第六章出口合同履行

2023国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行引言出口合同是国际贸易中的一项重要文件,它规定了买卖双方的权利和义务,在实践中履行出口合同是确保交易顺利进行的关键环节。

本文将探讨国际贸易实务中出口合同的履行内容,包括合同的签订、履行义务、违约责任等方面。

出口合同的签订出口合同的签订是国际贸易中的首要步骤。

买卖双方在签订合同时应明确定义相关条款,确保合同的明确性和有效性。

是一些常见的出口合同条款:1.商品描述:合同中应包含商品的详细描述,包括名称、数量、规格、质量标准等信息,以避免产生歧义。

2.价格条款:合同中应明确商品的价格及支付方式,例如,是否包含运输费用、保险费用等。

3.交货方式:合同中应明确商品的交货方式和时间,确保买卖双方对交货地点和时间有同等的理解。

4.运输和保险:合同中应规定运输方式和责任的转移时间点,以及是否需要购买货物运输保险。

5.不可抗力条款:合同中通常包含不可抗力条款,以规定在不可抗力事件发生时买卖双方的责任和义务。

出口合同的履行义务出口合同的履行义务是指买卖双方在合同中规定的权利和责任。

是买卖双方在履行合同中常见的义务:1.供货方的履行义务:供货方有义务按照合同的约定交付商品,并确保商品符合合同规定的质量标准。

2.买方的履行义务:买方有义务按时支付商品的价格,并提供合同约定的付款方式和方式。

3.文件和通知的交付:买卖双方都有义务及时交付合同中规定的文件和通知,例如,装船通知、提货单等。

4.合同变更和解决争议的程序:买卖双方应遵守合同约定的程序来进行合同的变更和解决争议。

违约责任如果买卖双方一方未能履行合同义务,就构成了违约。

合同在违约责任方面通常包含内容:1.违约责任认定:合同中应规定违约行为的认定标准和程度,例如,如果一方无法按照约定交付商品,是否构成违约。

2.违约赔偿:合同中应规定违约方应承担的赔偿责任,包括合同损失和其他相关损失。

3.免责条款:合同中通常包含免责条款,规定不可抗力等特殊情况下的违约责任。

出口合同的履行

出口合同的履行1. 引言出口合同是指出口商与进口商之间就货物的销售和交付等事项所订立的协议。

出口合同的履行对于出口商和进口商双方来说都至关重要,因为它涉及到各种交付、支付和合规等问题。

本文将介绍出口合同的履行过程,包括合同签订、交付和付款等环节。

2. 出口合同的签订出口合同的签订是出口过程的起点。

在签订合同之前,出口商和进口商需要进行谈判以确定货物的种类、数量、价格、品质标准以及交付和支付条件等。

一旦双方达成一致意见,就可以签订合同。

在合同中,应该明确规定双方的权利和义务,并且将合同条款以书面形式记录下来。

合同的签订有助于减少纠纷和风险,并且对于后续的履行非常重要。

3. 货物的生产和准备在合同签订后,出口商需要按照合同的规定开始生产和准备货物。

这包括制造、包装和标记等环节。

出口商应该确保生产的货物符合合同规定的品质标准,并且能够按时交付。

4. 货物的运输和交付货物的运输和交付是出口合同履行过程中的关键环节。

出口商需要选择适宜的运输方式和物流效劳商来运送货物。

出口商应该确保货物能够按照合同规定的地点和时间交付给进口商。

在货物交付时,出口商应当向进口商提供必要的装运文件和法律文件,以确保货物顺利通过海关。

5. 付款的处理付款是出口合同中一个非常重要的环节。

根据合同的约定,进口商应当按照合同规定的方式和时间支付货款给出口商。

出口商应当确保合同款项的收取和处理符合相关法律法规,并且与金融机构合作以确保资金的平安和可靠。

一旦货款收到并确认无误,出口商可以对货物的交付进行结算并完成合同的履行。

6. 合同的变更和解决争议在出口合同履行过程中,可能会出现一些变更或争议。

如果双方对合同条款有任何变更的要求,应当及时协商并达成一致意见,然后以书面形式修改合同。

如果双方无法解决争议,可以考虑通过调解、仲裁或诉讼等方式解决。

7. 合规要求在出口合同履行过程中,出口商需要遵守相关的法律法规和国际贸易条约。

出口商应当确保货物的出口符合相关的出口管制规定,并保证所出口的货物不违反任何国家的进口限制和禁止性规定。

国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行引言出口合同是指国际贸易中出口商与进口商之间的合同,用于约定双方在商品交易过程中的权利和义务。

