会计学教程与案例 第5章 对报表影响

会计课程辅导必备手册

会计课程辅导必备手册1. 导言欢迎阅读本手册,本手册旨在为会计课程学习者提供必备的辅导材料。

无论您是初学者还是有一定会计知识的学习者,本手册将为您提供丰富的学习资源和实用的解决方案。

通过本手册,您将更好地理解会计基础知识和方法,并能够应用于实际情境中。

2. 目录• 2.1 会计基础知识– 2.1.1 会计原理– 2.1.2 会计核算– 2.1.3 财务报表• 2.2 会计学习方法– 2.2.1 有效学习技巧– 2.2.2 学习资源推荐• 2.3 实践应用案例– 2.3.1 个人财务管理– 2.3.2 公司财务分析2.1 会计基础知识会计基础知识是学习会计的关键基础,本节将介绍会计原理、会计核算和财务报表等基础概念。

2.1.1 会计原理会计原理是会计学的基本原则和准则,规范了会计的核算和报告方法。

了解和掌握会计原理是学习会计的重要一步。

以下是一些常见的会计原理:•实体概念:企业应被视为独立的经济实体,与其所有者分开看待。

•货币计量:所有交易和业务应以货币计量,并以货币为基础进行记录和报告。

•会计周期:会计活动应按照规定的时间周期进行核算和报告。

2.1.2 会计核算会计核算是会计过程中的关键环节,它涉及到记账、分类、账簿记录和准确计算等内容。

以下是一些常见的会计核算内容:•借贷记账法:会计交易应按照借贷记账法进行记录,即对每一项交易都要对应地进行借方和贷方的记账记录。

•分类账簿:分类账簿是对会计科目进行分类记录的账簿,它有助于对账户余额和交易历史进行清晰的了解。

•试算平衡:试算平衡是核对会计记录和账户余额的过程,以确保借贷方相等。

2.1.3 财务报表财务报表是会计信息的主要输出形式,它呈现了企业财务状况和业绩情况。

以下是一些常见的财务报表:•资产负债表:资产负债表反映了企业的资产、负债和所有者权益的状况,是衡量企业偿债能力和财务稳定性的重要依据。

•利润表:利润表展示了企业在一定时期内的收入、成本和利润情况,是了解企业盈利能力和经营效果的重要指标。

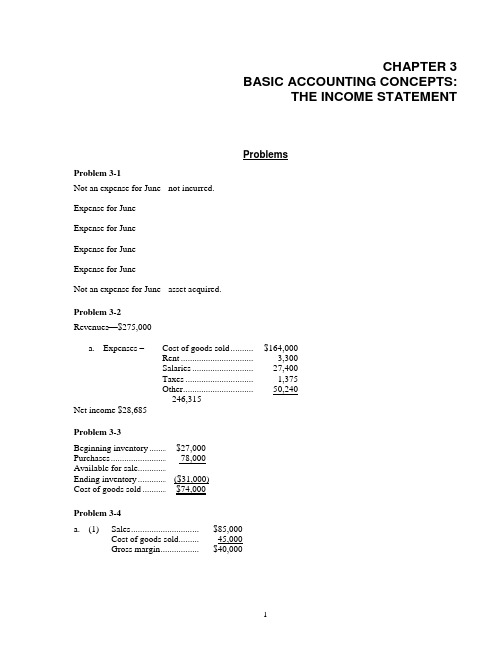

会计学教程与案例财务会计分册第十12版第3章答案

CHAPTER 3BASIC ACCOUNTING CONCEPTS:THE INCOME STATEMENTProblemsProblem 3-1Not an expense for June - not incurred.Expense for JuneExpense for JuneExpense for JuneExpense for JuneNot an expense for June - asset acquired.Problem 3-2Revenues $275,000a.Expenses –Cost of goods sold ...............$164,000Rent .....................................3,300Salaries ................................27,400Taxes ...................................1,375Other ....................................50,240246,315Net income $28,685Problem 3-3Beginning inventory ............$27,000Purchases ............................. 78,000Available for sale .................Ending inventory .................($31,000)Cost of goods sold ...............$74,000Problem 3-4a.(1) Sales ...................................$85,000Cost of goods sold..............45,000Gross margin ......................$40,0001Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/Merchant(2)47 percent gross margin ($40,000 / $85,000)(3)11 percent profit margin (9000/85000)The Woden Corporation had a tax rate of 40 percent ($6,000 / $15,000) on its pretax profit that represented 17.7 percent of its sales ($15,000 / $85,000). The company’s operating expenses were 82.3 percent of sales ($70,000 / $85,000) and its cost of goods sold was 53 percent of sales. The company’s gross margin was 47 percent of sales ($40,000 / $85,000).Problem 3-5Depreciation. Each year for the next 5 years depreciation will be charged to income.No income statement charge. Land is not depreciated.Cost of goods sold. $3,500 charged to current year’s income. $3,500 charged to next year’s income. Subscription expense. $36 charged to current year. $36 charged to next year. Alternatively, $72 charged to current year on grounds $72 is immaterial.Problem 3-6Asset value:October 1, 20X5 $30,000December 31, 20X5 26,250December 31, 20X6 11,250December 31, 20X7 0Expenses:20X5 $3,750 ($1,250 x 3 months)20X6 $15,000 ($1,250 x 12 months)20X7 $11,250 ($1,250 x 9 months)One month’s insurance charge is $1,250 ($30, 000 / 24 months)2©2007 McGraw-Hill/Irwin Chapter 3Problem 3-7QED ELECTRONICS COMPANYIncome Statement for the month of April, ----.Sales ...................................................$33,400Expenses:Bad debts .......................................$ 645Parts ...............................................2,100Interest (880)Wages ............................................10,000Utilities (800)Depreciation ..................................2,700Selling ............................................1,900Administrative ...............................4,700 ______26,925Profit before taxes .............................. 8,075Provision for taxes .............................. 2,800.Net income $6,875Truck purchase has no income statement effect. It is an asset.Sales are recorded as earned, not when cash is received. Bad debt provision of 5 percent related to sales on credit ($33,400 - $20,500) must be recognized. Wages expense is recognized as incurred, not when paid.March’s utility bill is an expense of March when the obligation was incurred.Income tax provision relates to pretax income. Must be matched with related income.Problem 3-8First calculate sales:Sales ($45,000 / (1 - .45)) .................$81,818+Beginning inventory .........................$35,000Purchases ..........................................$40,000Total available ..................................75,000Ending inventory .............................. 30,000Cost of goods sold ............................$45,000Gross margin ....................................$36,818If the gross margin percentage is 45 percent, the cost of goods sold percentage must be 55 percent.Once sales are determined, calculate net income:Net income ($81,818 x .1) $8,1823Accounting: Text and Cases 12e – Instructor’s Manual Anthony/Hawkins/Merchant4Next, prepare balance sheet:Assets LiabilitiesCurrent assets ($50,000 x 1.6) ............................ $ 80,000 Current liabilities .........................$ 50,000 Other assets ($218,182 - $50,000) ................... 138,182 Long term debt 40,000 Total liabilities ............................$ 90,000Owners’ equityBeginning balance .......................$120,000 Plus net income ........................... 8,182 Ending balance ............................$128,182Total assets ..................... $218,182+Total liabilitiesand owners’ equity ......................$218,182+Total assets = Total liabilities and Owner’s equity.Problem 3-9Sales LC 26,666,667 [LC 20,000,000 x (200 / 150)] January cash LC 1,000,000 [LC 500,000 x (200 / 100)] December cash LC 600,000At year-end the company was more liquid in terms of nominal currency (LC 600,000 versus LC 500,000) but in terms of the purchasing power of its cash it was worse off (LC 1,000,000 versus LC 600,000).CasesCase 3-1: Maynard Company (B)Note: This case is unchanged from the Eleventh Edition. Question 1 See below.Question 2This question brings out the difference between cash accounting and accrual accounting. Cash increased by $31,677 whereas net income was $19,635. Explaining the exact difference may be too difficult at this stage, but students should see that:1. The bank loan, a financing transaction, increased cash by $20,865 but did not affect net income.Cash collected on credit sales made last period ($21,798) also increased cash, but did not affect net income this period. (The same is true of the collection of the $11,700 note receivable from Diane Maynard, but it was offset by the payments of the $11,700 dividend to Diane Maynard, the sole shareholder.)©2007 McGraw-Hill/Irwin Chapter 32.MAYNARD COMPANYINCOME STATEMENT, JUNESales ($44,420 cash sales + $26,505 credit sales) .....................$70,925 Less: Cost of sales * ............................................................ 39,345Gross Margin .............................................................................31,580ExpensesWages($5,660+$2,202-$1,974) ..........................................$5,888Utilities (900)Supplies ($5,559+$1,671-$6,630) (600)Insurance($3,150-$2,826) (324)Depreciation ($157,950-$156,000)+($5,928-$5,304) .........2,574Miscellaneous ..................................................................... 135 10,421Income before income tax .........................................................21,159 Income tax expense ($7,224 - $5,700) ................................1,524Net Income ................................................................................19,635 Less: Dividends ................................................................... 11,700Increase in retained earnings .....................................................$ 7,935*Cost of sales:Merchandise purchased for cash .........................................$14,715Merchandise purchased on credit ........................................21,315 [$21,315+($8,517-$8,517)] Inventory, June 1 ................................................................. 29,835Total goods available during June ................................65,865Inventory, June 30 ............................................................... 26,520Cost of Sales .................................................................$39,3453.The purchase of equipment ($23,400) and other assets ($408) decreased cash but did not affectnet income (at least not by this full amount) this period.4.Credit sales made this period ($26,505) increased net income, but did not affect cash.5.Noncash expenses such as depreciation ($2,574) and insurance ($324) decreased net income butdid not affect cash as they relate largely, if not wholly, to cash outflows made for asset acquisition in prior periods. (Exception: such expenses on an entity’s first income statement are not related to prior period expenditures but they will be a much smaller amount than the first accounting period’s expenditures.Question 3(a)$14,715 is incorrect because it is the amount of cash purchases rather than the cost of sales. Thecost of cash purchases and cost of sales amounts would be equal for a period in which all purchases were for cash, and in which the dollar amount of beginning inventory was the same as the dollar amount of ending inventory, since Cost of Sales = Beginning Inventory + Purchases - Ending Inventory.(b)$36,030 is the sum of cash purchases ($14,715) and credit purchases ($21,315). As explainedabove, purchases equal cost of sales for the period only if beginning and ending inventory amounts are the same.5Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/MerchantCase 3-2: Lone Pine Café (B)Note:This case is updated from the Eleventh Edition.ApproachThis case introduces students to preparation of an income statement based on analyzing transactions. At this stage, students are not expected to set up accounts in the formal sense. However, in effect they do so for those income statement items that did not coincide exactly with cash flows.Question 1A suggested income statement as required by Question 1 is shown below. The following notes applyto the income statement.1.The student needs to refer back to Lone Pine Café (A) in order to construct the income statementon the accrual basis. Amounts for sales on credit, purchases on credit, beginning and ending inventory, beginning and ending prepaid operating license, and depreciation expense are to be found there. Specifically:a.Sales revenues = $43,480 cash sales + $870 credit sales to ski instructors = $44,350.b.Food and beverage expense = $2,800 beginning inventory + $10,016 cash purchases + $1,583credit purchases - $2,430 ending inventory = $11,969.2.Since the entity is unincorporated, it is also correct (though less meaningful for evaluativepurposes) to treat the $23,150 partners’ salaries as owners’ drawings. This treatment would result in an income of $12,296 and a decrease in equity (after drawings) of $10,854.LONE PINE CAFE (B)INCOME STATEMENT FOR NOVEMBER 2, 2005, THROUGHMARCH 30, 2006Sales ...........................................................................$ 44,350Expenses:Salaries to partners ................................................$23,150Part-time employee wages .....................................5,480Food and beverage supplies ...................................l1,969Telephone and electricity ......................................3,270Rent expense ..........................................................7,500Depreciation ..........................................................2,445Operating license expense (595)Interest (540)Miscellaneous expenses (255)Total expenses ............................................................55,204(Loss) ..........................................................................$(10,854)6©2007 McGraw-Hill/Irwin Chapter 3Question 2The income statement tells Mrs. Antoine that the partnership has suffered a $10,854 loss for the first five months of operation. This $10,854 loss is the correct figure for evaluative purposes, not the $12,296 income before partners’ salaries. This assumes, of course, that nonowner salaries for the cook and table servers would also have been $23,150, which is questionable. It would appear that Lone Pine Cafe cannot support three partners, even at a bare level of sustenance ($23,150 was only an average of $1,543 per partner/employee per month). Of course the three owner/employees did receive room and board, for which no value has been imputed here.Case 3-3: Dispensers of California, Inc.Note: This is a new case for the Twelfth Edition.ApproachThe case can be used for two class sessions. The first day is devoted to analyzing the accounting transactions, including a preliminary discussion of Hynes’ accounting policy d ecisions. The second class deals with preparing the financial statements and an analysis of how they may change if alternative accounting procedures had been adopted by Hynes.The first class should start with the case Question 1. Its purpose is to give the students a sense of the managerial purpose of profit plans and a context for the later accounting discussions.The use of the asset equals liability plus equity structure to answer Question 2 is recommended so that the instructor can 1) highlight the retained earnings link between net income and the balance sheet 2) illustrate how any accounting transaction can be analyzed using the basic accounting equation and 3) to lay the foundation for the debit-credit framework material in Chapter 4. (At this point in the course debit and credit terminology and analysis should not be used.)Questions 3 and 4 require the preparation of an income statement and balance sheet, respectively. Some instructors prefer to end the first class with a discussion of the balance sheet, including a completed balance sheet. Typically, these instructors want to leave time in the second class to discuss the relationship between net income and the change in cash on the balance sheet.Question 5 is designed to illustrate the role of judgment in accounting for transactions.Answers to QuestionsQuestion 1Profit plans are used for a variety of purposes. These include:▪To force short range planning▪As a basis for evaluating performance and determining compensation.▪To encourage coordination and communication between different organization units and levels.▪As a challenge to improve performance.