信用证的有关术语

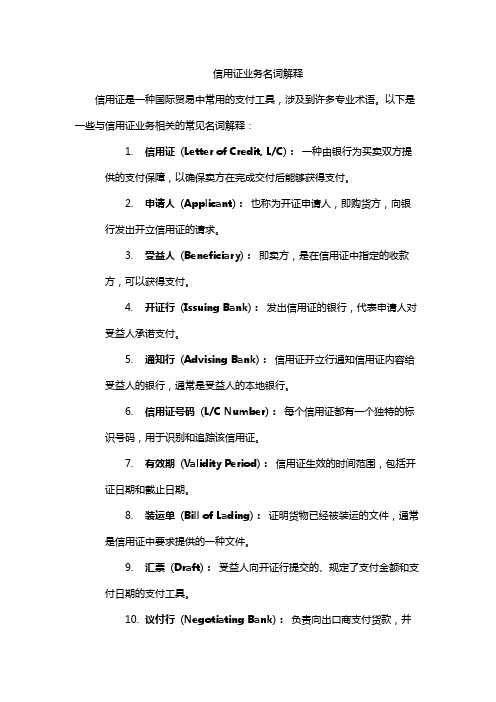

信用证业务名词解释

信用证业务名词解释信用证是一种国际贸易中常用的支付工具,涉及到许多专业术语。

以下是一些与信用证业务相关的常见名词解释:1.信用证(Letter of Credit, L/C):一种由银行为买卖双方提供的支付保障,以确保卖方在完成交付后能够获得支付。

2.申请人(Applicant):也称为开证申请人,即购货方,向银行发出开立信用证的请求。

3.受益人(Beneficiary):即卖方,是在信用证中指定的收款方,可以获得支付。

4.开证行(Issuing Bank):发出信用证的银行,代表申请人对受益人承诺支付。

5.通知行(Advising Bank):信用证开立行通知信用证内容给受益人的银行,通常是受益人的本地银行。

6.信用证号码(L/C Number):每个信用证都有一个独特的标识号码,用于识别和追踪该信用证。

7.有效期(Validity Period):信用证生效的时间范围,包括开证日期和截止日期。

8.装运单(Bill of Lading):证明货物已经被装运的文件,通常是信用证中要求提供的一种文件。

9.汇票(Draft):受益人向开证行提交的、规定了支付金额和支付日期的支付工具。

10.议付行(Negotiating Bank):负责向出口商支付货款,并向开证行索取款项的银行。

11.合理信仰(Reasonable Belief):银行在处理信用证事务时应当合理相信相关文件的真实性和合规性。

12.不可撤销信用证(Irrevocable Letter of Credit):一旦开出,除非所有相关方同意,否则不能修改或撤销的信用证。

13.可撤销信用证(Revocable Letter of Credit):开证行在未通知受益人的情况下可以修改或取消的信用证。

14.跟单信用证(Documentary Letter of Credit):要求提供一系列与货物装运和付款相关的文件的信用证。

这些名词代表了信用证业务中的关键概念,理解它们有助于参与国际贸易的各方更好地管理和执行交易。

有关信用证的英文术语

有关信用证的英文术语英文, 撤销, payment, credit, 信用证Letter of credit (L/C) 信用证Documentary L/C 跟单信用证Irrevocable L/C 不可撤销信用证revocable L/C 可撤销信用证Sight L/C 即期信用证Term L/C 远期信用证Deferred payment L/C 延期付款信用证Acceptance L/C 承兑信用证Negotiation L/C 议付信用证Confirmed L/C 保兑信用证Unconfirmed L/C 不保兑信用证Transferrable L/C 可转让信用证Revolving L/C 循环信用证Reciprocal L/C 对开信用证Back to back L/C 对背信用证Applicant 申请人Beneficiary 受益人Negotiation bank 议付行Issuing bank 开证行Advising bank 通知行Confirming bank 保兑行Reimbursing bank 偿付行Drawee bank 受票行Date of issue 开证日期T/T Reimbursement 电汇索偿Expiry date/place 到期日/到期地点Commission 佣金Drawn under 出票根据All banking charges 所有银行费用Original documents 正本单据Account 账户Amount 金额Partial shipment 分批装运Transshipment 转运Additional conditions 附加条款Currency code 币种代码Available with/byDescription of goods 货物描述Shipment period 装运期The latest date of shipment 装运期限Documents required 需要单据Special conditions 特殊条款BANK信用证单据(注:范文素材和资料部分来自网络,供参考。

信用证的内容

信用证的内容一、信用证的基本内容在国际贸易中,各国银行开出的信用证并没有统一的格式,有繁有简,有标准格式的,也有非标准格式的,但其内容基本相似,主要包括以下几个方面:(一)信用证的当事人1、开证申请人APPLICANT2、受益人(卖方): BENEFICIARY3、开证行:OPENING BANK, ISSUING BANK4、通知行: ADVISING BANK5、议付行:NEGOTIATING BANK6、付款行:PAYING BANK7、偿付行:REIMBURING BANK(二).信用证的性质、种类一般为不可撤消的跟单信用证,如:IRREVOCABLE DOCUMENTARY CREDITCONFIRMED /UNCONFIRMED L/C 保兑信用证/不保兑信用证SIGHT L/C/USANCE L/C 即期信用证/远期信用证TRANSFERABLE / UNTRANSFERABLE L/C 可转让信用证/不可转让信用证REVOLVING L/C 循环信用证DEFERRED PAYMENT L/C 延期付款信用证(三).信用证号码、开证日期与地点如:L/C NO: E-02-L-02969DATE AND PLACE OF ISSUE:2001/09/28 HONGKONG(四).信用证的有效期及到期地点常见的条款有:例1.Expiry date: May 20, 2001 in the country of the beneficiary fornegotiation.有效期:2001年5月20日前,在受益人国家议付有效。

