审计报告中英文范本

2023 审计报告 英文版

2023 审计报告英文版全文共四篇示例,供读者参考第一篇示例:2023 Audit ReportIntroductionThe 2023 Audit Report provides a comprehensive overview of the financial status and operations of the company for the fiscal year ended December 31, 2023. The audit was conducted in accordance with generally accepted auditing standards and included a review of the company's financial statements, internal controls, and compliance with relevant regulations.Financial PerformanceBalance SheetInternal ControlsComplianceRisks and Challenges第二篇示例:2023 Audit ReportFinancial PerformanceOur audit revealed that the majority of the companies examined in 2023 showed promising financial performance. The revenue growth of the companies was steady, and most of them reported healthy profit margins. However, there were instances where the financial statements were not prepared in accordance with the generally accepted accounting principles. These discrepancies were due to errors in recording transactions or improper classification of expenses. We recommend that companies improve their financial reporting processes to ensure accuracy and transparency.RecommendationsBased on our findings, we offer the following recommendations to the companies audited in 2023:第三篇示例:2023 Audit ReportIntroductionFinancial PerformanceThe company's financial performance in 2023 was strong, with total revenue increasing by 10% compared to the previousyear. This growth was driven by an increase in sales of new products and services, as well as improved efficiency in operations. The company's gross margin also improved by 2% due to cost-saving initiatives and better pricing strategies. Overall, the company's profitability increased, with net income growing by 15% compared to the previous year.Balance SheetInternal ControlsCompliance第四篇示例:2023 Audit ReportExecutive Summary:The 2023 Audit Report provides a comprehensive overview of the financial statements and operations of the company for the fiscal year ending December 31, 2023. This report includes an assessment of the company's financial position, internal controls, compliance with regulations, and recommendations for improvement.Financial Statements:Internal Controls:Compliance:Recommendations:Based on our audit findings, we have the following recommendations for the company to strengthen its financial controls and operations:。

中英文对照的标准版审计报告

标准审计报告的参考格式Example of Standard Auditor’s Report审计报告Auditor’s ReportABC股份有限公司全体股东:To the shareholders of ABC Company Limited,我们审计了后附的ABC股份有限公司(以下简称ABC公司)财务报表,包括20×1年12月31日的资产负债表,20×1年度的利润表、股东权益变动表和现金流量表以及财务报表附注。

We have audited the accompanying financial statments of ABC Company Limited (hereinafter “ABC Company”),which comprise the balance sheet as at December 31,20XX, and the income statement, statement of changes in equity and cash flow statement for the year then ended, and a summary of significant accounting policies and other explanatory notes.一、管理层对财务报表的责任Management’s Responsibility for the Financial Statements按照企业会计准则和《××会计制度》的规定编制财务报表是ABC公司管理层的责任。

这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报;(2)选择和运用恰当的会计政策;(3)作出合理的会计估计。

Management is responsible for the preparation and fair presentation of these financial statements in accordance with the Accounting Standards for Business Enterprises and China Accounting System for Business Enterprises. This responsibility includes: (a) designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; (b) selecting and applying appropriate accounting policies; and (c) making accounting estimates that are reasonable in the circumstances.二、注册会计师的责任Auditor’s Responsibility我们的责任是在实施审计工作的基础上对财务报表发表审计意见。

会计师事务所 英文审计报告

会计师事务所英文审计报告(中英文版)Audit Report by Accounting FirmThe audit report prepared by our esteemed accounting firm is a comprehensive evaluation of the financial statements for the fiscal year ended.It is our professional opinion that the financial records present a true and fair view of the company"s financial performance and position.会计师事务所英文审计报告本所尊贵的会计师事务所编制的审计报告对截至财务年度末的财务报表进行了全面评估。

我们专业认为,这些财务记录真实公允地反映了公司的财务业绩与财务状况。

Methodology and FindingsOur audit was conducted in accordance with generally accepted auditing standards, employing a risk-based approach.We found the internal controls to be effective, with no material misstatements detected in the financial statements.方法和发现本次审计是根据普遍接受的审计标准进行的,采用了风险导向的方法。

我们发现内部控制有效,财务报表中没有发现重大错报。

Opinions and RecommendationsBased on our examination, it is our opinion that the financial statements are free from material misstatement.However, we recommendthe company to enhance its inventory management system to mitigate the risk of potential fraud.意见与建议根据我们的审查,我们认为财务报表在重大方面没有错报。

小学财务收支审计报告

小学财务收支审计报告【中英文版】English:The audit report of the primary school"s financial income and expenses is as follows.Firstly, we examined the financial records and found that all transactions were properly recorded.The school"s revenue mainly came from tuition fees, donations, and government grants.The expenses included teacher salaries, utility bills, textbooks, and maintenance costs.中文:小学财务收支审计报告如下。

首先,我们审查了财务记录,发现所有交易均已被适当记录。

学校的收入主要来自学费、捐赠和政府补助。

支出包括教师工资、水电费、教材和维护费用。

English:ext, we reviewed the school"s financial statements and found them to be accurate and transparent.The school"s revenue exceeded its expenses, resulting in a surplus for the fiscal year.The surplus was used to improve the school"s facilities and purchase new educational equipment.中文:接着,我们审查了学校的财务报表,发现它们是准确和透明的。

