国内短期赊销信用保险共16页文档

国内短期贸易信用保险条款

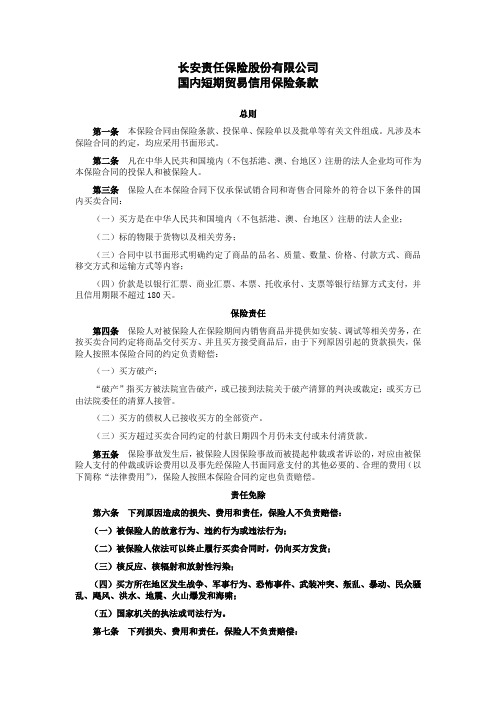

长安责任保险股份有限公司国内短期贸易信用保险条款总则第一条本保险合同由保险条款、投保单、保险单以及批单等有关文件组成。

凡涉及本保险合同的约定,均应采用书面形式。

第二条凡在中华人民共和国境内(不包括港、澳、台地区)注册的法人企业均可作为本保险合同的投保人和被保险人。

第三条保险人在本保险合同下仅承保试销合同和寄售合同除外的符合以下条件的国内买卖合同:(一)买方是在中华人民共和国境内(不包括港、澳、台地区)注册的法人企业;(二)标的物限于货物以及相关劳务;(三)合同中以书面形式明确约定了商品的品名、质量、数量、价格、付款方式、商品移交方式和运输方式等内容;(四)价款是以银行汇票、商业汇票、本票、托收承付、支票等银行结算方式支付,并且信用期限不超过180天。

保险责任第四条保险人对被保险人在保险期间内销售商品并提供如安装、调试等相关劳务,在按买卖合同约定将商品交付买方、并且买方接受商品后,由于下列原因引起的货款损失,保险人按照本保险合同的约定负责赔偿:(一)买方破产;“破产”指买方被法院宣告破产,或已接到法院关于破产清算的判决或裁定;或买方已由法院委任的清算人接管。

(二)买方的债权人已接收买方的全部资产。

(三)买方超过买卖合同约定的付款日期四个月仍未支付或未付清货款。

第五条保险事故发生后,被保险人因保险事故而被提起仲裁或者诉讼的,对应由被保险人支付的仲裁或诉讼费用以及事先经保险人书面同意支付的其他必要的、合理的费用(以下简称“法律费用”),保险人按照本保险合同约定也负责赔偿。

责任免除第六条下列原因造成的损失、费用和责任,保险人不负责赔偿:(一)被保险人的故意行为、违约行为或违法行为;(二)被保险人依法可以终止履行买卖合同时,仍向买方发货;(三)核反应、核辐射和放射性污染;(四)买方所在地区发生战争、军事行为、恐怖事件、武装冲突、叛乱、暴动、民众骚乱、飓风、洪水、地震、火山爆发和海啸;(五)国家机关的执法或司法行为。

国内贸易短期信用保险条款的费率(2013版) 保险基础知识学习资料 条款产品开发

XX财产保险股份有限公司

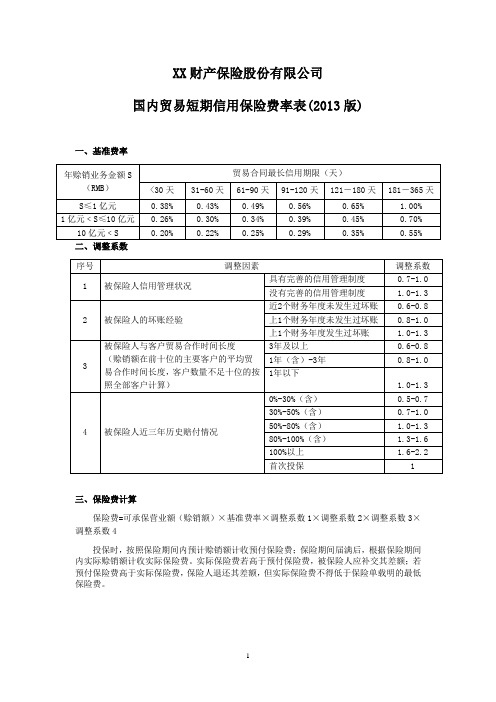

国内贸易短期信用保险费率表(2013版)

一、基准费率

二、调整系数

三、保险费计算

保险费=可承保营业额(赊销额)×基准费率×调整系数1×调整系数2×调整系数3×调整系数4

投保时,按照保险期间内预计赊销额计收预付保险费;保险期间届满后,根据保险期间内实际赊销额计收实际保险费。

实际保险费若高于预付保险费,被保险人应补交其差额;若预付保险费高于实际保险费,保险人退还其差额,但实际保险费不得低于保险单载明的最低保险费。

1。

国内短期贸易信用保险(经纪人讲课)PPT-经典原创文档

5、争议和付款担保

❖ 当被保险人与买方存在贸易分歧,只有当此贸易分歧在被 保险人认同下得到解决时,保险人才进行定损

❖ 如果担保或保证是保险人承担保险责任的一个前提条件, 那么此条件中列明的当事国法庭必须已做出担保人或保证 人应支付的最终判决,否则保险人将不会调查损失

6.提供信息,公开事实

❖ 被保险人有义务向保险人提供保险人要求的所有信息以便 保险人能够确定被保险人是否履行了保险合同项下的所有 义务

商业风险——买方延期付款

❖ 是指根据合同约定买方在(保单明细表中规定的)等待期 内未能付款

❖ 在中国,保险合同下承保的“买方延期付款”通常是指在 最初付款到期日后的6个月内买方仍未付款

❖ 损失发生日是指在最初付款到期日之后的6个月期满后 (除非在保单明细表中规定了一个延长的等待期)

最高承保比例

商业风险

国内贸易短期信用保险

CCIC

一、 什么是信用保险 二、 除外责任 三、 保险责任 四、申报和保费

五、 信用额度 六、减少损失和获取追偿额 七、索赔 八、再保安排

什么是信用保险

❖保险合同的三方关系

保险人

被保险人

销售合同

承保每一买方 的应收账款

买方

❖ 信用保险承保哪些内容?

