证券投资学第版课后习题参考答案

《证券投资学》课后习题答案

《证券投资学》课后习题答案第一章证券市场概述1、什么是投资?实体投资与金融投资、直接金融与间接金融、直接金融投资与间接金融投资的区别在哪里?答:投资是经济主体为了获得未来的收益而垫支资本转换为资产的过程,这一结果因存在风险而存在不确定性。

实体投资是指对设备、建筑物等固定资产的购置以形成新的生产能力。

其最终的结果是增加了社会物质财富和经济总量。

金融投资是指投资者为了获得收益而通过银行存款,购买股票、债券等金融资产方式让渡资金使用权以获取收入行为过程。

直接金融是融资方与投资方不通过金融中介而直接融通资金的方式,间接金融是融资方与投资方通过金融中介而间接融通资金的方式,二者的区别是资金融通过程中是否有中介机构的参与并与投资者产生契约关系,在间接融资中,投资银行只起帮助其中一方寻找或撮合适当的另一方以实现融资的委托代理关系的作用。

直接金融投资是投资者通过在资本市场直接买卖股票、债券等由筹资者发行的基础证券以获得收益的投资方式,而间接金融投资指投资者不直接购买股票、债券等有价证券,他们购买银行存单、基金、信托产品或金融衍生产品以间接的获取收益。

直接金融投资者可以参加股东大会或债权人大会,了解发行公司信息较为容易,而间接金融投资者无这些特权。

2、什么是证券?其特征有哪些?可以分成几类?答:证券是一种凭证,它表明持有人有权依凭证所记载的内容取得相应的权益并具有法律效力。

按权益是否可以带来收益,证券可以分为有价证券和无价证券。

有价证券可分为广义有价证券和狭义有价证券。

广义有价证券分为商品证券、货币市场证券、和资本证券三种,狭义有价证券仅指资本证券。

证券的基本特征主要如下:1.所有权特征。

该特征指有价证券持有人依所持有的证券份额或数量大小对相应的资产拥有一定的所有权。

2.收益性特征。

指证券持有人可以通过转让资本的使用权而获取一定数额的资本收益。

3.流通性特征。

指证券持有人可以在规定的场所按自己的意愿快速地转让证券以换取现金。

证券投资学习题及答案

《证券投资学》习题(1-6章)一. 单项选择1.证券经纪商的收入来源是()A、买卖价差B、佣金C、股利和利息D、税金2.贴现债券的发行属于()A、平价方式B、折价方式C、溢价方式D、时价方式3.世界上历史最悠久的股价指数是()A、金融时报指数B、道琼斯股价指数C、标准普尔股价指数D、日经指数4.在我国股票发行通常采用()方式。

A、平价B、溢价C、时价D、贴现5.股份公司向股东送股体现了资本增值收益,这种送股的资金来源是()A、公积金B、税后利润C、借入资金D、社会闲置资金6.优先股票的“优先”体现在()A、对企业经营参与权的优先B、认购新发行股票的优先C、公司盈利很多时,其股息高于普通股股利D、股利分配和剩余资产清偿的优先7.以银行金融机构为中介进行的融资活动场所是()A、直接融资市场B、间接融资市场C、资本市场D、货币市场8.公司不以任何资产作担保而发行的债券是()A、信用公司债B、保证公司债C、抵押公司债D、信托公司债9.()是股份有限公司最基本的筹资工具。

A、普通股票B、优先股票C、公司债券D、银行贷款10.()的投资者可以享受税收优惠。

A、优先股票B、公司债券C、政府债券D、金融债券11.一般来讲,公司债券与政府债券比较()A、公司债券风险小,收益低B、公司债券风险大,收益高C、公司债券风险小,收益高D、公司债券风险大,收益低12.我国证券交易所实行()。

A、公司制B、会员制C、股份制D、合伙制13.股份有限公司的设立,一般有两种方法()A、公募设立和私募设立B、发起设立和募集设立C、直接设立和委托设立D、直接设立和投标设立14.贴现债券的发行属于()A、平价方式B、折价方式C、溢价方式D、时价方式15.金融机构证券是金融机构为筹集资金而发行的证券,以下不属于这类证券的是()A、大额可转让定期存单B、银行承兑汇票C、银行本票D、银行股票16.世界上第一个股票交易所是()A、纽约证券交易所B、阿姆斯特丹证券交易所C、伦敦证券交易所D、美国证券交易所17.以下不属于证券交易所的职责的是()A、提供交易场所和设施B、制定交易规则C、制定交易价格D、公布行情18.根据市场组织形式的不同,可以将证券市场划分为()。

证券投资学习题及答案

课后习题答案总结第一章股票1、什么是股份制度?它的主要功能有哪些?答:股份制度亦称股份公司制度,它是指以集资入股、共享收益、共担风险为特点的企业组织制度。

股份公司一般以发行股票的方式筹集股本,股票投资者依据他们所提供的生产要素份额参与公司收益分配。

在股份公司中,各个股东享有的权利和义务与他们所提供的生产要素份额相对应。

功能:一、筹集社会资金;二、改善和强化企业的经营管理。

2、什么是股票?它的主要特性是什么?答:股票是股份有限公司发行的,表示其股东按其持有的股份享受权益和承担义务的可转让的书面凭证。

股票作为股份公司的股份证明,表示其持有者在公司的地位与权利,股票持有者为公司股东.特性:1 、不可返还性2、决策性3、风险性4、流动性5、价格波动性6、投机性3、普通股和优先股的区别?答:普通股是构成股份有限公司资本基础股份,是股份公司最先发行、必须发行的股票,是公司最常见、最重要的股票,也是最常见的股票。

其权利为:1、投票表决权2、收益分配权3、资产分配权4、优先认股权。

对公司优先股在股份公司中对公司利润、公司清理剩余资产享有的优先分配权的股份。

第一是领取股息优先。

第二是分配剩余财产优先。

优先股不利一面:股息率事先确定;无选举权和被选举权,无对公司决策表决权;在发放新股时,无优先认股权。

有利一面:投资者角度:收益固定,风险小于普通股,股息高于债券收益;筹资公司发行角度:股息固定不影响公司利润分配,发行优先股可以广泛的吸收资金,不影响普通股东经营管理权。

4、我国现行的股票类型有哪些?答:我国现行的股票按投资主体不同有国有股、法人股、公众股和外资股。

国有股是有权代表国家投资的部门或机构以国有资产向公司投资形成的股份,包括公司现有的国有资产折算的股份。

法人股是指企业法人或具有法人资格的事业单位和社会团体以其依法可支配的资产向股份有限公司非上市流通股权部分投资所形成的股份。

公众股即个人股,指社会个人或股份公司内部职工以个人合法财产投入公司形成的股份。

证券投资学习题集答案(新)

《证券投资学》第一部分参考答案一、单项选择题1、下面属于有价证券的是(C)。

A、信用证B、存款单C、股票D、提单2、中期债券的偿还期限为(B)。

A、1年以下B、1-10年C、10-15年D、15年以上3、根据我国股票发行条件规定,向社会公众发行的股份应不少于公司股本总额的( B )。

A、20%B、25%C、35%D、50%4、契约型证券投资基金反映的是一种(B)关系。

A、产权B、信托C、借贷D、租赁5、具有标准化合约特征的金融衍生工具是(A)。

A、期货合约B、远期合约C、期权合约D、掉期合约6、证券场内市场是指(A)。

A、交易所交易B、柜台交易C、店头交易D、第三市场7、在股利尚未分派之前,该种股票被称为(A)股票。

A、含权B、除权C、填权D、贴权8、《证券法》规定:股票上市公司应当在每一会计年度结束之日起(C)个月内,应向有关单位提交年度报告并予公告。

A、2B、3C、4D、59、我国《公司法》要求,动用公积金送股后留存的法定公积金应不少于注册资本的(D)。

A、15℅B、18℅C、20℅D、25℅10、根据中国证监会的规定,上市公司每次配股比例最多只能10股配(D)。

A、6B、5C、4D、3二、多项选择题1、证券按其性质不同,可以分为(ABC)。

A、证据证券B、凭证证券C、有价证券D、资本证券2、有价证券按发行的主体不同,可分为(BCD)。

A、货币证券B、政府证券C、金融证券D、公司证券3、目前我国境外上市的外资股有(AC)。

A、H股B、A股C、N股D、B股4、证券市场上的中介机构主要有(BC)。

A、筹资者B、证券交易所C、证券公司D、投资者5、上市公司持续信息披露主要包括(ABCD)。

A、季度报告B、中期报告C、年度报告D、临时公告6、我国《公司法》规定,股票可以按(BC)价格发行。

A、折价B、面值C、溢价D、市价三、判断题1、证券是各类财产所有权或债权凭证的通称。

(∨)2、有价证券是虚拟资本的一种形式,是筹措资金的重要手段。

《证券投资学》习题参考答案

《证券投资学》习题参考答案第一章证券投资概述1.证券投资三个要素是什么?它们之间有何关系?证券投资的三要素是收益、风险和时间。

它们是密切联系、相互作用的。

一般来说,收益和风险成正比例关系;风险和时间也成正比例关系;当收益一定时,时间越长,收益率越低,收益率为正时,时间越长,绝对收益越高。

2.证券投资与实物投资的联系与区别?证券投资与实物投资的联系。

(1)证券投资与实物投资是相互影响、相互制约的。

(2)证券投资与实物投资是可以相互转化的。

证券投资与实物投资在投资对象、投资活动内容、投资制约度等方面有较大区别。

(1)投资对象不同。

(2)投资活动的内容不同。

(3)投资制约度不同。

3.什么是股票?股票的特性有哪些?股票是股份证书的简称,是股份有限公司在筹集资本时向出资人公开或私下发行的、用以证明出资人的股东身份和权利,并根据持有人所持有的股份数享有权益和承担义务的凭证。

股票的主要特性主要表现在如下几个方面:不可返还性(稳定性)、流通性、权责性、收益性、波动性和风险性。

4.什么是债券?债券的特征是什么?债券与股票有何区别?债券是一种有价证券,是债务人为筹集资金而向债券投资者出具的、承诺按一定利率定期支付利息并到期偿还本金的债权债务凭证。

债券主要有以下特征:偿还性、收益性、流动性和安全性。

债券与股票的区别:性质不同、发行主体不同、发行期限不同、本金收回的方式不同、取得收益的稳定性不同、责任和权利不同、交易场地不同、付息办法不同。

5.证券投资基金的特点是什么?集合投资、分散风险、专业理财、监管严格信息透明、利益共享,风险共担。

6.衍生证券有何功能?转移风险、发现价格、优化资源配置。

第二章证券市场及其制度一、重要术语1. 证券市场,有广狭义之分,广义的证券市场是指有关股票、债券、基金单位等有价证券及其衍生产品进行发行和交易活动的场所;而狭义的证券市场,则仅指投资者将在发行市场上取得的证券再次乃至重复多次在投资者之间不断买卖的场所,也即证券交易或流通市场。