学校的收入超过了支出,导致了财政年度的盈余。

审计报告 英文

审计报告英文Auditing ReportDate: [Date]To: [Recipient]From: [Auditor]Subject: Auditing ReportIntroduction:This report presents the findings and conclusions of the audit conducted by [Auditor] for the period [Audit Period]. The objective of the audit was to assess the financial statements and internal controls of [Company/Organization] to ensure accuracy, transparency, and compliance with relevant regulations and standards.Scope:The audit covered the financial records, statements, and relevant internal controls of [Company/Organization] for the period [Audit Period].Findings:1. Financial Statements:- The financial statements of [Company/Organization] were prepared in accordance with generally accepted accounting principles (GAAP) and provide a true and fair view of the financialposition, performance, and cash flows of the organization during the audit period.- No material misstatements were identified in the financial statements.2. Internal Controls:- The internal controls of [Company/Organization] were found to be adequate and effective in ensuring the accuracy and reliabilityof financial reporting.- However, some minor control weaknesses were identified in [specific area], which management should address to strengthen internal controls.3. Compliance:- [Company/Organization] demonstrated compliance with applicable laws, regulations, and internal policies governing its operations.- No instances of non-compliance were observed during the audit. Recommendations:Based on the audit findings, the following recommendations are provided for consideration:1. Address the control weaknesses identified in [specific area] by implementing appropriate remedial measures to strengthen internal controls.Conclusion:In conclusion, the audit of [Company/Organization] for the period [Audit Period] resulted in a positive assessment of the financialstatements, internal controls, and compliance with relevant regulations. The management of [Company/Organization] is encouraged to implement the recommended actions to further enhance financial transparency and control effectiveness.If you have any queries or require further information, please do not hesitate to contact us.[Sincerely/Best regards],[Auditor][Audit Firm][Contact Information]。

国有公司 分立 审计报告

国有公司分立审计报告【中英文实用版】**Audit Report on the Spin-off of a State-owned Company**The board of directors of the state-owned company has requested our firm to conduct an audit on the spin-off transaction.Our audit objective is to verify the fairness and accuracy of the financial statements related to the spin-off and to ensure compliance with relevant laws and regulations.本次审计是为了验证国有公司在分立过程中财务报表的公正性与准确性,并确保其遵守相关法律法规。

We have performed audit procedures in accordance with generally accepted auditing standards.Our audit included examining documentation, interviewing personnel, and performing analytical procedures to obtain reasonable assurance about whether the financial statements are free from material misstatement.我们依据普遍接受的审计准则执行了审计程序。

审计包括检查文件、访谈人员以及执行分析程序,以获得合理保证,确保财务报表没有重大错报。

Based on our audit, we have issued an unqualified opinion, indicating that the financial statements are presented fairly, in all material respects, in accordance with accounting principles generally accepted in the PRC.基于我们的审计,我们出具了无保留意见,表明财务报表在所有重大方面按照中国会计准则公正呈现。

审计报告说明中英文版

审计报告说明中英文版审计报告说明中英文版审计报告 Auditors’Report 德信(20XX)审字第 XXXXX 号 De Xin (20XX) Audit No. XXXXXXXX ABC股份有限公司全体股东: To the shareholders of ABC Co., Ltd. (the “Company”): 我们审计了后附的ABC股份有限公司(以下简称“贵公司”)及其子公司和合营企业(以下统称“贵集团”)财务报表,包括20XX 年12月31日的合并及母公司资产负债表、20XX年度的合并及母公司利润及利润分配表、股东权益增减变动表和现金流量表以及财务报表附注。

We have audited the accompanying consolidated balance sheet of ABC (the “Company”) and its subsidiaries (collectively referred to as the “Group”) as of 31st December 20XX and the related consolidated in come statement, consolidated statement of changes in equity and consolidated cash flow statement for the year then ended, and a summary of significant accounting policies and other explanatory notes. 一、管理层对财务报表的责任按照企业会计准则和《企业会计制度》的规定编制财务报表是贵公司管理层的责任。

这种责任包括:(1) 设计、实施和维护与财务报表编制相关的`内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报;(2) 选择和运用恰当的会计政策;(3) 作出合理的会计估计。

投资收益审计报告

投资收益审计报告【中英文实用版】英文文档内容:Investment Returns Audit ReportIntroduction:This audit report aims to evaluate the investment returns of a company for the financial year ended on December 31, 2022.The audit was conducted to ensure the accuracy and reliability of the financial statements and to identify any potential risks or discrepancies in the investment activities.Scope of the Audit:The audit covered the company"s investment portfolio, including stocks, bonds, mutual funds, and other investment vehicles.The audit procedures included a review of the investment policies, documentation of investment transactions, valuation of investments, and assessment of the overall investment performance.Findings:pliance with Investment Policies: The company has established and followed appropriate investment policies, which were designed to achieve the company"s investment objectives and manage risks effectively.2.Accuracy of Investment Records: The audit revealed that thecompany maintains accurate and complete records of its investment transactions.All investments were properly documented, and the supporting documentation was properly maintained.3.Valuation of Investments: The audit confirmed that the company has a proper process in place for valuing its investments.The investments were valued in accordance with the relevant accounting standards and any significant adjustments were properly disclosed.4.Investment Performance: The audit revealed that the company"s investment portfolio performed well during the audit period.The returns generated from the investments were in line with the expectations and objectives set forth in the investment policies.Conclusion:Based on the audit findings, we conclude that the company has achieved a satisfactory level of investment returns for the financial year ended on December 31, 2022.The company"s investment activities were in compliance with the established policies and procedures, and the investment records were accurate and complete.The valuation of investments was done in a proper manner, and the overall investment performance was encouraging.Recommendations:1.Continuously monitor and review the investment portfolio to ensure alignment with the company"s objectives and risk tolerance.2.Regularly assess the performance of investment managers and consider replacing or reallocating investments if necessary.3.Maintain a strong internal control environment to ensure the accuracy and reliability of investment records and minimize the risk of fraud or error.中文文档内容:投资收益审计报告引言:本审计报告旨在评估该公司截至2022年12月31日的财务年度的投资收益。

个体财务审计报告

个体财务审计报告(中英文实用版)Individual Financial Audit Report个人财务审计报告This audit report is prepared for the individual client, Mr.John Smith, to assess the accuracy and completeness of his financial records for the fiscal year 2022.The audit was conducted in accordance with the generally accepted auditing standards and the relevant financial regulations.本审计报告是为个人客户约翰·史密斯先生准备的,目的是评估他在2022财政年度的财务记录的准确性和完整性。

