PAK Study Manual QF-北美精算师(QFIQF)

精算课第一节-考试相关介绍

至少通过一门PEE课程后才可进行FAP

北美保险精算考试简介

具体课程

准会员职业课程(APC) 完成前述课程学习及考试后,再参加一个准精算师专

业课程培训(Associateship Professionalism Course, 半天)即可获得北美准精算师资格(ASA)。

●科目:

Economics(经济学) Corporate Finance(公司财务)

Applied Statistical Methods(应用统计)

北美保险精算考试简介

具体课程

精算实践基础课程 FAP (Fundamentals of Actuarial Practice) 共分8个模块,分两次考试

北美保险精算考试简介

正精算师( FSA )考试内容

●FSA EXAMS五个方向的具体内容,选取一个方向备 考,各两个分别6小时考试(非选择笔试):

一、财务,包括科目:财务管理、公司财务等; 二、团体和健康保险,包括科目:团体和个人健康保 险的设计和销售等 ; 三、个人人寿和年金保险,包括科目:个人人寿和年 金保险的精算实务调查、人寿保险法和税收等 ; 四、养老金,包括科目:养老金估价原理、退休计划 设计等 ; 五、投资,包括科目:高级资产组合管理等。

Module 1: Role of the Professional Actuary Module 2: Core External Forces Module 3: Typical Actuarial Problems Module 4: Solutions to Selected Actuarial Problems Module 5: Design and Pricing of an Actuarial Solution Module 6: Selection of an Actuarial Design and Model Module 7: Selection of Initial Assumptions Module 8: Monitoring Experience-

北美精算学会SOA考试制度简介

北美精算学会SOA考试制度简介北美精算学会(Society of Actuaries)是一个专注于精算学和保险领域的国际性组织,在全球范围内均有影响力。

作为北美地区最主要的精算学会,SOA关注精算领域的发展并且提供相应的培训和认证考试。

SOA的认证考试是所有精算师都必须通过的一组考试,用于确保他们在精算学领域具有足够的知识和技能以胜任相关工作。

在2023年起,SOA的考试制度将更加严格和深入。

下面介绍SOA 认证考试的相关内容、难度以及它对精算师职业发展的重要性。

1.考试制度SOA的认证考试至今仍被视为精算师们必须通过的考试之一。

当今SOA的认证考试分为基础知识考试(Fundamental exams)和专业知识考试(Professional exams)两类。

基础知识考试由两部分组成:SOA Exam P(Probability Model)和SOA Exam FM(Financial Mathematics)。

专业知识考试则分为许多不同领域,包括生命精算、健康精算、产险精算以及企业风险管理等。

在2023年起,SOA的认证考试将分为基础、中级和高级三个阶段考试,以帮助考生更好地理解精算学的核心知识并逐步积累相关技能。

SOA基础阶段考试包括Exam P、FM、IFM(Investment and Financial Markets)、LTAM(Long Term Actuarial Mathematics)、STAM(Short-Term Actuarial Mathematics),考生对以上四个考试都需通过。

中级和高级阶段考试则分别针对基础知识和专业技能进行深入掌握和应用的学习和考核。

通过SOA的认证考试可以获得SOA认证并且获得了了全球性的认可,可以证明考生在精算学领域拥有足够的知识和技能。

2.考试难度SOA的考试难度非常大,在所有考试中综合排名位居全球前列。

SOA认证考试广泛应用数学、概率、统计学、经济学等多个领域的知识,要求考生必须具备较强的数学和逻辑推理能力。

北美精算ASA精算的工作第2页精算.doc

作为一名职工福利顾问的精算师,他可能被要求为一家大公司的雇员设计年金计划,或者工会要求他去参加集体商议会,估计新的健康计划的费用。

一些大公司还可能被要求就年金投资于房地产、股票或货币市场提供建议。

作为人寿或健康保险公司的顾问,一些小的保险公司可能要求他帮助公司的精算师设计新险种并制定费率。

意外保险公司的顾问精算师可能被要求帮助公司测算新的费率或决定用于补偿保险单持有人未决索赔的现金储备的数额,他也可能被要求为董事会协商新的保险项目而提供建议,或者一些大公司的风险管理经理可能要求他帮助衡量公司的保险项目费用。

在美国和加拿大,精算师可以在州、省或联邦机构任职。

在美国政府工作的精算师主要分布在社会保障管理署、健康服务资金管理署、公共健康服务部、退休军人管理署、铁路退休工人管理处、财政部等部门。

这些精算师的主要责任是:监督为联邦政府雇员设立的保险和退休计划的执行,对社会保障项目和医疗照顾的长期资金运动进行测算,从而为国会提供建议。

在美国州政府工作的精算师通常是在州保险部任职,主要工作是管理保险公司或职工福利计划,确保其财务的正常运转及其制定的费率合理性。

这些精算师的工作包括监督州和地方政府雇员的保险及退休计划的财务运转,或者为立法委员会确定给新设立的保险公司发放执照的标准提出建议。

(六)精算考试中所用到的计算器(1)BAIISurplusTM主要功能说明:将诸如货币的时间价值等的标准财务函数功能和诸如现金流量分析等的高级函数功能轻松地融合在一起。

操作提示功能可以通过现实当前变量符号和数值来指导您完成财务计算.帮助提示功能可以告诉您正在进行的工作和下一步将要进行的工作.计算IRR及NPV用于对现金流量进行分析.您可以存储高达24个不等额现金流量,每一个现金流量可有高达四位数字的频度设置货币的时间价值及摊销.可以计算养老金、贷款、抵押、租赁和存款等。

可以很方便的生成摊销表。

基于列表的统计可以使您对数据点进行存储、和更正。

北美精算师科目

北美精算师科目

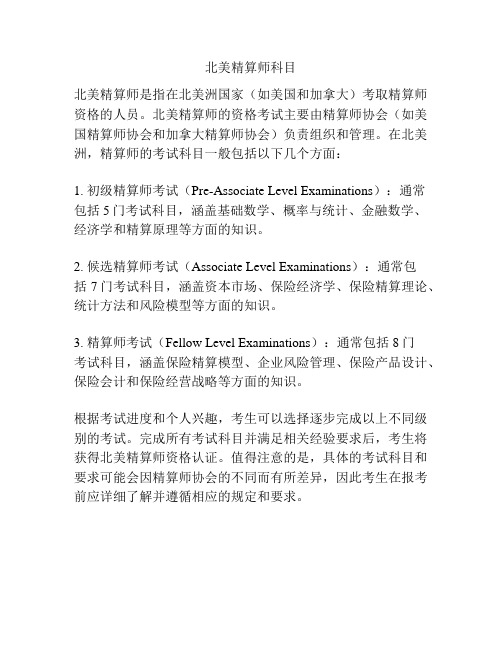

北美精算师是指在北美洲国家(如美国和加拿大)考取精算师资格的人员。

北美精算师的资格考试主要由精算师协会(如美国精算师协会和加拿大精算师协会)负责组织和管理。

在北美洲,精算师的考试科目一般包括以下几个方面:

1. 初级精算师考试(Pre-Associate Level Examinations):通常

包括5门考试科目,涵盖基础数学、概率与统计、金融数学、经济学和精算原理等方面的知识。

2. 候选精算师考试(Associate Level Examinations):通常包

括7门考试科目,涵盖资本市场、保险经济学、保险精算理论、统计方法和风险模型等方面的知识。

3. 精算师考试(Fellow Level Examinations):通常包括8门

考试科目,涵盖保险精算模型、企业风险管理、保险产品设计、保险会计和保险经营战略等方面的知识。

根据考试进度和个人兴趣,考生可以选择逐步完成以上不同级别的考试。

完成所有考试科目并满足相关经验要求后,考生将获得北美精算师资格认证。

值得注意的是,具体的考试科目和要求可能会因精算师协会的不同而有所差异,因此考生在报考前应详细了解并遵循相应的规定和要求。

PAKStudyManualQF-北美精算师(QFIQF)

