公司法英文词汇

公司法的词汇

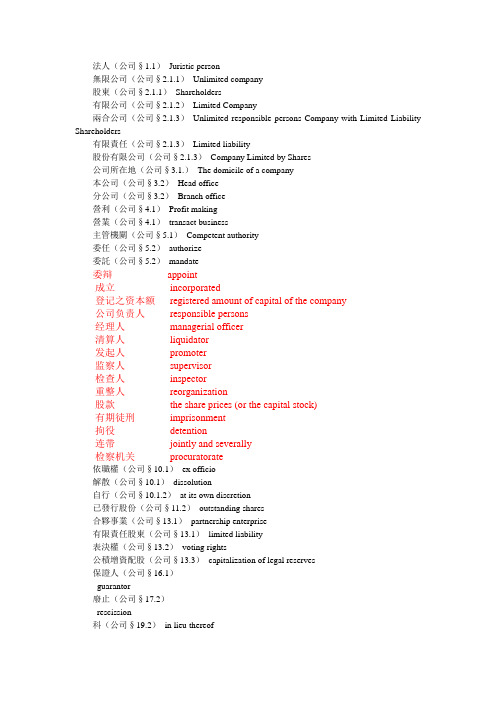

法人(公司§1.1)Juristic person無限公司(公司§2.1.1)Unlimited company股東(公司§2.1.1)Shareholders有限公司(公司§2.1.2)Limited Company兩合公司(公司§2.1.3)Unlimited responsible persons Company with Limited Liability Shareholders有限責任(公司§2.1.3)Limited liability股份有限公司(公司§2.1.3)Company Limited by Shares公司所在地(公司§3.1.)The domicile of a company本公司(公司§3.2)Head office分公司(公司§3.2)Branch office營利(公司§4.1)Profit making營業(公司§4.1)transact business主管機關(公司§5.1)Competent authority委任(公司§5.2)authorize委託(公司§5.2)mandate委辩appoint成立incorporated登记之资本额registered amount of capital of the company公司负责人responsible persons经理人managerial officer清算人liquidator发起人promoter监察人supervisor检查人inspector重整人reorganization股款the share prices (or the capital stock)有期徒刑imprisonment拘役detention连带jointly and severally检察机关procuratorate依職權(公司§10.1)ex officio解散(公司§10.1)dissolution自行(公司§10.1.2)at its own discretion已發行股份(公司§11.2)outstanding shares合夥事業(公司§13.1)partnership enterprise有限責任股東(公司§13.1)limited liability表決權(公司§13.2)voting rights公積增資配股(公司§13.3)capitalization of legal reserves保證人(公司§16.1)guarantor廢止(公司§17.2)rescission科(公司§19.2)in lieu thereof並科(公司§19.2)in addition thereto會計年度(公司§20.1)fiscal year虧損撥補(公司§20.1)surplus earnings distribution報酬(公司§20.3)remuneration會同(公司§21.1)in conjunction with目的事業(公司§21.1)end enterprise妨礙、拒絕或規避(公司§21.1)impede, refuse or evade單據(公司§21.1)V oucher善良管理人(公司§23.1)good administrator合併(公司§24.1)consolidation or merger分割(公司§24.1)split-up了結現務(公司§26.1)settling pending affairs已作必要脩改(公司§26.1)mutatis mutandis善意第三人(公司§27.4)bona fide third party.章程(公司§29.1)articles of incorporation董事(公司§29.1.3)director董事會(公司§29.1.3)the board of directors組織犯罪防制條例(公司§30.1.1)the Statute for Prevention of Organizational Crimes 詐欺(公司§30.1.2)fraud背信(公司§30.1.2)breach of trust侵占(公司§30.1.2)misappropriation公務虧空公款(公司§30.1.3)misappropriating public funds行為能力(公司§30.1.6)disposing capacity依照(公司§32.1)pursuant to債權(公司§44.1)monetary claim(債權)到期(公司§44.1)upon maturity請求報酬(公司§49.1)Clairemuneration代墊之款項(公司§50.1)advance money提供相當之擔保(公司§50.1)furnish appropriate security關於(公司§57.1)pertaining to分派盈餘(公司§63.1)Make distribution of surplus profit違反(公司§63.2)in violation of抵銷(公司§64.1)set off對於(公司§64.1)vis-a-vis。

中国公司法中英文

中国公司法中英文Chinese Company Law (中国公司法)Article 1. This Law is formulated in accordance with the Constitution of the People's Republic of China in order to regulate corporate activities, protect the lawful rights and interests of corporate investors, maintain social and economic order, and promote the development of the socialist market economy.第一条为了规范公司活动,保护公司投资者的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,根据《中华人民共和国宪法》制定本法。

Article 2. This Law shall apply to companies registered within the territory of the People's Republic of China.第二条本法适用于在中华人民共和国境内设立的公司。

Article 3. The term "company" as used in this Law refers to limited liability companies, joint stock limited companies, and other companies as specified by laws and administrative regulations.第三条本法所称公司,是指有限责任公司、股份有限公司,以及法律、行政法规规定的其他公司。

Article 4. The establishment of a company shall comply with the principle of voluntariness, fairness, and honesty; shall not impair public interests, harm the legitimate rights and interests of others, or violate laws and administrative regulations.第四条设立公司应当遵循自愿、公平、诚实的原则,不得损害社会公共利益,不得侵害他人的合法权益,不得违反法律、行政法规。

公司法英文对照(1)完整篇.doc

公司法英文对照(1)-; TABLE OF CONTENTS; 第一章:总则Chapter One:General Provisions; 第二章:有限责任公司的设立和组织机构Chapter Two:Establishment and Organs of Limited Liability Company; 第一节:设立Section One Establishment; 第二节:组织机构Section Two Organs; 第三节:国有独资公司Section Three. Wholly State-owned Company; 第三章:股份有限公司的设立和组织机构Chapter Three:Establishment and Organs of Joint Stock Limited Company; 第一节:设立Section One. Establishment; 第二节:股东大会Section Two. Shareholders’ general committee; 第三节:董事会、经理Section Three. Board Of Directors And General Manager; 第四节:监事会Section Four. Board Of Supervisors; 第四章:股份有限公司的股份发行和转让Chapter Four:Issue and Transfer of Shares of Joint Stock Limited Company; 第一节:股份发行Section One. Issue Of Shares; 第二节:股份转让Section Two. Transfer Of Shares; 第三节:上市公司Section Three. Listed Company; 第五章:公司债券Chapter Five:Company Bonds; 第六章:公司财务、会计Chapter Six:Financial and Accounting Affairs of Company; 第七章:公司合并、分立Chapter Seven:Merger and Division of Company; 第八章:公司破产、解散和清算Chapter Eight:Bankruptcy,Dissolution and Liquidation of Company; 第九章:外国公司的分支机构Chapter Nine:Branch of Foreign Company; 第十章:法律责任Chapter Ten:Legal Liabilities; 第十一章:附则Chapter Eleven:Supplementary Provisions; 第一章:总则Chapter One:General Provisions; 第一条:为了适应建立现代企业制度的需要,规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,根据宪法,制定本法。

公司法(中英)

Order of the President(No. 42 [2005])The Company Law of the People's Republic of China was amended and adopted at the 18th session of the Standing Committee of the Tenth National People's Congress of the People's Republic of China on October 27, 2005. The amended Company Law of the People's Republic of China is hereby promulgated and shall come into force on January 1, 2006.President of the People's Republic of China Hu JintaoOctober 27, 2005Company Law of the People's Republic of China(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993. Revised for the first time on December 25, 1999 according to the Decision of the Thirteenth Session of the Standing Committee of the Ninth People's Congress on Amending the Company Law of the People's Republic of China. Revised for the second time on August 28, 2004 according to the Decision of the 11th Session of the Standing Committee of the 10th National People's Congress of the People's Republic of China on Amending the Company Law of the People's Republic of China. Revised for the third time at the 18th Session of the 10th National People's Congress of the People's Republic of China on October 27, 2005)ContentsChapter I General ProvisionsChapter II Establishment and Organizational Structure of A Limited Liability Company中华人民共和国主席令(第42号)《中华人民共和国公司法》已由中华人民共和国第十届全国人民代表大会常务委员会第十八次会议于2005年10月27日修订通过,现将修订后的《中华人民共和国公司法》公布,自2006年1月1日起施行。

