一般条款及细则

规定办法及细则的区别(5篇)

规定办法及细则的区别制度中的规定、办法、细则一、规定(一)什么是规定规定是规范性公文中使用范围最广、使用频率最高的文种。

它是领导机关对特定范围内的工作和事务制订相应措施,要求所属部门和下级机关贯彻执行的法规性公文。

规定是局限于落实某一法律、法规;加强其项管理工作而制定的,具有较强的约束力,而且内容细致,可操作性较强。

(二)规定的分类规定大致可以分为方针政策性和具体事宜性两种。

(三)规定的结构规定一般由首部和正文两部分组成。

1.首部。

包括标题、制发时间和依据等项目。

(1)标题:一般有两种构成形式:一种是由发文单位、事由、文种构成;另一种是由事由和文种构成。

(2)时间和依据。

用括号在标题之____明规定发布和签发的时间和依据。

有的规定是随命令、令等文种同时发布的。

2.正文。

正文的内容由总则、分则和附则组成。

总则交代制定规定的缘由、依据、指导思想、适用原则和范围等。

分则即规范项目,包括规定的实质性内容和要求具体执行的依据。

附则说明有关执行要求等。

正文的表述形式一般采用条款式或章条式。

二、办法(一)什么是办法办法是汉语中常用的一个词语,意为处理事情或解决问题的方法,现今也指一种应用写作的法规性公文文件。

(二)办法的特点(1)办法的法规约束性侧重于行政约束力。

(2)办法的条款都具体、完整,不能抽象笼统。

(三)办法的分类办法的分类根据内容、性质的不同,办法可分为实施文件办法和工作管理办法两种。

(四)办法的写法办法由首部和正文两部分组成。

1.首部。

包括标题、制发时间和依据等项目内容。

标题。

由发文机关、事由、文种构成。

制发时间、依据。

标题之下用括号注明规定制发的年、月、日和会议;或通过的会议、时间及发布的机关、时间;或批准的机关、时间等。

有的办法随命令、令等文种同时发布,这一项目内容可不再写。

2.正文。

一般由依据、规定、说明这三层意思组成,可分章、分条叙述。

办法中的各条规定,是办法的主体部分,要将具体内容和措施依次逐条写清楚。

细则的写作方法及范本

细则的写作方法及范本细则是一种详细描述某项事物、政策或规则的文本,通常包含具体的条款、规定和操作细节,以帮助人们准确地理解和遵守。

下面是一些关于细则的写作方法以及一个范本,希望对您有所帮助。

一、细则的写作方法1.明确目的:在开始编写细则之前,需要明确细则的目的和范围。

确定您希望通过细则传达什么信息,以及细则覆盖的范围是什么。

2.分条列举:细则通常以分条列举的方式来呈现,每个条款描述一个具体的规定或要求。

使用编号或符号来清晰地标识每个条款,以便读者能够快速定位所需内容。

3.明确语言:细则的语言应该准确、明确,避免使用模糊或歧义的词汇。

遵循简明扼要的原则,尽量使用简单、直接的语句,避免冗长的句子和复杂的措辞。

4.遵循逻辑顺序:按照一定的逻辑顺序来组织和呈现细则内容,例如按照时间先后、重要程度、操作步骤等进行排列。

这样可以使读者更容易理解和遵守细则。

5.提供解释和示例:在某些情况下,细则可能涉及较为复杂或具体的内容,需要提供解释和示例来帮助读者更好地理解和应用细则。

解释应该清晰明了,示例应该具体详细。

6.遵循格式规范:细则通常需要遵循一定的格式规范,例如使用特定的标题、字体、标点符号等。

确保细则的格式整齐一致,便于阅读和参考。

7.考虑读者需求:在编写细则时,需要考虑读者的需求和背景知识。

尽量使用通俗易懂的语言,避免使用过多的专业术语或行业内部的缩写词语,以方便读者理解。

二、细则范本下面是一个关于公司休假政策的细则范本:公司休假政策1. 休假申请:1.1 所有员工享有休假的权利,包括带薪休假和非带薪休假。

1.2 员工在享受休假前需提前至少两周向主管提交休假申请书。

1.3 休假申请书应包括休假开始日期、休假结束日期、休假类型(带薪休假或非带薪休假)以及休假目的。

2. 带薪休假:2.1 全职员工每年享有10天带薪休假的权利,按照工作时长比例计算。

2.2 带薪休假的使用需提前向主管提交书面申请,并得到主管的批准。

合作合同条款细则9篇

合作合同条款细则9篇第1篇示例:合作合同是一种法律文件,用于明确双方合作关系的条款和细则。

在商业合作中,合作合同起着非常重要的作用,它可以帮助双方明确权利和义务,防范风险,保障双方的合法权益。

下面我们就来详细了解一份合作合同的条款细则。

一、合同的立项和签署1.1 合同的立项合作双方应当确定合作的内容、方式、时限和目标,明确合作的具体内容及责任,为签署合同做好准备。

1.2 合同的签署双方在制定好合同草案后,应当进行详细的讨论和确认,最终由双方代表签署合同。

二、合作内容和责任2.1 合作内容合同应当明确合作的具体内容,包括合作项目、合作方式、工作分工等,确保双方对合作内容有明确的了解。

2.2 合作责任双方应当在合同中对各自的合作责任进行详细说明,包括工作任务、工作要求、完成时限等,确保责任的明确性和可执行性。

三、权利和利益分配3.1 权利的明确合同中应当明确双方在合作中的权利范围,包括对合作成果、知识产权、商业机密等权利的归属。

3.2 利益分配合同应当对合作利益的分配方式进行详细规定,包括合作收益的分成比例、分成方式等,确保双方在合作中的利益得到合理保障。

四、风险控制与保障4.1 风险预警合同应当明确双方在合作中可能面临的风险,并确定相应的风险预警机制,及时应对可能出现的问题。

4.2 合作保障合同中应当规定双方在合作中的保障措施,包括合作期间的保密、保险等条款,确保合作的安全和顺利进行。

五、违约与解除5.1 违约责任合同应当明确双方违约的责任和后果,包括违约责任的承担和违约行为的处理方式。

5.2 合同解除合同中应当规定双方解除合同的条件和程序,当出现严重分歧或无法继续合作时,双方可以按照合同的规定解除合同。

六、争议解决6.1 协商解决双方在合同中应当规定对于合作中可能出现的争议应当采取的解决方式,首先应当通过友好协商解决。

6.2 仲裁与诉讼如无法通过协商解决,合同中可以约定采取仲裁或诉讼的方式解决争议,确保争议能够得到及时有效解决。

合同起草细则模板

合同起草细则模板一、合同的背景与目的1.1 背景本合同是由甲方(以下简称甲方)与乙方(以下简称乙方)双方按照平等自愿、公平合理的原则,就双方之间的某项具体事务达成的一致意见的书面文件。

1.2 目的为了规范双方的行为,明确各方的权利义务,维护双方的合法权益,特制定本合同。

二、合同的主要内容本合同共分为以下几个主要内容:2.1 合同的当事人及联系方式甲方:(单位或个人名称)、地址、联系方式乙方:(单位或个人名称)、地址、联系方式2.2 合同的签订日期与期限本合同自双方签字盖章之日起生效,至双方履行完毕各自在本合同中的义务之日终止。

2.3 合同的约定事项(1)合同的目的和内容根据本合同约定的事项,甲方与乙方应当分别完成什么工作或提供什么服务。

(2)合同价格及支付方式双方对合同中的费用应当如何支付,支付方式为何。

(3)合同履行地点和方式双方应当在何地履行合同,履行方式为何。

(4)合同变更或解除的条件在何种情况下可以对本合同进行变更或解除。

(5)违约责任双方违约时应负何种责任。

2.4 其他约定双方可根据合同需要,进一步约定其他事项。

三、合同的履行与解决争议3.1 合同的履行本合同自签署之日起生效,双方应当按照合同约定的内容履行各自的义务。

3.2 合同的解决争议双方因本合同引起的任何争议,应当友好协商解决;协商不成的,应当依法向有关部门申请仲裁或依法诉讼解决。

四、其他事项4.1 本合同一式两份,双方各持一份,具有同等法律效力。

4.2 本合同自双方签字盖章之日生效,至合同终止之日止。

4.3 本合同如需变更,应当经双方书面协商一致后,办理相关手续。

5. 本合同未尽事宜,由双方协商解决。

甲方(盖章):乙方(盖章):签订日期:签订日期:以上为合同的起草细则,双方应当严格遵守合同约定,共同维护双方的合法权益。

希望双方能够共同履行本合同,达到合作共赢的目的。

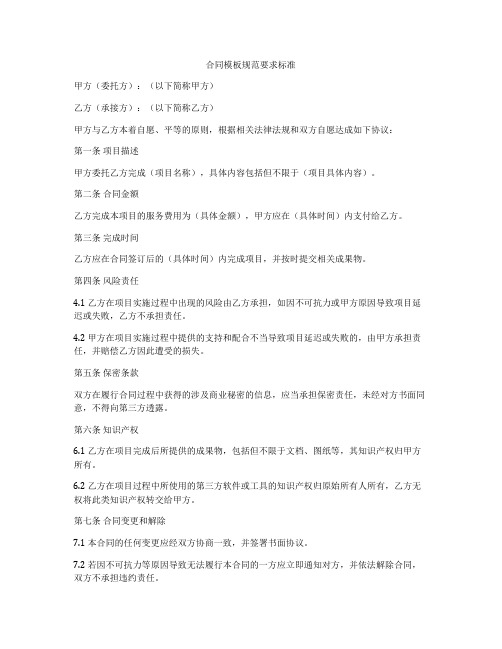

合同模板规范要求标准

合同模板规范要求标准甲方(委托方):(以下简称甲方)乙方(承接方):(以下简称乙方)甲方与乙方本着自愿、平等的原则,根据相关法律法规和双方自愿达成如下协议:第一条项目描述甲方委托乙方完成(项目名称),具体内容包括但不限于(项目具体内容)。