出口合同的履行是确保双方权益得到保障的关键环节。

本文将探讨出口合同的履行过程及其可行性、风险与策略。

出口合同的履行过程合同签订出口合同的履行过程始于合同的签订。

合同签订是双方达成协议的重要一步,需要明确商品的品种、数量、价格、交货时间、支付方式等关键条款。

合同签订应注重条款的明确性、合法性和可执行性,合同的规范性对双方履行合同具有指导作用。

准备货物在履行出口合同之前,出口商需要准备货物并确保其符合合同约定的质量和规格。

出口商应遵循相关国际质量标准和出口国家的法律法规,进行货物质量检验和检疫,并获得相应的证书和许可。

配送和运输根据出口合同的要求,出口商应将货物交付给指定的运输公司,并按照约定的交货时间送达目的地。

在配送和运输过程中,出口商应关注货物的安全和准确性,采取适当的包装措施,降低货物损坏和丢失的风险。

报关和支付出口商在将货物运输至目的地之前,需要进行出口报关手续。

出口商应提供必要的文件和资料,如发票、装箱单、出口许可证等,以便进口商可以按约定支付货款。

支付方式可以通过电汇、信用证或托收等方式进行,出口商需要确保所选择的支付方式符合合同约定。

履行付款和验收当货物到达目的地后,进口商进行验收并确认货物的完好性和数量是否与合同约定相符。

在验收通过后,进口商应按约定支付货款。

出口商应密切关注付款是否及时和合规,并及时跟进付款情况。

出口合同履行的可行性、风险与策略可行性出口合同的履行可行性主要取决于合同的条款是否具有明晰性、合法性和可执行性。

双方应确保合同的约定能够被有效执行,并且遵守相关的国际贸易规则和法律法规。

风险出口合同履行过程中存在一定的风险,如货物损坏、延误、质量不符合要求等。

为降低这些风险,出口商可以采取以下策略:•选择可靠的运输公司和保险公司,确保货物在运输过程中能够得到妥善的保管和赔偿;•根据合同约定,对货物进行适当的包装和标记,以减少损坏和丢失的风险;•根据目的地国家的法律法规和文化差异,调整合同条款,尽量避免纠纷和争议的发生;•与进口商建立密切的合作关系,加强沟通和交流,增加互信和合作的可能性。

出口合同的履行

四、制单结汇

出口合同的履行

1.出口结汇的方法

➢ 收妥结汇:是指议付行收到出口单据,审记通知书(Credit Note)时,即按当日外 汇牌价,折成人民币拨给出口单位。

➢ 押汇:又称买单结汇,是指议付行在审单无误的情况下,按信用证条款买入出口商的 汇票和单据,从票面金额中扣除从议付日至收到票款之日的利息,将余款按议付日外 汇牌价折成人民币,拨给出口商。押汇是真正意义上的议付。

2

一、准备货物

出口合同的履行

2.出口报验

出口报验是指出口生产、经营单位按照《商检法》规定,向当地出入境检验检疫局申 请办理检验手续。一般在货物备妥后填写“出境货物报验单”,附上合同和信用证副本等 凭据,向商检部门报验,实施“先报验,后报关”的通关模式。

对于法定检验商品,检验合格后,商检部门签发“出境货物通关单”,加盖检验检疫 专用章,海关凭以放行。

5

二、落实信用证

1.2 审证

2 出口商审证

出口商审证的要点如下: ① 仔细核对开证申请人和受益人的名称及地址。 ② 信用证金额、币种、付款期限规定是否与合同一致。 ③ 品名、货号、规格、数量规定是否与合同一致。 ④ 信用证中的装运条款是否与合同一致。 ⑤ 信用证交单日、到期日和到期地点是否正确。 ⑥ 对单据的审核。 ⑦ 对其他特殊条款的审查。 ⑧ 对银行费用条款的审核。

通知行将改 证转交卖方

7

三、组织装运

出口合同的履行

1.租船订舱

我国进出口货物多采用班轮运输。 ✓ 出口商通过提交订舱委托书向船公司或货运代理委托办理订舱事宜。同时,出口商还要

提交其他相关的商业发票、装箱单、出口货物报关单等单据。 ✓ 货运代理接受委托后缮制托运单,向船公司办理订舱手续。 ✓ 船公司接受订舱后,将托运单中的配舱回执单、装货单退还给托运人,托运人凭借装货

出口合同的履行程序

出口合同履行程序合同方:甲方:_________________________________乙方:_________________________________第1章总则第1.1条合同目的本合同旨在建立出口合同履行程序,以确保甲、乙双方在出口业务中的利益和义务得到充分保障和有效执行。

第1.2条合同范围本合同适用于甲、乙双方签订的每一份出口合同,包括货物的销售、装运、运输和交货。

第2章货物的销售第2.1条货物规格乙方应按照甲方提供的规格、样品或技术文件生产或采购货物。

货物应符合相应行业的标准和质量要求。

第2.2条价格条款货物的价格应按照合同中约定的方式和时间支付。

价格条款可能包括离岸价(FOB)、成本加运费(CIF)或其他国际贸易惯例认可的条款。

第2.3条付款方式甲方应按照合同约定的付款方式支付货款。

付款方式可能包括即期信用证、远期信用证、电汇或其他通行的付款方式。

第3章货物的装运第3.1条装运时间乙方应按照合同约定的时间装运货物。

装运时间应考虑货物生产、运输和交货所需的时间。

第3.2条装运方式货物可能通过海运、空运或陆运的方式装运。

装运方式应按照合同中约定的方式或甲方的要求选择。

第3.3条运输文件乙方应准备并提供必要的运输文件,包括提单、装箱单、发票和产地证明书。

这些文件应符合合同的要求和相关法律法规。

第4章货物的运输第4.1条保险乙方应对货物投保适当的运输保险。

保险范围应涵盖在运输过程中货物遭受的损失或损坏。

第4.2条风险转移货物风险在装运时从乙方转移至甲方。

风险转移后,货物因任何原因造成的损失或损坏由甲方承担。

第4.3条货物的追踪乙方应提供货物的追踪信息,使甲方随时知晓货物的运输进度。

第5章货物的交货第5.1条交货地点货物应交付至甲方指定的地点。

交货地点可能位于甲方的工厂、仓库或其他指定的地点。

第5.2条交货时间货物应按照合同约定的时间交货。

交货时间应考虑货物运输所需的时间和海关清关程序。

国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行引言出口合同是国际贸易中非常重要的一环,它规定了买卖双方的权利和义务,以确保交易的顺利进行。

