曼昆《宏观经济学》(第五版)课堂讲义PPT(英文)Ch19

合集下载

精品课程《宏观经济学》课件ppt(349页全)

国际收支总差额经常项目差额资本与金融项目差额净误差与遗漏国际收支总差额储备资产变化0各项差额该项的贷方数字减去借方数字2011122161第二节宏观经济的衡量一经济活动价值的衡量二物价水平和失业的衡量三流量与存量四利率与现值第一章导论关于数据的经典语句见word文件2011122162第二节宏观经济的衡量一经济活动价值的衡量第一章导论一国内生产总值与国民生产总值的概念二收入和支出的循环流动三国民收入核算的生产法四国民收入核算的支出法五国民收入核算的收入法六gdp与社会福利西蒙库兹涅茨

h

26

二、 宏观经济学的产生与发展

宏观经济学又叫总量经济学。

微观经济学:研究的是单个经济主体的经济行为,

涉及的内容是单个市场的均衡价格和产量的决 定,要说明资源如何才能得到优化配置。

2020/11/24

h

4

(二)宏观经济学的研究对象

“宏观经济学论述整个经济的行为——或经济生活

的宏观总量。它研究的是一国产出、就业、失业 和价格总水平”——萨谬尔森

h

23

(四)宏观经济学与微观经济学的区别和联系 1、 宏观经济学与微观经济学的区别

宏观经济学

微观经济学

基本假设 市场失灵(大多数假设) 市场出清、完全理性与信息

研究对象 整个国民经济

单个经济单位:家庭与厂商

研究方法 总量分析:总价格水平 个量分析 :商品或要素价格

研究重点 国民收入的决定

市场价格

研究目的 充分利用资源 争议大小 较大

研究对象之一:长期经济增长(Economic Growth)

增长源泉:劳动人口增长、储蓄率、投资率、技术 创新、教育及其他因素

2004-2008年国内生产总值及其增长速度(见WORD文件)

h

26

二、 宏观经济学的产生与发展

宏观经济学又叫总量经济学。

微观经济学:研究的是单个经济主体的经济行为,

涉及的内容是单个市场的均衡价格和产量的决 定,要说明资源如何才能得到优化配置。

2020/11/24

h

4

(二)宏观经济学的研究对象

“宏观经济学论述整个经济的行为——或经济生活

的宏观总量。它研究的是一国产出、就业、失业 和价格总水平”——萨谬尔森

h

23

(四)宏观经济学与微观经济学的区别和联系 1、 宏观经济学与微观经济学的区别

宏观经济学

微观经济学

基本假设 市场失灵(大多数假设) 市场出清、完全理性与信息

研究对象 整个国民经济

单个经济单位:家庭与厂商

研究方法 总量分析:总价格水平 个量分析 :商品或要素价格

研究重点 国民收入的决定

市场价格

研究目的 充分利用资源 争议大小 较大

研究对象之一:长期经济增长(Economic Growth)

增长源泉:劳动人口增长、储蓄率、投资率、技术 创新、教育及其他因素

2004-2008年国内生产总值及其增长速度(见WORD文件)

曼昆《经济学原理》宏观经济学ppt课件

研究对象

宏观经济学主要关注整个经济体系的总体运行,包 括总需求、总供给、国民收入、物价水平、就业和 经济增长等。

宏观经济学与微观经济学的关系

相互联系

宏观经济学和微观经济学是经济学的两个重要分支,它们之间相互联系、相互补充。 微观经济学是宏观经济学的基础,而宏观经济学则是微观经济学的延伸和扩展。

区别

开放经济下的政策目标

货币政策与财政政策

实现内外部经济均衡,即国内经济增长、充 分就业、物价稳定和国际收支平衡。

在开放经济下,政府可以运用货币政策和财 政政策来调节经济,但需要考虑汇率和国际 收支等因素。

汇率政策

国际经济政策协调

政府可以通过调整汇率水平来影响国际经济 活动和国内经济状况。

各国政府需要加强国际经济政策协调,共同 应对全球性经济问题,促进世界经济稳定发 展。

支持通货膨胀

凯恩斯主义宏观经济学派认为,适度的通货膨胀可以刺激 经济增长,政府可以通过控制货币供应量等手段来调节通 货膨胀率。

货币主义宏观经济学派

强调货币供应量

货币主义宏观经济学派认为,货币供应量的变化是影响经济波动 的主要因素,政府应该通过控制货币供应量来调节经济。

主张单一规则

该学派主张政府应该制定一个固定的货币增长规则,并严格执行, 以保持物价的稳定和经济的增长。

VS

政策效应互补

货币政策和财政政策在调控经济时具有不 同的特点和优势,可以相互补充、协调配 合,提高宏观调控效果。例如,在治理通 货膨胀时,可以采取紧缩性货币政策和扩 张性财政政策相配合的方式;在促进经济 增长时,可以采取扩张性货币政策和紧缩 性财政政策相配合的方式。

05

国际经济学与宏观经济政策

Chapter

曼昆《经济学原理》(宏观经济学分册)英文原版PPT课件

© 2007 Thomson South-Western

THE COMPONENTS OF GDP • GDP includes all items produced in the economy and sold legally n markets. • What Is Not Counted in GDP?

