt reached374.66billion dollars at the end of 2008,an increase of 18%.After RMB appreciation, the outstanding external debt servicing will be required to present a corresponding reduction in the number of RMB,easing the pressure on China's foreign debt to a certain extent.The appreciation of RMB surely makes foreign currency-denominated debt shrink,accordingly reducing debt burden of the government and enterprises.1.1.6 With the adjustment of the RMB exchange rate, the prices ofChina's export products will certainly rise.Although it can not solve thoroughly trade surplus of Sino-US trade, it will serve to ease the trade frictions with the United States, Japan and other major trading partners. It would show trading partners that China is notattempting to manipulate its exchange rate,thereby lessening the threat of protectionist measures against China's exports.1.2.4 Suffered the loss of China's foreign exchange reserves. By theend of 2007,China's foreign exchange reserves have reached 15282billion dollars.If the appreciation of RMB is to dollar-denominated foreign exchange, foreign exchange reserves will be shrinking. China will suffer huge foreign exchange losses. Adequate foreign exchange reserves are an important sign that China's economic strength has been continuously strengthened.It is also a powerful guarantee for China to participate in global economy.However,once the RMB appreciation,China's huge foreign exchange reserves will face the possibility of shrinking.2.Japan’s experience and lessons for ChinaThese circumstances China now faces are similar to Japan's situation at the time of the Nixon Shock. Japan experienced a sharp appreciation of the Yen which led to the economic bubble in the late 1980sand then underwent a long recession (the “lost decade”). There is worry about ifthe RMB is sharply appreciated for a very short period, China might take the old road of recession that Japan experienced.2.1 Experience of appreciation of Japan YenMore than 30years ago,the Yen appreciated all the way from ¥360:$US1 in August 1971 to ¥80:$US1 in April 1995. The overvaluedYen,however,destabilized the Japanese financial system,the bubble economy of the late 1980s was followed by a deflationary slump and a zero-interest liquidity trap in the 1990s.2.2 The lessons of Japan’s experience and the apocalypse for ChinaAs described above, these periods are somewhat similar to the recent economic situation China faced, just as Japan was in the early 1970s and the mid-1980s.So whatis the apocalypse should China learn from Japan's experience? The lessons of Japan’s experience and the apocalypse for China mainly may be as follow.1. To deal with the Yen appreciation, there was strong opposition orconcern about the possible adverse impacts of a sharp appreciation of the Yen inJapan.Instead of taking the initiative to response to the Yen appreciation, the passive Yen appreciation resulted Japan in sinking into being forced to sign the agreement of "PlazaAccord"which led to Japanese economic bubble in late of 1980.It is important and considerable for China to take the initiative to response to the RMB appreciation to avoid the RMB fluctuate violently which Japan has experienced last century under the "Plaza Accord".3.ConclusionRMB appreciation will have a profound impact not only on China's economy but also on the regional economy and the world economy.Facing the increasing pressure of RMB appreciation from internal and external,China should maintain the RMB exchange rate basically stable, at the same time, effective measures should be taken to response to the BMB appreciation from the current and long-term perspective.Providing China mishandles the RMB appreciation,it will suffer a slowdown in economic growth including imports and eventually deflation,with no predictable effect on its trade surplus–as with Japan from the 1970sto the mid-1990s.China should embrace the new opportunities that appreciation has opened-up and allow more room for the national economy to grow in the process of globalization.Reference:Alan, M. Taylor y Mark P. Taylor(2004) The Purchasing Power Parity Debate. NBER Working Paper No. 10607Krueger, A.(2005) China and the Global Economic Recovery. A Keynote Address at the American Enterprise Institute Seminar, Washington, D. C, 2005.01.10Kwan, C. H. ( 2008) China’s Transition to a Freely Floating Exchange Rate System –Lessons from Japan’s Experience.Ogawa, E. &Sakane, M.(2006) Chinese Yuan after Chinese exchange rate system reform. China &World Economy / 39–57, Vol. 14, No. 6, 2006Paul, S. L. YIP,(2007) China’s exchande rate system reform. The Singapore Economic Review,Vol. 52, No. 3363–402Chen, F. X.(2006) The impact of RMB appreciation, People's DailyOnline,。

人民币升值对中国经济的影响(英文版)