公司法单词1-90

1.sole proprietorship个人独资企业Eg. An individual who is operating a business is said to be running a …sole proprietorship‟.2.limited liability有限责任Eg. The corporate form allows for limited liability.3.transferable可转让的Eg. Ownership interests in the corporation are freely transferable.4.corporate acquisitions and mergers公司并购Eg. The requirements for corporate acquisitions and mergers are determined by the law of the state of incorporation.5.dividend股息Eg. The circumstances under which dividends may be paid are determined by the law of the state of incorporation.6.incorporate设立Eg. Half of all the corporations listed on the New Y ork Stock Exchange are incorporated in Delaware.7.tax征税;税收Eg. The entity can elect to be taxed either as a corporation or as a partnership.8.general partnership普通合伙Eg. The most important single fact about general partnerships is that each partner is liable for all the debts of the partnership.9.promulgate颁布Eg. The most recent version of the UPA was promulgated in 1997.10.estoppel禁止反言Eg. The two people who don‟t actually intend to be in partnership with each other can even be found to have created a partnership …by estoppel‟if they represent to the outside world that they are in partnership together.11.limited partnership(LP)有限合伙Eg. Limited partnerships may only be created by filling a formal document with a state official.12.Limited Liability Partnership(LLP)特殊普通合伙Eg. Most states now also allow something called a …limited liability partnership‟.13.make initial capital contribution首次出资Eg. If the corporation runs up large debts after the shareholders have made their initial capital contribution, the shareholders are normally not responsible for those debts.14.guarantee担保Eg. Lenders usually simply will not lend money to the corporation without personal guarantees by some or all shareholders.15.joint liability连带责任Eg. This joint liability applies even where one partner does not participate in the act that causes the partnership to become liable.16.breach of the agreement违约Eg. He will have a claim over against Smith for breach of the agreement.17.accounting firm会计师事务所Eg. The biggest users of LLP status are professional service firms, like law firms and accounting firms.18.malpractice不法行为Eg. The biggest practical benefit of the LLP status to such a service firm is that the individual partners will not be liable for acts of malpractice committed by other partners.19.entrust委托Eg. If the investors desire to entrust management to non-shareholders, the centralized management structure of the corporation is helpful.20.bind on有约束力,对..有效的Eg. Such internal agreements concerning decision-making authority are not binding on outsiders who are unaware of these agreements.21.dissolve解散Eg. A general partnership is dissolved by the death of any general partner.22.assign转移(财产等)Eg. A partner may …assign‟his partnership interests, but this does not make the transferee the partner, instead the transferee merely obtains limited economic rights.23.veto power否决权Eg. V eto power over new partners is absolutely essential.24.income tax所得税Eg. The federal income tax consequences of operating as a corporation rather than as a partnership are enormous.25.double taxation双重税收Eg. One consequence of the corporation‟s status as a separate tax-payer is that there will often be so-called …double taxtation‟.26.fringe benefits边缘利益Eg. Many fringe benefits given to owner/managers of corporations receive very favorable taxation.27.offset抵消Eg. So long as a partner is actively involved in management of the partnership, he may offset his share of losses incurred by the partnership against gains from other activities.Veil-piercing / pierce the veil 刺破面纱e.g.: It may turn out that it is easier to “pierce the veil”of an LLC than that of a corporation.P13Dispute 争论Arbitration 仲裁、公断e.g.: The Agreement contains a clause saying that all disputes must be subjects to arbitration.Derivative action 股东代表诉讼e.g.: Elf brings a “derivative action” against Jaffari and Malek LLC in Delaware. Litigation 诉讼Jaffari asserts that the Agreement‟s arbitration and forum-selection clauses bar this Delaware litigation.Formality 正式手续e.g.: But there is at least one factor often used in corporation veil-piercing case s —failure to follow organizational formalities —that perhaps ought not to be interpreted the same way in LLC-piercing case.Dividend 红利、股息、股利e.g.: The rules about circumstances under which a corporation may declare a dividend must approve a merger or sale of all the corporation‟s assets are set by the state of incorporation.Permissive 许可的,宽容的e.g.: “permissive” stateDomicile <律>原籍、住所e.g.: costs of using foreign domicileRetroactive<律>溯及既往的,有溯及效力的The date of incorporation is usually made retroactive to the date of filing Capitalization .资本值、资产化、资本总额Bylaws/articles of incorporation (公司)章程Amendment/amend 修订、修改e.g.: The bylaws may easily amended.1、majority vote:多数决Under most statutes any class of stockholders who would be adversely affected by the amendment must approve the amendment by majority vote.2、accrued dividends:应计股息/preferred stockholders:优先股股东For instance, suppose that a particular charter amendment would eliminate the accrued dividends owed to preferred stockholders (a change which help the common stockholders at the preferred stockholders‟ expense).3、appraisal rights:估价收购权An unhappy shareholder whose rights are adversely affected will usually get appraisal rights which permit him to sell his shares back to the corporation at a judicially-determined fair price.4、ultra vires:越权The doctrine of “ultra vires”was once extremely important, but is of little practical significance today.5、repudiate:拒绝接受,声明不承认After P has begun the work, D repudiate the contract, and P sues for breach.6、executory:待履行的But notwithstanding these exceptions, the ultra vires doctrine was frequently used——for instance, when the contract was fully executory.7、charitable donations:慈善性捐赠In general, the shareholder who tries to block a corporate charitable donation will lose unless the donation is manifestly unreasonable.8、stock option:股票期权,优先认股权/fringe benefit:附加福利,补贴A related issue arises when the corporation grants an employee or retired former employee a bonus, a stock option, or some other kind of fringe benefit.9、self-dealing:自利性交易行为Therefore, the arrangement will usually not be attackable by shareholders unless it is clearly excessive or based upon self-dealing.10、principal:委托人The court may assert that “a person who purports to act as agent for a nonexistentprincipal thereby automatically becomes a principal.”11、conceal:隐瞒,隐匿/misrepresentation:错误或虚假的表述,不正当代表The promoter, by concealing the fact that the corporation has not yet been formed, is liable for misrepresentation.12、revocable:可撤回的/irrevocable:不可撤回的The other party is making a revocable or irrevocable offer to the no n-existing corporation, which results in a contract if the corporation is formed while the offer is still open.13、novation:债的变更This will depend on whether the parties, including the other party to the original transaction, intended a novation.14、retroactive:有溯及力的When adoption occurs, it is usually held not to be retroactive to the date of the original contract, but merely to run from the date of the corporation‟s assent.15、fiduciary obligation:信托(的)义务Most courts appear to hold that during the pre-incorporation period the promoter has a fiduciary obligation to the to-be-formed corporation, and therefore may not pursue his own profit at the corporation‟s ultimate expense.P 31-41mencement 开端,开始They try to protect passive investors from personal liability,even investors who put up money for the commencement of operations without an honest belief that incorporation has taken place.2.claimant 要求者,所有者The doctrine(Corporation by estoppel) is essentially limited to contract cases,and is virtually never applied against tort claimants.3.pierce 刺破,捅破veil 面罩,面纱;托词,藉口However,this shield(limited liability)is not complete: In a few very extreme cases,courts sometimes “pierce the corporate veil”,and hold some or all of the shareholders personally liable for the corporation‟s debts.4.siphon 吸取,抽there are a number of factors that seem to be important components pf courts‟decisions to pierce:whether the defendant stockholders have engaged in fraud or wrongdoing (knowingly siphoning ort all the profits of the corporation).5.scenario 方案scenario 1:…6.involuntary creditor:非自愿的债权人e.g:tort claimant7.inadequate capitalization 资本不实Inadequate capitalization is especially likely to be a key factor where the claimant is an “involuntary creditor ”who cannot be said to have willingly accepted the risk of inadequate capitalization.8.affirmative 肯定的,统一的;n.肯定,同意most courts require that there be either some affirmative fraud or wrongdoing by the shareholder,before the veil is pierced.9.rebut v.反驳,证明错误insurance as rebutting inference of undercapitalization 以买了保险作为资本不实责任的抗辩10.fraud 欺诈; fraudulent 欺诈的fraudulent conveyance 欺诈性的资产转移11.subsidiary 辅助的,次要的;子公司The courts probably have greater tendency to pierce the corporate veil in the parent/subsidiary context than in the individual shareholder situation.12.sobering 冷静的An individual‟s non-business assets are being taken is a more sobering thoughts to most courts.非执行那些非用于商业的资产,对法院来说是(考虑当事人利益的)更为平静的选择。

