中级金融学 (1)

经济师中级金融专业知识与实务计算公式汇总教学内容

经济师中级金融计算公式汇总第二章利率与金融资产定价1、单利本息和公式:FV n=P(1+rn)复利本息和(求终值、现值)公式:FV n=P(1+r/m)nm2、预期理论:长期债券的利率等于在有效期内人们所预期的短期利率的均值。

流动性溢价理论:长期债券的利率等于在有效期内人们所预期的短期利率的均值+流动性溢价3、名义收益率r=C/F F:面值实际收益率=名义收益率—通货膨胀率本期收益率r=C/P P:本期市场价格一年期持有期收益率:r=(买卖差价+利息)/买入价格零息债券的到期收益率付息债券的到期收益率债券定价到期一次还本付息:债券价格的定价=债券票面价值/(1+r)n债券定价分期付息到期还本:净价=全价-应计利息股票定价股票价格=预期股息收入/市场利率股票价格=市盈率×每股税后盈利4、预期收益率=无风险收益率+贝塔系数*(投资组合收益率-无风险收益率)投资组合收益率(贝塔系数)是各组合证券预期收益率(贝塔系数)的加权平均数第四章商业银行经营与管理核心一级资本充足率=(核心一级资本—对应资本扣减项)/风险加权资产:≥5% 一级资本充足率=(一级资本—对应资本扣减项)/风险加权资产:≥6% 资本充足率=(总资本—对应资本扣减项)/风险加权资产:≥8%第五章投资银行与证券投资基金市盈率=股票市场价格/每股收益市净率=股票市场价格/每股净资产净值增长率=(期末份额净值-期初份额净值+每份期间分红)/期初份额净值×100%; β=(基金净值增长率/股票指数增长率)×100%持股集中度=(前十大重仓股投资市值/基金股票投资总市值)×100%久期=债券贴现现金流的加权平均到期时间利率变动对债券基金净值的影响=久期×利率变化第七章金融工程与金融风险无红利股票的远期价格有现金收益资产的远期价格有红利率资产的远期价格 远期利率协议交割额=(协议利率一参考利率)×名义本金×协议期限/[1+协议利率×协议期限]基差=待保值资产的现货价格一用于保值的期货价格金融期货套期保值比率 =期货的份数×(一份期货合约规模/待保值资产的数量) 股指期货合约数=β值×(股票组合价值/单份股指期货合约价值)利率期货合约数=[需进行套期保值资产的价格×需进行套期保值资产的久期]/[利率期货的价格×期货合约标的债券的久期]()()t T r e I S F --=()t T q r Se F --=)(第八章货币供求及其均衡基础货币B=C+Rr+Rt+Re我国的货币层次划分:M0=流通中现金M1=M0+单位活期存款(狭义货币供应量)M2=M1+个人储蓄存款+单位定期存款+其他存款(广义货币供应量)M3=M2+商业票据+大额可转让定期存单派生存款△D= △B×1/(r+e+c)货币供给量Ms等于基础货币(MB)与货币乘数(m)之积货币乘数第九章中央银行与金融监管一、风险迁徙类指标:1、正常类贷款迁徙率为正常贷款中变为不良贷款的金额与正常类贷款之比,不得高于0.5%;2、关注类贷款迁徙率为关注贷款中变为不良贷款的金额与关注类贷款之比,不得高于1.5%;3、次级类贷款迁徙率为次级贷款中变为可疑类贷款和损失贷款的金额与次级类贷款之比,不得高于3%;4、可疑类贷款迁徙率为可疑类贷款中变为损失类贷款的金额与可疑类贷款之比,不得高于40%。

金融英语中级会计学汇总真题一 (1)

