增值税纳税申报表 英语版

增值税纳税申报表英语版-converted

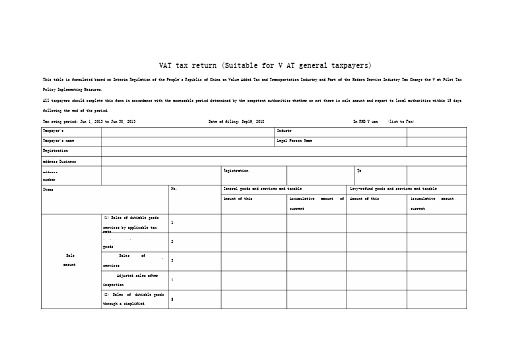

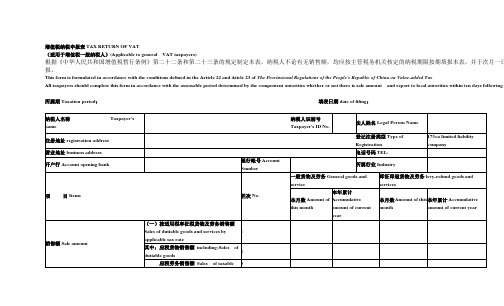

VAT tax return (Suitable for V AT general taxpayers)This table is formulated based on Interim Regulation of the People's Republic of China on Value Added Tax and Transportation Industry and Part of the Modern Service Industry Tax Change the V at Pilot Tax Policy Implementing Measures.All taxpayers should complete this form in accordance with the assessable period determined by the competent authorities whether or not there is sale amount and report to local authorities within 15 days following the end of the period.Tax owing period: Jun 1, 2013 to Jun 30, 2013 Date of filing: Sep19, 2018 In RMB Y uan (list to Fen)Taxpayer's ID Industr yTaxpayer's name Legal Person Name Registrationaddress Businessaddress RegistrationtypeTelnumberItems No.General goods and services and taxableservices Levy-refund goods and services and taxable servicesAmount of this month Accumulative amount of Amount of thismonthAccumulative amountof currentyearcurrentyear(1) Sales of dutiable goodsand1services by applicable taxrateIncluding: Sales of2goodsSale Sales oftaxabl3 amount servicesAdjusted sales after4inspection(2) Sales of dutiable goods5through a simplifiedmethodincluding: Adjusted sales after6 tax inspection(3)S ales of export goods through"exemption, credit and refund 7"method(4)Sales of exempt goods and8 servicesSales of exempt goods 9Sales of exempt services 10 Output tax 11 Input tax 12 Tax retained of last month 13 Changeover withholdings on14 VATRefundable tax for TaxExemption, Offset and Refund15of goodsOverdue tax payable after taxTax calculatio ns inspection calculated by 16applicable tax rateTotal deductible taxActual tax deductible17=12+13-14-15+1618Tax payable19=11-18Tax retained end of thismonth20=17-18Tax payable calculated by asimplified method21Overdue tax payable after taxinspection through a simplified22methodTax reduction amount of tax23payableTotal tax payable 24=19+21-23 Underpaid tax at the beginning ofthis month(overpaid tax is 25 negative)Refund in special bill ofpayment issued for paid -in tax 26of exportTax payment Tax paid in this month 27=28+29+30+31① prepaid tax in parts 28② Prepaid tax in Special bill of29payment issued for export③ Paying tax payable of last30month in this month④ Outstanding tax amount paid31in this monthUnderpaid tax at the end ofthis month (overpaid tax isnegative)32=24+25+26-27Including: Outstanding tax (≥)33=25+26-27 Overdue tax (Refundable tax)34=24-28-29this monthActual tax credits of levy-refund 35Overdue tax underpaid afterinspection at the beginningof 36 this monthOverdue tax underpaid aftertaxation inspection ofinflowing37into State TreasuryOverdue tax underpaid afterinspection at the end of this38=16+22+36-37If you have entrusted an agent with declaring, please complete the following I declare that this form has been completed according to TheAuthorize d To deal with all tax issues, we now authorize (address) to be agent of our company, andanyProvisional Regulations of the People's Republic ofChina onDeclarantstatementsstatemen t correspondence related to statement is considered reasonable to be sent to this agent.Value-added Tax and all information supplied herein istrue,Signature of theauthorizercorrect and complete to the best of my knowledge andbelief.Signature of thedeclarant:Filled by taxation authority: Receiving date: Recipient: Seal of competent taxation agency:。

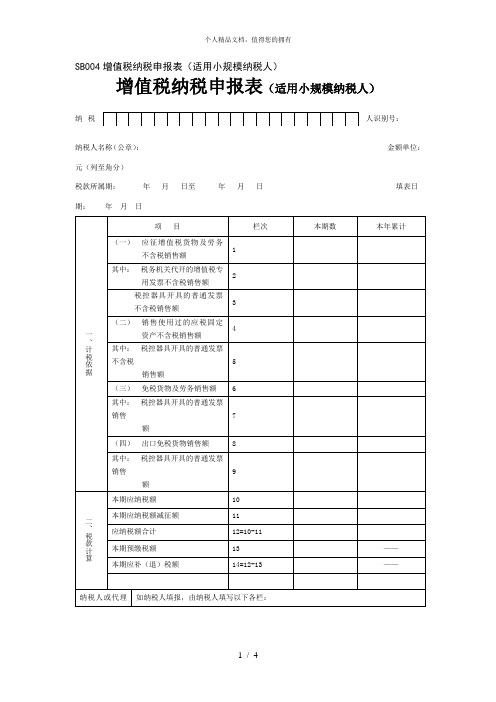

SB004增值税纳税申报表(适用小规模纳税人)

