信用证常用英语

国际结算英文专用语集锦

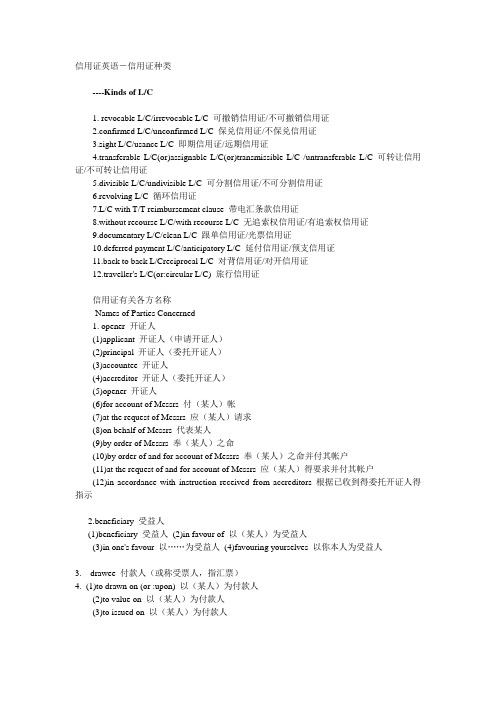

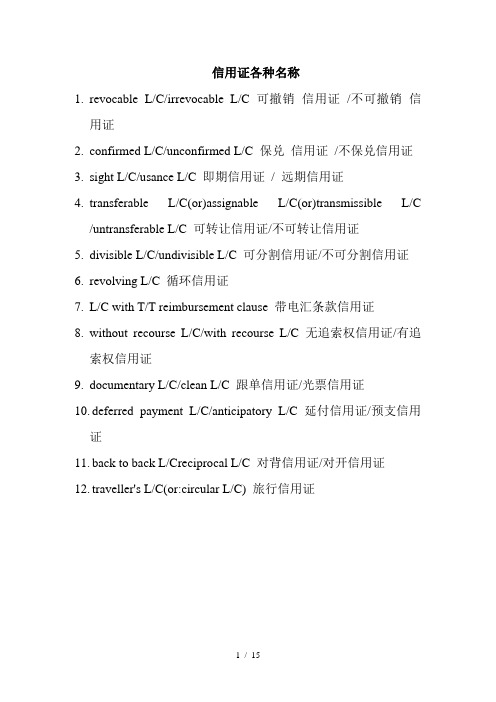

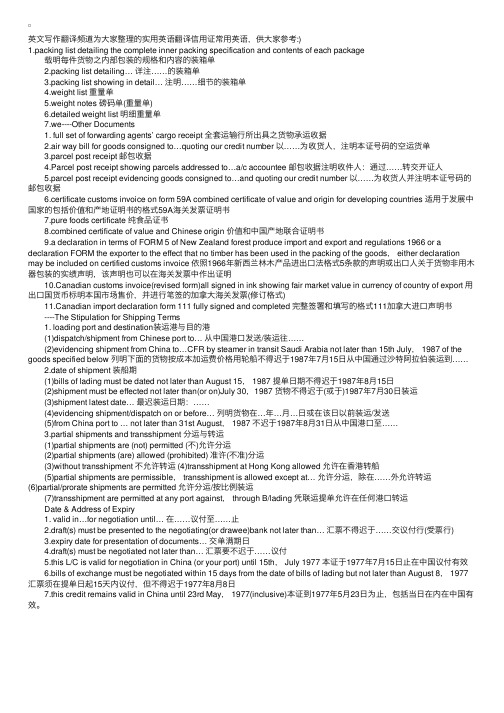

信用证英语-信用证种类----Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称----Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3. drawee 付款人(或称受票人,指汇票)4. (1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥…金额:人民币2.up to an aggregate amount of Hongkong Dollars…累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP…总金额不得超过英镑……4.to the extent of HKD…总金额为港币……5.for the amount of USD…金额为美元……6.for an amount not exceeding total of JPY…金额的总数不得超过……日元的限度----- The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by…汇票要随附(指单据)……----Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…”本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978”汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…”即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank”汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”---Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.…date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票Bill of Loading ---提单1. full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to …Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S …Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of…提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment”B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本-----Certificate of Origin 原产地证书1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of …origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin "form A" “格式A”产地证明书7.genetalised system of preference certificate of origin form "A" 普惠制格式“A”产地证明书-----Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单7.we----Other Documents1. full tet of forwarding agents'cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书----The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to…从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date…最迟装运日期:……(4)evidencing shipment/despatch on or before…列明货物在…年…月…日或在该日以前装运/发送(5)from China port to …not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运------Date & Address of Expiry 有效日期与地点1. valid in…for negotiation until…在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents…交单满期日4.draft(s) must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date…满期日……14.…if negotiation on or before…在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents'cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付-----The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付----In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Y uan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

信用证英语词汇

信用证常用词语的理解一. against 在L/C 中的高频率出现及正确理解。

我们常见的against 是介词, 通常意为“反对”( indicating opposite ion) , 例如:Public opinion was against the Bill. 舆论反对此法案。

The resolution was adopted by a vote of 30 in favor to 4 against it. 议以30 票同意、4 票反对获得通过。

另外还有“用. . . 交换, 用. . . 兑付”之意。

如:“the rates against U. S. dollars”中的against 就是指美元兑换率。

但在信用证中常出现的against 这个词及词义却另有所指, 一般词典无其释义及相关用法。

注意以下两个出现在信用证句中的against 之意, 其意思是凭. . . ”“以. . . ”(“take as the basis ” or meaning of “by”)。

而不是“以. . . 为背景”“反对”“对照”“兑换”或其他什么意思。

1. This credit valid until September 17, 2001 in Switzerland for payment available against the presentation of following documents . . . 本信用证在2001年9月17日在瑞土到期前, 凭提交以下单据付款. . . . . .2. Documents bearing discrepancies must no t be negotiated against guarantee and reserve. 含有不符点的单据凭保函或在保留下不能议付。