本文将重点介绍国际贸易实务中出口合同的履行问题。

首先,将简要介绍出口合同的定义和形式,然后详细讨论履行的主要内容和注意事项,最后总结出口合同履行的重要性。

出口合同的定义和形式出口合同是指出口方(即卖方)与进口方(即买方)就特定商品的销售和运输事宜达成的书面协议。

它的主要目的是确保买卖双方的权益得到保护并推动贸易的顺利进行。

出口合同的形式多样,可以是合同书面形式、电子邮件形式或其他书面形式。

无论形式如何,出口合同应该包含重要内容:合同名称、合同双方的名称和地质、商品名称及规格、数量和价格、交货和装运方式、付款条件、售后服务和纠纷解决方式等条款。

履行的主要内容和注意事项1. 交货和装运出口合同中规定的交货和装运方式对于出口合同的履行至关重要。

卖方应按照合同的规定,按时将商品交付给买方并负责商品的装运和运输。

在履行中,卖方必须确保商品的质量和数量与合同规定的一致,并采取适当的包装和保护措施以确保商品的完好无损交付给买方。

同时,卖方还应及时向买方提供有关装运和交货的必要文件,如装运单、发票和保险单等。

2. 付款条件付款是出口合同中一个关键的履行内容。

买方应按合同规定的付款方式和时间支付货款。

卖方在履行中应确保提供准确的付款要求,并与买方就付款方式和时间达成共识。

为降低支付风险,卖方可以要求买方使用信用证方式付款,以确保买方按时支付货款。

3. 售后服务在出口合同履行中,卖方应提供必要的售后服务以满足买方的需求。

这包括提供产品的技术支持、维修和保养服务以及提供商品的配件和备件等。

卖方在履行中应积极响应买方的需求,并及时解决买方的问题和投诉,以确保买方对商品和服务的满意度和信任度。

4. 纠纷解决在合同履行过程中,由于各种原因,可能会发生纠纷。

为避免和解决合同纠纷,合同当事人应事先约定适用的法律和仲裁管辖地,并明确纠纷解决的程序和方法。

出口贸易合同的履行

出口贸易合同的履行1. 引言出口贸易合同是国际贸易中至关重要的法律文件,规定了双方当事人之间的权利和义务。

本文将重点讨论出口贸易合同的履行。

2. 合同履行的意义合同履行是指合同双方按照合同条款和约定,执行各自的权利和义务,完成合同所规定的交付、支付、承诺等事项。

出口贸易合同的履行对于双方当事人都具有重要意义。

对于出口商来说,履行合同可以获得货款,推动企业的发展;对于进口商来说,合同的履行可以确保按时获得所需的货物或服务。

3. 履行合同的要求为了顺利履行出口贸易合同,双方当事人需要根据合同条款和国际贸易惯例遵守以下要求:3.1 准确无误的合同条款合同条款应具体明确,包括商品名称、规格、数量、质量标准、交货期限、付款方式、检验和验收标准等。