SB004增值税纳税申报表(适用小规模纳税人)增值税纳税申报表(适用小规模纳税人)纳税人识别号:纳税人名称(公章):金额单位:元(列至角分)税款所属期:年月日至年月日填表日期:年月日受理人:受理日期:年月日受理税务机关(签章):本表为A3竖式一式三份,一份纳税人留存,一份主管税务机关留存、一份征收部门留存增值税纳税申报表(适用于小规模纳税人)填表说明一、本申报表适用于增值税小规模纳税人(以下简称纳税人)填报。

纳税人销售使用过的固定资产、销售免税货物或提供免税劳务的,也使用本表。

二、具体项目填写说明:(一)本表“税款所属期”是指纳税人申报的增值税应纳税额的所属时间,应填写具体的起止年、月、日。

(二)本表“纳税人识别号”栏,填写税务机关为纳税人确定的识别号,即:税务登记证号码。

(三)本表“纳税人名称”栏,填写纳税人单位名称全称,不得填写简称。

(四)本表第1项“应征增值税货物及劳务不含税销售额”栏数据,填写应征增值税货物及劳务的不含税销售额,不包含销售使用过的固定资产应征增值税的不含税销售额、免税货物及劳务销售额、出口免税货物销售额、稽查查补销售额。

(五)本表第2项“税务机关代开的增值税专用发票不含税销售额”栏数据,填写税务机关代开的增值税专用发票的销售额合计。

(六)本表第3项“税控器具开具的普通发票不含税销售额”栏数据,填写税控器具开具的应征增值税货物及劳务的普通发票金额换算的不含税销售额。

(七)本表第4项“销售使用过的应税固定资产不含税销售额”栏数据,填写销售使用过的、固定资产目录中所列的、售价超过原值的应按照4%征收率减半征收增值税的应税固定资产的不含税销售额。

(八)本表第5项“税控器具开具的普通发票不含税销售额”栏数据,填写税控器具开具的销售使用过的应税固定资产的普通发票金额换算的不含税销售额。

(九)本表第6项“免税货物及劳务销售额”栏数据,填写销售免征增值税货物及劳务的销售额,包括销售使用过的、固定资产目录中所列的、售价未超过原值的固定资产的销售额。

税务英语

税务英语State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from author's remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴营业税:business tax or turnover tax消费税:excise tax or consumption tax增值税:value added tax关税:custom duty印花税:stamp tax土地增值税:land appreciation tax个人所得税:individual income tax企业所得税:income tax on corporate business外商投资企业所得税:income tax on foreign investment enterprisesState Administration for Taxation 国家税务总局Yangzhou Taxation Training College of State Administration of Taxation国家税务总局扬州税务进修学院Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment andForeign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区营业税:business tax增值税:V AT value added tax消费税:excise印花税:Stamp tax/duty个人所得税:personal income tax城市维护建设税:city maintenance construction tax企业所得税:corporate/enterprise/business income tax 资源税:resource tax土地增值税:increment tax on land value房产税:house property tax土地使用税:land use tax车船使用税:operation tax of vehicle and ship耕地占用税:farmland use tax教育费附加:extra charges of education funds accept 受理p.0accounting software 会计核算软件affix 盖章application letter 申请报告apply for reimbursement 申请退税apply for a hearing 申请听证apply for nullifying the tax registration 税务登记注销apply for reimbursement of tax payment 申请退税ask for 征求audit 审核author’s remuneration 稿酬;稿费averment 申辩bill/voucher 票证bulletin 公告bulletin board 公告牌business ID number 企业代码business license 营业执照business tax 营业税call one’s number 叫号carry out/enforce/implement 执行check 核对check on the cancellation of the tax return 注销税务登记核查checking the tax returns 审核申报表city property tax 城市房地产税company-owned 公司自有的conduct an investigation/investigate 调查construction contract 建筑工程合同consult; consultation 咨询consulting service/advisory service 咨询服务contact 联系contract 承包copy 复印;副本deduct 扣除delay in filing tax returns 延期申报(缴纳)税款describe/explain 说明document 文件;资料examine and approve 审批extend the deadline for filing tax returns 延期税务申报feedback 反馈file tax returns(online) (网上)纳税申报fill out/in 填写foreign-owned enterprise 外资企业guest rooms 客房hearing 听证hotel 酒店ID(identification) 工作证Identical with the original 与原件一样IIT(Individual income tax) 个人所得税Implementation 稽查执行income 收入;所得inform/tell 告诉information desk 咨询台inspect 稽查inspection notice 稽查通知书instructions 使用说明invoice book(purchase) 发票购领本invoice 发票invoice tax control machine 发票税控机legal person 法人代表letter of settlement for tax inspection 稽查处理决定书list 清单local tax for education 教育地方附加费lunch break 午间休息make a supplementary payment 补缴make one’s debut in handling tax affairs 初次办理涉税事项manuscript 底稿materials of proof 举证材料material 资料modify 修改modify one’s tax return 税务变更登记Nanjing Local Taxation Bureau 南京市地方税务局Notice 告知nullify 注销office building 办公楼office stationery 办公用品on-the-spot service 上门服务on-the-spot tax inspection 上门稽查opinion 意见original value 原值pay an overdue tax bill 补缴税款pay 缴纳penalty 处罚penalty fee for overdue payment 滞纳金penalty fee 罚款personal contact 面谈post/mail/send sth by mail 邮寄procedure/formality 手续proof material to backup tax returns 税收举证资料purchase 购领real estate 房产receipt 回执;反馈单record 记录reference number 顺序号register outward business administration 外出经营登记relevant materials of proof 举证资料rent 出租reply/answer 答复sales tax 营业税satisfy /satisfaction 满意sell and pay foreign exchange 售付汇service trade 服务业settlement 处理settle 结算show/present 出示special invoice books of service trade 服务业发票stamp tax 印花税stamp 公章State Administration of Taxation 国家税务局Statement 陈述submit a written application letter 提供书面申请报告supervision hotline 监督电话tax inspection bureau 稽查局tax inspection permit 税务检查证tax inspection 税务稽查tax law 税法tax officer 办税人员tax payable/tax applicable 应缴税tax payment assessment 纳税评估tax payment receipt 完税凭证tax payment 税款tax rate 税率tax reduction or exemption 减免税tax registration number 纳税登记号tax registration certificate 税务登记证tax registration 税务登记tax related documents 涉税资料tax return/tax bill 税单tax return forms and the acknowledgement of receipt 申报表回执tax returns 纳税申报表tax voucher 凭证the accounting software 会计核算软件the acknowledgement of receipt 送达回证the application for an income refund 收入退还清单the author’s remuneration 稿费the business ID number 企业代码the certificate for outward business administration 外出经营管理证明/the certificate for exchange of invoice 换票证the deadline 规定期限the income tax of foreign investment ventures and foreignenterprises 外商投资企业和外国企业所得税the inspection statement/report 检查底稿the legal person 法人代表the letter of statement and averment 陈述申辩书the main hall 大厅the online web address for filling tax returns 纳税申报网络地址the penalty fee for the overdue tax payment 税款滞纳金the penalty notice 处罚告知书the real estate 房产the registration number of the tax returns 纳税登记号the special invoice of service trade 服务业专用发票the special nationwide special invoice stamp 发票专用章the special nationwide invoice stamp 发票专用章the State Administration of Taxation 国家税务局supervision of taxation 税收监督tax inspection department 税务稽查局tax inspection permit 税务检查证tax officer 办税人员tax return form 纳税申报表格tax voucher application for the sale and purchase of foreignexchange 售付汇税务凭证申请审批表the use of invoice 发票使用trading contract 购销合同transportation business 运输业under the rate on value method 从价urban house-land tax 城市房地产税V AT(value-added tax, value added tax) 增值税Written application letter 书面申请报告国税局:State Administration of Taxation地税局:bureau of local taxation外汇管理局:Foreign Exchange Control Board海关:customs财政局:finance bureau统计局:Statistics Bureau工商行政管理局:Administration of Industry and Commerce 出入境检验检疫局:Administration for EntryExit Inspection and Quarantine中国证监会:China Securities Regulatory Commission (CSRS) 劳动和社会保障部:Ministry of Labour and Social Security。