审计是根据普遍接受的审计标准和相关的财务规定进行的。

The audit process included a review of Mr.Smith"s bank statements, cash receipts and disbursements, credit card statements, and other relevant financial documents.We also conducted inquiries with Mr.Smith and his accountant to clarify any discrepancies or unusual transactions.审计过程包括审查史密斯先生的银行对账单、现金收据和支付、信用卡对账单和其他相关的财务文件。

我们还与史密斯先生和他的会计师进行了询问,以澄清任何差错或异常交易。

Based on our examination, we have determined that Mr.Smith"s financial records are substantially complete and accurate.However, we did identify a few discrepancies that require further explanation orclarification.基于我们的审查,我们确定史密斯先生的财务记录在很大程度上是完整和准确的。

审计报告中英文对照5篇

审计报告中英文对照5篇第一篇:审计报告中英文对照最新审计报告中英文对照(转载)审计报告中英对照2008-12-27 13:38:21 阅读2557 评论5字号:大中小订阅山西**联合会计师事务所ShanXi**Unite Accountant Office审计报告AUDITOR’S REPORT晋**审字(2007)第000**号Jin **(2007)Audit No.00****铸造有限公司:To **foundry Co., Ltd:我们审计了后附的**铸造有限公司(以下简称贵公司)财务报表,包括2006年12月日的资产负债表,2006年度的利润表以及财务报表附注。

We have audited the accompanying balance sheet of ** foundry Co., Ltd(the “Company”)as of Dec.31,2006, and the related consolidated income statement for the2006then ended, and a summary of significant accounting policies and otherexplanatory notes.一、管理层对财务报表的责任1.Management’s Responsibility for the Financial Statements按照企业会计准则和《企业会计制度》的规定编制财务报表是贵公司管理层的责任。

这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报:(2)选择和运用恰当的会计政策:(3)作出合理的会计估计。

The management is responsible for the preparation and fair presentation of thesefinancial statements in accordance with the Accounting Standards for Business Enterprises and China Accounting System for Business Enterprises.This responsibility includes:(i)designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error;(ii)selecting and applying appropriate accounting policies;and(iii)making accounting estimates that are reasonable in thecircumstances.二、注册会计师的责任2.Auditor’s Responsibility我们的责任是在实施审计工作的基础上对财务报表发表审计意见。

工资总额清算审计报告模板

工资总额清算审计报告模板(中英文版)英文文档内容:Audit Report on Wage Total Settlement1.IntroductionThis report is prepared based on the audit conducted on the wage total settlement for the financial year ended [Year].The audit was performed to ensure the accuracy and compliance of the wage calculations and payments made by the company.2.Scope of AuditThe audit covered the wage records, payroll processes, and wage payments for the entire financial year.The audit procedures included a review of the company"s wage policies, verification of employee time cards and attendance records, examination of payroll calculations, and confirmation of wage payments made.3.Findingsa) Wage Calculations: The audit revealed that the wage calculations were generally accurate and in compliance with the company"s policies and applicable laws.However, there were minor discrepancies in the calculation of overtime pay for a few employees, which have been identified and corrected.b) Payroll Records: The payroll records were well-maintained andupdated regularly.However, there were instances where the records were not properly documented, leading to discrepancies in the wage calculations.The company has been advised to improve the documentation of payroll records to avoid such issues in the future.c) Wage Payments: The audit confirmed that wage payments were made timely and in accordance with the company"s policies.However, there were instances where the payments were not properly recorded in the accounting system, resulting in discrepancies in the financial records.The company has been advised to ensure proper recording of wage payments to maintain accurate financial records.4.Recommendationsa) Review and update wage policies: The company should periodically review and update its wage policies to ensure compliance with changing laws and regulations.b) Training and supervision: The company should provide training to its payroll staff on proper wage calculations and maintain proper supervision to ensure accuracy and compliance.c) Improve documentation: The company should improve the documentation of payroll records, including time cards, attendance records, and wage payments, to avoid discrepancies and ensure accurate wage calculations.5.ConclusionBased on the audit conducted, the wage total settlement for the financial year ended [Year] was generally accurate and in compliance with the company"s policies and applicable laws.However, there were minor discrepancies and issues in the wage calculations and payroll records, which have been identified and corrected.The company has been advised to implement the recommendations to improve the accuracy and compliance of its wage calculations and payments.中文文档内容:工资总额清算审计报告模板1.引言本报告基于对截至[年份]年度的工资总额清算的审计。

审计报告中英文对照

最新审计报告中英文对照(转载)审计报告中英对照2008-12-27 13:38:21 阅读2557 评论5 字号:大中小订阅山西**联合会计师事务所ShanXi**Unite Accountant Office审计报告AUDITOR’S REPORT晋**审字(2007)第000**号Jin ** (2007) Audit No.00****铸造有限公司:To **foundry Co., Ltd:我们审计了后附的**铸造有限公司(以下简称贵公司)财务报表,包括2006年12月31 日的资产负债表,2006年度的利润表以及财务报表附注。

We have audited the accompanying balance sheet of ** foundry Co., Ltd (the “Company”) as of Dec.31,2006, and the related consolidated income statement for the 2006 then ended, and a summary of significant accounting policies and otherexplanatory notes.一、管理层对财务报表的责任1.Mana gement’s Responsibility for the Financial Statements按照企业会计准则和《企业会计制度》的规定编制财务报表是贵公司管理层的责任。

这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报:(2)选择和运用恰当的会计政策:(3)作出合理的会计估计。

The management is responsible for the preparation and fair presentation of these financial statements in accordance with the Accounting Standards for Business Enterprises and China Accounting System for Business Enterprises. This responsibility includes: (i) designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; (ii) selecting and applying appropriate accounting policies; and (iii) making accounting estimates that are reasonable in thecircumstances.二、注册会计师的责任2. Auditor’s Responsibility我们的责任是在实施审计工作的基础上对财务报表发表审计意见。