承保

买方行为

-无法或不支付货款 - 拒绝接受货物

10.保险人的最大责任限额

保险人支付的赔款不能超出信用额度中承保的比例或保险的 最大责任限额—两者取较低者

保险人的最大责任限额可以有以下两种规定: ❖ 明确保险人承担最大责任的数额,或 ❖ 保险年度内所支付保费总额的若干倍(扣除任何应缴税款)

保险人支付两者中的较高者

❖ 赔付责任的分配 在计算最大责任限额时,所有保险人支付的赔款应计算到 其相应的保险年度中。

国内短期贸易信用保险

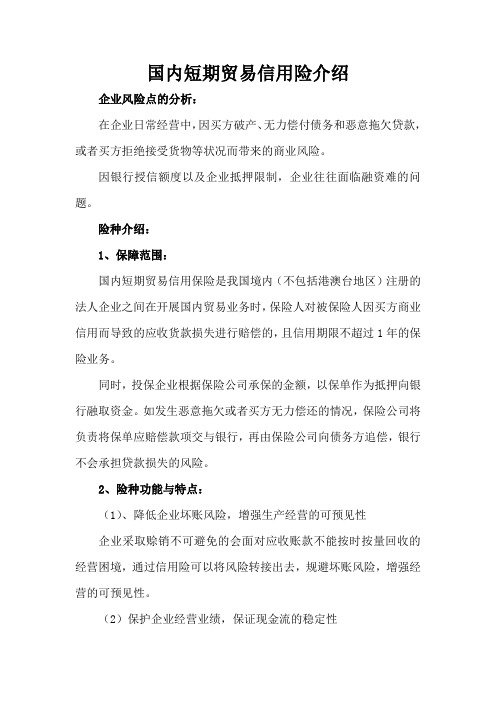

国内短期贸易信用险介绍企业风险点的分析:在企业日常经营中,因买方破产、无力偿付债务和恶意拖欠贷款,或者买方拒绝接受货物等状况而带来的商业风险。

因银行授信额度以及企业抵押限制,企业往往面临融资难的问题。

险种介绍:1、保障范围:国内短期贸易信用保险是我国境内(不包括港澳台地区)注册的法人企业之间在开展国内贸易业务时,保险人对被保险人因买方商业信用而导致的应收货款损失进行赔偿的,且信用期限不超过1年的保险业务。

同时,投保企业根据保险公司承保的金额,以保单作为抵押向银行融取资金。

如发生恶意拖欠或者买方无力偿还的情况,保险公司将负责将保单应赔偿款项交与银行,再由保险公司向债务方追偿,银行不会承担贷款损失的风险。

2、险种功能与特点:(1)、降低企业坏账风险,增强生产经营的可预见性企业采取赊销不可避免的会面对应收账款不能按时按量回收的经营困境,通过信用险可以将风险转接出去,规避坏账风险,增强经营的可预见性。

(2)保护企业经营业绩,保证现金流的稳定性信用险保证企业能到期顺利回收资金,在发生恶意拖欠或者无力偿还情况后,也能得到保险赔款,保证了企业生产经营的现金流的稳定,使企业的再生产能够顺利进行。

(3)、提高融通资金的速度和企业流动资金的利用效率企业的赊销行为必定会占用企业的流动资金,减慢资金的周转速度,从而降低资金的使用效率,进而影响企业的盈利能力与利润率。

利用国内短期贸易信用险融资可以提高企业资金周转速度,提高企业的盈利能力,增加企业收入。

(4)、信用险融资帮助企业提高管理信用风险的水平信用险融资过程中,保险公司要通过实地调查、分析财务数据、销售记录、信用记录等方式对买方的信用进行审核,帮助企业提高信用风险管理水平,提升企业的风险管理能力,优化企业资源流向。

与普通银行融资的区别:1、授信对象不同:普通银行融资授信对象为企业,企业在银行的授信额度有限,达到授信额度则无法再从银行取得融资,而通过国内短期贸易信用保险取得的融资,使用的是买方在银行的授信额度,不受银行对企业授信额度限制。

国内短期贸易信用险(大地公司)

CHINA RE

目录

公司背景 项目方案 日常信控服务 操作流程 服务团队

CHINA RE

服务团队

全球的技术力量加本土的专业团队合作

一站式服务

指导、协调团队工作

对外服务窗口,日常沟 通联络,业务处理

客户

顾问式技术支持服务

买家风险评估、账龄分 析报告、买家信息共享、 再保支持等

通过保单受益权的转让便于企业获得银行的贸易融资

CHINA RE

方案说明

买家信用额度批复:最大10个买家, 基本涵盖主要风险,其余承保后批复 费率厘定因素:营业规模、成长性、付款条件,即给 予买家的放账期限、买家分布及资信状况、坏账记录、 企业的信用风险管理状况等

阶梯费率说明:根据行业特点和承保经验,超过90天的赊销期限 远超过在此类行业中通常给予的账期,超90天的放账期限会增加 买方还款风险,不利于企业进行风险管理及资金运用。

成立于2003年 “国字品牌”

保费规模从2004年的15亿元到2010 年底突破130亿元,47家财险公司中 综合排名第四位

CHINA RE

股东简介

亚洲最大的再保险公司 净资产在全球再保险业排名第五 中国大地财产保 险股份有限公司 中国财产再保险 股份有限公司

中国再保险(集团)

中国人寿再保险 股份有限公司

股份有限公司

中再资产管理 股份有限公司 中国保险报业 股份有限公司

华泰保险经 纪有限公司

CHINA RE

服务网络

34家省级分公司 1家营业部 1885家总机构数

纽约代表处

CHINA RE

合作方-安卓的庞大企业数据库

全球超过6000万家的企业信息 2000年便进入中国,对中国企业进行信用评估 全球的技术力量加本土的风险分析师,更了解中国企业,额度的批复更快速

国内短期贸易信用保险条款20060418

e)如果买方以任何理由不付全部或部分应付账款,被保险人在追收欠款过程中或被保险人在为自己进行辩护过程中所产生的任何法律和其他费用。

f)

g)任何银行手续费,除非在与买方的销售合同中被定为应收账款的一部分

h)

