股权购买协议中英文

股权购买协议 中英文

股权购买协议中英文协议名称:股权购买协议Equity Purchase Agreement协议双方:甲方:[甲方名称]乙方:[乙方名称]一、背景与目的1. 甲方是一家注册于[注册地]的公司,经营[业务范围]业务。

2. 乙方是一家注册于[注册地]的公司,经营[业务范围]业务。

3. 甲方拥有[公司名称]的股权,拟将部分股权出售给乙方。

4. 双方就股权出售事宜达成一致,特制定本协议。

二、股权出售1. 股权出售:甲方同意将其持有的[公司名称]的股权出售给乙方。

2. 股权比例:甲方将出售[股权比例]%的股权给乙方。

3. 股权交割:股权交割完成后,甲方应将相关股权证书或其他相关文件交付给乙方。

4. 股权价格:乙方同意以[股权价格]的价格购买甲方所持有的股权。

5. 交易款项:乙方应在本协议签署后[交易款项支付期限]内支付全部交易款项给甲方。

三、交易条件1. 审计:乙方有权在[交易完成前]对[公司名称]进行财务审计。

甲方应提供所有必要的财务文件和信息。

2. 股东批准:本协议的有效性和交易完成受到[公司名称]股东大会的批准。

3. 合规审查:乙方有权对[公司名称]的合规情况进行审查。

甲方应提供所有必要的文件和信息。

4. 保密义务:双方同意对于协议中的商业秘密和机密信息予以保密,并禁止向任何第三方透露。

四、法律适用与争议解决1. 本协议的签署、生效、履行和解释均适用[法律适用地]的法律。

2. 双方如发生争议,应通过友好协商解决。

若协商不成,任何一方均可向[仲裁机构]提起仲裁。

3. 仲裁裁决是终局的,对双方均具有法律约束力。

五、其他条款1. 本协议的任何修改、补充或变更应以书面形式并经双方签字确认生效。

2. 本协议的任何条款被认定为无效或不可执行,不影响其他条款的有效性和可执行性。

3. 本协议自双方签署之日起生效,并持续有效直至交易完成。

4. 本协议一式两份,甲方和乙方各执一份,具有同等法律效力。

甲方:乙方:签名:签名:日期:日期:。

股权转让协议中英文版

股权转让协议中英文版股权转让协议Equity Transfer Agreement甲方:(身份信息)Party A: (Identity Information) 乙方:(身份信息)Party B: (Identity Information)鉴于甲方拥有特定比例的公司股权,乙方希望购买该股权;Whereas, Party A owns a specific percentage of equity in the company and Party B wishes to purchase such equity;双方本着平等、自愿、公平和诚实信用的原则,经友好协商,达成如下协议:Both parties, on the basis of equality, voluntariness, fairness and honesty, have reached the following agreement through friendly consultations:第一条买卖股权的标的Article 1. Object of Equity Transfer(1)甲方将其名下持有的公司股权转让给乙方,具体比例为(填写数字及百分数),转让金额为人民币(填写数字),其中(填写详细说明)。

Party A shall transfer its equity in the company to Party B, the specific percentage of which is (fill in the numerical and percentage), and the transfer amount is RMB (fill in the numerical), of which (fill in the detailed description).(2)甲方同意将转让所需完成的所有手续办妥,确保转让顺利进行。

股权转让协议中英文模板(两篇)

股权转让协议中英文模板(二)股权转让协议中英文模板股权转让协议(英文版)Agreement for the Transfer of Equity本协议由下列各方于(日期)签署:This Agreement is entered into on (date) by and among the following parties:甲方(Transferor)姓名/公司名称:地址:法定代表人/负责人:电话:传真:电子邮件:Party A (Transferor)Address:Legal representative/Responsible person:Phone:Fax:乙方(Transferee)姓名/公司名称:地址:法定代表人/负责人:电话:传真:电子邮件:Party B (Transferee)Address:Legal representative/Responsible person: Phone:Fax:注册地:公司地址:法定代表人/负责人:电话:传真:电子邮件:Registered place:Legal representative/Responsible person: Phone:Fax:鉴于:Whereas:1. 甲方即(Transferor)为乙方(Transferee)现持有的位于(公司注册地)的(公司名称)的(股权比例)的股权转让有意愿。

2. 乙方(Transferee)同意购买甲方(Transferor)所持有的股权,并为此支付一定金额。

Whereas Party B (Transferee) agrees to purchase the equity held by Party A (Transferor), and will pay a certain amount for this purpose.各方经协商一致,达成如下协议:Now, therefore, in consideration of their mutual covenants herein contained, the parties agree as follows:第一条股权转让Article 1 Transfer of Equity1.1 股权转让说明Instructions for the Transfer of Equity1.1.1 甲方(Transferor)同意将其在(公司名称)所持股份中的(转让数量)股权转让给乙方(Transferee)。

股权转让协议(中英版本)

M EMBER I NTEREST P URCHASE A GREEMENT成员权益购买协议T HIS M EMBER I NTEREST P URCHASE A GREEMENT(this “Agreement”) is entered into, effective upon execution by the parties and delivery of consideration set forth in Section 1.2, by and between [],(“Buyer”), and[], (“Seller”).本成员权益购买协议(“本协议”)由[],(“买方”)与[],(“卖方”)订立,本协议自双方签署且交付第1.2条约定的对价时生效。

R ECITALS:序言:W HEREAS, pursuant to that certain Amended and Restated Limited Liability Company Agreement (the “LLC Agreement”) of [](the “Company”) dated January 1, 2008, Sel ler is the record and beneficial owner of 400,000 Units constituting a forty percent (60%) Member Interest (as defined in the LLC Agreement) in the Company (the “Transferred Interest”);鉴于,根据2008年1月1日签署的[]的经修订及重述的有限责任公司协议(“有限公司协议”),卖方系拥有代表公司百分之四十(60%)成员权益(如有限公司协议所定义)的600,000股权单位的记录及实益拥有人(“转让权益”);W HEREAS, Seller and Buyer have entered into that certain Settlement Agreement and Release (“Settlement Agreement”), dated September _____, 2009, pursuant to which the Seller and Buyer agreed that Seller will sell to Buyer, and Buyer will purchase from Seller, the Transferred Interest on the terms and conditions set forth herein;鉴于,卖方和买方已于2009年9月日订立了特定的和解及解除协议(“和解协议”),根据该协议,卖方和买方同意卖方将出售给买方且买方将从卖方处购买基于本协议所载条款和条件规定的转让权益。