增值税纳税申报表一般纳税人英文版

—— —— ——

The Provinsional Regulations of the People's Republic of China on true, correct and complete to the best of my knowledge and belief.

Levy-refund goods and services

0.00 0.00 0.00

0.00 0.00 0.00

—— —— ——

Declarant statements

I declare that this form has been completed according to The Provinsional Regulations of the People's Republic of China on Value-added Tax and all information supplied herein is true, correct and complete to the best of my knowledge and belief. Signature of the declarant: Song Lili

Yuan Jiao Fen Ma Qiang

Levy-refund goods and services Accumulative amount of current year 0.00 0.00 0.00 0.00 0.00 0.00 —— —— —— —— 0.00 0.00 —— 0.00 —— —— —— 0.00 0.00 —— 0.00 —— 0.00 0.00 0.00 —— 0.00 —— —— 0.00 0.00 0.00 —— —— 0.00

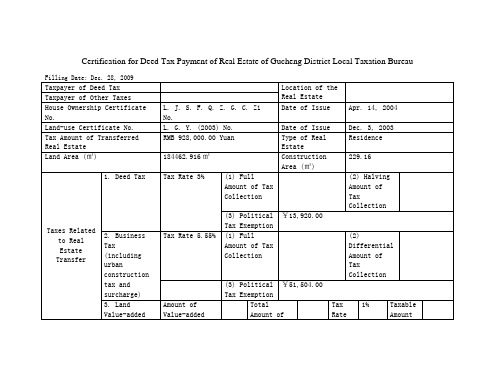

税务局房地产契税纳税证明英文模板

Tax Rate 5.55%

(1) Full Amount of Tax Collection

(2) Differential Amount of Tax Collection

Dec. 28, 2009

Opinions of the responsible person of the sub-bureau:

[With seal of Yunnan Province Lijiang Municipal Gucheng District Local Taxation Bureau No. 1 Sub-bureau]

(3) Political Tax Exemption

¥51,504.00

3. Land Value-addedTax

Amount of Value-addedTax

Total Amount ofDeduction Items

Tax Rate

1%

Taxable Amount

Political Tax Exemption

YANG Hongsheng (seal)

Dec. 28, 2009

Notes: This certification is in quadruplicate which are held by the competent tax authority, county-level tax authority, land office, urban construction bureau and the taxpayer respectively.