双方当事人应明确自己的权利和义务,并明确约定违约责任和争议解决方式。

3.2 准时交货出口商应按照合同约定的交货期限和提供商定的方式和地点交付货物。

进口商在收到货物时应进行验收,确保货物的数量和质量与合同要求一致。

3.3 保证质量出口商需要确保货物符合合同约定的质量标准,并提供相关的质量证明文件。

进口商在验收货物时应注意检查货物的质量并及时提出质量异议。

3.4 付款方式和期限双方当事人需在合同中明确支付货款的方式、期限和付款账户。

一般来说,进口商可以选择信用证支付、电汇或托收等方式。

出口商应在收到货款后及时提供货物、文件和证明。

3.5 遵守合同解决争议的程序如果在合同履行过程中出现争议,双方当事人应按照合同中约定的争议解决方式进行沟通和协商。

如果无法达成一致,可以通过仲裁或法院起诉等方式解决争议。

4. 履行合同的问题和解决方法在出口贸易合同履行过程中,可能会遇到各种问题。

以下是一些常见问题和解决方法:4.1 延迟交货或未能履行合同如果出口商无法按时交付货物或未能履行合同,进口商可以要求赔偿或解除合同。

双方当事人可以重新协商新的交货期限,并确保履行合同。

4.2 质量问题如果货物质量与合同约定不符,进口商可以要求退货或索赔。

国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行

1. 合同签订:合同签订是出口合同履行的起点。

双方按照法律法规和国际惯例,就商品的价格、数量、质量、包装、运输方式、付款条件等进行协商,达成一致后签署合同。

2. 生产或采购准备:出口商品的生产或采购准备是合同履行的重要步骤。

出口商需按照合同约定生产或采购商品,并确保商品符合合同规定的质量标准。

3. 商品检验:出口商品在出口前需要进行检验,以确保商品符合合同规定的标准和质量要求。

出口商可以选择国内检验机构进行检验,或者委托第三方检验机构进行验证。

4. 订舱或包装:出口商品需要进行适当的包装,以保护商品在运输过程中不受损坏。

出口商可根据运输方式和目的地要求订舱或选择合适的包装方式。

5. 运输和保险:出口商品需要通过运输工具(如船舶、飞机、卡车等)进行运输到买方所在地。

出口商需要与货代或运输公司联系,安排运输,并购买适当的保险以覆盖货物在运输途中可能发生的损失或损坏。

6. 报关和报检:出口商品到达目的地国家后,需要进行报关和报检手续,以便进入目的地国家市场。

出口商需提供必要的文件和资料,配合海关和检验机构完成相关手续。

7. 结汇和付款:买方根据合同约定支付货款,出口商需提供相应的结汇证明和付款凭证,以确保货款的合法收汇。

8. 完成合同:当出口商收到货款后,合同履行完成。

出口商需向买方提供相应的出口文件和单证,以证明合同的履行。

出口合同的履行需要遵守国内外的相关法律法规和合同约定,出口商应仔细了解并按照相关规定和程序进行操作,以确保合同的顺利履行。

国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行

出口合同的履行是指出口方和进口方在合同约定的交货、付款、文件传递等方面履行各自责任的过程。

1. 出口货物的交货:根据合同约定的交货地点和时间,出口方需按时将货物交付给进口方或其指定的代理商。

出口方需要确保货物的质量、数量和包装符合合同要求,并提供相应的装运文件。

2. 付款方式与期限:出口方和进口方在合同中约定了付款方式和付款期限。

出口方应按照合同约定的方式要求进口方支付货款,并在规定的期限内提供商业发票、提单和其他相关支付文件。

3. 文件传递:出口方需要按照合同的规定,在交货后将必要的装运文件如提单、商业发票、装箱单等传递给进口方。

这些文件是进口方办理清关手续,支付货款的必要依据。

4. 商品检验与验收:进口方在收到货物后,需要进行商品检验与验收,确保货物质量、数量和包装符合合同约定。

如果发现问题,进口方有权要求出口方负责修补、更换或退款。

5. 违约责任:在合同履行过程中,如果任何一方未能按照合同约定履行义务,对方有权向违约方提出索赔要求。

违约方可能需要支付赔偿金,并承担其他可能的法律后果。

出口合同的履行需要双方共同努力,遵守合同约定,确保交易顺利进行。

在实际操作中可能会遇到一些问题和风险,双方需谨慎处理合同条款,并在遇到问题时及时沟通解决,以确保合同的有效履行。

国际贸易实务 出口合同的履行

国际贸易实务出口合同的履行

出口合同的履行是指卖方按照合同的约定,将货物或服务交付给买方,并收取相应的款项。

下面是出口合同的履行的一些关键要点:

1.货物交付:卖方应按照合同约定的方式和时间将货物交付给买方。

货物的交付方式可以是直接交付给买方,也可以是交付给承运人并提供相应的运输文件给买方。

2.文件准备:卖方应按照合同要求准备和提供必要的文件,如装箱单、发票、保险单、出口许可证等。

这些文件是买方获得货物的凭证,也是办理报关、支付货款以及索赔等的重要文件。

3.支付货款:买方应按照合同的约定支付货款。

常见的支付方式包括电汇、信用证和托收等。

卖方可以通过向买方提供相应的证据(如提单、商业发票等)来要求支付货款。

4.合同履行期限:合同约定了履行期限,卖方应在约定的时间内履行合同义务。

如果卖方未能按时履行合同,买方有权采取相应的法律措施来保护自己的权益。

5.货物质量和包装:卖方应按照合同的要求提供符合质量标准的货物,并采取适当的包装措施保护货物。

买方有权对货物进行验收,并提出合理的质量异议。

6.合同变更和解决争议:在合同履行过程中,双方可能需要对合同条款进行变更或者解决争议。

对于合同的变更,双方应通过协商一致并签订书面变更协议。

对于争议的解决,双方可以选择通过谈判、调解、仲裁或诉讼等方式解决。

,出口合同的履行是一个复杂的过程,需要卖方和买方共同努力,按照合同约定的方式履行各自的义务,以保护彼此的权益。

出口合同的履行内容

出口合同的履行内容

以下是 7 条关于出口合同履行内容:

1. 哎呀,咱先得把货物准备得妥妥当当的呀!比如说,就像要去参加一场重要考试,你得把文具都准备齐全一样。

咱得按照合同要求的质量、数量、规格来准备货物,可不能有一丝马虎啊!要是货物出了问题,那不就麻烦大了嘛!

2. 然后呢,包装也得重视起来呀!这就好比给一件珍贵的礼物穿上漂亮的外衣。

要是包装不好,在运输过程中货物受损了怎么办?那可真是让人欲哭无泪呀!

3. 接下来运输安排可不能马虎哟!这不就跟规划出门旅游的路线似的。

选好合适的运输方式,确保货物能安全、及时到达目的地,这多关键呀!

4. 报关哇,这可真是个重要环节呢!就像是要过一道关卡,得按规矩来,把该准备的文件都准备好。

不然怎么能顺利通过呢,是不是?

5. 付款方式也得搞清楚呀!难道不是吗?这就像你和朋友出去吃饭,得先说好谁买单一样。

要是没弄明白,到时候可别闹出不愉快哦!

6. 保险也别忘了呀!这就好像给货物穿上了一层保护衣。

万一出了啥事,还有个保障呢,不然多不放心呀!

7. 最后呀,双方的沟通合作那得紧密无间呀!这就好比两个人跳舞,得相互配合好才行。

彼此及时反馈情况,遇到问题共同解决,这样合同履行才能顺顺利利的呀!