审计报告中英文对照

审计报告中英文对照Audit Report审计报告致:XYZ公司管理层我们对XYZ公司及其附属公司(统称为“集团”)2024年12月31日的合并财务报表以及截至该日的年度进行了审计。

合并财务报表包括截至2024年12月31日的合并资产负债表,年度综合收益表,股东权益变动表和合并现金流量表,以及合并财务报表的附注。

Responsibility of the Management for the Consolidated Financial Statements管理层对合并财务报表的责任The management of the Group is responsible for the preparation and fair presentation of these consolidatedfinancial statements in accordance with International Financial Reporting Standards. This responsibility includes designing, implementing, and maintaining internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.集团管理层负责根据国际财务报告准则编制并公正呈现这些合并财务报表。

这一责任包括设计、实施和维护与合并财务报表编制和公正呈现有关的内部控制,确保合并财务报表不存在重大错误或舞弊。

Responsibility of the Auditor审计师的责任我们的责任是根据我们所进行的审计,对这些合并财务报表发表意见。

审计报告中英文对照

一、管理层对财务报表的责任

1.Management’s Responsibility for the Financial Statements

按照企业会计准则和《企业会计制度》的规定编制财务报表是贵公司管理层的责任。这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报:(2)选择和运用恰当的会计政策:(3)作出合理的会计估计。

审计报告中英文对照终审稿)

The report was made by Chinese and English. If the two files differ, the standard will be Chinese.

山西**联合会计师事务所 中国注册会计师:

ShanXi** Unite Accountant OfficeCertifiedPublic Accountant:

我们审计了后附的**铸造有限公司(以下简称贵公司)财务报表,包括2006年12月31 日的资产负债表,2006年度的利润表以及财务报表附注。

We have audited the accompanying balance sheet of** foundry Co., Ltd (the “Company”)as of Dec.31,2006, and the related consolidated income statement for the 2006 then ended, and a summary of significant accounting policies and other explanatory notes.

三、审计意见

3. Opinion

我们认为, 贵公司财务报表已经按照企业会计准则和《企业会计制度》的规定编制,在所有重大方面公允反映了贵公司2006年12月31 日的财务状况以及 2006年度的经营成果。

In our opinion, the financial statements give a true and fair view of the financial position of the Company as of Dec.31, 2006, and of its financial performance for the 2006 years then ended in accordance with theAccounting Standards for Business EnterprisesandChina Accounting System for Business Enterprises.

法人财务混同审计报告

法人财务混同审计报告(中英文版)English:The audit report on the confusion of legal person and financial affairs 中文:法人财务混同审计报告English:We have conducted an audit of the financial statements of ABC Company for the fiscal year ended December 31, 2020, and have identified a significant amount of financial confusion between the company and its legal person.中文:我们对ABC公司截至2020年12月31日的财务报表进行了审计,并发现公司及其法人之间存在大量的财务混同。

English:This confusion has resulted in a misstatement of the financial statements, which has affected the accuracy and reliability of the company"s financial information.中文:这种混同导致了财务报表的错误,影响了公司财务信息的准确性和可靠性。

English:Furthermore, we have also identified a lack of internal controls andsegregation of duties within the company, which has exacerbated the confusion and increased the risk of fraud.中文:此外,我们还发现公司内部控制不足,职责分离不当,这加剧了财务混同,并增加了欺诈风险。

审计报告免责声明

审计报告免责声明(中英文实用版)English:To the extent permitted by law, we, as auditors, hereby disclaim any responsibility or liability for any loss or damage of any kind arising out of or in connection with the use of the audit report.中文:在法律允许的范围内,我们作为审计师特此声明,对于因使用审计报告而导致的任何损失或损害,我们将不承担任何责任或义务。

English:Our audit work was conducted in accordance with generally accepted auditing standards and principles.However, we cannot guarantee the accuracy or completeness of the information provided by the company, or the occurrence of errors or omissions in the audit report.中文:我们的审计工作是根据普遍接受的审计标准和原则进行的。

然而,我们无法保证公司提供的信息的准确性或完整性,也无法保证审计报告中存在错误或遗漏。

English:We have obtained sufficient and appropriate audit evidence to provide reasonable assurance that the financial statements are free from material misstatement.However, due to the limitations of an audit, we cannot provide absolute assurance that the financial statements are freefrom all misstatements.中文:我们已经获得了足够的适当审计证据,以提供合理保证,使财务报表免受重大错报的影响。

真实性完整性审计报告

真实性完整性审计报告(中英文实用版)英文文档:Title: Audit Report on Authenticity and CompletenessThe audit report on authenticity and completeness is a comprehensive evaluation of an organization"s or individual"s adherence to standards of honesty, accuracy, and thoroughness in their records and operations.This report assesses the degree to which the subject of the audit has maintained valid and complete information, ensuring that all relevant data is disclosed and accurately represented.The authenticity and completeness audit report commences with an introduction outlining the purpose and scope of the audit.It identifies the specific areas examined, the criteria used for evaluation, and the period covered by the audit.The report then delves into the methodology employed, detailing the audit procedures followed, such as examining documentation, interviewing personnel, and testing systems.The core of the report involves a detailed analysis of the findings.This includes a review of the policies and procedures in place to ensure authenticity and completeness, an assessment of their effectiveness, and an identification of any instances of non-compliance or deficiencies.The report provides a critical evaluation of the strengths and weaknesses of the current systems and offers recommendations for improvement.Finally, the audit report concludes with a summary of the key findings and provides an overall opinion on the authenticity and completeness of the subject"s records and operations.This conclusion is based on the evidence gathered during the audit and the assessment of the organization"s or individual"s adherence to the established criteria.中文文档:标题:真实性完整性审计报告真实性完整性审计报告是对一个组织或个人在记录和运营中遵守诚实、准确和彻底的标准的全面评估。

审计报告英文版(全)