例2:31D DATE AND PLACE OF EXPIRY: April 30, 2002 IN CHINA(五).金额、币种金额条款是信用证的核心内容之一。

其表达方式有:例1.Amount: USD…金额:……美元汇票条款(六).汇票条款汇票条款主要注明汇票的金额、付款人、付款期限、出票依据等。

信用证常见条款中英文对照表述词语

信用证常见条款中英文对照表述词语来源:考试大【考试大:中国教育考试第一门户】 2008/3/18从形式上来看,信用证只是一封普通的商业信函。

它的格式和内容多种多样,不同的国家、不同的银行开立的信用证各有不同。

但是其中的内容基本相同,一般可分为十大部分。

(一)、各方当事人在信用证中的表述文句(THE PARTIES CONCERNING TO THE CREDIT)⑴开证人(The Applicant for the credit)在国际贸易中,信用证的开立是由进口商向银行申请办理的。

所以开证人指的就是进口商。

信用证中用的词汇和词组常常是这样的:Applicant/Principal/Accountee/ Accreditor / OpenerAt the request of………应。

的请求By order of…………按。

的指示For account of………由。

付款At the request of and for…….应。

的请求Account of ……..并由。

付款By order of and for account of ……….按。

的指示并由。

付款⑵受益人(The beneficiary)在国际贸易中,受益人一般就是出口商。

信用证中常见的词汇或词组有:Beneficiary 受益人In favour of …….以。

为受益人In your favour……..以你方为受益人Transferor………转让人(可转让信用证的第一受益人)Transferee……….受让人(可转让信用证的第二受益人)⑶开证行(The Opening Bank)应开证人要求开立信用证的银行叫开证行。

在信用证中常见的词汇和词组有:Opening BankIssuing BankEstablishing Bank①通知行(Advising Bank)开证行将信用证寄送的一家受益人所在地的银行,并通过该银行通知受益人信用证开出,这家银行就是通知行。

信用证术语

常见信用证条款英汉对照翻译1.B/l showing costs additional to freight charges not acceptable. 除了运费以外,提单上不能显示其他费用.2.THIS CERTIFICATE IS NOT REQUIRED IF SHIPMENT IS EFFECTED THRU N.S.C.S.A/U.A.S.C.如果货由N.S.C.S.A/U.A.S.C运输,则无须此证明.3. Extra copy of invoice for issuing bank"s file is required. 另外提交一份发票作为开证行留档.4. A CONFIRMATION CERTIFICATE ISSUED BY THE APPLICANT’S REPRESENTATIVE, WHOSE NAME WILL BE INTRODUCED BY THE ISSUING BANK. 开证人代表出具的证明书,且签字要和开证行留存的相同.5.SHOULD THE APPLICANT WAIVE THE DISCREPANCY (IES)WE SHALL RELEASE DOCUMENTS. 如果开证人接受不符点,我们将放单给开证人.6. DOCUMENTS TO BE AIR COURIERED IN ONE LOT TO NEDBANK LTD. 单据需通过航空快递一次性寄给(开证行).7. THIRD PARTY DOCUMENTS ARE ACCEPTABLE. 接受第三方单据.8. SIGNED COMMERCIAL INVOICE IN TRIPLICATE.ORIGINAL LEGALIZED AND CERTIFIED BY C.C.P.I.T.3份签字的发票,其中正本需要贸促会认证.9. SIGNED COPY OF THE BENEFICIARY"S LETTER ADDRESSED TO US ACCOMPANIED WITH COPY OFD.H.L .RECEIPT. 加签字的受益人证明,并提交DHL快邮底单.10. B/L showing costs additional to freight charges not acceptable. 除了运费以外,提单上不能显示其他费用.11. BENEFICIARY MUST COURIER ONE SET OF NON-NEGOTIABLE DOCUMENTS TO THE APPLICANT .受益人必须快递一套副本单据给开证人.12. ONE ORIGINAL BILL OF LADING PLUS COPY OF SHIPPING DOCUMENTS HAVE BEEN SENT TO U S DIRECTLY BY D.H.L WITHIN 7 DAYS FROM BILL OF LADING DATE.一正一副的提单已经在装船后的7天之内通过DHL寄给我们了.13.DOCUMENTS PRODUCED BY REPROGRAPHIC SYSTEMS, AUTOMATED OR COMPUTERIZED SYS TEMS OR AS CARBON COPIES IF MARKED AS ORIGINAL ARE ACCEPTABLE.接受复印,计算机打印等自动制单完成的单据,但需表面注名ORIGINAL.14.A HANDING FEE OF USD80.00 TO BE DEDUCTED FOR ALL DISCREPANT. 有不符点的单据将收取80美元的费用.15. Please advise beneficiaries by telecommunication. 请用电讯方式通知受益人.16. If documents presented under this credit are found to be discrepant, we shall give notice of re fusal and shall hold document at your deposal.如果单据有不符点,我们将拒付,然后替你保管单据.17. PACKING LIST IN THREE COPIES MENTIONING THE GROSS AND NET WEIGHT OF EACH PACKAGE AND THE MARKS. 3份装箱单,显示毛重净重和唛头.18. NOTWITHSTANDING THE PROVISONG OF UCP500, IF WE GIVE NOTICE OF REFUSAL OF DOCU MENTS PRESENTED UNDER THIS CREDIT WE SHALL HOWEVER RETAIN THE RIGHT TO ACCEPT A W AIVER OF DISCREPANCIES FROM THE APPLICANT.即使UCP500有规定,我行拒付了该信用证下提交的单据后,我行也保留开证人接受不符点后的我行的权利。

国际贸易术语大全

国际贸易术语大全一、出口术语1. EXW(Ex Works:卖方工厂交货)EXW是指卖方只需将货物准备妥当并提供给买方,不负责安排运输和报关手续等,买方需要自行承担这些费用和风险。

