CASE-IN-POINT-咨询行业面试案例分析

咨询公司面试案例咨询入门系列:咨询案例分析

Firm: A.T. KearneyCase Number:Case setup (facts offered by interviewer):Your client is a U.S. based oil refineryThe refinery has a single location and is a small to medium-sized refineryYour client, although profitable, believes it is lagging behind the competition and could improve You are brought in as part of a joint consultant-client team that will review overall operations and make recommendations on ways to improve the bottom lineYou have been assigned to work with the maintenance divisionThe maintenance department’s primary objective is to prevent equipment failure and to repair equipment when it does failUnderstanding of its organization is important. It consists of three primary areas: nine assets areas, one central maintenance area and one group of contractors. The first two areas are employees of the client, the third an external source of labor.An asset is a physical area of the plant that contains various pieces of equipment (pumps, heat exchangers, etc.). There are nine assets. Each asset has a Maintenance Supervisor who is responsible for all maintenance to be performed in his/her asset. Working for the MaintenanceSupervisor in each asset is, on average, eleven “craftsmen”. The craftsmen are the actual workers that perform the maintenance. The craftsmen are unionized and divide into twelve different craft designations (e.g. electricians, pipefitters, welders, etc.). Each craft designation has a defined set of skills they are qualified to perform. They are not allowed to perform skills outside of their defined craft, or help in the performance of activities involving skills beyond their craft. Collectively the twelve different crafts can perform any maintenance job that might arise at the refinery. The maintenance supervisor and his/her assigned craftsmen are “hardwired” to their asset. That is, they work only on equipment in their given asset.Central maintenance is a centralized pool of Maintenance Supervisors and Craftsmen, who are dispatched to support the different assets during times of high workload. They are employees of your client and fit the description contained in the above Asset explanation. The only difference is that they may work in any of the different assets as determined by workload. There are a total of 11 Maintenance Supervisors and 100 Craftsmen that comprise Central Maintenance Contractors are a group of outside Supervisors and Craftsmen who support your client during times of high workload. They also are capable of performing any maintenance job that may arise, but differ from your client’s Craftsmen in that they divide the collective skills required into five designations rather than twelve. Thus, the craftsmen of the contractor are capable of performing a broader set of skills. They, like your client’s craftsmen, don’t perform skills outside of their defined craft but do allow different craft designations to help each other. There are an average of 7 contractor Maintenance Supervisors and 140 contractor Craftsmen at the refinery on any given day.Question:What opportunities exist to increase profits?What recommendations can you make to capture savings related to the identified opportunities?What are the cost savings associated with your recommendations?Suggested solutions:The first question involves identifying opportunities to improve profits. The candidate must start with either revenues or costs. Although one could make the argument that maintenance supports revenue by maximizing the operating time of the refinery equipment, maintenance should be seen to be a support function. Thus, it is more appropriate to focus on costs and cost reduction. The following questions will help the candidate gain insight into cost reduction opportunities.How does the maintenance department track its costs?If the candidate phrases the question about material or overhead costs, the interviewer would inform the candidate that detailed reviewed showed no major opportunities. The candidatewould be steered toward labor costs and given the following tables regarding maintenance labor costs for the past year.To support understanding of the following tables, Turnaround work is long term preventive maintenance (e.g. complete rebuilding of a boiler) that may be performed once every few years.All other work (short term emergency repairs, small scale preventive maintenance, other routine work, etc.) fits into the category of Daily workCraftsmen Daily work Turnaround TotalClient$ 8MM$ 2MM$ 10MMContractor$ 5MM$ 9MM$ 14MMTotal$ 13MM$ 11MM$ 24MMSupervisor TotalClient$ 1MMContractor$ 0.5MMTotal$ 1.5MM pursue cost savings opportunities in this area first.What is the utilization of Craftsmen in the assets? In central maintenance? And for contractors?Assume each area is utilized 100% of the time, 50 weeks per year, 40 hours per week.How does the labor cost of craftsmen ($24MM) on a refinery-sized basis (i.e., $cost / per barrel of crude oil processed) compare with industry averages?Consulting your industry data base shows that costs appear to be about 20% above the average of peer refineries.This is an important question to determine if ther e is a problem with costs (don’t assume there is, the client may be performing better than industry average!)Is there any particular reason why turnaround work is so heavily skewed toward contractors?Turnaround work tends to be more cyclical. An external workforce is used to absorb some of this additional work. Keep in mind that both client and contractor Craftsmen are capable of performing any maintenance job at the plant.After further analysis of the tables the key fact that should become appear odd is the large difference in the cost per unit of labor between your client’s Craftsmen and the outside contractor’s Craftsmen. Often candidates will ask for the hourly wage rates of these two groups. There is sufficient data to calculate these numbers. The calculation is:Annual cost of client craftsmen = $10MM/ ( 11 Craftsmen/asset x 9 assets + 100Craftsmen inCentral maintenance)= $50,000 / yearAnnual cost of contractor craftsmen = $ 14 MM/ 140 contractor Craftsmen= $100,000 / yearAgain, this difference should provoke a series of questions to understand the difference.Is there any difference in the work performed by the client and contractor craftsmen?No, other than the different levels of Turnaround work vs. Daily work performed as noted in the previous table. Both groups are capable of doing any job with roughly equal levels of quality.Is there any difference in efficiency between the two groups of Craftsmen?The candidate would at this point be asked how they would measure this.After reaching an understanding of the difficulty involved in measuring the efficiency of aworkforce (especially a unionized workforce), the candidate would be told that through a series of interviews with maintenance supervisors, there is a consensus that contractor Craftsmen are roughly twice as productive as client craftsmen.This is a critical point in the case. The candidate must recognize that in the present environment the client is largely indifferent about units of labor. You can have a client worker who is half as efficient or a contractor worker who is twice as expensive. The key now is to determine if there are ways to create an opportunity where the client would no longer be indifferent.What is causing the inefficiencies asso ciated with the client’s labor?Again, the candidate would be encouraged to offer their own ideas.After some discussion the candidate would be told that many of the Maintenance Supervisors complain endlessly about restrictions placed on them by the existing union labor contract and the tightness of craft designations.The interviewer would probe to ensure the candidate understands why the present craftdesignation create the inefficiencies. Essentially work is too finely divided. It makes planning and supervision extremely cumbersome. As an example, if one of six crafts required to perform a job is absent or late, the entire job must shut down, as craft designations are not allowed tosupport other craft designations.Is it possible to change the existing union contract?The present labor contract is a three year contract that is due to be renegotiated/renewed in six months.Will the union resist changes to the existing contract?Indeed!!At this point, the candidate should recognize a major (albeight difficult) opportunity to reduce labor costs. The client would essentially like to have its own employees look and function like its contractors, but continue to get paid at present rates. In reality, management will need to make wage concessions in order to change present work practices. However, through planned negotiations a scenario can be created which presents a favorable opportunity for your client to begin to replace outside contractors with its own Craftsmen.There are several ways to address the third question of the case, the actual savings that might be achieved. One quick method is to assume that these changes would bring maintenance costs back in line with industry average. Utilizing the cost benchmark mentioned earlier, one could assume costs could be reduced to $24MM/1.20 = $20MM, a $4MM savings.A se cond, and more detailed, method would be to take the extreme scenario where the client’s Craftsmen is paid its present rate, but is made as efficient as the contractor’s Craftsmen. In this case, you begin with the present level of 200 client craftsmen who are functioning as 100 equivalent contractor Craftsmen (they’re one-half as efficient). By improving their efficiency, you are effectively “creating” 100 equivalent contractors. Thus, you are immediately able to replace 100 contractors and save $10MM. This could be taken one step further by assuming you would want to replace all contractors. This would save an additional $2.5MM ($4MM existing contractor expense - $2MM required to hire additional client craftsmen + $0.5MM in contractor supervisors). As noted earlier, in reality, this approach would require wage concessions to the union, so actual savings may be something significantly less.Key takeaways:This case requires the candidate to quickly digest a large amount of organizational issues and then quickly check some ratios to uncover the basic problem (the client workforce is inefficient). Creativity must then be used to structure a recommendation that would create a more favorable situation for the client. As in other cases, acceptable solutions need not follow the exact method above nor cover all of the above points.。

