国际贸易实务保险习题及谜底

国际贸易实务-货物运输保险练习题

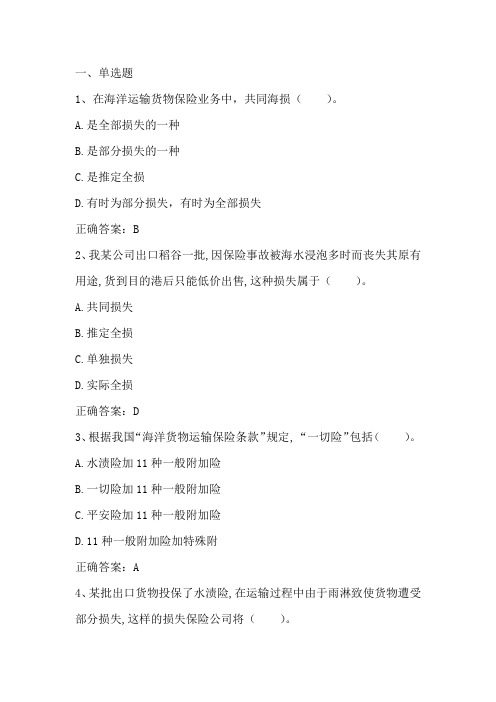

国际贸易实务-货物运输保险练习题【国际货物运输保险】一、单选题1.根据我国“海洋货物运输保险条款”规定,“一切险”包括()。

A、平安险加11种一般附加险B、一切险加11种一般附加险C、水渍险加11种一般附加险D、11种一般附加险加特殊附加险2.有一批出口服装,在海上运输途中,因船体触礁导致服装严重受浸,如果将这批服装漂洗后再运至原定目的港所花费的费用已超过服装的保险价值,这批服装应属于()。

A、共同海损B、实际全损C、推定全损D、单独海损3.平安险不赔偿()A、自然灾害造成的实际全损B、自然灾害造成的推定全损C、意外事故造成的全部损失和部分损失D仅由自然灾害造成的单独海损4.我方按CIF条件成交一批罐头食品,卖方投保时,按下列()投保是正确的。

A、平安险+水渍险B、一切险+偷窃提货不着险C、平安险+ 一切险D、水渍险+偷窃提货不着险5.按国际保险市场惯例,投保金额通常在CIF总值的基础上()。

A、加四成B、加三成C、加二成D、加一成6.在海洋运输货物保险业务中,共同海损()。

A、是部分损失的一种B、是全部损失的一种C、有时为部分损失,有时为全部损失D、是推定全损7.根据我国海洋货物运输保险条款的规定,承保范围最小的基本险别是()。

A平安险B水渍险C一切险D罢工险8.战争、罢工风险属于()A自然灾害B意外事故C一般外来风险D特殊外来风险9.“特殊附加险”是指在特殊情况下,要求保险公司承保的险别,()。

A、一般可以单独投保B、不能单独投保C、可单独投保两项以上的“特殊附加险”D、在被保险人统一的情况下,可以单独投保10.仓至仓条款是()A承运人负责运输责任起讫的条款B保险人负责保险责任起讫的条款C出口商负责交货责任起讫的条款D进口商负责收货责任起讫的条款11.海运货物保险中,按“仓至仓”条款的规定,货物运抵目的港后没有进入指定仓库,多少天内保单仍然有效。

()A.30天B.60天C.90天D.120天12.船舶在航行途中因故搁浅,船长为了解除货船共同危险,有意识地、合理地将部分货物抛入海中,使船舶起浮,继续航行至目的港。

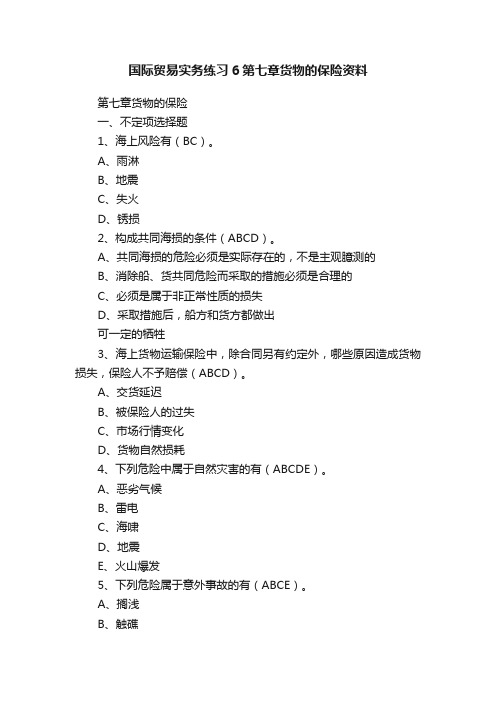

国际贸易实务练习6第七章货物的保险资料

国际贸易实务练习6第七章货物的保险资料第七章货物的保险一、不定项选择题1、海上风险有(BC)。

A、雨淋B、地震C、失火D、锈损2、构成共同海损的条件(ABCD)。

A、共同海损的危险必须是实际存在的,不是主观臆测的B、消除船、货共同危险而采取的措施必须是合理的C、必须是属于非正常性质的损失D、采取措施后,船方和货方都做出可一定的牺牲3、海上货物运输保险中,除合同另有约定外,哪些原因造成货物损失,保险人不予赔偿(ABCD)。

A、交货延迟B、被保险人的过失C、市场行情变化D、货物自然损耗4、下列危险中属于自然灾害的有(ABCDE)。

A、恶劣气候B、雷电C、海啸D、地震E、火山爆发5、下列危险属于意外事故的有(ABCE)。

A、搁浅B、触礁C、失踪D、雷电E、爆炸6、构成实际全损的情况有(ABC)。

A、保险标的物全部灭失B、保险标的物完全变质C、保险标的物不可能归还被保险人D、施救费用和救助费用超过保险价值7、出口茶叶,为防止运输途中串味,办理保险时,应投保(B)。

一般附加险项目中不能单独投保必须得在平安险和水渍险的基础上再加一般附加险里面的险种A、串味险B、平安险加串味险C、水渍险加串味险D、一切险8、土畜产公司出口盐渍肠衣一批,为防止在运输途中因容器损坏而引起渗漏损失,保险时应投保(D)。

A、渗漏险B、一切险C、一切险加渗漏险D、水渍险加渗漏险9、根据我国海洋运输保险条款规定,一般附加险包括(ABD)。

A、短量险B、偷窃提货不着险C、交货不到险D、串味险10、某国远洋货轮,满载货物从s港启航,途中遇飓风,货轮触礁货物损失惨重。

货主向其投保的保险公司发出委付通知,在此情况下,该保险公司可以选择的处理方法是什么?(BD)A、必须接受委付B、拒绝接受委付C、先接受委付,然后撤回D、接受委付,不得撤回二、判断题1、海上保险业务的意外事故,仅局限于发生在海上的意外事故。

(F)2.船舶失踪达半年以上可以推定全损处理。

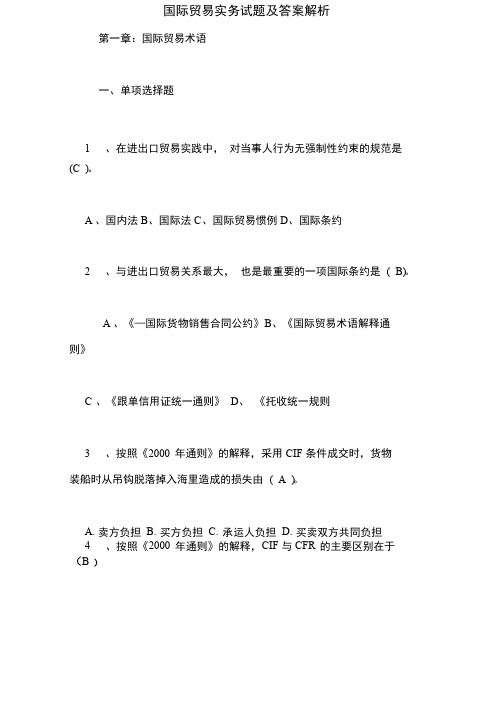

国际贸易实务试题及答案解析

国际贸易实务试题及答案解析第一章:国际贸易术语一、单项选择题1 、在进出口贸易实践中,对当事人行为无强制性约束的规范是(C )。

A 、国内法B、国际法C、国际贸易惯例D、国际条约2 、与进出口贸易关系最大,也是最重要的一项国际条约是( B)。

A 、《—国际货物销售合同公约》B、《国际贸易术语解释通则》C 、《跟单信用证统一通则》D、《托收统一规则3 、按照《2000年通则》的解释,采用CIF条件成交时,货物装船时从吊钩脱落掉入海里造成的损失由( A ) 。

A. 卖方负担B. 买方负担C. 承运人负担D. 买卖双方共同负担4 、按照《2000年通则》的解释,CIF与CFR的主要区别在于(B )A. 办理租船订舱的责任方不同B. 办理货运保险的责任方不同C. 风险划分的界限不同D. 办理出口手续的责任方不同5 、在实际业务中,FOB条件下,买方常委托卖方代为租船、订舱,其费用由买方负担。