这种术语适用于买方具备自主进口能力和资源的情况。

2. FCA(Free Carrier:卖方交货)FCA是指卖方将货物交给指定的承运人或者由买方安排的承运人,卖方负责准备符合出口要求的货物,并将货物交承运人,买方需要承担货物的风险和费用,包括运输费用、保险费用和报关手续等。

3. FOB(Free On Board:船上交货)FOB是指卖方将货物交给指定的装运港口,并在货物装上船时,卖方完成交货。

买方需要负责运输和保险费用,以及从装运港口到目的港口的海上运费和相关费用。

4. CIF(Cost, Insurance and Freight:成本加保险加运费)CIF是指卖方在FOB的基础上,承担将货物运输到指定的目的港口并购买保险的责任。

卖方需支付货物的成本、保险费用和运费,但买方仍需承担货物抵达目的港口后的进口手续、清关费用和税务等。

5. DAP(Delivered at Place:目的地交货)DAP是指卖方承担将货物发送至买方指定的目的地的责任,并支付货物的成本、运费和相关费用。

买方需要负责报关手续、支付进口税款等。

二、进口术语1. CFR(Cost and Freight:成本加运费)CFR是指卖方负责将货物运输到指定的目的港口,并支付运费,但不包括购买保险的费用。

买方需要自行负责购买保险、支付进口税款以及清关手续等费用。

2. CPT(Carriage Paid To:运费付至)CPT是指卖方将货物交给指定的承运人,并支付货物运输至指定地点的费用,除此之外买方需要承担其他费用和风险。

3. CIP(Carriage and Insurance Paid To:运费加保险费付至)CIP是指卖方在CPT的基础上,购买保险并支付保险费用。

信用证

信用证(Letter of Credit,L/C)支付方式是产生于19世纪后期,在第二次世界大战后随着后继贸易、航运、保险以及国际金融的迅速发展而逐渐发展起来的一种结算方式。

它以银行信用为基础,由进口地银行向出口商提供付款保证,是的出口商的收款风险降低;而出口商必须提供与信用证相符的单据,才可以获得付款,进口商的收货风险也相对减少。

因此,信用证在一定程度上解决了进出口人之间互不信任的矛盾。

自出现信用证以来,这种支付方式发展很快,并在国际贸易中被广泛应用。

一、信用证概述(一)信用证的含义根据国际商会《跟单信用证统一惯例》的解释,信用证是指有银行(开证行)依照客户(申请人)的要求和指示或自己主动,在符合信用证条款的条件下,凭规定单据向第三者(受益人)或其指定的人进行付款,或承兑和(或)支付受益人凯利的汇票;或授权另一银行进行该项付款,或承兑和支付汇票;或授权另一银行议付。

简言之,信用证是一种银行开立的有条件的承诺付款的书面文件。

当然,信用证也可以不经客户申请,有开证行根据自身业务需要,直接向受益人开立,这种情况主要是银行为了向他人融资或购买物品时开立的备用信用证。

(一)信用证的特点1.信用证交易的的标的物是单据对出口商来说,只要按信用证规定条件提交了单据,在单单一致,单证一致的情况下,即可从银行得到付款;对出口商来说,只要在申请开征时,保证收到符合信用证规定的单据即行付款并交付押金,即可从银行取得代表货物所有权的单据。

因此,银行开立信用证实际是进行单据的买卖。

2.信用证的开证行提供银行信用在信用证交易中,银行根据信用证取代买方承担了作为第一付款人的义务,日后只要卖方提供了符合信用证的单据,即使买方破产,卖方也能从银行得到付款保证。

这样,银行提供了远优于进口商个人信誉的银行信用,较之托收或直接付款方式来说,使卖方风险大的为坚减少。

3.信用证的交易具有独立性。

信用证是独立于买卖合同货任何其他合同之外的交易,开立信用证的基础是买卖合同,但阴阳鱼买卖合同无关,也不受其约束。

信用证术语

信用证术语20 DOCUMENTARY CREDIT NUMBER (信用证号码)23 REFERENCE TO PRE-ADVICE (预先通知号码)27 SEQUENCE OF TOTAL (电文页次)31C DATE OF ISSUE (开证日期)31D DATE AND PLACE OF EXPIRY (信用证有效期和有效地点)32B C URRENCY CODE, AMOUNT (信用证结算的货币和金额)39A PERCENTAGE CREDIT AMOUNT TOLERANCE (信用证金额上下浮动允许的最大范围)39B 与39A 不能同时出现。

39B MAXIMUM C REDIT AMOUNT (信用证最大限制金额)39B 与39A 不能同时出现。

39C ADDITIONAL AMOUNTS COVERED (额外金额)表示信用证所涉及的保险费、利息、运费等金额。

40A FORM OF DOCUMENTARY CRE D IT (跟单信用证形式)41D,内容为: ANY BANK IN...42a DRAWEE (汇票付款人)42C 同时出现。

42C DRAFTS AT... (汇票付款日期)必须与42a 同时出现。

42M MIXED PAYMENT DETAILS (混合付款条款)42P DEFERRED PAYMENT DETAILS (迟期付款条款)43P PARTIAL SHIPMENTS (分装条款)表示该信用证的货物是否可以分批装运。

43T TRANSSHIPMENT (转运条款)表示该信用证是直接到达,还是通过转运到达。

44A LOADING ON BOARD/DISPATCH/TAKING I NCHARGE AT/FORM (装船、发运和接收监管的地点)44B FOR T RANSPORTATION T O... (货物发运的最终地)44C LATEST DATE OF SHIPMENT (最后装船期)装船的最迟的日期。

信用证外贸术语-单证

国际贸易是一个复杂的流程,各环节都涉及不同单据,相关的英语专业性也很强~~本文档收录了一些外贸用语,列出了外贸操作流程中各单证的具体内容和常用术语如信用证、汇票、收据、提单、装箱单、及其个别保险条款。

