国际投资学教程 綦建红 第3版 课后题答案(完整精排版)

国际投资学教程课后题答案(完整版) (2)(word文档良心出品)

第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的一阴历为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够沈村冰持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资这这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化 2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

资本流动的原因在于前者的资本价格低于后者。

国际投资第三章课后习题答案

Chapter 3Foreign Exchange Determination andForecasting1. Applying expansionary macroeconomic policy, which results in higher goods prices and lower realinterest rates, will not reduce the balance of payments deficit. Higher prices will make the country’s goods less competitive internationally, and lower interest rates will discourage foreign capital. Thus, the balance of payments deficit will worsen instead of improve. On the other hand, (a), (b), and (d) will help in remedying the balance of payments deficit. Accordingly, the answer is (c).2. a. One advantage of a wider band is “emotional.” France could claim that it did not devalue itscurrency. Another advantage is flexibility. If there were no long-term fundamental reasons(inflation, balance of payments deficit, etc.) for a devaluation, the temporary pressure on thefranc could ease and the franc could later revert to its previous level. The disadvantage of a wider band is exchange rate uncertainty for all firms. A “credible” small band is preferable for firmsconducting international trade,b. A wider band makes speculation less attractive, because there is no guarantee that a central bankwill defend its currency until the wide fluctuation margin is reached.3. a. The American investor has paid a 25 percent premium over the price paid by a domestic investor.Yet, he receives the same dividends as the domestic investor. Therefore, his investment bears asmaller yield than it would for a domestic investor.b. Lifting of the exchange controls would be bad news to an existing foreign investor in Paf, sinceher asset could only be repatriated at the normal pif rate (1.00), while she had bought it at thefinancial rate (1.25).c. Lifting of the exchange controls would be good news to foreign investors planning to invest inPaf in the future, because they would no longer have to pay the 25 percent premium when buying assets in Paf.4. Remember that the Eurozone is made up of those countries in the EU that have adopted the euro ascommon currency. Statements I and III are clearly correct. Statement II is clearly not correct, because there is a possibility that more countries may join the Eurozone in future. For example, the British are debating whether to join the Eurozone.5. The statement is true. Because of riskless arbitrage, interest rate parity between two currencies wouldhold if the markets for both are free and deregulated. Developed financial markets tend to be more free and deregulated. A developing country is more likely to impose various forms of capital controls and taxes that impede arbitrage. A developing country is economically not as well integrated with the world financial markets as the developed markets are. Also, some smaller currencies can only be borrowed and lent domestically, and the domestic money markets of developing countries are more likely to be subjected to political risk.Chapter 3 Foreign Exchange Determination and Forecasting 156. a. Using the first-order approximation of PPP relationship, the variation in rupee to dollar exchangerate should equal the inflation differential between rupee and dollar. So, the rupee to dollarexchange rate should increase by 6 − 2.5 = 3.5%. That is, the rupee should depreciate by 3.5%relative to the dollar.b. The nominal dollar return for the U.S. institutional investor is approximately 12 − 5 = 7%. Thereal return for the U.S. investor is approximately 7 − 2.5 = 4.5%. The real return for the Indianinvestor is approximately 12 − 6 = 6%. Thus, the U.S. investor has a lower real return than theIndian investor. This is so because the rupee depreciated with respect to the dollar by more thanwhat the PPP relationship would indicate. Indeed, the difference between the real returns is6 − 4.5 = 1.5%, which is the same as the difference between the actual depreciation of the rupeeand the depreciation that should have occurred as per PPP (5 − 3.5 = 1.5%).7. If a country’s currency is undervalued, it means that the real prices of assets in this country are lowcompared with other countries. Also, the wages are lower in real terms than in other countries. Thus, investors from other countries would invest in this country to take advantage of low prices andwages. This action would help in the appreciation of the undervalued currency and restoration of the PPP in the long run. In terms of foreign trade, an undervalued currency implies that exports from this country would get a boost while imports would become less attractive. This would also help in the appreciation of the undervalued currency and restoration of the PPP in the long run.8. In risk-neutral efficient foreign exchange markets, the forward rate is the expected value of the futurespot rate. The forward rate can be computed using the interest rate parity relation. Because the exchange rate is given in $:SFr terms, the appropriate expression for the interest rate parity relation isSFr $11r F Sr +=+ (that is, r SFr is a part of the numerator and r $ is a part of the denominator). Accordingly, the three-month forward rate is10.00951.4723 1.460010.0180F +==+ thus, the implied market prediction for the three-month ahead exchange rate is SFr1.4600 per $.9. As per the model, one € would be worth $0.9781 six months later. Based on the forward rate, one €would be worth $0.9976 six months later. Therefore, the market participants, who believe that the model is quite good, would buy the dollar in the forward market (sell euros). Consequently, the price of the euro forward would decrease (the dollar forward would increase) and the forward rate would become equal to $0.9781 per €. The spot exchange rate and the dollar and euro interest rates would change so as to be consistent with this forward rate. A look at the interest rate parity relationship— written in the form€$11r F S r+=+ as F and S are in €:$ terms—suggests that with the decrease in forward rate from $0.9976 per € to$0.9781 per €, the spot rate and interest rate in dollars are likely to go down and interest rate in euros is likely to go up.16 Solnik/McLeavey • Global Investments, Sixth Edition10. a. The forward rate can be computed using the interest rate parity relation. Because the exchange rate is given in £:$ terms, the appropriate expression for the interest rate parity relation is$£11r F S r +=+ (that is, r $ is a part of the numerator, and r £ is a part of the denominator). Accordingly, the one-year forward rate is1.02001.5620$1.5283 per £1.0425F .