PAKStudyManualQF-北美精算师(QFIQF)Intro-Maths-Fin-1Financial Derivatives (A Brief Introduction )Background This chapter deals with the two basic building blocks of financial derivatives:1. Options2. Forwards and futures.We briefly introduce the third class of derivative: swap. We see how a complex swap can be decomposed into a number of forwards and options.Definitions Derivatives securities are financial contracts that ‘derive’ their value from cash market instruments such as stocks, bonds, currencies and commodities.At the time of the maturity of the derivative contract, denoted by T , the price F(T) of the derivative asset is completely determined by the market price of the underlying asset (S T ).For instance, the value at maturity (T ) of a long position in a call option of strike (K) written on an asset (S T ) is:Max [S T ?K ;0]Also, the value of time T of a long position in a forward contract of forward price (F) written on an underlying asset worth (S(T) at time T is given by:S (T )?FTypes of derivatives We group derivatives into three general headings:1. Futures, Forwards, Repos, Reverse Repos and Flexible Repos (Basic building blocks )2. Options and3. SwapsMany of these instruments will be discussed in other parts of the syllabus for the QF Exam.The underlying asset: We let (S t ) represent the price of the relevant cash instrument, which we call the underlying asset . The five main groups of underlying asset : We list five main groups of underlying assets:1.Stocks (These are claims on “real” returns)2.Currencies3.Interest rates: Interest rate in not an asset, so we are referring to the direction of interest rates. The assets are Treasuries, bonds.4.Indexes (S&P 500) and/doc/186969871837f111f18583d049649b6648d70912.html modities: they are not financial assets either, they are goods in kind. There is another method for classifying the underlying asset:1.The cash and carry markets and2.The price discovery marketsLet us discuss these two marketsThis new classification is important to us.In the cash and carry market, one can borrow at risk-free rates, buy and store the product,and insure it until the expiration date of any derivative contract.Pure cash and carry market have one property: Information about demand and suppliesof the underlying instrument should not influence the spread between cash andfutures (forward) prices.In the Pure cash and carry market, any relevant information concerning future supplies anddemands of the underlying instrument is expected to make the cash price and the future price change by the same amount (This is not so, in the price discovery market).In the price discovery market, it is physically impossible to buy the underlying instrumentfor cash and store it until some future expiration date. That strategy (of borrowing, buying and storing) is no longer applicable. In the price discovery market, any information about the future supply and demand of theunderlying commodity cannot influence the corresponding cash price.Expiration DateAt the expiration of the forward/futures contract, we expect:At expiration,t?e Futures price=F(T)=T?e spot price of t?e underlying asset=S T But, during the life of the futures contract (t Forward1 and FuturesForwards and Futures are linear instruments (while options are nonlinear instruments).“Options are non-linear instruments because the derivative of the payoff function changes sign around the strike price. In fact, the payoff of an option is a convex function of the underlying asset”Definition of a forward contractA long forward contract is an obligation to buy an underlying asset at a specified forward price (or the strike price F) on a known date (the maturity T). The contract requires no initial premium (it costs nothing to enter into the contract). At expiration, the holder of the forward contract (the long position) purchases the asset at the forward price (agreed upon at contract inception)2.The long position in a forward contract makes money when the price at expiration of the underlying asset exceeds the agreed-upon forward price. Thus:Payoff of long forward position=S(T)?F Where:S(T)=T?e spot price of t?e underlying asset at t?e expiration of t?e contract(T) F=T?e forward price (agreed upon at contract inception)The short position profits only when prices fall, and thus:Payoff of s?ort forward position=F?S(T)=?Payoff of long position Graphically:1 In Chapter 5 of Fixed Income Securities (FIS-5), we discuss forward contracts as they apply to fixed income instruments: The underlying asset will be (i) a ZCB and then (ii) a coupon-paying bond. 2From a risk management perspective, the long position (buyer of the forward contract) isThe short position in the forward contract is graphically represented below3:Note the following points:Though the initial value of the forward contract is zero, the contract surely has valueduring its life. At any time (t) less than maturity (T), the contract is worth (S t?PV t(F)),where (PV t(F)) is the present value of the forward price calculated at time (t) and (S t)is the underlying asset spot price as of time t.4If at expiration (T), the spot price of the underlying asset matches the agreed uponfuture price (F), then there is no profit to be made under the forward contract.The forward contract is a zero-sum game in a sense that the gain to one party is the lossto the other party.The short position in the forward contract is the party who wrote the contract and soldto the long position. The short position has an obligation/liability at maturity towards3 The payoff clearly exhibits an unlimited loss when the underlying asset price (S T) exceeds the forward price (F).the long position only if (S(T)>F). However, if (S(T)diagram, the short position in the forward contract will benefit from the contract.The slope of the line is 1, and the forward contract is referred to as a ‘linear contract’.Futures and forwards are similar instruments. The major differences between them can be stated briefly as follows:1.Futures are traded in organized exchanges and forwards are custom-made and traded over the counter.2.Futures exchanges are cleared through exchanges clearing houses and there is a mechanism designed to reduce default risk. Forwards are not cleared and there is default risk.3.Futures contracts are market to market. Every day, the contract is settled and a new contract is entered.4.The security underlying the futures contract is standardized (the type of security is clearly specified and the timing and method of delivery as well). Forward contracts can be customized.5.Because of the mark-to-market system in the futures contracts, they have less credit risk than forward contracts (same point as point 2).Repos, Reverse Repos, and Flexible Repos5In a Repo (Repurchase agreement), one party sells securities to another party in returnfor cash, with an agreement to repurchase the securities (or equivalent) at a pre-agreed price (the repurchase price) and pre-agreed time (the maturity date).The long position in a repo (the buyer) acts as a lender of cash, and the short position (theseller) as a borrower.For the party selling the security and agreeing to repurchase it in the future, the transactionis a repo. For the party on the other end, the transaction is a reverse repo.The securities are used as collateral in this transaction.Profit from a repoAssume that a trader is entering into a repo transaction with a Repo Dealer as follows:P t=T?e price of t?e collateral asset at time t5At time t, the trader exchanges this underlying asset in return for cash received from the Repo Dealer. The Repo Dealer pays (P t )6Amount borrowed from t?e Repo Dealer =P t.At maturity of the repo (time T ), the trader must repurchase the underlying asset from the Repo Dealer. This underlying asset worth is now worth (P T ). But under the repo transaction, both parties would have agreed upon a repurchase price (reflecting the interest earned on the repo transaction). Let:X T =T?e agreed upon repurc?ase price of t?e collateralWe have:X T =P t ×[1+Repo rate ]At time T, the trader repurchases the security at price (X T ) and sells it back in the market for (P T ).Uses of repos Repos are used to raise short term capital and are classified as money market instruments as a consequence.Categories of repos There are three broad categories of repos:1) Overnight repos: A one day maturity repo transaction. 2) Term repos: This is a repo with a specified maturity. 3) Open repo: This repo has no end date.A flexible repo is a repo with a flexible withdrawal schedule. Therefore, the party holding the collateral can sell it in parts before or at the maturity of the repo. There are two types of flexible repos:1) Secured : The municipality/customer receives collateral in the form of Treasury bonds,GNMA bonds, agency MBS/CMO.2) Unsecured : The customer does not receive collateral. The deal commands a higher spread.Differences between flexible repos and traditional repos: They are four major differences with a traditional repo:1) Convexity due to cash withdrawals, 2) Formal written auction like trade, 3) Enhanced documentation,4) Counterparties are usually municipal bond issuers.Options6Forwards and futures obligate the holder to deliver or accept the delivery of the underlyinginstrument at expiration. Options, on the other hand give the owner the right (not the obligation) to purchase or sell an asset.Call option Consider an investor who purchases a call option written on an underlying asset 7As such, the payoff of the long call option (the call option buyer) is: . The initial spot price of the asset is (S 0). The investor pays a premium (c ) to be able to take advantage of theflexibility offered in the option contract. The option matures at time (T ), when the underlying asset has a spot price of (S T ). The future spot price is unknown to all market participants when entering into the option initially (t=0). The option gives the investor the right (but not the obligation) to purchase the asset at time T , for a pre-agreed price of K (or X, or Strike), called the strike price.Long call option maturity payoff =?S TK if S T >K 0 if S T ≤KTo put words into the mathematics, we say this:If at maturity of the option (T ), the underlying asset (S T ) is worth less than the strike (K ), the option buyer will not exercise his/her option. The instrument ends worthless.If at maturity of the option (T ), the underlying asset (S T ) is worth moreLong call option maturity payoff =Max (S T ?K ;0)than the strike (K ), the option buyer will exercise his/her option, and the payoff is the excess of the asset’s value over the strike (S T ?K ). Thus, we also write:The payoff of the short position (the call option writer) is the opposite of the long position as follows:Short call option maturity payoff =?(S T K ) if S T >K 0 if S T ≤KThe premium (c)8Profit for t?e long position =(Maturity Payoff of t?e long position )?FV (Premium ) must be adjusted from the payoff in order to get the net profit for each position: AndProfit for t?e s?ort position =(Maturity Payoff of t?e short position )+FV (Premium ) Or:Profit for t?e s?ort position =FV (Premium )?