▪As a means for training managers▪As an early warning system and▪As a guide to spending.7Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/MerchantQuestion 2TN-Exhibit 1 presents an analysis of the planned transactions using the basic accounting equation framework. This analysis follows Hynes’ accounting policy.Question 3TN-Exhibit 2 presents Hynes’ profit plan using the Question 1 transaction analysis.The instructor should expect that most students will not calculate the cost of goods sold figure correctly. The instructor will have to explain that the components of the cost of manufactured goods includes direct materials and their conversion costs, including manufacturing equipment depreciation.The distinction between operating and finance costs in the income statement is another accounting practice most students will miss. Again, the instructor will have to explain this format and its rationale, which is to permit statement users to evaluate how well management has operated the company before considering the impact of their financing decisions.Question 4TN-Exhibit 3 presents the year-end balance sheet using the Question 1 transaction analysis.Equipment is reported net. Most students will follow this presentation. A better presentation is:Equipment (cost) $85,000Accumulated depreciation (8,500)Equipment (net) $76,500The patent is reported net. This is the correct presentation for intangible assets.TN-Exhibit 4 presents a reconciliation of beginning (zero) and ending ($47,500) retained earnings. The instructor may want to share this exhibit with the students. It links the income statement to the balance sheet. It also illustrates that dividends are distributions of capital and not an expense.The instructor should point out to students that many intra period transactions, such as the borrowing and repaying of the bank loan, do not appear on the end of the period balance sheet.Question 5There are three accounting decisions that require Hynes to exercise judgment. They are: ▪Patent valuation▪Patent amortization period▪Equipment depreciation periodStudents might believe Hynes must exercise judgment in the accounting for the redesign and incorporation costs. Under current GAAP this is not the case. Redesign and organization costs must be expensed as incurred.8©2007 McGraw-Hill/Irwin Chapter 3 The patent can not be valued directly. There is no current liquid market for this type of patent. Hynes must value it indirectly. He chose to use the value of the comp any’s equity he received based on the cash paid by the investors for their equity interest to value the patent. This is an acceptable approach.Hopefully, the patent amoralization and depreciation periods represent Hynes’ best estimate of the related asse ts’ useful life (useful to Dispensers of California.)Students should be asked what would be the impact on the balance sheet and income statement if different lives had been used. So that students do not get the impression that differences in judgment are driven by a desire to manage earnings, the instructor should be careful during the discussion to remind the students that different reasonable life estimates can be made by responsible managers acting in good faith.Cash Flow AnalysisIf the instructor wishes to incorporate some aspect of cash flows in the case discussion, TN-Exhibit 5 and 6 present two analysis of cash flows. TN-Exhibit 5 uses a cash receipts and distribution format. TN-Exhibit 6 uses a direct method statement of cash flows format. Instructors should not use the indirect method at this point in the course. It confuses students. Chapter 11 introduces students to indirect method statement of cash flows.9Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/MerchantExhibit 1Dispensers of California, IncBalance Sheet Transaction Analysis* Beginning component parts inventory $0 **Component parts used $197,000Purchases 212,100 Manufacturing payroll 145,000Total available 212,100 Other manufacturing costs 62,000Ending component parts inventory 15,100 Depreciation 8,500Components parts used 197,000 Cost of goods sold 412,50010Exhibit 2Dispensers of California, Inc.12-month Profit PlanSales $598,500Cost of goods soldComponents $197,000Mfg payroll 145,000Other Mfg. 62,000Depreciation 8,500 412,500 Gross margin $186,000Selling, general andAdministration 63,000Patent 20,000Redesign costs 25,000Incorporation costs 2,500Operating profit $75,500Interest 500Profit before taxes $75,000Tax expense 22,500Net Income $52,500Exhibit 3Dispensers of California, Inc.Projected Year-end Balance SheetAssets LiabilitiesCash $78,400 Taxes payable $22,500 Components inventory 15,100 Current liabilities $22,500 Current assets $93,500Equipment (net) 76,500 Owner’s EquityPatent (net) 100,000 Capital stock $200,000___ Retained earnings 47,500$270,000 $270,000Exhibit 4Dispensers of California, Inc.Change in Retained EarningsBeginning retained earnings $0Net income 52,500Dividends (5,000)Ending retained earnings $47,500Exhibit 5Dispensers of California, Inc.Cash ReconciliationReceipts Disbursements New equity capital $80,000Incorporation $2,500Equipment 85,000Redesign 25,000Component parts 212,100Bank loan 30,000Bank loan 30,000Loan interest 500Manufacturing payroll 145,000Other manufacturing 62,000S G & A 63,000Sales 598,500Dividend 5,000Total $708,500 $630,100 Cash ReconciliationReceipts $708,500Disbursements 630,100Ending Balance $78,400Exhibit 6Dispensers of California, Inc.Statement of Cash Flows (Direct Method)Collections from customers $598,500Payments to suppliers (212,100)Payments to employees (295,000)Legal payments (2,500)Interest (500)Operating cash flow $89,400Equipment purchases (85,000)Investing cash flow $(85,000)Bank loan 30,000Repayment of bank loan (30,000)Capital 80,000Dividends (5,000)Financing cash flow $75,000Change in cash $78,400Beginning cash 0Ending cash $78,400Case 3-4: Pinetree MotelNote: This case is updated from the Eleventh Edition.ApproachThis case treats the transition from cash to accrual accounting; also, the inherent difficulties in comparison of data with industry averages are illustrated. The case does not require a full 80 minutes of class time, so I use the final portion of time for review.Comments on QuestionsThe operating statement called for in Question I is shown below. For many terms—e.g., revenues, advertising, depreciation is no difficulty in fitting Pinetree’s account names with the journal’s standard format; but for other items, there are problems:1.Th e Kims’ drawings conceptually should be divided between payroll costs andadministrative/general, since the Kims’apparently perform both operating and administrative tasks.2.Some students may treat replacement of glasses, bed linens, and towels as general expense ratherthan as direct operating expense (although I feel the latter is more appropriate).3.Some students may treat payroll taxes and insurance as a general expense; nevertheless, itproperly is part of payroll costs.Question 2Based on profit as a percent of sales, Pinetree Motel is only about one-third as profitable as the survey average return on sales. The key percentage disparity is on payroll costs, which may reflect two things: (1) the Kims’ tasks could be done by two employees who would work for less than $86,100 a year (which is equivalent to saying the Kims’ drawings reflect both a fair salary and a distribution of entity profits); or (2) the survey data are dominated by motels having twice as many rooms as Pinetree Motel does, thus spreading fixed labor costs over a higher volume (e.g., a motel of 20 units and one of 40 units each needs only one desk clerk). Of course, there is probably a lot of ―noise‖ in the survey data for payroll and administrative/general costs: owner-operators respond ing to the journal’s survey would encounter the same problems as a student does in answering Question 1.PINETREE MOTELOPERATING STATEMENT FOR 2005(in industry trade journal format)Dollars Percentages* Revenues:Room rentals ($236,758- $1,660) .........................................................$235,098 96.8 Other revenue ....................................................................................... 7,703 3.2 Total Revenues ..............................................................................242,801 100.0 Operating Expenses:Payroll costs($86,100+$26,305+$2,894-$795-$84+$1,128+$126) ..........................115,674 47.6 Administrative and general...................................................................——Direct operating expense ($8,800 + $1,660 + $6,820) .........................17,280 7.1 Fees and commissions ..........................................................................——Advertising and promotion($2,335 - $600 + $996) ..............................2,731 1.1 Repairs and maintenance ......................................................................8,980 3.7 Utilities20,767 8.6 ($12,205+$2,789+$5,611-$933-$105-$360+$840+$75+$153+492) .......................................................................................................Total ...............................................................................................165,432 68.1 Fixed expenses:Property taxes, fees ($9,870 - $1,005 + $1,119)...................................9,984 4.1 Insurance ($11,584 - $2,025) ................................................................9,559 3.9 Depreciation .........................................................................................30,280 12.5 Interest ($10,605 - $687 + $579) ..........................................................10,497 4.3 Rent ......................................................................................................——Total ............................................................................................... 60,320 24.8 Profit(pretax) ..............................................................................................$ 17,049 7.1*May not add exactly owing to rounding.As a rough composition that attempts to adjust for the Kims’ (and probably other survey respondents’) dual roles as owners and operators, I suggest adding three accounts:Pinetree AveragePayroll costs .............................47.6 22.5Administrative/general .............— 4.2Profit ......................................... 7.1 20.7Total .........................................54.7 47.4This tends to substantiate the hypothesis that hired employees would perform the Kims’ task for less than $86,100.Pinetree’s other operating costs do not seem to be out of line compared with the survey averages. the higher-than-average utilities may reflect a location with cold winters. Insurance and taxes are essentially uncontrollable. Repairs and maintenance may be below average because the Kims’ personally do some of this work, whereas other motels pay outsiders to do it.Note that both rent and depreciation are shown in the journal’s survey data. This also causes comparison problems. For Pinetree, there is no rent, but the motel buildings are depreciated, whereas for some motels the depreciation would include only furnishings. Adding the rent and depreciation percentages may be more meaningful than working at either one in isolation; but, of course, building depreciation is only a very rough proxy for fair rental value.No final conclusion on the success of their operation can be made as information on the following is lacking:Capital (re: the average) Occupancy rateLocation Seasonality (re: Florida annual season vs. New England)Pricing Efficiency in using their own timeCheck on income calculation:Receipts in 2005 ...........................................................................$244,461Less: 2004 revenue collected ................................................. 1,660Revenues in 2005 .........................................................................$242,801Checks written in 2005 ................................................................196,558Plus: 2005 expenses not paid .......................................................5,508Depreciation .................................................................... 30,280232,346Less: 2004 expenses paid....................................................... 6,594Expenses in 2005 .........................................................................225,752Profit ............................................................................................$ 17,049Case 3-5: National Association of AccountantsNote:This case has been updated since the Eleventh Edition.ApproachThis case describes a typical problem in the management of membership associations and of many other nonprofit organizations. Each year a new governing board is elected and becomes responsible for the operations of the organization for that year. As a general rule, the governing board should so conduct affairs that the organization breaks even financially. If it operates at a deficit, it is eating into resources intended for future members, as suggested in the case. If it operates at a surplus, it is not providing the members with as many services as they are entitled to.Thus, the difference between the concept of income described in the text for business organization and the income concept appropriate for a nonprofit membership organization is that a business organization should earn satisfactory net income, while the membership organization should break even. The measurement of revenues and expenses follows the same principles in both types of organizations (at least with respect to the transactions given in this case.)The case is based, loosely, on experiences of the American Accounting Association, and instructors may wish to refer to the AAA financial statements. The case relates to the ―general fund,‖ which is the portion of the financial statements that reports normal operations. The other columns in these statements can be disregarded. (The NAA is no longer in existence.)In the interest of simplicity, students are not given balance sheets. The case can be made more complicated by assuming a beginning balance sheet, perhaps showing only cash and equity of $55,000 each. Students can then be asked to set up assets and liabilities that result from the transactions described in the case.Answers to QuestionVarious ―correct‖ answers are possible. One set is given in Exhibit A and dis cussed below.1.The grant relates to services to be performed in 2006, so it should not be counted as 2005 revenue.However, the $2,700 already spent must be matched against the grant in some way. This can be done either by subtracting it from 2005 expenses and setting it up as a prepaid asset or, more simply, by transferring $51,300 of the grant to 2006 revenue. The effect on the bottom line is the same. The fact that the president obtained the grant is irrelevant. The principle is to recognize the revenue in the period in which the services are performed. The legal question is probably also irrelevant; the intention was to perform the services in 2006, and that probably would be the governing factor. This is a debatable point, however, because it gives no credit to the 2005 president for the fine work he or she has done in obtaining the grant.2.The desktop publishing system is not an expense of 2005. It will be an expense of future yearsand is therefore an asset on December 31, 2005. Because it was acquired so near the end of the year, there is no need to deal with depreciation. The question can be asked about depreciation in future years, and this raises the question of estimating the future life. Desktop publishing systems are a ―hot‖ item. They are likely t o improve in performance and decrease in price fairly rapidly.The useful life is therefore probably not more than five years. Note that although this is not an expense of 2005, and the 2005 board has created a depreciation cost that will affect the surplus of future boards.。