== b. Based on the forward rate, one pound would be worth $1.5283 one year later. The model predictsthat one pound would be worth $1.5315 one year later. Thus, as per the model, the pound isunderpriced in the forward market. Accordingly, Dustin Green would buy pounds forward at$1.5283/£.c. If everyone were to buy pounds forward, the price of pounds forward would increase and becomeequal to $1.5315 per £. The spot exchange rate and the dollar and pound interest rates wouldchange so as to be consistent with this forward rate. A look at the interest rate parity relationship suggests that the spot rate and the interest rate in dollars are likely to go up and the interest rate in pounds is likely to go down, to be consistent with the increase in the forward rate.11. a. If the market participants are risk-neutral, the expected future spot exchange rate would be thesame as the current forward rate. The forward rate is determined based on the current spotexchange rate and the interest rate differential between the two currencies. Thus, the expectedfuture spot exchange rate would depend on the current spot exchange rate and the interest ratedifferential.b. If the market participants are risk-averse, the forward rate would differ from the expected futurespot exchange rate by the risk premium. The risk premium, based on the extent of risk aversionof the market participants, could be positive or negative. So, the expected future spot exchangerate is the forward rate less the risk premium. Since the forward rate is based on the current spot exchange rate and the interest rate differential between the two currencies, the expected futurespot exchange rate would depend on the current spot exchange rate, the interest rate differential, and the risk premium.12. There is some evidence of positive serial correlation in exchange rate movements (real and nominal).Hence, when a currency is going up, a reasonable forecast is that it will continue going up. Similarly, when a currency is going down, a reasonable forecast is that it will continue going down. However, at some point in time, the trend would reverse, and the problem is that a trend-based forecasting model cannot forecast when this turning point would occur. Although these turning points may be infrequent, they can be the occasion of a huge swing. The Mexican peso is a good example. For a few years until the end of 1994, the real value of the peso appreciated steadily. So, forecasters using trendmodels for the real exchange rates were quite successful for many months. However, in December 1994, the peso suddenly crashed and lost around half of its value.13. Statements (a), (c), and (d) are true. Statement (b) is not true, because the objective of central bankactivity in the foreign exchange market is not to profit from trading activities, but to implementmonetary policy and exchange rate targets.Chapter 3 Foreign Exchange Determination and Forecasting 17 14. A mean-reverting time series is one that may diverge from its fundamental value in the short run butreverts to its fundamental value in the long run. Empirical evidence suggests that exchange rates are mean reverting. The real exchange rates (observed exchange rate minus inflation) do deviate from the fundamental value implied by PPP in the short run, but tend to revert to the fundamental value in the long run.15. Most econometric models are unsuitable for short-term exchange rate forecasts, as they model long-term structural economic relationships. For long-term exchange rate forecasts, the use of econometric models has some problems. First, most of them rely on predictions for certain key variables, such as money supply and interest rates. It is not easy to forecast these variables. Second, the structuralcorrelation estimated by the parameters of the equation can change over time, so that even if allcausative variables are correctly forecasted, the model can still yield poor exchange rate predictions.In periods when structural changes are rapid compared with the amount of time-series data required to estimate parameters, econometric models are of little help.16. Technical analysis is more likely to be used for short-term exchange rate movements, while theeconometric approach is more likely to be used for long-term exchange rate movements. The manager of a currency hedge fund and currency traders change their foreign exchange positions quite quickly, and are interested in short-term changes in exchange rates. On the other hand, the manager of an international stock portfolio is unlikely to change his foreign exchange positions quickly, because the transaction costs of buying and selling stocks are quite high. Therefore, the manager of aninternational stock portfolio is more interested in the long-term movements in exchange rates.Similarly, the long-term strategic planner of a corporation is interested in the long-term movements.Accordingly, the answers are:a. Technical analysisb. Econometric approachc. Technical analysisd. Econometric approach17. a. The absolute values of prediction errors are as follows: Forward rate: 1.440 − 1.308 = 0.132;Analyst A: 1.410 − 1.308 = 0.102; and Analyst B: 1.580 − 1.308 = 0.272. Thus, the forecast byAnalyst A was the most accurate.b. The forward rate and Analyst B erroneously predicted that the SFr to $ exchange rate would goup from the then-spot rate of SFr 1.420 per $; that is, the SFr would depreciate. Only Analyst Acorrectly predicted that the Swiss franc would appreciate.18. a. The absolute values of forecast errors are as follows: Forward rate: 148.148 − 144.697 = 3.451;Commerzbank: 148.148 − 142 = 6.148; and Harris Bank: 156 − 148.148 = 7.852. Thus, theforecast as per the forward rate was the most accurate, followed by Commerzbank, and then byHarris Bank.b. Although the forward rate and Commerzbank were more accurate than Harris Bank, both of themerroneously predicted that the yen would appreciate relative to the dollar. Only Harris Bankcorrectly predicted that the yen would depreciate.18 Solnik/McLeavey • Global Investments, Sixth Editionc. Commerzbank’s forecast was ¥142 per $, which was less than the forward rate. Therefore, DavidBrock bought yen forward (sold dollars) at the rate of ¥144.697 per $. Because the actual rateturned out to be ¥148.148 per $, buying yen forward did not turn out to be the right strategy. On the other hand, Harris Bank’s forecast was ¥156 per $, which was more than the forward rate.Therefore, Brian Lee sold yen forward (bought dollars) at the rate of ¥144.697 per $. Because the actual rate turned out to be ¥148.148 per $, selling yen forward turned out to be the right strategy. d. Commerzbank’s forecast had a lower forecast error than Harris Bank’s in Part (a). However, inPart (c), it was right to buy and sell based on Harris Bank’s forecast and not Commerzbank’s.The reason is that Harris Bank’s forecast turned out to be on the right side of the forward rate,while Commerzbank’s did not.19. Let the forecasts made by the Industrial Bank of Japan at the beginning of period t for the beginningof period t + 1 be E (S t + 1|φt ). Let the forward rates quoted at the beginning of period t for thebeginning of period t + 1 be F t , and the actual spot rates at the beginning of periods t and t + 1 be S t and S t +1, respectively. The percentage forecast errors (∈and e ) for each forecast made by the Industrial Bank of Japan and the forward rate are computed as εt +1 = [S t +1 − E (S t +1|φt )]/S t and e t +1 = [S t +1 − F t ]/S t , respectively. The following table details the computations.Pd. S t F t E (S t +1|φt ) S t +1 εt +1e t +1 ε2t +1 e 2t +1 1 143.164 142.511 140 144.3000.03000.01250.0009 0.0002 2 144.300 143.968 141 152.7500.08140.06090.0066 0.0037 3 152.750 153.600 151 149.400−0.0105−0.02750.0001 0.0008 4 149.400 149.400 143 129.600−0.0897−0.13250.0080 0.0176 5 129.600 129.700 130 129.500−0.0039−0.00150.0000 0.0000 6 129.500 129.800 131 139.2500.06370.07300.0041 0.0053 MSE0.0033 0.0046RMSE 0.0573 0.0678 The RMSE for the Industrial Bank of Japan is lower than that for the forward rate. Thus, as per thelimited data set in this problem, the Industrial Bank outperformed the forward rate in terms ofaccuracy of the forecasts, as measured by the RMSE. We have not tested whether the difference in forecast performances is statistically significant.。