我的观点结论:出口合同的履行真是好多细节都要注意呀,每个环节都至关重要,只有都做好了,才能圆满完成呀!。

国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行出口合同履行指的是出口方和进口方按照合同约定的条款和条件,履行各自在合同中规定的权利和义务。

为了保证双方的权益和减少纠纷的发生,出口合同的履行过程需要严格按照国际贸易的规定进行操作。

本将详细介绍出口合同履行的相关内容,包括合同签订、商品交付、支付方式等方面的具体操作流程。

一、合同签订合同签订是出口合同履行的起点,双方应当明确约定合同的内容,包括商品名称、规格、数量、价格、交付地点、支付方式、包装标准等。

同时,合同还应当明确约定双方的权利和义务,包括商品质量、交货期限、违约责任、争议解决等条款。

合同签订后,双方应当尽快确认合同的有效性,并办理相关手续,以确保合同的正式生效。

二、商品交付商品交付是出口合同的核心环节,出口方应当按照合同规定的交货期限和交货地点,准备并委托运输公司进行货物的运输。

在货物运输过程中,出口方应当妥善保管货物,并确保货物完整无损地到达目的地。

同时,出口方还需要根据合同要求提供相关的出口证明和单据,如发票、装箱单、商检报告等。

三、支付方式支付方式是出口合同履行中的重要环节,双方应当根据合同约定选择合适的支付方式。

常见的支付方式包括电汇、信用证、托收等。

出口方在货物交付后,应当向进口方提供相应的付款单据,并确保款项能够按时收到。

进口方应当按照合同约定的付款方式和期限,及时付款给出口方。

四、商品质量和检验合同中应当明确约定商品的质量标准和检验要求。

出口方应当确保出口商品符合约定的质量标准,并按照进口方的要求办理相关的检验手续。

进口方在收到货物后,应当及时进行检验,并按照合同规定的检验标准和程序,对货物的质量进行评估。

如发现货物存在质量问题,进口方应当及时通知出口方,并要求出口方采取对应的措施解决问题。

附件1. 合同正本和副本2. 商品清单及规格说明3. 支付相关的文件和单据4. 出口证明文件(如出口报关单、商检报告等)5. 检验报告及质量证明文件法律名词及注释1. 出口方:指合同中承诺向国外提供商品或者服务的一方。