这里的英文翻译翻的很好~~很准确,符合术语的法律性内容在此也感谢参与编辑工作的石精凯同学信用证种类——Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/ 远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C/untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称——Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s)to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must co ntain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s)drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses “Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s)so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s)bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating(showing/evidencing/specifying/declaration of)the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as required for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have be en sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票Bill of Loading——提单1. full set shipping(company's)clean on board bill(s)of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsedin blank marked "Freight Prepaid" notify: importer(openers, accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean “on board” bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked “Freight prepaid” / “Freight Payable at Destination”全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit andnot later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer, “Freight Prepaid”“Linerterms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin “form A” “格式A”产地证明书7.genetalised system of preference certificate of origin form “A” 普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in detail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full set of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A 海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书The Stipulation for Shipping Terms1. loading port and destination装运港与目的港(1)despatch/shipment fro m Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to… CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/ despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5) from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5) partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4. draft(s) must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the dateof bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiatio n within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn andnegotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be sent by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been compliedwith 偿付办法,由你行开出英镑即期汇票向……银行支取。

信用证应用词汇

信用证应用词汇(精简版)LCA NO信用证授权书号码IRC NO.进口许可证号码TIN NO税务登记号码VAT NO增值税号码HS CODE海关编码号customhouse 海关DC跟单信用证Bill of exchange=Draft汇票endorse背书Issuing bank 开证银行ETD预计交货时间ETA预计到达时间SWIFT:环球银行金融电信协会BL:bill of lading提单COO/CO:Certificate of origin产地证FTA自由贸易协定SEQ=Seq uence of total合计次序,也叫电文页次Date of Issue和Date Of Expiry开证日期和有效期限Currency code 货币transhipment转船转运drafts at出票条件shipment advice装运通知Quoting报价marine海运的At sight 即期Drawee汇票付款人,受票人drawer出票人Identifier code识别代码Port of discharge卸货港=destination port目的港Merchandise 商品consignment装运的货物,托运的货物reimbursement退还,偿还presentation 提交enfaced写、印或盖在面上As per按照Quality质量,品质quantity量,数量net weight and gross weight净重和毛重T are weight皮重,(集装箱)自重Containerised shippment 货柜船container seals集装箱封条Vessel 容器Trade terms贸易术语Manually signed 手签premium额外费用;;保险费;附加费octuplicate 一式八份triplicate一式三份in duplicate一式两份clean shipped清洁运输Agent代理人DULY及时,按时dispatched派遣Comfirmation instructions 确认指示counters柜台on the reverse of在....的背面strictly complying严格遵守INCOTERMS 2010 2010年国际贸易术语解释通则SEAWORTHY(尤指船舶)适航的Be forwarded to寄往...deducted扣除,减去discrepant差异存在差异(LES)is subject to 受支配,从属于CLAUSE索赔ALTERATIONS改动SIGNED AND STAMPED 签字盖章proceeds (买卖等的)收入,收益assigned to 以...为准。

常见信用证明条款英汉对照

常见信用证明条款英汉对照在国际贸易中,信用证是一种常见的付款方式。

以下是一些常见的信用证条款的英汉对照:1. Amount: 金额2. Beneficiary: 受益人3. Applicant: 申请人4. Issuing bank: 开证行5. Advising bank: 通知行6. Expiry date: 到期日期7. Shipment date: 装运日期8. Port of loading: 装运港9. Port of discharge: 卸货港10. Documents required: 所需单据11. Shipping marks: 装运唛头12. Insurance coverage: 保险覆盖范围13. Partial shipment: 分批装运14. Transshipment: 转运15. L/C negotiation: 信用证议付16. L/C confirmation: 信用证保兑17. Bill of lading: 提单18. Commercial invoice: 商业发票19. Packing list: 装箱单20. Insurance policy: 保险单21. Inspection certificate: 检验证书22. Certificate of origin: 原产地证书23. Clean on board B/L: 清洁提单24. FOB (Free On Board): 离岸价25. CIF (Cost, Insurance, and Freight): 成本、保险加运费价26. CFR (Cost and Freight): 成本加运费价27. D/P (Documents against Payment): 付款交单28. D/A (Documents against Acceptance): 承兑交单29. Sight payment: 即期付款30. Usance payment: 远期付款请注意,在特定的贸易合同和信用证中,可能会有自定义的条款和定义。

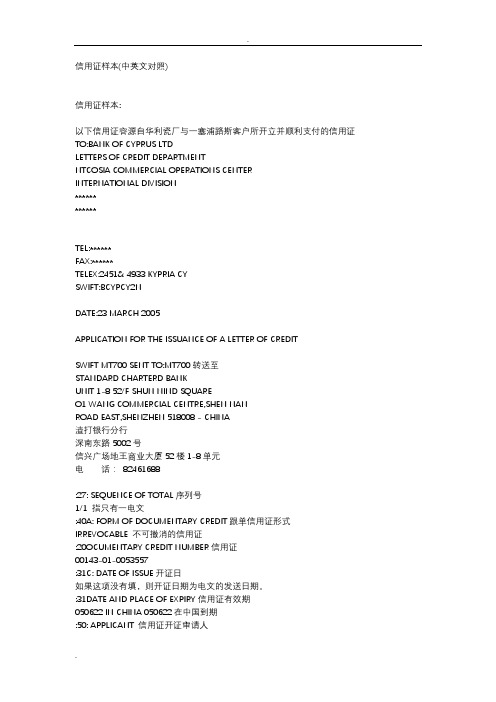

信用证样本+信用证常用术语(中英文对照)