3. The payment is available at sight against the following documents. 凭下列单据即期付款。

信用证英语

信用证术语汇总1.信用证关系人Parties to a letter of Credit(1) The Applicant/Principal/Accountee/Accreditor/Opener for the Credit 开证申请人/开证人,即出口商(2) Beneficiary 受益人,即出口商(3) Opening/Issuing/Establishing Bank 开证行(4) Advising/Notifying Bank 通知行(5) Negotiating/Honoring Bank 议付行(6) Paying Bank, Drawee Bank 付款行(7) Confirming Bank 保兑行(8) Accepting Bank 承兑行(9) Claiming Bank 索偿行(10) Remitting Bank 寄单行(11) Transferor 转让人(12) Transferee 受让人2. 信用证单据通常包括:(1) Commercial Invoice 商业发票(2) Bill of Lading 提单(3) Insurance Policy 保险单(4) Bill of Exchange 汇票(5) Origin 原产地证(6) Inspection Certificate 检验证3.信用证类型:(1) Irrevocable L/C 不可撤销信用证(2) Sight L/C 即期信用证(3) Deferred Payment L/C 延期付款信用证(4) Acceptance Credit 承兑信用证(5) Confirmed L/C 保兑信用证(6) Transferable L/C 可转让信用证(7) Revolving L/C 循环信用证 Revolving(8) Red Clause L/C 红条款信用证(9) Reciprocal L/C 对开信用证(10) Back-to-back L/C 背对背信用证(11) Standby L/C 备用信用证4. Establishment of Letter of Credit 信用证的开立(方式包括:信开和电开两种)(1) Documentary Credit Application/Request to Open Documentary Credit 开证申请书(2) Written undertaking 书面担保(3) Acknowledgement 确认书(4) Master L/C 主证(5) Usance L/C 远期信用证(6) SWIFT(Society for Worldwide Interbank Financial Telecommunication):环球银行同业金融电讯协会5. Inspection of Letter of Credit信用证的审核1) Background Information 来证背景2) Form of Credit 信用证形式:(六种)IRREVOCABLE(不可撤销跟单信用证)REVOCABLE(可撤销跟单信用证)IRREVOCABLE TRANSFERABLE(不可撤销可转让跟单信用证)REVOCABLE TRANSFERABLE(可撤销可转让跟单信用证)IRREVOCABLE STANDBY(不可撤销备用信用证)REVOCABLE STANDBY(可撤销备用信用证)注:我国出口要求外来证是不可撤销,无追索权的信用证(Irrevocable, without recourse)3) Validity, Negotiating Place and Limitation for Document Submission有效期、议付地点和交单期限4) Shipment 装运条款①Date 日期:常用限制词:latest(最迟),not later than(不迟于),until(截止),before(在……之前)②Vessel 货船(九种)Conventional Vessel:一般货船,区别于集装箱船只(Container Vessel);Fast Vessel:快船;First Availiable Vessel :在L/C中规定的装运期内最早的开航船只;Regular Line Vessel: 定期班轮(议付时需提供船运公司的证明书或在提单上打明;“Regular Line Vessel”)Schedule Vessel:有船期预报的船只或在报纸上登有船期公告的船只;Classified Vessel:指经船级检验机构检验合格给予注册的船只;Conference Line Vessel:公会班轮;Vessel Aged under 15 years:要求装载船舶的船龄不超过15年;Intend ed Vessel:“拟装船只”或“预期船只”,用于联合运输提单;注:我国的海运船只都算班轮“Liner”,如来证指定某等级的船,或限装15年以上船龄的船,或公会班轮,一般不应接受,应要求修改。

商务英语:各类信用证的表达

商务英语:各类信用证的表达acceptance L/C 承兑信用证advising bank 通知行anticipatory L/C 预支信用证applicant 开证申请人applicant 开证申请人back to back redit(back to back L/C) 背对背信用证banker's acceptance L/C 银行承兑信用证beneficiary 受益人buyer's usance L/C 买方远期信用证clean credit (clean L/C)光票信用证collecting bank 代收银行confirmed L/C 保兑信用证confirming bank 保兑行credit with T/T reimbursement clause 带有电报索汇条款的信用证deferred payment credait (deferred payment L/C) 延期(迟期)付款信用证divisible L/C 可分割信用证documentary credit(documentary L/C) 跟单信用证documentary credit amendment 跟单信用证更改单expiry date 有效期fixed L/C (fixed amount L/C) 有固定金额的信用证freely negotiation L/C 自由议付信用证irrevocable cradit (irrevocable L/C) 不可撤销信用证issuing bank 开证银行letter of credit (L/C) 信用证negotiable 可议付的negotiating bank 议付行negotiation advice 议付通知书negotiation cradit(negotiation L/C) 议付信用证non-transferable L/C(non-transferable credit) 不可转让信用证notification 通知书notifying bank 通知行open by airmail 信开open by cable 电开open negotiation credit(open negotiation L/C)公开议付信用证opener 开证人opening bank (issuing bank) 开证行original credit 原信用证overriding credit 母证payee 收款人paying bank (drawee bank) 付款行payment advice 支付通知书payment credit 付款信用证payment order 付款单preadvice of a credit 信用证预先通知书presenting bank 提示行principal 委托开证人reciprocal L/C(reciprocal credit)对开信用证red clause L/C "红条款"信用证remitting bank 汇出行restricted negotiation L/C 限制议付信用证revocable credit (revocable L/C) 可撤销的信用证revolving credit (revolving L/C) 循环信用证sight credit (sight L/C) 即期信用证sight payment L/C 即期付款信用证stand-by L/C 备用信用证subsidiary credit 从属信用证terms of validity 信用证效期trade acceptance L/C 商业承兑信用证transferable L/C(transferable credit) 可转让信用证traveler's L/C 旅行信用证unconfirmed letter of credit 不保兑信用证usance L/C payable at sight 假远期信用证usance letter of credit 远期信用证with recourse L/C 有追索权信用证本文出自: 转载请注明出处!。

商务英语--跟单信用证

商英:跟单信用证商务英语大全商英:信用证相关短语及条款大全(1)一、Kinds of L/C 信用证类型1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证二、L/C Parties Concerned 有关当事人1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C 信用证金额1.amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of US D… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents 跟单条款1.available against surrender of the following documents bearing our credit nu mber and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……五、Draft(Bill of Exchange) 汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 原期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Und er Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C N o.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…date d…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown a bove) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice 发票1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration o f) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copi es as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票商英:跟单信用证商务英语大全(2)七、Bill of Loading 提单1.full set shipping (company's) clean on board bill(s) of lading marked " Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyer s 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to o ur order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freig ht Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading ma rked notify: buyer,“Freight Prepaid”“Liner terms”“recei ved for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Insurance Policy (or Certificate) 保险单(或凭证)1.Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destination Hongko ng, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险2.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People's Insurance Co. of China dated 1/1/1976. with extended cover up to Kual a Lumpur with claims payable in (at) Kuala Lumpur in the currency of dr aft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

