chapter4习题

细胞生物学课后练习题及答案chapter4

第四章细胞质膜及其表面一、名词解释:1. 糖萼(glycocalyx)2. 磷脂转换蛋白(phospholipid exchange proteins)3. 膜骨架(membrane skeleton)4. 血型糖蛋白(glycophorin )5. 单位膜模型(unit membrane model)6. 翻转扩散(transverse diffusion)7. 侧向扩散(lateral diffusion)8. 脂锚定蛋白(lipid-anchored)9. 外周蛋白(peripheral protein)10. 整合蛋白(integral protein)11. 脂质体(liposome)12. 血影蛋白(spectrin)二、选择题:请在以下每题中选出正确答案,每题正确答案为1-6个,多选和少选均不得分1. 动物细胞质膜外糖链构成的网络状结构叫做A.细胞外被B.微绒毛C.膜骨架2. 以下关于质膜的描述哪些是正确的A.膜蛋白具有方向性和分布的区域性B.糖脂、糖蛋白分布于质膜的外表面C.膜脂和膜蛋白都具有流动性D. 某些膜蛋白只有在特定膜脂存在时才能发挥其功能3. 以下哪一种去污剂为非离子型去污剂A.十二烷基磺酸钠B.脱氧胆酸C.Triton-X100D.脂肪酸钠4. 用磷脂酶处理完整的人类红细胞,以下哪种膜脂容易被降解A.磷脂酰胆碱,PCB.磷脂酰乙醇胺,PEC.磷脂酰丝氨酸,PS5. 以下哪一种情况下膜的流动性较高A.胆固醇含量高B.不饱和脂肪酸含量高C.长链脂肪酸含量高D.温度高6. 跨膜蛋白属于A.整合蛋白(integral protein)B.外周蛋白(peripheral protein)C.脂锚定蛋白(lipid-anchored protein)7. 用磷脂酶C(PLC)处理完整的细胞,能释放出哪一类膜结合蛋白A.整合蛋白(integral protein)B.外周蛋白(peripheral protein)C.脂锚定蛋白(lipid-anchored protein)D.脂蛋白(lipoprotein)8. 红细胞膜下的血影蛋白网络与膜之间具有哪两个锚定点A.通过带4.1蛋白与血型糖蛋白连结B.通过带4.1蛋白带3蛋白相连C.通过锚蛋白(ankyrin)与血型糖蛋白连结D.通过锚蛋白与带3蛋白相连9. 质膜A.是保持细胞内环境稳定的屏障B.是细胞物质和信息交换的通道C.是实现细胞功能的基本结构D.是酶附着的支架(scaffold)10. 鞘磷脂(Sphngomyelin SM)A.以鞘胺醇(Sphingoine)为骨架B.含胆碱C.不存在于原核细胞和植物D.具有一个极性头和一个非极性的尾11. 以下关于膜脂的描述哪些是正确的A.心磷脂具有4个非极性的尾B.脂质体是人工膜C.糖脂是含糖而不含磷酸的脂类D.在缺少胆固醇培养基中,不能合成胆固醇的突变细胞株很快发生自溶。

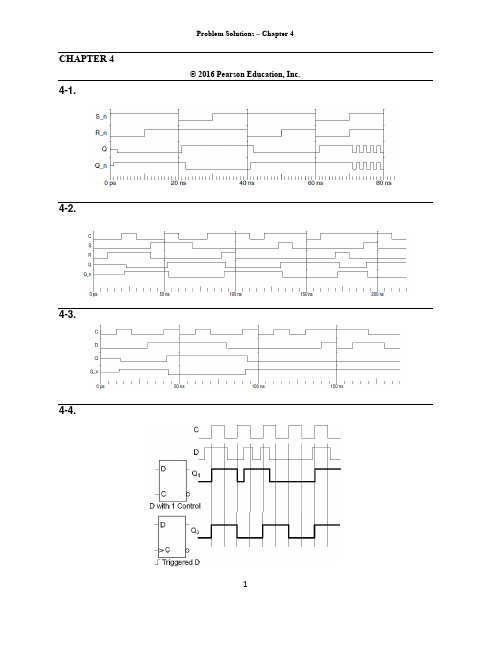

《逻辑与计算机设计基础》(原书第五版)课后习题答案-chapter04_solutions-5th

X Y

DA

Clock C

D

BX

Z

Clock C

2

Present state

AB

00 00 00 00 01 01 01 01 10 10 10 10 11 11 11 11

Inputs

XY

00 01 10 11 00 01 10 11 00 01 10 11 00 01 10 11

Next state

Input

1 0 011 0 1

1

1

1

0

Output

0 1 000 1 0

0

0

0

1

Next State 01 00 00 01 11 00 01 11 10 10 00

4-10.

00/0 11/1

01/0 10/1 11/0 0

00/0 01/1 10/0 11/1 01/0

00/1 1

01/1, 10/0

0

0

0 00

0 0

001

0

11

1 10

1 10

1 11

11

0

1

10

0

1

1 0

1

01

0

00

1

11

0

10

1

1

Nextt state state AB

A 0B 0

1

0

0 00 1

1 00 0

0 11 0

0 1

1

0 0

1

1 11 1

1 01 1

01

DA

B

1

A1 1

1

X

DDAA = AAXX+BBXX

现代移动通信蔡跃明第三版思考题与习题参考答案chapter_4

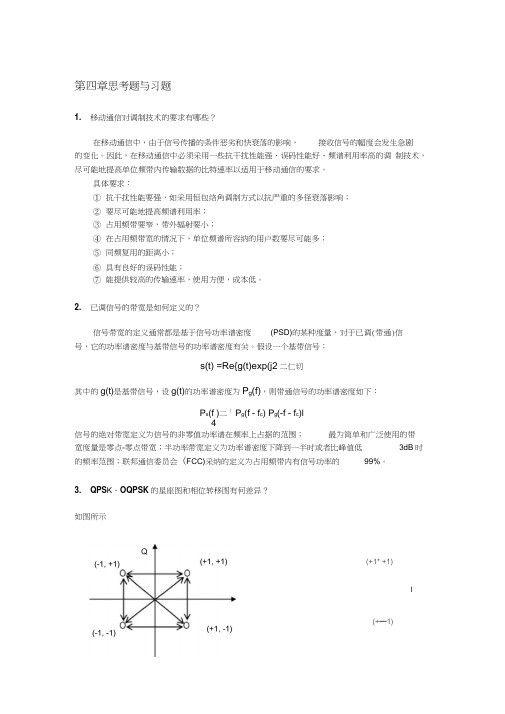

I (+1* +1)(+—1)第四章思考题与习题1. 移动通信对调制技术的要求有哪些?在移动通信中,由于信号传播的条件恶劣和快衰落的影响, 接收信号的幅度会发生急剧 的变化。

因此,在移动通信中必须采用一些抗干扰性能强、误码性能好、频谱利用率高的调 制技术,尽可能地提高单位频带内传输数据的比特速率以适用于移动通信的要求。

具体要求:① 抗干扰性能要强,如采用恒包络角调制方式以抗严重的多径衰落影响;② 要尽可能地提高频谱利用率;③ 占用频带要窄,带外辐射要小;④ 在占用频带宽的情况下,单位频谱所容纳的用户数要尽可能多;⑤ 同频复用的距离小;⑥ 具有良好的误码性能;⑦ 能提供较高的传输速率,使用方便,成本低。

2. 已调信号的带宽是如何定义的?信号带宽的定义通常都是基于信号功率谱密度 (PSD)的某种度量,对于已调(带通)信 号,它的功率谱密度与基带信号的功率谱密度有关。

假设一个基带信号:s(t) =Re{g(t)exp(j2二仁切其中的g(t)是基带信号,设g(t)的功率谱密度为P g (f),则带通信号的功率谱密度如下:P s (f )二1 P g (f - f c ) P g (-f - f c )l 4信号的绝对带宽定义为信号的非零值功率谱在频率上占据的范围; 最为简单和广泛使用的带宽度量是零点-零点带宽;半功率带宽定义为功率谱密度下降到一半时或者比峰值低 3dB 时的频率范围;联邦通信委员会 (FCC)采纳的定义为占用频带内有信号功率的99%。

3. QPS K 、OQPSK 的星座图和相位转移图有何差异?如图所示QPSK相位星座图OPSK相位星座图QPSK信号的相位有90°突变和180°突变。

OQPSK信号的相位只有90°跳变,而没有180°的相位跳变。

4. QPSK和OQPSK的最大相位变化量分别为多少?各自有哪些优缺点?OPSK的最大相位变化量为1800, OPSK最大相位变化量为900。

电子科大-微机原理习题解答-chap4

Chapter44.1 阐述总线的概念。

计算机系统为什么需要采用总线结构?总线是计算机系统中的信息传输通道,由系统中各个部件所共享。

总线的特点在于公用性,总线由多条通信线路(线缆)组成采用总线结构,能:减少部件间连线的数量;扩展性好,便于构建系统;便于产品更新换代4.3 微机系统中总线层次化结构是怎样的?按总线所处位置可分为:片内总线、系统内总线、系统外总线。

按总线功能可分为:地址总线、数据总线、控制总线。

按时序控制方式可分为:同步总线、异步总线。

按数据格式可分为:并行总线、串行总线。

4.4 评价一种总线的性能有那几个方面?总线时钟频率、总线宽度、总线速率、总线带宽、总线的同步方式和总线的驱动能力等。

4.5 微机系统什么情况下需要总线仲裁?总线仲裁有哪几种?各有什么特点?总线仲裁又称总线判决,其目的是合理的控制和管理系统中多个主设备的总线请求,以避免总线冲突。

当多个主设备同时提出总线请求时,仲裁机构按照一定的优先算法来确定由谁获得对总线的使用权。

集中式(主从式)控制和分布式(对等式)控制。

集中式特点:采用专门的总线控制器或仲裁器分配总线时间,总线协议简单有效,总体系统性能较低。

分布式特点:总线控制逻辑分散在连接与总线的各个模块或设备中,协议复杂成本高,系统性能较高。

4.6总线传输方式有哪几种?同步总线传输对收发模块有什么要求?什么情况下应该采用异步传输方式,为什么?总线传输方式按照不同角度可分为同步和异步传输,串行和并行传输,单步和突发方式。

