管理会计(英文版)课后习题答案(高等教育出版社)

管理会计(英文版)课后习题答案(高等教育出版社)chapter 17

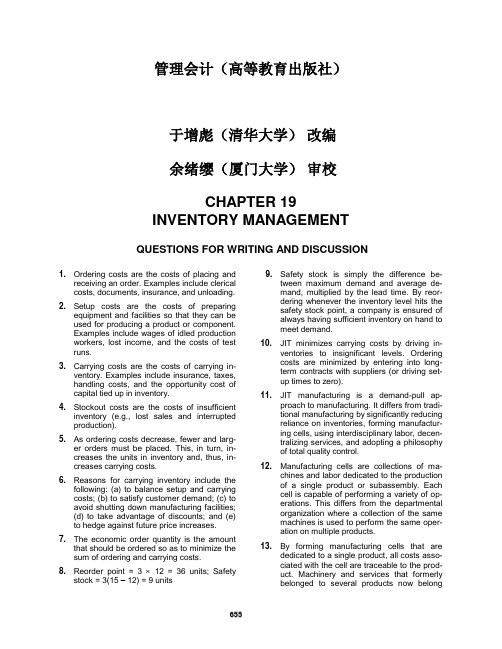

管理会计(高等教育出版社)于增彪(清华大学)改编余绪缨(厦门大学)审校CHAPTER 17 TACTICAL DECISION MAKING QUESTIONS FOR WRITING AND DISCUSSION1. A tactical decision is short-run in nature; itinvolves choosing among alternatives with an immediate or limited end in view. A stra-tegic decision involves selecting strategies that yield a long-term competitive advantage.2.Depreciation is an allocation of a sunk cost.This cost is a past cost and will never differ across alternatives.3.The salary of a supervisor in an accept orreject decision is an example of an irrelevant future cost.4.If one alternative is to be judged superior toanother alternative on the basis of cash-flow comparisons, then cash flows must be ex-pressed as an annual amount (or periodic amount); otherwise, consideration must be given to the time value of the nonperiodic cash flows.5.Disagree. Qualitative factors also have animportant bearing on the decision and may, at times, overrule the quantitative evidence from a relevant costing analysis.6.The purchase of equipment needed to pro-duce a special order is an example of a fixed cost that is relevant.7.Relevant costs are those costs that differacross alternatives. Differential costs are the differences between the costs of two alterna-tives.8.Depreciation is a relevant cost whenever it isa future cost that differs across alternatives.Thus, it must involve a capital asset not yetacquired.9.Past costs can be used as information tohelp predict future costs.10.Yes. Suppose, for example, that sufficientmaterials are on hand for producing a partfor two years. After two years, the part will bereplaced by a newly engineered part. If thereis no alternative use of the materials, thenthe cost of the materials is a sunk cost andnot relevant in a make-or-buy decision.plementary effects may make it moreexpensive to drop a product.12. A manager can identify alternatives by usinghis or her own knowledge and experienceand by obtaining input from others who arefamiliar with the problem.13.No. Joint costs are irrelevant. They occurregardless of whether the product is sold atthe split-off point or processed further.14.Yes. The incremental revenue is $1,400, andthe incremental cost is only $1,000, creatinga net benefit of $400.15.Regardless of how many units are produced,fixed costs remain the same. Thus, fixedcosts do not change as product mixchanges.16.No. If a scarce resource is used in producingthe two products, then the product providingthe greatest contribution per unit of scarceresource should be selected. For more thanone scarce resource, linear programmingmay be used to select the optimal mix.17.If a firm is operating below capacity, then aprice that is above variable costs will in-crease profits.18.Different prices can be quoted to customersin markets not normally served, to noncom-peting customers, and in a competitive bid-ding setting.19.Linear programming is used to select theoptimal product mix whenever there are mul-tiple constrained scarce resources.20.An objective function is the function that is tobe maximized (or minimized) subject to a setof constraints. A constraint is simply a func-tion that restricts the possible values of va-riables appearing in the objective function.Usually, a constraint is concerned with ascarce resource. A constraint set is the col-lection of all constraints for a given problem.21. A feasible solution is a solution to a linearprogramming problem that satisfies theprob lem’s constraints. The feasible set ofsolutions is the collection of all feasible solu-tions.22.To solve a linear programming problemgraphically, use the following four steps: (1) graph each constraint, (2) identify the feasi-ble set of solutions, (3) identify all corner points in the feasible set, and (4) select the corner point that yields the optimal value for the objective function. Typically, when a li-near programming problem has more than two or three products, the simplex method must be used.EXERCISES17–1The correct order is: D, E, B, F, C, A.17–2Steps in A ustin’s decision:Step 1: Define the problem. The problem is whether to continue studying at his present university, or to study at a university with a nationally recog-nized engineering program.Step 2: Identify the alternatives. Events A and B. (Students may want to include event I—possible study for a graduate degree. However, future eventsindicate that Austin still defined his problem as in Step 1 above.)Step 3: Identify costs and benefits associated with each feasible alternative.Events C, E, F, and I. (Students may also list E and F in Step 5—they areincluded here because they may help Austin estimate future incomebenefits.)Step 4: Total relevant costs and benefits for each feasible alternative. No specif-ic event is listed for this step, although we can intuit that it was done,and that three schools were selected as feasible since event J mentionsthat two of three applications met with success.Step 5: Assess qualitative factors. Events D, E, F, G, and H.Step 6: Make the decision. Event J is certainly relevant to this. (What did Austin ultimately decide? The author doesn’t know—at the time this text waspublished, Austin was still deciding. We certainly wish him luck!)1. The two alternatives are to make the component in house or to buy it fromCouples.2. Alternatives DifferentialMake Buy Cost to Make Direct materials $ 5.00 —$ 5.00 Direct labor 2.38 — 2.38 Variable overhead 1.90 — 1.90 Purchase cost —$11.00 (11.00) Total relevant cost $ 9.28 $11.00 $ (1.72) Pierre should make the component in house because it will save $9,116 ($1.72 5,300) over purchasing it from Couples.17–41. If Product C is dropped, profit will decrease by $15,000 since the avoidabledirect fixed costs are only $45,000 ($70,000 – $25,000). Depreciation is not re-levant.2. A new income statement, assuming that C is dropped and demand for B de-creases by 10 percent, is given below (amounts are in thousands).A B TotalSales revenue $800 $1,755 $2,555Less: Variable expenses 350 900 1,250Contribution margin $450 $ 855 $1,305Less: Direct fixed expenses 150 300 450Segment margin $300 $ 555 $ 855Less: Common fixed expenses 340 Operating income $ 515 Operating income will decrease by $85,000 ($600,000 – $515,000).1. Relevant manufacturing costs are $6.90 per unit ($2.00 + $3.10 + $1.80), so thegross profit per unit from the special order is $0.60 ($7.50 –$6.90). The in-crease in gross profit is $2,280 (3,800 $0.60).2. Again, the relevant manufacturing costs are $6.90 per unit. The increase ingross profit is $2,280, from which the $1,000 of packing capacity must be subtracted. The overall effect is to increase profit by $1,280 if the