金融英语中级会计学汇总真题一(总分:120.50,做题时间:120分钟)一、SECTION ONE (Compulsory) Answer all six questions in this section. Each question carries 10 marks. (总题数:7,分数:10.50)1.A “Carriage Outwards” account normally has a debit balance.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:2.“Long Term Investment” is an item of shareholders’ fund.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:3.“Cash basis accounting” means that accounts only record items which have realizable values in cash.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:4.A “Purchases” acco unt records only items which were bought for resale.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:5.“Share Premium” is a capital profit.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:6.A “quick ratio” tests the liquidity of a business.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:7.A variable cost is a cost which changes according to market conditions.(分数:1.50)__________________________________________________________________________________________正确答案:()解析:二、Question 2 (Total: 10 marks) Read the following statements and choose the correct answers by writing the alphabetical letter on the answer sheets.(总题数:10,分数:10.00)8.A “relevant cost” is(分数:1.00)A.a cost which has been paidB.a future cost which is associated with the decision at hand.C.a future cost which must be incurred if a firm is to continue in business.D.a fixed cost in a project解析:9.Provision for doubtful debts is(分数:1.00)A.an account recording all debts which are doubtful in collection.B.a current liability.C.a current asset.D.a reduction in the value of an asset.解析:10.A cash flow statement(分数:1.00)A.shows the amounts of money in cash, or near cash form, received and paid out by a firm from trading during a period.B.shows the amounts of money in cash, or near cash form, received and paid out by a firm from all activities during a period.C.shows the change in financial positions of a firm during a period.D.shows a firm’s cash transactions during a period.解析:11.A sole trader’s capital at a particular dat e equals(分数:1.00)A.the amount of cash he has in the business.B.his net assets at cost in the business.C.all his assets in the business at realizable values.D.all his assets at book values in the business less all liabilities of the business.解析:12.A balance sheet shows(分数:1.00)A.all assets of a firm at market values and all its liabilities at a particular date.B.all known assets and all known liabilities and capital of a firm at a particular date.C.estimated values of all assets, capital and liabilities of a firm at a particular date.D.all assets, all liabilities and proprietors’ fund at book values of a firm at a particular date.解析:13.A “liquid asset” means(分数:1.00)A.an asset in cash or readily convertible to cash.B.an asset which has not a physical form.C.an investment which is realizable at any time.D.a current asset other than trading stock解析:14. A machine bought for resale is(分数:1.00)A.a capital expenditureB.a trading stock itemC.a fixed assetD.a production cost15.A “break-even” sales volume means(分数:1.00)A.a sale volume which will produce no profit or lossB.a minimum sales volume which will produce the target profit.C.a sales volume which is very close to budget.D.a sales volume which is below the break-even point.解析:16.A pidend paid by a company is(分数:1.00)A.an appropriation of profits.B.a capital expenditure.C.a revenue expenditure.D.a return on capital解析:17.Capital profits mean(分数:1.00)A.profits derived from the use of capitalB.profits derived from the use of fixed assets.C.returns on capital.D.profits from disposal of fixed assets.解析:三、Question 3 (Total: 10 marks)(总题数:1,分数:10.00)18.$000 Stocks at 1 Jan 01: Raw materials 20 Work in progress 10 Finished goods 25 Wages paid to production workers 60 Raw materials bought in year 150 Factory administration expenses 12 Depreciation of production machinery 15 Further information: Closing stocks at 31 Dec 01: Raw materials 18 Work in progress 3 Finished goods 30 Required: Prepare a manufacturing account in good form for the business.(分数:10.00)__________________________________________________________________________________________ 正确答案:()解析:四、Question 4 (Total: 10 marks)(总题数:1,分数:10.00)The following are the account balances of a limited company as at 31 December 2001: $,000 $,000 Ordinary share capital 600 10% Preferential share capital 400 share premium on Ordinary shares 300 Retained profits 500 Debentures (due 30 June 2002 ) 1,300 Plant and machinery 1,700 Provision for depreciation of plant and machinery 600 Dividends declared: Preferential 40 Ordinary 10 Trade creditors 700 Trade debtors 1,200 Provision for doubtful debts 80 Office expenses due but unpaid 20 Investments income receivable 30 Investments in associated companies 920 Trading stock 700 _____ 4,500 4,500 Net profit for the year, after deducting profits tax $30,000 and interest payments $23,000, was $220,000. Required: Calculate the following accounting ratios for the company: (分数:10.00)(1).Current ratio (2 marks) (分数:2.50)__________________________________________________________________________________________ 正确答案:()解析:(2).Quick ratio (2 marks) (分数:2.50)__________________________________________________________________________________________ 正确答案:()(3).Return on investment (or assets) (3 marks) (分数:2.50)__________________________________________________________________________________________正确答案:()解析:(4).Return on equity (3 marks)(分数:2.50)__________________________________________________________________________________________正确答案:()解析:五、Question 5 (Total: 10 marks)(总题数:1,分数:10.00)X and Y were trading in partnership sharing profits and losses in the ratio of 1:1. They agreed to accept Z as a new partner. The new profit and loss sharing ratio among X, Y and Z would be 2:2:1. The capital account balances of X and Y were $100,000 (Cr) respectively. Z was to contribute $50,000 cash as his capital and also contribute $200,000 cash to the business as consideration for his share of the goodwill of the partnership. (分数:10.00)(1).Prepare a statement showing the sharing of the goodwill between the old partners and among the new partners. (5 marks)(分数:5.00)__________________________________________________________________________________________正确答案:()解析:(2).Make journal entries for Z’s contributions assuming that no goodwill account is to be raised.(5 marks)(分数:5.00)__________________________________________________________________________________________正确答案:()解析:六、Question 6 (Total: 10 marks)(总题数:1,分数:10.00)On 1 May 2002 the cash book of a business showed a bank balance of $7,712 (Dr) but the bank statement of the same date showed a credit balance of $10,912. After checking the records, the following information was found: 1. Cheque received in the amount of $1,000 has been recorded in the cash book but has not been banked. 2. Cheque in the sum $4,360 has been drawn and sent out but it has not been presented to the bank for payment. 3. A cheque for $960 was banked but was subsequently returned by the bank marked “Insufficient fund”. No entry has been made for this in the cash book. 4. Interest $200 has been charged by the bank but no entry has been made in the cash book.5. A cheque for $3,700 from a customer has been incorrectly entered in the cash book as $2,700. It was correctly recorded by the bank. Required: (分数:10.00)(1).Make adjusting entries in the cash book to show the correct balance. (分数:5.00)__________________________________________________________________________________________正确答案:()解析:(2).Prepare a bank reconciliation statement from the correct cash book balance to the balance in the bank statement. (分数:5.00)__________________________________________________________________________________________正确答案:()解析:七、SECTION TWO Answer any two questions in this section.(总题数:3,分数:60.00) Question 7 (Total: 20 marks) The book of Delta Ltd as at 31 December 2001 showed the following balances: $ Ordinary share capital ($1 per share) 3,000,000 8% Preferential Share capital ($1 per share) 300,000 Retained earnings at 1 Jan 2001 62,000 Plant and machinery at cost 6,000,000Provision for depreciation of plant and machinery 2,400,000 Sales 8,000,000 Purchases 4,500,000 Discounts received from suppliers 200,000 Trading stock at 1 Jan 2001 500,000 Trade debtors 600,000 Bad debts written off 40,000 Provision for doubtful debts at 1 Jan 2001 30,000 Trade creditors 200,000 Auditors’ fees 90,000 Salaries and wages 700,000 Rents and rates 1,200,000 General expenses 500,000 Interim Preferential dividend paid 12,000 Cash 50,000 Additional informations (分数:20.00)(1).Trading stock at 31 December 2001 was $700,000 (分数:4.00)__________________________________________________________________________________________ 正确答案:()解析:(2).A dividend of 2 cents per share on the Ordinary Shares and a final dividend of 4% on the Preferential Shares had been declared but had not been accounted for. (分数:4.00)__________________________________________________________________________________________ 正确答案:()解析:(3).20% depreciation using the straight line method should be provided for the plant and machinery. (分数:4.00)__________________________________________________________________________________________ 正确答案:()解析:(4).Provision for doubtful debts at 3% of the trade debtors should be made. (分数:4.00)__________________________________________________________________________________________ 正确答案:()解析:(5).Corporate tax rate at 16% should be provided for in the accounts. Required: Prepare a Trading and Profit and Loss Account for the company for the year ended 31 December 2001 and a Balance Sheet of the company as at that date. (分数:4.00)__________________________________________________________________________________________ 正确答案:()解析:19.Question 8 (Total: 20 marks) Mr Lee is a sole trader. He does not know accounting and he only keeps records of cash receipts and payments. The following is a statement of a receipts and payments of his business for the year ended 31.12 .01: $ $ Cash in hand 1.1.01 50,400 Payments for goods 1,131,000 Sales receipts 1,569,000 Transport expenses 87,000 Cash put in by Mr Lee 26,000 Rents and rates 38,100 Loan from Mr Wong 200,000 Wages paid to office assistants 60,000 Drawings by Mr Lee 120,000 Purchase of equipment 400,000 ________ Balance at 31.12.01 9,300 1,845,400 1,845,400 Further information: (a) The loan from Mr Wong was received on 1.1.01 . Interest payable is 10% p.a. (b) The equipment was purchased on 1.1.01. Estimated life is 5 years with no residue value. Depreciation should be provided for it on the straight line mrthod. (c) The assets and liabilities of Mr Lee were as follows: 1.1.01 31.12.01 $ $ Stock in trade at cost 150,000 240,000 Trade debtors 138,000 200,000 Trade creditors 100,000 120,000 Equipment at cost __ 400,000 Cash balance 50,400 9,300 Required:Prepare a Trading and Profit and Loss Account for Mr Lee for the year ended 31.1.01 and a Balance Sheet as at that date. (分数:20.00)__________________________________________________________________________________________ 正确答案:()解析:20.Question 9 (Total: 20 marks) X and Y are in partnership sharing profits and losses in the ratio 3:2. They agree to draw interest on their capital at 8% p.a.; an annual salary to Y of $50,000;and interest on drawings at 10% p.a.; and to allow interest on loans from partners at p.a. The capitals of the partners are to be kept intact. The financial information of the partnership as at 31 january 2001 disclosed the following: $ $ Capital : X 1,000,000 Y 600,000 1600,000 Current Accounts : X 52,600 Cr Y 10,420 Cr 63,020 Loan from X 300,000 Net capital employed 1,963,020 The partners took drawings on 1 July 01: X $60,000; Y $ 30,000 Net trading profit for the year ended 31 December 2001 before interest and salaries to partners was $ 250,000. Required:Prepare an Appropriation Account or Statement and the partners’ Current Accounts for the year.(分数:20.00)__________________________________________________________________________________________ 正确答案:()解析:。