同步总线传输时,总线上收模块与发模块严格按系统时钟来统一定时收发模块之间的传输操作。

异步总线常用于各模块间数据传送时间差异较大的系统,因为这时很难同步,采用异步方式没有固定的时钟周期,其时间可根据需要可长可短。

4.7 AMBA总线定义了哪三种总线?他们各有什么特点?先进高性能总线AHB,先进系统总线ASB,先进外设总线APBAHB适用于高性能和高吞吐设备之间的连接,如CPU、片上存储器、DMA设备、DSP等。

Chapter04_Exercises

C. 识别、控制和跟踪需求的变化

D. 以上选项都不是

11. (

)需求工程师的任务是将所有利益相关者的信息进行分类以便允许决策者选择一

个相互一致的需求集。

A. 真

B. 假

12. 下面的(

)不是在项目启动阶段被提出的“与环境无关”的问题。

A. 成功的解决方案将带来什么样的经济收益?

B. 谁反对该项目?

C. 谁将为该项目付款?

2. 请指出下面需求描述存在的问题,并进行适当的修改。

(1) 系统用户界面友好。 (2) 系统运行时应该占用尽量少的内存空间。 (3) 即使在系统崩溃的情况下,用户数据也不能受到破坏。 (4) ATM 系统允许用户查询自己银行帐户的现存余额。 (5) ATM 系统应该快速响应用户的请求。 (6) ATM 系统需要检验用户存取的合法性。 (7) 所有命令的响应时间小于 1 秒;BUILD 命令的响应时间小于 5 秒。 (8) 软件应该用 JAVA 语言实现。 答案要点: (1) 问题:“友好”是不可验证的。

B. 每个指定系统的实现

C. 软件体系结构的元素

D. 系统仿真所需要的时间

9. 组织需求评审的最好方法是(

)。

A. 检查系统模型的错误

B. 让客户检查需求

C. 将需求发放给设计团队去征求意见

D. 使用问题列表检查每一个需求

10. 使用跟踪表有助于(

)。

A. 在后续的检查运行错误时调试程序

B. 确定算法执行的性能

(2) 需求分析:分析和综合所采集的信息,建立系统的详细逻辑模型。 (3) 需求规格说明:编写软件需求规格说明书,明确、完整和准确地描述已确定的需求。 (4) 需求验证:评审软件需求规格说明,以保证其正确性、一致性、完备性、准确性和清