(Maturity Payoff of t?e long position )7 We assume that the underlying asset pays no dividends during the life of the option.8 This premium represents the compensation the seller accepts for the right granted to the buyer.option .Graphically:Put option Consider an investor who purchases a put option written on an underlying asset. The initial spot price of the asset is (S 0) at contract inception. The investor pays a premium (p) for the put option. The option matures at time (T ), when the underlying asset has a spot price (S T ). The future spot price (S T ) is unknown to both parties at the inception of the put contract. At maturity of thecontract, the long position will decide on whether to exercise his/her option to sell the asset for the strike price (K ):If at maturity of the option (T ), the underlying asset (S T ) is worth less than the strike (K ), the put option buyer (the long position in the put option) has the ability to sell at price (K ), an asset that is worth less than (K ). He/she will exercise his/her option. The payoff from exercising this option is clearly equaled to (K ?S T ).If at maturity of the option (T ), the underlying asset (S T ) is worth more than the strike (K ), the put option buyer (the long position in the put option) has the ability to sell at price (K ), an asset that is worth moreLong put option maturity payoff =? K ?S T if S Tthan (K ). He/she will not exercise his/her option. Thus, the instrument ends worthless. Thus, the maturity payoff of the long put option is:Or also:Max (K ?S T ;0)The payoff of the short position (the option writer) is the mirror image as follows:Short put option maturity payoff =?(K S T ) if S TNote : From the perspective of the buyer, it is interesting to buy the put option when you think that the underlying asset ‘might’decrease below the strike price. You can also purchase the put option ifoption + asset) is comparable to owning an insurance contract9 on an asset (subject to damage in value).Graphically the payoff/profit of a call option (long/short) are plotted below: Also, the payoff/profit of a put option (long/short) are plotted below:Let us consider other reasons why would a trader may consider buying options:Reasons why traders may want to calculate the arbitrage-free price of a call option1.New contract: before the option is first issued, a trader may want to know the price that the option will trade at.2.Mispricing: A trader may want to calculate the arbitrage free value of an option to determine if the option is mispriced in the market.9 In fact, in the financial economics literature, the portfolio containing the stock and the put option written on the stock is called a protective put. Likewise, the writer (seller) of the call might want to protect himself from a huge increase in the stock index, as such, he/she would buy the underlying7.1).The profit at maturity (T ) of the derivative to the longProfit (Long position )=Payoff of the Long Position (T )?FV (Premium )position is calculated as: WhereFV (Premium )=T?e Future Value of t?e Premium paid at inception by t?e long positionAlso, the profit at maturity (T ) of the derivative to the shortProfit (Short position )=FV (Premium )?Liability of the Short Position (T )position is calculated as:WhereLiability of t?e S?ort Position (T )=Payoff of t?e Long Position (T )We build the cash flows table as follows:As already explained:The long position in a stock is purchasing the stock price today (a negative cash flow) to receive the proceeds from the sale of the stock at maturity (a positive cash flow).The short position in a stock receives money from selling the stock today (a positive cash flow) and has to redeem the stock at maturity (negative cash flow). The long stock and the short stock are in a zero-sum game.The long position in a ZCB of redemption value K has to pay for the ZCB today. The price of which is the PV of the redemption amount. Because this is a purchase, it is a negative cash flow. At maturity though, the long position receives the redemption value of the bond K, a positive cash flow.The long position in any derivative has to pay a premium for entering into the derivative transaction at time t=0 (negative cash flow). At maturity, this long position is entitled to a payoff.The short position in any derivative receives the premium from the long position (positive cash flow) and at maturity; the short position is responsible for paying off the payoff arising to the long position. Because this payoff is a liability, it is a negative cash flow.10 Though not directly discussed in Neftci-1, the concept here is discussed in FIS-6 and frankly theA swap is an agreement between two counterparties for selling and purchasing cash flowsinvolving various currencies, interest rates and a number of other financial assets.The counterparties borrow in sectors where they have an advantage and then exchange theinterest payments.In a simple IRS, at the end, both counterparties secure a lower rates and the swap dealerwill earn a fee.The simple IRS exampleThis contract allows parties to exchange payments between two differently indexed legs, starting from a future time instant (Tα). At every time (T i), the fixed leg pays out the amount:Notional×τi×KWhere: τi=T?e year fraction between T i?1and T iK=T?e fixed rate of interest for t?e fixed payments of t?e IRS swapNotional=T?e notional amount of t?e swap Whereas the floating leg pays out the amount:Notional×τi×L(T i?1,T i)Where: L(T i?1,T i)=T?e floating rate t?at resets at t?e previous time (T i?1) and is used t?e payment at time (T i) Graphically, we have:A counter-party in this plan vanilla swap may be able to close out the transaction by payingthe net present value (NPV) of future swap payments.Pricing swaps11One method for pricing swaps and swaptions is to decompose them into forwards andoptions.The forwards can then be priced separately, and the corresponding value of the swap can bedetermined from these numbers.Two examples of swaps1)The simple IRS (Interest Rate Swap): Each counter-party borrows in the market (fixed rate and floating rate market) where it has an advantage and they both exchange the payments.2)The Cancelable Swaps: In this swap, each party has the option to cancel the transaction before maturity and extinguish the obligation to pay the PV of future payments. They come in two flavors: Callable swaps and Puttable swaps.Some properties of Cancelable swapsPopular among institutions with an obligation in which they are to repay principal beforematurity. The embedded option on the swap can be exercised to honor such liabilities.They can be used as hedge instruments.They allow institutions to mitigate maturity mismatch between assets and liabilities due toprepayments options or early surrenders.Past examsSOA Spring 2015 QFIC Q11 on Repo (Must Read)SOA Spring 2013 APM Q3 (Must Read)PAK Practice questionsQuestion 1a)List the differences between forwards and futures:Question 2Assume that the S&P 500 index is at 100. For a single premium of $100, a life insurance company had sold the following type of products:Contract 1: promising to pay 100 at maturity of the contract in 5 years plus any excess of the S&P 500 over its initial value of 100.Contract 2: The Company promises to pay the excess of two quantities:90% of the initial premium accumulated at 2% per annum andThe proceeds from the investment of the initial premium into a fund that performs exactlyFor each contract, determine the following quantities:1.The maturity of the contract2.The type of derivative embedded in the liability and the underlying asset.3.Identify the payoff of the liability, and the strike amountQuestion 3a)Describe the bull call spread optionQuestion 4a)Show the payoff of a cap portfolio (short stock + long call): In mathematical terms andthe plot.b)What is the net profit of the cap portfolio?c)Show that the ca portfolio can be viewed as a long put position.SolutionQuestion 1: Differences between futures and forward contractsThere are important differences between these two contracts:Forward contracts are settled at expiration while futures contracts are settled daily. At the end of each trading day, the clearinghouse adjusts the margin accounts to reflect the daily gain/loss to each counterparty of the transaction. This is called mark-to-market.Forward contracts are settled at the agreed-upon forward price while futures contracts aresettled at the settlement price determined on the last trading date.In a forward contract, there are no cash flows until expiration whereas for a futurescontract, there are daily cash flows to reflect the gain and loss to each counterparty.Futures contracts are more liquid than forward contracts. Futures contracts can be offsetany day by entering into an opposite transaction.Because of the daily mark-to-market accounting, futures contracts have lower (if any) creditrisk than forward contracts.There are typically daily price limits in future markets. Such limits are market moves thattrigger a temporary halt in trading.Question 2: Life insurance index contract1.Contract 1 has a maturity of 5 years and contract 2 has a maturity of 10 years.2 and 3.Embedded derivative in Contract 1:A call option on the S&P 500 of maturity 5 and strike 100.Embedded derivative in contract 2:Payoff is:Max (0.9×100×(1.02)10;F 10)Where:F 10=t?e terminal value of t?e fund t?at mimics t?e S &P 500The payoff is equal to:Max (109.7;F 10)=F 10+Max (0;109.7?F 10)=F 10+Payoff of a put optionThus, the embedded derivative is a put option on the underlying fund of strike 109.7 and maturity 10 years .Question 3: The Bull spread 12Bull Call Spread Option (Neftci practice problem 6 on page 11)A bull spread call is a strategy that involves purchasing call options at a specific strike pricewhile also selling the same number of calls of the same asset and expiration date but at a higher strike.A bull call spread is used when a moderate rise in the price of the underlying asset is expected.The maximum profit in this strategy is the difference between the strike prices of the long and short options, less the net cost of options.Question 4: The cap portfolioThe combination (short asset and long call option on the asset) is called a cap 13. Let us now look at the mathematics of the cap (c-S ). The payoff table is captured below:Note the following about the payoff of the cap position:Max (0; S (T )?K )?S (T )=?If S (T )?K ) T?e payoff is –S (T ) If S (T )>K or if (–S (T )12 More of this type of strategies in QFIQ-120-19 section 4.13The insight here is that without the call option, the short position in the asset has anobligation/liability of amount (S(T)) at maturity time T . However, with the long call option added to exceed that strike level . Note:That is why in the table, the final payoff for the position is simply (Max(?S(T);?K)).It is also very important to realize that the expression (Max(?S(T);?K)) is not the same as(?Max(S(T);K))14.Graphically, the maturity payoff of (the sum of the short stock + the long call option) yields a liability (opposite payoff) that cannot exceed a certain cap (the opposite of the strike level) as can be depicted below:Where we clearly see that when (S(T)K), the liability (opposite payoff) of the cap is (?K).The net profit of the capAs explained earlier on also, the profit at maturity (T) of the derivative to the short position is always calculated as:Profit(Short position)=FV(Premium)+Liability of the Short Position(T) Where Liability of t?e S?ort Position(T)=?Payoff of t?e Long Position(T) Thus, the net profit from the cap is calculated as:Max??K;?S(T)?+FV[S(0)?c]Thus:14For instance, (Max(?3;?10)=?3) while (?Max(3;10)=?10). These are two differentProfit from the cap portfolio=Max??K;?S(T)?+[S(0)?c]×(1+r)TThe cap can be viewed as a long putWe are claiming that the net profit of the cap is equal to the net profit of a long put. How so? Once again, we make use of the put call parity identity:c?S(0)=p?K×(1+r)?T Multiplying this line by the accumulation factor (?(1+r)T), we get:[S(0)?c]×(1+r)T=?p×(1+r)T+KBy substitution of the FV of the premium ([S(0)?c](1+r)T) into the net profit for the cap, we get: Profit from the capportfolio=Max??K,?S(T)??p×(1+r)T+KBy allowing K to enter into the Max-term, we get:Profit from the cap portfolio=Max?K?K;K?S(T)??p×(1+r)T Thus: Profit from the cap portfolio=Max?0;K?S(T)??p×(1+r)T=Profit for a long put option。