公司法词汇

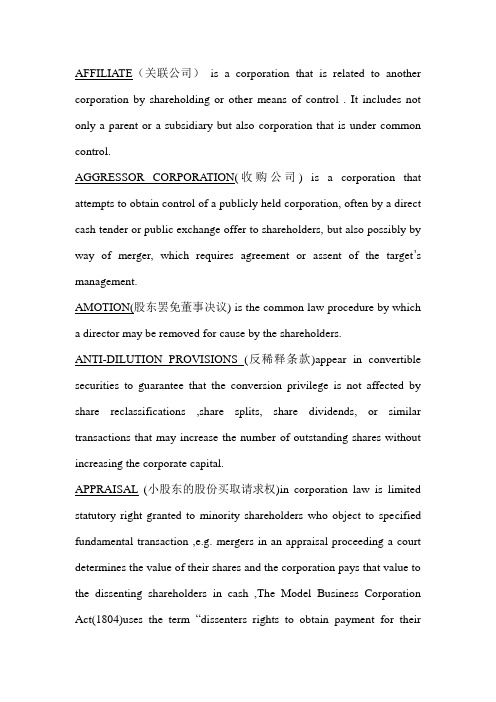

AFFILIATE(关联公司)is a corporation that is related to another corporation by shareholding or other means of control . It includes not only a parent or a subsidiary but also corporation that is under common control.AGGRESSOR CORPORATION(收购公司) is a corporation that attempts to obtain control of a publicly held corporation, often by a direct cash tender or public exchange offer to shareholders, but also possibly by way of merger, which requires agreement or assent of the target’s management.AMOTION(股东罢免董事决议) is the common law procedure by which a director may be removed for cause by the shareholders.ANTI-DILUTION PROVISIONS (反稀释条款)appear in convertible securities to guarantee that the conversion privilege is not affected by share reclassifications ,share splits, share dividends, or similar transactions that may increase the number of outstanding shares without increasing the corporate capital.APPRAISAL (小股东的股份买取请求权)in corporation law is limited statutory right granted to minority shareholders who object to specified fundamental transaction ,e.g. mergers in an appraisal proceeding a court determines the value of their shares and the corporation pays that value to the dissenting shareholders in cash ,The Model Business Corporation Act(1804)uses the term “dissenters rights to obtain payment for theirshares “to describe this right.ARTICLES OF INCORPORATION(公司设立章程)is the name customarily given to the document that is filed in order to form a corporation .Under various state statutes ,this document may be called the “certificate of incorporation ””charter””articles of association ,” or other similar name.ATTHORIZED SHARES (授权股份) are the shares described in the articles of incorporation which a corporation may issue .Modern corporate practice recommends authorization of more shares than it is currently planned to issueBONUS SHARES (免费赠股,即在缺乏对价的情况下发行的面值股份) are par value shares issued without consideration ,usually in connection with the issuance of preferred or senior securities , or debt instruments, Bonus shares are considered a species of watered shares and many impose a liability on the recipient equal to the amount of par value. BOOK V ALUE (账面价值) is the value of shares determined on the basis of the books of the corporation ,Using the corporation’s latest balance sheet ,the liabilities are subtracted from assets , an appropriate amount is deduced to reflect the interest of senior securities (preferred shares), and what remains is divided by the number of outstanding common shares to obtain the book value per share.BROKER(证劵经纪人)in a securities transaction , means a person whoacts as an agent for a buyer or seller, or an intermediary between a buyer and seller, usually charging a commission .A broker who specializes in shares ,bonds ,commodities, or options must be registered with the exchange where the specific securities are traded. A broker should be distinguished from a dealer who, unlike a broker, buys or sells for his own account. Securities firms typically act as dealers and brokers, depending on the security involved.BYLAWS(公司附属章程) are the formal rules of internal governance adopted by a corporation , State corporation statutes contemplate that every corporation will adopt bylaws , though special close corporation statutes may make bylaws optional for qualifying close corporations.C CORPORATION (C类公司)is a corporation that is subject to federal income tax at the corporation level. See S Corporation.CALL FOR REDEMPTION (请求赎回) See: redemptionCALLS (购买证劵选择权) are options to buy securities at a stated price for a stated period. Calls are written on a variety of indexes, foreign currencies, and other securities. The person who commits himself of herself to sell the security upon the request of the call holder is referred to as the call writer; the act of making the purchase of the securities pursuant to the call option is referred to as exercise of the option. The price at which the call is exercisable is the strike price .See also: puts CAPITAL STOCK (资本股票) is another phrase for common shares ,often used when the corporation has only one class of shares outstanding. CAPITAL SURPLUS(资本余额) in the old Model Business Corporation Act nomenclature, is an equity or capital account which reflects the capital contributed for shares not allocated to stated capital :the excess of issuance price over the par value of issued shares or the consideration paid for no par shares allocated specifically to capital surplusCASH FLOW(现金合并) is a merger transaction in which certain shareholders or interest in a corporation are required to accept cash for their shares.CASH TENDER OFFER(收购要约)is a technique by which an aggressor seeks to obtain control of a target corporation by making a public offer to purchase a specified fraction (usually a majority)of the target corporation’s shares from persons who tender their shares.CEO(首席执行官)stands for “chief executive officer” of a publicly held corporation. CEO is a preferred and useful designation because official titles of such persons vary widely from corporation to corporation.CFO(首席财务官)stands for “chief financial officer”CLO(首席财务官)stands for “chief legal officer”COO(首席经营官)stands for” chief operation officer”CERTIFICATE OF INCORPORATION (公司成立证书)in most states is the document prepared by the secretary of state that evidences the acceptance of articles of incorporation and the commencement of thecorporate existence. In Delaware the certificate of incorporation is the name given to the document filed with the secretary of state .The Model Business Corporation Act(1984)has eliminated certificates of incorporation , requiring only a fee receipt.CHARTER(公司章程)may mean (i)the document filed with the secretary of state, i.e. the articles of incorporation, or (ii)the grant by the state of the privilege of conducting business with limited liability. Charter is often used in a colloquial sense to refer to the basic constitutive documents of the corporation.CLASS A SHARES (A类股份)See participating preferred shares. CLASS VOTING (种类表决权)See:voting groupCLASSIFIED BOARD OF DIRECTORS (分类董事会)may refer either (1)to a board of directors of which the individual members are elected by different classes of shares or (2)to a board of directors of which one-third or one-half are elected each year. See staggered boardCLOSE CORPORATION or CLOSELY HELD CORPORATION (内部控股公司)is a corporation with relatively few shareholders and no regular markets for its shares .Close corporations usually have never made a public offering of shares and the shares themselves may be subject to restriction on transfer. Close and Closely held are synonymous. COMMON SHAREHOLDERS(普通股东)are holders of common shares, the ultimate owners of the residual interest of a corporation.COMMON SHARES(普通股份)represent the residual ownership interests in the corporation . Holders of common shares select directors to manage the enterprise, are entitled to dividends out of the earnings of the enterprise declared by the directors, and are entitled to a per share distribution of whatever assets remain upon dissolution after satisfying or making provisions for creditors and holders of senior securities. CONSOLIDATION(公司的新设合并)is an amalgamation of two corporation pursuant to statutory provision in which both of the corporations disappear and a new corporation is formed. The Model Business Corporation Act (1984) eliminates the consolidation as a distinct type of corporate amalgamation.CONTROL OF A CORPORATION BA A PERSON(人对公司的控制)normally means that a person has power to vote a majority of the outstanding shares. However, control may be reflected in a significantly smaller block if the remaining shares are scattered in small, disorganized holding.CONTROL PERSON(控制人)in securities law is a person who is deemed to be in a control relationship with the issuer. Sales of securities by control person are subject to many of the requirements applicable to the sale of securities directly by the issuer. In addition, controlling person have a duty under ITSFEA to prevent insider trading by persons under their control.CONVERSON CECURITIES(转换证券)are the securities into which convertible securities may be converted.CONVERTIBLE SECURITIES(可转换证券)are securities that include the right of exchanging the convertible securities, usually preferred shares or debentures, at the option of their holders, for a designated number of shares of another class, usually common shares, called the conversion securities. The ratio between the convertible and conversion securities is fixed at the time the convertible securities are issued, and is usually protected against dilution.CO-PROMOTERS(共同发起人)See: promoters.CORPORATE OPPORTUNITY(公司机会)is a fiduciary concept that limits the power of officers, directors, and employees to take personal advantage of opportunities that belong to the corporation. CORPORTION BY ESTOPPEL(禁反言的公司)is a doctrine which prevents a third person from holding an “officer,”“director,”or “shareholder”of an nonexistent corporation personally liable on an obligation entered in the name the nonexistent corporation on the theory that the third person relied on the existence of the corporation and is now “estopped” from denying that the corporation existed.CUMULATIVE VOTING(累积投票权)is a method of voting that allows substantial minority shareholders to obtain representation on the board of directors. When voting cumulatively, a shareholder may cast all of his orher available votes in an election in favor of a single candidate.D﹠O INSURANCE(董事与经理保险)refers to directors’and officers’liability insurance. Such insurance, which is widely available commercially, insures persons against claims based on negligence, failure to disclose, and to a limited extend, other defalcations. D﹠O insurance provides coverage against expense and to a limited extend fines, judgments, and amounts paid in settlement.DEADLOCK(僵局)in a closely held corporation arises when a control structure permits one or more factions of shareholders to block corporate action if they disagree with some aspect of corporate policy. A deadlock often arises with respect to the election of directors, e.g., by an equal division of shares between two factions, but many also arise at the level of the board of directors itself.DEEP ROCK DOCTRINE(“深石”法理)is a principle in bankruptcy law by which unfair or inequitable claims presented by controlling shareholders of bankrupt corporations may be subordinated to claims of general or trade creditors. The doctrine received its name from the corporate name of the subsidiary involved in the leading case articulating the doctrine.DE FACTO CORPORATION(事实上的公司)at common law is a partially formed corporation that provides a shield against personal liability of shareholders for corporation obligations; such a corporationmay be attacked by the state.DE FACTO MERGER(事实上的公司吸收合并)is a transaction that has the economic effect of a statutory merger but is cast in the form of an acquisition of assets or an acquisition of voting stock and is treated by a court as if it were a statutory merger.DE JURE CORPORATION(法律上的公司)at common law is a corporation that is sufficiently formed to be recognized as a corporation for all purposes. A de jure corporation may exist even though some minor statutory requirements have not been fully complied with.DELECTUS PERSONAE(合伙人对新合伙人入伙的接受或拒绝)is a Latin phrase used in partnership law to describe the power each partner possesses to accept or reject proposed new members of the firm. DEPOSITORY TRUST CIRPORATION(保管信托公司)is the principle central clearing agency for securities trades. See: book entry.DERIV ATIVE SUIT(代表诉讼)is a suit brought by a shareholder in the name of a corporation to correct a wrong done to the corporation. DISCOUNT SHARES(折价发行的股份)are par value shares issued for cash less than par value. Discount shares are a species of watered shares or watered stocks.DISSENSION(公司内部诉讼)in a closely held corporation refers to personal quarrels or disputes between shareholders that may make business relations unpleasant and interfere with the successful operationof the business. Dissension may occur without constitution oppression or causing a deadlock or adversely affect the corporation's business. DISSENTERS’RIGHT(异议股东的权利)See: appraisal. DISTRIBUTION(分配)is a payment to shareholders by a corporation. If out of present or past earnings it is a dividend. The word describing is sometimes accompanied by a word describing the source or purpose of the payment, e.g. Distribution of Capital Surplus, or Liquidating Distributing.DIVIDEND(股利)is a payment to shareholders from or out of current or past earnings.DOWN STREAM MERGER(下游公司吸收合并)is the merger of a parent corporation into its subsidiary.EARNINGS PER SHARE(每股收益)equals a firm’s net income divided by the number of shares held by shareholders.EQUITY or EQUITY INTEREST(股东权或者股东权益)are financial terms that refer in general to the extent of an ownership interest in a venture. In this context, equity refers not to a legal concept but to the financial definition that an owner’s equity in a business is equal to the business’s assets minus its liabilities.EQUITY INANCING(股权融资)is raising money by the sale of common shares or preferred shares.EQUITY SECURITY(股权证券)is a security that represents anownership interest in the business, i.e. Common or preferred shares.EX DIVIDEND(除息日)refers to the date on which a purchaser of publicity traded shares is not entitled to receive a dividend that has been declared and the seller of such shares is entitled to retain the dividend. The ex dividend date is a matter of agreement or of convention to be established by the securities exchange.EX RIGHTS(除权日)refers to the date on which a purchaser of publicity traded shares is not entitled to receive rights that have been declared on the shares.FACE V ALUE(面值)is the value of a bond , note, mortgage, or other security, as stated on the certificate or instrument, payment upon maturity of the instrument. Face value is also often referred to as the par value or nominal value of the instrument.FORCED CONVERSION(强制转换)refers to a conversion of a