国际贸易实务出口合同的履行

国际贸易实务出口合同的履行1. 引言国际贸易是不同国家之间进行商品和服务交换的重要方式。

对于出口商来说,出口合同的履行是确保交易顺利进行的关键环节。

本文将介绍国际贸易实务中出口合同的履行过程、合同履行的主要要素以及合同履行中的一些常见问题。

2. 出口合同的履行过程出口合同的履行过程可分为几个阶段:2.1 合同签订合同签订是确定交易双方关系和权利义务的重要步骤。

双方应明确合同的基本条款,包括商品描述、价格、数量、质量、付款方式、起始和截止日期等。

同时还应考虑到国际贸易中的特殊要求,如运输方式、保险、报关等。

2.2 履行合同出口商在履行合同时应严格遵守合同约定的各项规定。

履行合同包括准备货物、装运货物、办理出口手续、通知买方等环节。

出口商应保证货物的质量、数量和交货期等符合合同要求。

付款和结算是出口合同履行的最后环节。

出口商应按照合同约定的付款方式向买方收取货款。

一般常见的付款方式包括信用证、托收、电汇等。

出口商在收到货款后需办理结汇手续,将外汇收入兑换为本国货币。

3. 出口合同的履行要素出口合同的履行要素如下:3.1 商品质量商品质量是出口合同履行的重要要素之一。

出口商需要确保出口的商品符合合同约定的质量标准,并对货物进行必要的检验和测试。

如果货物质量不符合合同要求,将面临索赔和违约的风险。

3.2 交货期交货期是出口合同约定的另一个重要要素。

出口商需要按照合同规定的交货期准时交付货物。

如果无法按时交货,可能会导致买方违约并索赔的情况发生。

3.3 证书和文件出口商在履行合同时需要提供相关的证书和文件。

例如,出口商需要提供货物的质量证明、数量证明以及其他必要的出口证书和报关单据。

这些证书和文件对于货物的顺利通关和目的地国家的入境手续非常重要。

付款和结算是出口合同履行的关键环节。

出口商需要确保买方按照合同约定的方式和时间付款。

同时,出口商还需提供必要的结算证明和文件,以便顺利收取货款并完成结汇手续。

4. 出口合同履行中的常见问题在出口合同履行过程中,可能会遇到一些常见问题。

出口合同的履行

投诉和索赔。

3

3

遵守出口国家的法规和规定,确保业务

4

4

顺利。

与客户保持密切联系,处理任何质量问

题。

5

5

协调与运输公司和海关的关系,确保货 物的顺利通关。

最终交易和客户满意度

确认最终交易

确认货款收到,并为客户提供完整的交易记录和必 要的证明文件。

确认客户满意度

与客户保持沟通,及时解决问题,并确认客户对交 付的货物和服务的满意度。

确认付款方式

了解出口国家的常见付款方式

确保了解出口国家的常见付款方式,并确认与客户 约定的付款方式。

开立信用证

在客户的要求下,开立符合要求的信用证,确保交 易款项的安全性。

确认付款到账

确认客户已按照合同要求足额付款,并验证相关付 款信息。

交货和售后服务

1

1

按照约定的时间和质量要求交付货物。

2

2及Βιβλιοθήκη 响应并解决可能出现的交付问题、2

2

确保货物的数量和质量信息正确无误,并填写相应的申报和报关单。

3

3

向有关部门申请必要的出口许可证和其他证明文件。

安排货物装运

1

安排货物装箱和堆放,确保货物稳定和安全。

3

根据合同要求提供相应的运输保险和其他保障 措施。

2

安排物流供应商运输货物,确保货物达到目的 地。

4

在货物发运前核对货物清单,确保完整无误。

准备出口产品

11

与供应商确认产品数量和质量标准。

22

根据合同要求生产并包装货物,确保装箱符合出口要求。

33

准备货物发票和装箱单。

产品检验和质量控制

1

生产过程检验

国际贸易实务 出口合同的履行-无删减范文

国际贸易实务出口合同的履行国际贸易实务 - 出口合同的履行引言出口合同是国际贸易中至关重要的一环,它规定了商品的交付和支付方式,同时也规范了双方当事人的权利和义务。

合同的履行是确保贸易顺利进行的关键环节。

本文将介绍出口合同的履行过程,包括合同签订后的准备工作、履行中的注意事项以及合同履行后的收尾工作。

合同签订后的准备工作在合同签订后,出口商需要做好一系列的准备工作,以确保合同的顺利履行。

1. 准备出口货物出口商需要根据合同约定准备好货物,确保其质量和数量与合同的要求相符。

同时,出口商需要注意货物的包装和标识,以确保货物在运输过程中不受损或遗失。

2. 办理相关证件和手续出口商需要根据国家和地区的相关法律法规,办理出口所需的证件和手续,如出口报关单、出口许可证等。

这些证件和手续是保证合法出口的必要条件,出口商需按时办理并妥善保管。

3. 安排运输方式和保险出口商需要根据合同的约定安排合适的运输方式,并购买适当的货物运输保险。

合适的运输方式和保险可以确保货物安全抵达目的地,并减少运输过程中的风险。

履行中的注意事项在履行合同的过程中,出口商需要注意以下几个重要事项,以避免合同纠纷和损失。

1. 严格按合同履行出口商需要严格按照合同的约定进行货物交付和支付。

任何变更或修改合同都需要经过双方当事人的协商和书面确认。

合同中的条款和条件是双方共同遵守的法律依据,出口商不得擅自改变或违反。

2. 关注货物运输和交付出口商需要密切关注货物的运输和交付过程,确保货物按时抵达目的地。

出口商可以与货运代理或运输公司保持密切联系,及时了解货物的运输状态,并采取必要的措施解决可能出现的问题。

3. 控制交付风险在货物交付过程中,出口商需要采取适当的措施控制交付风险。

出口商可以选择使用信用证等支付方式,以确保合同款项的安全支付。

同时,出口商可以要求买方提供相关的贷款担保或支付担保,以确保自身权益不受损害。

4. 处理合同纠纷如果在合同履行过程中发生纠纷,出口商需要及时与买方进行沟通和协商,尽力解决纠纷。

国际贸易实务之出口合同的履行

国际贸易实务之出口合同的履行出口合同是国际贸易中的重要文件,它规定了出口方和进口方之间的权利和义务,并约定了具体的交货、付款和争议解决等细节。

出口合同的履行是保障贸易双方权益的关键环节,本文将从合同签订、商品交付、付款方式和争议解决等方面探讨国际贸易实务中出口合同的履行。

一、合同签订出口合同的签订是贸易交易正式开始的标志,而且在合同签订之前,双方需进行多次洽谈与沟通,确保合同的条款和条件符合双方的意愿。

首先,在合同中要确立双方的身份和法律地位,明确双方的买卖主体、签约代表等信息。

其次,要明确商品的规格、数量和质量标准,确保商品的交付符合合同要求。

此外,还应明确交货时间、运输方式以及责任转移的时间点等,避免因物流环节导致的纠纷。

合同签订时,双方还可以约定一些其他条款,如索赔、违约责任和法律适用等,以确保合同履行的安全和可靠性。

二、商品交付在国际贸易中,商品的交付是出口合同履行的核心环节之一。

出口商应按照合同规定提前妥善准备货物,并采取适当的包装和质检措施,确保商品在运输过程中不受损坏。

双方应明确交货地点和方式,如EXW(离岸价)、FOB(船上交货,买方负责付运费)、CIF(成本、保险和运费)等,避免因交货问题引发纠纷。

同时,出口商还应及时通知进口商货物的发运时间和运输信息,确保进口商能够及时收到货物。

三、付款方式在国际贸易中,支付方式的选择直接影响到合同履行的顺利进行。

根据不同的风险和双方的交易关系,出口商和进口商可以选择不同的付款方式,如信用证、托收、电汇和跨境支付平台等。

其中,信用证是最常用的支付方式之一,它通过银行的担保作用,保障了出口商能够按照合同要求收到货款。

而托收和电汇则是相对便捷和灵活的支付方式,能够降低交易成本和支付风险。

双方在履行合同时,要严格按照付款方式和付款条件的约定进行操作,确保资金流动的安全和有效。

四、争议解决在国际贸易实务中,出口合同履行过程中难免会出现一些纠纷和争议。

出口合同的履行流程

出口合同的履行流程1. 导言出口合同是指国内企业与国外企业或个人之间签订的从国内向国外出口货物或提供服务的合同。

出口合同的履行流程主要包括合同签订、准备货物、货物装运、报关报检、国际运输、收款结算等多个环节,下面将逐一介绍。

2. 合同签订出口合同的签订是整个履行流程的起点。

在签订合同之前,双方应充分了解对方的资信状况、业务实力和信誉等情况,并明确合同的基本条款,包括货物名称、规格、数量、售价、付款方式、交货方式、保质期、索赔条件等。