International FinanceEffects of RMB Appreciation on the Chinese economicNAME: CHEN SISISTUDENT NUMBER: GBX1307JOSAI UNIVERSITYEffects of RMB Appreciation on the Chinese economicSince 2002, many countries like Japan and America have suggested that Renminbi(RMB)should increase in value. In fact, the exchange rate of RMB became higher and higher in recent years. The exchange rate was beyond 8 in 2005.but this year, It is only about 6. The appreciation of the RMB exchange rate and the corresponding impact on china’s economy are becoming the focus issues of international economy, and also has become the major theoretical and practical issues for China to deal with the increasingly complex international economic situation which must be faced up to. It has become a hot topic over the world. RMB appreciation affects the Chinese economy and the lives of Chinese people. Does it have a good effect or not? On this, the United States' 40-year history of pressuring Japan to let the yen appreciate against the dollar is instructive. So for RMB appreciation, we should learn the lessons of history and correctly assess the pros and cons of RMB appreciation. RMB appreciation is like a double-edged sword; on one hand, it has a positive effect on the Chinese Economy. On the other hand,it will have a negative impact. So I think it's very necessary to discuss the matter of RMB appreciation.1.The impacts on the economy of ChinaThe positive impact on the economy of RMB Appreciation1.1.1 The appreciation of the RMB will increase our personal wealth benefiting the people and improving people's living standards. Appreciation of the RMB improved terms of trade that it will make imported products relatively cheaper. With the continuous economic development and people's rising living standards, more and more people like vacations, tourism or education abroad. After the revaluation of the RMB, to study or travel abroad will spend less money than before or will be able to do more things than ever before with the same money. Just as Argentine, they traveled all over the world after the appreciation of thePeso (Argentine currency) in 80's last century, because they become "the rich countries of the South". Furthermore, Chinese people will feel richer as the value of their money grows and further stimulates domestic demand. Of greater strategic significance is the fact that the appreciation of the RMB will make the Chinese labor price higher.1.1.2 It is helpful to reduce burden of the debt. Since the implement of reform and opening policy, China has borrowed a lot of foreign debt in order to accelerate economic development. According to data published by the State Administration of Foreign Exchange, China's foreign debt reached374.66 billion dollars at the end of 2008, an increase of 18%. After RMB appreciation, the outstanding external debt servicing will be required to present a corresponding reduction in the number of RMB, easing the pressure on China's foreign debt to a certain extent. The appreciation of RMB surely makes foreign currency-denominated debt shrink, accordingly reducing debt burden of the government and enterprises.1.1.3 The appreciation of the RMB will conducive to accelerate industrial upgrading and improve the economic structure in the long run. The appreciation of the RMB means that the price of various domestic resources, especially land and labor, will go up in relative terms and this will speed up necessary adjustments to the commodity mix and domestic industry. So the RMB appreciation will be bond to trigger an upgrading or conversion of the industrial structure. More and more domestic enterprises will try to focus domestic production on more high-value added commodities. Thus one of the long-term desirable effect on China economy is what the appreciation of RMB will made China a more advanced or high-value added economy and a more reasonable industrial structure.1.1.4 The appreciation of the RMB will optimize the export trade structure and expand domestic demand. RMB appreciation will be disadvantageous to the labor-intensive export products. But in the longrun, RMB appreciation will spur export companies to rely more on technological progress and increase of products added-value. Some enterprises which rely on low-cost competition with low-tech, high pollution and high energy-consuming will be squeezed out of the international market. Accordingly the RMB appreciation will help to enhance China's export trade structure.1.1.5 The appreciation of the RMB will promote enterprises to perfect their management, enhance the capability of independent innovation and improve international competitiveness and risk-resisting ability. Under the circumstance of the RMB appreciation, the enterprises can not succeed in the international market if they don’t cut the cost of their products. The feasible way to cut the cost of their products should be taken are enhance management, improve productivity in order to enhance competitiveness. At the same time, the reform of RMB exchange rate regime requires export companies continue to develop high-tech and high value-added products.1.1.6 With the adjustment of the RMB exchange rate, the prices of China's export products will certainly rise. Although it can not solve thoroughly trade surplus of Sino-US trade, it will serve to ease the trade frictions with the United States, Japan and other major trading partners. It would show trading partners that China is not attempting to manipulate its exchange rate, thereby lessening the threat of protectionist measures against China's exports.1.2 The negative influence on the economy of RMB AppreciationNow China is the most populous country and the fifth-largest trading country in the world. Although evidences have shown that the RMB is indeed undervalued and appreciation would not be sufficient to weaken the competitive power of the economy, the appreciation of RMB will bring about some negative influences on Chinese economy.1.2.1 The appreciation of RMB will reduce China’s export and increases its import, further affect the economic growth goals. A numberof industries in China are still in the labor-intensive mode of production. The expansion of exports relay mainly on price competitiveness. After the continuous appreciation of RMB, China's commodity export relative prices could rise and the comparatively competitive powers come from those could to be weakened, resulting in export reduce. Meanwhile, the price of import commodities in Chinese currency could drop and stimulate import to increase. As a result, an appreciation of RMB could cut China’s current account surplus, and it will crimp China’s growth.1.2.2 Damage to basic industries lack of competitiveness. In China different industries have different endurances to the shocks of RMB appreciation. With the appreciation of the RMB, the price of China's labor-intensive exports corresponding increase. Thereby this undoubtedly will make the kinds of industries such as the agriculture sector and automobile sector which may be easily affected by a revaluation