第二条合同金额乙方完成本项目的服务费用为(具体金额),甲方应在(具体时间)内支付给乙方。

第三条完成时间乙方应在合同签订后的(具体时间)内完成项目,并按时提交相关成果物。

第四条风险责任4.1 乙方在项目实施过程中出现的风险由乙方承担,如因不可抗力或甲方原因导致项目延迟或失败,乙方不承担责任。

4.2 甲方在项目实施过程中提供的支持和配合不当导致项目延迟或失败的,由甲方承担责任,并赔偿乙方因此遭受的损失。

第五条保密条款双方在履行合同过程中获得的涉及商业秘密的信息,应当承担保密责任,未经对方书面同意,不得向第三方透露。

第六条知识产权6.1 乙方在项目完成后所提供的成果物,包括但不限于文档、图纸等,其知识产权归甲方所有。

6.2 乙方在项目过程中所使用的第三方软件或工具的知识产权归原始所有人所有,乙方无权将此类知识产权转交给甲方。

第七条合同变更和解除7.1 本合同的任何变更应经双方协商一致,并签署书面协议。

7.2 若因不可抗力等原因导致无法履行本合同的一方应立即通知对方,并依法解除合同,双方不承担违约责任。

第八条管辖法律本合同的签订、履行和争议解决适用中华人民共和国法律。

第九条争议解决双方如发生争议应通过友好协商解决,协商不成的,可提交至合同签订地的人民法院裁决。

第十条其他10.1 本合同一式两份,甲乙双方各执一份,具有同等法律效力。

10.2 本合同自双方签字盖章之日起生效,至合同约定的完成时间止。

甲方(盖章):_______________ 乙方(盖章):______________签署日期:_______________ 签署日期:______________。

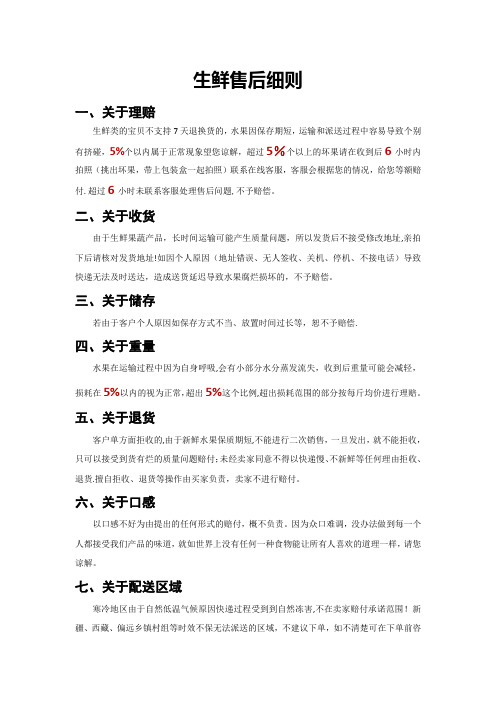

电商生鲜售后细则和售后赔付条款及生鲜保存方式-范本模板

生鲜售后细则一、关于理赔生鲜类的宝贝不支持7天退换货的,水果因保存期短,运输和派送过程中容易导致个别有挤碰,5%个以内属于正常现象望您谅解,超过5%个以上的坏果请在收到后6小时内拍照(挑出坏果,带上包装盒一起拍照)联系在线客服,客服会根据您的情况,给您等额赔付.超过6小时未联系客服处理售后问题,不予赔偿。

二、关于收货由于生鲜果蔬产品,长时间运输可能产生质量问题,所以发货后不接受修改地址,亲拍下后请核对发货地址!如因个人原因(地址错误、无人签收、关机、停机、不接电话)导致快递无法及时送达,造成送货延迟导致水果腐烂损坏的,不予赔偿。

三、关于储存若由于客户个人原因如保存方式不当、放置时间过长等,恕不予赔偿.四、关于重量水果在运输过程中因为自身呼吸,会有小部分水分蒸发流失,收到后重量可能会减轻,损耗在5%以内的视为正常,超出5%这个比例,超出损耗范围的部分按每斤均价进行理赔。

五、关于退货客户单方面拒收的,由于新鲜水果保质期短,不能进行二次销售,一旦发出,就不能拒收,只可以接受到货有烂的质量问题赔付;未经卖家同意不得以快递慢、不新鲜等任何理由拒收、退货.擅自拒收、退货等操作由买家负责,卖家不进行赔付。

六、关于口感以口感不好为由提出的任何形式的赔付,概不负责。

因为众口难调,没办法做到每一个人都接受我们产品的味道,就如世界上没有任何一种食物能让所有人喜欢的道理一样,请您谅解。

七、关于配送区域寒冷地区由于自然低温气候原因快递过程受到到自然冻害,不在卖家赔付承诺范围!新疆、西藏、偏远乡镇村组等时效不保无法派送的区域,不建议下单,如不清楚可在下单前咨询在线客服是否可派送。

八、温馨提示自然生长的果子表面可能会有凹痕、褶皱等,属于正常现象,只有出现腐烂、发霉、长毛等现象,才属于品质问题。

关于掉柄的果子,属于熟大的果子,不影响食用。

生鲜赔付细则一、百香果理赔百香果属于不支持7天退换货的,水果因保存期短,运输和派送过程中容易导致个别有挤碰,3个以内属于正常现象望您谅解,损坏3个或超过以上的坏果请在收到后6小时内拍照(挑出坏果,带上包装盒一起拍照)联系在线客服,客服会根据您的情况,给您等额赔付。

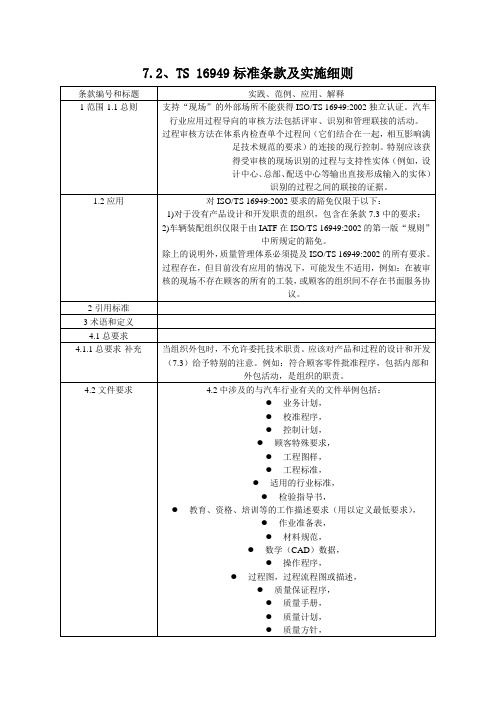

7.2、TS 16949标准条款及实施细则.

条款编号和标题

实践、范例、应用、解释

1范围-1.1总则

支持“现场”的外部场所不能获得ISO/TS 16949:2002独立认证。汽车

行业应用过程导向的审核方法包括评审、识别和管理联接的活动。

过程审核方法在体系内检查单个过程间(它们结合在一起,相互影响满足技术规范的要求)的连接的现行控制。特别应该获得受审核的现场识别的过程与支持性实体(例如,设计中心、总部、配送中心等输出直接形成输入的实体)识别的过程之间的联接的证据。

6.2.2.3在职培训

“对在顾客的影响”包括意识到不合格对内部、外部顾

客和最终使用者的影响。

6.2.2.4员工激励和授权

工业实践的要素包括意识、了解、承诺和实施。可以通过PDCA循环阐明。组织应该使用能够促进连接到顾客满意的联系、沟通和小组合作的方法。通常的测量方法是进行员工调查。

其它例子包括:

奖励研讨会

2引用标准

3术语和定义

4.1总要求

4.1.1总要求-补充

当组织外包时,不允许委托技术职责。应该对产品和过程的设计和开发(7.3)给予特别的注意。例如:符合顾客零件批准程序,包括内部和外包活动,是组织的职责。

4.2文件要求

4.2中涉及的与汽车行业有关的文件举例包括:

业务计划,

校准程序,

控制计划,

顾客特殊要求,

管理者不必须与现场认证的相同,但在任何情况下都必须清楚的加以定义。

组织分析和最优化过程间相互作用的过程目标-持续改进,

直接关系到组织的成功的产品实现过程的识别,

影响实现过程效率的支持过程的识别,

过程更改中的验证,保持质量体系提供的功能所需的资源和沟通,

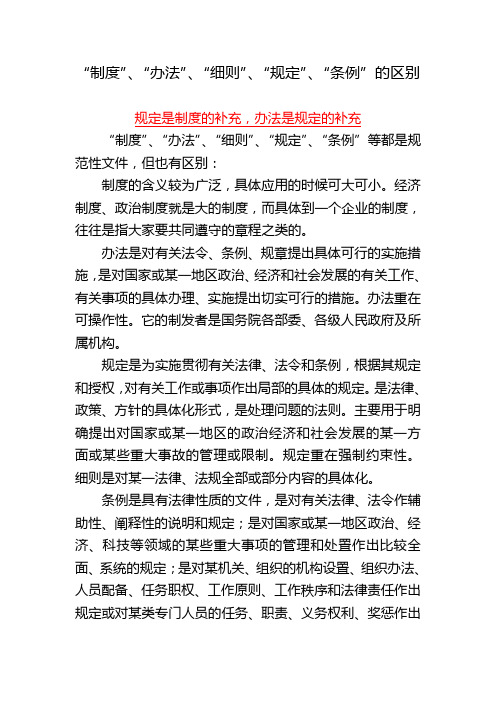

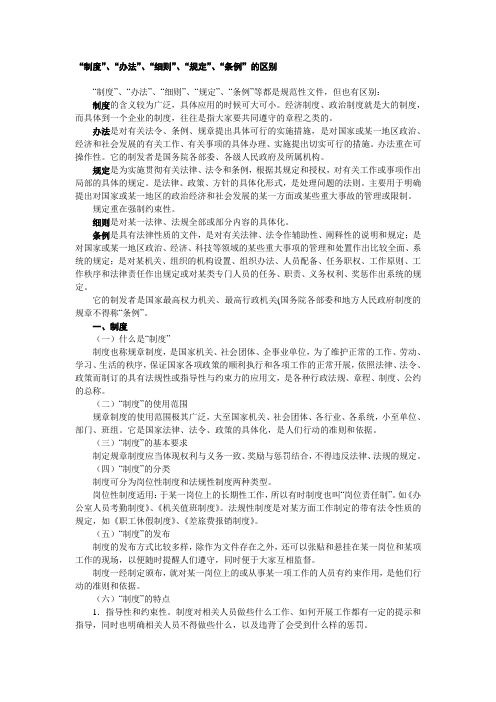

制度、规定、办法、细则区别

“制度”、“办法”、“细则”、“规定”、“条例”的区别规定是制度的补充,办法是规定的补充“制度”、“办法”、“细则”、“规定”、“条例”等都是规范性文件,但也有区别:制度的含义较为广泛,具体应用的时候可大可小。