合同签订后,双方应妥善保管合同原件,以备日后参考和争议解决之用。

3. 货物准备在履行出口合同的过程中,出口方需要按照合同规定准备货物。

货物准备工作包括货物的生产、采购、加工、包装等环节。

出口方应严格按照合同规定的质量标准和交货时间进行生产和采购。

在生产和采购过程中,出口方需要做好货物质量控制和监督,确保质量符合合同规定。

4. 货物装运货物装运是指将准备好的货物进行包装、装箱,并运送到港口或机场等出口口岸。

出口方需要按照国际贸易惯例和运输要求进行合理的包装和标识。

在货物装运过程中,出口方需要与货代公司或物流公司等合作,确保货物能够按时、安全地运送到目的地。

5. 报关报检在货物装运之前,出口方需要进行报关报检手续。

报关是指出口方向海关申报货物出口的手续,报检是指对货物进行质量、数量、规格等方面的检验和检疫。

出口方需要提供相应的报关单证和报检文件,并执行海关和检验检疫部门的要求,确保货物符合出口国家的相关标准和要求。

6. 国际运输国际运输是指将货物从出口国家运输到进口国家的过程。

国际运输通常由海运、空运、陆运等多种方式组成。

出口方需要根据货物性质和具体情况选择合适的运输方式,并与承运人签订相应的运输合同。

在国际运输过程中,出口方需要与承运人保持密切联系,及时获取运输情况,并协调处理可能发生的问题。

7. 收款结算出口合同的最后一个环节是收款结算。

出口方应根据合同的约定,向进口方发出货款要求,并提供相应的结算单证和文件。

出口合同的履行程序4篇

出口合同的履行程序4篇篇1出口合同是指一方国际贸易商与另一方国际购货商之间签订的关于出口货物的合同。

对于出口合同的履行程序,是指在合同签订之后,双方按照合同约定的条件和条款,完成货物的生产、装运、运输和交付等一系列程序的过程。

本文将介绍一般出口合同的履行程序,并重点阐述在实际操作中需要注意的事项。

一、出口合同签订出口合同签订是指双方采购商和销售商在经过谈判、协商之后达成一致意见,签署正式合同的过程。

在签订出口合同之前,双方应明确约定货物的品种、数量、质量、价格、交付地点、交付方式、付款方式、交付期限等相关条款。

在签订合同时,双方应认真核对各项条款,确保符合国际贸易法律法规的规定,避免合同纠纷。

二、生产准备在出口合同签订后,供应商需要进行生产准备工作。

这包括生产计划的制定、原材料的采购、生产设备的调整、生产线的组织、生产过程的控制等工作。

供应商应根据合同约定的交货期,合理安排生产计划,确保按时交付货物。

三、货物生产货物生产是出口合同履行的关键环节。

在生产过程中,供应商应按照合同约定的质量标准和规格要求,生产合格的产品。

同时,供应商应不断监控生产过程,及时发现并解决生产中出现的问题,确保货物质量符合合同约定。

四、货物检验在货物生产完成后,需要进行货物检验。

货物检验是确保货物质量符合合同约定的重要环节。

供应商可以委托第三方检验机构对货物进行检验,以确保产品符合合同标准。

通过检验合格的货物,才能交付给购货商。

五、货物装运货物装运是出口合同履行的重要环节。

在货物检验合格后,供应商需要按照合同约定的交付方式和交付地点,进行货物装运。

货物装运包括货物包装、运输手续、运输方式的选择等环节。

供应商应选择可靠的运输公司,并保证货物按时安全到达目的地。

六、付款结算付款结算是出口合同履行的最后环节。

购货商在收到货物后,根据合同约定的付款方式,进行付款结算。

供应商应妥善保管相关付款凭证,以确保能及时收到款项。

综上所述,出口合同的履行程序包括合同签订、生产准备、货物生产、货物检验、货物装运和付款结算等环节。

第六篇 出口合同履行

第三节 安排装运

1)托运 一般向船公司或货代办理 相关单证包括:提货单,商业发票,装 箱单/重量单,报关单,外汇核销单,有 的要需要出口许可证,商检证等 船公司和货代回以配舱回单(shipping order)

第三节 安排装运

2)定舱 SHIPPING ORDER 船公司及其代理向船上负责人(船长或 大副)和集装箱装卸作业区签发的一种 通知其接受装货的指示文件。 是报关时必须向海关提交的单据之一。 场站收据(集装箱运输)和大副收据 (散货运输),装船后换取已装船提单。

修改信用证

1)不可撤销信用证未经开证行,保兑行和受 益人同意,既不可撤销也不可修改。 2)发出修改后,开证行即受该修改内容的约 束,对发出的修改不可撤销。 3)受益人收到修改通知后要作出接受或拒绝 的通知,如果没有作出,而向银行提交符合信 用证以及修改件的单据,则视为接受。 4)对同一修改的部分接受是不允许的。 对多处需要修改的,应一次提出,以节省费用。 将信用证修改件和原件附在一起。