投资学第三版课后练习题含答案

投资学第三版课后练习题含答案一、选择题1.以下哪项不属于投资组合构建的步骤?A. 目标收益率的选择B. 资产的选择C. 根据资产的收益率确定资产权重D. 确定资产市场价值答案:D2.一个资产组合的收益率为3%,标准差为5%,均值为4.5%。

则根据夏普指数计算,该资产组合的风险溢价为多少?A. 0.9B. 0.3C. 0.6D. 0.4答案:C3.以下哪项不属于投资组合风险管理的方法?A. 分散化投资B. 建立资产组合C. 选择高风险资产D. 进行资产选择答案:C二、填空题1.投资的合理选择应该以投资者的______、______、______等因素为依据。

答案:财务状况、风险承受能力、投资目标2.夏普指数是评价投资组合风险调整后收益的一种指标,指标的数学表达式为______。

答案:(组合预期收益率 - 无风险利率) / 组合标准差3.整体风险分为两种,即______风险和特定风险。

答案:系统性三、计算题1.对于两种不同的资产,假设它们的回报率分别为10%和20%,其权重分别为40%和60%,则这个组合的预期回报率是多少?答案:16%解析:预期回报率 = 10% * 0.4 + 20% * 0.6 = 16%2.一个资产组合的预期收益率为10%,标准差为5%,无风险利率为3%,则根据夏普指数计算,该资产组合的夏普指数是多少?答案:1.4解析:夏普指数 = (10% - 3%) / 5% = 1.43.假设两个不同资产的预期回报率分别为8%和20%,标准差分别为10%和15%,则通过组合这两个资产,可以得到下面的资产组合:资产 A 的权重为60%,资产 B 的权重为40%。

计算这个组合的预期回报率和标准差。

答案:预期回报率为14.4%,标准差为10.5%解析:预期回报率 = 8% * 0.6 + 20% * 0.4 = 14.4%标准差= √(10%^2 * 0.6^2 + 15%^2 0.4^2 + 2 0.6 * 0.4 * 10% * 15%) = 10.5%。

(3-4)国际投资学教程(第二版)綦建红

2013-6-15

非股权参与 (国际合作经 营企业)

以合同为基础的契约式合营, 14 不按股权分配收益

一、国际合资经营企业

(一) 概念 :

国际合资经营企业,又称股份式 合营企业(Equity Joint Venture),是指由两个或两个以上国

家或地区的投资者在东道国境内,经 东道国批准,并按照该国或地区的有 关法律以股权结合方式建立起来的企 业。国际合资经营企业由投资者共同 经营、共同管理、共担风险、共负盈 亏。

国对坦桑尼亚的援外项目, 交钥匙工程——友谊纺织 厂改为中坦合资企业,中 方控制51%(中方出技术、 设备,坦方出原材料棉花、 劳动力)。

16

2013-6-15

(二)国际合资经营企业的特征 (二)国际合资经营企业的特征

1.共同投资:按照一定比例提供资本

资产,二者投资在总投资所占比例直接 关系着对生产经营的控制程度;

2013-6-15

13

第二节

全部股权参与 (独资企业 )

国际三资企业

全部拥有(母公司拥有子公 司股权为95%以上)

股权参 与及非 股权参 与:国 际三资 企业

多数拥有(母公司拥有子公司股

权为51—94% )

部分股权参与 (合资企业)

对等拥有(母公司拥有子公司股权 为50%

少数拥有(母公司拥有子公 司股权为49%—10 % )

举例:“拉玛斯”为何拉不动了——对中美合资老河口 拉玛斯玻璃纤维有限公司破产的调查

2013-6-15 23

二、国际独资经营企业

国际独资经营企业(Sole Proprietorship ),国际独资经营 企业是指外国投资者按照东道国法 律,经东道国批准,在东道国境内 设立的全部资本为外国投资者所拥 有的企业。这是国际直接投资最典 型、最传统的形式。

国际经济学第三版课后练习题含答案

国际经济学第三版课后练习题含答案Chapter 1: IntroductionExercises1.1a.What is international economics?b.Define globalization.c.What is the difference between international trade andinternational finance?d.Expln why international trade and international finance arerelated.1.2a.Expln the difference between positive and normativestatements.b.Provide an example of each type of statement as it relatesto international economics.1.3a.Discuss the economic arguments for and agnst free trade.b.Discuss the political arguments for and agnst free trade.1.4a.Expln the theory of comparative advantage.b.Provide an example of comparative advantage.1.5a.Discuss the gns and losses from trade.b.Provide an example of the gns from trade.Answers1.1a.International economics is the study of how countriesinteract economically with each other and the consequences ofthose interactions.b.Globalization is the integration of economies and societiesacross the world through the exchange of goods, services, capital and people.c.International trade is the exchange of goods and servicesbetween countries. International finance refers to the movement of financial capital across borders, including foreign directinvestment, portfolio investment and international borrowing and lending.d.International trade and finance are related because tradenecessarily involves exchange of currencies, which in turn affects the demand and supply of currencies in international markets.1.2a.Positive statements are factual statements that can betested and verified or rejected based on evidence. Normativestatements are statements that express judgments or opinions about what ought to be.b.An example of a positive statement in international economics is。