证券投资学课后习题答案smart_foi12_IM03

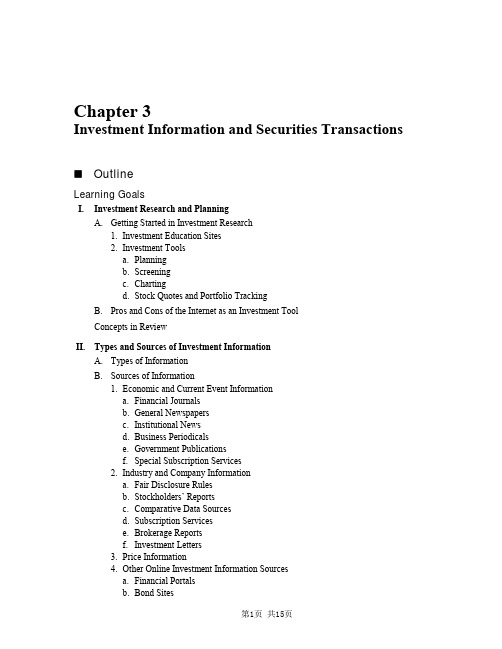

Chapter 3Investment Information and Securities TransactionsOutlineLearning GoalsI. Investment Research and PlanningA. Getting Started in Investment Research1. Investment Education Sites2. Investment Toolsa. Planningb. Screeningc. Chartingd. Stock Quotes and Portfolio TrackingB. Pros and Cons of the Internet as an Investment ToolConcepts in ReviewII. Types and Sources of Investment InformationA. Types of InformationB. Sources of Information1. Economic and Current Event Informationa. Financial Journalsb. General Newspapersc. Institutional Newsd. Business Periodicalse. Government Publicationsf. Special Subscription Services2. Industry and Company Informationa. Fair Disclosure Rulesb. Stockholders’ Reportsc. Comparative Data Sourcesd. Subscription Servicese. Brokerage Reportsf. Investment Letters3. Price Information4. Other Online Investment Information Sourcesa. Financial Portalsb. Bond Sites第1页共15页c. Mutual Fund Sitesd. International Sitese. Investment Discussion Forums5. Avoiding ScamsConcepts in ReviewIII. Understanding Market Averages and IndexesA. Stock Market Averages and Indexes1. The Dow Jones Averages2. Standard & Poor’s Indexes3. NYSE, NYSE Amex, and Nasdaq Indexes4. Value Line Indexes5. Other Averages and IndexesB. Bond Market Indicators1. Bond Yields2. Bond IndexesConcepts in ReviewIV. Making Securities TransactionsA. The Role of Stockbrokers1. Brokerage Services2. Types of Brokerage Firms3. Selecting a Stockbroker4. Opening an Accounta. Single or Jointb. Cash or Marginc. Wrap5. Odd-Lot and Round-Lot TransactionsB. Basic Types of Orders1. Market Order2. Limit Order3. Stop-Loss OrdersC. Online Transactions1. Day Trading2. Technical and Service Problems3. Tips for Successful Online TradesD. Transaction CostsE. Investor Protection: SIPC and ArbitrationConcepts in ReviewV. Investment Advisers and Investment ClubsA. Using Investment Advisers1. Regulation of Advisers2. Online Investment Advice3. The Cost and Use of Investment AdviceB. Investment ClubsConcepts in ReviewSummaryKey TermsDiscussion QuestionsProblemsCase Problems3.1 The Perezes’ Good Fortune3.2 Peter and Deborah’s Choices of Brokers and AdvisersExcel with SpreadsheetsKey Concepts1. The Internet empowers individual investors, provides savings in time and money, and offers currentinformation formerly available only to investing professionals. Tools such as financial planningcalculators and more are free, making buying and selling online convenient, relatively simple,inexpensive, and fast.2. The role, types, and uses of traditional and online investment information for making investmentdecisions3. Some of the key sources of investment information for economic and current events4. Sources of information to assess the performance of specific industries/companies5. The most commonly cited market averages and indexes, their interpretation, and their use in assessingmarket conditions; both stock and bond index covered6. The role of the stockbroker in making security transactions, the types of brokerage services available,and the various types of brokerage accounts7. A comparison of full-service, premium, and discount brokerage services8. The basic types of orders—market, limit, and stop-loss; their use in making security transactions; andtransaction costs9. The products and services offered, regulation, types, and cost of investment advisers10. The investment club as a device for pooling knowledge and money to create and manage a jointlyowned portfolio⏹Overview1. The Internet and online investing offer the individual investor advantages once enjoyed by only theprofessional investor. The number of households using online information for investment purposes is quickly expanding. The challenge now is to use the tools offered by the Internet wisely.2. Investment information is broadly classified into descriptive and analytical information. It isimportant that students understand the difference between these two kinds of information and the inves tor’s need for both types. Online investment tools help investors plan, screen, chart individual securities, and track portfolio performance.3. The chapter next mentions the benefits and costs of obtaining investment information. The instructorshould drive home the point that although an informed investor may perform better in the long run, obtaining and analyzing information costs the investor money and time. Therefore, an investor should analyze the worth of information.4. Five different types of information are delineated, and the instructor should point out that an investorusually needs all five types. For example, knowledge about a particular company alone would be insufficient for investment decision making. The investor would also require information about the economy, current events, the industry, and market prices in order to be able to make a good decision.5. The text mentions a number of specific sources of information, appropriately beginning with theWall Street Journal. Various other financial publications provide information of different types. The instructor might require students to bring their own copies of the WSJ to class and go through various sections with them. This is a good way to demonstrate how to read stock price quotations, as well as bond, option, mutual fund, commodity, and other quotations. The instructor might also find it useful to bring a company stockholder’s report to class and explain its contents. Presenting current examples of Internet sites also works well.6. The popular market averages and indexes are presented next. Movements in market averages andindexes are important indicators of the state of the economy; the instructor should describe, in class, stock market averages and indexes such as the Dow Jones, the S&P, and the NYSE Index, explaining the difference between averages and indexes and specifying what they measure and showing how to find recent listings in the print and online versions of the WSJ. The bond yield, which providesadditional information about the market and the economy, should be defined and the listing ofvarious yields pointed out in the WSJ.7. The next part examines the role of stockbrokers and the services they provide. Students usuallyencounter difficulties with the concepts of margin trading, market, limit, stop-loss orders, and short selling. Therefore, the instructor should devote adequate time to cover these topics and use examples for clarification.8. The role of the SIPC in protecting investors and procedures for settling disputes between investorsand brokerage firms is explained.9. The nature and functions of investment advisers are discussed next. The structure and regulation oftheir activities and the types of information they provide are described. The chapter closes with a discussion of investment clubs.⏹Answers to Concepts in Review1. In addition to providing low-cost investing, the Internet supplies a multitude of information sourcesdesigned to assist the individual investor in the decision-making process. Investment education sites range from the tutorials and online classes that educate the novice investors to the screening tools, financial calculators and worksheets used by experienced investors.2. The four types of online investment tools are as follows:a. Planning. Online calculators and worksheets help you find answers to your financial planningand investing questions.b. Screening. Screening tools help you sort through huge databases of stocks and mutual funds tofind those that have specific characteristics.c. Charting. This technique allows you to plot the performance of a stock or a group of stocks overa specified time period.d. Stock quotes and portfolio tracking. This tool allows the investor to track his or her investment,to be alerted whenever an analyst changes the rating, or to indicate how well the portfolio isdiversified among major asset classes.3. As for the advantages of online investing, it is now possible for even novice investors to participate inthe stock markets with a huge amount of information available at their fingertips to assist in making their decisions to invest. Commissions for online trades can be as low as $3.00 per trade, although $10 to $12 is more typical.On the con side, trading on the Internet requires that investors exercise the same caution they would if they were getting information from a human broker. Furthermore, you don’t have the safety net of dealing with a human who may be suggesting that you exercise additional caution. The ease of point-and-click investing can be the financial downfall of inexperienced investors. Transaction costs add up, and margin trading results in interest payments on a loan that will reduce possible gains.4. Descriptive information is factual information on past behavior of the economy, the market, or agiven investment vehicle. Analytical information, on the other hand, tends to analyze existing data and make projections and is quite often a source of recommendations for potential investments. The investor must evaluate whether the costs of acquiring the information are justified by the potential increase in return. Either direct or indirect costs are associated with information gathering. Direct costs include subscription fees and adviser’s fees. Indirect costs include the ti me involved to gather information.5.The Wall Street Journal, published by the Dow Jones, is perhaps the most popular source of financialnews in this country. Published daily, it provides daily price quotations on a multitude of securities. It also has a wealth of world reports, national reports, and regional and corporate news. Regular features, like “Your Money Matters,” address topics of interest to individual investors. Barron’s, on the other hand, is a weekly publication also published by Dow Jones. The articles in Barron’s are generally more in-depth and directed to financial issues than those in The Wall Street Journal. Barron’s also has special interest columns like “Up and Down Wall Street.” In addition, there are current price quotations and summary statistics on a wider variety of investments. Other sources of financial news include Investor’s Business Daily and the Financial Times.General news is available from a variety of published sources, especially daily newspapers in the local community. Many business people also rely on daily papers that have national reputations in the political and economic arena, such as the New York Times and the Los Angeles Times. USA Today isa national daily newspaper containing a “Money” section devoted to busi ness and personal financialnews. Time and Newsweek are also major periodicals in the general news category.Business news articles and statistics on general business and economic activities in the United States and abroad can be found in the Wall Street Journal and in such magazines as Newsweek, Time, U.S.News & World Report, Business Week, Fortune, The Economist, Federal Reserve Bulletin, and the Survey of Current Business. A variety of articles discussing the activities of securities markets and corporations can be found in the Wall Street Journal, Barron’s, Investor’s Business Daily, Forbes, Kiplinger’s Personal Finance, Money, and Smart Money. The last three are oriented toward individual investors and managing personal finances. Local metropolitan newspapers also provide information on securities of local interest.The distinctions between print sources and online sources has been blurring because many of the print sources now make their information available online. Two advantages of the online sources are the limited amount of advertising and the ability to be continually updated. And with the advances in mobile technology, such as smartphones and tablets, current information can be accessed quickly and easily just about anywhere.6. a. The sto ckholder’s report,also called the “annual report,” is an annual publication of publiclyheld corporations. These reports are usually free and contain a wealth of descriptive andanalytical information, including financial statements, about the firm. Stockholder reports are just one of the pieces of information that can be downloaded from company websites.b. Comparative data sources enable investors to analyze the financial condition of companies andare typically grouped by industry and size of firm. Thes e include Dun & Bradstreet’s KeyBusiness Ratios;RMA’s Annual Statement Studies; the Quarterly Financial Report for U.S.Manufacturing, Mining, and Wholesale Trade Corporations; and the Almanac of Business &Industrial Financial Ratios.c. Standard & Poor’s Stock Reports is a major service of the Standard & Poor’s Corporation. Itcontains up-to-date reports on numerous firms, including a summary of the firm’s financialhistory, its current financial situation, and for NYSE companies, an opinion on the firm’s future prospects.d.Mergent provides detailed financial information on companies and industries.e. Value Line Investment Survey offers ratings for all widely held stocks with full-page reportsincluding financial data, descriptions, analysis, and advice.7. a. The prospectus is part of the registration statement required by the SEC on a new security issue.It describes in detail the key aspects of the issuer, its management and financial position, and the security to be issued. Brokerage firms provide prospectuses at no cost to their clients. (Note: This information source is available only when a firm is making an issue of new securities.)b. Back office research reports present analyses and recommendations on the current and futureprospects for the security markets, specific industries, and specific securities. These are prepared by brokerage firm research staffs and are available (usually free of charge) to existing as well as potential clients. Several information vendors, such as Reuters and Zacks, consolidate researchfrom many companies and put it on the web.c. Investment letters provide the conclusions and recommendations of various analysts. Commonexamples of investment letters are Blue Chip Advisors, The Dines Letter,Dow Theory Letters,the Growth Stock Outlook, and Zacks Advisor. Although some investment letters concentrate on specific types of securities, others are concerned solely with assessing the economy and/orsecurity markets. There is a fee for subscription to these letters, which are generally weekly ormonthly. The Hulbert Financial Digest monitors the performance of investment letters.d. Price quotations include the current prices and price statistics for various types of securities.Almost all brokerage houses have automated