经济制度、政治制度就是大的制度,而具体到一个企业的制度,往往是指大家要共同遵守的章程之类的。

办法是对有关法令、条例、规章提出具体可行的实施措施,是对国家或某一地区政治、经济和社会发展的有关工作、有关事项的具体办理、实施提出切实可行的措施。

办法重在可操作性。

它的制发者是国务院各部委、各级人民政府及所属机构。

规定是为实施贯彻有关法律、法令和条例,根据其规定和授权,对有关工作或事项作出局部的具体的规定。

是法律、政策、方针的具体化形式,是处理问题的法则。

主要用于明确提出对国家或某一地区的政治经济和社会发展的某一方面或某些重大事故的管理或限制。

规定重在强制约束性。

细则是对某一法律、法规全部或部分内容的具体化。

条例是具有法律性质的文件,是对有关法律、法令作辅助性、阐释性的说明和规定;是对国家或某一地区政治、经济、科技等领域的某些重大事项的管理和处置作出比较全面、系统的规定;是对某机关、组织的机构设置、组织办法、人员配备、任务职权、工作原则、工作秩序和法律责任作出规定或对某类专门人员的任务、职责、义务权利、奖惩作出系统的规定。

它的制发者是国家最高权力机关、最高行政机关(国务院各部委和地方人民政府制度的规章不得称“条例”。

一、制度(一)什么是“制度”制度也称规章制度,是国家机关、社会团体、企事业单位,为了维护正常的工作、劳动、学习、生活的秩序,保证国家各项政策的顺利执行和各项工作的正常开展,依照法律、法令、政策而制订的具有法规性或指导性与约束力的应用文,是各种行政法规、章程、制度、公约的总称。

(二)“制度”的使用范围规章制度的使用范围极其广泛,大至国家机关、社会团体、各行业、各系统,小至单位、部门、班组。

公文《细则》的写法和范例

细则细则,是贯彻执行条例中某一规定或几条规定的详细规则。

细则的特点是:具体、详尽,明细。

细则与条例、办法虽同属于规范性的公文文种,都要经过有关会议通过,主管机关颁发,在相应范围内,具有强制执行的法律效力,但比起条例,它是条例某一部分的具体化;比起办法,它不重在叙述具体作法和要求,而重在叙述具体的规定和要求。

同时,细则在执行过程中,也有较大的灵活性,一旦情况有变化,便可根据实际情况,及时调整与修订。

细则的结构,一般由标题、发布单位及日期、正文组成。

标题。

一是由适用地区、事由和文种组成。

二是由发布单位、事由和文种组成。

发布单位和日期。

在标题下面写上何时由何单位公布(或发布),加括号。

正文。

正文的写法有:条款式。

就是采用分条叙述,有的其中章下有条,条下有款。

或采用总则、分则、附则式。

总则写细则的依据;分则写细则的主体;附则写细则的结尾,作有关实施细则的说明,如施行的具体时限、细则的解释权和修改权等。

或者,只用序号,不列条款。

制订细则,首先,应深刻理解国家有关政策、规定及指示;其次,要全面深入地掌握本单位的具体情况,订得具体、详尽、明细。

文字要简洁明确,语言要通俗易懂。

范例中华人民共和国土地增值税暂行条例实施细则第一条根据《中华人民共和国土地增值税暂行条例》(以下简称条例)第十四条规定,制定本细则。

第二条条例第二条所称的转让国有土地使用权、地上的建筑物及其附着物并取得收入,是指以出售或者其他方式有偿转让房地产的行为。

不包括以继承、赠与方式无偿转让房地产的行为。

第三条条例第二条所称的国有土地,是指按国家法律规定属于国家所有的土地。

第四条条例第二条所称的地上的建筑物,是指建于土地上的一切建筑物,包括地上地下的各种附属设施。

条例第二条所称的附着物,是指附着于土地上的不能移动,一经移动即遭损坏的物品。

第五条条例第二条所称的收入,包括转让房地产的全部价款及有关的经济收益。

第六条条例第二条所称的单位,是指各类企业单位、事业单位、国家机关和社会团体及其他组织。

2024医院进修人才管理细则及协议条款

20XX 标准合同模板范本PERSONAL RESUME甲方:XXX乙方:XXX2024医院进修人才管理细则及协议条款本合同目录一览第一条:合同主体及定义1.1 甲方:指X医院1.2 乙方:指参与进修的医生、护士等医疗人才第二条:进修人才的基本条件2.1 乙方需具备的相关资质和资格2.2 乙方的工作经历和业务能力要求2.3 乙方的进修计划和目标第三条:进修期限及进修内容3.1 乙方的进修期限3.2 乙方进修的具体内容和要求3.3 乙方进修期间的培训和考核第四条:进修期间的工作安排4.1 乙方向甲方提交的工作计划4.2 甲方为乙方提供的资源和条件4.3 乙方的工作汇报和反馈机制第五条:进修期间的待遇和保障5.1 乙方的工资和福利5.2 甲方为乙方提供的生活和工作保障5.3 乙方的人身安全和保险问题第六条:知识产权和保密协议6.1 乙方在进修期间产生的知识产权归属6.2 乙方的保密义务和保密期限6.3 违反保密协议的法律责任第七条:合同的变更和解除7.1 合同变更的条件和程序7.2 合同解除的条件和程序7.3 合同解除后的相关处理事项第八条:违约责任及争议解决8.1 双方违反合同约定的责任8.2 合同争议的解决方式和法律适用8.3 违约金的计算和支付方式第九条:合同的生效、终止和延续9.1 合同的生效条件9.2 合同的终止条件9.3 合同的延续条件和程序第十条:其他约定10.1 双方认为需要约定的其他事项10.2 双方对合同的解释权和修改权第十一条:合同的签署和生效11.1 合同签署的时间和地点11.2 合同的生效日期11.3 合同的份数和保存方式第十二条:甲方和乙方的联系人和联系方式12.1 甲乙双方的联系人不定期交换和更新12.2 双方联系方式的保密和有效期内保持畅通第十三条:进修成果的评价和反馈13.1 甲方对乙方进修成果的评价标准和程序13.2 乙方对甲方提供的进修条件的评价和建议13.3 评价结果的反馈和改进措施第十四条:进修期间的特殊情况处理14.1 对乙方进修期间出现特殊情况的处理原则14.2 甲方对乙方进修期间特殊情况的协助和支持14.3 特殊情况处理的结果和效果评估第一部分:合同如下:第一条:合同主体及定义1.1 甲方:指X医院,是一家具有独立法人资格的医疗机构,依法从事医疗、预防、保健、康复等服务。

大宗商品交易合同:通用条款及细则

20XX 标准合同模板范本PERSONAL RESUME甲方:XXX乙方:XXX大宗商品交易合同:通用条款及细则合同编号_________一、合同主体地址:_________联系人:_________联系电话:_________地址:_________联系人:_________联系电话:_________二、合同前言2.1 背景和目的鉴于甲方是一家专业从事大宗商品交易的企业,具备丰富的市场资源和经验;乙方有意向参与大宗商品交易业务,为实现双方在各自领域的优势互补,促进双方共同发展,经双方友好协商,特订立本合同。

2.2 合同依据三、定义与解释3.1 专业术语(1)大宗商品:指在商品交易所、现货市场等交易平台上进行交易的具有较大规模、标准化程度较高、价格波动较大的商品。

(2)交易日:指本合同约定的商品交易的具体日期。

(3)交易价格:指甲乙双方在交易过程中确定的具体商品交易价格。

3.2 关键词解释(1)交易:指甲乙双方在大宗商品交易合同约定范围内,进行商品买卖的行为。

(2)合同履行:指甲乙双方按照本合同的约定,完成商品交易、支付货款、交付商品等义务。

四、权利与义务4.1 甲方的权利和义务(1)甲方应按照本合同的约定,向乙方提供符合质量、数量要求的商品。

(2)甲方有权根据市场行情和供需关系调整商品价格,但需提前通知乙方。

(3)甲方应确保乙方的合法权益不受侵害。

4.2 乙方的权利和义务(1)乙方有权按照本合同的约定,要求甲方提供符合质量、数量要求的商品。

(2)乙方应按照本合同的约定,按时支付货款。

(3)乙方不得将本合同项下的权利和义务转让给第三方。

五、履行条款5.1 合同履行时间本合同自双方签字盖章之日起生效,有效期为____年,自合同生效之日起计算。

5.2 合同履行地点甲方:_________乙方:_________5.3 合同履行方式(1)线上交易:通过商品交易所、现货市场等交易平台进行交易。

(2)线下交易:双方协商确定交易方式、交易地点等。

安全生产管理制度及实施细则

安全生产管理制度及实施细则第一章总则第一条为加强(以下简称)安全生产管理,明确和落实安全责任,防范安全事故发生,根据《中华人民共和国安全生产法》、《中华人民共和国劳动法》等相关法律法规和集团的有关规定,结合实际,特制订本制度。

第二条本制度适用于各部门。

第三条本制度所指的员工为本部全体在岗员工。

第四条安全生产工作的目标:1.预防因工责任伤亡事故,杜绝责任重伤、死亡事故发生;2.预防火灾事故,杜绝重大以上火灾事故;3.预防各类案件,杜绝重大以上内部案件;4.预防信息安全事故,杜绝重大以上信息安全事故;5.预防群体性不稳定事件,企业内部秩序良好、稳定。

第二章安全生产职责第一条安全生产工作小组成员及职责:(一)工作小组组长及成员:组长:成员:(二)安全生产主要职责:组长的安全生产职责:1、组长是的安全生产第一责任人,对的安全生产负全面领导责任;2、监督落实各项安全生产管理制度和安全生产操作规程;3、监督落实员工的安全生产教育培训;4、组织开展安全生产检查,落实安全隐患的整改;5、发生安全生产事故时,立即组织抢救人员、保护现场,立即报告省安全管理部门及分管安全工作领导。

各成员安全生产职责:1、组织制订的安全生产管理实施细则,监督落实安全员和员工的岗位安全生产职责;2、组织员工进行部门安全培训,明确操作规程,做到不违章指挥、不违章作业;3、建立的安全生产档案,审核的安全生产管理台帐;4、按规定落实劳保防护用品的发放和使用;5、经常开展安全生产检查:查不安全生产行为、查工具设备、查作业环境,纠正习惯性违章,消除隐患;6、发生安全生产事故时,协助事故调查,如实反映情况。