咨询公司case分析方法共11页word资料

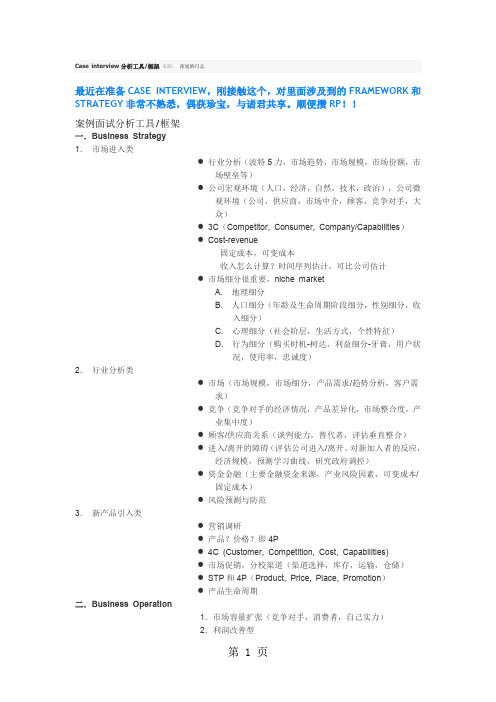

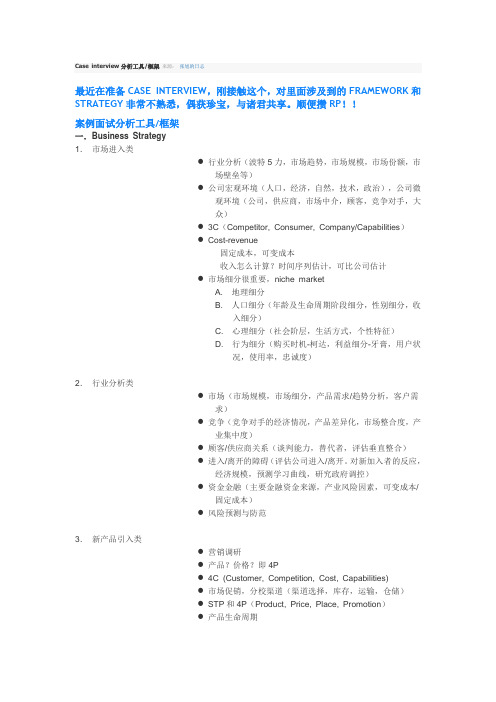

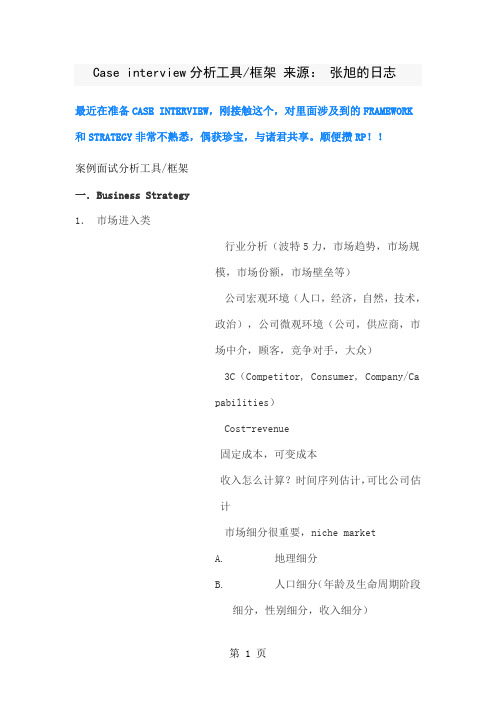

Case interview分析工具/框架来源:张旭的日志最近在准备CASE INTERVIEW,刚接触这个,对里面涉及到的FRAMEWORK和STRATEGY非常不熟悉,偶获珍宝,与诸君共享。

顺便攒RP!!案例面试分析工具/框架一.Business Strategy1.市场进入类●行业分析(波特5力,市场趋势,市场规模,市场份额,市场壁垒等)●公司宏观环境(人口,经济,自然,技术,政治),公司微观环境(公司,供应商,市场中介,顾客,竞争对手,大众)●3C(Competitor, Consumer, Company/Capabilities)●Cost-revenue固定成本,可变成本收入怎么计算?时间序列估计,可比公司估计●市场细分很重要,niche marketA.地理细分B.人口细分(年龄及生命周期阶段细分,性别细分,收入细分)C.心理细分(社会阶层,生活方式,个性特征)D.行为细分(购买时机-柯达,利益细分-牙膏,用户状况,使用率,忠诚度)2.行业分析类●市场(市场规模,市场细分,产品需求/趋势分析,客户需求)●竞争(竞争对手的经济情况,产品差异化,市场整合度,产业集中度)●顾客/供应商关系(谈判能力,替代者,评估垂直整合)●进入/离开的障碍(评估公司进入/离开。