special or-der is accepted.17–61. The amounts Heather has spent on purchasing and improving the Grand Amare irrelevant because these are sunk costs.2. AlternativesRestore Grand Am Buy Neon Transmission $2,000Water pump 400Master cylinder 1,100Sell Grand Am —$(6,400)Cost of new car —9,400 Total $3,500 $ 3,000 Heather should sell the Grand Am and buy the Neon because it provides a net savings of $500.Note: Heather should consider the qualitative factors. If she restored the Grand Am, how much longer would it last? What about increased license fees and insurance on the newer car? Could she remove the stereo and put it in the Neon without decreasing the Grand Am’s resale value by much?1. Make BuyDirect materials $360,000 —Direct labor 120,000 —Variable overhead 100,000 —Fixed overhead 88,000 —Purchase cost —$640,000 ($16 ⨯ 40,000) Total relevant costs $668,000 $640,000Sherwood should purchase the part.2. Maximum price = $668,000/40,000 = $16.70 per unit3. Income would increase by $28,000 ($668,000 – $640,000).17–81. Make BuyDirect materials $360,000 —Direct labor 120,000 —Variable overhead 100,000 —Purchase cost —$640,000 ($16 ⨯ 40,000) Total relevant costs $580,000 $640,000Sherwood should continue manufacturing the part.2. Maximum price = $580,000/40,000 = $14.50 per unit3. Income would decrease by $60,000 ($640,000 – $580,000).1. Make BuyDirect materials $30.00 —Direct labor 26.60 —Variable overhead 6.40 —Purchase cost —$65Total relevant costs $63.00 $65 Income would decrease by $180,000 [($65 – $63) ⨯ 90,000].2. Make BuyVar. manu. costs (90,000 ⨯ $63) $ 5,670,000 —Materials handling (3,000 ⨯ $25) 75,000 —Purchasing (4,000 ⨯ $17) 68,000 —Setups (800 ⨯ $200) 160,000 —Engineering (1,000 ⨯ $90) 90,000 —Maintenance (7,000 ⨯ $4) 28,000 —Purchase cost (90,000 ⨯ $65) —$5,850,000 Total relevant costs $ 6,091,000 $5,850,000 Income would increase by $241,000 ($6,091,000 – $5,850,000).1. Product B TotalSales $ 100,000 $ 250,000 $ 350,000 Less: Variable expenses 50,000 145,000 195,000 Contribution margin $ 50,000 $ 105,000 $ 155,000 Less: Direct fixed expenses* 60,000 60,000 120,000 Segment margin $ (10,000) $ 45,000 $ 35,000 Less: Common fixed expenses 70,000 Operating (loss) $ (35,000) *Product A: $100,000/$350,000 ⨯ $70,000 = $20,000;$80,000 – $20,000 = $60,000Product B: $250,000/$350,000 ⨯ $70,000 = $50,000;$110,000 – $50,000 = $60,0002. Alternatives:Keep Drop Drop A/ Drop B/Both Both Keep B Keep A Sales $ 350,000 —$ 312,500 $ 150,000 Less: Variable expenses 195,000 —181,250 75,000 Contribution margin $ 155,000 —$ 131,250 $ 75,000 Less: Direct fixed expenses 120,000 —60,000 60,000 Segment margin $ 35,000 —$ 71,250 $ 15,000 Less: Common fixed expenses 70,000 $ 70,000 70,000 70,000 Operating income (loss) $ (35,000) $ (70,000) $ 1,250 $ (55,000) Gutierrez should drop Product A unless the common fixed expenses can be avoided if both products are dropped.1. The company should not accept the offer because the additional revenue isless than the additional costs (assuming fixed overhead is allocated and will not increase with the special order):Incremental revenue per calendar $4.20Incremental cost per calendar 4.25Loss per calendar $0.05Total loss: $0.05 ⨯ 5,000 = $2502. Costs associated with the layoff:Increase state UI premiums (0.01 ⨯ $1,460,000) $14,600Notification costs ($25 ⨯ 20) 500Rehiring and retraining costs ($150 ⨯ 20) 3,000 Total $18,100 The order should be accepted. The loss of $250 on the order is more than off-set by the $18,100 saved by not laying off employees.17–121. Sales $ 293,000Costs 264,000Operating profit $ 29,0002. Sell Process Further DifferenceRevenues $40,000 $73,700 $33,700 Further processing cost 0 23,900 23,900 Operating income $49,800 $ 9,800 The company should process Delta further, because operating profit would increase by $9,800 if it were processed further. (Note: Joint costs are irrele-vant to this decision, because the company will incur them whether or not Delta is processed further.)17–131. ($30 ⨯ 2,000) + ($60 ⨯ 4,000) = $300,0002. HeraContribution margin $30 $60÷ Pounds of material ÷2 ÷5Contribution margin/pound $15 $12Norton should make as much of Juno as can be sold, then make Hera.2,000 units of Juno ⨯ 2 = 4,000 pounds16,000 pounds – 4,000 pounds = 12,000 pounds for HeraHera production = 12,000/5 = 2,400 unitsProduct mix is 2,000 Juno and 2,400 Hera.Total contribution margin = (2,000 ⨯ $30) + (2,400 ⨯ $60)= $204,00017–141. Let X = Number of Product A producedLet Y = Number of Product B producedMaximize Z = $30X + $60Y (objective function)2X + 5Y ≤ 6,000 (direct material constraint)3X + 2Y ≤ 6,000 (direct labor constraint)X ≤ 1,000Y ≤ 2,000X ≥ 0Y ≥ 017–14 Concluded2.AX0 1,000 2,000 3,000Solution: The corner points are the origin, the points where X = 0, Y = 0, and where two linear constraints intersect. The point of intersection of the two li-near constraints is obtained by solving the two equations simultaneously.A 0 0 $ 0B 1,000 0 30,000C 1,000 800 78,000*D 0 1,200 72,000*The values for X and Y are found by solving the simultaneous equations:X = 1,0002X + 5Y = 6,0002(1,000) + 5Y = 6,000Y = 800Z = $30(1,000) + $60(800) = $78,000Optimal solution: X = 1,000 units and Y = 800 units3. At the optimal level, the contribution margin is $78,000.AlternativesRelevant Item Keep Buy Revenues $ 10,000,000 $12,000,000Note savings 0 16,500 Operating costs (63,000) (50,000) Maintenance (8,500) (4,000) Net recurring benefit $ 9,928,500 $11,962,500One-time cash outflow —$(540,000)The relevant items include both recurring and nonrecurring items. The decision to keep or buy must include the opportunity cost of the one-time outlay of $540,000. Since the opportunity cost is likely to be much less than the difference between the recurring benefits, the buy alternative appears to be superior. While net present value analysis is the best framework for this problem, it is useful to identify relevant items.17–161. Process Differential AmountSell Further to Process Further Revenues $24,000 $42,000 $18,000Processing cost —(7,150) (7,150) Total $34,850 $10,850 Pyrol should be processed further as it will increase profit by $10,850 for every 1,000 liters.2. Process Differential AmountSell Further to Process Further Revenues $24,000 $42,000 $ 18,000Processing cost —(7,150) (7,150)Distribution cost —(800) (800)Commissions —(4,200) (4,200) Total $29,850 $ 5,850 Pyrol should be processed further as it will increase profit by $5,850 for every 1,000 liters. Note that the liability issue was not quantified, so that it would need to be considered as a qualitative factor—possibly reducing the attrac-tiveness of making pyrolase.1. Model M-3Contribution margin $24 $ 15÷ Hours on lathe ÷ 6 ÷ 3Contribution margin/hours on lathe $ 4 $ 