事故发生后,组织落实事故调查、解析事故发生的原因、明确事故责任,进行善后处理,向提交事故经过报告和整改意见。

(三)安全生产管理员职责1、落实各项安全生产管理、检查、监督等工作;2、负责安全生产规章制度的修改与制订;3、组织开展员工的安全生产培训及相关学习;4、协助安全生产事故进行调查、处理;5、协助业务部开展对员工(含派遣制员、业务外包工)的岗前安全生产教育培训;6、负责防火器材的采购和管理;7、负责车辆的驾驶、维修、清洁、保养工作;8、撰写年度安全生产管理工作总结。

termsandconditions条款及细则

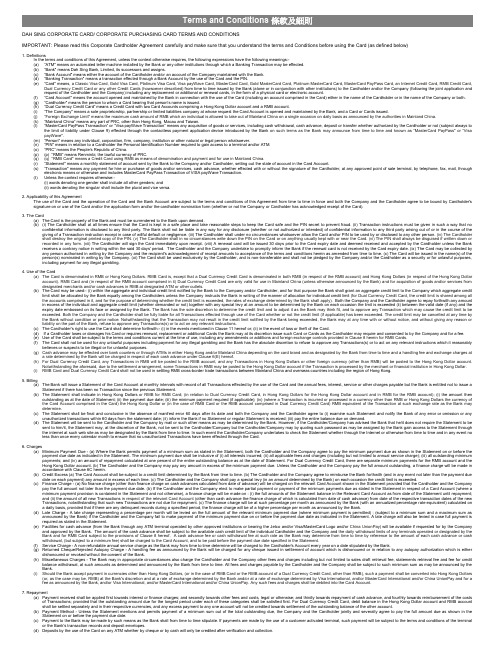

DAH SING CORPORATE CARD/ CORPORATE PURCHASING CARD TERMS AND CONDITIONSIMPORTANT: Please read this Corporate Cardholder Agreement carefully and make sure that you understand the terms and Conditions before using the Card (as defined below)1. DefinitionsIn the terms and conditions of this Agreement, unless the context otherwise requires, the following expressions have the following meanings:-(a) “ATM" means an automated teller machine installed by the Bank or any other institutions through which a Banking Transaction may be effected.(b) “Bank" means Dah Sing Bank, Limited, its successors and assigns.(c) “Bank Account" means either the account of the Cardholder and/or an account of the Company maintained with the Bank.(d) “Banking Transaction" means a transaction effected through a Bank Account by the use of the Card and the PIN.(e) “Card" means, a Classic Visa Card, Gold Visa Card, Platinum Visa Card, Visa payWave Card, MasterCard Card, Gold MasterCard Card, Platinum MasterCard Card, MasterCard PayPass Card, an Internet Credit Card, RMB Credit Card,Dual Currency Credit Card or any other Credit Cards (howsoever described) from time to time issued by the Bank (alone or in conjunction with other institutions) to the Cardholder and/or the Company (following the joint application and request of the Cardholder and the Company) including any replacement or additional or renewal cards, in the form of a physical card or electronic account.(f) “Card Account" means the account opened and maintained by the Bank in connection with the use of the Card (including an account comprised in the Card) either in the name of the Cardholder or in the name of the Company or both.(g) “Cardholder" means the person to whom a Card bearing that person's name is issued.(h) “Dual Currency Credit Card” means a Credit Card with two Card Accounts comprising a Hong Kong Dollar account and a RMB account.(i) “The Company" means a sole proprietorship, partnership or limited liabilities company at whose request the Card Account is opened and maintained by the Bank, and a Card or Cards issued.(j) “Foreign Exchange Limit" means the maximum cash amount of RMB which an individual is allowed to take out of Mainland China on a single occasion on daily basis as announced by the authorities in Mainland China.(k) “Mainland China” means any part of PRC, other than Hong Kong, Macau and Taiwan.(l) “MasterCard PayPass Transaction”or “Visa payWave Transaction” means any acquisition of goods or services, including cash withdrawal, cash advance, deposit or transfer whether authorized by the Cardholder or not (subject always to the limit of liability under Clause 9) effected through the contactless payment application device introduced by the Bank on such terms as the Bank may announce from time to time and known as “MasterCard PayPass" or “Visa payWave".(m) “Person" means any individual, corporation, firm, company, institution or other natural or legal person whatsoever.(n) “PIN" means in relation to a Cardholder the Personal Identification Number required to gain access to a terminal and/or ATM.(o) “PRC” means the People’s Republic of China.(p) (p) “RMB” means Renminbi, the lawful currency of PRC.(q) (q) “RMB Card" means a Credit Card using RMB as means of denomination and payment and for use in Mainland China.(r) “Statement" means a monthly statement of account sent by the Bank to the Company and/or Cardholder, setting out the state of account in the Card Account.(s) “Transaction" means any payment for hire or purchase of goods and/or services, cash advance, whether effected with or without the signature of the Cardholder, at any approved point of sale terminal, by telephone, fax, mail, through electronic means or otherwise and includes MasterCard PayPass Transaction of VISA payWave Transaction.(t) Unless the context requires otherwise:-(i) words denoting one gender shall include all other genders; and(ii) words denoting the singular shall include the plural and vice versa.2. Applicability of this AgreementThe use of the Card and the operation of the Card and the Bank Account are subject to the terms and conditions of this Agreement from time to time in force and both the Company and the Cardholder agree to be bound by Cardholder's signature on or use of the Card and/or the application form and/or the cardholder nomination form (whether or not the Company or Cardholder has acknowledged receipt of the Card).3. The Card(a) The Card is the property of the Bank and must be surrendered to the Bank upon demand.(b) (i) The Cardholder shall at all times ensure that the Card is kept in a safe place and take reasonable steps to keep the Card safe and the PIN secret to prevent fraud. (ii) Transaction instructions must be given in such a way that noconfidential information is disclosed to any third party. The Bank shall not be liable in any way for any disclosure (whether or not authorized or intended) of confidential information to any third party arising out of or in the course of the giving of a Transaction instruction except in case of willful default or negligence. (iii) The Cardholder shall under no circumstances whatsoever allow the Card and/or PIN to be used by or disclosed to any other person. (iv) The Cardholder shall destroy the original printed copy of the PIN. (v) The Cardholder shall in no circumstances write down the PIN on the Card or on anything usually kept with or near the Card. (vi) The PIN shall always be disguised if written down or recorded in any form. (vii) The Cardholder will sign the Card immediately upon receipt. (viii) A renewal card will be issued 30 days prior to the Card expiry date and deemed received and accepted by the Cardholder unless the Bank receives a contrary notice in writing within the said 30 days' period. The Cardholder and the Company undertake to promptly inform the Bank if the renewal card is not received by the Card expiry date. (ix) The Card may be collected by any person authorised in writing by the Company and the recipient's acknowledgment of receipt amounts to acceptance of the terms and conditions herein as amended from time to time. (x) The Card will be issued in the name(s) of the person(s) nominated in writing by the Company. (xi) The Card shall be used exclusively by the Cardholder, and is non-transferable and shall not be pledged by the Company and/or the Cardholder as a security or for unlawful purposes, including payment for any illegal gambling.4. Use of the Card(a) The Card is denominated in RMB or Hong Kong Dollars. RMB Card is, except that a Dual Currency Credit Card is denominated in both RMB (in respect of the RMB account) and Hong Kong Dollars (in respect of the Hong Kong Dollaraccount). RMB Card and (in respect of the RMB account comprised in it) Dual Currency Credit Card are only valid for use in Mainland China (unless otherwise announced by the Bank) and for acquisition of goods and/or services from designated merchants and/or cash advances in RMB at designated ATM or other outlets.(b) The Card may be used:- (i) within the aggregate and individual credit limit notified by the Bank to the Company and/or Cardholder, and for that purpose the Bank shall grant an aggregate credit limit to the Company which aggregate creditlimit shall be allocated by the Bank equally among the Cardholders unless the Company instructs the Bank in writing of the manner of allocation for individual credit limit (for Dual Currency Credit Card, the credit limit is shared among all the accounts comprised in it, and for the purpose of determining whether the credit limit is exceeded, the rates of exchange determined by the Bank shall apply). Both the Company and the Cardholder agree to repay forthwith any amount in excess of the individual and aggregate credit limit (whether demanded or not) together with any special levy at an amount to be determined by the Bank on each occasion the limit is exceeded (ii) between the valid date (if any) and the expiry date embossed on its face or assigned by the Bank. The Bank has the sole discretion to determine the credit limit and to adjust it as the Bank may think fit, and to approve any Transaction which may cause the credit limit to be exceeded. Both the Company and the Cardholder shall be fully liable for all Transactions effected through use of the Card whether or not the credit limit (if applicable) has been exceeded. The credit limit may be cancelled at any time by the Bank without condition or prior notice. Notwithstanding that the Transaction may not result in the credit limit notified by the Bank being exceeded, the Bank may at any time with or without notice, and without giving any reason or liability on the part of the Bank, refuse to approve any Transactions(s) or to act on any relevant instructions.(c) The Cardholder's right to use the Card shall determine forthwith:- (i) in the events mentioned in Clause 11 hereof or; (ii) in the event of loss or theft of the Card.(d) If a Cardholder loses or damages his Card or requires renewal, replacement or additional Cards the Bank may at its discretion issue such Card or Cards as the Cardholder may require and consented to by the Company and for a fee.(e) Use of the Card shall be subject to the terms and conditions current at the time of use, including any amendments or additions and foreign exchange controls provided in Clause 8 herein for RMB Cards.(f) The Card shall not be used for any unlawful purposes including payment for any illegal gambling and the Bank has the absolute discretion to refuse to approve any Transactions(s) or to act on any relevant instructions which it reasonablybelieves or suspects to be illegal or for unlawful purposes.(g) Cash advance may be effected over bank counters or through ATMs in either Hong Kong and/or Mainland China depending on the card brand and as designated by the Bank from time to time and a handling fee and exchange charges ata rate determined by the Bank will be charged in respect of each cash advance under Clause 6(E) hereof.(h) For Dual Currency Credit Card, any Transactions in RMB will be posted to the RMB account, and any Transactions in Hong Kong Dollars or other foreign currency (other than RMB) will be posted to the Hong Kong Dollar account.Notwithstanding the aforesaid, due to the settlement arrangement, some Transactions in RMB may be posted to the Hong Kong Dollar account if the Transaction is processed by the merchant or financial institution in Hong Kong Dollar.(i) RMB Card and Dual Currency Credit Card shall not be used in settling RMB cross-border trade transactions between Mainland China and overseas countries including the region of Hong Kong.5. Billing(a) The Bank will issue a Statement of the Card Account at monthly intervals with record of all Transactions effected by the use of the Card and the annual fees, interest, service or other charges payable but the Bank is entitled not to issue aStatement if there has been no Transaction since the previous Statement.(b) The Statement shall indicate in Hong Kong Dollars or RMB for RMB Card; (in relation to Dual Currency Credit Card, in Hong Kong Dollars for the Hong Kong Dollar account and in RMB for the RMB account);(i) the amount thenoutstanding as at the date of Statement; (ii) the payment due date; (iii) the minimum payment required (if applicable); (iv) (where a Transaction is incurred or processed in a currency other than RMB or Hong Kong Dollars the currency of the Card Account comprised in the Card) the Hong Kong Dollar or (in the case of RMB Card or the RMB account comprised in Dual Currency Credit Card) RMB equivalent of the Transaction at such exchange rate as the Bank may determine.(c) The Statement shall be final and conclusive in the absence of manifest error 60 days after its date and both the Company and the Cardholder agree to (i) examine such Statement and notify the Bank of any error or omission or anyunauthorized transactions within 60 days from the statement date; (ii) inform the Bank if no Statement or regular Statement is received; (iii) pay the entire balance due on demand.(d) The Statement will be sent to the Cardholder and the Company by mail or such other means as may be determined by the Bank. However, if the Cardholder/Company has advised the Bank that he/it does not require the Statement to besent to him/it, the Statement may, at the discretion of the Bank, not be sent to the Cardholder/Company but the Cardholder/Company may by quoting such password as may be assigned by the Bank gain access to the Statement through the internet at such web site as may be designated by the Bank from time to time. In such event the Cardholder/Company undertakes to check the Statement whether through the Internet or otherwise from time to time and in any event no less than once every calendar month to ensure that no unauthorized Transactions have been effected through the Card.6. Charges(a) Minimum Payment Due - (a) Where the Bank permits payment of a minimum sum as stated in the Statement, both the Cardholder and the Company agree to pay the minimum payment due as shown in the Statement on or before thepayment due date as indicated in the Statement. The minimum payment due shall be inclusive of (i) all interests incurred; (ii) all applicable fees and charges (including but not limited to annual service charge); (iii) all outstanding minimum payments; and (iv) an amount of repayment calculated at one percent of the entire outstanding balance as at the date of Statement. For Dual Currency Credit Card, there are separate minimum payments for the RMB account and the Hong Kong Dollar account. (b) The Cardholder and the Company may pay any amount in excess of the minimum payment due. Unless the Cardholder and the Company pay the full amount outstanding, a finance charge will be made in accordance with Clause 6C herein.