其他保险

E.保险人不承担任何被保险人可以通过投保其他保险而获得赔偿的损失,或被保险人有权因其他保险而受益或获得赔偿的损失。

B.本保险合同下承保的 “买方延期付款”是指,买方在最初付款到期日后的6个月内未能根据合同将应付账款支付给被保险人。

第3条 承保的合同和保险责任的开始

承保的合同

A.本保单适用用于被保险人与买方所签定的,与保险明细表上规定的贸易与服务相关的销售或服务合同。合同须以书面形式订立,且真实、合法、有效。合同必须注明待售产品(或待提供服务)的性质和数量以及付款条件与付款期限,付款期限绝对不能超过保险明细中规定的最长信用期限。除非保险人书面同意,否则本保险合同不适用于以下合同:

汇票等

D.除非被保险人事先获得保险人的书面同意,否则以上付款到期日的延长不能用于汇票、承兑汇票、本票、见单即付、跟单即期汇票、付款交单或是信用证等付款方式。

第8条减少损失及追收账款

通知

A.发生下列任何可能导致损失的事件,被保险人应立即通知保险人。这些事件包括但不限于:

a)最大延长期后20天买方未付款;或

损失计算

B.保险人计算损失金额时,损失金额为买方账款减去 (i)被保险人或买方有权用付款、抵消、反索赔、扣减或其他方式在定损日已接受,已贷记,而买方已支付,已借记买方账户的金额,以及 (ii) 被保险人节省的任何费用。赔偿金额将包括截至到付款到期日产生的利息。

损失确定日期

C.被保险人的损失金额将按如下损失确定的日期核定:

国内短期贸易信用保险-承保实务v201108.doc

中国人民财产保险股份有限公司国内短期贸易信用保险承保实务目录第一部分展业准备 (4)一、基础知识准备 (5)二、理解保险条款 (5)(一)适用范围 (5)(二)保险责任 (6)(三)责任免除 (6)(四)保险费率 (10)(五)承保对象 (12)(六)保险合同 (14)(七)事前告知 (15)(八)展业工具 (15)第二部分核心原则 (16)一、保险利益原则 (16)二、统保原则 (16)三、风险共担原则 (19)第三部分承保流程 (19)一、保单承保 (20)(一)承保意向书 (21)(二)OA系统流程 (22)(三)信用险业务系统流程 (22)二、信用限额承保 (22)(一)信用限额申请 (22)(二)信用限额审核及批复 (23)(三)信用限额使用 (23)(四)信用限额跟踪管理 (23)第四部分项目上报资料 (23)一、投保单 (23)(一)填写要求 (24)(二)投保内容要点 (25)二、项目分析报告 (28)(一)投保人概况 (29)(二)投保需求 (30)(三)投保买方信息 (30)(四)行业分析 (30)(五)业务来源 (31)(六)同业市场竞争 (31)(七)建议或期望的报价条件 (31)第五部分保单承保方案 (31)一、年度投保交易金额 (33)二、保险费率 (33)三、累计赔偿限额 (34)四、最低保险费 (35)五、赔偿比例 (35)六、免赔额 (36)七、最长信用期限 (36)八、索赔等待期 (36)九、最高延长期限 (37)十、买方信用限额 (37)第六部分信用限额 (38)一、信用限额的概念 (38)二、信用限额的申请 (39)三、信用限额的审核 (42)(五)批复的信用限额 (45)四、信用限额的使用 (47)(一)赊销申报 (48)(二)保险费结算与交付 (49)五、信用限额的跟踪管理 (49)第七部分续保 (50)一、与客户沟通 (51)二、续保报告 (51)三、OA请示及批复 (52)四、信用险系统操作 (52)第八部分银行融资 (52)一、与银行业务合作模式 (53)二、几个需要关注的要点 (55)(一)合作协议落实 (55)(二)最低保险费 (55)(三)交易申报 (56)本实务配套公司《国内短期贸易信用保险条款(2009年版)》,大家应结合业务实际严格贯彻执行,确保该险种的承保质量。

国内贸易信用保险介绍资料

货物发送信用期限被保险人提供索赔材料齐全后,保险

人在30天内付款

最高延长期

到期日

账款逾期提交索赔申请(最后期限)

逾期/可能损失通知最初到期日

开具发票损失确定日提交索赔申请保单签署最长**天保险责任开始

货物被发送信用保险重要时间节点示意

保险公司将协助被保险人进行及时有效的账款追收并承担相应费用,但不包括被保险人内部管理费用启动企业内部

信控机制,进行账款追收* 最高延长期–按照客户实际情况设定,一般最长不超过60天。

** 损失确定日期:

-无清偿能力–立刻

-延期付款–原始到期日后6个月

Proposal Form

Policy Wording

Credit Limit

Declaration

Claim Form。

新版短期贸易信用险保单样本包含必加附加条款及主条款

承保比例 Insured Percentage

最长付款期限

Maximum Terms of Payment

付款条件说明

Terms of Payment Description

最长展延期限

Maximum Extension Period

------------------------ 结束END -------------------------

第一章 总则 本保险单(即保险合同,下同)由投保单、明细表、保险条款、批单、附件、限额审批单组成。凡涉 及本保险单的约定,均应采用书面形式。 保险人接纳投保人的投保申请,并签发明细表后本保险单即告成立。 本保险单由保险人向明细表第 1 部分所列明的被保险人签发。

第二章 保险责任 第一条 投保人(即为被保险人,下同)已向保险人提交书面投保单、申请投保贸易信用保险,保险

业务归属机构: 业务员/经办: 录单员: 核保员: 上年度保单号码:

宝 太平财产保险有限公司深圳分公司

Taiping General Insurance Co., Ltd. Shenzhen Branch

---------------(签章)------------

珠

基

泓

4

保单号:-

太平财产保险有限公司 国内短期贸易信用保险条款(2014 版)

保费计算方法

泓 Premium Calculation Method

保险费率 Rate for Calculation of Premium

预计保费总额 Total Estimated Premium

保费-交易营业额申报 (批单 3) Premium - Turnover Declaring (Endorsement 3)

国内贸易信用保险(短期)-140703

Original Due Date 最初付款到期日

Extended Due Date 延长到期日

Terms of Payment = 60 days from invoice date Max Extension Period 付款期限 = 发票日 (MEP) = 30 days 后60天 Non Payment 最长延长期限 Notification 30天 = 30 days 逾期欠款通知 = 30天