信用证样本(中英文对照)信用证样本:以下信用证容源自华利瓷厂与一塞浦路斯客户所开立并顺利支付的信用证TO:BANK OF CYPRUS LTDLETTERS OF CREDIT DEPARTMENTNTCOSIA COMMERCIAL OPERATIONS CENTERINTERNATIONAL DIVISION************TEL:******FAX:******TELEX:2451& 4933 KYPRIA CYSWIFT:BCYPCY2NDATE:23 MARCH 2005APPLICATION FOR THE ISSUANCE OF A LETTER OF CREDITSWIFT MT700 SENT TO:MT700转送至STANDARD CHARTERD BANKUNIT 1-8 52/F SHUN NIND SQUAREO1 WANG COMMERCIAL CENTRE,SHEN NANROAD EAST,SHENZHEN 518008 - CHINA渣打银行分行深南东路5002号信兴广场地王商业大厦52楼1-8单元电话:82461688:27: SEQUENCE OF TOTAL序列号1/1 指只有一电文:40A: FORM OF DOCUMENTARY CREDIT跟单信用证形式IRREVOCABLE 不可撤消的信用证:20OCUMENTARY CREDIT NUMBER信用证00143-01-0053557:31C: DATE OF ISSUE开证日如果这项没有填,则开证日期为电文的发送日期。

:31DATE AND PLACE OF EXPIRY信用证有效期050622 IN CHINA 050622在中国到期:50: APPLICANT 信用证开证审请人******* NICOSIA 较对应同发票上是一致的:59: BENEFICIARY 受益人CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.华利瓷洁具厂:32B: CURRENCY CODE,AMOUNT 信用证项下的金额USD***7841,89:41D:AVAILABLE WITH....BY.... 议付适用银行STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行:42CRAFTS AT 开汇票SIGHT 即期:42A RAWEE 付款人BCYPCY2NO10BANK OF CYPRUS LTD 塞浦路斯的银行名:43PARTIAL SHIPMENTS 是否允许分批装运NOT ALLOWED 不可以:43T:TRANSHIPMENT转运ALLOWED允许:44AOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM...装船港口SHENZHEN PORT:44B:FOR TRANSPORTATION TO 目的港LIMASSOL PORT发票中无提及:44C: LATEST DATE OF SHIPMENT最后装船期050601:045A ESCRIPTION OF GOODS AND/OR SERVICES 货物/服务描述SANITARY WARE 瓷洁具F O B SHENZHEN PORT,INCOTERMS 2000 fob港,INCOMTERMS 2000:046A OCUMENTS REQUIRED 须提供的单据文件*FULL SET (AT LEAST THREE) ORIGINAL CLEAN SHIPPED ON BOARD BILLSOF LADING ISSUED TO THE ORDER OF BANK OF CYPRUS PUBLIC COMPANYLTD,CYPRUS,NOTIFY PARTIES APPLICANT AND OURSELVES,SHOWING全套清洁已装船提单原件(至少三份),作成以“塞浦路斯股份”为抬头,通知开证人和我们自己,注明*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THISCREDIT.运费在目的港付注明该信用证*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIRAGENT STATING THE B/L NO(S) AND THE VESSEL(S) NAME CERTIFYINGTHAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDING A VALID SAFETYMANAGEMENT SYSTEM CERTIFICATE AS PER TERMS OF INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/2001BY AN APPROPRIATE CLASSIFICATION SOCIETY由船公司或代理出有注明B/L号和船名的证明书证明他们的船是:A)持有根据国际安全管理条款编码的有效安全管理系统证书; 和B)由相关分级协会根据2001年1月1日颁布的ICC条款分类的.*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COPIES DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO.HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输:A)原产地为中国B)同为HL050307 开立日为07/03/05的商业发票容一致:047A: ADDITIONAL CONDITIONS附加条件* THE NUMBER AND DATE OF THE CREDIT AND THE NAME OF OUR BANK MUSTBE QUOTED ON ALL DRAFTS (IF REQUIRED).信用证及日期和我们的银行名必须体现在所有单据上(如果有要求)*TRANSPORT DOCUMENTS TO BE CLAUSED: ’VESSEL IS NOT SCHEDULED TOCALL ON ITS CURPENT VOYAGE AT FAMAGUSTA,KYRENTA OR KARAVOSTASSI, CYPRUS.运输单据注明" 船在其航行途中不得到塞***的Famagusta, Kyrenta or Karavostassi这些地方*INSURANCE WILL BE COVERED BY THE APPLICANTS.保险由申请人支付*ALL DOCUMENTS TO BE ISSUED IN ENGLISH LANGUAGE.所有单据由英文缮制*NEGOTIATION/PAYMENT:UNDER RESERVE/GUARANTEE STRICTLY 保结押汇或是银行保函PROHIBITED.禁止*DISCREPANCY FEES USD80, FOR EACH SET OF DISCREPANT DOCUMENTS PRESENTED UNDER THIS CREDIT,WHETHER ACCEPTED OR NOT,PLUS OURCHARGES FOR EACH MESSAGE CONCERNING REJECTION AND/OR ACCEPTANCEMUST BE BORNE BY BENEFICIARIES THEMSELVES AND DEDUCTED FROM THEAMOUNT PAYABLE TO THEM.修改每个单据不符点费用将扣除80美元(最多40)*IN THE EVENT OF DISCREPANT DOCUMENTS ARE PRESENTED TO US AND REJECTED,WE MAY RELEASE THE DOCUMENTS AND EFFECT SETTLEMENT UPON APPLICANT’S WAIVER OF SUCH DISCREPANCIES,NOTWITHSTANDING ANY COMMUNICATION WITH THE PRESENTER THAT WE ARE HOLDING DOCUMENTS ATITS DISPOSAL,UNLESS ANY PRIOR INSTRUCTIONS TO THE CONTRARY ARE RECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃修改这个不符点的权利。