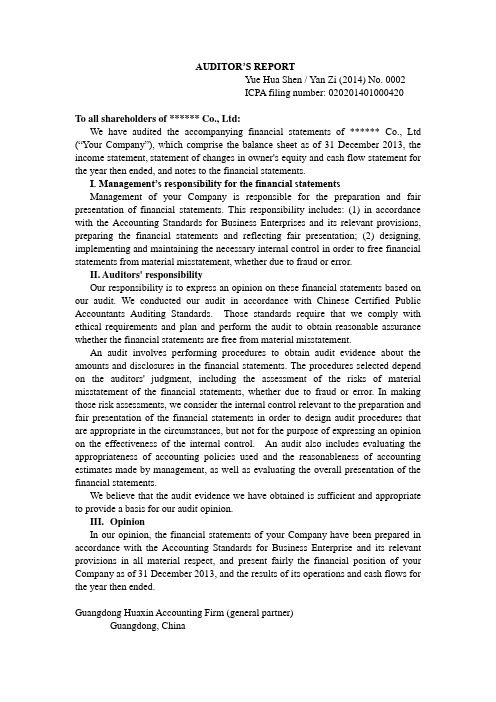

AUDITOR’S REPORTYue Hua Shen / Yan Zi (2014) No. 0002ICPA filing number: 020201401000420To all shareholders of ****** Co., Ltd:We have audited the accompanying financial statements of ****** Co., Ltd (“Your Company”), which comprise the balance sheet as of 31 December 2013, the income statement,statement of changes in owner's equity and cash flow statement for the year then ended, and notes to the financial statements.I. Management’s responsibility for the financial statementsManagement of your Company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1) in accordance with the Accounting Standards for Business Enterprises and its relevant provisions, preparing the financial statements and reflecting fair presentation; (2) designing, implementing and maintaining the necessary internal control in order to free financial statements from material misstatement, whether due to fraud or error.II. Auditors' responsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Chinese Certified Public Accountants Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors' judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider the internal control relevant to the preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. OpinionIn our opinion, the financial statements of your Company have been prepared in accordance with the Accounting Standards for Business Enterprise and its relevant provisions in all material respect, and present fairly the financial position of your Company as of 31 December 2013, and the results of its operations and cash flows for the year then ended.Guangdong Huaxin Accounting Firm (general partner)Guangdong, ChinaChinese Certified Public Accountant:Chinese Certified Public Accountant:January 3, 2014BALANCE SHEETAS OF 31 DECEMBER 2013 Unit: RMB YuanINCOME STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2013 Unit: RMB YuanCASH FLOW STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2013 Unit: RMB YuanSTATEMENT OF CHANGES IN OWNERS’ EQUITY FOR THE YEAR ENDED 31 DECEMBER 2013department:****** CO., LTDNOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2013(All amounts in RMB Yuan) I. Company Profile******* Co., Ltd. (hereinafter referred to as the "Company") is a limited liability company (Sino-foreign joint venture) jointly invested and established by **** Co., Ltd. and ******* Limited on 24 June 2013. On December 26, 2013, the shareholders have been changed to ***** CO., LTD and ******* LIMITED.Business License of Enterprise Legal Person License No.:Legal Representative:Registered Capital: RMB (Paid-in Capital: RMB )Address:Business Scope: Financing and leasing business; leasing business; purchase of leased property from home and abroad; residue value treatment and maintenance of leased property; consulting and guarantees of lease transaction (articles involved in the industry license management would be dealt in terms of national relevant stipulations) II. Declaration on following Accounting Standard for Business EnterprisesThe financial statements made by the Company are in accordance with the requirements of Accounting Standard for Business Enterprises, which reflects the financial position, financial performance and cash flow of the Company truly and completely.III. Basic of preparation of financial statementsThe Company implements the Accounting Standards for Business Enterprises (‘Finance and Accounting [2006] No. 3”) issued by the Ministry of Finance on February 15, 2006 and the successive regulations. The Company prepares its financial statements on a going concern basis, and recognizes and measures its accounting items in compliance with the Accounting Standards for Business Enterprises – Basic Standards and other relevant accounting standards, application guidelines and criteria for interpretation of provisions as well as the significant accounting policies and accounting estimates on the basis of actual transactions and events.IV. The main accounting policies, accounting estimates and changesFiscal yearThe Company adopts the calendar year as its fiscal year from January 1 to December 31.Functional currencyRMB was the functional currency of the Company.Accounting measurement attributeThe Company adopts the accrual basis for accounting treatments and double-entry bookkeeping of borrowing for financial accounting. The historical cost is generally as the measurement attribute, and when accounting elements determined are in line with the requirements of Accounting Standards for Enterprises and can be reliably measured, the replacement cost, net realizable value and fair value can be used for measurement.Accounting method of foreign currency transactionsThe Company’s foreign currency transactions adopt approximate spot exchange rate of the transaction date to convert into RMB in accordance with systematic and rational method; on the balance sheet date, the foreign currency monetary items use the spot exchange rate of the balance sheet date. All balances of exchange arising from differences between the balance sheet date spot exchange rate and the initial recognition or the former balance sheet date spot exchange rate, except that the exchange gains and losses arising by borrowing foreign currency for the construction or production of assets eligible for capitalization are transacted in accordance with capitalization principles, are included in profit or loss in this period; the foreign currency non-monetary items measured at historical cost will still be converted with the spot exchange rate of the transaction date.The standard for recognizing cash equivalentWhen making the cash flow statement, cash on hand and deposits readily to be paid will be recognized as cash, and short-term (usually no more than three months), highly liquid and readily convertible to known amounts of cash with insignificant risk of changes in value are recognized as cash equivalent.Financial InstrumentsClassification, recognition and measurement of financial assets- The company at the time of initial recognition of financial assets divides it into the following four categories: financial assets measured at fair value with changes included in the profit or loss of this period, loans and receivables, financial assets available for sale and held-to-maturity investments. Financial assets are measured at fair value when initially recognized. Relevant transaction costs of financial assets measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other categories of financial assets are recognized in the amount initially recognized.-- Financial assets measured at fair value with changes included in the profit or loss of this period refer to the short-term sales financial assets, including financial assets held for trading or financial assets measured at fair value with changes included in the profit or loss of this period designated upon initial recognition by the management. Financial assets measured at fair value with changes included in the profit or loss of this period are subsequently measured at fair value, and the interest or cash dividends obtained during the holding period will be recognized as investment income, and the gains or losses of the change in fair value at the end of this period are recognized in the profit or loss in this period. When it is disposed, the difference between the fair value and the initial recorded amount is recognized as investment income, while adjusting gains from changes in the fair value.--Loans and receivables: the non-derivative financial assets without the price in an active market and with fixed and determinable recovery cost are classified as loans and receivables. Loans and receivables adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.-- Financial assets available for sale: including non-derivative financial assets available for sale recognized initially and other non-derivative financial assets except for loans and receivables, held-to-maturity investments and trading financial assets. Financial assets available for sale are subsequently measured at fair value, and interest or cash dividends obtained during the holding period will be recognized as investment income, and gains or losses arising from the changes in fair value at the end of this period are recognized directly in owners' equity until the financial asset is derecognized or impaired and then is recognized as the profit or loss in this period.