¥928.00

6. Farmland Occupancy Tax

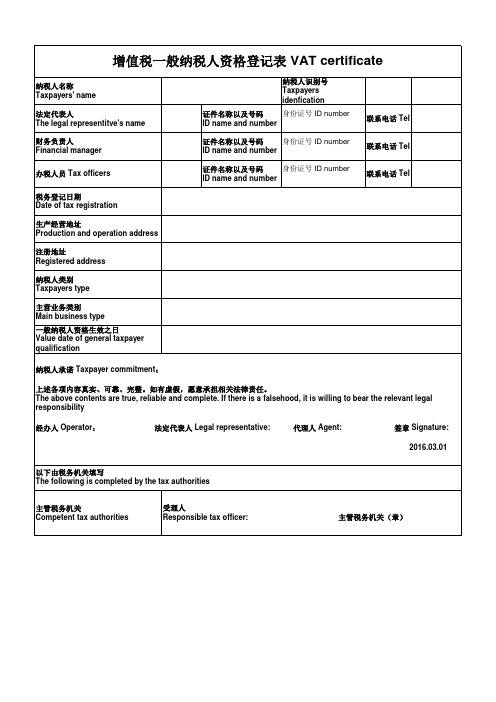

增值税一般纳税人资格登记表 英文

联系电话 Tel

联系电话 Tel

主管税务机关 Competent tax authorities

ate

纳税人名称 Taxpayers' name 法定代表人 The legal representitve's name 财务负责人 Financial manager 办税人员 Tax officers 税务登记日期 Date of tax registration 生产经营地址 Production and operation address 注册地址 Registered address 纳税人类别 Taxpayers type 主营业务类别 Main business type 一般纳税人资格生效之日 Value date of general taxpayer qualification 纳税人承诺 Taxpayer commitment: 上述各项内容真实、可靠、完整。如有虚假,愿意承担相关法律责任。 The above contents are true, reliable and complete. If there is a falsehood, it is willing to bear the relevant legal responsibility 经办人 Operator: 法定代表人 Legal representative: 代理人 Agent: 签章 Signature: 2016.03.01 以下由税务机关填写 The following is completed by the tax authorities 受理人 Responsible tax officer: 纳税人识别号 Taxpayers idenfication 证件名称以及号码 身份证号 ID number ID name and number 身份证号 ID number 证件名称以及号码 ID name and number 身份证号 ID number 证件名称以及号码 ID name and number 联系电话 Tel

申报表中英文对照

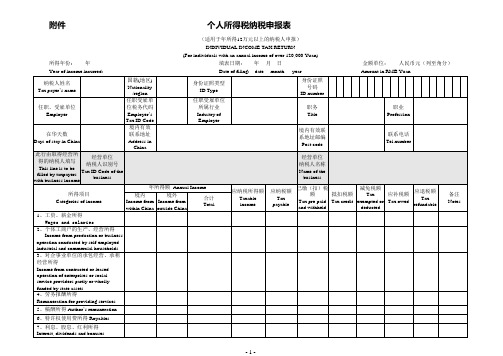

附件个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB YuanSignature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax office填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:1、所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2、身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

3、身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

4、任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5、任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6、任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

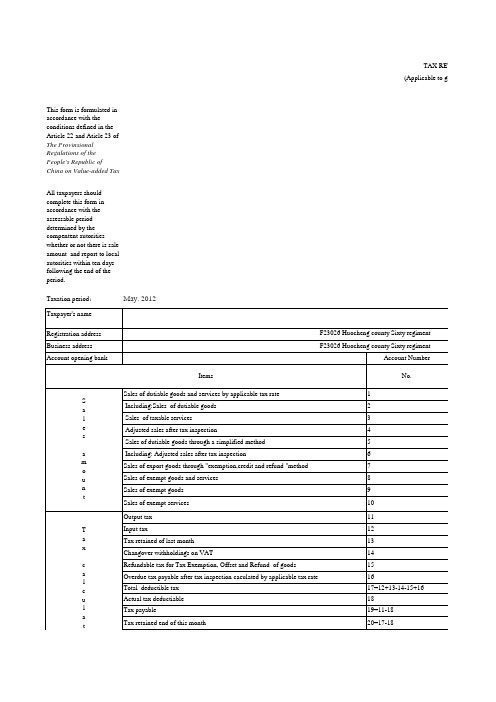

增值税纳税申报表TAX RETURN OF VAT

This form is formulated in accordance with the conditions defined in the Article 22 and Aticle 23 ofThe Provinsional Regulations of the People's Republic of China on Value-added Tax

28

——

②出口开具专用缴款书预缴税额Prepaid tax in Special bill of payment issued for export

29

——

——

③本期缴纳上期应纳税额paying tax payable of last month in this month

30

④本期缴纳欠缴税额outstanding tax amount paid in this month

——

应纳税额减征额Tax reduction amount of tax payable

23

应纳税额合计total tax payable

24=19+21-23

税款缴纳tax payment

期初未缴税额(多缴为负数)underpaid tax at the beginning of this month(overpaid tax is negative)