常用商务英语【外汇、保险、信用证、包装、品质……】

信用证英语acceptance L/C 承兑信用证advising bank 通知行anticipatory L/C 预支信用证applicant 开证申请人applicant 开证申请人back to back redit(back to back L/C) 背对背信用证banker's acceptance L/C 银行承兑信用证beneficiary 受益人buyer's usance L/C 买方远期信用证clean credit (clean L/C) 光票信用证collecting bank 代收银行confirmed L/C 保兑信用证confirming bank 保兑行credit with T/T reimbursement clause 带有电报索汇条款的信用证deferred payment credait (deferred payment L/C) 延期(迟期)付款信用证divisible L/C 可分割信用证documentary credit(documentary L/C) 跟单信用证documentary credit amendment 跟单信用证更改单expiry date 有效期fixed L/C (fixed amount L/C) 有固定金额的信用证freely negotiation L/C 自由议付信用证irrevocable cradit (irrevocable L/C) 不可撤销信用证issuing bank 开证银行letter of credit (L/C) 信用证negotiable 可议付的negotiating bank 议付行negotiation advice 议付通知书negotiation cradit(negotiation L/C) 议付信用证non-transferable L/C(non-transferable credit) 不可转让信用证notification 通知书notifying bank 通知行open by airmail 信开open by cable 电开open negotiation credit(open negotiation L/C) 公开议付信用证opener 开证人opening bank (issuing bank) 开证行original credit 原信用证overriding credit 母证payee 收款人paying bank (drawee bank) 付款行payment advice 支付通知书payment credit 付款信用证payment order 付款单preadvice of a credit 信用证预先通知书presenting bank 提示行principal 委托开证人reciprocal L/C(reciprocal credit) 对开信用证red clause L/C "红条款"信用证remitting bank 汇出行restricted negotiation L/C 限制议付信用证revocable credit (revocable L/C) 可撤销的信用证revolving credit (revolving L/C) 循环信用证sight credit (sight L/C) 即期信用证sight payment L/C 即期付款信用证stand-by L/C 备用信用证subsidiary credit 从属信用证terms of validity 信用证效期trade acceptance L/C 商业承兑信用证transferable L/C(transferable credit) 可转让信用证traveler's L/C 旅行信用证unconfirmed letter of credit 不保兑信用证usance L/C payable at sight 假远期信用证usance letter of credit 远期信用证with recourse L/C 有追索权信用证包装英语aluminum Bottle 铝瓶amp(o)ule 安瓿 (药针支)bag 袋bale 捆,包bale cargo capacity 包装容积bales off 散包basket 笼、篓、篮、筐block 块bobbin 绕线筒bolt(piece) 匹Bottle 瓶bundle (Bd) 捆(包装单位)bottom 下端,底部,底层box 盒braid 瓣bundle 捆can 罐cartridge container 尾管case(-s) 一件(货物/行李)casing 套(罩)coil 卷container 集装箱,盂,箱copper Pot 铜壶cup 杯、盂deep 深degree 度denominator 分母depth 深度dozen 打drum 桶fraction 分数gross 箩hard 硬的height 高度high 高in the form of a fraction 分数形式kilogram 公斤length 长度line 直线long 长lot 堆nailed on 钉上numerator 分子pair 双package 一件(货物/行李)piece 件、支、把、个pot 壶ream 捻,令roll(reel) 卷sack 袋set(kit) 架、台、套sharp 锋利的side 边side of a case 箱子的一面thick 厚thickness 厚度tin 听unit(cart) 辆water tight 水密wide 宽width 宽度yard 码packing material 包装材料adhesive tape 压敏胶带backing 缓冲衬板bales 包件bamboo batten 竹条bamboo skin 竹篾batten 狭木条bituminous Kraft paper 地沥青牛皮纸brass wire 铜丝buckle 扣箍buffer 缓冲材料bulrush mat 蒲、苇by pattern, by stencil 按图安板canvas cloth 防水布,粗帆布canvas sheet 防水布,粗帆布cardboard paper 厚板纸cargo compressor 货用压缩机cargo lashing chain 货物捆绑链cellophane 玻璃纸cloth, canvas 粗麻布coated paper 涂层纸container loader 装箱机,集装箱装箱机container moulding apparatus 容器成型装置container sealing compound 容器封口胶compressed gas 压缩气体container boar 盒纸板container board 盒纸板container material 容器材料cord 绳子,绳索cushioning material 衬垫材料film 薄膜,胶片film membrane 薄膜Flexible Container 集装包/集装袋foamed plastics 泡沫塑料foamed rubber 泡沫橡胶foam plastic bag 泡沫塑料袋foil 箔纸heat seal 热封口indelible paint 不褪色的涂料,耐洗涂料iron Rod 铁条iron Wire 铁丝Kraft paper 牛皮纸lead Pot 铅壶metal strap 铁箍metal tag 金属标牌non returnable container 一次用包装old gunny bag 旧麻袋packet (pkt.) 包裹,封套,袋packing case 包装箱,包装件packing cloth, packing canvas 包装用的粗麻布packing cord 包装用的细绳packing paper 包装纸packing string 包装用的绳子,运单packing, package 包装,包装材料packing supplies 包装材料paint 颜料,油漆,涂料pallet 托盘pallet 卡板palletizer 堆卡板机paper 纸paper scrap 纸屑paper slip 纸条paper tag 纸标签paper tape 纸带paper wool 纸层paperboard 纸板partition 隔板patter, template, stencil 图案板plastic foam 泡沫塑料plywood 胶合板poly foam(snow box) 保丽龙(泡沫塑料)polyethylene film 聚乙烯薄膜polythene 聚乙烯preservative 防腐剂press packed bale 紧压包reusable tare 多次使用的包皮satin-covered 缎包装的seal 封口second-hand case 用过的箱子silk ribbon 绸带single sound bag 单层完整袋子size of a case 箱子的大小strap 带,铁皮带staple U型钉stencil 印上油墨tarpaulin 防水布,粗帆布throwaway tare 不能继续使用的包皮transparent paper 透明纸twine, string, pack thread 绳子,绳索.used gunny bag 旧麻袋vial 玻璃小瓶kind of packing 包装种类bag container packing 集装袋装bare in loose 裸装can 罐装,听装card board package 硬纸盒包装collective packing 组合包装container packing 集装箱装consumer packing 消费包装customary packing 普通包装, 习惯包装flexible container packing 集装包装/集装袋装flexible package 软包装hinge cover container 挂式包装homogeneous cargo bagged for stowage purpose 同类散货压舱包装,同类散货袋用压包in aluminum foil packing 铝箔包装in block 块装in bulk 散装in bundle 捆(扎)装inner packing 内包装,小包装in nude 裸装in slice 片装in spear 条装interior packaging 内部包装moisture proof packaging 防潮包装neutral packing 中性包装nude parched 裸装outer package 外包装outer packing 大包装,外包装packing exterior 外部包装packing for export goods 出口商品(货物)的包装packing interior 内部包装packing of nominated brand 定牌包装palletizing 托盘包装paper packing 纸包装plastic packing 塑料包装prepackaging 预包装regular packing for export 正规出口包装rustproof packaging 防锈包装sales package 销售包装,内包装seaworthy packing 海运包装sellers usual packing 卖方习惯包装single packing 单件包装shipment packing 运输包装shock proof packaging 防震包装tin 罐装,听装transparent package 透明包装transport package 运输包装tropical packing 适应热带气候的包装unpacked 散装vacuum packaging 真空包装water proof packaging 防水包装water proof packing 防水包装(材料),不透水包装without packing 裸装outer packing 大包装,外包装保险英语actual total loss 实际全损additional premium 附加保险费additional risk 附加险aflatoxin risk 黄曲霉素险air transportation risk 航空运输险average 海损breakage of packing 包装破碎险China Insurance Clauce (CIC) 中国保险条款claim adjustment (settlement of claim) 理赔claims and arbitration 索赔与仲裁clash and breakage 碰损,破碎险co-insurance 共同保险constructive total loss 推定全损contractors all risks insurance 建筑工程一切险cover note 暂保单(证明同意承保的临时文件);cover note 承保单,保险证明damage caused by heating and sweating 受热受潮险disbursement policy (船舶)驶费保险单double insurance 双保险endowment insurance 养老保险extra premium 额外保险费extraneous risks (additional risks) 附加险failure to delivery risk 交货不到险floating policy 浮动保险单franchise (deductible) 免赔额;免赔率free from/of particular average(FPA, F.P.A.) 