5Model M-3 has the higher contribution margin per hour of drilling machine use, so all 12,000 hours should be spent producing it. If that is done, 4,000 (12,000 hours/3 hours per unit) units of Model M-3 should be produced. Zero units of Model A-4 should be produced.2. If only 2,500 units of Model M-3 can be sold, then 2,500 units should be pro-duced. This will take 7,500 hours of drilling machine time. The remaining 4,500 hours should be spent producing 750 (4,500/6) units of Model A-4.17–181. Model 14-DContribution margin $ 12 $ 10÷ Hours on lathe ÷ 4 ÷ 2Contribution margin/hours on lathe $ 3 $ 5Model 33-P has the higher contribution margin per hour of lathe use, so all 12,000 hours should be spent producing it. If that is done, 6,000 (12,000 hours/2 hours per unit) units of Model 33-P should be produced. Zero units of Model 14-D should be produced.2. If only 5,000 units of Model 33-P can be sold, then 5,000 units should be pro-duced. This will take 10,000 hours of lathe time. The remaining 2,000 hours should be spent producing 500 (2,000/4) units of Model 14-D.17–191. Let X = Number of Model 14-D producedLet Y = Number of Model 33-P producedMaximize Z = $12X + $10Y (objective function)4X + 2Y ≤ 12,000 (lathe constraint)X ≤ 2,000 (demand constraint)Y ≤ 5,000 (demand constraint)X ≥ 0Y ≥ 02.X0 1,000 2,000 3,000 4,000 5,000Solution: The corner points are points A, B, C, D, and E. The point of intersec-tion of the linear constraints is obtained by solving the two equations simul-taneously.Corner Point X-Value Y-Value Z = $12X + $10YA 0 0 $ 0B 0 5,000 50,000C 500 5,000 56,000D 2,000 2,000 44,000E 2,000 0 24,000*The intersection values for X and Y can be found by solving the simultane-ous equations:Corner Point C:Y = 5,0004X + 2Y = 12,0004X + 2(5,000) = 12,0004X = 2,000X = 500Z = $12(500) + $10(5,000) = $56,000Corner Point D:X = 2,0004X + 2Y = 12,0004(2,000) + 2Y = 12,0002Y = 4,000Y = 2,000Z = $12(2,000) + $10(2,000) = $44,000Optimal solution is Point C, where X = 500 units and Y = 5,000 units.3. At the optimal level, the contribution margin is $56,000.17–201. COGS + Markup(COGS) = Sales$144,300 + Markup($144,300) = $206,349Markup($144,300) = $206,349 – $144,300Markup = $62,049/$144,300Markup = 0.43, or 43%2. Direct materials $ 800Direct labor 1,600Overhead 3,200Total cost $ 5,600Add: Markup 2,408Initial bid $ 8,00817–211. Standard DeluxePrice $ 9.00 $30.00 $35.00 Variable cost 6.00 20.00 10.00 Contribution margin $ 3.00 $10.00 $25.00 ÷ Machine hours ÷0.10 ÷0.50 ÷0.75 Contribution margin/MHr. $30.00 $20.00 $33.33 The company should sell only the deluxe unit with contribution margin per machine hour of $33.33. Sealing can produce 20,000 (15,000/0.75) deluxe units per year. These 20,000 units, multiplied by the $25 contribution margin per unit, would yield total contribution margin of $500,000.2. Produce and sell 12,000 deluxe units, which would use 9,000 machine hours.Then, produce and sell 50,000 basic units, which would use 5,000 machine hours. Then produce and sell 2,000 standard units, which would use the re-maining 1,000 machine hours.Total contribution margin = ($25 ⨯ 12,000) + ($3 ⨯ 50,000) + ($10 ⨯ 2,000)= $470,00017–221. d2. a3. d4. c5. b6. bPROBLEMS17–231. Costs for Two YearsSite 1 Site 2 Site 3 Rent $11,400 $12,000 —Partitions 2,040 1,500 —Renovation ——$15,000 Total $13,440 $13,500 $15,000Costs for Three YearsSite 1 Site 2 Site 3 Rent $17,100 $18,000 —Partitions 3,060 1,500 —Renovation ——$15,000 Total $20,160 $19,500 $15,000 Yes, it matters. If the center exists for two years, then Site 1 is least expen-sive. If the center exists for three years, Site 3 is least expensive.2. MEMORANDUMTO: Alice KnappFROM: Site ConsultantRE: New Location for the CenterThree sites are under serious consideration for the center’s location. Quant i-tatively, the sites are ranked as follows:Two Years Three YearsSite 1 = $13,440 Site 3 = $15,000Site 2 = $13,500 Site 2 = $19,500Site 3 = $15,000 Site 1 = $20,160 Clearly, it is important for you to determine whether the Center will continue to serve the people of Newkirk for two more years or for three more years.17–23 ConcludedQualitative factors are also important and are discussed for each site in turn.Site 1: The location of this site is a good one for the center because it is cen-trally located and will be convenient for clients. Neighbors include an attor-ney, two insurance agencies, and a bail bond agency. These businesses can be expected to accept the Drug Counseling Center readily. However, the space is somewhat smaller than the other sites, and total privacy for client and counselor cannot be ensured.Site 2: This site is convenient to ca seworkers’ homes. However, it is som e-what less convenient for clients. Additionally, some stores in the mall may resent the location of a drug counseling center and fight to block your mov-ing in. While you would no doubt eventually win any legal battles, the poten-tial legal action would require time and money. The space provided by Site 2 is ideal for the center’s purposes. Client privacy would be ensured. Private o f-fice space exists for administrative needs.Site 3: Considerably more space is provided by Site 3 than by the other sites.Currently, however, it is virtually unusable. It will take time to complete the renovation. During that time period, the center may have to cancel client ap-pointments and/or operate out of temporary quarters (e.g., the courthouse).17–241. Make BuyDirect materials$218,000 —Direct labor b70,200 —Variable overhead c20,800 —Fixed overhead d58,000 —Purchase cost e—$340,000Total $367,000 $340,000a($70 ⨯ 2,000) + ($130 ⨯ 600)b$27 ⨯ 2,600c$8 ⨯ 2,600d$26,000 + $32,000e($125 ⨯ 2,000) + ($150 ⨯ 600)Net savings by purchasing: $27,000. Hetrick should purchase the crowns ra-ther than make them.2. Qualitative factors that Hetrick should consider include quality of crowns, re-liability and promptness of producer, and reduction of workforce.3. It reduces the cost of making the crowns to $335,000, which is less than thecost of buying.4. Make BuyDirect materials $316,000 —Direct labor 108,000 —Variable overhead 32,000 —Fixed overhead 58,000 —Purchase cost —$515,000Total $514,000 $515,000Hetrick should produce its own crowns if demand increases to this level be-cause the fixed overhead is spread over more units.17–251. @ 600 lbs. Process Further Sell DifferenceR evenues a$24,000 $7,200 $16,800B ags b—(39) 39S hipping c(384) (60) (324)G rinding d(1,500) —(1,500)B ottles e(2,400) —(2,400)Total $19,716 $7,101 $12,615 a600 ⨯ 10 ⨯ $4 = $24,000; $12 ⨯ 600b$1.30 ⨯ (600/20)c[(10 ⨯ 600)/25] ⨯ $1.60 = $384; $0.10 ⨯ 600 = $60d$2.50 ⨯ 600e10 ⨯ 600 ⨯ $0.40Zanda should process depryl further.2. $12,615/600 = $21.025 additional income per pound$21.025 ⨯ 265,000 = $5,571,62517–261. System B Headset TotalSales $45,000 $ 32,500 $8,000 $ 85,500 Less: Variable expenses 20,000 25,500 3,200 48,700 Contribution margin $25,000 $ 7,000 $4,800 $ 36,800 Less: Direct fixed costs* 526 11,158 1,016 12,700 Segment margin (loss) $24,474 $ (4,158) $3,784 $ 24,100 Less: Common fixed costs 18,000 Operating income $ 6,100 *$45,000/$85,500 ⨯ $18,000 = $9,474; $10,000 – $9,474 = $526$32,500/$85,500 ⨯ $18,000 = $6,842; $18,000 – $6,842 = $11,158$8,000/$85,500 ⨯ $18,000 = $1,684; $2,700 – $1,684 = $1,01617–26 Concluded2. Headset TotalSales $58,500 $6,000 $64,500Less: Variable expenses 26,000 2,400 28,400Contribution margin $32,500 $3,600 $36,100Less: Direct fixed costs 526 1,016 1,542Segment margin $31,974 $2,584 $34,558Less: Common fixed costs 18,000 Operating income $16,558 System B should be dropped.3. System C Headset TotalSales $45,000 $ 26,000 $7,200 $78,200 Less: Variable expenses 20,000 13,000 2,880 35,880 Contribution margin $25,000 $ 13,000 $4,320 $42,320 Less: Direct fixed costs 526 11,158 1,016 12,700 Segment margin $24,474 $ 1,842 $3,304 $29,620 Less: Common fixed costs 18,000 Operating income $11,620 Replacing B with C is better than keeping B, but not as good as dropping B without replacement with C.1. Steve should consider selling the part for $1.85 because his division’s profitswould increase by $12,800:Reject Revenues (2 ⨯ $1.85 ⨯ 8,000) $29,600 $0Variable expenses 16,800 0 Total $12,800 $0 Pat’s div isional profits would increase by $18,400:Accept Reject Revenues ($32 ⨯ 8,000) $ 256,000 $0Variable expenses:Direct materials ($17 ⨯ 8,000) (136,000) 0Direct labor ($7 ⨯ 8,000) (56,000) 0Variable overhead ($2 ⨯ 8,000) (16,000) 0Component (2 ⨯ $1.85 ⨯ 8,000) (29,600) 0 Total relevant benefits $ 18,400 $02. Pat should accept the $2 price. This price will increase the cost of the com-ponent from $29,600 to $32,000 (2 ⨯ $2 ⨯ 8,000) and yield an incremental ben-efit of $16,000 ($18,400 – $2,400).Steve’s division will see an increase in profit of $15,200 (8,000 units ⨯ 2 com-ponents per unit ⨯ $0.95 contribution margin per component).3. Yes. At full price, the total cost of the component is $36,800 (2 ⨯$2.30 ⨯8,000), an increase of $7,200 over the original offer. This still leaves an in-crease in profits of $11,200 ($18,400 –$7,200). (See the answer to Require-ment 1.)1. Sales a$ 3,751,500Less: Variable expenses b2,004,900Contribution margin $ 1,746,600Less: Direct fixed expenses c1,518,250Divisional margin $ 228,350Less: Common fixed expenses c299,250Operating (loss) $ (70,900)a Based on sales of 41,000 unitsLet X = Units sold$83X/2 + $100X/2 = $3,751,500$183X = $7,503,000X = 41,000 unitsb$83/1.25 = $66.40 Manufacturing cost20.00 Fixed overhead$46.40 Per internal unit variable cost5.00 Selling$51.40 Per external unit variable costVariable costs = ($46.40 ⨯ 20,500) + ($51.40 ⨯ 20,500)= $2,004,900c Fixed selling and admin: $1,100,000 – $5(20,500) = $997,500Direct fixed selling and admin: 0.7 ⨯ $997,500 = $698,250Direct fixed overhead: $20 ⨯ 41,000 = $820,000Total direct fixed expenses = $698,250 + $820,000 = $1,518,250Common fixed expenses = 0.3 ⨯ $997,500 = $299,2502. Keep DropSales $ 3,751,500 $ —Variable costs (2,004,900) (2,050,000)*Direct fixed expenses (1,518,250) —Annuity —100,000 Total $ 228,350 $(1,950,000) *$100 ⨯ 20,500 (The units transferred internally must be purchased external-ly.)The company should keep the division.1. Napkins: CM/machine hour = ($2.50 – $1.50)/1 = $1.00Tissues: CM/machine hour = ($3.00 – $2.25)/0.5 = $1.50Tissues provide the greatest contribution per machine hour, so the company should produce 400,000 packages of tissues (200,000 machine hours times 2 packages per hour) and zero napkins.2. Let X = Boxes of napkins; Y = Boxes of tissuesa. Z = $1.00X + $0.75Y (objective function)X+ 0.5Y ≤ 200,000 (machine constraint)X≤ 150,000 (demand constraint)Y≤ 300,000 (demand constraint)X≥ 0Y≥ 017–29 Concludedb. andc.(in thousands) Y400 300 200 100X100 200300 400Corner Point X-ValueY-ValueZ = $1.00X + $0.75YA 00 0B 150,000 0150,000 C* 150,000 100,000 225,000 D* 50,000300,000 275,000*E 0300,000 225,000*Point C: Point D:X = 150,000 Y = 300,000X + 0.5Y = 200,000 X + 0.5Y = 200,000150,000 + 0.5Y = 200,000 X + 0.5(300,000) = 200,000Y = 100,000X = 50,000The optimal mix is D: 50,000 packages of napkins and 300,000 boxes of tis-sues. The maximum profit is $275,000.A B C DE17–301. Segmented income statement (in thousands):D P T TotalSales $900 $1,600 $900 $3,400 Less: Variable expenses a710 1,008 900 2,618 Contribution margin $190 $ 592 $ 0 $ 782 Less: Direct fixed expenses 100 210 40 350 Segment margin $ 90 $ 382 $ (40) $ 432 Less: Common fixed expenses b490 Operating (loss) $ (58)a D: $900,000/$90 = 10,000 unitsP: $1,600,000/$200 = 8,000 unitsT: $900,000/$180 = 5,000 unitsD P T TotalVariable production* $670 $ 928 $850 $2,448 Shipping expenses** 40 80 50 170$1,008 $900 $2,618 *$67 ⨯ 10,000; $116 ⨯ 8,000; $170 ⨯ 5,000**$4 ⨯ 10,000; $10 ⨯ 8,000; $10 ⨯ 5,000b Fixed OH (10,000 ⨯ $10) + (8,000 ⨯ $15) + (5,000 ⨯ $20) $320,000Common fixed S & A ($690,000 – $350,000 – $170,000) 170,000Total common fixed expenses $490,0002. Yes, the T-gauge production should be discontinued:D P TotalS ales $900 $1,600 $2,500L ess: Variable expenses 710 1,008 1,718C ontribution margin $190 $ 592 $ 782L ess: Direct fixed expenses 100 210 310S egment margin $ 90 $ 382 $ 472L ess: Common fixed expenses 490 Operating (loss) $ (18)3. D P TotalSales $450 $2,000 $2,450Less: Variable expenses 355 1,260 1,615Contribution margin $ 95 $ 740 $ 835Less: Direct fixed expenses 80 310 390Segment margin $ 15 $ 430 $ 445Less: Common fixed expenses 490 Operating (loss) $ (45) Promoting the P-gauge makes sense since it has the higher unit contribution margin. Also, the increase in P’s contribution margin more than covers the increased advertising. However, cutting production of D to allow increased production of P is unacceptable, since the $48,000 gain of the P-gauge is more than offset by the $75,000 loss of the D-gauge.17–311. Dept. 1 Dept. 3 TotalProduct 401 (500 units):Labor hours a1,000 1,500 1,500 4,000 Machine hours b500 500 1,000 2,000 Product 402 (400 units):Labor hours c400 800 —1,200 Machine hours d400 400 —800 Product 403 (1,000 units):Labor hours e2,000 2,000 2,000 6,000 Machine hours f2,000 2,000 1,000 5,000 Total labor hours 3,400 4,300 3,500 11,200 Total machine hours 2,900 2,900 2,000 7,800 a2 ⨯ 500; 3 ⨯ 500; 3 ⨯ 500 d1 ⨯ 400; 1 ⨯ 400b1 ⨯ 500; 1 ⨯ 500; 2 ⨯ 500 e2 ⨯ 1,000; 2 ⨯ 1,000; 2 ⨯ 1,000c1 ⨯ 400; 2 ⨯ 400 f2 ⨯ 1,000; 2 ⨯ 1,000; 1 ⨯ 1,000The demand can be met in all departments except for Department 3. Produc-tion requires 3,500 labor hours in Department 3, but only 2,750 hours are available.。