如到期订不到舱,租不到船,( A )。

A. 卖方不承担责任,其风险由买方承担B. 卖方承担责任,其风险也由卖方承担C. 买卖双方共同承担责任、风险D. 双方均不承担责任,合同停止履行6 、以下关于国际贸易术语“ CIF”的内容提法正确的是(A )。

A 卖方除承担成本加运费的义务外,还要负责办理运输保险并支付保险费。

B 卖方在投保时应投保一切险。

C 卖方必须将货物实际交付给买方,才算完成了交货义务D 货物的风险在货物实际交付时由卖方转移给卖方7 、根据《INCOTERMS200啲解释,进口方负责办理出口清关手续的贸易术语是(B) 。

A. FAS B. EXW C. FCA D. DDP 8 、CIF Ex Ship ' s Hold 属于属于(B )。

A 、内陆交货类B、装运港船上交货类C、目的港交货类D、目的地交货类9 、根据《INCOTERMS200啲解释,出口方负责办理进口清关手续的贸易术语是(D ) 。

国际贸易实务习题(含答案)

国际贸易实务习题答案第二章(一)货物描述-品质条款一、单选题1.大路货是指(D)。

A.适于商销B.上好可销品质C.质量劣等D.良好平均品质2.某美国客商到我国一家玩具厂参观,之后对该厂的部分产品很感兴趣,于是立即签定购买合同,批量购买他所见到的那部分产品,决定按实物样品作为合同中交收货物的品质要求。

这种表示品质的方法是(B)。

A.看货购买 B.凭卖方样品C.凭买方样品D.凭对等样品3.凭样品买卖时,如果合同中无其他规定,那么卖方所交货物(B )。

A.可以与样品大致相同B.必须与样品完全一致C.允许有合理公差D.允许在包装规格上有一定幅度的差异4.外商在收到我方寄送的样品后,来电表示愿意按我所提交易条件成交,并嘱其签订销售合同。

我方在合同内详细列出该商品的品质规格,经对方签字后寄回无误。

我方按约装船,忽然接到对方来电:“你方所装货物品质是否与样品相符。

”我方的正确答复应该是(D)。

A.我方所装货物品质与样品相符B.我方所装货物品质与样品大致相符C.我方所装货物品质与样品完全相符D.我方所装货物品质以合同为准,样品仅供参考5.对等样品也称之为(B )。

A.复样B.回样C.卖方样品D.买方样品6.在国际贸易中造型上有特殊要求或具有色香味方面特征的商品适合于(A)。

A.凭样品买卖B.凭规格买卖C.凭等级买卖D.凭产地名称买卖7.凡货样难以达到完全一致的,不宜采用( A )。

A.凭样品买卖B.凭规格买卖C.凭等级买卖D.凭说明买卖8.凭卖方样品成交时,应留存(C )以备交货时核查之用。

A.对等样品B.回样C.复样D.参考样品9.在品质条款的规定上,对某些比较难掌握其品质的工业制成品或农副产品,我们多在合同中规定( C )。

A.溢短装条款B.增减价条款C.品质公差或品质机动幅度D.商品的净重10.若合同规定有品质公差条款,则在公差范围内,买方(A )。

A.不得拒收货物B.可以拒收货物C.可以要求调整价格D.可以拒收货物也可以要求调整价格二、多选题1.表示品质方法的分类可归纳为(BC )。

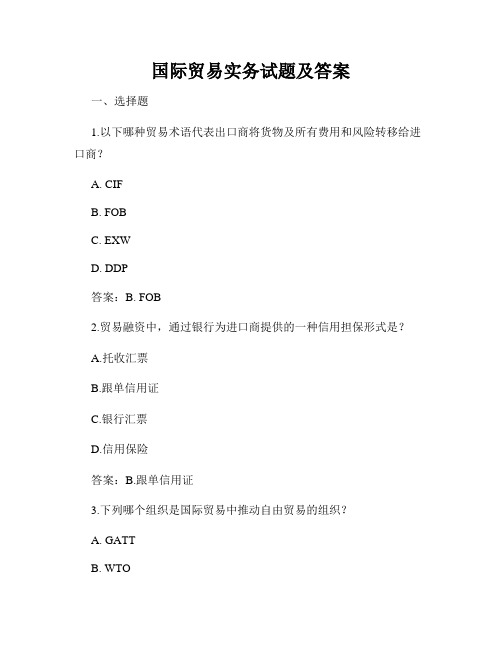

国际贸易实务试题及答案

国际贸易实务试题及答案一、选择题1.以下哪种贸易术语代表出口商将货物及所有费用和风险转移给进口商?A. CIFB. FOBC. EXWD. DDP答案:B. FOB2.贸易融资中,通过银行为进口商提供的一种信用担保形式是?A.托收汇票B.跟单信用证C.银行汇票D.信用保险答案:B.跟单信用证3.下列哪个组织是国际贸易中推动自由贸易的组织?A. GATTB. WTOC. IMFD. UN答案:B. WTO4.以下哪个国际贸易术语代表进口商负责将货物从船上卸载并承担所有费用和风险?A. CIFB. FOBC. EXWD. DDP答案:A. CIF5.下列哪个国际支付方式最为安全可靠,同时需通过银行间接结算?A.电汇B.信用证C.承兑汇票D.票据汇款答案:B.信用证二、简答题1.请简要介绍自由贸易区(FTA)和关税同盟(CU)的区别。