平安险freight policy 运费保险单General Average (G.A.) 共同海损guarantee of insurance 保险担保书health insurance 健康保险hook damage 勾(钩)损险Institute Cargo Clauses (ICC,I.C.C.) 协会货物(保险)条款insurance 保险;保险金额insurance against air risk (air transportation insurance) 航空运输保险insurance against all risks 保一切险,综合险insurance against breakage 保渗漏险insurance against extraneous(additional) risks 附加险insurance against rain or fresh water 保淡水雨淋险insurance against strike, riot and civil commotion (SRCC) 罢工、暴动、民变险insurance against total loss only (TLO) 全损险insurance agent(s) 保险代理,保险代理人insurance amount 保险额insurance applicant 投保人insurance broker 保险经纪人insurance business 保险业insurance certificate 保险凭证,保险证书insurance claim 保险索赔insurance clause 保险条款insurance commission 保险佣金insurance company 保险公司insurance conditions 保险条件,保险契约约定条款insurance coverage 保险范围,保额insurance declaration sheet (bordereau) 保险申报单(明细表) insurance document 保险单据insurance expense 保险费用insurance industry 保险业insurance instruction 投保通知,投保须知insurance law 保险法insurance on last survivor 长寿保险insurance policy 保险单, 保单insurance premium 保险费insurance proceeds 保险赔偿金,保险赔款insurance rate 保险费率insurance slip 投保申请书,投保单insurance underwriter 保险承保人insurance value (insurance amount) 保险金额insurant 被保险人insure 保险;投保insured amount 保险金额insurer 保险人,保险商insurer (underwriter) 承保人、保险人investment insurance 投资保险land transit insurance 陆上运输保险letter of guarantee 保函,保证书life insurance 人寿保险loss (damage)cuased by breakageof packing 包装破裂险marine insurance 海运保险,水险Marine Loss 海损medical insurance 医疗保险ocean marine cargo clauses 海洋运输货物保险条款on deck risk 舱面险open policy 预约保险单open policy insurance 预约保险overland (transportation) insurance 陆上运输保险parcel post insurance 邮包运输保险partial loss 部分损失particular average (P.A.) 单独海损perils of the sea 海上风险policy 保单,保险契约policy holder 保险客户,保险单持有人policy package 承保多项内容的保险单policy proof of interest 保险单权益证明 policy reserves 保险单责任准备金premium 保险费premium rate 保险费率premium rebate 保险费回扣property insurance 财产保险rejection risk 拒收险renew coverage 续保riks of non-delivery 提货不着险risk 保险,保险额risk of bad odour 恶味险,变味险risk of breakage 破碎险risk of clashing 碰损险risk of contamination 污染险risk of contingent import duty 进口关税险risk of deterioration 变质险risk of error 过失险risk of hook damage 钩损险risk of import duty 进口关税险risk of inherent vice 内在缺陷险risk of labels being washed off 标签破损险risk of leakage 渗漏险risk of loss 损失险risk of mould 发霉险risk of normal loss (natural loss) 途耗或自然损耗险risk of oil damage 油渍险risk of packing breakage 包装破裂险risk of rain and/or fresh water damage 淡水雨淋险risk of rust 锈蚀险risk of shortage in quantity 短量险risk of shortage in weight 短重险risk of spontaneous combustion 自燃险risk of sweating and/or heating 受潮受热险risk of theft, pilferage and nondelivery (TRND) 盗窃、提货不着险risk premium 风险贴水、风险溢价sickness insurance 疾病保险social insurance 社会保险special additional risk 特别(特殊)附加险survey at jetty risk 码头检验险survey in customs risk 海关检验险the insured 受保人,被保险人the People's Insurance Company of China 中国人民保险公司Theft, Pilferage and Non-delivery (PTND, P.T.N.D.) 偷窃、提货不着险time policy 定期保险单total loss 全部损失transportation insurance 运输保险under deck risk 舱内险underwriter 保险商(指专保水险的保险商),保险公司valued policy 定值保险单voyage policy 航程保险单war risk 战争险with particular average(WPA) 水渍险,基本险,单独海损赔]品质英语5% plus or minus 增减5%above the average quality 一般水平以上的质量article No. 货号 assortment 花色(搭配)average quality 平均质量bad quality 劣质below the average quality 一般水平以下的质量best quality 最好的质量better quality 较好质量brand 牌名catalogue 商品目录 choice quality或selected quality 精选的质量colour 色彩colour sample 色彩样品common quality 一般质量counter sample 对等样品description 说明 design 图案duplicate sample 复样fair average quality (f.a.q.) 大路货,良好平均品质 fair quality 尚好的质量fine quality 优质first-class 一等品first-class quality 头等的质量first-rate quality 头等的质量good merchantable quality 全销质量good quality 好质量grade 等级high quality 高质量inaccurate 不精确的inferior quality 次质量low quality 低质量original sample 原样pamphlet 宣传小册 particulars 细节pattern sample 型式样品poor quality 质量较差popular quality 大众化的质量prime quality 第一流的质量qualitative 质量的qualitatively 在质量上quality 质量,品质quality as per buyer's sample 凭买方样品质量交货quality as per seller's sample 凭卖方样品质量交货quality certificate 品质证明书quality clause 品质条款quality control 质量管理quality landed 卸岸品质quality of export and import commodities 进出口商品质量quality shipped 装船品质quality to be considered as being about equal to the sample 品质与样品大致相同reference sample 参考样品representative sample 代表性样品Sales by Description 凭说明书买卖sales by sample 凭样品买卖sales by specification, grade, of standard 凭规格、等级或标准买卖sales by trade mark of brand 凭商标和牌名买卖sample 样品sample for reference 参考样品sampling 抽样sealed sample 封样sound quality 完好的质量specification 规格standard 标准standard quality 标准质量standard type 标准 subject to the counter sample 以对等样品为准superior quality 优等的质量tip-top quality 第一流的质量to be in conformity with 与...一致to be inferior to 次于...to be responsible for 对...