管理会计(英文版)课后习题答案(高等教育出版社)chapter 4

管理会计(高等教育出版社)于增彪(清华大学)改编余绪缨(厦门大学)审校CHAPTER 4ACTIVITY-BASED COSTINGQUESTIONS FOR WRITING AND DISCUSSION1.Unit costs provide essential informationneeded for inventory valuation and prepara-tion of income statements. Knowing unit costs is also critical for many decisions such as bidding decisions and accept-or-reject special order decisions.2.Cost measurement is determining the dollaramounts associated with resources used in production. Cost assignment is associating the dollar amounts, once measured, with units produced.3.An actual overhead rate is rarely used be-cause of problems with accuracy and timeli-ness. Waiting until the end of the year to en-sure accuracy is rejected because of the need to have timely information. Timeliness of information based on actual overhead costs runs into difficulty (accuracy problems) because overhead is incurred nonuniformly and because production also may be non-uniform.4.For plantwide rates, overhead is first col-lected in a plantwide pool, using direct trac-ing. Next, an overhead rate is computed and used to assign overhead to products. 5.First stage: Overhead is assigned to produc-tion department pools using direct tracing, driver tracing, and allocation. Second stage: Individual departmental rates are used to assign overhead to products as they pass through the departments.6.Departmental rates would be chosen overplantwide rates whenever some depart-ments are more overhead intensive than others and if certain products spend more time in some departments than they do in others.7.Plantwide overhead rates assign overheadto products in proportion to the amount of the unit-level cost driver used. If the prod-ucts consume some overhead activities in different proportions than those assigned by the unit-level cost driver, then cost dis-tortions can occur (the product diversity factor). These distortions can be significant if the nonunit-level overhead costs represent a significant proportion of total overhead costs.8.Low-volume products may consume non-unit-level overhead activities in much greater proportions than indicated by a unit-levelcost driver and vice versa for high-volumeproducts. If so, then the low-volume prod-ucts will receive too little overhead and thehigh-volume products too much.9.If some products are undercosted and oth-ers are overcosted, a firm can make a num-ber of competitively bad decisions. For ex-ample, the firm might select the wrongproduct mix or submit distorted bids.10.Nonunit-level overhead activities are thoseoverhead activities that are not highly corre-lated with production volume measures. Ex-amples include setups, material handling,and inspection. Nonunit-level cost driversare causal factors—factors that explain theconsumption of nonunit-level overhead. Ex-amples include setup hours, number ofmoves, and hours of inspection.11.Product diversity is present whenever prod-ucts have different consumption ratios fordifferent overhead activities.12.An overhead consumption ratio measuresthe proportion of an overhead activity con-sumed by a product.13.Departmental rates typically use unit-levelcost drivers. If products consume nonunit-level overhead activities in different propor-tions than those of unit-level measures, thenit is possible for departmental rates to moveeven further away from the true consumptionratios, since the departmental unit-level ra-tios usually differ from the one used at theplant level.14.Agree. Prime costs can be assigned usingdirect tracing and so do not cause cost dis-tortions. Overhead costs, however, are notdirectly attributable and can cause distor-tions. For example, using unit-level activitydrivers to trace nonunit-level overhead costswould cause distortions.15.Activity-based product costing is an over-head costing approach that first assignscosts to activities and then to products. Theassignment is made possible through theidentification of activities, their costs, and theuse of cost drivers.16.An activity dictionary is a list of activitiesaccompanied by information that describeseach activity (called attributes)17. A primary activity is consumed by the finalcost objects such as products and custom-ers, whereas secondary activities are con-sumed by other activities (ultimately con-sumed by primary activities).18.Costs are assigned using direct tracing andresource drivers.19.Homogeneous sets of activities are pro-duced by associating activities that have thesame level and that can use the same driverto assign costs to products. Homogeneoussets of activities reduce the number of over-head rates to a reasonable level.20. A homogeneous cost pool is a collection ofoverhead costs that are logically related tothe tasks being performed and for whichcost variations can be explained by a singleactivity driver. Thus, a homogeneous pool ismade up of activities with the same process,the same activity level, and the same driver.21.Unit-level activities are those that occur eachtime a product is produced. Batch-level activi-ties are those that are performed each time abatch of products is produced. Product-levelor sustaining activities are those that areperformed as needed to support the variousproducts produced by a company. Facility-level activities are those that sustain a facto-ry’s general man ufacturing process.22.ABC improves costing accuracy wheneverthere is diversity of cost objects. There arevarious kinds of cost objects, with productsbeing only one type. Thus, ABC can be use-ful for improving cost assignments to costobjects like customers and suppliers. Cus-tomer and supplier diversity can occur for asingle product firm or for a JIT manufactur-ing firm.23.Activity-based customer costing can identifywhat it is costing to service different custom-ers. Once known, a firm can then devise astrategy to increase its profitability by focus-ing more on profitable customers, convertingunprofitable customers to profitable oneswhere possible, and “firing” customers thatcannot be made profitable.24.Activity-based supplier costing traces allsupplier-caused activity costs to suppliers.This new total cost may prove to be lowerthan what is signaled simply by purchaseprice.EXERCISES4–11.Quarter 1 Quarter 2 Q uarter 3 Quarter 4 Total Units produced 400,000 160,000 80,000 560,000 1,200,000 Prime costs $8,000,000 $3,200,000 $1,600,000 $11,200,000 $24,000,000 Overhead costs $3,200,000 $2,400,000 $3,600,000 $2,800,000 $12,000,000 Unit cost:Prime $20 $20 $20 $20 $20Overhead 8 15 45 5 10Total $28 $35 $65 $25 $30 2. Actual costing can produce wide swings in the overhead cost per unit. Thecause appears to be nonuniform incurrence of overhead and nonuniform production (seasonal production is a possibility).3. First, calculate a predetermined rate:OH rate = $11,640,000/1,200,000= $9.70 per unitThis rate is used to assign overhead to the product throughout the year.Since the driver is units produced, $9.70 would be assigned to each unit.Adding this to the actual prime costs produces a unit cost under normal cost-ing:Unit cost = $9.70 + $20.00 = $29.70This cost is close to the actual annual cost of $30.00.1. $13,500,000/3,600,000 = $3.75 per direct labor hour (DLH)2. $3.75 ⨯ 3,456,000 = $12,960,0003. Applied overhead $ 12,960,000A ctual overhead 13,600,000U nderapplied overhead $ 640,0004. Predetermined rates allow the calculation of unit costs and avoid the prob-lems of nonuniform overhead incurrence and nonuniform production asso-ciated with actual overhead rates. Unit cost information is needed throughout the year for a variety of managerial purposes.4–31. Predetermined overhead rate = $4,500,000/600,000 = $7.50 per DLH2. Applied overhead = $7.50 ⨯ 585,000 = $4,387,5003. Applied overhead $ 4,387,500Actual overhead 4,466,250Underapplied overhead $ (78,750)4. Unit cost:Prime costs $ 6,750,000Overhead costs 4,387,500Total $ 11,137,500Units ÷750,000Unit cost $ 14.851. Predetermined overhead rate = $4,500,000/187,500 = $24 per machine hour(MHr)2. Applied overhead = $24 187,875 = $4,509,0003. Applied overhead $ 4,509,000Actual overhead 4,466,250Overapplied overhead $ 42,7504. Unit cost:Prime costs $ 6,750,000Overhead costs 4,509,000Total $ 11,259,000Units ÷750,000Unit cost $ 15.01**Rounded5. Gandars needs to determine what causes its overhead. Is it primarily labordriven (e.g., composed predominantly of fringe benefits, indirect labor, and personnel costs), or is it machine oriented (e.g., composed of depreciation on machinery, utilities, and maintenance)? It is impossible for a decision to be made on the basis of the information given in this exercise.1. Predetermined rates:Drilling Department: Rate = $600,000/280,000 = $2.14* per MHrAssembly Department: Rate = $392,000/200,000= $1.96 per DLH*Rounded2. Applied overhead:Drilling Department: $2.14 ⨯ 288,000 = $616,320Assembly Department: $1.96 ⨯ 196,000 = $384,160Overhead variances:Drilling Assembly Total Actual overhead $602,000 $ 412,000 $ 1,014,000 Applied overhead 616,320 384,160 1,000,480 Overhead variance $ (14,320) over $ 27,840 under $ 13,520 3. Unit overhead cost = [($2.14 ⨯ 4,000) + ($1.96 ⨯ 1,600)]/8,000= $11,696/8,000= $1.46**Rounded1. Activity rates:Machining = $632,000/300,000= $2.11* per MHrInspection = $360,000/12,000= $30 per inspection hour*Rounded2. Unit overhead cost = [($2.11 ⨯ 8,000) + ($30 ⨯ 800)]/8,000= $40,880/8,000= $5.114–71. Yes. Since direct materials and direct labor are directly traceable to eachproduct, their cost assignment should be accurate.2. Elegant: (1.75 ⨯ $9,000)/3,000 = $5.25 per briefcaseFina: (1.75 ⨯ $3,000)/3,000 = $1.75 per briefcaseNote: Overhead rate = $21,000/$12,000 = $1.75 per direct labor dollar (or 175 percent of direct labor cost).There are more machine and setup costs assigned to Elegant than Fina. This is clearly a distortion because the production of Fina is automated and uses the machine resources much more than the handcrafted Elegant. In fact, the consumption ratio for machining is 0.10 and 0.90 (using machine hours as the measure of usage). Thus, Fina uses nine times the machining resources as Elegant. Setup costs are similarly distorted. The products use an equal number of setups hours. Yet, if direct labor dollars are used, then the Elegant briefcase receives three times more machining costs than the Fina briefcase.4–7 Concluded3. Overhead rate = $21,000/5,000= $4.20 per MHrElegant: ($4.20 ⨯ 500)/3,000 = $0.70 per briefcaseFina: ($4.20 ⨯ 4,500)/3,000 = $6.30 per briefcaseThis cost assignment appears more reasonable given the relative demands each product places on machine resources. However, once a firm moves to a multiproduct setting, using only one activity driver to assign costs will likely produce product cost distortions. Products tend to make different demands on overhead activities, and this should be reflected in overhead cost assign-ments. Usually, this means the use of both unit- and nonunit-level activity drivers. In this example, there is a unit-level activity (machining) and a non-unit-level activity (setting up equipment). The consumption ratios for each (using machine hours and setup hours as the activity drivers) are as follows:Elegant FinaMachining 0.10 0.90 (500/5,000 and 4,500/5,000)Setups 0.50 0.50 (100/200 and 100/200)Setup costs are not assigned accurately. Two activity rates are needed—one based on machine hours and the other on setup hours:Machine rate: $18,000/5,000 = $3.60 per MHrSetup rate: $3,000/200 = $15 per setup hourCosts assigned to each product:Machining: Elegant Fina$3.60 ⨯ 500 $ 1,800$3.60 ⨯ 4,500 $ 16,200Setups:$15 ⨯ 100 1,500 1,500Total $ 3,300 $ 17,700Units ÷3,000 ÷3,000Unit overhead cost $ 1.10 $ 5.90Activity dictionary:Activity Activity Primary/ ActivityName Description Secondary Driver Providing nursing Satisfying patient Primary Nursing hours care needsSupervising Coordinating Secondary Number of nurses nurses nursing activitiesFeeding patients Providing meals Primary Number of mealsto patientsLaundering Cleaning and Primary Pounds of laundry bedding and delivering clothesclothes and beddingProviding Therapy treatments Primary Hours of therapy physical directed bytherapy physicianMonitoring Using equipment to Primary Monitoring hours patients monitor patientconditions1. dCost of labor (0.75 ⨯ $40,000) $30,000Forklift (direct tracing) 6,000 Total cost of receiving $36,000 2. b3. a4. c5. dActivity rates (Questions 2–5):Receiving: $36,000/50,000 = $0.72 per partSetup: $60,000/300 = $200 per setupGrinding: $90,000/18,000 = $5 per MHrInspecting: $45,000/4,500 = $10 per inspection hour6. aOverhead rate = $231,000/20,000 = $11.55 per DLH Direct materials $ 850Direct labor 600Overhead ($11.55 ⨯ 50) 578*Total cost $ 2,028Units ÷100Unit cost $ 20.28*Rounded4–9 Concluded7. bDirect materials $ 850.00Direct labor 600.00Overhead:Setup 200.00 ($200 ⨯ 1)Inspecting 40.00 ($10 ⨯ 4)Grinding 100.00 ($5 ⨯ 20)Receiving 14.40 ($0.72 ⨯ 20) Total costs $ 1,804.40Units ÷100Unit cost $ 18.04**Rounded4–101. Unit-level: Testing products, inserting dies2. Batch-level: Setting up batches, handling wafer lots, purchasingmaterials, receiving materials3. Product-level: Developing test programs, making probe cards,engineering design, paying suppliers4. Facility-level: Providing utilities, providing space4–111. Unit-level activities: MachiningBatch-level activities: Setups and packing Product-level activities: ReceivingFacility-level activities: None2. Pools and drivers:Unit-levelPool 1:Machining $80,000Activity driver: Machine hoursBatch-levelPool 2:Setups $24,000Packing 30,000Total cost $54,000Product-levelPool 3:Receiving $18,000Activity driver: Receiving orders4–11 Concluded3. Pool rates:Pool 1: $80,000/40,000 = $2 per MHrPool 2: $54,000/300 = $180 per setupPool 3: $18,000/600 = $30 per receiving order 4. Overhead assignment:InfantryPool 1: $2 ⨯ 20,000 = $ 40,000Pool 2: $180 ⨯ 200 = 36,000Pool 3: $30 ⨯ 200 = 6,000Total $ 82,000Special forcesPool 1: $2 ⨯ 20,000 = $ 40,000Pool 2: $180 ⨯ 100 = 18,000Pool 3: $30 ⨯ 400 = 12,000Total $ 70,0004–121. Deluxe Percent Regular PercentPrice $900 100% $750 100% Cost 576 64 600 80 Unit gross profit $324 36% $150 20% Total gross profit:($324 ⨯ 100,000) $32,400,000($150 ⨯ 800,000) $120,000,0002. Calculation of unit overhead costs:Deluxe Regular Unit-level:Machining:$200 ⨯ 100,000 $20,000,000$200 ⨯ 300,000 $60,000,000 Batch-level:Setups:$3,000 ⨯ 300 900,000$3,000 ⨯ 200 600,000 Packing:$20 ⨯ 100,000 2,000,000$20 ⨯ 400,000 8,000,000 Product-level:Engineering:$40 ⨯ 50,000 2,000,000$40 ⨯ 100,000 4,000,000 Facility-level:Providing space:$1 ⨯ 200,000 200,000$1 ⨯ 800,000 800,000 Total overhead $ 25,100,000 $ 73,400,000 Units ÷100,000 ÷800,000 Overhead per unit $ 251 $ 91.75Deluxe Percent Regular Percent Price $900 100% $750.00 100%Cost 780* 87*** 574.50** 77***Unit gross profit $120 13%*** $175.50 23%***Total gross profit:($120 ⨯ 100,000) $12,000,000($175.50 ⨯ 800,000) $140,400,000*$529 + $251**$482.75 + $91.75***Rounded3. Using activity-based costing, a much different picture of the deluxe and regu-lar products emerges. The regular model appears to be more profitable. Per-haps it should be emphasized.4–131. JIT Non-JITSales a$12,500,000 $12,500,000Allocation b750,000 750,000a$125 ⨯ 100,000, where $125 = $100 + ($100 ⨯ 0.25), and 100,000 is the average order size times the number of ordersb0.50 ⨯ $1,500,0002. Activity rates:Ordering rate = $880,000/220 = $4,000 per sales orderSelling rate = $320,000/40 = $8,000 per sales callService rate = $300,000/150 = $2,000 per service callJIT Non-JITOrdering costs:$4,000 ⨯ 200 $ 800,000$4,000 ⨯ 20 $ 80,000Selling costs:$8,000 ⨯ 20 160,000$8,000 ⨯ 20 160,000Service costs:$2,000 ⨯ 100 200,000$2,000 ⨯ 50 100,000T otal $ 1,160,000 $ 340,000For the non-JIT customers, the customer costs amount to $750,000/20 = $37,500 per order under the original allocation. Using activity assignments, this drops to $340,000/20 = $17,000 per order, a difference of $20,500 per or-der. For an order of 5,000 units, the order price can be decreased by $4.10 per unit without affecting customer profitability. Overall profitability will decrease, however, unless the price for orders is increased to JIT customers.3. It sounds like the JIT buyers are switching their inventory carrying costs toEmery without any significant benefit to Emery. Emery needs to increase prices to reflect the additional demands on customer-support activities. Fur-thermore, additional price increases may be needed to reflect the increased number of setups, purchases, and so on, that are likely occurring inside the plant. Emery should also immediately initiate discussions with its JIT cus-tomers to begin negotiations for achieving some of the benefits that a JIT supplier should have, such as long-term contracts. The benefits of long-term contracting may offset most or all of the increased costs from the additional demands made on other activities.4–141. Supplier cost:First, calculate the activity rates for assigning costs to suppliers: Inspecting components: $240,000/2,000 = $120 per sampling hourReworking products: $760,500/1,500 = $507 per rework hourWarranty work: $4,800/8,000 = $600 per warranty hourNext, calculate the cost per component by supplier:Supplier cost:Vance Foy Purchase cost:$23.50 ⨯ 400,000 $ 9,400,000$21.50 ⨯ 1,600,000 $ 34,400,000 Inspecting components:$120 ⨯ 40 4,800$120 ⨯ 1,960 235,200 Reworking products:$507 ⨯ 90 45,630$507 ⨯ 1,410 714,870 Warranty work:$600 ⨯ 400 240,000$600 ⨯ 7,600 4,560,000 Total supplier cost $ 9,690,430 $ 39,910,070Units supplied ÷400,000 ÷1,600,000Unit cost $ 24.23* $ 24.94**RoundedThe difference is in favor of Vance; however, when the price concession is con sidered, the cost of Vance is $23.23, which is less than Foy’s component.Lumus should accept the contractual offer made by Vance.4–14 Concluded2. Warranty hours would act as the best driver of the three choices. Using thisdriver, the rate is $1,000,000/8,000 = $125 per warranty hour. The cost as-signed to each component would be:Vance Foy Lost sales:$125 ⨯ 400 $ 50,000$125 ⨯ 7,600 $ 950,000$ 50,000 $ 950,000 U nits supplied ÷ 400,000 ÷1,600,000I ncrease in unit cost $ 0.13* $ 0.59**RoundedPROBLEMS4–151. Product cost assignment:Overhead rates:Patterns: $30,000/15,000 = $2.00 per DLHFinishing: $90,000/30,000 = $3.00 per DLHUnit cost computation:Duffel BagsPatterns:$2.00 ⨯ 0.1 $0.20$2.00 ⨯ 0.2 $0.40Finishing:$3.00 ⨯ 0.2 0.60$3.00 ⨯ 0.4 1.20Total per unit $0.80 $1.602. Cost before addition of duffel bags:$60,000/100,000 = $0.60 per unitThe assignment is accurate because all costs belong to the one product.4–15 Concluded3. Activity-based cost assignment:Stage 1:Pool rate = $120,000/80,000 = $1.50 per transactionStage 2:Overhead applied:Backpacks: $1.50 ⨯ 40,000* = $60,000Duffel bags: $1.50 ⨯ 40,000 = $60,000*80,000 transactions/2 = 40,000 (number of transactions had doubled)Unit cost:Backpacks: $60,000/100,000 = $0.60 per unitDuffel bags: $60,000/25,000 = $2.40 per unit4. This problem allows the student to see what the accounting cost per unitshould be by providing the ability to calculate the cost with and without the duffel bags. With this perspective, it becomes easy to see the benefits of the activity-based approach over those of the functional-based approach. The activity-based approach provides the same cost per unit as the single-product setting. The functional-based approach used transactions to allocate accounting costs to each producing department, and this allocation probably reflects quite well the consumption of accounting costs by each producing department. The problem is the second-stage allocation. Direct labor hours do not capture the consumption pattern of the individual products as they pass through the departments. The distortion occurs, not in using transac-tions to assign accounting costs to departments, but in using direct labor hours to assign these costs to the two products.In a single-product environment, ABC offers no improvement in product cost-ing accuracy. However, even in a single-product environment, it may be poss-ible to increase the accuracy of cost assignments to other cost objects such as customers.4–161. Plantwide rate = $660,000/440,000 = $1.50 per DLHOverhead cost per unit:Model A: $1.50 ⨯ 140,000/30,000 = $7.00Model B: $1.50 ⨯ 300,000/300,000 = $1.502. Departmental rates:Department 1: $420,000/180,000 = $2.33 per MHr*Department 2: $240,000/400,000 = $0.60 per DLHDepartment 1: $420,000/40,000 = $10.50 DLHDepartment 2: $240,000/40,000 = $6.00 per MHrOverhead cost per unit:Model A: [($2.33 ⨯ 10,000) + ($0.60 ⨯ 130,000)]/30,000 = $3.38Model B: [($2.33 ⨯ 170,000) + ($0.60 ⨯ 270,000)]/300,000 = $1.86Overhead cost per unit:Model A: [($10.50 ⨯ 10,000) + ($6.00 ⨯ 10,000)]/30,000 = $5.50Model B: [($10.50 ⨯ 30,000) + ($6.00 ⨯ 30,000)]/300,000 = $1.65*Rounded numbers throughoutA common justification is that of using machine hours for machine-intensivedepartments and labor hours for labor-intensive departments. Using this rea-soning, the first set of departmental rates would be selected (machine hours for Department 1 and direct labor hours for Department 2).3. Calculation of pool rates:Driver Pool RateBatch-level pool:Setup and inspection Product runs $320,000/100 = $3,200 per runUnit-level pool:Machine andmaintenance Machine hours $340,000/220,000 = $1.545 per MHr Note: Inspection hours could have been used as an activity driver instead of production runs.Overhead assignment:Model BBatch-level:Setups and inspection$3,200 ⨯ 40 $ 128,000$3,200 ⨯ 60 $ 192,000Unit-level:Power and maintenance$1.545 ⨯ 20,000 30,900$1.545 ⨯ 200,000 309,000Total overhead $ 158,900 $ 501,000Units produced ÷30,000 ÷ 300,000Overhead per unit $ 5.30 $ 1.674. Using activity-based costs as the standard, we can say that the first set ofdepartmental rates decreased the accuracy of the overhead cost assignment (over the plantwide rate) for both products. The opposite is true for the second set of departmental rates. In fact, the second set is very close to the activity assignments. Apparently, departmental rates can either improve or worsen plantwide assignments. In the first case, D epartment 1’s costs are assigned at a 17:1 ratio which overcosts B and undercosts A in a big way.Yet, this is the most likely set of rates at the departmental level! This raises some doubt about the conventional wisdom regarding departmental rates.4–171. Labor and gasoline are driver tracing.Labor (0.75 ⨯ $120,000) $ 90,000 Time = Resource driverGasoline ($3 ⨯ 6,000 moves) 18,000 Moves = Resource driverDepreciation (2 ⨯ $6,000) 12,000 Direct tracingTotal cost $ 120,0002. Plantwide rate = $600,000/20,000= $30 per DLHUnit cost:DeluxePrime costs $80.00 $160Overhead:$30 ⨯ 10,000/40,000 7.50$30 ⨯ 10,000/20,000 15$87.50 $1753. Pool 1: Maintenance $ 114,000Engineering 120,000Total $ 234,000Maintenance hours ÷4,000Pool rate $ 58.50Note:Engineering hours could also be used as a driver. The activities are grouped together because they have the same process, are both product lev-el, and have the same consumption ratios (0.25, 0.75).Pool 2: Material handling $ 120,000Number of moves ÷6,000Pool rate $ 20Pool 3: Setting up $ 96,000Number of setups ÷80Pool rate $ 1,200Note: Material handling and setups are both batch-level activities but have dif-ferent consumption ratios.Pool 4: Purchasing $ 60,000Receiving 40,000Paying suppliersTotal $ 130,000Orders processed ÷750Pool rate $ 173.33Note:The three activities are all product-level activities and have the same consumption ratios.Pool 5: Providing space $ 20,000Machine hours ÷10,000Pool rate $ 2Note: This is the only facility-level activity.4. Unit cost:Basic Deluxe Prime costs $ 3,200,000 $ 3,200,000Overhead:Pool 1:$58.50 ⨯ 1,000 58,500$58.50 ⨯ 3,000 175,500 Pool 2:$20 ⨯ 2,000 40,000$20 ⨯ 4,000 80,000 Pool 3:$1,200 ⨯ 20 24,000$1,200 ⨯ 60 72,000 Pool 4:$173.33 ⨯ 250 43,333$173.33 ⨯ 500 86,665 Pool 5:$2 ⨯ 5,000 10,000$2 ⨯ 5,000 10,000 Total $ 3,375,833 $ 3,624,165Units produced ÷40,000 ÷20,000Unit cost (ABC) $ 84.40 $ 181.21Unit cost (traditional) $ 87.50 $ 175.00The ABC costs are more accurate (better tracing—closer representation of actual resource consumption). This shows that the basic model was over-costed and the deluxe model undercosted when the plantwide overhead rate was used.1. Unit-level costs ($120 ⨯ 20,000) $ 2,400,000Batch-level costs ($80,000 ⨯ 20) 1,600,000Product-level costs ($80,000 ⨯ 10) 800,000Facility-level ($20 ⨯ 20,000) 400,000Total cost $ 5,200,0002. Unit-level costs ($120 ⨯ 30,000) $ 3,600,000Batch-level costs ($80,000 ⨯ 20) 1,600,000Product-level costs ($80,000 ⨯ 10) 800,000Facility-level costs 400,000Total cost $ 6,400,000The unit-based costs increase because these costs vary with the number of units produced. Because the batches and engineering orders did not change, the batch-level costs and product-level costs remain the same, behaving as fixed costs with respect to the unit-based driver. The facility-level costs are fixed costs and do not vary with any driver.3. Unit-level costs ($120 ⨯ 30,000) $ 3,600,000Batch-level costs ($80,000 ⨯ 30) 2,400,000Product-level costs ($80,000 ⨯ 12) 960,000Facility-level costs 400,000Total cost $ 7,360,000Batch-level costs increase as the number of batches changes, and the costs of engineering support change as the number of orders change. Thus, batches and orders increased, increasing the total cost of the model.4. Classifying costs by category allows their behavior to be better understood.This, in turn, creates the ability to better manage costs and make decisions.1. The total cost of care is $1,950,000 plus a $50,000 share of the cost of super-vision [(25/150) ⨯ $300,000]. The cost of supervision is computed as follows: Salary of supervisor (direct) $ 70,000Salary of secretary (direct) 22,000Capital costs (direct) 100,000Assistants (3 ⨯ 0.75 ⨯ $48,000) 108,000Total $ 300,000Thus, the cost per patient day is computed as follows:$2,000,000/10,000 = $200 per patient day(The total cost of care divided by patient days.) Notice that every maternity patient—regardless of type—would pay the daily rate of $200.2. First, the cost of the secondary activity (supervision) must be assigned to theprimary activities (various nursing care activities) that consume it (the driver is the number of nurses):Maternity nursing care assignment:(25/150) ⨯ $300,000 = $50,000Thus, the total cost of nursing care is $950,000 + $50,000 = $1,000,000.Next, calculate the activity rates for the two primary activities:Occupancy and feeding: $1,000,000/10,000 = $100 per patient dayNursing care: $1,000,000/50,000 = $20 per nursing hour。