– Every transaction has a buyer and a seller. – Every dollar of spending by some buyer is a dollar of income for some seller.

© 2007 Thomson South-Western

Y = C + I + G + NX

© 2007 Thomson South-Western

THE COMPONENTS OF GDP • Consumption (C):

• The spending by households on goods and services, with the exception of purchases of new housing. • Investment (I):

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

• “. . . Final . . .” – It records only the value of final goods, not intermediate goods (the value is counted only once).

THE COMPONENTS OF GDP • GDP includes all items produced in the economy and sold legally n markets. • What Is Not Counted in GDP?

– Every transaction has a buyer and a seller. – Every dollar of spending by some buyer is a dollar of income for some seller.

© 2007 Thomson South-Western

Y = C + I + G + NX

© 2007 Thomson South-Western

THE COMPONENTS OF GDP • Consumption (C):

• The spending by households on goods and services, with the exception of purchases of new housing. • Investment (I):

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

• “. . . Final . . .” – It records only the value of final goods, not intermediate goods (the value is counted only once).

宏观经济学曼昆ppt课件

版权所有

谢绝拷贝

宏观经济学

MACROECONOMICS

N.Gregory Mankiw (曼昆)

此幻灯片为纪念从教《西方经济学》二十周年

而作,并把她献给你们

我心中的太阳。

1

第1章 宏观经济学的科学

第一 节 宏观经济学家研究什么 Y = F(L,N,K,H)

总产出=总投入 总支出=总收入 总需求=总供给

6

4) GDP是计算期内生产的最终产品和劳务 的市场价值。 5) GDP 是一国范围内生产的最终产品和劳 务的市场价值。 6) GDP一般仅指市场活动导致的价值。

7

3.名义的GDP和实际的GDP

1) 名义的GDP(Nominal GDP) 以一定时期市场价格表示的国内生产总值, 称作该时期的名义的GDP。 2) 实际的GDP(Real GDP) 以某一年作为基年的价格表示的国内生产 总值,称作该时期的实际的GDP。

23

4. 漏出和注入

1)漏出指居民或企业的收入中作为储蓄、税 收和进口等而没有支付给对方的那部分。

2)注入指居民或企业得到的收入中,不是相 互由对方付给的那部分。如投资、出口、政 府支出等。

▪

W=J

▪ S + TA + IM + = I + G +EX +TR

24

5.漏出和注入的关系 漏出来之于注入,又归入于注入之中。 ▪ W > J,国民经济收缩。 ▪ W < J,国民经济扩张。 ▪ W = J,国民经济均衡。

D

QS= S(P,Pm)

0

Q

Q0 Q1

3

2. 模型的多样性

3. 价格: 伸缩性与粘性 市场出清 伸缩性

谢绝拷贝

宏观经济学

MACROECONOMICS

N.Gregory Mankiw (曼昆)

此幻灯片为纪念从教《西方经济学》二十周年

而作,并把她献给你们

我心中的太阳。

1

第1章 宏观经济学的科学

第一 节 宏观经济学家研究什么 Y = F(L,N,K,H)

总产出=总投入 总支出=总收入 总需求=总供给

6

4) GDP是计算期内生产的最终产品和劳务 的市场价值。 5) GDP 是一国范围内生产的最终产品和劳 务的市场价值。 6) GDP一般仅指市场活动导致的价值。

7

3.名义的GDP和实际的GDP

1) 名义的GDP(Nominal GDP) 以一定时期市场价格表示的国内生产总值, 称作该时期的名义的GDP。 2) 实际的GDP(Real GDP) 以某一年作为基年的价格表示的国内生产 总值,称作该时期的实际的GDP。

23

4. 漏出和注入

1)漏出指居民或企业的收入中作为储蓄、税 收和进口等而没有支付给对方的那部分。

2)注入指居民或企业得到的收入中,不是相 互由对方付给的那部分。如投资、出口、政 府支出等。

▪

W=J

▪ S + TA + IM + = I + G +EX +TR

24

5.漏出和注入的关系 漏出来之于注入,又归入于注入之中。 ▪ W > J,国民经济收缩。 ▪ W < J,国民经济扩张。 ▪ W = J,国民经济均衡。

D

QS= S(P,Pm)