西财《会计报表分析》教学资料包 课后习题答案 第五章

第五章所有者权益变动表与会计报表附注分析一、复习思考题1.什么是所有者权益变动表?所有者权益变动表的内容有哪些?所有者权益变动表是反映构成所有者权益的各组成部分当期的增减变动情况的报表。

新企业会计准则规定所有者权益变动表至少应单独列示反映下列内容:(1)净利润;(2)直接计入所有者权益的利得和损失项目及其总额;(3)会计政策变更和差错更正的累积影响金额;(4)所有者投入资本和向所有者分配利润等;(5)按照规定提取的盈余公积;(6)实收资本、资本公积、盈余公积、未分配利润的期初和期末余额及其调节情况。

2.阐述所有者权益变动表的结构。

所有者权益变动表应当以矩阵的形式列示,所有者权益变动表属于动态报表,从左到右列示了所有者权益的组成项目,自下而上反映了各项目年初至年末的增减变动过程。

从纵向上看,列示导致所有者权益变动的交易或事项,并根据所有者权益变动的来源对一定时期所有者权益变动情况进行全面反映;从横向上看,按照所有者权益各组成部分(包括实收资本、资本公积、盈余公积、未分配利润和库存股)及其总额列示交易或事项对所有者权益的影响。

从反映的时间看,所有者权益变动表列示两个会计年度所有者权益各项目的变动情况,便于对前后两个会计年度的所有者权益总额和各组成项目进行动态分析;从反映的项目看,所有者权益变动表反映的内容包括:所有者权益各项目本年年初余额的确定、本年度取得的影响所有者权益增减变动的收益和利得或损失、所有者投入或减少资本引起的所有者权益的增减变化、利润分配引起的所有者权益各项目的增减变化、所有者权益内部项目之间的相互转化。

3.什么是会计报表附注?会计报表附注由哪几项构成?会计报表附注是对在资产负债表、利润表、现金流量表和所有者权益变动表等报表中列示项目的文字描述或明细资料,以及对未能在这些报表中列示项目的说明。

其构成:(1)企业的基本情况;(2)财务报表的编制基础;(3)遵循企业会计准则的声明;(4)重要会计政策和会计估计的说明;(5)重要会计政策和会计估计变更以及差错更正的说明;(6)重要报表项目的说明;(7)或有事项的说明;(8)资产负债表日后事项的说明;(9)关联方关系及其交易的说明。

Accounting《会计学:教程与案例》财务会计答案解析 第一章

《会计学:教程与案例》财务会计答案第一章案例一:Case 1-1: Ribbons an’ Bows, Inc.Note: This case is unchanged from the Twelfth Edition.注:本案与第十二版持平。

Approach方法This is an introductory case and it should be taught as an introductory case. There will be plenty of time in the course for the students to learn the correct form of financial statements and details of accounting standards. In short, the instructor should be prepared to allow a variety of formats for the financial statements and tolerate some “not quite correct” accounting.这是一个介绍性案例,应该作为一个介绍性案例来教授。

课程中有足够的时间让学生学习财务报表的正确格式和会计准则的细节。

简言之,教师应准备好允许各种财务报表格式,并容忍一些“不太正确”的会计。

The instructor may want to have students discuss Carmen’s March 31 statement, but the bulk of the class should focus on the three case questions. Any discussion of the March 31 statement should deal with the nature of the various accounts (i.e. prepaid rent is rent paid in advance of using the property and it is an asset because it has future economic benefits for the company, etc), rather than the format of the statement. It is better to leave the beginning of the course’s instruction in financial statement formats to the assigned case question discussions.讲师可能希望学生讨论卡门3月31日的声明,但大部分的课应该集中在三个问题上。