国际投资学教程 綦建红 第3版 课后题答案(完整精排版)

国际投资学教程綦建红第3版课后题答案(完整精排版)第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的以盈利为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够生存并持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资在这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化 2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

国际投资学教程课后练习答案

第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的一阴历为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够沈村冰持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资这这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

资本流动的原因在于前者的资本价格低于后者。

投资项目评价第三版课后答案

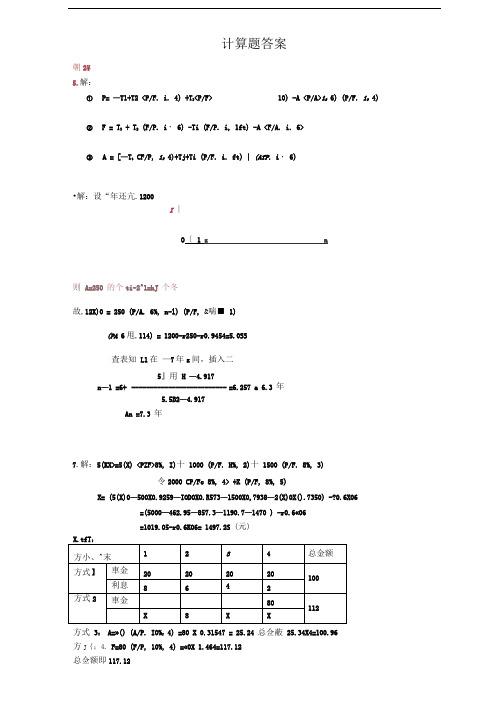

计算题答案朝2¥5.解:①P= —T1+T2 <P/F. i. 4) +T3<P/F> 10) -A <P/A>i9 6) (P/F. i9 4)② F = T3 + T2 (F/P. i・ 6) -Ti (F/P. i, 1ft) -A <F/A. i. 6>③ A = [—T t CF/P, i9 4)+Tj+Ti (P/F. i. ft) | (AfP. i・ 6)•解:设“年还亢.1200I丨O〔 1 z n则A=250 的个ti-2^1=hJ 个冬故,12X)0 = 250 (P/A. 6%, n-l) (P/F, &喘■ 1)(PA 6甩,114) = 1200-r250-r0.9454=5.0SS査表知L1在—7年z间,插入二5』用H —4.917n—1 =6+ -------------------------- =6.257 a 6.3 年5.5B2—4.917An =7.3 年7.解:5(KX>=5(X) <PZF>8%, I)十1000 (P/F. H%, 2)十1500 (P/F. 8%, 3)令2000 CP/Fe 8%, 4> +X (P/F, 8%, 5)X= (5(X)0—500X0.9259—IODOXO.R573—1500X0,7938—2(X)0X().7350) -?0.6X06=(5000—462.95—857.3—1190.7—1470 ) -r0.6«06=1019.05-r0.6K06= 1497.2S (元)方式3:A=»() (A/P. IO%7 4) =80 X 0.31547 = 25.24 总佥蔽25.34X4=100.96方J{;4. F=80 (F/P, 10%, 4) =«0X 1.464=117.12总佥额即117.12X 飒占比卜床題需耍求出i=£LO^ A=2f»美元。