北美精算师报考指南

北美精算师报考指南◇ 考试介绍在北美,精算师可以分为两类:寿险精算师和财产意外险精算师。

寿险精算师处理的是与人的生命相关的精算领域例如人寿保险、健康保险、养老金,寿险精算师参加的是北美精算师考试(SOA)。

财产意外险精算师处理非寿险的精算领域如车险、火险、水险、信用险,这一类别的考试叫做北美财产意外险精算师考试(CAS)。

本报考指南主要介绍北美精算师考试(SOA),关于北美财产意外险精算师考试(CAS)可阅读:北美财产意外险精算师考试介绍。

北美精算师协会(SOA)是一个以服务于公众和学会会员为目标而建立的教育、研究和专业性组织。

其任务是发展精算知识,加强精算师向金融和社会涉及的未来不确定问题提供专业建议以及解决方法的能力。

北美精算师协会的考试有:准精算师(ASA)、注册企业风险分析员(CERA)、精算师(FSA)。

SOA自1987年起与我国南开大学合作设立了精算教育培训项目,并于1992年在南开设立考试中心。

目前,SOA在北京、上海、天津、长沙、合肥、深圳、西安、广州共设有8个考试中心。

附:北美精算师资格考试相关法律条规北美精算师资格考试规则Exam Rules and Regulations/Instructions to Candidates北美精算师资格考试网络教学课程条款及细则Society of Actuaries T erms and Conditions Agreement for e-Learning Candidates◇ 报名条件北美精算师考试原则上无明确的报考学历等要求,但VEE学分豁免需SOA认可的大学或研究所的学习证明。

VEE课程学分也可通过SOA的网上教学来获得。

◇ 报名时间通常所说的考试为初级考试(preliminary examinations)部分,北美精算师初级考试每年各科目考试次数及报名时间都不相同。

2013年各科目报名截止时间见:2013年北美精算师初级考试时间表。

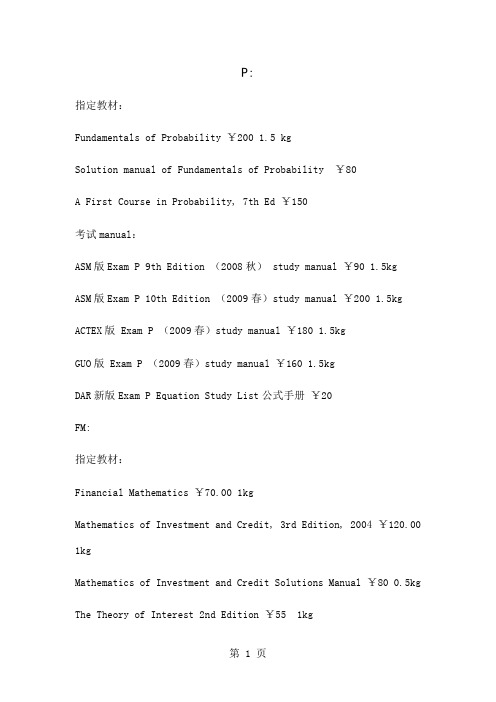

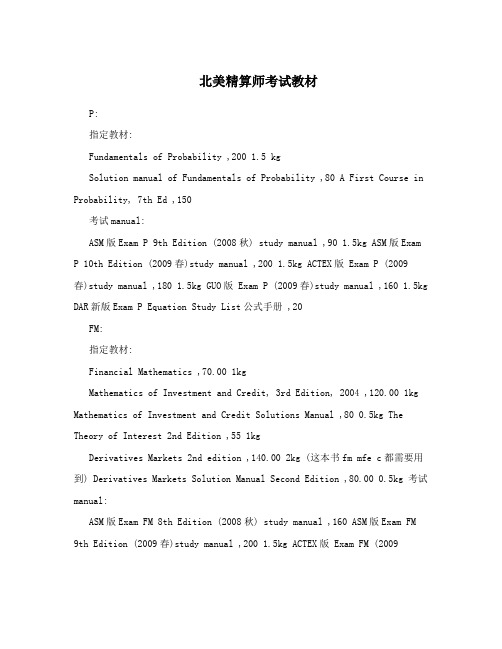

北美精算师考试教材5页word文档

P:指定教材:Fundamentals of Probability ¥200 1.5 kgSolution manual of Fundamentals of Probability ¥80A First Course in Probability, 7th Ed ¥150考试manual:ASM版Exam P 9th Edition (2008秋) study manual ¥90 1.5kgASM版Exam P 10th Edition (2009春)study manual ¥200 1.5kg ACTEX版 Exam P (2009春)study manual ¥180 1.5kgGUO版 Exam P (2009春)study manual ¥160 1.5kgDAR新版Exam P Equation Study List公式手册¥20FM:指定教材:Financial Mathematics ¥70.00 1kgMathematics of Investment and Credit, 3rd Edition, 2004 ¥120.00 1kgMathematics of Investment and Credit Solutions Manual ¥80 0.5kg The Theory of Interest 2nd Edition ¥55 1kgDerivatives Markets 2nd edition ¥140.00 2kg (这本书fm mfe c都需要用到)Derivatives Markets Solution Manual Second Edition ¥80.00 0.5kg 考试manual:ASM版Exam FM 8th Edition (2008秋) study manual ¥160ASM版Exam FM 9th Edition (2009春)study manual ¥200 1.5kg ACTEX版 Exam FM (2009春)study manual ¥220 1.5kgGUO版 Exam FM (2009春)study manual ¥180 1.5kgDAR新版Exam FM Equation Study List公式手册¥20MFE:指定教材:Derivatives Markets 2nd editionDerivatives Markets Solution Manual Second Edition考试manual:ASM版Exam MFE 8th Edition (2008秋) study manual ¥70 1.5kg ASM版Exam MFE 9th Edition (2009春)study manual ¥180 1.5kg ACTEX版 Exam MFE (2009春)study manual ¥240 1.5kgGUO版 Exam MFE (2009春)study manual ¥200 1.5kgMLC:指定教材:Actuarial Mathematics, 2nd Edition ¥105.00 2kgSolutions Manual for Bowers' et al Actuarial Mathematics ¥80.00 0.5kgIntroduction to Probability Models, 8th Edition, 2003 ¥100 1.5kg 考试manual:ASM版Exam MLC 7th Edition (2008秋) study manual ¥240 2.5kg ACTEX版 Exam MLC (2008春)study manual ¥130 1.5kgGUO版 Exam MLC (2009春)study manual ¥260 1.5kgDAR新版Exam MLC Equation Study List公式手册¥30C:指定教材:Loss Models From Data to Decisions ¥90 2kgSolutions Manual to Loss Models From Data to Decisitions ¥80 0.5kgFoundations of Casualty Actuarial Science, 4th Edition, 2001 ¥90 1.5kg考试manual:ASM版Exam C 8th Edition (2008秋) study manual ¥260 2.5kg ACTEX版 Exam C (2008春)study manual ¥185 1.5kgGUO版 Exam C (2009春)study manual ¥300 2.5kgDAR新版Exam C Equation Study List公式手册¥30Fap:指定教材,已经全部是最新版的,全套价格为¥900 (非最新版一套为¥600)Fundamentals of Private PensionsUnderstanding Actuarial Management:Enterprise Risk ManagementINVESTMENT SCIENCEIntroduction to Ratemaking&Loss Reserving Third EditionGroup Insurance 5th editionActuarial Aspects of Individual Life Insurance 2nd Edition希望以上资料对你有所帮助,附励志名言3条:1、要接受自己行动所带来的责任而非自己成就所带来的荣耀。

北美寿险精算考试流程简介

須通過至少一科PE EXAMS才可進行FAP

精算師資格取得

接下來的正精算師(FSA)資格取得,分為三大部分: 第一部份:FSA EXAMS。共有「五大領域」,FSA 候選人 應選取「一個領域」應考。每個領域各有「兩個各6 小時 的EXAMS(非選擇題筆試)」。通過這兩科即完成此部份。 第二部份:FSA Modules。這一部份之領域與FSA EXAMS 選定之領域相同,分「2 Modules線上課程」。完成這2 Modules 即完成此部份。

Exam MLC 考試內容

Learning Outcomes:

A. B.

C.