会计信息系统操作案例教程 第05章 总账管理系统日常业务处理

13

第五章 总账管理系统日常业务处理

(一)日记账及资金日报表

1、日记账 日记账通常包括库存现金日记账和银行存款日

记账。出纳欲查询日记账,则库存现金和银行存款 科目必须在“会计科目”功能下的“指定科目”中 预先指定。

2、资金日报表 资金日报表主要用于查询、输出或打印资金日

报表,提供当日借、贷金额合计和余额及发生额的 业务量等信息。

19

第五章 总账管理系统日常业务处理

5、填制凭证的其他功能 生成和调用常用凭证 汇总凭证 查看凭证有关信息

11

第五章 总账管理系统日常业务处理

6、凭证记账

(1)记账

条件——期初余额试算平衡、凭证已审核、上月已经结账。 记账过程——选择记账范围、显示记账报告、自动记账,记账

过程一旦中断系统可自动恢复。

(2)取消记账

操作——执行【期末】/【对账】命令; 按 Ctrl+H 键,激活【恢复记账前状态】功能。 (以账套主管的身份进性操作)

12

第五章 总账管理系统日常业务处理

二、出纳管理

总账系统为出纳人 员提供了一个集成办公 环境,包括支票登记簿 功能,用来登记支票的 领用情况;查询现金日 记账、银行存款日记账 及资金日报表;进行银 行对账,并生成银行存 款余额调节表。

主要任务:

出纳签字 库存现金/银行日记账查询 资金日报 支票登记簿 银行对账

(2)“有痕迹”修改凭证 对象——已记账凭证 修改——红字冲销法或补充更正法

7

第五章 总账管理系统日常业务处理

3、作废和删除凭证 对象——未审核、未签字的凭证。 方法——执行〖作废/恢复〗命令; 对作废凭证进行“整理”即可删除。

注意! 作废凭证不能修改、不能审核 作废凭证应参与记账,否ห้องสมุดไป่ตู้月末无法结账

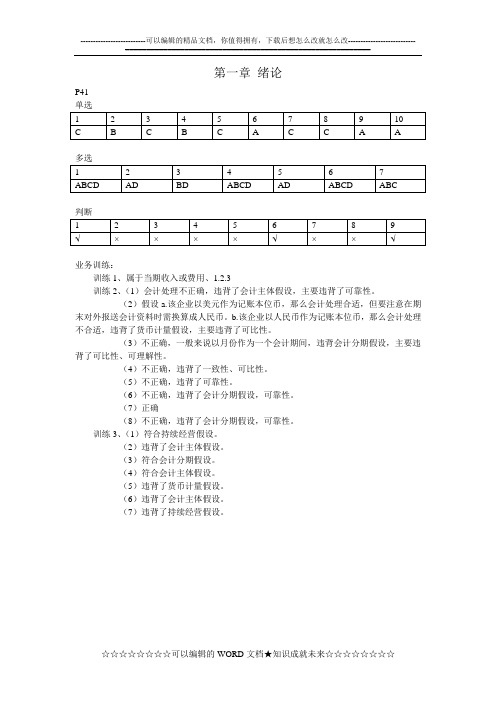

《基础会计学教程与案例》课后习题答案

第一章绪论P41单选多选判断业务训练:训练1、属于当期收入或费用、1.2.3训练2、(1)会计处理不正确,违背了会计主体假设,主要违背了可靠性。

(2)假设a.该企业以美元作为记账本位币,那么会计处理合适,但要注意在期末对外报送会计资料时需换算成人民币。

b.该企业以人民币作为记账本位币,那么会计处理不合适,违背了货币计量假设,主要违背了可比性。

(3)不正确,一般来说以月份作为一个会计期间,违背会计分期假设,主要违背了可比性、可理解性。

(4)不正确,违背了一致性、可比性。

(5)不正确,违背了可靠性。

(6)不正确,违背了会计分期假设,可靠性。

(7)正确(8)不正确,违背了会计分期假设,可靠性。

训练3、(1)符合持续经营假设。

(2)违背了会计主体假设。

(3)符合会计分期假设。

(4)符合会计主体假设。

(5)违背了货币计量假设。

(6)违背了会计主体假设。

(7)违背了持续经营假设。

第二章会计要素、账户与复式记账P81业务训练:训练11.涉及的资产:库存现金银行存款账户性质:资产资产记账方位:借方贷方登记余额: 80000 800002.涉及的资产:原材料银行存款应付账款账户性质:资产资产负债记账方位:借方贷方贷方登记余额: 15000 10000 50003. 涉及的资产:银行存款库存现金应收账款账户性质:资产资产资产记账方位:借方借方贷方登记余额: 10000 500 10500训练2.资料(一)中的1235为负债,因为符合负债的定义,第4笔只是计划,是未来的交易事宜。

资料(二)中的第123笔属于收入。

训练3.训练4.(1)(2)(3)计入“固定资产”→资产类→借方记增加,贷方记减少,余额在借方(4))(5)计入“原材料”→资产类→借方记增加,贷方记减少,余额在借方(6)计入“生产成本”→借方记增加,贷方记减少,余额在借方(7)计入“库存商品”→借方记增加,贷方记减少,余额在借方(8)计入“银行存款”→资产类→借方记增加,贷方记减少,余额在借方。

会计学电子教案(第五章附加补充内容、无考试要求)

4 5 6 7 8

**5+ 4 3我国与西方国家企业收益表的差异

收益表通过一定的格式,将一定营业期间的收入与同期的相关费用进行配比,以 计算出当期净利润。 5+ 4 3 1 改革前我国企业利润表与西方的差异

5+ 4 3 2 改革后我国企业利润表与西方的差异

新准则对利润表规定的重大变化包括:

1

/其他业务收入、主营业务成本/其他业务支出的划分,全部

归类为营业收入与营业成本,相应的“主营业务税金及附加”改为“营业税金”;

2

3

非流动资产处置损益,等等。

• 本附加章要点 •1

费用和销售费用两大类。在销货成本与销货收入进行配比的基础之上,营业 费用与销货收入进行第二步配比,计算得到营业利润。 •2 用已经确认而现金尚未支付,会产生应计费用或称预提费用,在期末资产负 债表中列示为流动负债;现金已经支付而营业费用尚未确认,会产生预付费 用或称待摊费用,在期末资产负债表中列示为流动资产。 •3 税和保险等福利扣款,以及为员工额外支付工薪税。代扣代缴的税金和福利 扣款属于工资费用的一部分,上缴之前作为流动负债列示;工薪税是工资费 用之外的营业费用,按照一定的标准计提并按时上缴。 •4 一项销售费用核算;购货运费分配计入存货成本。如果按照约定由对方承担, 则作为垫付运费在结算购销货款时予以扣除或收回。 •5 定事项的发生或不发生予以证实。企业应根据或有事项发生的可能性大小及 金额的可估计性作出相应的处理。 •6 消费者负担,企业代收代缴。我国销售税主要包括增值税、营业税和消费税 等,其中增值税是价外税,按照销项税额抵扣进项税额之后的差额纳税;营 业税和消费税是价内税,构成企业的费用。企业需缴纳并构成当期损益项目 的税收还包括财产税和所得税。

高教第四版基础会计第5章

● ● ● ●

●

(二)银行存款日记账的设置和登记方法

3.银行存款日记账的登记方法

● ● ● ●

●

(二)银行存款日记账的设置和登记方法

3.银行存款日记账的登记方法

根据有关银行存款的收款 凭证、付款凭证,分别填写 “年、月、日”、“凭证编 号”、“摘要”各栏。

● ● ● ●

●

(二)银行存款日记账的设置和登记方法

格式设置

三栏式明细分类账的格式与总分类账的格式相同,也 使用“借方”、“贷方”、“余额”三栏式账页。三栏式 明细分类账适用于如“应收账款”、“应付账款”、“短 期借款”、“长期借款”等只需要对金额进行核算分析的 经济业务。

登记方法

会计人员应直接根据记载经济业务的收款凭证、付 款凭证、转账凭证及所附原始凭证逐日逐笔进行登记。

● ● ● ●

●

二、账簿登记规则

(二)内容准确、清楚、完整,并标明记账符号 防止 重记、 漏记

二、账簿登记规则

(三)一般用蓝黑墨水笔填写,特殊记账则使用红墨水笔 登记账簿必须使用蓝黑或者碳素墨水书写,不得使用铅 笔或圆珠笔(银行的复写账簿除外)。

● ● ● ●

●

二、账簿登记规则

(三)一般用蓝黑墨水笔填写,特殊记账则使用红墨水笔 红色墨水必须按照规定使用:

处

账簿编号

账簿页数 启用日期

第

本账簿共计 年 月

册 共

页 日 至

册

年 单位公章

月

经管人员 姓 名 接管

日

移交 会计负责人 姓 名 盖章

盖 年月日年月日 章

二、账簿登记规则

(一)登记及时

会计人员必须根据审核无误的会计凭证,及时完成登账工作,不得拖延、 迟办。

财务报表分析与估价 第五章 80页PPT文档

挑战2:义务能够计量吗?

• 环境负债

污染企业未来可能要承担环境整治的 成本,但这些成本的金额存在着众多的不 确定性,如分摊比例,支付时间等,这都会 影响企业对环境负债的确认.

• 产品保修费用

提供产品保修和无偿售后服务的企业 需要在销售产品当期确认一笔能体现未 来所需支付的产品保修和售后服务费用 的负债.这些预计负债的确认必须有合理 的依据,但仍有可能与实际发生额存在着 差距.