对新加入者的反应,经济规模,预测学习曲线,研究政府调控)●资金金融(主要金融资金来源,产业风险因素,可变成本/固定成本)●风险预测与防范3.新产品引入类●营销调研●产品?价格?即4P●4C (Customer, Competition, Cost, Capabilities)●市场促销,分校渠道(渠道选择,库存,运输,仓储)●STP和4P(Product, Price, Place, Promotion)●产品生命周期二.Business Operation1.市场容量扩张(竞争对手,消费者,自己实力)2.利润改善型●Revenue, Cost分析,到底是销售额下降造成,还是成本上升造成●如果销售额下降,看4P了(是价格过高?产品质量问题?分校渠道问题?还是promotion的efficacy有问题?)●如果成本上升,看固定成本or可变成本是否有问题?(固定成本过高,设备是否老化,需要关闭生产线、厂房,降低管理者工资等,可变成本过高,看原材料价格是否上升,有没有降低的可能,switch suppliers? 还是人员工资过高,需要裁员等)●成本结构是否合理,产能利用率如何(闲置率)3.推销任何一种产品/服务●4P,3c4.定价●以成本为基础的定价成本加成定价,以目标利润(盈亏平衡定价)●以价值为基础定价●以竞争为基础定价三.Market Sizing/Estimation●市场趋势,市场规模,市场份额,市场壁垒等●市场集中度●市场驱动因素(价格,服务,质量,外观)●关键成功要素KSF四.M&A类●整合原因(synergy, scale, management impulse, Taxconsideration, Diversification, Breakup Value)●5C(Character, Capacity, Capital, Conditions, Competitive Advantage)●类型:horizontal, vertical, congeneric, conglomerate●估值方法:DFC,Market Multiple( EBITDA,P/E,P/B)●DFC:Pro Forma Cash Flow Statement,Discount Rate●Hostile VS Friendly takeovers所有咨询公司面试可能用到的分析结构Advanced concepts & frameworksMBAs and other candidates with business background, take note - interviewers will expect you to have a more detailed take on your case than an undergrad uate would have. Here are some commonly used case concepts.Net present valuePerhaps the most important type of decision company managers must make o n a daily basis is whether to undertake a proposed investment. For example, should the company buy a certain piece of equipment? Build a particular facto ry? Invest in a new project? These types of decisions are called capital budgeting decisions. The consultant makes such decisions by calculating the net pres ent value of each proposed investment and making only those investments tha t have positive net present values.Example: Hernandez is the CFO of Western Manufacturing Corp., an automobil e manufacturer. The company is considering opening a new factory in Ohio th at will require an initial investment of $1 million. The company forecasts that t he factory will generate after-tax cash flows of $100,000 in Year 1, $200,000 in Year 2, $400,000 in Year 3, and $400,000 in Year 4. At the end of Year 4, the company would then sell the factory for $200,000. The company uses a discount rate of 12 percent. Hernandez must determine whether the company should go ahead and build the factory. To make this decision, Hernandez must calculate the net present value of the investment. The cash flows associated with the factory are as follows:Hernandez then calculates the NPV of the factory as follows:Since the factory has a negative net present value, Hernandez correctly decide s that the factory should not be built.The net present value ruleNote from the example above that once the consultant has figured out the NP V of a proposed investment, she then decides whether to undertake the invest ment by applying the net present value rule:Make only those investments that have a positive net present value.As long as the consultant follows this rule, she can be confident that each inv estment is making a positive net contribution to the company.The Capital Asset Pricing Model (CAPM)In the above example, we assumed a given discount rate. However, part of a consultant's job is to determine an appropriate discount rate (r) to use when c alculating net present values. The discount rate may vary depending on the in vestment.BetaThe first step in arriving at an appropriate discount rate for a given investmen t is determining the investments riskiness. The market risk of an investment i s measured by its "beta" (?), which measures riskiness when compared to the market as a whole. An investment with a beta of 1 has the same riskiness a s the market as a whole (so, for example, when the market moves down 10 percent, the value of the investment will on average fall 10 percent as well). An investment with beta of 2 will be twice as risky as the market (so when th e market falls 10 percent, the value of the investment will on average fall 20 percent).CAPMOnce the consultant has determined the beta of a proposed investment, he can use the Capital Asset Pricing Model (CAPM) to calculate the appropriate disc ount rate (r):The risk-free rate of return is the return the company could receive by makin g a risk-free investment (for example, by investing in U.S. Treasury bills). The market rate of return is the return the company could receive by investing in a well-diversified portfolio of stocks (for example, S&P 500).Example: Shen, Inc., a coal producer, is considering investing in a new ventur e that would manufacture and market carbon filters. Shen's chief financial offic er, Apelbaum, wants to calculate the NPV of the proposed venture in order to determine whether the company should make the investment. After studying t he riskiness of the proposed venture, Apelbaum determines that the beta of th e investment is 1.5. A U.S. Treasury note of comparable maturity currently yie lds 7 percent, while the return on the S&P 500 stock index is 12 percent. The refore, the discount rate Apelbaum will use when calculating the NPV of the in vestment will be:Although this is an overly simplified discussion of how consultants calculate dis count rate to use in their cash-flow analysis, it does give you an overview of how consultants incorporate the notion of an investment's market to select the appropriate discount rate.Porter's Five ForcesDeveloped by Harvard Business School professor Michael Porter in his book Co mpetitive Strategy, the Porter's Five Forces framework helps determine the att ractiveness of an industry. Before any company expands into new markets, di vests product lines, acquires new businesses, or sells divisions, it should ask it self, "Is the industry we're entering or exiting attractive?" By using Porter's Fi ve Forces, a company can begin to develop a thoughtful answer. Consultants f requently utilize Porter's Five Forces as a starting point to help companies eval uate industry attractiveness.Take, for example, entry into the copy store market (like Kinko's). How attract ive is the copy store market?Potential entrants: What is the threat of new entrants into the market? Copy s tores are not very expensive to open - you can conceivably open a copy store with one copier and one employee. Therefore, barriers to entry are low, so th ere's a high risk of potential new entrants.Buyer power: How much bargaining power do buyers have? Copy store custo mers are relatively price sensitive. Between the choice of a copy store that ch arges 5 cents a copy and a store that charges 6 cents a copy, buyers will usu ally head for the cheaper store. Because copy stores are common, buyers hav e the leverage to bargain with copy store owners on large print jobs, threatening to take their business elsewhere. The only mitigating factors are location a nd hours. On the other hand, price is not the only factor. Copy stores that ar e willing to stay open 24 hours may be able to charge a premium, and custo mers may simply patronize the copy store closest to them if other locations ar e relatively inconvenient.Supplier power: How much bargaining power do suppliers have? While paper p rices may be on the rise, copier prices continue to fall. The skill level employe es need to operate a copy shop (for basic services, like copying, collating, etc.) are relatively low as well, meaning that employees will have little bargaining power. Suppliers in this situation have low bargaining power.Threat of substitutes: What is the risk of substitution? For basic copying jobs, more people now possess color printers at home. Additionally, fax machines h ave the capability to fulfill copy functions as well. Large companies will normal ly have their own copying facilities. However, for large-scale projects, most in dividuals and employees at small companies will still use the services of a cop y shop. The Internet is a potential threat to copy stores as well, because som e documents that formerly would be distributed in hard copy will now be post ed on the Web or sent through e-mail. However, for the time being, there is s till relatively strong demand for copy store services.Competition: Competition within the industry appears to be intense. Stores oft en compete on price, and are willing to "underbid" one another to win printing contracts. Stores continue to add new features to compete as well, such as e xpanding hours to 24-hour service and offering free delivery.From this analysis, you can ascertain that copy stores are something of a com modity market. Consumers are very price-sensitive, copy stores are inexpensiv e to set up, and the market is relatively easily entered by competitors. Advan ces in technology may reduce the size of the copy store market. Value-added services, such as late hours, convenient locations, or additional services such as creating calendars or stickers, may help copy stores differentiate themselve s. But overall, the copy store industry does not appear to be an attractive one.As dot-coms come under fire, one case question we've heard increasingly is " How would you create barriers to entry as an Internet Startup?"Product life cycle curveIf you're considering a product case, figure out how "mature" your product or service isStrategy tool/framework chartHere's one way to think about the choice between being the lowest-cost provi der or carving out a higher-end market niche - what consultants call differenti ation.The Four PsThis is a useful framework for evaluating marketing cases. It can be applied t o both products and services. The Four Ps consist of:PriceThe price a firm sets for its product/service can be a strategic advantage. For example, it can be predatory (set very low to undercut the competition), or it can be set slightly above market average to convey a "premium" image. Consi der how pricing is being used in the context of the case presented to you. ProductThe product (or service) may provide strategic advantage if it is the only prod uct/service that satisfies a particular intersection of customer needs. Or it may simply be an extension of already existing products, and therefore not much of a benefit. Try to tease out the value of the product in the marketplace bas ed on the case details you have been given.Position/PlaceThe physical location of a product/service can provide an advantage if it is sup erior to its competition, if it is easier or more convenient for people to consu me, or if it makes the consumer more aware of the product/service over its c ompetition. In the context of a business case, you may want to determine the placement of the product or service compared to its competition.PromotionWith so much noise in today's consumer (and business to business) marketpla ce, it is difficult for any one product/service to stand out in a category. Promo tional activity (including