负责tolerance 公差trade mark 商标transferee 受让者transferer 转让者uniform quality 一致的质量unsatisfactory 不满意的usual quality 通常的质量外汇英语gold content 含金量adjustable peg 可调整的钉住(汇率)appreciation 升值at par 平价balance of payments 贸易支付差额bank note rate 现钞汇率banker's check 银行支票basic rate 基本汇率bear market 熊市bid 买价bid rate 出价汇率bid/ask spread 买入卖出差价bill of exchange 汇票Bretton Woods Accord of 1944 1944年布雷顿森林协定broker 经纪人bull market 牛市buying rate 买入汇率call rate 同业拆借利率cash market 现金市场closing rate 收盘汇率commercial rate 商业汇价,贸易汇率convertible currency 可兑换货币correspondent bank 代理银行,同业银行cross exchange 通过第三国汇付的汇兑cross rate 套算汇率currency option 货币期权currency risk 货币风险currency swap 货币掉期currency warrant 货币权证day trading 交易日demand rate 即期汇率devaluation 贬值discount 贴现discount rate 贴现率effective rate 实际汇率European Monetary System (EMS) 欧洲货币体系European Monetary Union 欧洲货币联盟exchange rate 汇率exchange rate risk 汇率风险Federal Reserve (Fed) 联邦储备(美国的中央银行) financial rate 金融汇率fixed rate 固定汇率flat /square 持平/轧平floating rate 浮动汇率foreign currency 外币foreign exchange 外汇foreign exchange control 外汇管制foreign exchange reserve 外汇储备foreign exchange swap 外汇交换forward 远期交易forward margin 远期差额forward rate 远期汇率freely floating exchange rate 自由浮动汇率fundamental analysis 基本面分析gold point 黄金输送点gold standard 金本位GTC (good till cancelled) 撤销前有效hard currency 硬通货hedging 对冲high/low 最高价/最低价inflation 通货膨胀initial margin 原始保证金interbank rates 银行同业买卖汇率International Monetary Fun(IMF) 国际货币基金组织joint floating exchange rate 联合浮动汇率limit order 限价定单long position 多头mail transfer 信汇managed floating exchange rate 管理浮动汇率margin 保证金margin call 追加保证market maker 做市者,市场主持者,代客或自行买卖股票者maturity 到期日medial rate 中间汇率merchant rate 商业汇价mint par 铸币平价multiple rate 复汇率offer 卖出价One Cancels Other Order (O.C.O.Order) 二择一定单open position 未结头寸,未结清期货合同over the counter (OTC) 柜台外交易overnight trading 隔夜交易paper money system 纸币制度pegged exchange rate 钉住汇率制pip (or points) 基本点(点)political risk 政治风险premium (货币、期货等)升水,溢价quotation 牌价,行情(表)regional monetary integration 区域性货币一体化resistance 阻力位risk capital 风险资金rollover 展期交割selling rate 卖出汇率settlement 清算short 空头(户),空头证券single floating exchange rate 单独浮动汇率single rate 单一汇率soft currency 软通货spot 即期spot rate 即期汇率spread 价差stop loss order 止损定单support levels 支持位two-way price 双向报价US prime rate 美国基本利率value date 交割日variation margin 变动保证金volatility 波幅报关英语accepting bank 承兑银行actual weight (A/W) 实际重量ad valorem 从价advice of shipment 装运通知,装船通知air waybill 航空运单anti-dumping duty 反倾销税art. No. 货号at sight (A/S ) 见票即付authorized agent 指定的代理人autonomous tariff 自主关税bank draft (B/D) 银行汇票barter trade 易货贸易bill drawn to order 指定式汇票bill for collection (B/C) 托收汇票bill head (BHD) 空白单据bill of entry (B/E) 进口报关单bill of lading (B/L) 提单air bill of lading 空运提单clean bill of lading 清洁提单bill of materials (B/M) 材料单bill of exit (B/E) 出口报送单booking list 定舱清单,装货定舱表bound rate 约束税率Brussels Definition of Value (BDV) 布鲁塞尔估价定义cargo in bulk 散装货cash against bill of lading 凭提单付款cash against delivery 货到付款cash against shipping document 凭单付款cash and delivery 付款交货、货到付款cash on delivery (COD) 货到付款charge paid (CD) 付讫chargeable weight 计费重量commission 佣金commodity code 商品编码compensation 赔偿,补偿complaint 投诉confirmed credit 保兑信用证confirming bank 保兑银行consignee 收货人consignment agent 寄售代理人consignor 发货人,寄售人cost and freight (CFR) 成本加运费价格(指定目的港)cost and freight (C&F,即CFR) 成本加运费价格cost, insurance and freight (CIF,c.i.f.) 成本加保险费、运费价,到岸价countervailing duty 反补贴税Customs 海关Customs Co-operation Council 关税合作理事会Customs duty 关税Customs Union 关税同盟Customs value 海关估价demand draft (D/D) 即期汇票description 品名,货名;规格说明书differential duty 差别关税documents against acceptance (D/A) 承兑交单documents against payment (D/P) 付款交单documents attached (DA) 附凭单effective rate of protection 有效保护率exchange tax 汇兑税expiration date (expiry date) 失效日期,有效期限export duty 出口税export rebates 出口退税extra large, extra long (XL) 超大、超长fair average quality (FAQ) 良好平均品质free on board (FOB) 装运港船上交货价格,离岸价freight 运费air freight 空运费full container load (FCL) 整箱货internal tax 国内税less than container load (LCL) 拼箱货letter of credit (L/C) 信用证letter of trust (L/T) 委托书margin of preference 优惠差额multiple rates of exchange 多种汇率par value of exchange 汇兑平价partial shipment 分批装运port of dispatch 发货口岸preferential rate 优惠税率price 价格product by product reduction of tariff 产品对产品减税方式protective tariff 保护关税quantity 数量quality assurance (QA) 质量保证reciprocity 互惠原则registered air mail (RAM) 航空挂号邮件specific duty 从量税tare 皮重,毛重tariff 关税tariff concession 关税减让tariff escalation 关税升级tariff quota 关税配额telegraphic transfer (T/T) 电汇General Agreement On Tariffs And Trade (GATT) 关税与贸易总协定most-favoured-nation rate of duty 最惠国税率total weight (TW) 总重量transhipment delivery order (TDO) 转船提货单transit duties 过境关税twenty-foot equivelent unit (TEU) 20英尺集装箱等量单位unit price 单价variable import levies 差价关税woven label (W/L) 编织标签索赔英语claim against carrier 向承运人索赔claim for compensation 要求补偿claim for damage 由于损坏而索赔claim for indemnity 要求索赔claim for loss and damage of cargo 货物损失索赔claim for short weight 由于短重而索赔claim for trade dispute 贸易纠纷(引起的)索赔 claim indemnity 索赔claim letter 索赔书claim on the goods 对某(批)货索赔claim on you 向某人(方)提出索赔claim report 索赔报告claimant 索赔人claimee 被索赔人claiming administration 索赔局claims 索赔;债权claims assessor 估损人claims department(commission board) 索赔委员会 claims documents 索赔证件claims rejected 拒赔claims settlement 理赔claims settling agent 理赔代理人claims settling fee 理赔代理费claims statement 索赔清单claims surveying agent 理赔检验代理人claimsman 损失赔偿结算人in settlement of 解决inability 无能力incorrect 不正确的insurance claim 保险索赔on my way home 顺路Sales Confirmation 销售确认书to bring up a (one's) claim 提出索赔to file a (one's) claim 提出索赔to lodge a (one's) claim 提出索赔to make a (one's) claim 提出索赔to make a claim for (on)sth. 就某事提出索赔to make a claim with(against) sb. 向某方提出索赔 to make an investigation 调查研究to put in a (one's) claim 提出索赔to raise a (one's) claim 提出索赔to register a (one's) claim 提出索赔to waive a claim 放弃索赔(要求)to withdraw a claim 撤消(某项)索赔arbitral tribunal 仲裁庭arbitration 仲裁claim 索赔;赔偿;赔偿金claim for inferior quality 由于质量低劣而索赔 compensate 赔偿,补偿disputes 争议force Majeure 不可抗力penalty 罚金条款to settle a claim 解决索赔(问题)。