项目

长期借款 应付债券 长期应付款

2000 年

金额

结 构(%)

2019 年

增减额

增减 (%)

2000年

2019年

结构变 动

4 433 11330 -6897 -60.87 27.51 29.80 -2.29

0

0

-

--

-

0

0

0

11684 26685 -15001 -56.22 72.49 70.20 2.29

负债分析的重点

• 短期借款用于长期用途: “短贷长投”,短期偿债风险高企。

• 应付账款账期的不正常延长: 资金链可能断裂

• 长期借款用于短期用途: 企业要承担高额的利息负担

• 担保负债和未决诉讼: 企业杀手,在会计上要注意表外披露还是表内披

露. • 举债过度:

资本金不足,长期偿债风险高。

一、短期借款分析

其他应交款 其他应付款 预提费用

3317 4813

332

2319 2734

467

998 43.04 2079 76.04 -135 -28.91

2.98 4.32 0.30

0.97 1.15 0.20

2.01 3.17 0.10

(48学时)会计学原理 第五章

应收账款净额: 应收账款净额:

1 000 000-40 000= 960 000(元) - = (

14 14

会计学原理 5

资产计价与收益决定

3.账龄分析法 账龄分析法

思路:

根据应收账款欠款期的长短确定坏账比例,进而计算 坏账损失数额。 计算公式

不同欠款期限的应收账款余额× 坏账损失数 = ∑不同欠款期限的应收账款余额×相应的坏账率 不同欠款期限的应收账款余额

较准确

17

(三)帐户设置

抵减帐户 借

应收账款

贷

借

坏账准备

贷

发生额

已收回、 已收回、 已冲作坏账

冲抵已认 定收不回 的坏账

坏账准备 的提取数

结余

结余

企业除了应该对应收账款进行总帐核算外, 企业除了应该对应收账款进行总帐核算外,还应该按照债 务人设立应收账款明细帐 务人设立应收账款明细帐 提取坏账准备时, 提取坏账准备时,会计分录为 借:资产减值损失 贷:坏账准备

会计学 第二版 高等教育出版社 第五章课后答案

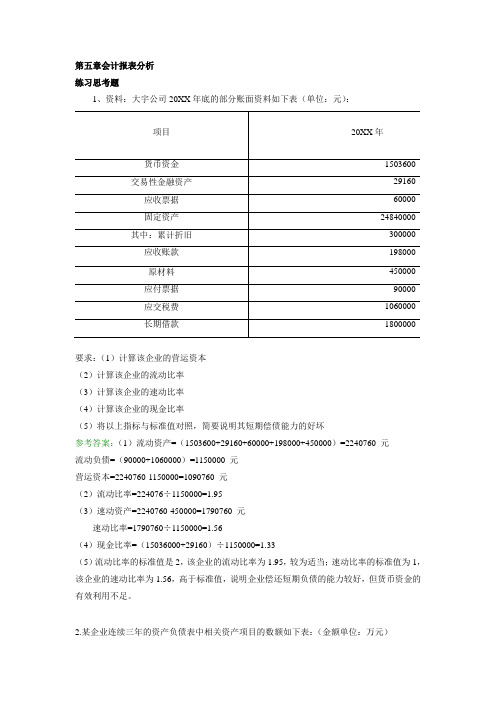

第五章会计报表分析练习思考题1、资料:大宇公司20XX年底的部分账面资料如下表(单位:元):要求:(1)计算该企业的营运资本(2)计算该企业的流动比率(3)计算该企业的速动比率(4)计算该企业的现金比率(5)将以上指标与标准值对照,简要说明其短期偿债能力的好坏参考答案:(1)流动资产=(1503600+29160+60000+198000+450000)=2240760 元流动负债=(90000+1060000)=1150000 元营运资本=2240760-1150000=1090760 元(2)流动比率=224076÷1150000=1.95(3)速动资产=2240760-450000=1790760 元速动比率=1790760÷1150000=1.56(4)现金比率=(15036000+29160)÷1150000=1.33(5)流动比率的标准值是2,该企业的流动比率为1.95,较为适当;速动比率的标准值为1,该企业的速动比率为1.56,高于标准值,说明企业偿还短期负债的能力较好,但货币资金的有效利用不足。

2.某企业连续三年的资产负债表中相关资产项目的数额如下表:(金额单位:万元)已知20XX年主营业务收入额为10465万元,比20XX年增长了15%,其主营业务成本为8176万元,比20XX年增长了12%。

试计算并分析。

(1)企业20XX年和20XX年的应收账款周转率,成本基础计算的存货周转率,流动资产周转率,固定资产周转率,总资产周转率。

(2)对该企业的资产运用效率进行评价。

参考答案:根据题意得20XX年主营业务收入=10465÷(1+15%)=9100万元20XX年主营业务成本=8176÷(1+12%)=7300万元20XX年:应收账款周转率=9100÷(1028+944)×2=9.23存货周转率(成本基础)=7300÷(928+1060)×2=7.34流动资产周转率=9100÷(2680+2200)×2=3.73固定资产周转率=9100÷(3340+3800)×2=2.55总资产周转率=9100÷(8800+8060)×2=1.0820XX年:应收账款周转率=10465÷(1028+1140)×2=9.65存货周转率(成本基础)=8176÷(928+1070)×2=8.18流动资产周转率=10465÷(2680+2680)×2=3.91固定资产周转率=10465÷(3340+3500)×2=3.06总资产周转率=10465÷(8920+8060)×2=1.23评价:综合来看,20XX年由于销售收入上升较快,使得各项资产周转率均好于20XX年,主要是因为主营业务收入上升的比例高于资产占用上升的比例。

会计报表分析实战指南

会计报表分析实战指南第1章会计报表分析基础 (4)1.1 会计报表的种类与作用 (4)1.2 会计报表分析的方法与步骤 (4)1.3 会计政策与会计估计对报表分析的影响 (5)第2章资产负债表分析 (5)2.1 资产负债表结构分析 (5)2.1.1 资产负债表的基本构成 (5)2.1.2 资产负债表的格式 (5)2.2 资产项目分析 (5)2.2.1 流动资产分析 (5)2.2.2 非流动资产分析 (6)2.3 负债及所有者权益项目分析 (6)2.3.1 流动负债分析 (6)2.3.2 长期负债分析 (6)2.3.3 所有者权益分析 (6)第3章利润表分析 (6)3.1 利润表结构分析 (6)3.1.1 营业收入分析 (6)3.1.2 营业成本与费用分析 (6)3.1.3 利润构成分析 (6)3.2 收入分析 (7)3.2.1 收入增长率分析 (7)3.2.2 收入结构分析 (7)3.2.3 收入质量分析 (7)3.3 费用与成本分析 (7)3.3.1 成本结构分析 (7)3.3.2 费用分析 (7)3.3.3 成本费用利润率分析 (7)3.4 利润质量分析 (7)3.4.1 利润现金含量分析 (7)3.4.2 利润构成分析 (8)3.4.3 会计政策与估计分析 (8)第4章现金流量表分析 (8)4.1 现金流量表结构分析 (8)4.1.1 现金流量表基本结构 (8)4.1.2 现金流量表项目分析 (8)4.2 经营活动现金流量分析 (8)4.2.1 销售收入分析 (8)4.2.2 利润质量分析 (8)4.2.3 现金流量构成分析 (9)4.3 投资活动现金流量分析 (9)4.3.2 资本支出分析 (9)4.3.3 投资活动现金流量趋势分析 (9)4.4 筹资活动现金流量分析 (9)4.4.1 债务融资分析 (9)4.4.2 股权融资分析 (9)4.4.3 现金分红分析 (9)第5章财务比率分析 (9)5.1 偿债能力分析 (9)5.1.1 短期偿债能力分析 (10)5.1.2 长期偿债能力分析 (10)5.2 营运能力分析 (10)5.2.1 存货周转率:销售成本/平均存货,反映企业存货的周转速度。