advertising, discounting to consumers and suppliers, c elebrity appearances, etc.) can be used to create or maintain consumer aware ness, open new markets, or target a specific competitor. You may want to sug gest a promotional strategy in the context of the case you are presented relati ve to the promotional activity of other competing products/services.The Four CsThe Four Cs are especially useful for analyzing new product introductions and for industry analysis.CustomersHow is the market segmented?What are the purchase criteria that customers use?CompetitionWhat is the market share of the clients?What is its market position?What is its strategy?What is its cost position?Does he/she have any market advantages?CostWhat kind of economies of scale does the client have?What is the client's experience curve?Will increased production lower cost?CapabilitiesWhat resources can the client draw from?How is the client organized?What is the production system?The Five CsThis framework is mostly applied to financial cases and to companies (althoug h it can be applied to individuals). You may employ it in other situations if yo u think it is appropriate.CharacterEvaluate the dedication, track record, and overall consumer perception of the company. Are there any legal actions pending against the company? If so, for what reason? Is the company progressive about its waste disposal, quality of l ife for its employees, and charitable contributions? What sort of impact would this have on the case you are evaluating?CapacityIf you are dealing with a manufacturing entity, are its factories at, above, or below capacity, and for what reasons? Are there plans to add new plants, imp rove the technology in existing plants, or close underperforming plants? What about production overseas?CapitalWhat is the company's cost of capital relative to its competitors? How healthy are its cash flows, revenues, and debt load relative to its competition? ConditionsWhat is the current business climate the company (and its industry) faces? W hat is the short- and long-term growth potential in the industry? How is the market characterized? Is it emerging or mature? These questions can assist yo u in evaluating the facts of the case against the environment that the compan y/industry inhabits.Competitive AdvantageThis is the unique edge a company possesses over its competitors. It can be an unparalleled set of business processes, the ability to produce a product/ser vice at a lower cost, charge a market premium, or any number of other asset s that create an advantage over other market players. Whatever the case, the se advantages are usually defensible and not easily copied.In evaluating business cases using the Five Cs framework, you should look for those unique qualities that a company possesses and identify any that meet t he criteria mentioned above. You may suggest that the company leverage its competitive advantage more aggressively or recommend alternatives if that co mpany has no discernible advantage.Value Chain AnalysisThis approach involves assessing a company's overall business processes and i dentifying where that company actually adds value to a product or service. Th e total margin of profit will be the value of the product or service to buyers, l ess the cost of its production, as determined by the value chain.In most cases, a competitive advantage is only temporary for many of today's products/services. Being first to market, having a unique formula or configura tion, or having exclusivity in a market were once long-term defensible strategi es. But today, businesses are globally connected by lightning-fast communicati ons and knowledge-sharing systems and manufacturing technologies are gettin g better and faster at reacting to and anticipating market conditions. Thus the se advantages are only fleeting or may not exist at all.Value Chain Analysis attempts to identify a competitive advantage by deconstr ucting the various "changes" a company's business processes perform on a set of raw materials or other inputs. Most can be easily copied by other competit ors, but there is usually a unique subset that represents the "value-added" qu alities only the company under scrutiny possesses. This set is that company's competitive advantage, or "value chain." Sometimes this set can be copied, bu t a unique set of circumstances may still allow the company in question to per form them at a lower cost, charge a premium in the market, or retain higher market share than its competitors.In the context of a business case, you can use this framework to identify a co mpany's overall business processes set and then determine if one or more of t he processes are defensible competitive advantages.For example, a manufacturer of fruit juice might have the following value chai n elements:•Research and development (Will mango really taste good with cloudberry juic e?)•Cost of goods sold (How much does it cost to manufacture the fruit juice? Is there a frost in Florida that drives up the costs of oranges? Is the currency c risis in Indonesia making papaya very cheap? Are per-volume purchases lower than, for example, those of Tropicana?)•Packaging and shipping (How much does that new banana-shaped container c ost? Are many bottles lost in transit? What are the fixed costs of shipping?) •Manufacturing (How much do those juice pulpers cost? How often do factories need to be reengineered?)•Labor (How many employees do we have? Where are they located? Are they unionized?)•Distribution (Where are the distribution centers? Where are the products distri buted?)•Advertising (Billboards, TV, magazines?)•Margin (How profitable is the juice company?)For more detailed information on this type of analysis, you may want to consider the authoritative text on competitive strategy: Competitive Strategy: Tech niques for Analyzing Industries and Competitors, by Michael E. Porter.Core competencies"Core competencies" is the idea that each firm has a limited number of things it is very good at (that is, its core competence or competencies).When restructuring or reengineering, one of the starting points for a company should be identifying its core competencies. A firm should define its core com petencies broadly in order to be flexible enough to adapt to changes in the m arketplace. (For instance, when Xerox defined itself as a "document company," rather than a maker of copy machines, it was able to take advantage of the more lucrative business of document handling and outsourcing for major corpo rations, as well as of the market for fax machines, scanners, and other docum ent-handling equipment.)Companies should seriously consider selling/spinning off business units that ar e not part of their "core" business. For instance, Pepsi recently spun off its re staurant operations after it concluded that its expertise was in manufacturing and marketing beverages, not in managing restaurants.Benchmarking and "best practices"A commonly used concept in consulting (especially in operations and implemen tation engagements) is "benchmarking." Benchmarking basically means researc hing what other companies in the industry are doing (usually in order to evalu ate whether your client is operating efficiently or to identify areas where the c lient can cut costs). For example, if a mail-order company wants to reduce its order-processing costs, it would want to compare its order processing costs w ith those of other mail-order companies, breaking down its costs for each part of the process (including order-taking and shipping) and comparing them with industry averages. It can then pinpoint those areas where its costs are higher than average for the industry.A related concept is "best practices": once you've benchmarked what other co mpanies are doing, you want to focus on those companies that have particular low costs or which otherwise operate particularly well. What are they doing ri ght (i.e., what are their "best practices")? And how can our client (in the case) emulate or copy what they're doing? Remember to look outside your client's particular industry, if necessary, to find the best practices for a particular proc ess or operation.The 2x2 matrixThe 2x2 matrix is a good framework to use any time you have two factors th at, when combined, yield different outcomes. A very rudimentary example wou ld be what happens when you turn on your bathroom faucets, as follows:A more business-appropriate example would involve acquiring a company. Let? s say a company is interested in understanding the difficulty of acquiring or b uilding a distribution center and it is considering financing this decision with ei ther stock or debt. The potential outcomes might look like this:The BCG MatrixThe BCG Matrix, named after the Boston Consulting Group (BCG), is perhaps t he most famous 2x2 matrix. The matrix measures a company's relative marke t share on the horizontal axis and its growth rate on the vertical axis.M&A cases: Determining the value of an acquisitionCase interviews aren't just for consultants. Mergers & acquisition cases are wil dly popular at investment banks. Here's how to analyze a potential acquisition.Value Drivers (M&A) FrameworkIn order to understand value, we need to understand the three primary value drivers:The value components can be further broken out into specific "value drivers":M&A Cases: Data Gathering and AnalysisMarket Analysis Tools• Competitive position framework• Relative value versus competitors to customer through supply chain• Product life cycle• Supply and demand analysis- Industry capacity- Industry utilization- Demand drivers- Regressions• Segmentation analysis• Porter's Five Forces• Experience curves• Trends and outlook• Key success factorsTarget Analysis Tools• Business system - comparison with competitors• Market share (over time and by segment)• Capacity (growth and utilization of)• Customer's key purchase criteria and relative performance• Financial history• Sales and profitability by segment• Cash flow analysis• Margin and expense structure• Relative cost position• Cost benchmarkingYour data gathering strategy will vary depending on industry:A framework cautionAll the frameworks detailed above are widely used, and most U.S. business sc hools teach them as part of their core curriculums. Your interviewers will insta ntly recognize when you are applying them, since they are already familiar wit h the techniques. While this is OK, consider that you are trying to demonstrat e your unique analytical and deductive reasoning skills that set you apart from other candidates. You must be creative and original in analyzing case questio ns. Use these frameworks sparingly. (Another note: No interviewer will be imp ressed if you proudly proclaim, "I'm going to apply Porters Five Forces now." Apply frameworks without identifying them.)第 11 页。