答案:自由贸易区是指一组国家或地区之间达成的贸易协议,取消彼此之间的关税和非关税壁垒,但每个成员国可以保留自己的关税政策对其他非成员国实施。

关税同盟是在自由贸易区的基础上进一步发展,成员国在取消彼此之间的关税的同时,还要对非成员国实施统一的关税政策。

2.请简述什么是最惠国待遇(MFN)原则。

答案:最惠国待遇原则是指在国际贸易中,对待所有成员国应当平等,不得对一国享有的一种贸易条件或优惠待遇而不给予另一国。

即一国对任何一个成员国给予的最有利的条件或待遇,都必须同时给予其他的成员国。

3.请解释什么是转口贸易。

答案:转口贸易是指进口商将其进口的商品再出口到其他国家或地区,而不经过进口国市场的贸易行为。

进口商在转口贸易中起到中间商的作用,通过转口贸易能够实现利润的最大化。

三、论述题请以500字左右的篇幅,阐述区域经济一体化对国际贸易的影响。

答:区域经济一体化对国际贸易具有深远的影响。

首先,区域经济一体化通过取消关税和非关税壁垒,促进了成员国之间的贸易自由化。

成员国之间的关税减少甚至取消,进口和出口商品的价格更为便宜,促进了贸易的增长。

国际贸易实务保险习题及答案

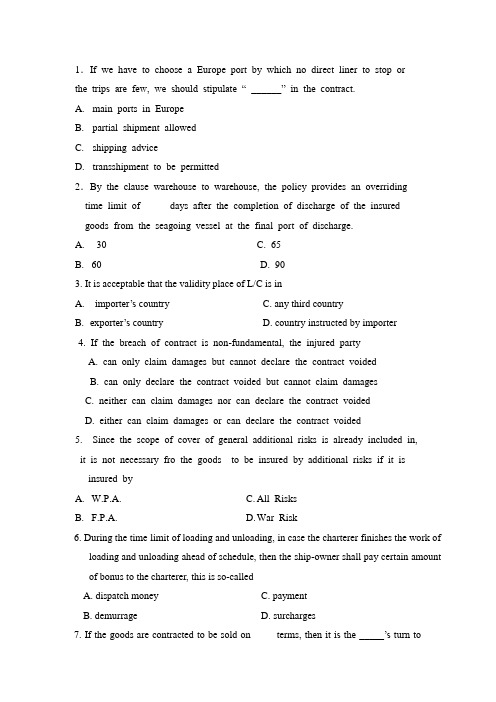

1.If we have to choose a Europe port by which no direct liner to stop or the trips are few, we should stipulate “ ______” in the contract.A.main ports in EuropeB.partial shipment allowedC.shipping adviceD.transshipment to be permitted2.By the clause warehouse to warehouse, the policy provides an overriding time limit of _____days after the completion of discharge of the insured goods from the seagoing vessel at the final port of discharge.A.30B.60C. 65D. 903. It is acceptable that the validity place of L/C is in ______A.importer‟s countryB.exporter‟s countryC. any third countryD. country instructed by importer4. If the breach of contract is non-fundamental, the injured party ____A. can only claim damages but cannot declare the contract voidedB. can only declare the contract voided but cannot claim damagesC. neither can claim damages nor can declare the contract voidedD. either can claim damages or can declare the contract voided5. Since the scope of cover of general additional risks is already included in, it is not necessary fro the goods to be insured by additional risks if it is insured by _____A.W.P.A.B. F.P.A.C.All RisksD.War Risk6. During the time limit of loading and unloading, in case the charterer finishes the work ofloading and unloading ahead of schedule, then the ship-owner shall pay certain amount of bonus to the charterer, this is so-called _______A. dispatch moneyB. demurrageC. paymentD. surcharges7. If the goods are contracted to be sold on ____ terms, then it is the _____‟s turn totake out the insurance and pay the premium.A. CFR … ExporterB. CIF … ImporterC. CFR … ShipperD. CIF … Exporter8. The shipper or consignor on B/L is normally theA. exporterB. importerC. shipping companyD. bank9. Since the opening bank takes the ____ responsibility for the payment, the opening bank should be carefully chosen.A. firstB. second C thirdD. fourth10. Perils of sea are those caused by ____A. calamities and accidentsB. fortuitous and accidentsC. accidentsD. calamities and fortuitouscase analysis:1. A contract was signed between the seller and the buyer for some kindof chemical product on the basis of FOB xxx port and the goods were foundto be in conformity with the requirement of the contract in respect of qualityby inspection before shipping. On arrival, it was found that part of the goodscoagulated (结成硬块) and the quality was not up to the standard set in thecontract after the buyer took delivery of the goods. The investigation showedthat it was caused by absorbing moisture in transit due to improper packing.So the buyer filed a claim against the seller for this but the seller pointed out that the goods conformed to the quality requirement before shipping and thedamage was caused during the transportation after the goods were loaded onboard at the port of shipment. The seller refused to make any compensationbecause such losses of or damages to the goods should be borne by the buyeraccording to international trade practices embodied in Inco-terms 2010.What is your opinion?2. Company A in Country xxx sent company B in country yyy an offer by telex for some kind of agricultural goods as follows:quantity: 1,000 metric tonsunit price: USD200/MT CIF San Franciscopacking: in new gunny bagspayment; by irrevocable letter of creditshipment time: within two months after receipt of relative L/CThis offer is good subject to your reply reaching us within 4 days.The following day after company A telexed this offer, it received a telex reply from company B reading “Accept your offer shipment immediately”. Company A did not respond to this. The next day company A received an irrevocable sight L/C issuedby Citi Bank stipulating “shipment within two months after receipt of relativeL/C” in r espect of shipment time. In view of the very booming international market for this product, company A refused to sell the goods as offered before and returned the L/C accordingly. But company B insisted that contract was formed betweeneach other so company A had obligation to deliver the goods as offered. What isyour opinion based on the stipulations in CISG (United NationsConvention on the International Sale of Goods 1980) if CISG is applicableto this case? Is there a contract between the two parties? (10 points)3. Company A in China exported some goods on the basis of CIF xxx port and took out insurance for 110% of invoice value against FPA as per the relevant Ocean Marine Cargo Clauses of the People‟s Insurance Company of China dated Jan. 1, 1981. The ship started sailing at the beginning of July. On July 13, the carrying vessel suffered a thunderstorm and it caused some loss of part of the goods valued at UDS 2,000.00. Days later, it struck upon the rocks in transit and caused partial loss of the goods valued at USD10,000.00. Will the insurance company be responsible forcompensation of both the losses caused? (10 points)1.Advise Tiresias Ltd (…Tiresias‟) on the following transaction.Tiresias sold a quantity of sultanas to Stetson Ltd (…Stetson‟) on terms …FOB, Liverpool, shipment September‟. Under the terms of the contract, Stetson was obliged to nominate a vessel. On 20th September, Stetson nominated the Wasteland, which was already in dock. The following day, Tiresias began to load the sultanas, but did not have sufficient to fulfil the contract and so waited for a further supply to arrive. The loading was completed just before midnight on 30th September. The vessel sailed the following day. Stetson claims Tiresias failed to fulfil its duty to deliver the goods as stipulated in the contract.2. Company A received an irrevocable L/C issued by bank ABC advised and confirmed by bank DEF. This company shipped the goods according to the requirements of the L/C and was going to present the documents for negotiation but received a notice from the confirming bank stating that the issuing bank had gone bankrupt and it would not pay but it could claim payment from the buyer on behalf of company A. What advice will you give company A about his legal position in this matter?3. Company A exported one batch of goods on the basis of payment by D/P at 90 days sight. Company A presented the draft accompanied by the shipping documents required by the relative contract to the remitting bank who forwarded all the documents to the collecting bank in the country of importer. The collecting bank presented all the documents to the importer and the importer accepted the draft presented as required. When the goods arrived at the destination port, the importer borrowed the shipping documents from the collecting bank by providing Trust Receipt in order to take delivery of the goods in time before the maturity of the draft. When the draft matured, the remitting bank was notified by the collecting bank that it was impossible for the importer to pay the accepted draft as it had gone bankrupt. What should company A do? Why?4. Company A cabled an offer to company B abroad on June 15th subject to the reply reaching on 20th inst. Company B submitted the cable of acceptance in the morning on 19th but it reached company A as late as 21st due to delay in transit. Company A did not make any response regarding the acceptance late. On June 26th, Company A sold the goods to another client at a higher price. On June 27th, company A received a cable from company B indicating that L/C had been established and requiring company A to ship the goods promptly. Company A replied company B immediately: “ your acceptance was late, no contract existed.” Company B insis ted that they delivered the cable on 19th and it did not know the fact that the cable was late anyway. In view of this, company B insisted that contract was formed and company A should fulfill its obligation to deliver the goods as offered. What is your opinion if CISG applies here?5. The following contract is entered into between company ABC in China and company XYZ in the USA: “1000 tons of "grade A" dried cod (鳕鱼), USD 1.500.000/MT, CIF Los Angeles INCOTERMS 2010, as per sample submitted. Payment to be by irrevocable letter of credit confirmed by Bank of China opened by October 3rd 2010 for a period of 2 weeks, and to be made against documents evidencing the fulfilment of his CIF obligations, and a certificate of inspection stating the cod to be of grade A quality.”The letter of credit facility is duly opened and the relevant documents being specified to Bank of China and company A proceeds to perform his obligations under the contract.Company B hears rumours that the consignment shipped will not be grade A but grade C, and that the certificate of inspection presented will be a forgery, and instructs both the issuing and confirming banks not to pay against it.Company A presents BOC with the following documents: shipped on board bill of lading for 1000 tons of grade A dried cod in apparent good order and condition; an invoice for the same goods; an insurance policy taken on Institute Cargo Clause C terms; and a certificate of inspection. BOC pays particular attention to the certificateof inspection but is unable to find anything wrong with it as it appears to be in order and as described in their mandate (instructions for opening the credit). BOC pays company A.During the voyage the ship is in a collision and part of her cargo is wet, whilst another portion is deliberately thrown overboard by the crew in order to reduce her weight.When the consignment arrives it is found to be 200 tons short (i.e. there are only 800 tons) and 100 tons of the consignment are damaged by water, and the consignment is found not to be up to sample and not of grade A qualityPlease answer the following questions:(1).Assume that CISG is to apply to the sale of goods transaction. Answer the following:(a) Discuss company A's obligations under the contract he has entered into.(b) Advise company B as to any rights he may have with respect to the seller, carrier, insurance company, bank and any other relevant parties. Inform him of any further details you may require.(2). What are the functions of the bill of lading in international trade? Mention brieflyhow these facilitate trade. ( to facilitate means to benefit, or make easier)(3).(a)What is a condition, a warranty in English law? What is the meaning of"fundamental breach" under the United Nations Convention on the International Sale of Goods 1980 (CISG)?(b) What are inherent vice; general average; seaworthiness?(c)What is an insurable interest? What is the duty of disclosure in relation tocontracts of insurance?(d)What is meant by: the autonomy of a letter of credit, and the doctrine of strictcompliance?(4).What are the requirements of formation of contract under the United NationsConvention on the International Sale of Goods 1980 (CISG)?。

国际贸易实务(订立合同的运输保险条款)单元习题与答案

一、单选题1、下列属于自然灾害的是()。

A.共同海损B.淡水雨淋C.恶劣气候D.黄曲霉素超标正确答案:C2、“仓至仓”条款是()。

A.承运人负责运输起讫的条款B.进口人负责付款责任起讫的条款C.出口人负责交货责任起讫的条款D.保险人负责保险责任起讫的条款正确答案:D3、我国海运货物保险条款中基本险的责任起讫采用()条款。

A.“港至港”B.OCPC.“仓至仓”D.“门到门”正确答案:C4、为防止运输途中货物被窃,应该投保()。

A.一切险、平安险、偷窃险B.一切险、偷窃险C.平安险、偷窃险D.水渍险正确答案:C5、某公司出口货物在运输途中遭遇风暴,运输船舶与货物均沉入海底。

该公司损失的货物应属于()。

A.共同海损B.单独海损C.全部损失D.部分损失正确答案:C6、公司出口茶叶5公吨,在海运途中遭受暴风雨,海水涌入仓内,致使一部分茶叶发霉变质,这种损失属于()。

A.共同海损B.实际全损C.单独海损D.推定全损正确答案:D7、按我国海运货物保险条款的规定,投保一切险后还可加保()。

A.战争险、罢工险B.淡水雨淋险C.偷窃、提货不着险D.卖方利益险8、按照国际保险市场的惯例,投保时的保险加成率一般为()。

A.5%B.2%C.没有惯例D.10%正确答案:D二、判断题1、某载货船舶在航行途中因故搁浅,船长为了解除船、货共同危险,命令将部分货物抛入海中,使船舶起浮,继续航行至目的港。

上述搁浅和抛货的损失均属共同海损。

正确答案:×2、附加险不能单独投保,水渍险的责任范围小于平安险。

正确答案:×3、我国某公司按FOB贸易术语进口时,在国内投保了一切险,保险公司的保险责任起讫期限应为“仓至仓”。

正确答案:×4、出口玻璃器皿,因运输途中易出现破碎,故应在投保一切险的基础上加保碰损和破碎险。

正确答案:×5、全部损失是指运输中的整批货物或不可分割的一批货物的全部损失。

6、ICC(A)类似于我国的平安险。

国际贸易实务:国际货物运输保险 习题与答案

一、单选题1、在海洋运输货物保险业务中,共同海损()。

A.是全部损失的一种B.是部分损失的一种C.是推定全损D.有时为部分损失,有时为全部损失正确答案:B2、我某公司出口稻谷一批,因保险事故被海水浸泡多时而丧失其原有用途,货到目的港后只能低价出售,这种损失属于()。