《会计学_教程和案例》财务会计答案与解析solutiontoAccounting_textandcases_Financialaccouting

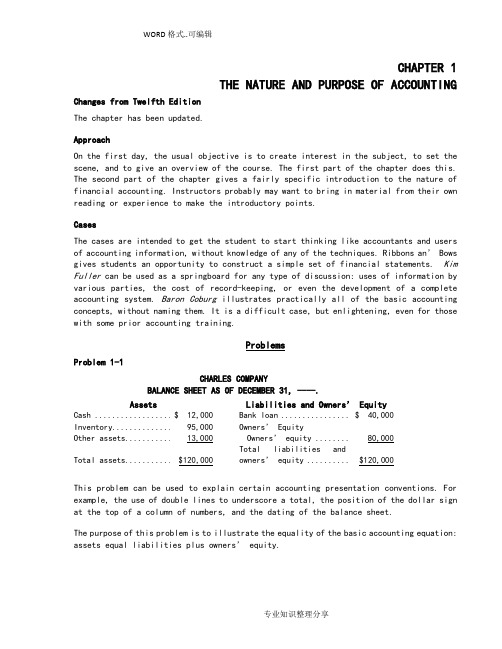

CHAPTER 1THE NATURE AND PURPOSE OF ACCOUNTING Changes from Twelfth EditionThe chapter has been updated.ApproachOn the first day, the usual objective is to create interest in the subject, to set the scene, and to give an overview of the course. The first part of the chapter does this. The second part of the chapter gives a fairly specific introduction to the nature of financial accounting. Instructors probably may want to bring in material from their own reading or experience to make the introductory points.CasesThe cases are intended to get the student to start thinking like accountants and users of accounting information, without knowledge of any of the techniques. Ribbons an’ B ows gives students an opportunity to construct a simple set of financial statements. Kim Fuller can be used as a springboard for any type of discussion: uses of information by various parties, the cost of record-keeping, or even the development of a complete accounting system. Baron Coburg illustrates practically all of the basic accounting concepts, without naming them. It is a difficult case, but enlightening, even for those with some prior accounting training.ProblemsProblem 1-1CHARLES COMPANYBALANCE SHEET AS OF DECEMBER 31, ----.Assets Liabilities and Owners’ EquityCash ....................$ 12,000 Bank loan ..................$ 40,000 Inventory................95,000 Owners’ EquityOther assets .............13,000 Owners’ equity ..........80,000Total assets .............$120,000 Total liabilities andowners’ equity ............$120,000This problem can be used to explain certain accounting presentation conventions. For example, the use of double lines to underscore a total, the position of the dollar sign at the top of a column of numbers, and the dating of the balance sheet.The purpose of this problem is to illustrate the equality of the basic accounting equation: assets equal liabilities plus owners’ equity.Problem 1-2The missing numbers are:Year 1Noncurrent assets ...................$410,976Noncurrent liabilities ..............240,518Year 2Current assets ......................$ 90,442Total assets ........................288,456Noncurrent liabilities ..............78,585Year 3Total assets ........................$247,135Current liabilities .................15,583247,135Total liabilities and owners’equity ..............................Year 4Current assets ......................$ 69,09Current liabilities .................17,539The basic accounting equation isAssets = Liabilities + Owners’ equityThe instructor might want to explain how this equation is used (as it is in this problem) to calculate “plug” numbers when managers construct projected balance sheets. The manager does not have to complete every balance because the manager can plug certain balances.The instructor may also draw attention to the other equations illustrated in the problem. These include:Current assets + Noncurrent assets = Total assetsCurrent liabilities + Noncurrent liabilities = Total liabilitiesPaid-in capital + Retained earnings = Owners’ equity.Later in the course the instructor should explain that the additional paid-in capital account is a special account to record the excess of capital received over par value in common stock issuances. At this stage in the course it is better to simply use adescriptive term, like paid-in capital, to describe capital received from stockholders. Also it avoids the use of the term common stock, which some students many not understand.Problem 1-3The missing numbers are:Year 1Gross margin ........................$9,000Tax expense .........................1,120Year 2Sales ...............................$11,968Profit before taxes .................2,547Year 3Cost of goods sold ..................$2,886Other expenses ......................6,296Other accounting equations such as the following are also illustrated by this problem:Gross margin = Sales - Cost of goods soldProfit before taxes = Gross margin - Other expensesNet income = Profit before taxes - Tax expenseThe instructor may want to point out to the students that ratios are often used by managers to construct projected financial statements. Year 4 is an example of this application.In order to estimate Year 4, the key ratios to compute are:Year 1 Year 2 Year 3 AverageSales ............ 100.0% 100.0% 100.0% 100.0%Gross margin ..... 75.0 75.0 75.0 75.0%Profit beforetaxes ............ 23.3 21.3 20.5 21.7%Net income ....... 14.0 12.8 12.2 13.0%Tax rate ......... 40.0 40.0 40.0 40.0Year 4Sales ...............................$10,000Cost of goods sold ..................2,500Gross margin (75% of sales) .........$ 7,500Other expenses ......................5,330Profit before taxes (21.7% of $ 2,170sales) ..............................Tax expense (870)Net income (13% of sales) ...........$ 1,300The basic accounting equation used is: Net income = Revenues – ExpensesProblem 1-4The explanation of these 11 transactions is:1.Owners invest $20,000 of equity capital in Acme Consulting.2.Equipment costing $7,000 is purchased for $5,000 cash and an account payable of $2,000.3.Supplies inventory costing $1,000 is bought for cash.4.Salaries of $4,500 are paid in cash.5.Revenues of $10,000 are earned, of which $5,000 has been recovered in cash. Theremaining $5,000 is owed to the company by its customers.6.Accounts payable of $1,500 are paid in cash.7.Customers pay $1,000 of the $5,000 they owe the company.8.Rent Expense of $750 is paid in cash.9.Utilities of $500 are paid in cash.10.A $200 travel expense has been incurred but not yet paid.11.Supplies inventory costing $200 are consumed.ACME CONSULTINGBALANCE SHEET AS OF JULY 31, ----.Assets Liabilities and Owners’EquityCash ..........................$12,750 Accounts payable ..............$ 700 Accounts receivable ...........4,000Supplies inventory ............800______ Current assets .............17,550 Current liabilities .. (700)Equipment .....................7,000 Owners’ equity...............23,850Total assets ..................$24,550 Total liabilitiesand owners’ equity...........$24,550ACME CONSULTINGINCOME STATEMENT JULY 1 - 31, ----.Revenues ...............................$10,000Expenses 不包含cost of good sales?Salaries .............................4,500Rent (750)Utilities (500)Travel (200)Supplies ............................. 200 6,150Net income ........................$ 3,850ACME CONSULTINGCASH RECEIPTS AND DISBURSEMENTS, JULY 1 - 31, ----.ReceiptsOwners’ investment..................$20,000Cash sales ...........................5,000Collection of accounts receivable .... 1,000Total receipts ....................$26,000DisbursementsEquipment purchase ...................$5,000Supplies purchase .................... 1,000Salaries paid ........................4,500Payments to vendors ..................1,500Rent paid (750)Utilities paid (500)Total disbursements ...............$13,250Increase in cash ..................$12,750The change in this cash account includes the owners’ investment, which is not an income statement item. The income statement includes revenues and expenses that have not yet been received in cash or paid in cash. The cash paid to purchase the equipment is not reflected in the income statement. (It is probably best if the instructor does not discuss depreciation at this point in the course.)This problem illustrates several important points that managers should understand. These are:a.Every transaction involves at least two accounts. income is not equivalent to the net change in the cash account during an accountingperiod.c.Cash is influenced by both balance sheet and income statement events.d.The basic accounting equation (Assets = Liabilities + Owners’ equity) can be usedto capture, illustrate, and explain the accounting consequences of many (but not all) transactions and events that involve a company.The cash receipts - disbursements display is used since it would be premature to introduce the cash flow statement display at this point in the course.Problem 1-5Cash + AccountsReceivable+SuppliesInventory + Equipment =AccountsPayable +Owners’Equity1. +$25,000+$25,000Investment2. -500- 500Rent3. +$8,000+ $8,0004. -500+ $5005. -750-750Advertising6. -3,000-3,000Salaries7. +2,000+$8,000+10,000Commissions8. -5,000- 5,0009. -100- 10010. +1,000-1,000ExpensesBON VOYAGE TRAVELBALANCE SHEET AS OF JUNE 30, ----.Assets Liabilities and Owners’ Equity Cash ......................$17,250 Accounts payable ..........$ 4,000 Accounts receivable .......8,000 Current liabilities ....4,000 Supplies inventory ........400 Owners’ equity...........29,650 Current assets .........25,650Equipment .................$ 8,00______Total Assets .........$33,650 Total liabilitiesand owners’equity$33,650BON VOYAGE TRAVELINCOME STATEMENT JUNE 1-30, ----. Commissions .......................$10,000 Expenses ..........................Rent ............................$500Advertising (750)Salaries ........................3,000Supplies (100)Misc. Expenses ..................1,0005,350 Net Income ...................$ 4,650BON VOYAGE TRAVELCASH RECEIPTS AND DISBURSEMENTS JUNE 1-30, ----.ReceiptsOwners’ investment..........................$25,000Collection of commissions ....................2,000Total receipts ............................$27,000DisbursementsPaid rent ....................................$ 500Bought supplies (500)Bought advertising (750)Paid salaries ................................3,000Paid vendors .................................5,000Total disbursements .......................$ 9,75Increase in cash ............................$17,250See Problem 1-4 for why change in cash account and the month’s income are not the same. The problem’s purpose and lessons for managers are similar to those in Problem 1-4.Case 1-1: Ribbons an’ Bows, Inc.Note: This case is unchanged from the Twelfth Edition.ApproachThis is an introductory case and it should be taught as an introductory case. There will be plenty of time in the course for the students to learn the correct form of financial statements and details of accounting standards. In short, the instructor should be prepared to allow a variety of formats for the financial statements and tolerate some “not quite correct” accounting.The instructor may want to have students discuss Carmen’s March 31 statement, but the bulk of the class should focus on the three case questions. Any discussion of the March 31 statement should deal with the nature of the various accounts (i.e. prepaid rent is rent paid in advance of using the property and it is an asset because it has future economic benefits for the company, etc), rather than the format of the statement. It is better to leave the beginning of the course’s instruction in financial statement formats to the assigned case question discussions.Comments on Information Gathered and Carmen’s Concerns1.The three month sales total is the sum of the cash sales ($7,400) and credit sales ($320).2.Cost of sales is derived from the following equationBeginning merchandise inventory $3,300Plus Purchases 2,900Equals Total available merchandise $6,200Less Ending merchandise inventory 4,100Equals Cost of sales $2,1003.4.Part-time employee expenses ($1600) is the sum of cash paid ($1510) plus amount owed($90).5.Supplies expense ($80) is beginning supplies inventory ($100) less supplies inventoryon hand on March 31 ($20).6.The prepaid advertising ($150) was run by the local paper on April 2. The benefit ofthe asset expired so the asset became an expense.7.The commercial sewing machine purchase led to an $1800 asset being recorded (a futurebenefit). The asset’s benefit was partly consumed during May and June resulting ina $60 depreciation charge ($1800/ 5 years/ 12 months x 2 months – straight linedepreciation.)8.Some of the future benefits of the computer and related software asset were consumedduring the three month period. A $250 depreciation charge must be recognized ($2000/ 2/ 12/ x 3 – straight line depreciation.)9.Cash balance at the end of period lower than beginning balance. See Question 1discussion.10.Four month’s interest must be recorded on the cousins’ $10,000 loan. ($10,000 x .06x 4/ 12). Carmen has “rented” the cousins’ money for four months. (She forgot toinclude the March rent in her March 31 balance sheet.)12.No depreciation is recorded on the cash register loaned by the local credit-card chargeprocessor and the furniture left by the former tenant. These “assets” were not recognized on the financial statement because they were neither donated nor acquired in business transactions.13.The uncle’s legal work is neither an asset nor an expense of the business. It didnot result in a business transaction.14.Carmen’s potential salary payment in July is neither an expense nor a liability asof March 31. The company does not have an obligation on March 31 to pay her any compensation.Question 1Exhibit 1 presents the company’s initial three month income statement. It does not contain a provision for taxes, since Carmen at this early date did not know if income taxes would be due on the annual results.The principal reasons why the cash balance declined during the three month profitable operating period are:1.The commercial sewing machine purchase reduced cash by $1,800 while the relateddepreciation charge only reduced income by $90.2.Ending inventory was higher than beginning inventory and the increase was paidfor with cash. That is, more inventory was bought for cash ($2,900) than thecost of goods sold ($2,100).Exhibit 2 present a cash flow analysis for the three month operating period.Question 2Exhibit 3 presents the company’s June 30 balance sheet.Question 3Carmen’s business is off to a good start, but it will have to do better over the rest of the year if Carmen plans to pay herself any meaningful compensations and repay the cousins’ loan at the end of the year.When discussing Question 3 some students believe that Carmen should include a consideration of an imputed compensation expense in deciding how well she has done. Students accept the non