0

Q

Q0 Q1

3

2. 模型的多样性

3. 价格: 伸缩性与粘性 市场出清 伸缩性

曼昆宏观经济学ppt课件(2024)

平台经济、共享经济等新模 式不断涌现,对传统经济理 论提出挑战。

2024/1/28

数据成为新的生产要素,对 经济增长贡献度不断提升。

需要加强数字经济理论研究 ,为政策制定提供科学依据 。

43

THANKS

感谢观看

2024/1/28

44

宏观经济学定义与研究对象

2024/1/28

宏观经济学定义

宏观经济学是研究整体经济现象 、经济运行规律及政府如何运用 经济政策调控经济的学科。

研究对象

宏观经济学以整个国民经济为研 究对象,包括总需求、总供给、 国民收入、就业、通货膨胀、经 济增长等问题。

4

宏观经济学与微观经济学关系

联系

宏观经济学与微观经济学都是经济学的重要分支,两者相互联系、相互补充。 微观经济学是宏观经济学的基础,宏观经济学则需要微观经济学的支持。

01

02

03

实际收入减少

物价上涨导致货币购买力 下降,实际收入减少。

2024/1/28

社会财富再分配

通货膨胀有利于债务人而 不利于债权人,导致社会 财富再分配。

经济秩序紊乱

通货膨胀可能导致价格信 号失真,经济秩序紊乱。

20

经济增长因素、模型及政策含义

劳动力投入

劳动力数量和质量的提高对经济增长有重要贡献。

04

实施积极的财政政策和货币政策,保持经 济稳定增长。

25

04

总供给与总需求模型分析

2024/1/28

26

总供给曲线形状及影响因素剖析

要点一

长期总供给曲线

要点二

短期总供给曲线

垂直,表示在长期内,经济总产出不受价格水平影响。

向右上方倾斜,表示短期内价格水平与总产出呈正相关。

曼昆经济学原理第五版宏观全ppt课件

Q 1000 1100 1200

增加:

= $6,000 = $8,250 = $10,800

37.5% 30.9%

26

例:

皮萨

年份

P

Q

2005

$10

400

2006

$11

500

2007

$12

600

计算每年的真实GDP, 以2005 年作为基年:

2005: $10 x 400 + $2 x 1000

2006: $10 x 500 + $2 x 1100

年是2000年)

$4,000 $2,000

名义GDP

$0 1965 1970 1975 1980 1985 1990 1995 2000 2005

30

GDP平减指数

• GDP平减指数是对总体价格水平的衡量 • 定义:

GDP平减指数= 100 x

名义 GDP 真实 GDP

▪ 衡量经济通货膨胀率的一种方法是计算从一年到

100.0

2006: 100 x (8250/7200) =

114.6

2007: 100 x (10,800/8400) =

128.6

32

主动学习 2

GDP的计算

物品 A 物品 B

2007 (基年)

2008

P

Q

P

Q

$30 900 $31 1,000

$100 192 $102 200

2009

P

Q

$36 1050

39

预期寿命 (年)

12个国家的GDP和预期寿命

印度尼西亚 中国 墨西哥

巴西 巴基斯坦

俄罗斯 印度 孟加拉国

宏观经济学曼昆版PPT

• Diversification refers to the reduction of risk achieved by replacing a single risk with a large number of smaller unrelated risks.

PPT文档演模板

宏观经济学曼昆版PPT

PPT文档演模板

宏观经济学曼昆版PPT

Efficient Markets Hypothesis

• A market is informationally efficient when it reflects all available information in a rational way.

• If markets are efficient, the only thing an investor can do is buy a diversified portfolio

Diversification of Idiosyncratic Risk

• Idiosyncratic risk is the risk that affects only a single person. The uncertainty associated with specific companies.

PPT文档演模板

宏观经济学曼昆版PPT

FYI: Rule of 70

• According to the rule of 70, if some variable grows at a rate of x percent per year, then that variable doubles in approximately 70/x years.

PPT文档演模板

PPT文档演模板

宏观经济学曼昆版PPT

PPT文档演模板

宏观经济学曼昆版PPT

Efficient Markets Hypothesis

• A market is informationally efficient when it reflects all available information in a rational way.

• If markets are efficient, the only thing an investor can do is buy a diversified portfolio

Diversification of Idiosyncratic Risk

• Idiosyncratic risk is the risk that affects only a single person. The uncertainty associated with specific companies.

PPT文档演模板

宏观经济学曼昆版PPT

FYI: Rule of 70

• According to the rule of 70, if some variable grows at a rate of x percent per year, then that variable doubles in approximately 70/x years.