咨询公司面试案例分析指南咨询面试系列a完整版

咨询公司面试案例分析指南咨询面试系列a 集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]Firm: A.T. KearneyCase Number:Case setup (facts offered by interviewer):Your client is a manufacturer of bicyclesThey have been in business for 25 yearsThey manufacturer and sell three categories of bicycles:Racing bikes: High end, high performance bikes for sophisticated cyclists Mainstream bikes: Durable, but not overly complicated bikes for everyday ridersChildren’s bikes: Small er, simpler versions of their mainstream bikes for childrenProfits at your client have decreased over the past five yearsQuestion:What is driving the decline in overall profits?What recommendations might correct the situation?Suggested solutions:The first question is to determine what has caused overall profits to decrease. To accomplish this the candidate must first understand what has transpired in each of the three product categories over the past five years during which profitability has slipped. The following are questions and answers that would be provided in an interview scenario.What are the client’s margins for a bicycle in each of the threesegments?Racing: Cost = $600/unit, Profit=$300/unitMainstream: Cost = $250/unit, Profit = $75/unitChildren’s: Cost = $ 200/unit, Profit = $50/unitWhat has happened to the market size of each of the three segments over the past five years?Racing: Has remained constant at its present size of $300MMMainstream: Has increased at 2% growth rate per year to its present size of $1.0BChildren’s: Has increased at 3% growth rate per year to its present size of $400MMWhat has happened to our client’s market share in each of these segments?Racing: Market share has decreased from 60% to 30%Mainstream: Market share has increased from 0% to 5%Children’s: Market share has increased from 0% to 3%Who are the client’s major competitor’s in each market segment What has happened to their market share in each segment over the past five yearsRacing: There is one main competitor and a host of small firms. Your main competitor has increased market share from 30% to 50%Mainstream: There exist many, large competitors, none of which holds more than 10% of the marketChildren’s: As in the mainstream segment, there are m any competitors, none with more than 10% of the marketThe above information provides enough information to put together a picture of why profits have decreased over the past five years : Your client, with a commanding position in a flat market segment (ra cing), expanded into new segments (mainstream and children’s). As this occurred, market share decreased dramatically in the most lucrative segment (racing), creating an unfavorable mix.The extent to which profits have decreased can be deduced from some quick math : profits have slipped from $60MM five years ago (=60% x $300MM x 33% racing margin) to $44MM today ( = (30% x $300MM x 33% racing margin) + (5% x $1B x 23% mainstream margin) + (3% x $400MMx 20% children’s margin)).The dramatic decrease in market share in the racing segment is at this point still unexplained. Questions that would help formulate an explanation include:Have there been any major changes in product quality in your client’s racing product Or in its main competitor’s racing productNoHave there been any major price changes in your client’s racing product Or in its main competitor’s racing productNoHave there been any major changes in distribution outlets for your client’s racingproduct Or for its main competitor’s racing productYes. Previously your client and its main competitor in the racing segment soldexclusively through small, specialty dealers. This remains unchanged for the competition.Your client, however, began to sell its racing bikes through mass distributors anddiscount stores (the distribution outlets for mainstream and children’s bikes) as it entered the mainstream and children’s segment.How do the mass distributors and discount stores price the racing bikes relative to the specialty stores?Prices at these stores tend to be 15 to 20% less.What percent of your client’s racing sales occur in mass distributors and discountstores?Effectively none. This attempt to sell through these distributors has failedHow has the decision to sell through mass distribut or’s and discount stores affected the image of the client’s racing product?No studies have been done.How has the decision to sell through mass distributor’s and discount stores affected your client’s relationship with the specialty outlets?Again, no formal analysis has been performed.Although some analysis and/or survey should be performed to answer more conclusively thelast two questions, a possible story can be put together. There has been no appreciablechange in either quality or price (or any oth er tangible factor) of your client’s racing product relative to its competition. It is not the product that is the problem, but rather its image. As your client came out with lower end, mainstream and children’s products and began to push their racing segment through mass distributors and discount outlets, their reputation was compromised. Additionally, the presence of the racing products in the discount outlets has put your historic racing distributor (the specialty shops) in a precarious position. The specialty shops must now lower price to compete, thereby cutting their own profits. Instead, they are likely to push the competition’s product. Remember, your client has no direct salesforce at the retail outlets. The specialty shops essentially serve as your client’s sales force.The above analysis offers an explanation of what has affected the top side of the profitability problem. Still to be examined is the cost, or bottom side, of theprofitability issue. Questions to uncover cost issues would include:How does the client account for its costs?The client has a single manufacturing and assembly plant. They have separate lines in this facility to produce racing, mainstream and children’s products. They divide their costs into the following categories: labor, material and overhead. Overall costs have been increasing at a fairly hefty rate of 10% per year.What is the current breakdown of costs along these categories for each product segment?Racing: Labor = 30%, Material = 40%, Overhead = 30%Mainstream: Labor = 25%, Material = 40%, Overhead = 35%Children’s: Labor = 25%, Material = 40%, Overhead = 35%How has this mix of expenses changed over the past five years?In all segments, labor is an increasing percentage of the costs.Does the basic approach to manufacturing (i.e. the mix of labor and technology) reflect that of its competition?Your client tells you that there is a continuing movement to automate and utilizetechnology to improve efficiency throughout the industry, but it is his/her opinion that the ir approach, maintaining the “human touch”, is what differentiates them from the competition. (Unfortunately, he’s right!!)Is the workforce unionized?YesWhat is the average age of the workforce?52 and climbing. There is very little turnover in the workforce.What is the present throughput rating How has it changed over the past five yearsPresently the plant is producing at about 80% of capacity. This has been decreasing steadily over the last several years.What is the typical reason for equipment shutdown?Emergency repairDescribe the preventive maintenance program in effect at the client’s facility?Preventive maintenance is performed informally based on the knowledge of seniortechnicians.How often has equipment been replaced Is this consistent with the original equipment manufacturer’s recommendationsThe client feels that most OEM recommendations are very conservative. They have followeda philosophy of maximizing the life of their equipment and have generally doubled OEMrecommendations.The above information is sufficient to add some understanding to the cost side of the equation. Your client has an aging workforce and plant that is behind the times in terms of technology and innovation. This has contributed to excessive breakdowns, decreased throughput, increased labor rates (wages increase with seniority) and greater labor hours (overtime to fix broken machines).In proposing recommendations to improve the client’s situation, there is no single correct approach. There are a number of approaches that might be explored and recommended. The following are some possibilities:Abandon the mainstream and children’s segment to recover leadership in the racingsegmentIssues to consider in this approach:How much of the racing segment is “recoverable”What are the expected growth rates of each segment?How badly damaged is the relationship with the specialty outlets?Are there alternative outlets to the specialty shops such as internet sales?How will this move affect overall utilization of the operating facilities?Maintain the mainstream and children’s segment, but sell under a different nameIssues to consider in this approach:Is there demand among the mass and discount distributors for bicycles under their name?What additional advertising and promotions costs might be incurred?What are the expected growth rates of each segment?What is driving the buying habits of the mainstream and children’smarket?Reduce costs through automation and innovationIssues to be considered:What technological improvements are to be made?What are the required investmentsWhat are the expected returns on those investments?How will these investments affect throughput?To which lines are these investments appropriateAre the mainstream and children’s segments potentially “over-engineered”What impact will this have on the required workforce levels?If layoffs are required to achieve the benefits, what impact will this have on labor relations?Reduce costs through establishing a formal preventive maintenance programIssues to be considered:What organizational changes will be required?What analysis will be performed to determine the appropriate amount of PM?What training is required of the workforce?What technical or system changes are required?How will the unionized workforce respond?Key takeaways:This case can prove to be lengthy and very involved. It is not expected that a candidate would cover all of the above topics, but rather work through selected topics in a logical fashion. It is important that the candidate pursue a solution that considers both revenue and cost issues to impact profit. Additionally, a conadidate’s ability to work comfortably with the quantitative side of this case is important. The above recommendations for improving profitability are just a few among many. The candidate may come with their own ideas.。