recognition of her compensation in the income statement, but believe she should recognize that personally she has incurred an opportunity cost for lost wages (at least four months x $1300).In addition, students believe Carmen’s nonrecognition of any cost associated with using the abandoned counters and display equipment overstates how well she is doing from an economic point of view. These students would include some depreciation cost based on the asset’s fair value in their evaluation of how “successful” the business has been to date.Some students advocate including the free legal advice’s value ($600) in their assessment of the company’s success to date.The instructor may challenge the class to consider why these items (free legal advice, imputed salary and depreciation) are not included in the company’s income statement.Exhibit 1Ribbons an’ BowsIncome Statement for the PeriodApril 1 to June 30, 2010Sales $7,720Cost of Sales (2,100)Gross Margin $5,620Employee wages (1,600)Rent (1,800)Office Supplies (80)Depreciation – Computer (250)Depreciation – Sewing Machine (60)Interest (200)Advertising (150)Profit before Taxes $1,480Exhibit 2Ribbons an’ BowsAnalysis of Cash Flows for the PeriodApril 1 to June 30, 2010Beginning Cash $4,000Sales 7,400Wages (1,510)Rent (1,800)Merchandise Inventory (2,900)Sewing Machine (1,800)Ending Cash $3,390Exhibit 3Ribbons an’ BowsBalance Sheet as of June 30, 2010Assets LiabilitiesCash $3,390 Wages owed $90Accounts receivable 320 Interest owed 200Merchandise Inventory 4,100 Cousins’ loan 10,000Supplies 20 $10,290Prepaid rent 1,200 Owner’s EquityComputer (net) 1,750 Carmen’s equity $1,000Sewing machine (net) 1,740 Earnings 1,480Cash register deposit 250 $2,480Total $12,770 Total $12,770Case 1-2: Kim FullerNote 1: This case is updated from the Kim Fuller case in the Twelfth Edition.Note 2: The instructor should be aware that the name, Kim Fuller, could refer either toa male or a female. The case uses no pronouns that indicate gender to refer toKim Fuller; the gender of Kim Fuller has been left open to interpretation by the students and/or the instructor.ApproachThis case is not, as it may appear to be, an “armchair” case. It is a real situation-the case writer is one of “Kim Fuller’s” (disguised name) sisters who invested in the business. The intent of the case is to get students to begin thinking about the financial information needs of a business and what kinds of underlying records must be maintained in order to support those needs. Some instructors may even wish to discuss the nature of the required source documents, since we often tend to ignore that important matter in accounting courses. Finally, the case can be used to begin introducing at an intuitive level some of the 11 basic concepts that will be presented in Chapters 2 and 3.Comments on QuestionsAn opening question might be, “What information does Kim Fuller need to maintain in order to operate this business?” Then, as students begin to identify information needed, the instructor can press for, “Who needs that information? What do they need it for?” The information needed, as well as the users and uses can be recorded on the blackboard. The diagram in Illustration 1-1 of the text can be used to summarize for students the variety of information and purposes they have identified. As suggested in the text, this information includes such things as detailed payroll records for Fuller’s employees, records of deliveries (which are sales) to Fuller’s customer and former employer, the chemical firm, and the amounts owed for these sales, records concerning purchases of used plastic bottles and the amounts owed to the sources of these bottles, checkbook records, records of the costs of the items of plant and equipment owned by the business, records of the business’s mortgage payments and balance, and records of who the firm’s owners are and the amount of each one’s ownership interests.By this point in the discussion, you will likely have developed a long list of information items that are required. I like to point out that we need some way of organizing this massive amount of information. The financial framework-especially the balance sheet and the income statement-provides a convenient way to organize much, but not all, of this information. As students list the company’s information needs, they shou ld classify it as either accounting or non-accounting information.This leads naturally to a discussion of which information would appear in balance sheet accounts (Question 2), which in turn provides an opportunity to introduce the entity, money measurement, cost, going concern, and dual aspect concepts (all described formally in Chapter 2). The amount of time spent on this discussion can be varied greatly at the discretion of the instructor: if assigned for a first session, the usual first-day “housekeeping” announcements will necessarily cause this discussion to be brief; if used on Day 2 of the course, the case can readily generate 60-80 minutes of discussion, if students are pressed to be specific in their recommendations.The balance sheet called for in Question 2 might look like this:Assets Liabilities and Owners’EquityCash ...................$ 50,000 Mortgage .............$112,00Equipment ..............65,000 Total paid-incapital ..............165,000Building ...............162,000__ _____$277,000 $277,00Question 3 provides the opportunity to introduce the time period, matching, and materiality concepts, although some of the basic concepts in Chapter 3 may be too difficult to introduce at this point (e.g., conservatism). It may also be possible to introduce the distinction between product costs and period costs. Question 3 together with Question 4 also naturally leads to the distinction between financial accounting and management accounting. With onlya few family members as owners, and with the bank’s mortgage on the building well secured(b y definition), the company’s financial reporting requirements are rather minimal. Indeed family-owned businesses of this small size and simplicity often prepare annual financial statements for tax purposes, and then distribute these same statements to the family owners and bank. However, Fuller would be well advised to have income statements—and probably also cash flow statements—prepared at least quarterly, and perhaps monthly, to help ensure that the business is not slipping into any financial holes. These would be management accounting reports, but they may, of course, be shared with the investors. (The Small Business Administration periodically reports that poor management accounting records, particularly inadequate records of product/production costs, are a major cause of small business failures). Ultimately, Fuller will have to judge the extent of the need (and cost justification) for preparation of formal management accounting reports to supplement Fuller’s personal observation of the business. Of cour se, the problem encountered by many businesses is that reports are not introduced as the business grows and becomes too complex to be managed primarily by the personal observation of its owner-founder-general manager, and this person slowly—often, unwittingly—loses control of the business.In sum, students should glean from their discussion of this case the idea that there are some accounting “universals”; but at the same time, the accounting records of a firm should fit its particular situation, not vice versa. This is true whether the firm is starting with an entirely manual accounting system, or whether it is purchasing some “off-the-shelf” accounting software for use on a personal or small business computer.Case 1-3: Baron CoburgNote: This case is unch anged from the Twelfth Edition. It is adapted from an “academic note,” written by W.T. Andrews of Guilford College, which appeared in the April 1974 Accounting Review. Parts of this commentary are adapted from Professor Andrews’s note.ApproachThis case enables a student to discover a number of important accounting concepts that are described in detail in Chapters 2 and 3. The students also discover intuitively—and of necessity—the relationship between two balance sheet “snapshots” and the income statement for the intervening period. In general, the case illustrates the usefulness of the accounting function: It would be almost impossible to compare the two performances without the logical structure of accounting.Some instructors will prefer to have students read and briefly discuss this case near the end of one class, identifying the basic problems of the case—what measurement unit isto be used, what the entities are and who their owner(s) is (are), what a balance sheet shows, what an income statement shows, and how relative performance might be measured. Then the next class can be devoted to discussing proposed statements. Other instructors will prefer to assign the case without any suggestions as to how a student should attack the problem. (I personally favor the latter approach, whereas Professor Andrews suggests the former.) I find that the case works well not only with beginning students, but also in management development programs where there are several experienced accountants in the group.Comments on QuestionsThe first issue confronted by the students is the definition of the entity. As Question 1 implies, each plot can be regarded as an entity, even though both plots are owned by the Baron. (Students should realize this earlier because the Baron is referred to as a “landlord,” or because they recall something about feudalism from a medieval history course.) The definition of separate entities is needed in order to compare their economic results.The second matter students must resolve is the basis of measurement. Although this is referred to as the money measurement concept in Chapter 2, this case illustrates that a barter-equivalent measurement unit—here, bushels of wheat—could also be used as a common denominator to value unlike things; a monetary unit is simply easier to use in most instances.Third, students must decide the basis of valuation. This issue arises most clearly in the case of the land, which is said to be “worth” five bushels of wheat per acre. At this early stage, most students will value the land at this amount per acre; but Chapter 2 will explain that assets are usually valued at acquisition cost, not current value. Of course, the acquisition cost is indeterminable in this instance, so the Baron’s appraisal is the only available valuation basis. Similar comments apply to the oxen.At this point, development of the balance sheet can begin. I find it useful to develop an intuitive concept of an asset, and then say that as each asset is valued, we will also record who provided the financing for the asset, and who, therefore, has a claim (equity) against the entity’s assets. This leads to the beginning balance sheets for the farms, as shown below.Note that I have not called the Plot worked by Ivan “Ivan’s Plot,” because that might suggest to a student that Ivan owns the Plot. Also, the balance sheet status report must show the date at which the status “snapshot” was taken. Since the Baron has given (i.e., contributed) the assets, all of the equities are his. I have not included the plows, assuming that the “snapshots” were taken as the farmers left the castle. It is useful, even if no student raises the question, to ask how the balance sheets would differ if the “snapshots” were taken after a plow had been acquired for each farm.BALANCE SHEET FOR PLOT WORKED BY IVANAs of the Beginning of the Growing SeasonAssets EquitiesSeed (20)bu. Baron’s equity (162)bu.Fertilizer (2)Ox (40)Land (100)Total ........................162 Total (162)BALANCE SHEET FOR PLOT WORKED BY FREDERICKAs of the Beginning of the Growing Season Assets EquitiesSeed ..............................10bu. Baron’s equity (101)bu.Fertilizer (1)Ox (40)Land (50)Total .......................101 Total . (101)BALANCE SHEET FOR PLOT WORKED BY IVANAs of the End of the Growing Season Assets EquitiesOx (36)bu. Payable to Feyador (3)bu.Land ..............................100 Baron’s equity:Wheat .............................223 Contributed capital .. (162)Plow .............................. 0 Retained earnings . (194)Total .............................359 Total . (359)BALANCE SHEET FOR PLOT WORKED BY FREDERICKAs of the End of the Growing SeasonAssets EquitiesOx (36)bu.Land .............................. 50 Baron’s equity:Wheat .............................105 Contributed capital .. (101)bu.Plow .............................. 2 Retained earnings . (92)Total .......................193 Total . (193)Next, the ending balance sheets can be prepared. This will raise the notion of depreciation. Most students will intuit the write-down of each ox from 40 bushels to 36 bushels, since each has a useful life of 10 years. The broken down plow used by Ivan will be more troublesome, especially since it hasn’t been paid for. I ask students to ignore for the moment how this plow was financed; does the plow have any further value to the farm? They then see that it should be valued at zero, though it’s not a bad idea to show it on the balance sheet, since it has not yet been disposed of. The plow used by Frederick is treated analogously to the oxen.On the equities side, the three bushels owed to Feyador introduce the concept of a liability and raise the distinction b etween a liability and owners’ equity. Presumably, Ivan has incurred this liability as the Baron’s agent; i.e., it is the entity’s obligation, not a personal debt of Ivan. We also can distinguish between the Baron’s initial equity, now labeled “contributed capital,” and the earnings thus far retained on the farm (“in the entity’’). At this stage, I introduce the dual aspect concept and treat retained earnings as a “plug” (i.e., balancing) amount. This gives the ending balance sheets that appear on page 13 of this manual.Next, I suggest we try to explain why the Baron’s equity (specifically, retained earnings) increased by 194 bushels and 92 bushels for the respective farms. Thus, students see at。