股权购买协议 中英文

股权购买协议中英文协议名称:股权购买协议Equity Purchase Agreement本协议由以下双方于(日期)签署,即买方(以下简称“买方”)和卖方(以下简称“卖方”)。

一、背景1.1 买方是一家注册于(国家/地区)的公司,主要从事(业务领域),合法存在并有效运营。

1.2 卖方是一家注册于(国家/地区)的公司,主要从事(业务领域),合法存在并有效运营。

二、定义在本协议中,除非上下文另有所指,下列术语应具有以下含义:2.1 “股权”指卖方持有的公司股份,具体包括但不限于普通股、优先股等。

2.2 “购买价格”指买方购买股权所支付的金额。

三、股权购买3.1 卖方同意向买方出售其持有的(公司名称)的股权,买方同意购买该股权。

3.2 股权的购买价格为(金额)。

3.3 股权的交割将在本协议签署之日起(天数)内完成。

四、保证与陈述4.1 卖方保证其对所出售的股权拥有合法的、有效的、不受限制的所有权,并有权将其出售给买方。

4.2 卖方保证其对所出售的股权的所有权没有被任何第三方主张或争议。

4.3 卖方保证其在(公司名称)中的股权没有被质押、冻结、抵押或以其他方式限制其转让的任何权利。

4.4 卖方保证其在(公司名称)中的股权没有受到任何法律、法规、合同或其他协议的限制。

4.5 卖方保证其提供的任何文件、信息或材料真实、准确、完整,并且没有隐瞒任何重要事实。

五、交割5.1 买方在收到卖方股权交割的同时,应向卖方支付购买价格。

5.2 股权交割完成后,卖方应将所有与该股权相关的权益转让给买方。

5.3 买方和卖方应共同努力确保股权交割的顺利进行,并履行与交割相关的一切必要手续。

六、保密6.1 买方和卖方同意在签署本协议后对协议内容以及交易过程中获得的任何商业、财务、技术或其他机密信息予以保密。

6.2 未经对方事先书面同意,任何一方不得向第三方透露本协议的内容。

七、争议解决7.1 本协议的解释和执行应受到(国家/地区)法律的管辖。

股份买卖协议书英文范本

股份买卖协议书英文范本Stock Purchase AgreementThis Stock Purchase Agreement (the "Agreement") is made and entered into as of [Date], by and between [Buyer], a company organized and existing under the laws of [Country], with its principal place of business at [Address] (the "Buyer"), and [Seller], a company organized and existing under the laws of [Country], with its principal place of business at [Address] (the "Seller").1. Sale and Purchase of Stock1.1. Purchase: The Seller agrees to sell, transfer, and deliver to the Buyer, and the Buyer agrees to purchase from the Seller, [Number] shares of [Company] common stock (the "Shares") at a purchase price of [Price] per share,for a total consideration of [Total Amount].1.2. Closing: The closing of the purchase and sale of the Shares shall take place on [Date] (the "Closing Date") at a location mutually agreed upon by the parties.2. Representations and Warranties2.1. Seller's Representations: The Seller represents and warrants to the Buyer that:a) It is the legal and beneficial owner of the Shares, free and clear of any liens, claims, or encumbrances.b) It has full power and authority to sell the Shares and to enter into this Agreement.c) The execution, delivery, and performance ofthis Agreement by the Seller does not violate any agreement, law, or regulation.2.2. Buyer's Representations: The Buyer representsand warrants to the Seller that:a) It has full power and authority to enter into this Agreement.b) The execution, delivery, and performance ofthis Agreement by the Buyer does not violate any agreement, law, or regulation.3. Closing Conditions3.1. Conditions Precedent: The obligations of the Buyer and the Seller under this Agreement are subject to the satisfaction of the following conditions precedent:a) Receipt of all necessary consents, approvals, and authorizations required under applicable laws and regulations.b) No material adverse change in the financial condition or business operations of the Seller.4. Governing Law and JurisdictionThis Agreement shall be governed by and construed in accordance with the laws of [Country]. Any dispute arising out of or in connection with this Agreement shall be subject to the exclusive jurisdiction of the courts of [Country].5. Miscellaneous5.1. Entire Agreement: This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior discussions, negotiations, and agreements, whether oral or written.5.2. Amendments: No amendment, modification, or waiver of any provision of this Agreement shall beeffective unless in writing and signed by both parties.5.3. Assignment: Neither party may assign or transfer any of its rights or obligations under this Agreement without the prior written consent of the other party.中文翻译:股份买卖协议书本股份买卖协议书(以下简称“协议”)于[日期]由[买方]和[卖方]双方签订。