国际投资第三章课后习题答案

Chapter 3Foreign Exchange Determination andForecasting1. Applying expansionary macroeconomic policy, which results in higher goods prices and lower realinterest rates, will not reduce the balance of payments deficit. Higher prices will make the country’s goods less competitive internationally, and lower interest rates will discourage foreign capital. Thus, the balance of payments deficit will worsen instead of improve. On the other hand, (a), (b), and (d) will help in remedying the balance of payments deficit. Accordingly, the answer is (c).2. a. One advantage of a wider band is “emotional.” France could claim that it did not devalue itscurrency. Another advantage is flexibility. If there were no long-term fundamental reasons(inflation, balance of payments deficit, etc.) for a devaluation, the temporary pressure on thefranc could ease and the franc could later revert to its previous level. The disadvantage of a wider band is exchange rate uncertainty for all firms. A “credible” small band is preferable for firmsconducting international trade,b. A wider band makes speculation less attractive, because there is no guarantee that a central bankwill defend its currency until the wide fluctuation margin is reached.3. a. The American investor has paid a 25 percent premium over the price paid by a domestic investor.Yet, he receives the same dividends as the domestic investor. Therefore, his investment bears asmaller yield than it would for a domestic investor.b. Lifting of the exchange controls would be bad news to an existing foreign investor in Paf, sinceher asset could only be repatriated at the normal pif rate (1.00), while she had bought it at thefinancial rate (1.25).c. Lifting of the exchange controls would be good news to foreign investors planning to invest inPaf in the future, because they would no longer have to pay the 25 percent premium when buying assets in Paf.4. Remember that the Eurozone is made up of those countries in the EU that have adopted the euro ascommon currency. Statements I and III are clearly correct. Statement II is clearly not correct, because there is a possibility that more countries may join the Eurozone in future. For example, the British are debating whether to join the Eurozone.5. The statement is true. Because of riskless arbitrage, interest rate parity between two currencies wouldhold if the markets for both are free and deregulated. Developed financial markets tend to be more free and deregulated. A developing country is more likely to impose various forms of capital controls and taxes that impede arbitrage. A developing country is economically not as well integrated with the world financial markets as the developed markets are. Also, some smaller currencies can only be borrowed and lent domestically, and the domestic money markets of developing countries are more likely to be subjected to political risk.Chapter 3 Foreign Exchange Determination and Forecasting 156. a. Using the first-order approximation of PPP relationship, the variation in rupee to dollar exchangerate should equal the inflation differential between rupee and dollar. So, the rupee to dollarexchange rate should increase by 6 − 2.5 = 3.5%. That is, the rupee should depreciate by 3.5%relative to the dollar.b. The nominal dollar return for the U.S. institutional investor is approximately 12 − 5 = 7%. Thereal return for the U.S. investor is approximately 7 − 2.5 = 4.5%. The real return for the Indianinvestor is approximately 12 − 6 = 6%. Thus, the U.S. investor has a lower real return than theIndian investor. This is so because the rupee depreciated with respect to the dollar by more thanwhat the PPP relationship would indicate. Indeed, the difference between the real returns is6 − 4.5 = 1.5%, which is the same as the difference between the actual depreciation of the rupeeand the depreciation that should have occurred as per PPP (5 − 3.5 = 1.5%).7. If a country’s currency is undervalued, it means that the real prices of assets in this country are lowcompared with other countries. Also, the wages are lower in real terms than in other countries. Thus, investors from other countries would invest in this country to take advantage of low prices andwages. This action would help in the appreciation of the undervalued currency and restoration of the PPP in the long run. In terms of foreign trade, an undervalued currency implies that exports from this country would get a boost while imports would become less attractive. This would also help in the appreciation of the undervalued currency and restoration of the PPP in the long run.8. In risk-neutral efficient foreign exchange markets, the forward rate is the expected value of the futurespot rate. The forward rate can be computed using the interest rate parity relation. Because the exchange rate is given in $:SFr terms, the appropriate expression for the interest rate parity relation isSFr $11r F Sr +=+ (that is, r SFr is a part of the numerator and r $ is a part of the denominator). Accordingly, the three-month forward rate is10.00951.4723 1.460010.0180F +==+ thus, the implied market prediction for the three-month ahead exchange rate is SFr1.4600 per $.9. As per the model, one € would be worth $0.9781 six months later. Based on the forward rate, one €would be worth $0.9976 six months later. Therefore, the market participants, who believe that the model is quite good, would buy the dollar in the forward market (sell euros). Consequently, the price of the euro forward would decrease (the dollar forward would increase) and the forward rate would become equal to $0.9781 per €. The spot exchange rate and the dollar and euro interest rates would change so as to be consistent with this forward rate. A look at the interest rate parity relationship— written in the form€$11r F S r+=+ as F and S are in €:$ terms—suggests that with the decrease in forward rate from $0.9976 per € to$0.9781 per €, the spot rate and interest rate in dollars are likely to go down and interest rate in euros is likely to go up.16 Solnik/McLeavey • Global Investments, Sixth Edition10. a. The forward rate can be computed using the interest rate parity relation. Because the exchange rate is given in £:$ terms, the appropriate expression for the interest rate parity relation is$£11r F S r +=+ (that is, r $ is a part of the numerator, and r £ is a part of the denominator). Accordingly, the one-year forward rate is1.02001.5620$1.5283 per £1.0425F .== b. Based on the forward rate, one pound would be worth $1.5283 one year later. The model predictsthat one pound would be worth $1.5315 one year later. Thus, as per the model, the pound isunderpriced in the forward market. Accordingly, Dustin Green would buy pounds forward at$1.5283/£.c. If everyone were to buy pounds forward, the price of pounds forward would increase and becomeequal to $1.5315 per £. The spot exchange rate and the dollar and pound interest rates wouldchange so as to be consistent with this forward rate. A look at the interest rate parity relationship suggests that the spot rate and the interest rate in dollars are likely to go up and the interest rate in pounds is likely to go down, to be consistent with the increase in the forward rate.11. a. If the market participants are risk-neutral, the expected future spot exchange rate would be thesame as the current forward rate. The forward rate is determined based on the current spotexchange rate and the interest rate differential between the two currencies. Thus, the expectedfuture spot exchange rate would depend on the current spot exchange rate and the interest ratedifferential.b. If the market participants are risk-averse, the forward rate would differ from the expected futurespot exchange rate by the risk premium. The risk premium, based on the extent of risk aversionof the market participants, could be positive or negative. So, the expected future spot exchangerate is the forward rate less the risk premium. Since the forward rate is based on the current spot exchange rate and the interest rate differential between the two currencies, the expected futurespot exchange rate would depend on the current spot exchange rate, the interest rate differential, and the risk premium.12. There is some evidence of positive serial correlation in exchange rate movements (real and nominal).Hence, when a currency is going up, a reasonable forecast is that it will continue going up. Similarly, when a currency is going down, a reasonable forecast is that it will continue going down. However, at some point in time, the trend would reverse, and the problem is that a trend-based forecasting model cannot forecast when this turning point would occur. Although these turning points may be infrequent, they can be the occasion of a huge swing. The Mexican peso is a good example. For a few years until the end of 1994, the real value of the peso appreciated steadily. So, forecasters using trendmodels for the real exchange rates were quite successful for many months. However, in December 1994, the peso suddenly crashed and lost around half of its value.13. Statements (a), (c), and (d) are true. Statement (b) is not true, because the objective of central bankactivity in the foreign exchange market is not to profit from trading activities, but to implementmonetary policy and exchange rate targets.Chapter 3 Foreign Exchange Determination and Forecasting 17 14. A mean-reverting time series is one that may diverge from its fundamental value in the short run butreverts to its fundamental value in the long run. Empirical evidence suggests that exchange rates are mean reverting. The real exchange rates (observed exchange rate minus inflation) do deviate from the fundamental value implied by PPP in the short run, but tend to revert to the fundamental value in the long run.15. Most econometric models are unsuitable for short-term exchange rate forecasts, as they model long-term structural economic relationships. For long-term exchange rate forecasts, the use of econometric models has some problems. First, most of them rely on predictions for certain key variables, such as money supply and interest rates. It is not easy to forecast these variables. Second, the structuralcorrelation estimated by the parameters of the equation can change over time, so that even if allcausative variables are correctly forecasted, the model can still yield poor exchange rate predictions.In periods when structural changes are rapid compared with the amount of time-series data required to estimate parameters, econometric models are of little help.16. Technical analysis is more likely to be used for short-term exchange rate movements, while theeconometric approach is more likely to be used for long-term exchange rate movements. The manager of a currency hedge fund and currency traders change their foreign exchange positions quite quickly, and are interested in short-term changes in exchange rates. On the other hand, the manager of an international stock portfolio is unlikely to change his foreign exchange positions quickly, because the transaction costs of buying and selling stocks are quite high. Therefore, the manager of aninternational stock portfolio is more interested in the long-term movements in exchange rates.Similarly, the long-term strategic planner of a corporation is interested in the long-term movements.Accordingly, the answers are:a. Technical analysisb. Econometric approachc. Technical analysisd. Econometric approach17. a. The absolute values of prediction errors are as follows: Forward rate: 1.440 − 1.308 = 0.132;Analyst A: 1.410 − 1.308 = 0.102; and Analyst B: 1.580 − 1.308 = 0.272. Thus, the forecast byAnalyst A was the most accurate.b. The forward rate and Analyst B erroneously predicted that the SFr to $ exchange rate would goup from the then-spot rate of SFr 1.420 per $; that is, the SFr would depreciate. Only Analyst Acorrectly predicted that the Swiss franc would appreciate.18. a. The absolute values of forecast errors are as follows: Forward rate: 148.148 − 144.697 = 3.451;Commerzbank: 148.148 − 142 = 6.148; and Harris Bank: 156 − 148.148 = 7.852. Thus, theforecast as per the forward rate was the most accurate, followed by Commerzbank, and then byHarris Bank.b. Although the forward rate and Commerzbank were more accurate than Harris Bank, both of themerroneously predicted that the yen would appreciate relative to the dollar. Only Harris Bankcorrectly predicted that the yen would depreciate.18 Solnik/McLeavey • Global Investments, Sixth Editionc. Commerzbank’s forecast was ¥142 per $, which was less than the forward rate. Therefore, DavidBrock bought yen forward (sold dollars) at the rate of ¥144.697 per $. Because the actual rateturned out to be ¥148.148 per $, buying yen forward did not turn out to be the right strategy. On the other hand, Harris Bank’s forecast was ¥156 per $, which was more than the forward rate.Therefore, Brian Lee sold yen forward (bought dollars) at the rate of ¥144.697 per $. Because the actual rate turned out to be ¥148.148 per $, selling yen forward turned out to be the right strategy. d. Commerzbank’s forecast had a lower forecast error than Harris Bank’s in Part (a). However, inPart (c), it was right to buy and sell based on Harris Bank’s forecast and not Commerzbank’s.The reason is that Harris Bank’s forecast turned out to be on the right side of the forward rate,while Commerzbank’s did not.19. Let the forecasts made by the Industrial Bank of Japan at the beginning of period t for the beginningof period t + 1 be E (S t + 1|φt ). Let the forward rates quoted at the beginning of period t for thebeginning of period t + 1 be F t , and the actual spot rates at the beginning of periods t and t + 1 be S t and S t +1, respectively. The percentage forecast errors (∈and e ) for each forecast made by the Industrial Bank of Japan and the forward rate are computed as εt +1 = [S t +1 − E (S t +1|φt )]/S t and e t +1 = [S t +1 − F t ]/S t , respectively. The following table details the computations.Pd. S t F t E (S t +1|φt ) S t +1 εt +1e t +1 ε2t +1 e 2t +1 1 143.164 142.511 140 144.3000.03000.01250.0009 0.0002 2 144.300 143.968 141 152.7500.08140.06090.0066 0.0037 3 152.750 153.600 151 149.400−0.0105−0.02750.0001 0.0008 4 149.400 149.400 143 129.600−0.0897−0.13250.0080 0.0176 5 129.600 129.700 130 129.500−0.0039−0.00150.0000 0.0000 6 129.500 129.800 131 139.2500.06370.07300.0041 0.0053 MSE0.0033 0.0046RMSE 0.0573 0.0678 The RMSE for the Industrial Bank of Japan is lower than that for the forward rate. Thus, as per thelimited data set in this problem, the Industrial Bank outperformed the forward rate in terms ofaccuracy of the forecasts, as measured by the RMSE. We have not tested whether the difference in forecast performances is statistically significant.。