A.共同损失B.推定全损C.单独损失D.实际全损正确答案:D3、根据我国“海洋货物运输保险条款”规定,“一切险”包括()。

A.水渍险加11种一般附加险B.一切险加11种一般附加险C.平安险加11种一般附加险D.11种一般附加险加特殊附正确答案:A4、某批出口货物投保了水渍险,在运输过程中由于雨淋致使货物遭受部分损失,这样的损失保险公司将()。

A.负责赔偿整批货物B.不给予赔偿C.在被保险人同意的情况下,保险公司负责赔偿被雨淋湿的部分D.负责赔偿被雨淋湿的部分正确答案:B5、按国际保险市场惯例,投保金额通常在CIF总值的基础上()。

A.加一成B.加四成C.加两成D.加三成正确答案:A二、多选题1、某载货船只载着甲货主的3 000箱棉织品、乙货主的50公吨小麦、丙货主的200公吨大理石驶往美国纽约。

货轮起航的第二天不幸遭遇触礁事故,导致船底出现裂缝,海水入侵严重,使甲货主的250箱棉织品和乙货主约5公吨的小麦被海水浸湿。

因裂口太大,船长为解除船、货的共同危险,使船舶浮起并及时修理,下令将丙货主的50公吨大理石货物抛入海中,船舶修复后继续航行。

货轮继续航行的第三天又遭遇恶劣气候:使甲货主另外50箱货物被海水浸湿,此时,以下答案中正确的是()。

A.因触礁而产生的船底裂缝及甲、乙货主的货物损失属于单独海损B.因触礁而产生的船底裂缝及甲、乙货主的货物损失属于单独海损C.因触礁而产生的船底裂缝及甲、乙货主的货物损失属于单独海损D.因触礁而产生的船底裂缝及甲、乙货主的货物损失属于单独海损正确答案:A、B、C、D2、共同海损与单独海损的区别是()。

A.共同海损由受益各方按受益大小的比例分摊,单独海损由受损方自行承担B.共同海损由保险公司负责赔偿,单独海损由受损方自行承担C.共同海损是为了解除或减轻风险而人为造成的损失,单独海损是承保范围内的风险直接导致的损失D.共同海损属于全部损失,单独海损属于部分损失正确答案:A、C3、共同海损的构成条件有()。

国际贸易实务(国际货物运输保险)习题与答案

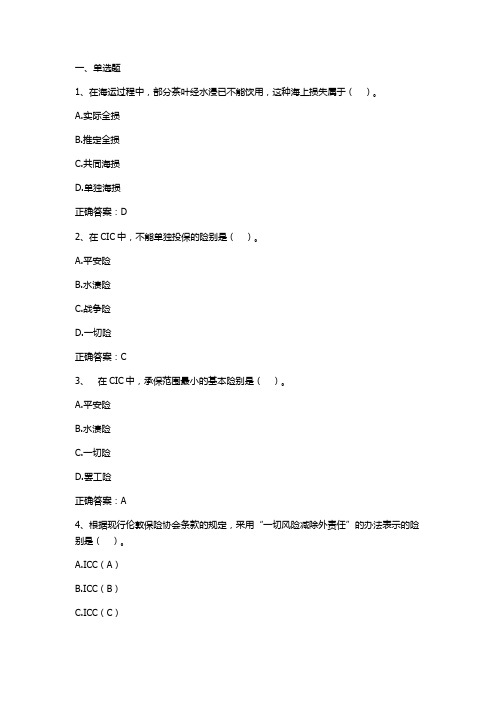

1、在海运过程中,部分茶叶经水浸已不能饮用,这种海上损失属于()。

A.实际全损B.推定全损C.共同海损D.单独海损正确答案:D2、在CIC中,不能单独投保的险别是()。

A.平安险B.水渍险C.战争险D.一切险正确答案:C3、在CIC中,承保范围最小的基本险别是()。

A.平安险B.水渍险C.一切险D.罢工险正确答案:A4、根据现行伦敦保险协会条款的规定,采用“一切风险减除外责任”的办法表示的险别是()。

A.ICC(A)B.ICC(B)C.ICC(C)正确答案:A二、多选题1、施救费用与救助费用的区别主要有()。

A.采取行为的主体不同B.给付报酬的原则不同C.保险人的赔偿责任不同D.前者一般与共同海损联系在一起,后者并非如此正确答案:A、B、C2、为了防止运输中货物被盗,应该投保()。

A.平安险B.一切险C.偷窃、提货不着险D.平安险加保偷窃、提货不着险正确答案:B、D3、根据现行伦敦保险协会条款的规定,能单独投保的险别是()。

A.ICC(A)B.ICC(B)C.ICC(C)D.罢工险正确答案:A、B、C、D4、在海运保险业务中,构成共同海损的条件是()。

A.危险必须是实际存在威胁到各方的共同安全B.必须是承保风险直接导致的船、货损失C.必须属于非常性质的损失D.费用支出是额外的正确答案:A、C、D三、判断题1、如果保险标的发生推定全损,被保险人可以向保险人要求部分损失的赔偿。

(√)2、即使保险标的发生了全损,保险人也应该向被保险人赔付施救费用。

(√)3、海上货物运输保险的保险人只对货物在海上发生的损失和费用负责。

(×)4、在国际贸易中,向保险公司投保一切险后,在运输途中由于任何外来原因造成的一切货损,保险公司都负责赔偿。

(×)5、平安险指保险公司为使货物安全到达,对所有运输途中发生风险造成的损失均负责。

(×)6、在CIC中,罢工险的责任起讫和三个基本险的责任起讫相同,都采用仓至仓条款。

国际贸易实务试题及答案

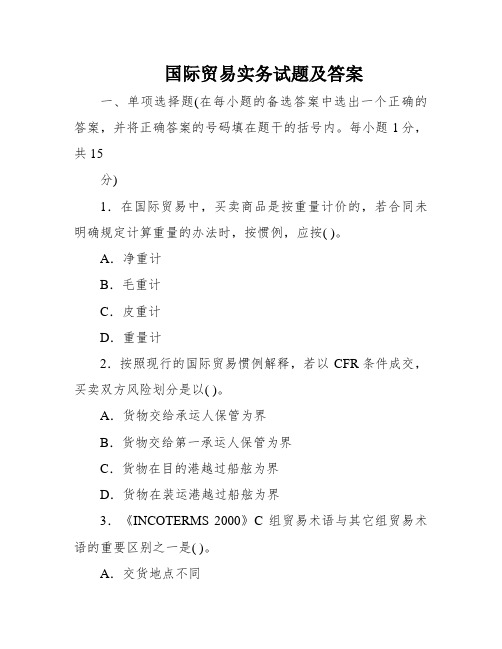

国际贸易实务试题及答案一、单项选择题(在每小题的备选答案中选出一个正确的答案,并将正确答案的号码填在题干的括号内。

每小题1分,共15分)1.在国际贸易中,买卖商品是按重量计价的,若合同未明确规定计算重量的办法时,按惯例,应按( )。

A.净重计B.毛重计C.皮重计D.重量计2.按照现行的国际贸易惯例解释,若以CFR条件成交,买卖双方风险划分是以( )。

A.货物交给承运人保管为界B.货物交给第一承运人保管为界C.货物在目的港越过船舷为界D.货物在装运港越过船舷为界3.《INCOTERMS 2000》C组贸易术语与其它组贸易术语的重要区别之一是( )。

A.交货地点不同B.风险划分地点不同C.风险分别地点与费用分别地点分歧D.费用划分地点不同4.按照国际贸易有关惯例,卖方必须在运输单据上表明( )。

A.包装标记B.警告性标记C.指示性标志D.运输标志5.按FOB条件达成的条约,凡需租船运输大宗货物,应在条约中详细订明( )。

A.装船费用由谁担负B.卸船费用由谁负担C.保险费用由谁担负D.运费由谁负担6.在国际贸易中,海运提单的签发日期是表示( )。

A.货物开始装船的日期B.装载船只到达装运港口的日期C.货物已经装船完毕的日期D.装载船只抵达目的港口的日期7.海运货物中的班轮运输,其班轮运费应该( )。

A.包括装卸费,但不计滞期、速退费B.包孕装卸费,同时计滞期、速遣费C.包括卸货费,应计滞期费,不计速遣费D.包孕装货费,应计速遣费,不计滞期费8.必须经过背书才能进行转让的提单是( )。

A.记名提单B.不记名提单1C.指示提单D.备运提单9.在海洋运输货物保险业务中,共同海损( )。

A.是部分损失的一种B.是所有损失的一种C.有时是所有损失,有时是部分损失D.既是部分损失,又是全部损失10.在国际贸易运输保险业务中,仓至仓条款是( )。

A.承运人负责运输责任起讫的条件B.保险人负责保险责任起讫的条款C.出口人负责交货责任起讫的条款D.进口人负责接货责任起讫的条款11.按XXX海洋货物运输保险条款规定,三种基本险别就保险公司承担的风险责任范围的大小而言,下列四种排列顺序正确的是( )。