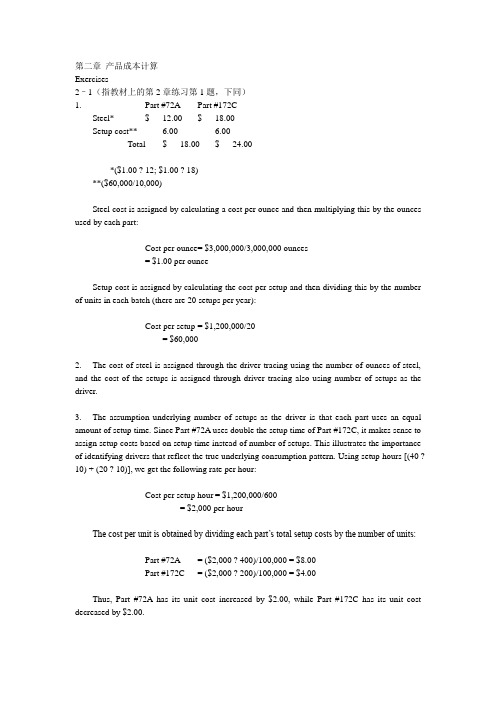

管理会计(英文版)课后习题答案(高等教育出版社)chapter 4

管理会计(高等教育出版社)于增彪(清华大学)改编余绪缨(厦门大学)审校CHAPTER 4ACTIVITY-BASED COSTINGQUESTIONS FOR WRITING AND DISCUSSION1.Unit costs provide essential informationneeded for inventory valuation and prepara-tion of income statements. Knowing unit costs is also critical for many decisions such as bidding decisions and accept-or-reject special order decisions.2.Cost measurement is determining the dollaramounts associated with resources used in production. Cost assignment is associating the dollar amounts, once measured, with units produced.3.An actual overhead rate is rarely used be-cause of problems with accuracy and timeli-ness. Waiting until the end of the year to en-sure accuracy is rejected because of the need to have timely information. Timeliness of information based on actual overhead costs runs into difficulty (accuracy problems) because overhead is incurred nonuniformly and because production also may be non-uniform.4.For plantwide rates, overhead is first col-lected in a plantwide pool, using direct trac-ing. Next, an overhead rate is computed and used to assign overhead to products. 5.First stage: Overhead is assigned to produc-tion department pools using direct tracing, driver tracing, and allocation. Second stage: Individual departmental rates are used to assign overhead to products as they pass through the departments.6.Departmental rates would be chosen overplantwide rates whenever some depart-ments are more overhead intensive than others and if certain products spend more time in some departments than they do in others.7.Plantwide overhead rates assign overheadto products in proportion to the amount of the unit-level cost driver used. If the prod-ucts consume some overhead activities in different proportions than those assigned by the unit-level cost driver, then cost dis-tortions can occur (the product diversity factor). These distortions can be significant if the nonunit-level overhead costs represent a significant proportion of total overhead costs.8.Low-volume products may consume non-unit-level overhead activities in much greater proportions than indicated by a unit-levelcost driver and vice versa for high-volumeproducts. If so, then the low-volume prod-ucts will receive too little overhead and thehigh-volume products too much.9.If some products are undercosted and oth-ers are overcosted, a firm can make a num-ber of competitively bad decisions. For ex-ample, the firm might select the wrongproduct mix or submit distorted bids.10.Nonunit-level overhead activities are thoseoverhead activities that are not highly corre-lated with production volume measures. Ex-amples include setups, material handling,and inspection. Nonunit-level cost driversare causal factors—factors that explain theconsumption of nonunit-level overhead. Ex-amples include setup hours, number ofmoves, and hours of inspection.11.Product diversity is present whenever prod-ucts have different consumption ratios fordifferent overhead activities.12.An overhead consumption ratio measuresthe proportion of an overhead activity con-sumed by a product.13.Departmental rates typically use unit-levelcost drivers. If products consume nonunit-level overhead activities in different propor-tions than those of unit-level measures, thenit is possible for departmental rates to moveeven further away from the true consumptionratios, since the departmental unit-level ra-tios usually differ from the one used at theplant level.14.Agree. Prime costs can be assigned usingdirect tracing and so do not cause cost dis-tortions. Overhead costs, however, are notdirectly attributable and can cause distor-tions. For example, using unit-level activitydrivers to trace nonunit-level overhead costswould cause distortions.15.Activity-based product costing is an over-head costing approach that first assignscosts to activities and then to products. Theassignment is made possible through theidentification of activities, their costs, and theuse of cost drivers.16.An activity dictionary is a list of activitiesaccompanied by information that describeseach activity (called attributes)17. A primary activity is consumed by the finalcost objects such as products and custom-ers, whereas secondary activities are con-sumed by other activities (ultimately con-sumed by primary activities).18.Costs are assigned using direct tracing andresource drivers.19.Homogeneous sets of activities are pro-duced by associating activities that have thesame level and that can use the same driverto assign costs to products. Homogeneoussets of activities reduce the number of over-head rates to a reasonable level.20. A homogeneous cost pool is a collection ofoverhead costs that are logically related tothe tasks being performed and for whichcost variations can be explained by a singleactivity driver. Thus, a homogeneous pool ismade up of activities with the same process,the same activity level, and the same driver.21.Unit-level activities are those that occur eachtime a product is produced. Batch-level activi-ties are those that are performed each time abatch of products is produced. Product-levelor sustaining activities are those that areperformed as needed to support the variousproducts produced by a company. Facility-level activities are those that sustain a facto-ry’s general man ufacturing process.22.ABC improves costing accuracy wheneverthere is diversity of cost objects. There arevarious kinds of cost objects, with productsbeing only one type. Thus, ABC can be use-ful for improving cost assignments to costobjects like customers and suppliers. Cus-tomer and supplier diversity can occur for asingle product firm or for a JIT manufactur-ing firm.23.Activity-based customer costing can identifywhat it is costing to service different custom-ers. Once known, a firm can then devise astrategy to increase its profitability by focus-ing more on profitable customers, convertingunprofitable customers to profitable oneswhere possible, and “firing” customers thatcannot be made profitable.24.Activity-based supplier costing traces allsupplier-caused activity costs to suppliers.This new total cost may prove to be lowerthan what is signaled simply by purchaseprice.EXERCISES4–11.Quarter 1 Quarter 2 Q uarter 3 Quarter 4 Total Units produced 400,000 160,000 80,000 560,000 1,200,000 Prime costs $8,000,000 $3,200,000 $1,600,000 $11,200,000 $24,000,000 Overhead costs $3,200,000 $2,400,000 $3,600,000 $2,800,000 $12,000,000 Unit cost:Prime $20 $20 $20 $20 $20Overhead 8 15 45 5 10Total $28 $35 $65 $25 $30 2. Actual costing can produce wide swings in the overhead cost per unit. Thecause appears to be nonuniform incurrence of overhead and nonuniform production (seasonal production is a possibility).3. First, calculate a predetermined rate:OH rate = $11,640,000/1,200,000= $9.70 per unitThis rate is used to assign overhead to the product throughout the year.Since the driver is units produced, $9.70 would be assigned to each unit.Adding this to the actual prime costs produces a unit cost under normal cost-ing:Unit cost = $9.70 + $20.00 = $29.70This cost is close to the actual annual cost of $30.00.1. $13,500,000/3,600,000 = $3.75 per direct labor hour (DLH)2. $3.75 ⨯ 3,456,000 = $12,960,0003. Applied overhead $ 12,960,000A ctual overhead 13,600,000U nderapplied overhead $ 640,0004. Predetermined rates allow the calculation of unit costs and avoid the prob-lems of nonuniform overhead incurrence and nonuniform production asso-ciated with actual overhead rates. Unit cost information is needed throughout the year for a variety of managerial purposes.4–31. Predetermined overhead rate = $4,500,000/600,000 = $7.50 per DLH2. Applied overhead = $7.50 ⨯ 585,000 = $4,387,5003. Applied overhead $ 4,387,500Actual overhead 4,466,250Underapplied overhead $ (78,750)4. Unit cost:Prime costs $ 6,750,000Overhead costs 4,387,500Total $ 11,137,500Units ÷750,000Unit cost $ 14.851. Predetermined overhead rate = $4,500,000/187,500 = $24 per machine hour(MHr)2. Applied overhead = $24 187,875 = $4,509,0003. Applied overhead $ 4,509,000Actual overhead 4,466,250Overapplied overhead $ 42,7504. Unit cost:Prime costs $ 6,750,000Overhead costs 4,509,000Total $ 11,259,000Units ÷750,000Unit cost $ 15.01**Rounded5. Gandars needs to determine what causes its overhead. Is it primarily labordriven (e.g., composed predominantly of fringe benefits, indirect labor, and personnel costs), or is it machine oriented (e.g., composed of depreciation on machinery, utilities, and maintenance)? It is impossible for a decision to be made on the basis of the information given in this exercise.1. Predetermined rates:Drilling Department: Rate = $600,000/280,000 = $2.14* per MHrAssembly Department: Rate = $392,000/200,000= $1.96 per DLH*Rounded2. Applied overhead:Drilling Department: $2.14 ⨯ 288,000 = $616,320Assembly Department: $1.96 ⨯ 196,000 = $384,160Overhead variances:Drilling Assembly Total Actual overhead $602,000 $ 412,000 $ 1,014,000 Applied overhead 616,320 384,160 1,000,480 Overhead variance $ (14,320) over $ 27,840 under $ 13,520 3. Unit overhead cost = [($2.14 ⨯ 4,000) + ($1.96 ⨯ 1,600)]/8,000= $11,696/8,000= $1.46**Rounded1. Activity rates:Machining = $632,000/300,000= $2.11* per MHrInspection = $360,000/12,000= $30 per inspection hour*Rounded2. Unit overhead cost = [($2.11 ⨯ 8,000) + ($30 ⨯ 800)]/8,000= $40,880/8,000= $5.114–71. Yes. Since direct materials and direct labor are directly traceable to eachproduct, their cost assignment should be accurate.2. Elegant: (1.75 ⨯ $9,000)/3,000 = $5.25 per briefcaseFina: (1.75 ⨯ $3,000)/3,000 = $1.75 per briefcaseNote: Overhead rate = $21,000/$12,000 = $1.75 per direct labor dollar (or 175 percent of direct labor cost).There are more machine and setup costs assigned to Elegant than Fina. This is clearly a distortion because the production of Fina is automated and uses the machine resources much more than the handcrafted Elegant. In fact, the consumption ratio for machining is 0.10 and 0.90 (using machine hours as the measure of usage). Thus, Fina uses nine times the machining resources as Elegant. Setup costs are similarly distorted. The products use an equal number of setups hours. Yet, if direct labor dollars are used, then the Elegant briefcase receives three times more machining costs than the Fina briefcase.4–7 Concluded3. Overhead rate = $21,000/5,000= $4.20 per MHrElegant: ($4.20 ⨯ 500)/3,000 = $0.70 per briefcaseFina: ($4.20 ⨯ 4,500)/3,000 = $6.30 per briefcaseThis cost assignment appears more reasonable given the relative demands each product places on machine resources. However, once a firm moves to a multiproduct setting, using only one activity driver to assign costs will likely produce product cost distortions. Products tend to make different demands on overhead activities, and this should be reflected in overhead cost assign-ments. Usually, this means the use of both unit- and nonunit-level activity drivers. In this example, there is a unit-level activity (machining) and a non-unit-level activity (setting up equipment). The consumption ratios for each (using machine hours and setup hours as the activity drivers) are as follows:Elegant FinaMachining 0.10 0.90 (500/5,000 and 4,500/5,000)Setups 0.50 0.50 (100/200 and 100/200)Setup costs are not assigned accurately. Two activity rates are needed—one based on machine hours and the other on setup hours:Machine rate: $18,000/5,000 = $3.60 per MHrSetup rate: $3,000/200 = $15 per setup hourCosts assigned to each product:Machining: Elegant Fina$3.60 ⨯ 500 $ 1,800$3.60 ⨯ 4,500 $ 16,200Setups:$15 ⨯ 100 1,500 1,500Total $ 3,300 $ 17,700Units ÷3,000 ÷3,000Unit overhead cost $ 1.10 $ 5.90Activity dictionary:Activity Activity Primary/ ActivityName Description Secondary Driver Providing nursing Satisfying patient Primary Nursing hours care needsSupervising Coordinating Secondary Number of nurses nurses nursing activitiesFeeding patients Providing meals Primary Number of mealsto patientsLaundering Cleaning and Primary Pounds of laundry bedding and delivering clothesclothes and beddingProviding Therapy treatments Primary Hours of therapy physical directed bytherapy physicianMonitoring Using equipment to Primary Monitoring hours patients monitor patientconditions1. dCost of labor (0.75 ⨯ $40,000) $30,000Forklift (direct tracing) 6,000 Total cost of receiving $36,000 2. b3. a4. c5. dActivity rates (Questions 2–5):Receiving: $36,000/50,000 = $0.72 per partSetup: $60,000/300 = $200 per setupGrinding: $90,000/18,000 = $5 per MHrInspecting: $45,000/4,500 = $10 per inspection hour6. aOverhead rate = $231,000/20,000 = $11.55 per DLH Direct materials $ 850Direct labor 600Overhead ($11.55 ⨯ 50) 578*Total cost $ 2,028Units ÷100Unit cost $ 20.28*Rounded4–9 Concluded7. bDirect materials $ 850.00Direct labor 600.00Overhead:Setup 200.00 ($200 ⨯ 1)Inspecting 40.00 ($10 ⨯ 4)Grinding 100.00 ($5 ⨯ 20)Receiving 14.40 ($0.72 ⨯ 20) Total costs $ 1,804.40Units ÷100Unit cost $ 18.04**Rounded4–101. Unit-level: Testing products, inserting dies2. Batch-level: Setting up batches, handling wafer lots, purchasingmaterials, receiving materials3. Product-level: Developing test programs, making probe cards,engineering design, paying suppliers4. Facility-level: Providing utilities, providing space4–111. Unit-level activities: MachiningBatch-level activities: Setups and packing Product-level activities: ReceivingFacility-level activities: None2. Pools and drivers:Unit-levelPool 1:Machining $80,000Activity driver: Machine hoursBatch-levelPool 2:Setups $24,000Packing 30,000Total cost $54,000Product-levelPool 3:Receiving $18,000Activity driver: Receiving orders4–11 Concluded3. Pool rates:Pool 1: $80,000/40,000 = $2 per MHrPool 2: $54,000/300 = $180 per setupPool 3: $18,000/600 = $30 per receiving order 4. Overhead assignment:InfantryPool 1: $2 ⨯ 20,000 = $ 40,000Pool 2: $180 ⨯ 200 = 36,000Pool 3: $30 ⨯ 200 = 6,000Total $ 82,000Special forcesPool 1: $2 ⨯ 20,000 = $ 40,000Pool 2: $180 ⨯ 100 = 18,000Pool 3: $30 ⨯ 400 = 12,000Total $ 70,0004–121. Deluxe Percent Regular PercentPrice $900 100% $750 100% Cost 576 64 600 80 Unit gross profit $324 36% $150 20% Total gross profit:($324 ⨯ 100,000) $32,400,000($150 ⨯ 800,000) $120,000,0002. Calculation of unit overhead costs:Deluxe Regular Unit-level:Machining:$200 ⨯ 100,000 $20,000,000$200 ⨯ 300,000 $60,000,000 Batch-level:Setups:$3,000 ⨯ 300 900,000$3,000 ⨯ 200 600,000 Packing:$20 ⨯ 100,000 2,000,000$20 ⨯ 400,000 8,000,000 Product-level:Engineering:$40 ⨯ 50,000 2,000,000$40 ⨯ 100,000 4,000,000 Facility-level:Providing space:$1 ⨯ 200,000 200,000$1 ⨯ 800,000 800,000 Total overhead $ 25,100,000 $ 73,400,000 Units ÷100,000 ÷800,000 Overhead per unit $ 251 $ 91.75Deluxe Percent Regular Percent Price $900 100% $750.00 100%Cost 780* 87*** 574.50** 77***Unit gross profit $120 13%*** $175.50 23%***Total gross profit:($120 ⨯ 100,000) $12,000,000($175.50 ⨯ 800,000) $140,400,000*$529 + $251**$482.75 + $91.75***Rounded3. Using activity-based costing, a much different picture of the deluxe and regu-lar products emerges. The regular model appears to be more profitable. Per-haps it should be emphasized.4–131. JIT Non-JITSales a$12,500,000 $12,500,000Allocation b750,000 750,000a$125 ⨯ 100,000, where $125 = $100 + ($100 ⨯ 0.25), and 100,000 is the average order size times the number of ordersb0.50 ⨯ $1,500,0002. Activity rates:Ordering rate = $880,000/220 = $4,000 per sales orderSelling rate = $320,000/40 = $8,000 per sales callService rate = $300,000/150 = $2,000 per service callJIT Non-JITOrdering costs:$4,000 ⨯ 200 $ 800,000$4,000 ⨯ 20 $ 80,000Selling costs:$8,000 ⨯ 20 160,000$8,000 ⨯ 20 160,000Service costs:$2,000 ⨯ 100 200,000$2,000 ⨯ 50 100,000T otal $ 1,160,000 $ 340,000For the non-JIT customers, the customer costs amount to $750,000/20 = $37,500 per order under the original allocation. Using activity assignments, this drops to $340,000/20 = $17,000 per order, a difference of $20,500 per or-der. For an order of 5,000 units, the order price can be decreased by $4.10 per unit without affecting customer profitability. Overall profitability will decrease, however, unless the price for orders is increased to JIT customers.3. It sounds like the JIT buyers are switching their inventory carrying costs toEmery without any significant benefit to Emery. Emery needs to increase prices to reflect the additional demands on customer-support activities. Fur-thermore, additional price increases may be needed to reflect the increased number of setups, purchases, and so on, that are likely occurring inside the plant. Emery should also immediately initiate discussions with its JIT cus-tomers to begin negotiations for achieving some of the benefits that a JIT supplier should have, such as long-term contracts. The benefits of long-term contracting may offset most or all of the increased costs from the additional demands made on other activities.4–141. Supplier cost:First, calculate the activity rates for assigning costs to suppliers: Inspecting components: $240,000/2,000 = $120 per sampling hourReworking products: $760,500/1,500 = $507 per rework hourWarranty work: $4,800/8,000 = $600 per warranty hourNext, calculate the cost per component by supplier:Supplier cost:Vance Foy Purchase cost:$23.50 ⨯ 400,000 $ 9,400,000$21.50 ⨯ 1,600,000 $ 34,400,000 Inspecting components:$120 ⨯ 40 4,800$120 ⨯ 1,960 235,200 Reworking products:$507 ⨯ 90 45,630$507 ⨯ 1,410 714,870 Warranty work:$600 ⨯ 400 240,000$600 ⨯ 7,600 4,560,000 Total supplier cost $ 9,690,430 $ 39,910,070Units supplied ÷400,000 ÷1,600,000Unit cost $ 24.23* $ 24.94**RoundedThe difference is in favor of Vance; however, when the price concession is con sidered, the cost of Vance is $23.23, which is less than