devices for obtaining up-to-the-minute quotations.Many firms still use a ticker, a lighted screen on which stock transactions made on the floor ofthe exchange are reported immediately as they occur. The stock names are shown in anabbreviated form called ticker symbols. Recently, more firms have acquired sophisticatedcomputer terminals to more efficiently provide up-to-the-minute stock price information. Themost common sources of such information, however, are the daily newspaper and the WallStreet Journal, which contains current quotations on numerous investment vehicles. Barron’sand Investor’s Daily also provide a wealth of security price quotations, which is especiallyuseful for bond quotations.8.Online investment information allows individual investors to get timely historical and currentinformation, such as stock quotes and economic and financial information. Online information is generally more timely, as it is updated more frequently, and offers more educational resources for the novice investor. The resources on the Internet provide different levels of information through various subscriptions, allowing investors to receive as little or as much information as they are willing to pay for. Print versions of publications provide deeper analysis as well as a comprehensive view of the factors that affect investments. Table 3.4 lists a number of popular sites and describes the data that can be found on each site.9.Stock market averages and indexes are used to measure the general behavior of securities markets.Averages reflect the arithmetic average price behavior of a certain group of stocks at a given point in time, whereas indexes measure the current price behavior of the group relative to a base value set at an earlier point in time.Averages and indexes provide a convenient way of capturing the general mood of the market. When the averages or indexes reflect an upward trend in prices, a bull market is said to exist. Likewise, when these measures exhibit a downward trend, a bear market exists.10. a. The four Dow Jones Averages include the Dow Jones Industrial Average (30 widely held stocksissued by large firms), the Dow Jones Transportation Average (20 transportation stocks), theDow Jones Utility Average (15 public utility stocks), and the Dow Jones U.S. Total Market Index (includes all of the above).b. The six Standard & Poor’s (S&P) Indexes include the S&P 400 Industrial Index (400 industrialfirms); the Transportation Index (20 transportation companies); the Utilities Index (40 publicutility stocks); the Financials Index (40 financial stocks); the Composite Index (includes the 500stocks in the S&P indexes mentioned above); the MidCap Index (400 medium-sized companies);the SmallCap Index(made up of 600 small-sized companies); and the 1,500 SuperComp Index,which includes all stocks in the Composite, MidCap, and SmallCap indexes.Nearly all these indexes can be found in financial newspapers such as the Wall Street Journal,Barron’s, Investor’s Business Daily, and local newspapers in major metropolitan areas.11. a. The New York Stock Exchange Index includes the 2,100 stocks listed on the New York StockExchange. It is calculated in a manner similar to the S&P indexes. This index reflects the value of the stocks listed on the NYSE relative to a base of 5,000 set on December 31, 2002.b. The American Stock Exchange Index reflects the price of shares on the American StockExchange relative to a base of 550 set on December 29, 1995.c. The Nasdaq Stock Market Indexes reflect the behavior of the Nasdaq stock market. The mostpopular, the Nasdaq Composite Index, is calculated using more than 4,000 domestic commonstocks traded on the Nasdaq system. The index is based on a value of 100 set on February 5,1971. Another popular Nasdaq index is the Nasdaq 100, which includes 100 of the largestdomestic and international nonfinancial companies that are listed on the Nasdaq.d. The Value Line Composite Average includes the approximately 1,700 stocks in the Value LineInvestment Survey, which are traded on a broad cross section of exchanges as well as in the over-the-counter market. The base of 100 reflects the June 30, 1961, average of the stocks.12. a. Bond yields capture the behavior of market interest rates and represent a type of summarymeasure of the return an investor would receive on a bond if it were held to maturity. Barron’squotes the yields on the Dow Jones bond average of 10 high-grade corporate bonds and10 medium-grade corporate bonds; a ratio of the high-grade yield to the medium-grade yield iscalculated and known as the Confidence Index.b. The Dow Jones Corporate Bond Index, quoted in the Wall Street Journal and Barron’s, is themathematical average of the closing prices of 32 industrial, 32 financial, and 32 utility/telecombonds.13. Stockbrokers help investors buy and sell securities. Besides this major role, full-service stockbrokersprovide clients with several other benefits. For example, most brokerage firms offer their clients a wide variety of information. Many of them have research staffs who periodically review published economic, market, industry, or company behavior forecasts and make recommendations to their clients as to which securities they should buy or sell. Every month, they mail investors a record of transactions for that month with a total ending balance. Some brokerage firms also makearrangements to transfer funds from the sale of securities directly to an investor’s savings account, where the funds can earn interest. Many brokers have reference libraries that clients can use toresearch securities. They can provide up-to-the-minute stock price quotations. Many brokerage firms will also hold certificates for safekeeping to protect against loss.The major role of a stockbroker is to execute a client’s transactio ns at the best possible price. While it is not necessary to know your stockbroker personally, he or she should understand your investment goals. This should avoid potential conflicts. You should also make sure that the broker does notcharge you too much for the services provided and that you are not paying for services that you do not need.14. a. A brokerage account may be either single or joint. Joint accounts are typically between marriedcouples or between parent and child.b. A custodial account is one in which a parent or a guardian will take responsibility for alltransactions undertaken on behalf of a minor.c. A cash account is one in which a customer can only use cash to make transactions. This isperhaps the most common type of account.d. A customer who wishes to trade in securities using borrowed money establishes a marginaccount. By leaving the securities with the brokerage firm as collateral, the customer can borrowa pre-specified amount to trade in securities. Needless to say, the brokerage firm will first verifythe customer’s creditworthiness before opening a margin account in that customer’s name.e. A wrap account is an account in which customers with large portfolios pay the brokerage firm aflat annual fee, typically between 2% and 3% of their portfolio’s total asset value, to cover thecombined costs of a money manager’s services and the cost of commissions on their trades.These accounts allow the wealthy investor to conveniently shift the burden of stock-selectiondecisions to a professional—either in-house or independent—money manager.15. A market order is an order to buy or sell a security at the best price available at the time the order isplaced. It is the quickest way to make securities transactions. A limit order is an order to buy stock at or below or to sell stock at or above a specified price. It is best used when securities prices fluctuate widely. A stop-loss order is an order to buy or sell the stock when its market price reaches or drops below a specified level. It is used primarily by investors who wish to protect themselves from a rapid decline in the price of the stock. The stop-loss order gives them the opportunity to sell the stock when the price declines to the stop price, thereby reducing their potential losses. It becomes a market order and may in fact be executed at a lower price than the price at which the order was initiated.16. Typically, brokers charge fixed commissions in return for facilitating the purchase or sale ofsecurities. Negotiated commissions are also available to investors who maintain large accounts with the broker. The commissions usually vary depending on the services the broker provides to theinvestor. The major difference between a full-service and discount broker is the full-service broker provides investment advice. Because investing through a discount or deep-discount broker can save from 30% to 80% on the commission, the investor must weigh the benefit of advice against the higher commission. Online brokers are typically deep-discount brokers through whom investors can execute trades electronically online. These brokers charge very low commissions but offer little orno individualized research, information, or investment advice.Full-service brokers provide personalized, timely research and information. Basic discountersprovide low costs and fast trades. Premium discount brokers are in between these extremes.17.Day trading is the opposite of a buy-and-hold strategy since true day traders do not even own stocksovernight. The method is highly risky since it often involves margin and short transactions that may result in a total loss. In addition, day traders have high expenses for brokerage commissions, training, and computer equipment.You should consider several important factors before trading securities. First, know how to place and confirm your order before you begin trading. Second, verify the stock symbol of the security you wish to buy. Third, use limit orders. Fourth, don’t ignore the online reminders that ask you to check an d recheck. Fifth, don’t get carried away. Sixth, open accounts with two brokers. Lastly, double-check orders for accuracy.Many investors set aside an amount of their capital that is designated for purely speculative purposes and not required for day-to-day survival. In this way, they are not jeopardizing themselves or their loved ones if they suffer heavy losses.18. Most firms use a fixed-commission schedule for individual investors with accounts less than $50,000.Traditional brokers generally charge on the basis of the number of shares and price per share(e.g., market value of the purchase). They sometimes charge an annual management fee and lowercommissions. Online brokers, by comparison, charge a flat rate for transactions of up to 1,000 shares.Online investors will pay a surcharge if they seek personalized broker assistance.19. The Securities Investor Protection Corporation (SIPC), a nonprofit membership corporation, wasauthorized to protect customer accounts against the consequences of financial failure of the brokerage firm.Mediation is an informal, voluntary approach in which you and the broker agree to a third party who facilitates negotiations between the two of you to resolve disputes. If mediation is not pursued or it fails, you may choose arbitration, a formal process whereby you and your broker present the two sides of the argument before a panel of third-party individuals.20.Investment advisers are individuals or firms who advise clients about portfolio management. Thismay be done on a discretionary basis, in which case the adviser has complete control over the client’s portfolio. In other cases, the adviser provides investment information and advice, and the clientmakes his or her own investment decisions. Professional investment advisers are required to register and file regular reports with the SEC under the Investment Advisers Act of 1940; a 1960 amendment gave the SEC broader powers to monitor their activities. However, those who provide investment advice in addition to their primary job responsibility—such as financial planners, stockbrokers,bankers, and accountants—are not regulated by the act. Many states have similar legislation. It is important to remember that these laws only protect against fraud and unethical practices. They do not provide the investor any indication of the quality of investment advice. Professional investmentadvice usually costs between 1/4 of 1% and 3% annually of the amount of money being managed.For larger portfolios, the fee is in the range of 1/4% to 3/4%; for small portfolios, the annual feeranges from 2% to 3% of the dollar amount of funds managed.21. Investment clubs offer the individual investor access to information and/or advice from a broad rangeof differently experienced people who have similar attitudes, investments strategies, and goals. Also, through the investment club, the individual investor can participate in a larger and probably more diversified investment portfolio, therefore increasing the probability of earning a favorable return on his or her investments. For the novice investor, a club can provide an excellent mechanism forlearning key aspects of portfolio construction and investment management.Investment clubs regularly outperform the market and the professional money managers because they buy stocks for the long term instead of trying to time the market.⏹Suggested Answers to Ethics in Investing QuestionHello, I am Tim, an Insider TraderSuppose you are on an airplane and you overhear two executives of a company talking about a merger that is about to take place. If you buy stock based on what you overheard, are you committing insider trading?Answer:No, the information was unsolicited, acquired passively, and there is no guarantee that you are interpreting it correctly. If you purchase the stock, you are still at risk. Most important, your purchase would involve no breach of fiduciary duty or promise of confidentiality. Your purchase would not seem to violate either the law or any personal, ethical obligation.⏹Suggested Answers to Discussion QuestionsQuestions 1,2,4 and 6 will have answers that will vary depending on the choices made by the student.3. The broad categories of information and some examples of sources include economy-specific andcurrent event information (newspapers, magazines, journals, government releases and databases), industry or firm-specific information (company reports, brokerage firm reports, subscription services), price information relating to specific financial instruments (internet-based financial portals, websites of major newspapers and business sections of television networks) and other information, usually available online on investment strategies and skills (websites and forums such as on Yahoo! Finance).。