PPT文档演模板

曼昆《宏观经济学》课件讲义

需求拉动

消费需求、投资需求等总需求超过总供给,推动物价上涨。

通货膨胀类型、原因及影响分析

• 成本推动:原材料、劳动力等成本上升推动物价上涨。

通货膨胀类型、原因及影响分析

01

02

03

实际收入水平下降

物价上涨导致货币购买力 下降,实际收入水平降低。

社会财富再分配

通货膨胀使得财富从固定 收入者向变动收入者转移, 从债权人向债务人转移。

总需求-总供给模型在政策分析中应用

• 财政政策分析:财政政策是政府通过调整财政支出和税收政策来影响总需求和总供给的重要手段。在总需求总供给模型中,财政政策可以通过改变政府购买支出、转移支付和税收等方式来影响总需求和总供给的平衡。 例如,增加政府购买支出可以刺激总需求增长;减少税收可以增加居民可支配收入和企业盈利能力,进而促进 消费和投资支出增加;增加转移支付可以提高低收入群体收入水平和消费能力,推动总需求上升。

财政政策与货币政策的协调配合

分析在开放经济条件下,如何协调配合财政政策和货币政策以实现宏观经济目标,如经济增 长、物价稳定、国际收支平衡等。

THANKS

感谢观看

意义

宏观经济学对于政府制定经济政策、促进经 济增长、维护社会稳定等方面具有重要意义。

通过宏观经济学的研究,政府可以更好地了 解国民经济的运行状况,制定更加科学合理 的经济政策,以实现经济的持续健康发展。 同时,宏观经济学也有助于我们更好地认识 和理解现实生活中的各种经济现象和问题。

02 国民收入核算与 衡量

06 开放经济条件下 宏观经济政策

汇率制度选择及影响分析

01

固定汇率制与浮动汇率制的比较

固定汇率制下,政府承诺维持汇率稳定;浮动汇率制下,汇率由市场供

消费需求、投资需求等总需求超过总供给,推动物价上涨。

通货膨胀类型、原因及影响分析

• 成本推动:原材料、劳动力等成本上升推动物价上涨。

通货膨胀类型、原因及影响分析

01

02

03

实际收入水平下降

物价上涨导致货币购买力 下降,实际收入水平降低。

社会财富再分配

通货膨胀使得财富从固定 收入者向变动收入者转移, 从债权人向债务人转移。

总需求-总供给模型在政策分析中应用

• 财政政策分析:财政政策是政府通过调整财政支出和税收政策来影响总需求和总供给的重要手段。在总需求总供给模型中,财政政策可以通过改变政府购买支出、转移支付和税收等方式来影响总需求和总供给的平衡。 例如,增加政府购买支出可以刺激总需求增长;减少税收可以增加居民可支配收入和企业盈利能力,进而促进 消费和投资支出增加;增加转移支付可以提高低收入群体收入水平和消费能力,推动总需求上升。

财政政策与货币政策的协调配合

分析在开放经济条件下,如何协调配合财政政策和货币政策以实现宏观经济目标,如经济增 长、物价稳定、国际收支平衡等。

THANKS

感谢观看

意义

宏观经济学对于政府制定经济政策、促进经 济增长、维护社会稳定等方面具有重要意义。

通过宏观经济学的研究,政府可以更好地了 解国民经济的运行状况,制定更加科学合理 的经济政策,以实现经济的持续健康发展。 同时,宏观经济学也有助于我们更好地认识 和理解现实生活中的各种经济现象和问题。

02 国民收入核算与 衡量

06 开放经济条件下 宏观经济政策

汇率制度选择及影响分析

01

固定汇率制与浮动汇率制的比较

固定汇率制下,政府承诺维持汇率稳定;浮动汇率制下,汇率由市场供

MacroBEBernanke Ch 5 PPT宏观经济学

5-6

Cost of Living

CPI = 1050 / 850 = 1.31

2005 Spending Rent (2 bedroom apartment) Hamburgers (60 at $2 each) Movie tickets (10 at $6 each) Monthly Cost in 2005 $500 120 60

Year 2005 2011

Nominal Income $20,000 $22,000

CPI 1.00 1.25

Real Income $20,000/1.00 = $20,000 $22,000/1.25 = $17,600

5-12

Baseball Stars

• Compare Babe Ruth's salary with Barry Bonds'

5-13

Barry Bonds

2001

$10,300,000

1.780

Real Wages

• The real wage is the wage paid to the worker measured in terms of purchasing power

– The real wage for any given period is calculated by dividing the nominal wage by the CPI for that period

5-2

Keeping up with Grandpa

• Prices of goods change over time

– Adjust values, incomes, or spending for change in prices – Constant purchasing power