股权购买协议中英文

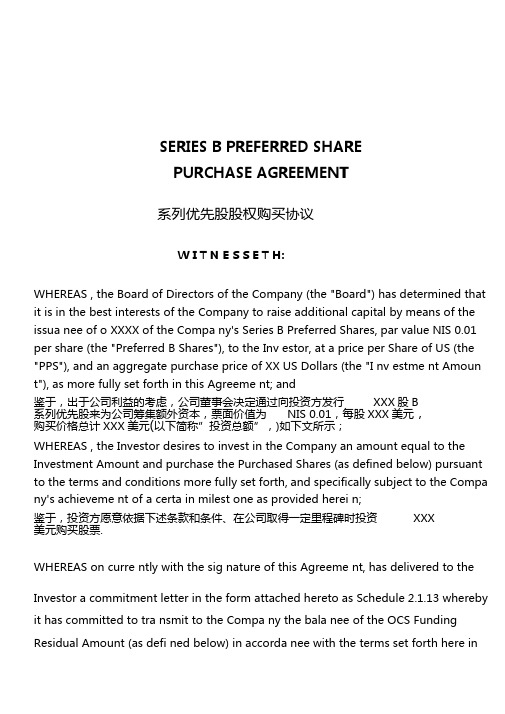

SERIES B PREFERRED SHAREPURCHASE AGREEMENT系列优先股股权购买协议W I T N E S S E T H:WHEREAS , the Board of Directors of the Company (the "Board") has determined that it is in the best interests of the Company to raise additional capital by means of the issua nee of o XXXX of the Compa ny's Series B Preferred Shares, par value NIS 0.01 per share (the "Preferred B Shares"), to the Inv estor, at a price per Share of US (the "PPS"), and an aggregate purchase price of XX US Dollars (the "I nv estme nt Amoun t"), as more fully set forth in this Agreeme nt; and鉴于,出于公司利益的考虑,公司董事会决定通过向投资方发行XXX股B系列优先股来为公司筹集额外资本,票面价值为NIS 0.01,每股XXX美元,购买价格总计XXX美元(以下简称”投资总额”,)如下文所示;WHEREAS , the Investor desires to invest in the Company an amount equal to the Investment Amount and purchase the Purchased Shares (as defined below) pursuant to the terms and conditions more fully set forth, and specifically subject to the Compa ny's achieveme nt of a certa in milest one as provided herei n;鉴于,投资方愿意依据下述条款和条件、在公司取得一定里程碑时投资XXX美元购买股票.WHEREAS on curre ntly with the sig nature of this Agreeme nt, has delivered to the Investor a commitment letter in the form attached hereto as Schedule 2.1.13 whereby it has committed to tra nsmit to the Compa ny the bala nee of the OCS Funding Residual Amount (as defi ned below) in accorda nee with the terms set forth here inand there in.鉴于,本协议签署之时,XXXX(如下文定义)要向投资方以附件“ 2.1.13 ” 的格式递交承诺函,承诺向公司支付OCS资金残留金额(如下文定义)NOW, THEREFORE, i n con siderati on of the mutual promises and cove nants set forth here in, the parties hereby agree as follows:现在,在考虑到双方的承诺和契约规定,双方据此同意如下:Issue and Purchase of ShareS殳票的发行和购买1.1. Issue and Purchase of Share殳票的发行和购买Subject to the terms and con diti ons hereof, the Compa ny shall issue and allot to the Inv estor, and the Inv estor shall purchase from the Compa ny, an aggregate of (xxxx) of the Compa ny's Series B Preferred Shares (the "Purchased Shares"), at a price per Share equal to the PPS, reflecting a pre-money valuation of the Company of xxx and calculated on a Fully Diluted Basis (as defi ned below), for the aggregateInv estme nt Amount. The capitalizati on table of the Compa ny reflect ing the issued and outstanding share capital of the Company on a Fully Diluted Basis (as defined below), immediately prior to and immediately following the Closing (as defined below), is attached hereto as Schedule 1.1 (the "Capitalization Table").根据相关条款及条件,公司应对投资方发行并分配股票,投资方应从公司购买总计xxxx股B 系列优先股(以下简称”购买的股票”每股价格为xxx美元,反映出在全面摊薄基础上,公司交易总额的交易前市值为xxx美元.附件1.1(简称”资产表”公司的资产表反映了交易结束前后在全面摊薄基础上公司已发行的流通股本.1.2. For the purposes of this Agreement, "Fully Diluted Basis" shall mean allissued and outstanding share capital of the Company, including (i) all ordinary shares of the Company, par value of NIS 0.01 each (the "Ordinary Shares"), (ii) all Preferred A shares of the Compa ny, par value of NIS 0.01 each (the“ Preferr edShares ” and all Preferred B Shares, (iii) all securities convertible into Ordinary Shares being deemed so converted, (iv) all convertible loans being deemed so converted (v) all options, warrants and other rights to acquire shares or securities excha ngeable or conv ertible for shares of the Compa ny, being deemed so allocated,exercised and converted, and (vi) all options reserved for (including any unallocated option pool) and/or allocated for issuanee to employees, consultants, officers, service providers or directors of the Company pursuant to any current share option plans, agreementsor arrangementsheretofore, prior to the Closing, approved by the Board of the Company (the "ESOP Pool") deemed converted an d/or gran ted an d/or exercised. 全面摊薄基础”代表公司已发行流通的股票.包括:1)所有的普通股,每股票面价值为NIS0.01;2)公司的A轮优先股和B轮优先股,每股票面价值为NIS0.01;3) 所有被转换为普通股的证券;4)所有可转换贷款;5)被分配,行使和转换的所有期权,许可证或可取得可转换股票的其他权益;6)在交割前,由公司董事会批准的、根据任何目前或未来激励性股票期权计划的协议或安排,为公司员工,顾问,高级管理人员,服务提供商,董事所保留的或直接向其分配的可被转化,授予,或行使的期权.1.3. _The Investment Amount shall be invested by the Investor in the Company in three installments as follows: (i) an amount of(the “ First Installment ” ) shall be paid to the Compa ny at and subject to the Clos ing as defi ned in Secti on 2 here in, in con sideratio n for the issua nce to the Inv estor of xxxx Preferred B Shares (the "Closing Purchased Shares"), (ii) an amount of (the “Second Installment ” ) shall be paid to the Compa ny within xx mon ths followi ng the Closi ng Date (the "Sec ond n stallme nt Date") in con siderati on for the issua nce to the Inv estor of xxx Preferred B Shares (the "Second Installment Shares"), and (iii) the remaining amount of the“ Third In stallme nt shall be paid to the Compa ny at and subject to the Third Installment Date (as defined below), in consideration for the issuanee to the Investor of xxxxPreferred B Shares (the "Third Installment Shares").投资方的注资金额应分三期投资如下:1)在交割时应投资xxxx美元(以下简称” 首期投资”)(根据第2章定义的“交割”的定义),作为对价,投资方将享有 xxx轮优先股(以下简称”交割购买的股票”)2应在交割日结束后的xx月内投资60万美元(以下简称”二期投资” 投资方将获得xxxx股B轮优先股(以下简称”二期投资股票”);3剩下的作为第三期投资应于三期投资日支付,投资方可获得xxxx优先股(以下简称”三期投资股票”)2. The Closi ng.交割 /结束The elosing of the sale and purchase of the Purchased Shares (the "Closing") shall take place at the offices of xxxx or remotely via the excha nge of docume nts and sig natures, at a time and on a date to be specified by the Parties, which shall be no later tha n the third (3>d) Busin ess Day after the satisfacti on or waiver of all of the conditions set forth in Sections 7 and 8 below to be satisfied orwaived (other than those conditions that by their nature are to be satisfied at theClosing) or at such other time and place as the Company and the Investormutually agree upon in writ ing , but in any eve nt, no later tha n 45 days followi ng the sig ning of this Agreement (the date of the Closing being herein referred to as the "Closing Date"). "Bus in ess Day" shall mean any day other tha n Friday, Saturday, Sun day or any other day on which banks are legally permitted to be closed in Israel or in China. It is hereby clarified that to the extent the conditions set forth in Sections 7 and 8 below have not bee n satisfied (an d/or waived as set forth here in) as of the Clos ing Date, the Parties agree that this Agreement will be of no further force and effect and each of the Parties agree that thisAgreeme nt will be of no further force and effect and each of the herebyirrevocably waive any dema nd or claim aga inst the other Party in this respect except with respect to any breach by any Party of any preclos ing obligati ons un der this agreeme nt that occurred prior to the Clos ing Date.股票购买的售卖结束地点是xxxx或通过远程交换文件和签名,具体日期双方决定,但不得晚于如下7和8条规定条件圆满完成或免除(除了依其特点应于交割满足的条件)后的 3个工作日,或者投资方和公司书面商定的日期和地点,但是任何情况下不得超过本协议签署后的45天..工作日可为任何一天,但不包括周五,周六和周日或以色列或中国银行的法定非营业时间.此处需要澄清的是,如果截止交割日7条和8条规定下的条件不满意(和/或放弃此处规定),双方同意此协议不具有效力,此处的任何一方不可撤销的放弃对对方的要求或本协议交割前出现的不利于预交割义务一方。