证券投资学练习答案(第一讲到第五讲)

证券投资学课后练习(第一讲到第五讲)第一讲投资环境1、假设你发现了一只装有100亿美元的宝箱。

1)这是实物资产还是金融资产?答:金融资产。

现金是一种为了财务管理而产生的资产,它本身并不能创造财富,其价值的体现必须依附于其他实物资产的价值,因此,这个宝箱应该属于金融资产。

2)社会财富会因此而增加吗?答:不会。

只有实物资产才是真正的财富,因此金融资产本省是不具有价值的,整个社会的金融资产总量为零,此宝箱并不能够增加社会财富。

3)你会更富有吗?答:会。

金融资产虽然本身不能创造财富,但可以依赖于实物资产而使其具有价值。

拥有这个装有100亿美元的宝箱即可交换等值的实物资产,实物资产为真正的财富,可以使拥有者更加富有。

4)你能解释你回答(2)、(3)时的矛盾吗?有没有人因为这个发现而受损呢?答:这个宝箱的拥有者购买力增加,必定以其他人购买力的下降为代价,最终使得社会财富不变。

因此,由于拥有者购买力的增加而导致购买力下降的经济中的其他人即为这个发现的受损方。

2、Lanni Products是一家新兴的计算机软件开发公司,它现有计算机设备价值30000美元,以及由Lanni的所有者提供的20000美元现金。

在下面的交易中,指明交易涉及的实物资产和(或)金融资产。

在交易过程中有金融资产的产生和损失吗?1)Lanni公司向银行贷款。

它共获得50000美元现金,并且签发了一张票据保证3年内还款。

答:银行贷款是Lanni公司的金融债务,而Lanni公司签发的票据则是银行的金融资产。

Lanni 公司从银行贷款获得的50000美元现金是金融资产,而为此签发的票据则是新产生的金融资产。

2)Lanni公司使用这笔现金和它自由的20000美元为其一新的财务计划软件开发提供融资。

答:Lanni公司将其金融资产(即70000美元现金)融资给某个软件开发公司进行新的财务计划的软件开发,而作为回报,Lanni公司则获得了实物资产,即为软件公司所开发的软件成品。

证券投资学习题及答案

一:名词解释:风险: 未来结果的不确定性或损失.股票: 股份有限公司在筹集资金时向出资人或投资者发行的的股份凭证,代表股东对股份公司的所有权.证券市场: 股票,债券,证券投资基金,金融衍生工具等各种有价证券发行和买卖的场所.经济周期: 由于受多种因素的影响,宏观经济的运行总是呈现出周期性变化,一般包括四个阶段:即萧条,附属,繁荣,衰退.财政政策: 通过财政收入和财政支出的变动来影响宏观经济活动水平的经济政策.成长型产业: 依靠技术进步,推出新产品,提供更优质的服务及改善经营管理,可实现持续成长. 产业生命: 周期:产业经历一个有产生到成长再到衰落的发展演变过程.财务杠杆: 总资产和所有者权利的比值.杜邦分解: 将资产用净资产收益率(ROE),总资产收益率(ROA),财务杠杆(FL),销售净利率(PM),总资产周转率(TAT)表现出来的形式。

市盈率: 股票理论价值和每股收益的比例.股利贴现模型: 满足假设“股票的价值等于未来用虚线现金流的现值”的模型。

二:简答题1.简述普通股股票的基本特征和主要种类。

基本特征:不可偿性,参与性,收益性,流通性,价格的波动性和风险性主要种类:按上市地区划分:A股,B股H股N股S股按股票代表的股东权利划分:优先股,普通股其他分类:记名股票和无记名股票,有票面价值股票和无票面值股票,单一股票和复数股票,表决权股票和无表决权股票2.金融衍生工具的主要功能有哪些?衍生工具通过组合单个基础金融工具,利用衍生工具的多头或空头,转移风险,事先避险目的,衍生工具一招所有交易者对未来市场发现价格,价格的预期定价,两大功能:转移风险,发现价格3.简述证券市场的基本功能融通资金,资本定价,资本配置,转换机制,宏观调控4.套利定价理论的思想是什么?它与资本资产定价模型的差异和联系是什么?套利定价理论(APT)的思想是套利均衡;APT所做的假设比资本资产定价模型(CAPM)少很多,其核心是假设不存在套利机会,APT认为,资产价格受多方面因素的影响,其表现形式是一个多因素模型,APT在更广泛的意义上建立了证券收益与宏观经济中其他因素的联系,相对于CAPM 而言更具有实用性,并且其套利均衡思想为将来的期权定价的推导提供了重要的思想武器。

证券投资学课后习题答案参考

1、有价证券的种类和特征:按证券的经济性质可分为股票、债券和其他证券三大类有价证券的特征:1)、产权性。

有价证券的产权性是指它记载着权利人的财产权内容,代表着一定的财产所有权,拥有证券就意味着享有财产的占有、使用、收益和处分的权利。

2)、收益性。

收益性是指持有证券本身可以获得一定数额的收益,这是投资者转让资金使用权的回报。

3)、流动性。

证券的流动性又称变现性,是指证券持有人可按自己的需要,灵活地转让证券以换取现金。

4)、风险性。

证券的风险性是指证券持有者面临着预期投资收益不能实现,甚至使本金也受到损失的可能。

2. 股票的主要类型----------------课本P313. 普通股股票的基本特征和主要种类基本特征:(1) 持有普通股的股东有权获得股利,但必须是在公司支付了债息和优先股的股息之后才能分得。

普通股的股利是不固定的,一般视公司净利润的多少而定。

当公司经营有方,利润不断递增时普通股能够比优先股多分得股利,股利率甚至可以超过50%;但赶上公司经营不善的年头,也可能连一分钱都得不到,甚至可能连本也赔掉。

(2) 当公司因破产或结业而进行清算时,普通股东有权分得公司剩余资产,但普通股东必须在公司的债权人、优先股股东之后才能分得财产,财产多时多分,少时少分,没有则只能作罢。

由此可见,普通股东与公司的命运更加息息相关,荣辱与共。

当公司获得暴利时,普通股东是主要的受益者;而当公司亏损时,他们又是主要的受损者。

(3) 普通股东一般都拥有发言权和表决权,即有权就公司重大问题进行发言和投票表决。

普通股东持有一股便有一股的投票权,持有两股者便有两股的投票权。

任何普通股东都有资格参加公司最高级会议枣每年一次的股东大会,但如果不愿参加,也可以委托代理人来行使其投票权。

(4) 普通股东一般具有优先认股权,即当公司增发新普通股时,现有股东有权优先(可能还以低价)购买新发行的股票,以保持其对企业所有权的原百分比不变,从而维持其在公司中的权益。

《证券投资学》课后练习题9 大题答案

第九章证券投资技术分析主要理论与方法二、名词解释K线、开盘价、收盘价、最高价、最低价、阳线、阴线、影线、跳空、空头、多头、支撑线、压力线、趋势线、轨道线、黄金分割线、百分比线、速度线、甘氏线、反转形态、整理形态、头肩顶、头肩底、双重底、双重顶、三重底、三重顶、圆形底、圆形顶、三角形、矩形、楔形、旗形、喇叭形、菱形、V形、突破、随机漫步理论、循环周期理论、相反理论。

1. K线:K线图最早是日本德川幕府时代大阪的米商用来记录当时一天、一周或一月中米价涨跌行情的图示法,后被引入股市。

K线图有直观、立体感强、携带信息量大的特点,蕴涵着丰富的东方哲学思想,能充分显示股价趋势的强弱、买卖双方力量平衡的变化,预测后市走向较准确,是应用较多的技术分析手段。

2. 开盘价:目前我国股票市场采用集合竞价的方式产生开盘价。

3. 收盘价:是多空双方经过一段时间的争斗后最终达到的共识,是供需双方最后的暂时平衡点,具有指明价格的功能。

4. 最高价:是交易过程中出现的最高的价格。

5. 最低价:是交易过程中出现的最低的价格。

6. 阳线:收盘价高于开盘价时用空(或红)实体表示,称为阳线。

7. 阴线:开盘价高于收盘价时用黑(或蓝)实体表示,称为阴线。

8. 影线:影线表示高价和低价。

9.跳空:股价受利多或利空影响后,出现较大幅度上下跳动的现象。

大小所决定.10、空头:空头是投资者和股票商认为现时股价虽然较高,但对股市前景看坏,预计股价将会下跌,于是把借来的股票及时卖出,待股价跌至某一价位时再买进,以获取差额收益。

空头指的是变为股价已上涨到了最高点,很快便会下跌,或当股票已开始下跌时,认为还会继续下跌,趁高价时卖出的投资者。

采用这种先卖出后买进、从中赚取差价的交易方式称为空头。

人们通常把股价长期呈下跌趋势的股票市场称为空头市场,空头市场股价变化的特征是一连串的大跌小涨。

11、多头:多头是指投资者对股市看好,预计股价将会看涨,于是趁低价时买进股票,待股票上涨至某一价位时再卖出,以获取差额收益。

证劵投资学课后答案.doc

证券投资学课后答案:第一章:一:名词解释1. 证券:是各种财产所有权或债券凭证的统称,是用来证明证券持有人有权取得相应权益的凭证。

2. 债券具有一般有价证券共有的特征:即期限性、风险性、流动性和收益性,但它又有其独特之处3. 金融债券:广义地说,由金融机构发行的债券即为金融债券。

金融债券多为中长期债券,是金融机构利用自身较好的资信筹集更多的中、长期资金的手段,一般要经特别的法律许可, 有由特别的金融机构发行。

发行金融债券的银行或财务公司对金融债券持有人作出债务承诺,在一定期间还本付息。

4. 机构投资者:主要是指一些金融机构,包括银行、保险公司、投资信托公司、信用合作社、国家或团体设立的退休基金等组织5. 场外交易市场:是指证券交易所以外的证券交易市场的总称。