suffer enormous. So if the RMB is sharply appreciated, it will affect the China’s noncompetitive agriculture sector and state-owned enterprises (SOEs). In addition, the appreciation of the RMB would be harm to China's some strategic industries.1.2.3 Deteriorating domestic job situation and increasing labor pressure. Full employment, price stability and the balance of international payments is the world's countries common objectives. Especially full employment is the most problem the government concerned in China. Currently, cheap labor costs have been served as the biggest contribution to the China’s surging exports. With the appreciation of RMB, the cheap labor advantage of China will be challenged. The appreciation of the RMB would lose millions of jobs in China, and worse the China’s already grim employment situation. This might make the unemployment problem more serious and may even lead to economic (and political) instability.1.2.4 Suffered the loss of China's foreign exchange reserves. By the end of 2007, China's foreign exchange reserves have reached 15282 billion dollars. If the appreciation of RMB is to dollar-denominatedforeign exchange, foreign exchange reserves will be shrinking. China will suffer huge foreign exchange losses. Adequate foreign exchange reserves are an important sign that China's economic strength has been continuously strengthened. It is also a powerful guarantee for China to participate in global economy. However, once the RMB appreciation, China's huge foreign exchange reserves will face the possibility of shrinking.2. Japan’s experience and lessons for ChinaThese circumstances China now faces are similar to Japan's situation at the time of the Nixon Shock. Japan experienced a sharp appreciation of the Yen which led to the economic bubble in the late 1980s and then underwent a long recession (the “lost decade”). There is worry about if the RMB is sharply appreciated for a very short period, China might take the old road of recession that Japan experienced.2.1 Experience of appreciation of Japan YenMore than 30 years ago, the Yen appreciated all the way from ¥360:$US1 in August 1971 to ¥80:$US1 in April 1995. The overvalued Yen, however, destabilized the Japanese financial system, the bubble economy of the late 1980s was followed by a deflationary slump and a zero-interest liquidity trap in the 1990s.Japan suffered from its exchange rate appreciation seriously. Facing the upward pressure on the yen’s appreciation, Japan tried to stabilize the exchange rate and maintain a pegged rate system. Initially, Japan intervened in the foreign exchange market to sell Yen and buy dollars. Then, in order to offset the adverse impact of the appreciation on economic activities, Japanese Monetary authorities adopted a loose monetary policy to stimulate the economy and reduce the trade surplus. Thus the increasing money supply and massive interventions in the foreign exchange market gave rise to excessive liquidity, which was channeled into stock and real estate markets. Consequently the “economic bubble” was followed in the late 1980s and after the collapse of thebubble, Japan entered a prolonged recession.2.2 The lessons of Japan’s experience and the apocalypse for ChinaAs described above, these periods are somewhat similar to the recent economic situation China faced, just as Japan was in the early 1970s and the mid-1980s. So what is the apocalypse should China learn from Japan's experience? The lessons of Japan’s experience and the apocalypse for China mainly may be as follow.1. To deal with the Yen appreciation, there was strong opposition or concern about the possible adverse impacts of a sharp appreciation of the Yen in Japan. Instead of taking the initiative to response to the Yen appreciation, the passive Yen appreciation resulted Japan in sinking into being forced to sign the agreement of "Plaza Accord" which led to Japanese economic bubble in late of 1980. It is important and considerable for China to take the initiative to response to the RMB appreciation to avoid the RMB fluctuate violently which Japan has experienced last century under the "Plaza Accord".2. Due to serious concern about the negative impact of its appreciation on the economy, Japan authority believed that one of the principal goals of monetary policy was to stabilize the exchange rate and try to lighten the pressure of Yen appreciation as much as possible by adopting a loose monetary policy. This resulted in that the monetary policy was excessively loose. It could create a zero-interest liquidity trap in financial markets that leaves the central bank helpless to combat future deflation arising out of actual currency appreciation as in the earlier experience of Japan. This suppressed Japanese monetary authorities' capacity to implement effective monetary policy. While policymakers seemed to be aware that the loose monetary policy might be excessive and tried to tighten it, it inevitably resulted in the prolonged economic recession. The principle says an economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. Unfortunately, China has not taken advantage of thislesson and in recent years has allowed a similar situation to arise. Inflationary pressure, especially in real estate, has been increasing in recent years in China. Yi Gang warned that a large economy like China cannot give up the independence of monetary policy. So it is an important principle to stick to the independence of monetary policy for China to deal with the RMB appreciation.3. ConclusionRMB appreciation will have a profound impact not only on China's economy but also on the regional economy and the world economy. Facing the increasing pressure of RMB appreciation from internal and external, China should maintain the RMB exchange rate basically stable, at the same time, effective measures should be taken to response to the BMB appreciation from the current and long-term perspective. Providing China mishandles the RMB appreciation, it will suffer a slowdown in economic growth including imports and eventually deflation, with no predictable effect on its trade surplus–as with Japan from the 1970s to the mid-1990s. China should embrace the new opportunities that appreciation has opened-up and allow more room for the national economy to grow in the process of globalization.Reference:Alan, M. Taylor y Mark P. Taylor (2004) The Purchasing Power Parity Debate. NBER Working Paper No. 10607Krueger, A. (2005) China and the Global Economic Recovery. A Keynote Address at the American Enterprise Institute Seminar, Washington, D. C, 2005.01.10Kwan, C. H. ( 2008) China’s Transition to a Freely Floating Exchange Rate System – Lessons from Japan’s Experience.Ogawa, E. & Sakane, M. (2006) Chinese Y uan after Chinese exchange rate system reform. China &World Economy / 39 – 57, V ol. 14, No. 6, 2006Paul, S. L. YIP, (2007) China’s exchande rate system reform. The Singapore Economic Review,V ol. 52, No. 3 363–402Chen, F. X. (2006) The impact of RMB appreciation, People's Daily Online, /200611/22/eng20061122_324127.html。