2024年股权买卖协议(中英文对照)

20XX 专业合同封面COUNTRACT COVER甲方:XXX乙方:XXX2024年股权买卖协议(中英文对照)本合同目录一览1. 第一条股权转让1.1 第二条股权转让价格1.2 第三条股权转让支付方式1.3 第四条股权转让的交割2. 第一条股权转让的条件2.1 第二条受让方的资格2.2 第三条股权转让的审批2.3 第四条股权转让的登记3. 第一条股东权益3.1 第二条股东大会的权利3.2 第三条董事会和管理层的职责3.3 第四条股东的信息披露4. 第一条股权转让后的经营管理4.1 第二条受让方的经营管理权4.2 第三条原有经营管理层的留用4.3 第四条经营管理层的激励机制5. 第一条合同的解除和终止5.1 第二条解除和终止的条件5.2 第三条解除和终止的法律后果5.3 第四条解除和终止的程序6. 第一条争议解决6.1 第二条争议解决的方式6.2 第三条仲裁地点和语言6.3 第四条仲裁结果的执行7. 第一条合同的生效7.1 第二条合同的签署地点和日期7.2 第三条合同的修改和补充7.3 第四条合同的终止日期8. 第一条合同的保密8.1 第二条保密信息的范围8.2 第三条保密信息的保管和利用8.3 第四条保密信息的泄露后果9. 第一条合同的适用法律9.1 第二条法律冲突的选择9.2 第三条法律的适用9.3 第四条法律解释的权利10. 第一条合同的履行10.1 第二条履行的时间和地点10.2 第三条履行的方式和条件10.3 第四条履行的监督和检查11. 第一条合同的权益转让11.1 第二条权益转让的条件11.2 第三条权益转让的程序11.3 第四条权益转让的法律后果12. 第一条合同的继承12.1 第二条合同继承的条件12.2 第三条合同继承的程序12.3 第四条合同继承的法律后果13. 第一条合同的附件13.1 第二条附件的说明13.2 第三条附件的效力13.3 第四条附件的修改和补充14. 第一条其他事项14.1 第二条双方的其他约定14.2 第三条合同的补充协议14.3 第四条合同的完整性和效力第一部分:合同如下:第一条股权转让1.1 第二条股权转让价格1.1.1 股权转让的总价款为人民币【】万元整(大写:【】万元整),受让方应按照本合同约定的方式和期限向转让方支付。

股权购买协议 中英文 (2)

股权购买协议中英文协议标题:股权购买协议Agreement Title: Stock Purchase Agreement本协议由以下各方(以下简称为“卖方”和“买方”)于(填写日期)签署:This Agreement is entered into on (insert date) by and between the following parties (hereinafter referred to as the "Seller" and the "Buyer"):一、背景1.1 卖方拥有(填写公司名称)的股权,占总股本的(填写比例)。

1.2 买方有意购买卖方所持有的股权,并达成本协议以明确双方的权益和义务。

I. Background1.1 The Seller owns (insert company name) shares, representing (insert percentage)of the total share capital.1.2 The Buyer intends to purchase the shares held by the Seller and enter into this Agreement to clarify the rights and obligations of both parties.二、定义在本协议中,除非上下文另有规定,下列术语定义如下:II. DefinitionsIn this Agreement, unless otherwise specified in context, the following terms shall have the meanings ascribed to them below:2.1 “股权”指卖方在(填写公司名称)中所持有的股份。