(企业管理咨询)咨询公司面试案例分析指南咨询面试系列

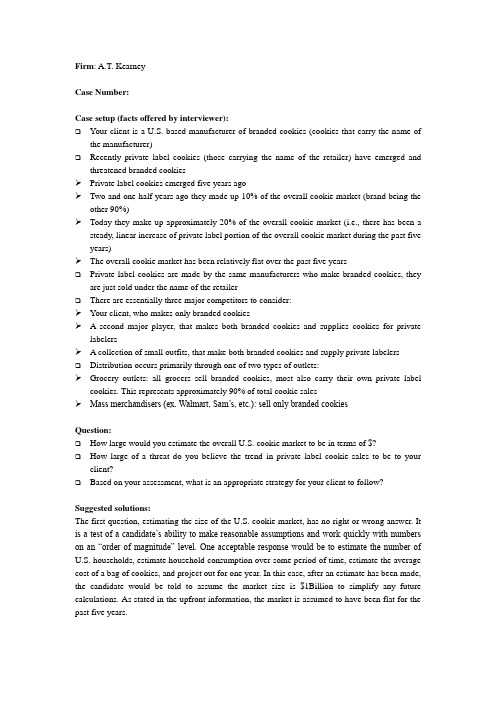

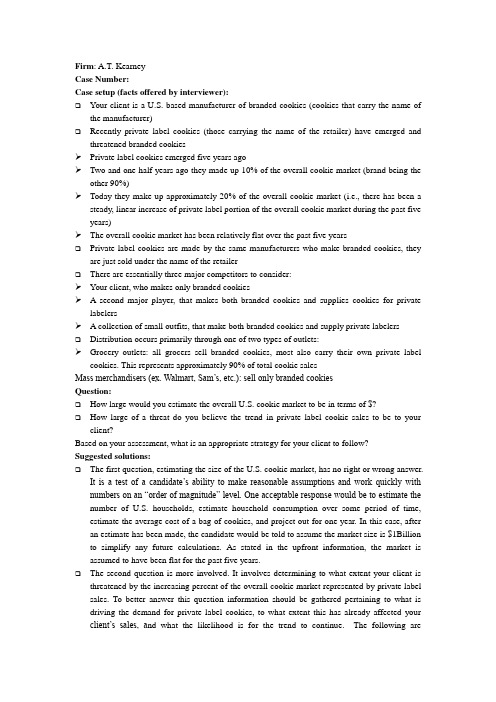

Firm: A.T. KearneyCase Number:Case setup (facts offered by interviewer):❑Your client is a U.S. based manufacturer of branded cookies (cookies that carry the name of the manufacturer)❑Recently private label cookies (those carrying the name of the retailer) have emerged and threatened branded cookies➢Private label cookies emerged five years ago➢Two and one-half years ago they made up 10% of the overall cookie market (brand being the other 90%)➢Today they make up approximately 20% of the overall cookie market (i.e., there has been a steady, linear increase of private label portion of the overall cookie market during the past five years)➢The overall cookie market has been relatively flat over the past five years❑Private label cookies are made by the same manufacturers who make branded cookies, they are just sold under the name of the retailer❑There are essentially three major competitors to consider:➢Your client, who makes only branded cookies➢ A second major player, that makes both branded cookies and supplies cookies for private labelers➢ A collection of small outfits, that make both branded cookies and supply private labelers❑Distribution occurs primarily through one of two types of outlets:➢Grocery outlets: all grocers sell branded cookies, most also carry their own private label cookies. This represents approximately 90% of total cookie sales➢Mass merchandisers (ex. Walmart, Sam’s, etc.): sell only branded cookiesQuestion:❑How large would you estimate the overall U.S. cookie market to be in terms of $?❑How large of a threat do you believe the trend in private label cookie sales to be to your client?❑Based on your assessment, what is an appropriate strategy for your client to follow?Suggested solutions:The first question, estimating the size of the U.S. cookie market, has no right or wrong answer. It is a test of a candidate’s ability to make reasonable assumptions and work quickly with numbers on an “order of magnitude” level. One acceptable response would be to estimate the number of U.S. households, estimate household consumption over some period of time, estimate the average cost of a bag of cookies, and project out for one year. In this case, after an estimate has been made, the candidate would be told to assume the market size is $1Billion to simplify any future calculations. As stated in the upfront information, the market is assumed to have been flat for the past five years.The second question is more involved. It involves determining to what extent your client is threatened by the increasing percent of the overall cookie market represented by private label sales. To better answer this question information should be gathered pertaining to what is driving the demand for private label cookies, to what extent this has already affected your client’s sal es, and what the likelihood is for the trend to continue. The following are questions and answers that would be provided in an interview scenario.❑What are the sales trends for the client over the past five years?Your client’s sales have been flat at $600M for the time frame of five to two and one-half years ago. Over the past two and one-half years, sales have decreased steadily down to a present level of $560MM.❑How has market share of the private label segment been split over the past five years between your client’s main competitor and the other smaller players?The smaller players combined had 100% of the private label subsegment five years ago.Two and one-half years ago your client’s main competitor began supplying private labelers.Today, this main competitor owns 40% of the private label subsegment, the smaller players own the remaining 60%❑How has market share of the branded segment been split over the past five years?Your client held 60% of this segment five years ago, 67% two and one-half years ago and 70% today. Its main competitor held 30% five years ago, 25% two and one-half years ago and 23% today. The combined smaller players owned 10% five years ago, 8% two and one-half years ago and 7% today.Analsis of the above information tells a very important story. The private label segment was launched five years ago by the smaller players. As private label first cut into the branded segment, it came at the expense of your client’s main competitor and the smaller players, not your client. In re sponse to this, your client’s main competitor entered into the private label segment two and one-half years ago. This further hurt their own sales and those of the smaller players, but also began to hurt your client’s sales. Additional information is requi red to understand what is driving the demand for private label cookies❑How does the quality of a private label cookie compare to that of a branded cookie?Consumer studies have shown that there is a noticeable difference in taste, texture and quality in favor of the branded cookies❑At the manufacturing level, what is the difference in cost of production and price between branded and private label products?It costs approximately $1.50 to manufacture a bag of private label cookies which will sell for$2.00 to retailers. It costs approximately $2.00 to manufacture a bag of branded cookies which will sell for $2.75.