中级经济师核心知识点总结

中级经济师核心知识点总结一、宏观经济学1.经济增长与循环-经济增长:经济总量的增加,包括生产能力的提高、劳动力增加、资本积累等因素。

-经济循环:经济波动的周期性,包括景气期、衰退期、复苏期和繁荣期。

2.通货膨胀与货币政策-通货膨胀:市场物价总体上持续上涨。

-货币政策:央行通过调控货币供给和利率来控制通货膨胀。

3.国民收入与经济发展-国民收入:一个国家居民在一定时间内所得到的全部收入。

-经济发展:国民收入不断增长,经济结构逐渐优化,人民生活水平提高。

二、金融学1.金融市场与金融产品-金融市场:为买卖金融资产和债券等提供场所和平台的市场。

-金融产品:包括股票、债券、期货、银行存款等金融资产。

2.银行与金融机构-银行:负责储蓄、存款、贷款和支付等金融业务的机构。

-金融机构:包括证券公司、保险公司、基金公司等提供金融服务的机构。

3.金融风险与风险管理-金融风险:指金融市场上存在的可能导致损失的不确定性。

-风险管理:通过风险评估和控制来规避金融风险。

三、国际贸易与汇率1.国际贸易与国际收支-国际贸易:不同国家之间进行的商品和服务的买卖。

-国际收支:一个国家与其他国家之间的贸易和金融交易。

2.汇率与外汇市场-汇率:一国货币与另一国货币之间的兑换比率。

-外汇市场:进行货币兑换和外汇买卖的市场。

3.贸易保护与贸易自由化-贸易保护:为保护本国产业而采取的贸易限制措施,如关税、配额等。

-贸易自由化:取消或减少贸易限制,促进贸易自由化的政策。

四、投资与资本市场1.投资方式与投资组合-投资方式:包括股票、债券、房地产、基金等不同的投资方式。

-投资组合:根据个人或机构的风险偏好和收益目标,将不同投资方式进行组合。

2.股票市场与债券市场-股票市场:交易股票的市场,可通过股票投资来获取公司的股权。

-债券市场:交易债券的市场,债券是公司或政府借款的工具。

3.证券投资基金与衍生品市场-证券投资基金:由专业机构管理的资金,用于购买各种证券以分散风险。

初定中级职称专业对照表

0707一级学科:海洋科学

70701物理海洋学 70702海洋化学 70703海洋生物学 70704海洋地质 中学一级教师,小学高级教师(从事数学、物理、化学、 科学、通用技术、信息技术、劳动技术、综合实践等课程 教学,从事职高相关专业课程教学),助理实验师,助理 研究员(自然科学研究、教育管理研究)(从事相关专业 研究工作),工程师(从事相关专业工程技术工作),讲师 (高校教师、中专教师、技工学校教师)(从事相关专业 课程教学),馆员(文物博物)(自然科学类博物馆相关 专业研究工作)

70301无机化学 70302分析化学 70303有机化学 70304物理化学(含:化学物理) 70305高分子化学与物理 中学一级教师,小学高级教师(从事数学、物理、化学、 科学、通用技术、信息技术、劳动技术、综合实践等课程 教学,从事职高相关专业课程教学),助理实验师,助理 研究员(自然科学研究、教育管理研究)(从事相关专业 研究工作),工程师(从事相关专业工程技术工作),讲师 (高校教师、中专教师、技工学校教师)(从事相关专业 课程教学),馆员(文物博物)(自然科学类博物馆相关 专业研究工作)

专业技术资格名称 经济师 经济师 经济师 中学一级教师、小学高级教师(从事品德与生活、品德与 社会、思想品德、思想政治等课程教学),思政讲师

中学一级教师、小学高级教师(从事品德与生活、品德与 社会、思想品德、思想政治等课程教学),思政讲师

中学一级教师、小学高级教师(从事品德与生活、品德与 社会、思想品德、思想政治等课程教学),思政讲师

01学科门类:哲学

0101一级学科:哲学 10101马克思主义哲学 10102中国哲学 10103外国哲学 10104逻辑学 10105伦理学 10106美学 10107宗教学 10108科学技术哲学 02学科门类:经济学 0201一级学科:理论经济学 20101政治经济学 20102经济思想史 20103经济史 20104西方经济学 20105世界经济 20106人口、资源与环境经济学 0202一级学科:应用经济学 20201国民经济学 20202区域经济学 20203财政学(含∶税收学) 20204金融学(含∶保险学) 20205产业经济学 20206国际贸易学 20207劳动经济学 20208统计学 20209数量经济学 20210国防经济 03学科门类:法学 0301一级学科:法学 30101法学理论 30102法律史 30103宪法学与行政法学 30104刑法学 经济师,中学一级教师(从事职高相关专业课程教学), 助理研究员(社会科学研究、教育管理研究)(从事相关 专业研究工作),讲师(高校教师、中专教师、技工学校 教师)(从事相关专业课程教学)