convertible security that follows a call for redemption at a time when the value of the conversion security is greater than the amount that will be received if the holder permits the security to be redeemed.FREEZE-OUT MERGER(排挤或公司吸收合并). See: cash merger. GENERAL PARTNERS(普通合伙人)are partners that participate in management of the business. General partner is traditionally used in contrast with limited partner in a limited partnership, but general partner is also sometimes used to refer to any partner in a general partnership. Ageneral partner is liable for the obligations of the business if the partnership has not elected to be a limited liability partnership.GOING PRIV ATE(公司股份有公众持有改为经营者与大股东持有)refer to a transaction in which shareholders of a publicity held corporation are compelled to accept cash for their shares while the business continues to be owned by officers, directors, or large shareholders. A going private transaction may involve a merger of the publicity held corporation into a subsidiary in a cash merger.GOLDEN PARACHUTE(金降落伞)is a slang term for a lucrative contract to a top executive of a corporation which provides additional benefits in cash the company is taken over and the executive is either forced to leave the target company or voluntarily leaves it. A golden parachute may include severance pay, stock options, or a bonus payable when the executive’s employment at the company ends.HOLDING COMPANY(控股公司)is a corporation that owns a majority of the shares of one or more other corporations. A holding company is not engaged in any business other than the ownership of shares. See: investment companies.INCORPORATORS(公司设立人)are the person or the persons who execute the articles of incorporation. Historic restrictions on who may serve as incorporators have largely been eliminated.INDEPENDENT DIERCTORS(独立董事)as directors of a publicity heldcorporation who are not officers or executive of the corporation and have no substantial direct or indirect financial interest in transactions with the corporation.INSIDE DIRECTORS(内部董事)are directors of a publicity held corporation who hold executive positions with management.INSIDER(内幕人)is a term of uncertain scope that refers to persons having some relationship to a corporation, and whose securities trading on the basic of nonpublic information may be a violation of law. Insider is broader than inside director.INSIDER TRADING(内幕交易)refers to transactions in shares of publicity held corporation by person with inside or advance information on which the trading is based. Usually the trader himself is an insider with an employment or other relationship of trust and the confidence with the corporation.INSTITUTIONAL INVESTORS(机构投资者)are large investors who largely invest other person’s money, e.g. mutual funds, pension funds, insurance companies, and others.INTERLOCKING DIRECTORS(连锁董事)are persons who serve simultaneously on the boards of directors of two or more corporations that have dealings with each other.INVESTMENT COMPANIES(投资公司)are corporations that are engaged in the business of investing in securities of other businesses. Themost common kind of investment company is the mutual fund. An investment company differs from a holding company in that the latter seeks control of the ventures in which it invests while an investment company seeks investment for its own sake and normally diversifies its investments.ISSUED SHARES(已发行股份)are shares a corporation has actually issued and has not canceled.JOINT VENTURE(合资企业)is a limited purpose partnership largely governed by the rules applicable to partnerships. In an earlier day, many states permitted corporations to participate in joint ventures but treated as ultra virus an attempt by a corporation to become a partner in a general partnership.LEVERAGE(杠杆)refers to the advantages that may accrue to a business though the use of debt obtained from third persons in lieu of contributed capital. Third party debt improves the earnings allocable to contributed capital if the business earns more on each dollar invested than the interest cost of borrowing funds.LEVERAGED BUYOUT (or “LOB”) (杠杆式收购)is a transaction by which an outside entity purchases all the shares of a public corporation primarily with borrowed funds. Ultimately the debt incurred to finance the takeover is assumed by the acquired business. If incumbent management has a financial and participatory interest in the outside entity,the transaction may be referred to as a management buyout or MBO. LIMITED LIABILITY COMPANY (usually called an LLC)(有限责任公司)is an unincorporated business from that provides limited liability for its owners and may be taxed as a partnership. To created an LLC, a certificate must be filed with a state official.LIMITED LIABILITY PARTNERSHIP (usually called an LLP) (有限责任合伙)is a general partnership that has elected to register under state statutes that provide some protection against liability for actions of co-partners. To create an LLP a certificate, renewable annually, must be filed with a state official.LIMITED LIABILITY LIMITED PARTNERSHIP (usually called an LLLP)(有限责任有限合伙)is a limited partnership that has elected to register under state statutes that provide some protection for general partner against liability for actions of other general partners. To create an LLLP a certificate, renewable annually, must be filed with a state official. LIMITED PARTNERSHIP(有限合伙)is a partnership consisting of one or more limited partners (whose liability for partnership debts is limited to the amount originally invested) and one or more general partners. To create a limited partnership a certificate must be filed with a state official. MERGER(公司吸收合并)is an amalgamation of two corporations pursuant to statutory provision in which one of the corporations survives and the other disappears.NASDAQ(纳斯达克)is an acronym for “Nations Association of Securities Dealers Automated Quotations” and is the principal recording device for transactions on the over-the-counter market.NEW ISSUE(初次发行)is a security being offered to the public for the first time. The distribution of new issues is usually subject to SEC rules. New issues may be initial public offerings by previously private companies or additional securities offered by public companies.NON-CALLABLE(不可赎回的)preferred shares or bonds are securities that cannot be redeemed at the option of the issuer.NON-CUMULATIVE VOTING or STRAIGHT VOTING(非累积性投票或直接股票)limits a shareholder to voting no more than the number of shares he or she owns for a single candidate.NONVOTING COMMON SHARES(无表决权普通股)are shares that expressly have general power to vote for directors and for other issues coming before the shareholders. Nonvoting shares may be entitled to vote as a separate voting group on certain proposed changes adversely affecting that class as such.NO PAP SHARES(无面值股份)are shares issued under a traditional par value statute that are stated to have no par value. Such shares may be issued for the consideration designated by the board of directors. In many respects no par shares do not differ significantly from par value shares. In state that have abolished par value, the concept of no par value shares isobsolete.OUTSIDE DIRECTORS(外部董事)are directors of publicly held corporations who do not hold executive positions with management. Outside directors, however, may include investment bankers, attorneys, or other who provide advice or services to incumbent management and thus have financial ties with management.OVER-THE-COUNTER (柜台市场)refers to the NASDAQ securities market which consists of brokers who purchase or sell securities by computer hook-up or telephone rather than through the facilities of a securities exchange.PAR V ALUE or STATED V ALUE(票面价值或者载明价值)of share is an arbitrary or nominal value assigned to each other share. At one time par value represented the selling or issuance price of shares, but in modern corporate practice, par value has little or no significance. Shares issued for less than par value are usually referred to as watered shares. The Model Business Corporation Art(1984) and the statutes of many states has eliminated the concept of par value.PARTICIPATING PREFERRED SHARES(可参加的优先股)are preferred shares that, in addition to paying a stipulated dividend, give the holder the right to participate with the common shareholders in additional distributions of earnings, if declared, under specified conditions. Participatory preferred shares may be called class A common or given asimilar designation to reflect their open-ended rights.PAYABLE DATE(股利支付日)is the date on which a dividend or distribution is actually paid to a shareholder.POISON PILL(毒药丸)is an issue of shares by a corporation as a protection against an unwanted takeover. A poison pill creates rights in existing shareholders to acquire debt or stock of the target (or of the aggressor upon a subsequent merger) upon the occurrence of specified events, such as the announcement of a cash tender offer or the acquisition by an outsider of a specified percentage of the shares of the target. A poison pill raises the potential cost of an acquisition, usually thereby compelling the aggressor to negotiate with the target in order to persuade it to withdraw the pill.POOLING AGREEMENT(集合投票协议)is a contracture arrangement among shareholders relating to the voting of their shares. PREEMPTIVE RIGHTS(优先权)given an existing shareholder the opportunity to purchase or subscribe for a pro proportionate part of a new issue of shares before it is offered to other persons. Its purpose is to protect shareholders from dilution of value and control when new shares are issued. In modern statutes, preemptive rights may be limited or denied.PREFERRED SHARES(优先股份)are shares that have preferential rights to dividends or to amounts distributable on liquidation, or to both, aheadof common shareholders. Preferred shares are usually entitled only to receive specified limited amounts as dividends or on liquidation. PREFERRED SHAREHOLDERS’CONTRACT(优先股东的合同)refers to the provisions of the articles of incorporation, the bylaws, or the resolution of the board of directors, creating and defining the rights of holders of the preferred shares in question. Preferred shareholders have only limited statutory or common law rights outside of the preferred shareholders’ contract. Provisions creating and defining the rights of the holders of preferred shares may usually be amended without the consent of each individual holder of preferred shares if they are approved by the holders of the class of preferred shares.PREINCORPORATION SUBSCRIPTION(公司设立前认购). See: subscription.PROMOTERS(发起人)are persons who develop or take the initiative in funding or organizing a business venture. Where more than one promoter is involved in a venture, their described as co-promoters.PROXY(投票代理人)is a person authorized to vote someone else’s shares. Depending on the context, proxy may also refer to the grant of authority itself (the appointment), or the document grating the authority (the appointment form).PUBLIC OFFERING(公开募集股份)involves the sales of securities by an issuer or a person controlling the issuer to members of the public.Generally, any offering that is not exempt under Regulation D or the private offering exemption of the Securities Act of 1933 and/or similar exemptions under state blue sky law is considered a public offering. Normally registration of a public offering under those statutes is required though in some instance other exemptions from registration may be available.PUBLIC HELD CORPORATION(公开上市公司)is a corporation with shares held by numerous persons. Shares of publicly held corporations are usually trade either on a securities exchange or over-the-counter. RECAPITALIZATION(公司资产重组)is are restructuring of the capital of the corporation through amendment of the articles of incorporation or a merger with a subsidiary or parent corporation. Recapitalization may involve the elimination of unpaid cumulated preferred dividends, the reduction or elimination of par value, the creation of new chasses of senior securities, or similar transactions. A leveraged recapitalization involves the substitution of debt for equity in the capital structure. REDEMPTION(赎回)means the reacquisition of a security by their issuer persuade to a provision in the security that specifies the terms on which the reacquisition may take place. Typically, a holder of a security that has been called for redemption will have a limited period thereafter to decide whether or not to exercise a conversion right, if one exists. REGISTERED CORPORATION(登记公司)is a publicly heldcorporation which has registered a publicity held class of securities under section 12 of the Securities Exchange Act of 1934. Section 12 may apply to issuers other than corporations. The registration of an outstanding issue under this section of the 1934 Act should be contrasted with the registration of a public distribution under the Securities Act of 1933. REGISTRATION(登记)of an issue of securities under the Securities Act of 1933 permits the public sale of those securities in interstate commercial or with the use of the mails. That registration should be distinguished from the registration of already publicly held classes of securities under the Securities Exchange Act of 1934. REORGANIZATION(公司重组)is a general term describing corporate amalgamations or readjustments. The classification of the Internal Revenue Code is widely used in general corporate literature. A Class A reorganization is a statutory merger or consolidation (i.e. pursuant to the business corporation act of a specific state). A class B reorganization is a transaction by which one corporation exchange s its voting shares for the voting shares of another corporation. A class C reorganization is a transaction in which one corporation exchange s its voting shares for the property and assets of another corporation. A class D reorganization is a “spin off” of assets by one corporation to a new corporation. A class E reorganization is a recapitalization. A class F reorganization is a “mere change of identity, form, or place of organization, however effected.” A。