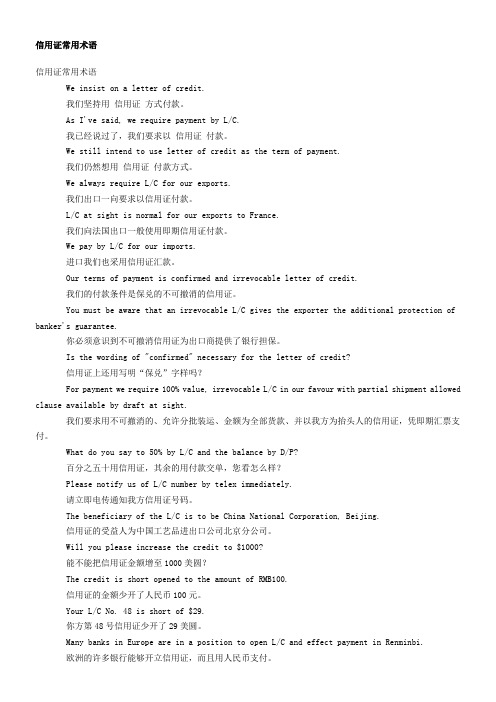

信用证条款及词汇大全

信用证常用术语信用证常用术语We insist on a letter of credit.我们坚持用信用证方式付款。

As I've said, we require payment by L/C.我已经说过了,我们要求以信用证付款。

We still intend to use letter of credit as the term of payment.我们仍然想用信用证付款方式。

We always require L/C for our exports.我们出口一向要求以信用证付款。

L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

We pay by L/C for our imports.进口我们也采用信用证汇款。

Our terms of payment is confirmed and irrevocable letter of credit.我们的付款条件是保兑的不可撤消的信用证。

You must be aware that an irrevocable L/C gives the exporter the additional protection of banker's guarantee.你必须意识到不可撤消信用证为出口商提供了银行担保。

Is the wording of "confirmed" necessary for the letter of credit?信用证上还用写明“保兑”字样吗?For payment we require 100% value, irrevocable L/C in our favour with partial shipment allowed clause available by draft at sight.我们要求用不可撤消的、允许分批装运、金额为全部货款、并以我方为抬头人的信用证,凭即期汇票支付。

信用证中英文对照

信用证中英文对照一、基本术语对照1. 信用证(Letter of Credit,简称LC)2. 申请人(Applicant)3. 受益人(Beneficiary)4. 开证行(Issuing Bank)5. 通知行(Advising Bank)6. 议付行(Negotiating Bank)7. 付款行(Paying Bank)8. 保兑行(Confirming Bank)二、信用证类型对照1. 可撤销信用证(Revocable Letter of Credit)2. 不可撤销信用证(Irrevocable Letter of Credit)3. 即期信用证(Sight Letter of Credit)4. 远期信用证(Usance Letter of Credit)5. 可转让信用证(Transferable Letter of Credit)6. 循环信用证(Revolving Letter of Credit)7. 背对背信用证(BacktoBack Letter of Credit)8. 预支信用证(Anticipatory Letter of Credit)三、信用证关键条款对照1. 信用证金额(Credit Amount)英文:The total amount for which the Letter of Credit is issued.2. 信用证有效期(Validity of the Credit)英文:The date until which the Letter of Credit remains valid for presentation of documents.3. 交单期限(Period for Presentation)英文:The time frame within which the shipping documents must be presented to the bank.4. 货物描述(Description of Goods)英文:A detailed description of the merchandise covered the Letter of Credit.5. 装运条款(Shipment Terms)英文:The conditions under which the goods are to be shipped, including the latest date of shipment.6. 付款条件(Payment Terms)英文:The conditions under which the payment will be made, whether at sight or on a deferred basis.四、信用证相关单据对照1. 发票(Invoice)英文:A document issued the seller to the buyer, indicating the goods sold and their agreed prices.2. 提单(Bill of Lading,简称B/L)英文:A receipt issued the carrier to the shipper, acknowledging receipt of goods for transportation.3. 保险单(Insurance Policy)4. 检验证书(Inspection Certificate)5. 装箱单(Packing List)英文:A detailed list of the contents of each package, prepared the shipper.五、信用证操作注意事项对照1. 信用证条款审核(Review of Credit Terms)英文:Carefully examine the terms and conditions ofthe Letter of Credit to ensure they match the sales contract.2. 单据准备与提交(Preparation and Submission of Documents)英文:Prepare all required documents accurately and submit them to the bank within the specified time frame.3. 银行费用承担(Bank Charges)英文:Clarify which party is responsible for the bank charges associated with the Letter of Credit.4. 风险防范(Risk Prevention)英文:Be aware of potential risks such as discrepancies in documents, bank defaults, and changes intrade policies.六、信用证修改与撤销对照1. 信用证修改(Amendment to the Letter of Credit)英文:A formal request to change certain terms or conditions of the Letter of Credit after it has been issued.2. 信用证撤销(Cancellation of the Letter of Credit)英文:The act of terminating the Letter of Credit before its expiry date, if it is a revocable credit.七、信用证常见问题及解决方案对照1. 文件不符(Discrepancy in Documents)英文:When the documents presented do not conform to the terms and conditions of the Letter of Credit.解决方案:Rectify the discrepancies and resubmit the corrected documents within the allowed time frame.2. 信用证延期(Extension of the Letter of Credit)英文:Requesting an extension of the validity period of the Letter of Credit.解决方案:Coordinate with the applicant to request the issuing bank to extend the credit's validity.3. 信用证付款延迟(Delay in Payment)英文:When the payment under the Letter of Credit is not made on time the issuing bank.解决方案:Communicate with the issuing bank to expedite the payment process or seek assistance from the confirming bank, if applicable.八、信用证在国际贸易中的作用对照1. 降低交易风险(Reducing Transaction Risks)英文:The Letter of Credit provides a secure payment method, reducing the risk of nonpayment for the seller.2. 促进贸易便利化(Facilitating Trade)英文:By offering a guarantee of payment, the Letter of Credit facilitates smoother trade transactions between parties in different countries.3. 融资工具(Financing Instrument)英文:The Letter of Credit can be used the beneficiary to obtain financing from the bank before the actual payment is received.。