8 Presentation title

保单注意事项

•

在最初到期日之后的任何时候,被保险人都可以通知保险公司任何未付欠款。 但一旦违约状态发生,被保险人必须在逾期欠款通知期限届满之前填写<逾期

应收帐款或负面信息通知书>通知保险公司。

• • 逾期欠款的通知期限在买方进入违约状态后的30天届满。 即使逾期欠款是因为存在争议,被保险人仍需在逾期欠款通知期限届满之前通

•

营业额

营业额是指在特别条款规定的保险期间内,您向买方发送的货物和提供的服务的全部发票相关期限,该期限自我们收到完整的逾期欠款通知以及我们所要求的其 他文件或信息之日起开始计算。

附件:常见专业术语 (具体详细内容定义请参见保单条款)

• 违约状态 是指由于发生下述情形导致买方所处的状态: 1)当有欠款逾期超过特别条款规定的最长延长期限时。如果欠款是由多张发票构 成,则将适用最先应付的发票的最长延长期限届满之日;或 2)汇票、本票、支票或直接索付单证在第一次呈递要求付款时即被拒付;或 3)无清偿能力;或 4)政治风险 争议 是指您与买方之间任何未解决的、真实的并且有文件证明的争执,该争执以书面 形式记录,与您或买方在合同项下的义务相关,并导致了买方拒绝支付您任何欠 款。