证券场外市场是一个分散的无形市场。

它没有固定的、集中的交易场所,而是由许多各自独立的证券公司分别进行交易。

6. 一级市场:指股票的初级市场也即发行市场,在这个市场上投资者可以认购公司发行的股票7. 二级市场:指流通市场,是已发行股票进行买卖交易的场所。

8. 场内交易市场:指由证券交易所组织的集中交易市场,有固定的交易场所和交易活动时间。

证券交易所接受和办理符合有关法令规定的证券上市买卖,投资者则通过证券商在证券交易所进行证券买卖。

二,简答1. 证券市场有哪些基本特征?答:第一,证券市场是价值直接交换的场所。

有价证券是价值的直接代表,其本质上只是价值的一种直接表现形式。

虽然证券交易的对象是各种各样的有价证券,但由于它们是价值的直接表现形式,所以证券市场本质上是价值的直接交换场所。

第二,证券市场是财产权利直接交换的场所。

证券市场上的交易对象是作为经济权益凭证的股票、债券、投资基金券等有价证券,它们本身仅是一定量财产权利的代表,所以,代表着对一定数额财产的所有权或债权以及相关的收益权。

证券市场实际上是财产权利的直接交换场所。

第三,证券市场是风险直接交换的场所。

证券投资学课后习题答案

证券投资学课后习题答案证券投资学是一门研究股票、债券等金融资产投资方法和策略的学科。

课后习题是帮助学生巩固理论知识和提高实际分析能力的重要手段。

以下是一些证券投资学课后习题的参考答案:一、选择题1. 股票的内在价值是指:A. 股票的市场价格B. 股票的账面价值C. 股票的清算价值D. 股票的预期收益的现值答案:D2. 以下哪项不是证券投资分析的基本方法?A. 基本分析B. 技术分析C. 宏观经济分析D. 心理分析答案:D3. 债券的到期收益率是指:A. 债券的票面利率B. 债券的购买价格C. 债券的市场价格D. 债券的年利息收入与购买价格的比率答案:D二、简答题1. 简述基本分析和技术分析的区别。

基本分析关注的是影响证券价格的基本面因素,如公司的财务状况、行业地位、宏观经济状况等。

它试图通过评估证券的内在价值来预测其价格走势。

技术分析则不考虑基本面因素,而是通过分析历史价格和交易量数据来预测证券价格的未来走势,它基于市场行为反映所有信息的假设。

2. 什么是有效市场假说(EMH)?有效市场假说认为在一个信息传递无阻的市场中,证券的价格总是反映其所有可获得的信息。

根据这一假说,任何新信息都会迅速被市场吸收,导致证券价格的即时调整,使得任何人都无法通过分析来获得超额回报。

三、计算题1. 假设你购买了一张面值为1000元,票面利率为5%,期限为5年的债券,如果市场利率为6%,计算债券的当前价格。

债券的年利息收入为1000元 * 5% = 50元。

使用现值公式计算债券的当前价格:\[ P = \frac{50}{(1+0.06)^1} + \frac{50}{(1+0.06)^2} + ... + \frac{50}{(1+0.06)^5} + \frac{1000}{(1+0.06)^5} \]通过计算,我们可以得到债券的当前价格。

2. 如果某公司的股票当前价格为50元,预计未来一年每股收益为5元,市场预期的股息支付率为40%,计算该股票的股息率和市盈率。

证券投资学课后答案

第一章1、投资的特征有哪些①目的性。

现在支出价值的活动。

②时间性。

从支出到报酬经过一段时间,越长不确定性越大。

③目的在于(牺牲现在价值)获得(未来)报酬。

④风险性和不确定性。

2、试比较实物资产投资与金融资产投资的异同①实物资产投资是指直接拥有实物资本,包括土地、建筑物、知识、机器设备及人力资本。

金融资产投资是对实物资本的间接持有。

是脱离实际生产的第一步。

②实物资产投资包含实物和现实消费。

金融资产投资不在现时消费。

③实物资产投资决定提供产品和服务的能力,决定社会物质财富数量。

金融资产投资对实物资产所创造的利润和收入有要求权,能为个人带来财富,按比例分配给投资者。

同:①都是通过持有某种资产,获得该资产产生的与所承担的风险比例的收益的过程。

②目标都是为了获得收益。

③存在时间要素和投资价值不确定性。

3、为什么长期投资与短期投资是一个相对的概念?由可转让性和流动性决定。

通过出售行为缩短到合意的期限,使长期变为短期。

4、阐述投资与投机的区别和联系①行为看:投机者赚取高低差价,经常“赌一把”,风险高②持券时间:投机者频繁买卖;投资者长期持有,不理会短期涨跌③获利形式:投机者依靠买卖差价;投资者看重长期利息和股利④关注点:投机者关注价格波动;投资者一来基本分析证券内在价值5、试描述投资者持有各种金融资产要求权的性质债务类工具的要求权是固定的,持有者基于利率和证券面值来确定获得的收入流。

权益类证券的要求权是权益类证券持有者对公司支付债务类工具持有者以后的剩余收入的要求权。

混合类证券介于上述二者之间。

以上二种权利或多或少的都具备。

6、比较基本分析法和技术分析法在投资分析思路上的差异①前提:基本分析法的前提条件是内在价值等于预期收益流的现值。

再用内在价值与市场价格比较。

技术分析法是根据证券市场过去的统计资料来研究证券市场未来价格走势。

前提是历史会再现。

②股票价值影响因素:基本分析法是宏观面、行业面、公司面。

(三方面分析法)技术分析法只注重市场内部因素。

《证券投资学》课后习题答案

卖空股票所得资金 初始保证金 融入股票的市值

卖空股票所得资金

卖空股票所得资金

P

20%,

得到:P 12元。

由:保证金的实际维持率

保证金实际值

卖空股票所得资金 初始保证金 融入股票的市值 投入的现金

卖空股票所得资金

卖空股票所得资金

投入的现金 40%,

得到:投入的现金 10 000元。

第四章 复习题

一、名词解释 (略)

二、讨论题 1. ①期望收益率主要是根据持有期内租金和房价的预测进行计算。必要收益率主要是根据房 地产的风险进行计算,包括无风险收益以及风险溢价。对于自主性购房,购房者主要从房屋的使 用价值出发;对于投资性购房,购房者主要从房屋的投资价值出发。

②打新股的平均收益率需要考虑中签率、资金占用天数、新股持有时间假设、持有期间的价 格与中签价格之间的比较等等。普通股票投资不存在中签率的问题,持有的时间和持有的目的也 不一样。

组合的期望收益率为 19.24%( = 10% × 500 + 25% × 800 +13.33% × 240 + 24% × 300 )。

1840

1840

1840

1840

3.答:资产

1、资产

2、资产

3

和资产

4

的期望收益率分别是

10%

⎛ ⎜⎝

=

550 − 500 500

⎞ ⎟⎠

、25%、

13.33%、24%,投资组合的期望收益率为 19.24%

)S1 × 1+ f1,5 4 )S2 2 × 1+ f2,3

= (1+ S5 )5 = (1+ S3 )3

( ) ⎨

证券投资学第版课后习题参考答案

证券投资学第版课后习题参考答案The document was prepared on January 2, 2021证券投资学(第2版)课后习题参考答案程蕾邓艳君黄健第一章导论1、证券投资与证券投机的关系答:联系:二者的交易对象都是有价证券,都是投入货币以谋取盈利,同时承担损失的风险。

二者还可以相互转化。

区别:1)交易的动机不同。

投资者进行证券投资,旨在取得证券的利息和股息收入,而投机者则以获取价差收入为目的。

投资者通常以长线投资为主,投机者则以短线操作为主。

2)投资对象不同。

投资者一般比较稳健,其投资对象多为风险较小、收益相对较高、价格比较稳定或稳中有升的证券。

投机者大多敢于冒险,其投资对象多为价格波动幅度大、风险较大的证券。

3)风险承受能力不同。

投资者首先关心的是本金的安全,投机者则不大考虑本金的安全,一心只想通过冒险立即获得一笔收入。

4)运作方法有差别。

投资者经常对各种证券进行周密的分析和评估,十分注意证券价值的变化,并以其作为他们选购或换购证券的依据。

投机者则不大注意证券本身的分析,而密切注意市场的变化,以证券价格变化趋势作为决策的依据。

2、简述证券投资的基本步骤。

答:1)收集资料;2)研究分析;3)作出决策;4)购买证券;5)证券管理。

3、试述金融市场的分类及其特点。

答:1)按金融市场的交易期限可分为:货币市场和资本市场。

2)按金融市场的交易程序可分为:证券发行市场和证券交易市场。

3)按金融交易的交割期限可分为:现货市场和期货市场。

4)按金融交易标的物的性质可分为:外汇市场、黄金市场、保险市场和各种有价证券市场。

第二章证券投资工具1、简述债券、股票、投资基金的性质和特点。

答:债券是发行人对全体应募者所负的标准化证券,具有公开性、社会性和规范性的特点,一般可以上市流通转让。

债券具有一般有价证券共有的特征,即期限性、风险性、流动性和收益性,但它又有其独特之处。

股票只是代表股份资本所有权的证书,它本身并没有任何价值,不是真实的资本,而是一种独立于实际资本之外的虚拟资本。

《证券投资学》课后习题答案

《证券投资学》课后习题答案第1章证券投资工具一、名词解释【风险】(易)风险可以理解为“未来结果的不确定性或损失”,也可以进一步定义为“个人和群体在未来获得收益和遇到损失的可能性以及对这种可能性的判断与认知”。

【债券】(易)债券(bond)是一种金融契约,是政府、金融机构、工商企业等机构直接向社会借债筹措资金时,向投资者发行,同时承诺按一定利率支付利息并按约定条件偿还本金的债权债务凭证。

【货币的时间价值】(中)不同时间发生的等额资金在价值上的差别。

【股票】(易)股票是股份有限公司在筹集资本时向出资人或投资者发行的股份凭证,代表其持有者(即股东)对股份公司的所有权。

【普通股】(易)普通股是指在公司的经营管理、盈利及财产的分配上享有普通权利的股份,代表满足所有债权偿付要求及优先股股东的收益权与求偿权要求后对企业盈利和剩余财产的索取权。