有关信用证的英文术语

有关信用证的英文术语英文, 撤销, payment, credit, 信用证Letter of credit (L/C) 信用证Documentary L/C 跟单信用证Irrevocable L/C 不可撤销信用证revocable L/C 可撤销信用证Sight L/C 即期信用证Term L/C 远期信用证Deferred payment L/C 延期付款信用证Acceptance L/C 承兑信用证Negotiation L/C 议付信用证Confirmed L/C 保兑信用证Unconfirmed L/C 不保兑信用证Transferrable L/C 可转让信用证Revolving L/C 循环信用证Reciprocal L/C 对开信用证Back to back L/C 对背信用证Applicant 申请人Beneficiary 受益人Negotiation bank 议付行Issuing bank 开证行Advising bank 通知行Confirming bank 保兑行Reimbursing bank 偿付行Drawee bank 受票行Date of issue 开证日期T/T Reimbursement 电汇索偿Expiry date/place 到期日/到期地点Commission 佣金Drawn under 出票根据All banking charges 所有银行费用Original documents 正本单据Account 账户Amount 金额Partial shipment 分批装运Transshipment 转运Additional conditions 附加条款Currency code 币种代码Available with/byDescription of goods 货物描述Shipment period 装运期The latest date of shipment 装运期限Documents required 需要单据Special conditions 特殊条款BANK信用证单据。

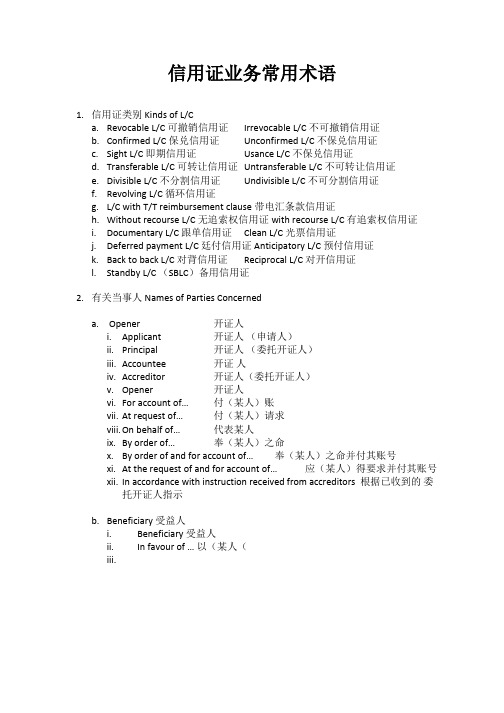

信用证业务常用术语

信用证业务常用术语1.信用证类别 Kinds of L/Ca.Revocable L/C 可撤销信用证Irrevocable L/C 不可撤销信用证b.Confirmed L/C 保兑信用证Unconfirmed L/C 不保兑信用证c.Sight L/C 即期信用证Usance L/C 不保兑信用证d.Transferable L/C 可转让信用证Untransferable L/C 不可转让信用证e.Divisible L/C 不分割信用证Undivisible L/C 不可分割信用证f.Revolving L/C 循环信用证g.L/C with T/T reimbursement clause 带电汇条款信用证h.Without recourse L/C 无追索权信用证with recourse L/C 有追索权信用证i.Documentary L/C 跟单信用证Clean L/C 光票信用证j.Deferred payment L/C 廷付信用证 Anticipatory L/C 预付信用证k.Back to back L/C 对背信用证Reciprocal L/C 对开信用证l.Standby L/C (SBLC)备用信用证2.有关当事人 Names of Parties Concerneda. Opener 开证人i.Applicant 开证人(申请人)ii.Principal 开证人(委托开证人)iii.Accountee 开证人iv.Accreditor 开证人(委托开证人)v.Opener 开证人vi.For account of…付(某人)账vii.At request of…付(某人)请求viii.On behalf of…代表某人ix.By order of…奉(某人)之命x.By order of and for account of…奉(某人)之命并付其账号xi.At the request of and for account of…应(某人)得要求并付其账号xii.In accordance with instruction received from accreditors 根据已收到的委托开证人指示b.Beneficiary 受益人i.Beneficiary 受益人ii.In favour of … 以(某人(iii.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

信用证常用词语的理解一. against 在L/C 中的高频率出现及正确理解。

我们常见的against 是介词, 通常意为“反对”( indicating opposite ion) , 例如:Public opinion was against the Bill. 舆论反对此法案。

The resolution was adopted by a vote of 30 in favor to 4 against it. 议以30 票同意、4 票反对获得通过。

另外还有“用. . . 交换, 用. . . 兑付”之意。

如:“the rates against U. S. dollars”中的against 就是指美元兑换率。

但在信用证中常出现的against 这个词及词义却另有所指, 一般词典无其释义及相关用法。

注意以下两个出现在信用证句中的against 之意, 其意思是凭. . . ”“以. . . ”(“take as the basis ” or meaning of “by”)。

而不是“以. . . 为背景”“反对”“对照”“兑换”或其他什么意思。

1. This credit valid until September 17, 2001 in Switzerland for payment available against the presentation of following documents. . . 本信用证在2001年9月17日在瑞土到期前, 凭提交以下单据付款. . . . . .2. Documents bearing discrepancies must no t be negotiated against guarantee and reserve. 含有不符点的单据凭保函或在保留下不能议付。

3. The payment is available at sight against the following documents. 凭下列单据即期付款。

这里的against 都是“凭. . . 为条件, 以. . . 为前提”( in re turn for sth. or on condition that) 之意。