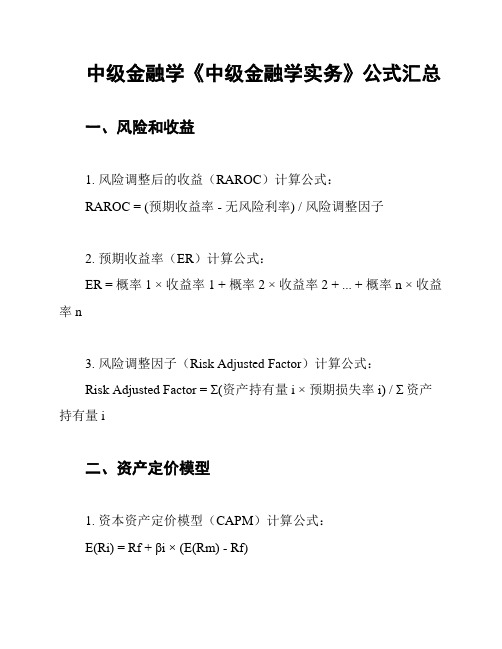

中级金融学《中级金融学实务》公式汇总

中级金融学《中级金融学实务》公式汇总一、风险和收益1. 风险调整后的收益(RAROC)计算公式:RAROC = (预期收益率 - 无风险利率) / 风险调整因子2. 预期收益率(ER)计算公式:ER = 概率1 ×收益率1 + 概率2 ×收益率2 + ... + 概率n ×收益率n3. 风险调整因子(Risk Adjusted Factor)计算公式:Risk Adjusted Factor = Σ(资产持有量i ×预期损失率i) / Σ资产持有量i二、资产定价模型1. 资本资产定价模型(CAPM)计算公式:E(Ri) = Rf + βi × (E(Rm) - Rf)- E(Ri):资产i的预期收益率- Rf:无风险利率- βi:资产i的贝塔系数- E(Rm):市场预期收益率2. 资本成本(Cost of Equity)计算公式:Cost of Equity = Rf + β × (E(Rm) - Rf)- Rf:无风险利率- β:股票的贝塔系数- E(Rm):市场预期收益率3. 资本结构理论中的无风险资产资本成本(Cost of Debt)计算公式:Cost of Debt = (1 - Tc) × Rd- Tc:公司税率- Rd:债务的利率三、股票估值1. 股票的市盈率(P/E Ratio)计算公式:P/E Ratio = Price per Share / Earnings per Share- Price per Share:每股股价- Earnings per Share:每股收益2. 股票的市净率(P/B Ratio)计算公式:P/B Ratio = Price per Share / Book Value per Share- Price per Share:每股股价- Book Value per Share:每股净资产3. 股票的现金流量倍数(P/CF Ratio)计算公式:P/CF Ratio = Price per Share / Cash Flow per Share- Price per Share:每股股价- Cash Flow per Share:每股现金流以上是《中级金融学实务》中的一些重要公式的汇总。

中级经济专业技术资格金融的考试内容

中级经济专业技术资格金融的考试内容

中级经济专业技术资格金融考试的内容通常涵盖以下几个方面:

1. 金融市场与金融机构:包括金融市场的分类、金融市场的功能和特点、金融机构的分类、金融机构的业务和运作等。

2. 金融产品与金融服务:包括各类金融产品的特点、风险和收益分析、理财产品的认识与分析、金融服务的内容和企业的选择等。

3. 金融风险管理:包括金融风险的分类和特点、金融风险管理的基本原则和方法、金融风险管理的工具和技术、金融风险管理的实务操作等。

4. 金融法律与法规:包括金融法律的基本原则和规范、金融法律的实施和执行、金融法律的适用和调整等。

5. 金融市场的监管与改革:包括金融市场的监管机构与监管规则、金融市场的监控与调控、金融市场的改革与发展等。

6. 国际金融与国际支付:包括国际金融市场与国际金融体系、国际支付的方式与特点、国际支付的风险管理等。

考试内容还可能涉及具体的案例分析和实际问题解决。

考生需具备扎实的金融学基础知识,熟悉各类金融产品和金融市场的运作机制,了解金融风险管理和法律法规等相关知识。

中级经济师《金融专业》学习计划

第六章

一、信托概述

理解信托的性质、功能、起源与发展、设立及管理、市场及其体系,进行信托公司的经营与管理。

★★★★

二、信托公司的经营与管理

三、租赁概述

理解租赁的性质、种类、特点、功能、产生与发展,进行租金管理,开展融资租赁,进行金融租赁公司的经营与管理。

章

节

知识点

重要

程度

第一章

一、金融市场与金融工具概述

理解金融市场与金融工具的性质与类型。

★★★★

二、货币市场及其工具

理解货币市场及其工具。

三、资本市场及其工具

理解资本市场及其工具。

四、金融衍生品市场及其工具

理解金融衍生品市场及其工具,分析我国的各类金融市场及其工具。

五、互联网金融

理解互联网金融的特点和模式,分析我国的互联网金融。

★★★

二、货币政策体系

三、金融监管概述

理解金融监管的基本原则和主要理论,分析我国金融监管的发展演进,分析我国金融监管的框架和内容。

四、金融监管的框架和内容

第十章

一、汇率

理解汇率及其决定的基础与因素、变动的影响,理解汇率制度的类型和划分,分析我国人民币汇率制度的改革。

★★★

二、国际收支及其调节

理解国际收支平衡表,理解国际收支不均衡及其调节,提出我国国际收支不均衡及其调节措施。

三、国际储备及其管理

理解国际储备及其管理,分析我国国际储备及其管理措施。

四、国际货币体系

理解国际货币体系。

五、离岸金融市场

理解离岸金融市场及其业务,进行外汇管理与外债管理,提出我国外汇管理与外债管理改革措施。

六、外汇管理与外债管理

中级经济师金融专业考试内容

中级经济师金融专业考试内容

中级经济师金融专业考试的内容主要包括以下几个方面:

1. 金融市场:包括金融市场的组织和功能、金融市场的基本交易术语和方法、金融市场的监管和监督机构等。

2. 金融机构:包括商业银行、证券公司、保险公司、信托公司等各类金融机构的业务和管理。

3. 金融产品:包括金融产品的分类和特点、金融产品的设计与创新、金融产品的销售和风险管理等。

4. 货币银行学:包括货币发行与供求、货币政策、银行运营管理、贷款与信用创造、支付结算等。

5. 投资学:包括投资决策的基本理论和方法、证券投资分析和组合、风险管理等。

6. 金融法律法规:包括金融机构法律法规、金融产品法律法规、金融市场法律法规等。

7. 金融风险管理:包括信用风险、市场风险、操作风险等各类金融风险的识别、评估和控制方法。

8. 金融市场分析与预测:包括金融市场的基本面分析、技术分析、行为金融学等方法。

考试形式一般为笔试,包括选择题、填空题、计算题、案例分析题等。

考试内容涵盖宏观经济、微观经济、金融学等相关领域的知识。

专业知识和实务(金融)中级

专业知识和实务(金融)中级金融是一个涵盖广泛领域的专业知识,从个人理财到公司投资,再到全球金融市场,无处不在。

作为金融领域的中级从业者,需要具备一定的专业知识和实务经验,以应对复杂多变的金融环境。

本文将就金融中级人士应具备的核心能力和实务技能进行探讨。

金融中级从业者需要具备扎实的金融知识基础。

这包括对金融市场、金融产品、金融工具等方面的理解和掌握。

同时,还需要了解金融监管政策、风险管理、投资组合管理等相关知识。

只有建立在坚实的理论基础之上,才能更好地应对各种复杂的金融情况。

金融中级从业者需要具备较强的数据分析能力。

金融领域的决策往往需要依据大量的数据和信息,进行深入分析和研究。

因此,熟练运用数据分析工具,如Excel、Python等,进行数据处理和建模是必不可少的技能。

只有通过对数据的深入挖掘,才能做出更为准确和有效的决策。

金融中级从业者需要具备较强的沟通能力和团队合作精神。

金融工作往往需要与各方面的人员进行沟通和协作,包括上级领导、同事、客户等。

因此,良好的沟通能力和团队合作精神是非常重要的。

只有通过有效的沟通和合作,才能更好地完成工作任务,并实现个人和团队的发展目标。

金融中级从业者需要具备较强的问题解决能力和应变能力。

金融市场的变化无常,随时可能会出现各种问题和挑战。

因此,金融中级人士需要具备快速反应和解决问题的能力,能够灵活应对各种突发情况。

只有具备了这些能力,才能在激烈的竞争中脱颖而出,取得更大的成功。

作为金融领域的中级从业者,需要具备扎实的金融知识基础、较强的数据分析能力、良好的沟通能力和团队合作精神,以及较强的问题解决能力和应变能力。

只有通过不断地学习和提升自己的能力,才能在金融领域取得更大的成就。

希望本文的探讨能够对金融中级人士的职业发展有所帮助,也希望更多的人能够在金融领域中获得成功。

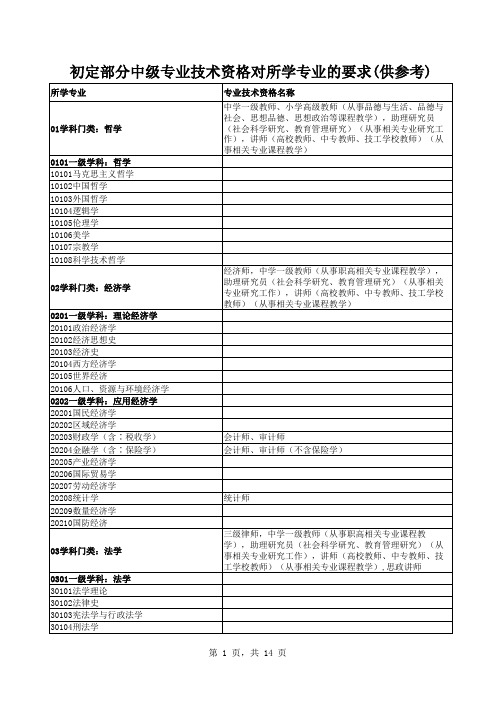

1金融经济学(第一章 金融经济学概论)

二、什么是金融经济学?

(一)国内外金融学发展差异 国外:主要包括公司财务和资本 市场两个部分,金融经济学则是 其微观经济学基础。

国内:以货币银行学和国际金融学为核心。 金融经济学的着眼点在企业和市场的微观层 面;而货币经济学讨论货币、金融与经济的 关系;国际金融学则主要研究国际资本流动 和汇率变化对经济的影响。

1984年 恢复了中国人民保险公司,建立了中国国际信托投资公司等非银行金融机构

1986年

1992年 1994年

恢复组建交通银行

证监会成立 成立了三家政策性银行 国务院调整中国证券监督委员会职能,成立了保险监督管理委员会,并在全 国设立若干排除机构,分别负责证券业和保险业的监管。中国人民银行撤消 了31个省自治区直辖市分行,建立了9个跨省区分行,在不设分行的省会城市 设立金融监管办事处 全国人大决定将银行的监管职能从中央银行中分离出来,成立一个独立运作 的监管机构——银监会,来履行银行监管职能。4月28日该机构成立

金融租赁公司

典当行

融资租赁。目前共有15家。

典当行,亦称当铺,是专门发放质押贷款的非正规边 缘性金融机构,是以货币借贷为主和商品销售为辅的 市场中介组织。

投资银行

投资基金

1995年:合资投资银行——中国国际金融公司

基金管理公司

中国银行业现状

截止2009年末,我国银行业金融机构包括政策性银行及 国家开发银行3家,大型商业银行5家,股份制商业银行 12家,城市商业银行143家,城市信用社11家,农村商 业银行43家,农村合作银行196家,农村信用社3,056家, 邮政储蓄银行1家,金融资产管理公司4家,外资法人金 融机构37家,信托公司58家,企业集团财务公司91家, 金融租赁公司12家,货币经纪公司3家,汽车金融公司 10家,村镇银行148家,贷款公司8家以及农村资金互助 社16家。 我国银行业金融机构共有法人机构3,857家,营业网点 19.3万个,从业人员284.5万人。

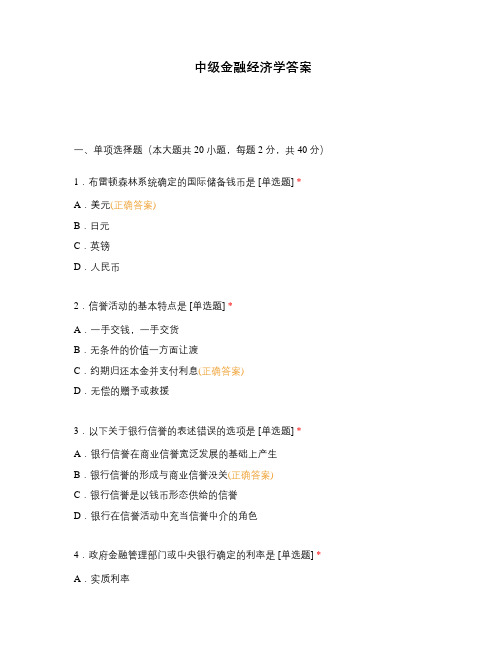

中级金融经济学答案

中级金融经济学答案一、单项选择题(本大题共20 小题,每题2 分,共 40 分)1.布雷顿森林系统确定的国际储备钱币是 [单选题] * A.美元(正确答案)B.日元C.英镑D.人民币2.信誉活动的基本特点是 [单选题] *A.一手交钱,一手交货B.无条件的价值一方面让渡C.约期归还本金并支付利息(正确答案)D.无偿的赠予或救援3.以下关于银行信誉的表述错误的选项是 [单选题] * A.银行信誉在商业信誉宽泛发展的基础上产生B.银行信誉的形成与商业信誉没关(正确答案)C.银行信誉是以钱币形态供给的信誉D.银行在信誉活动中充当信誉中介的角色4.政府金融管理部门或中央银行确定的利率是 [单选题] * A.实质利率B.官定利率(正确答案)C.行业利率D.市场利率5. 2005 年今后我国股权分置改革方案的核心是 [单选题] *A.对价支付(正确答案)B.增资扩股C.股权激励D.股权合并6.一张面额为1000元,3个月后到期的汇票,持票人到银行贴现,若该票据的年贴现率为4%,则持票人可得的贴现金额为 [单选题] *A. 1000 元B. 999 元C. 10 元D. 990 元(正确答案)7.以下不属于钱币市场的是 [单选题] *A.同业拆借市场B.票据市场C.股票市场(正确答案)D.国库券市场8.上海证券交易所推行的交易制度是 [单选题] *A.做市商交易制度B.报价驱动制度C.竞价交易制度(正确答案)D.协议交易制度9.投资者预期某种金融财富价格将要上涨时平时会买入 [单选题] * A.美式期权B.欧式期权C.看跌期权D.看涨期权(正确答案)10.债券的票面年收益与当期市场价格的比率为 [单选题] *A.现时收益率(正确答案)B.名义收益率C.拥有期收益率D.到期收益率11.以下关于金融期货合约表述错误的选项是 [单选题] *A.在交易所内进行交易(正确答案)B.流动性强C.采用盯市原则D.为非标准化合约12.金融互换合约产生的理论基础是 [单选题] *A.比较优势理论(正确答案)B.对价理论C.财富组合理论D.合理预期理论13.国际钱币基金组织最主要的资本本源是 [单选题] *A.国际金融市场借款B.成员国认缴的基金份额(正确答案)C.资本运用利息收入D.会员国捐款14.我国金融机构系统中居于主体地位的金融机构是 [单选题] *A.商业银行B.政策性银行(正确答案)C.证券企业D.保险企业15.由政府出资成立的特地收买和集中办理银行业不良财富的金融机构是 [单选题] *A.投资银行B.政策性银行C.金融财富管理企业(正确答案)D.财务企业16.汇兑结算属于商业银行的 [单选题] *A.负债业务B.财产业务D.衍生产品交易业务17.保险经营中最大诚信原则的内容主要包括 [单选题] * A.诚实与相信B.见告与保证(正确答案)C.诚实与保证D.见告与相信18.重申利率对钱币需求影响作用的经济学者是 [单选题] * A.费雪B.卡甘C.凯恩斯(正确答案)D.弗里德曼19.经常转移记入国际进出平衡表中的 [单选题] *A.经常账户(正确答案)B.资本账户C.金融账户D.储备财富20.当前我国钱币政策的中介指标是 [单选题] *A.利率B.汇率C.股票价格指数二、多项选择题(本大题共5 小题,每题4 分,共 20 分)在每题列出的五个备选项中最少有两个是吻合题目要求的,请将其代码填写在题后的括号内。