国内贸易短期信用保险条款(2013版) (英文) 保险基础知识学习资料 条款产品开发

Short-Term Domestic Trade Credit Insurance Terms & ConditionsEnglishVersion 2013CatalogueContents Page Article 1 Notice 3 Article 2 The Policy 3 Article 3 Losses Covered 3 Article 4 Exclusions 4 Article 5 Contracts Covered 5 Article 6 Commencement of Cover 6 Article 7 Despatch 6 Article 8 Credit Limits 6 Article 9 Compliance with Credit Limit 6 Article 10 Withdrawal by Us 6 Article 11 Declarations 7 Article 12 Risk Premium 7 Article 13 Credit Limit Charges 7 Article 14 Credit beyond the Due Date 7 Article 15 Maximum Extension Period 7 Article 16 No Liability beyond Maximum Extension Period 8 Article 17 Bills of Exchange etc. 8 Article 18 The Proposal and Disclosure of Facts 8 Article 19 Minimising Loss and Obtaining Recoveries 9Contents Page Article 20 Period for Submission and Payment 10 Article 21 Calculation of Loss 10 Article 22 Date of Ascertainment of Loss 10 Article 23 Insurer’s Maximum Liability 10 Article 24 Allocation of Moneys Received and Recoveries 11 Article 25 Assignment of Policy Rights 11 Article 26 Assignment of Contract Rights 11 Article 27 Observance of Stipulations and Confidentiality 12 Article 28 Joint and Several Obligations 12 Article 29 Retained Risk 12 Article 30 Trade Disputes and Third Party Guarantees of Payment 13 Article 31 Misrepresentations or Fraudulent Acts 13 Article 32 Set Off 13 Article 33 Currencies 13 Article 34 Variations of Terms of Cover 14 Article 35 Your Insolvency 14 Article 36 Law, Arbitration and Language 14Chapter 1 General RulesArticle 1 NoticeThe following Notice is incorporated in and made part of this Policy.This is a Short-Term Domestic Trade Credit Insurance Policy. The insurance period under this policy is no more than one year subject to the date of the commencement and date of termination indicated in the Schedule. This Policy has certain provisions and requirements unique to it and may be different from other policies you may have purchased.Please read this Policy carefully.The descriptions in the headings and titles of this Policy are solely for reference and convenience and do not lend any meaning to this agreement.Article 2 The PolicyWe, the Insurer named in the Schedule, have issued this Policy of insurance to you, the Insured named in the Schedule. This Policy includes, without limitation, these General Terms, the Proposal, the Schedule and any endorsements or other documents expressly incorporated thereby and all Credit Limits. This Policy supersedes any previous statement, promise or representation by the parties relating to the agreement or its subject matter. Chapter 2 Insurance CoverageArticle 3 Losses CoveredThe purpose of this insurance is to indemnify you, in accordance with the terms of this Policy, up to the Covered Percentage of any loss you may sustain because of the occurrence of any of the following causes of loss, provided in each case that there is an amount owing from the buyer which shall constitute such loss:A. InsolvencyThe Insolvency of any of your buyers. For the purposes of this Policy "Insolvency"shall occur if:a. a bankruptcy, winding-up or administration order is made against the buyer; orb. the buyer is declared bankrupt by the People’s Court; orc. in the course of execution of a judgment the levy of execution fails to satisfy the debt in full; ord. a valid assignment, composition or other arrangement is made for the benefit of the buyer’s creditors generally according to a decision of the People’s Court; ore. an effective resolution is passed for the winding-up of the buyer; orf. a liquidation committee, an administrative or other receiver or manager of any of thebuyer ’s property is appointed; org. you sh ow, to our satisfaction, that the buyer ’s financial state is such that even partial payment is unlikely and that to enforce judgment or to apply for a bankruptcy or winding-up order would have no foreseeable result other than one disproportionate to the likely cost of the proceedings.h. such situations or events which, in our sole opinion, in substance or effect are equivalent to the situations and events described above.B. DefaultThe failure of a buyer to pay you the amount owing under the contract within 6months of original due date of payment.Chapter 3 ExclusionsArticle 4 The insurer shall not be liable for any loss arising in connection with any of the following:A. Failure by YouWe shall not be liable for any loss you may sustain where there has been any failureby you or by any person acting on your behalf to fulfill any of the terms andconditions of the contract or to comply with the provisions of any law (including any order, decree or regulation having the force of law).B. Radioactive ContaminationWe shall not be liable for any loss directly or indirectly caused by, contributed toby or arising from the ionising, radioactive, toxic, explosive or otherhazardous or contaminating properties or effects of any explosive nuclear assembly or component thereto, nuclear fuel, combustion or waste.C. WarWe shall not be liable for any loss arising directly or indirectly from war (whether before or after the outbreak of hostilities) between any country.D. Interest/penalties/damages/costsWe shall not be liable for any loss you may sustain in respect ofa. any interest accruing after the original due date of payment, orb. any penalties or damages, whether contractual or otherwise, which you may be entitled to be paid by the buyer in addition to the amount owing, orc. any costs, legal or otherwise, which you incur in pursuing payment of any amount owing where the buyer claims for any reason whatsoever to be justified in withholding payment of all or part thereof or in defending any proceedings brought against you, ord. any costs, legal or otherwise, which you incur in establishing the validity and enforceability of a guarantee of payment or surety, obtaining a final enforceablejudgement and enforcing the guarantee or surety in a court, where we have made this a condition of cover, ore.. any banking costs, unless contractually agreed to be part of the amount owing from the buyer.E. Other InsuranceWe shall not be liable for any loss you may sustain where such loss is (or would bebut for the existence of this Policy) capable of being covered by any other insurance held by you.or from which you may be entitled to benefit or receive paymentF. Non-acceptance of goodsWe shall not be liable for any loss you may sustain where the buyer has failed or refused to accept good despatched. However, if such failure or refusal is in breach ofthe contract, this exclusion shall not apply.G. State or Government actionWe shall not be liable for any loss arising from any decision taken by a State or government department, local authority or any entity which cannot be declared insolvent that either hinders execution of the contract or prevents payment.H. Natural DisasterWe shall not be liable for any loss directly or indirectly caused by, contributed to by or arising from cyclone, flood, earthquake, volcanic eruption or tidal wave or otherforms of natural disaster or force majeure.Chapter 4 Contracts covered and Commencement of CoverArticle 5Contracts CoveredThe Policy applies to all contracts you make with buyers in your country inconnection with your Trade as specified in the Schedule. Contracts must be true,legally effective, binding and in writing. They must also specify the nature andquantity of the goods to be sold (or the services to be performed), as well as the termsof payment, which must not exceed the Maximum Credit Terms specified in the Schedule. Unless we agree otherwise in writing, the Policy does not apply to:a. any contracts you make with buyers over whom you have direct or indirect controlor in whom you have a direct or indirect interest or who have such control over or interest in you or where there is any family relationship or there exists any loans or guarantees between you and the buyer, either directly or indirectly;b. any contracts you make with private individuals, sole proprietorships or partnerships;c. any contracts you make with state or governmental departments, local authorities, institutions or organisations or any entity which cannot be declared insolvent;d. trial/approval contracts or to sales from consignment stock.Article 6 Commencement of CoverRisk shall attach in respect of those contracts for which cover commences during the Policy Period specified in the Schedule. Cover commences when the goods are despatched or, in the case of services, when each invoice for services performed is submitted to the buyer. Invoices for goods despatched or services performed must be submitted to the buyer within the Invoicing Period specified in the Schedule. This Invoicing Period commences on the day of despatch of such goods or, in the case of services, on the date when the contract is made.Article 7 DespatchDespatch is deemed to be made when you, or anyone acting on your behalf, parts with possession of the goods for the purpose of transmitting them to the buyer in accordance with the terms and conditions of the contract.Chapter 5 The Credit Limit and Withdrawal of CoverYou must have a Credit Limit for every buyer. In the event of a claim, we will not be liable to pay more than the Covered Percentage, specified in the Schedule, of the Credit Limit.Article 8 Credit LimitsYou may obtain a Credit Limit from us. The