支付方式中的两个贸易术语“D/A (承兑交单) ”、“D/P (付款交单) ”, 展开后为“Documents against acceptance” “Documents against payment”; 其against 的意思都是“凭承兑单据而交单”“凭付款而交单”之意。

以下这句话就是理解上发生错误所致:The consignment is handed over for disposal against payment by the buyer.误译: 货物交由买方处置——不用付款。

正译: 货物凭买方付款后, 方可移交其处置。

注意以下这样的句子, 不可译错:We cleaned the room against your coming. 我们把房间打扫干净, 等候您的光临。

二. subject to 在同一份信用证中有两种意思, 此概念在审证时必须把握清楚。

This documentary credit is subject to the Uniform Customs and Practice for DocumentaryCredits (1993 Revision) International Chamber of Commerce (publicities on No. 500).本信用证受《跟单信用证统一惯例》国际商会第500 号出版物(1993 年修订本) 管辖(或约束)。

本句话中的subject to 在证中意为“受. . . 约束, 受. . . 管制”。

此条款一般在来证的上方或页面的空白处载明, 表明其适用的范围和承担的义务。

类似的含义如:We are subject to the law of the land. 我们受当地法律约束。

以上是一种意思。

而同时, 它出现在证内其他一些条款中, 又是何意? 请看下面这个条款。

The certificate of inspect ion would be issued and signed by authorized applicant of L/C before shipment of cargo, whose signature is subject to our final confirmation. 发货前由开证申请人授权开立并签署的检验证书, 其签字须待我方最终确认。

这是一条软条款( the soft clause) , 意在发生对进口人不利的情况时, 限制这份信用证的实际生效, 做出了对我方出口人极其不利的设限, 使其从收到信用证的第一天起就处在被动之中。

你的货备好之后, 进口人随时都可以以检验不合格等借口不履行付款责任或乘机压价。

这里的subject to 意为“有待于, 须经. . . 的, 以. . . 为条件”(conditionally upon)之意。

这样的限制性条款往往又出现在信用证的最下端或和其他条款混在一起, 用词讲究, 很容易被忽略; 或即使被看到了, 审证人一扫而过, 没有要求对方改证, 最后给企业造成损失。

搞国际贸易的人除了要具备良好的英语审证能力外, 还须养成对每一项条款都仔细阅读的好习惯。

同一种含义的句子还会出现在证内其他所要求的单据条款中:This Proforma Invoice is subject to our last approval.本形式发票有待我方最后同意。

三. draw 在信用证中的释义及正确的翻译。

首先要对draw 这个词以及它的派生词准确理解, 之后明白其动词和其过去分词的意义。

这个词的词义和用法非常多, 在此不一一赘述。

我们现在看看它在信用证中的含义。

drawer 意为“出票人”, 一般指的就是信用证的受益人。

drawee 意为“付款人”, 信用证的开证人。

drawn clause 意为“出票条款”, 即信用证、商业汇票中的一些特别条款。

需要特别提醒的是, 一些外贸业务员常常混淆了这两个词的不同意思, 在信用证要求的汇票缮制中错打, 造成单证不符点。

在以下的两个句子中请注意分词形式的drawn 的意思。

We hereby est ablish this Irrevocable Credit which is available against beneficiary’s drafts drawn in duplicate on applicant at 30 days sight free of interest for 100% of invoice value. Document against acceptance. 我方兹开立不可撤消信用证, 本证凭受益人开给申请人的30 天一式两份汇票付款, 不计利息, 承兑交单。

此句中drawn 为“开给”“向. . . 开立的”之意。

(established or written out to such as draft/Bill/cheque, etc) 信用证中, 开给xxx 汇票的“开给”, 英语常用draw n 和valued, 有时也用issued。

用draw n 这个词时, 后面常跟的是介词on 如:Drawn on Bank of China, Head Office. 开给中国银行总行。

The beneficiary's drafts drawing at 120 days after sight are to be paid in face value as drawn at sight basis, discounting charges, accountance commissions and usance interest are for account of the accountee. 受益人开立的120天远期汇票, 按票面金额即期付款, 银行贴现费用、佣金和远期利息由付款人负担。

此外, 还要注意drawn on 后面跟的三个人称复数词, 当后面跟的是第一人称us, ourselves 时, 它指的就是开证行。

而若是跟了you, yourselves, 指的是通知行。

如果是them; themselves, 指的是买方既进口商。

审证时应该特别仔细, 以防出错。

四. negotiate 和honor 在信用证中都有付款的含义, 但其确切的含义并不相同。

negotiate 在外贸业务中的含义是“议付”, 既get or give money for (checks, bonds, etc. ) 之意。

请看以下句子。

At the time of negotiation, 5% commission to be deducted from invoice value and should be remitted by the negotiating bank in the form of a bank draft in favour of Cima Co. 议付到期时, 将按发票金额扣除百分之五的佣金, 该扣除金额须由议付行以银行汇票形式开给西马公司。

negotiable 这个形容词, 指代的又是具有物权凭证的议付单据, 意为“可议付的, 可流通的, 可兑现的”, 如: negotiable documents“议付单据”, 包括汇票、发票、提单等正本。

而non-negotiable documents 是指“非议付单据”, 即提单、保单一类的副本单据, 而不是结汇单据。

honor 之意是“兑现”、“承付”, accept and pay“如期支付, 承兑”, honor a bill (cheque, draft, etc. ) “兑现票据(支票, 汇票, 信用证; 托收) ”。

而外贸实务当中的acceptance 指的是“承兑, 认付”; 即买方在见到汇票时答应并签字确认, 待到汇票到期后一定付款, (accept/promise to pay on due date by signing the draft)而不是马上付款!This L/C will be duly honored only if the seller submits whole set of documents that all terms and requirements under L/C No. 45675 have been complied with. 只有出口人提供与信用证No. 45675号项下相符的全套单据, 本行才予承付。