普通股构成公司资本的基础,是股票的一种基本形式。

【优先股】(易)优先股在利润分红及剩余财产分配的权利方面,优先于普通股。

优先股股东有两种权利:①优先分配权。

②剩余财产优先分配权。

【基金】(难)泛指证券投资基金及其发行的作为一种有价证券的基金单位。

【证券投资基金】(中)证券投资基金是一种实行组合投资、专业管理、利益共享、风险共担的集合投资方式。

与股票、债券不同,证券投资基金是一种间接投资工具,基金投资者、基金管理人和基金托管人是基金运作中的主要当事人。

【契约型基金】(难)契约型基金是指以信托法为基础,根据当事人各方之间订立的信托契约,由基金发起人发起设立的基金,基金发起人向投资者发行基金单位筹集资金。

契约型基金也称信托型基金。

【公司型基金】(难)公司型基金是指以《公司法》为基础设立、通过发行基金单位筹集资金并投资于各类证券的基金。

【封闭式基金】(难)封闭式基金是指基金的单位数目在基金设立时就已确定,在基金存续期内基金单位的数目一般不会发生变化,但出现基金扩募的情况除外。

【开放式基金】(难)放式基金是指基金股份总数是可以变动的基金,它既可以向投资者销售任意多的基金单位,也可以随时应投资者要求赎回已发行的基金单位。

证券投资学课后习题答案smart_foi12_IM02

Chapter 2Securities Markets and TransactionsOutlineLearning GoalsI. Securities MarketsA. Types of Securities Markets1. The Primary Marketa. Going Public: The IPO Processb. The Investment Banker’s Role2. The Secondary MarketB. Broker Markets and Dealer Markets1. Broker Markets2. The New York Stock Exchangea. Trading Activityb. Listing Policies3. NYSE Amex4. Regional Stock Exchanges5. Options Exchanges6. Futures Exchanges7. Dealer Marketsa. Nasdaqb. The Over-the-Counter MarketC. Alternative Trading SystemsD. General Market Conditions: Bull or BearConcepts in ReviewII. Globalization of Securities MarketsA. Growing Importance of International MarketsB. International Investment PerformanceC. Ways to Invest in Foreign SecuritiesD. Risks of Investing InternationallyConcepts in Review第1页共17页III. Trading Hours and Regulation of Securities MarketsA. Trading Hours of Securities MarketsB. Regulation of Securities Markets1. Securities Act of 19332. Securities Exchange Act of 19343. Maloney Act of 19384. Investment Company Act of 19405. Investment Advisers Act of 19406. Securities Acts Amendments of 19757. Insider Trading and Fraud Act of 19888. Sarbanes-Oxley Act of 2002Concepts in ReviewIV. Basic Types of Securities TransactionsA. Long PurchaseB. Margin Trading1. Essentials of Margin Tradinga. Magnified Profits and Lossesb. Advantages and Disadvantages of Margin Trading2. Making Margin Transactionsa. Initial Marginb. Maintenance Margin3. The Basic Margin Formula4. Return on Invested Capital5. Uses of Margin TradingC. Short Selling1. Essentials of Short Sellinga. Making Money When Prices Fallb. Who Lends the Securities?c. Margin Requirements and Short Sellingd. Advantages and Disadvantages2. Uses of Short SellingConcepts in ReviewSummaryKey TermsDiscussion QuestionsProblemsCase Problems2.1 Dara’s Dilemma: What to Buy?2.2 Ravi Dumar’s High-Flying Margin AccountExcel with Spreadsheets⏹Key Concepts1. The types of securities markets in which transactions are made2. The operations, function, and nature of broker (organized securities exchanges) and dealer (the over-the-counter) market3. The importance of international securities markets and a discussion on the performance and riskinvolved in these investments4. General market conditions and extended hours trading5. Regulation of the securities markets6. The basic long transaction7. The motives for margin transactions and the procedures for making them8. Margin requirements, formulas for initial and maintenance margin, and the uses of margin trading9. The short sale transaction, why one shorts securities, and the uses of short selling⏹Overview1. The text divides securities markets into money markets and capital markets. The instructor shouldexplain the difference.2. Both primary and secondary transactions are carried out in capital markets. The instructor shoulddefine these transactions for students and explain the role of the investment banker in the selling of new securities (primary transactions).3. Initial public offerings (IPOs) are the most important transactions in the primary market. Thesequence of events includes filing a prospectus with SEC, a quit period, the distribution of the “red herring” preliminary prospectus, and finall y the first day of trading. First day returns and the number of IPOs vary greatly over time with market conditions. Most IPOs take place with the assistance of an investment banking firm. In the underwriting process, the investment bankers buy all of the stock from the issuing firm and bear the risk of reselling at a profit.4. The secondary markets include various broker markets and dealer markets. Broker markets includethe organized securities exchanges, while dealer markets include the Nasdaq (the NationalAssociation of Securities Dealers Automated Quotation System) and over-the-counter (OTC) markets.The instructor should emphasize the importance of the NYSE Amex among all these markets. The instructor might also discuss these aspects of organized security exchanges: the membership of an exchange; its listing policies; the role of the brokers, traders, and specialists; trading activity; and the auctioning process. Instructors may also wish to mention the roll of the Amex and regionalexchanges in trading ETFs and options contracts.5. The dealer markets are described next. The instructor should point out that the Nasdaq and OTCmarkets are not physical institutions like the organized securities exchanges. The instructor should also mention that while there is only one specialist for each stock on an exchange, there may beseveral or even many dealers for large companies traded on Nasdaq. The distinctions between broker and dealer markets are blurring as more and more trades are executed electronically. Nasdaq includes larger companies than the over-the-counter market, with companies listed on the OTC Bulletin Board being larger than those included in the OTC Pink Sheets. The instructor should also point out that shares normally traded in the broker markets may trade in the dealer market, in what is known as the third market, while fourth market trades between institutions are completed using electroniccommunications networks.6. The chapter then discusses the globalization of international securities markets, including a descriptionof investing in the foreign securities marketplace, how to buy foreign securities, and the risks ofinternational investment. Related issues are the existence of after-hours trading and the mergers of stock markets foreshadowing the creation of a worldwide stock exchange, the NYSE Euronext. The chapter outlines the various options available for international investing including multinationalcorporations, global and country mutual funds, and ADRs.7. In the next section, various regulations applicable to brokers, investment advisers, and stockexchanges are described. The instructor need not dwell on this section at length; however, theinstructor might want to bring in any recent litigation or securities market trial (e.g., the insidertrading scandal involving Raj Rajaratnam of the defunct hedge fund Galleon Group) that is being widely covered by the press. Widespread allegations of malfeasance on the part of financial firms leading up to the crisis of 2007–2008 have perhaps added to the importance of this topic. Ethical issues and insider trading are interesting and serve to make a point about the challenges facing those attempting to regulate the exchanges.8. The text now moves to the different types of transactions, beginning with long purchases. The nextsection deals extensively with margin trading, including the magnification of profits and losses, initial and maintenance margin, and the formulas for their calculation. A number of review problems and a case at the end of the chapter will aid students in understanding the concept of margin.9. The final section of the chapter deals with short selling, including the mechanics and uses of shortsales. The text explains initial and maintenance margin requirements and the calculation of profit and loss on short sale transactions.Answers to Concepts in Review1. a. In the money market, short-term securities such as CDs, T-bills, and bankers’ acceptances aretraded. Long-term securities such as stocks and bonds are traded in the capital markets.b. A new security is issued in the primary market. Once a security has been issued, it can be boughtand sold in the secondary market.c.Broker markets are organized securities exchanges that are centralized institutions wheresecurities listed on a particular exchange are traded. The dealer market is a complex system ofbuyers and sellers linked by a sophisticated telecommunication network. Dealer markets include Nasdaq and OTC markets.2. The investment banker is a financial intermediary who specializes in selling new security issues inwhat is known as an initial public offering(IPO). Underwriting involves the purchase of the security issue from the issuing firm at an agreed-on price and bearing the risk of reselling it to the public at a profit. For very large issues, an investment banker brings in other bankers as partners to form the underwriting syndicate and thus spread the financial risk. The investment banker also provides the issuer with advice about pricing and other important aspects of the issue.In a public offering, a firm offers its shares for sale to the general public after registering the shares with the SEC. Rather than issue shares publicly, a firm can make a rights offering, in which it offers shares to existing stockholders on a pro rata basis. In a private placement of its shares, a firmsells directly to groups of investors, such as insurance companies and pension funds, and does not register with the SEC.3. a. 5. NYSE Amex is the second largest organized U.S. exchange.b. 2. The Chicago Board of Trade (CBT) is a futures exchange.c. 6. NYSE has the most stringent listing requirement.d. 4. The Boston Stock Exchange is a regional stock exchange.e. 3. The Chicago Board Options Exchange (CBOE) is an options exchange.f. 1. The over-the-counter (OTC) market trades unlisted securities.4. The dealer market is really a system of markets spread all over the country and linked together by asophisticated telecommunication system. It accounts for about 40% of the total dollar volume of all shares traded. These markets are made up of traders known as dealers, who offer to buy or sell stocks at specific prices. The “bid” price is the highest price offered by the dealer to purchase a security; the “ask” p rice is the lowest price at which the dealer is willing to sell the security. The dealers are linked together through Nasdaq. In order to create a continuous market for unlisted securities, IPOs, both listed and unlisted, are sold in the dealer market. About 2,700 Nasdaq stocks are included in the Nasdaq/National Market System, which lists, carefully tracks, and provides detailed quotations on these actively traded stocks. The Nasdaq Global Select Market contains the 1,000 biggest and most actively traded companies. An additional 1,000 firms are included in the Nasdaq National Market listing. Another 700 firms that are generally smaller can be found on the Nasdaq Capital Markets list.Companies that do not make the Nasdaq listing standards are traded on the OTC market’s Bulletin Board or “Pink Sheets.”Trading in large blocks of outstanding securities, known as secondary distributions, also takes place in the OTC market in order to reduce potential negative effects of such transactions on the price of listed securities. Third markets are over-the-counter transactions made in securities listed on the NYSE, the Amex, or any other organized exchange. Mutual funds, pension funds, and life insurancecompanies use third markets to make large transactions at a reduced cost. Fourth markets include transactions made directly between large institutional investors. Unlike the third market, this market bypasses the dealer; however, sometimes an institution will hire a firm to find a suitable buyer or seller and facilitate the transaction.5. The third market consists of over-the-counter transactions made in securities listed on the NYSE orone of the other exchanges. The fourth market consists of transactions using a computer network, rather than an organized exchange, between large institutional buyers and sellers of securities.6. A bull market is a favorable market normally associated with rising prices, investor optimism,economic recovery, and governmental stimulus. In contrast, bear markets are associated withfalling prices, investor pessimism, economic downturn, and government restraint.7. The globalization of securities markets is important because today investors seek out securities withhigh returns in markets other than their home country. They may invest in companies based incountries with rapidly growing economies or choose international investments to diversify theirportfolios. The U.S. securities markets, while still the world’s largest, no longer dominate theinvestment scene. In recent years, foreign exchanges have provided investors with high returns. Only once since 1980 has the United States finished number one among the major stock markets of the world. In 2005, investors could have earned higher returns from investing in markets in South Korea, Mexico, Japan, Finland, Germany, and France than from investing in markets in the United States. 8. To achieve some degree of international diversification, an investor can make foreign securityinvestments either indirectly or directly. An investor can diversify indirectly by investing in shares of U.S.