-- Held-to-maturity investments: the non-derivative financial assets with clear intention and ability to hold to maturity by the management of the company, a fixed maturity date and fixed or determinable payments are classified as held-to-maturity investments. Held-to-maturity investments adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.Classification, recognition and measurement of financial liabilities- The company at the time of initial recognition of financial liabilities divides it into the following two categories: financial liabilities measured at fair value with changes included in the profit or loss of this period and other financial liabilities. Financial liabilities are measured at fair value when initially recognized. Relevant transaction costs of financial liabilities measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other financial liabilities are recognized in the amount initially recognized.-- Financial liabilities measured at fair value with changes included in the profit or loss of this period include the trading financial liabilities and financial liabilities measured at fair value with changes included in the profit or loss of this period designated upon initial recognition. Financial liabilities are subsequently measured at fair value, and the gains or losses of the change in fair value are recognized in the profit or loss in this period.-- Other financial liabilities: adopting the effective interest method and taking amortized cost for subsequent measurement. The gains or losses arising from derecognition or amortization is included in the profit or loss of this period. Requirements for derecognition of financial liabilitiesFinancial liabilities shall be entirely or partially derecognized if the present obligations derived from them are entirely or partially discharged. Where the Company enters into an agreement with a creditor so as to substitute the current financial liabilities with new ones, and the contract clauses of which are substantiallydifferent from those of the current ones, it shall recognize the new financial liabilities in place of the current ones. Where substantial revisions are made to some or all of the contract clauses of the current financial liabilities, the Company shall recognize the new financial liabilities after revision of the contract clauses in place of the current ones entirely or partially.Upon entire or partial derecognition of financial liabilities, differences between the carrying amounts of the derecognized financial liabilities and the consideration paid (including non-monetary assets surrendered or new financial liabilities assumed) are charged to profit or loss for the current period.Where the Company redeems part of its financial liabilities, it shall allocate the carrying amounts of the entire financial liabilities between the relative fair values of the parts that continue to be recognized and the derecognized parts on the redemption date. Differences between the carrying amounts allocated to the derecognized parts and the consideration paid (including non-monetary assets surrendered and the new financial liabilities assumed) are charged to profit or loss for the current period. Recognition and measurement for transfer of financial assetsIf the Company has transferred nearly all of the risks and rewards relating to the ownership of the financial assets to the transferee, they shall be derecognized. If it retains nearly all of the risks and rewards relating to the ownership of the financial assets, they shall not be derecognized and will be recognized as a financial liability. If the Company has not transferred nor retained nearly all of the risks and rewards relating to the ownership of the financial assets:(1) to give up the control of the financial assets to be derecognized; (2) not giving up control of the financial asset to be recognized based on the extent of its continuing involvement in the transferred financial assets and liabilities are recognized accordingly.If the transfer of entire financial assets satisfy the criteria for derecognition, differences between the amounts of the following two items shall be recognized in profit or loss for the current period: (1) the carrying amount of the transferred financial asset; (2) the aggregate consideration received from the transfer plus the cumulative amounts of the changes in the fair values originally recognized in the owners’ equity. If the partial transfer of financial assets satisfy the criteria for derecognition, the carrying amounts of the entire financial assets transferred shall be split into the derecognized and recognized parts according to their respective fair values and differences between the amounts of the following two items are charged to profit or loss for the current period: (1) the carrying amounts of the derecognized parts;(2) The aggregate consideration for the derecognized parts plus the portion of the accumulative amounts of the changes in the fair values of the derecognized parts which are originally recognized in the owners’ equity.Determination of the fair value of financial instruments- If financial instruments trade in an active market, the quoted price in an active market determines its fair value; if financial instrument trade not in an active market, the valuation techniques determine the fair value. Valuation techniques include recent market transaction price reference to the familiar situation and volunteer transaction, current fair value reference to other substantially similar financial instruments,discounted cash flow method and option pricing model and so on.Test and Provisions for impairment loss on financial assets--Except trading financial assets, the Company makes assessment on the carrying values of financial assets at the balance sheet date. If there is evidence that the fair value of specific financial asset has been impaired, provisions for impairment loss is made accordingly.-- Measurement of impairment of financial assets measured at amortized costIf there is objective evidence that the financial asset measured at amortized cost has been impaired, the carrying amount of the financial asset is written down to the present value of estimated future cash flows (excluding future credit losses that have not yet occurred), and the amount of reduction is recognized as impairment loss and is recognized in the profit or loss of this period. The Company carries out the impairment test of significant single financial asset separately, carries out the impairment test on insignificant single financial asset from a single or combination of angles, and carries out the impairment test on single asset without objective evidence of impairment along with the financial assets with similar credit risk characteristics to constitute a combination, but does not carry out the impairment test on the provision for impairment of financial assets based on the single in the portfolio. In the subsequent period, if there is objective evidence that the value of financial asset has been restored and recognized relevant to the objective matters occurring after the impairment, previously recognized impairment loss shall be reversed and charged into the profit or loss of this period. But the book value after the reversal should not exceed the amortized cost at the reversal date of the financial assets supposed no provision for impairment. When the financial assets measured at amortized cost actually occur loss, offset against the related provision for impairment.--Available for sale financial assetsIf there is objective evidence that an impairment of available for sale financial assets occurs, even though the financial asset has not been derecognised, the cumulative loss of decrease of the faire value originally recorded in the owner's equity should be transferred out and charged into the current profit and loss. The cumulative loss is the initial acquisition cost of available for sale financial assets, deducting the fair value of the withdrawing principal and amortization amount and impairment loss as well as net impairment amount originally charged into the profit or loss.Recognition and provision for bad debts of accounts receivableIf there is objective evidence that receivables are impaired at the end of this period, the carrying value will be written down to its present value of estimated future cash flows, and the amount of reduction is recognized as impairment loss and is recognized in the current profit or loss. Present value of estimated future cash flows is determined through future cash flows (excluding credit losses that have not been incurred) discounted at the original effective interest rate, taking into account the value of related collateral (less estimated disposal costs, etc.). Original effective interest rate is the actual interest rate when the receivables are recognized initially. The estimated future cash flows of short-term receivables have small difference from the present value, and the estimated future cash flows are not discounted in determining therelated impairment loss.The significant single receivables are separately carried out impairment test at the end of this period, and if there