国际投资学教程第3版纂建红编期末复习资料名词解释

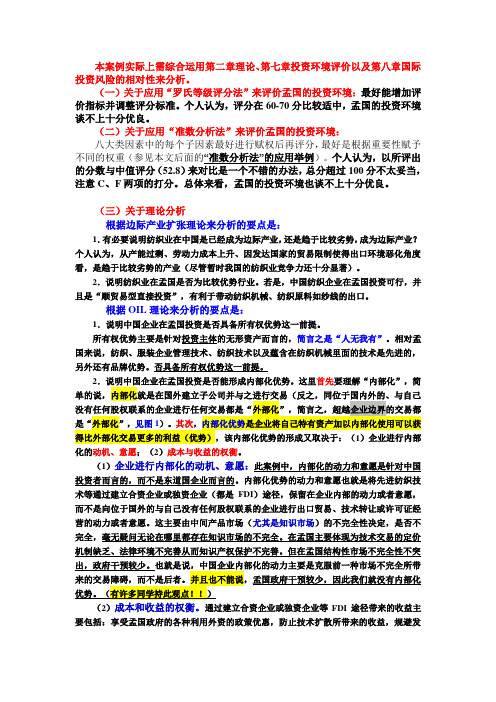

本案例实际上需综合运用第二章理论、第七章投资环境评价以及第八章国际投资风险的相对性来分析。

(一)关于应用“罗氏等级评分法”来评价孟国的投资环境:最好能增加评价指标并调整评分标准。

个人认为,评分在60-70分比较适中,孟国的投资环境谈不上十分优良。

(二)关于应用“准数分析法”来评价孟国的投资环境:八大类因素中的每个子因素最好进行赋权后再评分,最好是根据重要性赋予不同的权重(参见本文后面的“准数分析法”的应用举例)。