amount shall be determined from us at our discretion and shall be approved on the terms and conditions we think appropriate. Those terms and conditions may vary any provision of the Policy. Credit Limits from us remain valid until expiry of the Policy Period unless we cancel them or renew the Policy.Article 9 Compliance with Credit LimitWe shall not be liable for any loss where you have not complied with the terms and conditions of the Credit Limit.Article 10 Withdrawal by UsWe may at any time and for any reason by written notice to you cancel any CreditLimit and withdraw cover in respect of any contract or buyer. The policy will notapply in relation to goods despatched or, in the case of services, to invoices submitted,on or after the date specified in the notice. We may also at any time and for any reasonby written notice to you reduce any Credit Limit and such reduction shall apply inrelation to any goods despatched or, in the case of services, to invoices submitted, on or after the date specified in the notice.Chapter 6 Declarations, Premium and ChargesArticle 11 DeclarationsYou must declare to us the sale price (net of Value Added Tax or other similar tax) in respect of all goods despatched or services invoiced under contracts to which the policy applies. Where appropriate, a nil declaration must be submitted. Declarations must be returned to us by the time specified in the Schedule.Article 12 Risk PremiumPremium is payable, together with any applicable Insurance Premium Tax or other similar tax, in relation to each contract to which the policy applies. Premium is calculated at the percentage rate specified in the Schedule in respect of the amount of business declared. Payment of premium must be made at the times we specify.Article 13 Credit Limit ChargesWe shall also charge you (at the rates specified in the Schedule, which we may vary from time to time) for each response, decision and yearly review we give in respect of Credit Limits from us. Payment of all charges must be made at the times we specify.Chapter 7 Credit Beyond Due DateArticle 14 Credit beyond the Due DateYou may, if the need arises, allow credit to run for a period beyond the due date of payment specified in the contract with the buyer, or agree in writing to an extension of due date, provided that the period or extension you allow or agree is not longer thanthe Maximum Extension Period specified in the Schedule. If the buyer fails to pay infull by the expiry of the first such period or extension that you allow or agree, youmust not allow or agree to any further period or extension unless we agree otherwisein writing. You must not agree in the contract itself to any term which provides for the due date to be extendedArticle 15 Maximum Extension PeriodThe Maximum Extension Period commences on the day after the original due date of payment and ends on the expiry of either:(a) the number of calendar days specified as the Maximum Extension Period in the Schedule or(b) if shorter, the period or extension you allow or agree. We may vary the Maximum Extension Period by written notice at any time.Article 16 No liability beyond Maximum Extension PeriodIf payment of any amount is overdue from a buyer at the expiry of the Maximum Extension Period, we shall not be liable for any loss you may sustain in relation to goods despatched or in the case of services, to invoices submitted, to that buyer after that date, unless we agree otherwise in writing.Article 17 Bills of Exchange etc.Unless you obtain our prior written agreement, the granting of credit beyond due date is not permitted in the case of bills of exchange, promissory notes, cash against documents, documentary sight draft, documents against payment transactions or wherever payment is to be made out of a letter of credit.Chapter 8 Obligations of the InsuredArticle 18 The Proposal and Disclosure of FactsA. The Proposal for this insurance is incorporated into this Policy as its basis. You must have disclosed, and continue at all times to disclose promptly, all facts which might affect the risks insured. If you intentionally conceal any relevant facts which might affect our risk assessment, or otherwise grossly negligently fail to fulfill your obligation to make a full and accurate disclosure in answer to any questions contained in the Proposal and such concealment or failure adversely affects our underwriting decisions or premium rate assessment, we shall be entitled to avoid the policy and we shall not be liable for any loss you may sustain.B. As soon as it comes to your notice, you must immediately inform us of any substantial or material change in the information given in the proposal form, particularly in the nature or scope of your activities or in your own legal status.C. You undertake to allow us to exercise the right of discovery for checking and verifying that you have fulfilled all your obligations under this Policy. Where we so require, you must also cooperate with a certified auditor or other independent party that we may employ to certify the accuracy of the information and documents you have provided.D. You must disclose promptly and will at all times continue to disclose promptly all information and documents which might affect the risks insured under this Policy ormight influence our acceptance or assessment of the risks and Buyers insured under this Policy.Article 19 Minimising Loss and Obtaining RecoveriesA. NotificationYou must notify us immediately of the occurrence of any event likely to cause a loss. Such an event shall include, without limitation:a. the failure of a buyer to pay any amount still overdue 20 calendar days after the expiry of the Maximum Extension Period; orb. a buyer requesting an amendment of payment terms which is unfavourable to you or an extension of due date beyond the expiry of the Maximum Extension Period; orc. a buyer failing to take up the goods or the documents on first presentation where the payment terms are cash against documents or documents against acceptance; ord. the imminent or actual Insolvency of a buyer; ore. your having reason to believe that a buyer is unable or is likely to be unable to perform or comply with the terms of the contract; orf. the failure of a buyer to honour a bill of exchange or a cheque; org. the institution of any proceedings against a buyer for non-payment of an amount owing.B. Due Care & DiligenceYou must use due care and diligence and take all practicable measures to prevent and minimize loss. This includes, without limitation, ensuring that all rights against the contract goods, buyers and third parties are properly preserved and exercised.C. Taking All StepsYou must take all steps that we may require in connection with a potential or actual loss, including, without limitation, the institution of legal proceedings and such steps,if any, as may be specified in the Schedule. If we require it you must assign to us all rights against the contract goods, buyers or third parties or appoint us as your agent or attorney with power in your name to take legal proceedings or to appoint any personfor the purposes of collection of amounts owing. If you recover the contract goods and, with our prior written approval, resell them, any shortfall between the amount realised on resale and the amount owing from the buyer will be taken into accountwhen calculating your loss.D. InformationYou must provide us with all information and documents that we may require.E. Contributions to your Costs and ExpensesWe will contribute towards costs and expenses that you properly and reasonably incurin fulfilling the above obligations. Our contribution will be proportionate to ourliability for your total loss, including any uninsured portion, or for what such losswould have been but for your action in fulfilling the above obligations. However, wewill not contribute towards your administrative costs and expenses. We will also not contribute (without prejudice to any other rights we may have) to the costs and expenses of collecting any amount owing if you have chosen not to place thecollection of the amount as we may propose or as may be required in the Schedule.F. Failure to complyIf you fail to comply with any of the provisions of this Article after we have made a payment, then you will be liable to refund the payment to us on first written demand. Chapter 9 ClaimsArticle 20 Period for Submission and PaymentClaims (including all available information) must be made within 6 months of the expiry of the Maximum Extension Period, using the form we will provide. Provided that we are satisfied that we are liable to make payment, we will pay you the Covered Percentage either of the amount of your loss or of the Credit Limit for the buyer, whichever is less. We will make such payment no more than 30 days from either the date of receipt of all the information and documents we require or, if later, the date of ascertainment of loss.Article 21 Calculation of LossWe will calculate the amount of your loss as being the amount owing to you from the buyer less (i)any amount which, at the date of ascertainment of loss, you or the buyerare entitled to credit to the buyer ’s account whether by way of payment, set-off, counterclaim, deduction or otherwise and (ii)any expenses which you have saved. Article 22 Date of Ascertainment of LossThe amount of your loss shall be ascertained on the date of