(b) Credit Excess (a) The Card Account shall be subject to a credit limit determined by the Bank from time to time. (b) The Cardholder and the Company agree to reimburse the Bank forthwith (and in any event not later than the payment duedate on each payment) any amount in excess of each time. (c) The Cardholder and the Company shall pay a special levy (in an amount determined by the Bank) on each occasion the credit limit is exceeded.(c) Finance Charge - (a) No finance charge (other than finance charge on cash advances calculated from date of advance) will be charged on the relevant Card Account shown in the Statement provided that the Cardholder and the Companypay the full amount not later than the payment due date. (b) If the Cardholder and the Company elect to make partial payment or payment of the minimum payments due as stated in the Statement in respect of a Card Account (where a minimum payment provision is contained in the Statement and not otherwise), a finance charge will be made on : (i) the full amounts of the Statement balance in the Relevant Card Account as from date of the Statement until repayment;and (ii) the amount of all new Transactions in respect of the relevant Card Account (other than cash advance the finance charge of which is calculated from date of cash advance) from date of the respective transaction dates of the new Transactions, notwithstanding that such new Transactions are not due for repayment. (c) The finance charge will be at such percentage per month as announced by the Bank (with an annualized percentage rate equivalent) calculated ona daily basis, provided that if there are any delinquent records during a specified period, the finance charge will be of a higher percentage per month as announced by the Bank.(d) Late Charge - A late charge representing a percentage per month will be levied on the full amount of the relevant minimum payment due (where minimum payment is permitted) ; (subject to a minimum sum and a maximum sum asannounced by the Bank) if the Cardholder and the Company fail to make payment of the minimum payment due on or before the payment due date as indicated in the Statement. A late charge will also be levied in case full payment is required as stated in the Statement.(e) Facilities for cash advance (from the Bank through any ATM terminal operated by other approved institutions or bearing the Jetco and/or Visa/MasterCard Logo and/or China UnionPay) will be available if requested for by the Companyand approved by the Bank. The amount of the cash advance shall be subject to the available cash credit limit of the individual Cardholder and the Company and the daily withdrawal limits of any terminals operated or designated by the Bank and for RMB Card subject to the provisions of Clause 8 hereof. A cash advance fee or cash withdrawal fee at such rate as the Bank may determine from time to time by reference to the amount of each cash advance or cash withdrawal, (but subject to a minimum fee) shall be charged to the Card Account, and to be paid before the payment due date specified in the Statement.(f) Service Charge - A non-refundable annual service charge as the Bank may from time to time determine will be charged to the Cardholder's Account every year on a date stipulated by the Bank.(g) Returned Cheque/Rejected Autopay Charge - A handling fee as announced by the Bank will be charged for any cheque issued in settlement of account which is dishonoured or in relation to any autopay authorization which is eitherdishonoured or revoked without the consent of the Bank.(h) Miscellaneous Charges - The Bank may in appropriate circumstances also charge the Cardholder and the Company other fees and charges including but not limited to sales draft retrieval fee, statements retrieval fee and fee for creditbalance withdrawal, at such amounts as determined and announced by the Bank from time to time. All fees and charges payable by the Cardholder and the Company shall be subject to such minimum sum as may be announced by the Bank.(i) Should the Bank accept payment in currencies other than Hong Kong Dollars, (or in the case of RMB Card or the RMB account of a Dual Currency Credit Card, other than RMB), such a payment shall be converted into Hong Kong Dollars(or, as the case may be, RMB) at the Bank's discretion and at a rate of exchange determined by the Bank and/or at a rate of exchange determined by Visa International, and/or MasterCard International and/or China UnionPay and for a fee as announced by the Bank, and/or Visa International, and/or MasterCard International and/or China UnionPay. Any such fees and charges shall be debited into the Card Account.7. Repayment(a) Payment received shall be applied first towards interest or finance charges; and secondly towards other fees and costs, legal or otherwise; and thirdly towards repayment of cash advance, and fourthly towards reimbursement of the costsof Transactions; provided that the outstanding amount due for the longest period under each of these categories shall be satisfied first. For Dual Currency Credit Card, debit balance in the Hong Kong Dollar account and RMB account shall be settled separately and in their respective currencies, and any excess payment to any one account will not be credited towards settlement of the outstanding balance of the other account.(b) Payment Method - Unless the Statement mentions and permits payment of a minimum sum out of the total outstanding due, the Company and the Cardholder jointly and severally agree to pay the full amount due as shown in theStatement on or before the payment due date.(c) Payment to the Bank may be made by such means as the Bank shall from time to time stipulate. If payments are made by the use of a customer activated terminal, such payment will be subject to the terms and conditions of the terminalor the Bank's transaction records and deposit envelopes.(d) Deposits by the use of the Card on any ATM whether by cheque or by cash will only be credited after verification and collection.(e) If the Bank shall have incurred any legal fees for the recovery of any sums, costs and expenses payable hereunder by the Cardholder and the Company or as a result of the enforcement of any terms or conditions hereof, the Cardholderand the Company shall fully reimburse the Bank of all such legal fees and other fees or expenses incurred in that connection without any deduction whatsoever (in reasonable amounts and as reasonably incurred and detailed breakdown of such legal fees and expenses shall be provided by the Bank at the request of the Cardholder and the Company).(f) The Cardholder shall directly settle disputes between merchants and the Cardholder for goods and services purchased and the Bank shall not be responsible for goods and services supplied by merchants or for refusal or failure of anymerchant to accept or honour the Card or provide the goods or services purchased. The Cardholder and the Company shall be responsible for the payment of the amount of any transaction notwithstanding the refusal or failure by the merchant to supply the goods or services purchased.(g) Where payment is made by means of a bank draft or any other similar instrument, only such amount net of collection, administrative or handling fees for processing such bank draft or instrument will be credited into the Card Account.(h) Credits to the Card Account for refunds made by merchants will be made only when the Bank receives a properly issued credit voucher duly signed by the merchants making the refund.(i) Payment shall only be deemed to have been made when actually received by the Bank and without any set off, claim, condition, restriction, deduction or withholding whatsoever.(j) For RMB Cards, payments made to the Bank shall be in RMB at designated locations in Mainland China (or, at the option of the Cardholder/Company, in Hong Kong dollars at designated locations in Hong Kong) at an exchange rate determined by the Bank. Should the Bank accept payment in currencies other than RMB or Hong Kong Dollars the currency of the relevant Card Account, such a payment shall be converted into RMB or Hong Kong Dollars the currency of the relevant Card Account at the Bank's discretion and at a rate of exchange determined by the Bank and for a fee as announced by the Bank. Any conversion fees shall be debited into the Card Account.8. (For RMB Cards and the RMB account of Dual Currency Credit Cards only) Credit Balance and Cash Advance(A) (a) If there is any credit balance in the Card Account ("Credit Balance") after settlement of all Transaction fee and charges, the Cardholder may collect the entire Credit Balance (or any part thereof) in RMB at designated locations inMainland China. (b) The Cardholder may also withdraw the entire Credit Balance in Hong Kong and in Hong Kong dollars on termination of the Card Account or where the Credit Balance does not exceed the Foreign Exchange Limit. (c) Where the Foreign Exchange Limit is exceeded, the Cardholder may only withdraw Hong Kong dollars in Hong Kong up to the Foreign Exchange Limit with the remaining Credit Balance to be withdrawn in Mainland China and in RMB. (d) Notwithstanding anything aforesaid, the Bank has the sole discretion to refund the Credit Balance either in Hong Kong dollars or RMB and at such locations as the Bank may determine and the Bank is entitled to charge a handling fee anda currency conversion fee (where applicable) at a rate determined by the Bank for each such refund.(B) Cash Advance can be made in Mainland China subject to the available Credit Limit and the Foreign Exchange Limit.(C) The Cardholder and the Company shall observe all laws and regulations from time to time in force in Mainland China in relation to the use of the Cards in Mainland China.9. Loss and Theft(a) The Cardholder must report to the Bank and to the Police in writing as soon as reasonably practicable after he finds any loss or theft of the Card or disclosure of the PIN to any unauthorised person. In any event, the Cardholder and theCompany shall be jointly and severally responsible for all Transactions, costs and damages effected or caused by the use of the Card whether or not authorised by the Cardholder or the Company(b) If the Cardholder reports the loss or theft or unauthorized disclosure as soon as reasonably practicable after he finds any loss or theft of the Card or unauthorized disclosure of the PIN and had acted diligently and in good faith (includingtaking reasonable steps to safeguard the safety of the Card and the secrecy of the PIN and keep the PIN separately from the Card) the maximum liability of the Cardholder shall not exceed HK$500.00.(c) The limit of liability is confined to loss specifically related to the Card Account and in circumstances described above and does not cover cash advance, or cases involving fraud or negligence or when the Cardholder has failed to informthe Bank as soon as reasonably practicable after having found that the Card has been lost or stolen or that there has been an unauthorized disclosure of the PIN when the Cardholder is liable for all losses.10. Amendments and Additions(a) The Bank hereby reserves the right to amend the terms and conditions hereof including but not limited to the rates of interest charges or amount of fees and method of payment or to provide additional terms at any time and from time totime to take effect on the date stipulated by the Bank (where any such amendments involving an increase of annualized percentage rate or a significant change in the terms and conditions of this Agreement, the Bank shall give notice to the Cardholder and the Company, which shall be not less than 60 days before the change takes effect). For other amendments relating to an increase in the Bank's fee or charges and/or affecting the liabilities and obligations of the Cardholder or the Company, the Bank shall give at least 30 days' prior notice to the Cardholder and the Company unless it is not practicable for the Bank to do so. In such other cases, reasonable notice shall be given.(b) If the Cardholder and the Company do not accept such amendments or additions, the Cardholder shall in conjunction with the Company before the day when the amendment or addition is to take effect give written notice to the Bankterminating the Card Account and the use of the Card and returning the Card and the Bank shall repay the annual or other periodic fee of the Card on a pro-rata basis, if the fee can be separately distinguished and unless the amount involved is minimal.