is objective evidence that the impairment has occurred, based on the difference of the present value of future cash flows less than the book value, the impairment loss is recognized and the provision of bad debts is done. The significant single amount refers to top five receivable balances or the sum of payments accounting for more than 10% of receivable balances.If there is objective evidence that the individual non-significant receivables impairment has occurred, separate impairment test is done, the impairment loss is recognized and the provision for bad debts is done; other individual non-significant receivables and receivables not impaired after separate test are together divided into several combinations for impairment testing with aging as the similar credit risk characteristics, to determine the impairment loss and do provision for bad debts.In addition to separate provision for impairment of receivables, the company is based on the actual loss rate of receivable portfolio with the same or similar to the previous year and aging as the similar credit risk characteristics, and combines the currentFixed assets and depreciation accounting methodRecognition criteria of fixed assets: fixed assets refer to tangible assets held for the purpose of producing commodities, providing services, renting or business management with useful lives exceeding one accounting year and high unit value. Classification of fixed assets: buildings and constructions, machinery equipment, transport equipment and office equipment.Fixed assets pricing and depreciation method: the fixed assets is priced based on actual cost and depreciated in a straight-line method. The estimated useful lives, estimated residual rate and annual depreciation rate of various categories of fixedend of the reporting period, and if the market continuing to fall or technological obsolescence, damage, long-term idle and other reasons result in fixed assets recoverable amount lower than its book value, in accordance with the differenceprovision for impairment of fixed assets, the impairment loss is recognized in fixed assets and can not be reversed in a subsequent accounting period. The recoverable amount is recognized based on the fair value of the assets deducting the net amount after disposal expenses and the present value of cash flows of the estimated future assets. The present value of the future cash flows of the asset is determined in accordance with the resulting estimated future cash flows in the process of continuous use and final disposal to select its appropriate discount rate and the amount of the discount.Accounting method of construction in progressThe construction in progress is priced on the actual cost, to temporarily transfer to fixed assets when reaching the intended use state in accordance with the project budget and the actual cost of the project, and to adjust the book value of fixed assets according to the actual cost after handling final settlement of accounts. Acquisition, construction or production of assets eligible for capitalization borrowed specifically or the interest on general borrowing costs and auxiliary expenses of specific borrowings occurred can be included in the cost of capital assets and subsequently recognized in the current profit or loss before the acquisition, construction or production of the qualifying asset reaches the intended use state or the sale state.Impairment of construction in progress: the Company conducts a comprehensive inspection of construction in progress at the end of the reporting period; if the construction in process is stopped for long time and will not be constructed in the next three years and the construction in progress brings great uncertainty to the economic benefits of enterprises due to backward performance or techniques and the construction in progress occurs impairment, the balance of recoverable amount of single construction in progress lower than the book value of construction in progress is for impairment provisions of construction in progress. Impairment loss on the construction in progress shall not be reversed in subsequent accounting periods once recognized.The pricing and amortizing of intangible assetsPricing of the intangible assets---The cost of outsourcing intangible assets shall be priced based on the actual expenditure directly attributable to intangible assets for the expected purpose.--- Expenditure on internal research and development projects is charged into the current profit or loss, and expense in the development stage can be recognized as intangible costs if meeting the criteria for capitalization.--- Intangible assets of investment is in accordance with the agreed value of the investment contract or agreement as costs, excluding not fair agreed value of the contract or agreement.--- Intangible assets of the debtor obtained in the non-cash asset cover debt method can be accepted; if the receivable creditor’s right is changed into intangible assets, then record according to the fair value of intangible assets.--- For non-monetary transaction intangible assets, the fair value and related taxes payable of non-monetary assets should be the accounting cost.Amortization of intangible assets: as for the intangible assets with limited service life,it is amortized by straight-line method when it is available for use within the service period. As for unforeseeable period of intangible assets bringing future economic benefits to the company, it is regarded as intangible assets with uncertain service life, and intangible assets with uncertain service life can not be amortized. The Company’s intangible assets include land use rights, forest land use rights and the production and marketing information management software. The land use rights are amortized averagely in accordance with 50 years of service life, forest land use rights are amortized averagely in accordance with 30 years of service life, and the production and marketing information management software are amortized averagely in accordance with 5 years of service life.Expenditures arising from development phase on internal research and development projects can be recognized as intangible assets when satisfying all of the following conditions: (1) there is technical feasibility of completing the intangible assets so that they will be available for use or sale; (2) there is intention to complete and use or sell the intangible assets; (3) the method that the intangible assets generate economic benefits, including existence of a market for products produced by the intangible assets or for the intangible assets themselves, shall be proved. Or, if to be used internally, the usefulness of the intangible assets shall be proved; (4) adequate technical, financial, and other resources are available to complete the development of intangible assets, and the Company has the ability to use or sell the intangible assets;(5) the expenditures arising from development phase of the intangible assets can be measured reliably.Impairment of intangible assets: the Company conducts a comprehensive inspection on intangible assets at the end of the reporting period. If the intangible assets have been replaced by other new technologies so as to seriously affect its capacity to create economic benefits for the enterprise, the market value of certain intangible assets sharply fall and is not expected to recover in the remaining amortization period, certain intangible asset has exceeded the legal time limit but still has some value in use as well as the intangible asset impairment has occurred, the provision for impairment is done according to the difference between the individual estimated recoverable amount and the book value. Impairment loss on the intangible asset shall not be reversed in subsequent accounting periods once recognized.Accounting method of capitalization of borrowing costsBorrowing costs that are directly attributable to the acquisition, construction or production of qualifying assets for capitalization should be charged into the relevant costs of assets and therefore should be capitalized. Borrowing costs incurred after qualifying assets for capitalization reaches the estimated use state are charged to profit or loss in the current period. Other borrowing costs are recognized as expenses based on the accrual and are charged to profit or loss in the current period.Capitalization of borrowing costs should meet the following conditions: expenditures are being incurred, which comprise disbursements incurred in the form of payments of cash, transfer of non-monetary assets or assumption of interest-bearing debts for the acquisition, construction or production of qualifying assets for capitalization; borrowing costs are being incurred; purchase, construction or manufacturing activities。