Foy’s component.Lumus should accept the contractual offer made by Vance.4–14 Concluded2. Warranty hours would act as the best driver of the three choices. Using thisdriver, the rate is $1,000,000/8,000 = $125 per warranty hour. The cost as-signed to each component would be:Vance Foy Lost sales:$125 ⨯ 400 $ 50,000$125 ⨯ 7,600 $ 950,000$ 50,000 $ 950,000 U nits supplied ÷ 400,000 ÷1,600,000I ncrease in unit cost $ 0.13* $ 0.59**RoundedPROBLEMS4–151. Product cost assignment:Overhead rates:Patterns: $30,000/15,000 = $2.00 per DLHFinishing: $90,000/30,000 = $3.00 per DLHUnit cost computation:Duffel BagsPatterns:$2.00 ⨯ 0.1 $0.20$2.00 ⨯ 0.2 $0.40Finishing:$3.00 ⨯ 0.2 0.60$3.00 ⨯ 0.4 1.20Total per unit $0.80 $1.602. Cost before addition of duffel bags:$60,000/100,000 = $0.60 per unitThe assignment is accurate because all costs belong to the one product.4–15 Concluded3. Activity-based cost assignment:Stage 1:Pool rate = $120,000/80,000 = $1.50 per transactionStage 2:Overhead applied:Backpacks: $1.50 ⨯ 40,000* = $60,000Duffel bags: $1.50 ⨯ 40,000 = $60,000*80,000 transactions/2 = 40,000 (number of transactions had doubled)Unit cost:Backpacks: $60,000/100,000 = $0.60 per unitDuffel bags: $60,000/25,000 = $2.40 per unit4. This problem allows the student to see what the accounting cost per unitshould be by providing the ability to calculate the cost with and without the duffel bags. With this perspective, it becomes easy to see the benefits of the activity-based approach over those of the functional-based approach. The activity-based approach provides the same cost per unit as the single-product setting. The functional-based approach used transactions to allocate accounting costs to each producing department, and this allocation probably reflects quite well the consumption of accounting costs by each producing department. The problem is the second-stage allocation. Direct labor hours do not capture the consumption pattern of the individual products as they pass through the departments. The distortion occurs, not in using transac-tions to assign accounting costs to departments, but in using direct labor hours to assign these costs to the two products.In a single-product environment, ABC offers no improvement in product cost-ing accuracy. However, even in a single-product environment, it may be poss-ible to increase the accuracy of cost assignments to other cost objects such as customers.4–161. Plantwide rate = $660,000/440,000 = $1.50 per DLHOverhead cost per unit:Model A: $1.50 ⨯ 140,000/30,000 = $7.00Model B: $1.50 ⨯ 300,000/300,000 = $1.502. Departmental rates:Department 1: $420,000/180,000 = $2.33 per MHr*Department 2: $240,000/400,000 = $0.60 per DLHDepartment 1: $420,000/40,000 = $10.50 DLHDepartment 2: $240,000/40,000 = $6.00 per MHrOverhead cost per unit:Model A: [($2.33 ⨯ 10,000) + ($0.60 ⨯ 130,000)]/30,000 = $3.38Model B: [($2.33 ⨯ 170,000) + ($0.60 ⨯ 270,000)]/300,000 = $1.86Overhead cost per unit:Model A: [($10.50 ⨯ 10,000) + ($6.00 ⨯ 10,000)]/30,000 = $5.50Model B: [($10.50 ⨯ 30,000) + ($6.00 ⨯ 30,000)]/300,000 = $1.65*Rounded numbers throughoutA common justification is that of using machine hours for machine-intensivedepartments and labor hours for labor-intensive departments. Using this rea-soning, the first set of departmental rates would be selected (machine hours for Department 1 and direct labor hours for Department 2).3. Calculation of pool rates:Driver Pool RateBatch-level pool:Setup and inspection Product runs $320,000/100 = $3,200 per runUnit-level pool:Machine andmaintenance Machine hours $340,000/220,000 = $1.545 per MHr Note: Inspection hours could have been used as an activity driver instead of production runs.Overhead assignment:Model BBatch-level:Setups and inspection$3,200 ⨯ 40 $ 128,000$3,200 ⨯ 60 $ 192,000Unit-level:Power and maintenance$1.545 ⨯ 20,000 30,900$1.545 ⨯ 200,000 309,000Total overhead $ 158,900 $ 501,000Units produced ÷30,000 ÷ 300,000Overhead per unit $ 5.30 $ 1.674. Using activity-based costs as the standard, we can say that the first set ofdepartmental rates decreased the accuracy of the overhead cost assignment (over the plantwide rate) for both products. The opposite is true for the second set of departmental rates. In fact, the second set is very close to the activity assignments. Apparently, departmental rates can either improve or worsen plantwide assignments. In the first case, D epartment 1’s costs are assigned at a 17:1 ratio which overcosts B and undercosts A in a big way.Yet, this is the most likely set of rates at the departmental level! This raises some doubt about the conventional wisdom regarding departmental rates.4–171. Labor and gasoline are driver tracing.Labor (0.75 ⨯ $120,000) $ 90,000 Time = Resource driverGasoline ($3 ⨯ 6,000 moves) 18,000 Moves = Resource driverDepreciation (2 ⨯ $6,000) 12,000 Direct tracingTotal cost $ 120,0002. Plantwide rate = $600,000/20,000= $30 per DLHUnit cost:DeluxePrime costs $80.00 $160Overhead:$30 ⨯ 10,000/40,000 7.50$30 ⨯ 10,000/20,000 15$87.50 $1753. Pool 1: Maintenance $ 114,000Engineering 120,000Total $ 234,000Maintenance hours ÷4,000Pool rate $ 58.50Note:Engineering hours could also be used as a driver. The activities are grouped together because they have the same process, are both product lev-el, and have the same consumption ratios (0.25, 0.75).Pool 2: Material handling $ 120,000Number of moves ÷6,000Pool rate $ 20Pool 3: Setting up $ 96,000Number of setups ÷80Pool rate $ 1,200Note: Material handling and setups are both batch-level activities but have dif-ferent consumption ratios.Pool 4: Purchasing $ 60,000Receiving 40,000Paying suppliersTotal $ 130,000Orders processed ÷750Pool rate $ 173.33Note:The three activities are all product-level activities and have the same consumption ratios.Pool 5: Providing space $ 20,000Machine hours ÷10,000Pool rate $ 2Note: This is the only facility-level activity.4. Unit cost:Basic Deluxe Prime costs $ 3,200,000 $ 3,200,000Overhead:Pool 1:$58.50 ⨯ 1,000 58,500$58.50 ⨯ 3,000 175,500 Pool 2:$20 ⨯ 2,000 40,000$20 ⨯ 4,000 80,000 Pool 3:$1,200 ⨯ 20 24,000$1,200 ⨯ 60 72,000 Pool 4:$173.33 ⨯ 250 43,333$173.33 ⨯ 500 86,665 Pool 5:$2 ⨯ 5,000 10,000$2 ⨯ 5,000 10,000 Total $ 3,375,833 $ 3,624,165Units produced ÷40,000 ÷20,000Unit cost (ABC) $ 84.40 $ 181.21Unit cost (traditional) $ 87.50 $ 175.00The ABC costs are more accurate (better tracing—closer representation of actual resource consumption). This shows that the basic model was over-costed and the deluxe model undercosted when the plantwide overhead rate was used.1. Unit-level costs ($120 ⨯ 20,000) $ 2,400,000Batch-level costs ($80,000 ⨯ 20) 1,600,000Product-level costs ($80,000 ⨯ 10) 800,000Facility-level ($20 ⨯ 20,000) 400,000Total cost $ 5,200,0002. Unit-level costs ($120 ⨯ 30,000) $ 3,600,000Batch-level costs ($80,000 ⨯ 20) 1,600,000Product-level costs ($80,000 ⨯ 10) 800,000Facility-level costs 400,000Total cost $ 6,400,000The unit-based costs increase because these costs vary with the number of units produced. Because the batches and engineering orders did not change, the batch-level costs and product-level costs remain the same, behaving as fixed costs with respect to the unit-based driver. The facility-level costs are fixed costs and do not vary with any driver.3. Unit-level costs ($120 ⨯ 30,000) $ 3,600,000Batch-level costs ($80,000 ⨯ 30) 2,400,000Product-level costs ($80,000 ⨯ 12) 960,000Facility-level costs 400,000Total cost $ 7,360,000Batch-level costs increase as the number of batches changes, and the costs of engineering support change as the number of orders change. Thus, batches and orders increased, increasing the total cost of the model.4. Classifying costs by category allows their behavior to be better understood.This, in turn, creates the ability to better manage costs and make decisions.1. The total cost of care is $1,950,000 plus a $50,000 share of the cost of super-vision [(25/150) ⨯ $300,000]. The cost of supervision is computed as follows: Salary of supervisor (direct) $ 70,000Salary of secretary (direct) 22,000Capital costs (direct) 100,000Assistants (3 ⨯ 0.75 ⨯ $48,000) 108,000Total $ 300,000Thus, the cost per patient day is computed as follows:$2,000,000/10,000 = $200 per patient day(The total cost of care divided by patient days.) Notice that every maternity patient—regardless of type—would pay the daily rate of $200.2. First, the cost of the secondary activity (supervision) must be assigned to theprimary activities (various nursing care activities) that consume it (the driver is the number of nurses):Maternity nursing care assignment:(25/150) ⨯ $300,000 = $50,000Thus, the total cost of nursing care is $950,000 + $50,000 = $1,000,000.Next, calculate the activity rates for the two primary activities:Occupancy and feeding: $1,000,000/10,000 = $100 per patient dayNursing care: $1,000,000/50,000 = $20 per nursing hour。