国际贸易实务模考试题+参考答案

国际贸易实务模考试题+参考答案一、单选题(共50题,每题1分,共50分)1、在保险人所承担的海上风险中,恶劣气候、地震属于( )A、特殊外来事故B、意外事故C、一般外来事故正确答案:B2、根据我国现行的《海洋运输保险条款》规定,自然灾害不指( )A、爆炸B、地震C、海啸D、雷电正确答案:A3、银行审单议付的依据是( )。

A、单据和信用证B、信用证和委托书C、合同和信用证D、合同和单据正确答案:A4、对其判定具有强制执行权的机构为( )A、调节中心B、仲裁机构C、贸促会D、法院正确答案:D5、“仓至仓”条款是( )A、出口人负责交货责任起讫的条款B、保险人负责保险责任起讫的条款C、承运人负责运输起讫的条款D、进口人负责付款责任起讫的条款正确答案:B6、在国际贸易中,造型上有特殊要求或具有色香味方面特征的商品适合于( )。

A、凭样品买卖B、凭等级买卖C、凭产地名称买卖D、凭规格买卖正确答案:A7、国外开来的不可撤销信用证规定,汇票的付款人为开证行,货物装船完毕后,闻悉申请人已破产倒闭,则( )。

A、由于付款人破产,货款将落空B、可立即通知承运人行使停运权C、待付款人财产清算后才可以收回货款D、只要单证相符,受益人仍可以从开证行取得货款正确答案:D8、出口换汇成本高于当时的外汇牌价时,说明该批出口()。

( )A、亏损B、盈利C、不能确定D、持平正确答案:A9、按我国《商检法》的规定:为出口危险货物生产包装容器的企业必须向商检机构申请包装容器的( )A、包装标志鉴定B、性能鉴定C、安全性鉴定D、使用鉴定正确答案:B10、发生( )违约方可援引不可抗力条款要求免责。

A、世界市场价格上涨B、货币贬值C、生产制作过程中的过失D、洪灾正确答案:D11、采用何种贸易术语,卖方承担的合同义务最低( )A、E组B、F组C、D组D、C组正确答案:A12、目前我国出口的某些工艺品、服装、轻工业品等常用来表示品质的方法是( )。

国际贸易实务习题(附参考答案)

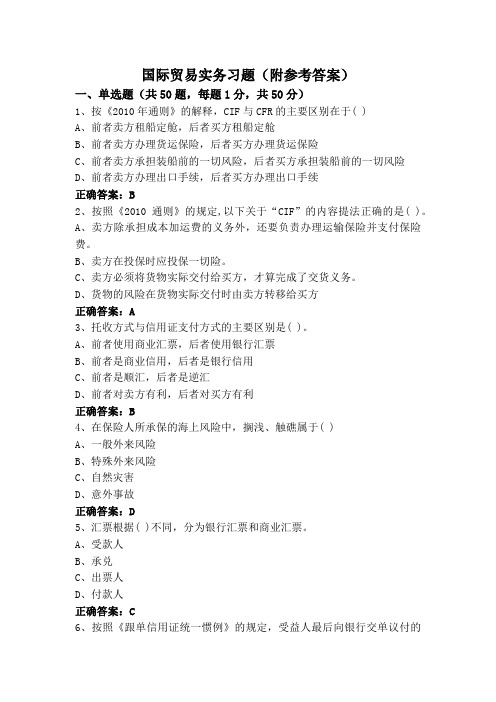

国际贸易实务习题(附参考答案)一、单选题(共50题,每题1分,共50分)1、按《2010年通则》的解释,CIF与CFR的主要区别在于( )A、前者卖方租船定舱,后者买方租船定舱B、前者卖方办理货运保险,后者买方办理货运保险C、前者卖方承担装船前的一切风险,后者买方承担装船前的一切风险D、前者卖方办理出口手续,后者买方办理出口手续正确答案:B2、按照《2010通则》的规定,以下关于“CIF”的内容提法正确的是( )。

A、卖方除承担成本加运费的义务外,还要负责办理运输保险并支付保险费。

B、卖方在投保时应投保一切险。

C、卖方必须将货物实际交付给买方,才算完成了交货义务。

D、货物的风险在货物实际交付时由卖方转移给买方正确答案:A3、托收方式与信用证支付方式的主要区别是( )。

A、前者使用商业汇票,后者使用银行汇票B、前者是商业信用,后者是银行信用C、前者是顺汇,后者是逆汇D、前者对卖方有利,后者对买方有利正确答案:B4、在保险人所承保的海上风险中,搁浅、触礁属于( )A、一般外来风险B、特殊外来风险C、自然灾害D、意外事故正确答案:D5、汇票根据( )不同,分为银行汇票和商业汇票。

A、受款人B、承兑C、出票人D、付款人正确答案:C6、按照《跟单信用证统一惯例》的规定,受益人最后向银行交单议付的期限是不迟于提单签发日的( )。

A、21B、25C、11D、15正确答案:A7、在进出口贸易实践中,对当事人行为无强制性约束的规范是( )。

A、国际法B、国内法C、国际条约D、国际贸易惯例正确答案:D8、如出口商品盈亏为0时,计算得出的出口销售人民币净收入通过汇率折算出的外汇价格应该为()。

( )A、FOB出口价B、CIF出口价C、FOB进口价D、CIF进口价正确答案:A9、在CIF出口贸易中,码头工人野蛮装运导致数件货物包装破损,收货后买方寻找的索赔方为( )A、卖方B、船长C、港务D、保险公司正确答案:A10、国际贸易中,运输标志一般由()。

国际贸易单证实务-各章习题答案 第六章 保险单证-习题答案

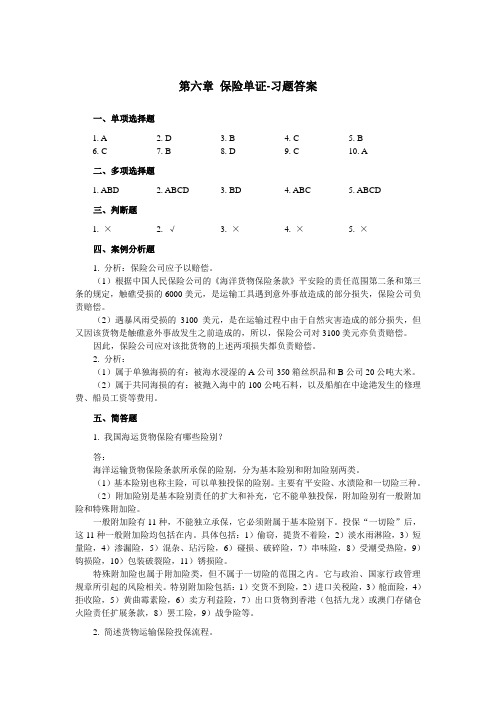

第六章保险单证-习题答案一、单项选择题1. A2. D3. B4. C5. B6. C7. B8. D9. C 10. A二、多项选择题1. ABD2. ABCD3. BD4. ABC5. ABCD三、判断题1. ×2. √3. ×4. ×5. ×四、案例分析题1. 分析:保险公司应予以赔偿。

(1)根据中国人民保险公司的《海洋货物保险条款》平安险的责任范围第二条和第三条的规定,触礁受损的6000美元,是运输工具遇到意外事故造成的部分损失,保险公司负责赔偿。

(2)遇暴风雨受损的3100美元,是在运输过程中由于自然灾害造成的部分损失,但又因该货物是触礁意外事故发生之前造成的,所以,保险公司对3100美元亦负责赔偿。

因此,保险公司应对该批货物的上述两项损失都负责赔偿。

2. 分析:(1)属于单独海损的有:被海水浸湿的A公司350箱丝织品和B公司20公吨大米。

(2)属于共同海损的有:被抛入海中的100公吨石料,以及船舶在中途港发生的修理费、船员工资等费用。

五、简答题1. 我国海运货物保险有哪些险别?答:海洋运输货物保险条款所承保的险别,分为基本险别和附加险别两类。

(1)基本险别也称主险,可以单独投保的险别。

主要有平安险、水渍险和一切险三种。

(2)附加险别是基本险别责任的扩大和补充,它不能单独投保,附加险别有一般附加险和特殊附加险。

一般附加险有11种,不能独立承保,它必须附属于基本险别下。

投保“一切险”后,这11种一般附加险均包括在内。

具体包括:1)偷窃,提货不着险,2)淡水雨淋险,3)短量险,4)渗漏险,5)混杂、玷污险,6)碰损、破碎险,7)串味险,8)受潮受热险,9)钩损险,10)包装破裂险,11)锈损险。

特殊附加险也属于附加险类,但不属于一切险的范围之内。

它与政治、国家行政管理规章所引起的风险相关。

特别附加险包括:1)交货不到险,2)进口关税险,3)舱面险,4)拒收险,5)黄曲霉素险,6)卖方利益险,7)出口货物到香港(包括九龙)或澳门存储仓火险责任扩展条款,8)罢工险,9)战争险等。