公司法(中英对照版)

中华人民共和国公司法Company Law of the People's Republic of China(1993年12月29日第八届全国人民代表大会常务委员会第五次会议通过根据1999年12月25日第九届全国人民代表大会常务委员会第十三次会议《关于修改〈中华人民共和国公司法〉的决定》第一次修正根据2004年8月28日第十届全国人民代表大会常务委员会第十一次会议《关于修改〈中华人民共和国公司法〉的决定》第二次修正2005年10月27日第十届全国人民代表大会常务委员会第十八次会议修订根据2013年12月28日第十二届全国人民代表大会常务委员会第六次会议《关于修改〈中华人民共和国海洋环境保护法〉等七部法律的决定》第三次修正)(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993; amended for the first time in accordance with the Decision on Amending the Company Law of the People's Republic of China adopted at the 13 th Session of the Standing Committee of the Ninth National People's Congress on December 25, 1999; amended for the second time in accordance with the Decision on Amending the Company Law of the People's Republic of China adopted at the 11th Session of the Standing Committee of the Tenth National People's Congress on August 28, 2004; Revised at 18 th Session of the Standing Committee of the Tenth National People's Congress on October 27, 2005; and amended for the third time in accordance with the Decision on Amending Seven Laws Including the Marine Environment Protection Law of the People's Republic of China adopted at the Sixth Session of the Standing Committee of the 12 th National People's Congress on December 28, 2013)目录Contents第一章总则Chapter I General Provisions第二章有限责任公司的设立和组织机构Chapter II Establishment and Organizational Structureof A Limited Liability Company第一节设立Section 1 Establishment第二节组织机构Section 2 Organizational structure第三节一人有限责任公司的特别规定Section 3 Special Provisions on One-person LimitedLiability Companies第四节国有独资公司的特别规定Section 4 Special Provisions on Wholly State-ownedCompanies第三章有限责任公司的股权转让Chapter III Transfer of Stock Right of A Limited LiabilityCompany第四章股份有限公司的设立和组织机构Chapter IV Establishment and Organizational Structureof A Joint Stock Limited Company第一节设立Section 1 Establishment第二节股东大会Section 2 Shareholders' Assembly第三节董事会、经理Section 3 Board of Directors, Managers第四节监事会Section 4 Board of Supervisors第五节上市公司组织机构的特别规定Section 5 Special Provisions on the OrganizationalStructure of A Listed Company第五章股份有限公司的股份发行和转让Chapter V Issuance and Transfer of Shares of A JointStock Limited Company第一节股份发行Section 1 Issuance of Shares 第二节股份转让Section 2 Transfer of Shares第六章公司董事、监事、高级管理人员的资格和义务Chapter VI Qualifications and Obligations of the Directors, Supervisors and Senior Managers of A Company第七章公司债券Chapter VII Corporate Bonds第八章公司财务、会计Chapter VIII Financial Affairs and Accounting of ACompany第九章公司合并、分立、增资、减资Chapter IX Merger and Split-up of Company; Increaseand Deduction of Registered Capital第十章公司解散和清算Chapter X Dissolution and Liquidation of A Company 第十一章外国公司的分支机构Chapter XI Branches of Foreign Companies第十二章法律责任Chapter XII Legal Liabilities第十三章附则Chapter XIII Supplementary Provisions第一章总则Chapter I General Provisions第一条为了规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,制定本法。