34=24-28-29

——

即征即退实际退税额actual tax credits of levy-refund35 Nhomakorabea——

期初未缴查补税额overdue tax underpaid after inspection at the beginning of this month

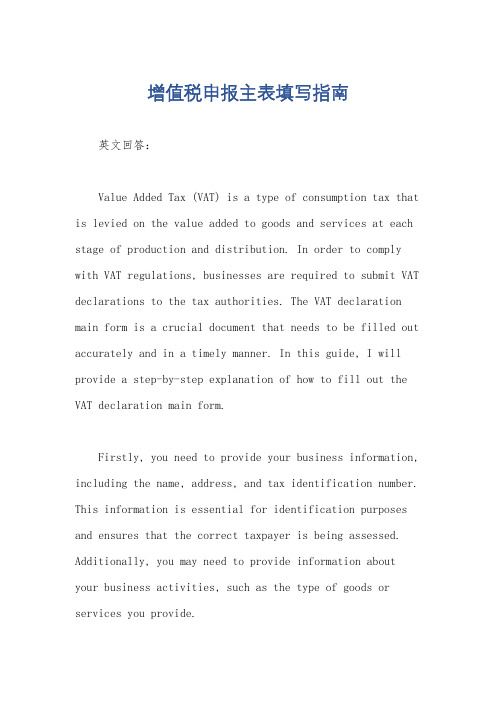

增值税申报主表填写指南

增值税申报主表填写指南英文回答:Value Added Tax (VAT) is a type of consumption tax that is levied on the value added to goods and services at each stage of production and distribution. In order to comply with VAT regulations, businesses are required to submit VAT declarations to the tax authorities. The VAT declaration main form is a crucial document that needs to be filled out accurately and in a timely manner. In this guide, I will provide a step-by-step explanation of how to fill out the VAT declaration main form.Firstly, you need to provide your business information, including the name, address, and tax identification number. This information is essential for identification purposes and ensures that the correct taxpayer is being assessed. Additionally, you may need to provide information about your business activities, such as the type of goods or services you provide.Next, you will need to report your taxable sales and purchases. This includes the total value of goods or services sold or provided during the reporting period, as well as the total value of goods or services purchased for use in your business. It is important to accurately report these figures, as any discrepancies may result in penalties or fines.After reporting your sales and purchases, you will need to calculate the VAT payable or refundable. This is done by subtracting the total input VAT (VAT paid on purchases) from the total output VAT (VAT collected on sales). If the output VAT exceeds the input VAT, the difference is the VAT payable. Conversely, if the input VAT exceeds the output VAT, the difference is the VAT refundable.Once you have calculated the VAT payable or refundable, you will need to make the necessary payment or request a refund. The payment can be made through various methods, such as bank transfer or online payment platforms. If you are eligible for a VAT refund, you will need to submit arefund application along with supporting documents.In addition to the main form, there may be supplementary forms that need to be filled out depending on the specific circumstances of your business. These forms may include additional information or calculations related to specific transactions or activities. It is important to carefully review the instructions and requirements for each form to ensure compliance.In conclusion, filling out the VAT declaration main form requires attention to detail and accuracy. By providing the necessary business information, reporting sales and purchases correctly, calculating the VAT payable or refundable, and making the appropriate payment or refund request, businesses can fulfill their VAT obligations. Itis important to stay updated on any changes to VAT regulations and seek professional advice if needed.中文回答:增值税申报主表是一份重要的文件,需要准确填写并及时提交给税务机关。

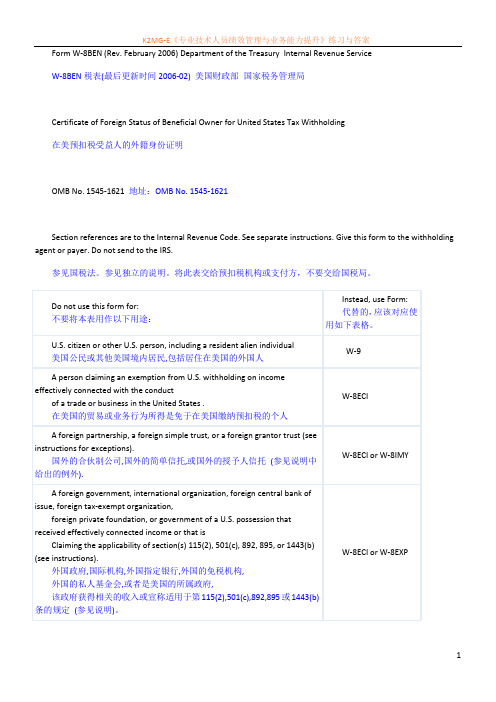

W-8BEN税表中英文翻译

Form W-8BEN (Rev. February 2006) Department of the Treasury Internal Revenue ServiceW-8BEN税表(最后更新时间2006-02) 美国财政部国家税务管理局Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding在美预扣税受益人的外籍身份证明OMB No. 1545-1621 地址:OMB No. 1545-1621Section references are to the Internal Revenue Code. See separate instructions. Give this form to the withholding agent or payer. Do not send to the IRS.参见国税法。

参见独立的说明。

将此表交给预扣税机构或支付方,不要交给国税局。

Note: These entities should use Form W-8BEN if they are claiming treaty benefits or are providing the form only to claim they are a foreign person exempt from backup withholding.备注:如果以上这些实体希望获得税收协定优惠待遇,或只是提供表格来要求作为不受预扣税限制的外国居民,则应该使用表格W-8BENNote: See instructions for additional exceptions.备注: 参见说明中给出的其它例外情况。

Part I Identification of Beneficial Owner (See instructions.) 受益方身份(参见说明)1 Name of individual or organization that is the beneficial owner 作为受益方的个人或机构的名称:(填写你的名字)2 Country of incorporation or organization 成立或组织的所在国家(填写China)3 Type of beneficial owner:受益方类型:(一般我们选择第一个即可,个人)Individual 个人 Corporation 股份公司Disregarded entity 非独立实体Partnership合伙制公司Simple trust简单信托Grantor trust授予人信托Complex Trust复合信托Estate房地产Government政府International organization 国际组织Central bank of issue国外指定银行Tax-exempt organization免税机构Private Foundation私人基金4 Permanent residence address (street, apt. or suite no., or rural route). Do not use P.O. box or in-care-of address.永久居住地址(街道,室号,或邮道). 不要填写邮政信箱或转交地址,用英文填写。