Cost of Living

CPI = 1050 / 850 = 1.31

2005 Spending Rent (2 bedroom apartment) Hamburgers (60 at $2 each) Movie tickets (10 at $6 each) Monthly Cost in 2005 $500 120 60

Year 2005 2011

Nominal Income $20,000 $22,000

CPI 1.00 1.25

Real Income $20,000/1.00 = $20,000 $22,000/1.25 = $17,600

5-12

Baseball Stars

• Compare Babe Ruth's salary with Barry Bonds'

5-13

Barry Bonds

2001

$10,300,000

1.780

Real Wages

• The real wage is the wage paid to the worker measured in terms of purchasing power

– The real wage for any given period is calculated by dividing the nominal wage by the CPI for that period

5-2

Keeping up with Grandpa

• Prices of goods change over time

– Adjust values, incomes, or spending for change in prices – Constant purchasing power

曼昆《宏观经济学》(第五版)课堂讲义PPT(英文)Ch10

Chapter Ten

Y2 Y* Y1

Income, Output, Y

9

Consider how changes in government purchases affect the economy. Because government purchases are one component of expenditure, higher government purchases result in higher planned expenditure, for any given level of income. Expenditure, E B G A Actual Expenditure, Y=E Planned Expenditure, E=C+I+G

A PowerPointTutorial to Accompany macroeconomics, 5th ed. N. Gregory Mankiw

CHAPTER TEN Aggregate Demand I

Mannig J. Simidian

Chapter Ten 1

The Great Depression caused many economists to question the validity of classical economic theory (from Chapters 3-6). They believed they needed a new model to explain such a pervasive economic downturn and to suggest that government policies might ease some of the economic hardship that society was experiencing. In 1936, John Maynard Keynes wrote The General Theory of Employment, Interest and Money. In it, he proposed a new way to analyze the economy, which he presented as an alternative to the classical theory. Keynes proposed that low aggregate demand is responsible for the low income and high unemployment that characterize economic downturns. He criticized the notion that aggregate supply alone determines national income.

曼昆宏观经济学全部课件

03

如人均GDP、人均GNI等,用于更全面地反映一国的经济规模

和人民生活水平。

经济增长的度量与源泉

经济增长的度量

通常使用GDP增长率、人均GDP增长 率等指标来衡量经济增长的速度和趋 势。

经济增长的源泉

经济增长模型

如索洛模型、内生增长模型等,用于 解释经济增长的机制和影响因素。

主要包括资本积累、技术进步、劳动 力投入和全要素生产率提高等方面。

预测政策效果

政府可以通过财政政策或货币政策影响总需求或总供给,进而调控 经济。

国际经济分析

通过比较不同国家的总供给和总需求状况,可以分析国际经济关系 和贸易状况。

05

财政政策与货币政策的 效果分析

财政政策的效应分析

1 2 3

乘数效应

财政政策通过公共支出和税收等手段影响总需求 ,从而产生乘数效应,使得初始财政政策变动对 总产出产生倍数影响。

发展经济学的主要理论

发展经济学的主要理论包括结构主义、新古典主义和激进主义等。这些理论在发展中国家的发展实践中产生了不同的 影响。

发展经济学的最新进展

近年来,发展经济学在研究方法、研究内容和研究领域等方面都取得了新的进展,如实证研究方法的应 用、对制度和文化等因素的深入研究等。

发展中国家的经济发展战略

货币政策的目标

货币政策的主要目标是维持物价稳定、促进经济增长和实现 充分就业。中央银行通过制定和执行货币政策来实现这些目 标。

货币政策的工具

中央银行可以运用多种货币政策工具来实现政策目标,包括 调整法定存款准备金率、调整再贴现率、公开市场操作等。 这些工具可以影响市场利率和货币供应量,从而调节总需求 和物价水平。