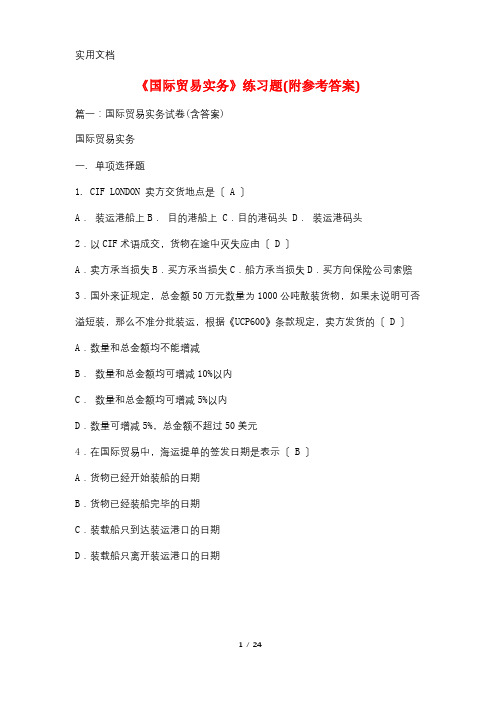

《国际贸易实务》练习题(附参考答案)

《国际贸易实务》练习题(附参考答案)篇一:国际贸易实务试卷(含答案)国际贸易实务一. 单项选择题1. CIF LONDON 卖方交货地点是〔 A 〕A.装运港船上B.目的港船上 C.目的港码头 D.装运港码头2.以CIF术语成交,货物在途中灭失应由〔 D 〕A.卖方承当损失B.买方承当损失C.船方承当损失D.买方向保险公司索赔3.国外来证规定,总金额50万元数量为1000公吨散装货物,如果未说明可否溢短装,那么不准分批装运,根据《UCP600》条款规定,卖方发货的〔 D 〕A.数量和总金额均不能增减B.数量和总金额均可增减10%以内C.数量和总金额均可增减5%以内D.数量可增减5%,总金额不超过50美元4.在国际贸易中,海运提单的签发日期是表示〔 B 〕A.货物已经开始装船的日期B.货物已经装船完毕的日期C.装载船只到达装运港口的日期D.装载船只离开装运港口的日期5.某货轮在航行途中,A舱失火,船长误以为B舱也同时失火,命令对两舱同时施救。

A舱中共有两批货物,甲批货物全部烧毁,乙批货物为棉被单,全部遭水浸,B舱货物也全部遭水浸。

那么〔 D 〕A.A舱乙批货物与B舱货物均属共同海损B.A舱乙批货物与B舱货物均属单独海损C.A舱货物均属共同海损D.A舱乙批货物属于共同海损,B舱货物属于单独海损6.在国际贸易中,买卖商品是按重量计价的,假设合同未明确规定计算重量的方法时,按惯例,应按〔 A 〕。

A.净重计 B.毛重计 C.皮重计 D.重量计7.以下单价表示方式正确的选项是〔 C 〕A.USD 100/PC B. 1000/MT CIFC.USD 100/PC London D.USD 100 CIF London8.必须经过背书才能进行转让的提单是〔 C 〕。

A.记名提单B.不记名提单 C.指示提单 D.备运提单9.国际货物买卖使用托收方式,委托并通过银行收取货款使用的汇票是〔 C 〕A.商业汇票,属于银行信用B.银行汇票,属于银行信用C.商业汇票,属于商业信用D.银行汇票,属于商业信用10.D/P at 30 Days Sight 与 D/A at 30 Days Sight 的区别是〔 A 〕A.前者30天后付款交单;后者承兑后交单,30天后付款B.都是30天后付款交单C.都是承兑后交单D.付款和交单的时间都不一样二.多项选择题1.海洋运输货运险的根本险别有〔 ABC 〕2. FOB、CFR、CIF这三个贸易术语的相同点是〔 AD 〕A.买卖双方的报关责任相同 B.买卖双方承当的运费责任相同C.买卖双方承当的保险费责任相同 D.买卖双方承当的货物风险责任相同3.构成共同海损的条件是〔ABCE〕A.共同海损的危险必须是实际存在的,不是主观臆测的B.消除船、货共同危险而采取的措施必须是合理的C.必须是属于非正常性质的损失D.采取措施后,船方和货方都作出了一定的牺牲E.支出的费用必须是额外的4.租船运输包括〔 AD 〕A.定期租船 B.集装箱运输 C.班轮运输 D.定程租船5.海运提单的性质与作用主要是〔 BCD 〕A.它是海运单据的惟一表现形式B.它是承运人或其代理人出具的货物收据C.它是代表货物所有权的凭证D.它是承运人与托运人之间订立的运输契约的证明6.海上货物保险中,除合同另有约定外,哪些原因造成货物损失,保险人不予赔偿〔ABCD〕A.交货延迟 B.被保险人的过失C.市场行情变化 D.货物自然损耗7.共同海损分摊时,涉及的收益方包括〔 ABC 〕A.货方 B.船方 C.运费方 D.救助方8.信用证支付方式的特点是〔 BCD 〕A.信用证是一种商业信用 B.信用证是一种银行信用C.信用证是一种单据的买卖 D.信用证是一种自足的文件9.罚金条款一般适用于〔 ABC 〕A.卖方延期交货 B.买方延迟开立信用证C.买方延期接运货物 D.一般商品买卖10.备用信用证与一般的跟单信用证的区别主要在于〔 ABC 〕A.适用的范围不同B.银行付款的条件不同C.受款人要求银行付款时所需要提交的单据不同D.备用信用证属于商业信用,而跟单信用证那么属于银行信用三.判断并说明原因1.贸易术语的变形是由于在程租船运输的情况下,CIF要明确目的港的卸货费用由谁承当的问题。

国际贸易实务 第5章课后练习参考答案

第5章综合练习答案一、问答题1.中国保险条款(海运)规定的基本险和附加险都有哪些?中国保险条款将海运货物保险险别分为基本险别和附加险别两类。

基本险包括:平安险、水渍险、一切险。

其中平安险责任范围最小,水渍险比平安险责任范围大,一切险是三种险别中责任范围最大的一种,除了平安险和水渍险的责任范围外,还包括由于一般外来原因造成的全部或部分损失。