税务局房地产契税纳税证明 英文模板

5.方茴说:“那时候我们不说爱,爱是多么遥远、多么沉重的字眼啊。

我们只说喜欢,就算喜欢也是偷偷摸摸的。

”6.方茴说:“我觉得之所以说相见不如怀念,是因为相见只能让人在现实面前无奈地哀悼伤痛,而怀念却可以把已经注定的谎言变成童话。

”7.在村头有一截巨大的雷击木,直径十几米,此时主干上唯一的柳条已经在朝霞中掩去了莹光,变得普普通通了。

8.这些孩子都很活泼与好动,即便吃饭时也都不太老实,不少人抱着陶碗从自家出来,凑到了一起。

9.石村周围草木丰茂,猛兽众多,可守着大山,村人的食物相对来说却算不上丰盛,只是一些粗麦饼、野果以及孩子们碗中少量的肉食。

1.“噢,居然有土龙肉,给我一块!”2.老人们都笑了,自巨石上起身。

而那些身材健壮如虎的成年人则是一阵笑骂,数落着自己的孩子,拎着骨棒与阔剑也快步向自家中走去。

3.石村不是很大,男女老少加起来能有三百多人,屋子都是巨石砌成的,简朴而自然。

Certification for Deed Tax Payment of Real Estate of Gucheng District Local Taxation BureauFilling Date: Dec. 28, 2009Taxpayer of Deed Tax Location of the Real EstateTaxpayer of Other TaxesHouse Ownership Certificate No. L. J. S. F. Q. Z. G. C. Zi No. Date of Issue Apr. 14, 2004 Land-use Certificate No.L. G. Y. (2003) No. Date of IssueDec. 3, 2003 Tax Amount of Transferred Real EstateRMB 928,000.00 Yuan Type of Real EstateResidenceLand Area (㎡)184462.916㎡Construction Area (㎡)229.16 Taxes Related to Real EstateTransfer1. Deed TaxTax Rate 3% (1) Full Amount of Tax Collection (2) Halving Amount of Tax Collection(3) Political Tax Exemption¥13,920.00 2. Business Tax (including urbanconstruction taxand surcharge) Tax Rate 5.55% (1) Full Amount of Tax Collection (2) Differential Amount of Tax Collection(3) Political Tax Exemption¥51,504.003. Land Value-added TaxAmount of Value-added Tax Total Amount of Deduction ItemsTax Rate 1% Taxable AmountPolitical Tax Exemption ¥9,280.00 4. Individual Income TaxTax Rate 1% Taxable Amount Political Tax Exemption¥9,280.005.方茴说:“那时候我们不说爱,爱是多么遥远、多么沉重的字眼啊。

英文版《增值税纳税申报表(适用于增值税一般纳税人)》及其附列资料

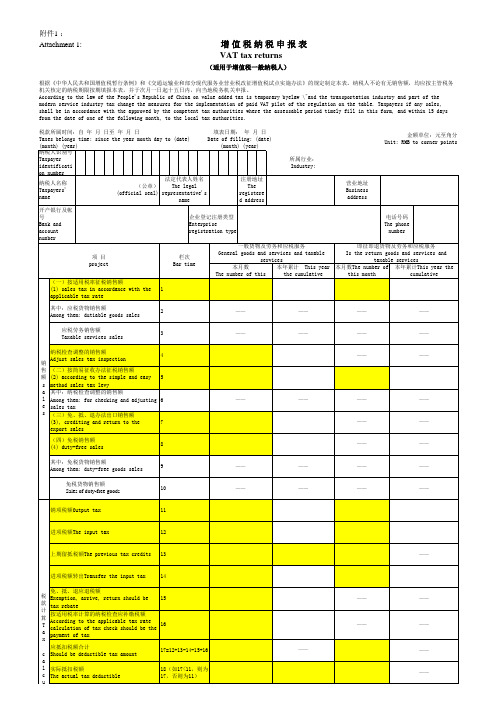

附件1 :Attachment 1: 增 值 税 纳 税 申 报 表VAT tax returns(适用于增值税一般纳税人)根据《中华人民共和国增值税暂行条例》和《交通运输业和部分现代服务业营业税改征增值税试点实施办法》的规定制定本表。

纳税人不论有无销售额,均应按主管税务机关核定的纳税期限按期填报本表,并于次月一日起十五日内,向当地税务机关申报。

According to the law of the People's Republic of China on value added tax is temporary byelaw \"and the transportation industry and part of the modern service industry tax change the measures for the implementation of paid VAT pilot of the regulation on the table. Taxpayers if any sales,shall be in accordance with the approved by the competent tax authorities where the assessable period timely fill in this form, and within 15 days from the date of one of the following month, to the local tax authorities.税款所属时间:自 年 月 日至 年 月 日Taxes belongs time: since the year month day to (date)填表日期: 年 月 日Date of filling: (date)金额单位:元至角分Unit: RMB to corner pointsl a主管税务机关盖章:The competent tax authorities sealed:T a x c a l c The following by the tax authority fill in:收到日期:Date of receipt of:接收人:Receiver:。

纳税申报调整表英文模板

1,226,897.21

1,226,897.21

1,226,897.21 1,076,225.62 150,671.59

1,226,897.21 1,076,225.62 150,671.59

Practitioners sign QingdaoZhenqing Certified Public Accountants Co., Ltd

Company Income Tax Schedule Adjustment

Company: Qingdao Topjoin Electric Co., Ltd Line Item I.Increased part of paying tax adjustment Wage salary expenses labor union dues Welfare expense Education fees Interest expenditure Business reception Reversal of previously recognized timing differences of this year Depreciation and amortization expense Advertising expenses Business promotion expenses Sales commission Net loss of equity investments transfer Property damage Bad debt reserve Various types of social security contributions Including:basic old-age insurance Unemployment insurance Basic medical insurance Basic maternity insurance Injury Insurance Supplementary old-age insurance Supplementary medical insurance Management feesto the head office Housing Fund All increase reserve this year including: Inventories losss Impairment of fixed assets Impairment of intangible assets Impairment of construction in progress Self-employed securities decline Provision for doubtful debts Difference of Insurance liability reserve funds Other provisions Penalty expenses Income-unrelated expenses Expected profit of pre-sale income (For real estate business) Other tax adjustments 1.Business Insurance 2.No fee charged to the legal documents 3 Actual list book amount 1,363,046.81 131,945.24 158,472.33 Year: 2006 Agency Determined amount 1,363,046.81 131,945.24 158,472.33 Unt: Yuan Remark

VAT(增值税)申报表

——

实际抵扣税额

应纳税额 期末留抵税额 简易征收办法计算的应纳税额

18(如 17<11,则为 17,否则为11) 19=11-18 20=17-18 21

11,000.00 2,600.00

—— —— —— ——

按简易征收办法计算的纳税检查应补缴税额 22 应纳税额减征额 应纳税额合计 期初未缴税额(多缴为负数) 实收出口开具专用缴款书退税额 本期已缴税额 ①分次预缴税额 ②出口开具专用缴款书预缴税额 ③本期缴纳上期应纳税额 税 款 ④本期缴纳欠缴税额 缴 期末未缴税额(多缴为负数) 纳 其中:欠缴税额(≥0) 本期应补(退)税额 即征即退实际退税额 期初未缴查补税额 本期入库查补税额 期末未缴查补税额 23 24=19+21-23 25 26 27=28+29+30+31 28 29 30 31 32=24+25+26-27 33=25+26-27 34=24-28-29 35 36 37 38=16+22+36-37