公司法英文词汇

公司法英文词汇1. 公司corporation; company2. 合伙partnership3. 合股公司 joint-stock company4. 特许公司 chartered corporation5. 注册公司 registered corporation6. 法定公司 statutory corporation7. 无限公司 unlimited corporation8.有限责任公司 limited corporation; company with limited liability9. 股份有限公司 company limited by shares 10. 母公司 parent corporation11. 子公司 subsidiaries12. 总公司 Headquarter; Main Branch 13. 分公司 branch14. 国有独资公司wholly state-owned company 15. 上市公司 quoted corporation; listed company 16. 公司集团 groups of companies17. 保证公司 limited by guarantee18. 慈善公司 charitable corporation 19. 控股公司 holding corporation; holding company20. 公开公司publicly held corporation 21. 闭锁公司closely held corporation 22. 公公司 pub1ic company23. 私公司 private companyperson company 24. 一人公司one-25. 一人有限责任公司 one-person company with limited liability26. 外国公司的分支机构 branches of foreign company 27. 公司设立incorporation28. 组织机构 organizational structure 29. 股权转让 equity transfer30. 股份发行 issue of shares31. 股份转让 transfer of shares32. 股东大会 shareholders general assembly 33. 公司债券 corporate bonds34. 财务 financial affairs35. 会计 accounting36. 公司合并 merger of companies37. 公司分立 division of companies 38. 增资 increase of capital39. 减资 reduction of capital40. 公司解散和清算 dissolution and liquidation of company41. 企业法人 an enterprise legal person 42. 名称 name43. 住所 domicile44. 注册资本 registered capital45. 实收资本 actually received capital 46. 换发营业执照 renew business license 47. 符合法律规定的条件 meet the conditions provided for by law48. 债权 the rights of credit49. 债务 the debts50. 主要办事机构 main administrative organization 51. 对……有约束力have binding force on 52. 法人资格 the status of a legal person 53. 公司治理corporation governance 54. 公司人格corporation personality 55. 契约contract56. 公司法人格否认Disregard of Corporate Personality57. 刺破公司面纱Piercing the Corporate Veil 58. 揭开公司面纱Lifting the veil of the Corporation59. 普通合伙general partnership60. 有限合伙Limited partnerships61. 合伙人partner62. 有限责任limited liability63. 公司章程articles of association 64. 注册证书certificate of incorporation articles of incorporation65. 发起人的受托义务promoter’s fiduciary obligation 66. 认购协议subscription agreement 67. 既成事实公司de facto corporation 68. 法律上的公司de jure corporation69. 公司设立瑕疵defective incorporation 70. 受托人义务fiduciary obligation71. 结论性证据conclusive evidence72. 股份share73. 股息dividends74. 关联第三方connected third parties 75. 出资(投资)invest76. 股东shareholder77. 小股东 minority shareholder78. 单个股东individual shareholder 79. 消极股东passive shareholder80. 积极股东active shareholder81. 逆向合并 reverse merger82. 正向合并forward merger83. 股权收购share acquisition84. 收购公司acquiring company 85. (收购)目标公司target company 86. 资产收购asset acquisition 87. 公司责任liability of corporation 88. 公司结构(组织)corporation structure 89. 董事director90. 高级职员officer91. 股东权powers of shareholder 92. 选任elect93. 解任remove94. 年会(常会)annual meeting95. 兼并merger96. 解散dissolution97. 自愿解散 voluntary dissolution 98. 强制解散 involuntary dissolution 99. 法院解散 judicial dissolution 100.清算 liquidation 101.董事会 board of directors 102.经理 manager103.监事会 board of supervisors 104.累计投票权cumulative voting right 105.任期term106.董事的延期holdover director 107.董事的解除removal of director 108.董事会会议directors’ meeting109.公告notice110.法定人数quorum111.少数lower number112.绝对多数super majority113.自己表决present at vote114.多数higher number115.委员会committee116.细则bylaw117.董事长president; the chairman of the board of directors118.执行董事 the executive director 119.公司秘书secretary120.股东诉讼shareholders ’action121.股东的信息获取权shareholders’ informational right122.股东的帐簿与记录检查权shareholders’ inspect ion of books and records123.公司融资corporation finance 124.财务报告financial report 125.损益表 income statement126.资产负债表balance sheet127.年度报告annual report128.季度报告quarterly report129.掺水股票watered stock130.许可authorization131.发起人promoter132.营业执照 trade charter; business license133.经营范围business scope134.优先购买权pre-emptive right 135.库藏股treasury shares136.受托责任fiduciary duty137.有价证券security138.权益证券equity security139.债务证券debt security140.债券bond141.普通股 common stock142.优先股 preferred stock143.资本capital144.授权且己发行资本authorized and issued capital145.授权资本(名义资本)authorized capital; nominal capital146.己发行资本issued capital147.已缴资本paid—up capital148.待缴资本uncalled capital149.催缴股本 called-up capital 150.保留资本reserve capital151.股权资本 equity capital152.借贷资本 loan capital153.声明股本stated capital154.票面价值 par value,缩写为 PV155.无票面价值 no par value 缩写NPV156.法定资本制 legal capital system 157.授权资本制 system authorized Capital 158.转投资 reinvestment159.资本确定原则prinzipdes festen grund capitals; doctrine of capital determination160.资本维持原则doctrine of capital maintenance161.资本不变原则Prinzipder Bestandingkedes Grund kapitals; doctrine of unchangingcapital162.重组re-classified163.股票再分割sub-divide164.注销cancel165.未发行的股份Unissued capital stock 166.注册资本the registered capital 167.分配 distribution168.公司登记官the Registrar169.合并股份consolidate170.分割股份divide171.库存股treasure stock172.减资决议a resolution for reducing share capital 173.红利股bonus shares174.雇员持股制度an employees’share system175.设立报告incorporators,report176.资本不足inadequate capitalization177.最低资本额制度grundsatz des mindestgrund kapitals 178.商业登记官the commercial Register179.授权资本额the amount of the authorized capital 180.创立主义konstruktionsprinzip、Incorporation181.净资产net assets; net worth182.资本盈余 capital surplus183.缴付盈余 paid-in surplus184.减资盈余reduction surplus185.泡沫法案the bubble act186.合股公司法The joint-stock companies Act 187.泡沫废止法The Bubble Act Repeal Act188.代理理论Principal-agent Theory189.契约的集合nexus of contracts190.越权行为 ultra vires act191.特许公司中chartered corporation192.优先债权人senior creditor193.次位债权subordinated creditor194.公司治理 corporate governance195.股东之公平对待the equitable treatment of shareholders 196.股东之权利the rights of shareholders 197.信息揭露及透明性disclosure and transparency 198.董事会的责任the responsibilities of the board 199.股权代理人proxy200.董事与公司间之交易self-dealing201.动机不纯之公司行为corporate action with mixed motives 202.挪用公司或股东财产the taking of corporate or shareholder property 203.代表诉讼 derivative suit204.少数股东权 derivative action205.董事义务与责任 shareholder' right and liability 206.买回repurchase207.交叉持股 cross ownership208.重整 corporate reorganization209.股东会 shareholder meeting210.董事会 board of directors211.独立董事 Independent Director212.内部董事inside director213.公司经理人officer214.外部监察人 outside supervisor215.执行委员会executive committee216.监察委员会audit committee217.报酬委员会remuneration committee 218.提名委员会nominating committee 219.经营判断原则The Business Judgment Rule 220.关系人交易conflict of interest 221.股份收买请求权 appraisal right 222.资本不足under capitalization223.未遵守公司形式failure to follow corporate formalities224.公司财务报表、功能、或人员之重叠overlap of corporate records, function orpersonnel225.资产混淆commingling of assets 226.股东之支配能力shareholder domination 227.不实陈述misrepresentation228.诈欺fraud229.具有支配权之股东 dominant shareholder 230.公司机会corporate opportunity 231.无表决权股non-voting share232.多数表决权股 multiple-voting share 233.表决权信托voting trust 234.认股选择权制度stock option235.新股认购权warrant236.章程(组织)[英]memorandum of association; articles of association[美]articles;bylaws237.公司分割corporate division238.资本收益capital gain239.公司分立spin-off、split-off 及split-up240.模范公司法model business corporation act 241.注意义务duty of care242.了解公司业务之义务duty to become informed 243.询问义务duty of inquiry244.了解后为决定之义务duty of informed judgment 245.监督义务duty of attention246.忠诚义务duty of loyalty247.与公司为合理交易之义务duty of fair dealing 248.公司债debenture 249.公司债所有者bondholder250.营业执照business license251.承担连带责任assume joint and several liability252.企业改制structural reform253.劳动保护occupational protection 254.职业教育和岗位培训vocational education and on-the-job training255.非货币财产non-currency property 256.按期足额on schedule and in full257.验资证明capital verification certificates 258.出资证明书investment certificates259.关联关系affiliated relations260.资本公积金capital surplus fund261.法定公积金statutory surplus fund262.任意公积金discretionary surplus fund263.记名股票registered shares264.无记名股票bearer shares265.招股说明书prospectus266.认股书subscription form267.国有资产监督管理机构State-owned assets regulatory institution 268.抽逃出资secretly withdraw capital contributions 269.经营方针operational policy。

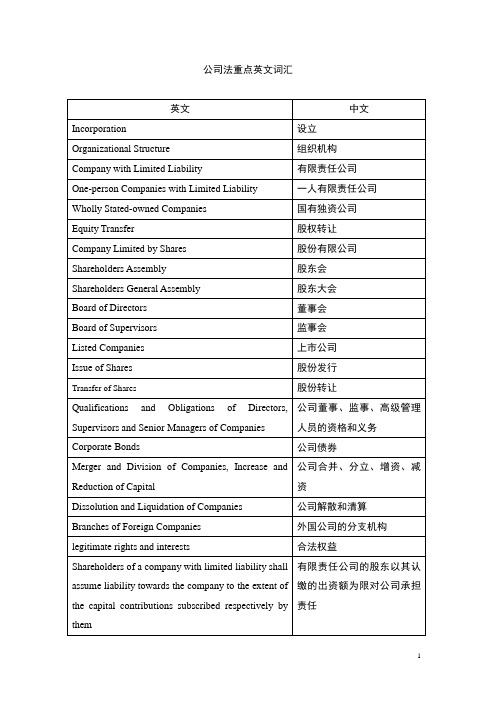

公司法重点英文词汇

executive director

执行董事

serve as

担任

branches

分公司

subsidiaries

子公司

assumejoint and several liability

承担连带责任

preceding paragraph

前款规定

occupational protection

国独资公司

Equity Transfer

股权转让

Company Limited by Shares

股份有限公司

Shareholders Assembly

股东会

Shareholders General Assembly

股东大会

Board of Directors

董事会

Board of Supervisors

公司股东会或者股东大会、董事会的决议内容违反法律、行政法规的无效。

Where the procedures for convening the meeting of the shareholders assembly or the shareholders general assembly, or the board of directors, or the voting formulas are against laws, administrative regulations or the articles of association of a company, or thecontent of the resolution adopted is against the company’s articles of association, the shareholders may, within 60 days from the date the resolution is adopted, request the people’s court to rescind the resolution.