总需求曲线

总需求曲线的形状

(2024年)曼昆经济学原理第五版宏观全ppt课件

11

03

货币市场与利率决定

2024/3/26

12

货币市场概述及工具

01

货币市场定义

货币市场是短期资金供求的场所, 主要交易一年以内的短期金融工

具。

2024/3/26

02

货币市场工具

03

货币市场功能

包括商业票据、银行承兑汇票、 大额可转让定期存单、回购协议

等。

提供短期资金融通、管理流动性、 发现短期资金价格等。

总供给

总供给减少会导致价格水平上升。

预期

预期通货膨胀率上升会导致价格水平上升。

2024/3/26

19

价格水平决定因素及模型

货币数量论

MV=PY,其中M为货币供应量,V为货币流 通速度,P为价格水平,Y为实际产出。该模 型认为价格水平由货币供应量和实际产出决 定。

2024/3/26

总供给-总需求模型

2024/3/26

27

国际金融理论与政策实践

国际金融理论

包括汇率决定理论、国际收支理论等,解释国 际金融市场的运行和汇率波动的原因。

2024/3/26

国际金融政策工具

包括汇率政策、国际储备政策、国际金融机构等,分 析其对国际金融稳定和发展的作用。

国际金融危机与应对

探讨国际金融危机的成因、传导机制和应对措 施,以及国际合作在危机应对中的重要性。

结构类型

根据劳动力供求双方的特点和交易方式,劳动市场可分为完 全竞争市场、买方垄断市场、卖方垄断市场和双边垄断市场 四种类型。

2024/3/26

23

工资水平决定因素及模型

决定因素

工资水平受多种因素影响,包括劳动力供求关系、劳动生 产率、经济发展水平、行业差异、地区差异等。

03

货币市场与利率决定

2024/3/26

12

货币市场概述及工具

01

货币市场定义

货币市场是短期资金供求的场所, 主要交易一年以内的短期金融工

具。

2024/3/26

02

货币市场工具

03

货币市场功能

包括商业票据、银行承兑汇票、 大额可转让定期存单、回购协议

等。

提供短期资金融通、管理流动性、 发现短期资金价格等。

总供给

总供给减少会导致价格水平上升。

预期

预期通货膨胀率上升会导致价格水平上升。

2024/3/26

19

价格水平决定因素及模型

货币数量论

MV=PY,其中M为货币供应量,V为货币流 通速度,P为价格水平,Y为实际产出。该模 型认为价格水平由货币供应量和实际产出决 定。

2024/3/26

总供给-总需求模型

2024/3/26

27

国际金融理论与政策实践

国际金融理论

包括汇率决定理论、国际收支理论等,解释国 际金融市场的运行和汇率波动的原因。

2024/3/26

国际金融政策工具

包括汇率政策、国际储备政策、国际金融机构等,分 析其对国际金融稳定和发展的作用。

国际金融危机与应对

探讨国际金融危机的成因、传导机制和应对措 施,以及国际合作在危机应对中的重要性。

结构类型

根据劳动力供求双方的特点和交易方式,劳动市场可分为完 全竞争市场、买方垄断市场、卖方垄断市场和双边垄断市场 四种类型。

2024/3/26

23

工资水平决定因素及模型

决定因素

工资水平受多种因素影响,包括劳动力供求关系、劳动生 产率、经济发展水平、行业差异、地区差异等。

曼昆宏观经济学课件 (19)

banks have not lent.

§ A bank’s liabilities include deposits,

assets include reserves and outstanding loans.

§ 100-percent-reserve banking: a system in

which banks hold all deposits as reserves.

SEVENTH EDITION

§ how the banking system “creates” money § three ways the Fed can control the money

supply, and why the Fed can’t control it precisely

§ leading theories of money demand § a portfolio theory § a transactions theory: the Baumol-Tobin

model

Banks’ role in the money supply

§ The money supply equals currency plus

demand (checking account) deposits: M = C + D

§ Since the money supply includes demand

and loan the rest out:

THIRDBANK’S balance sheet Assets Liabilities reserves $128 $640 loans $0 $512 deposits $640

CHAPTER 19

§ A bank’s liabilities include deposits,

assets include reserves and outstanding loans.

§ 100-percent-reserve banking: a system in

which banks hold all deposits as reserves.

SEVENTH EDITION

§ how the banking system “creates” money § three ways the Fed can control the money

supply, and why the Fed can’t control it precisely

§ leading theories of money demand § a portfolio theory § a transactions theory: the Baumol-Tobin

model

Banks’ role in the money supply

§ The money supply equals currency plus

demand (checking account) deposits: M = C + D

§ Since the money supply includes demand

and loan the rest out:

THIRDBANK’S balance sheet Assets Liabilities reserves $128 $640 loans $0 $512 deposits $640

CHAPTER 19

宏观经济学曼昆版PPTpptx-2024鲜版

产折旧后的价值。

国民生产总值(GNP)

指一个国家或地区所有常住单位在一定时期内收入初次分配的最终结果,等于所有常住 单位的增加值之和。

2024/3/28

国民生产净值(NNP)