407.00 2,193.00

—— ——

应交税费-应交增值税-减免税控

—— ——

— ——

如果你已委托代理人申报,请填写下列资料: 授 权 声 明 申 报 (地址) 为本纳税人的代理申报人,任何与本 人 声 申报表有关的往来文件,都可寄予此人。 明 授权人签字: 以下由税务机关填写: 收到日期: 接收人: 主管税务机关盖章: 为代理一切税务事宜,现授权 此纳税申报表是根据《中华人民共和国增值税暂行条例》的规定填报的,我相信它是

增值税纳税申报表

(适用于增值税一般纳税人)

根据《中华人民共和国增值税暂行条例》和《交通运输业和部分现代服务业营业税改征增值税试点实施办法(试行)》的规定制定本表。纳税人不论有 无销售额,均应按主管税务机关核定的纳税期限按期填报本表,并于次月一日起十五日内,向当地税务机关申报。 税款所属时间:自 纳税人识别号 纳税人名称 开户银行及帐号 项 目 1 2 3 4 10

月(季)度预缴纳税申报表中英文

月(季)度预缴纳税申报表中英文Quarterly Prepayment Tax Return Form in Chinese and English税务局税务申报表申报期:2022 年第一季度报表类型:月(季)度预缴纳税申报表一、表格说明:本表由纳税人根据税法规定填报,按真实、准确、完整的原则填写。

如有更正,应在更正声明框内填写清楚,并在本表上签名。

若填写过程中有任何疑问,请咨询税务机关。

二、填报纳税人信息:1. 纳税人姓名:_________________________2. 纳税人识别号:_______________________3. 纳税人地址:_________________________4. 纳税人联系电话:_____________________三、填报所属期间:报送月份/季度:_________________________四、税款计算:1. 全年预计销售额:_______________________(填报单位:人民币)2. 税率适用情况:- 增值税率:___________________________(填报百分比)- 企业所得税率:________________________(填报百分比) - 个人所得税率:________________________(填报百分比)3. 销售额应纳税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)4. 实际预缴税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)5. 本期应补(退)税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)五、附注:填写附注以说明填报表格中出现的特殊情况或异常情形。

增值税纳税申报表英文版

—— —— ——

The Provinsional Regulations of the People's Republic of China on true, correct and complete to the best of my knowledge and belief.

Yuan Jiao Fen Ma Qiang

Levy-refund goods and services Accumulative amount of current year 0.00 0.00 0.00 0.00 0.00 0.00 —— —— —— —— 0.00 0.00 —— 0.00 —— —— —— 0.00 0.00 —— 0.00 —— 0.00 0.00 0.00 —— 0.00 —— —— 0.00 0.00 0.00 —— —— 0.00

Authorised statement

If you have entrusted an agent with declaring, please complete the following information.To deal with all tax issues, we now authorize _____ (address) to be agent of our company, and any correspondence related to statement is considered reasonable to be sent to this agent. Signature of the authorizer

Jun. 3rd, 2012

Amount Unit:RMB Yuan Legal representative Type of Registration TEL: Industry

增值税纳税申报表中英对照精译版

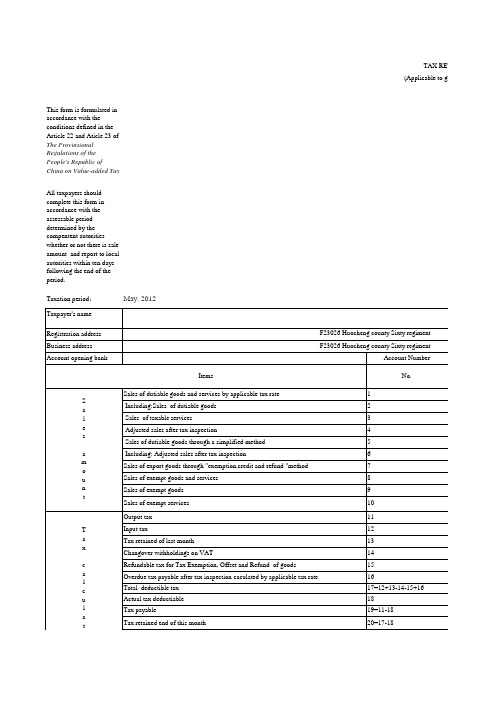

增值税纳税申报表TAX RETURN OF VAT(适用于增值税一般纳税人)(Applicable to general VAT taxpayers)根据《中华人民共和国增值税暂行条例》第二十二条和第二十三条的规定制定本表,纳税人不论有无销售额,均应按主管税务机关核定的纳税期限按期填报本表,并于次月一日起十日内,向当地税务机关申报。

This form is formulated in accordance with the conditions defined in the Article 22 and Article 23 of The Provisional Regulations of the People's Republic of China on Value-added TaxAll taxpayers shall complete this form in accordance with the assessable period determined by the competent authorities whether or not there is any sale amount and report to the local authorities within ten days following the end of the period.所属期Taxation period:填表日期date of filing:金额单位:元至角分Monetary Unit:RMB, including Yuan, Jiao and Fen以下由税务机关填写:Only for the use of the taxation institution only below:收到日期:接收人:主管税务部门签章:Date of receipt: Receiver: Seal of competent taxation institution。