2.2 “购买价格”指买方购买股权所支付的金额。

股权转让协议中英文版

股权转让协议中英文版Stock Transfer AgreementThis Stock Transfer Agreement (“Agreement”) is made and entered into as of [date], by and between [Seller], a corporation organized and existing under the laws of[state/country], with its principal place of business at [address], (“Seller”), and [Buyer], a corporation organized and existing under the laws of [state/country], with its principal place of business at [address], (“Buyer”).WHEREAS, Seller is the owner of [number] shares of common stock (the “Shares”) of [Company], a corporation organized and existing under the laws of [state/country], with its principal place of business at [address], (the “Company”); andWHEREAS, Seller desires to sell and transfer the Shares to Buyer, and Buyer desires to purchase the Shares from Seller, upon the terms and conditions set forth in this Agreement.NOW, THEREFORE, in consideration of the mutual covenants and promises set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:1. Sale and Transfer of Shares. Seller hereby sells, assigns, transfers, and delivers to Buyer, and Buyer hereby purchases and accepts from Seller, free and clear of all liens, claims, encumbrances, and security interests, the Shares in the form of one or more certificates, with all dividends and other rights accruing thereto since the dateof the last dividend payment.2. Purchase Price. The purchase price for the Shares shall be [dollar amount] per Share, for a total purchase price of [total dollar amount]. Buyer shall pay the purchase price by wire transfer of immediately available funds to the bank account designated by Seller.3. Representations and Warranties of Seller. Seller represents and warrants as follows:(a) Seller has full power and authority to sell, assign, transfer, and deliver the Shares, and no other consent or approval is required for the completion of this transaction.(b) Seller is the lawful owner of the Shares, and the Shares are free and clear of all liens, claims, encumbrances, and security interests.(c) Seller has not entered into any agreement, commitment, or arrangement that conflicts with this Agreement or that would prevent Seller from performing its obligations under this Agreement.(d) This Agreement constitutes the legal, valid, and binding obligation of Seller, enforceable against Seller in accordance with its terms.4. Representations and Warranties of Buyer. Buyer represents and warrants as follows:(a) Buyer has full power and authority to enter into this Agreement and to purchase the Shares.(b) Buyer is not relying on any representations, warranties, covenants, or agreements of Seller not contained in this Agreement.(c) Buyer understands the risks associated with purchasing the Shares, and has made its own investigation and decision to purchase the Shares.(d) This Agreement constitutes the legal, valid, and binding obligation of Buyer, enforceable against Buyer in accordance with its terms.5. Closing. The closing of the purchase and sale of the Shares shall take place on [date], at [time], at theoffices of [law firm], or at such other time and place as the parties may mutually agree.6. Expenses. Each party shall pay its own expenses incurred in connection with this transaction.7. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of[state/country].8. Entire Agreement. This Agreement constitutes the entire agreement between the parties with respect to the purchase and sale of the Shares, and supersedes all prior understandings and agreements between the parties, whether oral or written.9. Amendments. This Agreement may not be amended or modified except in writing signed by both parties.10. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.[Seller]By:Name:Title:[Buyer]By:Name: Title:。

股权购买协议 中英文

股权购买协议中英文协议名称:股权购买协议Equity Purchase Agreement本协议由以下各方于(日期)签署:甲方:(姓名/公司名称)地址:联系方式:乙方:(姓名/公司名称)地址:联系方式:鉴于:1. 甲方是一家[公司类型],注册于[注册地],经营范围为[经营范围]。

2. 乙方是一家[公司类型],注册于[注册地],经营范围为[经营范围]。

3. 甲方拥有乙方公司的股权,约占总股本的[比例]。

4. 双方希望就乙方公司的股权转让达成一致,并依法履行相关法律义务。

现双方就乙方公司股权的购买事宜达成如下协议:第一条定义和解释1. “股权”指乙方公司的全部或部分股份。

2. “转让价格”指乙方公司股权的购买价格,以人民币计价。

第二条股权转让1. 甲方同意将其持有的乙方公司的股权以转让的方式出售给乙方。

2. 甲方将以书面形式通知乙方其拟出售的股权比例和转让价格。

3. 乙方同意购买甲方所拟出售的股权比例,并按照约定的转让价格支付购买款项。

4. 股权转让完成后,甲方应向乙方提供完整的股权转让文件和所有相关权利证书。

第三条转让价格和支付方式1. 乙方同意按照双方协商一致的转让价格购买甲方所拟出售的股权。

2. 乙方应在签署本协议之日起[时间]内支付全部购买款项。

3. 乙方应以电汇、支票或其他双方同意的方式支付购买款项。

第四条股权过户1. 甲方应协助乙方完成股权过户手续,并向乙方提供必要的文件和资料。

2. 乙方应承担因股权过户而产生的一切费用和税款。

第五条保证与陈述1. 甲方保证其所出售的股权是合法的、有效的,并不存在任何限制性约束。

2. 甲方保证其所出售的股权没有质押、抵押或处于任何其他担保状态。

3. 甲方保证其所出售的股权没有任何未公开的债务、赔偿或索赔。

4. 甲方保证其所出售的股权没有任何未公开的法律纠纷或争议。

5. 甲方保证其所出售的股权没有被任何第三方主张权利。

第六条违约责任1. 若甲方违反本协议的任何条款或陈述,乙方有权要求违约方承担违约责任,并要求违约方赔偿因此造成的一切损失。

股权购买协议 中英文

股权购买协议中英文协议名称:股权购买协议Agreement Title: Share Purchase Agreement协议双方:甲方:[甲方名称](以下简称“买方”)乙方:[乙方名称](以下简称“卖方”)一、协议背景1.1 买方拟购买卖方持有的股权。

1.2 买方和卖方均同意按照本协议的规定进行股权交易。

二、股权购买2.1 股权描述2.1.1 股权种类:[股权种类]2.1.2 股权数量:[股权数量]2.1.3 股权比例:[股权比例]2.1.4 股权购买价格:[股权购买价格]2.2 股权交付2.2.1 卖方应在本协议签署之日起[交付期限]将股权过户给买方。

2.2.2 股权过户的相关费用由卖方承担。

2.3 交易款项2.3.1 买方应在[交付期限]内向卖方支付全部交易款项。

2.3.2 交易款项以[货币单位]支付,并通过[支付方式]进行支付。

2.4 股权保证2.4.1 卖方保证其所出售的股权为合法拥有,并不存在任何限制性条件。

2.4.2 卖方保证其所出售的股权没有被任何第三方主张或争议。

三、协议条款3.1 保密条款3.1.1 双方同意对本协议的内容及股权交易过程保密。

3.1.2 未经对方书面同意,任何一方不得向任何第三方透露协议内容。

3.2 违约责任3.2.1 任何一方违反本协议的约定,应承担相应的违约责任。

3.2.2 违约方应赔偿守约方因此遭受的一切损失,包括但不限于合理的律师费用。

3.3 协议解除3.3.1 双方协商一致,可以解除本协议。

3.3.2 协议解除后,双方应按照解除协议的约定处理相关权益和义务。

3.4 适用法律和争议解决3.4.1 本协议的解释、执行和争议解决应适用[适用法律]。

3.4.2 双方一致同意将因本协议产生的争议提交[仲裁机构]进行仲裁,并接受仲裁裁决。

四、其他条款4.1 本协议自双方签署之日起生效,并对双方具有约束力。

4.2 本协议的附件构成本协议的完整组成部分,与本协议具有同等法律效力。

股权购买协议 中英文

股权购买协议中英文协议标题:股权购买协议Agreement Title: Stock Purchase Agreement协议编号:[协议编号]Agreement Number: [Agreement Number]本股权购买协议(以下简称“本协议”)由以下双方(以下简称“买方”和“卖方”)于[协议签署日期]签署:买方:公司名称:[买方公司名称]注册地:[买方公司注册地]地址:[买方公司地址]法定代表人:[买方法定代表人]联系电话:[买方联系电话]电子邮件:[买方电子邮件]卖方:公司名称:[卖方公司名称]注册地:[卖方公司注册地]地址:[卖方公司地址]法定代表人:[卖方法定代表人]联系电话:[卖方联系电话]电子邮件:[卖方电子邮件]鉴于:1. 买方拟购买卖方所持有的股权,以便获得卖方公司的股权份额;2. 卖方同意出售其所持有的股权,并接受买方支付的对价。