《人民币升值对中国出口型企业的影响及对策》中英文

The Impact and Countermeasures of RMB Appreciation on Export-Based Enterprises in ChinaMin YuanSchool of Economics, Tianjin Polytechnic UniversityTianjin 300387, ChinaE-mail:*************************Zhuang ZhouSchool of Economics, Tianjin Polytechnic UniversityTianjin 300387, ChinaE-mail:*******************.cnAbstractRMB appreciation will pose a challenge to export-based enterprises in China, and bring a sense of crisis to them. Therefore, China's export enterprises should take active measures to deal with the impact caused by the RMB appreciation, so that export-oriented enterprises can better adapt to the changes in the global economy, thus materializing their sustainable and stable development.Keywords: RMB appreciation, Export-based industries, Pros and cons, CountermeasuresThe appreciation of the RMB has become much-discussed focus in the international economy and society. China has begun to implement the managed floating exchange rate system based on market supply and demand, with reference to a basket of currencies. RMB exchange rate is no longer pegged only to the U.S. dollar, and instead China has formulated a more flexible RMB exchange rate mechanism. RMB appreciation will pose a challenge to export-based enterprises in China, and bring a sense of crisis to them. Therefore, China's export enterprises should take active measures to deal with the impact caused by the rising Yuan, so that export-oriented enterprises can better adapt to the changes in the global economy, thus materializing their sustainable and stable development.In June, 2008, the exchange rate of RMB against the U.S. dollar exceeded the 7:1 boundary. The trend of a Yuan’s rise is foreseeable, and in the irreversible environment, we must take appropriate steps to prevent large fluctuations in RMB to mitigate its negative impact on the import and export trade, while at the same time making full use of the small rise in yuan to promote trade development. Yuan’s rise is not only conducive to a decrease in import costs and domestic inflation, stimulation to consumption, acceleration of structural adjustment, promotion of foreign investment and the reduction in trade friction, but in the short term will also have a negative impact on exports, influencing foreign investment and employment.1. Major industries damaged by and benefiting from Yuan’s riseThe impact of a Yuan’s rise on various kinds of sectors varies according to the differentcharacteristics of industries. RMB appreciation brings advantages to the industries that need to import raw materials, but is not favorable to ones that are export-oriented. It also brings opportunities to the upgrade and optimization of these industries, though certain industries will be adversely affected by it.The main industries benefiting from Yuan’s rise are as follows: (1) real estate and infrastructure ones, which belong to the non-real estate industry, with its domestic real estate value comprehensively enhanced by a rise in Yuan; (2) ones such infrastructure industries as airports, ports, railways, and highways characterized by limited resources, monopoly, the long construction period, and small supply elasticity; (3) the financial sector, especially banking and securities, which is among capital-intensive industries dealing with currencies and capital. Because of good liquidity, it is categorized into the industry with a high value of RMB assets, benefiting from attracting a large amount of international capital; (4) ones such as aviation, electricity, oil refining, paper-making, engineering machinery, and so on, which will see a reduction in costs owning to its main dependence on procurement of foreign raw materials or equipments, or because of the benefits resulted from large amounts of external debt service and the exchange gains and losses, in particular the aviation industry with the dominance of the domestic market; (5) high-tech ones relying upon importing technology, which don’t have any advantage in intellectual property rights related to key sciences and technologies, will also maintain the momentum of a large amount of imports in a certain period of time, and are able to keep up their advantage in costs under the premise of a rise in Yuan.Major industries damaged by Yuan’s rise are as follows: (1) as for export-oriented ones, such as the textile industry (especially garment industry with the high degree of dependence on exports more damage, followed by the cotton spinning industry and wool industry), household appliances, building materials, whose product competitiveness will be weakened to a large extent; (2) foreign trade enterprises have a disadvantageous position in the industry chain, and their import business will be unable to gain excess profits from the appreciation of the RMB, with the export business suffering a lot; (3) mining, petrochemical, and non-ferrous metal industries, which will be given a big blow by their export business; (4) agriculture with a larger proportion of exports.2. The impact of RMB appreciation on China's export enterprises2.1 Adverse effects on China's export enterprises2.1.1 The export of manufactured goods is greatly affected by fluctuations in exchange rate on a wide basisRMB appreciation will induce a increase in currency exchange cost in Chinese export firms, resulting in the loss of price advantage. The cost refers to the RMB cost paid domestically on the net revenue from one dollar’worth of exports. China's manufacturing exports are more concentrated on low-end products, with competitive advantage weak. These products compete with other ones mainly by means of prizing, and as a result the Yuan’s rise will have a retarding effect on their exports. For employees in the manufacturing sector, those that are seriously affected may face the reduced income, or even the risk of unemployment. The adverse impact of enterprises in labor-intensive industries will be greater than ones in capital-intensive industries.2.1.2 Causing a slow growth in the export of most of products related to raw materialsThe majority of products related to raw materials don’t have any competitive edge in the export price, with a stronger reliance on the exchange rate, such as paper, cotton yarn, black metal (steel, manganese, etc.), aluminum, wood and other decorations. RMB appreciation will induce a slow growth in exports of these primary products and raw material products, having a negative impact on economic growth in the short run. It will also reduce the exports of crude oil, refined oil, timber, copper, gold and other resource-based commodities, and bring about the loss of the enterprises, worse still such cascade effects as increased unemployment and banking bad debts. Because our resources are not rich, these resource-based products belong to highly energy-consuming and polluting industries. Over-exports of resource-based products make it easy to intensify the tense contradiction between domestic coal, electricity and oil transportation in the short term. In the long term, it will increase the pressure of the domestic environment and resources, which is not conducive to the sustainable development of the domestic economy.2.1.3 The psychological effect of trade impact on peopleIn the international market, the increase in production costs will be passed on to the price, and consequently the exchange rate appreciation will not affect the profits of these enterprises too much. China's export products cause the price fluctuations in foreign countries due to our currency appreciation, and the appreciation of the RMB will increase the domestic production costs of these enterprises, and in the international market these enterprises have a substantial cost advantage, with the minimal impact on the interests of traders. However, those with ulterior motives will instigate a negative psychological effect on China in the international community. People will believe the prices of products from China are higher, and foreign businessmen also believe that they will not made a lot of money from products imported from China, which causes the really adverse impact on China's exports.2.2 Beneficial effects on China's export enterprises2.2.1 Enhancing the independent innovation capacity of enterprisesAt present, China is at a stage of technology overtaking, and enterprises have a strong capacity of technology introduction, digestion and absorption. And the Yuan’s rise can reduce the cost of independent development, indirectly promote the technological upgrading of firms and enhance their core competitiveness, thus speeding up the pace of optimizing and upgrading the industrial structure and boosting the structure adjustment of exports.2.2.2 Optimizing the structure of introduced foreign capitalRMB appreciation makes improve the treatment of workers, which is beneficial to attracting high-tech talents. Under the prerequisite of the country's independent innovation and technological progress, foreign capital will invest in those industries with a high technological content, thereby promoting industrial structure upgrading and optimizing the structure of exports.2.2.3 Promoting China's enterprise investment overseasFor enterprises to invest directly in foreign nations, they must use the currency of investment destination country. The RMB appreciation significantly reduces their overseas investment costs, and meanwhile enhances the firm's international purchasing power and capacity of foreigninvestment, paving the way for a part of powerful enterprises to implement "going out" strategy.2.2.4 Facilitating the development in service and trade industriesRMB appreciation can most effectively crowd out those firms in the manufacturing sector with low technology content and added value, poor management and low efficiency, to the benefit of changing the situation of excessive resources gathering to export industries (mainly the secondary industry), and thus make industrial structure service-industry-oriented, promoting the optimization and upgrading of industrial structure and facilitating the rapid development of service industries including trade services. This way, the coordinated development can be ultimately realized between service and commodity trade, enhancing the country's overall competitiveness.2.2.5 Boosting China's imports of raw materials and technologyThe prices of foreign consumer goods and capital goods are lower than ever before, and manufacturers dependent on importing raw