(c) If the Cardholder uses or retains the Card after the relevant date mentioned in Clause 10(b) hereof, the Cardholder and the Company shall be deemed to have accepted and agreed to such amendments and additions without reservation.(d) The Bank may give notice of amendment or addition in a Statement, which shall be served by ordinary post to the address last notified to the Bank by the Cardholder and the Company and deemed served on the day after posting, or bydisplay at its branches, press advertisement or otherwise, stipulating a date on which such amendment or addition shall take effect. Service on either the Cardholder or the Company shall be deemed service on both.11. Breach and Termination(A) BreachIn event of any breach of the terms of this Agreement the Cardholder and the Company shall jointly and severally pay to the Bank on demand (i) all monies due as at date of demand (or subsequent demands); (ii) all losses, damages, costs and expenses (including legal fee as stated above and collector fee) arising out of the use of the Card by the Cardholder.(B) Termination(a) Use of the Card and the credit limit granted by the Bank in relation to the use of the Card shall be subject to termination or cancellation at any time unconditionally by the Bank without giving any prior notice or reason therefor .(b) The Bank reserves the right to suspend, withdraw, cancel or terminate the use of the Card and any services thereby offered or disapprove any Transaction (including Banking Transaction) without giving any prior notice or reason andthe Bank shall not be liable for any loss or damage of whatsoever nature which the Cardholder or the Company may suffer directly or indirectly as a result of such suspension, withdrawal, cancellation, termination or disapproval unless caused by the Bank’s negligence or willful default and whereupon the Cardholder and the Company shall surrender the Ca rd unconditionally and immediately on demand.(c) The Cardholder and the Company may at any time terminate the use of the Card. Any notice by a Cardholder or the Company shall be in writing and returning the Card (and notice by either the Company or the Cardholder issufficient) and both the Cardholder and the Company shall be jointly and severally liable for all Transactions effected through the use of the Card prior to the Bank's receipt of the surrendered Card (duly defaced by cutting off the front top right-hand corner ensuring that both the hologram and magnetic tape have been cut).(d) Use of Dual Currency Credit Card shall be terminated upon termination of either the Hong Kong Dollar account or RMB account comprised in it.(e) Upon termination or cancellation for whatever reason, the provisions of Clause 11A (i) and (ii) shall apply.12. Exclusion of Liability(A) The Bank shall be under no liability whatsoever to the Cardholder or the Company in respect of any loss or damage arising directly or indirectly out of(a) any defect in any goods or services supplied;(b) the refusal of any person or terminal to honour or accept a Card;(c) the malfunction of any computer terminal or contactless payment application device;(d) the giving of a Transaction instruction other than by a Cardholder;(e) any statement made by any person requesting the return of the Card or any act performed by any person in conjunction therewith;(f) the exercise by the Bank of its right to demand and procure surrender of the Card prior to the expiry date embossed on its face, whether such demand and surrender are made and/or procured by the Bank or by any other person orcomputer terminal;(g) the exercise by the Bank of its right to terminate any Card or the Card Account pursuant to Clause 11 herein;(h) any injury to the credit character and reputation of the Cardholder or the Company in and about the repossession of the Card, any request for its return or the refusal of any person to honour or accept the Card.(B) N othing in 12A shall exempt the Bank from liabilities where there is wilful default or negligence or where such exclusion is prohibited by the laws of Hong Kong.13. Disclosure and Use of InformationThe Bank may from time to time send to the Cardholder &/or the Company its Notice to Custome rs relating to Customers’ Data (the “Notice”). The current version of the Notice may also be made available on the website of the Bank from time to time. The Bank may use the data of the Cardholder &/or the Company for such purposes and disclose the same to such classes of persons as set out in such Notice from time to time.14. Expenses of EnforcementThe Cardholder and the Company acknowledge that the Bank may appoint agents for the collection of any money due by the Cardholder and the Company and without prejudice to the indemnity in Clause 7(e) herein, the Cardholder and the Company agree to indemnify the Bank on demand all costs, expenses and charges in such collection (in reasonable amounts and were reasonably incurred and detailed breakdown of such costs, expenses and charges shall be provided by the Bank at the request of the Cardholder and the Company).15. ATM Facilities (If applicable)Except to the extent that these terms and conditions require otherwise the Bank Accounts shall be governed by the respective prevailing terms and conditions of the Bank Accounts and the terms and conditions governing the Bank Accounts operated through ATM or any other devices or terminals for effecting payment or deposit or transfer of funds by electronic means from time to time announced by the Bank, including any banking or foreign exchange regulations and terms and conditions in Mainland China.16. Use of Dah Sing Credit Card 24-Hour Phone Banking Service System (“the System") (If available)(a) The Cardholder shall strictly follow such operating instructions for the use of the System as from time to time issued by the Bank;(b) The Bank is authorized to act on any Instructions which the Bank in good faith believes emanate from the Cardholder, and in no circumstances shall the Bank be liable to the Cardholder or the Company for acting in good faith andwithout negligence upon Instructions which turn out to have emanated from fraudulent or unauthorized persons and the Bank shall not be under any duty to verify the identity of the persons giving Instructions purportedly in the name of the Cardholder.(c) Any information given by the System is for reference only. The Bank shall not be liable or responsible for the sufficiency or accuracy of the information so given and the Bank reserves the right to update and vary such information fromtime to time and at any time.(d) In connection with the use of the System, the Bank makes no representations or warranties of any kind, including but not limited to any warranties of fitness for a particular purpose or merchantability, nor are any such warranties to beimplied with respect to the information given or services furnished by or in connection with the use of the System. In the absence of negligence, the Bank shall not under any circumstances be liable or responsible in contract, tort or otherwise for any direct, indirect or consequential loss or damage (whether foreseeable or not) of whatever nature or extent arising out of or in connection with any act, omission, error (except in case of negligence or wilful default) of the Bank in connection with the use by the Cardholder of the System including, but not limited to, the Bank acting upon any fraudulent and/or unauthorized Instructions, any failure, delay or default on the part of the Bank due wholly or in part to defects, delays, malfunction, interruptions, failures or lack of security in any communication line, telephone, computer system or other equipment used for or in connection with the operation of the System or any cause beyond the Bank's control.(e) The Cardholder and the Company shall be responsible for all consequence of any Instructions and/or his use of the System and shall keep the Bank indemnified at all times against all claims, demands, actions, proceedings, damages,losses, costs and expenses (in reasonable amounts and were reasonably incurred and detailed breakdown of such costs and expenses shall be provided by the Bank at the request of the Cardholder and the Company) which may be brought against or incurred by the Bank and which arise directly or indirectly out of or in connection with his use of the System unless due to the wilful default or negligence of the Bank such indemnity shall continue notwithstanding the termination of the Dah Sing Credit Card 24-Hour Phone Banking Service.(f) The Bank may (but shall not be obliged to) record and the Cardholder and the Company hereby consent to the Bank recording Instructions by writing and/or tape recording and/or any other method and such record of any Instructionsshall be conclusive and binding on the Cardholder and the Company.(g) Nothing herein shall operate so as to exclude or restrict any liability, the exclusion or restriction of which is prohibited by the laws of Hong Kong.(h) For the purposes of the foregoing, "Instructions" means any instructions given by the Cardholder or purported to be given by the Cardholder for the use or in connection with the use of the System.(i) The Bank may at any time terminate the Dah Sing Credit Card 24-Hour Phone Banking Service without notice, without assigning any reason and without incurring any liability to the Cardholder and/or the Company.(j) No warranty is given by the Bank that any or all of the service mentioned herein would be available and the Bank may announce from time to time such service or additional services available as the Bank may deem appropriate.17. Cancellation and Set Off Right(a) The Bank may (where the circumstances are considered reasonable) at any time suspend, withdraw, cancel or terminate the Card and/or any related services offered and/or disapprove any proposed Transaction and may not give anyreason. Although prior notice of any such step may be given, this will not always be possible. The Bank shall not be liable for any loss or damage of whatever nature suffered or incurred by the Company and/or the Cardholder whether directly or indirectly as a result of suc h suspension, withdrawal, cancellation, determination or disapproval unless caused by the Bank’s negligence or wilful default. The Company and Cardholder shall unconditionally and immediately upon demand return the Card to the Bank.(b) In addition to any right of set-off or other general lien or similar right to which the Bank may be entitled in law, the Company and the Cardholder hereby agree that the Bank shall have the right and is authorized to the fullest extentpermitted by law, at any time and from time to time hereafter and, without prior notice to the Company and/or the Cardholder, to set-off and/or initiate transfers of and apply all or any of the credit balances (whether or not matured or due and payable or subject to any notice or not, and including property in the possession or control of the Bank) of the accounts (whether or not in Hong Kong or foreign currency) maintained with the Bank or with any Bank Group Company, whether singly held by the Company and/or the Cardholder or jointly with another person, in or towards discharging the Company’s and/or the Cardholder’s liabilities to the Bank. Insofar as any of the sums may only be due to the Bank contingently or in future, the liability of the Bank or any Bank Group Company to the Company and the Cardholder to make payment of any sums standing to the credit of any such accounts will to the extent necessary to cover such sums be suspended until the happening of the contingency or future event. The Bank’s right under this clause will most likel y be exercised by the Bank if the Company and/or the Cardholder fails to repay any outstanding indebtedness due to the Bank. Where such combination, set-off or transfer require the conversion of one currency into another, such conversion shall be calculated at the then prevailing spot rate of exchange of the Bank as absolutely determined by the Bank (the details of which will be provided to the Company and/or the Cardholder upon request). For the purpose of this clause, the expression "Bank Group Company" means holding company of the Bank, any subsidiary of the Bank or of its holding company and all associated or related companies.18. Law and Language(a) This Agreement shall be construed by Hong Kong Laws and the parties agree to submit to the non-exclusive jurisdiction of the Hong Kong Courts, and the terms herein may be enforced in any place where the Cardholder and theCompany or his and its assets may be found.(b) If at any time, any of these terms and conditions is or becomes illegal, invalid or unenforceable in any respect, the legality, validity and enforceability of the remaining terms and conditions shall not be affected thereby.(c) Nothing in this Agreement shall operate so as to exclude or restrict any liability, the exclusion or restriction of which is prohibited by the laws of Hong Kong.(d) This Agreement is written in both English and Chinese and in the event of conflict, the English version shall prevail.。