个人认为,以所评出的分数与中值评分(52.8)来对比是一个不错的办法,总分超过100分不太妥当,注意C、F两项的打分。

总体来看,孟国的投资环境也谈不上十分优良。

(三)关于理论分析根据边际产业扩张理论来分析的要点是:1.有必要说明纺织业在中国是已经成为边际产业,还是趋于比较劣势,成为边际产业?个人认为,从产能过剩、劳动力成本上升、因发达国家的贸易限制使得出口环境恶化角度看,是趋于比较劣势的产业(尽管暂时我国的纺织业竞争力还十分显著)。

2.说明纺织业在孟国是否为比较优势行业。

若是,中国纺织企业在孟国投资可行,并且是“顺贸易型直接投资”,有利于带动纺织机械、纺织原料如纱线的出口。

根据OIL理论来分析的要点是:1.说明中国企业在孟国投资是否具备所有权优势这一前提。

所有权优势主要是针对投资主体的无形资产而言的,简言之是“人无我有”。

相对孟国来说,纺织、服装企业管理技术、纺织技术以及蕴含在纺织机械里面的技术是先进的,另外还有品牌优势。

否具备所有权优势这一前提。

2.说明中国企业在孟国投资是否能形成内部化优势。

这里首先要理解“内部化”,简单的说,内部化就是在国外建立子公司并与之进行交易(反之,同位于国内外的、与自己没有任何股权联系的企业进行任何交易都是“外部化”,简言之,超越企业边界的交易都是“外部化”,见图1)。

其次,内部化优势是企业将自己特有资产加以内部化使用可以获得比外部化交易更多的利益(优势),该内部化优势的形成又取决于:(1)企业进行内部化的动机、意愿;(2)成本与收益的权衡。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

国际投资学教程綦建红第3版课后题答案(完整精排版)第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的以盈利为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够生存并持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资在这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化 2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

资本流动的原因在于前者的资本价格低于后者。

资本国际流动的结果将通过资本存量的调整使各国资本价格趋于均等,从而提高世界资源的利用率,增加世界各国的总产量和各国的福利。

虽然麦克杜格尔模型的假设较之现实生活要简单得多,且与显示生活有很大的反差,但是这个模型的理念确实是值得称道的,既国际投资能够同时增加资本输出输入国的收益,从而增加全世界的经济收益。

第二章1、三优势范式决定跨国公司行为和对外直接投资的最基本因素有三,即所有权优势、内部化优势和区位优势。

所有权特定优势(Ownership)指一国企业拥有能够得到别国企业没有或难以得到的资本、规模、技术、管理和营销技能等方面的优势。

邓宁认为的所有权特定优势有以下几个方面:①资产性所有权优势。

对有价值资产的拥有大公司常常以较低的利率获得贷款,并且具有广泛的资金来源渠道。

②交易性所有权优势。

企业所拥有的无形资产,包括生产诀窍、营销技能、信息、专利、管理、品牌、商誉等。

大公司拥有丰富的组织管理经验和大批各种专业的人才,形成管理方面的优势。

③规模经济优势。

规模经济带来的研发、创新优势以及低成本优势。

企业规模越大,就越容易向海外扩张,成为国际企业。

寡头企业多利用直接投资来扩大化规模经济的优势。

内部化优势(Internalization)内部化优势是指拥有所有权优势的企业为避免市场不完善而把企业的所有权优势保持在企业内部所获得的优势。

由于外部市场的不完美及市场失灵,企业必须具有把所有权优势内部化的能力。

只有通过内部化在一个共同所有的企业内部实行供给和需求的交换关系,用企业自己的程序来配置资源,才能使企业的垄断优势发挥最大的效用。

所有权优势指出了对外直接投资的能力,而内部化优势决定了企业对外直接投资的目的与形式。

但是,一个企业具备了所有权优势并将之内部化,还不能准确地解释直接投资活动,因为出口也能发挥这两种优势。

因此,所有权优势和内部化优势仍只是对外直接投资的必要条件,而非充分条件。

区位特定优势(Location)指一个国家或地区比另一国家或地区能为外国厂商在本国或本地区投资设厂提供更有利的条件的优势,也即某一个国家或地区的投资环境。

区位特定优势决定企业对外直接投资的国际生产布局的地点选择。

具体的区位因素包括:①劳动成本和自然资源。

对外直接投资在选择区位时,优先考虑劳动力成本较低的地区,尤其是标准化以后的产品。

优越的地理位置、丰富的自然资源、合适的气候条件②市场潜力。

多数情况下,国际企业只有当其产品能够进入或部分进入东道国市场的条件下,才会作出直接投资的决定。

③关税与非关税壁垒。

贸易壁垒会影响国际企业在直接投资和出口之间进行选择。

④政府政策。

政府的政策情况和投资环境状况直接影响投资的国家风险,包括有关的金融贸易政策、法律完善程度、基础设施、公用事业、运输通讯等情况。

2.试述垄断企业优势理论和内部化理论的异同垄断优势理论从市场不完全性和企业的特定优势角度出发,论述了发达国家企业对外直接投资的动机和决定因素。

而市场内部化理论着重从自然性市场不完全出发。

并结合国际分工和企业国际生产组织形式分析企业对外直接投资行为。

(书)企业拥有这些特有财产本身的特殊优势,这种财产的内部化过程赋予了企业以特有的优势。

内部化理论通过对中间产品市场缺陷的论述,将海默的理论进一步延伸,将交易成本纳入不完全市场的研究中。

只要内部化的收益大于内部市场交易成本和为实现内部化而付出的成本,企业便拥有内部化优势,从而可以实现跨国经营。

内部化理论从成本和收益的角度解释国际直接投资的动因。

(ppt.)3.试述发展中国家对外直接投资的适用性理论发展中国家国际直接投资的适用性理论1.小规模技术理论:美国经济学家威尔斯80年代提出的小规模技术理论弥补了传统直接投资理论把竞争优势绝对化的不足。