materials witness a decline in costs, such as steel, electrolytic aluminum, gasoline, oil and other consumption goods more and more dependent on imports. China's industrialization need to purchase a large number of advanced foreign technology; the appreciation of the RMB can reduce the purchase cost of foreign technology. As imports increase, the purchasing power of foreign raw materials increase, with exports declining, so it is helpful to ease the current trade surplus, enhance the balance of China's international balance of payments and weaken the formation of the RMB foreign exchange accounting, and improve the independence and initiative of monetary policy and the balance of money supply.2.2.6 Reducing pressure from external debt servicingThe appreciation of the RMB is advantageous to repaying foreign debts, and there is a corresponding reduction in the amount of outstanding external debt servicing.2.2.7 Strengthening the international purchasing power of common people in our countryAs the exchange rate rises, the prices of foreign consumer goods purchased by ordinary people will fall, promoting the import of consumer goods. At the same time the drop in the cost of travel abroad can promote the growth of national consumption.3. Counter-measures by China's export firms after RMB appreciationIn theory, the rising RMB exchange rate is bound to have a negative effect on China's export enterprises, but according to the actual trade volume, it’s still uncertain whether the rise in the RMB exchange rate lead to such results, which can be verified by the fact that China's foreign trade volume continues to maintain a favorable balance. However, export enterprises should response in a positive manner under the premise of the growing appreciation of the RMB.3.1 Avoiding exchange rate risk is an expedient measure for export enterprises to grapple with the appreciation of the RMB in the short runFaced with the steadily rising RMB exchange rate, export enterprises must take precautions, apart from enhancing its anti-risk capacity. In addition, financial instruments developed by banks and other financial institutions must also be relied on to be hedged against risks and prepare more “life buoy”, so as to achieve the purposes of avoiding risks and improving operational efficiency.3.1.1 Focus on the RMB exchange rate changes, and increase exchange rate risk awareness Concern about the RMB exchange rate changes is one of long-term management tasks in export businesses, with great importance attached to this. Special force must be organized to learn exchange rate management knowledge and closely track the movement of the RMB exchange rate changes, in particular the movements in the recent exchange rate of RMB against the U.S. dollar, euro, Japanese Yen, and other major currencies. Firms have to conduct an in-depth study of the impact of RMB appreciation on export products, and strive to improve the relevance and effectiveness of work. Export enterprises should enhance the risk awareness of exchange rate changes, take control of the effective means of exchange rate risk, and continuously boost their capacity to deal with exchange rate risk. For instance, when signing export contracts, firms can add some relevant provisions of avoiding exchange rate risk to prevent unexpected situations.3.1.2 Flexibly use various financial tools to lock and avoid exchange rate risksFlexible and effective financial instruments should be adopted, such as the use of multi-currency clearing method to transfer exchange rate risk, appropriate use of foreign exchange forward trading, hedging and other means to lock the exchange rate risk. Through the appropriate U.S. dollar loans, interest payments and the losses can be reduced. In addition, under the conditional premise, this method can be used to keep the exchange rate risk within the business source through long-term foreign exchange transactions, options transactions and foreign exchange futures trading.3.1.3 Accelerate the realization of exports, and reduce the occupation of receivable foreign exchange accountsExport enterprises accelerate the documentation transfer, strive to withdraw export documentations as soon as possible, actively take notes trade, factoring and other ways to make timely settlement in hand instruments realizable, and use this method to implement the money worth more than half of the export volume into cash. Enterprises should carry out the more rapid recovery of the export business, appropriate control of the export business with a long recovery period, and at the same time increase the collection of receivable foreign exchange accounts, thus shortening the settlement period and reducing in-transit funds occupation as soon as possible.3.1.4 Increase foreign exchange liabilities, and strike a balance between foreign exchange income and expenditureThrough the application of remittances, enterprises can replace Yuan loans for foreign exchange loans, delaying payment of imports and appropriately increasing foreign exchange liabilities. After the appreciation of the RMB, the amount of outstanding loans due to sell or buy foreign exchange return and external payment can be used to offset the risk of devaluation of foreign exchange assets, or directly profit from it.3.2 Main strategies for export enterprises to deal with the long-term appreciation of the RMBIn the evasion of exchange rate risk, the pace of restructuring needs to be accelerated, and the ability of independent innovation and competitiveness enhanced. By strengthening internal management, carrying out technological transformation to develop the potential, and taking theroad of branding, this is the long-term and fundamental solution to enterprise development.3.2.1 Enterprises carry out the "going out" strategyWe ought to solve problems related to ideas, accelerate the pace of opening to the outside world, and encourage strong, qualified enterprises to conduct foreign investment and overseas acquisition of the ore, nonferrous metals and other important resources. In particular, electrolytic aluminum enterprises should give full play to the available import-export rights, invest in foreign nations and establish a supply base of stable alumina, bauxite and other resources. In the case of the appreciation of the RMB, the prices of imported raw materials can increase, further reducing production costs. We should seriously study the feasibility of setting up factories in developing countries and regions, develop new products, and increase the technological content of products. The value-added products should be increased, enterprise costs management strengthened, and production and operation costs lowered. The government should choose low value-added processing enterprises with sales network support them to set up production plants and put departments and services at home in these countries with lower labor costs, which can not only use goodwill and marketing networks built up for many year, but also keep part of work positions, thus achieving the curve exports and reducing the trade surplus with major trading countries and the pressure on RMB appreciation.3.2.2 Optimize the structure of export commodities, and vigorously develop the international marketExport enterprises, especially production-oriented enterprises, ought to actively use new technology, develop new products and continuously improve the value-added products, reducing the exports with lowest profits and expanding own-brand product exports of good quality and efficiency. In addition, export enterprises should conscientiously strengthen the costs and cost management of procurement, production, marketing, financial planning and other aspects, fully develop the internal potential, and reduce costs and expenses, expanding product margins and increasing the competitiveness of export products. Only this way is the risk of exchange rate fluctuations avoided. During the RMB revaluation period, adjusting industrial structure of exports is a top priority. The international market is not infinite, and the traditional theory of comparative advantage in the international trade is greatly challenged. Some countries which have industries with comparative advantages face the issue of out-of-step growth in demand for international trade in the international market. This means that the protection of these industries may not be conducive to the long-term development of enterprises.3.2.3 Speed up the upgrading of products, and improve the quality of export productsChina is a manufacture-based country. If a product is sold well, there will be many homogenized products available on the market overnight, especially export enterprises. Many of China's enterprises are in the phrase of pursuit of survival, and lack long-term brand planning. The majority of export products win at low prices. Export enterprises based on production should increase technical transformation investment, speed up product upgrading, and strive to improve product quality and added value, improving the comprehensive competitiveness of export products and taking the road of difference and branding. The appreciation of the RMB may force some companies to upgrade products, enhancing export competitiveness in terms of quality and brand.At the moment, many light industrial products, particularly export products with high added value and high-tech content, remain relatively short. Therefore, enterprises should gradually conduct product restructuring and integration of resources, and vigorously develop the international market and export diversification strategy, achieving the output from product to capital and brand, product structure adjustment, and improvement in product quality and grades. Efforts to adjust the structure of export commodities need to intensified, and the opportunity of the appreciation of the RMB caught to actively import advanced equipment and technology, key components, promoting the restructuring in export industries and technological upgrading and transforming the mode of foreign trade growth.References:Phelps, E.S. (1994). Structural Slumps: The Model Equilibrium Theory of Unemployment, Interest, and Assets. Cambridge, Mass: Harvard University Press.Rotemberg, J.J and M. Woodford. (1991). Mark-Ups and the Business Cycle. NBER Macroeconomics Annual, (6)63-129.Sachs, J.D and H. J. Shatz. (1994).Trade and Jobs in U.S. Manufacturing. Brookings Papers on Economic Activity, (1):1-80.摘要人民币升值会对中国的出口型企业的带来挑战,并带来给他们危机感。