综合辅导:信用证英语大全

综合辅导:信用证英语大全Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单7.we----Other Documents1. full tet of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to…从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date…最迟装运日期:……(4)evidencing shipment/despatch on or before…列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运 (4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运 (6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until…在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents…交单满期日4.draft(s) must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date…满期日……14.…if negotiation on or before…在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

信用证常用英语句子

1. In the case of sight credits, payment can be made promptly upon presentationof draft and impeccable shipping documents.在即期信用证情况下,提示汇票和正确无误的单据后便立即付款。

2. L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

3. Is the credit at sight or after sight?我同意用即期信用证付款。

4. L/C at sight is what we request for all our customers.开即期信用证是我方对我们所有客户的要求。

5. We'll agree to change the terms of payment from L/C at sight to D/P at sight.我们同意将即期信用证付款方式改为即期付款交单。

6. Payment: 100% by irrevocable and confirmed letter of credit drawn at sight.100%的不可撤消、保兑的即期信用证。

7. We insist on payment by irrevocable sight credit.我们坚持凭不可撤消的即期信用证付款。

8. I agree to use letter of credit at sight.我同意用即期信用证付款。

9. As this is the first deal between us, I hope we can trade on customary terms, i.E., Letter of credit payable against sight draft.由于这是我们之间进行的第一笔交易,我很希望能够遵照惯例,也就是说,用即期信用证付款。

常见信用证明条款英汉对照

常见信用证明条款英汉对照在国际贸易中,信用证是一种常见的付款方式。

以下是一些常见的信用证条款的英汉对照:1. Amount: 金额2. Beneficiary: 受益人3. Applicant: 申请人4. Issuing bank: 开证行5. Advising bank: 通知行6. Expiry date: 到期日期7. Shipment date: 装运日期8. Port of loading: 装运港9. Port of discharge: 卸货港10. Documents required: 所需单据11. Shipping marks: 装运唛头12. Insurance coverage: 保险覆盖范围13. Partial shipment: 分批装运14. Transshipment: 转运15. L/C negotiation: 信用证议付16. L/C confirmation: 信用证保兑17. Bill of lading: 提单18. Commercial invoice: 商业发票19. Packing list: 装箱单20. Insurance policy: 保险单21. Inspection certificate: 检验证书22. Certificate of origin: 原产地证书23. Clean on board B/L: 清洁提单24. FOB (Free On Board): 离岸价25. CIF (Cost, Insurance, and Freight): 成本、保险加运费价26. CFR (Cost and Freight): 成本加运费价27. D/P (Documents against Payment): 付款交单28. D/A (Documents against Acceptance): 承兑交单29. Sight payment: 即期付款30. Usance payment: 远期付款请注意,在特定的贸易合同和信用证中,可能会有自定义的条款和定义。

信用证英语词汇汇总

信用证各种名称1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/ 远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C/untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称----Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两份;in triplicate 一式三份;in quadruplicate 一式四份;in quintuplicate 一式五份;in sextuplicate 一式六份;in septuplicate 一式七份;in octuplicate 一式八份;in nonuplicate 一式九份;in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据8aaabined invoice is not acceptable 不接受联合发票Bill of Loading --- 提单1. full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“L iner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本原产地证明-----Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地声明)5.certificate of origin separated 单独出具的产地证6.certificate of origin "form A" “格式A”产地证明书10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书----The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to… CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运------Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4.draft(s) must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

1、信用证的英语

(四)表示“支付”的词

settle, effect settlement 结算。如:“in settlement, 结算。 we shall cover you by T/T as per your instruction upon receipt of documents complied with”结算的时 ” 候,我行一待收到相符的单据将根据你行指示通过电汇向 你行支付款项。 你行支付款项。 for account of, for one’s account, to be borne by 由 ’ 某人支付。 某人支付。如:“telex charges are for account of the beneficiary”电传费用由受益人承担。 ”电传费用由受益人承担。 levy 征收。如:“additional fees on beneficiary’s 征收。 ’ account may be levied for each presentation of documents bearing discrepancies”若每次提交的单据 ” 有不符点,将向受益人收取额外费用。 有不符点,将向受益人收取额外费用。

(四)表示“支付”的词

be charge by 由…收取费用;be charged to 向…收取 收取费用; 收取费用 收取 费用。 费用。如:“a discrepancy fee of USD 40 will be charged by us”我行将收取 美元不符点费用。 美元不符点费用。 ”我行将收取40美元不符点费用 remit, remit the proceeds, remittance 汇款。如:“we 汇款。 shall remit the proceeds to the negotiating bank”我 ” 行将向议付行汇款。 行将向议付行汇款。 pay, payable, make payment付款。如:“Claims are 付款。 付款 to be payable in New York in the currency of the draft”索赔以汇票币种在纽约得以给付。 ”索赔以汇票币种在纽约得以给付。