指一个国家或地区在一定时期内,所有常住单位的生产活动创造的最终成果扣除固定资 产折旧后的价值,加上来自国外的净要素收入。

9

国民收入核算的局限性与改进

36

THANKS

2024/3/28

37

2024/3/28

16

经济增长的定义、影响因素与政策

01

经济增长定义

02

影响因素

经济增长是指一个国家或地区在一定 时期内,生产总值的增加或人均生产 值的提高,反映了一个国家或地区经 济总量的增长速度和经济发展水平。

经济增长的影响因素包括资本积累、 劳动力数量和质量、技术进步、制度 变迁、自然资源等。

动性。

02

存款准备金率

调整商业银行必须存放在中央银 行的存款比例,影响银行的信贷

能力。 24

货币政策的定义、工具与目标

• 利率政策:通过调整基准利率,引导市场利率变动,影响 投资和消费。

2024/3/28

25

货币政策的定义、工具与目标

物价稳定

保持通货膨胀率在合理水平,避免物 价大幅波动对经济和民生的影响。

政策目标

实现内外经济均衡,包括内部均衡(充分就业、物价稳定、经济增长)和外部均衡(国际 收支平衡)。

政策工具

财政政策、货币政策、汇率政策等,用于调节总需求、总供给和国际收支。

2024/3/28

政策搭配

根据经济形势和政策目标,灵活运用各种政策工具进行搭配,以实现最佳政策效果。例如 ,在面临通货膨胀和国际收支赤字时,可以采取紧缩性财政政策和紧缩性货币政策,同时 配合本币贬值的汇率政策。

国民生产总值(GNP)

指一个国家或地区所有常住单位在一定时期内收入初次分配的最终结果,等于所有常住 单位的增加值之和。

2024/3/28

国民生产净值(NNP)

指一个国家或地区在一定时期内,所有常住单位的生产活动创造的最终成果扣除固定资 产折旧后的价值,加上来自国外的净要素收入。

9

国民收入核算的局限性与改进

36

THANKS

2024/3/28

37

2024/3/28

16

经济增长的定义、影响因素与政策

01

经济增长定义

02

影响因素

经济增长是指一个国家或地区在一定 时期内,生产总值的增加或人均生产 值的提高,反映了一个国家或地区经 济总量的增长速度和经济发展水平。

经济增长的影响因素包括资本积累、 劳动力数量和质量、技术进步、制度 变迁、自然资源等。

动性。

02

存款准备金率

调整商业银行必须存放在中央银 行的存款比例,影响银行的信贷

能力。 24

货币政策的定义、工具与目标

• 利率政策:通过调整基准利率,引导市场利率变动,影响 投资和消费。

2024/3/28

25

货币政策的定义、工具与目标

物价稳定

保持通货膨胀率在合理水平,避免物 价大幅波动对经济和民生的影响。

政策目标

实现内外经济均衡,包括内部均衡(充分就业、物价稳定、经济增长)和外部均衡(国际 收支平衡)。

政策工具

财政政策、货币政策、汇率政策等,用于调节总需求、总供给和国际收支。

2024/3/28

政策搭配

根据经济形势和政策目标,灵活运用各种政策工具进行搭配,以实现最佳政策效果。例如 ,在面临通货膨胀和国际收支赤字时,可以采取紧缩性财政政策和紧缩性货币政策,同时 配合本币贬值的汇率政策。

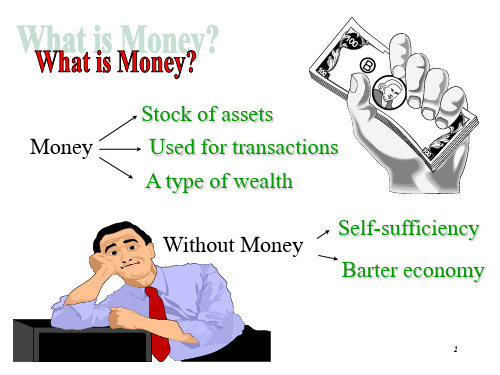

曼昆《宏观经济学》(第五版)课堂讲义PPT(英文)Ch04共28页文档

Money

Stock of assets Used for transactions A type of wealth

Self-sufficiency Without Money

Barter economy

Chapter Four

1

Functions of Money

• Store of value • Unit of account • Medium of exchange

Money Velocity = Price Output M V = P Y

Because Y is also total income, V in the quantity equations is called the income velocity of money. This tells us the number of times a dollar bill changes hands in a given period of time.

Chapter Four

5

Chapter Four

• To expand the Money Supply: The Federal Reserve buys U.S. Treasury Bonds and pays for them with new money.

• To reduce the Money Supply: The Federal Reserve sells U.S. Treasury Bonds and receives the existing dollars and then destroys them.

Chapter Four

8

Let’s now express the quantity of money in terms of the quantity of goods and services it can buy. This amount, M/P is called real money balances. Real money balances measure the purchasing power of the stock of money. A money demand function is an equation that shows what determines the quantity of real money balances people wish to hold. Here is a simple money demand function:

Stock of assets Used for transactions A type of wealth

Self-sufficiency Without Money

Barter economy

Chapter Four

1

Functions of Money

• Store of value • Unit of account • Medium of exchange

Money Velocity = Price Output M V = P Y

Because Y is also total income, V in the quantity equations is called the income velocity of money. This tells us the number of times a dollar bill changes hands in a given period of time.