-based multinational companies with large overseas operations that receive more than 50% of their revenues from overseas operations. Investors can make these transactions conventionallythrough their stockbrokers; the procedure is similar to buying a domestic security. An investor can also purchase foreign securities indirectly by purchasing shares in a mutual fund that primarilyinvests in these securities. The investor can also purchase foreign stocks and bonds directly onforeign exchanges, buy shares of foreign companies that are traded on organized or over-the-counter U.S. exchanges, or buy American depositary receipts (ADRs) and Yankee bonds.9. The investor must be aware of the additional risks involved in buying foreign securities: country risk,government policies, market regulation (or lack thereof), and foreign currency fluctuations. Investors must consider risks beyond those in making any security transaction. In particular, investors inforeign markets must bear risks associated with doing business in the foreign country, such as trade policies, labor laws, taxes, and political instability.Because investing internationally involves purchasing securities in foreign currencies, trading profits and losses are affected not only by security price changes, but by foreign exchange risk. This risk is caused by the varying exchange rates between two countries. Profits in a foreign security maytranslate into losses once the foreign currency has been exchanged for dollars. Similarly, transaction losses can result in gains. The bottom line is that investors must be aware that the value of the foreign currency relative to the dollar can have profound effects on returns from foreign security transactions.10. The exchanges, Nasdaq, and electronic communications networks (ECNs) offer extended tradingsessions before and after regular hours. Most of the after-hours markets are crossing markets, inwhich orders are only filled if they can be matched with identical opposing orders at the desired price. One after-hours session trades stocks at that day’s closing price on a first-come, first-served basis. Many large brokerage firms, both traditional and online, offer their clients after-hours trading services .ECNs handle after-hours trading for their client brokerages. ECNs are generally crossing markets, in which orders are filled only if they can be matched at the desired price. Obviously, the twoinvestors would have to have different expectations about subsequent share price performance. The development of securities markets around the globe has essentially created the situation where we have continuous trading in stocks. After-hours trading sessions carry more risk. Price changes tend to be more volatile than regular sessions, and the markets are generally less liquid than day-trading sessions.11. a. The Securities Act of 1933 requires companies to disclose all information relevant to newsecurity issues. The company must file a registration statement with the Securities and Exchange Commission (SEC) giving required and accurate information about the new issue. No newsecurities can be sold publicly unless the SEC approves the registration statement.b. The Securities Exchange Act of 1934 established the SEC as the agency in charge ofadministration of the federal securities laws. It gave the SEC power to regulate the organizedexchanges and the OTC. It required stock exchanges to register with the SEC a list of all stockstraded on the exchange.c. The Maloney Act of 1938 requires that all trade associations be registered with the SEC andallows for the self-regulation of the securities industry. Since its passage, only the NationalAssociation of Securities Dealers (NASD) has been formed under this act.d. The Investment Company Act of 1940 set certain rules and regulations for investment companies.It also empowered the SEC to regulate their practices and procedures. Investment companieswere required to register with the SEC and fulfill certain disclosure requirements. The actwas amended in 1970 to prohibit investment companies from paying excessive fees to advisersand charging excessive commissions to purchasers of shares.e. The Investment Advisers Act of 1940 was passed to protect the public from potential abuses byinvestment advisers. Advisers were required to register and file regular reports with the SEC. Ina 1960 amendment, the SEC was authorized to inspect the records of advisers and to revoke theirregistration if they violated the provisions of this act.f. The Securities Acts Amendments of 1975 were enacted to require the SEC and the securitiesindustry to develop a competitive national system for trading securities. The first step the SECtook was to abolish fixed commission rates. In 1978, the Intermarket Trading System (ITS) wasestablished, which today links eight markets in an electronic communications network.g. The Insider Trading and Fraud Act of 1988 established penalties for using nonpublic informationto make personal gain. An insi der, which originally referred only to a company’s employees,directors, and their relatives, was expanded to include anyone who obtains private informationabout a company. To allow the SEC to monitor insider trades, the SEC requires corporateinsiders to file monthly reports detailing all transactions made in the company stock.h. The Sarbanes-Oxley Act of 2002 attempts to eliminate fraudulent accounting and regulateinformation releases. Heavy penalties are applied to CEOs and financial officers who releasedeliberately misleading information. The law also establishes guidelines minimizing analystconflicts of interest, increases SEC authority, and requires instant disclosure of stock sales bycorporate executives.12. When an investor purchases a security in the hope that it will increase in value and can be sold laterfor a profit, the investor is making a long purchase. The long purchase, the most common type of transaction, derives its returns from dividends or interest received during ownership, plus capital gains or losses—the difference between the purchase price and the sale price.Margin trading involves buying securities in part with borrowed funds. Therefore, investors can use margin to reduce their money and use borrowed money to make a long purchase. Once theinvestment increases in value, the investor will pay off the loan (with fixed interest charges)and keep the rest as profits. Of course, buying on margin is quite risky, as the investors can losetheir whole capital if the investment decreases in value.13. When buying on margin, the investor puts up part of the required capital (perhaps 50% to 70% of thetotal); this is the equity portion of the investment and represents the investor’s margin. The investor’s broker (or banker) then lends the rest of the money required to make the transaction. Magnification of profits (and losses) is the main advantage of margin trading. This is called financial leverage and is created when the investor purchases stocks or other securities on margin. Only the equity portion is financed by the investor, but if the stock goes up, the investor gets all the capital gains, so leverage magnifies the return.Through leverage, an investor can (1) increase the size of his or her total investment, or (2) purchase the same investment with less of his or her own funds. Either way, the investor increases the potential rate of return (or potential loss). If the margin requirement is, say, 50%, the investor puts up only half the funds and borrows the other half. Suppose the security goes up 10%. If the investor bought the stock without using margin, he or she would earn 10%. However, if the investor used 50% margin, ignoring margin interest, he or she would earn the same dollar return with only half the funds, so the rate of return would double to 20%. On the other hand, suppose the stock fell by 10%. Withoutmargin trading, he or she has a 10% loss. With margin trading, the loss is also doubled. Both profits and losses are magnified using leverage. Note: Table 2.3 provides an excellent illustration of this point.Margin trading has both advantages and disadvantages. Advantages: Margin trading provides the investor leverage and the ability to magnify potential profits. It can also be used to improve current dividend income. Through margin trading, an investor can gain greater diversification or be able to take larger positions in the securities he or she finds attractive. Disadvantages: With greater leverage comes greater risk, and this is a disadvantage of margin trading. Interest rates on the debit balance can be high, a further disadvantage since these costs can significantly lower returns.14. In order to execute a margin transaction, an investor first must establish a margin account. Althoughthe Federal Reserve Board sets the minimum amount of equity for margin transactions, it is notunusual for brokerage houses and exchanges to establish their own, more restrictive, requirements.Once a margin account has been established, the investor must provide the minimum amount ofrequired equity at the time of purchase. This is called the initial margin, and it is required to prevent excessive trading and speculation. If the value of the investor’s account drops below this initialmargin requirement, the investor will have a restricted account. The maintenance margin is theabsolute minimum amount of equity that an investor must maintain in the margin account. If thevalue of the account drops below the maintenance margin, the investor receives a margin call, in which case the investor has limited time to replenish the equity up to the initial margin. If the investor cannot meet the margin call, the broker is authorized to sell the investor’s holdings to bring theaccount up to the required initial margin.The size of the margin loan is called the debit balance and is used along with the value of thesecurities being margined (the collateral) to calculate the amount of the investor’s margin.Typically, margin is used to magnify the returns to a long purchase. However, when a margin account has more equity than is required by the initial margin, an investor can use this “paper” equity topurchase more securities. This tactic is called pyramiding and takes the concept of magnifyingreturns to the limit.15. An investor atte mpting to profit by selling short intends to “sell high and buy low,” the reverse of theusual (long purchase) order of the transaction. The investor borrows shares and sells them, hoping to buy them back later (at a lower price) and return them to the lender. Short sales are regulated by the SEC and can be executed only after a transaction where the price of the security rises; in other words, short sales are feasible only when there is an uptick.Equity capital must be put up by a short seller; the amount is defined by an initial margin requirement that designates the amount of cash (or equity) the investor must deposit with a broker. For example, if an investor wishes to sell (short) $4,000 worth of stock when the prevailing short sale marginrequirement is 50%, he or she must deposit $2,000 with the broker. This margin and the proceeds of the short sale provide the broker with assurance that the securities can be repurchased at a later date, even if their price increases.16. In order to make a short sale, the investor must make a deposit with the broker that is equal to theinitial margin requirement. Maintenance margins are still the lowest allowed percentage of equity ina position. Short seller margins decline if the share price rises because some of the deposit (plus theinitial proceeds) will be necessary to buy back the shares. If the stock price rises by an amountsufficient to reduce short seller margins to the maintenance levels, they will receive a margin call.The short sellers can either deposit initial margin (and bet on a share price decline) or close out their position by buying back the shares (and take the loss).17. The major advantage of short selling is the chance to convert a price decline into a profit-makingsituation. The technique can also be used to protect profits already earned and to defer taxes on those profits. The major disadvantage of short selling is the high risk exposure in the face of limited return opportunities. Also, short sellers never earn dividends but must pay them as long as the transaction is outstanding.Short sales can earn speculative profits because the investor is betting against the market, whichinvolves considerable risk exposure. If the market moves up instead of down, the investor could lose all (or more) of the short sale proceeds and margin.Suggested Answers to Discussion Questions1. One reason for the large initial returns is the significant amount of hype surrounding new issues.This was especially true in the late 1990s, during what is now described as the “tech-stock bubble.”Investor demand for shares of these firms far exceeded the supply.Underwriters may intentionally underprice issues to increase their own profits and make it easier to sell the shares. Issuing firms may be willing to accept a lower price if it draws attention to their firm, making it easier to sell additional shares at a later date. Institutional investors tend to receive most of the shares in IPOs, particularly for those issues in great demand. Since they do not want to overpay for the shares, this is yet another factor contributing to underpricing. In any case, in recent years extraordinary profits from initial returns have become quite unusual. In some cases, like the highly publicized Facebook IPO, investors in the IPO experienced dramatic losses rather than profits.2. The main advantage of listing on the NYSE is the perception of greater prestige and public awarenessof the firm. The main disadvantage is that the NYSE has the strictest listing requirements of anysecurities market in the United States. For large tech firms, listing on Nasdaq is a part of their public image as innovative, technology-oriented companies.3. Not all securities markets are open simultaneously, although the possibility exists of trading in after-hour markets. This assumes the markets are equivalent when it comes to liquidity and information ability. There is talk of a market that could trade any share in the world, with the many mergers and cooperative arrangements among securities exchanges enhancing the likelihood of a worldwide stock exchange. Large companies headquartered in North America, Europe, or Japan already trade onmany national markets. However, major impediments to such trading still exist especially in listing and trading requirements. Many developing economies place foreign ownership restrictions on their listed stocks and do not insist on the level of disclosure required on the NYSE or other majorexchanges. Another stumbling block still prevails related to currency conversion. At present, there are still many foreign currencies that are not acceptable internationally. These restrictions prevent many foreign stocks from trading in one market place.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

证券投资学(第2版)课后习题参考答案程蕾邓艳君黄健第一章导论1、证券投资与证券投机的关系?答:联系:二者的交易对象都是有价证券,都是投入货币以谋取盈利,同时承担损失的风险。