基于上述情况,双方达成如下协议:第一条股权出售1.1 卖方同意将其持有的股权出售给买方,买方同意购买该股权。

1.2 股权出售的标的是卖方所持有的[股权份额]股份,占卖方公司总股本的[比例]%。

1.3 股权出售的对价为[对价金额],买方应在[支付期限]内支付给卖方。

第二条股权过户2.1 在对价支付完毕后,卖方应立即办理相关手续,将其所持有的股权过户给买方。

2.2 股权过户的相关费用由买方承担。

第三条保证与承诺3.1 卖方保证其所持有的股权是合法有效的,并不存在任何限制性约定。

3.2 卖方保证其所持有的股权未被质押、冻结或受到其他任何形式的担保限制。

3.3 卖方保证其所持有的股权未涉及任何未解决的法律纠纷或争议。

3.4 卖方保证其所持有的股权未受到任何第三方的索赔、诉讼或其他法律程序的影响。

3.5 卖方承诺在股权过户后,不再主张与该股权相关的任何权利或利益。

第四条股权转让的附加条件4.1 本协议生效的前提是,买方完成对卖方公司的尽职调查,并对卖方公司的财务状况、经营状况、合规性等进行了全面评估,并对评估结果表示满意。

股权购买协议英文翻译

股权购买协议英文翻译Equity Purchase AgreementThis Equity Purchase Agreement ("Agreement") is made and entered into as of [insert date] by and between [Company A], a corporation duly organized and existing under the laws of [insert country], with its principal place of business at [insert address] ("Seller"), and [Company B], a corporation duly organized and existing under the laws of [insert country], with its principal place of business at [insert address] ("Buyer").WHEREAS, Seller desires to sell, and Buyer desires to purchase, equity interests in [insert name of company], a corporation duly organized and existing under the laws of [insert country] (the "Company").NOW, THEREFORE, in consideration of the premises and the mutual promises and covenants contained herein, the parties agree as follows:1. Basic Information of the Parties. The parties affirm that they have the requisite power and authority to enter into this Agreement and to consummate the transactions contemplated herein. The basic information of each party is as follows:(a) Seller: [insert name of company], a corporation duly organized and existing under the laws of [insert country], with its principal place of business at [insert address];(b) Buyer: [insert name of company], a corporation duly organized and existing under the laws of [insert country], with its principal place of business at [insert address].2. Identity, Rights, Obligations, Performance, Term, and Breach. The parties shall comply with all applicable laws and regulations of China in connection with the performance of this Agreement. The identity, rights, obligations, performance, term, and breach of each party shall be as follows:(a) Seller represents and warrants that it is the lawful owner of the equity interests in the Company that are being sold to Buyer, free and clear of any liens or encumbrances;(b) Buyer agrees to purchase the equity interests in the Company from Seller on the closing date specified in Section 3 below;(c) Seller agrees to transfer to Buyer, on the closing date, the equity interests in the Company being sold by Seller to Buyer, free and clear of any liens or encumbrances;(d) Buyer shall pay the purchase price for the equity interests in the Company to Seller in accordance with the terms and conditions set forth in Section 3 below;(e) This Agreement shall become effective on the closing date specified in Section 3 below and shall remain in effect until the respective parties have performed all of their obligations hereunder;(f) In the event of a breach of this Agreement by either party, the non-breaching party shall have all rights and remedies available at law or in equity.3. Closing. The closing of the purchase and sale of the equity interests in the Company shall take place on [insert date], at [insert location], or at such other time or place as the parties may mutually agree upon (the "Closing").(a) On the Closing, Buyer shall deliver to Seller the purchase price for the equity interests in the Company by wire transfer or other acceptable form of payment;(b) Seller shall deliver to Buyer the documents necessary to evidence the transfer of the equity interests in the Company to Buyer, including, but not limited to, share certificates, stock powers, and any necessary notarizations or filings with the relevant authorities.4. Binding Effect; Governing Law; Amendments. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. This Agreement shall be governed by and construed in accordance with the laws of China. This Agreement may be amended,modified, or supplemented only in writing and signed by both parties.5. Entire Agreement; Severability. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior negotiations, understandings, and agreements. If any provision of this Agreement is held to be invalid or unenforceable, such provision shall be deemed to be modified or limited to the extent necessary to make it valid and enforceable, and the remaining provisions of this Agreement shall remain in full force and effect.6. Notices. All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be given or made to the addresses set forth in Section 1 above, or to such other address as the party to be served may designate by written notice to the other party.7. Assignment. This Agreement may not be assigned by either party without the prior written consent of the other party.8. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same instrument.9. Legal Effect and Enforceability. The parties acknowledge and agree that this Agreement is fully enforceable to the extent required by applicable law. The parties further acknowledge and agree that all terms and conditions of this Agreement are legallybinding and shall be enforceable in accordance with their respective terms.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.[insert signature blocks]。