公司法重点英文词汇

外国公司的分支机构

legitimate rights and interests

合法权益

Shareholders of a company with limited 有限责任公司的股东以 liability shall assume liability towards the 其认缴的出资额为限对 company to the extent of the capital 公司承担责任 contributions subscribed respectively by them

损方案

adopt resolution

作出决议

regular meetings

定期会议

interim meetings

临时会议

jointly elected by half and more of the 半数以上股东共同推举 directors

exercise voting rights

行使投票权

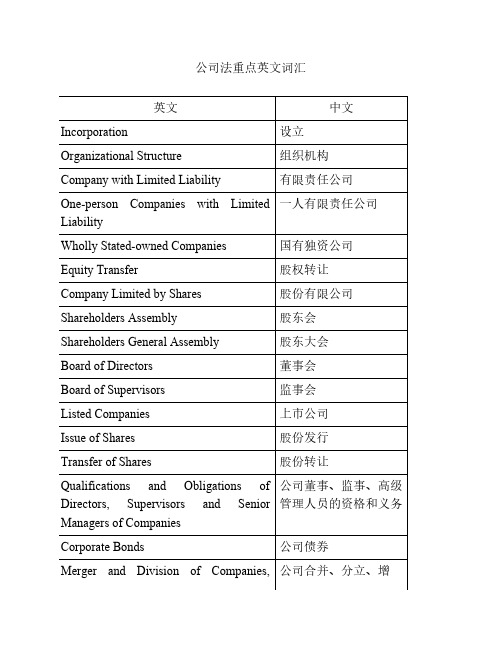

公司法重点英文词汇

英文

中文

Incorporation

设立

Organizational Structure

组织机构

Company with Limited Liability

有限责任公司

One-person Companies with Limited 一人有限责任公司 Liability

Wholly Stated-owned Companies

Where the procedures for convening the 股东会或者股东大会、 meeting of the shareholders assembly or 董事会的会议召集程 the shareholders general assembly, or the 序、表决方式违反法 board of directors, or the voting formulas 律、行政法规或者公司 are against laws, administrative 章程,或者决议内容违 regulations or the articles of association of 反公司章程的,股东可 a company, or the content of the 以自决议作出之日起六 resolution adopted is against the 十日内,请求人民法院 company’s articles of association, the 撤销。 shareholders may, within 60 days from the date the resolution is adopted, request the people’s court to rescind the

公司法英文版

公司法英文版Company LawChapter 1: General Provisions- Article 1: Purpose- Article 2: Definitions- Article 3: Formation of Companies- Article 4: Legal Personality- Article 5: Limited Liability- Article 6: Company Name- Article 7: Registered Office- Article 8: Scope of ApplicationChapter 2: Incorporation- Article 9: Types of Companies- Article 10: Incorporation Procedures- Article 11: Memorandum and Articles of Association - Article 12: Share Capital- Article 13: Registered Agent- Article 14: Corporate Bylaws- Article 15: Corporate Seal- Article 16: Directors and Officers- Article 17: Shareholders' Meetings- Article 18: Shareholders' Rights and Obligations- Article 19: Share TransfersChapter 3: Management and Control- Article 20: Board of Directors- Article 21: Directors' Duties and Liability- Article 22: Directors' Meetings- Article 23: Appointment and Removal of Directors - Article 24: Executive Officers- Article 25: Company Secretary- Article 26: Auditors- Article 27: Shareholders' Meetings- Article 28: Voting Rights- Article 29: Proxy Voting- Article 30: Annual General Meeting- Article 31: Financial ReportingChapter 4: Capital and Shares- Article 32: Share Capital Increase- Article 33: Share Capital Reduction- Article 34: Share Transfers- Article 35: Shareholders' Rights- Article 36: Shareholders' Meetings- Article 37: Dividends- Article 38: Other Distributions- Article 39: Treasury Shares- Article 40: Share Certificates- Article 41: Shareholders' Agreements- Article 42: Capital ReserveChapter 5: Corporate Governance- Article 43: Board of Directors- Article 44: Independent Directors- Article 45: Committees- Article 46: Board Meetings- Article 47: Remuneration of Directors and Officers - Article 48: Related Party Transactions- Article 49: Corporate Auditors- Article 50: Audit Committees- Article 51: Internal Control Systems- Article 52: Disclosure Requirements Chapter 6: Mergers and Acquisitions- Article 53: Merger by Acquisition- Article 54: Merger by Consolidation- Article 55: Share Exchange- Article 56: Transfer of Undertaking- Article 57: Squeeze-out and Sell-out Rights - Article 58: Disclosure of Information- Article 59: Voluntary Dissolution Chapter 7: Liquidation and Bankruptcy- Article 60: Liquidation- Article 61: Distribution of Assets- Article 62: Bankruptcy Proceedings- Article 63: Liquidation Committee- Article 64: Liquidator and Supervisor- Article 65: Debt Priority- Article 66: RestructuringChapter 8: Miscellaneous Provisions- Article 67: Applicable Law- Article 68: Dispute Resolution- Article 69: Penalties and Liability- Article 70: Transition Provisions- Article 71: Amendments to the Law- Article 72: Effective Date。

公司法(部分)翻译中英对照(便于打印版)

英译汉1.A company shall regard its main office as its domicile. 公司以其主要办事机构所在地为住所。

2.The shareholders should affix their signatures or seals to the bylaw of the company. 股东应当在公司章程上签名、盖章。

3.The term "company" as mentioned in this Law refers to a limited liability company or a joint stock company limited set up within the territory of the People's Republic of China according to the provisions of this Law. 本法所称公司是指依照本法在中国境内设立的有限责任公司和股份有限公司。

4.The legitimate rights and interests of a company shall be protected by laws and may not be trespassed. 公司的合法权益受法律保护,不受侵犯。

5.A limited liability company established according to this Law shall include the words of "limited liability company" or "limited company" in its name. 依照本法设立的有限责任公司,必须在公司名称中标明有限责任公司或者有限公司字样。

6.If a company intends to provide guaranty to a shareholder or actual controller of the company, it shall make a resolution through the shareholder's meeting or shareholders' assembly. 公司为公司股东或者实际控制人提供担保的,必须经股东会或者股东大会决议。

CPA经济法英语词汇

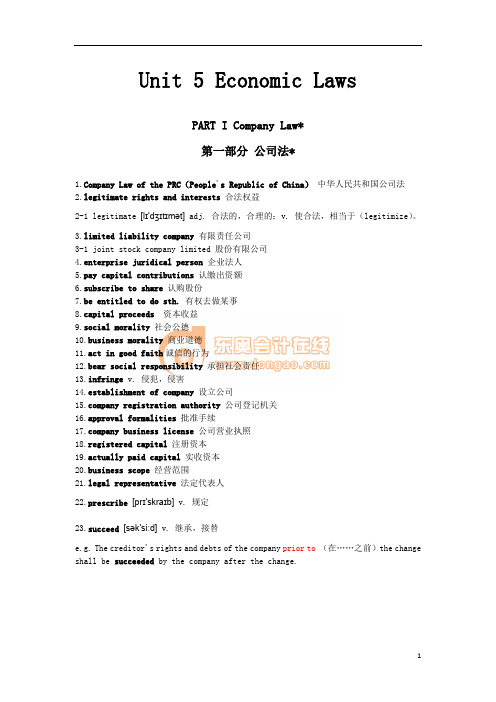

Unit 5 Economic LawsPART I Company Law*第一部分公司法*pany Law of the PRC(People's Republic of China)中华人民共和国公司法2.legitimate rights and interests合法权益2-1 legitimate [lɪ'dʒɪtɪmət] adj. 合法的,合理的;v. 使合法,相当于(legitimize)。

3.limited liability company有限责任公司3-1 joint stock company limited 股份有限公司4.enterprise juridical person企业法人5.pay capital contributions认缴出资额6.subscribe to share认购股份7.be entitled to do sth.有权去做某事8.capital proceeds资本收益9.social morality社会公德10.business morality 商业道德11.act in good faith诚信的行为12.bear social responsibility承担社会责任13.infringe v. 侵犯,侵害14.establishment of company设立公司pany registration authority 公司登记机关16.approval formalities批准手续pany business license公司营业执照18.registered capital注册资本19.actually paid capital实收资本20.business scope经营范围21.legal representative法定代表人22.prescribe[prɪ'skraɪb] v. 规定23.succeed[sək'siːd] v. 继承,接替e.g. The creditor's rights and debts of the company prior to(在……之前)the change shall be succeeded by the company after the change.24.articles of association公司章程e.g. The company established according to this law shall formulate its articles of association which are binding on the company, its shareholders, directors, supervisors and senior managers.【译】设立公司必须依法制定公司章程。

公司法重点英文词汇

ExistingDirector

原董事

decide on the establishment of the internal administrative bodies of the company

决定公司内部管理机构的设置

The one-person one-vote system shall be practiced for voting on resolutions of the board of directors.