二者还可以相互转化。

区别:1)交易的动机不同。

投资者进行证券投资,旨在取得证券的利息和股息收入,而投机者则以获取价差收入为目的。

投资者通常以长线投资为主,投机者则以短线操作为主。

2)投资对象不同。

投资者一般比较稳健,其投资对象多为风险较小、收益相对较高、价格比较稳定或稳中有升的证券。

投机者大多敢于冒险,其投资对象多为价格波动幅度大、风险较大的证券。

3)风险承受能力不同。

投资者首先关心的是本金的安全,投机者则不大考虑本金的安全,一心只想通过冒险立即获得一笔收入。

4)运作方法有差别。

投资者经常对各种证券进行周密的分析和评估,十分注意证券价值的变化,并以其作为他们选购或换购证券的依据。

投机者则不大注意证券本身的分析,而密切注意市场的变化,以证券价格变化趋势作为决策的依据。

2、简述证券投资的基本步骤。

答:1)收集资料;2)研究分析;3)作出决策;4)购买证券;5)证券管理。

3、试述金融市场的分类及其特点。

答:1)按金融市场的交易期限可分为:货币市场和资本市场。

2)按金融市场的交易程序可分为:证券发行市场和证券交易市场。

3)按金融交易的交割期限可分为:现货市场和期货市场。

4)按金融交易标的物的性质可分为:外汇市场、黄金市场、保险市场和各种有价证券市场。

第二章证券投资工具1、简述债券、股票、投资基金的性质和特点。

答:债券是发行人对全体应募者所负的标准化证券,具有公开性、社会性和规范性的特点,一般可以上市流通转让。

债券具有一般有价证券共有的特征,即期限性、风险性、流动性和收益性,但它又有其独特之处。

股票只是代表股份资本所有权的证书,它本身并没有任何价值,不是真实的资本,而是一种独立于实际资本之外的虚拟资本。

股票在发行与流通中,具有收益性、风险性、非返还性、参与性、流通性、价格的波动性。

投资基金是一种利益共享,风险共担的集合证券方式。

具有特点:1)具有组合投资、分散风险的好处;2)是有专家运作、管理并专门投资于证券市场的资金;3)具有投资小、费用低的优点;4)流动性强;5)经营稳定,收益可观2、债券可以分为哪几类?答:1)根据发行主体的不同,债券可分为政府债券、金融债券和公司债券2)按照偿还期限的不同,债券可分为短期债券、中期债券和长期债券3)按发行方式的不同,债券可分为公募债券和私募债券4)根据利息支付方式的不同,债券可分为附息债券和贴现债券5)根据有无抵押担保,债券可分为信用债券和担保债券6)按利率规定的情况不同,债券可分为固定利率债券和浮动利率债券7)按发行的区域不同,债券可分为国内债券和国际债券除上述分类外,还可以按债券票面是否记名分为记名债券和不记名债券;按是否参加分红分为参加公司债和非参加公司债;按是否上市交易分为上市债券和非上市债券;按债券发行时间先后分为新发债券和既发债券等。

3、金融衍生工具的功能有哪些?答:1)转移价格风险。

2)发现价格。

3)提高资产管理质量。

4)提高资信度。

5)可使收入存量和流量发生转换。

第三章证券市场1、什么是证券市场?证券市场的结构与分类有哪些?答:定义:证券市场是股票、债券、投资基金等各类有价证券发行和流通场所的总称。

证券市场是金融市场的重要组成部分。

结构:纵向结构关系,按证券进入市场的顺序结构关系划分,证券市场的构成可分为一级市场和二级市场;横向结构关系,这是按有价证券的品种而形成的结构关系。

这种结构关系划分,证券市场的构成主要有股票市场、债券市场、基金市场等。

分类:按职能可分为证券发行市场和证券流通市场。

按交易对象可分为股票市场、债券市场和基金市场。

按交易场所可分为交易所市场、店头市场、第三市场、第四市场等。

2、试述证券市场对国民经济和社会生活的积极作用和消极影响。

答:积极作用:1)为筹措长期资金提供重要渠道。

2)有利于提高企业的经营管理水平,促进企业的发展。

3)调节社会资金的流向,促进社会资金分配的合理化。

4)有利于减少投资风险,创造相对稳定的投资环境。

5)灵敏地反映经济发展动向,为进行经济分析和宏观调控提供依据。

6)证券市场是中央银行实施公开市场操作进行宏观调控的重要机制和手段,从而对国民经济持续、稳定、健康的发展具有重要意义。

消极作用:证券市场的消极作用集中表现在证券市场本身所固有的高投机性和高风险上。

证券市场由于普遍采用信用手段,资金的杠杆作用十分明显,这使得证券市场的投机性特别强烈,其风险性也远远超过了一般商品市场。

因此,在发挥证券市场积极作用,为社会主义市场经济服务的同时,应加强证券市场的监管,以抑制其消极影响。

3、证券市场的参与主体有哪些?他们各自的职能和作用是什么?答:证券发行主体,是指为筹集资金而发行证券的企业、政府及其公共机构、银行及其它非银行金融机构。

证券发行主体是资金的需求者和证券的供给者。

证券投资主体,是指以获得收益或分散风险为目的而进入证券市场进行证券买卖的个人和机构。

证券投资主体是证券发行市场的资金供给者,也是证券的购买者,它一般包括个人投资者和机构投资者。

4、试述证券交易所和场外交易市场的特点与功能。

答:特点:1)公平性 2)公开性 3)组织性功能:1)提供连续的证券交易场所;2)形成证券的合理价格;3)集中社会资金参与投资;4)引导投资的合理流向;5)反映国民经济运行状况5、试述我国证券市场现存的主要问题以及改革方向。

答:主要问题:1)股票市场分割;2)投机市场特征明显;3)上市公司质量不高,股权结构不尽合理;4)居民金融资产结构单一;5)证券市场结构失衡;6)市场监管体系薄弱改革方向:1)改革股票发行和证券经营机构设立制度,完善证券发行上市核准制度;2)健全资本市场体系,丰富证券投资品种;3)鼓励合规资金入市,拓宽证券公司融资渠道;4)积极稳妥解决股权分置问题;5)重视信息披露,切实保护投资者利益;6)进一步提高上市公司质量,推进上市公司规范运作;7)促进资本市场中介服务机构规范发展,提高执业水平,完善证券市场行业性自律管理系统;8)加强法制和诚信建设,提高资本市场监管水平;9)加速证券市场人才的培养;10)积极稳妥地推进证券市场的对外开放第四章证券发行市场1、证券发行市场的作用是什么?答:1)创造投资工具;2)筹资;3)优化资源配置;4)规范和分散风险;5)提供政府实施宏观调控政策依托2、简述股票的具体定价发行方式以及股票初次发行的条件。

答:定价发行方式:1)储蓄存单发行方式。

2)上网定价发行方式。

3)上网竞价发行方式。

初次发行条件:1)股票发行人必须是具有股票发行资格的股份有限公司。

2)其生产符合国家产业政策。

3)发行的普通股限于一种,同股同权。

4)发起人认购的股本数额不少于公司拟发行的股本总额的35%。

5)公司拟发行的股本总额中,发行人认购的部分不少于人民币3000万元,国家另有规定的除外;本次发行后,公司的股本总额不少于人民币5000万元。

6)向社会公众发行的部分不少于公司拟发行的股本总额的25%,其中公司职工认购的股本数额不超过拟向社会公众发行的股本总额的10%;公司拟发行的股本总额超过人民币4亿元,证监会按照规定可以酌情降低向社会公众发行的部分的比例,但是最低不低于公司拟发行的股本总额的10%。

7)发行人在最近3年没有重大违法行为,财务报表无虚假记载。

8)证券委规定的其他条件3、简述股票的发行程序,如何正确选择承销方式?答:发行程序:1)发行前的准备工作。

2)发行人提出申请。

3)中国证监会受理申请文件并进行初审。

4)发行审核委员会审核。

5)公开信息。

6)核准决定的撤销。

7)签订股票承销协议。

8)备案。

选择承销方式时,一般主要时考虑以下因素:1)发行人在证券市场上地知名度和信誉状况。

2)发行人使用资金的时间性。

3)成本信息因素。

4)中介机构的技术能力和资金能力。

4、简述债券的发行条件和发行目的。

答:发行目的:(1)国债发行的目的:1)弥补财政收支赤字;2)扩大政府的公共投资;3)解决临时性资金需求。

(2)金融债券的发行目的:1)获得长期资金来源;2)提供负债的稳定性;3)扩大资产业务。

(3)企业(公司)债券的发行目的:1)扩大资金来源;2)降低筹资成本,灵活运用资金;3)维持对企业的控制权。

发行条件:1)股份有限公司的净资产额不低于人民币3000万元,有限责任公司的不低于6000万元;2)累计债券总额不超过公司净资产额的40%;3)最近三年平均可分配利润足以支付公司债券一年的利息;4)资金投向符合国家产业政策;5)债券地利率不得超过国务院限定的利率水平;6)国务院规定的其他条件。

5、简述债券信用评级的作用及其局限性。

答:作用:1)降低筹资成本。

2)降低投资风险。

3)有利于规范交易和管理。

局限性:1)信用评级的自身风险:一是信用评级体系缺乏权威性。

二是评级机构缺乏独立性。

三是信用评级功能尚未充分发挥。

2)信用评级资料的局限性。

6、简述现行的国债发行方式,如何选择国债承销策略?答:现行的发行方式:1)承购包销发行。

2)公开招标发行:a.美国式招标。

b.荷兰式招标。

确定国债承销决策时,要考虑考虑以下几个方面:1)国债自身的发行条件。

2)承销商的资金实力。

3)发行市场与流通市场的状况。

7、简述证券投资基金的设立条件。

答:(1)投资基金发起人的条件:1)主要发起人为按照国家规定设立的证券公司、信托公司、基金管理公司;2)主要发起人有3年以上从事证券投资的经验和连续盈利的记录,每个发起人的实收资本不少于3亿元;3)有健全的组织机构、管理制度,财务状况良好;4)基金管理人、基金托管人有符合要求的营业场所、安全防范设施和与业务有关的其他措施;5)主管机关规定的其他条件。

(2)投资基金托管人的条件:1)设立专门的基金托管部门;2)有足够的熟悉托管业务的专门人才;3)实收资本不少于80亿元;4)具备安全、高效的清算、交割能力;5)具备安全保管基金全部资产的能力;(3)投资基金管理人的条件:1)主要发起人是按照国家规定设立的证券公司、信托投资公司,经营状况良好,最近3年连续盈利;2)每个发起人的实收资本不低于3亿元人民币;3)拟设立的基金管理公司的最低实收资本为1000万元;4)有健全的组织机构,可行的基金管理计划和足够合格的基金管理人才;5)主管部门要求的其他条件。

1111332211++++++++=t t k D k D k D k D V )()()()( 第五章 证券交易市场1、试述证券流通市场的功能和特点答:功能:1)流动性;2)资金期限转化;3)维持证券的合理价格;4)资金的导向;5)反映宏观经济。