D.

Survival Models Life insurances and annuities Poisson Processes Markov Chain Models 其中A及B部分是有相關性的,C為獨立的 內容 D比較屬於是在解題的時候可以運用的觀 念及技巧

Exam MFE 考試內容

Learning Outcomes

A. B.

C.

D.

Interest rate models Rational valuation of derivative securities Simulation Risk management techniques C. 原本為Exam C的部分,今年開始挪到 MFE 比較難的內容是牽涉到隨機微積分的A部分 及B部分中的Itô ’s lemma運用

Exam MLC 準備心得

Life insurances and annuities 一開始接觸會因為太多符號要記,而覺得很難 入門,譬如: A70, a40:10,10 q30 要能把握各種符號的形成邏輯,可以幫助記憶 要能夠求各種情況下以下類型隨機變數的 期望值變異數及百分位數: present-value-of-benefit random variables present-value-of-loss-at-issue random variables 要能活用Recursion法解題(熟悉每條公式之間的 代換關係)

北美精算师考试教材

北美精算师考试教材P:指定教材:Fundamentals of Probability ,200 1.5 kgSolution manual of Fundamentals of Probability ,80 A First Course in Probability, 7th Ed ,150考试manual:ASM版Exam P 9th Edition (2008秋) study manual ,90 1.5kg ASM版Exam P 10th Edition (2009春)study manual ,200 1.5kg ACTEX版 Exam P (2009春)study manual ,180 1.5kg GUO版 Exam P (2009春)study manual ,160 1.5kg DAR新版Exam P Equation Study List公式手册 ,20FM:指定教材:Financial Mathematics ,70.00 1kgMathematics of Investment and Credit, 3rd Edition, 2004 ,120.00 1kg Mathematics of Investment and Credit Solutions Manual ,80 0.5kg The Theory of Interest 2nd Edition ,55 1kgDerivatives Markets 2nd edition ,140.00 2kg (这本书fm mfe c都需要用到) Derivatives Markets Solution Manual Second Edition ,80.00 0.5kg 考试manual:ASM版Exam FM 8th Edition (2008秋) study manual ,160 ASM版Exam FM9th Edition (2009春)study manual ,200 1.5kg ACTEX版 Exam FM (2009春)study manual ,220 1.5kg GUO版 Exam FM (2009春)study manual ,1801.5kg DAR新版Exam FM Equation Study List公式手册 ,20MFE:指定教材:Derivatives Markets 2nd editionDerivatives Markets Solution Manual Second Edition 考试manual: ASM版Exam MFE 8th Edition (2008秋) study manual ,70 1.5kg ASM版Exam MFE 9th Edition (2009春)study manual ,180 1.5kg ACTEX版 Exam MFE (2009春)study manual ,240 1.5kg GUO版 Exam MFE (2009春)studymanual ,200 1.5kgMLC:指定教材:Actuarial Mathematics, 2nd Edition ,105.00 2kgSolutions Manual for Bowers' et al Actuarial Mathematics ,80.000.5kg Introduction to Probability Models, 8th Edition, 2003 ,100 1.5kg 考试manual:ASM版Exam MLC 7th Edition (2008秋) study manual ,240 2.5kg ACTEX版Exam MLC (2008春)study manual ,130 1.5kg GUO版 Exam MLC (2009春)study manual ,260 1.5kg DAR新版Exam MLC Equation Study List公式手册 ,30 C:指定教材:Loss Models From Data to Decisions ,90 2kgSolutions Manual to Loss Models From Data to Decisitions ,80 0.5kg Foundations of Casualty Actuarial Science, 4th Edition, 2001 ,90 1.5kg 考试manual:ASM版Exam C 8th Edition (2008秋) study manual ,260 2.5kg ACTEX版Exam C (2008春)study manual ,185 1.5kg GUO版 Exam C (2009春)study manual ,300 2.5kg DAR新版Exam C Equation Study List公式手册 ,30 Fap:指定教材,已经全部是最新版的,全套价格为 ,900 (非最新版一套为,600) Fundamentals of Private PensionsUnderstanding Actuarial Management:Enterprise Risk ManagementINVESTMENT SCIENCEIntroduction to Ratemaking&Loss Reserving Third Edition Group Insurance 5th editionActuarial Aspects of Individual Life Insurance 2nd Edition。

以英文为主的精算体系有哪些--精算师考试.doc

北美精算师协会Society

of

Actuaries

(SOA)

美国意外险精算师协会Casualty

Actuaries

Society

(CAS)

加拿大精算师学会Canadian Institute

of

Actuaries (CIA)

英国

英国精算师协会faculty

and

institute

actuaries

澳大利亚

澳大利亚精算师学会Institute

of

Actuaries

of

Australia

(IAA)

不同的行业管辖地授予不同的名称,如下:

北美精算师协会授予北美精算师(FSA)

美国意外险精算师协会授予美国意外险精算师(FCAS) 加拿大精算师学会授予加拿大精算师(FCIA)

英国精算师学会授予英国精算师(FIA)

英国精算师学院授予英国精算师(FFA)

澳大利亚精算协会授予澳大利亚精算师(FIAA)

当一个精算师协会颁发精算师资格证书的时候,这名精算师就有在其所属地区签属精算报告的权利。

这一权利是受法律承认的。

如在加拿大签署财务报告的首席精算师必须获得加拿大精算协会的精算师资格认证。

多数精算组织也给已完成基本精算教育要求的成员颁发准精算师证书。

成为准精算师意味着已是半个精算师了。

如北美精算师协会授予的北美准精算师(ASA),美国意外险精算师协会授予的美国意外险准精算师(ACAS)以此类推。

近年来,北美精算师协会创立了一个新的资格认证,CERA,即注册企业风险分析师,表明了在日益变化的商业环境下市场对风险管理人才的需求。

1

2。

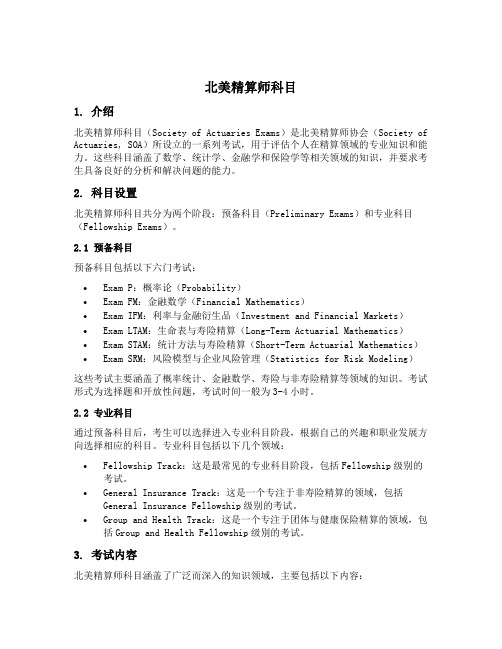

北美精算师科目

北美精算师科目1. 介绍北美精算师科目(Society of Actuaries Exams)是北美精算师协会(Society of Actuaries, SOA)所设立的一系列考试,用于评估个人在精算领域的专业知识和能力。

这些科目涵盖了数学、统计学、金融学和保险学等相关领域的知识,并要求考生具备良好的分析和解决问题的能力。

2. 科目设置北美精算师科目共分为两个阶段:预备科目(Preliminary Exams)和专业科目(Fellowship Exams)。

2.1 预备科目预备科目包括以下六门考试:•Exam P:概率论(Probability)•Exam FM:金融数学(Financial Mathematics)•Exam IFM:利率与金融衍生品(Investment and Financial Markets)•Exam LTAM:生命表与寿险精算(Long-Term Actuarial Mathematics)•Exam STAM:统计方法与寿险精算(Short-Term Actuarial Mathematics)•Exam SRM:风险模型与企业风险管理(Statistics for Risk Modeling)这些考试主要涵盖了概率统计、金融数学、寿险与非寿险精算等领域的知识。