2.(1)不妥当。

因为一切险包括一般附加险,投保了一切险就不用另保一般附加险,而锈损险和串味险属于一般附加险。

(2)不妥当。

按照保险习惯,投保一种基本险的基础上即可加保附加险,况且一切险已包含了平安险的责任范围,两项都保没有必要而且浪费。

(3)妥当。

(4)不妥当。

没有投保基本险,只有一般附加险和特殊附加险。

只有投保了基本险方可投保附加险。

(5)不妥当。

航空运输一切险不包括类似于淡水雨林险这样的一般附加险。

3.该项损失应由卖方负责。

CFR术语成交,买卖双方风险划分在装运港船舷,该项损失发生在装船之前,当由卖方负责。

而且买方在国外投保时,一般保险公司都不承担装船前的风险。

至于买方又向保险公司索赔遭到拒绝,是因为在货运保险业务中,被保险人在货物发生损失时必须具有保险利益,保险公司才予赔偿。

此案损失发生时,买方对该批货物尚未具有保险利益(因风险没有从卖方转移到买方),买方的保险公司并无赔付的义务。

4.被火焚毁的那部分文具用品属于单独海损;被水浸泡的那部分文具用品和全部茶叶属于共同海损。

文具用品的货主只需投保平安险,即可得到损失赔偿,因为被火烧毁的文具和被水浸泡的文具均属于平安险责任范围。

茶叶货主也只需投保平安险即可获得全部赔付,因为其损失是共同海损分摊的部分,属于平安险的责任范围。

5.特殊附加险与一般附加险的共同之处在于两者不能单独投保,必须附属于主险项下。

特殊附加险与一般附加险的区别在于:1、两者承保的风险不同。

一般附加险承保一般外来风险,如偷窃、雨淋、短量、破碎、串珠受潮等;而特殊附加险承保特殊外来风险,如战争、罢工、拒收、交货不到等。

国际贸易实务保险习题及答案-推荐下载

1.If we have to choose a Europe port by which no direct liner to stop or the trips are few, we should stipulate “ ______” in the contract.A.main ports in EuropeB.partial shipment allowedC.shipping adviceD.transshipment to be permitted2.By the clause warehouse to warehouse, the policy provides an overriding time limit of _____days after the completion of discharge of the insured goods from the seagoing vessel at the final port of discharge.A.30B.60C. 65D. 903. It is acceptable that the validity place of L/C is in ______A. importer’s countryB.exporter’s countryC. any third countryD. country instructed by importer4. If the breach of contract is non-fundamental, the injured party ____A. can only claim damages but cannot declare the contract voidedB. can only declare the contract voided but cannot claim damagesC. neither can claim damages nor can declare the contract voidedD. either can claim damages or can declare the contract voided5. Since the scope of cover of general additional risks is already included in, it is not necessary fro the goods to be insured by additional risks if it is insured by _____A.W.P.A.B. F.P.A.C.All RisksD.War Risk6. During the time limit of loading and unloading, in case the charterer finishes the work ofloading and unloading ahead of schedule, then the ship-owner shall pay certain amount of bonus to the charterer, this is so-called _______A. dispatch moneyB. demurrageC. paymentD. surcharges7. If the goods are contracted to be sold on ____ terms, then it is the _____’s turn totake out the insurance and pay the premium.A. CFR … ExporterB. CIF … ImporterC. CFR … ShipperD. CIF … Exporter8. The shipper or consignor on B/L is normally theA. exporterB. importerC. shipping companyD. bank9. Since the opening bank takes the ____ responsibility for the payment, the opening bank should be carefully chosen.A. firstB. second C thirdD. fourth10. Perils of sea are those caused by ____A. calamities and accidentsB. fortuitous and accidentsC. accidentsD. calamities and fortuitouscase analysis:1. A contract was signed between the seller and the buyer for some kindof chemical product on the basis of FOB xxx port and the goods were found to be in conformity with the requirement of the contract in respect of qualityby inspection before shipping. On arrival, it was found that part of the goodscoagulated (结成硬块) and the quality was not up to the standard set in thecontract after the buyer took delivery of the goods. The investigation showedthat it was caused by absorbing moisture in transit due to improper packing.So the buyer filed a claim against the seller for this but the seller pointed out that the goods conformed to the quality requirement before shipping and thedamage was caused during the transportation after the goods were loaded onboard at the port of shipment. The seller refused to make any compensationbecause such losses of or damages to the goods should be borne by the buyeraccording to international trade practices embodied in Inco-terms 2010.What is your opinion? 2. Company A in Country xxx sent company B in country yyy an offer by telex for some kind of agricultural goods as follows:quantity: 1,000 metric tonsunit price: USD200/MT CIF San Franciscopacking: in new gunny bagspayment; by irrevocable letter of creditshipment time: within two months after receipt of relative L/CThis offer is good subject to your reply reaching us within 4 days.The following day after company A telexed this offer, it received a telex reply from company B reading “Accept your offer shipment immediately”. Company A did notrespond to this. The next day company A received an irrevocable sight L/C issuedby Citi Bank stipulating “shipment within two months after receipt of relativeL/C” in respect of shipment time. In view of the very booming international marketfor this product, company A refused to sell the goods as offered before and returnedthe L/C accordingly. But company B insisted that contract was formed betweeneach other so company A had obligation to deliver the goods as offered. What isyour opinion based on the stipulations in CISG (United NationsConvention on the International Sale of Goods 1980) if CISG is applicableto this case? Is there a contract between the two parties? (10 points)3. Company A in China exported some goods on the basis of CIF xxx port andtook out insurance for 110% of invoice value against FPA as per the relevant Ocean Marine Cargo Clauses of the People’s Insurance Company of China dated Jan. 1, 1981. The ship started sailing at the beginning of July. On July 13, the carrying vessel suffered a thunderstorm and it caused some loss of part of the goods valued at UDS 2,000.00. Days later, it struck upon the rocks in transit and caused partial loss of the goods valued at USD10,000.00. Will the insurance company be responsible forcompensation of both the losses caused? (10 points)1.Advise Tiresias Ltd (‘Tiresias’) on the following transaction.Tiresias sold a quantity of sultanas to Stetson Ltd (‘Stetson’) on terms ‘FOB, Liverpool, shipment September’. Under the terms of the contract, Stetson was obliged to nominate a vessel. On 20th September, Stetson nominated the Wasteland, which was already in dock. The following day, Tiresias began to load the sultanas, but did not have sufficient to fulfil the contract and so waited for a further supply to arrive. The loading was completed just before midnight on 30th September. The vessel sailed the following day. Stetson claims Tiresias failed to fulfil its duty to deliver the goods as stipulated in the contract.2. Company A received an irrevocable L/C issued by bank ABC advised and confirmed by bank DEF. This company shipped the goods according to the requirements of the L/C and was going to present the documents for negotiation but received a notice from the confirming bank stating that the issuing bank had gone bankrupt and it would not pay but it could claim payment from the buyer on behalf of company A. What advice will you give company A about his legal position in this matter?3. Company A exported one batch of goods on the basis of payment by D/P at 90 days sight. Company A presented the draft accompanied by the shipping documents required by the relative contract to the remitting bank who forwarded all the documents to the collecting bank in the country of importer. The collecting bank presented all the documents to the importer and the importer accepted the draft presented as required. When the goods arrived at the destination port, the importer borrowed the shipping documents from the collecting bank by providing Trust Receipt in order to take delivery of the goods in time before the maturity of the draft. When the draft matured, the remitting bank was notified by the collecting bank that it was impossible for the importer to pay the accepted draft as it had gone bankrupt. What should company A do? Why?4. Company A cabled an offer to company B abroad on June 15th subject to the reply reaching on 20th inst. Company B submitted the cable of acceptance in the morning on 19th but it reached company A as late as 21st due to delay in transit. Company A did not make any response regarding the acceptance late. On June 26th, Company A sold the goods to another client at a higher price. On June 27th, company A received a cable from company B indicating that L/C had been established and requiring company A to ship the goods promptly. Company A replied company B immediately: “ your acceptance was late, no contract existed.” Company B insisted that they delivered the cable on 19th and it did not know the fact that the cable was late anyway. In view of this, company B insisted that contract was formed and company A should fulfill its obligation to deliver the goods as offered. What is your opinion if CISG applies here?5. The following contract is entered into between company ABC in China and company XYZ in the USA: “1000 tons of "grade A" dried cod (鳕鱼), USD 1.500.000/MT, CIF Los Angeles INCOTERMS 2010, as per sample submitted. Payment to be by irrevocable letter of credit confirmed by Bank of China opened by October 3rd 2010 for a period of 2 weeks, and to be made against documents evidencing the fulfilment of his CIF obligations, and a certificate of inspection stating the cod to be of grade A quality.”The letter of credit facility is duly opened and the relevant documents being specified to Bank of China and company A proceeds to perform his obligations under the contract.Company B hears rumours that the consignment shipped will not be grade A but grade C, and that the certificate of inspection presented will be a forgery, and instructs both the issuing and confirming banks not to pay against it.Company A presents BOC with the following documents: shipped on board bill of lading for 1000 tons of grade A dried cod in apparent good order and condition; an invoice for the same goods; an insurance policy taken on Institute Cargo Clause C terms; and a certificate of inspection. BOC pays particular attention to the certificateof inspection but is unable to find anything wrong with it as it appears to be in order and as described in their mandate (instructions for opening the credit). BOC pays company A.During the voyage the ship is in a collision and part of her cargo is wet, whilst another portion is deliberately thrown overboard by the crew in order to reduce her weight.When the consignment arrives it is found to be 200 tons short (i.e. there are only 800 tons) and 100 tons of the consignment are damaged by water, and the consignment is found not to be up to sample and not of grade A qualityPlease answer the following questions:(1).Assume that CISG is to apply to the sale of goods transaction. Answer the following:(a) Discuss company A's obligations under the contract he has entered into.(b) Advise company B as to any rights he may have with respect to the seller, carrier, insurance company, bank and any other relevant parties. Inform him of any further details you may require.(2). What are the functions of the bill of lading in international trade? Mention brieflyhow these facilitate trade. ( to facilitate means to benefit, or make easier)(3).(a)What is a condition, a warranty in English law? What is the meaning of"fundamental breach" under the United Nations Convention on the International Sale of Goods 1980 (CISG)?(b) What are inherent vice; general average; seaworthiness?(c)What is an insurable interest? What is the duty of disclosure in relation tocontracts of insurance?(d)What is meant by: the autonomy of a letter of credit, and the doctrine of strictcompliance?(4).What are the requirements of formation of contract under the United NationsConvention on the International Sale of Goods 1980 (CISG)?。

国际贸易实务第六章习题

第六章国际货物运输保险一、名词解释1.可保利益:2.推定全损:3.单独海损:4.共同海损:5.委付:6.施救费用:7.救助费用:8.“仓至仓”条款:9.出口信用保险:10.保险单:11.投保加成二、单项选择题1、在海洋运输货物保险业务中,共同海损()。

A.是部分损失的一种B.是全部损失的一种C.有时是全部损失,有时是部分损失D.既是全部损失,又是部分损失2、在国际贸易运输保险业务中,单独海损仅涉及受损货物所有人单方面的利益,因而仅有受损方单独承担损失。

这种损失是()。

A.部分损失 B.全部损失C.单件损失 D.有时是全部损失,有时是部分损失3、在海洋运输货物保险业务中,涉及单方面利益的损失,达到全部损失程度时,()。

A.按全损处理 B.按单独海损处理C.按推定全损处理 D.按共同损失处理4、按照英国伦敦保险协会《协会货物条款》,保险公司对ICC.(A)、ICC.(B)及ICC.(C)三种基本险所承担的责任范围最大的是()。

A.ICC.(A) B.ICC.(B) C.ICC.(C)5、某货轮在航行途中,A舱失火,船长误以为B舱也同时失火,命令丢两舱同时施救,A舱共有两批货物,甲批货物全部焚毁,乙批货物为棉织被单,全部遭受水浸;B舱货物也全部遭受水浸。

那么()。

A.A舱乙批货物与B舱货物都属单独海损B.A舱乙批货物与B舱货物都属共同海损C.A舱乙批货物属共同海损,B舱货物属单独海损D.A舱乙批货物属于单独海损,B舱货物属于共同海损6、我公司以CIF条件与国外客户达成一比出口交易,我公司应负责替国外客户投保,按照国际商会《INCOTERMS》的规定,应投保()。