Chapter Four

5

Chapter Four

• To expand the Money Supply: The Federal Reserve buys U.S. Treasury Bonds and pays for them with new money.

• To reduce the Money Supply: The Federal Reserve sells U.S. Treasury Bonds and receives the existing dollars and then destroys them.

Chapter Four

8

Let’s now express the quantity of money in terms of the quantity of goods and services it can buy. This amount, M/P is called real money balances. Real money balances measure the purchasing power of the stock of money. A money demand function is an equation that shows what determines the quantity of real money balances people wish to hold. Here is a simple money demand function:

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter Nineteen

11

Chapter Nineteen

New Keynesian Economics

12

Most economists are skeptical of the theory of real business cycles and believe that short-run fluctuations in output and employment represent deviations from the economy's natural rate. They think these deviations occur because wages and prices are slow to adjust to changing economic conditions. This stickiness makes the short-run aggregate supply curve upward sloping rather than vertical. As a result, fluctuations in aggregate demand cause short-run fluctuations in output and employment. But, why are prices sticky? New Keynesian research has attempted to answer this question by examining the microeconomics behind short-run price adjustment.

Chapter Nineteen 5

Critics of the real business cycle theory believe: Fluctuations in employment do not reflect changes in the amount people want to work. Desired employment is not sensitive to the real wage and the real interest rate– unemployment fluctuates over the business cycle. The high unemployment in recessions implies that markets don't clear and that wages do not equilibrate labor demand and labor supply.

A PowerPointTutorial to Accompany macroeconomics, 5th ed. N. Gregory Mankiw

CHAPTER NINETEEN Advances in Business Cycle Theory

Mannig J. Simidian

Chapter Nineteen 1

Chapter Nineteen 3

Real business cycle theory emphasizes the idea that the quantity of labor supplied at any given time depends on the incentives that workers face. The willingness to reallocate hours of work over time is called the intertemporal substitution of labor. Consider this example: Let W1 be the real wage in the first period. Let W2 be the real wage in the second period. Let r be the real interest rate. If you work in the first period, and save your earnings, you will have (1 + r)W1 a year later. If you work in period 2, you will have W2.

Real business cycle theorists believe that the assumption of flexible prices is superior methodologically to the assumption of sticky prices. Critics point out that wages and prices are not flexible. They believe that this inflexibility explains both the existence of unemployment and the non-neutrality of money.

Criticisms of

Real business cycle theorists reply: Unemployment statistics are difficult to interpret. Simply because unemployment rate is high does not mean that intertemporal substitution Chapter of labor Nineteen is unimportant.

Chapter Nineteen

2

The interpretation of the labor market: Do fluctuations in employment reflect voluntary changes in the quantity of labor supplied? The importance of technology shocks: Does the economy's production function experience large, exogenous shifts in the short run? The neutrality of money: Do changes in the money supply have only nominal effects? The flexibility of wages and prices: Do wages and prices adjust quickly and completely to balance supply and demand?

Chapter Nineteen 4

Intertemporal Relative Wage = (1 + r) W1 W2 Working the first period is more attractive if the interest rate is high or if the wage is high relative to the wage expected to prevail in the future. According to real business cycle theory, all workers perform this cost-benefit analysis when deciding whether to work or enjoy leisure. If the wage is high, or if the interest rate is high, it is a good time to work. If the wage or interest rate is low, then it is a good time to

Critics of the real business cycle theory: Are skeptical that the economy experiences large technology shocks, and propose that technological improvements happen more gradually. Believe that technological regress is especially implausible. Real business cycle theorists reply: Adopt a broader view of shocks to technology. Events, although not technological, have a similar affect on the economy (i.e. weather, regulations, oil prices).

Chapter Nineteen

Criticisms of Real Business Cycle Theory

9

Real business cycle theory assumes that money is neutral, even in the short run. That is, it is assumed not to affect real variables such as output and employment. Critics argue that the evidence does not support short-run monetary neutrality. They point out that reductions in money growth and inflation are almost always associated with periods of high unemployment. Advocates of real business cycle argue that their critics confuse the direction of causation between money and output. They claim the money supply is endogenous: fluctuations in output might cause fluctuations in the money supply. For example, when Y rises, because of a tech shock, the quantity of money demanded rises. The Fed may then increase the money supply to accommodate greater demand. 10 Chapter Nineteen This gives the illusion of non-money neutrality.