扎维模拟CMOS集成电路设计第四章习题

I SS 1103 0.72V 4 0.383510 50 W p Cox L 3

Vout max 3 0.72 2.28V Vout , swing 2Vout max Vout min 22.28 0.673 3.214 V

Chapter 4 习题

4.11

Cox

0 ox

tox

8.851014 F / cm 3.9 7 2 3 . 835 10 F / cm 9 109 m

cm2 F 4 A nCox 350 3.835107 1 . 34225 10 V s cm2 V2 cm2 F 4 A pCox 100 3.835107 0 . 3835 10 V s cm2 V2

b. VDD 0.8V时,M 3截止,Vout 0, AV 0 VDD 0.8V时,M 3导通,M1工作在线性区,VDD ,Vout , AV 当VDD 上升到一定值时,M1进入饱和区。

VinCM 1.2V时,满足M1工作在饱和区的最小电 源电压为 VDD min VinCM VTH 1 VGS 3 1.2 0.7 1.607 2.107V

2 I D1 VGS 1 Vod 1 VTH 1 0.7 W nCox L 1 2 0.25103 0.7 0.893 V 4 1.3422510 100

VinCM min VodSS VGS 1 0.273 0.893 1.166 V

a. VinCMmin VodSS VGS1 VinCMmax VDD VGS3 VTH1

Introduction to Management Science 5th Edition, 课后习题答案 Chapter 4

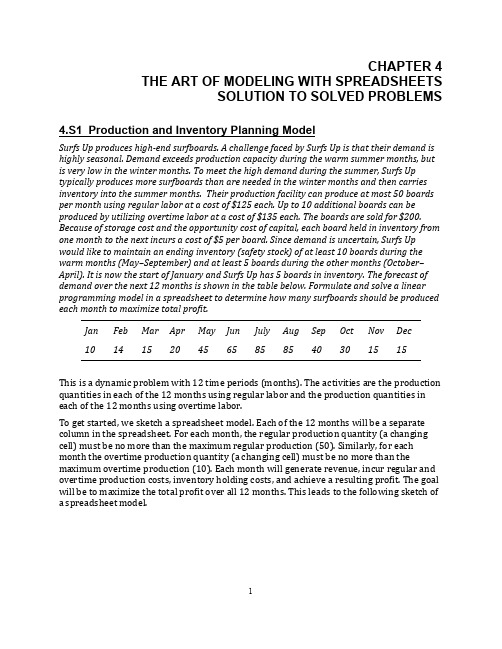

CHAPTER 4 THE ART OF MODELING WITH SPREADSHEETSSOLUTION TO SOLVED PROBLEMS4.S1Production and Inventory Planning ModelSurfs U p p roduces h igh-‐end s urfboards. A c hallenge f aced b y S urfs U p i s t hat t heir d emand i s highly s easonal. D emand e xceeds p roduction c apacity d uring t he w arm s ummer m onths, b ut is v ery l ow i n t he w inter m onths. T o m eet t he h igh d emand d uring t he s ummer, S urfs U ptypically p roduces m ore s urfboards t han a re n eeded i n t he w inter m onths a nd t hen c arries inventory i nto t he s ummer m onths. T heir p roduction f acility c an p roduce a t m ost 50 b oards per m onth u sing r egular l abor a t a c ost o f $125 e ach. U p t o 10 a dditional b oards c an b e produced b y u tilizing o vertime l abor a t a c ost o f $135 e ach. T he b oards a re s old f or $200. Because o f s torage c ost a nd t he o pportunity c ost o f c apital, e ach b oard h eld i n i nventory f rom one m onth t o t he n ext i ncurs a c ost o f $5 p er b oard. S ince d emand i s u ncertain, S urfs U p would l ike t o m aintain a n e nding i nventory (safety s tock) o f a t l east 10 b oards d uring t he warm m onths (May–September) a nd a t l east 5 b oards d uring t he o ther m onths (October–April). I t i s n ow t he s tart o f J anuary a nd S urfs U p h as 5 b oards i n i nventory. T he f orecast o f demand o ver t he n ext 12 m onths i s s hown i n t he t able b elow. F ormulate a nd s olve a l inear programming m odel i n a s preadsheet t o d etermine h ow m any s urfboards s hould b e p roduced each m onth t o m aximize t otal p rofit.Jan Feb Mar Apr May Jun July Aug Sep Oct Nov Dec10 14 15 20 45 65 85 85 40 30 15 15This i s a d ynamic p roblem w ith 12 t ime p eriods (months). T he a ctivities a re t he p roduction quantities i n e ach o f t he 12 m onths u sing r egular l abor a nd t he p roduction q uantities i n each o f t he 12 m onths u sing o vertime l abor.To g et s tarted, w e s ketch a s preadsheet m odel. E ach o f t he 12 m onths w ill b e a s eparate column i n t he s preadsheet. F or e ach m onth, t he r egular p roduction q uantity (a c hanging cell) m ust b e n o m ore t han t he m aximum r egular p roduction (50). S imilarly, f or e ach month t he o vertime p roduction q uantity (a c hanging c ell) m ust b e n o m ore t han t he maximum o vertime p roduction (10). E ach m onth w ill g enerate r evenue, i ncur r egular a nd overtime p roduction c osts, i nventory h olding c osts, a nd a chieve a r esulting p rofit. T he g oal will b e t o m aximize t he t otal p rofit o ver a ll 12 m onths. T his l eads t o t he f ollowing s ketch o f a s preadsheet m odel.The e nding i nventory e ach m onth w ill e qual t he s tarting i nventory (the g iven s tartinginventory f or J anuary, o r t he p revious m onth’s e nding i nventory f or f uture m onths) p lus a ll production (regular a nd o vertime) m inus t he f orecasted s ales. T he e nding i nventory a t t he end o f e ach m onth m ust b e a t l east t he m inimum s afety s tock l evel. T he r evenue w ill e qual the s elling p rice t imes f orecasted s ales. T he r egular (or o vertime) p roduction c ost w ill b e the r egular (or o vertime) p roduction q uantity t imes t he u nit r egular (or o vertime)production c ost. T he h olding c ost w ill e qual t he e nding i nventory t imes t he u nit h olding cost. T he m onthly p rofit w ill b e r evenue m inus b oth p roduction c osts m inus h olding c ost. Finally, t he t otal p rofit w ill b e t he s um o f t he m onthly p rofits. T he f inal s olved s preadsheet, formulas, a nd S olver i nformation a re s hown b elow.Unit Cost (Reg)Unit Cost (OT)Selling Price Holding Cost Starting Inventory<=Max Regular <=Max OTForecasted Sales Ending Inventory>=Safety StockThe v alues i n R egularProduction (C10:N10) a nd O TProduction (C14:N14) s how h ow m anysurf b oards S urfs U p s hould p roduce e ach m onth s o a s t o a chieve t he m aximum p rofit o f $31,150.Set Objective Cell: TotalProfit To: MaxBy Changing Variable Cells:RegularProduction, OTProduction Subject to the Constraints:RegularProduction <= MaxRegular OTProduction <= MaxOTEndingInventory >= SafetyStock Solver Options:Make Variables Nonnegative Solving Method: Simplex LP4.S2Aggregate Planning: Manpower Hiring/Firing/TrainingCool P ower p roduces a ir c onditioning u nits f or l arge c ommercial p roperties. D ue t o t he l owcost a nd e fficiency o f i ts p roducts, t he c ompany h as b een g rowing f rom y ear t o y ear. A lso, d ue to s easonality i n c onstruction a nd w eather c onditions, p roduction r equirements v ary f rommonth t o m onth. C ool P ower c urrently h as 10 f ully t rained e mployees w orking i nmanufacturing. E ach t rained e mployee c an w ork 160 h ours p er m onth a nd i s p aid a m onthly wage o f $4000. N ew t rainees c an b e h ired a t t he b eginning o f a ny m onth. D ue t o t heir l ack o f initial s kills a nd r equired t raining, a n ew t rainee o nly p rovides 100 h ours o f u seful l abor i n their f irst m onth, b ut a re s till p aid a f ull m onthly w age o f $4000. F urthermore, b ecause o f required i nterviewing a nd t raining, t here i s a $2500 h iring c ost f or e ach e mployee h ired. A fter one m onth, a t rainee i s c onsidered f ully t rained. A n e mployee c an b e f ired a t t he b eginning o f any m onth, b ut m ust b e p aid t wo w eeks o f s everance p ay ($2000). O ver t he n ext 12 m onths, Cool P ower f orecasts t he l abor r equirements s hown i n t he t able b elow. S ince m anagement anticipates h igher r equirements n ext y ear, C ool P ower w ould l ike t o e nd t he y ear w ith a t l east 12 f ully t rained e mployees. H ow m any t rainees s hould b e h ired a nd/or w orkers f ired i n e ach month t o m eet t he l abor r equirements a t t he m inimum p ossible c ost? F ormulate a nd s olve a linear p rogramming s preadsheet m odel.Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1600 2000 2000 2000 2800 3200 3600 3200 1600 1200 800 800This i s a d ynamic p roblem w ith 12 t ime p eriods (months). T he a ctivities a re t he n umber o fworkers t o h ire a nd f ire i n e ach o f t he 12 m onths.To g et s tarted, w e s ketch a s preadsheet m odel. E ach o f t he 12 m onths w ill b e a s eparate column i n t he s preadsheet. F or e ach m onth, t here a re c hanging c ells f or b oth t he n umber o f workers h ired a nd f ired. B ased o n t he v alues o f t hese c hanging c ells, w e c an d etermine t he number o f t rainees a nd t rained e mployees. T he n umber o f l abor h ours g enerated b y t he employees m ust b e a t l east t he r equired l abor h ours e ach m onth. F inally, l abor c osts (for trainees a nd t he t rained w orkforce), h iring c ost, a nd s everance p ay l eads t o a t otal m onthly cost. T he g oal w ill b e t o m inimize t he t otal c ost o ver a ll 12 m onths. T his l eads t o t he following s ketch o f a s preadsheet m odel.Labor Monthly WageHiring Cost Severance PayLabor Hours/Trainee/MonthLabor Hours/Trained Worker/MonthStarting Trained WorkforceMinimum to Start the TraineesNext YearTrained Employees >=Labor Hours Available>=Required Labor HoursWhen a n e mployee i s f irst h ired, h e o r s he i s a t rainee f or o ne m onth b efore b ecoming afully-‐trained e mployee. T herefore, t he n umber o f t rainees (row 14) i s e qual t o t he n umber of w orkers h ired i n t hat m onth, w hile t he n umber o f t rained e mployees (row 15) i s t henumber o f t rained e mployees a nd t rainees f rom t he p revious m onth m inus a ny e mployee that i s f ired. T he l abor h ours a vailable i n e ach m onth e quals t he s umproduct o f t he l abor hours p rovided b y e ach t ype o f w orker (trained o r t rainees) w ith t he n umber o f e ach t ype of e mployee. T he l abor c osts i n e ach m onth a re t he m onthly w age m ultiplied b y t he number o f e mployees. T he h iring c ost i s t he u nit h iring c ost m ultiplied b y t he n umber o f workers h ired. T he s everance p ay i s t he u nit s everance c ost m ultiplied b y t he n umber o f workers f ired. T hen, t he t otal m onthly c ost i s t he s um o f t he l abor c osts, h iring c ost, a nd severance p ay. F inally, t he t otal c ost w ill b e t he s um o f t he m onthly c osts. F or a rbitrary values o f w orkers h ired a nd f ired e ach m onth, t his l eads t o t he f ollowing s preadsheet.The S olver i nformation i s s hown b elow, f ollowed b y t he s olved s preadsheet.Thus, W orkersHired (C11:N11) s hows t he n umber o f w orkers C ool P ower s hould h ire e achmonth a nd W orkersFired (C12:N12) s hows t he n umber o f w orkers C ool P ower s hould f ire each m onth s o a s t o a chieve t he m inimum T otalCost (O26) o f $787,500.Solver ParametersSet Objective Cell: TotalCost To: MinBy Changing Variable Cells: WorkersHired, WorkersFired Subject to the Constraints:N15 >= MinimumToStartNewYearLaborHoursAvailable >= RequiredLaborHours WorkersHired = integer WorkersFired = integer Solver Options:Make Variables Nonnegative Solving Method: Simplex LP。