货币贬值影响英语作文

货币贬值影响英语作文The Impact of Currency Depreciation。

Currency depreciation refers to the decrease in the value of a country's currency in relation to other currencies. This can have a significant impact on acountry's economy, affecting everything from trade to inflation. In this essay, we will discuss the impact of currency depreciation on various aspects of the economy.One of the most immediate effects of currency depreciation is its impact on trade. When a country's currency depreciates, its exports become cheaper for foreign buyers, while imports become more expensive for domestic consumers. This can lead to an increase in exports and a decrease in imports, which can help to improve the country's trade balance. However, it can also lead to higher prices for imported goods, which can increase the cost of living for consumers.Currency depreciation can also have an impact on inflation. When a country's currency depreciates, the cost of imported goods and raw materials increases, which can lead to higher production costs for domestic producers. This can lead to an increase in the prices of goods and services, which can contribute to inflation. In addition, currency depreciation can also lead to higher prices for imported goods, which can further contribute to inflation.Currency depreciation can also have an impact on the financial markets. When a country's currency depreciates,it can lead to capital flight as investors move their money to countries with stronger currencies. This can lead to a decrease in the value of the country's currency, as well as a decrease in the value of its financial assets. In addition, currency depreciation can also lead to higher interest rates, as the central bank may raise interest rates in an attempt to stabilize the currency.In conclusion, currency depreciation can have a significant impact on a country's economy, affecting everything from trade to inflation. While it can lead to anincrease in exports and a decrease in imports, it can also lead to higher prices for imported goods and raw materials, which can contribute to inflation. In addition, it can also lead to capital flight and higher interest rates, which can further impact the country's economy. Therefore, it is important for policymakers to carefully consider the potential impact of currency depreciation and take appropriate measures to mitigate its effects.。

人民币贬值英语作文

人民币贬值英语作文Possible high-quality English composition:The Depreciation of RMB: Causes, Effects, and Responses。

Recently, the value of RMB has been declining against major foreign currencies, especially the US dollar. This trend has aroused widespread concern and speculation among economists, policymakers, and the public, as it may have significant impacts on China's economy, trade, investment, inflation, and global relations. In this essay, I will analyze the causes, effects, and responses of the depreciation of RMB from various perspectives.The causes of the depreciation of RMB are complex and multifaceted. One major factor is the divergence of monetary policies between China and the US, which has ledto a widening interest rate differential and capitaloutflows from China to the US. The US Federal Reserve has been raising its interest rates since 2015, while thePeople's Bank of China has been keeping its ratesrelatively stable or even lowering them to stimulate domestic growth. This has made US assets more attractive to investors than Chinese assets, and thus reduced the demand for RMB and increased the supply of foreign currencies, which in turn has put downward pressure on RMB's exchange rate.Another factor is the structural imbalances of China's economy, such as overcapacity, debt, and low productivity, which have weakened investors' confidence in the long-term prospects of the Chinese economy and increased their risk aversion. This has made them more willing to sell RMB and buy foreign currencies, such as the US dollar, which is seen as a safe haven for their wealth. Furthermore, the trade tensions between China and the US, which have escalated since 2018, have also contributed to the depreciation of RMB, as they have reduced the demand for Chinese exports and increased the uncertainty andvolatility in the global financial markets.The effects of the depreciation of RMB are bothpositive and negative, depending on the sectors and stakeholders involved. On the positive side, the lower value of RMB can boost China's exports by making them more competitive in the global market, as foreign buyers can purchase more Chinese goods with the same amount of foreign currency. This can help to offset the negative impacts of the US tariffs on Chinese products and improve China's trade balance. Moreover, the depreciation of RMB canattract more foreign investments in China, as foreign investors can buy more Chinese assets with the same amount of foreign currency, and thus benefit from the potential growth and diversification of the Chinese economy.On the negative side, the depreciation of RMB can also lead to inflation and higher costs for Chinese consumers and businesses, as the prices of imported goods and services will rise. This can erode the purchasing power of RMB and reduce the standard of living for many Chinese people, especially those who rely on imported goods or services for their daily needs. Furthermore, the depreciation of RMB can increase the debt burden of Chinese companies and local governments that have borrowed inforeign currencies, as they need to repay more RMB to cover their debts. This can lead to financial risks and defaults, which can ripple through the entire economy and affect the stability and growth of China's financial system.The responses to the depreciation of RMB are also diverse and controversial, depending on the policy goals and priorities of different actors. The Chinese government has taken various measures to stabilize the exchange rate of RMB, such as intervening in the foreign exchange market, tightening capital controls, and promoting domestic consumption and innovation. However, these measures have their own limitations and trade-offs, as they may reduce the flexibility and efficiency of the market, distort the allocation of resources, and undermine the confidence and trust of foreign investors and partners. Therefore, the Chinese government needs to strike a balance between short-term stability and long-term sustainability, and adopt a more comprehensive and coordinated strategy to address the structural challenges of the Chinese economy and enhanceits competitiveness and resilience in the global market.In conclusion, the depreciation of RMB is a complex and dynamic phenomenon that reflects the interplay of multiple factors and interests. Its causes, effects, and responses are intertwined and interdependent, and require a holistic and nuanced analysis and action. As a global citizen and learner, I believe that we need to deepen our understanding and awareness of the issues and trends related to the depreciation of RMB, and engage in constructive and respectful dialogue and cooperation with people from different backgrounds and perspectives, in order to build a more inclusive, sustainable, and peaceful world.。