1、信用证的英语

(四)表示“支付”的词

assess 确定金额收取。如:“a handling charge of HKD 450 will be assessed for each set of documents containing discrepancies”将向每套含有不符点的单据 收取450港元的手续费。 cover 负担费用。如:“we shall cover you in accordance with your reimbursement instruction” 我行将根据你方索偿指示向你方付款。 credit, debit 贷记,借记。贷记,即把钱数打入账户;借 记,即把钱数从账户中扣除。如:“we will credit negotiating bank according to their instruction”我方 将根据指示将款项计入议付行贷方;“please debit our A/C with you”请借记我方账户。

第一节 信用证的用词

(一)用累赘词表达单一含义

in effect/force 生效,如“remain in effect/force until May 10th”。

null and void 失效,如“become null and void”。 reserves, guarantee or indemnity 保函,如“payment under reserves, guarantee or indemnity is not allowed”。

5、in compliance with, in the light of, in line with 与2、3、4相同,可以 互换使用。

(二)表示“根据、依照”的词

6、on the basis of 如:“you may negotiate the documents on a sight basis”本单证可以即期议付。 7、pursuant to 如:“pursuant to US law we are prohibited from …”根据美国法律,我们禁止… 8、subject to 主要强调以某事为依据,相当于on the basis of, 如:“this documentary credit is subject to UCP600”本跟单信用证受UCP600约束。

L C信用证英语缩写词汇

L C信用证英语缩写词汇L/C信用证英语缩写词汇1)SWIFT的英文全称是:Society for Worldwide Interbank Financial Telemunication 环球金融同业电讯协会2) CHIPS的英文全称是:Clearinghouse Interbank Payments Systems国际银行同业结算系统目前世界上应用最普遍的美元清算系统是CHIPS,也就是纽约银行同业电子清算系统。

这个清算系统1970年建于纽约,为纽约清算协会所拥有并由其经营,现有140多家成员银行,其中三分之二为外国成员银行,分布于40多个国家。

在纽约以外的其他城市收付结算,需要通过美国联邦储备系统的FEDWIRE(FEDERAL RESERVES WIRE TRANSFER SYSTEM)进行。

3) FedWire的英文全称是:FEDERAL RESERVES WIRE TRANSFER SYSTEM联邦储备通信系统美国的第一条支付网络是联邦储备通信系统(Federal Reserve Communication System),通常称之为FedWire。

这条通信系统是属于美国联邦储备体系(Federal Reserve System)所有,并由其管理的。

它是美国国家级的支付系统,用于遍及全国12个储备区的1万多家成员银行之间的资金转账。

它实时处理美国国内大额资金的划拨业务,逐笔清算资金。

4) CHATS的'英文全称是:Clearing House Automated Transfer System票据交换所自动转账系统自2000年8月21日,香港实施了CHATS,也就是香港美元即时结算系统。

CHATS系统是亚洲范围内最先进的美元支付结算系统,现在香港汇丰银行(HSBC)为金融管理局委任的香港美元结算银行。

加入该系统的银行为香港美元清算会员行,可以实现美元在系统内即时清算。

在CHATS系统实施之前,如果通过香港的银行间接汇款,因美元都要到美国清算,至少要两天以上收款人才会收到汇款;成立CHATS之后,如果收款人、汇款人同在亚洲,汇款一天就可以收到。

外贸英语口语外贸信用证用语大全

外贸英语口语:外贸信用证用语大全(二)Certificate of origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin “form A” “格式A”产地证明书7.genetalised system of preference certificate of origin form “A” 普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in detail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full tet of forwarding agents'cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食物证书8.combined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大入口声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to… 从中国口岸发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按本钱加运费价钱用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国口岸至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not)permitted (不)允许分运(2)partial shipments (are) allowed (prohibited)准予(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何口岸转运Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s)must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4.draft(s)must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port)until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s)drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 按照本证项下开具的汇票须在1977年8月30日或该日前在中邦交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非还有规定,(本证)于1977年8月15日受益人国家满期12.draft(s)drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring)date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until… 本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents'cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s)drawn under and in compliance with the terms of the credit that such draft (s)shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit)凡按照本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡按照本证的条款开具并提示汇票,咱们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有依照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必需由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须别离由持续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全数单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding)airmails 单据要由持续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

外贸英语:信用证英语-信用证种类(1)

信⽤证英语-信⽤证种类 ----Kinds of L/C 1. revocable L/C/irrevocable L/C 可撤销信⽤证/不可撤销信⽤证 2.confirmed L/C/unconfirmed L/C 保兑信⽤证/不保兑信⽤证 3.sight L/C/usance L/C 即期信⽤证/远期信⽤证 4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信⽤证/不可转让信⽤证 5.divisible L/C/undivisible L/C 可分割信⽤证/不可分割信⽤证 6.revolving L/C 循环信⽤证 7.L/C with T/T reimbursement clause 带电汇条款信⽤证 8.without recourse L/C/with recourse L/C ⽆追索权信⽤证/有追索权信⽤证 9.documentary L/C/clean L/C 跟单信⽤证/光票信⽤证 10.deferred payment L/C/anticipatory L/C 延付信⽤证/预⽀信⽤证 11.back to back L/Creciprocal L/C 对背信⽤证/对开信⽤证 12.traveller's L/C(or:circular L/C) 旅⾏信⽤证 信⽤证有关各⽅名称 ----Names of Parties Concerned 1. opener 开证⼈ (1)applicant 开证⼈(申请开证⼈) (2)principal 开证⼈(委托开证⼈) (3)accountee 开证⼈ (4)accreditor 开证⼈(委托开证⼈) (5)opener 开证⼈ (6)for account of Messrs 付(某⼈)帐 (7)at the request of Messrs 应(某⼈)请求 (8)on behalf of Messrs 代表某⼈ (9)by order of Messrs 奉(某⼈)之命 (10)by order of and for account of Messrs 奉(某⼈)之命并付其帐户 (11)at the request of and for account of Messrs 应(某⼈)得要求并付其帐户 (12)in accordance with instruction received from accreditors 根据已收到得委托开证⼈得指⽰ 2.beneficiary 受益⼈ (1)beneficiary 受益⼈ (2)in favour of 以(某⼈)为受益⼈ (3)in one's favour 以……为受益⼈ (4)favouring yourselves 以你本⼈为受益⼈ 3.drawee 付款⼈(或称受票⼈,指汇票) (1)to drawn on (or :upon) 以(某⼈)为付款⼈ (2)to value on 以(某⼈)为付款⼈ (3)to issued on 以(某⼈)为付款⼈ 4.drawer 出票⼈ 5.advising bank 通知⾏ (1)advising bank 通知⾏ (2)the notifying bank 通知⾏ (3)advised through…bank 通过……银⾏通知(4)advised by airmail/cable through…bank 通过……银⾏航空信/电通知 6.opening bank 开证⾏ (1)opening bank 开证⾏ (2)issuing bank 开证⾏ (3)establishing bank 开证⾏ 7.negotiation bank 议付⾏ (1)negotiating bank 议付⾏(2)negotiation bank 议付⾏ 8.paying bank 付款⾏ 9.reimbursing bank 偿付⾏ 10.the confirming bank 保兑⾏ Amount of the L/C 信⽤证⾦额 1. amount RMB¥… ⾦额:⼈民币 2.up to an aggregate amount of Hongkong Dollars… 累计⾦额为港币…… 3.for a sum (or :sums) not exceeding a total of GBP… 总⾦额不得超过英镑…… 4.to the extent of HKD… 总⾦额为港币…… 5.for the amount of USD… ⾦额为美元…… 6.for an amount not exceeding total of JPY… ⾦额的总数不得超过……⽇元的限度 ----- The Stipulations for the shipping Documents 1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证⼈的全称及地址的单据付款 2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据 3.accompanied against to documents hereinafter 随附下列单据 4.accompanied by following documents 随附下列单据 5.documents required 单据要求 6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据⼀式两份 7.drafts are to be accompanied by… 汇票要随附(指单据)……。