认为发展中国家跨国企业的竞争优势来自低生产成本,这种低生产成本是与其母国的市场特征紧密相关的。

威尔斯主要从三个方面分析了发展中国家跨国企业的比较优势:(1)拥有为小市场需要提供服务的小规模生产技术。

(2)发展中国家在民族产品的海外生产上颇具优势。

(3)低价产品营销战略。

2.技术地方化理论:英国经济学家拉奥在对印度跨国公司的竞争优势和投资动机进行深入研究后提出的。

主要观点:发展中国家企业对进口的技术和产品加以改造和创新,更好满足当地市场,便会形成独特的竞争优势。

证明落后国家企业以比较优势参与国际生产和经营活动的可能性。

3.国家利益优先取得论:从国家利益的角度看,大多数发展中国家,尤其是社会主义国家的企业,其对外直接投资有其本身的特殊性。

这些国家的企业按优势论的标准来衡量是根本不符合跨国经营的条件。

但是由于国家战略利益的原因,企业不得不进行对外直接投资,寻求和发展自身的优势。

在这种情况下,国家将支持和鼓励企业进行跨国经营活动。

第三章一、名词解释1.国际投资环境指影响国际投资的各种因素相互依赖、相互完善、相互制约所形成的矛盾统一体,国际直接投资环境的优劣直接决定了一国对外资吸引力的大小。

2硬环境指能够影响投资环境的外部物质条件,如能源供应、交通和通信、自然资源以及社会生活服务设施等。

3软环境指能够影响国际直接投资的各种非物质形态的因素,如外资政策、法规、经济管理水平、职工技术熟练程度以及社会文化传统等等。

4.冷热比较分析法指出要从政治稳定性、市场机会、经济发展与成就、文化一元化、法令障碍、实质障碍、地理与文化差异等7个方面对各国投资环境进行综合比较分析。

其中,政治稳定性、市场机会、经济发展与成就、文化一元化同属“热”因素,而法令障碍、实质障碍、地理与文化差异同属“冷”因素。

“热”因素越大,“冷”因素越小,一国投资环境越好,外国投资者在该国的投资参与成分就越大。

5,简述国际直接投资环境的重要性及其决定因素重要性:它是开展国际投资活动所具备的一切条件的有机整体。

国际直接投资环境的优劣直接决定了一国对外资吸引力的大小。

决定因素:自然因素:它是跨国投资企业生存和发展的必要条件,某些情况下对一定的投资项目起着决定性作用;经济环境:是最直接、最基本的因素,也是首要考虑的因素。

政治因素:是指东道国的政治状况、政策和法规;法律环境:是直接关系到安全性的问题的重要方面社会因素:指对投资有重要影响的社会方面的关系。

6,试总结各种国际投资环境评估方法的基本思路和共性 P81基本思路和共性是将总投资环境分解为若干具体指标,然后再综合评判。

7. 试结合本章专栏3-1和专栏3-3,分析我国改善投资环境的重点和具体措施。

改善投资环境的重点是改善软环境和社会因素中的价值观念、教育水平、社会心理与习惯。

具体措施是降低贸易壁垒、提高私有财产保护程度、降低企业运行障碍、提高政府清廉程度、提高经济自由程度和提高法律完善程度。

8.国际投资环境具有1)综合性:国际投资的特点和现代经济社会的复杂性,决定了国际投资环境整体是由多种因素综合构成的。

2)系统性:构成国际投资环境的各个因素既有各自独立的性质和功能,又是相互连接、相互作用的,它们共同构成国际投资环境系统。

这个系统的功能强弱不仅取决于各个因素的状况,而且还取决于各种因素相互间的协调程度。

3)层次性:影响国际投资活动的各种外部因素是存在于不同的空间层次上的,有国际因素、国家因素、国内地区因素和厂址因素。

国家环境包括政治、法律、经济、社会喝自然五大因素,但厂址环境一般不包括政治、法律因素,而在国家环境中政治、法律、经济因素是最重要的;在厂址环境中,自然和广义的基础设施等尤为重要。

对于投资者来说这一性质要求投资环境时,必须对四个层次的投资环境都进行分析的基础上,对整个投资环境进行综合评价。

4)相对性:同样的投资环境会对不同的投资活动,显示出不同的功能作用。

产生这一性质的原因在于,国际投资本来就是相对于投资活动而言的,不同的投资活动所要求的投资环境和受同一环境因素的影响是不同的。

这启示人们在评价和改善投资环境时,不仅可以从共性出发,进行总体上的评价和改善,而且应从特殊性出发,针对具体投资活动评价和改善。

第四章1,名词解释:国际直接投资(International Direct Investment)是指一国的自然人、法人或其他经济组织单独或共同出资,在其他国家的境内创立新企业,或增加资本扩展原有企业,或收购现有企业,并且拥有有效管理控制权的投资行。

横向型投资是指一国企业到外国投资建立与国内生产和经营方向一致的子公司或附属机构,同时这种机构或子公司能独立地完成产品的全部生产与销售过程------一般适用于机器制造业和食品加工业。

纵向型投资是某一企业到国外建立与国内的产品生产有关联的子公司,并在母公司与子公司间实行专业化协作--------多见于汽车、电子等专业化分工水平较高的行业。