中级会计学:金融资产习题与答案

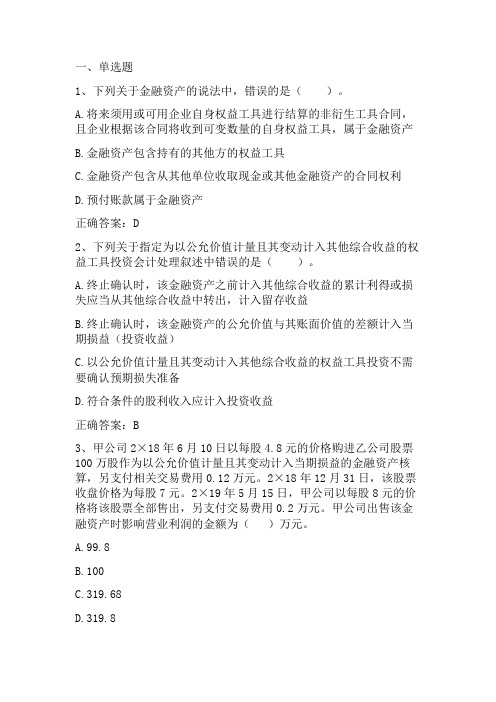

一、单选题1、下列关于金融资产的说法中,错误的是()。

A.将来须用或可用企业自身权益工具进行结算的非衍生工具合同,且企业根据该合同将收到可变数量的自身权益工具,属于金融资产B.金融资产包含持有的其他方的权益工具C.金融资产包含从其他单位收取现金或其他金融资产的合同权利D.预付账款属于金融资产正确答案:D2、下列关于指定为以公允价值计量且其变动计入其他综合收益的权益工具投资会计处理叙述中错误的是()。

A.终止确认时,该金融资产之前计入其他综合收益的累计利得或损失应当从其他综合收益中转出,计入留存收益B.终止确认时,该金融资产的公允价值与其账面价值的差额计入当期损益(投资收益)C.以公允价值计量且其变动计入其他综合收益的权益工具投资不需要确认预期损失准备D.符合条件的股利收入应计入投资收益正确答案:B3、甲公司2×18年6月10日以每股4.8元的价格购进乙公司股票100万股作为以公允价值计量且其变动计入当期损益的金融资产核算,另支付相关交易费用0.12万元。

2×18年12月31日,该股票收盘价格为每股7元。

2×19年5月15日,甲公司以每股8元的价格将该股票全部售出,另支付交易费用0.2万元。

甲公司出售该金融资产时影响营业利润的金额为()万元。

A.99.8B.100C.319.68D.319.8正确答案:A4、甲公司于2×18年1月1日以19 800万元购入当日发行的一项3年期到期还本、按年付息的公司债券,每年12月31日支付利息。

该公司债券票面年利率为5%,实际年利率为5.38%,面值总额为20 000万元,甲公司将其分类为以摊余成本计量的金融资产;2×18年12月31日,该债券投资的信用风险自初始确认后未显著增加,甲公司由此确认的预期信用损失准备为5万元。

假定不考虑其他因素,甲公司持有该债券投资2×19年应确认的投资收益为()万元。

A.1065.24B.1068.75C.1076D.1000正确答案:B5、企业持有的股票型基金应当分类下列哪一类()。

中级经济师金融知识点汇总

中级经济师金融知识点汇总一、宏观经济学基础知识1.GDP(国内生产总值)的计算方法及意义2.消费者物价指数(CPI)和生产者物价指数(PPI)的计算方法及影响因素3.货币供应量及其对经济的影响4.定义失业率并分析其影响5.经济增长的驱动力及其影响因素6.财政政策和货币政策的定义、目标和实施方法7.经济周期的特征及其对经济运行的影响8.通货膨胀、通缩和通胀风险的定义及其原因二、货币银行学知识点1.货币的定义、功能和性质2.货币的供求关系及调控手段3.存款扩张和货币乘数的概念和计算方法4.银行的角色、职能和经营模式5.存款准备金率和存款准备金制度的作用及调控6.商业银行与中央银行的关系与合作7.货币政策工具和货币政策传导机制8.货币政策执行工具的操作方法和效果三、证券投资学知识点1.金融市场和证券市场的概念和分类2.股票、债券和衍生品的定义、特点和交易方式3.证券市场的参与主体及其行为特点4.投资组合理论和资本市场线的理解及应用5.现代证券投资理论的主要观点和方法6.风险与收益的关系及风险管理的方法与工具7.股票评估的方法和指标8.债券估值模型和影响债券价格的因素四、金融机构学知识点1.银行的种类和业务范围2.银行的资产负债表和利润表3.非银行金融机构的分类和业务特点4.保险公司的业务模式和产品种类5.证券公司的业务范围和运作流程6.信托公司的定义、职能和运作方式7.基金管理公司的业务模式和产品分类8.国际金融机构的组织和功能五、金融市场知识点1.股票市场的分类和运作机制2.债券市场的分类和交易方式3.期货市场和期权市场的定义和交易特点4.外汇市场和黄金市场的概念、参与主体和交易方式5.金融衍生品市场的定义和分类6.OTC市场和交易所市场的区别和特点7.市场风险和流动性风险的定义和应对措施8.金融市场监管机构和监管措施及其作用这些是中级经济师金融知识点的一些汇总,包括宏观经济学、货币银行学、证券投资学、金融机构学和金融市场等方面的知识。