Where the shareholder of a company abuses the independent status of the company as a legal person or the limited liability of shareholders, evades debts and thus seriously damages the interests of the creditors of the company, he shall assume joint and several liability for the debts of the company.

公司股东应当遵守法律、行政法规和公司章程,依法行使股东权利,不得滥用股东权利损害公司或者其他股东的利益;不得滥用公司法人独立地位和股东有限责任损害公司债权人的利益。

公司股东滥用股东权利给公司或者其他股东造成损失的,应当依法承担赔偿责任。

公司股东滥用公司法人独立地位和股东有限责任,逃避债务,严重损害公司债权人利益的,应当对公司债务承担连带责任。

Where the shareholder of a company abuses the rights of shareholders and thus causes losses to the company or other shareholders, he shall be liable for compensation according to law.

公司法法律英语

最牛英语口语培训模式:躺在家里练口语,全程外教一对一,三个月畅谈无阻!洛基英语,免费体验全部在线一对一课程:/(报名网址)公司法法律英语关于法律英语,有很多很细致的分类,比如今天小编整理的公司法法律英语就是其一。

这里选编的主要是一些公司法条文的英文,请大家注意学习掌握。

有点生硬,但是不难哦。

1. A company director owes a fiduciary duty to the company.公司董事应对公司负受托人的责任。

2. A company is regarded by the law as a person:an artificialperson.公司被法律认作为“人”:“拟制人”3. An enterprise as a legal person shall conduct operations within the range approved andregistered.企业法人应当在核准登记的经营范围内从事经营。

4. He is a director appointed under the articles of the company.他是一名按公司章程任命的董事。

5. Prior to application for registration, the share capital must be stipulated in the Articles and allshares must be subscribed.在申请注册登记前,在公司章程中必须载明股本额,并且所有股份必须认购完毕。

6. The chairman was personally liable for the company’s debts.洛基英语是中国英语培训市场上的一朵奇葩,是全球已被验证的东方人英语学习的最佳模式。

洛基英董事长对公司债务承担个人责任。

7. The company has complied with the court order.公司履行了法院的命令。

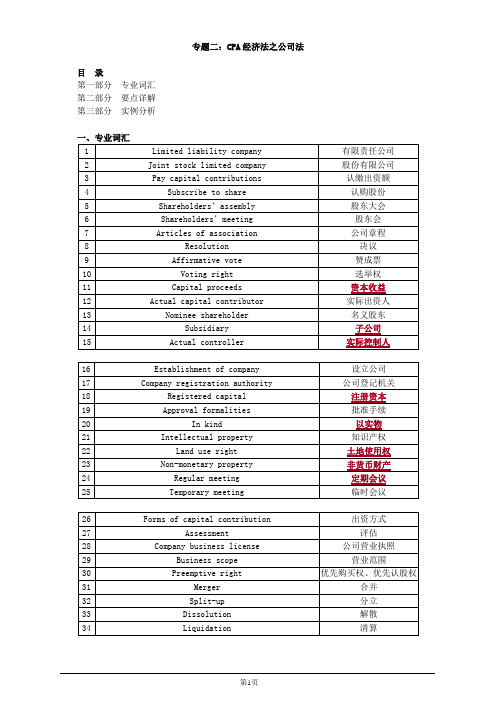

注册会计师-经济法英语基础-专题二:CPA经济法之公司法(19页)

专题二:CPA经济法之公司法目录第一部分专业词汇第二部分要点详解第三部分实例分析一、专业词汇二、要点详解(一)独立法人公司是企业法人,有独立的法人财产,享有法人财产权。

公司以其全部财产对公司的债务承担责任。

有限责任公司的股东以其认缴的出资额为限对公司承担责任;股份有限公司的股东以其认购的股份为限对公司承担责任。

I Independent Legal PersonCompany is an enterprise legal person, which has independent legal person property and enjoys the right to legal person property. It shall bear the liabilities for its debts with all its property.As for a limited liability company, a shareholder shall be liable for the company to the extent of the capital contributions he/she has paid. As for a joint stock limited company, a shareholder shall be liable for the company to the extent of the shares he/she has subscribed for.(二)公司法人权利能力限制1.对外投资的限制公司可以向其他企业投资;但是,除法律另有规定外,不得成为对所投资企业的债务承担连带责任的出资人。

II Restrictions on company’s capacity for civil right1.Restrictions on outward investmentA company may invest in other enterprises. However, unless it is otherwise provided for by any law, it shall not become a capital contributor that shall bear several and joint liabilities for the debts of the enterprises in which it invests.2.担保的限制公司向其他企业投资或者为他人提供担保,按照公司章程的规定由董事会或者股东会、股东大会决议;公司章程对投资或者担保的总额及单项投资或者担保的数额有限额规定的,不得超过规定的限额。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

任的董事、监事

examine and approve

审议批准

annual financial budgept lan and final accounts plan 公司年度预决算方案

of the company

company¡¯splans for profit distribution and for 利润分配方案和弥补亏损方

Corporate Bonds

公司债券

Merger and Division of Companies,Increaseand 公司合并、分立、增资、减

Reduction of Capital

资

Dissolution and Liquidation of Companies

公司解散和清算

Branches of Foreign Companies

making up losses

案

adopt rer meetings

定期会议

interim meetings

临时会议

jointly elected by half and more of the directors 半数以上股东共同推举

exercise voting rights

国有独资公司

Equity Transfer

股权转让

Company Limited by Shares

股份有限公司

Shareholders Assembly

股东会

Shareholders General Assembly

股东大会

Board of Directors

董事会

Board of Supervisors

administrative bodies of the company

置

The one-personone-vote systemshall be practiced 董事会应当对所议事项的决

Where the shareholderof a company abusesthe 公司股东滥用公司法人独立

independent status of the company as a legal perso地n位和股东有限责任,逃避

or the limited liability of shareholderse, vadesdebts 债务,严重损害公司债权人

公司法重点英文词汇

英文

中文

Incorporation

设立

Organizational Structure

组织机构

Company with Limited Liability

有限责任公司

One-person Companies with Limited Liability

一人有限责任公司

Wholly Stated-owned Companies

行使投票权

4

The modes of meeting and voting procedureosf the 股东会的议事方式和表决程

shareholders assembly

序

in addition to what is provided for in this Law

除本法另有规定的外

The term of office of a director

the company¡¯asrticles of association,and shall be 规定,并依法登记

registered according to law

executive director

执行董事

serve as

担任

branches

分公司

subsidiaries

子公司

assume joint and several liability

several liability therefore

investment certificates

出资证明书

roster of shareholders

股东名册

Minutes

备忘录、会议记录

draw dividends

分取红利

secretly withdraw capital contributions

监事会

Listed Companies

上市公司

Issue of Shares

股份发行

Transfer of Shares

股份转让

Qualifications and Obligations of Directors, 公司董事、监事、高级管理

Supervisors and Senior Managers of Companies 人员的资格和义务

Where the shareholderof a company abusesthe 公司股东滥用股东权利给公 rights of shareholdersand thus causeslossesto the 司 或 者 其 他 股 东 造 成 损 失 company or other shareholders, he shall be liable fo的r ,应当依法承担赔偿责任。 compensation according to law.

验资证明

Submit

报送

make up the difference

补足差额

others who are shareholdersat the time of the 公司设立时的其他股东承担

incorporation of the company shall bear joint and 连带责任

承担连带责任

preceding paragraph

前款规定

occupational protection

劳动保护

vocational education and on-the-job training

职业教育和岗位培训

structural reform

企业改制

major issues in business operation

the shares subscribed respectively by them

任

actually received capital

实收资本

registered capital

注册资本

business license

营业执照

The business scope of a company shall be defined公in司的经营范围由公司章程

the capital contributionssubscribedrespectivelyby 责任

them

1

shareholdersof a company limited by sharesshall 股份有限公司的股东以其认

assume liability towards the company to the extent 购of的股份为限对公司承担责

breach of contract towards the shareholderswho 资的股东承担违约责任

have, on scheduleand in full, made their capital

contributions.

capital verification certificates

non-currency property

非货币财产

on schedule and in full

按期足额

in addition to paying to the company of his portion o除f 应当向公司足额缴纳外,

3

the capital contributions in full, he shall be liable for还应当向已按期足额缴纳出

外国公司的分支机构

legitimate rights and interests

合法权益

Shareholders of a company with limited liability sha有ll 限责任公司的股东以其认

assume liability towards the company to the extent 缴of的出资额为限对公司承担

董事的任期

A director may, if reelectedupon expiration of his 董事任期届满,连选可以连

term of office, serve consecutive terms.

任

Existing Director

原董事

decide on the establishment of the internal 决定公司内部管理机构的设

and thus seriously damagesthe interests of the 利益的,应当对公司债务承

creditorsof the company,he shall assumejoint and 担连带责任。

several liability for the debts of the company.

directors of a company,which in content violates 律、行政法规的无效。

laws or administrative regulations, shall be invalid.

Where the proceduresfor conveningthe meetingof 股东会或者股东大会、董事

抽逃出资

operational policy

经营方针

investment plan

投资计划