❑How do the same numbers translate at the retail level?A retailer, paying $2.00 for private label cookies can sell that product for $2.50. The $2.75 bag ofbranded cookies can be sold for $3.50.The key finding is that from a cost-price-margin perspective it is advantageous for both the manufacturers and the retailers, with all else equal, to sell a bag of branded cookies. Other factors must be contributing to the demand for private label cookies. Think about the incentives at each level in the chain (manufacturer, retailer, consumer). The following questions can help fill in details❑Have any of the manufacturers been able to gain additional shelf space for branded products by supplying grocers with private label products?No❑Has their been excess capacity at your client, its main competitor or the smaller competitors that has been used up through the manufacturing of private label products?Th ere was some excess capacity at the smaller competitors and your client’s main competitor (your client is unsure as to how much).. There is little excess capacity anywhere in the industry today..❑Has your client’s relationship with its retailers suffered as a result of it not supplying private label products?Not noticeably❑Are grocery stores using private labels in other food categories?Yes, there has been a major push by grocery stores to populate shelves with private labels❑Is competition increasing or decreasing among grocers?Generally increasing. Grocer chains are expanding and the number of grocers to be found servinga given area has generally increased over the past five years❑What general macroeconomic trends have occurred over the past five years?The economy has been slowing over the past five years. There is concern about recessionThe above information begins to expose a clearer story. A number of factors have contributed to the emergence of the private label segment: manufacturer’s interest in utilizing excess capacity, grocer’s desire to sell products with their name on it (they may believe this creates return customers in an increasing competitive environment), consumers concerns about a troubled economy (price vs. quality tradeoffs).At this point the candidate would be encouraged to state what they believe the magniturde of the private label threat to be to the client. There is no right answer. One can argue either way.If the threat is seen as high, the likely recommendation is for your client to begin supplying private label products. The candidate should recognize that in competing in the private label segment, the basisof competition is primarily cost. At the same time, the client’s branded product should be protected. The following tactics might prove appropriate:❑Seek to wring costs out of all phases of the operation➢Utilize all existing excess capacity➢Gain maximum product knowledge as quickly as possible➢Understand low cost positions on product ingredients and mix➢Review process improvement/ manufacturing efficiency opportunities➢Undertake overhead reduction efforts(Any of these points could be discussed in great detail)❑Ensure there is no customer confusion between private label offering and branded product❑Seek partnering agreements with retailers➢Joint advertising and promotions❑Explore deals with mass merchandisers to enter private labels (remember, mass merchandisers presently sell no private label)If the threat is seen as low, the likely recommendation is for your client to stay with branded cookies only. The candidate should recognize that in competing in the branded segment the basis of competition is one of differentiation. Additionally, your client should do all it can to halt or reverse the momentum of the private label segment. The following tactics might prove useful:❑Pursue a maximum differentiation strategy➢Invest in brand image to support premium price➢Make it difficult to copy product: innovate wisely through product advances, smart product line extensions, frequent changes to the product➢Manage price gap: explore price increases where appropriate( Again, any of these points could be discussed in great detail)❑Explore exclusive partnering with mass merchandisers❑Consider alternative distribution channels❑Seek partnering agreements with grocers regarding branded products❑Educate grocers as available➢Customers who buy private labels are the most price sensitive. They also tend to be the least loyal customers and spend less per store visit.➢Grocers financial stake in private label products extends beyond the product margins. There is lost profit from branded products that could occupy the same shelf space, advertising costs of the private label products, etc.Key takeaways:This case has no right or wrong answ er. It forces the candidate to take a stand in a “grey” situation and defend it. It also provides a large amount of data upfront which the candidate must quickly sort through and determine what is important and what is not. The key is to understand the story behind the data. How did the private label segment emerge? What is driving it? How has it affected manufacturers, retailers and consumers?。

CaseInterviewInPoint-通往咨询公司必经之路共45页word资料

Case Interview In Point—通往咨询的必经之路前序咨询行业属于出租头脑的行业,咨询顾问赚钱的方式就是针对客户给定的问题,综合大量不相关的数据资料,去粗取精,去伪存真,构思解决方案,当着公司高层的面,提出既合情合理又富有创意的设想。

其实这也是为什么咨询公司特别重视进行案例分析面试的原因,他们想借此机会来判断candidate的逻辑思维能力和说服能力,basically, 案例面试无异于扮演咨询顾问角色的一次练习。

想必各位对于去年teclast的那篇《Looking Beyond the Case Interview》还意犹未尽,那么我希望我这篇文章能让各位再次加深对于咨询以及case interview的理解,并有所突破。

记得我是从大三下开始认识和熟悉管理咨询行业的(比起现在的大一大二学生真是惭愧了),当年读了《麦肯锡方法》、《麦肯锡意识》后,对于咨询工作产生了强烈的兴趣和向往。

作为一个非经管专业的学生,我知道要踏入这一行,需要比别人付出更多,经历了两年多的历练、磨练、锤炼,终于修成正果。

要想进咨询公司,就必须过案例面试这一关;要过案例面试这一关,就必须知道如何进行准备和如何表现自己,必须知道面试官希望在你身上看到哪些素质,你也需要知道有哪些类型的案例问题,然后还要知道有一些怎样的思维框架,也就是我们俗称的framework。

所以仅以此文和有志于往咨询业发展的兄弟姐妹分享我的个人经验(有一些经验我在去年5月爱因斯特组织的牛人经验介绍会上已经share过了),此文和《Looking Beyond the Case Interview》不同的是,此文还是主要focus在case interview上,全文纯属个人意见,不足或遗漏之处望补正。