工程款支付管理办法实施细则

工程款支付管理办法实施细则一、一般条款1、本细则是《工程款支付管理办法》(以下简称“《办法》”)实施的细则。

2、本细则所称工程款支付是指针对工程项目所支付的费用,包括工程结算款、违约金、支付定金等。

3、本细则所称工程项目是指与工程项目签订的相关合同项目,包括设计、施工、政府采购、建设性租赁、公用事业建设等。

二、资金支付1、在工程实施期间,当事人应根据工程合同或签定的额外约定,依法缴付工程工程结算款。

2、工程结算款的支付方式和付款期限应严格遵循工程合同的约定,不得违反合同双方的约定,不得以任何理由拖延付款。

3、当事人若无正当理由拖延付款,将会支付违约金,违约金的收取标准以及支付方式由双方当事人的约定确定。

4、当双方当事人发生纠纷时,应根据双方协商或裁判所作出的书面确定,确定工程结算款的支付余额,当事人应按此确定余额支付工程结算款及应付款项。

5、对于公用事业工程,可以依据有关规定向相关负责部门申请资金,资金发放完毕后,当事人应及时支付工程结算款。

三、政府采购1、政府采购项目的支付余额应按照政府采购法及有关规定根据政府采购合同进行确定,不得超过政府预算的批准额度。

2、政府采购项目的最终支付余额,应由当事人按有关规定填报并根据财政部门审核为准,财政部门有权拒绝不符合政府采购政策的支出等信息。

3、政府采购工程,采购方有权要求承接方按照采购合同中约定的期限,缴付预付款、定金及按照施工进度等要求支付定期付款。

四、税务筹划1、购置工程工程施工承包及技术顾问等机构、个人应按照当地有关税务政策及规定缴纳各项税费。

2、工程款支付经双方当事人协商后,应按照有关税务规定开具发票,由当事人完成税费筹划。

3、当地财政主管机关应根据实际情况,对入库单位、运输单位等投入工程的单位及人员,依据客观情况合理确定认证免税的余额及税收减免办法。

五、账务处理1、当事人应依据《办法》规定,建立全面健全的工程款支付报账制度,对账户内的收付款及其他财务科目进行记录、统计、审计和及时报告,保障财务事务的合理有效性。

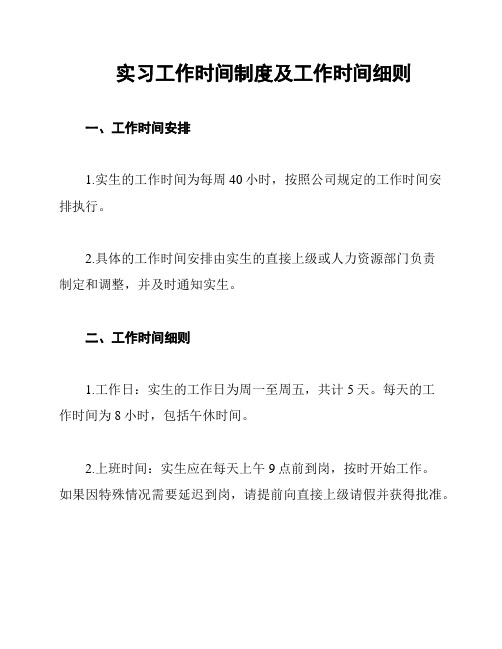

实习工作时间制度及工作时间细则

实习工作时间制度及工作时间细则一、工作时间安排1.实生的工作时间为每周40小时,按照公司规定的工作时间安排执行。

2.具体的工作时间安排由实生的直接上级或人力资源部门负责制定和调整,并及时通知实生。

二、工作时间细则1.工作日:实生的工作日为周一至周五,共计5天。

每天的工作时间为8小时,包括午休时间。

2.上班时间:实生应在每天上午9点前到岗,按时开始工作。

如果因特殊情况需要延迟到岗,请提前向直接上级请假并获得批准。

3.下班时间:实生的下班时间为每天下午6点,或根据工作需要调整的时间。

如果实生需要提前离岗,请提前向直接上级请假并获得批准。

4.加班:实生的加班情况应根据工作需要和实生本人意愿进行安排。

如实生需要加班,应提前向直接上级请假并获得批准。

公司将根据加班情况支付相应的加班费或安排补休时间。

5.周末和法定节假日:实生一般不需要在周末和法定节假日工作,如因工作需要需要实生在这些时间工作,将提前通知实生,并根据相关法律法规安排加班费或补休。

6.其他时间条款:根据实生的工作需要和特殊情况,公司有权对工作时间进行调整和变动,并提前通知实生。

三、请假和迟到早退规定1.请假规定:实生请假需提前至少一天向直接上级请假,并注明请假原因和请假日期。

请假时间在一天以内的,实生应提前尽量事先请假,以便获得批准。

2.迟到早退规定:实生应按时到岗,如因特殊原因需要迟到或早退,应提前向直接上级请假并获得批准。

迟到或早退时间超过30分钟的,将计入请假时间。

四、其他规定1.实生在工作期间应严格遵守公司的保密制度和其他相关规定,不得泄露公司的商业机密和其他保密信息。

2.具体的工作时间制度和细则可能根据公司政策的调整而变化,实生应及时了解并遵守最新的制度和规定。

以上为实习工作时间制度及工作时间细则,希望各位实习生遵守并按照规定执行。

如有任何问题或需要进一步说明,请咨询人力资源部门。

2024年门窗采购协议细则版B版

20XX 专业合同封面COUNTRACT COVER甲方:XXX乙方:XXX2024年门窗采购协议细则版B版本合同目录一览1. 定义与术语1.1 合同双方1.2 门窗产品1.3 数量与质量1.4 交货时间与地点1.5 付款条件1.6 售后服务1.7 违约责任1.8 争议解决1.9 合同的生效与终止1.10 一般条款1.11 附件第一部分:合同如下:1. 定义与术语1.1 合同双方1.2 门窗产品1.2.1 产品范围:本合同所述门窗产品包括但不限于铝合金门窗、塑钢门窗、木纹门窗等。

1.2.2 产品标准:所有产品应符合国家及行业相关标准,如GB/T 84782020《铝合金建筑型材》等。

1.2.3 产品质量:产品应保证无缺陷,满足设计要求,并经双方验收合格。

1.3 数量与质量1.3.1 数量:详见附件一《产品数量及规格》。

1.3.2 质量:供应商应保证交付的产品符合约定的质量和标准。

1.4 交货时间与地点1.4.1 交货时间:供应商应按照附件一《交货时间表》规定的日期交付产品。

1.4.2 交货地点:产品交付至采购商指定的地点,具体地址见附件一。

1.5 付款条件1.5.1 付款方式:采购商在验货合格后,按照附件二《付款计划》支付款项。

1.5.2 付款条件:供应商提供符合规定的发票,采购商在确认产品质量无误后支付约定的款项。

1.6 售后服务1.6.1 质保期:产品质保期为 [质保期限],自产品交付之日起计算。

1.6.2 售后服务内容:供应商应提供产品安装、维修、更换等服务。

1.6.3 售后服务响应时间:供应商在接到售后服务请求后 [响应时间] 内响应,并在 [服务时间] 内完成服务。

1.7 违约责任1.7.1 供应商违约:供应商未能按约定时间、数量、质量交付产品,应支付违约金,具体金额见附件三《违约金计算方式》。

1.7.2 采购商违约:采购商未能按约定时间支付款项,应支付违约金,具体金额见附件三《违约金计算方式》。

“制度”、“办法”、“细则”、“规定”、“条例”的区别

“制度”、“办法”、“细则”、“规定”、“条例”的区别“制度”、“办法”、“细则”、“规定”、“条例”等都是规范性文件,但也有区别:制度的含义较为广泛,具体应用的时候可大可小。