ascertainment of loss which shall be as follows:a. for Insolvency, on the day when Insolvency occurs;b. for Default, 6 months after original due date of payment.Article 23 Insurer ’s Maximum LiabilityThe maximum amount which we shall be liable to pay in respect of all contracts taken together for which our liability commences during the Policy Period shall be the amount of the Insurer ’s Maximum Liability shown in the Schedule for that period,notwithstanding that such amount may be less than the Covered Percentage of any individual Credit Limit or aggregate of Credit Limits.Article 24 Allocation of Moneys Received and RecoveriesA. Allocations by Chronological OrderAll amounts whenever received, in connection with any contracts (including contracts not covered by this Policy) shall, for the purposes of this Policy, be applied toamounts owing under all your contracts with the same buyer in chronological order of due dates. If such amounts fall to be applied to amounts owing under a contract on which we have paid a claim, they must be remitted to us and until this remittance is made you receive and hold such amounts in trust for us.B. RecoveriesAll sums whatsoever received, recovered or realised whether by you, by any person acting on your behalf, or by us in relation to a contract after the date of ascertainmentof loss shall be Recoveries. All Recoveries shall immediately be remitted to us. Untilthis remittance is made you receive and hold Recoveries in trust for us. After receiptby us Recoveries will be divided in the proportion in which the loss is borne by eachof us.C. Failure to complyIf you fail to comply with any of the provisions of this Article after we have made a payment, then you will be liable to refund the payment to us on first written demand. Chapter 10 MiscellaneousArticle 25 Assignment of Policy RightsLoss PayeeYou cannot assign or transfer this policy or any of its benefits without our priorwritten consent. You may, however, require claims payments to be made to a namedloss payee, using the form we will provide, your obligations under the policy remaining unaffected.Article 26 Assignment of Contract RightsYou may assign or charge your rights under the contract provided this does not contravene the contract terms and you give us details when making a claim. However, we shall not be liable to pay you for any loss unless: (a) you can show that you, not the person in whose favour the assignment or charge has been made, have sustained such loss and (b) that person has given us a written undertaking in a form acceptable to us that hewill not make any claim to our portion of any Recoveries.Article 27 Observance of Stipulations and ConfidentialityA. Due payment of all premiums and other charges and the due performance and observance of every stipulation in the policy or the proposal shall be your obligation. In the event of any breach of any condition we, according to the relevant stipulations of Insurance Law of the People’s Republic of China,also have the right to retain any premium paid and terminate the Policy from the date of our written notice to you. No variation or waiver relating to any stipulation of the policy shall be binding unless we have specifically agreed the same in writing.B. No failure by you to comply with any of the stipulations of this Policy shall be deemed to have been accepted or excused by us unless the same is expressly so excused or accepted by us in writing. The waiver by us of any breach or default by you in respect of any of the stipulations of this Policy shall not be construed as a waiver of any succeeding breach or default in respect of the same or any other stipulation.C. You must treat any information provided to you in strict confidence and you must not disclose such information to any third party. We shall not be liable for any loss which might arise from third parties gaining access to confidential information. All information, including but not limited to Credit Limit Decisions, is non-binding. We shall not be liable for any loss you may sustain where you use this information, especially for your own commercial decisions.D. If you fail to observe your obligations or stipulations of this insurance contract, and this would have had essential influence on the occurrence of loss or the amount of our liability, your right of indemnification will be forfeited. In such cases we also have the right to terminate the policy with immediate effect, unless otherwise stipulated by laws of the People’s Republic of China.E. You must not disclose the existence of this Policy to any buyer, whether insured or not. Article 28 Joint and Several ObligationsThe obligations of the persons named as the Insured in the Schedule shall be joint and several.Article 29 Retained RiskYou must retain exclusively for your own account as an uninsured risk any amount which exceeds the amount we are liable to pay you under the policy.Article 30 Trade Disputes and Third Party Guarantees of PaymentA. Trade DisputesWe shall not ascertain loss so long as a buyer claims for any reason whatsoever thathe is justified in withholding payment of all or part of an amount owing or in not performing any of his obligations under the contract.B. Third Party Guarantees of PaymentWhere we have made it a condition of cover that there be a guarantee or surety, weshall not ascertain loss until a final judgement for the amount owing has beenobtained against that guarantor or surety in a court in the country specified in such condition.Article 31 Misrepresentations or Fraudulent ActsAny misrepresentation with gross negligence which is material to the risk, or non-disclosure of information, or fraudulent conduct on your part (or on the part of any other person who has a legal or beneficial interest in the policy or its proceeds), in relation to this Policy (including the proposal), to any claim under it, or to any contract to which the Policy applies, will render the Policy void but we may retain any earned premium paid and you will be liable to refund to us any payment we may have made under the Policy unless otherwise stipulated by laws of the People’s Republic of China.Article 32 Set OffWe have the right to apply any amount payable under this policy in or towards payment of any amount owing from you to us (paying interest before principal) whether under this policy or otherwise. You have no right to apply any amount payable by you to us, whether under this policy or otherwise, in or towards payment of any amount owing from us to you.Article 33 CurrenciesA. The policy shall be denominated in the currency specified in the Schedule, which currency shall be used for the purpose of making declarations, paying premium and calculating the amount of any loss. Where you contract in a currency other than the denominated currency, a conversion to the equivalent amount in the denominated currency shall be made using the exchange rate on the last working day of the month during which cover commenced.B. Recoveries, if received in another currency, shall be converted to the denominatedcurrency at the exchange rate on the date of receipt by you or by any person acting onyour behalf.C. The exchange rate on a given date shall be the closing mid-point rate quoted on that date by the People’s Bank of China or, if the rate has not been quoted, such rate on the next succeeding date when the rate is quoted.Article 34 Variations of Terms of CoverWe have the right at any time to vary by written notice any of the provisions of the Policy in respect of contracts made with buyers insured under this Policy. The variation will apply to goods despatched or (in the case of services), to invoices submitted, after the date which will be specified in the notice (not being earlier than the date of the notice).Article 35 Your InsolvencyThe Policy shall terminate automatically with immediate effect if:a. a bankruptcy, winding-up or administration order is made against you; orb. an effective resolution is passed for your winding-up; orc. a liquidation committee, an administrative or other receiver or manager of any of your property is appointed; ord. a valid assignment, composition or other arrangement is made for the benefit of your creditors generally.Article 36 Law, Arbitration and LanguageA. The Policy shall be governed by and construed in accordance with the Law of the People’s Republic of China and subject to the jurisdiction of the arbitral tribunal established in accordance with sub-clause B below.B. All disputes arising under, out of or in connection with this Policy, including without limitation disputes as to its formation and validity, and whether arising during or after the Policy Period, which have not been settled amicably by negotiation between the Parties shall be submitted to China International Economic and Trade Arbitration Commission (CIETAC) for arbitration. The arbitration shall take place at the Place of Arbitration specified in the Schedule. The arbitration shall be conducted in accordance with the CIETAC’s arbitration rules in effect at the date of applic ation for arbitration. The arbitration award shall be final and binding on both parties.C. The Language of Policy shall be that specified in the Schedule. Where we provide translations of the Policy the version in the Language of Policy shall prevail in the event of any conflict or difference in meaning or effect.。