The Impact of RMB Depreciation on the China Real Estate Market ENG

on the real estate market is minimal, Nerida Conisbee, Director of Research, Colliers International, Asia Pacific argues. China is now the largest offshore investor in Australia, overtaking the U.S., Canada and Singapore, and this trend should continue in the next 12 months at least.

The Impact of RMB Depreciation on the China Real Estate Market

Special Report | 14 August 2015

Background

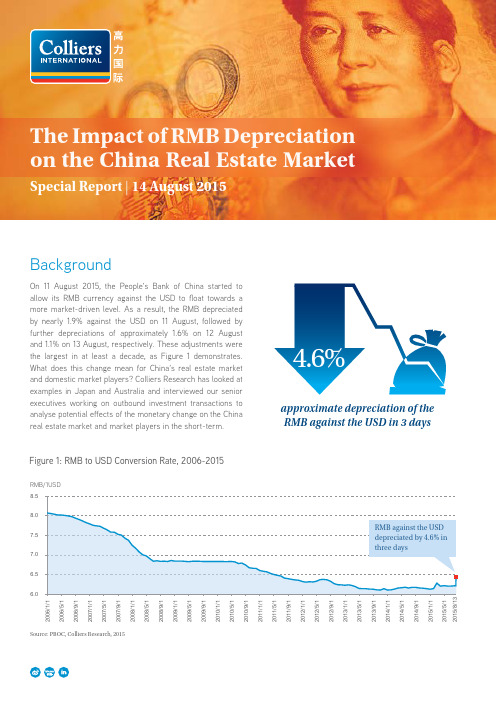

On 11 August 2015, the People’s Bank of China started to allow its RMB currency against the USD to float towards a more market-driven level. As a result, the RMB depreciated by nearly 1.9% against the USD on 11 August, followed by further depreciations of approximately 1.6% on 12 August and 1.1% on 13 August, respectively. These adjustments were the largest in at least a decade, as Figure 1 demonstrates. What does this change mean for China’s real estate market and domestic market players? Colliers Research has looked at examples in Japan and Australia and interviewed our senior executives working on outbound investment transactions to analyse potential effects of the monetary change on the China real estate market and market players in the short-term.

人民币汇率变动对中国贸易收支的影响

国际贸易©人民币汇率变动对中国贸易收支的影响饶恒玮(南京审计大学,江苏南京211815)摘要:入世以来,中国的对外贸易额与日俱增,国际收支占国内生产总值的比重也随之提高增加。

而汇率作为国际收支的影响因素之一,也成了众多学者的研究对象。

在以往学者的研究之上,论文通过利用VAR模型,探究人民币有效汇率对中国国际收支的影响,从而得出结论:汇率波动对我国国际收支在短期内有显著影响,因此我国应该制定适当的货币与财政政策,调整汇率,从而达到实施有管制的浮动汇率制的目的,有效避免汇率波动对我国国际收支产生不利影响。

关键词:人民币汇率;中国贸易收支;VAR模型中图分类号:F832+F752文献标识码:A文章编号:1008-4428(2021)09-0159-04The impact of RMB exchange rate fluctuation on China9simport and export tradeRao Hengwei(Nanjing Audit University,Nanjing,Jiangsu,211815)Abstract:Since China's entry into the WTO,China's foreign trade volume has increased day by day,and the proportion of international payments in China's GDP has also increased.As one of the factors affecting the balance of payments, exchange rate has also become the research object of many scholars.On the basis of previous studies,this paper uses the VAR model to explore the impact of the effective exchange rate of RMB on China's balance of payments,and concludes that exchange rate fluctuations have a significant impact on China's balance of payments in the short term,so China should adjust the exchange rate through appropriate monetary and fiscal policies,so as to achieve the purpose of implementing a regulated floating exchange rate system,effectively avoid adverse effects on China's balance of payments due to exchange rate fluctuations.Key words:RMB exchange rate;China^s import and export trade;panel VAR一、弓言(一)研究背景汇率的变动一直以来是一国对外贸易关注的重点,其对中国对外贸易额的重要影响不言而喻。