货币金融学(全英)chapter 4习题

• 4.current yield is the most accurate index of interest rate, when economist talk about interest rate, they refer to current yield.

Choose the best answer

• 1. the present value of security that interest payment is $52.5 next year and $110.25 the second year, interest rate is 5%

• A $162.5 • B $50 • C $100 • D $150 •d

• 16.if the present value of security is $150 which interest payment is $55 next year and you will get $133 in the end of third year, the interest rate is ( )

•b

• 18. the present value of A+B is

• A. (present value of A) *B

• B. (present value of A+B)/future value

• C. (present value of A)+ (present value of B)

• B next year$6m, and every year$4m in next 4 year after that

化学热力学习题

ቤተ መጻሕፍቲ ባይዱ

04B23. 2mol Hg(l) 在沸点温度 (630K) 蒸发过程所吸收的热量为 109.12kJ, 则 汞的标准摩尔蒸发焓 ΔvapHmθ = _______; 该过程对环境做功 W = ________ ; ΔU = ________ ; ΔS = _________ ; ΔG = ______. 10.5 kJ 54.56 kJ/mol 173.2 J/K 0 98.6 kJ 54.56 kJ/mol 98.6 kJ 10.5kJ 173.2 J/K 0 10.5kJ 54.56kJ/mol 98.6kJ 173.2 J/K 0 54.56 kJ/mol 10.5 kJ 98.6 kJ 173.2 J/k 0 D 04B24. 1mol 液态的苯完全燃烧, 生成CO2(g)和H2O(l), 则该反应的 Qp 与 Qv 的差值为________ kJ/mol (温度为 25℃). 3.72 7.44 -3.72 -7.44 C 04B25. 反 应 ① C(s) + O2(g) = CO2(g) ② 2CO(g) + O2(g) = 2CO2(g) ③ NH4Cl(s) = NH3(g) + HCl(g) ④ CaCO3(s) = CaO(s) + CO2(g) 按 ΔrSmθ减 小的顺序为___________ . ③>④>②>① ③>④>①>② ④>③>①>② ②>①>④>③ B 04B26. 已知 25℃ 时, ΔfHmθ (Br2, g) = 30.71 kJ/mol, ΔfGmθ (Br2, g) = 3.14 kJ/mol, 则 Br2(l) 的 摩 尔 蒸 发 熵 和 正 常 沸 点 分 别 为 ________ J/mol·K 和 ________ ℃. 92.5 332 92.5 59 46.2 29.5 29.5 46.2 B

语言学chapter4习题

语⾔学chapter4习题Chapter 4 SyntaxMultiple Choice1. The sentence structure is ________.A. only linearB. only hierarchicalC. complexD. both linear and hierarchical2. A __________ in the embedded clause refers to the introductory word that introduces the embedded clause.A. coordinatorB. particleC. prepositionD. subordinator3. Phrase structure rules have ____ properties.A. recursiveB. grammaticalC. socialD. functional4. The head of the phrase “the city Rome” is __________.A. the cityB. RomeC. cityD. the city Rome5. The phrase “on the shelf” belongs to __________ construction.A. endocentricB. exocentricC. subordinateD. coordinate6. The sentence “They were wanted to remain quiet and not to expose themselves.” is a __________ sentence.A. simpleB. coordinateC. compoundD. complex7. In the sentence “Mary gave a book to him”, “him” is with a(n) _________ case.A. accusativeD. nominative8. The relation between any two words in “What a nice day!” is known as ___________.A. choice relationB. paradigmatic relationC. vertical relationD. syntagmatic relation9. __________is mostly a category of the noun and pronoun.A. GenderB. TenseC. AspectD. Number10. Paradigmatic relation is known as _______________.A. horizontal relationB. chain relationC. choice relationD. semantic relation11. Which of the following phrases is exocentric?A. a clever girlB. an ugly manC. in timeD. fork and knife12. refers to the relations holding between elements replaceable with each at particular place in structure, or between one element present and the others absent.A. Syntagmatic relationB. Paradigmatic relationC. Co-occurrence relationD. Exocentric relation13. ______ is a grammatical category used for the analysis of word classes displaying such contrasts as masculine: feminine: neuter, animate: inanimate, etc.A. CaseB. GenderC. NumberD. Category14. Syntactically, English is an example of ________ language.C. SOVD. OSV15. What is the construction of the sentence “The boy smiled”?A. ExocentricB. EndocentricC. CoordinateD. Subordinate16. the relation between elements that form part of the same form, sequence, construction, etc. e.g between s, p and r in a form such as spring, or between a subject and a verb in constructions such Bill hunts is called .A. syntagmatic relationB. paradigmatic relationC. positional relationD. relation of substitutabilityFill in each blank below with one word which begins with the letter given:1. A __________ sentence consists of a single clause which contains a subject and a predicate and stands alone as its own sentence.2. A __________ is a structurally independent unit that usually comprises a number of words to form a complete statement, question or command.3. A __________ may be a noun or a noun phrase in a sentence that usually precedes the predicate.4. The part of a sentence which comprises a finite verb or a verb phrase and which says something about the subject is grammatically called __________.5. In the complex sentence, the incorporated or subordinate clause is normally called an __________ clause.6. construction usually includes basic sentence, prepositional phrase, predicate (verb + object) construction, and connective (be complement) construction.7. IC is the short form of immediate used in the study of syntax.8. A sentence contains two clauses joined by a linking word, such as "and", "but", "or".Put a T for true or F for false in the brackets in front of each statement.1. In a complex sentence, the two clauses hold unequal status, one subordinating the other.2. Constituents that can be substituted for one another without loss of grammaticality belong to the same syntactic category.3. In English syntactic analysis, four phrasal categories are commonly recognized and discussed, namely, noun phrase, verb phrase, infinitive phrase, and auxiliary phrase.4. In English the subject usually precedes the verb and the direct object usually follows the verb.5. A noun phrase must contain a noun, but other elements are optional.6. Syntax is a subfield of linguistics that studies the sentence structure of language, including the combination of morphemes into words.7. In the phrase “in the near future”, the word “future” is head.8. Words like “actor”and “actress” manifest that grammatical gender strictly corresponds to biological gender.9. Paradigmatic relation in syntax is alternatively called horizontal relation.10.“The student” in the sentence “The student liked the linguistic lecture.”, and “The linguistic lecture” in the sentence “The linguistic lecture liked the student.” belong to the same syntactic category.Define the following terms1. Syntax2. IC analysisAnswer the following questions.1.What are endocentric construction and exocentric construction? (武汉⼤学,2004)2.Distinguish the two possible meanings of “more beautiful flowers” by means of IC analysis. (北京第⼆外国语⼤学,2004)3. Suggest a tree diagram of the sentence The little girl ran into the garden. The student wrote a letter yesterday. Examine each of the following sentences and indicate if it is a simple, coordinate, complex or compound complex sentences:(1)Jane did it because she was asked to.(2)The soldiers were warned to remain hidden and not to expose themselves.(3)David was never there, but his brother was. (4)She leads a tranquil life in the country. (5)Unless I hear from her, I won’t leave this town..Draw on your linguistic knowledge of English and paraphrase each of the following sentences in two different ways to show how syntactic rules account for the ambiguity of sentences:(1)After a two-day debate, they finally decided on the helicopter.(2)The little girl saw the big man with the telescope.(3) The shooting of the hunters might be terrible.(4) He saw young men and women present.。