2023年中级经济师 金融专业三色笔记

2023年中级经济师金融专业三色笔记2023年中级经济师金融专业三色笔记【引子】1. 从过去的笔记经验来看,良好的笔记对于统考中级经济师金融专业的学习至关重要。

在2023年的考试中,为了更好地备考,我结合自己的学习经验和前辈的建议,总结出了一种高效的笔记方法——三色笔记。

这种方法不仅可以帮助我理清知识脉络和重点理论,还能够通过颜色分类使笔记更加直观易懂。

现在,我将与大家分享这种笔记方法和我的学习心得。

【主体】2. 为什么选择三色笔记?- 分类明确:使用三种不同颜色的笔(如红、蓝、绿)可以将不同类型的知识清晰地区分开来,例如定义、关键词、实例等。

- 突出重点:通过使用不同颜色的笔在重点知识上做标记,可以方便我在复习时更快地找到重要素材。

- 养成良好的学习习惯:通过彩色笔记的方式,我可以更加主动地去思考和总结笔记,加深对知识的理解和记忆。

3. 如何使用三色笔记?- 红笔:用于标记定义、公式、定理等重要概念。

红色的鲜艳和醒目可以吸引我的注意力,使这些重要内容一目了然。

- 蓝笔:用于写关键词、解析步骤、观点等。

蓝色比较柔和,让我能够更好地理解和串联不同知识点之间的关系。

- 绿笔:用于写实例、案例、拓展内容等。

绿色给人一种温和和积极的感觉,适用于陈述例子和其他扩展资料。

4. 三色笔记的例子:- 对于一个名词定义,我可以用红笔将其突出标记,并用蓝笔记录关键词和解释步骤,用绿笔给出实例辅助理解。

- 如果是一道计算题,我可以用红笔标记公式,用蓝笔记录计算步骤,用绿笔写出一些类似的实例以及相关的拓展内容。

【个人观点和理解】5. 我个人认为,三色笔记不仅对2023年中级经济师金融专业的考试备考有很大帮助,而且在学习其他知识领域时也同样适用。

通过使用不同颜色的笔记录笔记,我们可以更好地整理和理解知识,加深记忆和理解。

通过这种分类和归纳的方法,我们可以更好地掌握知识的重点和难点,提高学习效率。

【总结】6. 2023年中级经济师金融专业的备考对我们来说是一个重要的挑战。

山东理工大学经济学院金融学《中级宏观经济学》期末试题及答案一

P34 4,54.CPI和PCE平减指数的相似和不同之处是什么?答:(1)相似之处:①都只包括消费者购买的产品和服务的价格,而将属于投资和政府购买的产品和服务的价格排除在外;②都包括了进口品的价格。

(2)不同之处:PCE平减指数允许产品篮子随着消费者支出的构成变动而变动,而CPI给不同产品的价格分配固定的权重,即CPI是用固定的一篮子产品来计算的。

5.列出劳工统计局用来把经济中每个人归入的三种类型。

劳工统计局如何计算失业率?答:美国劳工统计局调查人口时,把所有成年人归入三种类型中的一种:就业者、失业者或非劳动力者。

失业率是失业者在劳动力总数中所占的比例,即失业率=失业人数/劳动力总数×100%。

P61 问题应用1,81.用新古典分配理论预期下列每个事件对际工资和资本实际租赁价格的影响:a.移民潮增加了劳动力。

b.地震摧毁了部分资本存量。

c.技术进步改善了生产函数。

d.高通货膨胀令经济中所有要素和产出的价格翻倍。

答:a.根据新古典分配理论,实际工资等于劳动边际产量。

移民潮增加了劳动力供给,由于劳动的边际报酬递减,劳动力的增加,引起劳动边际产量下降,使得实际工资降低。

b.地震摧毁了部分资本存量(并奇迹般地没有出现人员伤亡,劳动力数量不变),资本的边际产出上升。

根据新古典分配理论,实际租赁价格等于资本边产出。

因此,实际租赁价格将上升。

c.实际工资和资本的实际租赁价格都将上升。

因为,技术进步意味着同样多的劳动和资本将生产更多的产品,即单位劳动和单位资本的回报将上升。

而据新古典分配理论,实际工资应等于劳动的边际回报率,实际资本租赁价格应等于资本的边际回报率。

因此,它们都将上升。

d.当名义工资W、名义资本租赁价格R和价P都变为原来的两倍时,根据实际工资和资本实际租赁价格的计算公式,可知此时实际工资和资本实租赁价格都保持不变。

8.政府增加税收1000亿美元,如果边际消费倾向是0.6,以下各项会发生什么变化?它们会增加还是减少?增加或减少的数量是多少?a.公共储蓄b.私人储蓄c.国民储蓄d.投资答:政府增税对公共储蓄、私人储蓄以及国储蓄的影响可以用下面的关系式来分析:国民储蓄=私人储蓄+公共储蓄=[Y-T-C(Y-T)]+[T-G]=Y-C(Y-T)-G。

中级经济师金融做题技巧

中级经济师金融做题技巧

作为中级经济师金融考试的学习者,你可以采取以下一些技巧来提高做题效率和准确性:

1. 熟悉考试大纲:了解考试大纲中的知识点和权重,重点关注高频和重点考点,有针对性地进行复习。

2. 做好基础知识点的准备:掌握经济学和金融学的基本概念、原理和模型,建立起全面的基础知识体系。

3. 注重理解和应用:通过阅读题目,理解题目的要求和背景,将理论知识运用到具体情景中,分析问题并找出合理的解决方案。

4. 练习真题和模拟考试:通过做大量的真题和模拟考试,熟悉考试形式和题型,提高解题速度和把握题目的能力。

5. 学会归纳总结:复习过程中,将常见的考点、知识点进行归纳总结,制作笔记或思维导图,方便回顾和巩固。

6. 纠错和提升:对每次做题的错误和不足进行反思和总结,找出自己的薄弱点并针对性地进行强化练习,避免犯同样的错误。

7. 时间管理:掌握做题的时间节奏,根据不同的题目难度和知识点分配合理的时间,避免在某一道题目上花费过多时间而无法完成其他题目。

8. 注意审题和答题技巧:仔细审题,理清问题的逻辑和关键点,避免冗余和多余的答案,注意格式和表达的准确性。

9. 多维度复习:通过多种学习方式进行复习,包括阅读教材、参加培训班、听讲座等,综合提高对知识点的理解和应用能力。

10.保持积极心态:考试备考是一个持续的过程,要保持积极

的学习态度和心态,不断提高自信和应对压力的能力。

金融学基础与实务(中级)四简答题

金融学基础与实务(中级)四简答题问题一请简要解释金融市场的功能和作用。

金融市场是各种金融资产买卖的场所或渠道,主要有证券市场、货币市场和债券市场等。

金融市场的主要功能和作用包括:- 提供资金募集渠道:企业和政府可以通过发行证券等方式从金融市场上筹集资金。

- 提供投资渠道:投资者可以通过金融市场购买不同类型的金融资产,实现资金增值和风险分散。

- 价格发现和资源配置:金融市场上的交易活动和价格波动反映了供求关系和市场预期,对资源的配置起到引导作用。

- 提供风险管理工具:金融市场上的衍生品合约等产品可以帮助投资者管理风险,降低市场波动对其投资组合的影响。

- 促进经济发展:金融市场的健康发展有助于促进经济增长和资本流动,提高资源配置效率。

总之,金融市场在资金流通、资源配置、风险管理等方面发挥着重要的功能和作用。

问题二请简要介绍金融风险的种类。

金融风险是指金融活动中可能导致损失或不确定性的因素。

下面是几种常见的金融风险:1. 市场风险:由于市场价格波动或不确定性,导致投资资产价值下跌的风险。

2. 信用风险:由于借款人或债务人无法按时兑付本金和利息,导致损失的风险。

3. 利率风险:由于利率波动导致债券价格变动、利息收入变动的风险。

4. 流动性风险:由于资产无法迅速变现或市场交易不活跃,导致难以满足资金需求的风险。

5. 操作风险:由于内部失误、欺诈行为或技术故障等导致损失的风险。

6. 法律风险:由于合同纠纷、法律规定或司法决定等行为导致损失的风险。

以上是一些常见的金融风险,金融从业者需要认识和管理这些风险,以保护自身和客户利益。

问题三请简要概述金融市场的监管机构职责。

金融市场的监管机构负责监管金融机构和金融市场,维护市场秩序和保护投资者利益。

其主要职责包括:1. 制定和执行相关法律法规:监管机构制定并监督实施金融领域的法律法规,确保市场公平、透明,并维护金融稳定。

2. 监督和监管金融机构:监管机构负责监督和监管银行、证券公司、保险公司等金融机构的业务运行和风险管理,确保其合规经营。

中级货币时间价值公式全部汇总

中级货币时间价值公式全部汇总中级货币时间价值公式是金融学中非常重要的概念,它指的是货币在不同的时间点上所具有的不同价值。

这些公式能够帮助我们理解和计算货币的时间价值,从而更好地进行投资和财务决策。

以下是对中级货币时间价值公式的全部汇总:一、现值(Present Value)和终值(Future Value)1. 现值(PV)是指现在的货币价值,而终值(FV)则是指未来的货币价值。

2. 终值公式:FV = PV ×(1 + r)^n其中,r 是年利率,n 是时间期限。

该公式表示在一定利率下,一定数量的货币在未来的价值。

3. 现值公式:PV = FV / (1 + r)^n该公式表示在一定利率下,未来一定数量的货币在现在的价值。

二、年金的现值和终值1. 年金(Annuity)是指在一定时间间隔内等额收付的一系列款项。

2. 年金现值公式:PV_an = A / r ×[1 - (1 + r)^(-n)] / r其中,A 是年金金额,r 是年利率,n 是时间期限。

该公式表示在一定利率下,一定期限内等额收付的年金在现在的价值。

3. 年金终值公式:FV_an = A / r ×[(1 + r)^n - 1] / r该公式表示在一定利率下,一定期限内等额收付的年金在未来的价值。

三、永续年金的现值永续年金是指无限期等额收付的年金。

其现值公式为:PV_perpetuity = A / r其中,A 是年金金额,r 是年利率。

该公式表示在一定利率下,无限期等额收付的年金在现在的价值。

四、折现率(Discount Rate)的计算折现率是指将未来现金流折算为现值的利率。

常用的折现率计算方法有:无风险利率加风险溢价法、到期收益率法和市盈率法等。

具体计算方法因情况而异,需要根据具体情况进行评估和计算。

五、货币时间价值的特殊情况1. 零息债券:指发行时没有利息支付的债券,其价格等于未来现金流量的折现值。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions

1.2- Desynchronization: The Risk Dimension

Diversify, insure, hedge: to achieve smooth consumption across states of nature

Intermediate Financial Theory

˙ = EFF · I − ΩK K or, multiplying and dividing I with each of the newly defined variables

(1)

˙ = EFF · (I /BOR ) · (BOR /FS ) · (FS /S ) · (S /Y ) · Y − ΩK (2) K

*Hong Kong, Singapore, Real GDP growth (% increase) Taiwan, S. Korea, Indonesia, Total savings (% GDP) Malaysia, Thailand

Intermediate Financial Theory

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions

Intermediate Financial Theory

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions

Main Message

Worth stepping back and asking yourselves: Does finance make sense on social grounds? What functions does financial markets/instruments really fulfill?

Intermediate Financial Theory

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions

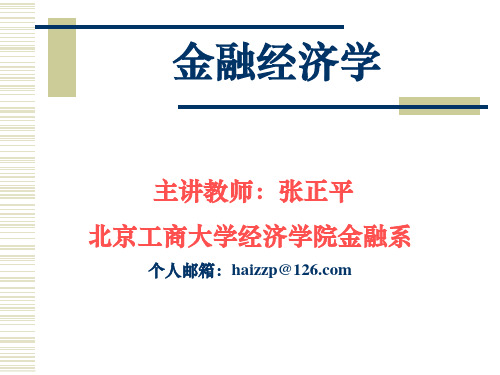

1.4- The Financial System and Economic Growth

Fig. 1.2 Savings and Growth in 90 Developing Countries

0.35 0.30 0.25 0.20 0.15 0.10 0.05 0 High-growth countries Middle-growth countries Low-growth countries *East Asia 0.07 0.04 0.02 0.08 0.20 0.18 0.27 0.29

1.3- The Screening and Monitoring Functions of the Financial System

Finance: a lot more: incentive issues raised by asymmetric information Ch. 15 Corporate Finance: see chapter 2

Intermediate Financial Theory

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension General Equilibrium 1.3- The Screening and Monitoring Functions of the Financial System Time and Risk Dimensions 1.4- The Financial System and Economic Growth Complete Markets 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions

1.5- Financial Intermediation and the Business Cycle

Financial Accelerator: the effect of monetary policy changes on economic activity goes beyond the direct effect of changes in r on the profitability of investment project - r : changes the value of collateralizable assets, thus the access to credit to small (credit-constrained) firms in particular

1.1 Finance: The Time Dimension

Borrow and save: to achieve consumption stream smoother than income stream

Intermediate Financial Theory

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conancial Theory

Chapter I. On the Role of Financial Markets and Institutions

June 26, 2006

Intermediate Financial Theory

Introduction 1.1- Finance: The Time Dimension 1.2- Desynchronization: The Risk Dimension 1.3- The Screening and Monitoring Functions of the Financial System 1.4- The Financial System and Economic Growth 1.5- Financial Intermediation and the Business Cycle 1.6- Financial Markets and Social Welfare 1.7 Conclusions