持续经营 审计报告

持续经营审计报告(中英文实用版)英文文档内容:The audit report on the continuation of operations is prepared to provide assurance to stakeholders that the company has the ability to continue its operations for the foreseeable future.This report is conducted by an independent auditor who examines the company"s financial statements and assesses its financial condition, cash flow, and overall business prospects.The auditor will review the company"s financial statements, including the balance sheet, income statement, and cash flow statement, to ensure they are presented fairly and in accordance with generally accepted accounting principles.They will also assess the company"s compliance with relevant laws and regulations, and evaluate the company"s internal controls and risk management processes.Based on their assessment, the auditor will issue an opinion on the company"s ability to continue its operations.A "clean" or unqualified opinion indicates that the auditor believes the company will be able to continue operating for the foreseeable future.A qualified, adverse, or disclaimer of opinion may be issued if the auditor has concerns about the company"s ability to continue operating.The audit report on the continuation of operations is an importanttool for stakeholders, including investors, creditors, and regulators, as it provides them with confidence in the company"s ability to continue its operations and fulfill its financial obligations.中文文档内容:持续经营审计报告是为了向利益相关方提供保证,确认公司具备在可预见的未来继续运营的能力。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

审计报告

AUDITOR’S REPORT

晋**审字(2007)第000**号

Jin ** (2007) Audit No.00**

**铸造有限公司

To **foundry Co., Ltd:

我们审计了后附的**铸造有限公司(以下简称贵公司)财务报表,包括2006年12月31 日的资产负债表,2006年度的利润表以及财务报表附注

We have audited the accompanying balance sheet of ** foundry Co., Ltd (the “Company”) as of Dec.31,2006, and the related consolidated income statement for the 2006 then ended, and a summary of significant accounting policies and other explanatory notes

一、管理层对财务报表的责任

1.Management’s Responsibility for the Financial Statements

按照企业会计准则和《企业会计制度》的规定编制财务报表是贵公司管理层的责任。

这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报:(2)选择和运用恰当的会计政策:(3)作出合理的会计估计

The management is responsible for the preparation and fair presentation of these financial statements in accordance with the Accounting Standards for Business Enterprises and China Accounting System for Business Enterprises. This responsibility includes: (i) designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; (ii) selecting and applying appropriate accounting policies; and (iii) making accounting estimates that are reasonable in the circumstances

二、注册会计师的责任

2. Auditor’s Responsibility

我们的责任是在实施审计工作的基础上对财务报表发表审计意见。

我们按照中国注册会计师审计准则的规定执行了审计工作。

中国注册会计师审计准则要求我们遵守职业道德规范,计划和实施审计工作以对财务报表是否不存在重大错报获取合理保证

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing for Certified Public Accountants.Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement

审计工作涉及实施审计程序,以获取有关财务报表金额和和披露的审计证据。

选择的审计程序取决于注册会计师的判断,包括对由于舞弊或错报导致的财务报表重大错报风险的评估。

在进行风险评估时,我们考虑与财务报表编制相关的内部控制,以设计恰当的审计程序,但目的并非对内部控制的有效性发表意见。

审计工作还包括评价管理层选用会计政策的恰当性和作出会计估计的合理性,以及评

价财务报表的总体列报

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fai r presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit als o includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

我们相信,我们获取的审计证据是充分、适当的,为发表审计意见提供了基础We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

三、审计意见

3. Opinion

我们认为, 贵公司财务报表已经按照企业会计准则和《企业会计制度》的规定编制,在所有重大方面公允反映了贵公司2006年12月31 日的财务状况以及2006年度的经营成果

In our opinion, the financial statements give a true and fair view of the financial position of the Company as of Dec.31, 2006, and of its financial performance for the 2006 years then ended in accordance with the Accounting Standards for Business Enterprises and China Accounting System for Business Enterprises

此报告中、英文各一份,两者若有差异,以中文为准

The report was made by Chinese and English. If the two files differ, the standard will be Chinese

山西**联合会计师事务所中国注册会计师

ShanXi ** Unite Accountant Office Certified Public Accountant

中国·太原二○○七年七月十日

Shanxi, P.R.C Date: Jul.10, 2007。