英文股权合同范本

英文股权合同范本Shareholder AgreementThis Shareholder Agreement (the "Agreement") is made and entered into as of [date], and between [Party A name] (the "Party A") and [Party B name] (the "Party B").1. Definitions:"Shares" shall mean the equity shares of the Company.2. Transfer of Shares:Party A agrees to transfer [number] of Shares to Party B, and Party B agrees to accept such transfer.3. Rights and Obligations:The shareholders shall have the rights and obligations as provided in the Company's articles of association and applicable laws.Each shareholder shall have the right to participate in the management and decision-making of the Company in proportion to their shareholding.4. Dividends:Dividends shall be distributed among the shareholders in accordance with their shareholdings.5. Meetings:Regular shareholder meetings shall be held as required law and the Company's articles of association.6. Confidentiality:The parties agree to keep all information regarding the Company and this Agreement confidential.7. Dispute Resolution:In the event of any dispute or disagreement between the parties, they shall attempt to resolve it through friendly negotiation. If unsuccessful, the dispute shall be submitted to arbitration in accordance with the applicable arbitration rules.8. Governing Law:This Agreement shall be governed and construed in accordance with the laws of [applicable jurisdiction].IN WITNESS WHEREOF, the parties have signed this Agreement as of the date first written above.Party A: [Party A signature]Party B: [Party B signature]Please note that this is just a basic template and may need to be customized and adapted according to specific circumstances and legal requirements. It is advisable to consult a legal professional before finalizing any shareholder agreement.。

全版本的股权合同书英文版

全版本的股权合同书英文版Comprehensive Stock Equity AgreementThis document serves as a comprehensive stock equity agreement between the undersigned parties. The purpose of this agreement is to outline the terms and conditions related to the ownership and transfer of stock in the company.Parties Involved- The company, represented by [Company Name]- Stockholders, represented by [Name of Stockholder]Stock Ownership- The stockholders acknowledge that they hold a certain number of shares in the company.- Any transfer of stock ownership must be approved by the company.Rights and Responsibilities- Stockholders have the right to vote on major company decisions.- Stockholders are entitled to receive dividends based on the company's performance.- Stockholders must act in the best interest of the company and not disclose confidential information.Restrictions on Transfer- Stockholders cannot transfer their shares without the consent of the company.- Any transfer of shares must be done in accordance with the laws and regulations governing stock ownership.Termination of Agreement- This agreement can be terminated by mutual consent of the parties involved.- In the event of a breach of the agreement, the company has the right to take legal action.Governing Law- This agreement shall be governed by the laws of [Jurisdiction].- Any disputes arising from this agreement shall be resolved through arbitration.This comprehensive stock equity agreement is a legally binding document that outlines the rights and responsibilities of stockholders in the company. By signing this agreement, the parties involved agree to abide by the terms and conditions set forth herein.Signed:[Company Name] [Name of Stockholder] __________________________________________________Date: _________________ Date: _________________。

股权购买协议 中英文

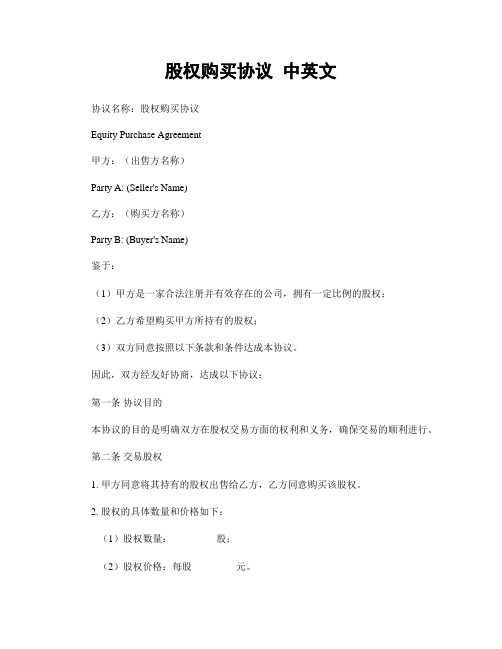

股权购买协议中英文协议名称:股权购买协议Equity Purchase Agreement甲方:(出售方名称)Party A: (Seller's Name)乙方:(购买方名称)Party B: (Buyer's Name)鉴于:(1)甲方是一家合法注册并有效存在的公司,拥有一定比例的股权;(2)乙方希望购买甲方所持有的股权;(3)双方同意按照以下条款和条件达成本协议。

因此,双方经友好协商,达成以下协议:第一条协议目的本协议的目的是明确双方在股权交易方面的权利和义务,确保交易的顺利进行。

第二条交易股权1. 甲方同意将其持有的股权出售给乙方,乙方同意购买该股权。

2. 股权的具体数量和价格如下:(1)股权数量:_________股;(2)股权价格:每股_________元。

第三条交易条件1. 甲方保证其所出售的股权是合法且有效的,不存在任何形式的限制或负担。

2. 乙方同意按照约定的价格支付购买股权的款项。

3. 双方同意在本协议签署之日起_________日内完成交割手续。

4. 交割手续包括但不限于:(1)甲方向乙方提供所有必要的股权转让文件和证明文件;(2)乙方向甲方支付全部购买款项。

第四条保密条款双方同意对于本协议及其相关交易保密,不得向任何第三方透露相关信息,除非双方另有约定或法律法规要求。

第五条违约责任1. 若一方违反本协议的任何条款,守约方有权要求违约方承担相应的违约责任,并有权采取合理的措施维护自身权益。

2. 违约方应承担的违约责任包括但不限于赔偿损失、支付违约金等。

第六条争议解决凡因履行本协议发生的争议,双方应友好协商解决。

如协商不成,任何一方均有权向有管辖权的法院提起诉讼。

第七条适用法律和管辖本协议的解释、效力和履行均适用中华人民共和国的法律。

如发生争议,双方同意将争议提交有管辖权的法院解决。

第八条其他事项1. 本协议自双方签字盖章之日起生效,有效期为_________年。

公司股权认购协议(中英文)

公司股权认购协议(中英文)AGREEMENT OF PREFERRED STOCK FINANCING鉴于涉及此项投资的投资人已投入和将投入的时间和成本,无论此次融资是否完成,本条款清单之限制出售/保密条款、律师及费用条款对公司都具有强制约束力。

未经各方一致签署并交付的最终协议,本条款清单之其他条款不具有强制约束力。

本条款清单并非投资人进行投资的承诺,其生效以完成令投资人满意的尽职调查、法律审查和文件签署为条件。

本条款清单各方面受特拉华州法律管辖。

In consideration of the time and expense devoted and to be devoted by the Investors with respect to this investment, the No Shop/Confidentiality and Counsel and Expenses provisions of this Term Sheet shall be binding obligations of the Company whether or not the financing is consummated. No other legally binding obligations will be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligence, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all respects by the laws of the State of Delaware.出资条款:Offering Terms交割日:当公司接受此条款清单且交割条件完备时即尽快交割(“交割”)。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