A.一切险加战争险 B.一切险C.平安险 D.水渍险7、仓至仓条款是()。

A.承运人负责运输责任起讫的条款B.保险人负责保险责任起讫的条款C.出口商负责交货责任起讫的条款D.进口商负责收货责任起讫的条款8、为防止运输途中货物被窃,应该()。

A.投保一切险,加保偷窃险B.投保水渍险(即单独海损赔偿)C.投保平安险D.投保一切险或投保平安险和水渍险的一种,脚保偷窃险9、按中国人民保险公司海洋货物运输保险条款规定,在三种基本险别中,就保险公司承担的风险责任范围的大小而言,下列四种排列程序,()是正确的。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1.If we have to choose a Europe port by which no direct liner to stop or the trips are few, we should stipulate “ ______” in the contract.A.main ports in EuropeB.partial shipment allowedC.shipping adviceD.transshipment to be permitted2.By the clause warehouse to warehouse, the policy provides an overriding time limit of _____days after the completion of discharge of the insured goods from the seagoing vessel at the final port of discharge.A.30B.60C. 65D. 903. It is acceptable that the validity place of L/C is in ______A. importer’s countryB.exporter’s countryC. any third countryD. country instructed by importer4. If the breach of contract is non-fundamental, the injured party ____A. can only claim damages but cannot declare the contract voidedB. can only declare the contract voided but cannot claim damagesC. neither can claim damages nor can declare the contract voidedD. either can claim damages or can declare the contract voided5. Since the scope of cover of general additional risks is already included in, it is not necessary fro the goods to be insured by additional risks if it is insured by _____A.W.P.A.B. F.P.A.C.All RisksD.War Risk6. During the time limit of loading and unloading, in case the charterer finishes the work ofloading and unloading ahead of schedule, then the ship-owner shall pay certain amount of bonus to the charterer, this is so-called _______A. dispatch moneyB. demurrageC. paymentD. surcharges7. If the goods are contracted to be sold on ____ terms, then it is the _____’s turn totake out the insurance and pay the premium.A. CFR … ExporterB. CIF … ImporterC. CFR … ShipperD. CIF … Exporter8. The shipper or consignor on B/L is normally theA. exporterB. importerC. shipping companyD. bank9. Since the opening bank takes the ____ responsibility for the payment, the opening bank should be carefully chosen.A. firstB. second C thirdD. fourth10. Perils of sea are those caused by ____A. calamities and accidentsB. fortuitous and accidentsC. accidentsD. calamities and fortuitouscase analysis:1. A contract was signed between the seller and the buyer for some kindof chemical product on the basis of FOB xxx port and the goods were found to be in conformity with the requirement of the contract in respect of qualityby inspection before shipping. On arrival, it was found that part of the goodscoagulated (结成硬块) and the quality was not up to the standard set in thecontract after the buyer took delivery of the goods. The investigation showedthat it was caused by absorbing moisture in transit due to improper packing.So the buyer filed a claim against the seller for this but the seller pointed out that the goods conformed to the quality requirement before shipping and thedamage was caused during the transportation after the goods were loaded onboard at the port of shipment. The seller refused to make any compensationbecause such losses of or damages to the goods should be borne by the buyeraccording to international trade practices embodied in Inco-terms 2010.What is your opinion? 2. Company A in Country xxx sent company B in country yyy an offer by telex for some kind of agricultural goods as follows:quantity: 1,000 metric tonsunit price: USD200/MT CIF San Franciscopacking: in new gunny bagspayment; by irrevocable letter of creditshipment time: within two months after receipt of relative L/CThis offer is good subject to your reply reaching us within 4 days.The following day after company A telexed this offer, it received a telex reply from company B reading “Accept your offer shipment immediately”. Company A did notrespond to this. The next day company A received an irrevocable sight L/C issuedby Citi Bank stipulating “shipment within two months after receipt of relativeL/C” in respect of shipment time. In view of the very booming international marketfor this product, company A refused to sell the goods as offered before and returnedthe L/C accordingly. But company B insisted that contract was formed betweeneach other so company A had obligation to deliver the goods as offered. What isyour opinion based on the stipulations in CISG (United NationsConvention on the International Sale of Goods 1980) if CISG is applicableto this case? Is there a contract between the two parties? (10 points)3. Company A in China exported some goods on the basis of CIF xxx port andtook out insurance for 110% of invoice value against FPA as per the relevant Ocean Marine Cargo Clauses of the People’s Insurance Company of China dated Jan. 1, 1981. The ship started sailing at the beginning of July. On July 13, the carrying vessel suffered a thunderstorm and it caused some loss of part of the goods valued at UDS 2,000.00. Days later, it struck upon the rocks in transit and caused partial loss of the goods valued at USD10,000.00. Will the insurance company be responsible forcompensation of both the losses caused? (10 points)1.Advise Tiresias Ltd (‘Tiresias’) on the following transaction.Tiresias sold a quantity of sultanas to Stetson Ltd (‘Stetson’) on terms ‘FOB, Liverpool, shipment September’. Under the terms of the contract, Stetson was obliged to nominate a vessel. On 20th September, Stetson nominated the Wasteland, which was already in dock. The following day, Tiresias began to load the sultanas, but did not have sufficient to fulfil the contract and so waited for a further supply to arrive. The loading was completed just before midnight on 30th September. The vessel sailed the following day. Stetson claims Tiresias failed to fulfil its duty to deliver the goods as stipulated in the contract.2. Company A received an irrevocable L/C issued by bank ABC advised and confirmed by bank DEF. This company shipped the goods according to the requirements of the L/C and was going to present the documents for negotiation but received a notice from the confirming bank stating that the issuing bank had gone bankrupt and it would not pay but it could claim payment from the buyer on behalf of company A. What advice will you give company A about his legal position in this matter?3. Company A exported one batch of goods on the basis of payment by D/P at 90 days sight. Company A presented the draft accompanied by the shipping documents required by the relative contract to the remitting bank who forwarded all the documents to the collecting bank in the country of importer. The collecting bank presented all the documents to the importer and the importer accepted the draft presented as required. When the goods arrived at the destination port, the importer borrowed the shipping documents from the collecting bank by providing Trust Receipt in order to take delivery of the goods in time before the maturity of the draft. When the draft matured, the remitting bank was notified by the collecting bank that it was impossible for the importer to pay the accepted draft as it had gone bankrupt. What should company A do? Why?4. Company A cabled an offer to company B abroad on June 15th subject to the reply reaching on 20th inst. Company B submitted the cable of acceptance in the morning on 19th but it reached company A as late as 21st due to delay in transit. Company A did not make any response regarding the acceptance late. On June 26th, Company A sold the goods to another client at a higher price. On June 27th, company A received a cable from company B indicating that L/C had been established and requiring company A to ship the goods promptly. Company A replied company B immediately: “ your acceptance was late, no contract existed.” Company B insisted that they delivered the cable on 19th and it did not know the fact that the cable was late anyway. In view of this, company B insisted that contract was formed and company A should fulfill its obligation to deliver the goods as offered. What is your opinion if CISG applies here?5. The following contract is entered into between company ABC in China and company XYZ in the USA: “1000 tons of "grade A" dried cod (鳕鱼), USD 1.500.000/MT, CIF Los Angeles INCOTERMS 2010, as per sample submitted. Payment to be by irrevocable letter of credit confirmed by Bank of China opened by October 3rd 2010 for a period of 2 weeks, and to be made against documents evidencing the fulfilment of his CIF obligations, and a certificate of inspection stating the cod to be of grade A quality.”The letter of credit facility is duly opened and the relevant documents being specified to Bank of China and company A proceeds to perform his obligations under the contract.Company B hears rumours that the consignment shipped will not be grade A but grade C, and that the certificate of inspection presented will be a forgery, and instructs both the issuing and confirming banks not to pay against it.Company A presents BOC with the following documents: shipped on board bill of lading for 1000 tons of grade A dried cod in apparent good order and condition; an invoice for the same goods; an insurance policy taken on Institute Cargo Clause C terms; and a certificate of inspection. BOC pays particular attention to the certificateof inspection but is unable to find anything wrong with it as it appears to be in order and as described in their mandate (instructions for opening the credit). BOC pays company A.During the voyage the ship is in a collision and part of her cargo is wet, whilst another portion is deliberately thrown overboard by the crew in order to reduce her weight.When the consignment arrives it is found to be 200 tons short (i.e. there are only 800 tons) and 100 tons of the consignment are damaged by water, and the consignment is found not to be up to sample and not of grade A qualityPlease answer the following questions:(1).Assume that CISG is to apply to the sale of goods transaction. Answer the following:(a) Discuss company A's obligations under the contract he has entered into.(b) Advise company B as to any rights he may have with respect to the seller, carrier, insurance company, bank and any other relevant parties. Inform him of any further details you may require.(2). What are the functions of the bill of lading in international trade? Mention brieflyhow these facilitate trade. ( to facilitate means to benefit, or make easier)(3).(a)What is a condition, a warranty in English law? What is the meaning of"fundamental breach" under the United Nations Convention on the International Sale of Goods 1980 (CISG)?(b) What are inherent vice; general average; seaworthiness?(c)What is an insurable interest? What is the duty of disclosure in relation tocontracts of insurance?(d)What is meant by: the autonomy of a letter of credit, and the doctrine of strictcompliance?(4).What are the requirements of formation of contract under the United NationsConvention on the International Sale of Goods 1980 (CISG)?。