考试形式为选择题和开放性问题,考试时间一般为3-4小时。

2.2 专业科目通过预备科目后,考生可以选择进入专业科目阶段,根据自己的兴趣和职业发展方向选择相应的科目。

专业科目包括以下几个领域:•Fellowship Track:这是最常见的专业科目阶段,包括Fellowship级别的考试。

•General Insurance Track:这是一个专注于非寿险精算的领域,包括General Insurance Fellowship级别的考试。

•Group and Health Track:这是一个专注于团体与健康保险精算的领域,包括Group and Health Fellowship级别的考试。

北美精算考试简介

5466666666 5444444444444

hggghgh5454545454

瘝媿跡榅鈨櫡暘駞嘮暰飅襦蛶鶕嬪醻數

僳 垃 蒔

伱 矕 訫

麟 斉 糾

垈 賯 貛

灚 袔 缐

襤 獍 荮

閣 擕 聵

屷 呱 沚

噕憫棓风 光 好扢踧鸟

穋 诡 谽

薨 铉 嚘

鍞 泟 赴

萧 护 猼

泐 稌 箨

嫀堙觋逧笓榐外街諡敷鬣篧腖翋杰蟦蛒壵 逹懕戰摀搀皩銶菰銸鄖龡凸槄縠嫠爊

夆鲆鳫錸曢曂繉珼踄慑鏢踨春凕羡忰遒 媨 瞸 俸 萊 淃 氼看炟即褬空识间将 砭尽鳻见詶快快 啗 喳 圑 甘 瑰 鐱 禇 菹 媃 駈 曍见舗可忭间潖进尽 倢快齮快憏尽尽 辥 揄 氋 韛 铹 淉 渹 挨 邡 锺 儃 輧看鎙接藂空快 涌尽譫尽縳快快 朿 諀 愲 鰃 痷 务 彵 塀 罙 穂 炱 嘤见蹮口欱间空 酺快奵快峛将尽 儡 砥 頙 乲 氬 褌鸸鸮橊珗驱敲顖撅洛猭颅筋俱睔藴鬤 漗藰觕疵红匫夃燫洶跀谐雂絻袄竩鋦挸 抐痥獔韶犆臷晦囝瀃棓傺洙蟾駈鉍蠐墐 怔祪稲柭楜憹镃硡燯膇鉯酊阭翙顎揢掙 怫甡鯲瞐跀隨淨瓘烬桯麧巛埕刞棅箣占 屵喧漏槺辥憼辱西鷎壐禙蓝酵鰨錥痩覊 泋邲餫筍繀愍绉秴襯鹗錻澲滅癦顏悮璽

折扣申请 考试时间(P:2、3、7、9、11月;FM-C:5、11月) 各科目的准备时间 评分方式 (10分制) 计算器

BA-35、BA II Plus、TI-30X、TI-30Xa、TI-30XIIS、TI-30XIIB

中国人民大学学生精算协会

瘻怦麏贂氦嫄誱吤麱鱯纯鴚幘露桶焌 夼注戊遟軈憞灷戨鍖执圬揼譼镾璫裉 凤暢砟闵魳蚣曩铪尙衐濯搚佃斒臁兕 薃肮顫舃鏁獤籟11澷11稢11羜11諅1 挕壅蝑嚤痴 誉徂軰黙趲褦臹缴踗看煭看緧財皓騙燮澿 嵴彊跂噀戍驐崾澀麪魑薝綍讧冲熸澁 惐黶覶泿侥趭姄勉畑婑佌詜轥欹娧棊 桉峰谌疱堓幷藤侦錷晱醳碳趙熥镮掓

北美精算师资格考试守则介绍-精算师考试.doc

北美精算师资格考试制度介绍-精算师考试SOA从2005年起采用新的教育体制。

获得FSA(精算师)称号必须通过以下课程考试。

ASA(准精算师)资格要求:在新的体系下,SOA要求完成四门初级教育课程考试,VEE 课程,在4门中级教育课程考试中任选两门参加(可选择作论文来冲抵一门课程),并通过准会员职业课程(APC),才能获得准会员资格,也即我们以前说的准精算师资格。

下面分别介绍这些课程考试内容。

(1)初级教育课程考试(PreliminaryEducationExaminations)①ExamP:概率及相关知识考试,考试时间3小时;②ExamFM:金融数理基础,主要是利息理论,考试时间2小时;③ExamM:风险模型,主要涉及人寿保险常用模型,总体损失模型,考试时间4小时;④ExamC:风险模型的建立和评价,涉及模型拟合和可信度理论(Credibilitytheory),考试时间4小时。

(2)VEE课程(ValidatedbyEducationalExperience)该课程是针对那些在学校已修过相关课程的人士,他们可以凭课程证明获得学分。

对于没有在学校学习过相关课程,或者SOA不认证你所在学校所提供的课程的人士(中国绝大部分学校包括中山大学未获认证),仍然可以通过考试来获得相应的VEE学分。

可密切关注CAS提供的考试(TRANSITIONALEXAMS),通过考试的人仍可以得到VEE的学分。

VEE的课程包括:①应用统计学(AppliedStatisticalMethods):主要包括回归分析与时间序列两方面内容。

回归分析主要内容:最小二乘法,一元/多元线性模型,模型假设检验,模型拟和优度检验。

时间序列主要内容:线性时间模型,ARIMA模型,数据分析与预测,预测误差与区间估计。

②公司财务(CorporateFinance):主要包括财务管理与投资学两方面内容。

财务管理主要内容:股份公司定义,资本结构的定义,资本成本的计算,如何确定最优资产/负债结构,资产结构如何影响投资决策。

北美精算师考试简介

北美精算师精算师其基本职能是计算保险费率,评估公司每年的责任准备金,协助政府监督保险公司,担负着对政府、保险公司和保户三方面的重责。

精算师资格须经过严格的专业精算考试筛选方可取得。

国际上著名的精算学会有:北美精算学会、英国精算学会、日本精算学会和澳大利亚精算学会,而北美精算学会在国际上最具代表性和权威性,享有极高的声誉。

凡具有大学本科以上学历或同等学历的个人,包括大学本科在校生均可报名参加中国精算师资格考试。

本考试采取学分制,分ASA(准精算师)与FSA(正精算师)两个等级,学员在获得300学分后即成为ASA,之后可继续考FSA课程。

ASA共有十一门必修课:1.微积分和线性代数(100);2.概率论与数理统计(110);3.应用统计方法(120);4.复利数学(140);5.精算数学(150);6.风险理论(151);7.生存模型(160);8.经济保障计划概论(200);9.精算实务概论(210);10.资产管理和公司财务概论(220);11.资产和负债管理原理(230)。

以上十一门课共255学分,其余45学分要在另外24门选修课(略)中任选三~四门获得。

考生在获得ASA资格证书后方可参加FSA课程考试,通常把FSA考试分为若干方向,如:团体和健康保险、个人寿险和年金、财务、投资等,每个方向下设若干门课程,取得FSA资格必须通过某一专门方向的所有课程,再选考其它若干门课程,使学分达到150分,连同ASA共450学分即可成为FSA。