信用证英语必备知识

第三章国际贸易结算方式信用证英语必备I agree to use letter of credit at sight.我同意用即期信用证付款。

Is the credit at sight or after sight?信用证是即期的还是远期的?Our letter of credit will be opened early March.我们在3月初开出信用证。

We'll open the credit one month before shipment.我们在装船前1个月开立信用证。

Please open the L/C 20 to 30 days before the date of delivery.请在交货前20到30天开出信用证。

This letter of credit expires on 15th July.这张信用证7月15日到期。

The validity of the L/C will be extended to 30th August.信用证的有效期将延至8月30日。

Will you persuade your customer to arrange for a one-month extension of L/C No.TD204?你们能不能劝说客户将TD204号信用证延期一个月?To do so, you could save bank charges for opening an L/C.这样做,你们可以省去开证费用。

It's expensive to open an L/C because we need to put a deposit in the bank.开证得交押金,因此花费较大。

We pay too much for such a letter of credit arrangement.这种信用证付款方式让我们花费太大了。

There will be bank charges in connection with the credit.开立信用证还要缴纳银行手续费。

实用英语翻译信用证常用英语

英⽂写作翻译频道为⼤家整理的实⽤英语翻译信⽤证常⽤英语,供⼤家参考:)1.packing list detailing the complete inner packing specification and contents of each package 载明每件货物之内部包装的规格和内容的装箱单 2.packing list detailing… 详注……的装箱单 3.packing list showing in detail… 注明……细节的装箱单 4.weight list 重量单 5.weight notes 磅码单(重量单) 6.detailed weight list 明细重量单 7.we----Other Documents 1. full set of forwarding agents’ cargo receipt 全套运输⾏所出具之货物承运收据 2.air way bill for goods consigned to…quoting our credit number 以……为收货⼈,注明本证号码的空运货单 3.parcel post receipt 邮包收据 4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件⼈:通过……转交开证⼈ 5.parcel post receipt evidencing goods consigned to…and quoting our credit number 以……为收货⼈并注明本证号码的邮包收据 6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适⽤于发展中国家的包括价值和产地证明书的格式59A海关发票证明书 7.pure foods certificate 纯⾷品证书 bined certificate of value and Chinese origin 价值和中国产地联合证明书 9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regulations 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林⽊产品进出⼝法格式5条款的声明或出⼝⼈关于货物⾮⽤⽊器包装的实绩声明,该声明也可以在海关发票中作出证明 10.Canadian customs invoice(revised form)all signed in ink showing fair market value in currency of country of export ⽤出⼝国货币标明本国市场售价,并进⾏笔签的加拿⼤海关发票(修订格式) 11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿⼤进⼝声明书 ----The Stipulation for Shipping Terms 1. loading port and destination装运港与⽬的港 (1)dispatch/shipment from Chinese port to… 从中国港⼝发送/装运往…… (2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下⾯的货物按成本加运费价格⽤轮船不得迟于1987年7⽉15⽇从中国通过沙特阿拉伯装运到…… 2.date of shipment 装船期 (1)bills of lading must be dated not later than August 15, 1987 提单⽇期不得迟于1987年8⽉15⽇ (2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7⽉30⽇装运 (3)shipment latest date… 最迟装运⽇期:…… (4)evidencing shipment/dispatch on or before… 列明货物在…年…⽉…⽇或在该⽇以前装运/发送 (5)from China port to … not later than 31st August, 1987 不迟于1987年8⽉31⽇从中国港⼝⾄…… 3.partial shipments and transshipment 分运与转运 (1)partial shipments are (not) permitted (不)允许分运 (2)partial shipments (are) allowed (prohibited) 准许(不准)分运 (3)without transshipment 不允许转运 (4)transshipment at Hong Kong allowed 允许在⾹港转船 (5)partial shipments are permissible, transshipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are permitted 允许分运/按⽐例装运 (7)transshipment are permitted at any port against, through B/lading 凭联运提单允许在任何港⼝转运 Date & Address of Expiry 1. valid in…for negotiation until… 在……议付⾄……⽌ 2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付⾏(受票⾏) 3.expiry date for presentation of documents… 交单满期⽇ 4.draft(s) must be negotiated not later than… 汇票要不迟于……议付 5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7⽉15⽇⽌在中国议付有效 6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977汇票须在提单⽇起15天内议付,但不得迟于1977年8⽉8⽇ 7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5⽉23⽇为⽌,包括当⽇在内在中国有效。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第三章国际贸易结算方式信用证英语必备I agree to use letter of credit at sight.我同意用即期信用证付款。

Is the credit at sight or after sight?信用证是即期的还是远期的?Our letter of credit will be opened early March.我们在3月初开出信用证。

We'll open the credit one month before shipment.我们在装船前1个月开立信用证。

Please open the L/C 20 to 30 days before the date of delivery.请在交货前20到30天开出信用证。

This letter of credit expires on 15th July.这张信用证7月15日到期。

The validity of the L/C will be extended to 30th August.信用证的有效期将延至8月30日。

Will you persuade your customer to arrange for a one-month extension of L/C No.TD204?你们能不能劝说客户将TD204号信用证延期一个月?To do so, you could save bank charges for opening an L/C.这样做,你们可以省去开证费用。

It's expensive to open an L/C because we need to put a deposit in the bank.开证得交押金,因此花费较大。

We pay too much for such a letter of credit arrangement.这种信用证付款方式让我们花费太大了。

There will be bank charges in connection with the credit.开立信用证还要缴纳银行手续费。

A letter of credit would increase the cost of my import.信用证会增加我们进口货物的成本。

The seller will request to amend the letter of credit.卖方要修改信用证。

Please amend L/C No.205 as follows.请按下述意见修改第205号信用证。

Your refusal to amend the L/C is equivalent to cancellation of the order.你们拒绝修改信用证就等于取消订单。