IntermediateAccountingChapter4中级会计学第四章课后习题答案

Chapter 4The Income Statement and Statement of Cash FlowsQUESTIONS FOR REVIEW OF KEY TOPICSQuestion 4-5The term earnings quality refers to the ability of reported earnings (income) to predict a company’s future earnings. After all, an income statement simply reports on events that already have occurred. The relevance of any historical-based financial statement hinges on its predictive value.Question 4-7The process of intraperiod tax allocation matches tax expense or tax benefit with each major component of income, specifically continuing operations and any item reported below continuing operations. The process is necessary to achieve the desired result of separating the total income effects of continuing operations from the two separately reported items - discontinued operations and extraordinary items, and also to show the after-tax effect of each of those two components.Question 4-9Extraordinary items are material gains and losses that are both unusual in nature and infrequent in occurrence, taking into account the environment in which the entity operates.Question 4-11GAAP permit alternative treatments for similar transactions. Common examples are the choice among FIFO, LIFO, and average cost for the measurement of inventory and the choice among alternative revenue recognition methods. A change in accounting principle occurs when a company changes from one generally accepted treatment to another.In general, we report voluntary changes in accounting principles retrospectively. This means revising all previous periods’ financial statements as if the new method were used in those periods. In other words, for each year in the comparative statements reported, we revise the balance of each account affected. Specifically, we make those statements appear as if the newly adopted accounting method had been applied all along. Also, if retained earnings is one of the accounts whose balance requires adjustment (and it usually is), we revise the beginning balance of retained earnings for the earliest period reported in the comparative statements of shareholders’ equity (or statements of retained earnings if they’re presented instead).Then we create a journal entry to adjust all account balances affected as of the date of the change. In the first set of financial statements after the change, a disclosure note would describe the change and justify the new method as preferable. It also would describe the effects of the change on all items affected, including the fact that the retained earnings balance was revised in the statement of shareholders’ equity along with the cumulative effect of the change in retained earnings.An exception is a change in depreciation, amortization, or depletion method. These changes are accounted for as a change in estimate, rather than as a change in accounting principle. Changes in estimates are accounted for prospectively. The remaining book value is depreciated, amortized, or depleted, using the new method, over the remaining useful life.Question 4-15Comprehensive income is the total change in equity for a reporting period other than from transactions with owners. Reporting comprehensive income can be accomplished with a separate statement or by including the information in either the income statement or the statement of changes in shareholders’ equity.Question 4-22U.S. GAAP designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. Dividends paid to shareholders are classified as financing cash flows. IFRS allows more flexibility. Companies can report interest and dividends paid as either operating or financing cash flows and interest and dividends received as either operating or investing cash flows. Interest and dividend payments usually are reported as financing activities. Interest and dividends received normally are classified as investing activitiesBRIEF EXERCISESBrief Exercise 4-6*$850,000 x 40%Note: Restructuring costs, interest revenue, and loss on sale of investments are included in income before income taxes and extraordinary item.Brief Exercise 4-9*$5,800,000 x 30%** Loss from operations of discontinued component:Impairment loss ($8 million book value less$7 million net fair value) $(1,000,000) Operating loss (3,600,000) Total before-tax loss $(4,600,000)EXERCISES Exercise 4-3* 30% x $440,000Pretax income from continuing operations $14,000,000Income tax expense (5,600,000) Income from continuing operations 8,400,000 Less: Net income 7,200,000 Loss from discontinued operations $1,200,000 $1,200,000 60%* = $2,000,000 = before tax loss from discontinued operations.*1-tax rate of 40% = 60%Pretax income of division $4,000,000 Add: Loss from discontinued operations 2,000,000 Impairment loss $6,000,000 Fair value of division’s assets$11,000,000 Add: Impairment loss 6,000,000 Book value of division’s assets$17,000,000Requirement 1This is a change in accounting estimate.Requirement 2$2,400,000 Cost$240,000 Previous annual amortization ($2,400,000 ÷ 10 years) x 21/2 yrs. 600,000 Amortization to date (2009-2011)1,800,000 Book value÷ 5 yrs. Estimated remaining life(given)$ 360,000 New annual amortizationTiger EnterprisesStatement of Cash FlowsFor the Year Ended December 31, 2011($ in thousands)Cash flows from operating activities:Net income $ 900Adjustments for noncash effects:Depreciation expense 240Changes in operating assets and liabilities:Decrease in accounts receivable 80Increase in inventory (40)Increase in prepaid insurance (30)Decrease in accounts payable (60)Decrease in administrative and other payables (100)Increase in income taxes payable 50Net cash flows from operating activities $1,040 Cash flows from investing activities:Purchase of plant and equipment (300) Cash flows from financing activities:Proceeds from issuance of common stock 100Proceeds from note payable 200Payment of dividends (1) (940)Net cash flows from financing activities(640)Net increase in cash 100 Cash, January 1 200 Cash, December 31 $ 300(1)Retained earnings, beginning $540+ Net income 900- Dividends x x = $940Retained earnings, ending $500The T-account analysis of the transactions related to operating cash flows is shown below. To derive the cash flows, the beginning and ending balances in the related assets and liabilities are inserted, together with the revenue and expense amounts from the income statements. In each balance sheet account, the remaining (plug) figure is the other half of the cash increases or decreases.Based on the information in the T-accounts above, the operating activities section of the SCF for Tiger Enterprises would be as shown next.Exercise 4-23 (concluded)Tiger EnterprisesStatement of Cash FlowsFor the Year Ended December 31, 2011($ in thousands)Cash flows from operating activities:Collections from customers $ 7,080Prepayment of insurance (130)Payment to inventory suppliers (3,460)Payment for administrative & other exp. (1,900)Payment of income taxes (550)Net cash flows from operating activities $ 1,040CPA / CMA REVIEW QUESTIONSCPA Exam Questions1. c. U.S. GAAP requires that discontinued operations be disclosed separatelybelow income from continuing operations.2. d.Other than sales, COGS, and administrative expenses, only the gain or lossfrom disposal of equipment is considered part of income from continuingoperations. Income from continuing operations was ($5,000,000 - 3,000,000- 1,000,000 + 200,000) = $1,200,000.3. a. In a single-step income statement, revenues include sales as well as otherrevenues and gains.Sales revenue $187,000Interest revenue 10,200Gain on sale of equipment 4,700Total $201,900The discontinued operations and the extraordinary gain are reported belowincome from continuing operations.4.a.The $400,000 impairment loss and the $1,000,000 loss from operationsshould be combined for a total loss of $1,400,000.5.d. The change in the estimate for warranty costs is based on new informationobtained from experience and qualifies as a change in accounting estimate. Achange in accounting estimate affects current and future periods and is notaccounted for by restating prior periods. The accounting change is a part ofcontinuing operations.6. a. Dividends paid to shareholders is considered a financing cash flow, not anoperating cash flow.7. c. Issuing common stock for cash is considered a financing cash flow, not aninvesting cash flow.CMA Exam Questions1.d. Discontinued operations and extraordinary gains and losses are shownseparately in the income statement, below income from continuing operations.The cumulative effect of most voluntary changes in accounting principle isaccounted for by retrospectively revising prior years’ financial statements.2.c.The operating section of a retailer’s income statement includes all revenuesand costs necessary for the operation of the retail establishment, e.g., sales,cost of goods sold, administrative expenses, and selling expenses.3 a. Extraordinary items should be presented net of tax after income fromoperations.PROBLEMSProblem 4-9Requirement 1Diversified Portfolio CorporationStatement of Cash FlowsFor the Year Ended December 31, 2011Cash flows from operating activities:Collections from customers (1)$880,000Payment of operating expenses (2)(660,000)Payment of income taxes (3)(85,000)Net cash flows from operating activities $135,000Cash flows from investing activities:Sale of investments 50,000Net cash flows from investing activities 50,000Cash flows from financing activities:Proceeds from issue of common stock 100,000Payment of dividends (80,000)Net cash flows from financing activities 20,000Increase in cash 205,000Cash and cash equivalents, January 1 70,000Cash and cash equivalents, December 31 $275,000(1)$900,000 in service revenue less $20,000 increase in accounts receivable.(2) $700,000 in operating expenses less $30,000 in depreciation less $10,000 increase in accounts payable.(3)$80,000 in income tax expense plus $5,000 decrease in income taxes payable.Problem 4-9 (concluded)Requirement 2Diversified Portfolio CorporationStatement of Cash FlowsFor the Year Ended December 31, 2011Cash flows from operating activities:Net income $120,000Adjustments for noncash effects:Depreciation expense 30,000Changes in operating assets and liabilities:Increase in accounts receivable (20,000)Increase in accounts payable 10,000Decrease in income taxes payable (5,000)Net cash flows from operating activities $135,000。