第一部分. 认识咨询,认识自我第一部分我觉得还是老规矩,先谈谈Why consulting? Why hires you? 这两个问题。

比如你今天去Bain参加一面,面试官肯定会问你为什么选择咨询,为什么选择贝恩,我们为什么要聘用你?这是需要首先解决的问题。

咨询业面试必看 case interview 及其经典案例分析

(1) 什么是Case Interview?一般来说,Case Interview主要针对咨询公司面试而言。

也有一些公司如Dell二面会用一些小case来考察面试者的应变能力、考虑问题的全面性以及逻辑分析能力。

咨询公司的Case Interview可以分成两个部分,一开始先是Warm-up。

在这一部分,你可能需要自我介绍,然后大致回答一下面试官针对简历以及个人选择提出的一些问题。

接下来才是真正的Case Interview。

简而言之,Case Interview就是现场对一个商业问题进行分析的面试。

但是和大多数其他面试不同,这是一个互动的过程。

你的面试官会给你提出一个Business Issue,并且会让你给出分析和意见。

而你的任务是向面试官有逻辑的提出一些问题以使得你能够对这个Business Issue有更全面,更细致的了解,并且通过系统的分析最后给出建议。

一般而言,Case Interview是没有绝对正确的答案的。

面试官看重的不是答案,而是从面试过程当中你表现出来的分析能力和创造力。

对于大学毕业,没有工作经验的学生来说,大多数情况下Case不会很难,也不会需要你对那个行业有系统的了解。

Case Interview一般是一对一的,一轮会有两个Case Interview,由两个不同的面试官来负责,每个Interview持续45分钟,包括10-15分钟的warm-up以及一些Behavior questions,剩下的30分钟就是讨论Case。

10-15分钟的Warm-up一般用英文,Case可能是英文,也有可能是中文,不同的公司以及不同的面试官对语言是有不同的偏好的。

(2) 为什么使用Case Interview?由于咨询师在工作上的不少时间都是在和客户以及同事进行相互的沟通,同时咨询工作本身的特点要求咨询师必须具备一系列的特质才能够成功。

这些特质包括:在压力之下保持冷静,对问题能够很快的根据细节建立假设,并且运用很强的逻辑分析能力来解决问题等等。

CASE-IN-POINT-咨询行业面试案例分析

CASE IN POINT 咨询行业面试案例分析作者:Marc P. Cosentino目录1概述2面试2.1开场2.2关于你的问题2.3为什么选择咨询行业2.4可能出现的数学问题2.5案例题2.6由你提问2.7最给力的压轴题3案例题3.1案例题的目的3.2案例题的准备3.3案例题的步骤3.4案例题的种类3.5书面案例题和测试3.6激怒面试官3.7如果你思路卡住了3.8关于数学的困难4 Ivy案例系统4.1最给力的案例分析思路4.2最初的四个步骤4.3十二个案例情景4.4Ivy案例系统概观5分析工具和框架5.1 5C和4P5.2 BCG矩阵5.3 波特五力5.4价值链5.5 7S框架5.6现金流量表5.7应该记住的“如果”情境5.8商业案例贴士5.9亚里士多德框架6案例练习6.1 35个案例6.2案例类型6.3没有答案的案例题7给你室友的指南8最后的话9咨询术语1概述一个欧洲铁矿公司在澳洲买了一块富含铁矿的地。

他们应该开采吗?回答这个问题的时候,我要你告诉我每吨的成本、盈亏平衡点、利润率和对全球市场的影响。

咨询公司做的是出租脑袋的生意。

咨询顾问综合大量的陌生数据,剔除不相关的信息,构建一个针对特定客户的问题的对策,在位高权重的人面前做出兼具逻辑性和创造性的假定(比如矿业公司的大亨),通过这种方式来赚钱。

这就是为什么咨询公司那么注重案例分析——因为这让他们能够判断一个未来的咨询顾问(比如你)的案例展示有多少逻辑性和说服力。

在本质上,案例面试是一个角色扮演练习。

为了通过案例面试,你必须知道怎么去准备和表现。

这本书会帮助你做到这两点。

它会带你过一遍整个咨询面试流程,教你如何去做准备,告诉你咨询公司看重一个应聘者的什么,挖掘各种类型的案例题,向你介绍Ivy案例系统。

作为一个在哈佛十五年有余的职业导师,我已经帮助了超过八千名全国最优秀的学生准备咨询公司面试。

在此期间,学生们疯狂地记忆各种独立的框架并且焦头烂额地考虑运用哪个框架。

最新CaseInterviewInPoint-通往咨询公司必经之路汇总

C a s e I n t e r v i e w I n P o i n t-通往咨询公司必经之路Case Interview In Point—通往咨询的必经之路前序咨询行业属于出租头脑的行业,咨询顾问赚钱的方式就是针对客户给定的问题,综合大量不相关的数据资料,去粗取精,去伪存真,构思解决方案,当着公司高层的面,提出既合情合理又富有创意的设想。

其实这也是为什么咨询公司特别重视进行案例分析面试的原因,他们想借此机会来判断candidate的逻辑思维能力和说服能力,basically, 案例面试无异于扮演咨询顾问角色的一次练习。

想必各位对于去年teclast的那篇《Looking Beyond the Case Interview》还意犹未尽,那么我希望我这篇文章能让各位再次加深对于咨询以及case interview的理解,并有所突破。

记得我是从大三下开始认识和熟悉管理咨询行业的(比起现在的大一大二学生真是惭愧了),当年读了《麦肯锡方法》、《麦肯锡意识》后,对于咨询工作产生了强烈的兴趣和向往。

作为一个非经管专业的学生,我知道要踏入这一行,需要比别人付出更多,经历了两年多的历练、磨练、锤炼,终于修成正果。

要想进咨询公司,就必须过案例面试这一关;要过案例面试这一关,就必须知道如何进行准备和如何表现自己,必须知道面试官希望在你身上看到哪些素质,你也需要知道有哪些类型的案例问题,然后还要知道有一些怎样的思维框架,也就是我们俗称的framework。

所以仅以此文和有志于往咨询业发展的兄弟姐妹分享我的个人经验(有一些经验我在去年5月爱因斯特组织的牛人经验介绍会上已经share过了),此文和《Looking Beyond the Case Interview》不同的是,此文还是主要focus在case interview上,全文纯属个人意见,不足或遗漏之处望补正。

第一部分. 认识咨询,认识自我第一部分我觉得还是老规矩,先谈谈Why consulting? Why hires you? 这两个问题。

咨询公司case分析方法

Case interview分析工具/框架来源:张旭的日志最近在准备CASE INTERVIEW,刚接触这个,对里面涉及到的FRAMEWORK和STRATEGY非常不熟悉,偶获珍宝,与诸君共享。

顺便攒RP!!案例面试分析工具/框架一.Business Strategy1.市场进入类●行业分析(波特5力,市场趋势,市场规模,市场份额,市场壁垒等)●公司宏观环境(人口,经济,自然,技术,政治),公司微观环境(公司,供应商,市场中介,顾客,竞争对手,大众)●3C(Competitor, Consumer, Company/Capabilities)●Cost-revenue固定成本,可变成本收入怎么计算?时间序列估计,可比公司估计●市场细分很重要,niche marketA.地理细分B.人口细分(年龄及生命周期阶段细分,性别细分,收入细分)C.心理细分(社会阶层,生活方式,个性特征)D.行为细分(购买时机-柯达,利益细分-牙膏,用户状况,使用率,忠诚度)2.行业分析类●市场(市场规模,市场细分,产品需求/趋势分析,客户需求)●竞争(竞争对手的经济情况,产品差异化,市场整合度,产业集中度)●顾客/供应商关系(谈判能力,替代者,评估垂直整合)●进入/离开的障碍(评估公司进入/离开。