经济制度、政治制度就是大的制度,而具体到一个企业的制度,往往是指大家要共同遵守的章程之类的。

办法是对有关法令、条例、规章提出具体可行的实施措施,是对国家或某一地区政治、经济和社会发展的有关工作、有关事项的具体办理、实施提出切实可行的措施。

办法重在可操作性。

它的制发者是国务院各部委、各级人民政府及所属机构。

规定是为实施贯彻有关法律、法令和条例,根据其规定和授权,对有关工作或事项作出局部的具体的规定。

是法律、政策、方针的具体化形式,是处理问题的法则。

主要用于明确提出对国家或某一地区的政治经济和社会发展的某一方面或某些重大事故的管理或限制。

规定重在强制约束性。

细则是对某一法律、法规全部或部分内容的具体化。

条例是具有法律性质的文件,是对有关法律、法令作辅助性、阐释性的说明和规定;是对国家或某一地区政治、经济、科技等领域的某些重大事项的管理和处置作出比较全面、系统的规定;是对某机关、组织的机构设置、组织办法、人员配备、任务职权、工作原则、工作秩序和法律责任作出规定或对某类专门人员的任务、职责、义务权利、奖惩作出系统的规定。

它的制发者是国家最高权力机关、最高行政机关(国务院各部委和地方人民政府制度的规章不得称“条例”。

一、制度(一)什么是“制度”制度也称规章制度,是国家机关、社会团体、企事业单位,为了维护正常的工作、劳动、学习、生活的秩序,保证国家各项政策的顺利执行和各项工作的正常开展,依照法律、法令、政策而制订的具有法规性或指导性与约束力的应用文,是各种行政法规、章程、制度、公约的总称。

(二)“制度”的使用范围规章制度的使用范围极其广泛,大至国家机关、社会团体、各行业、各系统,小至单位、部门、班组。

它是国家法律、法令、政策的具体化,是人们行动的准则和依据。

规章制度通常条款内容有

规章制度通常条款内容有第二条本公司所有员工必须严格遵守公司的各项规章制度,遵守国家法律法规,维护公司的声誉和利益。

第三条公司的各项管理规定必须严格执行,任何违反公司规定的行为都将受到严惩。

第四条员工在工作时必须认真负责,遵守工作纪律,不得迟到早退,不得擅自离岗,不得私自接待顾客或他人。

第五条员工在工作中必须遵守公司的保密规定,不得泄露公司的商业秘密,不得向外界透露公司的经营情况。

第六条公司禁止员工在工作时间内擅自打游戏、上网购物等影响工作效率的行为,必须专心工作,提高工作效率。

第七条公司禁止员工私自借款,挪用公司资金或财物,一经发现将严肃处理。

第八条公司鼓励员工积极学习、提高自身技能,但禁止利用公司资源参与与公司无关的培训、考试等活动。

第九条公司保障员工的合法权益,不得随意解雇员工,必须按照国家相关法律法规进行解雇程序。

第十条员工在公司内务必保持良好的职业操守,不得利用职权谋取私利,不得私自调换、损毁公司物品。

第十一条公司严格执行工资发放制度,不得拖欠员工工资,一经发现将严肃处理。

第十二条公司鼓励员工提出合理化建议,促进企业发展,但禁止对公司领导进行人身攻击或影响公司正常运营。

第十三条公司要求员工要遵守公司的各项规定,服从上级领导的安排,保持团结、合作,共同努力为公司的发展贡献力量。

第十四条公司对于依法、依规标准工作认真负责、合理提出建议并为公司做出贡献的员工,将给予相应的奖励和表扬。

第十五条本规章制度自发布之日起正式生效,公司保留修改和解释的权利。

任何不服从公司规定的员工,公司有权进行处理。

以上是本公司规章制度通常条款,希望每位员工严格遵守,共同维护公司的利益和声誉。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

一般條款及細則:

1.除以下另有指明外,各項推廣(「推廣」)由2016年11月15日至2017年1月2日止(「推廣

期」)。

2.此推廣只適用於星展銀行(香港)有限公司 DBS Bank (Hong Kong) Limited (「本行」)的客戶

(「客戶」)。

3.上述保障計劃由三井住友海上火災保險(香港)有限公司(「三井住友保險」) 承保。

三井住友

保險保留最終批核投保申請的權利。

有關上述計劃的承保範圍及其他詳情,請參閱產品小冊子及保單條款。

4.所有折扣、獎賞均不可轉換或退款。

本行有權以其他獎賞代替而無須事先通知。

5.本行及三井住友保險並非電子兌換券(請參閱第18(c)條),咖啡券(請參閱第19條),天際100電子

門票兌換券(請參閱第20(a)條),折扣優惠碼(請參閱第22(a)條)或汽油禮券(請參閱第21(a)條)(統稱「禮券」)的供應商。

禮券須按其供應商指定的條款及細則使用及兌換。

如對禮券或相關的產品或服務有任何查詢或投訴,請直接與有關供應商聯絡,本行及三井住友保險對此不承擔任何責任/法律責任。

6.於本行或三井住友保險發出禮券時,客戶必須沒有取消相關投保申請及/或保單。

7.咖啡券將於成功投保單次旅遊保障計劃的月份結束後6星期內,電郵至合資格的星展豐盛理財及

星展豐盛理財私人客戶在網上投保時登記的電郵地址。

8.客戶投保旅遊保障計劃時如已獲享星展豐盛理財及星展豐盛理財私人客戶尊享優惠(請參閱第19

條),不可同時獲得旅遊保障獎賞。

9.本推廣不可與其他優惠同時使用。

10.客戶在本推廣中必須不涉及任何濫用/違規,方可參加本推廣,否則本行會在客戶的戶口內扣除

獎賞的等值金額而不事先通知及/或採取行動追討任何未償付金額。

11.本行有權修改本條款及細則/或更改/終止本推廣而無須給予通知。

本行的決定為最終定論。

12.中英文版本如有任何歧異,概以英文版本為準。

13.本行為三井住友保險授權的保險代理商。

14.三井住友保險可全權決定客戶是否合資格參與任何推廣。

15.MSIG 保障直線 (電話號碼:3122 6868)是三井住友保險特別為客戶而設的保險查詢熱線。

指定條款及細則

16.保費折扣優惠

(a)客戶在推廣期內經本行網站成功投保以下任何保障計劃(「一般保障計劃」),可享相關保費

折扣優惠:

(i)單次旅遊保障計劃;

(ii)全年旅遊保障;

(iii)家居財物保障;

(iv)業餘運動員保險 - 高爾夫球;

(v)優越住院現金保障計劃;或

(vi)危疾保障(包括危疾保障及孩之保危疾保障)

(b)全年旅遊保障、家居財物保障、業餘運動員保險 - 高爾夫球、優越住院現金保障計劃及危疾

保障(包括危疾保障及孩之保危疾保障)的保費優惠只適用於有關保單的首年保費。

17.全年旅遊保障限時優惠:

(a)在全年旅遊保障限時優惠下,客戶於2016年12月8日至2017年1月2日經本行網站成功

投保全年旅遊保障可享保費6折優惠。

(b)全年旅遊保障的保費優惠只適用於有關保單的首年保費。

(c)保費優惠不可轉換、退款、轉讓或退回。

(d)三井住友保險保留個別客戶享用上述任何折扣優惠的最終決定權。

18.旅遊保障獎賞

(a)客戶在推廣期內經本行網站成功投保單次旅遊保障計劃,以單一張保單計折扣後的保費達

HK$250或以上,將可獲得KLOOK App機場快綫單程車票電子兌換券(青衣站)(「單程電子

兌換券」) 一張。

(b)客戶在推廣期內經本行網站成功投保全年旅遊保障,每張保單將可獲得KLOOK App機場快綫

來回車票電子兌換券(香港站)(「來回電子兌換券」) 一張。

(c)在投保單次旅遊保障計劃及/或全年旅遊保障的月份結束後6星期內,單程電子兌換券及來

回電子兌換券(統稱「電子兌換券」)會電郵至合資格客戶在網上投保時登記的電郵地址。

(d)有關其他詳情,請瀏覽KLOOK應用程式的產品專頁,或致電KLOOK(電話號碼:3462

6208)。

19.星展豐盛理財及星展豐盛理財私人客戶尊享優惠:

優惠只適用於推廣期經本行網頁成功投保單次旅遊保障計劃的星展豐盛理財客戶及星展豐盛理財私人客戶(「Wealth客戶」)。

Wealth客戶必須於報價時輸入優惠編號「DBSTRE」方可享有:

(i) 45折保費折扣優惠,及

(ii)

20.天際

(a)客戶在推廣期內經本行網站成功投保家居財物保障、業餘運動員保險 - 高爾夫球、優越住

院現金保障計劃或危疾保障(包括危疾保障及孩之保危疾保障),可按已付保費(每張保

單折扣後保費)的金額獲得天際100香港之夜門票電子兌換券(價值HK$168) (「天際100電

(b)

括危疾保障及孩之保危疾保障)的月份結束後6星期內,天際100電子門票兌換券會電郵至

合資格客戶在網上投保時登記的電郵地址。

(c)客戶必須按照天際100電子門票兌換券上的指示,在KLOOK應用程式輸入兌換券上的優惠

碼,方可在KLOOK應用程式換取天際100電子門票。

(d)有關其他詳情,請瀏覽KLOOK應用程式的產品專頁,或致電KLOOK(電話號碼:3462

6208)。

21.汽油禮券獎賞

(a)客戶在推廣期內經本行網站成功投保私家車保險,可按已付的每年保費金額獲得以下相應金

額的汽油禮券(「汽油禮券」):

(b)汽油禮券將於成功投保的私家車保險保單生效日起計90日內郵寄予合資格客戶在網上投保

時登記的通訊地址。

22.KLOOK尊享優惠

(a)在推廣期內經本行網站成功投保的每份保單均可獲享HK$25折扣優惠碼(「折扣優惠碼」),

用以選購KLOOK任何全球旅遊產品。

(b)折扣優惠碼將與電子保單同時電郵至客戶在網上投保時登記的電郵地址。

(c)折扣優惠碼適用於透過KLOOK應用程式購買HK$150或以上的旅遊產品。

(d)折扣優惠碼不可與電子兌換券或天際100電子門票同時使用。