会计学原理课后笔记整理第五章

第三节:会计凭证的填制和审核

一、 原始凭证的填制与审核 (一) 原始凭证的基本要素 1. 都要说明每一项经济业务的具体发生和完成情况。都要明确经办单位,人 员以及其他相关单位的经济责任。 1) 原始凭证的名称 2) 填制原始凭证的日期。单位或个人。 3) 接受凭证单位的名称,抬头。 4) 经济业务的内容,数量,单价,金额。 5) 经办人员的签字或盖章。

时间:2009.12 讲述人:杨家亲 主题: 。会计凭证

地点:5DM31,41 Note 笔 记 记录人:鲁晓栋

本章提要:

1. 2. 3. 4. 5. 6. 7. 8. 会计凭证是用来记录经济业务,明确经济责任并以登记账簿的书面证明。会计凭证主要分为 原始凭证和记账凭证两大类 原始凭证是:在经济业务发生时直接取得或填制的,用以证明经济业务的发生或完成情况, 并作为记账原始依据的书面证明。具有法律效力。 原始凭证按其来源不同分:自制凭证和外来凭证。 按其编制方法不同分:一次凭证、累计凭证、汇总原始凭证 记账凭证是:由会计人员根据审核无误的原始凭证或原始凭证汇总表填制的,用以记载经济 业务简要内容、明确会计分录的书面证明。 记账凭证按其用途分为:专用凭证和通用凭证。 编制方法不同分为:单式记账凭证和复式记账凭证。 是否经过汇总,分为汇总记账凭证和非汇总记账凭证。

(二)

第四节:会计凭证的传递和保管

一、 二、 1. 2. 3. 会计凭证的传递 会计凭证的保管 定期装订成册 及时归档保管 办理概念和作用

会计凭证的三个环节: “凭证—账簿—报表” ,填制和审核会计凭证是会计循环中的起 点,是会计核算的重要载体之一,是会计核算的专门方法之一。 一、 会计凭证的概念 1. 会计凭证简称凭证,是记录经济业务,明确经济责任的书面证明,是登记账簿的 依据。 2. 会计核算必须遵循真实性原则 二、 1. 2. 3. 4. 会计凭证的作用 客观反映 严格监督 明确责任 记账依据

《会计核算基础》课件 第五章 会计报表

荆州职业技术学院会计核算基础课程教案第五章会计报表第一节编制会计报表的意义与要求一、编制会计报表的意义1、概念会计报表是综合反映企业某一特定日期的资产、负债和所有者权益状况,以及某一特定时期的经营成果和现金流量情况的书面文件。

它是企业根据日常的会计核算资料归集、加工和汇总后形成的,是企业会计核算的最终成果。

2、作用会计报表的基本作用是:报表使用者通过阅读会计报表,可以了解会计报表编报单位的有关经济信息。

二、编制会计报表的要求1、会计报表的数字必须真实、准确。

2、会计报表的指标,口径必须统一可比性原则介绍一致性原则3、会计报表的编制和报送必须及时(介绍及时性原则)4、会计报表的编制必须清晰明了(介绍清晰性原则)5、会计报表的内容必须完整另外,还要求编制会计报表前,必须做好一系列的准备工作:完整入帐,清查资产,清理核对账目,认真对帐和结帐,试算平衡等。

第二节资产负债表的编制一、资产负债表的意义(一)资产负债表的含义及反映的经济内容1、含义:资产负债表是反映企业某一特定日期财务状况的静态报表。

2、资产负债表反映的经济内容是企业的财务状况,通常表现为:(1)资产状况(2)权益状况(3)偿债能力(二)资产负债表的理论依据“资产=负债+所有者权益”等式所包含的经济内容和数学上的等量关系,是建立资产负债表的理论依据。

(三)资产负债表的作用1、可以反映企业的资产及其分布状况2、可以反映企业的负债及所有者权益状况3、可以通过分析比较,揭示企业的偿债能力4、可以与上期的比较,揭示企业财务状况的变动趋势二、资产负债表的基本结构表头帐户式(我国采用的)整体框架正表分报告式附注(补充资料)图表样例见课本课后小结:本次课的学习,要求能熟悉会计报表的几个编制要求,熟悉资产负债表的基本结构。

荆州职业技术学院会计核算基础课程教案第二节资产负债表的编制三、资产负债表的编制方法(一)资产负债表的编制,是指会计人员在规定的资产负债表的格式和栏目内,填列各有关具体项目金额的一项会计核算工作。

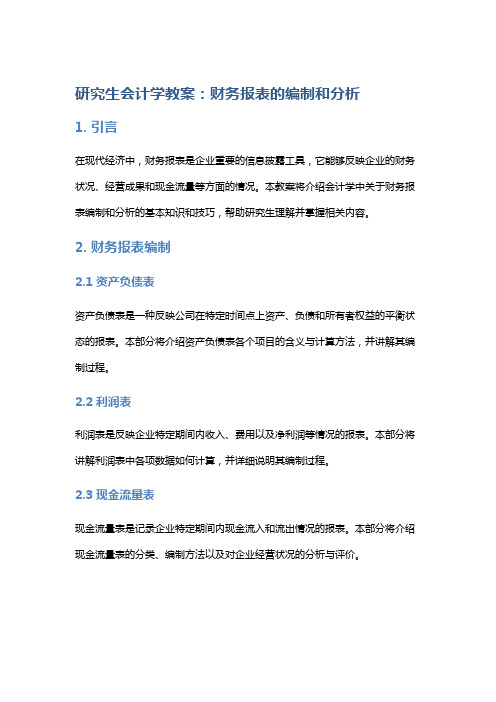

研究生会计学教案:财务报表的编制和分析

研究生会计学教案:财务报表的编制和分析1. 引言在现代经济中,财务报表是企业重要的信息披露工具,它能够反映企业的财务状况、经营成果和现金流量等方面的情况。

本教案将介绍会计学中关于财务报表编制和分析的基本知识和技巧,帮助研究生理解并掌握相关内容。

2. 财务报表编制2.1 资产负债表资产负债表是一种反映公司在特定时间点上资产、负债和所有者权益的平衡状态的报表。

本部分将介绍资产负债表各个项目的含义与计算方法,并讲解其编制过程。

2.2 利润表利润表是反映企业特定期间内收入、费用以及净利润等情况的报表。

本部分将讲解利润表中各项数据如何计算,并详细说明其编制过程。

2.3 现金流量表现金流量表是记录企业特定期间内现金流入和流出情况的报表。

本部分将介绍现金流量表的分类、编制方法以及对企业经营状况的分析与评价。

3. 财务报表分析3.1 比率分析比率分析是通过计算企业财务指标之间的关系来评估企业经营情况和财务状况的方法。

本部分将介绍常用的财务比率,并讲解如何利用比率分析对企业进行综合评价。

3.2 垂直与水平分析垂直分析和水平分析是财务报表分析中常用的两种方法。

本部分将详细说明这两种方法的原理和应用,以及如何通过垂直与水平分析挖掘出企业的潜在问题。

4. 课堂实践演练为了帮助学生更好地掌握财务报表编制和分析技能,本教案将设置一系列课堂实践演练环节。

学生将通过完成真实企业案例,在团队合作中运用所学知识,编制财务报表并进行相应的财务比较与分析。

5. 结语本教案通过系统地介绍了研究生会计学中关于财务报表编制和分析的基础知识和技巧。

通过学习本教案,研究生将能够理解财务报表的含义和编制方式,并运用相应的分析方法对企业进行综合评价。

这些知识和技能将为研究生今后从事会计与金融工作奠定坚实的基础。

浅谈会计基本假设和一般会计原则对报表信息的影响

浅谈会计基本假设和一般会计原则对报表信息的影响【摘要】会计假设与会计原则是传统会计理论的基础与重要组成部分。

通过对会计所面对的社会、经济环境进行推论,并在此基础上构建一系列有关确认与计量的基本原则,会计工作实现了对会计信息的收集、记录、汇总与产出。

但是,基于会计假设与一般会计原则而产生的财务报表信息是否就完全真实、可靠地反映了上市公司的全貌?通过分析这样的财务报表是否就能清楚、全面地了解上市公司的经营管理和财务状况?本文对此问题进行了分析。

【关键词】会计基本假设;会计原则;报表信息1.会计假设的影响现行的四条基本会计假设——会计主体、持续经营、会计分期、货币计量——最终形成于20世纪60年代,是与当时的工业时代的会计环境相适应的。

随着科技的迅猛发展,人类社会也步入了后工业经济时期并大步向知识经济迈进,会计赖以生存的经济环境发生了极大的变化,传统的会计假设与经济现实的差距越来越大,主要表现为:首先,上市公司形式的多样化发展使上市公司概念的外延越来越难以界定,给会计主体假设提出了挑战。

一般地说,一个上市公司便是一个会计主体,但在信息技术发展浪潮的推动下,上市公司的生产经营方式和组织方式都发生了巨大变化。

最典型的例子就是虚拟公司(Visual Corporation)的诞生。

虚拟公司是由众多的上市公司,特别是中小上市公司,通过现代信息技术相互结合而成,打破了普通联合公司的时间间隔和空间距离——一旦市场存在需要,众多公司甚至个人能充分利用各自的资源优势和信息优势,通过网络迅速联合成一个新公司,以最小的成本使资源得以最充分的利用。

对待如此形式的上市公司,若依据传统的会计主体假设则很难真实、公允地计量他们的资产、负债和所有者权益,由此产生的会计信息也就缺乏足够的相关性。

其次,竞争激烈的市场经济环境使持续经营假设关于会计主体前途稳定性的设想不断受到冲击。

持续经营假设认为,在正常的情况下,会计主体的生产经营活动将按照既定的目标不断地进行下去,在可以预见的将来不会面临清算或兼并。