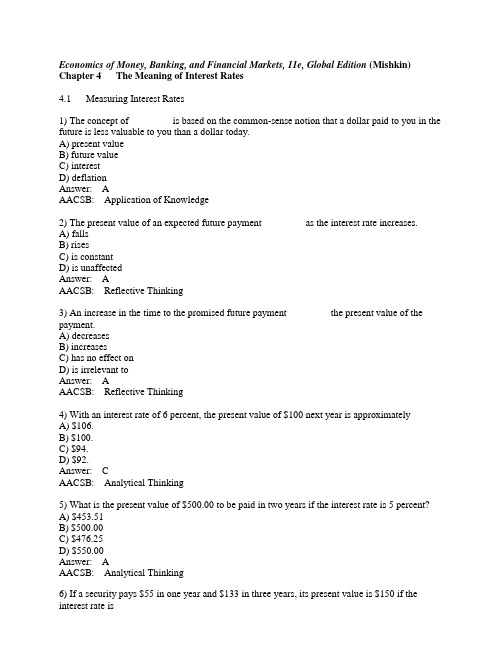

米什金 货币金融学 英文版习题答案chapter 4英文习题

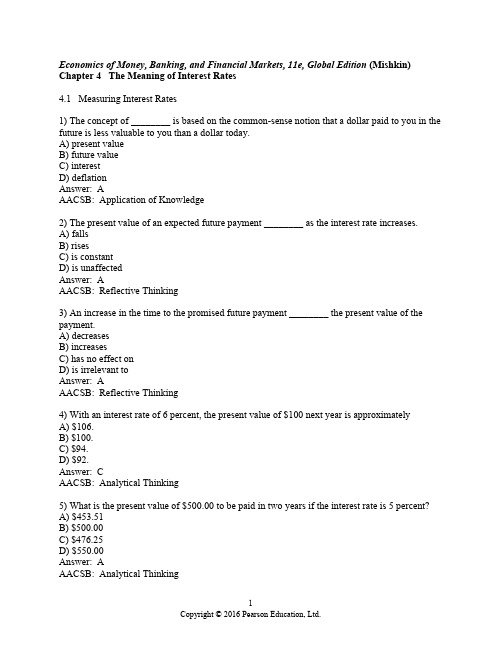

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 4 The Meaning of Interest Rates4.1 Measuring Interest Rates1) The concept of ________ is based on the common-sense notion that a dollar paid to you in the future is less valuable to you than a dollar today.A) present valueB) future valueC) interestD) deflationAnswer: AAACSB: Application of Knowledge2) The present value of an expected future payment ________ as the interest rate increases.A) fallsB) risesC) is constantD) is unaffectedAnswer: AAACSB: Reflective Thinking3) An increase in the time to the promised future payment ________ the present value of the payment.A) decreasesB) increasesC) has no effect onD) is irrelevant toAnswer: AAACSB: Reflective Thinking4) With an interest rate of 6 percent, the present value of $100 next year is approximatelyA) $106.B) $100.C) $94.D) $92.Answer: CAACSB: Analytical Thinking5) What is the present value of $500.00 to be paid in two years if the interest rate is 5 percent?A) $453.51B) $500.00C) $476.25D) $550.00Answer: AAACSB: Analytical Thinking6) If a security pays $55 in one year and $133 in three years, its present value is $150 if the interest rate isA) 5 percent.B) 10 percent.C) 12.5 percent.D) 15 percent.Answer: BAACSB: Analytical Thinking7) To claim that a lottery winner who is to receive $1 million per year for twenty years has won $20 million ignores the process ofA) face value.B) par value.C) deflation.D) discounting the future.Answer: DAACSB: Analytical Thinking8) A credit market instrument that provides the borrower with an amount of funds that must be repaid at the maturity date along with an interest payment is known as aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: AAACSB: Application of Knowledge9) A credit market instrument that requires the borrower to make the same payment every period until the maturity date is known as aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: BAACSB: Application of Knowledge10) Which of the following are TRUE of fixed payment loans?A) The borrower repays both the principal and interest at the maturity date.B) Installment loans and mortgages are frequently of the fixed payment type.C) The borrower pays interest periodically and the principal at the maturity date.D) Commercial loans to businesses are often of this type.Answer: BAACSB: Reflective Thinking11) A fully amortized loan is another name forA) a simple loan.B) a fixed-payment loan.C) a commercial loan.D) an unsecured loan.Answer: BAACSB: Application of Knowledge12) A credit market instrument that pays the owner a fixed coupon payment every year until the maturity date and then repays the face value is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: CAACSB: Application of Knowledge13) A ________ pays the owner a fixed coupon payment every year until the maturity date, when the ________ value is repaid.A) coupon bond; discountB) discount bond; discountC) coupon bond; faceD) discount bond; faceAnswer: CAACSB: Analytical Thinking14) The ________ is the final amount that will be paid to the holder of a coupon bond.A) discount valueB) coupon valueC) face valueD) present valueAnswer: CAACSB: Application of Knowledge15) When talking about a coupon bond, face value and ________ mean the same thing.A) par valueB) coupon valueC) amortized valueD) discount valueAnswer: AAACSB: Application of Knowledge16) The dollar amount of the yearly coupon payment expressed as a percentage of the face value of the bond is called the bond'sA) coupon rate.B) maturity rate.C) face value rate.D) payment rate.Answer: AAACSB: Application of Knowledge17) The ________ is calculated by multiplying the coupon rate times the par value of the bond.A) present valueB) face valueC) coupon paymentD) maturity paymentAnswer: CAACSB: Analytical Thinking18) If a $1000 face value coupon bond has a coupon rate of 3.75 percent, then the coupon payment every year isA) $37.50.B) $3.75.C) $375.00.D) $13.75Answer: AAACSB: Analytical Thinking19) If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment every year isA) $650.B) $1,300.C) $130.D) $13.Answer: AAACSB: Analytical Thinking20) An $8,000 coupon bond with a $400 coupon payment every year has a coupon rate ofA) 5 percent.B) 8 percent.C) 10 percent.D) 40 percent.Answer: AAACSB: Analytical Thinking21) A $1000 face value coupon bond with a $60 coupon payment every year has a coupon rate ofA) .6 percent.B) 5 percent.C) 6 percent.D) 10 percent.Answer: CAACSB: Analytical Thinking22) All of the following are examples of coupon bonds EXCEPTA) corporate bonds.B) U.S. Treasury bills.C) U.S. Treasury notes.D) U.S. Treasury bonds.Answer: BAACSB: Analytical Thinking23) A bond that is bought at a price below its face value and the face value is repaid at a maturity date is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: DAACSB: Application of Knowledge24) A ________ is bought at a price below its face value, and the ________ value is repaid at the maturity date.A) coupon bond; discountB) discount bond; discountC) coupon bond; faceD) discount bond; faceAnswer: DAACSB: Analytical Thinking25) A discount bondA) pays the bondholder a fixed amount every period and the face value at maturity.B) pays the bondholder the face value at maturity.C) pays all interest and the face value at maturity.D) pays the face value at maturity plus any capital gain.Answer: BAACSB: Reflective Thinking26) Examples of discount bonds includeA) U.S. Treasury bills.B) corporate bonds.C) U.S. Treasury notes.D) municipal bonds.Answer: AAACSB: Analytical Thinking27) Which of the following are TRUE for discount bonds?A) A discount bond is bought at par.B) The purchaser receives the face value of the bond at the maturity date.C) U.S. Treasury bonds and notes are examples of discount bonds.D) The purchaser receives the par value at maturity plus any capital gains.Answer: BAACSB: Reflective Thinking28) The interest rate that equates the present value of payments received from a debt instrument with its value today is theA) simple interest rate.B) current yield.C) yield to maturity.D) real interest rate.Answer: CAACSB: Application of Knowledge29) Economists consider the ________ to be the most accurate measure of interest rates.A) simple interest rate.B) current yield.C) yield to maturity.D) real interest rate.Answer: CAACSB: Reflective Thinking30) For simple loans, the simple interest rate is ________ the yield to maturity.A) greater thanB) less thanC) equal toD) not comparable toAnswer: CAACSB: Application of Knowledge31) If the amount payable in two years is $2420 for a simple loan at 10 percent interest, the loan amount isA) $1000.B) $1210.C) $2000.D) $2200.Answer: CAACSB: Analytical Thinking32) For a 3-year simple loan of $10,000 at 10 percent, the amount to be repaid isA) $10,030.B) $10,300.C) $13,000.D) $13,310.Answer: DAACSB: Analytical Thinking33) If $22,050 is the amount payable in two years for a $20,000 simple loan made today, the interest rate isA) 5 percent.B) 10 percent.C) 22 percent.D) 25 percent.Answer: AAACSB: Analytical Thinking34) If a security pays $110 next year and $121 the year after that, what is its yield to maturity if it sells for $200?A) 9 percentB) 10 percentC) 11 percentD) 12 percentAnswer: BAACSB: Analytical Thinking35) The present value of a fixed-payment loan is calculated as the ________ of the present value of all cash flow payments.A) sumB) differenceC) multipleD) logAnswer: AAACSB: Analytical Thinking36) Which of the following are TRUE for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are positively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) The yield is less than the coupon rate when the bond price is below the par value. Answer: AAACSB: Reflective Thinking37) The ________ of a coupon bond and the yield to maturity are inversely related.A) priceB) par valueC) maturity dateD) termAnswer: AAACSB: Reflective Thinking38) The price of a coupon bond and the yield to maturity are ________ related; that is, as the yield to maturity ________, the price of the bond ________.A) positively; rises; risesB) negatively; falls; fallsC) positively; rises; fallsD) negatively; rises; fallsAnswer: DAACSB: Reflective Thinking39) The yield to maturity is ________ than the ________ rate when the bond price is ________ its face value.A) greater; coupon; aboveB) greater; coupon; belowC) greater; perpetuity; aboveD) less; perpetuity; belowAnswer: BAACSB: Reflective Thinking40) The ________ is below the coupon rate when the bond price is ________ its par value.A) yield to maturity; aboveB) yield to maturity; belowC) discount rate; aboveD) discount rate; belowAnswer: AAACSB: Reflective Thinking41) A $10,000 8 percent coupon bond that sells for $10,000 has a yield to maturity ofA) 8 percent.B) 10 percent.C) 12 percent.D) 14 percent.Answer: AAACSB: Analytical Thinking42) Which of the following $1,000 face-value securities has the highest yield to maturity?A) a 5 percent coupon bond selling for $1,000B) a 10 percent coupon bond selling for $1,000C) a 12 percent coupon bond selling for $1,000D) a 12 percent coupon bond selling for $1,100Answer: CAACSB: Analytical Thinking43) Which of the following $5,000 face-value securities has the highest yield to maturity?A) a 6 percent coupon bond selling for $5,000B) a 6 percent coupon bond selling for $5,500C) a 10 percent coupon bond selling for $5,000D) a 12 percent coupon bond selling for $4,500Answer: DAACSB: Analytical Thinking44) Which of the following $1,000 face-value securities has the highest yield to maturity?A) a 5 percent coupon bond with a price of $600B) a 5 percent coupon bond with a price of $800C) a 5 percent coupon bond with a price of $1,000D) a 5 percent coupon bond with a price of $1,200Answer: AAACSB: Analytical Thinking45) Which of the following $1,000 face-value securities has the lowest yield to maturity?A) a 5 percent coupon bond selling for $1,000B) a 10 percent coupon bond selling for $1,000C) a 15 percent coupon bond selling for $1,000D) a 15 percent coupon bond selling for $900Answer: AAACSB: Analytical Thinking46) Which of the following bonds would you prefer to be buying?A) a $10,000 face-value security with a 10 percent coupon selling for $9,000B) a $10,000 face-value security with a 7 percent coupon selling for $10,000C) a $10,000 face-value security with a 9 percent coupon selling for $10,000D) a $10,000 face-value security with a 10 percent coupon selling for $10,000 Answer: AAACSB: Analytical Thinking47) A coupon bond that has no maturity date and no repayment of principal is called a。

投资学第10版课后习题答案Chap004