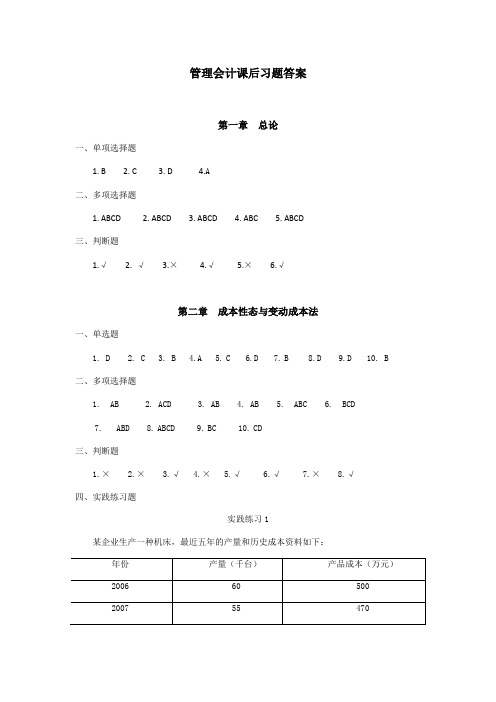

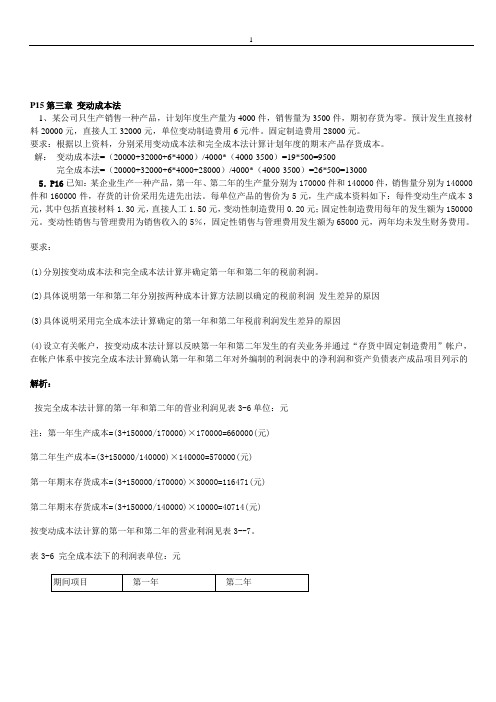

管理会计课后习题学习指导书习题答案

第一章课后习题一、思虑题1.从管理睬计定义的历史研究中你有哪些思虑和想法?答:从管理睬计定义的历史研究中我发现,管理睬计的看法是跟着历史的发展不停完美的,因为在历史进度中,人们会发现原有看法的不足,从而不停去改正完美,这才有了此刻的管理睬计。

这也启迪了我们,要擅长发现问题,去思虑,解决问题。

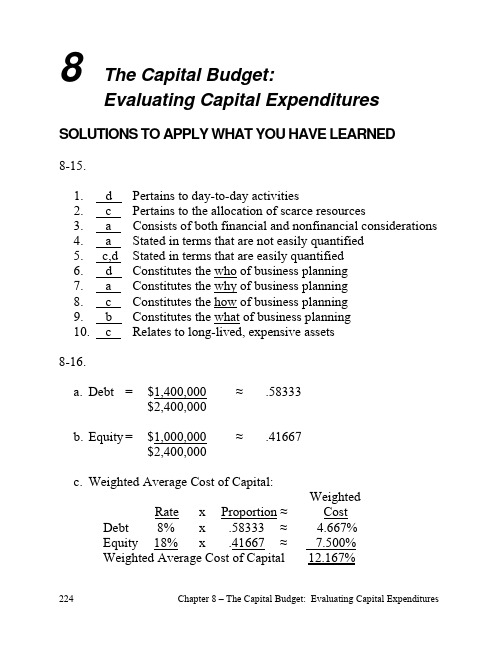

2.经济理论对管理睬计的产生和发展有哪些重要影响?你从中获取了什么启迪?答:社会经济的发展和经济理论的丰富,使得管理睬计的理论系统渐渐完美,内容更为丰富,逐渐形成了展望、决议、估算、控制、查核、评论的管理睬计系统。

因为市场竞争的日益强烈,人们认识到对外面环境的正确决议就是不行能的,公司的计划一定之外面环境的变化为基础,更为留意市场变化的动向,更为亲密关注竞争敌手。

与此相适应,战略管理的理论有了长足的发展。

这启迪了我们,要仔细察看,就地取材,适应变化无常的外面环境,进行自己调整。

同时,实践出真知,只有经过了实践考验理论才是好理论。

3.科学管理理论对现代管理睬计有哪些重要影响?这些影响在管理睬计的不一样发展阶段是怎样表现的?答:现代管理科学为管理睬计的形成确定了必定的基础。

在以成本控制为基本特色的管理睬计阶段,古典组织理论特别是科学管理理论的出现促进现代会计分化为财务会计和管理睬计,现代会计的管理职能得以表现出来。

该阶段,管理睬计以成本控制为基本特色,以提升公司的生产效率和工作效率为目的,其主要内容包含标准成本、估算控制、差异剖析。

在以展望、决议为基本特色的管理睬计阶段,以标准成本制度为主要内容的管理控制持续获取了增强并有了新的发展。

责任会计将行为科学的理论与管理控制的理论联合起来,不单进一步增强了对公司经营的全面控制(不只是是成本控制),并且将责任者的责、权、利联合起来,查核、评论责任者的工作业绩,从而极大地激发了经营者的踊跃性和主动性。

社会经济的发展和经济理论的丰富,使得管理睬计的理论系统渐渐完美。

4.什么是价值链剖析?价值链剖析的目的是什么?答:价值链剖析是指将一个公司的经营活动分解为若干战略性有关的价值活动,每一种价值活动都会对公司的相对成本产生影响,从而成为公司采纳差异化战略的基础。

管理会计(英文版)课后习题答案(高等教育出版社)chapter 16