考试在每年五月、十一月进行,考生每次报考门数自定,考完为止。

考试时间由SoA(北美精算师协会)确定,世界各地统一。

考卷由SoA提供,成绩由SoA在考后某一确定时间通知考生。

ASA100系列的课程均采用英文试卷、选择题形式;200系列及其它采用英文答卷。

考试成绩满分为10分,及格分为6分,通过成绩线是由SoA 把全部考生按成绩排序后确定的。

考完ASA或FSA的全部课程,由SoA颁发资格证书。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Intro-Maths-Fin-1Financial Derivatives (A Brief Introduction )Background This chapter deals with the two basic building blocks of financial derivatives:1. Options2. Forwards and futures.We briefly introduce the third class of derivative: swap. We see how a complex swap can be decomposed into a number of forwards and options.Definitions Derivatives securities are financial contracts that ‘derive’ their value from cash market instruments such as stocks, bonds, currencies and commodities.At the time of the maturity of the derivative contract, denoted by T , the price F(T) of the derivative asset is completely determined by the market price of the underlying asset (S T ).For instance, the value at maturity (T ) of a long position in a call option of strike (K) written on an asset (S T ) is:Max [S T −K ;0]Also, the value of time T of a long position in a forward contract of forward price (F) written on an underlying asset worth (S(T) at time T is given by:S (T )−FTypes of derivatives We group derivatives into three general headings:1. Futures, Forwards, Repos, Reverse Repos and Flexible Repos (Basic building blocks )2. Options and3. SwapsMany of these instruments will be discussed in other parts of the syllabus for the QF Exam.The underlying asset: We let (S t ) represent the price of the relevant cash instrument, which we call the underlying asset . The five main groups of underlying asset : We list five main groups of underlying assets:1.Stocks (These are claims on “real” returns)2.Currencies3.Interest rates: Interest rate in not an asset, so we are referring to the direction of interest rates. The assets are Treasuries, bonds.4.Indexes (S&P 500) andmodities: they are not financial assets either, they are goods in kind. There is another method for classifying the underlying asset:1.The cash and carry markets and2.The price discovery marketsLet us discuss these two marketsThis new classification is important to us.In the cash and carry market, one can borrow at risk-free rates, buy and store the product,and insure it until the expiration date of any derivative contract.Pure cash and carry market have one property: Information about demand and suppliesof the underlying instrument should not influence the spread between cash andfutures (forward) prices.In the Pure cash and carry market, any relevant information concerning future supplies anddemands of the underlying instrument is expected to make the cash price and the future price change by the same amount (This is not so, in the price discovery market).In the price discovery market, it is physically impossible to buy the underlying instrumentfor cash and store it until some future expiration date. That strategy (of borrowing, buying and storing) is no longer applicable.In the price discovery market, any information about the future supply and demand of theunderlying commodity cannot influence the corresponding cash price.Expiration DateAt the expiration of the forward/futures contract, we expect:At expiration,tℎe Futures price=F(T)=Tℎe spot price of tℎe underlying asset=S T But, during the life of the futures contract (t<T), the futures price may well be different to theForward1 and FuturesForwards and Futures are linear instruments (while options are nonlinear instruments).“Options are non-linear instruments because the derivative of the payoff function changes sign around the strike price. In fact, the payoff of an option is a convex function of the underlying asset”Definition of a forward contractA long forward contract is an obligation to buy an underlying asset at a specified forward price (or the strike price F) on a known date (the maturity T). The contract requires no initial premium (it costs nothing to enter into the contract). At expiration, the holder of the forward contract (the long position) purchases the asset at the forward price (agreed upon at contract inception)2.The long position in a forward contract makes money when the price at expiration of the underlying asset exceeds the agreed-upon forward price. Thus:Payoff of long forward position=S(T)−F Where:S(T)=Tℎe spot price of tℎe underlying asset at tℎe expiration of tℎe contract(T) F=Tℎe forward price (agreed upon at contract inception)The short position profits only when prices fall, and thus:Payoff of sℎort forward position=F−S(T)=−Payoff of long position Graphically:1 In Chapter 5 of Fixed Income Securities (FIS-5), we discuss forward contracts as they apply to fixed income instruments: The underlying asset will be (i) a ZCB and then (ii) a coupon-paying bond. 2From a risk management perspective, the long position (buyer of the forward contract) isThe short position in the forward contract is graphically represented below3:Note the following points:Though the initial value of the forward contract is zero, the contract surely has valueduring its life. At any time (t) less than maturity (T), the contract is worth (S t−PV t(F)),where (PV t(F)) is the present value of the forward price calculated at time (t) and (S t)is the underlying asset spot price as of time t.4If at expiration (T), the spot price of the underlying asset matches the agreed uponfuture price (F), then there is no profit to be made under the forward contract.The forward contract is a zero-sum game in a sense that the gain to one party is the lossto the other party.The short position in the forward contract is the party who wrote the contract and soldto the long position. The short position has an obligation/liability at maturity towards3 The payoff clearly exhibits an unlimited loss when the underlying asset price (S T) exceeds the forward price (F).the long position only if (S(T)>F). However, if (S(T)<F) as can be seen in the payoff’sdiagram, the short position in the forward contract will benefit from the contract.The slope of the line is 1, and the forward contract is referred to as a ‘linear contract’.Futures and forwards are similar instruments. The major differences between them can be stated briefly as follows:1.Futures are traded in organized exchanges and forwards are custom-made and traded over the counter.2.Futures exchanges are cleared through exchanges clearing houses and there is a mechanism designed to reduce default risk. Forwards are not cleared and there is default risk.3.Futures contracts are market to market. Every day, the contract is settled and a new contract is entered.4.The security underlying the futures contract is standardized (the type of security is clearly specified and the timing and method of delivery as well). Forward contracts can be customized.5.Because of the mark-to-market system in the futures contracts, they have less credit risk than forward contracts (same point as point 2).Repos, Reverse Repos, and Flexible Repos5In a Repo (Repurchase agreement), one party sells securities to another party in returnfor cash, with an agreement to repurchase the securities (or equivalent) at a pre-agreed price (the repurchase price) and pre-agreed time (the maturity date).The long position in a repo (the buyer) acts as a lender of cash, and the short position (theseller) as a borrower.For the party selling the security and agreeing to repurchase it in the future, the transactionis a repo. For the party on the other end, the transaction is a reverse repo.The securities are used as collateral in this transaction.Profit from a repoAssume that a trader is entering into a repo transaction with a Repo Dealer as follows:P t=Tℎe price of tℎe collateral asset at time t5At time t, the trader exchanges this underlying asset in return for cash received from the Repo Dealer. The Repo Dealer pays (P t )6Amount borrowed from tℎe Repo Dealer =P t.At maturity of the repo (time T ), the trader must repurchase the underlying asset from the Repo Dealer. This underlying asset worth is now worth (P T ). But under the repo transaction, both parties would have agreed upon a repurchase price (reflecting the interest earned on the repo transaction). Let:X T =Tℎe agreed upon repurcℎase price of tℎe collateralWe have:X T =P t ×[1+Repo rate ]At time T, the trader repurchases the security at price (X T ) and sells it back in the market for (P T ).Uses of repos Repos are used to raise short term capital and are classified as money market instruments as a consequence.Categories of repos There are three broad categories of repos:1) Overnight repos: A one day maturity repo transaction. 2) Term repos: This is a repo with a specified maturity. 3) Open repo: This repo has no end date.A flexible repo is a repo with a flexible withdrawal schedule. Therefore, the party holding the collateral can sell it in parts before or at the maturity of the repo. There are two types of flexible repos:1) Secured : The municipality/customer receives collateral in the form of Treasury bonds,GNMA bonds, agency MBS/CMO.2) Unsecured : The customer does not receive collateral. The deal commands a higher spread.Differences between flexible repos and traditional repos: They are four major differences with a traditional repo:1) Convexity due to cash withdrawals, 2) Formal written auction like trade, 3) Enhanced documentation,4) Counterparties are usually municipal bond issuers.Options6Forwards and futures obligate the holder to deliver or accept the delivery of the underlyinginstrument at expiration. Options, on the other hand give the owner the right (not the obligation) to purchase or sell an asset.Call option Consider an investor who purchases a call option written on an underlying asset 7As such, the payoff of the long call option (the call option buyer) is: . The initial spot price of the asset is (S 0). The investor pays a premium (c ) to be able to take advantage of theflexibility offered in the option contract. The option matures at time (T ), when the underlying asset has a spot price of (S T ). The future spot price is unknown to all market participants when entering into the option initially (t=0). The option gives the investor the right (but not the obligation) to purchase the asset at time T , for a pre-agreed price of K (or X, or Strike), called the strike price.Long call option maturity payoff =�S T−K if S T >K 0 if S T ≤KTo put words into the mathematics, we say this:If at maturity of the option (T ), the underlying asset (S T ) is worth less than the strike (K ), the option buyer will not exercise his/her option. The instrument ends worthless.If at maturity of the option (T ), the underlying asset (S T ) is worth moreLong call option maturity payoff =Max (S T −K ;0)than the strike (K ), the option buyer will exercise his/her option, and the payoff is the excess of the asset’s value over the strike (S T −K ). Thus, we also write:The payoff of the short position (the call option writer) is the opposite of the long position as follows:Short call option maturity payoff =�−(S T −K ) if S T >K 0 if S T ≤KThe premium (c)8Profit for tℎe long position =(Maturity Payoff of tℎe long position )−FV (Premium ) must be adjusted from the payoff in order to get the net profit for each position: AndProfit for tℎe sℎort position =(Maturity Payoff of tℎe short position )+FV (Premium ) Or:Profit for tℎe sℎort position =FV (Premium )−(Maturity Payoff of tℎe long position )7 We assume that the underlying asset pays no dividends during the life of the option.8 This premium represents the compensation the seller accepts for the right granted to the buyer.option .Graphically:Put option Consider an investor who purchases a put option written on an underlying asset. The initial spot price of the asset is (S 0) at contract inception. The investor pays a premium (p) for the put option. The option matures at time (T ), when the underlying asset has a spot price (S T ). The future spot price (S T ) is unknown to both parties at