SERIES B PREFERRED SHARE PURCHASE AGREEMENTB 系列优先股股权购买协议W I T N E S S E T H:WHEREAS , the Board of Directors of the Company (the "Board") has determined that it is in the best interests of the Company to raise additional capital by means of the issuance of o XXXX of the Company's Series B Preferred Shares, par value NIS 0.01 per share (the "Preferred B Shares"), to the Investor, at a price per Share of US (the "PPS"), and an aggregate purchase price of XX US Dollars (the "Investment Amount"), as more fully set forth in this Agreement; and鉴于,出于公司利益的考虑,公司董事会决定通过向投资方发行XXX股B 系列优先股来为公司筹集额外资本,票面价值为NIS 0.01,每股XXX美元,购买价格总计XXX美元(以下简称”投资总额”),如下文所示;WHEREAS , the Investor desires to invest in the Company an amount equal to the Investment Amount and purchase the Purchased Shares (as defined below) pursuant to the terms and conditions more fully set forth, and specifically subject to the Company's achievement of a certain milestone as provided herein;鉴于,投资方愿意依据下述条款和条件、在公司取得一定里程碑时投资XXX 美元购买股票.WHEREAS, concurrently with the signature of this Agreement, has delivered to the Investor a commitment letter in the form attached hereto asSchedule 2.1.13 whereby it has committed to transmit to the Company the balance of the OCS Funding Residual Amount (as defined below) in accordance with the terms set forth herein and therein.鉴于,本协议签署之时,XXXX(如下文定义)要向投资方以附件“2.1.13”的格式递交承诺函,承诺向公司支付OCS 资金残留金额(如下文定义)NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, the parties hereby agree as follows:现在,在考虑到双方的承诺和契约规定,双方据此同意如下:Issue and Purchase of Shares. 股票的发行和购买1.1.Issue and Purchase of Shares. 股票的发行和购买Subject to the terms and conditions hereof, the Company shall issue and allot to the Investor, and the Investor shall purchase from the Company, an aggregate of (xxxx) of the Company's Series B Preferred Shares (the "Purchased Shares"), at a price per Share equal to the PPS, reflecting apre-money valuation of the Company of xxx and calculated on a Fully Diluted Basis (as defined below), for the aggregate Investment Amount.The capitalization table of the Company reflecting the issued and outstanding share capital of the Company on a Fully Diluted Basis (as defined below), immediately prior to and immediately following the Closing (as defined below), is attached hereto as Schedule 0 (the "Capitalization Table").根据相关条款及条件,公司应对投资方发行并分配股票,投资方应从公司购买总计xxxx股B系列优先股(以下简称”购买的股票”),每股价格为xxx美元,反映出在全面摊薄基础上,公司交易总额的交易前市值为xxx美元.附件1.1(简称”资产表”)公司的资产表反映了交易结束前后在全面摊薄基础上公司已发行的流通股本.1.2. For the purposes of this Agreement, "Fully Diluted Basis" shall mean all issued and outstanding share capital of the Company, including (i) all ordinary shares of the Company, par value of NIS 0.01 each (the "Ordinary Shares"), (ii) all Preferred A shares of the Company, par value of NIS 0.01 each (the “Preferred A Shares”), and all Preferred B Shares, (iii) all securities convertible into Ordinary Shares being deemed so converted, (iv) all convertible loans being deemed so converted (v) all options, warrants and other rights to acquire shares or securities exchangeable or convertible for shares of the Company, being deemed so allocated, exercised and converted, and (vi) all options reserved for (including any unallocated option pool) and/or allocated for issuance to employees, consultants, officers, service providers or directors of the Company pursuant to any current share option plans, agreements or arrangements heretofore, prior to the Closing, approved by the Board of the Company (the "ESOP Pool") deemed converted and/or granted and/or exercised.“全面摊薄基础”代表公司已发行流通的股票.包括:1)所有的普通股,每股票面价值为NIS0.01;2)公司的A轮优先股和B轮优先股,每股票面价值为NIS0.01;3)所有被转换为普通股的证券;4)所有可转换贷款;5)被分配,行使和转换的所有期权,许可证或可取得可转换股票的其他权益; 6)在交割前,由公司董事会批准的、根据任何目前或未来激励性股票期权计划的协议或安排,为公司员工,顾问,高级管理人员,服务提供商,董事所保留的或直接向其分配的可被转化,授予,或行使的期权.1.3.1.4.1.5.1.6.The Investment Amount shall be invested by the Investor in the Company in three installments as follows: (i) an amount of (the “First Installment”) shall be paid to the Company at and subject to the Closing as defined in Section 0 herein, in consideration for the issuance to the Investorof xxxx Preferred B Shares (the "Closing Purchased Shares"), (ii) an amount of (the “Second Installment”) shall be paid to the Company within xx months following the Closing Date (the "Second Installment Date") in consideration for the issuance to the Investor of xxx Preferred B Shares (the "Second Installment Shares"), and (iii) the remaining amount of the “Third Installment” shall be paid to the Company at and subject to the Third Installment Date (as defined below), in consideration for the issuance to the Investor of xxxxPreferred B Shares (the "Third Installment Shares").投资方的注资金额应分三期投资如下:1)在交割时应投资xxxx美元(以下简称”首期投资”) (根据第2章定义的“交割”的定义),作为对价,投资方将享有xxx 轮优先股(以下简称”交割购买的股票”).2)应在交割日结束后的xx月内投资60万美元(以下简称”二期投资”),投资方将获得xxxx股B轮优先股(以下简称”二期投资股票”);3)剩下的作为第三期投资应于三期投资日支付,投资方可获得xxxx优先股(以下简称”三期投资股票”)1.7.1.8.1.9.2.The Closing. 交割/结束The closing of the sale and purchase of the Purchased Shares (the "Closing") shall take place at the offices of xxxx or remotely via the exchange of documents and signatures, at a time and on a date to be specified by the Parties, which shall be no later than the third (3rd) Business Day after the satisfaction or waiver of all of the conditions set forth in。