一般是在收到信用证后或收到对方汇付的部分 定金后开始生产。

在合同中要规定信用证开立的合理时间,或者 规定一个收到信用证的截止日期,若过了该日 期,则原合同的交货期就不予保证。

在备货中应注意的问题:

一般一次装运 也允许分期,分批装运,如合同中明确规定分 批,分期装运的时间和期限,则必须按照合同 规定逐批按期装运,如其中任何一期不按合同, 履行,买方有权宣布对此期及以后各期合同宣 布无效,并要求赔偿,如果各批货物是相互依 存的,如大型机械设备,则买方可宣布整个合 同无效。

在备货中应注意的问题:

2)包装 按照合同规定 运输标志按照合同或客户要求印制,如 未规定的,可由我方自行选定。 运输标志的四内容。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

UCP600第四条 信用证与合同:

a. A credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any reference whatsoever to it is included in the credit. Consequently, the undertaking of a bank to honour, to negotiate or to fulfil any other obligation under the credit is not subject to claims or defences by the applicant resulting from its relationships with the issuing bank or the beneficiary. A beneficiary can in no case avail itself of the contractual relationships existing between banks or between the applicant and the issuing bank.

➢ We hope that you will take commercial reputation into account in all seriousness and open L/C at once,otherwise you will be responsible for all the losses arising therefrom. 希望贵方认真考虑商业信誉,立即开证,否则,由此产生的一切损失均由 贵方负责。

货、证、船、款

第一节 信用证操作——催证、审证、改证

一、催证 催证指卖方通知或催促国外买方按合同规定(一般为装运前15 天)开出信用证。按合同规定及时开出信用证是买方在信用证 支付方式合同中一项主要义务,它是卖方在此种交易中顺利履 行合同、安全及时收回货款的前提。 催证方式:信函、电报、电传、传真、邮件

UCP600第五条单据与货物/服务/行为:

Banks deal with documents and not with goods, services or performance to which the documents may relate . 银行处理的是单据,而不是单据所涉及的货物、服务或其它行为

去信表示对该笔交易的重视。并提醒对方及时开证。

➢ As the goods against your order No.111 have been ready for shipment for quite some time,it is imperative that you take immediate action to have the covering credit established as soon as possible。 由于贵方 定单 第111号之货已备待运有相当长时间了,贵方必须立即行动 尽快开出 信用证 。

UCP600第三十四条 关于单据有效性的免责:

A bank assumes no liability or responsibility for the form, sufficiency, accuracy, genuineness, falsification or legal effect of any document, or for the general or particular conditions stipulated in a document or superimposed thereon; nor does it assume any liability or responsibility for the description, quantity, weight, quality, condition, packing, delivery, value or existence of the goods, services or other performance represented by any document, or for the good faith or acts or omissions, solvency, performance or standing of the consignor, the carrier, the forwarder, the consignee or the insurer of the goods or any other person.

需要催证的情况:

1、合同内规定的装运期距合同签订的日期较长,或合同规定 买方应在装运期前一定时间开出信用证。

2、卖方提早将货备妥,可以提前装运,可与买方商议提前交 货。

3、国外买方没有在合同规定期限内开出信用证。 4、买方信誉不佳,故意拖延开证,或因资金等问题无力向开

证行交纳押金。 5、签约日期和履约日期相隔较远应在合同规定开证日之前,

买方信用证最少应在货物装运期前15天开到卖方手中。对于资信情况不是很 了解的新客户原则上坚持在装运期前30天或45天甚至更长的期限,并且配 合生产加工期限和客户的要求灵活掌握信用证的开证日期。在实际业务中, 国外客户在遇到市场行情变化或缺乏资金的情况下,往往拖延开证,因此出 口商应及时经常检查买方的开证情况。

a. 就性质而言,信用证与可能作为其依据的销售合同或其它合同,是相互独 立的交易。即使信用证中提及该合同,银行亦与该合同完全无关,且不受其 约束。因此,一家银行作出兑付、议付或履行信用证项下其它义务的承诺, 并不受申请人与开证行之间或与受益人之间在已有关系下产生的索偿或抗辩 的制约。受益人在任何情况下,不得利用银行之间或申请人与开证行之间的 契约关系。

➢ The shipment time for your order is approaching,but we have not yet received the covering L/C.Pls do your utmost to expedite the same to reach here before the end of this month so that shipment may be effected without dealy。 贵方 定单 的装船期已经临近,但我们尚未收入到有关信用证,请尽最大 努力从速将信用证在本月底开到,以便及时装运。

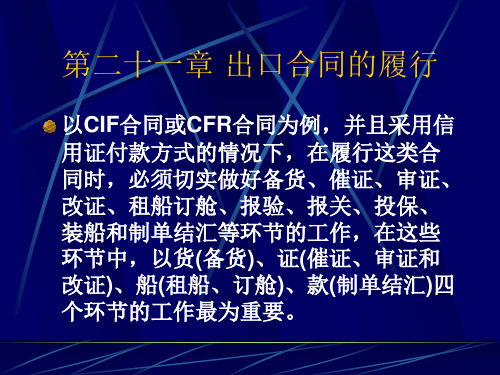

第6章 出口合同履行

学习目标

➢信用证的操作 ➢拟定合同价格条款 ➢租船、订舱 ➢备货报检 ➢办理保险 ➢集港报关 ➢出口退税与外汇核销

出,由卖方安排运输时

1.催证、审证、改证

2.备货 3.租船订舱 4.报检保险 5.货物集港 6.报关 7.装船 8.退税、外汇核销