the inception of the put contract. At maturity of thecontract, the long position will decide on whether to exercise his/her option to sell the asset for the strike price (K ):If at maturity of the option (T ), the underlying asset (S T ) is worth less than the strike (K ), the put option buyer (the long position in the put option) has the ability to sell at price (K ), an asset that is worth less than (K ). He/she will exercise his/her option. The payoff from exercising this option is clearly equaled to (K −S T ).If at maturity of the option (T ), the underlying asset (S T ) is worth more than the strike (K ), the put option buyer (the long position in the put option) has the ability to sell at price (K ), an asset that is worth moreLong put option maturity payoff =� K −S T if S T <K 0 if S T ≥Kthan (K ). He/she will not exercise his/her option. Thus, the instrument ends worthless. Thus, the maturity payoff of the long put option is:Or also:Max (K −S T ;0)The payoff of the short position (the option writer) is the mirror image as follows:Short put option maturity payoff =�−(K −S T ) if S T <K 0 if S T ≥KNote : From the perspective of the buyer, it is interesting to buy the put option when you think that the underlying asset ‘might’ decrease below the strike price. You can also purchase the put option ifoption + asset) is comparable to owning an insurance contract9 on an asset (subject to damage in value).Graphically the payoff/profit of a call option (long/short) are plotted below: Also, the payoff/profit of a put option (long/short) are plotted below:Let us consider other reasons why would a trader may consider buying options:Reasons why traders may want to calculate the arbitrage-free price of a call option1.New contract: before the option is first issued, a trader may want to know the price that the option will trade at.2.Mispricing: A trader may want to calculate the arbitrage free value of an option to determine if the option is mispriced in the market.9 In fact, in the financial economics literature, the portfolio containing the stock and the put option written on the stock is called a protective put. Likewise, the writer (seller) of the call might want to protect himself from a huge increase in the stock index, as such, he/she would buy the underlying7.1).Profit of call and put options 10The profit at maturity (T ) of the derivative to the longProfit (Long position )=Payoff of the Long Position (T )−FV (Premium )position is calculated as: WhereFV (Premium )=Tℎe Future Value of tℎe Premium paid at inception by tℎe long positionAlso, the profit at maturity (T ) of the derivative to the shortProfit (Short position )=FV (Premium )−Liability of the Short Position (T )position is calculated as:WhereLiability of tℎe Sℎort Position (T )=Payoff of tℎe Long Position (T )We build the cash flows table as follows:As already explained:The long position in a stock is purchasing the stock price today (a negative cash flow) to receive the proceeds from the sale of the stock at maturity (a positive cash flow).The short position in a stock receives money from selling the stock today (a positive cash flow) and has to redeem the stock at maturity (negative cash flow). The long stock and the short stock are in a zero-sum game.The long position in a ZCB of redemption value K has to pay for the ZCB today. The price of which is the PV of the redemption amount. Because this is a purchase, it is a negative cash flow. At maturity though, the long position receives the redemption value of the bond K, a positive cash flow.The long position in any derivative has to pay a premium for entering into the derivative transaction at time t=0 (negative cash flow). At maturity, this long position is entitled to a payoff.The short position in any derivative receives the premium from the long position (positive cash flow) and at maturity; the short position is responsible for paying off the payoff arising to the long position. Because this payoff is a liability, it is a negative cash flow.10 Though not directly discussed in Neftci-1, the concept here is discussed in FIS-6 and frankly theSwapsA swap is an agreement between two counterparties for selling and purchasing cash flowsinvolving various currencies, interest rates and a number of other financial assets.The counterparties borrow in sectors where they have an advantage and then exchange theinterest payments.In a simple IRS, at the end, both counterparties secure a lower rates and the swap dealerwill earn a fee.The simple IRS exampleThis contract allows parties to exchange payments between two differently indexed legs, starting from a future time instant (Tα). At every time (T i), the fixed leg pays out the amount:Notional×τi×KWhere: τi=Tℎe year fraction between T i−1and T iK=Tℎe fixed rate of interest for tℎe fixed payments of tℎe IRS swapNotional=Tℎe notional amount of tℎe swap Whereas the floating leg pays out the amount:Notional×τi×L(T i−1,T i)Where: L(T i−1,T i)=Tℎe floating rate tℎat resets at tℎe previous time (T i−1) and is used tℎe payment at time (T i) Graphically, we have:A counter-party in this plan vanilla swap may be able to close out the transaction by payingthe net present value (NPV) of future swap payments.Pricing swaps11One method for pricing swaps and swaptions is to decompose them into forwards andoptions.The forwards can then be priced separately, and the corresponding value of the swap can bedetermined from these numbers.Two examples of swaps1)The simple IRS (Interest Rate Swap): Each counter-party borrows in the market (fixed rate and floating rate market) where it has an advantage and they both exchange the payments.2)The Cancelable Swaps: In this swap, each party has the option to cancel the transaction before maturity and extinguish the obligation to pay the PV of future payments. They come in two flavors: Callable swaps and Puttable swaps.Some properties of Cancelable swapsPopular among institutions with an obligation in which they are to repay principal beforematurity. The embedded option on the swap can be exercised to honor such liabilities.They can be used as hedge instruments.They allow institutions to mitigate maturity mismatch between assets and liabilities due toprepayments options or early surrenders.Past examsSOA Spring 2015 QFIC Q11 on Repo (Must Read)SOA Spring 2013 APM Q3 (Must Read)PAK Practice questionsQuestion 1a)List the differences between forwards and futures:Question 2Assume that the S&P 500 index is at 100. For a single premium of $100, a life insurance company had sold the following type of products:Contract 1: promising to pay 100 at maturity of the contract in 5 years plus any excess of the S&P 500 over its initial value of 100.Contract 2: The Company promises to pay the excess of two quantities:90% of the initial premium accumulated at 2% per annum andThe proceeds from the investment of the initial premium into a fund that performs exactlyFor each contract, determine the following quantities:1.The maturity of the contract2.The type of derivative embedded in the liability and the underlying asset.3.Identify the payoff of the liability, and the strike amountQuestion 3a)Describe the bull call spread optionQuestion 4a)Show the payoff of a cap portfolio (short stock + long call): In mathematical terms andthe plot.b)What is the net profit of the cap portfolio?c)Show that the ca portfolio can be viewed as a long put position.SolutionQuestion 1: Differences between futures and forward contractsThere are important differences between these two contracts:Forward contracts are settled at expiration while futures contracts are settled daily. At the end of each trading day, the clearinghouse adjusts the margin accounts to reflect the daily gain/loss to each counterparty of the transaction. This is called mark-to-market.Forward contracts are settled at the agreed-upon forward price while futures contracts aresettled at the settlement price determined on the last trading date.In a forward contract, there are no cash flows until expiration whereas for a futurescontract, there are daily cash flows to reflect the gain and loss to each counterparty.Futures contracts are more liquid than forward contracts. Futures contracts can be offsetany day by entering into an opposite transaction.Because of the daily mark-to-market accounting, futures contracts have lower (if any) creditrisk than forward contracts.There are typically daily price limits in future markets. Such limits are market moves thattrigger a temporary halt in trading.Question 2: Life insurance index contract1.Contract 1 has a maturity of 5 years and contract 2 has a maturity of 10 years.2 and 3.Embedded derivative in Contract 1:A call option on the S&P 500 of maturity 5 and strike 100.Embedded derivative in contract 2: Payoff is: Max (0.9×100×(1.02)10;F 10) Where: F 10=tℎe terminal value of tℎe fund tℎat mimics tℎe S &P 500 The payoff is equal to: Max (109.7;F 10)=F 10+Max (0;109.7−F 10)=F 10+Payoff of a put option Thus, the embedded derivative is a put option on the underlying fund of strike 109.7 and maturity 10 years . Question 3: The Bull spread 12Bull Call Spread Option (Neftci practice problem 6 on page 11)A bull spread call is a strategy that involves purchasing call options at a specific strike pricewhile also selling the same number of calls of the same asset and expiration date but at a higher strike. A bull call spread is used when a moderate rise in the price of the underlying asset isexpected. The maximum profit in this strategy is the difference between the strike prices of the long and short options, less the net cost of options. Question 4: The cap portfolio The combination (short asset and long call option on the asset) is called a cap 13. Let us now look at the mathematics of the cap (c-S ). The payoff table is captured below:Note the following about the payoff of the cap position: Max (0; S (T )−K )−S (T )=�If S (T )<K or if (–S (T )>−K ) Tℎe payoff is –S (T ) If S (T )>K or if (–S (T )<−K ) Tℎe payoff is –K12 More of this type of strategies in QFIQ-120-19 section 4. 13 The insight here is that without the call option, the short position in the asset has an obligation/liability of amount (S(T)) at maturity time T . However, with the long call option added to exceed that strike level .Note:That is why in the table, the final payoff for the position is simply (Max(−S(T);−K)).It is also very important to realize that the expression (Max(−S(T);−K)) is not the same as(−Max(S(T);K))14.Graphically, the maturity payoff of (the sum of the short stock + the long call option) yields a liability (opposite payoff) that cannot exceed a certain cap (the opposite of the strike level) as can be depicted below:Where we clearly see that when (S(T)<K), the liability (opposite payoff) of the cap is (-S(T)) and when (S(T)>K), the liability (opposite payoff) of the cap is (−K).The net profit of the capAs explained earlier on also, the profit at maturity (T) of the derivative to the short position is always calculated as:Profit(Short position)=FV(Premium)+Liability of the Short Position(T) Where Liability of tℎe Sℎort Position(T)=−Payoff of tℎe Long Position(T) Thus, the net profit from the cap is calculated as:Max�−K;−S(T)�+FV[S(0)−c]Thus:14For instance, (Max(−3;−10)=−3) while (−Max(3;10)=−10). These are two differentProfit from the cap portfolio=Max�−K;−S(T)�+[S(0)−c]×(1+r)TThe cap can be viewed as a long putWe are claiming that the net profit of the cap is equal to the net profit of a long put. How so? Once again, we make use of the put call parity identity:c−S(0)=p−K×(1+r)−T Multiplying this line by the accumulation factor (−(1+r)T), we get:[S(0)−c]×(1+r)T=−p×(1+r)T+KBy substitution of the FV of the premium ([S(0)−c](1+r)T) into the net profit for the cap, we get: Profit from the cap portfolio=Max�−K,−S(T)�−p×(1+r)T+KBy allowing K to enter into the Max-term, we get:Profit from the cap portfolio=Max�K−K;K−S(T)�−p×(1+r)T Thus: Profit from the cap portfolio=Max�0;K−S(T)�−p×(1+r)T=Profit for a long put option。