RMB Appreciation

RMB AppreciationRecently, the appreciation of RMB is the focus of attention in the international community. On October 11, 2010, it was reported that the central parity of RMB against dollar is 6.6732. Compared with the exchange rate of October 8, it rose 98 basic points. RMB against dollar have reached a new level again.Coming to 21st century, the global economy is slowing down and in the Gloomy atmosphere. Many western countries are facing the deflationary pressure. On the contrary, Chinese economy is growing rapidly. The Balance of payments‟ double surplus and the increasing of foreign exchange reserves became direct reason to cause RMB appreciation. Especially America and Japan, they thought Chinese exporter grab the world market by the “unfairly low price”, so they focus to RMB appreciation and make great pressure to Chinese government.Japanese government urged RMB appreciation, for this reason, they made some steps. On December 2, 2002, the Japanese vice Finance Minister Haruhiko Kuroda, Masahiro Kawai and his deputies published a article named “global Inflation at the right time” in the "Financial Times" of the British. On February 22, 2002, Japan Finance Minister Masajuro Shiokawa Proposed a Proposal in Group of Seven meeting that require other six countries to force appreciation of RMB. This is first time that this organization publicly discussed the economic issue beyond member.On March 2, 2003, "Japanese Economic News" published an article called "China exports deflation to Asia and internationa l”. Japanese government believe that China exports deflation to the world especially Asia, this is the main reason that Japan require RMB appreciation. Japan is the first advocate of appreciation of RMB. Can RMB appreciation help recovery of Japanese economy? We can see that the economic relationship between China and Japan is not competitors, but a complementary relationship. First, China mainly exports labor-intensive products. There is not competition with Japanese technology-intensive products in international market. Therefore, even if RMB appreciates, Japanese export can not be Corresponding growth. Moreover, once the RMB appreciation cause the slowing down of Chinese economy, Japan exports to China also will be affected. Considering the above two points, it‟s not difficult to find that RMB appreciation will inhibit demand of Japanese product. On the supply and demand, the ascent of import price means increased cost, which will lead to shrinkage of the scale of production. From these, we can conclude that RMB appreciation will not sure have positive impact on Japanese economic recovery.The pressure of RMB appreciation shifted from Japan to the United States since June 2003. on June and July 2003, American Treasury Secretary John Snow and Federal Reserve Chairman Alan Greenspan publicly made a statement that hope RMB can choose more flexibleexchange rate system, and they thought nowadays‟ exchange rate system will eventually damage the Chinese economy. Then American Secretary of Commerce and Minister of Labor also issue the similar point of view. In addition, some interest groups actively require Revaluation of RMB. And the Snow's visit to China in September also was called “the trip of exchange rate”. They thought that China's currency manipulation cause the serious unemployment problem in Manufacturing. And RMB has been seriously underestimated. So US government gave greater pressure to urge the RMB appreciation. Recently, US pressure on the issue is becoming more and more intense. After financial crisis, China became the creditor of America. They want to reduce the US trade deficit by RMB appreciation. Chinese has implemented the RMB exchange rate reform since 2005. But from 2005 to 2008, the US trade surplus has increased except in 2009. We can see the RMB exchange rate is not the root causes of the U.S. trade deficit. So RMB appreciation doesn‟t reduce U.S. trade deficit, the United States require RMB appreciation and then to reduce Chinese exports, it doesn‟t means that American can produce these product by themselves to increase employment and consumption. Chinese reducing export will be shifted to other developing countries and at the same time, U.S. trade deficit shifts to other countries.The RMB appreciation will make Chinese product in America is more expensive and ultimately harm the American citizen interests. Therefore,the United States should produce more high-tech products to lost to the world instead of using political means to force the RMB appreciation, this is the best solution to global imbalances and create job opportunities for the American people.Although the RMB appreciation has the external pressure, the domestic factors can not be ignored. There are three main reasons. First, According to IMF estimates, RMB compared to other major trading partners, the nominal effective exchange rate fell by 6% in 2002. According to the measurement results of international organizations, RMB has been undervalued all the time. From 1998 to 2004, although China had been affected by the Asian financial crisis, the economies into recession of the United States, Japan and Europe and the SARS, the Chinese economy still remained growth of 7 % to 9%. Comparing Steady and rapid growth of Chinese economy with the world economic downturn, we can see that the trend of RMB appreciation. Second, the long-term equilibrium exchange rate is decided by the purchasing power of domestic currency and foreign currency, The "Human Development Report" of United Nations Development Program shows that China's per capita GDP is $ 1,352 in nominal exchange rate in 2005, if converted at purchasing power parity was $ 5,791, the nominal exchange rate is under valued for 4.06 times comparing with calculating by purchasing power parity. So RMB need to be appreciated. Finally, from the balance ofpayments, we can know that our country‟s current account and capital account balance has maintained a large trade surplus since 1994. Especially recent years, China has become the world's largest capital inflow country, and the FDI is up to 500 billion dollars each year. Therefore, according to the balance of payments, RMB has the trend of appreciation.The impact that the RMB appreciation bring to our country is more worthy of our consideration. There are three benefits. Domestic consumer will increase their demand for imported products. Because we will find their price become “cheap” .We will spend less money than before if we study abroad or travel. Second, RMB appreciation is beneficial for adjusting our country‟s industrial structure. During a long time, our country…s export depends on labor-intensive products and export structure can not be optimized. This is a good chance for export enterprises to improve technology and product quality. Thus promoting the adjustment of China's industrial structure and improve China‟s position in the international division. Third, in recent years, anti-dumping cases against China increased dramatically. Proper appreciation of the RMB will not only help ease the tension between China and major trading partners but also to set up good international image. RMB appreciation is a double-edged sword. It also brings some defects. First, in the past long time, the product we export is lower than other countries in theinternational market. Once the RMB revaluated, the price of our country‟s export product will increase, this will undermine the competitiveness. And that will affect the export enterprises, especially labor-intensive enterprises. Second, China accepts the most foreign direct investment in the world. After appreciation of RMB, the investment costs will increase and they will choose other developing countries. This is not conducive to the introduction of foreign direct investment. Third, the appreciation of RMB will reflect in domestic employment, domestic employment will face more pressure. Because the reducing of export will lead to lay off employees large-scale, and foreign-funded enterprises is one of sectors that provide new jobs. Fourth, RMB appreciation will not only make the money flow into the virtual economy, but also expanding the asset bubble that could eventually lead to bursting of the bubble, then lead to financial and currency crisis. Like the rapid appreciation of the Y en in 80 end of the 20th century. Fifth, China's foreign exchange reserve reached 2.4543 trillion dollars. It‟s the first of the world. Once the RMB appreciation, the huge foreign exchange reserves will face the threat of shrinking. This is a serious problem we have to face.The economic and trade relationship between China and other countries become closer and closer. The RMB appreciation is not conducive to Chinese economic development, and will bring a negative impact to the United States, Japan and the world economy. China'sexchange rate is related to the economic interests of countries, so China must strive for greater initiative in the international economy. We can try our best to promote economic globalization towards the right direction, and to create a favorable strategic international environment.China's current economic strength is growing and China plays important role in the world. Therefore, maintaining certain flexibility in the exchange rate and relatively stable exchange rate system in China is correct understanding of China's economy and the accurate decision-making in the world economy. In the current circumstances of the economic globalization, financial globalization, the best option is to keep the RMB exchange rate stability.。

Does Appreciation of the RMB Decrease Imports to the U.S. from China