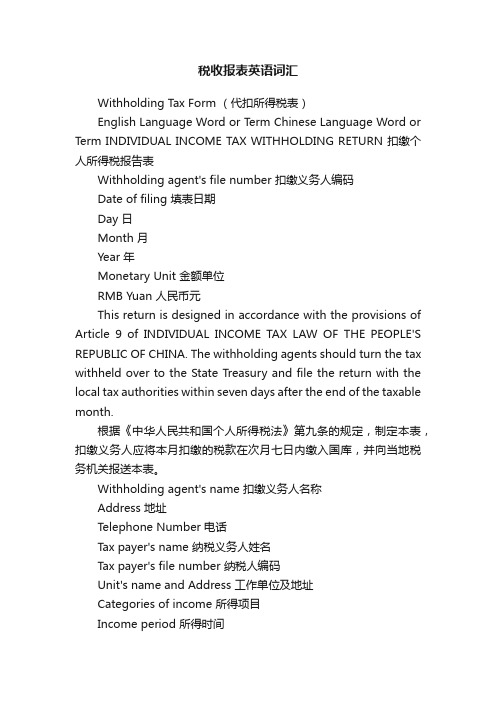

税收报表英语词汇

税收报表英语词汇Withholding Tax Form (代扣所得税表)English Language Word or Term Chinese Language Word or Term INDIVIDUAL INCOME TAX WITHHOLDING RETURN 扣缴个人所得税报告表Withholding agent's file number 扣缴义务人编码Date of filing 填表日期Day 日Month 月Year 年Monetary Unit 金额单位RMB Yuan 人民币元This return is designed in accordance with the provisions of Article 9 of INDIVIDUAL INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA. The withholding agents should turn the tax withheld over to the State Treasury and file the return with the local tax authorities within seven days after the end of the taxable month.根据《中华人民共和国个人所得税法》第九条的规定,制定本表,扣缴义务人应将本月扣缴的税款在次月七日内缴入国库,并向当地税务机关报送本表。

Withholding agent's name 扣缴义务人名称Address 地址Telephone Number 电话Tax payer's name 纳税义务人姓名Tax payer's file number 纳税人编码Unit's name and Address 工作单位及地址Categories of income 所得项目Income period 所得时间Revenue 收入额Renminbi (RMB)人民币Foreign currency 外币Name of currency 货币名称Amount 金额Exchange rate 外汇牌价Renminbi (RMB)converted into 折合人民币Total 人民币合计Deductions 减费用额Taxable Income 应纳税所得额Tax rate 税率Quick calculation deduction 速算扣除数Amount of tax withheld 扣缴所得税额Tax certificate number 完税证字号Date of tax payment 纳税日期In case the tax certificate is filled out by withholding agent, this returnshould be submitted together with 如果由扣缴义务人填写完税证,应在送此表时附完税证副联——份Withholding total amount yuan 合计扣缴金额——元Declaration by Withholding agent 扣缴义务人声明I declare that the return is filled out in accordance with the INDIVIDUAL INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA, and I believe that the Statements contained in this return are true, correct and complete.我声明:此扣缴申报报表是根据《中华人民共和国个人所得税法》的规定填报的,我确信它是真实的,可靠的,完整的。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Sales of exempt goods

9

Sales of exempt services

10

Tax

calculations

Output tax

11

Input tax

12

Tax retained of last month

13

Changeover withholdings on VAT

14

Refundable tax for Tax Exemption, Offset and Refund of goods

Authorized

statement

If you have entrusted an agent with declaring, please complete the following information:To deal with all tax issues, we now authorize _____ (address) to be agent of our company, and any correspondence related to statement is considered reasonable to be sent to this agent.Signature of the authorizer

22

Tax reduction amount of tax payable

23

Total tax payable

24=19+21-23

Tax

payment

Underpaid tax at the beginning of this month(overpaid tax is negative)

25

Refund in special bill of payment issued for paid -in tax of export

All taxpayers should complete this form in accordance with the assessable period determined by the competent authorities whether or not there is sale amount and report to local authorities within 15 days following the end of the period.

15

Overdue tax payable after tax inspection calculated by applicable tax rate

16

Total deductible tax

17=12+13-14-15+16

Actual tax deductible

18

Tax payable

19=11-18

1

Including: Sales of dutiable goods

2

Sales of taxable services

3

Adjusted sales after tax inspection

4

(2)Sales of dutiable goods through a simplified method

36

Overdue tax underpaid after taxation inspection of inflowing into State Treasury

37

Overdue tax underpaid after inspection at the end of this month

38=16+22+36-37

Business address

Bank of deposit and account numbms

No.

General goods and services and taxable services

Levy-refund goods and services and taxable services

Taxowing period: Jun 1, 2013toJun 30, 2013Date of filing: Sep19, 2018In RMB Yuan(list toFen)

Taxpayer's ID

Industry

Taxpayer's name

Legal Person Name

Registration address

30

④Outstanding tax amount paid in this month

31

Underpaid tax at the end of this month (overpaid tax is negative)

32=24+25+26-27

Including: Outstanding tax(≥0)

33=25+26-27

Overdue tax (Refundable tax) this month

34=24-28-29

Actual tax credits of levy-refund

35

Overdue tax underpaid after inspection at the beginning of this month

5

including: Adjusted sales after tax inspection

6

(3)Sales of export goods through "exemption, credit and refund "method

7

(4) Sales of exempt goods and services

Tax retained end of this month

20=17-18

Tax payable calculated by a simplified method

21

Overdue tax payable after tax inspection through a simplified method

VAT tax return (Suitable for VAT general taxpayers)

This table is formulated based onInterim Regulation of the People's Republic of China on Value Added TaxandTransportation Industry and Part of the Modern Service Industry Tax Change the Vat Pilot Tax Policy Implementing Measures.

26

Tax paid in this month

27=28+29+30+31

①prepaid tax in parts

28

②Prepaid tax in Special bill of payment issued for export

29

③Paying tax payable of last month in this month

Amount of this month

Accumulative amount of current year

Amount of this month

Accumulative amount of current year

Sale

amount

(1)Sales of dutiable goods and services by applicable tax rate

Signature of the declarant:

Filledby taxation authority:Receiving date:Recipient: Seal of competenttaxation agency:

Declarant statements

Ideclare that this form has been completed according toThe Provisional Regulations of the People's Republic of China on Value-added Taxand all information supplied herein is true, correct and complete to the best of my knowledge and belief.