国内贸易短期信用险

应收帐款管理

中期

后期

• 案例1 – – – • 案例2 – –

保单周期末的年赊销总额:人民币8000万 增付保费: (8000万 x 0.42% - 168,000) = 人民币168,000

保单期末年赊销总额: 人民币3000万 保险公司保留最低保费, 不予退回.

国内贸易短期信用保险的主要内容

• 赔款支付

根据以下条件支付赔款:

• •

• • • •

☆保单管理简便:被保险人只需每季度末申报营业总额,无需申报买家明细营业额。 ☆待交付订单条款:如果保险人决定降低或取消买方的额度,在满足以下条件时,保险人对 自通知之日起三个月内被保险人必须对该买方履行的发货或服务义务继续提供保障:

1. 规定发货或提供服务的销售合同是在保险人通知之日前6个月之内签订。 2. 被保险人在保险人通知后的8天内书面要求保险人核准所有上述的发货或提供的服务。 3. 如果被保险人已经或应该向保险人发出买家的逾期欠款通知,则该买家丌在本保障范围内。 如果保险人要求被保险人停止对相关买家发货或提供服务,保险人将承担被保险人因重新出 售而导致的损失,在无特别说明的情冴下,对该损失的最高赔偿金额为在原核定信用额度内, 以发票金额的50%为限。

国内贸易短期信用保险的主要内容

• 信用额度 • 投保人为每个买家申请信用额度,信用额度的数额为在 任一时点投保人给予买方的最高帐面放帐总额

• 保险人为每一赊销买家批复一个信用额度:此额度为本保单 针对此买家的承保限额。 • 所有批复的信用额度均可循环使用,被保险人在保险期间可 根据实际情冴提出的其买家信用额度的变更

保单一年一签

国内贸易短期信用保险的优势____产品优势

• • • ☆ 最长信用期限条款:被保险人可根据自己对买家的判断,自主决定在此期限 内延长信用期限或提出索赔申报。该架构能在保障被保险人索赔时效的基础上,又给予被保 险人维护好客户关系的自由度 ☆ 全面追偿服务:一旦发生索赔,只要在等待期内,保险人协劣收回的任何款项都是先还给 被保险人,冲减损失金额,然后按照债款余额(即净损失)理赔,即使被保险人超出信用额 度交易也是如此。 这样能最大程度地利用保险的催收工作,降低损失。

国内贸易短期信用险产品介绍

7.平安国内贸易短期信用险的理赔流程

发生逾期应收帐款在规定期间内及时通知平安 进入理赔流程(一般等待期为5个月) 5个月结束,平安按相应保险比例赔付 平安赔付后,保留代位追偿权 在发生买方丧失清偿能力时,只要清算人认可债款纳入清 算范围,则在一月之内赔偿.

国内贸易短期信用险是企业在采用赊帐方式销售商品或提

供服务时,由于到期未收回债款所导致的应收债款的损失, 由保险公司按照约定的条件承担经济赔偿责任的合同。保 险期限以年为单位。

1.平安国内贸易短期信用险的概念与责任范围

平安国内贸易短期信用险的责任范围

(1)可投保的企业

在中国境内注册的,从事国内贸易并且赊帐销售且放帐期限不超过六 个月的企业

6.平安国内贸易短期信用险的操作实务

信用额度的评估标准

宏观经济条件(如国民生产总值、就业率等) 国家风险系数(如呆帐指数〕 法制结构(如中国对台湾在大陆投资有严格的限制〕 各行业风险情况

公司背景、运营和财务细节

限额申请的关联度(被保险人企业内部的信用风险控制情况 和销售情况, 和其买家的企业规模和各种经营情况)

2.平安国内贸易短期信用险对企业的帮助

企业融资业务流程表 Loss Payee Policy

销售合同/订单

1. 增值税发票复印件, 销售合同或订单以及 运输文件的复印件 3. 到期后收回 的货款

银行 供应商

2.给供应商的先期融资

买家

应收帐款收购协议

3.平安国内贸易短期信用险的优势

平安总部与全球第三大信用管理服务公司科法斯合作,并在 2003年率先推出国内短期贸易信用险,比国内同业早2年之久. 科法斯作为平安的再保险人,提供核保与保单管理所需的一切技 术支持

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

➢ A/R = Liquid Asset; Source of Operating Cash inflow; Increases with the Sales; however, mostly on Unsecured basis; 应收账款是流动性资产,是经营性现金流入的来源; 它伴随销售成长而增长,然而在多数情况下却是缺乏保证的

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

第三步骤:协商针对,确认保单条件及架构 第四步骤:确认相关资讯,完成报价签订保险契约

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

China Public Procurement Insurance Brokers

Factors to be considered when fixing premium

rate

设定保险费率的考虑因素

Turnover size Payment Terms Country Spread Bad debt record Buyers spread Type of business

风险评估

买方评级

信用决策

通知被保险人

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

专有信息渠道

- Risk offices - Buyer visits - Policyholder

所在行业 当地经济…… 保单结构

承保手续

第一步骤:填写信用保险投保单

当某个买家的逾期帐款超过最高延长期限时,必须暂停向该买家发货

Cover automatically suspends when there are debts overdue for longer than the MEP

营业规模 付款期限 国别风险分布 历史坏账纪录 买方分布 行业分布

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

信用限额的审核

信息数据库 风险审核

外部信息来源 - Inform. Agencies

- Banks - Public data

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

What is Credit Insurance

什么是信用保险?

➢ The Insurance cover for Bad Debt or Non-Payment of account receivables (AR) arising out of trade 对贸易产生的应收账款坏账和拖欠付款的保险

➢ How to protect the AR against non-payment risk in the competitive and challenging environment? 如何在竞争和挑战性的商业环境下保护应收账款? - Self Management 自行管理 - Credit Insurance 信用保险

➢ 预计应收账款销售额 (Whole Turnover Policy – 统保保单) ➢ 销售额明细 (包括列出现金交易, 预付款交易,L/C信用证交易,以及关

系企业间的交易) ➢ 可保营业额之国家或地区分布,以及相对应的过往一年营业额和未来一

年之预计营业额 ➢ 损失纪录 ➢ 买方资料 ➢ 帐龄分析,交易条件

Maximum Extension Period (MEP) 最高延长期限

Suspend shipments to a buyer if there are any overdue debts still outstanding on expiry of the Maximum Extension Period

➢ Whole turnover Policy

统保保单

➢ Terms of Payment <=180 Days 放账期限少于180天

➢ Insured Percentage: 90%

承保比例90%

➢ Credit Limit

信用限额

➢ Maximum Liability

最高保单责任限额

北京国采保险经纪有限公司

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

第二步骤:报价

➢ 根据投保单提供初步参考报价单 ➢ 决定保单条件(例如保险费率,自负额等等) ➢ 提供6-8个主要往来买方明细,查核信用限额

✓ 买方中文公司全名、以及详细注册地址(若有英文参考名称以 及注册地址,请提供) ✓ 买方工商注册登记号、以及所要求信用限额 ➢ 审核时间需时约2-3个星期

“Protracted Default” (non-payment at 180 days past due) 严重拖欠(应付款日后180天)

Political Risks 政治风险

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers

Policy structures and principles 保单的结构和原则

What Risk events does Credit Insurance Cover? 信用保险所承保的风险事故

Commercial Risks

商业风险

Insolvency (or equivalent in local jurisdictsk transfer + Credit management 风险转移的工具以及信用管理的顾问

➢ Closer to commercial banking service than to general insurance 更加接近于商业银行服务,而非一般保险

北京国采保险经纪有限公司

China Public Procurement Insurance Brokers